Third Quarter 2024 Earnings Conference Call October 29, 2024 Louis J. Torchio T.K. Creal President and Chief Executive Officer Chief Credit Officer Douglas M. Schosser Joseph D. Canfield Chief Financial Officer Chief Accounting Officer

Forward-looking Statements and Additional Information The information contained in this presentation may contain forward-looking statements. When used or incorporated by reference in disclosure documents, the words “believe,” “anticipate,” “estimate,” “expect,” “project,” “target,” “goal” and similar expressions are intended to identify forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These forward-looking statements include but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to the following: inflation and changes in the interest rate environment that reduce our margins, our loan origination, or the fair value of financial instruments; changes in asset quality, including increases in default rates on loans and higher levels of nonperforming loans and loan charge-offs generally; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; changes in federal, state, or local tax laws and tax rates; general economic conditions, either nationally or in our market areas, that are different than expected, including inflationary or recessionary pressures; adverse changes in the securities and credit markets; cyber-security concerns, including an interruption or breach in the security of our website or other information systems; technological changes that may be more difficult or expensive than expected; changes in liquidity, including the size and composition of our deposit portfolio, and the percentage of uninsured deposits in the portfolio; the ability of third-party providers to perform their obligations to us; competition among depository and other financial institutions, including with respect to deposit gathering, service charges and fees; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to manage our internal growth and our ability to successfully integrate acquired entities, businesses or branch offices; changes in consumer spending, borrowing and savings habits; our ability to continue to increase and manage our commercial and personal loans; possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises; changes in the value of our goodwill or other intangible assets; the impact of the economy on our loan portfolio (including cash flow and collateral values), investment portfolio, customers and capital market activities; our ability to receive regulatory approvals for proposed transactions or new lines of business; the effects of any federal government shutdown or the inability of the federal government to manage debt limits; changes in the financial performance and/or condition of our borrowers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Securities and Exchange Commission, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board (“FASB”) and other accounting standard setters; changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses; our ability to access cost-effective funding; the effect of global or national war, conflict, or terrorism; our ability to manage market risk, credit risk and operational risk; the disruption to local, regional, national and global economic activity caused by infectious disease outbreaks, and the significant impact that any such outbreaks may have on our growth, operations and earnings; the effects of natural disasters and extreme weather events; changes in our ability to continue to pay dividends, either at current rates or at all; our ability to retain key employees; and our compensation expense associated with equity allocated or awarded to our employees. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These and other risk factors are more fully described in this presentation and in the Northwest Bancshares, Inc. (the “Company”) Annual Report on Form 10-K for the year ended December 31, 2023 under the section entitled "Item 1A - Risk Factors," and from time to time in other filings made by the Company with the SEC. These forward-looking statements speak only at the date of the presentation. The Company expressly disclaims any obligation to publicly release any updates or revisions to reflect any change in the Company’s expectations with regard to any change in events, conditions or circumstances on which any such statement is based. Use of Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. See the end of this presentation for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures where applicable. 2

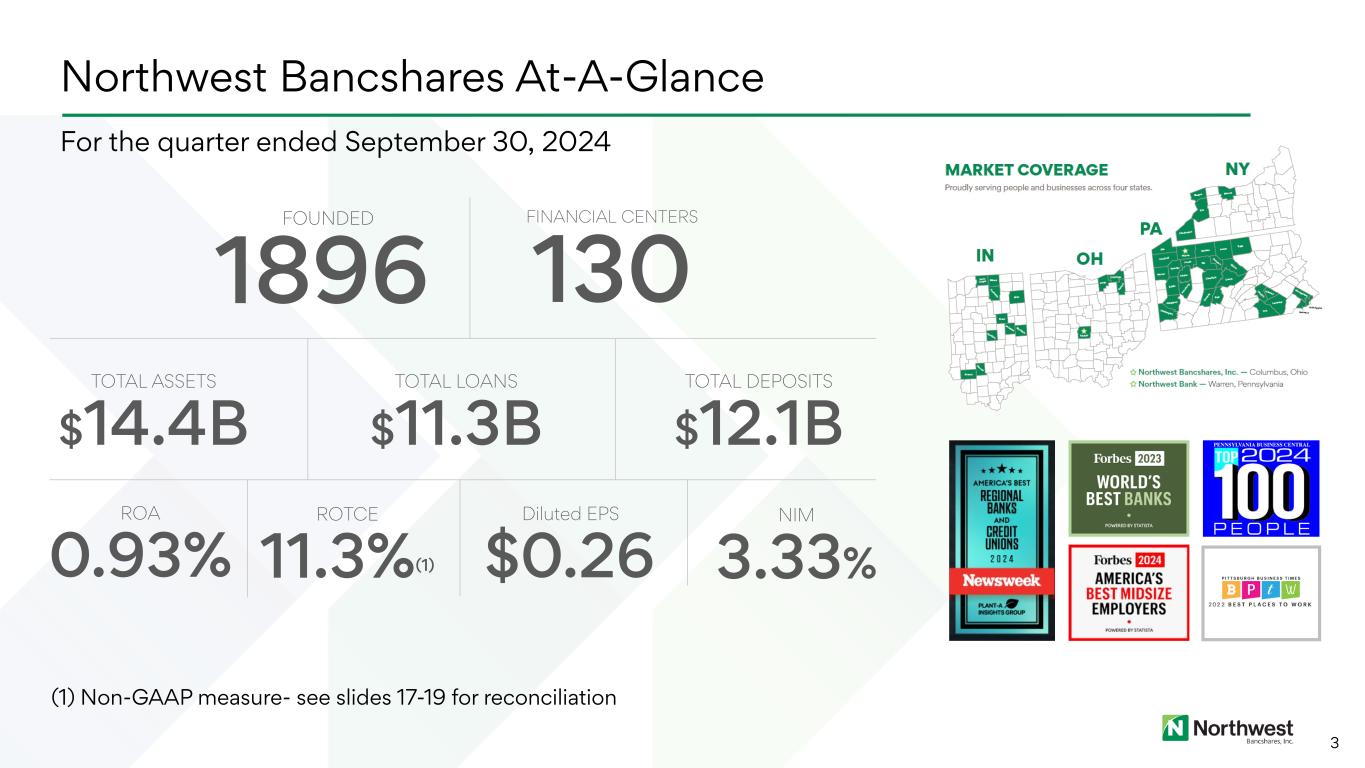

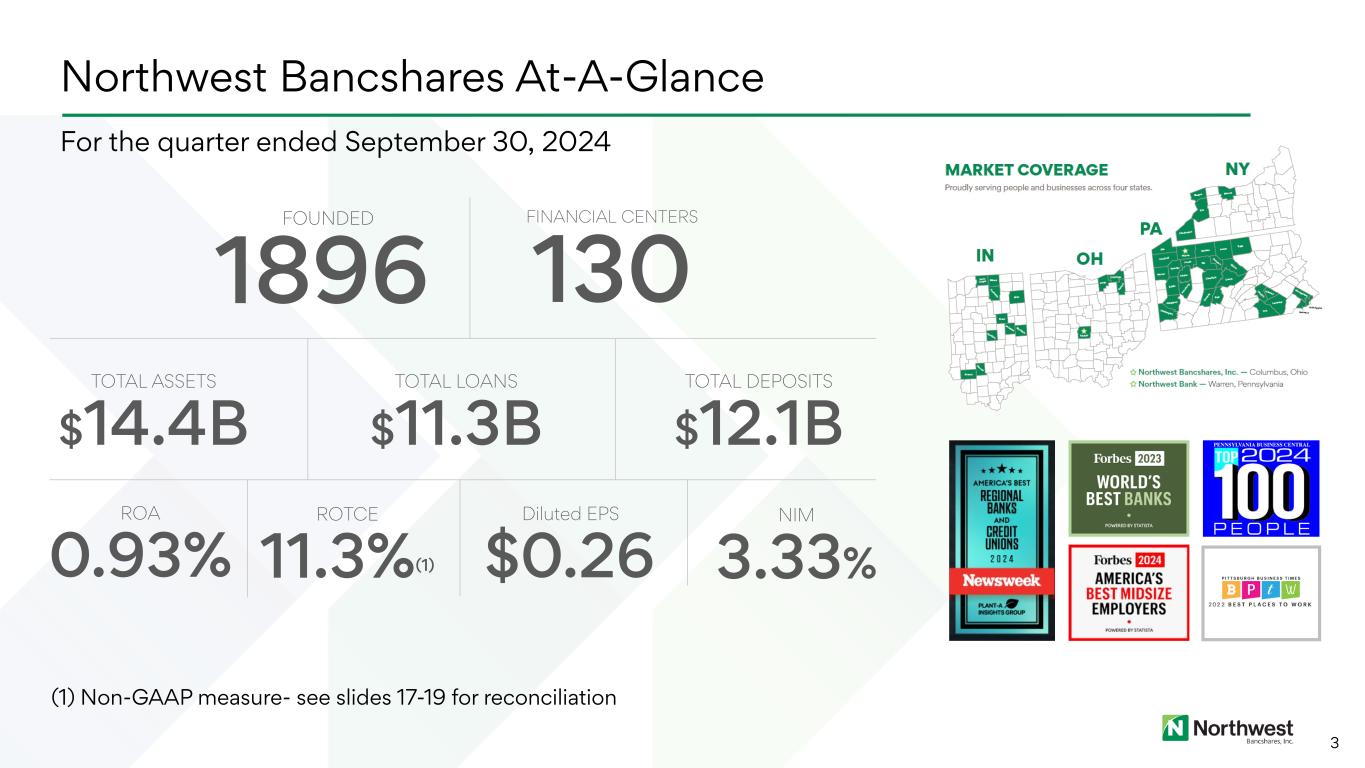

3 FOUNDED 1896 TOTAL ASSETS $14.4B TOTAL DEPOSITS $12.1B TOTAL LOANS $11.3B FINANCIAL CENTERS 130 ROA 0.93% ROTCE 11.3%(1) NIM 3.33% Northwest Bancshares At-A-Glance Diluted EPS $0.26 For the quarter ended September 30, 2024 (1) Non-GAAP measure- see slides 17-19 for reconciliation

