Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

File No. 333-248546

File No. 333-241569

File No. 333-230623

File No. 333-223943

December 30, 2020

FWP

NOTICE

The Teucrium Commodity Trust has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents that the Teucrium Commodity Trust has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, a copy of the prospectus for each Fund may be obtained at https://teucrium.com/ or by calling (802) 540-0019.

____________________________________

2021 Grain Outlook

The Big Shift

Jake Hanley, Portfolio Manager

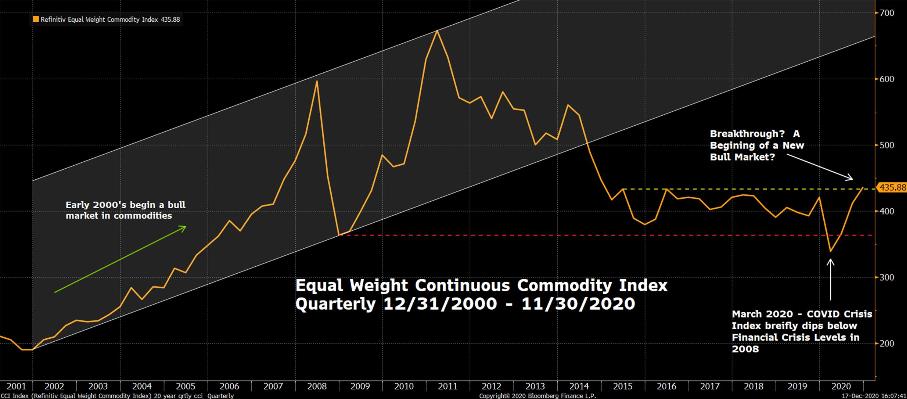

Last year we wrote that the 2020s could possibly mark the resurgence of a commodity bull market. That thesis was put to test early this year as pandemic fears gripped markets and initially caused assets across the globe to head lower. The Refinitiv Equal Weight Commodity Index briefly dipped below the 2008 financial crisis low, before reversing higher. Now the index looks poised to break through 5-year highs, a move that could potentially validate our commodity bull market thesis.

Chart 1

Chart created by Teucrium using Bloomberg Finance LP on 12/17/2020

Refinitiv Equal Weight Continuous Commodity Futures Price Index

Quarterly Price Chart 12/31/2000–11/30/2020

Past performance is not indicative of future results

Taking the grains specifically, we might one day point back to 2020 as the year that began the Big Shift. The Big Shift would mark the transition to a secular bull market. Price trends are indicating that the Big Shift in grains may already be underway. As the market picture becomes clear over the course of 2021, we will be looking to the fundamentals for confirmation of the Big Shift.

Ultimately, whether or not grains and commodity prices continue to move higher is anyone’s guess. Still, one trend remains clear: increasing investor appetite for exposure to alternative asset classes. Having lived through periods of high stock and bond price correlation, one can understand investor desire for “non-correlated” assets. That is, investments that tend to zig when others zag.

What follows is an investigation of the key drivers that may be leading to the Big Shift.

We begin our analysis by looking at current and historic price patterns. We then explore supply and demand fundamentals and review potential weather-related production issues. At a high level, we discuss geopolitics, a weakening US dollar, inflation on grain prices, and the potential diversification benefits of including grains in a portfolio. Finally, we conclude by relating our analysis back to the investor.

We hope you find this information interesting and valuable. Please do not hesitate to contact us with questions or ideas you would like to discuss.

On behalf of all of us at Teucrium, thank you for your continued interest in our funds.

We wish you a Merry Christmas, Happy Holidays, and a HAPPY NEW YEAR!

Prices Pointing to a Big Shift

Prices trend. When the price of an asset is rising, it is likely to continue rising for some period. Of course, the opposite is also true: when the price of an asset is declining, it will likely continue its decline for some period. The trick therefore is to identify, and determine the stage of, the prevailing trend. Identifying a price trend and trend stage is not easy to do. Even the best “trend followers” admit that it is an imperfect science. Still, the recognition that prices trend, and the potential to accurately identify the trend, has captivated analysts and traders for centuries.1

Similar to the exercise of predicting short-term weather versus long-term climate patterns, it is difficult to predict a daily, weekly, or even monthly price move. However, it can be much easier to accurately forecast longer-range price trends.

For example, take the following one-year daily line chart on the S&P GSCI Grains Index. Notice that the line is squiggly, even jagged, in some instances on a shorter-term basis. It would be exceedingly difficult to predict the price movement on any given day. Yet when you take a longer-term perspective, you can see two very distinct trends that occurred over two separate (approximate) six-month periods. There is a downtrend that begins at the start of the year and an uptrend beginning in early August.

