Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

File No. 333-248546

File No. 333-248545

File No. 333-241569

File No. 333-230623

File No. 333-254650

December 21, 2021

FWP

NOTICE

The Teucrium Commodity Trust has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents that the Teucrium Commodity Trust has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, a copy of the prospectus for each Fund may be obtained at https://teucrium.com/ or by calling (802) 540-0019.

____________________________________

2022 Grains Outlook – Time to Rebuild

Jake Hanley, Managing Director/Sr. Portfolio Specialist

Introduction

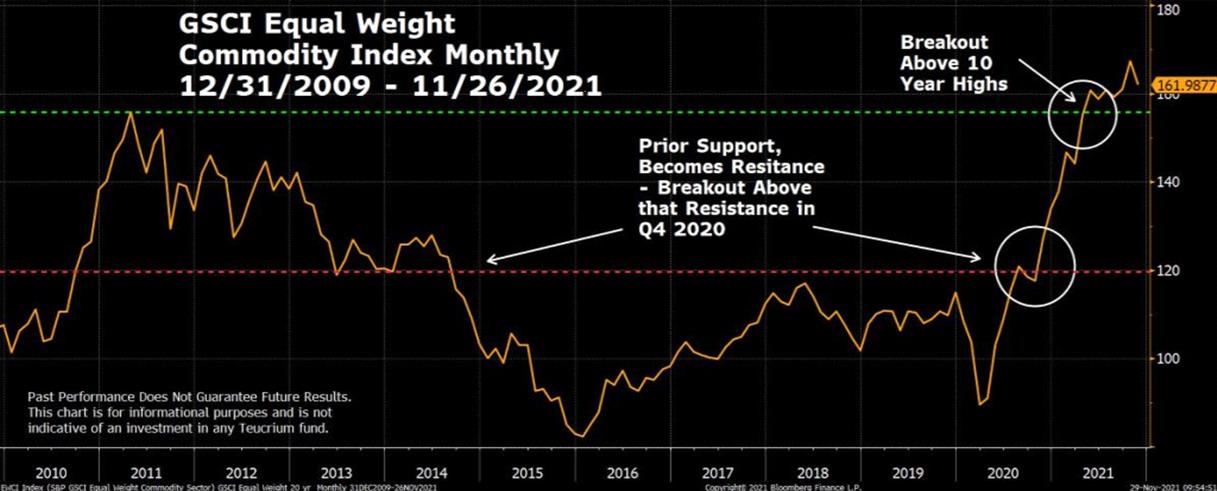

In our 2020 Outlook we wrote that the coming decade could possibly see the resurgence of a commodity bull market. That thesis was put to test with the onset of the global COVID-19 Pandemic. However, by the end of 2020 the GSCI Equally Weighted Commodity Index was pushing through 5-year highs. Since the breakthrough, there have only been a handful of speed bumps as commodity prices continue to climb and have now advanced beyond previous 10-year highs.

Chart #1

Source: Bloomberg Finance L.P. and Teucrium Created 11/29/2021.

GSCI Equal Weight Commodity Index

Monthly Price Chart 12/31/2009 – 11/26/2020

Past Performance is not indicative of future results. This chart is for informational purposes and is not indicative of an investment in any Teucrium fund.

The rally has been robust and practically all encompassing. Looking at the commodity futures markets, all but eight are on the plus side of unchanged this year and the majority are showing double digit percentage gains.1 As of this writing, both wheat and corn are up over 20% and 30% respectively.

Last December we wrote about the potential for the grains to make a “Big Shift” into a secular bull market. Indeed, grain prices in 2021 built on the momentum from 2020 and continued to rise against a backdrop of bullish fundamentals, namely tightening supplies, and growing demand. The “Big Shift” has happened.

Next will come a global effort to rebuild inventories. Note however, that grain prices have the potential to remain higher for longer for the simple reason that it will take time to rebuild supplies. Afterall, in agriculture there is no dial to turn to crank up production like there is in oil. It takes time to grow crops. Therefore, it will take time, likely multiple growing seasons, to rebuild inventories.

Ultimately, whether grains and other commodity prices continue to move higher is anyone’s guess. Still, one trend remains clear: there is an increasing investor appetite for exposure to alternative asset classes. Some investors are looking for ways to protect against inflation; others, having lived through periods of high stock and bond price correlations are looking for “non-correlated” assets (i.e. investments that tend to zig when others zag). As such, investors are increasingly turning to Commodities in general and grains in particular.

What follows is an examination of the grain markets as we look ahead to 2022.

The section outline is as follows:

I. Golden Grain Cycle: Review of the Golden Grain Cycle

II. Supply and Demand: Fundamental factors we’re watching

III. Inflation and the Dollar: Exploring the rapid growth in the money supply and currency valuations

IV. Grains in Your Portfolio: Relating our analysis back to you, the investor

V. Conclusion: Time to Rebuild

We hope you find this information interesting and valuable. Please do not hesitate to contact us with questions or ideas you would like to discuss.

On behalf of all of us at Teucrium, thank you for your continued interest in our funds.

We wish you a Merry Christmas, Happy Holidays, and a HAPPY NEW YEAR!

I. The Golden Grain Cycle

“Grains tend to trade at or near their cost of production until there is a supply disruption at which point prices historically have moved dramatically higher. Over time as production increases and/or demand decreases, inventories are rebuilt and prices trend back toward the cost of production once again.”

– Sal Gilbertie

The Golden Grain Cycle is, at its core, cosmic. Consider that growing seasons are dictated by the tilting of the Earth’s axis in proximity to the sun. As such, in North America there is only one harvest per year.

There are years when production exceeds demand, and prices are low. Alternatively, there are years when production lags demand, and prices are elevated. The variability of production in the face of steady, and often growing demand, lays the foundation for the grain market cycle. This cycle has repeated throughout history, offering those who recognize the cycle an opportunity for potential profit. Hence, we refer to the cycle as the Golden Grain Cycle.

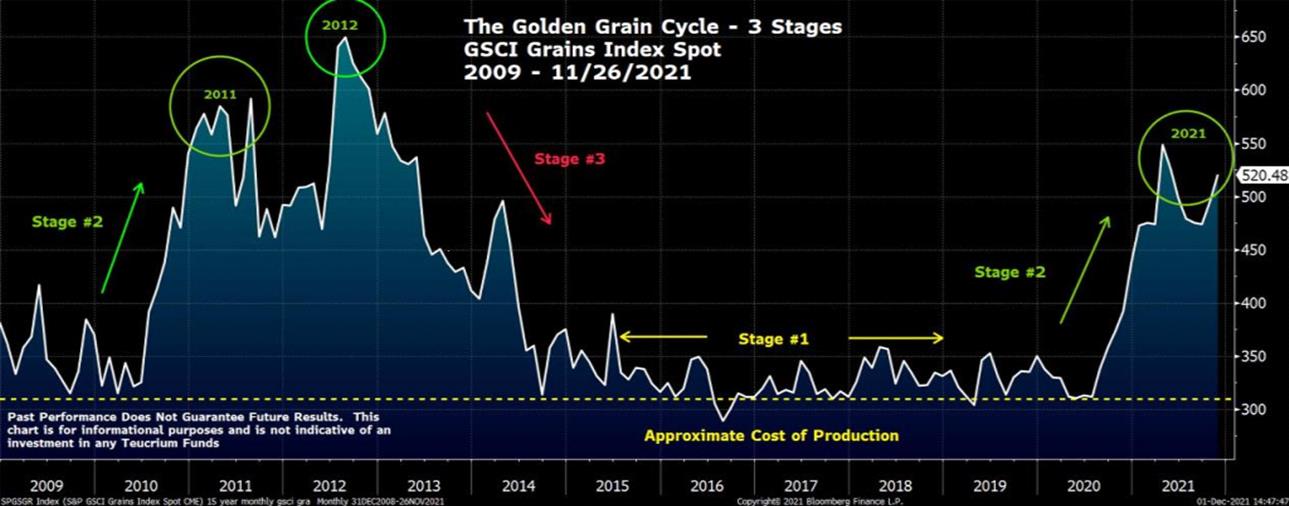

3 Stages of The Golden Grain Cycle

#1: Prices trade at or near the cost of production

#2: Prices advance amid supply/demand imbalance

#3: Supplies build due to increased production and prices head back toward the cost of production.

