Filed Pursuant to Rule 433

File No. 333-263293

TEUCRIUM WHEAT FUND

2023 Market Outlook

Jake Hanley

| Managing Director, Sr. Portfolio Strategist | January 4, 2023 |

Introduction

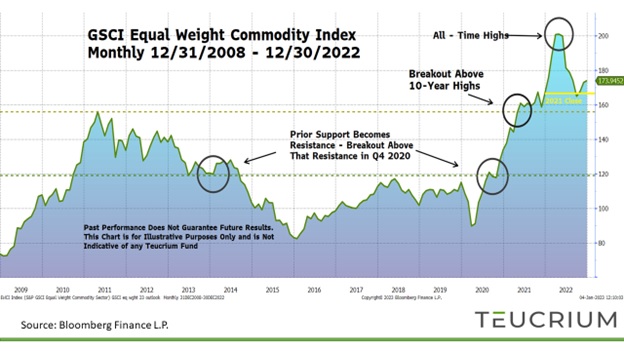

In our 2020 Outlook we wrote that a commodity bull market may re-emerge in the coming decade. That thesis was put to test with the onset of the global COVID-19 Pandemic. However, by the end of 2020 the GSCI Equally Weighted Commodity Index was pushing through 5-year highs.

In 2021, the Index broke above 10-year highs. In Spring of 2022 the Index jumped to new all-time highs. Since then, the Index has come back down and found support around the 2021 closing value around 166. The commodity bull market has returned.

Chart #1

GSCI Equal Weight Commodity Index – Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund.

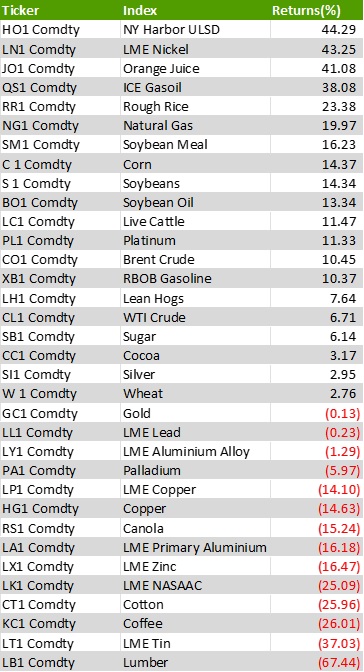

At the end of 2022 only 20 of 34 commodity futures markets we watch were positive on the year (see exhibit 1 in the appendix). By comparison, in 2021 the commodity market advance was much broader with 27 out of 34 markets in the green at year end.

Moving forward, we believe investors may do well to remain selective when considering opportunities in commodities. It is prudent to pay close attention to portfolio weightings within a broadly diversified commodity strategy. Note that some of the most popular commodity indexes remain underweight agricultural commodities. Yet we know from our conversations with financial advisors and individual investors that many of our readers have capitalized on opportunities in agriculture over the past 24 months.

In our 2021 Outlook we wrote about the potential for grain commodities (corn, wheat, and soybeans – from here on simply referred to as “grains”), to make a “Big Shift” into a secular bull market. Indeed, in 2021 prices built on the momentum from 2020 and continued to rise against a backdrop of bullish fundamentals, namely tightening supplies, and growing demand. The “Big Shift” happened.

Since then, there has been a global effort to rebuild inventories. In our 2022 Outlook we noted that grain prices had the potential to remain higher for longer for the simple reason that takes time to rebuild supplies. Afterall, in agriculture there is no dial to turn to crank up production. It takes time to grow crops. Writing in November of 2021, we also pointed out the potential for Russia to invade Ukraine:

…there is concern that Russia may be planning to invade the Ukraine. The Ukraine accounts for approximately 8% of global wheat exports measured in US dollars.1 A military conflict has the potential to disrupt trade and could provide additional upward pressure on wheat prices.

While the invasion should not have surprised our readers, it appears to have surprised the market with the front-month wheat futures contract advancing over 60% over the next 7 sessions. While wheat futures prices have retreated to pre-war levels, the war in Ukraine continues to be a major focus for grain traders. Unfortunately, geopolitical tensions in general will likely be a major theme in 2023 (more on that below).

Still, to the extent they trade in a free market, agricultural commodity prices are simply a reflection of supply and demand dynamics. Prices are pressured lower in markets where supply exceeds demand, and pressured higher in markets when supplies are seen as dwindling relative to demand.

Hence, there is a very good chance that prices advance if production fails to keep up with demand and/or availability remains constrained due to logistical hurdles and fractured supply chains. Alternatively, prices may head lower in the scenario where production keeps pace with demand and supply chains are operating efficiently.

For 2023, our base-case is for grain prices to trend lower amid a rebuilding of inventories, a global economic slowdown, and repairing (or rerouting) of supply chains.

Ultimately, whether grains and other commodity prices continue to move higher is anyone’s guess. Still, one trend remains clear: there is an increasing investor appetite for exposure to alternative asset classes.

Some investors are looking for ways to protect against inflation; others, having lived through periods of high stock and bond price correlations are looking for “non-correlated” assets (i.e. investments that tend to zig when others zag). As such, investors are increasingly turning to Commodities in general and grains in particular.

1 https://www.worldstopexports.com/wheat-exports-country/

What follows is an examination of select grain markets as we look ahead to 2023.

The section outline is as follows:

I. Golden Grain Cycle: Review of the Golden Grain Cycle

II. Supply and Demand: Fundamental factors we’re watching

III. Inflation and the Ultimate Currency: Exploring the rapid growth in the money supply and currency valuations

IV. Agriculture in Your Portfolio: Relating our analysis back to you, the investor

V. Conclusion: Come What May…

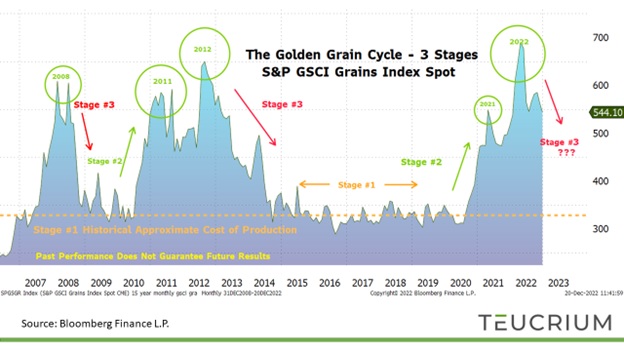

I. The Golden Grain Cycle

“Grains tend to trade at or near their cost of production until there is a supply disruption at which point prices historically have moved dramatically higher. Over time as production increases and/or demand decreases, inventories are rebuilt and prices trend back toward the cost of production once again.”

