Washington, D.C. 20549

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates (without admitting that any person whose shares are not included in such calculation is an affiliate) of the registrant on the last day of the registrant’s second fiscal quarter, was $18.1 million (based on the closing price for shares of the registrant’s common stock as reported on the Nasdaq Capital Market on that date).

The number of shares of the registrant’s common stock, par value $0.00033 per share, outstanding as of March 9, 2020 was $15,285,205.

Portions of registrant’s proxy statement relating to registrant’s 2020 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the close of the registrant’s fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the Proxy Statement is not deemed to be filed as part of this Annual Report on Form 10-K.

PDS BIOTECHNOLOGY CORPORATION

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019

| | | PAGE |

| PART I | | |

| Item 1 | | 4 |

| Item 1A | | 38 |

| Item 1B | | 62 |

| Item 2 | | 62 |

| Item 3 | | 62 |

| Item 4 | | 62 |

| PART II | | |

| Item 5 | | 63 |

| Item 7 | | 64 |

| Item 8 | | 73 |

| Item 9 | | 73 |

| Item 9A | | 73 |

| Item 9B | | 74 |

| PART III | | |

| Item 10 | | 75 |

| Item 11 | | 75 |

| Item 12 | | 75 |

| Item 13 | | 75 |

| Item 14 | | 75 |

| PART IV | | |

| Item 15 | | 75 |

| Item 16 | | 75 |

| | 80 |

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under the heading “Risk Factors” contained in Item 1A of this Annual Report. In light of these risks, uncertainties and assumptions, actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements in this Annual Report and you should not place undue reliance on these forward-looking statements.

These forward-looking statements include, but are not limited to, statements about:

| ● | the accuracy of estimates of our expenses, future revenue, capital requirements and our needs for additional financing; |

| ● | our ability to obtain funding for our operations in the event we determine to raise additional capital; |

| ● | our ability to retain key management personnel; |

| ● | the accuracy of our estimates regarding expenses, future revenues and capital requirements; |

| ● | our ability to maintain our listing on the Nasdaq Stock Market; |

| ● | regulatory developments in the United States and foreign countries; |

| ● | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”); and |

| ● | other risks and uncertainties, including those listed under Part II, Item 1A. Risk Factors. |

Any forward-looking statements in this Annual Report reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

In this Annual Report, unless otherwise stated or the context otherwise indicates, references to “PDS,” “the Company,” “we,” “us,” “our” and similar references refer to PDS Biotechnology Corporation, a Delaware corporation.

PART I

Company Overview

We are a clinical-stage biopharmaceutical company developing a new generation of multi- functional cancer immunotherapies. All PDS products are based on the proprietary Versamune® platform. Versamune® based cancer therapies are designed to stimulate disease-specific killer and helper T-Cell response in a quantity and quality that significantly surpasses current immunotherapeutic approaches. We believe that the Versamune® platform has the potential to rapidly become an industry-leading immuno-oncology technology and is currently being applied to the development of a robust pipeline of valuable new-generation, of advanced treatments for cancer as part of combination therapies and to help make standard of care therapies more effective.

Versamune® has been developed to encompass the attributes of the most successful immunotherapy approaches, such as checkpoint inhibitors, CAR-T cells and live-vector based vaccines, while also overcoming their limitations and potential negative side effects. It is well documented that the most critical attribute of an effective cancer immunotherapy is the induction of high levels of active antigen-specific CD8+ (killer) T-cells. Priming adequate levels of active CD8+ T-cells in-vivo continues to be a major obstacle facing immunotherapy. Our lead product PDS0101 (Versamune®+HPV antigens), is designed to address advanced HPV-associated cancers in its first human clinical trial, confirmed the impressive preclinical study results and demonstrated the unique in-vivo induction of high levels of active HPV-specific CD8+ T-cells in humans.

The unique combination of high potency and excellent safety of the Versamune® platform observed in preclinical studies appears to be corroborated in a successfully completed 12-patient Phase 1 clinical trial. In June 2019 the Versamune mechanism of action was published in one of the top peer reviewed journals in the field of immunology, (Journal of Immunology, 2019(202), 1215). The article describes the way PDS’ Versamune platform recruits and activates killer T-cells to recognize and effectively attack cancer cells while simultaneously making cancer cells more susceptible to T-cell attack. With respect to our lead therapeutic candidate, PDS0101 (a combination of Versamune® nanoparticles plus proprietary human papillomavirus (HPV)-16 E6 and E7 antigens), the Journal of Immunology article detailed Versamune®’s ability to overcome the critical mechanisms associated with ineffective immune responses mediated by HPV16 and cancer cells, therefore leading to a superior anti-tumor effect.