Typically, grain production exceeds demand. The excess is held in storage as inventory to be drawn down in years when demand exceeds production. When production exceeds demand, market prices will gravitate toward the cost of production effectively squeezing a farmer’s profit margins (stage 1).2 Lower profit margins can (and often do) result in fewer acres planted. This can lead to a situation where production may fail to keep pace with consumption in a given crop year. Historically, when grain production has lagged consumption, it has led to a reduction of inventories adding upward pressure on prices (stage 2). Historically, we have seen that higher prices are often the cure for high prices as farmers plant more acres in an attempt to ramp up production and capture higher prices (stage 3).

This cycle played out in textbook fashion over the previous decade (2010-2019)

In 2010 – 2012 a La Nina weather pattern led to poor growing conditions in key areas across the globe. As such, grain production lagged relative to demand and prices moved significantly higher, peaking in 2012 (see chart #2). Higher prices provided farmers the incentive needed to plant more acres.

The additional plantings led to increased harvest and global inventories began to grow. As you can see on chart #3 below, global grain inventories grew without interruption beginning in the 2013 – 2014 crop year and going through the 2018-2019 crop year. By 2016, grain prices were back near production costs and traded sideways for the rest of the decade (Stage 1).

Chart #2

Vertical axis represents S&P GSCI Grains Index values.3 Source: Bloomberg Finance L.P. and Teucrium Created 12/01/2021. Past performance does not guarantee future results. This chart is for illustrative purposes only and not indicative of any investment in a Teucrium Fund.

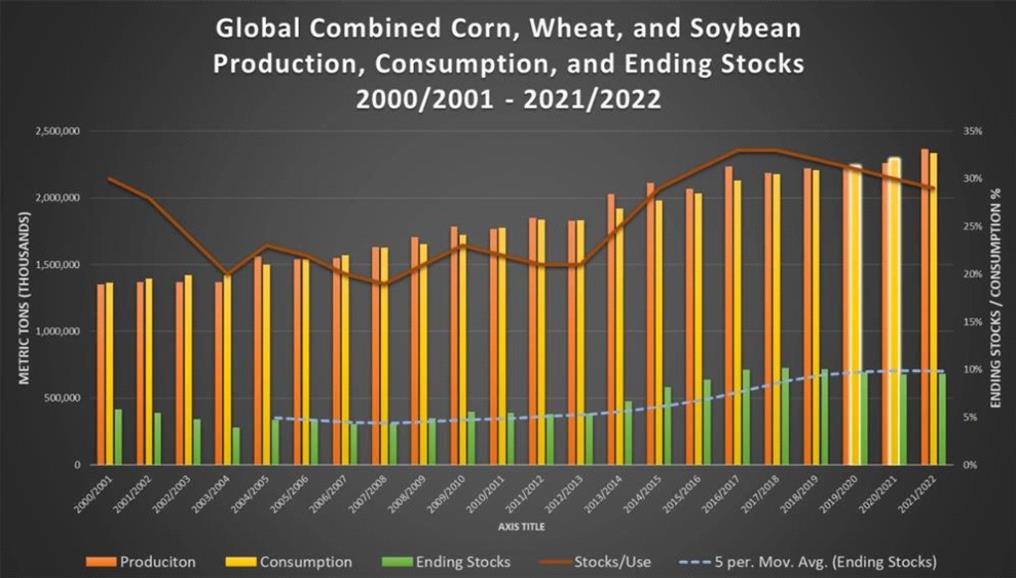

Then in the 2019-2020 crop year, the world consumed more corn, wheat, and soybeans than was produced. The globe didn’t run out of food, but rather drew down excess inventories that had been built over the preceding 6 years (beginning Stage 2). Again in 2020-2021, for the second year in a row, the world consumed more corn, wheat, and soybeans than was produced. This led to an additional draw down of inventories. Finally, in this current crop year (2021-2022), the world is expected to produce corn, wheat, and soybeans in excess of global demand4 (beginning Stage 3). Therefore, we expect to see global inventories begin to rebuild as we move through calendar year 2022.

Chart #3

Chart: Annual data from the 2000-2001 crop year through 2021-2022 crop year as of November 2021. Production, Consumption, and Ending Stock values found on the left axis measured in million metric tons. Stocks/Use ratio value found in the right axis measure in percentages.

Source: USDA and Teucrium. https://apps.fas.usda.gov/psdonline/app/index.html#/app/home

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

The chart above shows combined global corn, wheat, and soybean production (orange bars) and consumption (yellow bars) going back to the 2000 – 2001 crop year. When the orange bar is taller than the yellow bar, production exceeds consumption, and vis versa. The green bar represents ending stocks5 which increase in years when production exceeds consumption. The dotted blue line reflects the 5-year moving average of ending stocks. The brown line represents the stocks/use ratio6 (which is ending stocks dividend by consumption). The two highlighted yellow bars draw the eye to the 2019-2020, and 2020-2021 crop years when consumption outpaced production.

II. Supply and Demand

Supply

While the 2021-2022 crop year is expected to result in a build in global inventories of corn, wheat and soybeans, stocks/use ratios are likely to remain low relative to history. Given that global demand for grains is expected to remain robust (more on demand below), production in the coming 2022-2023 crop year will be critical.

There are several factors that may impact grain production in the coming months. Market participants are already following a number of these factors very closely, looking for any indication that production might come in above or below current expectations. Here are a few production and supply related items that the trade is currently and/or will likely be focused on going forward:

> Weather

> Planted Acres

> Availability

Weather

Weather is typically the most significant and relatively unknown variable. Long-term forecasts and climate patterns help paint a picture of what the weather might bring. However, like trying to pick tops and bottoms in the market, predicting weather is often an exercise in humility.