Chart 2

Chart created by Teucrium using Bloomberg Finance LP on 12/19/2020

S&P GSCI Grains Index

Daily Price Chart 12/31/2019–12/11/2020

Past performance is not indicative of future results

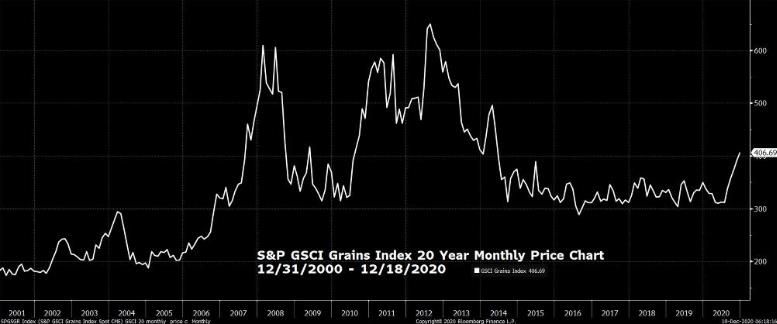

While the grain rally of 2020 has been impressive, it may prove to be nothing more than a short-term little shift in market sentiment. Evidence for the Big Shift must be derived from a longer-term analysis. For this we’ve examined the 20 year monthly price chart for the GSCI Grains Index.

Chart 3

Chart created by Teucrium using Bloomberg Finance LP on 12/19/2020

S&P GSCI Grains Index

Monthly Price Chart 12/31/2000–12/18/2020

Past performance is not indicative of future results

Chart 3 is a simple line chart showing the monthly closing price of the GSCI Grains Index over the last 20 years. Note the price spikes in the middle of the chart in 2008, 2011, and 2013. Those price rallies occurred during periods of tighter supplies resulting from decreased production or extraordinarily strong demand. Also, note the recent rally on the far right of the chart depicting the monthly price action for grains in 2020.

A quick glance reveals that the price advance appears to be coming off a price base that began in 2016. The recent highs also look to be testing price highs last seen in 2015. A test of the 2015 highs confirms that grain prices have moved to the upper end of their price range, but this alone is not confirmation of a Big Shift. A convincing monthly close above the 2015 highs, however, would be considered supporting evidence that the Big Shift is underway.

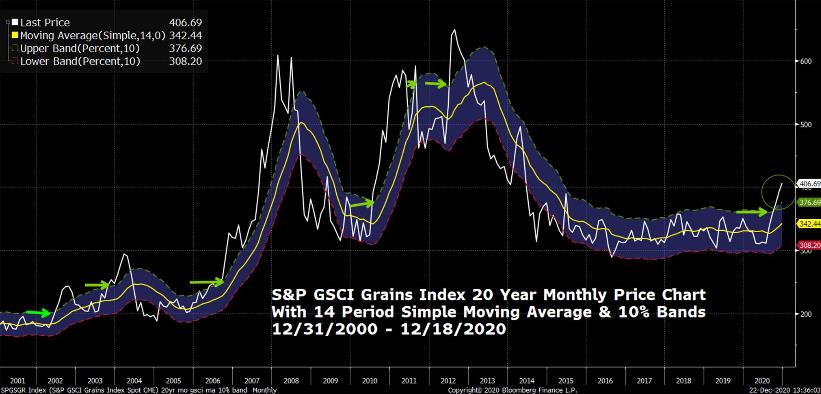

Additional context presents us with another view of the longer-term trend. Using the same monthly price chart, we’ve added a moving average line (yellow) as well as percentage bands to show when prices are 10% above or below the moving average.

Chart 4

Chart created by Teucrium using Bloomberg Finance LP on 12/22/2020

S&P GSCI Grains Index

Monthly Price Chart 12/31/2000–12/18/2020

With 14 period simple moving average & 10% Bands2 Past performance is not indicative of future results

Notice that the downtrend beginning in 2012 and identified by the moving average in 2013 continued through 2016. The moving average appears to have transitioned from a clear decline to a sideways pattern beginning in 2017. As grain prices advanced in 2020, the moving average has once again begun trending higher.

Moving averages are lagging indicators, and this positive trajectory does not confirm that a new uptrend is likely to continue. Still, market participants are likely to view this as a positive development.

Furthermore, prices are now more than 10% above the moving average for the first time since 2012.3The green arrows point to all periods since 2001 where this occurred. The chart shows that a break above this 10% line has historically preceded additional price appreciation without exception since 2001. Note too that a break below the 10% moving average band (red dotted line) has historically, but not always, preceded additional price declines. On both sides of the spectrum, about 50% of the moves above and below the 10% channel led to longer-term price rallies and longer-term price declines. The big question remains: where do we go from here?