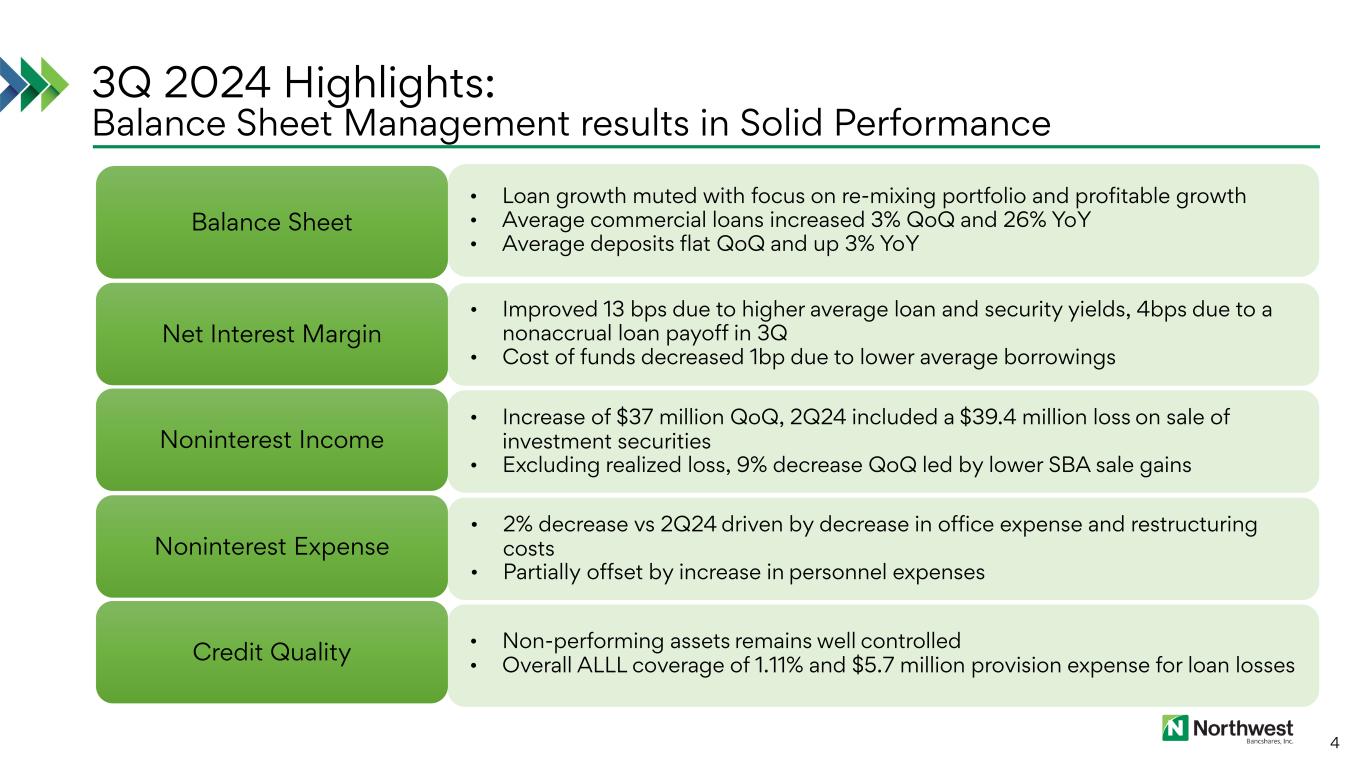

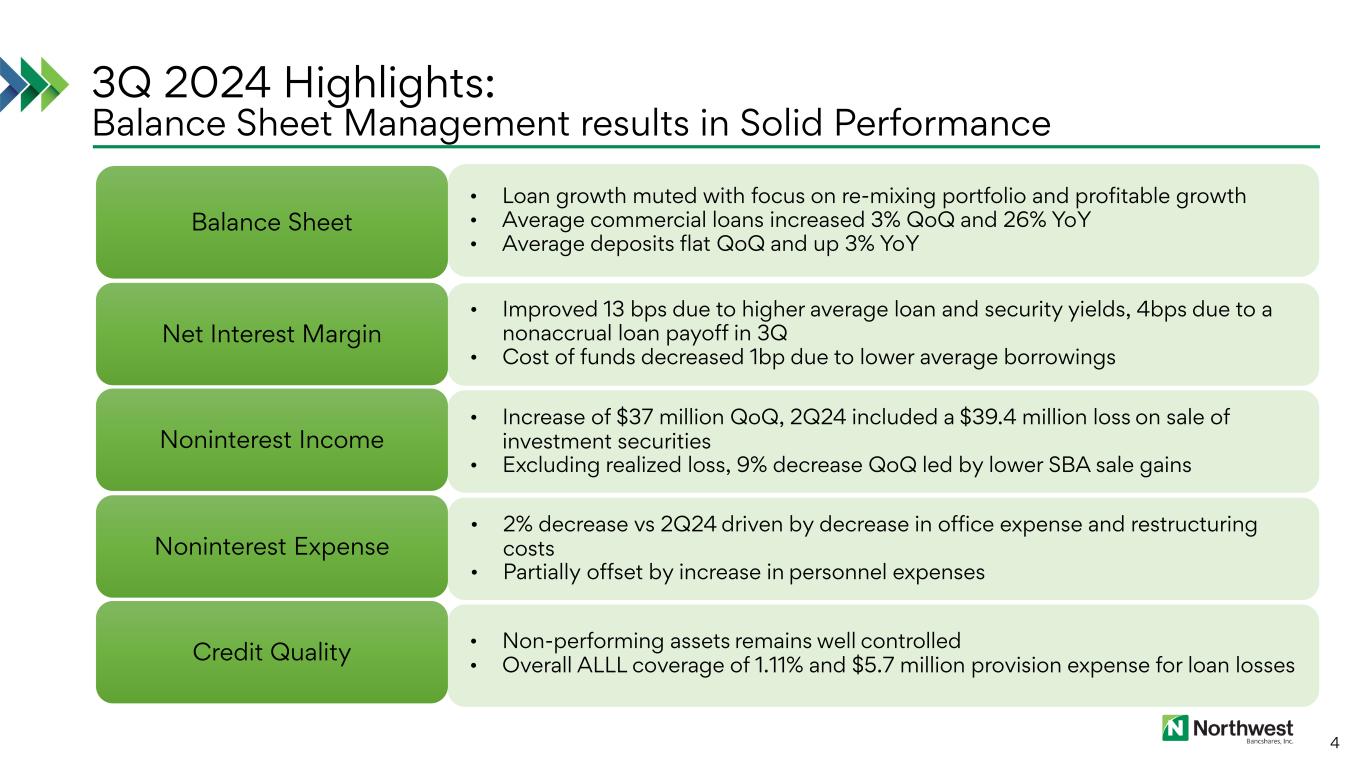

3Q 2024 Highlights: Balance Sheet Management results in Solid Performance 4 Balance Sheet Net Interest Margin Noninterest Income Noninterest Expense Credit Quality • Loan growth muted with focus on re-mixing portfolio and profitable growth • Average commercial loans increased 3% QoQ and 26% YoY • Average deposits flat QoQ and up 3% YoY • Improved 13 bps due to higher average loan and security yields, 4bps due to a nonaccrual loan payoff in 3Q • Cost of funds decreased 1bp due to lower average borrowings • Increase of $37 million QoQ, 2Q24 included a $39.4 million loss on sale of investment securities • Excluding realized loss, 9% decrease QoQ led by lower SBA sale gains • 2% decrease vs 2Q24 driven by decrease in office expense and restructuring costs • Partially offset by increase in personnel expenses • Non-performing assets remains well controlled • Overall ALLL coverage of 1.11% and $5.7 million provision expense for loan losses

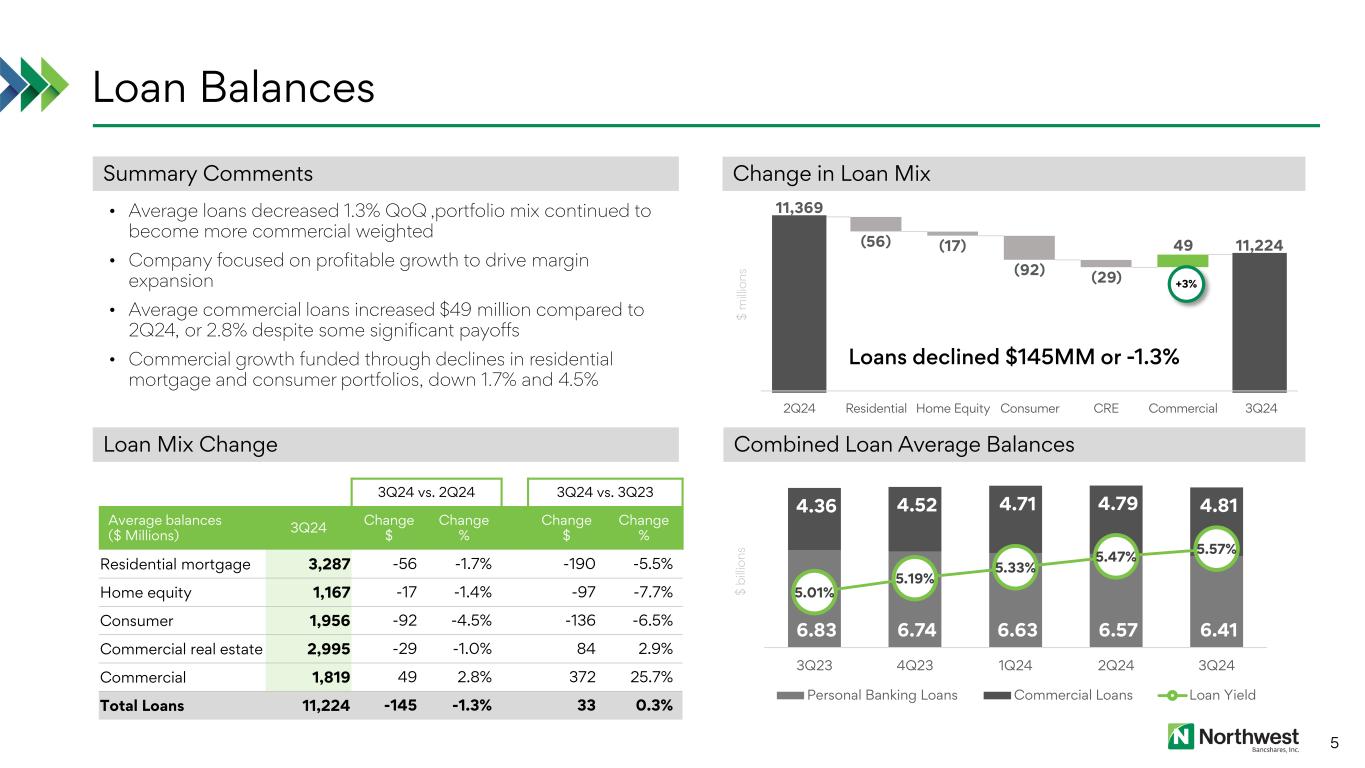

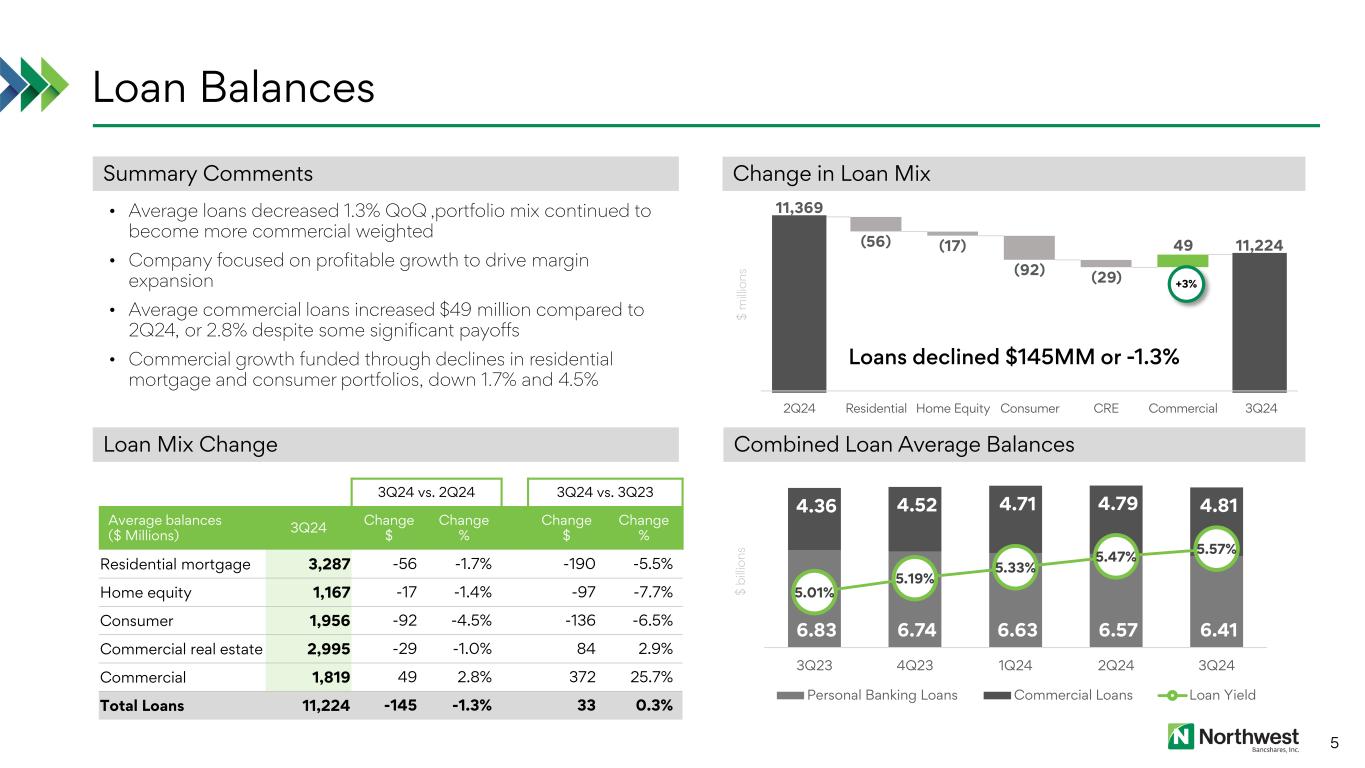

6.83 6.74 6.63 6.57 6.41 4.36 4.52 4.71 4.79 4.81 5.01% 5.19% 5.33% 5.47% 5.57% 4.30% 4.80% 5.30% 5.80% 6.30% - 2.00 4.00 6.00 8.00 10.00 12.00 3Q23 4Q23 1Q24 2Q24 3Q24 Personal Banking Loans Commercial Loans Loan Yield 11,369 (56) (17) (92) (29) 49 11,224 2Q24 Residential Home Equity Consumer CRE Commercial 3Q24 10,700 10,800 10,900 11,000 11,100 11,200 11,300 11,400 11,500 Loan Balances 5 3Q24 vs. 2Q24 3Q24 vs. 3Q23 Average balances ($ Millions) 3Q24 Change $ Change % Change $ Change % Residential mortgage 3,287 -56 -1.7% -190 -5.5% Home equity 1,167 -17 -1.4% -97 -7.7% Consumer 1,956 -92 -4.5% -136 -6.5% Commercial real estate 2,995 -29 -1.0% 84 2.9% Commercial 1,819 49 2.8% 372 25.7% Total Loans 11,224 -145 -1.3% 33 0.3% Change in Loan Mix • Average loans decreased 1.3% QoQ ,portfolio mix continued to become more commercial weighted • Company focused on profitable growth to drive margin expansion • Average commercial loans increased $49 million compared to 2Q24, or 2.8% despite some significant payoffs • Commercial growth funded through declines in residential mortgage and consumer portfolios, down 1.7% and 4.5% Summary Comments Loan Mix Change Loans declined $145MM or -1.3% +3% $ m illi on s $ bi llio ns Combined Loan Average Balances