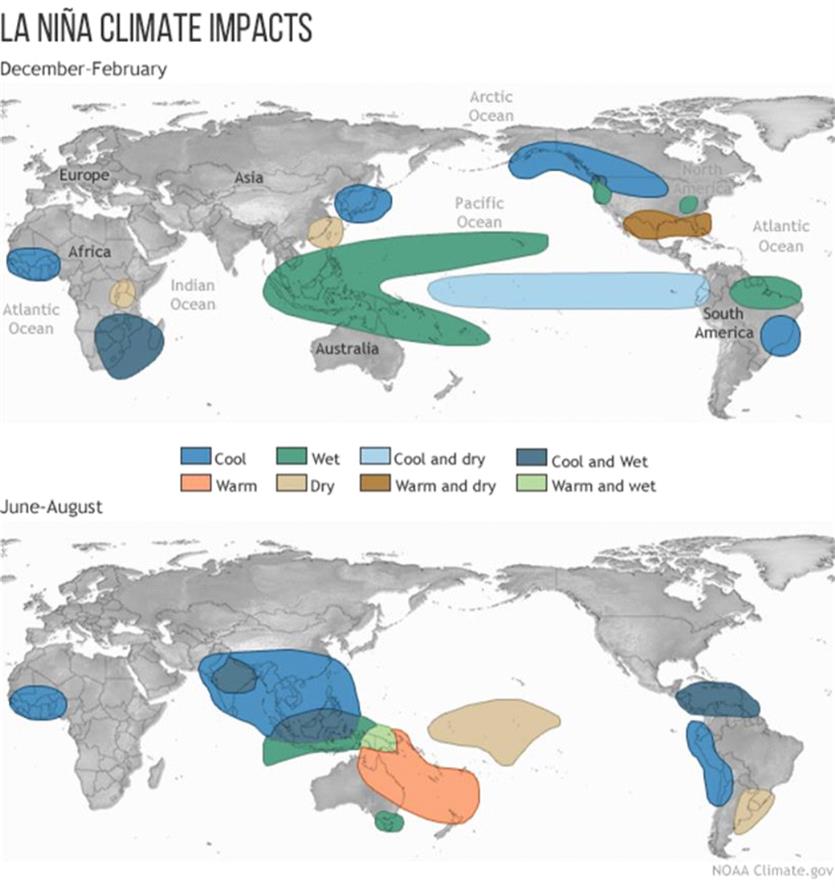

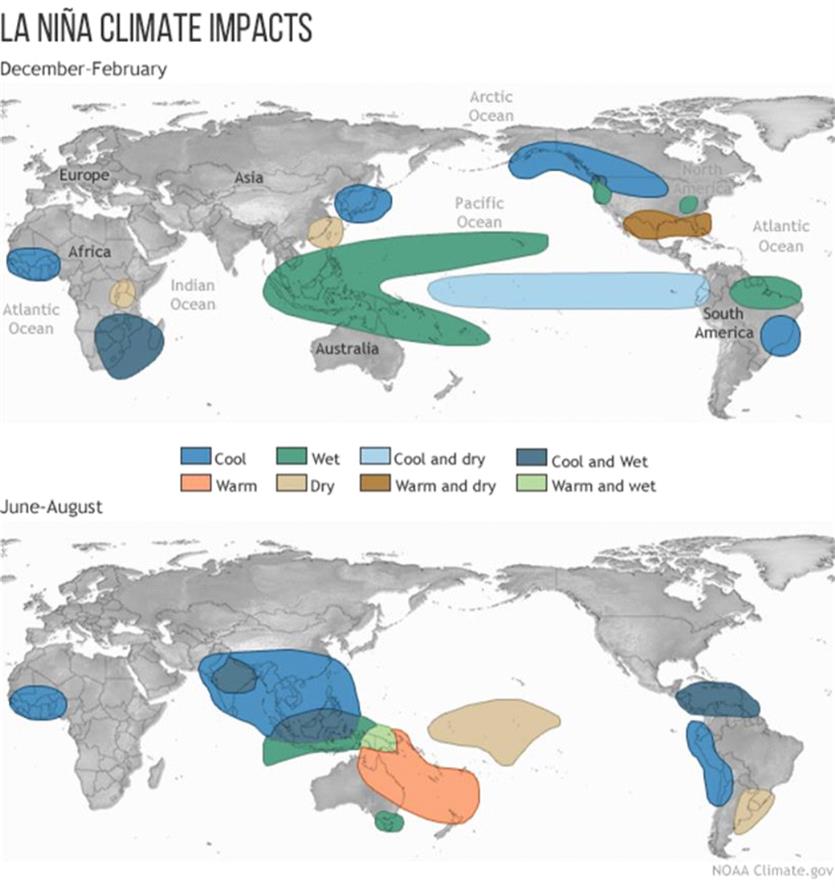

That said, based on current forecasts, it seems likely that weather will complicate grain production in many places across the globe in the coming months. The main culprit appears to be the La Nina conditions that have taken hold and are likely to remain over the winter. La Nina typically results in warm/dry weather in the US Southern Plains, dryness in Brazil and North/Eastern Argentina, and wet weather around Indonesia and Northern Australia.

Chart #4

Dryness in the US Southern plains has the potential to negatively impact winter wheat production. Dryness in Southern Brazil and North/Eastern Argentina has the potential to impact soybean and corn production. Already there are reports of excessive rains in Australia which is impacting the wheat harvest there.

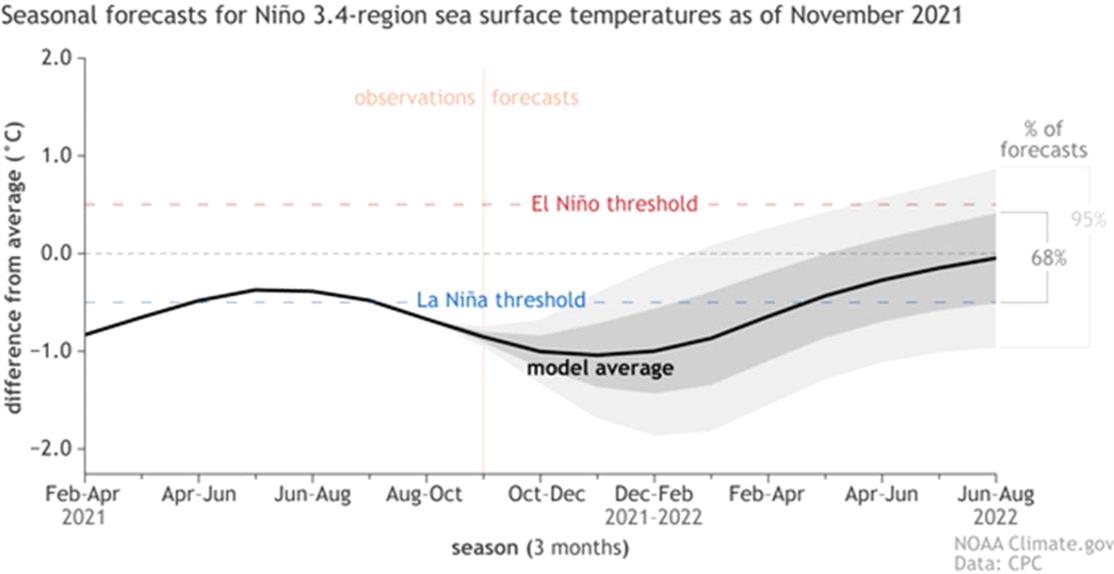

Current model shows that this La Nina will not likely be as strong as the one that just ended in the Spring 2021. Even so, the last La Nina carried some significant consequences (for example Brazilian corn production came in nearly 19% lower than initially forecast)7, and the fact that we are in the midst of another La Nina, no matter how strong, is understandably keeping the trade on edge.

Chart #5

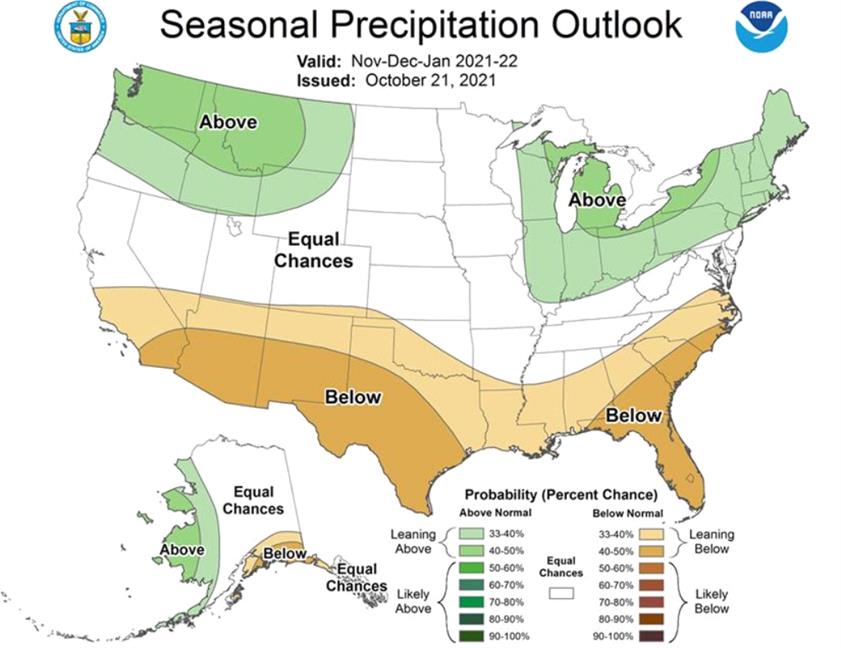

What’s more, a significant portion of the US farm belt remains considerably dry. As of November 16th, 17% of the US corn production, 13% of US soybean production and 44% of winter wheat production are within areas experiencing drought.8 Note that Winter wheat represents approximately 70% of total US wheat production.9

NOAA’s seasonal outlook shows above average precipitation expected for the Pacific Northwest, which could provide some relief for winter wheat farmers in Oregon, Washington, and Idaho. However, the seasonal outlook is also showing below average precipitation in the Southern Plains, which is consistent with the La Nina pattern.

