“NWBI” NASDAQGS Market Price - $13.72 April 19, 2016

Forward Looking Statements • This presentation contains forward-looking statements, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and words of similar meaning. These forward-looking statements include, but are not limited to: • statements of our goals, intentions and expectations; • statements regarding our business plans, prospects, growth and operating strategies; • statements regarding the asset quality of our loan and investment portfolios; and • estimates of our risks and future costs and benefits. • These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.. • The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: • changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; • general economic conditions, either nationally or in our market areas, that are worse than expected; • competition among depository and other financial institutions; • inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; • adverse changes in the securities markets; • our ability to enter new markets successfully and capitalize on growth opportunities; • our ability to successfully integrate acquired entities, if any; • changes in consumer spending, borrowing and savings habits; • changes in our organization, compensation and benefit plans; • our ability to continue to increase and manage our commercial and residential real estate, multi-family, and commercial and industrial loans; • possible impairments of securities held by us, including those issued by government entities and government sponsored enterprises; • the level of future deposit premium assessments; • the impact of the current recession on our loan portfolio (including cash flow and collateral values), investment portfolio, customers and capital market activities; • the impact of the current governmental effort to restructure the U.S. financial and regulatory system; • changes in the financial performance and/or condition of our borrowers; and • the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Securities and • Exchange Commission, the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters. • Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. 2

Attractive Franchise 3

Corporate Profile and Overview • 176 full service retail banking locations • 51 consumer finance locations • 2,186 full-time equivalent employees (2,007 full-time and 357 part-time employees) • Total assets of $8.95 billion • Net loans of $7.16 billion • Deposits of $6.61 billion • Tangible shareholders’ equity of $892 million Market Capitalization • Market capitalization of $1.38 billion* 4 * Based on a market price of $13.50 per share.

HISTORIC PERFORMANCE

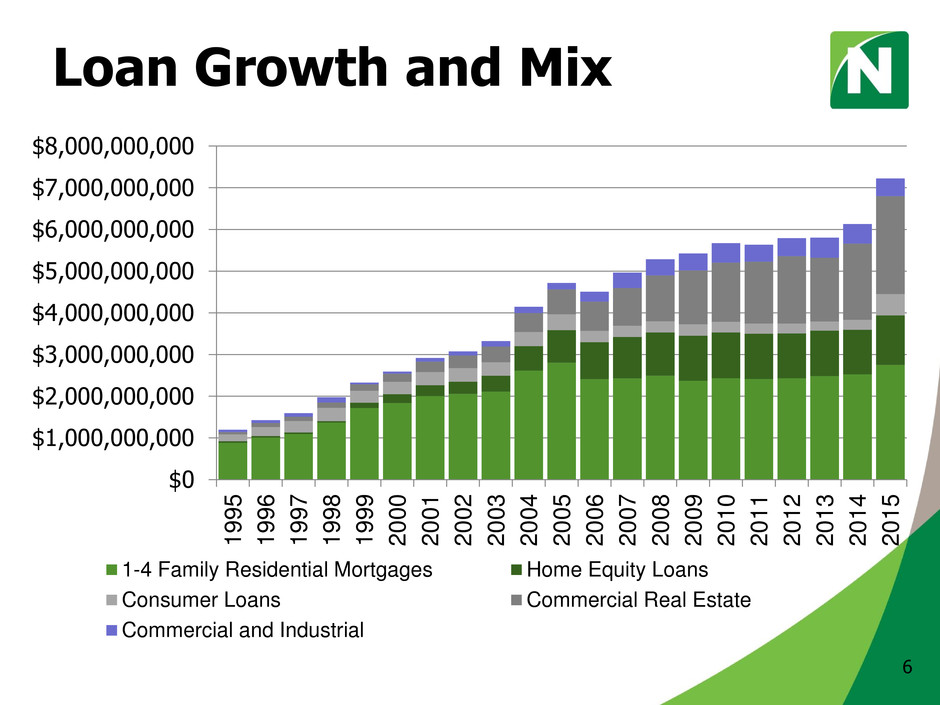

Loan Growth and Mix $0 $1,000,000,000 $2,000,000,000 $3,000,000,000 $4,000,000,000 $5,000,000,000 $6,000,000,000 $7,000,000,000 $8,000,000,000 199 5 199 6 199 7 199 8 199 9 200 0 200 1 200 2 200 3 200 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 201 5 1-4 Family Residential Mortgages Home Equity Loans Consumer Loans Commercial Real Estate Commercial and Industrial 6