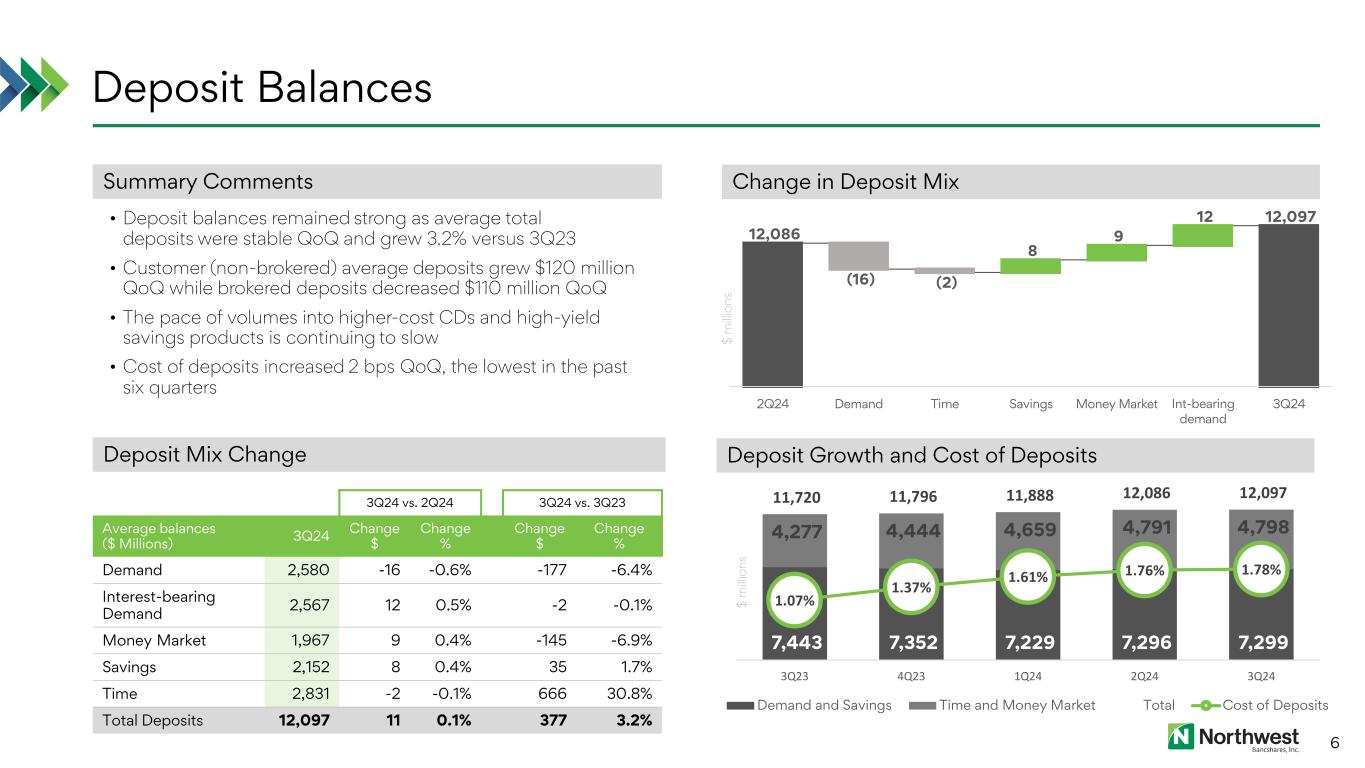

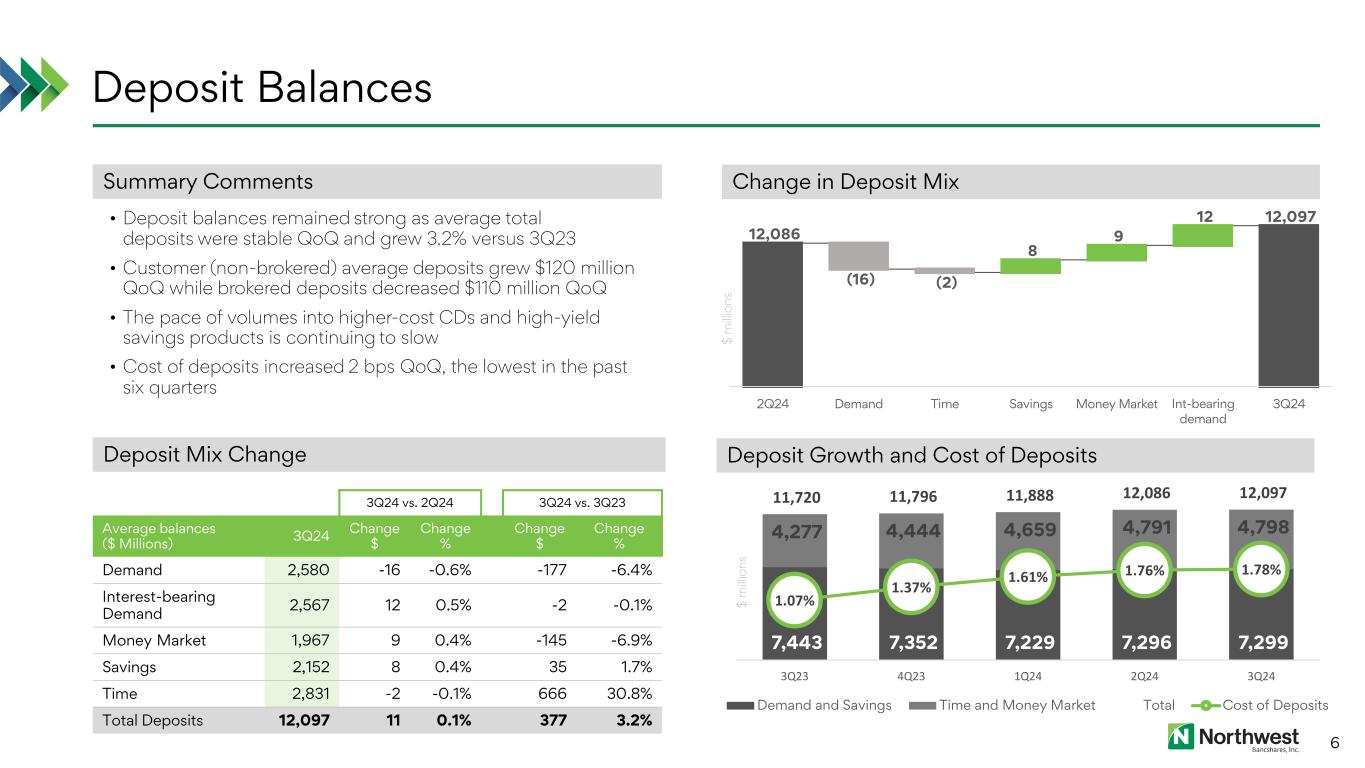

Deposit Balances 6 3Q24 vs. 2Q24 3Q24 vs. 3Q23 Average balances ($ Millions) 3Q24 Change $ Change % Change $ Change % Demand 2,580 -16 -0.6% -177 -6.4% Interest-bearing Demand 2,567 12 0.5% -2 -0.1% Money Market 1,967 9 0.4% -145 -6.9% Savings 2,152 8 0.4% 35 1.7% Time 2,831 -2 -0.1% 666 30.8% Total Deposits 12,097 11 0.1% 377 3.2% Change in Deposit Mix Deposit Growth and Cost of Deposits • Deposit balances remained strong as average total deposits were stable QoQ and grew 3.2% versus 3Q23 • Customer (non-brokered) average deposits grew $120 million QoQ while brokered deposits decreased $110 million QoQ • The pace of volumes into higher-cost CDs and high-yield savings products is continuing to slow • Cost of deposits increased 2 bps QoQ, the lowest in the past six quarters Summary Comments Deposit Mix Change $ m illi on s $ m illi on s 12,086 (16) (2) 8 9 12 12,097 2Q24 Demand Time Savings Money Market Int-bearing demand 3Q24 12,000 12,020 12,040 12,060 12,080 12,100 12,120 7,443 7,352 7,229 7,296 7,299 4,277 4,444 4,659 4,791 4,798 11,720 11,796 11,888 12,086 12,097 1.07% 1.37% 1.61% 1.76% 1.78% -0.30% 0.20% 0.70% 1.20% 1.70% 2.20% 2.70% 3.20% 3.70% - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 3Q23 4Q23 1Q24 2Q24 3Q24 Demand and Savings Time and Money Market Total Cost of Deposits

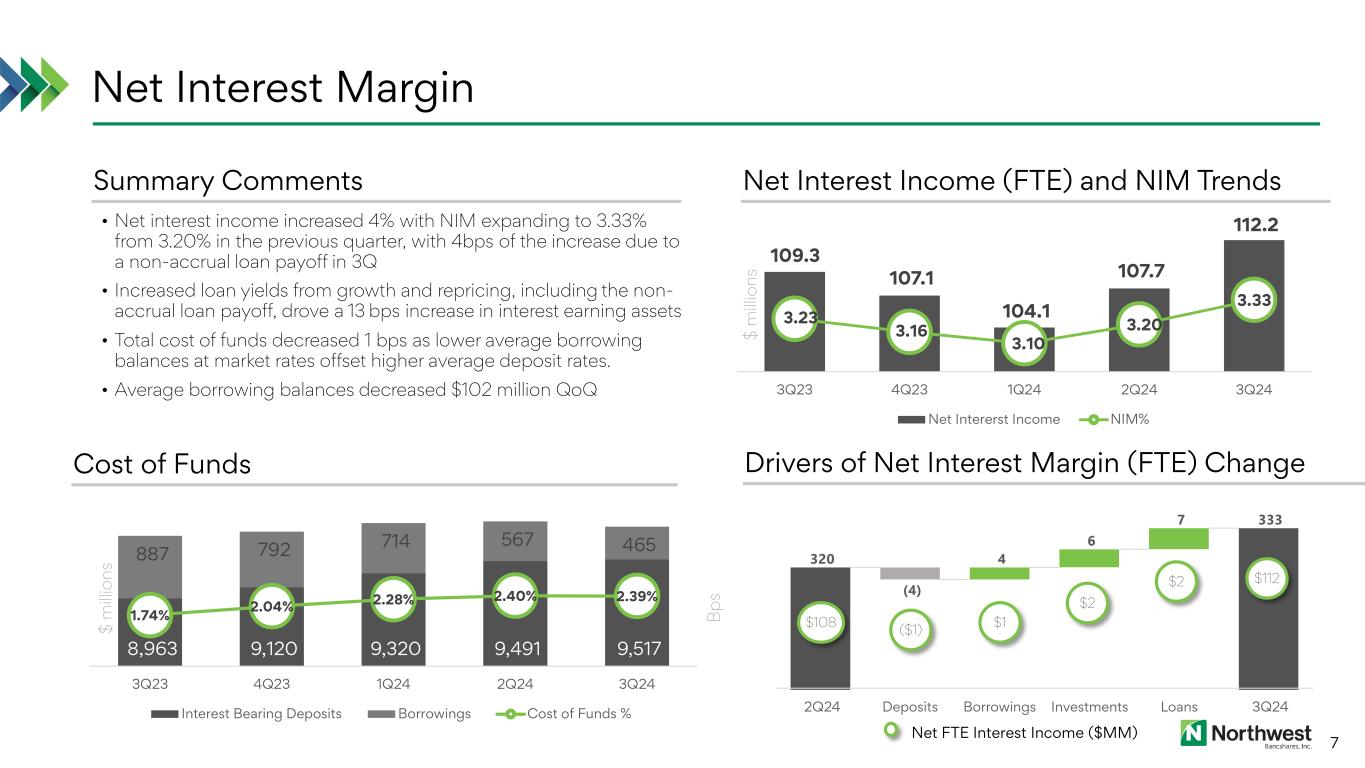

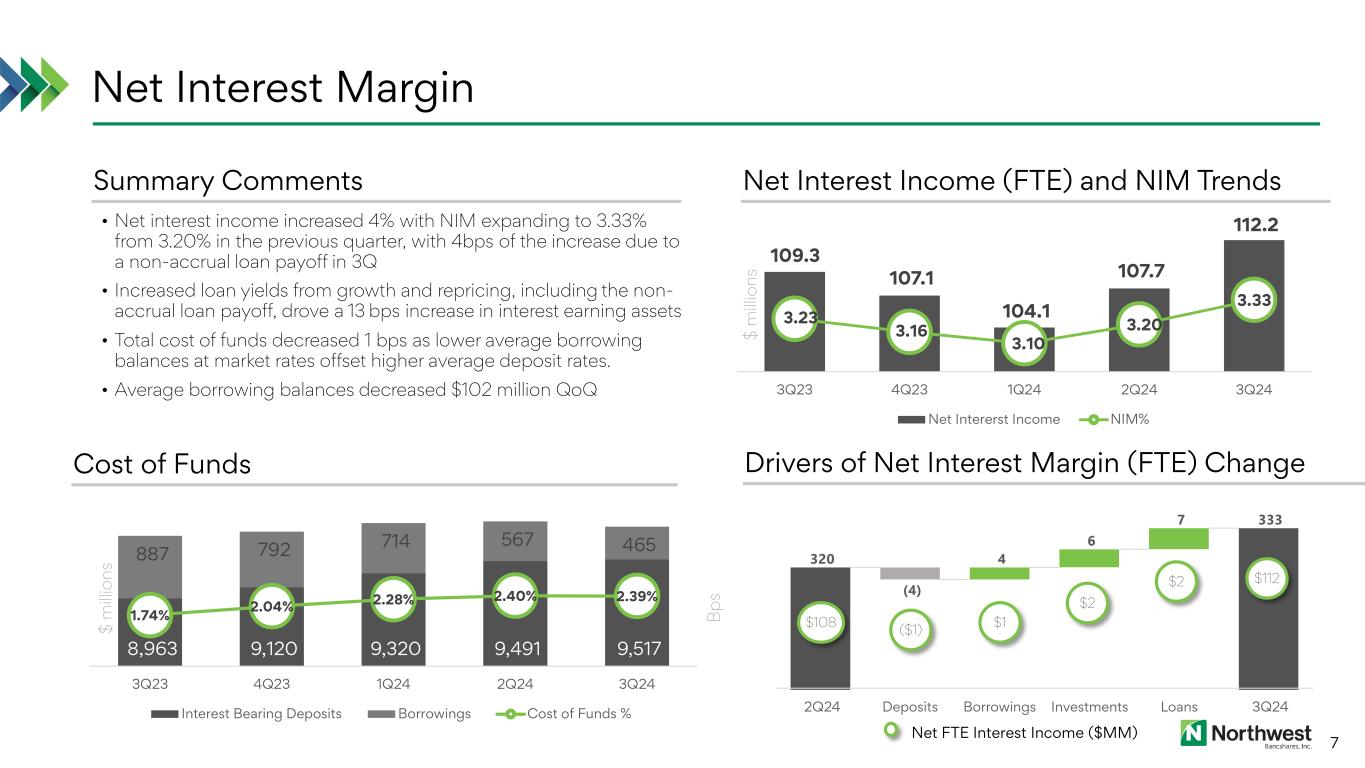

(4) 4 6 7 333 320 2Q24 Deposits Borrowings Investments Loans 3Q24 280 290 300 310 320 330 340 8,963 9,120 9,320 9,491 9,517 887 792 714 567 465 1.74% 2.04% 2.28% 2.40% 2.39% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 8,000 8,500 9,000 9,500 10,000 10,500 3Q23 4Q23 1Q24 2Q24 3Q24 Interest Bearing Deposits Borrowings Cost of Funds % 109.3 107.1 104.1 107.7 112.2 3.23 3.16 3.10 3.20 3.33 2.95 3.15 3.35 3.55 3.75 100.0 102.0 104.0 106.0 108.0 110.0 112.0 114.0 3Q23 4Q23 1Q24 2Q24 3Q24 Net Intererst Income NIM% Net Interest Income (FTE) and NIM Trends $ m illi on s Net Interest Margin 7 • Net interest income increased 4% with NIM expanding to 3.33% from 3.20% in the previous quarter, with 4bps of the increase due to a non-accrual loan payoff in 3Q • Increased loan yields from growth and repricing, including the non- accrual loan payoff, drove a 13 bps increase in interest earning assets • Total cost of funds decreased 1 bps as lower average borrowing balances at market rates offset higher average deposit rates. • Average borrowing balances decreased $102 million QoQ $ m illi on s Summary Comments B ps Drivers of Net Interest Margin (FTE) Change $108 ($1) $1 $2 $2 $112 Net FTE Interest Income ($MM) Cost of Funds