Chart #6

Planted Acres

You Can’t Reap What You Don’t Sow

The simple equation behind crop production is as follows: Production = Harvested Acres (x) Yield Per Acre. The number of acres harvested is a function of how many acres are planted. While the combined number of acres for corn, wheat, and soybeans has generally risen over time, there are years where one crop will be gain acres over the others. For example, in the United States, there is one growing season for corn and soybeans. Therefore, each year, farmers must decide how many acres they are going to plant in each crop. In any given year the economics may be more favorable for planting corn, versus soybeans and vice versa.

Currently, both of the corn and soybean balance sheets are extremely tight.10 Note that the United States is the world’s largest corn exporter and second largest soybean exporter. The supply and demand conditions in the US carry global implications.

The current price difference between the two crops suggests that in the Spring of 2022 US farmers may consider planting more corn acres at the expense of soybean acres. However, high fertilizer prices are increasing corn production costs, squeezing farmers’ profit margins. As such, US farmers might actually reduce the amount of corn acres they plant this coming Spring, opting to plant soybeans instead. Assuming larger soybean acres and fewer corn acres planted; we would expect upward pressure on corn prices.

The situation is somewhat different in Brazil where there are two growing periods compared to the US with only one. Brazilian farmers will typically plant and harvest a soybean crop and immediately turn around and plant corn. The ability to harvest two crops each crop year has helped Brazil secure a position as one of the most critical food producing countries in the world. Brazil is the world’s largest soybean exporter, and is 2nd only to the United States in corn exports.

The number of acres of corn and soybeans harvested in Brazil has more than doubled since the year 2000. Brazilian production increases have been instrumental in helping the world keep pace with growing global demand. Like US farmers, Brazilian farmers are also incentivized by higher prices and will likely seek to plant as much corn and soybeans as possible, even in the face of higher fertilizer costs.

The USDA forecasts slight increases to global planted acres but there is likely to be a reduction in the amount of fertilizer applied. Crop yields might suffer if plants don’t get the desired nutrients that fertilizers provide. The president of the Soybean and Corn Producers Association of Mato Grosso is reported to have urged farmers to “be cautious with their input purchases and not to feel pressured to purchase expensive inputs.” The thinking is that it’s better to produce less and still have a profit than to purchase high-cost inputs and lose money at the end of the season.11

If Brazilian farmers determine that they have a better chance of remaining profitable by producing less, then we might expect a smaller Brazilian crop relative to current estimates. Smaller than expected production from Brazil would likely provide some upward pricing pressure.

Availability

Geo- Politics

Global food production and trade is a highly politicized arena. After all when citizens go hungry a revolution is typically not far off. As such, governments across the globe are very concerned about food price stability. When food prices begin to rise, pressures increase domestically to limit food exports. We see this in Russia, as the world’s largest wheat exporter. Russia has recently announced that they might revise their grain-export tax in the event of rising food prices. A higher export tax would work to encourage Russian wheat suppliers to market their wheat domestically versus selling it into the global markets. What’s more, Russia’s agricultural minister announced that the country is planning to announce a “grain-export quota” for the first half of 2022, which effectively would put a cap on Russian grain exports.

While keeping more wheat within Russia’s borders may help suppress prices domestically, it is likely to have the opposite effect on global wheat prices.

What’s more, there is concern that Russia may be planning to invade the Ukraine. The Ukraine accounts for approximately 8% of global wheat exports measured in US dollars.12 A military conflict has the potential to disrupt trade and could provide additional upward pressure on wheat prices. Recall that when Russia annexed Crimea in 2014, US wheat futures prices rose approximately 18%.

Supply Chain Concerns

Having learned through experience, the global economy is not something that can be turned off and on at the flick of a switch. To say that the COVID-19 pandemic disrupted global trade logistics would be an understatement. Labor shortages have directly contributed to delays in both the production and delivery of goods across the globe. Those delays, in the face of strong demand, are adding to producer prices and shipping costs. In fact, the US Producer Price Index is up 12.5% year-over-year. That is a level that has not been seen since 1980.

Chart #7

US Producer Price Index Year Over Year (YoY) Percentage Change measured Quarterly 01/01/1947 – 11/22/2021. The vertical axis measures the YoY change in the Producer Price Index measured in percentages.

Source: Bloomberg Finance L.P. and Teucrium. Created on 12/02/2021This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

The Baltic Dry Index13 on the other hand is up approximately 127% year-over-year but is down over 50% from the highs reached in early October. Lower shipping rates may be indicating that some of the shipping back log is working through and that the delivery times may be improving. This would be welcome news for global consumers.

Shipping rates however remain relatively high and are likely suggesting that we are not out of the woods yet.

Chart #8

Baltic Dry Index Daily Chart 11/26/2020– 11/26/2021. The vertical axis reflects the Baltic Dry Index Value.

Source: Bloomberg Finance L.P. and Teucrium. Created on 12/02/2021. This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Demand

Near-Term

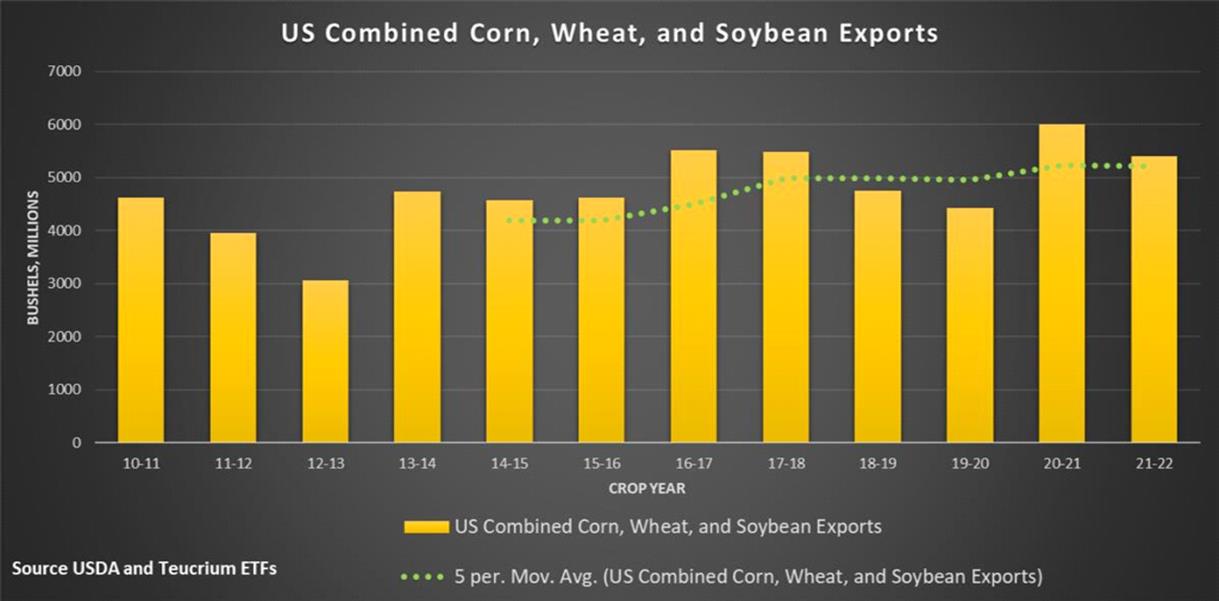

Global combined consumption of corn, wheat, and soybeans is projected to reach an all-time high over the 2021-2022 crop year. Additionally, combined global exports are also expected to reach record levels in ’21 – ’22. Record global demand, combined with record exports have the potential to provide price support for the grains as we move through 2022.