Deposit Growth and Mix $0 $1,000,000,000 $2,000,000,000 $3,000,000,000 $4,000,000,000 $5,000,000,000 $6,000,000,000 $7,000,000,000 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 Savings Accounts Checking Accounts Money Market Accounts Certificates of Deposit 7

Net Income (in millions of dollars) $16.3 $18.1 $20.4 $22.2 $23.9 $30.9 $31.4 $37.9 $40.0 $48.9 $57.8 $53.0 $53.5 $58.9 $48.5 $61.1 $67.0 $67.4 $66.0 $60.6 $68.0 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 D e c, 2 0 0 5 D e c, 2 0 0 6 D e c, 2 0 0 7 D e c, 2 0 0 8 D e c, 2 0 0 9 D e c, 2 0 1 0 D e c, 2 0 1 1 D e c, 2 0 1 2 D e c, 2 0 1 3 D e c, 2 0 1 4 D e c, 2 0 1 5 Excluding Gains and Losses on Sale of Assets, Write-Down on Assets, Amortization of Intangibles, Acquisition Expenses and Loss on Extinguishment of Debt 8

Earnings Per Share (Adjusted for Stock Splits and 2.25x Second-step Conversion) $0.13 $0.20 $0.19 $0.25 $0.25 $0.37 $0.39 $0.46 $0.49 $0.46 $0.44 $0.44 $0.30 $0.53 $0.64 $0.68 $0.73 $0.68 $0.71 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 1 9 9 7 199 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 200 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 * 9 *Excludes $6.47 million, after tax, of acquisition expenses ($.07 per share)

STOCK PERFORMANCE AND PER SHARE INFORMATION

Price Performance Since IPO 11 COMPARISON OF CUMULATIVE TOTAL RETURN SINCE IPO IN 1994 Among Northwest Bancshares, Inc., the NASDAQ Composite Index and the NASDAQ Bank Index

Annual Dividends Per Share $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 Current Dividend Yield - $.60/$13.50 = 4.44% 12

HIGHLIGHTS FOR 2015

Highlights for 2015 Shareholder Value • Paid regular dividends of $.56 for an approximate dividend yield that exceeded 4.0%. • The market value of Northwest shares increased $.86, or 6%, during 2015. • The combined return on Northwest shares in 2015 exceeded 10%, placing Northwest in an exclusive group among publicly traded companies. • The acquisition of LNB created dilution in tangible book value per share of approximately $.60, or 6.4%. Annual earnings per share accretion is expected to be approximately $.12, resulting in a projected five-year earnback. 14

Highlights for 2015 Meeting Regulatory Expectations • Continued to strengthen our Enterprise Risk Management program to meet the expectations of a $10 billion bank. o Launched projects to strengthen the management of vendor risk, interest rate risk, liquidity risk and credit risk. o Initiated the development of a plan to implement capital stress testing as mandated by Dodd-Frank for banks with assets in excess of $10 billion. Implementation period will be 2-3 years with a cost of $4 million. When fully implemented, the ongoing annual cost is estimated to be approximately $2.5 million. o Revised the responsibilities and the process for the lending and credit functions to provide for greater accountability, improved collaboration and enhanced credit quality. 15

DIVISION UPDATE Production and Revenue Enhancement Division Steven G. Fisher, Chief Revenue Officer 16

Division Charge “Utilizing highly-effective sales processes to enhance customer procurement, deepen customer relationships and promote revenue growth.” Areas of Responsibility Region Presidents and Office Network Commercial Lending Wealth Management Retirement Services Insurance Marketing Sales Senior EVP Steven Fisher Chief Revenue Officer Production and Revenue Enhancement Division 17

Production and Revenue Team Highlights for 2015 • Integration of LNB production personnel • Realignment of commercial lending team: • Mike Bickerton named EVP, Commercial Lending • Neil Hoffman named SVP, C & I Lending • Neil Aquino named SVP, Commercial Real Estate Lending • Forrest Tefft named SVP, Corporate Finance • Kirk Jacobson named SVP, Small Business Lending and SBA Lending • Significant growth in our two primary areas of focus: • Loans - originated $2.3 billion of new loans with net loan growth of $304.1 million, or 5% • Checking - opened 23,483 new checking accounts with checking account balances increasing by $163.5 million, or 9% • As a result of the growth in loans and checking, our net interest margin increased to 3.49% in 2015 from 3.47% in the prior year. 18