– Sal Gilbertie

The Golden Grain Cycle is, at its core, cosmic. Consider that growing seasons are dictated by the tilting of the Earth’s axis in proximity to the sun. As such, in the Northern Hemisphere there is only one harvest per year.

There are years when production exceeds demand, and prices are low. Alternatively, there are years when production lags demand, and prices rise. The variability of production in the face of steady, and often growing demand, lays the foundation for the grain market cycle. This cycle has repeated throughout history, offering those who recognize the cycle an opportunity for potential profit. Hence, we refer to the cycle as the Golden Grain Cycle.

3 Stages of The Golden Grain Cycle

#1: Prices trade at or near the cost of production

#2: Prices advance amid supply/demand imbalance

#3: Supplies build due to increased production and prices head back toward the cost of production.

Typically, grain production exceeds demand. Excess grain is held in storage as inventory to be drawn down in years when demand exceeds production.

When production exceeds demand, market prices will gravitate toward the cost of production effectively squeezing a farmer’s profit margins (stage 1).2 Lower profit margins can (and often do) result in fewer acres planted. This can lead to a situation where production may fail to keep pace with consumption in a given crop year. Historically, when grain production has lagged consumption, it has led to a reduction of inventories applying upward pressure on prices (stage 2). Historically, we have seen that higher prices are often the cure for high prices as farmers plant more acres in an attempt to ramp up production and capture higher prices (stage 3).

This cycle played out in textbook fashion over the previous decade (2010-2019)

In 2010 – 2012 a La Nina weather pattern led to poor growing conditions in key areas across the globe. As such, grain production lagged relative to demand and prices moved significantly higher, peaking in 2012 (see chart #2). Higher prices provided farmers the incentive needed to plant more acres.

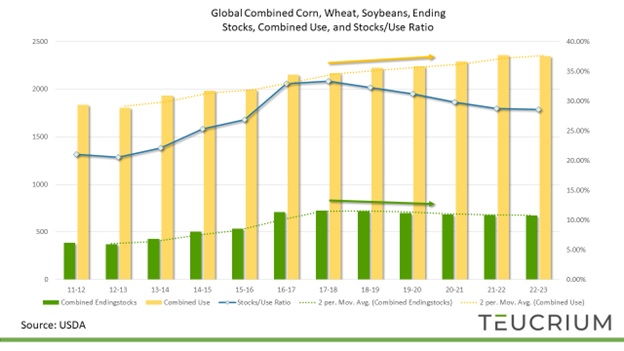

The additional plantings led to increased harvest and global inventories began to grow. As you can see on chart #3 below, global grain inventories grew without interruption beginning in the 2013 – 2014 crop year and going through the 2018-2019 crop year. By 2016, grain prices were back near production costs and traded sideways for the rest of the decade (Stage 1).

Then in the 2019-2020 crop year, the world consumed more corn, wheat, and soybeans than was produced. The globe didn’t run out of food, but rather drew down excess inventories that had been built over the preceding 6 years (beginning Stage 2). Again in 2020-2021, for the second year in a row, the world consumed more corn, wheat, and soybeans than was produced. This led to an additional draw down of inventories. Prices reacted accordingly, moving sharply higher in 2021.

Chart #2

S&P GSCI Grains Index. Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund.

2 USDA Historical WASDE Tables available at www.teucrium.com

Global ending stocks3 declined again in 2021-2022 while combined usage climbed to a new record high. The combined stocks/use ratio dipped below 30% for the first time in five years (see Chart #3 below). Tight balances sheets kept markets on edge entering the 2022-2023 crop year. Prices began trending higher after the 2021 harvest and then shot significantly higher amid Russia’s invasion of Ukraine.

Prices have since come off their highs, and the market is likely in stage #3 of the golden grain cycle. Still, global combined ending stocks of corn, wheat, and soybeans are expected to decline in the 2022-2023 crop year. Persistent balance sheet tightness suggests continued market volatility.

Chart #3

3 Ending Stocks (also called carry-out): The amount of a crop that will be available at the end of the crop year, given the estimated or actual beginning stocks, production, and usage.

II. Supply and Demand

Demand

We begin with demand, rather than supply, for the simple reason that grain demand is fairly predictable as it is mainly a function of population and income growth. The following is an excerpt from our World in Turmoil series:4

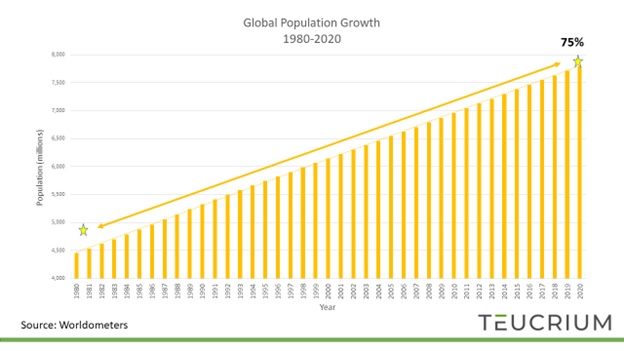

Population

Over 3.3 billion people were added to the planet between 1980 and 2020. Put in perspective, if you lived through the Carter administration, then you’ve witnessed a 75% increase in the human population.

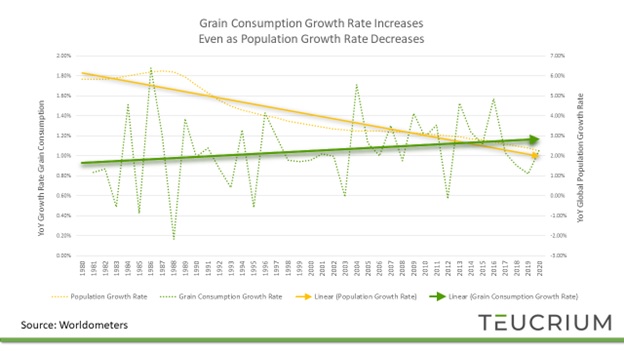

Chart #4

4 Newsletter subscribers receive our “World In Turmoil” series via email.

More people equates to more demand for just about everything. It absolutely means more demand for food.