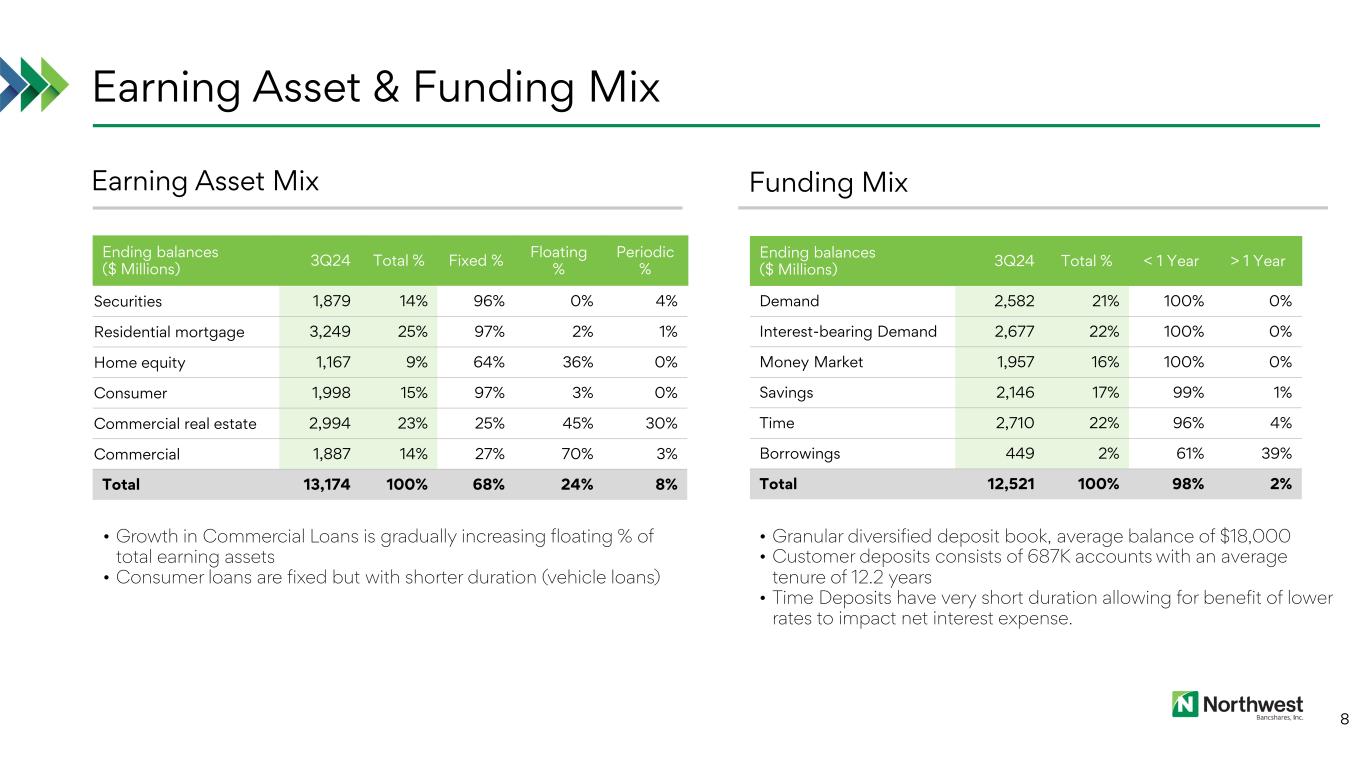

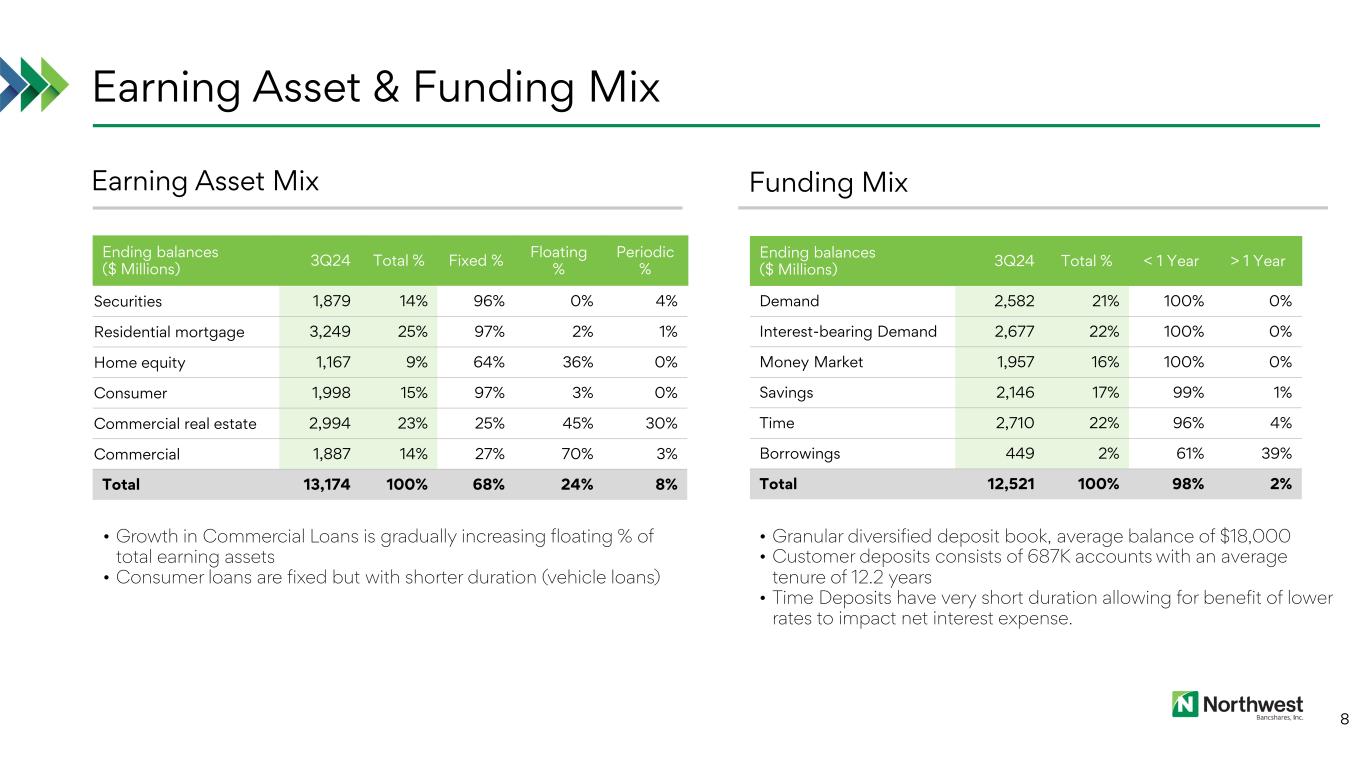

Earning Asset & Funding Mix 8 Funding MixEarning Asset Mix Ending balances ($ Millions) 3Q24 Total % Fixed % Floating % Periodic % Securities 1,879 14% 96% 0% 4% Residential mortgage 3,249 25% 97% 2% 1% Home equity 1,167 9% 64% 36% 0% Consumer 1,998 15% 97% 3% 0% Commercial real estate 2,994 23% 25% 45% 30% Commercial 1,887 14% 27% 70% 3% Total 13,174 100% 68% 24% 8% Ending balances ($ Millions) 3Q24 Total % < 1 Year > 1 Year Demand 2,582 21% 100% 0% Interest-bearing Demand 2,677 22% 100% 0% Money Market 1,957 16% 100% 0% Savings 2,146 17% 99% 1% Time 2,710 22% 96% 4% Borrowings 449 2% 61% 39% Total 12,521 100% 98% 2% • Growth in Commercial Loans is gradually increasing floating % of total earning assets • Consumer loans are fixed but with shorter duration (vehicle loans) • Granular diversified deposit book, average balance of $18,000 • Customer deposits consists of 687K accounts with an average tenure of 12.2 years • Time Deposits have very short duration allowing for benefit of lower rates to impact net interest expense.

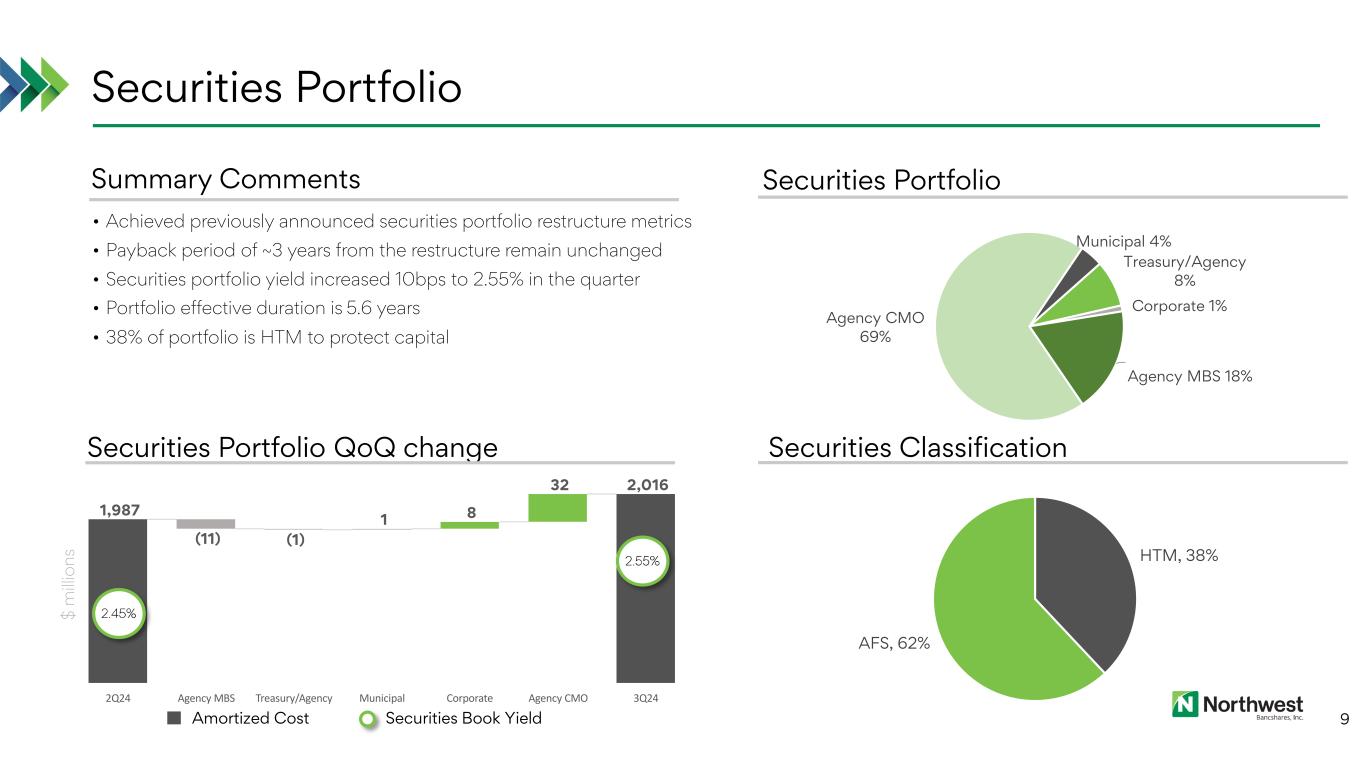

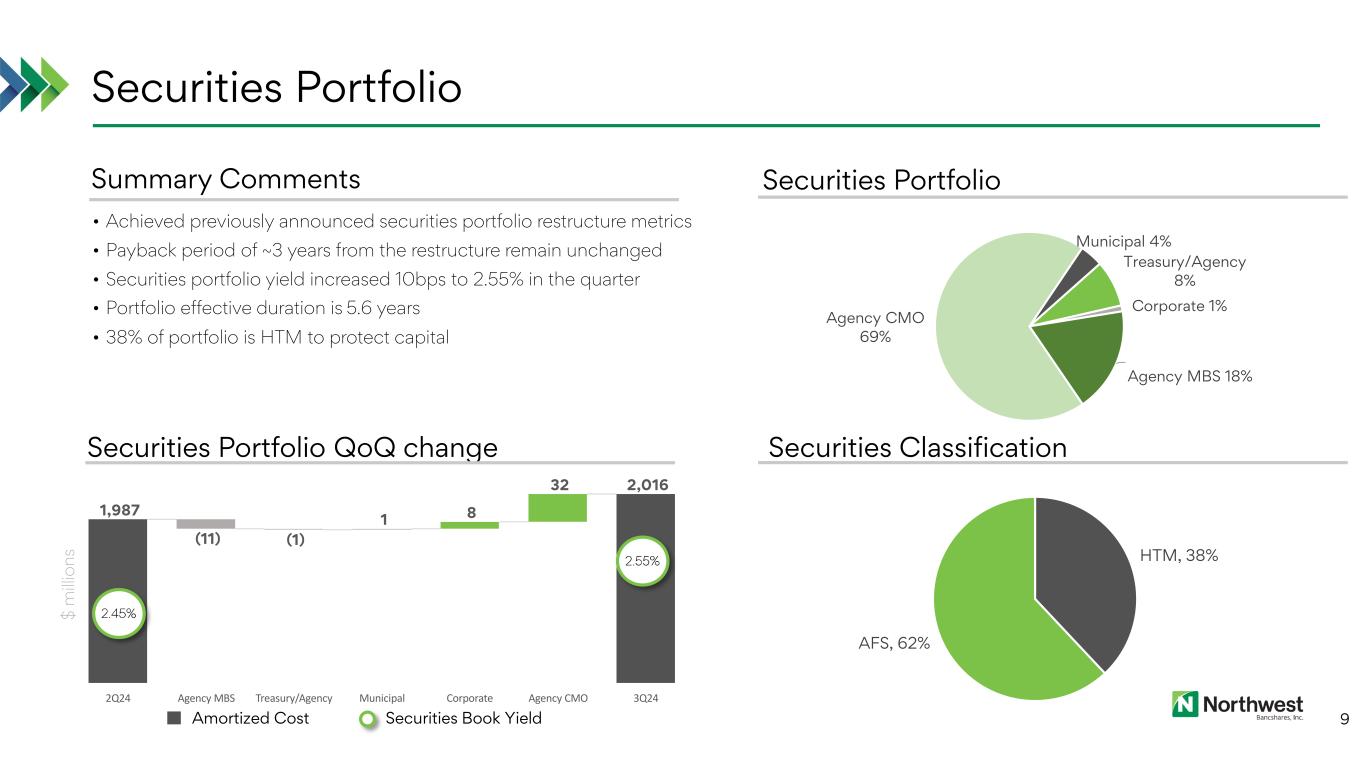

HTM, 38% AFS, 62% Municipal 4% Treasury/Agency 8% Corporate 1% Agency MBS 18% Agency CMO 69% 1,987 (11) (1) 1 8 32 2,016 2Q24 Agency MBS Treasury/Agency Municipal Corporate Agency CMO 3Q24 1,800 1,850 1,900 1,950 2,000 2,050 2,100 Securities Portfolio 9 • Achieved previously announced securities portfolio restructure metrics • Payback period of ~3 years from the restructure remain unchanged • Securities portfolio yield increased 10bps to 2.55% in the quarter • Portfolio effective duration is 5.6 years • 38% of portfolio is HTM to protect capital Summary Comments 2.55% 2.45% Securities Book Yield Securities Portfolio QoQ change Securities Portfolio $ m illi on s Amortized Cost Securities Classification