Production and Revenue Team Highlights for 2015 • Strengthened our business development teams under the leadership of our seven regional presidents. • Began rolling out the new Northwest brand to better establish Northwest as a full-service commercial bank while shedding our long-standing image as a limited service thrift institution. • With this change, our name was shortened to “Northwest Bank.” • Wealth assets under management and administration increased by $70 million to $2.1 billion or 3.42% from the prior year. • In line with our strategy to grow Insurance Services, we acquired the Petruso Agency and added a new producer in our Northwest Region. 19

DIVISION UPDATE Technology, Operations, Finance and Support Division William W. Harvey, Jr., Chief Financial Officer 20

Senior EVP William Harvey Chief Financial Officer Technology, Operations, Finance and Support Division Division Charge “Providing reliable support to all areas of our company while utilizing technology and streamlined processes to drive efficiency in all areas of our operations.” Areas of Responsibility Operations & Delivery Channels Info Technology/Process Improvement Finance Consumer Lending Facilities 21

Technology, Operations, Finance Team Highlights for 2015 • Full implementation of a modernized retail mortgage and home equity lending process which greatly improved turnaround times and customer satisfaction. • New process utilizes the consistency and efficiency of a staff of centralized, or virtual, lenders. • Advanced an initiative to optimize the efficiency of our branch network and announced the anticipated consolidation of 24 offices as well as the conversion of two full-service offices to drive-up facilities. • One time cost of $5.0 million. • Annual expense savings of $4.0 – $5.0 million. • Replaced all debit cards with EMV chip cards to enhance transaction security and fraud protection. 22

2015 FINANCIAL PERFORMANCE

Balance Sheet (Assets, Liabilities, Shareholders’ Equity) • Total assets grew by $1.18 billion, or 15%, primarily due to the acquisition of Lorain National Bank (LNB). • Loans increased $1.23 billion, or 20.6%, again primarily due to LNB. Organic loan growth was $304.1 million, or 5%. • The number of checking accounts increased by 29,710, or 11.4%, while checking account balances increased by $163.5 million, or 9%. • Shareholders’ equity increased by $100.5 million, or 9.5%, primarily as a result of the shares issued to purchase Lorain National Bank. Approximately 87% of our earnings from 2015 were distributed to shareholders via common stock dividends. • Our tangible common equity ratio of 10.28% as of December 31, 2015 provides significant excess capital to grow both internally and through acquisition. 24

12/31/2015 12/31/2014 12/31/2013 Amount ($ 000's) % Avg Assets Amount ($ 000's) % Avg Assets Amount ($ 000's) % Avg Assets A Net Interest Income $263,253 3.16% $248,840 3.15% $251,935 3.18% B Provision for Loan Losses ($9,712) (0.12%) ($20,314) (0.26%) ($18,519) (0.23%) C Noninterest Income $68,836 0.83% $70,766 0.90% $66,476 0.84% D Noninterest Expense ($224,126)* (2.69%) ($215,535) (2.73%) ($207,134) (2.61%) E Net Income/Return on Assets $67,012** 0.80% $61,962 0.79% $66,559 0.84% F Earnings Per Share, Diluted $.71** $0.67 $0.73 G Return on Shareholders’ Equity 6.08%** 5.69% 5.87% H Dividends Paid per Share $.56 $1.62 $0.50 I Closing Market Price $13.39 $12.53 $14.78 J P/TBV 1.53x 1.34x 1.42x K P/E 18.86x 18.70x 20.25x L Full Time Equivalent Employees 2,186 2,042 2,043 M # of full-service offices 176 162 165 25 Income Statement (Earnings and Shareholder Returns) * Excludes $9.75 million of acquisition expenses relating to the merger of Lorain National Bank. ** Excludes the after tax impact ($6.47 million, or $.07 per share) excluding the acquisition expenses relating to the merger of Lorain National Bank.

Asset Quality • Nonperforming assets decreased by $15.1 million, or 15.6%, to $81.7 million, or just .91% of assets, less than half of the ratio at December 31,2012. • Net loan charge-offs in 2015 were $14.6 million, or .23% of loans, the lowest level of charge-offs since 2007. 26

STRATEGIC DIRECTION

Strategic Direction Critical Issues A. Enhancing Shareholder Value • Enhancing Production Volume and Revenue Growth • Improving Profitability and Efficiency • Management of Capital B. Acquisition, Retention and Development of Talent C. Maintaining Effective Risk Management Oversight D. Crossing the $10 Billion Threshold E. Acquisitions will be pursued when they enhance our franchise and provide value to our shareholders. 28