Note, however, that the annual global population growth rate has slowed to 1.05% in 2020 versus 1.77% in 1980. That’s a meaningful slowdown. Even so, the annual growth rate of grain consumption continues to trend higher.

Chart #5

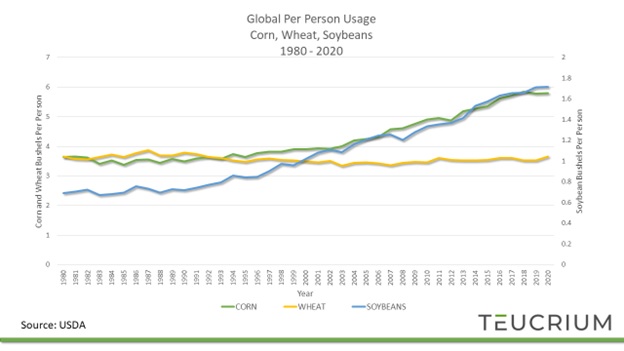

Even as the rate of population growth slows, there are still more people consuming more grain. In fact, per-person grain consumption jumped 40% in the 40-year period between 1980 and 2020.

Chart #6

As you can see on chart #6 above, the increased consumption is showing up in the corn and soybean markets, whereas wheat consumption has held steady for the past 40 years. The increased corn and soybean consumption makes sense when you consider the other primary factor driving demand: the expanding global middle class.

The Global Middle Class

In 2018 humanity crossed an exciting milestone. For the first time in history, the majority people on the planet were considered middle-class.5 This is perhaps the most under-reported good-news story of our time. There is no global standard by which to measure the middle class, however, Homi Kharas, Senior Fellow at the Brookings Institute, offers a compelling approach. Mr. Kharas measures the middle class based on households whose spending is between $11 and $110 per capita per day.6 People in this group have discretionary assets, i.e. the economic freedom to choose how to spend their money.7

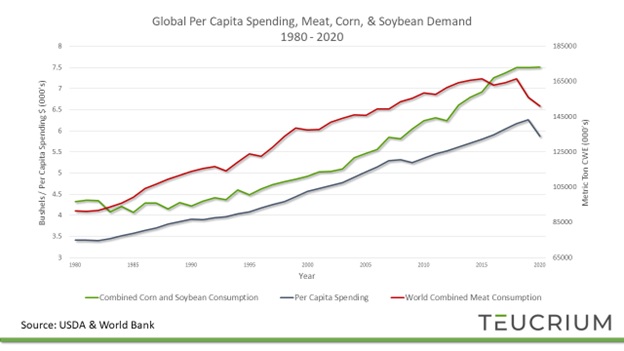

As people move from sustenance living to join the middle class, a common choice is to incorporate more animal protein into their diets. As demand for animal protein rises so too does demand for grain to feed livestock.

Recall from chart #6 above that per-person wheat consumption has remained steady over the past 40 years, yet per-person corn and soybean consumption has grown rather significantly. Corn and soybeans are both primarily used as animal feed whereas wheat is primarily consumed by humans. Therefore, it’s no surprise that as meat demand increases, so too does the demand for corn and soybeans.

Chart #7 below shows global per capita spending, combined meat consumption (beef, veal, swine), as well as combined corn and soybean usage. Note that the data is through 2020. The COVID-19 pandemic took a bite out of consumer spending and global meat consumption. Still, the global average per capita spending was more than $168 per day in 2020 above the middle-class minimum of $11 per day.

What’s more, meat demand has since rebounded. Current estimates for 2023 place combined meat consumption back above 156 million metric tons.

Chart #7

5 https://www.brookings.edu/blog/future-development/2018/09/27/a-global-tipping-point-half-the-world-is-now-middle-class-or-wealthier/

6 In 2011 dollars. Source: https://www.brookings.edu/wp-content/uploads/2021/09/DollarAndSense_Transcript_Kharas_GlobalMiddleClass.pdf

7 Note that Mr. Kharas uses spending rather than income when measuring the middle class. This is important because a person with little or no income may be wealthy and could spend from savings. Additionally, someone with limited income may be receiving financial support from family members which allows them to live a lifestyle consistent with a middle-class experience.

8 Measured in 2015 Dollars. https://data.worldbank.org/indicator/NE.CON.PRVT.PC.KD?end=2021&start=1960&view=chart

With history as a guide, it is reasonable to expect that as the global middle class grows so too will demand for animal protein. As meat demand increases so too does grain demand.

Additionally, corn and soybeans are used as feedstock for ethanol and biofuel production. As demand for fuels rises along with the rise in middle class consumption of both goods and services requiring fuels and other byproducts derived from corn and soybeans, the demand for corn and soybeans will likely continue to grow faster than the demand for wheat, which, as previously mentioned, is primarily consumed as food.

Supply

Production will be critical in the coming 2022-2023 growing season. A combination of low inventories and robust demand is leaving little room for error. Global grain supplies (i.e. ending stocks) are expected to decline yet again in ’22-’23 crop year while combined usage estimate is only expected to come in slightly below last year’s record.

There are several factors that may impact grain production in the coming year. Here are a few production and supply related items that the trade is currently and/or will likely be focused on going forward:

> Weather

> Fertilizer

> Availability

Weather

Weather is typically the most significant and relatively unknown variable. Long-term forecasts and climate patterns help paint a picture of what the weather might bring. However, like trying to pick tops and bottoms in the market, predicting weather is often an exercise in humility.

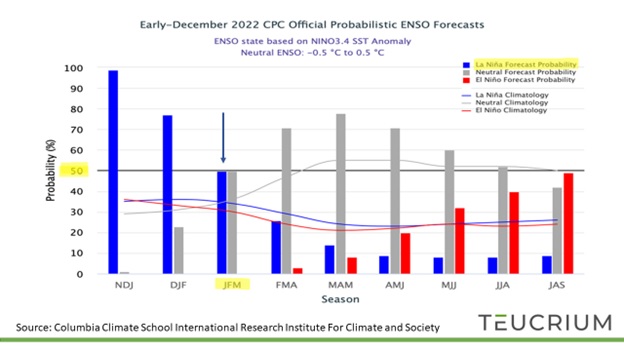

That said, based on current forecasts, it is likely that the weather will become more favorable for grain production due to waning La Nina conditions.