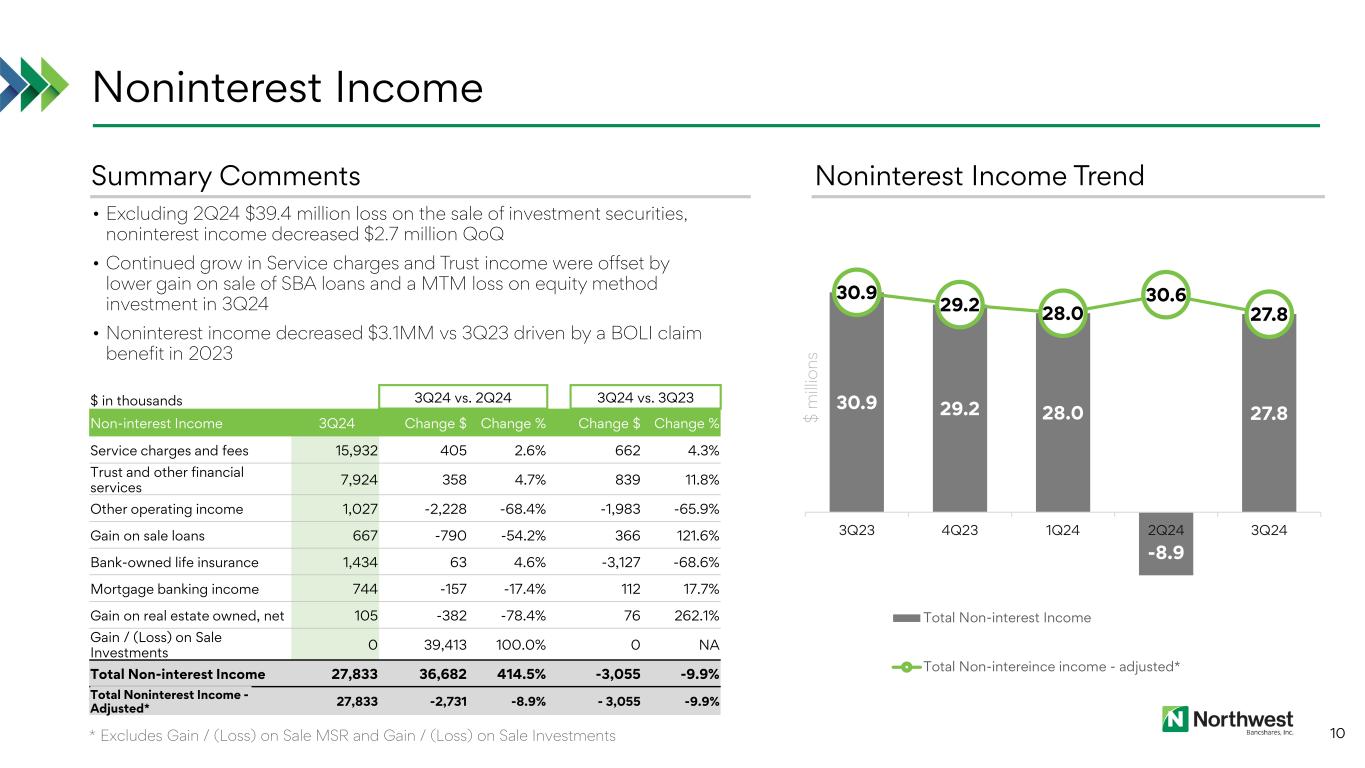

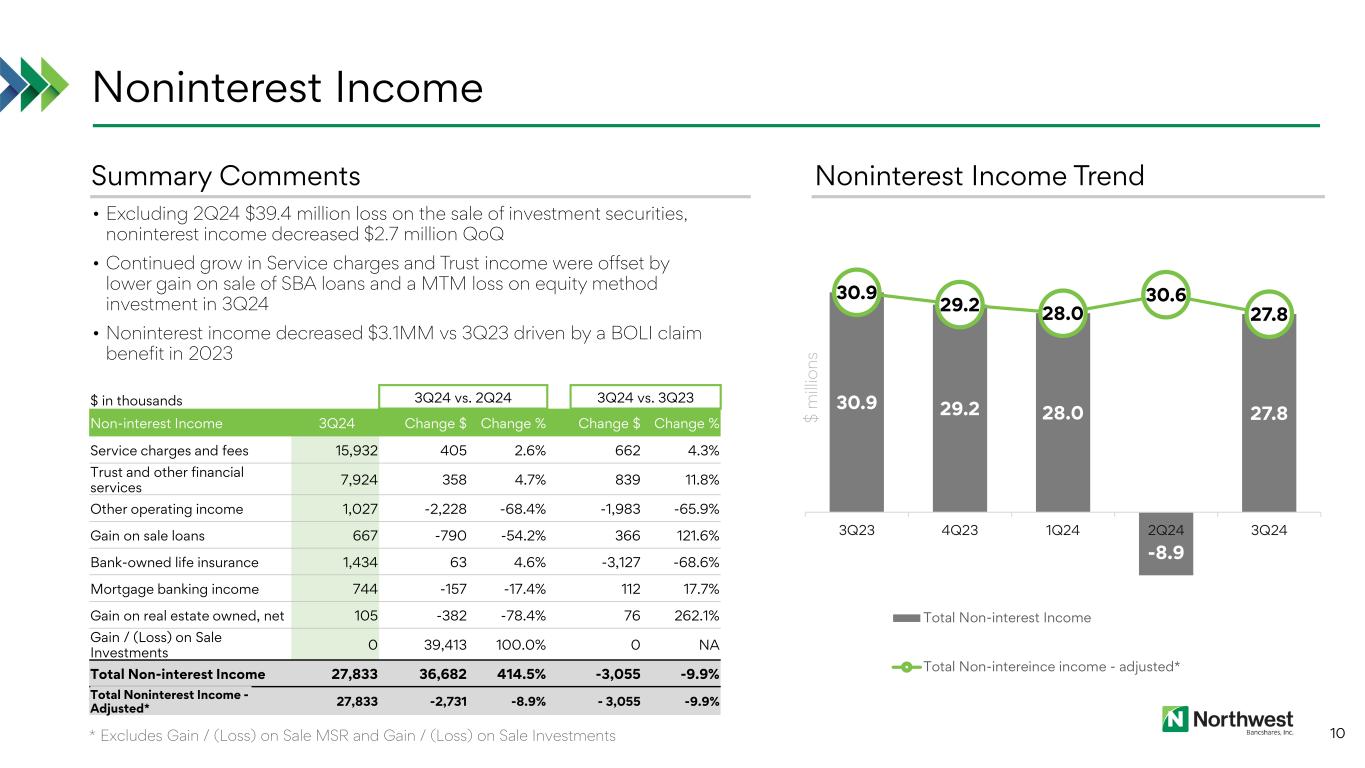

30.9 29.2 28.0 -8.9 27.8 30.9 29.2 28.0 30.6 27.8 (20.00) (10.00) - 10.00 20.00 30.00 40.00 3Q23 4Q23 1Q24 2Q24 3Q24 Total Non-interest Income Total Non-intereince income - adjusted* Noninterest Income 10 • Excluding 2Q24 $39.4 million loss on the sale of investment securities, noninterest income decreased $2.7 million QoQ • Continued grow in Service charges and Trust income were offset by lower gain on sale of SBA loans and a MTM loss on equity method investment in 3Q24 • Noninterest income decreased $3.1MM vs 3Q23 driven by a BOLI claim benefit in 2023 Summary Comments Noninterest Income Trend $ m illi on s $ in thousands 3Q24 vs. 2Q24 3Q24 vs. 3Q23 Non-interest Income 3Q24 Change $ Change % Change $ Change % Service charges and fees 15,932 405 2.6% 662 4.3% Trust and other financial services 7,924 358 4.7% 839 11.8% Other operating income 1,027 -2,228 -68.4% -1,983 -65.9% Gain on sale loans 667 -790 -54.2% 366 121.6% Bank-owned life insurance 1,434 63 4.6% -3,127 -68.6% Mortgage banking income 744 -157 -17.4% 112 17.7% Gain on real estate owned, net 105 -382 -78.4% 76 262.1% Gain / (Loss) on Sale Investments 0 39,413 100.0% 0 NA Total Non-interest Income 27,833 36,682 414.5% -3,055 -9.9% Total Noninterest Income - Adjusted* 27,833 -2,731 -8.9% - 3,055 -9.9% * Excludes Gain / (Loss) on Sale MSR and Gain / (Loss) on Sale Investments