The Phase 1 human trial immune responses mirrored the strong reported T-cell responses seen in preclinical studies, which led to superior anti-tumor regression efficacy in pre-clinical head-to-head studies with leading clinical development-stage technologies. In a retrospective analysis not contemplated in the initial study design, it was observed that 6 out of 10 evaluable patients experienced complete regression of their pre-cancerous lesions as early as 1-3 months after treatment, despite the fact that the HPV16 specific therapy was used on patients who were co-infected with multiple strains of the HPV virus. No lesion recurrence occurred within the 2 -year evaluation period.

We believe that the rational design of combination immunotherapies using agents that promote synergy with each other and reduce potential for compounded toxicity will substantially improve potential for combination therapies to deliver improved clinical benefit for cancer patients. Versamune® appears to activate the appropriate combination of immunological pathways that promote strong CD8+ T-cell induction, while also altering the tumor’s microenvironment to make the tumor more susceptible to T-cell attack, which PDS believes makes it an ideal complement to the checkpoint inhibitors by enhancing their potency. In addition, the differences in mechanism of action between Versamune® and checkpoint inhibitors, as well as the initial demonstrated safety profile of Versamune®, suggests that these combinations may be much better tolerated by patients than many or most other combination therapies involving checkpoint inhibitors.

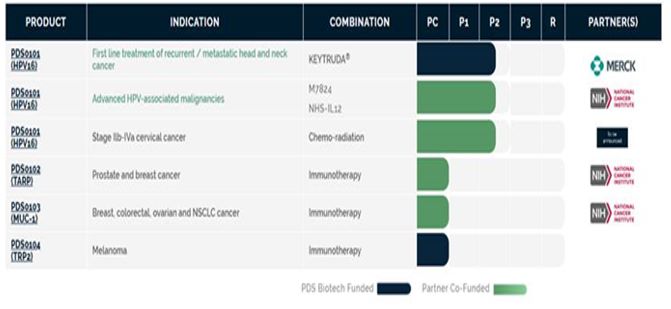

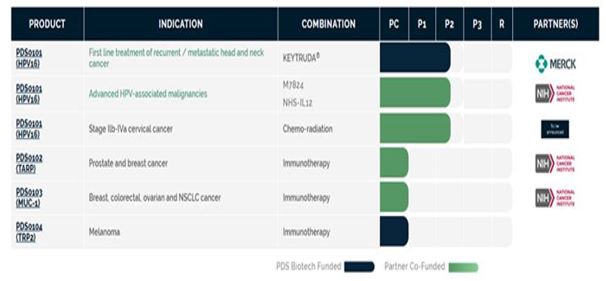

We expect substantial value accretion as our development-stage products successfully progress through upcoming human Phase 2 clinical studies. Initially, PDS intends to demonstrate the application of the Versamune® platform’s attributes by progression in areas of high unmet medical need supported by leaders in the field. Our current clinical development plan for PDS0101 is summarized in the table below. All studies are expected to be initiated in the first half of 2020.

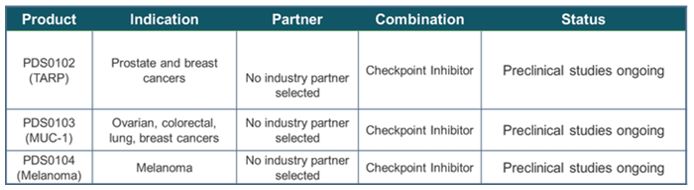

Our pipeline of Versamune® based products is summarized below. With additional financing, we plan to initiate clinical studies with PDS0102 (TARP-expressing cancers, e.g. prostate and breast cancers), PDS0103 (MUC-1 expressing cancers, e.g. colon, breast, lung and ovarian cancers) and PDS0104 (TRP2 expressing cancers, e.g. melanoma).

Corporate Information

We currently operate the existing business of Private PDS (as defined below) as a publicly traded company under the name PDS Biotechnology Corporation (PDSB). We were incorporated as Edge Therapeutics, Inc., or Edge, on January 22, 2009. Upon closing of the Merger (as defined below), we suspended Edge’s prior business and prioritized the business of PDS Biotechnology Corporation, a privately held Delaware corporation, which we refer to as Private PDS, which is a clinical-stage biopharmaceutical company developing multi-functional cancer immunotherapies that are designed to overcome the limitations of the current approaches.