Back-to-back years of La Nina have helped keep a lid on production. La Nina typically results in warm/dry weather in the US Southern Plains, dryness in Brazil and North/Eastern Argentina.

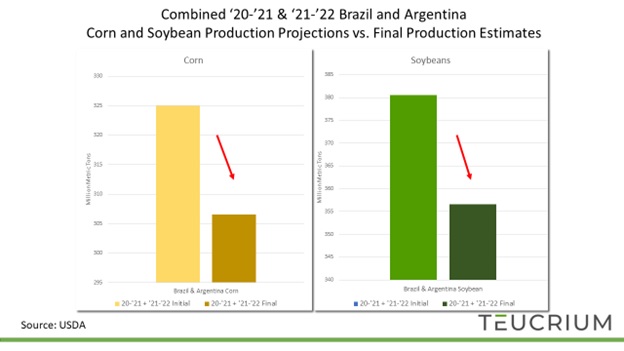

The US drought has taken a considerable bite out of wheat production. Final harvest estimates have come in 12% and 4.5% lower versus initial projections in the 21-22, and 22-23 crop years respectively.

Over the past two years final South American corn and soybean production has also significantly disappointed versus initial forecasts. See the chart #8 below.

Chart #8

The good news is the worst of the La Nina related weather issues are likely behind us. The latest models show an approximate 50% probability that La Nina recedes at some point early in 2023.

Chart #9

Still, a fading La Nina does not necessarily guarantee favorable weather. Persistent dryness is already taking a toll on Argentinian soybeans, and timely rains will be needed for current production estimates to be realized.

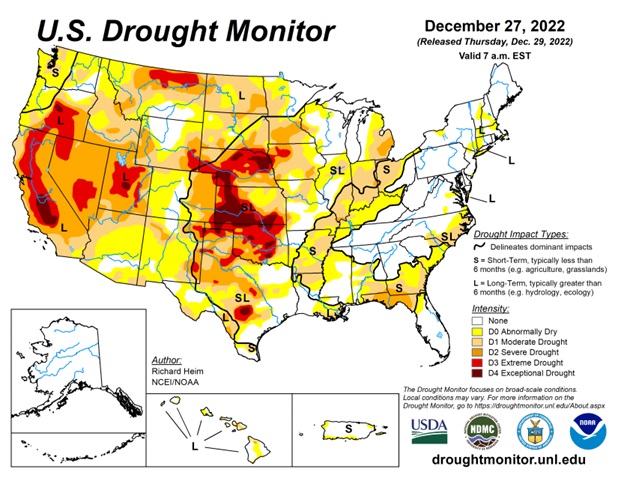

Here in the US conditions remain exceedingly dry. Unfortunately, the worst of the drought continues to impact much of the agricultural producing regions of California and key crop producing regions in the heartland.

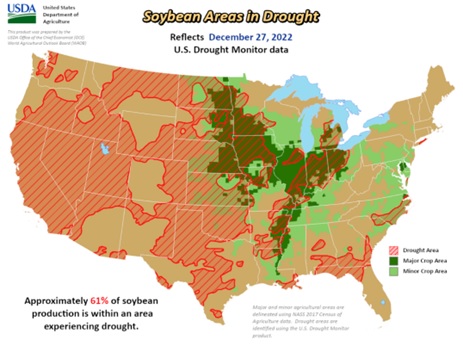

Chart #10

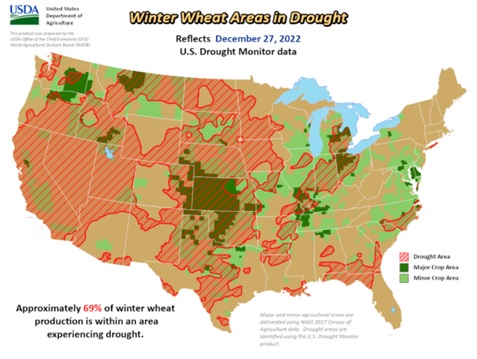

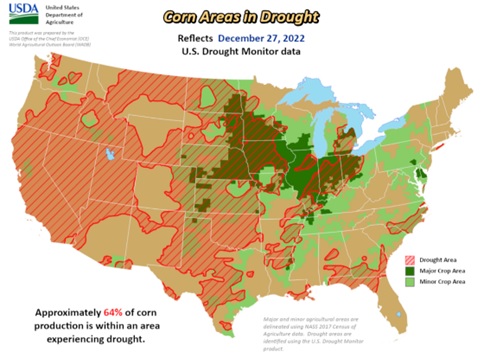

The drought is already complicating matters for the winter wheat crop. Approximately 69% of winter wheat production is within an area experiencing drought. What’s more, if conditions do not improve many corn and soybean farmers may find themselves planting the ’23-’24 crop in drought-like conditions.

The following three maps show the percentage of crop producing areas experiencing drought as of 12/27/2022.

Chart #11

Chart #12

Chart #13

Current long-range forecasts show the potential for below average precipitation for some of the driest areas over the next three months. There may be relief in the central/eastern corn belt with above average precipitation expected through the winter and into spring. However, current long range forecasts indicate Western Iowa, Western Minnesota, the Dakotas, and all of Nebraska at best might expect average rains.9

Favorable weather is, and always has been, the primary input for a healthy crop and robust harvest. Yet, for today’s farmers an appropriate application of fertilizer is almost equally as important as weather. Fertilizers help promote plant health and increase yields. If not for synthetic fertilizer, there would be a lot less food and a lot fewer people in the world.10 Failure to apply the proper amount of fertilizer means that yields suffer. Given the present supply/demand conditions, we need all the yield we can get.

