Risk of Leverage and Volatility

If the Sponsor causes or permits the Fund to become leveraged, you could lose all or substantially all of your investment if the Fund’s trading positions suddenly turn unprofitable.

Commodity pools’ trading positions in futures contracts or other commodity interests are typically required to be secured by the deposit of margin funds that represent only a small percentage of a futures contract’s (or other commodity interest’s) entire market value. This feature permits commodity pools to “leverage” their assets by purchasing or selling futures contracts (or other commodity interests) with an aggregate face amount in excess of the commodity pool’s assets. While this leverage can increase a pool’s profits, relatively small adverse movements in the price of the pool’s commodity interests can cause significant losses to the pool. While the Sponsor does not intend to leverage the Fund’s assets, it is not prohibited from doing so under the Trust Agreement. If the Sponsor were to cause or permit the Fund to become leveraged, you could lose all or substantially all of your investment if the Fund’s trading positions suddenly turn unprofitable.

The price of corn can be volatile which could cause large fluctuations in the price of Shares.

Movements in the price of corn will be the result of factors outside of the Sponsor’s control and may not be anticipated by the Sponsor. As discussed in more detail above, price movements for corn are influenced by, among other things, weather conditions, crop disease, transportation difficulties, various planting, growing and harvesting problems, governmental policies, changing demand, and seasonal fluctuations in supply. More generally, commodity prices may be influenced by economic and monetary events such as changes in interest rates, changes in balances of payments and trade, U.S. and international inflation rates, currency valuations and devaluations, U.S. and international economic events, and changes in the philosophies and emotions of market participants. Because the Fund invests primarily in interests in a single commodity, it is not a diversified investment vehicle, and therefore may be subject to greater volatility than a diversified portfolio of stocks or bonds or a more diversified commodity pool.

Over-the-Counter Contract Risk

Over-the-counter transactions are subject to little, if any, regulation.

A portion of the Fund’s assets may be used to trade over-the-counter corn interests, such as forward contracts or swap or spot contracts. Over-the-counter contracts are typically traded on a principal-to-principal basis through dealer markets that are dominated by major money center and investment banks and other institutions and are essentially unregulated by the CFTC. You therefore do not receive the protection of CFTC regulation or the statutory scheme of the Commodity Exchange Act in connection with this trading activity. The markets for over-the-counter contracts rely upon the integrity of market participants in lieu of the additional regulation imposed by the CFTC on participants in the futures markets. The lack of regulation in these markets could expose the Fund in certain circumstances to significant losses in the event of trading abuses or financial failure by participants.

The Fund will be subject to credit risk with respect to counterparties to over-the-counter contracts entered into by the Fund.

The Fund faces the risk of non-performance by the counterparties to the over-the-counter contracts. Unlike in futures contracts, the counterparty to these contracts is generally a single bank or other financial institution, rather than a clearing organization backed by a group of financial institutions. As a result, there will be greater counterparty credit risk in these transactions. A counterparty may not be able to meet its obligations to the Fund, in which case the Fund could suffer significant losses on these contracts.

If a counterparty becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties, the Fund may experience significant delays in obtaining any recovery in a bankruptcy or other reorganization proceeding. During any such period, the Fund may have difficulty in determining the value of its contracts with the counterparty, which in turn could result in the overstatement or understatement of the Fund’s NAV. The Fund may eventually obtain only limited recovery or no recovery in such circumstances.

The Fund may be subject to liquidity risk with respect to its over-the-counter contracts.

Over-the-counter contracts may have terms that make them less marketable than futures contracts. Over-the-counter contracts are less marketable because they are not traded on an exchange, do not have uniform terms and conditions, and are entered into based upon the creditworthiness of the parties and the availability of credit support, such as collateral, and in general, they are not transferable without the consent of the counterparty. These conditions may diminish the ability to realize the full value of such contracts.

Risk of Trading in International Markets

Trading in international markets would expose the Fund to credit and regulatory risk.

The Sponsor may make substantial investments for the Fund in Corn Futures Contracts, a significant portion of which will be on United States exchanges including the CBOT. However, a portion of the Fund’s trades may take place on markets and exchanges outside the United States. Some non-U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. None of the CFTC, NFA, or any domestic exchange regulates activities of any foreign boards of trade or exchanges, including the execution, delivery and clearing of transactions, nor has the power to compel enforcement of the rules of a foreign board of trade or exchange or of any applicable non-U.S. laws. Similarly, the rights of market participants, such as the Fund, in the event of the insolvency or bankruptcy of a non-U.S. market or broker are also likely to be more limited than in the case of U.S. markets or brokers. As a result, in these markets, the Fund has less legal and regulatory protection than it does when it trades domestically.

In some of these non-U.S. markets, the performance on a futures contract is the responsibility of the counterparty and is not backed by an exchange or clearing corporation and therefore exposes the Fund to credit risk. Additionally, trading on non-U.S. exchanges is subject to the risks presented by exchange controls, expropriation, increased tax burdens and exposure to local economic declines and political instability. An adverse development with respect to any of these variables could reduce the profit or increase the loss earned on trades in the affected international markets.

International trading activities subject the Fund to foreign exchange risk.

The price of any non-U.S. Corn Interest and, therefore, the potential profit and loss on such investment, may be affected by any variance in the foreign exchange rate between the time the order is placed and the time it is liquidated, offset or exercised. As a result, changes in the value of the local currency relative to the U.S. dollar may cause losses to the Fund even if the contract is profitable.

The Fund’s international trading could expose it to losses resulting from non-U.S. exchanges that are less developed or less reliable than United States exchanges.

Some non-U.S. exchanges also may be in a more developmental stage so that prior price histories may not be indicative of current price dynamics. In addition, the Fund may not have the same access to certain positions on foreign trading exchanges as do local traders, and the historical market data on which the Sponsor bases its strategies may not be as reliable or accessible as it is for U.S. exchanges.

Tax Risk

Please refer to “U.S. Federal Income Tax Considerations” for information regarding the U.S. federal income tax consequences of the purchase, ownership and disposition of Shares.

Your tax liability from holding Shares may exceed the amount of distributions, if any, on your Shares.