On March 15, 2019, we completed our previously disclosed reverse merger with privately-held Private PDS, which we refer to as the Merger, pursuant to and in accordance with the terms of the Agreement and Plan of Merger, dated as of November 23, 2018, as amended on January 24, 2019, by and among Edge, Echos Merger Sub, a wholly-owned subsidiary of Edge, which we refer to as Merger Sub, and Private PDS, whereby Private PDS merged with and into Merger Sub, with Private PDS surviving as our wholly-owned subsidiary. In connection with and immediately following completion of the Merger, we effected a 1-for-20 reverse stock split, or the Reverse Stock Split, and changed our corporate name from Edge Therapeutics, Inc. to PDS Biotechnology Corporation, and Private PDS changed its name to PDS Operating Corporation. All of the outstanding stock of Private PDS was converted into shares of our common stock or canceled upon closing of the Merger. Unless otherwise stated, all share and per share numbers in this Annual Report on Form 10-K give retroactive effect to both the Merger and the Reverse Stock Split.

Since our inception in 2005, we have devoted substantially all of our resources to developing our Versamune® platform, advancing preclinical programs, conducting clinical studies, manufacturing PDS0101 for clinical studies, and providing general and administrative support. We have funded our operations primarily from the issuance of common stock. We have not generated any product revenue.

We acquired an in-process research and development asset relating to Edge’s NEWTON 2 trials. Following the discontinuation of the NEWTON 2 trial for EG-1962, Edge had ceased all research and development efforts related to EG-1962 and suspended efforts on other legacy Edge product candidates. As of December 31, 2019, we are no longer seeking partners to continue the development of these product candidates and pursue them to commercialization.

Our principal executive offices are located 303A College Road East, Princeton, NJ 08540, and our telephone number is (800) 208-3343.

Commercial Strategy

Our mission is to apply the Versamune® platform, our proprietary and versatile immunotherapy technology, to develop a new generation of immuno-oncology products that are effective and safe across a broad range of cancer types. Our current development pipeline of cancer immunotherapy products is based on the Versamune® platform, and can potentially be used as a component of combination products with other leading technologies to provide effective treatments across a range of cancer types, including Human Papillomavirus (HPV)-based cancers, melanoma, colorectal, lung, breast and prostate cancers or as monotherapies in early-stage disease.

Key elements of PDS’s clinical and commercial execution strategy are as follows:

| 1. | Rapidly progress our lead product candidate, PDS0101 into three proof-of-concept phase 2 human clinical studies. In the first trial PDS0101 is being studied in combination with KEYTRUDA® (standard of care) as first line treatment of recurrent or metastatic head and neck cancer. In the second trial to treat advanced HPV related cancers, PDS0101 is being studied in combination with two novel immunotherapies , EMD Serono’s M7824 and NHS-IL12, in collaboration with the National Cancer Institute. In the third trial to treat advanced localized cervical cancer PDS0101 is being studied in combination with chemo-radiotherapy (standard of care); |

| 2. | Build our Versamune®-based immune-oncology pipeline, by continuing development of the PDS0102, 0103, and 0104 programs in prostate, breast, colorectal, lung, ovarian cancers and melanoma; |

| 3. | Commercialize our wholly-owned product candidates, including PDS0101, if approved, through partnerships or through a targeted sales force in the United States, Canada and Europe and with potential strategic partnerships outside of these regions; and |

| 4. | Continue to seek to maintain high barriers to entry around our product candidates and the markets in which they are utilized by using our composition of matter application patents as well as know how around our Versamune® platform technology. |

Commercialization of Product Candidates

PDS retains worldwide rights to all of our product candidates. If our product candidates are approved, we intend to establish targeted commercialization and marketing capabilities for our products in the United States, Canada and Europe by developing a sales force that would focus on academic medical centers and large oncology clinics. For commercialization outside of the United States, Canada and Europe, we generally expect to enter into collaborations with strategic partners

Cancer Immunotherapy

In the field of cancer immunotherapy, a well-documented and significant unmet need is the ability of therapies to safely induce in vivo an adequate number of highly active/polyfunctional CD8+ T-cells, coupled with the altering of the tumor microenvironment in order to limit its immune tolerance, in order to facilitate efficient tumor cell killing. Our data to date suggests that the Versamune® platform effectively promotes both critical immunotherapeutic characteristics, leading to strong antigen-specific CD8+ T-cell induction and regression of lesions in a human clinical trial.