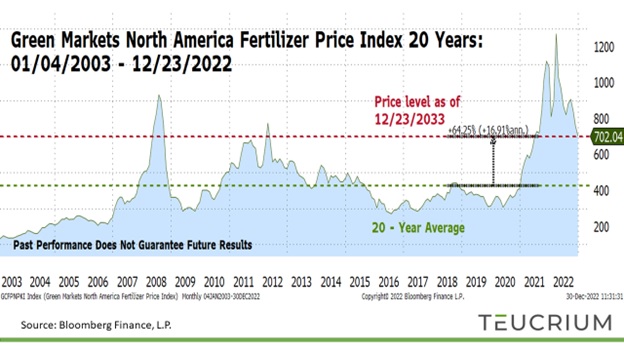

Fertilizer

North American fertilizer prices jumped 112% year-over-year reaching an all-time high in Q1 2022. The situation was worse in Europe where prices are reported to have increased nearly 150% in the 12 months since September 2021.11 Fertilizer shortages are expected to have contributed to a 2.4% production decline of corn, wheat, soybeans, and rice in 2022. While that may not sound like a lot, in terms of calories it’s enough to feed 282 million people for a year.12

9 https://www.cpc.ncep.noaa.gov/products/predictions/90day/

10 It’s estimated that more than three billion people are alive today due to crop increased crop production: https://www.nationalgeographic.com/environment/article/global-food-crisis-looms-as-fertilizer-supplies-dwindle

11 https://www.oliveoiltimes.com/business/e-u-announces-measures-to-ensure-fertilizer-supply-lower-costs/113980

12 https://www.wfp.org/stories/how-donation-fertilizers-countries-africa-comes-not-minute-too-soon

Chart #14

Green Markets North America Fertilizer Price Index. Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund. Chart Created on 01/04/2023, Last Price Updated on 12/23/2022.

Though well off their highs, North American fertilizer prices are still some 64% above their 20-year average.13 Higher fertilizer prices typically result in smaller profit margins for the farmer. As such, many farmers, particularly in developing countries, are opting to limit their fertilizer use.14 Growing a smaller profitable crop is more appealing than growing a larger crop at a financial loss.

Local production declines could force some countries to increase imports. Increased import demand is supportive for global prices. Inevitably, higher prices eventually hurt demand. While food demand is largely inelastic (i.e. not overly sensitive to price), there is a point when some people and/or countries become priced out of the market (i.e. cannot afford the food they require).

Lacking the Energy

Fertilizer production is energy intensive. The production process requires temperatures in excess of 750 degrees Fahrenheit and pressure equivalent to 100x the atmospheric pressure at sea level. Natural gas, the cleanest burning of the fossil fuels, is the primary feed stock for fertilizer. Therefore, fertilizer production costs are directly tied to natural gas prices. Hence, it’s no surprise that both fertilizer and natural gas prices established new record highs in 2022.

13 Green Markets North America Fertilizer Price Index - Bloomberg Finance L.P. 12/28/2022

14 https://www.wfp.org/stories/how-donation-fertilizers-countries-africa-comes-not-minute-too-soon

High gas prices are responsible for a 66% reduction in European fertilizer production capacity earlier this year.15 A production loss of that magnitude is concerning given that as late as 2019 the EU accounted for over 13%16 of global fertilizer exports.

European natural gas prices have retreated and are well off their 2022 highs. Yet, prices are still more than 200% higher versus the 20-year average.17 Stubbornly high gas prices are underpinning agricultural production costs. What’s more, there isn’t likely to be a quick fix.

Russian Gas, Russian Oil, Russia Fertilizer

Russia leads the world in natural gas exports and is the second largest crude oil exporter behind only Saudi Arabia. As late as 2021, Europe was importing more than 80% of it’s natural gas consumption, and more than 50% of that was coming from Russia. The bombing of the Nordstream pipeline has cut off the main artery for European gas imports.

What’s more, Europe and its allies are shunning Russian oil, establishing a price cap in attempt to avoid “funding” Russian war efforts. In retaliation, Russia will not allow their companies to sell oil to any country abiding to the price caps. The result: Europe is largely cut off from Russian energy.

Europe will increasingly rely on liquified natural gas (LNG) imports from western allies, namely the US. Still, it will take years to develop the infrastructure necessary to meet Europe’s energy demand. Europe’s energy woes will likely extend through 2024.

In addition, geopolitical tensions are likely to place continued strain on fertilizer markets. Russia is the world’s single largest fertilizer exporting nation representing roughly 16% of the global market.18 Amid the supply crunch in 2022 Russian fertilizer exports were down sharply adding further stress to an already precarious situation.

Reduced Russian fertilizer exports are an unintended consequence of Western sanctions. Food and fertilizer are both exempt from sanctions. However, western shipping companies, including banks and insurers, are hesitant to do business with Russian companies, particularly when those companies are owned and/or controlled by sanctioned Russian citizens.19

Continued geopolitical strife will weigh on fertilizer markets, energy markets, and agriculture markets. In 2023, as in 2022, the question is not is there enough (fertilizer, energy, food), but rather will it be available?

15 https://www.business-standard.com/article/international/higher-gas-prices-deepen-europe-s-fertiliser-crunch-threaten-food-crisis-122082700098_1.html

16 https://www.stlouisfed.org/publications/regional-economist/2022/oct/russia-ukraine-war-record-fertilizer-prices

17 Bloomberg Finance L.P. 12/28/2022

18 https://www.stlouisfed.org/publications/regional-economist/2022/oct/russia-ukraine-war-record-fertilizer-prices

19 “Russian Tycoon Urges Africa to Press EU on Fertilizer Snarl” Bloomberg News via the Bloomberg Terminal 12/28/2022

Availability

“Farmers need peace, and peace needs farmers.” - Theo de Jager20

In early 2022 the global wheat balance sheet was in decent shape. As late as March 2022 the USDA was reporting a global stocks/use ratio of roughly 35%, in-line with the 10-year average. Still, wheat prices were well on their way to record highs. The initial run-up in wheat prices wasn’t due to supply concerns, but rather availability concerns. Prior to the Russian invasion of Ukraine, roughly 30% of global wheat exports originated in the Black Sea region. Market participants correctly assumed that war in Ukraine would disrupt Black Sea exports.

Availability concerns began to melt away as Turkey lead UN negotiations with Russia to allow Black Sea shipping to resume. A deal was struck, shipping volumes increased, and wheat prices returned to pre-war price levels.

The 2022 wheat market provided a cautionary tale. The lesson being that in a globalized and interdependent world, conflict can upend everything; and fast. Increasing geo-political tensions pose a significant threat to our base case of grains trending back toward production costs in 2023.

