UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

Immunome, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 001-39580 | | 77-0694340 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

18702 N. Creek Parkway, Suite 100

Bothell, WA | | 98011 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (425) 939-7410

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, $0.0001 par value per share | | IMNM | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory Note

In this report, “Immunome,” “Company,” “we,” “us” and “our” refer to Immunome, Inc., and/or our wholly owned subsidiary, unless the context otherwise provides.

| Item 2.02 | Results of Operations and Financial Condition. |

On January 29, 2025, the Company announced the commencement of an underwritten public offering of its common stock (the Offering). The Company will file with the Securities and Exchange Commission (SEC) a preliminary prospectus supplement (the Preliminary Prospectus Supplement) to its automatic shelf registration statement on Form S-3 (File No. 333-277036), which was filed with the SEC on February 13, 2024, pursuant to Rule 424(b)(5) under the Securities Act of 1933, as amended (the Securities Act), relating to the Offering. The Company will include the following disclosure in the Preliminary Prospectus Supplement:

“Our financial statements for the quarter and year ended December 31, 2024 will not be available until after this offering is completed and consequently will not be available to you prior to investing in our common stock in this offering. Based on preliminary estimates and information available to us as of the date of this prospectus supplement, we expect to report that we had approximately $217.3 million of cash, cash equivalents and marketable securities as of December 31, 2024.”

Our actual financial statements as of and for the year ended December 31, 2024 are not yet available. The actual amounts that we report will be subject to our financial closing procedures and any final adjustments that may be made prior to the time our financial results for the year ended December 31, 2024 are finalized and filed with the SEC. Our independent registered public accounting firm has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. This estimate should not be viewed as a substitute for financial statements prepared in accordance with accounting principles generally accepted in the United States and it is not necessarily indicative of the results to be achieved in any future period.

The information in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

We are filing the following information for the purpose of updating certain aspects of our publicly disclosed description of our business contained in our other filings with the SEC and prior public disclosures.

Business Overview and Recent Developments

We are a biotechnology company focused on the development of targeted oncology therapies. We believe that the pursuit of novel or underexplored targets will be central to the next generation of transformative therapies, and we are dedicated to developing targeted cancer therapies with first-in-class and best-in-class potential. Our goal is to establish a broad pipeline of preclinical and clinical assets and develop these assets into approved products for commercialization. To support that goal, we pair business development activity with significant investment in our internal discovery programs.

We are advancing a pipeline comprising one clinical, one IND-cleared and four preclinical assets. Varegacestat, formerly AL-102, is an investigational gamma secretase inhibitor (GSI) currently under evaluation in a Phase 3 trial for the treatment of desmoid tumors. Our investigational new drug application (IND) for IM-1021, a receptor tyrosine kinase-like orphan receptor 1 (ROR1) antibody-drug conjugate (ADC) received clearance in December 2024, and we expect to initiate a phase 1 trial in the first quarter of 2025. Our other preclinical assets include IM-3050, a fibroblast activation protein (FAP) targeted radioligand therapy (RLT), for which we anticipate submitting an IND in the first quarter of 2025, and three solid tumor ADC potential drug candidates: IM-1617, IM-1340, and IM-1335, all of which are in IND-enabling manufacturing. We also have six additional ADCs currently undergoing lead optimization with development decisions expected later this year and into 2026.

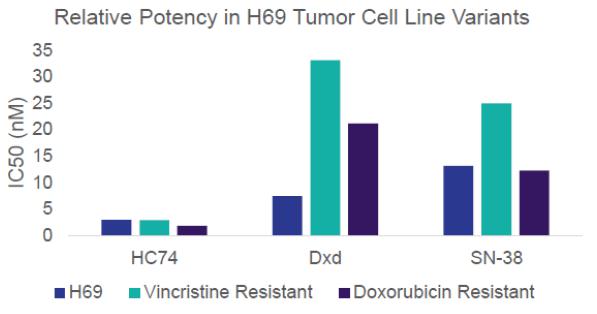

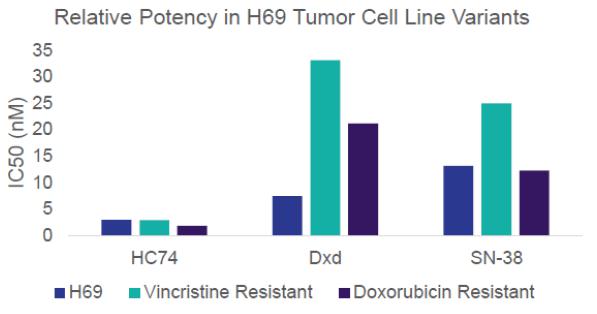

In addition to our pipeline assets, our proprietary payload topoisomerase 1 (TOP1) inhibitor, HC74, supports development of ADCs for novel targets. TOP1 inhibitors are validated ADC payloads, and ADCs with TOP1 inhibitors have been shown to achieve higher drug-to-antibody ratios and higher clinical doses than ADCs with microtubule inhibitor payloads. HC74 retains that mechanism of action while showing properties superior to DXd, the TOP1 inhibitor incorporated into Enhertu. Specifically, HC74 has demonstrated superior potency measured across 89 cell lines. It also retains potency in chemo-resistant cell lines. We also believe HC74’s increased permeability may lead to superior bystander effect, and that its rapid hepatocyte clearance may improve tolerability.