One of the most active areas of clinical testing in the field of cancer immunotherapy today is combining checkpoint inhibitors with other anti-cancer agents, with the goal of synergistic and thus superior and thus superior clinical efficacy compared with that of the individual products. We believe that next generation of combination immunotherapy agents, especially those including both checkpoint inhibitors and a second therapeutic agent, will need to have at least the following characteristics to achieve clinical and commercial success:

| 1. | In vivo induction of high levels of tumor infiltrating CD8+ T-cells; |

| 2. | Further alteration of the tumor microenvironment through activation of complimentary immunological mechanisms; and |

| 3. | Lack of substantially higher combined toxicity than either component alone, in order to contribute a viable clinical application to cancer patients. |

We believe based upon our research that Versamune®-based products fulfill each of these criteria.

Most immunotherapies work by training or priming our T-cells to recognize specific disease-related proteins (cancer, bacterial or viral) displayed or expressed by diseased cells. The ultimate goal of immunotherapy treatment is to harness the power of the immune system to target and kill specific diseased cells, and thereby cure the underlying disease.

Immunotherapies have recently been recognized as having significant potential to treat a broad range of cancers and infectious diseases. Several cancer immunotherapies have now been approved by the FDA, and other promising immunotherapy technologies and products are in various stages of advanced clinical development.

Despite the promise demonstrated by current immunotherapy technologies, these products still face significant hurdles to achieving optimal therapeutic value. Some key obstacles faced by the current technologies are the following:

Antigen Uptake by Dendritic Cells: Antigens are particular proteins recognizable by the immune system that are uniquely or highly expressed/present in tumor cells but not present in normal healthy cells. The first critical step in generating an effective antigen-specific or antigen-targeting T-cell response is efficient uptake of the particular antigens by dendritic cells, which are the key antigen presenting cells of the immune system. Proteins and peptides are not naturally highly taken up by dendritic cells, creating obstacles to effective T-cell response in existing immunotherapies. Versamune® has demonstrated the ability to promote antigen uptake by dendritic cells in-vivo.

Antigen Cross-Presentation and Killer (CD8+) T-Cell Priming: Suboptimal ability of the dendritic cells to internalize, process/break-down and present tumor antigens to the T-cells leads to ineffective activation or “priming” of killer T-cells. Dendritic cells are required to take up and process tumor antigens. These processed antigens must then enter into an internal compartment of the cell, called the cytoplasm. The peptide’s presence in the cytoplasm is necessary to allow smaller processed proteins (peptides) to be presented to killer T-cells via what is known as the Major Histocompatibility Complex (“MHC”) Class I pathway or to helper T-cells via the MHC Class II pathway. This is the process of T-cell priming. Current technologies have presented limited ability to adequately facilitate antigen presentation via the MHC Class I process in vivo, therefore leading sub-optimal killer T-cell priming and then weaker-than-optimal anti-tumor potency. Versamune® has demonstrated the ability to promote antigen processing and presentation via MHC Class I and Class II leading to effective CD8+ and CD4+ T-cell priming respectively (Ghandapudhi et al, J. Immunology, June 15, 2019, 202 (12) 3524-3536). T-cell priming trains the killer T-cells to effectively identify the tumor cells.

Immune Activation: Once T-cell priming has successfully occurred, a subsequent critical step is induction-specific immunological signals, including induction of certain chemokines and cytokines necessary for activation and proliferation of various classes of T-cells. Chemokines and cytokines are each a broad category of immunological proteins that are crucial for fighting off infections and other immune responses. Versamune® has demonstrated the ability to specifically activate the important type I interferon signaling pathway, leading to induction of the right phenotype of active CD8+ T-cells with potent killing function (Ghandapudhi et al, J. Immunology, June 15, 2019, 202 (12) 3524-3536).

Overcoming Immune Suppression: A number of immune-suppressive mechanisms and cells naturally exist in humans that can increase in number within tumors. This may result in an inhibition of the ability of killer and helper T-cells to identify and kill the tumor cells. This state of immune tolerance must generally be overcome for T-cells to be effective in killing antigen-expressing cancer cells. In preclinical studies, Versamune® was demonstrated to alter the tumor micro-environment, making the tumors more susceptible to attack by T-cells (Ghandapudhi et al, J. Immunology, June 15, 2019, 202 (12) 3524-3536).