In our view the war in Ukraine is far from being resolved. What’s more, the longer the war drags on, the greater the risk of escalation. For example, another missile landing in Poland, by accident or not, could evoke a military response from NATO. Additional attacks on Russian soil could result in increased retaliatory measures. The use of chemical or nuclear weapons would all but guarantee direct action from NATO. In short, Russia is in this to win. They would not be expending both blood and treasure if they were not committed to victory.21

Make no mistake, Russia can win, and is very likely to win a war with Ukraine. Even with a steady supply of Western money and weapons, Ukraine is outmatched. Ultimately soldiers are required to fight a war, and Ukraine is significantly outnumbered (4:1 +).22

As the war drags on it will become increasingly expensive for Western countries. At some point it may become evident that the Ukrainian cause is lost. That is, unless Western militaries become directly involved. In that case, Russia would be defeated…but at what cost?.

All Other Potential Conflicts

While many are focused on the war in Ukraine, we can’t ignore the deterioration of relations between the US and China. The dispute over Taiwan’s sovereignty also risks devolving into war. A Chinese invasion of Taiwan would significantly impact the global economy. Consider that over 1/5th of all global trade moves through the Taiwan Strait.23 It should go without saying that a direct conflict between the US and China would be catastrophic.

20 https://www.nationalgeographic.com/environment/article/global-food-crisis-looms-as-fertilizer-supplies-dwindle

21 Victory, we believe, involves safeguarding all annexed territory, including the land recently annexed in September this year, as well as Crimea.

22 Active military personnel Russia: 850,000 Ukraine: 200,000 https://www.globalfirepower.com/countries-comparison-detail.php?country1=ukraine&country2=russia

23 https://maritime-executive.com/editorials/report-invasion-of-taiwan-risks-container-shipping-internet-cables

In short, the world is in turmoil. It is beyond the scope of this piece to delve into all areas of conflict (actual, and potential). Yet, as the headlines unfold in 2023, our advice is to keep inmind the concept of availability. Consider how certain events may result in food, energy, and natural resources in general, becoming more or less available. The extent to which a commodity is available is relatively easy to ascertain. Simply observe the market price, in Dollars.

Inflation and The Ultimate Currency

The US Dollar is the world’s reserve currency. It is universally accepted, and often preferred to all other currencies. Yet the Dollar, like all currencies, is only worth that for which it may be exchanged. Itis common for consumers to speak of “rising costs,” but we don’t often hear people complaining about a decline in purchasing power. However, the two concepts are directly related. If a bushel of corn used to cost $3.50 and now costs $6.50, it is true that the cost for corn has increased. It is also true that the purchasing power of the Dollar, relative to corn, has declined.

While this point may seem elementary, it is important to understand the difference between rising prices and a general loss of purchasing power. The latter has everything to do with inflation while the former may be due to a fundamental dynamic in a specific market or commodity. Rising prices are not necessarily harmful, in fact, they may be tolerated and even welcomed. Inflation however is a force that can (and has) ruin(ed) nations.

2022 is a year that will be remembered for a resurgence of high inflation. To be certain, the US has experienced positive year-over-year inflation, every year going back to at least 1972.24 However, over the course of 2022 the inflation rate reached 40-year highs. Put another way, the purchasing power of the Dollar dropped faster than at any other time over the past 40-years. While it is beyond the scope of this paper to review the particular causes behind this rampant inflation, broadly speaking the heart of the issue is that there is simply too much money, chasing too few goods.25

In commodity markets, too much money chasing too few goods pressures prices higher. This has been the story of the past 18 – 24 months. Weather related production shortfalls and supply chain disruptions have reduced the availability of many commodities. At the same time the monetary and fiscal response to the COVID-19 pandemic has made the world flush with cash. There is too much money chasing too few commodities.

Note that money chases commodities. That is, as we’ve said, money is only worth that for which it may be exchanged. Ultimately human survival depends on food (obvious) and energy (warmth, at a minimum). Therefore, food and energy are the ultimate currencies. A person, or nation, rich in food and energy possesses the two things that all humans require, and for which all are willing to trade.

It is no surprise, therefore, that the United States and Russia, both countries rich in agriculture and energy resources, find themselves competing for global influence. One should also not be surprised if/when our fractured global economy becomes split into two or more distinct economic blocks. The era of globalization is over, and the world is rapidly moving to an era of regionalization. Favorable trade terms and security guarantees will be the sticking points underlying the new global order.

24 Measured by headline CPI. Bloomberg Finance L.P. 12/28/2022

25 Credit Milton Friedman’s monetarist theory – “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman.

What’s more an alternative global reserve currency is also required.

The United States economic and military hegemony is in no small way bolstered by the function of the Dollar as the world’s single global reserve currency. The simple ability to cut bad actors off from the Dollar system, provides the United States with enormous power. At least, it was once so perceived.

Consider that as the war in Ukraine has progressed that the Russian Ruble has strengthened versus the Dollar. This should seem counterintuitive given the historic sanctions which have been levied against Russia and include include barring Russia from the global payment system known as SWIFT.26 One can be forgiven for thinking that the Ruble should be collapsing.

Yet, recall that Russia is rich in both food and energy. Food and energy that much of the world relies upon. Earlier this year the Kremlin began requiring that countries pay Rubles for Russian natural gas.27 This immediately created demand for Rubles versus the USD. Moving forward however, Russia may increasingly move to settle commodity transactions in Chinese yuan. China presents a large market opportunity for Russia. In September this year Gazprom, the Russian State energy giant, inked a deal with a Chinese counterparty agreeing to settle trades in rubles and yuan (50-50).28

Furthermore India, much to the chagrin of the US and Western allies, imported a record amount of Russia crude oil this year.29 Note that India is the fastest growing G20 nation, and is expected to surpass China becoming the world’s most populous country in 2023.30 India is currently paying Russia in USD, however Russian exporters are urging India to switch to a different currency. At present it appears that India and Russia may reach a near-term agreement to settle transactions in dirhams (the UAE’s currency).31

Should recent trends continue, international demand for US Dollars could diminish as nations opt to settle trades in other currencies. Reduced demand for Dollars suggests that the Dollar would become less valuable. A less valuable Dollar means commodities may become more expensive in Dollar terms, i.e. purchasing power declines. Significant structural changes in international trade and payment systems may be inflationary for the US Dollar.

Still, it is very unlikely that the US Dollar losses its global reserve currency status in 2023. What’s more it may be years before a credible alternative currency/payment system emerges. While disaster is not imminent, nor even predetermined, future developments in currency markets deserve our attention.