Historical performance is not necessarily indicative of future results. Which way prices head from here is anyone’s guess. One thing is certain: the market will be keying in on supply and demand dynamics over the next year. The fundamentals will either confirm or dispel the theory of the Big Shift.

“Charts are a picture of the fundamentals.”—Sal Gilbertie

Fundamentals: Supporting Prices (for now)

Commodity markets are primarily driven by supply and demand. Grain market supply and demand is estimated and reported monthly by the USDA in their World Agricultural Supply and Demand Estimate report (WASDE). The supply and demand data as presented is referred to as the “balance sheet.” A balance sheet is said to be “tightening” when supplies are declining relative to demand, and “expanding” when supplies are increasing relative to demand.

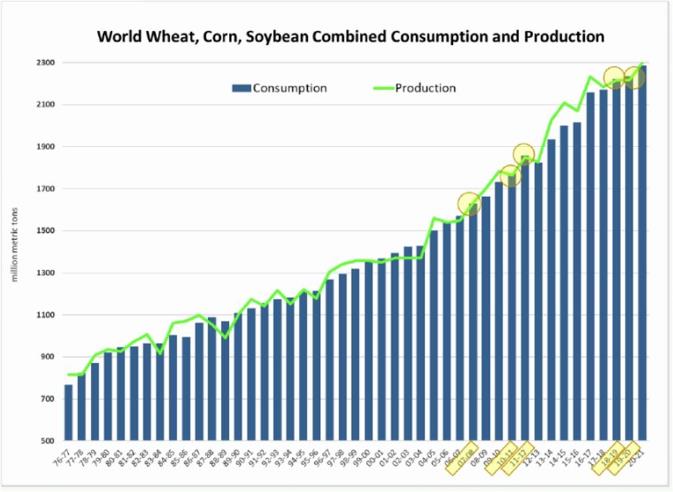

In general, US and global corn, wheat, and soybean balance sheets have been tightening the last few years. As part of that, the USDA is estimating all three grains will have record high demand for the current production year. In the past, we have learned that as the world builds a larger demand base, it is difficult to deviate from this demand going forward, even in years when there are production shortfalls.

Importantly, the prices of corn, wheat, and soybeans are highly correlated. This is due in large part to the common and sometimes interchangeable uses for grains. For example, the number one global use of corn and soybeans is to feed animals. Wheat is also used as animal feed, though to a much smaller extent. Corn, soybeans, and wheat can all also be used to create biofuels. Given their interchangeability, a meaningful price move in one of the grains can “pull” the prices of the other two in the same direction. Perhaps this is one reason why we continue to see relatively high wheat prices despite the expanding global balance sheet.

Chart 5

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Chart: DC Analysis, LLC, using data from USDA through Sep. 30, 2020. Used with permission from DC Analysis. https://apps.fas.usda.gov/psdonline/app/index.html#/app/home

The information and data contained herein do not constitute investment advice offered by Teucrium Trading, LLC and are provided solely for informational purposes.

Fundamentally, the move in grain prices this year appears to be justified. Current US Stocks/Use4 ratios for corn and soybeans are as low as they have been in the last five years or more.

SOYBEANS

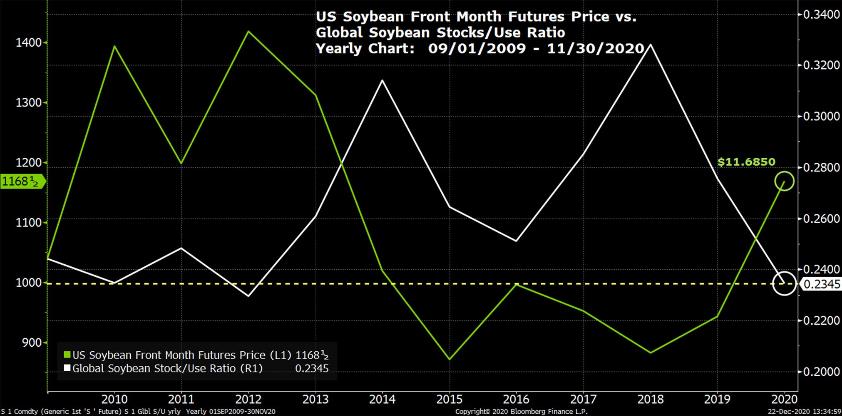

The US soybean balance sheet is currently tighter than corn and the Stocks/Use ratio is the lowest it’s been since the 2013–14 crop year. Globally, the soybean Stocks/Use ratio is as low as it has been since the 2015–16 crop year. See Chart 6.