Complexity and Costs: The relatively high formulation and manufacturing complexities, as well as related high costs, associated with most commercially available immunotherapies is well documented. For example, live vector-based cancer vaccines and dendritic cell vaccines require complex and expensive processes to enable manufacturing of live agent (virus or bacteria)-based products. Versamune® is based on synthetic positively charged lipids, and traditional lipid nanoparticle manufacturing methods which results in a much simpler and less expensive manufacturing process than most other immunotherapy technologies.

Versamune® - A Next Generation Immunotherapy and Cancer Immunotherapy

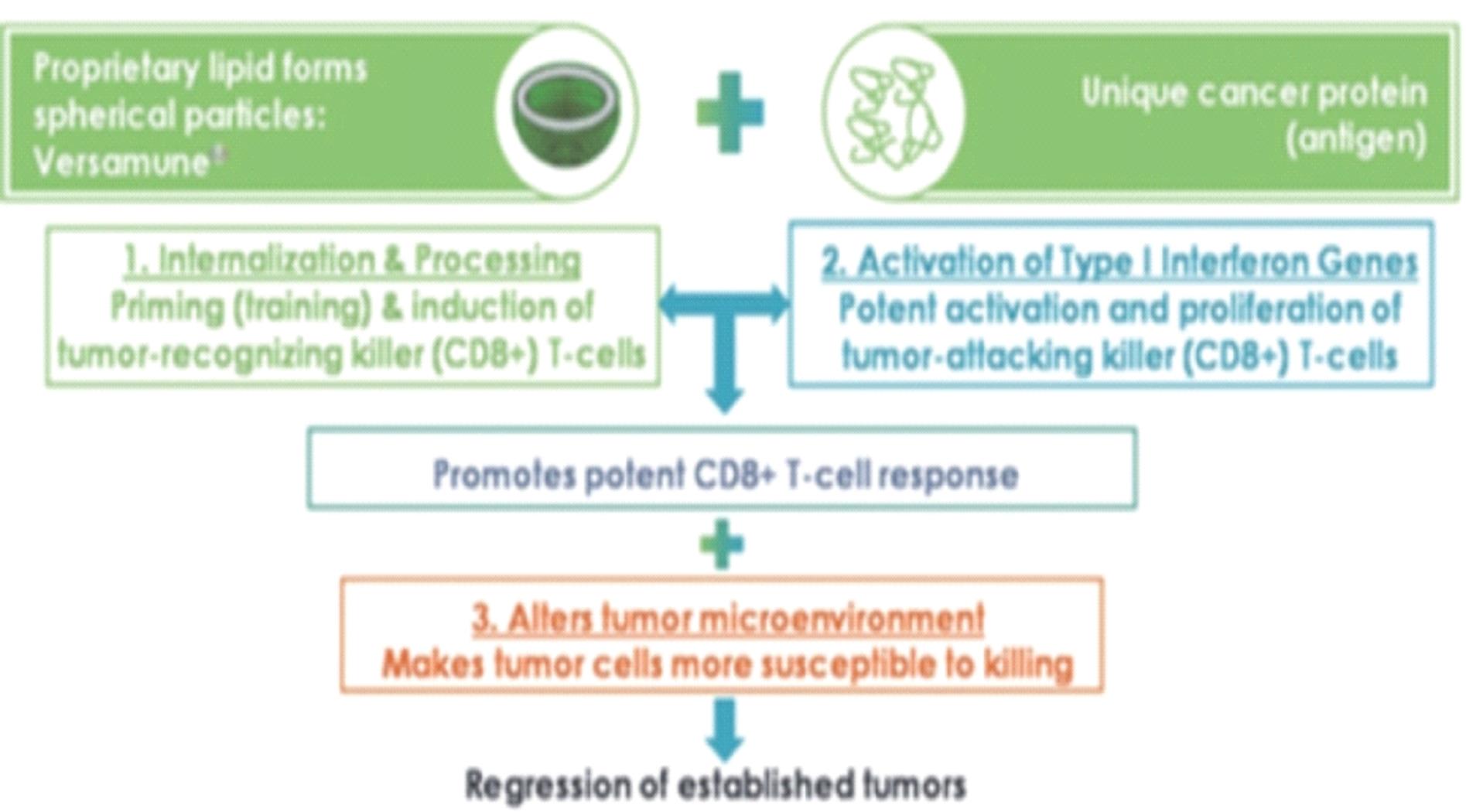

Based on the limitations of current therapies described above, we believe that next generation biologics that can overcome those limitations are likely to address significant unmet needs. Versamune®, a T-cell activating platform technology, has demonstrated potential to overcome the challenges of immune therapy as illustrated below:

Versamune® Platform

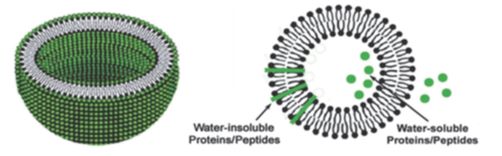

Versamune® has been rationally designed and is based on synthetic positively charged (cationic) lipids. The structure of these lipids leads to spontaneous formation of nanoparticles in an aqueous medium. The nanoparticles are sized to promote efficient uptake by the antigen presenting cells of the immune system, the dendritic cells. The nanoparticles are combined with tumor antigens (proteins, peptides, DNA or RNA) and administered by subcutaneous injection.

Figure 1: Versamune nanoparticles

The initial concept for Versamune® was first discovered and developed in 2005 by Professor Leaf Huang, at the University of Pittsburgh, School of Medicine. The Versamune® technology is based on the use of immune activating cationic (positively charged) lipids that spontaneously form spherical nanoparticles in aqueous media. Huang, a world-renowned expert in liposome drug delivery and non-viral gene therapy, was familiar with the ability of cationic lipids to effectively deliver DNA into the cytoplasm of cells. PDS’s targeted research and development efforts identified critical structural characteristics of bio-active lipids, and then refined and built upon that initial concept.

The resulting Versamune® technology is believed to induce active and potent disease-specific helper and killer T-cells, while simultaneously suppressing the tumor’s defenses, are due to the following:

| 1. | The specific design and composition of the Versamune® nanoparticles, which are sized to mimic viruses, promotes uptake of nanoparticles by the dendritic cells of the immune system. Versamune® the promotes internalization into the cell endosomes and destabilization of endosomal membranes. The associated disease-specific antigens are then processed and released, into the cytoplasm. As a result the antigens are able to access both the MHC Class I and MCH Class II presentation pathways to prime CD8+ killer T-cells and CD4+ helper T-cells respectively. |

Delivery into the right compartments of the cell leads to effective processing of the antigen and cross presentation of the processed antigen to CD8+ T-cells, therefore overcoming a key limitation of vaccine technologies.

| 2. | The structure of the cationic lipids induces specific activation of the Type I interferon (IFN-1) signaling pathway and the related down-stream cytokines and chemokines. IFN-1 activation is known to be highly important in the activation and proliferation of CD8+ T-cells. |

| a. | Localized induction of IFN-I at the injection site and within the lymph nodes restricts the cytokine and chemokine induction as well as resulting inflammation to the lymph nodes. Minimal systemic/blood stream inflammation limits toxicity, and the lymph node-localized cytokine induction promotes T-cell potency. |

| b. | Specific/targeted activation specifically of the IFN-I pathway eliminates the non-specific immune activation induced by the current approaches and leads to induction of the correct/required phenotype of active polyfunctional T-cells that present effective tumor targeting and killing. |

PDS0101

We believe PDS0101, our lead product candidate, can, if ultimately approved, fundamentally improve patient outcomes and transform the management of HPV-related cancers. PDS0101 combines the utility of PDS’ Versamune®, versatile multi-functional platform technology, with a proprietary mix of HPV 16 antigens, the most virulent high-risk type and by far the most prevalent in patients with advanced HPV- associated cancer.

Approximately 43,000 patients are diagnosed with HPV- associated cancers in the US each year, a number unlikely to be impacted by increased use of HPV preventative vaccines in the next decade. HPV associated cancers include oropharyngeal (head and neck) cervical, vulvar, anal and penile cancers. Cervical cancer is the most common HPV-associated cancer in women and there are about ~12,000 new cases diagnosed annually. The incidence of cervical cancer remains steady.

Head and neck cancers have been reported to be increasing in recent years and have been described as a silent epidemic attributed to HPV infection. A recent study showed the overall prevalence of oral HPV infection to be 11.5% in men and 3.2% in women, or 11 million men and 3.2 million women in the United States. High-risk oral HPV-16 was over three times more common in men. Over 70% of oropharyngeal cancers are estimated to be HPV-associated in developed Western countries. It has been reported that about 90% of the oral squamous cell carcinoma (OSCC) tumors were positive for HPV-16. The US National Cancer Institute (NCI) estimated that in 2013 about 36,000 people in the US would be diagnosed with OSCC. For 2017 the projections were increased to 49,670 new cases with an estimated 9,700 deaths. The current treatment options are surgery, radiation, chemotherapy or a targeted therapy, including checkpoint inhibitors.