26 SWIFT: Society for Worldwide Interbank Financial Telecommunications – SWIFT allows international banks to quickly and securely transmit banking instructions - https://www.investopedia.com/articles/personal-finance/050515/how-swift-system-works.asp

27 https://www.washingtonpost.com/world/2022/05/24/eu-russian-gas-putin-rubles/

28 https://www.thetrumpet.com/26111-russia-and-china-ink-historic-deal-to-settle-gas-sales-in-rubles-and-yuan

29 https://www.cnbc.com/2022/12/06/india-signals-it-will-continue-to-buy-oil-from-russia.html#:~:text=Indian%20imports%20of%20Russian%20oil,data%20from%20energy%20tracker%20Vortexa.

30 https://www.reuters.com/world/india/indias-population-growth-slows-world-reaches-8-billion-2022-11-15/

31 https://economictimes.indiatimes.com/industry/energy/oil-gas/india-is-still-paying-russia-in-dollars-for-oil-imports/articleshow/95388579.cms ; https://economictimes.indiatimes.com/news/economy/foreign-trade/india-uae-central-banks-discuss-rupee-dirham-trade/articleshow/95766373.cms

Chart #15

The US Dollar Index. Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund.

Agriculture in your Portfolio

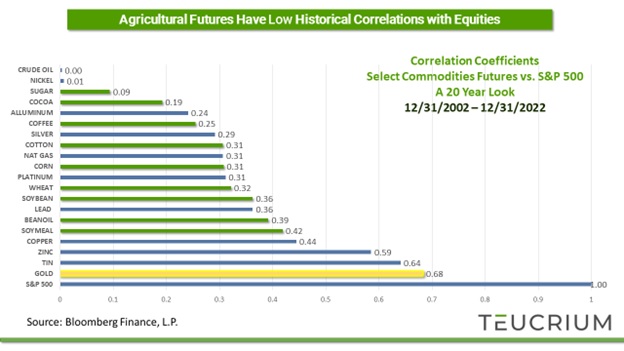

Investors with whom we spoke this past year consistently pointed to inflation as being a primary driver for their investment in our funds. Headline CPI (which includes food and energy) peaked and June and has been moving lower ever since. Regardless as to the direction of inflation, incorporating agriculture into your portfolio may provide important diversification benefits.

Agricultural commodities historically have low correlations to equities versus many other commodities and most notably gold (Chart 15). Low correlations have the potential to improve portfolio outcomes during periods of stock market volatility.

Chart #16

Note: Commodity futures contract values are from (generic first) spot continuation indexes. See Appendix for additional details. S&P 500 Index from Bloomberg: SPX Index. An investment cannot be made directly in an index. Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund.

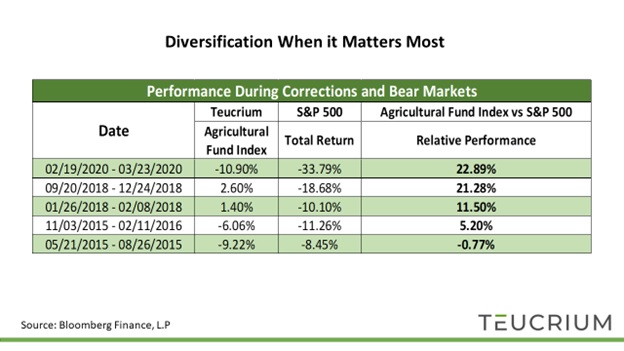

In fact, the Teucrium Agricultural Fund Index has outperformed the S&P 500 Total Return Index in 4 out of the last 5 stock market corrections of 10% or more (Chart 16). The latest example comes from the initial COVID sell-off in March of 2020. Here we saw the S&P 500 fall nearly 35% peak to trough through March, while at the same time the Teucrium Agricultural Fund Index only declined by 10.9%. That resulted in a relative outperformance of approximately 23%.

Chart #17

Dates of corrections and bear markets from Yardeni Research. For the entire period 05/21/2015 – 03/23/2020 the S&P 500 Index had annualized performance of 3.10% and the Teucrium Agriculture Fund Index had an annualized performance of -9.25%. Performance data quoted represents past performance. Past performance does not guarantee future results. This char is for informational purposes and is not indicative of an investment in any Teucrium Fund. One cannot invest directly in an index.

The historical tendency for grain prices to outperform equity prices during stock market corrections suggests that investors may benefit from a long allocation to agriculture precisely when it matters most; i.e. during significant stock market declines.

Price Volatility

Agricultural futures markets have a reputation of being volatile and considerably risky (especially when compared to tradition stock and bond markets). Volatility stems from the daily engagement between buyers and sellers trading at various prices throughout the day on the endless voyage of price discovery. Volatility presents both a challenge and an opportunity.

As an investor, the challenge is to be more right than wrong. Volatility swings both ways and prices can quickly change direction. Volatility also provides opportunity. Investors have an opportunity to potentially profit from being on the right side of the market.

Since 2010 Teucrium has provided ETF investors with long only futures price exposure to agricultural markets. For example, an investor believing that corn prices are heading higher may choose to invest in the Teucrium Corn Fund (ticker: CORN) in order to potentially capture the move higher. An investor in CORN is on the right side of the market so long as corn futures prices are rising. If, however, prices turn lower, the investor must sell his position or risk losing money.

Furthermore, an investor who does not currently own CORN, but believes that corn futures prices are heading lower, would not have a way to express that view outside of trading options, or selling CORN shares short if so permitted by his broker.