Chart 6

Chart created by Teucrium using Bloomberg Finance LP on 12/22/2020

Front Month Soybean Futures vs Global Stocks/Use Ratio

Monthly Price Chart 09/01/2009–11/30/2020

Past performance is not indicative of future results

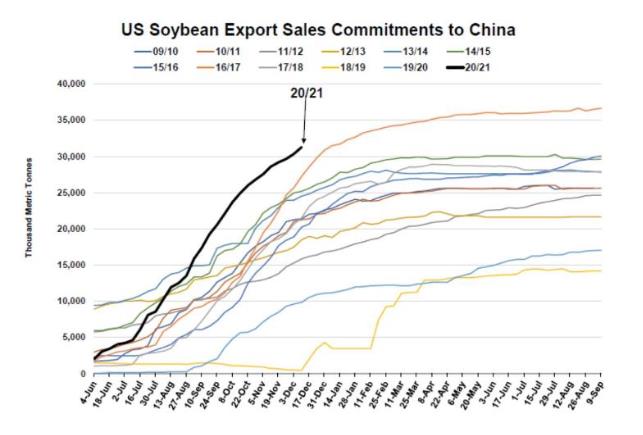

U.S. soybean supplies have dwindled as Chinese soybean imports have soared over the last two years. In the 2018–19 crop year, the Chinese imported a total of 82.54 million metric tons (MMT) of soybeans, equivalent to approximately 3 billion bushels. The 2020–21 crop year estimates show China importing 100 MMT, or nearly 3.7 billion bushels. That jump, if realized, would represent a 23% increase in just two years. The growth in Chinese soybean demand appears to be tied to the rebuilding of their hog herd and the stockpiling of strategic reserves.5 What’s more, the Chinese are relying heavily on US soybean exports, reflected by the historic amount of U.S. soybean sales commitments already made this crop year (see Chart 7).

Chart 7

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results. Chart: DC Analysis, LLC, using data from USDA through December 17, 2020. Used with permission from DC Analysis. The information and data contained herein do not constitute investment advice offered by Teucrium Trading, LLC and are provided solely for informational purposes

Currently, attention is on the South American soybean crop, specifically in Brazil and Argentina as various degrees of drought continue to persist across large portions of those countries. Brazilian and US combined soybean exports represent over 85% of total global soybean exports. Brazil alone accounts for about one-half of global soybean exports, and any significant impact on production will impact the overall balance sheet and place even more importance on the 2021–22 US crop. Brazilian soybean famers typically finish planting in December and harvest through March and April. Despite weather challenges, it is possible that Brazil could produce a record soybean crop even if the USDA reduces their current crop estimate of 133 MMT down to analysts’ estimate of around 130 MMT. Note that Brazilian production of 133 MMT is already reflected in the global balance sheet. Anything less than that would likely be viewed by the trade as supportive for prices.

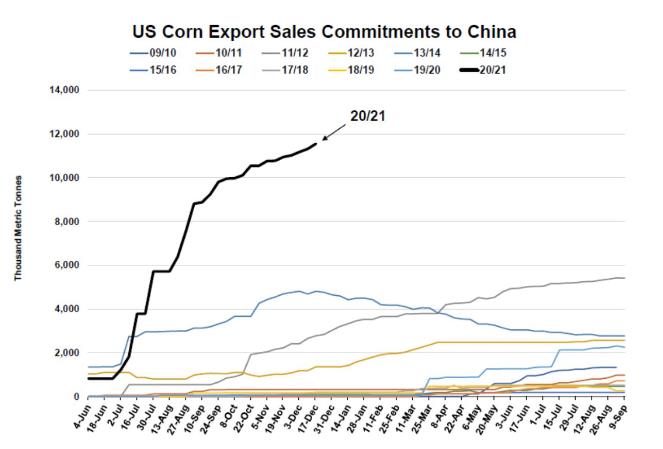

CORN

Importantly, the Chinese are also poised to import a record amount of US corn. As of December 17, 2020, U.S. corn export sales commitments to China stand at a record 11.55 MMT for the 2020–21 crop year, which began on September 1, 2020. China, until this year, has never imported more than 6 MMT from the world market.

Chart 8

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results. Chart: DC Analysis, LLC, using data from USDA through December 17, 2020. Used with permission from DC Analysis. The information and data contained herein do not constitute investment advice offered by Teucrium Trading, LLC and are provided solely for informational purposes

Internal Chinese corn demand appears to be robust, with domestic Chinese corn prices trading near 5-year highs. The Chinese aggressively auctioned off corn inventories this year to both alleviate price inflation and maintain freshness of state reserves. Presumably, China is replenishing their reserves and is taking advantage of pricing arbitrage, buying US corn for around $4 and selling older domestic reserves for as much as double that amount.