PDS0101 Phase 1 Clinical Data

PDS completed a Phase 1 trial of PDS0101, which was conducted at three sites in the United States. The study was an Open-label Escalating Dose Study to Evaluate the Safety, Tolerability, and Pharmacodynamics of PDS0101 in subjects with Cervical Intraepithelial Neoplasia (CIN) and high-risk Human Papillomavirus (HPV) infections. The study included 3 cohorts of 3 to 6 subjects each, based on a modified “3 + 3” dose-escalation study design.

The study enrolled Cohort 1 and progressed through Cohort 3, with each subsequent cohort receiving a higher dose of PDS0101. Successive cohorts all received a constant dose of the HPV-16 E6 and E7 antigens. Subjects were given three subcutaneous injections of PDS0101, three weeks apart, and blood was drawn 14 days after each injection, as well as 90 days after the last injection. HPV-specific CD8+ T-cells were quantified using both the Interferon- ELISPOT assay (quantifies all HPV-specific T-cells) granzyme-b ELISPOT assay (specifically quantifies active HPV-specific CD8+ T-cells). Dosing and dose escalation were based on safety evaluation for determination of potential dose-limiting toxicity (DLT).

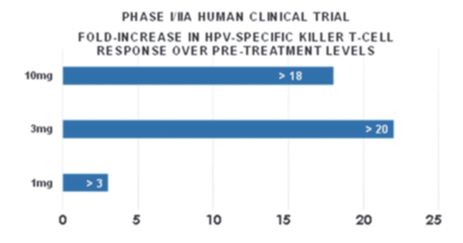

A total of 12 subjects were enrolled. We believe the data show a strong induction of active HPV-specific killer T-cells (CD8+) observed with quantifiable amounts of the CD8+ T-cells retrieved from patient blood 14 days after treatment.

Figure 2: CD8+ T-cell data generated by Granzyme-b ELISPOT in the phase 1 clinical trial

The CD8+ T-cells results seen in the Phase 1 study confirmed preclinical projections of high levels of active granzyme-b inducing, HPV-specific CD8+ T-cells. The results obtained 90 days after the last injection also confirmed preclinical projections of memory T-cell induction. Of note, T-cell responses were independent of patient genetic/HLA sub types.

No dose-limiting toxicities were observed, even at the highest tested dose of 10mg. A dose of approximately 3mg has been selected to move forward into the upcoming PDS0101 Phase 2 clinical studies.

During the third quarter of 2019, PDS received Institutional Review Board, or IRB approval to perform a retrospective analysis of the clinical benefit achieved by the patients who participate in the phase 1 clinical trial. Despite most of the patients being infected with multiple HPV strains other than HPV16, rapid and complete regression of pre-cancerous lesions was documented in at least 6 out of 10 patients within 1-3 months of treatment, strongly suggesting that the T-cells induced by PDS0101 were clinically active. This information strongly suggests the unique ability of PDS0101 to generate potent and biologically active CD8+ T-cells in-vivo. Two patients who had regression by cytology were not considered clinical responders despite the seemingly positive outcome. One patient regressed to atypical cells of undetermined significance at the first post- treatment evaluation at 3 months, but residual HPV was still detected. Another patient had complete regression by cytology at every post-treatment evaluation but had residual CIN by colposcopy. All responders remained disease-free though the 2-year evaluation period, suggesting a durable immune response.

PDS focused its clinical strategy on areas of more severe unmet medical need in which PDS0101 will be combined with other treatment modalities such as checkpoint inhibitors, immune-cytokines and chemoradiation to provide improved clinical benefit to patients. PDS feels that due to the ability of PDS0101 to generate potent HPV specific killer T-cell response in-vivo, that the quickest path to demonstrating proof of concept in a larger trial with the least risk would be to perform these studies in combination with synergistic agents in indications where a more effective therapy is needed. The three planned trial described below are designed to focus on efficiency and risk mitigation to proof of concept.