Cash or property will be distributed at the sole discretion of the Sponsor, and the Sponsor currently does not intend to make cash or other distributions with respect to Shares. You will be required to pay U.S. federal income tax and, in some cases, state, local, or foreign income tax, on your allocable share of the Fund’s taxable income, without regard to whether you receive distributions or the amount of any distributions. Therefore, the tax liability resulting from your ownership of Shares may exceed the amount of cash or value of property (if any) distributed.

Your allocable share of income or loss for tax purposes may differ from your economic income or loss on your Shares.

Due to the application of the assumptions and conventions applied by the Fund in making allocations for tax purposes and other factors, your allocable share of the Fund’s income, gain, deduction or loss may be different than your economic profit or loss from your Shares for a taxable year. This difference could be temporary or permanent and, if permanent, could result in your being taxed on amounts in excess of your economic income.

Items of income, gain, deduction, loss and credit with respect to Shares could be reallocated if the IRS does not accept the assumptions and conventions applied by the Fund in allocating those items, with potential adverse consequences for you.

The Fund will be treated as a partnership for United States federal income tax purposes. The U.S. tax rules pertaining to entities taxed as partnerships are complex and their application to publicly traded partnerships such as the Fund is in many respects uncertain. The Fund will apply certain assumptions and conventions in an attempt to comply with the intent of the applicable rules and to report taxable income, gains, deductions, losses and credits in a manner that properly reflects Shareholders’ economic gains and losses. These assumptions and conventions may not fully comply with all aspects of the Internal Revenue Code (the “Code”) and applicable Treasury Regulations, however, and it is possible that the U.S. Internal Revenue Service will successfully challenge our allocation methods and require us to reallocate items of income, gain, deduction, loss or credit in a manner that adversely affects you. If this occurs, you may be required to file an amended tax return and to pay additional taxes plus deficiency interest.

The Fund could be treated as a corporation for federal income tax purposes, which may substantially reduce the value of your Shares.

The Trust has received an opinion of counsel that, under current U.S. federal income tax laws, the Fund will be treated as a partnership that is not taxable as a corporation for U.S. federal income tax purposes, provided that (i) at least 90 percent of the Fund’s annual gross income consists of “qualifying income” as defined in the Code, (ii) the Fund is organized and operated in accordance with its governing agreements and applicable law, and (iii) the Fund does not elect to be taxed as a corporation for federal income tax purposes. Although the Sponsor anticipates that the Fund has satisfied and will continue to satisfy the “qualifying income” requirement for all of its taxable years, that result cannot be assured. The Fund has not requested and will not request any ruling from the IRS with respect to its classification as a partnership not taxable as a corporation for federal income tax purposes. If the IRS were to successfully assert that the Fund is taxable as a corporation for federal income tax purposes in any taxable year, rather than passing through its income, gains, losses and deductions proportionately to Shareholders, the Fund would be subject to tax on its net income for the year at corporate tax rates. In addition, although the Sponsor does not currently intend to make distributions with respect to Shares, any distributions would be taxable to Shareholders as dividend income. Taxation of the Fund as a corporation could materially reduce the after-tax return on an investment in Shares and could substantially reduce the value of your Shares.

PROSPECTIVE INVESTORS ARE STRONGLY URGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE POSSIBLE TAX CONSEQUENCES TO THEM OF AN INVESTMENT IN SHARES; SUCH TAX CONSEQUENCES MAY DIFFER IN RESPECT OF DIFFERENT INVESTORS.

THE OFFERING

The Fund in General

The Fund is a series of the Trust, a statutory trust organized under the laws of the State of Delaware on September 11, 2009. The Fund is currently the only series of the Trust, although additional series may be offered in the future at the Sponsor’s discretion. The Fund maintains its main business office at 232 Hidden Lake Road, Building A, Brattleboro, Vermont 05301. The Fund is a commodity pool. It operates pursuant to the terms of the Trust Agreement dated as of [date] 2010, which grants full management control to the Sponsor.

The Fund is publicly traded, and seeks to have the daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of the price of corn for future delivery, as measured by the Benchmark, less the Fund’s expenses. The Fund will invest in a mixture of listed Corn Futures Contracts, Cleared Corn Swaps, Other Corn Interests, short-term Treasury Securities, cash and cash equivalents.

THE FUND HAS NOT COMMENCED TRADING AND DOES NOT HAVE ANY PERFORMANCE HISTORY.

The Sponsor

The Sponsor of the Trust is Teucrium Trading, LLC, a Delaware limited liability company. The principal office of the Sponsor and the Trust are located at 232 Hidden Lake Road, Building A, Brattleboro, Vermont 05301. The Sponsor registered as a CPO with the CFTC and became a member of the NFA on November 10, 2009.

The Sponsor established the Trust and the Fund and registered the Shares of the Fund covered by this prospectus. Aside from this activity and obtaining capital from a small number of outside investors in order to engage in this activity, the Sponsor did not engage in any business activity prior to the date of this prospectus. Under the Trust Agreement, the Sponsor is solely responsible for the management and conducts or directs the conduct of the business of the Trust, the Fund, and any other series of the Trust that may from time to time be established and designated by the Sponsor. The Sponsor is required to oversee the purchase and sale of Shares by Authorized Purchasers and to manage the Fund’s investments, including to evaluate the credit risk of futures commission merchants and swap counterparties and to review daily positions and margin/collateral requirements. The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Fund’s Shares and the conduct of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting the Trustee, Administrator, Marketing Agent, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust. The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and will provide any required certification for such reports. No person other than the Sponsor and its principals was involved in the organization of the Trust or the Fund.

The Marketing Agent will assist the Sponsor in marketing the Shares. The Sponsor may determine to engage additional or successor marketing agents. See “Plan of Distribution” for more information about the Marketing Agent.

The Sponsor maintains a public website on behalf of the Fund, www.teucriumcornfund.com, which contains information about the Trust, the Fund, and the Shares, and oversees certain services for the benefit of Shareholders.

The Sponsor has discretion to appoint one or more of its affiliates as additional Sponsors.

The Sponsor receives a fee as compensation for services performed under the Trust Agreement. The Sponsor’s fee accrues daily and is paid monthly at an annual rate of 1.00% of the average daily net assets of the Fund. The Sponsor receives no compensation from the Fund other than such fee. The Fund is also responsible for other ongoing fees, costs and expenses of its operations, including brokerage fees, SEC and FINRA registration fees and legal, printing, accounting, custodial, administration and transfer agency costs, although the Sponsor has borne or will bear the costs and expenses related to the initial offer and sale of Shares.