Chart 9

Chart created by Teucrium using Bloomberg Finance LP on 12/22/2020

Front Month Dalian Corn Futures vs Front Month Corn Futures

Daily Price Chart 12/31/2019–12/18/2020

Past performance is not indicative of future results

Robust global demand and tighter balance sheets have helped push corn prices to their current levels, testing the 5-year highs. However, to confirm the Big Shift we will likely need to see continued tightening of the global corn balance sheet through the 2021–22 crop year.

Potential Weather Challenges

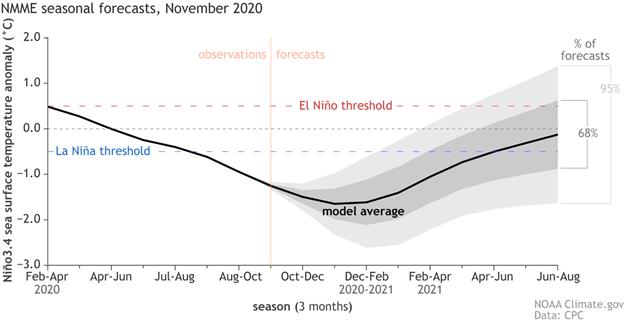

Weather challenges appear likely to extend beyond 2020 and confront farmers across the globe again in 2021. Furthermore, these challenges may be exacerbated if the current La Niña weather pattern strengthens.

NOAA confirmed La Niña in September 2020 and recent forecasts show that the pattern is likely to remain in place through spring 2021. Typically, La Niña occurring between June and August leads to drier weather in southern Brazil and northern Argentina (see Charts 8–9). La Niña occurring between December and February results in cooler but not necessarily dryer weather for Brazil. However, should La Niña continue on through June and August 2021, we would expect continued dry conditions in Brazil and Argentina which could negatively impact grain production in both countries.

Chart 10

Chart 11

The La Niña weather pattern is also likely responsible for dryness impacting US winter wheat farmers as well. Remember, impacts during the winter months when winter crops are in dormancy can be minimal but will grow in importance once those crops start their final growth stages in the spring. That said, current drought conditions extend far beyond the areas typically affected by La Niña in the US.

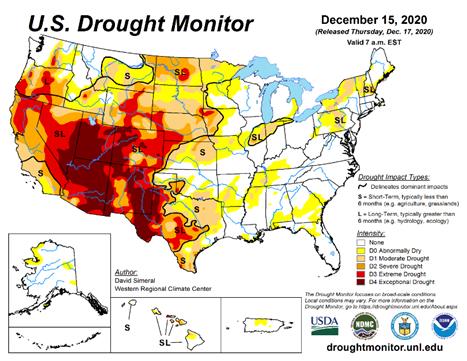

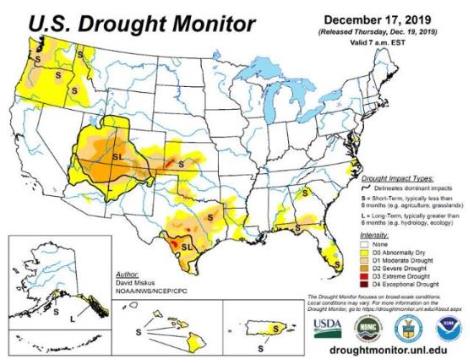

The most recent US Drought Monitor shows severe, extreme, and exceptional drought across midwestern states stretching down from North Dakota through Texas. The December 17th, 2019 map is shown below for the sake of comparison.

Chart 12

NOAA is forecasting above normal precipitation for northern states this winter, and below normal precipitation for southern states. If realized, this means states such as Kansas, Oklahoma, and Texas, which are already experiencing drought, will only get drier over the next few months.

Chart 13

As mentioned, the most immediate La Niña-influenced weather impact is on US winter wheat farmers. The US winter wheat crop condition ratings have taken a hit with 43% of the crop rated “Good to Excellent” versus 52% rated “Good to Excellent” last year.6 Wheat prices, however, are as likely to be heavily influenced by production in Russia, the world’s largest wheat exporter. The wheat trade is watching weather conditions in Russia and the Black Sea region more broadly as dryness has been a concern in key growing areas. According to the Russian agricultural consultancy Sovecon, 22% of the Russian wheat crop is in poor condition and in the worst shape since 2009–10.7 Despite all of this, global wheat production is forecast to exceed demand for the 2020–21 crop year.

International Relations and Trade

While weather may be the critical factor impacting grain prices in the year ahead, one cannot overlook the potential impact of geopolitics.

During the spring of 2020, wheat prices outperformed stocks as consumers and nations alike rushed to procure pastas, breads, and wheat. Russia, in an attempt to shore up their domestic supply, signaled that they would be capping their exports. This was a significant development for wheat importers and highlighted the need for sovereign nations to fortify both their food stocks and their international supply chains for all grains.