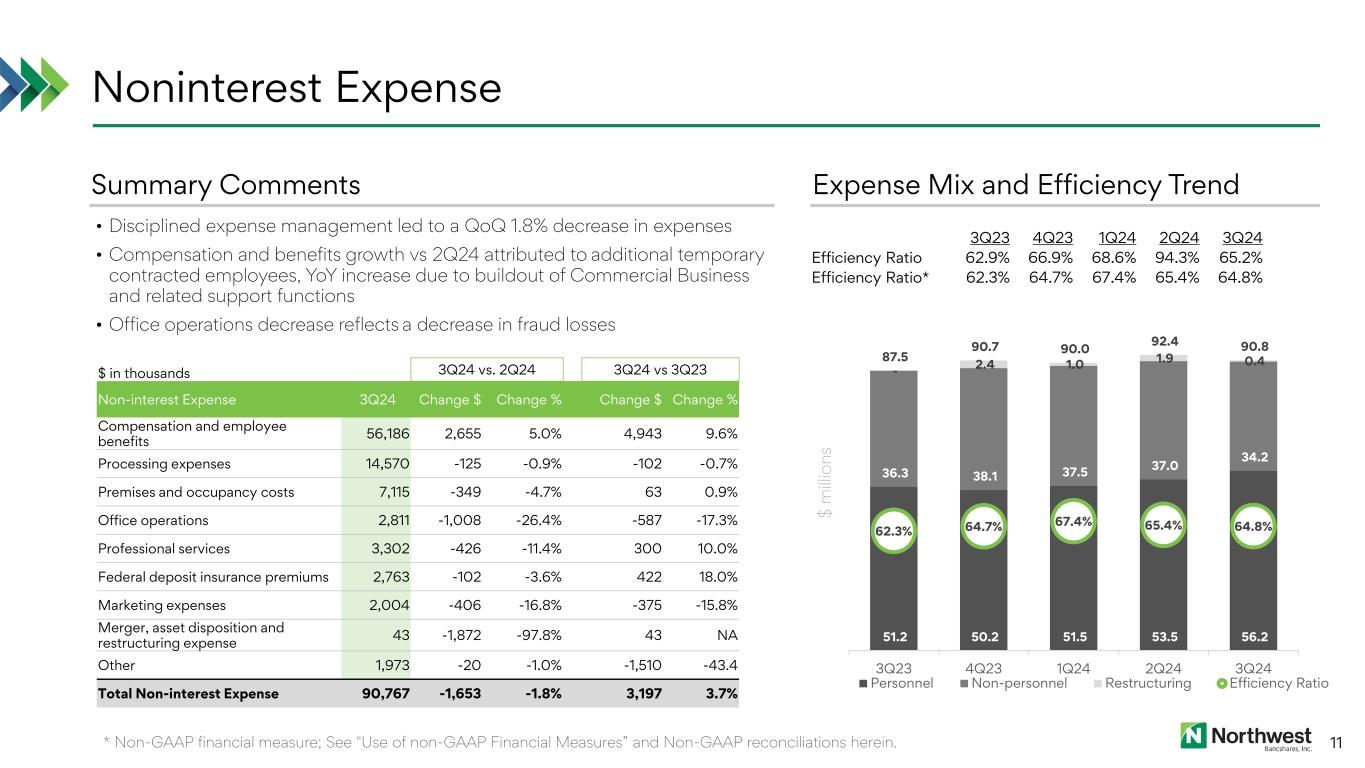

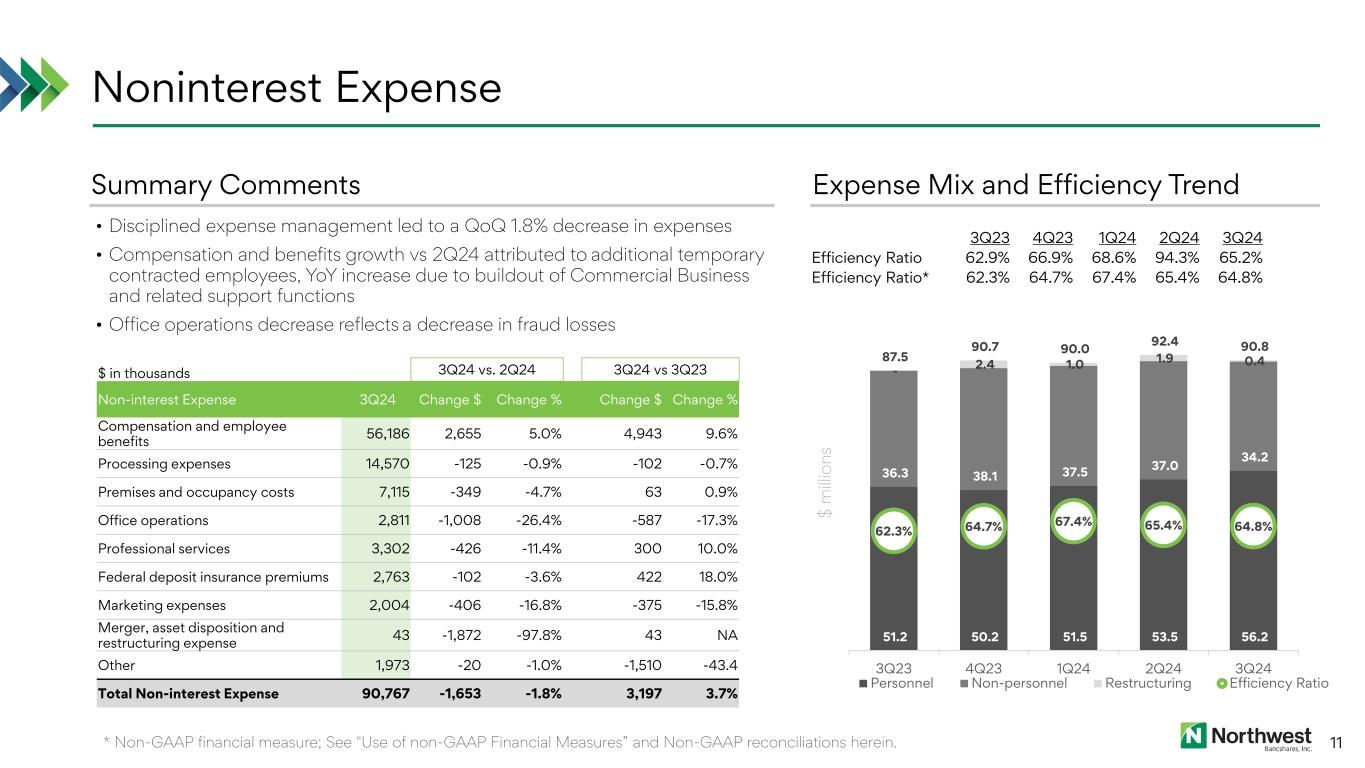

51.2 50.2 51.5 53.5 56.2 36.3 38.1 37.5 37.0 34.2 - 2.4 1.0 1.9 0.4 87.5 90.7 90.0 92.4 90.8 62.3% 64.7% 67.4% 65.4% 64.8% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% 160.0% 180.0% 200.0% - 20.0 40.0 60.0 80.0 100.0 120.0 3Q23 4Q23 1Q24 2Q24 3Q24 Personnel Non-personnel Restructuring Efficiency Ratio Noninterest Expense 11 • Disciplined expense management led to a QoQ 1.8% decrease in expenses • Compensation and benefits growth vs 2Q24 attributed to additional temporary contracted employees, YoY increase due to buildout of Commercial Business and related support functions • Office operations decrease reflects a decrease in fraud losses Summary Comments Expense Mix and Efficiency Trend $ m illi on s * Non-GAAP financial measure; See "Use of non-GAAP Financial Measures” and Non-GAAP reconciliations herein. $ in thousands 3Q24 vs. 2Q24 3Q24 vs 3Q23 Non-interest Expense 3Q24 Change $ Change % Change $ Change % Compensation and employee benefits 56,186 2,655 5.0% 4,943 9.6% Processing expenses 14,570 -125 -0.9% -102 -0.7% Premises and occupancy costs 7,115 -349 -4.7% 63 0.9% Office operations 2,811 -1,008 -26.4% -587 -17.3% Professional services 3,302 -426 -11.4% 300 10.0% Federal deposit insurance premiums 2,763 -102 -3.6% 422 18.0% Marketing expenses 2,004 -406 -16.8% -375 -15.8% Merger, asset disposition and restructuring expense 43 -1,872 -97.8% 43 NA Other 1,973 -20 -1.0% -1,510 -43.4 Total Non-interest Expense 90,767 -1,653 -1.8% 3,197 3.7% 3Q23 4Q23 1Q24 2Q24 3Q24 Efficiency Ratio 62.9% 66.9% 68.6% 94.3% 65.2% Efficiency Ratio* 62.3% 64.7% 67.4% 65.4% 64.8%

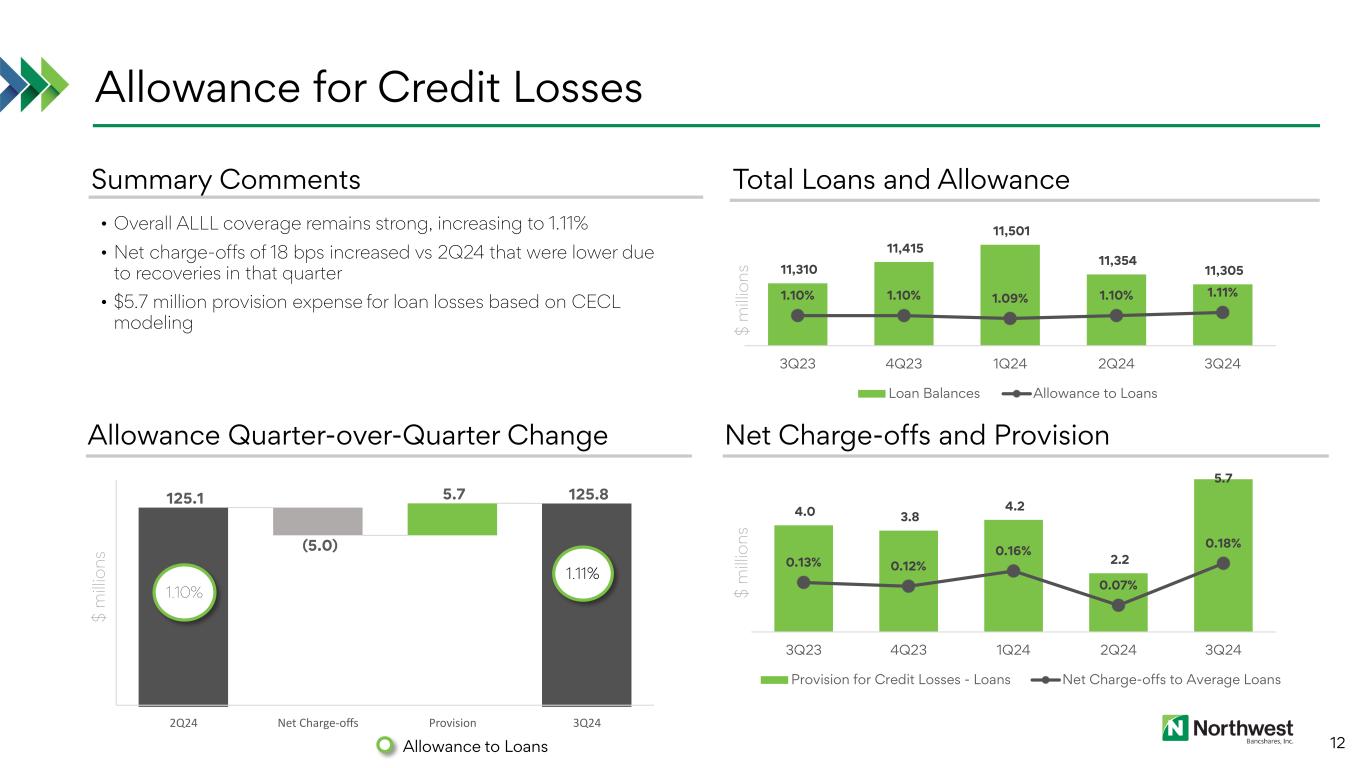

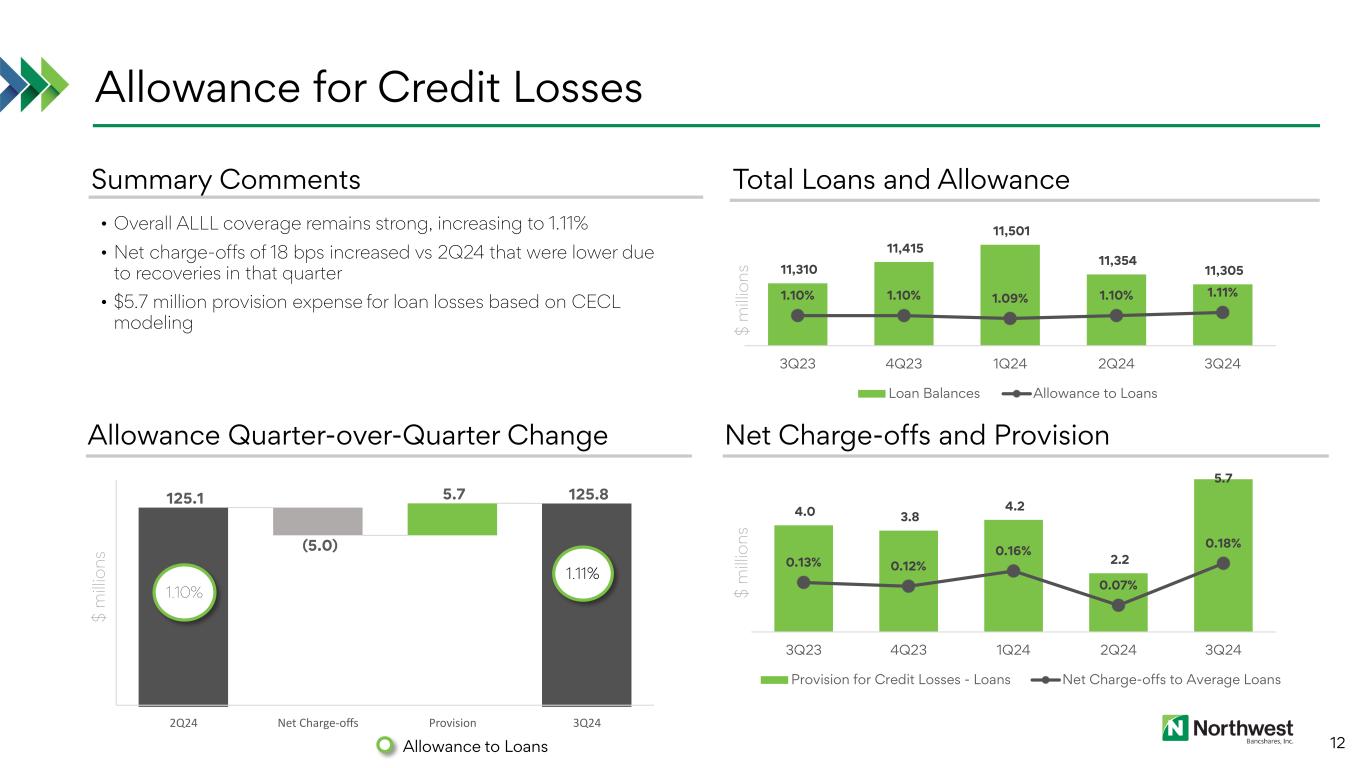

125.1 (5.0) 5.7 125.8 2Q24 Net Charge-offs Provision 3Q24 90.0 95.0 100.0 105.0 110.0 115.0 120.0 125.0 130.0 Allowance for Credit Losses 12 $ m illi on s • Overall ALLL coverage remains strong, increasing to 1.11% • Net charge-offs of 18 bps increased vs 2Q24 that were lower due to recoveries in that quarter • $5.7 million provision expense for loan losses based on CECL modeling Summary Comments Allowance Quarter-over-Quarter Change Total Loans and Allowance $ m illi on s Net Charge-offs and Provision $ m illi on s 1.11% 1.10% Allowance to Loans 11,310 11,415 11,501 11,354 11,305 1.10% 1.10% 1.09% 1.10% 1.11% 1.00% 1.10% 1.20% 1.30% 1.40% 11,000 11,100 11,200 11,300 11,400 11,500 11,600 3Q23 4Q23 1Q24 2Q24 3Q24 Loan Balances Allowance to Loans 4.0 3.8 4.2 2.2 5.7 0.13% 0.12% 0.16% 0.07% 0.18% 0.00% 0.06% 0.12% 0.18% 0.24% 0.30% 0.36% 0.42% 0.48% - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 3Q23 4Q23 1Q24 2Q24 3Q24 Provision for Credit Losses - Loans Net Charge-offs to Average Loans