Shareholders have no right to elect the Sponsor on an annual or any other continuing basis or to remove the Sponsor. If the Sponsor voluntarily withdraws, the holders of a majority of the Trust’s outstanding Shares (excluding for purposes of such determination Shares owned by the withdrawing Sponsor and its affiliates) may elect its successor. Prior to withdrawing, the Sponsor must give ninety days’ written notice to the Shareholders and the Trustee.

Ownership or “membership” interests in the Sponsor are owned by persons referred to as “members.” The Sponsor currently has three voting or “Class A” members – Mr. Sal Gilbertie, Mr. Dale Riker and Mr. Carl N. Miller III – and a small number of non-voting or “Class B” members who have provided working capital to the Sponsor. Messrs. Gilbertie and Riker each currently own 45% of the Sponsor’s Class A membership interests.

Management of the Sponsor

In general, under the Sponsor’s Limited Liability Company Agreement, the Sponsor (and as a result the Trust and the Fund) is managed by the officers of the Sponsor. In particular, the President of the Sponsor is responsible for the general and active management of the business of the Sponsor, and for the supervision and direction of the Sponsor’s other officers. However, certain fundamental actions regarding the Sponsor, such as the removal of officers, the addition or substitution of members, or the incurrence of liabilities other than those incurred in the ordinary course of business and de minimis liabilities, may not be taken without the affirmative vote of a majority of the Class A members (which is generally defined as the affirmative vote of Mr. Gilbertie and one of the other two Class A members). The Sponsor has no board of directors, and the Trust has no board of directors or officers.

The three Class A members of the Sponsor, two of whom also serve as its officers, are as follows:

Sal Gilbertie has been the President of the Sponsor since its inception, was approved by the NFA as a principal of the Sponsor on September 23, 2009, and was registered as an associated person of the Sponsor on November 10, 2009. He maintains his main business office at 653A Garcia, Santa Fe, NM 87505. From October, 2005 until December, 2009, Mr. Gilbertie was employed by Newedge USA, LLC, where he headed the Renewable Fuels/Energy Derivatives OTC Execution Desk and was an active futures contract and over-the-counter derivatives trader and market maker in multiple classes of commodities. (Between January 2008 and October 2008, he also held a comparable position with Newedge Financial, Inc., an affiliate of Newedge USA, LLC.) From October 1998 until October 2005, Mr. Gilbertie was principal and co-founder of Cambial Asset Management, LLC, an adviser to two private funds that focused on equity options, and Cambial Financing Dynamics, a private boutique investment bank. Mr. Gilbertie is 49 years old.

Dale Riker has been the Treasurer of the Sponsor since its inception and its Secretary since January, 2010, was approved by the NFA as a principal of the Sponsor on October 29, 2009, and was registered as an associated person of the Sponsor on ________. He maintains his main business office at 232 Hidden Lake Road, Brattleboro, Vermont 05301. From February 2005 to the present, Mr. Riker has been President of Cambial Emerging Markets LLC, a consulting company specializing in emerging market equity investment. From July 1996 to February 2005, Mr. Riker was a private investor. Mr. Riker is 51 years old.

Carl N. (Chuck) Miller III was approved by the NFA as a principal of the Sponsor on November 10, 2009, and was registered as an associated person of the Sponsor on __________. He maintains his main business office at 369 Montezuma Avenue, Suite 434, Santa Fe, New Mexico 87501. Mr. Miller has been a Member of Garnet Advisors, LLC, a proprietary trading firm that focuses on a broad array of investment opportunities, since he founded such firm in November, 2001. Mr. Miller is 57 years old.

The three individuals set forth above are individual “principals,” as that term is defined in CFTC Rule 3.1, for the Sponsor. These individuals are principals due to their positions and/or due to their ownership interests in the Sponsor. None of the principals owns or has any other beneficial interest in the Fund. In addition, each of the three Class A members of the Sponsor are registered with the CFTC as associated persons of the Sponsor and are NFA associate members. GFI Group LLC is a principal for the Sponsor under CFTC Rules due to its ownership of certain non-voting securities of the Sponsor.

Mr. Gilbertie and Kelly Teevan, an employee of the Sponsor who is not a principal or member of the Sponsor, are primarily responsible for making trading and investment decisions for the Fund, and for directing Fund trades for execution. Mr. Teevan has been a Managing Director of the Sponsor since October 2009. He maintains his main business office at 42 West Union Street, Goffstown, NH 03045. Mr. Teevan graduated from Phillips Exeter Academy, Harvard College and Stanford Graduate School of Business, following which he worked as commodities broker and trader at several brokerage and investment firms in New York City, San Francisco and Sydney, Australia. Since January 2000, he has been primarily engaged serving on non-profit boards, focusing on financial, treasury and endowment issues. Mr. Teevan is 58 years old.

Prior Performance of the Sponsor and Affiliates

NEITHER THIS POOL OPERATOR NOR ANY OF ITS TRADING PRINCIPALS HAS PREVIOUSLY OPERATED ANY OTHER POOLS OR TRADED ANY OTHER ACCOUNTS.

The Trustee

The sole Trustee of the Trust is Wilmington Trust Company, a Delaware banking corporation. The Trustee’s principal offices are located at 1100 North Market Street, Wilmington, Delaware 19890-0001. The Trustee is unaffiliated with the Sponsor. The Trustee’s duties and liabilities with respect to the offering of Shares and the management of the Trust and the Fund are limited to its express obligations under the Trust Agreement.

The Trustee will accept service of legal process on the Trust in the State of Delaware and will make certain filings under the Delaware Statutory Trust Act. The Trustee does not owe any other duties to the Trust, the Sponsor or the Shareholders. The Trustee is permitted to resign upon at least sixty (60) days’ notice to the Sponsor. If no successor trustee has been appointed by the Sponsor within such sixty-day period, the Trustee may, at the expense of the Trust, petition a court to appoint a successor. The Trust Agreement provides that the Trustee is entitled to reasonable compensation for its services from the Sponsor or an affiliate of the Sponsor (including the Trust), and is indemnified by the Sponsor against any expenses it incurs relating to or arising out of the formation, operation or termination of the Trust, or any action or inaction of the Trustee under the Trust Agreement, except to the extent that such expenses result from the gross negligence or willful misconduct of the Trustee. The Sponsor has the discretion to replace the Trustee.