Case in point, a portion of Chinese grain purchases, including corn, soybeans, wheat, and rice appears to be tied to an effort to restock and increase domestic grain reserves. China’s consumption needs and/or its desire to stockpile grains inextricably ties China to the US and other global grain exporters for the foreseeable future. While the relationship between China and the US is volatile, we do not see a scenario where the Chinese can turn away from American grain markets any time soon.

China accounts for approximately two-thirds of the world’s global soybean imports. Recall that the US and Brazil account for over 85% of global soybean exports. The US, Brazil, and Argentina are three of China’s largest markets for soybeans. China would not be able to meet its soybean demand without these three countries. What’s more, Brazil recently purchased soybeans from the US. Presumably, Brazilian farmers have “oversold” their crop and are importing in order to meet domestic demand. The point here is that China needs US soybeans, and they will likely continue to purchase from the US regardless of political tensions.

A Weakening US Dollar

Having recently dipped to around 90, the Dollar Index (DXY)8 is now approaching 5-year lows around 89.

Chart 14

Chart created by Teucrium using Bloomberg Finance LP on 12/19/2020

Dollar Index (DXY) Weekly Price Chart 12/31/2015–12/18/2020

Past performance is not indicative of future results

We see a weakening US dollar as providing additional incentive for China and other countries to purchase US grains. A weak US dollar has historically been a tailwind for US grain exports as well as for global grain prices. The dollar/grain commodity relationship is relatively straightforward. Globally, commodities are priced in dollars. A weakening US dollar means that commodities in general, and US exports in particular, become more competitive relative to other non-dollar currencies. For example, if the US dollar depreciates against the euro, then it will take fewer euros to purchase the same amount of goods priced in dollars. All else being equal, the increase in demand for dollar-denominated US goods would generally be supportive of prices.

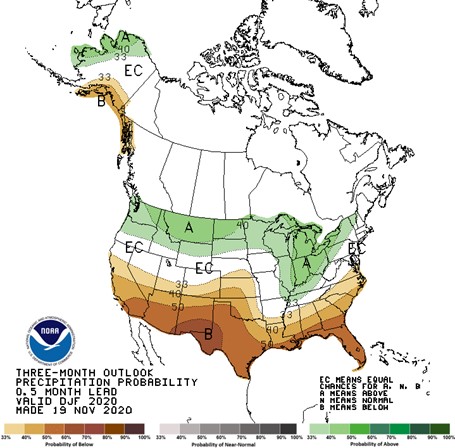

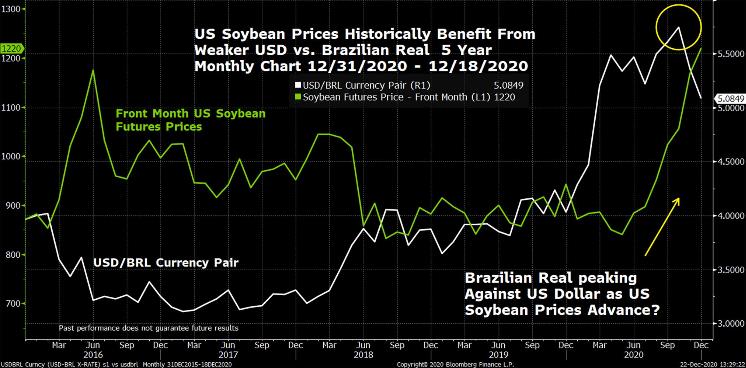

While the Dollar Index (DXY) provides a quick read on dollar strength/weakness, the dollar/real and dollar/ruble currency pairs are more important indicators relating to global grain prices. Historically, global soybean prices have moved higher as the dollar weakens versus the Brazilian real because Brazilian soybean farmers are less likely to export soybeans versus selling soybeans domestically.

Chart 15

Chart created by Teucrium using Bloomberg Finance LP on 12/22/2020

Front Month Soybean Futures vs USD/BRL Currency Pair

Monthly Price Chart 12/31/2015–12/18/2020

Past performance is not indicative of future results

The same relationship exists between the dollar/ruble currency pair and US wheat prices. Note, however, that the US is among a handful of large global wheat exporters. While a weaker dollar vs. the ruble makes US wheat “cheaper” vs. Russian wheat, global importers still have a multitude of options. Even so, given that Russia is the world’s largest wheat exporter, dollar weakness against the ruble is seen as being supportive for global wheat prices.