Domestically however, it’s a bit of a mixed picture. The USDA is estimating a year-over-year 10% decline in combined corn, wheat, and soybean exports versus last crop year. Still, combined exports are expected to be robust likely coming in above the 5-year trailing average.

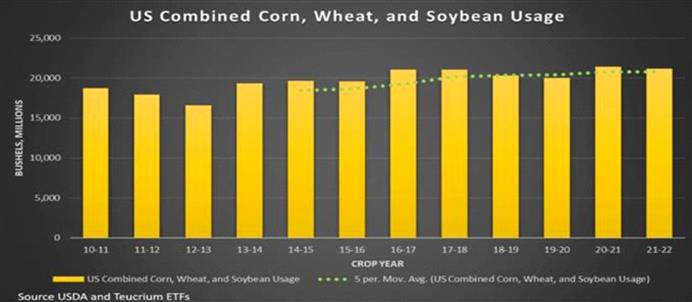

Chart #9

Chart: Annual data from the 2010-2011 crop year through 2021-2022 crop year as of November 2021. Exports measured in millions of bushels.

Source: USDA and Teucrium. https://apps.fas.usda.gov/psdonline/app/index.html#/app/home

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Meanwhile, combined domestic usage is expected to be relatively flat year over year with current estimates pointing roughly a 1% reduction. It’s worth pointing out that domestic demand for corn appears to be the most robust, due to increased ethanol demand (more on bio-fuels below). At this point, it looks like there are bigger question marks around demand for US wheat and soybeans in the year ahead.

The USDA is estimating a sizeable increase in the feed and residual usage category for wheat (42%). By allocating usage to the “residual” category the USDA may be implying that they have a high degree of confidence that the demand will be there, but that they are not exactly sure where it will show up yet. For example, it is possible to see a decline in the feed and residual column and an increase in the export column. The market would likely view this as a bullish development. It is also possible that the feed and residual estimate is reduced without an offsetting increase in any other usage category. That would likely be viewed as a bearish development that could lead to increased ending stocks.

Chart #10

Chart: Annual data from the 2010-2011 crop year through 2021-2022 crop year as of November 2021. Usage measured in millions of bushels.

Source: USDA and Teucrium. https://apps.fas.usda.gov/psdonline/app/index.html#/app/home

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Intermediate Term

Sustainable/Renewable Fuels – Closer than we think?

Here’s an interesting term, “sustainable aviation fuel (SAF).” It is estimated that approximately 2.5% of global carbon emissions come from burning jet-fuel.14 While that does not necessarily sound like a big number, consider that if global aviation were itself an independent country, it would rank among the top 20 of the world’s largest emitters of CO2.15 This has caught the attention of the Biden Administration which is reportedly setting a goal of “eliminating the airline industry’s fossil fuel usage by 2050.”16 Replacing fossil fuels for use in combustion (non-electric) engines of all types will likely require more use of agriculturally derived liquid fuels in the near term, which means ethanol (and its derivatives) along with soybean oil (currently a component of biodiesel) will see increased demand as new environmental policies are put into place.

There is another developing opportunity for soybeans in the “renewable diesel” markets. The interesting thing about renewable diesel is that it is not an additive but rather 100% a fuel unto itself. Renewable diesel, when compared to petroleum-based diesel, on a gallon per gallon basis, can reduce carbon emissions by up to 85%.17 Renewable diesel has the potential to replace petroleum-based fuels which are largely used in the transportation industry. On the flip side, we could easily see the ”food versus fuel” debate reignite during years of tighter soybean supply.

In September 2021, Tyne Morgan writing for Agweb.com attributed the following quote to Pete Meyer, head of Grain and Oilseed analytics at S&P Global Platts:

“…renewable diesel and aviation fuels made from soybeans has the potential to be bigger than what ethanol was for corn in the first couple of decades in the 2000’s.”

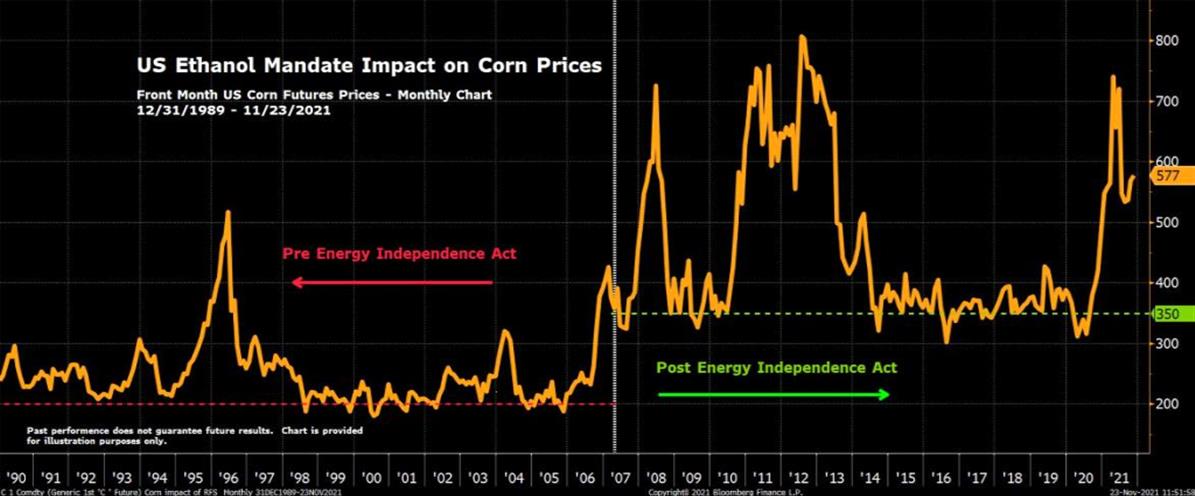

That is quite the statement given that the Energy Independence Act of 2007, which introduced the E10 gasoline blending mandate, resulted in a permanent shift higher for corn prices.

Chart #11

Source: Bloomberg Finance L.P. and Teucrium. Chart created on 11/23/2021.Prices are expressed in 1/100th of $1. i.e. 577 = $5.77This is for illustrative purposes only and not indicative of any investment in Teucrium Funds. Past performance is no guarantee of future results. For this purpose, corn commodity values are representative of the futures (generic first corn futures contract - <C 1 Comdty>) spot continuation chart as defined by and sourced on Bloomberg: Generic contracts, such as C 1, C 2, C 3, ...., are constructed by pasting together "rolling" contracts, according to the pre-selected roll types on the commodity default page. The generic contract uses the value of a particular contract month until it "rolls" to the next month in the series. You can access a generic contract by replacing the month/year code with the number 1, i.e. C 1<CMDTY>. Replacing the month/year code with the number 1 will yield the spot contract.” Energy Independence Act and RFS Standards Timeline: https://www.ag.ndsu.edu/energy/biofuels/energy-briefs/history-of-ethanol-production-and-policy

Note however, that the Energy Independence Act mandated ethanol fuel blends. Currently there is no such mandate for Sustainable Aviation Fuel (SAF) or renewable diesel. Absent government mandates, it will likely take multiple years for these new markets to fully materialize and impact the US soybean balance sheet in a meaningful way.