The Trustee has not signed the registration statement of which this prospectus is a part, and is not subject to issuer liability under the federal securities laws for the information contained in this prospectus and under federal securities laws with respect to the issuance and sale of the Shares. Under such laws, neither the Trustee, either in its capacity as Trustee or in its individual capacity, nor any director, officer or controlling person of the Trustee is, or has any liability as, the issuer or a director, officer or controlling person of the issuer of the Shares.

Under the Trust Agreement, the Trustee has delegated to the Sponsor the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does the Trustee have any liability for the acts or omissions of the Sponsor.

Because the Trustee has delegated substantially all of its authority over the operation of the Trust to the Sponsor, the Trustee itself is not registered in any capacity with the CFTC.

Operation of the Fund

The investment objective of the Fund is to have daily changes in percentage terms of the Shares’ NAV reflect the daily changes in percentage terms of a weighted average of the closing settlement prices of three Corn Futures Contracts: (1) the second-to-expire Corn Futures Contract traded on the CBOT, weighted 35%, (2) the third-to-expire CBOT Corn Futures Contract, weighted 30%, and (3) the CBOT Corn Futures Contract expiring in the December following the expiration month of the third-to-expire contracts, weighted 35%, less the Fund’s expenses. The Sponsor does not intend that the Fund will be operated in a fashion such that its NAV will equal, in dollar terms, the spot price of a bushel or other unit of corn or the price of any particular Corn Futures Contract.

The Fund seeks to achieve its investment objective by investing under normal circumstances in Corn Futures Contracts and/or Cleared Corn Swaps having an aggregate notional amount equal to at least 85% of the Fund’s net assets. The Fund may also invest in Other Corn Interests that generally will have an aggregate notional amount or no more than 15% of the Fund’s net assets. The Sponsor may pursue the Fund’s investment objective by investing in Other Corn Interests to a greater degree, and Corn Futures Contracts and Cleared Corn Swaps to a lesser degree, in the event that certain unusual circumstances arise. Such circumstances may include, for example, (1) highly depressed corn prices that cause position limits on Corn Futures Contracts and Cleared Corn Swaps to be applicable to the Fund at substantially lower asset levels than is currently the case, and (2) where Fund assets reach a level where position limits in Corn Futures Contracts have been reached or nearly reached and there is insufficient liquidity in the market for Cleared Corn Swaps to invest in them up to the applicable position limits. See “The Offering – Futures Contracts” below.

The Fund will invest in Corn Interests to the fullest extent possible without being leveraged or unable to satisfy its current or potential margin or collateral obligations with respect to its investments in Corn Interests. After fulfilling such margin and collateral requirements, the Fund will invest the remainder of its proceeds from the sale of baskets in short-term Treasury Securities or cash equivalents, and/or merely hold such assets in cash (generally in interest-bearing accounts). Therefore, the focus of the Sponsor in managing the Fund is investing in Corn Interests and in Treasury Securities, cash and/or cash equivalents. The Sponsor expects to manage the Fund’s investments directly, although it has been authorized by the Trust to retain, establish the terms of retention for, and terminate third-party commodity trading advisors to provide such management. The Sponsor has substantial discretion in managing the Fund’s investments consistent with meeting its investment objective of closely tracking the Benchmark, including the discretion: (1) to choose whether to invest in the Benchmark Component Futures Contracts or Cleared Corn Swaps or Other Corn Interests with similar investment characteristics; (2) to choose when to “roll” the Fund’s positions in Corn Interests as described below, and (3) to manage the Fund’s investments in Treasury Securities, cash and cash equivalents.

The Fund seeks to achieve its investment objective primarily by investing in a mix of Corn Interests such that the changes in its NAV will be expected to closely track the changes in the Benchmark. The Fund’s positions in Corn Interests will be changed or “rolled” on a regular basis in order to track the changing nature of the Benchmark. For example, five times a year (on the date on which a Corn Futures Contract expires), the second-to-expire Corn Futures Contract will become the next-to-expire Corn Futures Contract and will no longer be a Benchmark Component Futures Contract, and the Fund’s investments will have to be changed accordingly. In order that the Fund’s trading does not cause unwanted market movements and to make it more difficult for third parties to profit by trading based on such expected market movements, the Fund’s investments typically will not be rolled entirely on that day, but rather will typically be rolled over a period of days.

Consistent with achieving the Fund’s investment objective of closely tracking the Benchmark, the Sponsor may for certain reasons cause the Fund to enter into or hold Corn Futures Contracts other than the Benchmark Component Futures Contracts, Cleared Corn Swaps and/or Other Corn Interests. For example, certain Cleared Corn Swaps have standardized terms similar to, and are priced by reference to, a corresponding Benchmark Component Futures Contract. Additionally, over-the-counter Corn Interests can generally be structured as the parties to the contract desire. Therefore, the Fund might enter into multiple Cleared Corn Swaps and/or over-the-counter Corn Interests intended to exactly replicate the performance of each of the three Benchmark Component Futures Contracts, or a single over-the-counter Corn Interest designed to replicate the performance of the Benchmark as a whole. Assuming that there is no default by a counterparty to an over-the-counter Corn Interest, the performance of the Corn Interest will necessarily correlate exactly with the performance of the Benchmark or the applicable Benchmark Component Futures Contract. The Fund might also enter into or hold Corn Interests other than the Benchmark Component Futures Contracts to facilitate effective trading, consistent with the discussion of the Fund’s “roll” strategy in the preceding paragraph. In addition, the Fund might enter into or hold Corn Interests that would be expected to alleviate overall deviation between the Fund’s performance and that of the Benchmark that may result from certain market and trading inefficiencies or other reasons. By utilizing a combination of some or all of the investments described above, the Sponsor will endeavor to cause the Fund’s performance, before taking Fund expenses and any interest income from the cash, cash equivalents and Treasury Securities held by the Fund into account, to closely track that of the Benchmark.