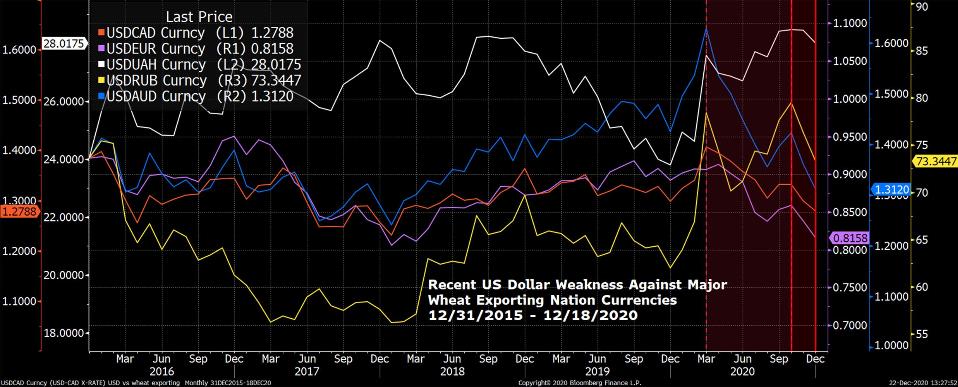

Note that the USD is simultaneously weakening against currencies of some of the world’s largest wheat exporting nations. The US dollar declining across the board could provide a tailwind for global wheat prices.

The world’s top wheat exporting nations according to the USDA are as follows: Argentina, Australia, Canada, European Union, Russia, and the Ukraine. The appreciation of the USD vs the Argentinian peso is beyond the chart and is not depicted in Chart 16. Argentina is the smallest of the seven major global wheat exporters.

Chart 16

Chart created by Teucrium using Bloomberg Finance LP on 12/22/2020

USDCAD, USDEUR, USDUAH, USDRUB, USDAUD Currency Pairs

Monthly Price Chart 12/31/2015–12/18/2020

Past performance is not indicative of future results

Inflated Inflation Expectations?

Many are pointing to the unprecedented US fiscal and monetary response to the COVID-19 pandemic as the key driver for a weaker dollar globally. Additionally, market participants seem to be increasingly weary of the potential for inflation in the US. Caution is warranted, however, as we do not believe that security purchases by the Federal Reserve (i.e., Quantitative Easing or QE) alone are enough to spark broad based inflation in the US.9 Consider that 12 years after QE 1 was announced, headline CPI remains below 2% year over year.

We do think inflation concerns are warranted when considering the Federal Reserve’s potential to adopt Modern Monetary Policy combined with fiscal experimentation with some level of Universal Basic Income. The combination of these two policies would amount to something new that we will call Monetary Spending.10 Monetary spending could lead to a scenario where demand for consumer goods outpaces the supply of those goods thereby sparking broad based inflation.

More immediately and far more likely in our opinion, is the effect rising crude oil and natural gas prices will have on future moves in headline inflation. New policy shifts in the U.S., and indeed throughout the globe, toward the “greening” of the current carbon-based energy industry will accelerate the already developing inflationary trends in crude oil and natural gas. New administrative, environmental, and tax policy burdens that disincentivize the production of fossil fuels will cause crude oil and gas prices to rise, raising overall inflation rates across the globe. In the end, this could create more demand for grains via increased usage of alternative fuels like ethanol and biodiesel.

While broad-based inflation would likely provide an additional tailwind to grain prices, food prices are already running far north of headline CPI. As of November 30, food prices are up 3.94% year over year versus a headline CPI of 1.175%.

We believe investors who are actively positioning their portfolios for future inflation might do well to consider current opportunities in grains, especially if the trend of a weaker dollar continues well into 2021.

Grains in Your Portfolio

Grains historically have low correlations to equities. Low correlations have the potential to improve portfolio outcomes during periods of stock market volatility.

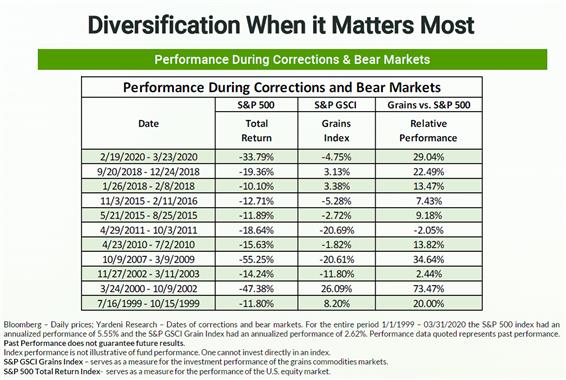

Chart 17

In our 2020 Outlook, we shared the view that investors would likely be looking to commodities as an alternative asset class, specifically looking at grains to further diversify their commodity exposure.

In fact, the GSCI Grains Index has outperformed the S&P 500 in 10 out of the last 11 stock market corrections of 10% or more. We included this data point in our 2020 Outlook last December. At that time, we had no idea that the next equity bear market was just around the corner. The S&P 500 fell nearly 35% peak to trough through March 2009. During that time the GSCI Grains declined by 4.75%, outperforming stocks once again by approximately 29%.