Still, the changes are coming, perhaps faster than many realize. Consider that there are already billions of dollars being invested in the space. For example, Chevron plans to invest $600 million dollars into two soybean crushing facilities to secure future supplies of soybean oil.18 In a separate deal, an ExxonMobil affiliate is proceeding with plans to produce renewable diesel at a Canadian refinery.19 To the extent that big oil companies continue to get involved we could be looking at the beginning of a meaningful shift in the usage categories for US grains, soybeans in particular.

We do not anticipate soybean prices to be impacted by demand for sustainable aviation fuel, or renewable diesel in the ’21-’22 crop year. However, looking ahead, we agree with Mr. Myer from S&P Global Platts that this could be impactful.

III. Inflation and the Dollar

Money Supply Boosting Demand?

Inflation concerns are real, and they are justified. Alternative asset classes, including commodities, tend to attract investment flows during periods of elevated inflation expectations. From the conversations we’ve had with investors and professional money managers, this year is no exception.

As we have mentioned several times in our newsletters this year, we believe grain prices are likely to remain elevated for a least one more growing season which should continue to put upward pressure on food inflation measurements. Fundamentally, grain prices reflect supply and demand dynamics of the underlying markets. While the supply side of the equation is largely dependent on favorable weather patterns supporting crop production, the demand side can be impacted by several different factors including monetary/fiscal policies.

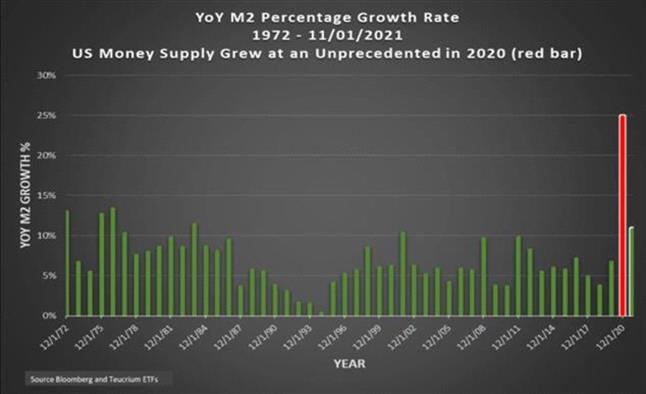

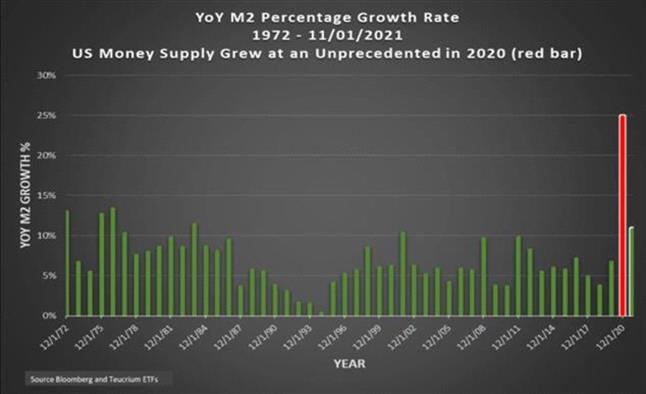

There is the potential that current monetary/fiscal policies will result in an excessive amount of cheap money sloshing around in the system. US Money supply, measured by M220, increases every year. In 2020 the supply of money grew an at the unprecedented rate of 25%!21 The issue, as it relates to grain prices is that abundant, cheap, and in some cases free money, could in effect end up subsidizing consumer demand.

Chart #12

Chart: Year over Year (YoY) percentage growth in M2 12/01/1972 – 11/01/2021

Source: Bloomberg Finance L.P. and Teucrium.

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Consider that high prices are typically the cure for high prices. That is to say that as prices continue to rise, demand eventually abates as increasingly consumers simply can no longer afford the higher prices. The key question therefore is how high will prices go before demand begins to wane.

In the current environment, given the amount of cheap/free money in the system, there is the risk that prices can go a lot higher. Simply put, the monetary/fiscal policies in the wake of the pandemic may have the effect of artificially supporting demand amid higher consumer prices that otherwise would be untenable. Grain prices will continue to trade based on supply and demand fundamentals, regardless as to whether that demand is real or inflated due to excessively accommodative monetary/fiscal policy.

The US Dollar

Consumer prices rose at the fastest pace in 30 years during October 2021. Yet, as of this writing, the US Dollar Index22 is only 5.75% off the 18-year highs reached in 2017 and gained roughly 4.5% since September. This may seem like somewhat of a paradox. After all, don’t higher consumer prices suggest a weaker dollar versus a stronger one? It’s important to keep in mind however that when it comes to currency valuations, it’s all relative.

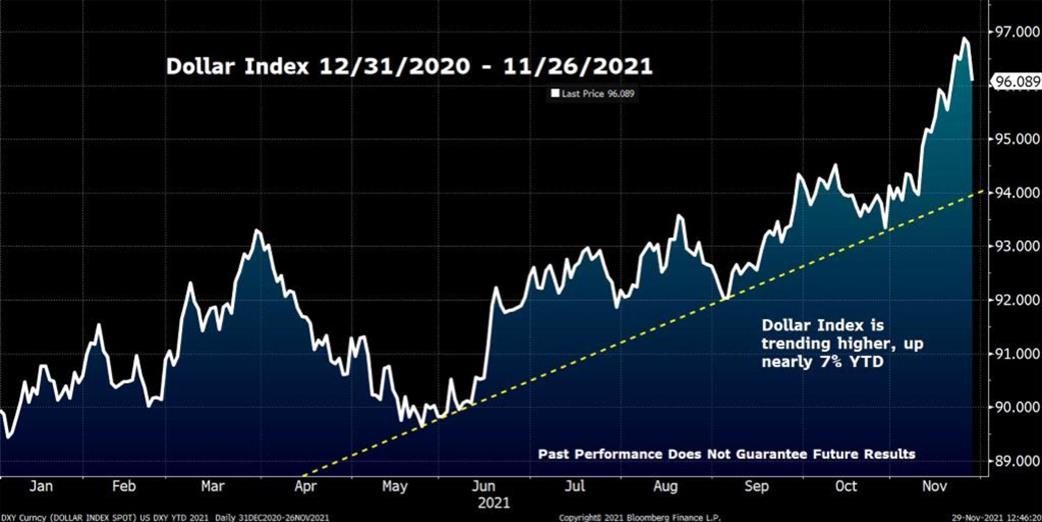

Chart #13

Chart: Dollar Index (DXY) 12/31/2020 – 11/26/2021. Source: Bloomberg Finance L.P. and Teucrium.

This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

The Dollar Index reflects the US Dollar valuation versus a basket of international currencies. The dollar, therefore, has been strengthening against some international currencies even as consumer prices are rising domestically.

Generally speaking, a strengthening US Dollar can generate headwinds for US exports. However, a rising dollar index does not necessarily negatively impact all commodity export markets all of the time. Seasonality of harvest/re-supply can also have significant impact on the relationship between exports and currency rates.