Varegacestat (formerly AL-102):

Our lead clinical asset is varegacestat, an investigational GSI that we acquired from Ayala Pharmaceuticals, Inc. on March 25, 2024 pursuant to an Asset Purchase Agreement. AL102 is currently under evaluation in a Phase 3 trial for the treatment of desmoid tumors. GSIs inhibit the NOTCH pathway, a driver of desmoid tumors. As previously disclosed, the Phase 2 RINGSIDE Part A study evaluated the activity of AL102 in patients with progressing desmoid tumors who required therapy. RINGSIDE Part A evaluated three dose levels, with a response rate of 64% in the 1.2mg daily dose arm (n=14) and an aggregate response rate of 55% across all three dose levels (n=42). As previously disclosed, varegacestat was well-tolerated with a safety profile consistent with the GSI class. The Phase 3 RINGSIDE Part B trial is fully enrolled, with topline data expected in the second half of 2025.

IM-1021 (Solid Tumor and B-Cell Lymphoma ADC):

IM-1021 is an ROR1 ADC that received IND clearance in December 2024. IM-1021 incorporates HC74, which is designed to target both lymphoma and solid tumors. IM-1021 showed superior efficacy to MK-2140 in the Jeko-1 mantle cell lymphoma (MCL) model and solid tumor models in preclinical studies.

Phase 1 clinical trial enrollment is expected to commence in the first quarter of 2025, and we expect dose escalation to include both patients with solid tumors and with B-cell lymphoma. The starting dose will be 2 mg/kg of adjusted ideal bodyweight.

IM-3050 (177Lu-FAP RLT):

We are developing IM-3050, a FAP-targeted Lu-177 RLT development candidate for the treatment of solid tumors. FAP is expressed in approximately 75% of solid tumors. FAP is predominantly expressed by cancer-associated fibroblasts, the most common tumor stromal cell. IM-3050 is designed to deliver radioactive Lu-177 directly to FAP-expressing cells, where the bystander effect of the radiation may damage or kill nearby tumor cells. We believe this RLT approach could overcome the limitations, such as poor internalization and low expression on tumor cells, that make FAP an unsuitable target for ADCs. In vivo data show single dose antitumor activity and tolerability.

We expect to submit an IND for the IM-3050 program to the FDA in the first quarter of 2025.

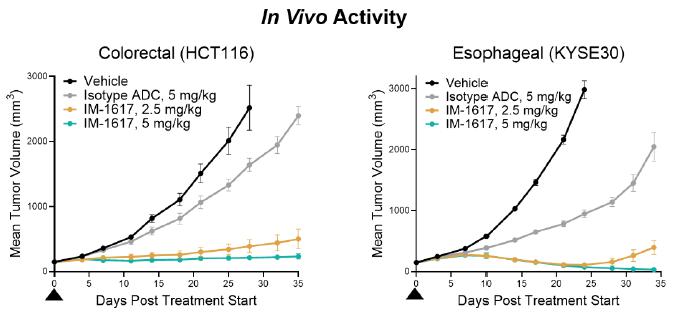

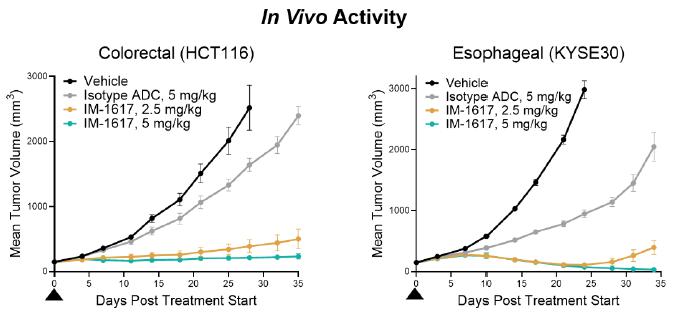

IM-1617 (Solid Tumor ADC):

IM-1617 is a potential first-in-class ADC that targets an undisclosed receptor that is preferentially expressed in a broad array of solid tumors, including colorectal cancer (CRC), non-small cell lung cancer (NSCLC), breast, and ovarian cancers. The target is a receptor tyrosine kinase that promotes tumor cell survival and mediates immune cell exclusion, providing potential for a secondary mechanism of action.

IM-1617 incorporates a proprietary antibody that was selected for attributes that may drive tumor binding while minimizing normal tissue binding; a cleavable, undisclosed linker; and HC74. An initial study in non-human primates (NHPs) found a highest non-severely toxic dose of 40 mg/kg, indicating a potentially robust therapeutic window. Preclinical in vivo efficacy studies have shown tumor regression after a single, clinically relevant dose of IM-1617 in tumor models derived from melanoma, esophageal cancer, CRC, NSCLC, and other carcinomas. IND-enabling work for IM-1617 was initiated in the fourth quarter of 2024.