Chart 18

The historical tendency for grain prices to outperform equity prices during stock market corrections suggests that investors may benefit from an allocation to grains precisely when it matters most, i.e., during significant stock market declines.

While an investment in grains comes with upside potential and downside risks, the potential portfolio diversification benefits should not be overlooked. In 2020, grains investors have experienced both portfolio diversification benefits and upside price moves.

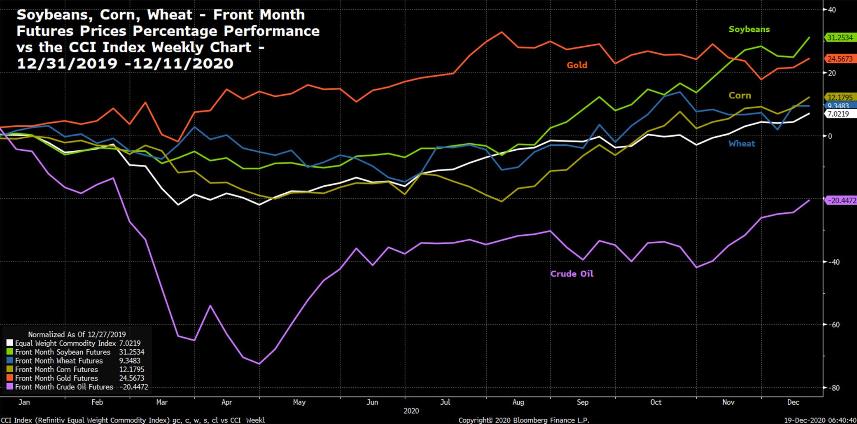

Stressing the importance of diversification may be cliché, yet too many investors tend to overlook the importance of diversifying their commodity exposure. Our experience has shown that many investors’ commodity allocations remain overweight in gold and oil. The chart below shows the percentage performance of corn, wheat, soybeans, gold, and oil versus the Refinitiv Equal Weight Commodity Index this year (through 12/11/2020). Note that gold, soybeans, corn, and wheat all outperformed the index while oil trailed significantly. Markets in 2020 clearly demonstrated why it’s important to diversify one’s commodity exposure beyond the most commonly held commodities of precious metals and energy by also considering an allocation to grains. We are confident in this view and point to the 67% increase in shares outstanding for Teucrium’s grain-based ETFs over the past 11 months.

Chart 19

Chart created by Teucrium using Bloomberg Finance LP on 12/19/2020

Front Month: Soybean Futures, Wheat Futures, Corn Futures, Gold Futures, Crude Oil Futures and the Refinitiv Equal Weight Continuous Commodity Futures Price Index

Weekly Price Chart 12/31/2019–12/18/2020

Past performance is not indicative of future results

Chart 20

Calling The Big Shift

Price performance of commodities in general, and grains specifically, is pointing to the potential shift to a secular bull market. Macro drivers, such as a weakening US dollar, increasing annual grain demand, and production uncertainties, seem to be providing tailwinds at the moment. Ultimately, the fundamental drivers of supply and demand will dictate where grain prices go from here. Weather is largely unpredictable and appears to be the biggest threat to production and therefore supply. Global demand appears to be steady and Chinese demand is expected to remain robust through the 2020–21 crop year.

A Big Shift in grain prices may ultimately be realized in a scenario where production struggles to keep pace with growing global demand.

Of course, production increases and/or a decrease in demand could potentially halt or reverse the Big Shift.

Time will tell.

For ongoing grain market commentary and analysis, please follow us on Twitter @TeucriumETFs

and visit our website at www.teucrium.com

Portfolio Diversification That Grows

Disclosure:

An investor should consider investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other information. Read the prospectus carefully before investing. The Teucrium Corn, Sugar, Soybean, Wheat and Agricultural Funds (the “Funds”) are not mutual funds or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and are not subject to regulation thereunder. Foreside Fund Services, LLC is the distributor for the Teucrium Funds. Teucrium’s FINRA Office of Supervisory Jurisdiction is located at Three Main Street, Suite 215, Burlington, Vermont 05401.

A copy of the prospectus for each Fund may be obtained at: https://teucrium.com/

Futures Risks: Commodities and futures generally are volatile and are not suitable for all investors.

Futures investing is highly speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment. Investing in commodity interests subject each Fund to the risks of its related industry. These risks could result in large fluctuations in the price of a particular Fund's respective shares. Funds that focus on a single sector generally experience greater volatility. Futures may be affected by Backwardation: a market condition in which a futures price is lower in the distant delivery months than in the near delivery months. As a result, the fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis; and Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storing and inuring the underlying commodity. Opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive one.

_________________________