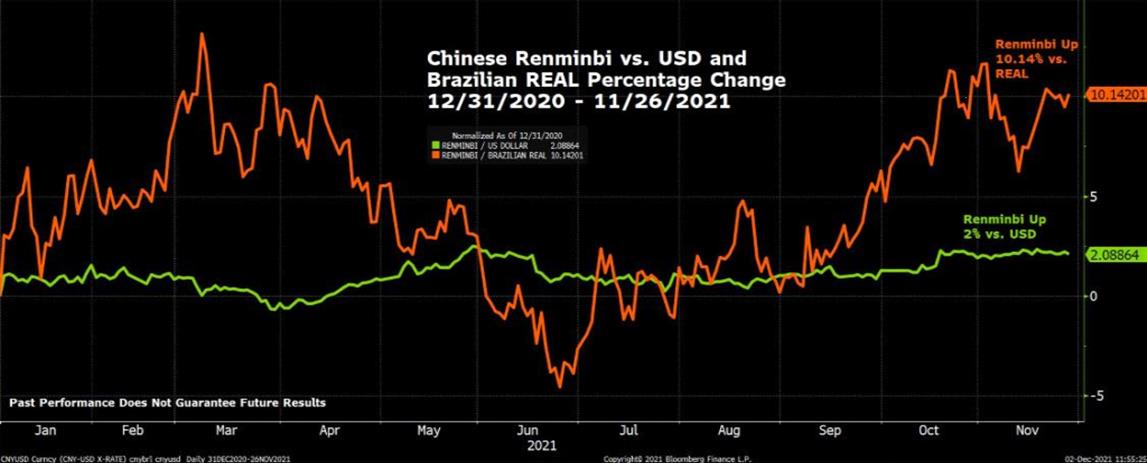

Take the soybean market for example, the US mainly competes against Brazil for export sales to China. Chinese importers are likely keeping a close eye on the value of the Renminbi versus the US Dollar compared to the Brazilian REAL. The Renminbi’s relative strength compared to the US Dollar and Brazilian REAL is likely an important factor for Chinese soybean importers when determining from which country they will source their soybeans when adequate supplies are available.

It is interesting to note that even as the US Dollar Index has risen sharply over the last couple of months, the US Dollar has been weakening versus the Chinese Renminbi. While this is a positive signal for US exports to China, note that the Renminbi is also strengthening against the Brazilian REAL.

Chart #14

Chart: Chinese Renminbi percentage appreciation vs. USD and Renminbi percentage appreciation vs. Brazilian REAL 12/31/2020 – 11/26/2021. Source: Bloomberg Finance L.P. and Teucrium. This is for illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results.

Looking out into 2022, we believe market participants will be well served to remember that currency values are always relative, and that different markets are more heavily impacted by different currency pairs. The world will likely be dealing with the impacts from the monetary and fiscal response to the COVID-19 pandemic for a long time. Additionally, there is the ongoing risk of political instability given the real pain/suffering that has accompanied the pandemic. As such, the economic and political stability of individual countries will likely continue to be a significant factor when calculating the relative value of global currencies.

IV. Grains in Your Portfolio

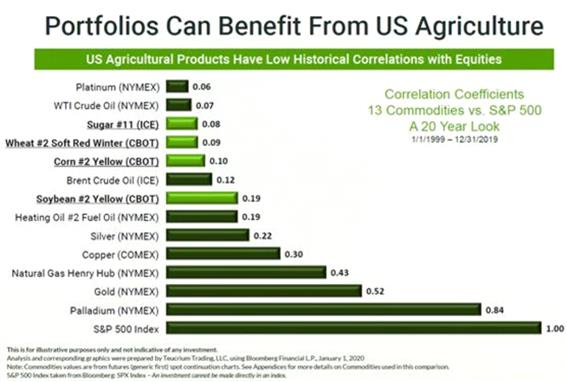

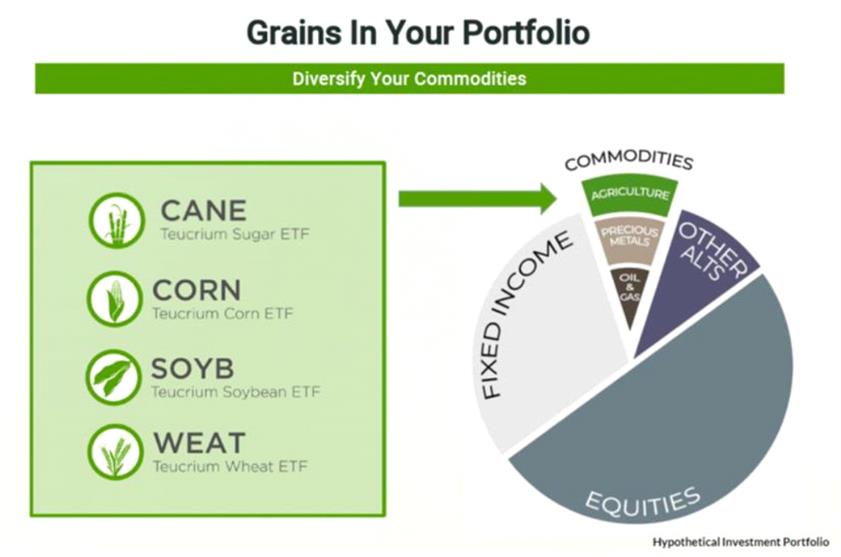

Grains historically have low correlations to equities versus many other commodities (Chart 15). Low correlations have the potential to improve portfolio outcomes during periods of stock market volatility.

Chart #15

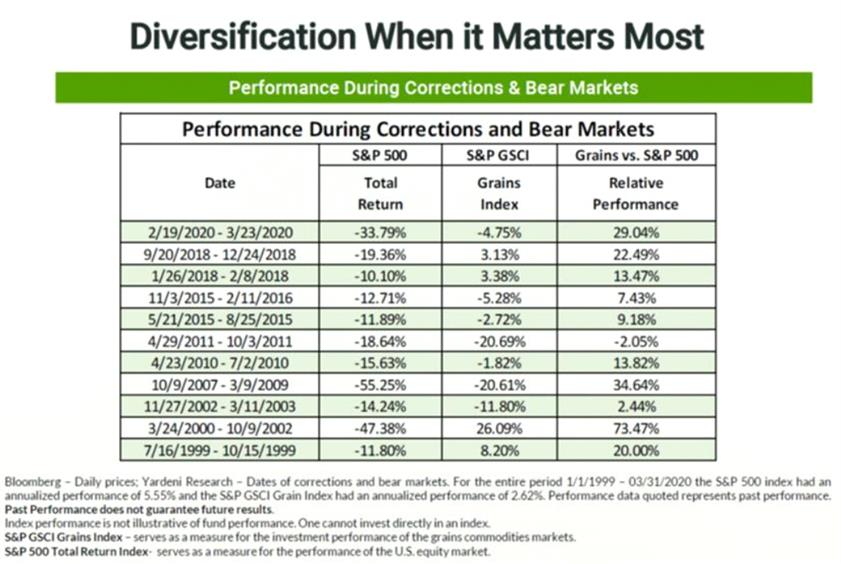

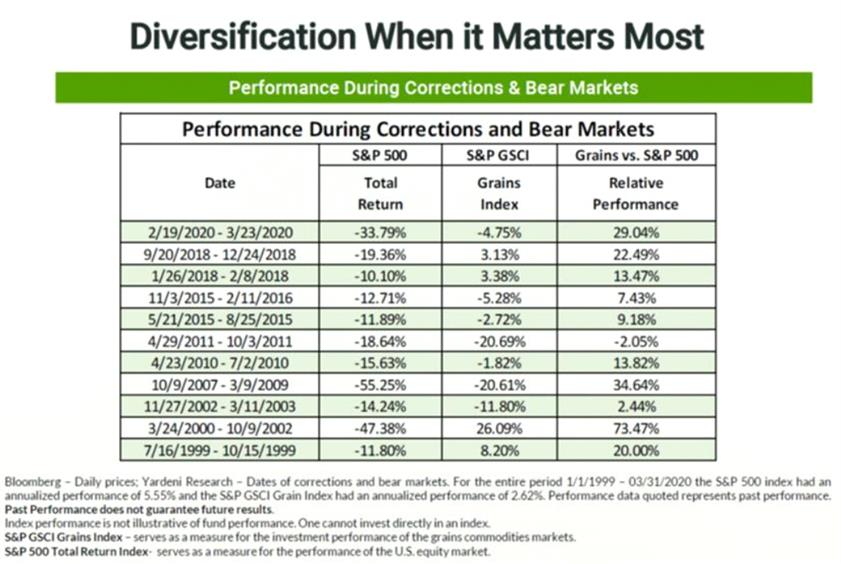

In fact, the GSCI Grains Index has outperformed the S&P 500 in 10 out of the last 11 stock market corrections of 10% or more (Chart 16). The latest example comes from the initial COVID sell-off in March of 2020. Here we saw the S&P 500 fall be nearly 35% peak to trough through March, while at the same time the GSCI Grains Index only declined by 4.75%. That resulted in a relative outperformance of approximately 29%.