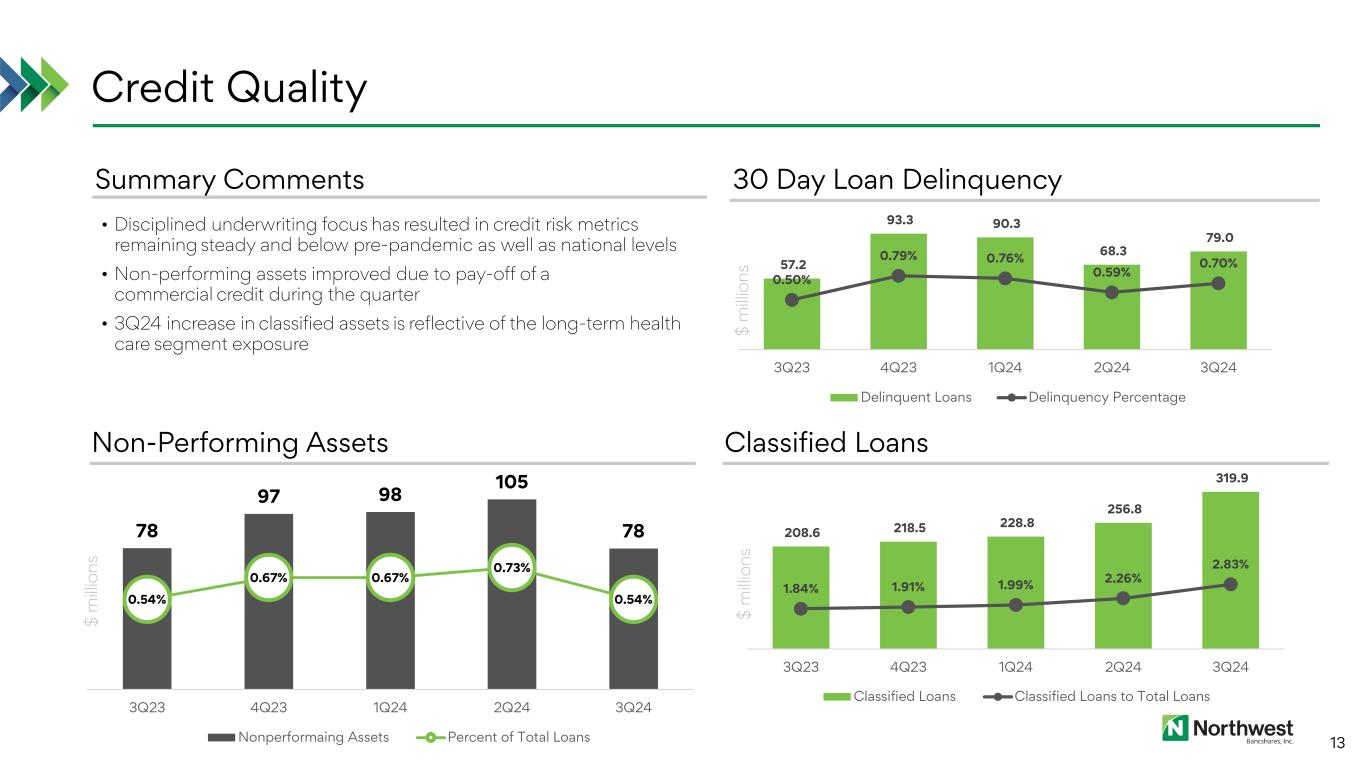

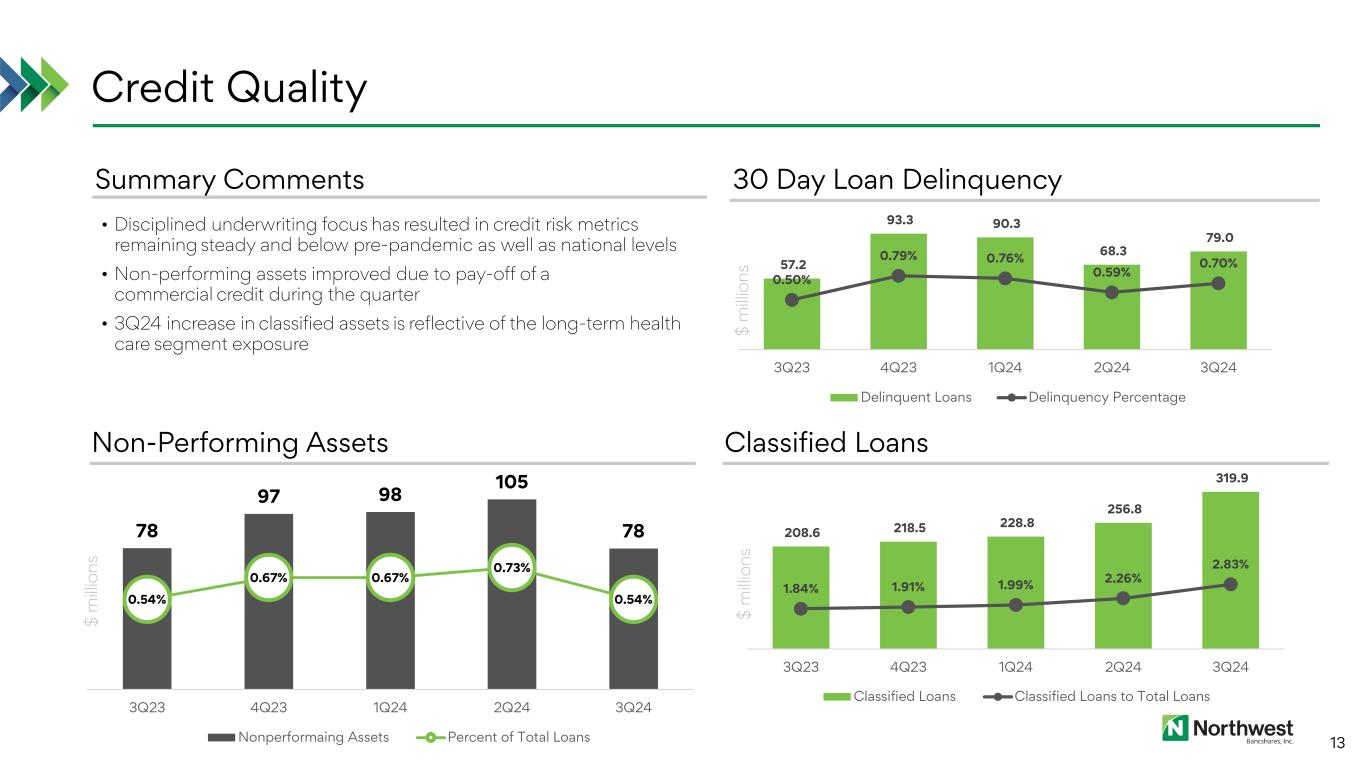

208.6 218.5 228.8 256.8 319.9 1.84% 1.91% 1.99% 2.26% 2.83% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% (10.0) 40.0 90.0 140.0 190.0 240.0 290.0 340.0 3Q23 4Q23 1Q24 2Q24 3Q24 Classified Loans Classified Loans to Total Loans Credit Quality 13 $ m illi on s • Disciplined underwriting focus has resulted in credit risk metrics remaining steady and below pre-pandemic as well as national levels • Non-performing assets improved due to pay-off of a commercial credit during the quarter • 3Q24 increase in classified assets is reflective of the long-term health care segment exposure Summary Comments Non-Performing Assets 30 Day Loan Delinquency $ m illi on s Classified Loans $ m illi on s 57.2 93.3 90.3 68.3 79.0 0.50% 0.79% 0.76% 0.59% 0.70% -0.10% 0.40% 0.90% 1.40% - 20.0 40.0 60.0 80.0 100.0 3Q23 4Q23 1Q24 2Q24 3Q24 Delinquent Loans Delinquency Percentage 78 97 98 105 78 0.54% 0.67% 0.67% 0.73% 0.54% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 0 20 40 60 80 100 120 3Q23 4Q23 1Q24 2Q24 3Q24 Nonperformaing Assets Percent of Total Loans

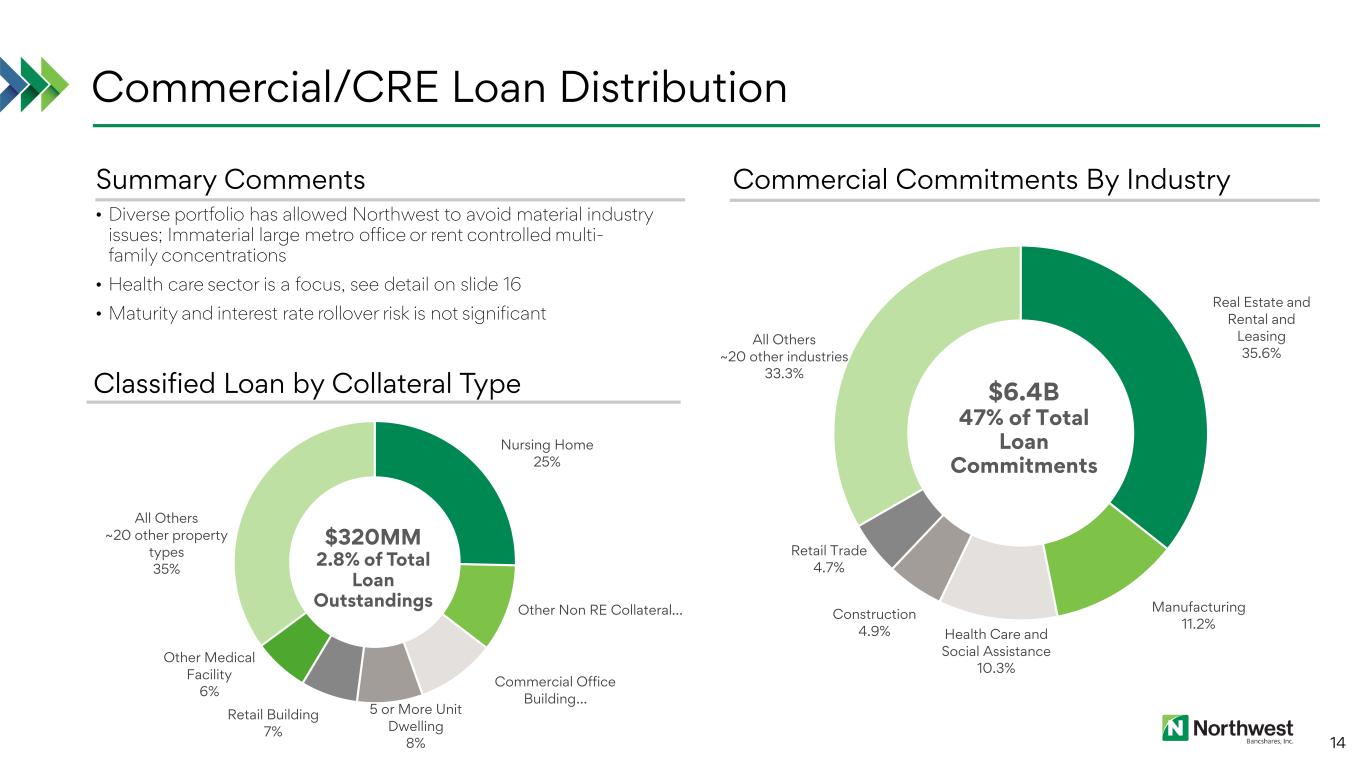

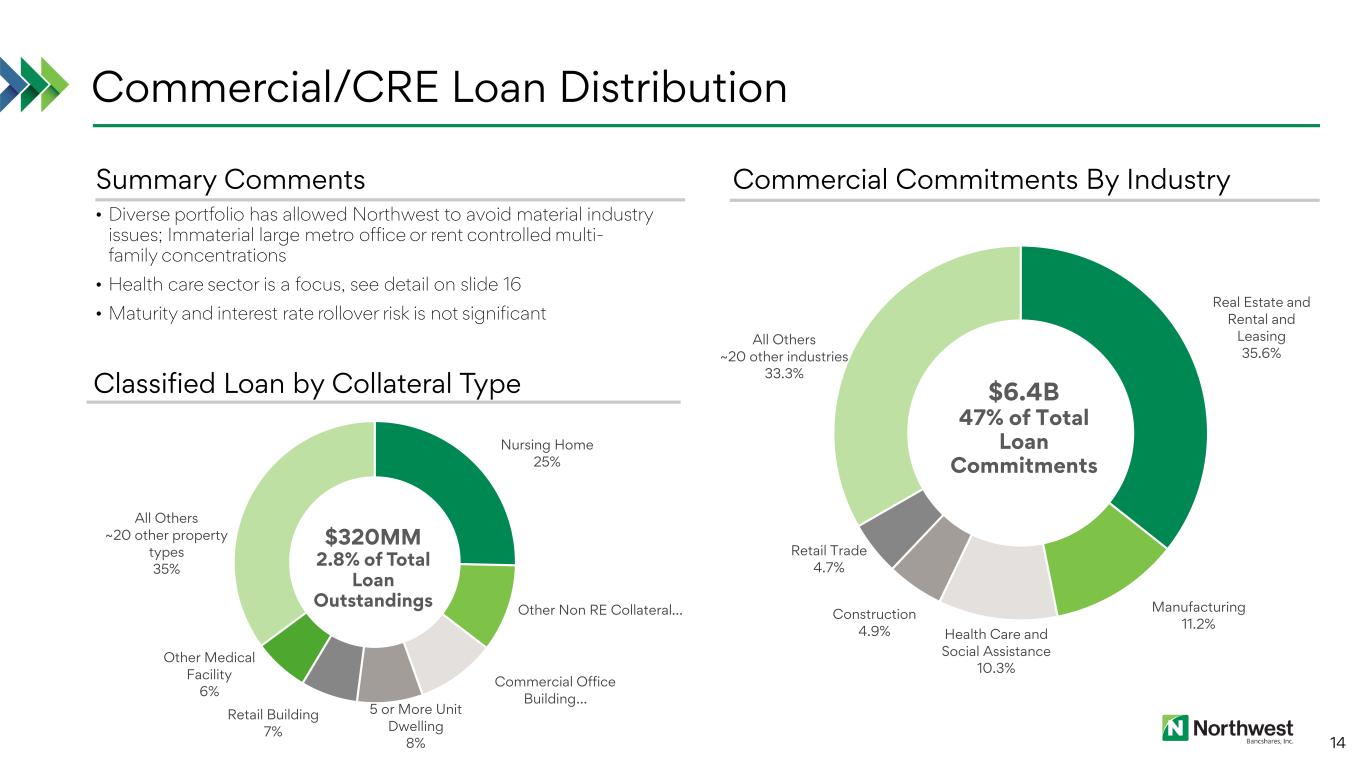

Nursing Home 25% Other Non RE Collateral… Commercial Office Building… 5 or More Unit Dwelling 8% Retail Building 7% Other Medical Facility 6% All Others ~20 other property types 35% Commercial/CRE Loan Distribution 14 • Diverse portfolio has allowed Northwest to avoid material industry issues; Immaterial large metro office or rent controlled multi- family concentrations • Health care sector is a focus, see detail on slide 16 • Maturity and interest rate rollover risk is not significant Classified Loan by Collateral Type Commercial Commitments By IndustrySummary Comments Real Estate and Rental and Leasing 35.6% Manufacturing 11.2% Health Care and Social Assistance 10.3% Construction 4.9% Retail Trade 4.7% All Others ~20 other industries 33.3% $6.4B 47% of Total Loan Commitments $320MM 2.8% of Total Loan Outstandings