The Sponsor endeavors to place the Fund’s trades in Corn Interests and otherwise manage the Fund’s investments so that the Fund’s average daily tracking error against the Benchmark will be less than 10 percent over any period of 30 trading days. More specifically, the Sponsor will endeavor to manage the Fund so that A will be within plus/minus 10 percent of B, where:

| | · | A is the average daily change in the Fund’s NAV for any period of 30 successive valuation days; i.e., any trading day as of which the Fund calculates its NAV, and |

| | · | B is the average daily change in the price of the Benchmark over the same period. |

The Sponsor believes that market arbitrage opportunities cause daily changes in the Fund’s Share price on the NYSE Arca to closely track daily changes in the Fund’s NAV per share. The Sponsor believes that the net effect of this expected relationship and the expected relationship described above between the Fund’s NAV and the Benchmark will be that daily changes in the price of the Fund’s Shares on the NYSE Arca will closely track daily changes in the Benchmark, less the Fund’s expenses. While the Benchmark is composed of Futures Contracts and is therefore a measure of the price of corn for future delivery, there is nonetheless expected to be a reasonable degree of correlation between the Benchmark and the cash or spot price of corn.

These relationships illustrated in the following diagram:

An investment in the Shares provides a means for diversifying an investor’s portfolio or hedging exposure to changes in corn prices. An investment in the Shares allows both retail and institutional investors to easily gain this exposure to the corn market in a transparent, cost-effective manner.

The Sponsor employs a “neutral” investment strategy intended to track changes in the Benchmark regardless of whether the Benchmark goes up or goes down. The Fund’s “neutral” investment strategy is designed to permit investors generally to purchase and sell the Fund’s Shares for the purpose of investing indirectly in the corn market in a cost-effective manner. Such investors may include participants in the corn industry and other industries seeking to hedge the risk of losses in their corn-related transactions, as well as investors seeking exposure to the corn market. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in the corn market and/or the risks involved in hedging may exist. In addition, an investment in the Fund involves the risk that the changes in the price of the Fund’s Shares will not accurately track the changes in the Benchmark, and that changes in the Benchmark will not closely correlate with changes in the price of corn on the spot market. Furthermore, as noted above, the Fund will also hold short-term Treasury Securities, cash and/or cash equivalents to meet its current or potential margin or collateral requirements with respect to its investments in Corn Interest and to invest cash not required to be used as margin or collateral. The Fund does not expect there to be any meaningful correlation between the performance of the Fund’s investments in Treasury Securities/cash/cash equivalents and the changes in the price of corn or Corn Interests. While the level of interest earned on or the market price of these investments may in some respects correlate to changes in the price of corn, this correlation is not anticipated as part of the Fund’s efforts to meet its objective.

The Fund’s total portfolio composition is disclosed each business day that the NYSE Arca is open for trading, on the Fund’s website at www.teucriumcornfund.com and the NYSE Arca’s website at www. ..com. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Corn Futures Contract and Cleared Corn Swap, the specific types of Other Corn Interests and characteristics of such Other Corn Interests, the name and value of each Treasury security and cash equivalent, and the amount of cash held in the Fund’s portfolio. The Fund’s website is publicly accessible at no charge.

The Shares issued by the Fund may only be purchased by Authorized Purchasers and only in blocks of 100,000 Shares called Creation Baskets. The amount of the purchase payment for a Creation Basket is equal to the aggregate NAV of Shares in the Creation Basket. Similarly, only Authorized Purchasers may redeem Shares and only in blocks of 100,000 Shares called Redemption Baskets. The amount of the redemption proceeds for a Redemption Basket is equal to the aggregate NAV of Shares in the Redemption Basket. The purchase price for Creation Baskets and the redemption price for Redemption Baskets are the actual NAV calculated at the end of the business day when a request for a purchase or redemption is received by the Fund. The NYSE Arca will publish an approximate NAV intra-day based on the prior day’s NAV and the current price of the Benchmark Component Futures Contracts, but the price of Creation Baskets and Redemption Baskets is determined based on the actual NAV calculated at the end of each trading day.

While the Fund issues Shares only in Creation Baskets, Shares may also be purchased and sold in much smaller increments on the NYSE Arca. These transactions, however, are effected at the bid and ask prices established by the specialist firm(s). Like any listed security, Shares can be purchased and sold at any time a secondary market is open.

The Fund’s Investment Strategy

In managing the Fund’s assets, the Sponsor does not use a technical trading system that automatically issues buy and sell orders. Instead, each time one or more baskets are purchased or redeemed, the Sponsor will purchase or sell Corn Interests with an aggregate market value that approximates the amount of cash received or paid upon the purchase or redemption of the basket(s).

As an example, assume that a Creation Basket is sold by the Fund, and that the Fund’s closing NAV per share is $25.00. In that case, the Fund would receive $2,500,000 in proceeds from the sale of the Creation Basket ($25.00 NAV per share multiplied by 100,000 Shares, and ignoring the Creation Basket fee of $1,000). If one were to assume further that the Sponsor wants to invest the entire proceeds from the Creation Basket in the Benchmark Component Futures Contracts and that the market value of each such Benchmark Component Futures Contracts is $20,600, the Fund would be unable to buy an exact number of Corn Futures Contracts with an aggregate market value equal to $2,500,000. Instead, the Fund would be able to purchase 121 Benchmark Component Futures Contracts with an aggregate market value of $2,492,600. Assuming a margin requirement equal to 10% of the value of the Corn Futures Contracts, the Fund would be required to deposit $249,260 in Treasury Securities and cash with the futures commission merchant through which the Corn Futures Contracts were purchased. The remainder of the proceeds from the sale of the Creation Basket, $2,250,740, would remain invested in cash, cash equivalents, and Treasury Securities as determined by the Sponsor from time to time based on factors such as potential calls for margin or anticipated redemptions.

The specific Corn Interests purchased will depend on various factors, including a judgment by the Sponsor as to the appropriate diversification of the Fund’s investments. While the Sponsor anticipates that a substantial majority of its assets will be invested in CBOT Corn Futures Contracts and Cleared Corn Swaps, for various reasons, including the ability to enter into the precise amount of exposure to the corn market and position limits on Corn Futures Contracts and Cleared Corn Swaps, it will also invest in Other Corn Interests, including swaps other than Cleared Corn Swaps, in the over-the-counter market to a potentially significant degree.