Chart #16

The historical tendency for grain prices to outperform equity prices during stock market corrections suggests that investors may benefit from an allocation to grains precisely when it matters most; i.e. during significant stock market declines.

Stressing the importance of diversification may be cliché, yet too many investors tend to overlook the importance of diversifying their commodity exposure. Our experience has shown that many investors remain overweight in gold and oil relative to other commodities. An overweighting to oil has thus far proven to be beneficial this year, while an overweighting in gold has likely been a drag on performance.

Oil, corn, and wheat front month futures are all up over 20%, where soybeans and gold are both down by approximately 5%, and 6% respectively year-to-date.

Given the low correlations and historical relative performance there is a case to be made that by including agriculture among other commodity investments may help in creating a more robust portfolio.

Chart #17

V. Conclusion

Time To Rebuild

Last December we called the Big Shift23 into a secular bull market for the grain markets. We believe that the shift has happened as grain prices rose to 8-year highs in 2021 and remain elevated to date. It appears to us that we are now entering the 3rd stage of the “Golden Grain Cycle,” where farmers around the globe are taking efforts to increase production in hopes of selling their crops at these relatively high prices. In fact, current estimates show that for the first year in the last three, the globe is expected to produce more corn, wheat, and soybeans combined than it consumes. This is expected to lead to a modest increase in global inventories. We believe however that it will likely take at least one more crop cycle to replenish global supplies to the point where prices revert to the cost of production.

Note however, that higher than expected production and/or a decrease in demand could result in the larger inventories being realized sooner rather than later. This would likely be bearish for grain prices. Of course, the opposite is true. lower than expected production and/or increased demand could create additional stress for global balance sheets and provide additional support for prices.

Time will tell.

For ongoing grain market commentary and analysis please follow us on Twitter @TeucriumETFs, connect with us on LinkedIn, and visit our website at www.teucrium.com

Risks and Disclosures

Read the prospectus carefully before investing.

A copy of the prospectus may be obtained at: www.teucrium.com

The expressed views were those of Teucrium Trading, LLC as of 11/26/2021 and may not reflect the views of Teucrium on the date the material is first published or any time thereafter. These views are intended to assist in understanding certain factors that may contribute to the price of agricultural commodities or commodity futures such as corn, wheat, soybean and sugar cane. In no way do the views expressed constitute investment advice, and this document should not be considered as an offer to sell or a solicitation of an offer to buy securities outside of the United States of America. Any decision to purchase or sell as a result of any information or opinions expressed in this communication will be the full responsibility of the person authorizing such transaction. An investor should consider investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other information.

The Teucrium Corn, Sugar, Soybean, Wheat and Agricultural Funds (the “Funds”) are not mutual funds or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and are not subject to regulation thereunder. The funds are commodity pools. Investors may choose to use the Funds as a vehicle to hedge against the risk of loss, and there are risks involved in such hedging activities. Unlike mutual funds, the Funds generally will not distribute dividends to its shareholders. Investors may choose to use the Funds as a means of investing indirectly in corn, soybean, wheat or sugar cane. There are risks involved in such investments. Shares of the Funds are not FDIC insured may lose value and have no bank guarantee.

The funds invest in corresponding commodity futures contracts, cash and cash equivalents and are not intended to directly track the spot price of a particular commodity (such as corn, wheat, soybeans or sugar cane).

Futures Risks: Commodities and futures generally are volatile and are not suitable for all investors.

Futures investing is highly speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment. Investing in commodity interests subject each Fund to the risks of its related industry. These risks could result in large fluctuations in the price of a particular Fund's respective shares. Funds that focus on a single sector generally experience greater volatility. For further discussion of these and additional risks associated with an investment in the Funds please read the respective Fund Prospectus before investing.

Futures may be affected by Backwardation: a market condition in which a futures price is lower in the distant delivery months than in the near delivery months. As a result, the fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis; and Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storage and insuring the underlying commodity. Opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive one.

Past performance is not necessarily indicative of future results. Diversification does not ensure a profit or protect against loss.

Foreside Fund Services, LLC is the distributor for the Teucrium Funds.

This material must be preceded or accompanied by a prospectus.

Copyright © 2021, Teucrium Trading LLC, All rights reserved.

Our mailing address is:

3 Main Street, Suite 215

Burlington, VT 05401

1 Bloomberg Finance L.P. <CRR Go> Futures Comparison, YTD as of November 26, 2021

3 For more information on the S&P GSCI Grains Index please visit: https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-grains/#overview

4 USDA

5 Ending Stocks (also called carry-out): The amount of corn that will be available at the end of the crop year given the estimated or actual beginning stocks, production, and usage.

6 Stocks/Use Ratio: Ending stocks divided by total usage (i.e. consumption).

7 Comparing ’20-‘21 Brazilian Production Estimates: May 2020 WASDE, vs. November 2021 WASDE

8 USDA https://www.usda.gov/sites/default/files/documents/AgInDrought.pdf

9 USDA https://www.ers.usda.gov/topics/crops/wheat/wheat-sector-at-a-glance/#:~:text=Winter%20wheat%20production%20represents%20approximately%2070%20percent%20of%20total%20U.S.%20production.&text=In%20the%20Northern%20Great%20Plains,or%20durum%20varieties%20are%20favored.

10The USDA provides the Government estimated balance sheets for corn, wheat, and soybeans on the monthly World Agricultural Supply and Demand Estimates Report. A balance sheet depicts both supply and demand. A tight balance sheet is when supplies are low relative to demand.

11 https://www.soybeansandcorn.com/articles/8983/

12 https://www.worldstopexports.com/wheat-exports-country/

13 The Baltic Dry Index measures international shipping costs. For more information visit: https://www.balticexchange.com/en/data-services/market-information0/dry-services.html

14 https://ourworldindata.org/co2-emissions-from-aviation

15 https://www.c2es.org/content/reducing-carbon-dioxide-emissions-from-aircraft/

16 https://www.agweb.com/news/policy/politics/sustainable-aviation-fuel-and-renewable-diesel-may-be-ticket-eliminating-us

17 https://www.darpro-solutions.com/media/blog/renewable-diesel-the-next-generation-of-fuel

18 https://www.reuters.com/business/energy/chevron-invest-bunge-soybean-crushers-secure-renewable-feedstock-2021-09-02/

19 https://corporate.exxonmobil.com/News/Newsroom/News-releases/2021/0825_ExxonMobil-affiliate-to-produce-renewable-diesel-to-reduce-emissions-in-Canada

20 According to Investopedia… “M2 is a calculation of the money supply that includes all elements of M1 as well as ‘near money.’ M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, mutual fund, and other time deposits.” –https://www.investopedia.com/terms/m/m2.asp

21 From 1972 through 2019 US money supply measured by M2 rose at an average annual rate of 6.65%. M2 grew at 25% in 2020, and YTD is up another 11% in 2021. For comparison, in 2008 during the Financial Crisis/Great Recession M2 grew at a rate of 10%.

22 According to Investopedia the U.S. dollar index is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.’s most significant trading partners. https://www.investopedia.com/terms/u/usdx.asp

23 You can read last year’s Outlook “The Big Shift” on our website -> https://www.teucrium.com/news-insights/242