IM-1340 (Solid Tumor ADC):

IM-1340 is a potentially first-in-class ADC for the treatment of multiple solid tumors. The target of IM-1340 has a unique tumor expression profile that spans both neuroendocrine tumors (NETs) and other carcinomas while showing limited expression on normal tissue. This target is known to promote tumor growth by accelerating proliferation, cell cycle progression, and migration of cancer cells. Additionally, it is a transport receptor for an endolysomal protease, leading to favorable ADC internalization dynamics.

It incorporates a proprietary antibody selected for attributes that drive tumor binding while minimizing normal tissue binding; a cleavable, undisclosed linker; and HC74. IM-1340 has shown robust preclinical efficacy, with evidence of regressions following a single 1 mg/kg dose in in vivo tumor models representing NETs (SCLC) and carcinomas (e.g., NSCLC, pancreatic, and prostate cancer). An initial study in NHPs found a highest non-severely toxic dose of 40 mg/kg, indicating potential for a robust therapeutic window. IND-enabling work for IM-1340 was initiated in the fourth quarter of 2024.

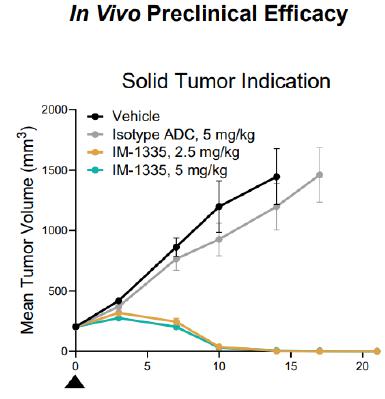

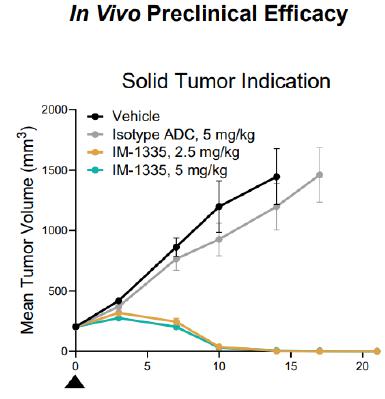

IM-1335 (Solid Tumor ADC):

IM-1335 is being developed for the treatment of solid tumor indications. It shares a target with a competitor’s now-discontinued investigational ADC that showed clinical activity prior to discontinuation. Our goal in designing IM-1335 was to optimize the safety and efficacy through a deep understanding of target biology and ADC optimization. We identified limitations that we expect contributed to the failure of the prior ADC against this target, and we believe that IM-1335 overcomes these limitations. Toward this end, the antibody portion of IM-1335 has been designed for improved pharmacokinetic and tumor biodistribution profiles. IM-1335 also incorporates a linker designed to enhance stability for on-target activity as well as our proprietary HC74 to match drug sensitivity in top indications.

As shown below, IM-1335 shows in vivo preclinical efficacy in a solid tumor indication.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements about the Company and its industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this report are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “vision,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “promising,” “projected,” “first step,” “ongoing,” or the negative of these terms, and similar words or expressions to identify these forward-looking statements. These forward-looking statements include, but are not limited to, statements about: the Company’s preliminary financial results for the quarter ended December 31, 2024; the expansion and advancement of the Company’s platform and pipeline and the Company’s approach and strategy related to the platform and pipeline; assessments of the clinical efficacy, best-in-class potential, and potential commercial success of varegacestat; the potential of the Company’s current and future pipeline to produce first-in-class and/or best-in-class drugs; the Company’s expectations with respect to its future performance; the Company’s timeline for filing INDs and other regulatory filings, commencing clinical trials, receiving and reporting data from such clinical trials, and seeking regulatory approval, for one or more of the Company’s current or future programs and product candidates and other anticipated milestones; and other statements regarding the management’s intentions, plans, beliefs, expectations or forecasts for the future. These forward-looking statements are based on the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, risks related to preliminary financial results, as described above; the risk that the Company will not be able to realize the benefits of its strategic transactions; the risk that regulatory approvals for the Company’s programs and product candidates are not obtained, are delayed or are subject to unanticipated conditions; the risk that pre-clinical data may not be predictive of clinical data; the risk that the Company’s product candidates and development candidates fail to achieve their intended endpoints; the reliance on the Company’s management; the prior experience and successes of the Company’s management team not being indicative of any future success; uncertainties related to the Company’s capital requirements and the Company’s expected cash runway; the Company’s ability to grow and successfully execute on its business plan, including the development and commercialization of its pipeline and integration of newly acquired assets; and other risks and uncertainties indicated from time to time as described in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 13, 2024, and in the Company’s other filings with the SEC.

In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although the Company believes that it has a reasonable basis for each forward-looking statement contained in this report, the Company cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur at all. Furthermore, if the Company’s forward-looking statements prove to be inaccurate, the inaccuracy may be material. Except as required by law, the Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | IMMUNOME, INC. |

| | | | |

| Date: January 29, 2025 | | By: | /s/ Clay Siegall |

| | | | Clay Siegall, Ph.D. |

| | | | President and Chief Executive Officer |