The Sponsor does not anticipate letting its Corn Futures Contracts expire and taking delivery of corn. Instead, the Sponsor will close out existing positions, e.g., in response to ongoing changes in the Benchmark or if it otherwise determines it would be appropriate to do so and reinvest the proceeds in new Corn Interests. Positions may also be closed out to meet orders for Redemption Baskets, in which case the proceeds from closing the positions will not be reinvested.

Futures Contracts

Futures contracts are agreements between two parties. One party agrees to buy a commodity such as corn from the other party at a later date at a price and quantity agreed-upon when the contract is made. In market terminology, a party who purchases a futures contract is long in the market and a party who sells a futures contract is short in the market. The contractual obligations of a buyer or seller may generally be satisfied by taking or making physical delivery of the underlying commodity or by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of delivery. The difference between the price at which the futures contract is purchased or sold and the price paid for the offsetting sale or purchase, after allowance for brokerage commissions, constitutes the profit or loss to the trader.

If the price of the commodity increases after the original futures contract is entered into, the buyer of the futures contract will generally be able to sell a futures contract to close out its original long position at a price higher than that at which the original contract was purchased, generally resulting in a profit to the buyer. Conversely, the seller of a futures contract will generally profit if the price of the underlying commodity decreases, as it will generally be able to buy a futures contract to close out its original short position at a price lower than that at the which the original contract was sold. Because the Fund seeks to track the Benchmark directly and profit when the price of corn and, as a likely result of an increase in the price of corn, the price of Corn Futures Contracts increase, the Fund will generally be long in the market for corn, and will generally sell Corn Futures Contracts only to close out existing long positions.

Corn Futures Contracts are traded on the CBOT in units of 5,000 bushels. Generally, futures contracts traded on the CBOT are priced by floor brokers and other exchange members both through an “open outcry” of offers to purchase or sell the contracts and through an electronic, screen-based system that determines the price by matching electronically offers to purchase and sell. Futures contracts may also be based on commodity indices, in that they call for a cash payment based on the change in the value of the specified index during a specified period. No futures contracts based on an index of corn prices are currently available, although the Fund could enter into such contracts should they become available in the future.

Certain typical and significant characteristics of Corn Futures Contracts are discussed below. Additional risks of investing in Corn Futures Contracts are included in “What are the Risk Factors Involved with an Investment in the Fund?”

Impact of Position Limits, Accountability Levels, and Price Fluctuation Limits.

The CFTC and U.S. designated contract markets such as the CBOT have established position limits and accountability levels on the maximum net long or net short positions in futures contracts in commodities that any person or group of persons under common trading control (other than as a hedge, which an investment by the Fund would not be) may hold, own or control. The net position is the difference between an individual or firm’s open long contracts and open short contracts in any one commodity. In addition, most U.S. futures exchanges, such as the CBOT, limit the daily price fluctuation for futures contracts.

Position limits generally impose a fixed ceiling on aggregate holdings in futures contracts relating to a particular commodity, and may also impose separate ceilings on contracts expiring in any one month, contracts expiring in the spot month, and/or contracts in certain specified final days of trading. The position limits currently established by the CFTC apply to certain agricultural commodity interests, including Corn Futures Contracts. Specifically, the CFTC’s position limits for Corn Futures Contracts (including related options) are 600 spot month contracts, 13,500 contracts expiring in any other single month, and 22,000 contracts for all months. All futures contracts held under the control of the Sponsor, including those held by any future series of the Trust, will be aggregated in determining the application of these position limits. The Fund is new and is not expected to reach asset levels that would cause these position limits to be implicated in the near future. Assuming a contract price of $4.12 per bushel and that the Fund was fully invested in Corn Futures Contracts, the position limit of 22,000 contracts total would apply when the Fund’s assets reached approximately $453 million ($4.12 per bushel times 5,000 bushels per contract times 22,000 contracts). If such position limits become applicable to the Fund in the future, the Sponsor may enter into for the Fund Other Corn Interests that are not subject to position limits to a greater degree than would otherwise be the case. (There are generally no position limits applicable to Other Corn Interests, except that options on Corn Futures Contracts must be aggregated with the related Corn Futures Contracts for purposes of the position limits on Corn Futures Contracts, and corn swaps cleared through the CBOT are covered by separate position limits that are similar to those covering Corn Futures Contracts.) In any event, however, position limits could in certain circumstances effectively limit the number of Creation Baskets that the Fund can sell.

In contrast to position limits, accountability levels are not fixed ceilings, but rather thresholds above which an exchange may exercise greater scrutiny and control over an investor, including by imposing position limits on the investor. In light of the position limits discussed above, the CBOT has not set any accountability levels for Corn Futures Contracts.

Futures exchanges, including the CBOT, also limit the amount of price fluctuation for Corn Futures Contracts. For example, the CBOT imposes a $0.30 per bushel ($1,500 per contract) daily price fluctuation limit for Corn Futures Contracts. Once the daily limit has been reached in a particular Corn Futures Contract, no trades may be made at a price beyond the limit. If two or more Corn Futures Contract months within the first five listed non-spot contracts close at the limit, the daily price limit increases to $0.45 per bushel ($2,250 per contract) the next business day and to $0.70 per bushel ($3,500 per contract) the next business day. These limits are based off the previous trading day’s settlement price.

Price Volatility

Despite daily price limits, the price volatility of futures contracts generally has been historically greater than that for traditional securities such as stocks and bonds. Price volatility often is greater day-to-day as opposed to intra-day. Economic factors that may cause volatility in Corn Futures Contracts include changes in interest rates; governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; weather and climate conditions; changing supply and demand relationships; changes in balances of payments and trade; U.S. and international rates of inflation; currency devaluations and revaluations; U.S. and international political and economic events; and changes in philosophies and emotions of market participants. Because the Fund invests a significant portion of its assets in futures contracts, the assets of the Fund, and therefore the price of the Fund’s Shares, may be subject to greater volatility than traditional securities.

Term Structure of Futures Contracts and the Impact on Total Return

Several factors determine the total return from investing in futures contracts. Because the Fund must periodically “roll” futures contract positions, closing out soon-to-expire contracts that are no longer part of the Benchmark and entering into subsequent-to-expire contracts, one such factor is the price relationship between soon-to-expire contracts and later-to-expire contracts. For example, if market conditions are such that the prices of soon-to-expire contracts are higher than later-to-expire contracts (a situation referred to as “backwardation” in the futures market), then the price of contracts will rise as they approach expiration. Conversely, if the price of soon-to-expire contracts is lower than later-to-expire contracts (a situation referred to as “contango” in the futures market), then absent a change in the market the price of contracts will decline as they approach expiration.