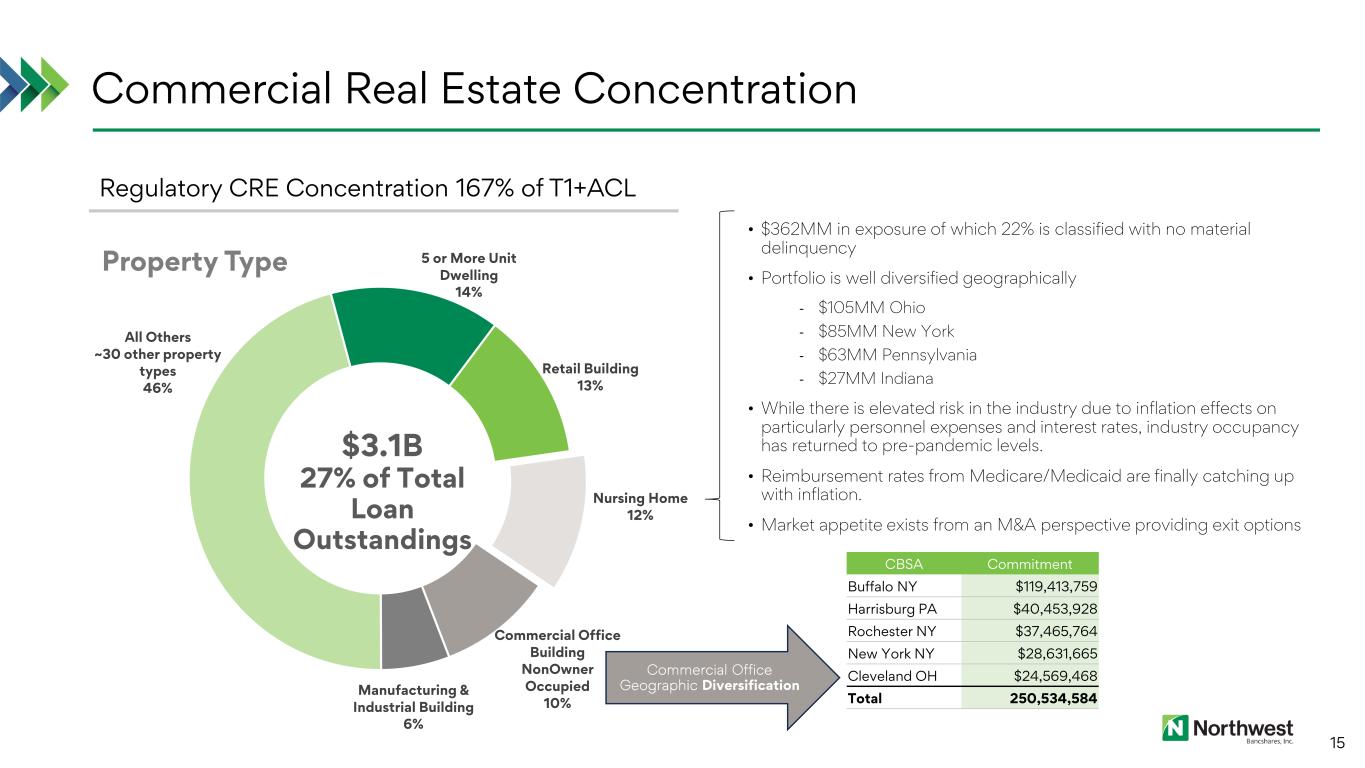

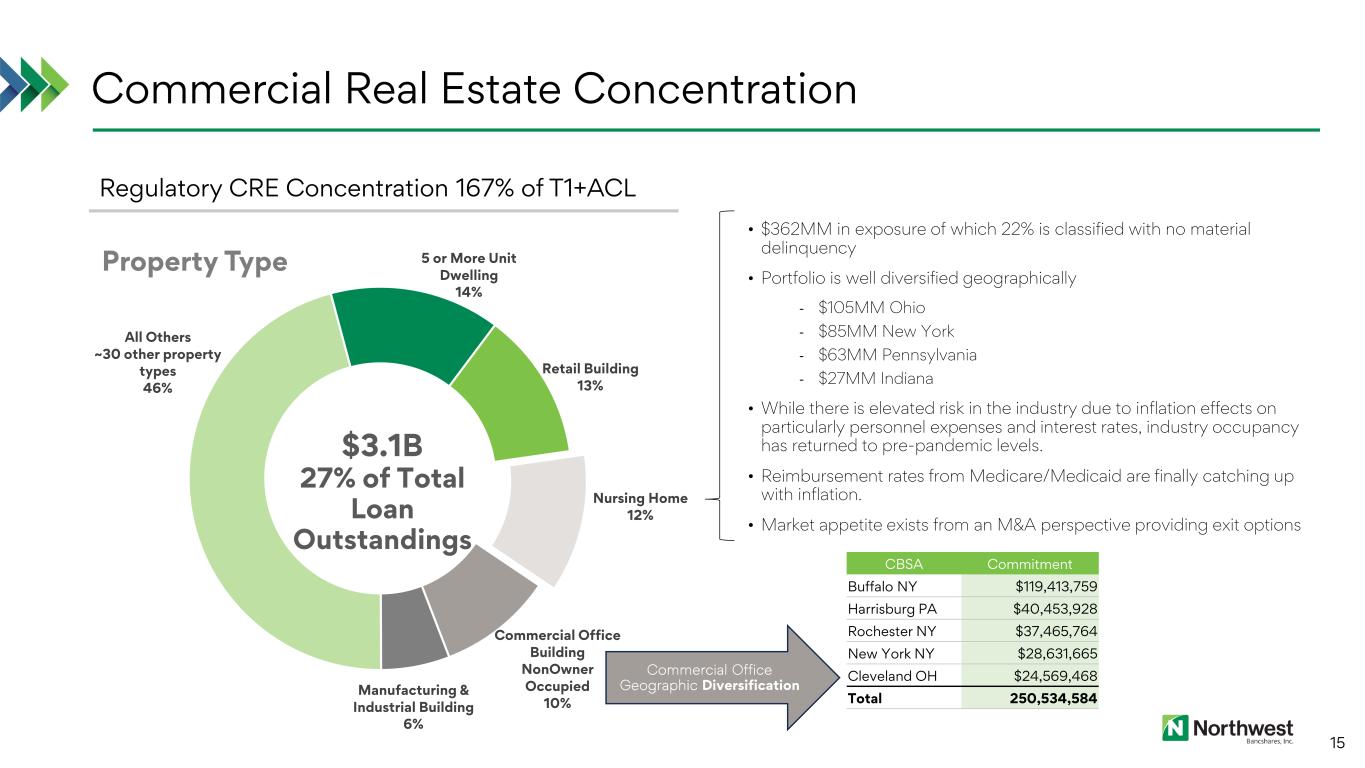

5 or More Unit Dwelling 14% Retail Building 13% Nursing Home 12% Commercial Office Building NonOwner Occupied 10% Manufacturing & Industrial Building 6% All Others ~30 other property types 46% $3.1B 27% of Total Loan Outstandings Commercial Real Estate Concentration 15 • $362MM in exposure of which 22% is classified with no material delinquency • Portfolio is well diversified geographically - $105MM Ohio - $85MM New York - $63MM Pennsylvania - $27MM Indiana • While there is elevated risk in the industry due to inflation effects on particularly personnel expenses and interest rates, industry occupancy has returned to pre-pandemic levels. • Reimbursement rates from Medicare/Medicaid are finally catching up with inflation. • Market appetite exists from an M&A perspective providing exit options Regulatory CRE Concentration 167% of T1+ACL Property Type Commercial Office Geographic Diversification CBSA Commitment Buffalo NY $119,413,759 Harrisburg PA $40,453,928 Rochester NY $37,465,764 New York NY $28,631,665 Cleveland OH $24,569,468 Total 250,534,584

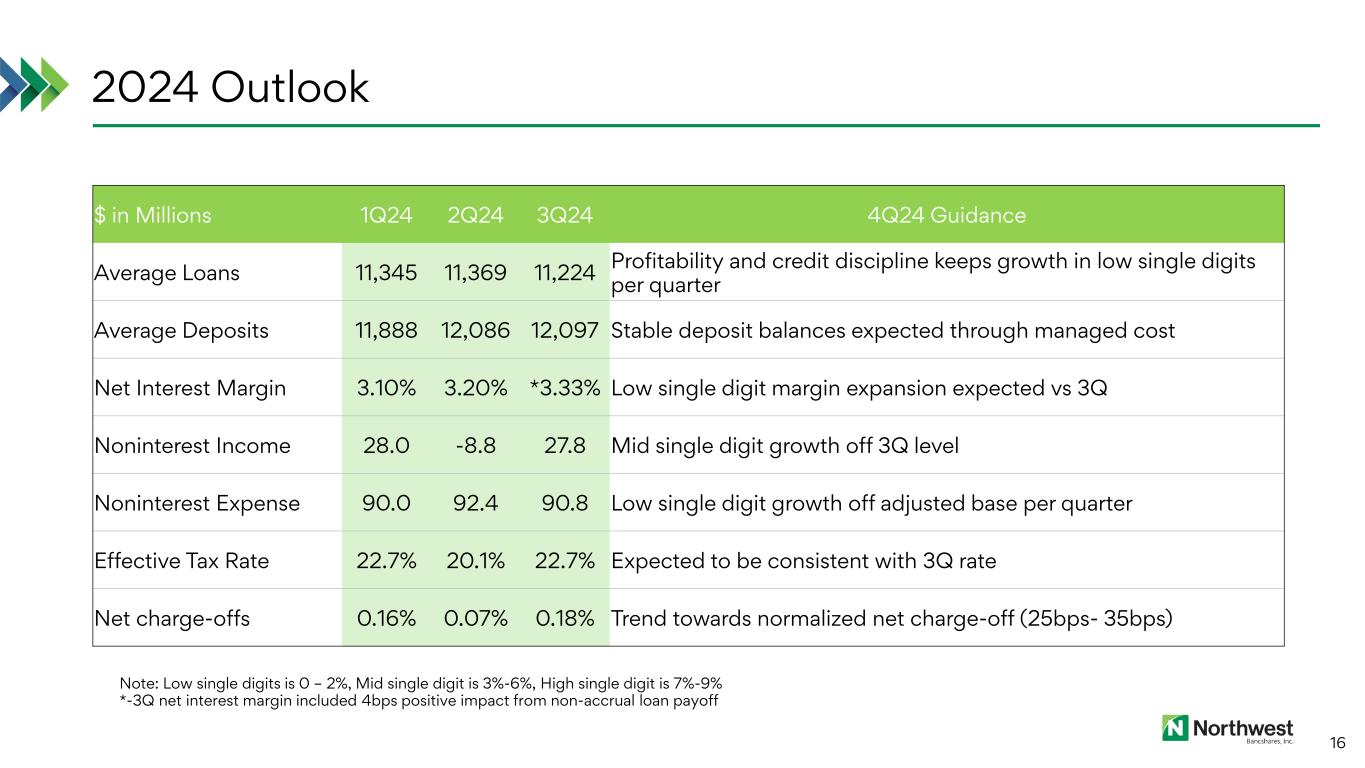

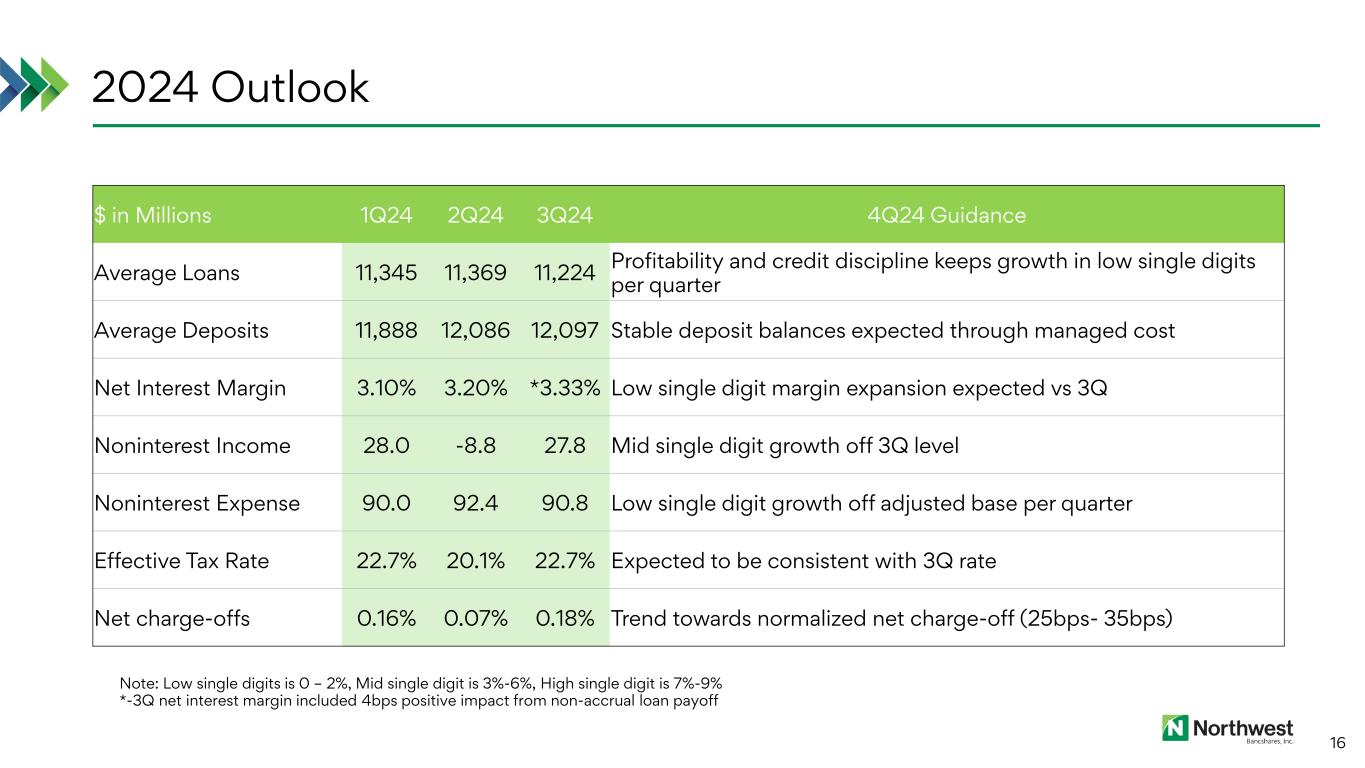

2024 Outlook 16 $ in Millions 1Q24 2Q24 3Q24 4Q24 Guidance Average Loans 11,345 11,369 11,224 Profitability and credit discipline keeps growth in low single digits per quarter Average Deposits 11,888 12,086 12,097 Stable deposit balances expected through managed cost Net Interest Margin 3.10% 3.20% *3.33% Low single digit margin expansion expected vs 3Q Noninterest Income 28.0 -8.8 27.8 Mid single digit growth off 3Q level Noninterest Expense 90.0 92.4 90.8 Low single digit growth off adjusted base per quarter Effective Tax Rate 22.7% 20.1% 22.7% Expected to be consistent with 3Q rate Net charge-offs 0.16% 0.07% 0.18% Trend towards normalized net charge-off (25bps- 35bps) Note: Low single digits is 0 – 2%, Mid single digit is 3%-6%, High single digit is 7%-9% *-3Q net interest margin included 4bps positive impact from non-accrual loan payoff

Non-GAAP Reconciliation 17*Dollars in thousands, except per share amounts

Non-GAAP Reconciliation – Continued 18 *Dollars in thousands