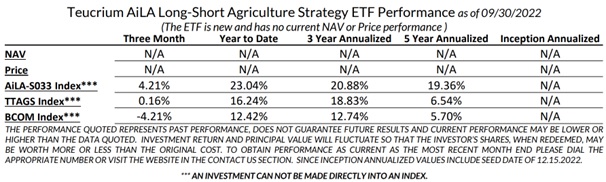

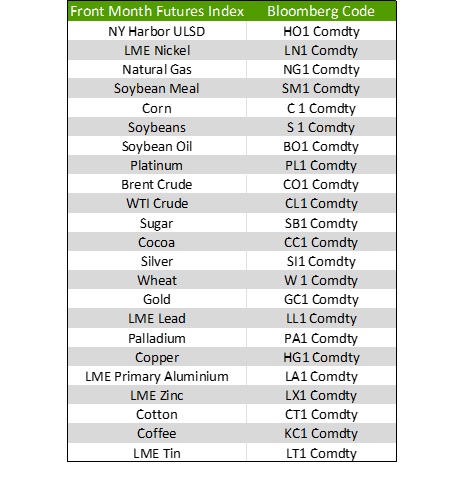

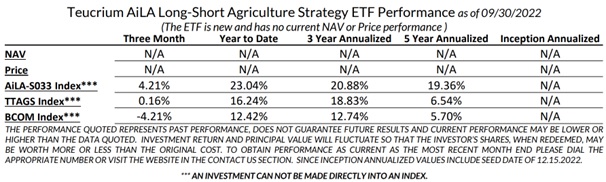

Finally, an investor seeking to diversify long-only commodity holdings by strategically allocating to agriculture may also desire a long-short strategy; especially given the volatile nature of the agricultural markets. For this reason we recently partnered with index provider AiLA to launch the Teucrium AiLA Long-Short Agricultural Strategy ETF, NYSE/Arca ticker: “OAIA”. As the name implies, OAIA can take both long and short positions in agricultural futures markets. OAIA seeks to track the total return performance, before fees and expenses, of the AiLA-S033 Market Neutral Absolute Return Index. While the fund, having recently launched on 12/20/2022, has not yet established a performance record, the AiLA-S033 Index has 6 years of publicly published performance. The following performance table is taken directly from the OAIA factsheet:

The Teucrium Agricultural Fund Index (TTAGS) is included to illustrate the performance of a long-only agriculture index over the same periods. Additionally, BCOM (the Bloomberg Commodity Index) is included for quick comparison to a multi-commodity index.32 Note that the AiLA S033 Index outperformed these indexes over a 5 year period, a 3 year period, and year to date.

Diversification Among Commodities

Stressing the importance of diversification may be cliché, yet too many investors tend to overlook the importance of diversifying their commodity exposure. Our experience has shown that many investors remain overweight in gold and oil relative to other commodities.

Given low historical correlations and relative performance of agricultural commodities, there is a case to be made that including long exposure to agriculture among other commodity investments may help in creating a more robust portfolio.

V. Conclusion

Come What May

2022 will go down in history as a year marked by war, inflation, and broad financial market duress. Most investors likely had a tough go of it this year with both stocks and bonds in the red and given significant volatility in commodities and other alternative markets. Renewed investor demand for alternatives resulted in record interest in our ETFs this year. We hope investors were able to properly utilize our products to help protect and/or increase, their personal purchasing power.

32 BCOM holds energies, and metals as well as agriculture.

Looking ahead to 2023 we believe global grain markets are squarely in the 3rd stage of the “Golden Grain Cycle,” where farmers around the globe will again make the effort to increase production in hopes of selling their crops at these relatively high prices. If the weather cooperates and geopolitics stabilize, then we expect grain prices to trend lower to trade closer to production costs by the end of 2023. Of course unfavorable weather and increased geopolitical tensions could help push grain prices higher as well. Either way, tight corn and soybean balance sheets suggest that grain markets will remain volatile during 2023. Keep in mind that our newest offering, the Teucrium AiLA Long-Short Agricultural Strategy ETF (OAIA) provides investors the potential to profit regardless of the market trend or direction.

Thank you for your confidence and for following along with us through 2022. We look forward to the opportunity to help you navigate your way through 2023. Come what may…

For ongoing grain market commentary and analysis please follow us on Twitter @TeucriumETFs, connect with us on LinkedIn, and visit our website at www.teucrium.com

Risks and Disclosure

Diversification does not ensure a profit or protect against loss.

An investor should consider investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other information. Read the prospectus carefully before investing. An investment in the Fund involves risk, including possible loss of principal. The material available on this site is not an offer or solicitation of any kind to buy or sell any securities outside of the United States of America.

Shares of the Funds are not FDIC Insured, may lose value, and have no bank guarantee. All supporting documentation provided upon request.

CORN, CANE, SOYB, WEAT, and TAGS are commodity pools regulated by the Commodity Futures Trading Commission (CFTC). These Funds, which are ETPs, are not mutual funds or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and are not subject to regulation thereunder. The funds do not track the spot price of corn, sugar, soybeans or wheat.

OAIA, OAIB & TILL are “non-diversified” investment companies under the Investment Company Act of 1940, as amended and, therefore, may invest a greater percentage of their assets in a particular security than a diversified fund. OAIA, OAIB & TILL are commodity pools regulated by the CFTC. OAIA, OAIB & TILL are new and have limited operating history.

OAIA & OAIB short selling involves the sale of commodities. The short seller profits if the commodity’s price declines. If a shorted commodity increases in value, a higher price must be paid to cover the short sale, resulting in a loss. The amount the Fund could lose on a short sale is theoretically unlimited.

OAIA & OAIB employ a “passive management” approach that seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index. There is no guarantee that the Fund will achieve a high degree of correlation to the underlying Index and therefore achieve its investment objective. Differences in timing of trades and valuation as well as fees and expenses, may cause the fund to not exactly replicate the index known as tracking error.

Futures Risks: Commodities and futures generally are volatile and are not suitable for all investors.

Futures investing is highly speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment. Investing in commodity interests subject each Fund to the risks of its related industry. These risks could result in large fluctuations in the price of a particular Fund's respective shares. Funds that focus on a single sector generally experience greater volatility. Futures may be affected by Backwardation: a market condition in which a futures price is lower in the distant delivery months than in the near delivery months. As a result, the fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis; and Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storing and inuring the underlying commodity. Opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive one.

For further discussion of these and additional risks associated with an investment in the Funds please read the respective Fund Prospectus before investing.

Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and value of the Fund shares will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted.

Foreside Fund Services, LLC is the distributor for the Teucrium Funds.

Check the background of our investment professional’s on FINRA’s BrokerCheck

Teucrium Investment Advisors, LLC is an investment adviser in Burlington, Vermont and is a wholly owned limited liability company of Teucrium Trading, LLC. Teucrium Investment Advisors, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Teucrium Investment Advisors, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Teucrium Investment Advisors, LLC’s current written disclosure brochure filed with the SEC which discusses among other things, Teucrium Investment Advisors, LLC’s business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Please note, the information provided on this website is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Please refer to the disclosure and offering documents for further information concerning specific products or services.

Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

A copy of the prospectus for each Fund may be obtained at:

www.teucrium.com

APPENDIX:

| | 1. | Commodity Futures Markets Performance 12/31/2021 – 12/31/2022 |

2.