Over time, the price of the corn will fluctuate based on a number of market factors, including demand for corn relative to its supply. The value of Corn Futures Contracts will likewise fluctuate in reaction to a number of market factors. If investors seek to maintain their holdings in Corn Futures Contracts with a roughly constant expiration profile and not take delivery of the corn, they must on an ongoing basis sell their current positions as they approach expiration and invest in later-to-expire contracts.

If the futures market is in a state of backwardation (i.e., when the price of corn in the future is expected to be less than the current price), the Fund will buy later-to-expire contracts for a lower price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing corn prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will rise as it approaches expiration, increasing the Fund’s total return (ignoring the impact of commission costs and the interest earned on Treasury Securities, cash and/or cash equivalents). As an example, assume that the Fund owns 100 Corn Futures Contracts that have recently become spot month contracts, that the price of spot month Corn Futures Contracts is $5 per bushel, and the price of second-to-expire Corn Futures Contracts is $4.75 per bushel. The Fund will close out the spot month Corn Futures Contracts at a value of $2,500,000 (100 contracts multiplied by 5,000 bushels per contract multiplied by $5), and will be able to enter into 105 second-to-expire Corn Futures Contracts with the proceeds, representing an additional 25,000 bushels of corn than it previously owned.

If the futures market is in contango, the Fund will buy later-to-expire contracts for a higher price than the sooner-to-expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing corn prices or the price relationship between the spot price, soon-to-expire contracts and later-to-expire contracts, the value of a contract will fall as it approaches expiration, decreasing the Fund’s total return (ignoring the impact of commission costs and the interest earned on Treasury Securities, cash and/or cash equivalents). As an example, assume the same facts as in the prior paragraph except that the price of second-to-expire Corn Futures Contracts is $5.25. The Fund will sell the spot month Corn Futures Contracts for $2,500,000, and will be able to purchase only 95 second-to-expire Corn Futures Contracts with the proceeds, representing 25,000 fewer bushels of corn than it previously owned.

Historically, the corn futures markets have experienced periods of both contango and backwardation. Typically, whether contango or backwardation exists is largely a function of the seasonality of the corn market and the corn harvest cycle, as discussed above.

Marking-to-Market Futures Positions

Futures contracts are marked to market at the end of each trading day and the margin required with respect to such contracts is adjusted accordingly. This process of marking-to-market is designed to prevent losses from accumulating in any futures account. Therefore, if the Fund’s futures positions have declined in value, the Fund may be required to post “variation margin” to cover this decline. Alternatively, if the Fund’s futures positions have increased in value, this increase will be credited to the Fund’s account.

Cleared Corn Swaps

A swap agreement is a bilateral contract to exchange a periodic stream of payments determined by reference to a notional amount, with payment typically made between the parties on a net basis. For instance, in the case of corn swap, the Fund may be obligated to pay a fixed price per bushel of corn and be entitled to receive an amount per bushel equal to the current value of an index of corn prices, the price of a specified Corn Futures Contract, or the average price of a group of Corn Futures Contracts such as the Benchmark.

The CFTC recently issued an order that permits certain privately-negotiated agricultural swap contracts, including certain types of corn swaps, to be cleared by the CBOT’s affiliated provider of clearing services. The Fund expects to focus on investments in these Cleared Corn Swaps, as well as Corn Futures Contracts, rather than over-the-counter corn swaps. Cleared Corn Swaps are subject to position limits that are substantially identical to, but measured separately from, the positions limits applicable to Corn Futures Contracts.

Like Corn Futures Contracts, Cleared Corn Swaps are standardized as to certain material economic terms, including that each such swap be for a quantity of 5,000 bushels, which permits less flexibility in their structuring than with over-the-counter Corn Interests. The two parties to a Cleared Corn Swap agree on the specific fixed price component and the calendar month of expiration, and agree to submit the Cleared Corn Swap to the clearing organization. The clearing organization assumes the credit risk relating to the transaction, which effectively eliminates the creditworthiness of the counterparty as a risk. Unlike Corn Futures Contracts, Cleared Corn Swaps call for settlement in cash, and do not permit settlement by delivery or receipt of physical corn.

Over-the-Counter Derivatives

In addition to futures contracts, options on futures contracts and cleared swaps, derivative contracts that are tied to various commodities, including corn, are entered into outside of public exchanges. These “over-the-counter” contracts are entered into between two parties in private contracts. Unlike most of the exchange-traded futures contracts or exchange-traded options on futures contracts, each party to such a contract bears the credit risk of the other party, i.e., the risk that the other party will not be able to perform its obligations under its contract.

Some over-the-counter derivatives contracts contain relatively standardized terms and conditions and are available from a wide range of participants. Others have highly customized terms and conditions and are not as widely available. Many of these over-the-counter contracts are cash-settled forwards for the future delivery of commodities that have terms similar to futures contracts. Others take the form of swaps.

To reduce the credit risk that arises in connection with such contracts, the Fund will generally enter into an agreement with each counterparty based on the Master Agreement published by the International Swaps and Derivatives Association, Inc. that provides for the netting of its overall exposure to its counterparty.

The creditworthiness of each potential counterparty will be assessed by the Sponsor. The Sponsor will assess or review, as appropriate, the creditworthiness of each potential or existing counterparty to an over-the-counter contract pursuant to guidelines approved by the Sponsor. The creditworthiness of existing counterparties will be reviewed periodically by the Sponsor. The Fund also may require that the counterparty be highly rated and/or provide collateral or other credit support. The Sponsor on behalf of the Fund may enter into over-the-counter contracts with various types of counterparties, including: (a) banks regulated by a United States federal bank regulator, (b) broker-dealers regulated by the SEC, (c) insurance companies domiciled in the United States, (d) producers of corn such as farmers and related agricultural enterprises, (e) users of corn such as producers of prepared food products and ethanol producers, (f) any other person (including affiliates of any of the above) who are engaged to a substantial degree in the business of trading commodities. Certain of these types of counterparties will not be subject to regulation by the CFTC or any other significant federal or state regulatory structure; While it is the Sponsor’s preference to use regulated entities as counterparties, the Sponsor will primarily consider creditworthiness in selecting counterparties rather than the primary business of the prospective counterparty or the regulatory structure to which it is subject.

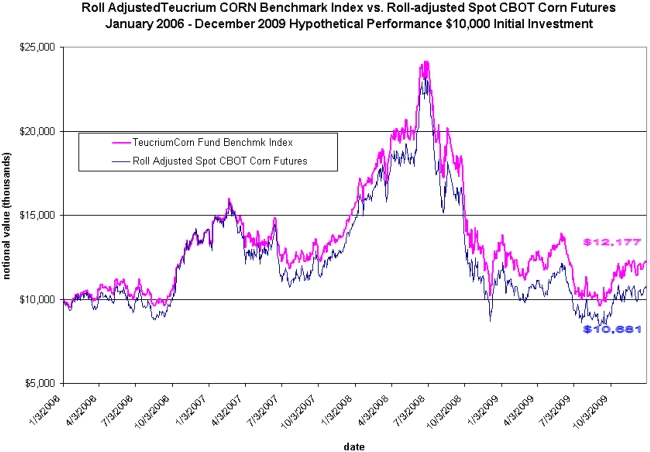

Benchmark Performance

See the graph below under “Benchmark Performance” in the Statement of Additional Information at the end of this prospectus.

The Corn Market

Corn is the most widely produced livestock feed grain in the United States, and the majority of the United States’ corn crop is used in livestock feed. Corn is also processed into food and industrial products, including starch, sweeteners, corn oil, and beverage and industrial alcohol. Additionally, corn is used in ethanol production.

The United States is the world’s leading producer and exporter of corn. Approximately 85% of U.S. produced corn is sold domestically, while approximately 15% is exported. Corn grain represented approximately 12 percent of all U.S. agricultural exports by value during 2008. Besides the United States, other principal world corn exporters include Argentina and China. Brazil, Ukraine, Romania, and South Africa also produce significant corn exports in certain years.

Standard Corn Futures Contracts trade on the CBOT in units of 5,000 bushels, although 1,000 bushel “mini-corn” Corn Futures Contracts also trade. Three grades of corn are deliverable under CBOT Corn Futures Contracts: Number 1 yellow, which may be delivered at 1.5 cents over the contract price; Number 2 yellow, which may be delivered at the contract price; and Number 3 yellow, which may be delivered at 1.5 cents under the contract price. There are five months each year in which CBOT Corn Futures Contracts expire: March, May, July, September and December.

The Fund’s Investments in Treasury Securities, Cash and Cash Equivalents

The Fund seeks to have the aggregate “notional” amount of the Corn Interests it holds approximate at all times the Fund’s aggregate NAV. At any given time, however, most of the Fund’s investments will be in short-term Treasury Securities, cash and/or cash equivalents that support the Fund’s positions in Corn Interests. For example, the purchase of a Corn Futures Contract with a stated or notional amount of $10 million would not require the Fund to pay $10 million upon entering into the contract; rather, only a margin deposit, generally of 5%-10% of the notional amount, would be required. To secure its Corn Futures Contract obligations, the Fund would deposit the required margin with the futures commission merchant and would separately hold its remaining assets through its Custodian in Treasury Securities, cash and/or cash equivalents. Such remaining assets may be used to meet future margin payments that the Fund is required to make on its Corn Futures Contracts. Cleared Corn Swaps and Other Corn Interests typically also involve collateral requirements that represent a small fraction of their notional amounts, so most of the Fund’s assets dedicated to these Corn Interests will also be held in Treasury Securities, cash and cash equivalents.

The Fund earns interest income from the Treasury Securities and/or cash equivalents that it purchases and on the cash it holds through the Custodian. The Sponsor anticipates that the earned interest income will increase the Fund’s NAV. The Fund applies the earned interest income to the acquisition of additional investments or uses it to pay its expenses. If the Fund reinvests the earned interest income, it makes investments that are consistent with its investment objectives.

Any Treasury Security and cash equivalent invested in by the Fund will have a remaining maturity of less than one year at the time of investment, or will be subject to a demand feature that enables that Fund to sell the security within one year at approximately the security’s face value (plus accrued interest). Any cash equivalents invested in by the Fund will be rated in the highest short-term rating category by a nationally recognized statistical rating organization or will be deemed by the Sponsor to be of comparable quality.

Other Trading Policies of the Fund

Exchange For Risk

An “exchange for risk” transaction, sometimes refers to a “exchange for swap” or “exchange of futures for risk,” is a privately negotiated and simultaneous exchange of a futures contract position for a swap or other over-the-counter instrument on the corresponding commodity. An exchange for risk can be used by the Fund as a technique to avoid taking physical delivery of corn, in that a counterparty will take the Fund’s position in a Corn Futures Contract into its own account in exchange for a swap that does not by its terms call for physical delivery. The Fund will be come subject to the credit risk of a counterparty when it acquires an over-the-counter position in an exchange for risk transaction.

Options on Futures Contracts

In addition to Corn Futures Contracts, there are also a number of options on Corn Futures Contracts listed on the CBOT. These contracts offer investors and hedgers another set of financial vehicles to use in managing exposure to the commodities market. The Fund may purchase and sell (write) options on Corn Futures Contracts in pursuing its investment objective, except that it will not sell call options when it does not own the underlying Corn Futures Contract. The Fund would make use of options on Corn Futures Contracts if, in the opinion of the Sponsor, such an approach would cause the Fund to more closely track its Benchmark or if it would lead to an overall lower cost of trading to achieve a given level of economic exposure to movements in corn prices.

Liquidity

The Fund invests only in Corn Futures Contracts that, in the opinion of the Sponsor, are traded in sufficient volume to permit the ready taking and liquidation of positions in these financial interests and in over-the-counter Commodity Interests that, in the opinion of the Sponsor, may be readily liquidated with the original counterparty or through a third party assuming the Fund’s position.

Spot Commodities

While most futures contracts can be physically settled, the Fund does not intend to take or make physical delivery. However, the Fund may from time to time trade in Other Corn Interests based on the spot price of corn.

Leverage

The Sponsor endeavors to have the value of the Fund’s Treasury Securities, cash and cash equivalents, whether held by the Fund or posted as margin or collateral, at all times approximate the aggregate market value of its obligations under the Fund’s Corn Interests.