PDS0101 + Keytruda® in HPV-positive recurrent or metastatic head and neck cancer

We have a collaboration agreement with a subsidiary of Merck & Co. (known as MSD International GmbH outside the United States and Canada) to combine PDS0101 with Merck’s anti-PD-1 checkpoint inhibitor, Keytruda®, in a Phase 2 human clinical trial for treatment of HPV-positive recurrent or metastatic head and neck cancer. On October 28, 2019, we entered into an amendment to the existing clinical trial collaboration agreement to evaluate the combination of PDS’s lead Versamune®-based immunotherapy, PDS0101, with Merck’s anti-PD-1 therapy, KEYTRUDA® (pembrolizumab), in a Phase II clinical trial. The planned clinical trial will now evaluate the efficacy and safety of the combination as a first-line treatment (rather than second or third line treatment in patients with recurrent or metastatic head and neck cancer and high-risk human papillomavirus-16 (HPV16) infection. The modification to the clinical trial design to evaluate PDS0101 in combination with KEYTRUDA® as first-line treatment comes as a result of Merck’s approval by the FDA on June 10, 2019 for first line treatment of patients with metastatic or unresectable recurrent head and neck squamous cell carcinoma (HNSCC) using KEYTRUDA® in combination with platinum and fluorouracil (FU) for all patients and as a single agent for patients whose tumors express PD-L1 as determined by an FDA-approved test.

The trial will be sponsored and funded by PDS and is expected to begin in the first half of 2020. The trial is designed to dose 96 patients with standard of care 200 mg IV KEYTRUDA® in 21-day cycles in combination with subcutaneous injection of PDS0101 for the first 4 cycles. PDS0101 will be administered again on the 12th treatment cycle in combination with KEYTRUDA®. A safety analysis is planned of the first 12 patients after cycle one and this information is expected in the fourth quarter of 2020. An interim analysis is planned in the second half of 2021. This study has the potential to validate the efficacy and safety of PDS0101 in combination with a checkpoint inhibitor and this study could lead the way for novel combination therapies in immuno-oncology.

PDS0101 + Checkpoint Inhibitors M7824 and NHS-IL12

We previously announced that we entered into a Cooperative Research and Development Agreement (CRADA) with the National Cancer Institute (NCI) for the development of the PDS0101 HPV cancer immunotherapy in combination with other immune-modulating agents as a potential treatment for all types of advanced HPV-related cancers. Under the agreement, we will collaborate with the NCI’s Genitourinary Malignancies Branch (GMB) and Laboratory of Tumor Immunology and Biology (LTIB) with plans to conduct a Phase 2 clinical study evaluating PDS0101 with two promising novel immune-modulating agents M7824 and NHS-IL12 being studied at NCI as part of a CRADA with EMD Serono (Merck KGaA). This study is anticipated to start in the first half of 2020. The CRADA also involves preclinical evaluation of PDS0101 in combination with other therapeutic modalities upon the mutual agreement of both parties.

All three agents have demonstrated efficacy as monotherapies in early studies. The phase 2 clinical study has been approved by the IRB and published is expected to enroll 30 subjects. M7824 is a novel first-in-class bifunctional fusion protein, a TGF-β “trap” fused with a human antibody against PD-L1. NHS-IL12 is a novel immunocytokine conjugate consisting of two IL12 heterodimers fused to the NHS76 antibody. Both agents have been shown to be well tolerated in on-going clinical trials. This trial will evaluate the objective response rate of this novel combination in patients with advanced HPV associated cancers.

PDS0101 + Chemoradiotherapy (CRT)

PDS Biotech anticipates a Phase 2 clinical study with a major cancer research center to begin in the first half of 2020. If initiated, the clinical study would likely investigate the safety and anti-tumor efficacy of the PDS0101-CRT combination, and their correlation with critical immunological biomarkers in patients with locally advanced cervical cancer. T-cell inducing power of Versamune® has the strong potential to enhance efficacy of the current standard of care chemo-radiotherapy. PDS Biotech is currently in negotiations regarding a definitive agreement concerning the investigator initiated Phase 2 study and the scope and nature of such study will be subject to the terms of the definitive agreement, once agreed to by the parties.

Other Development Programs

PDS0102 (TARP-expressing cancers) for the treatment of prostate and breast cancers

Prostate cancer: Based on a promising clinical study run by the NCI using TARP antigens, PDS and the NCI are collaborating to develop a Versamune® platform-based immunotherapy for prostate cancer. PDS0102 has been successfully formulated. A decision will be made as to when PDS0102 clinical studies will be initiated.

Prostate cancer is the most common non-skin cancer in the United States. Over 30,000 men die from the cancer every year according to the Prostate Cancer Foundation, and over two million Americans currently have prostate cancer. A recent report projects that the prostate cancer market will grow at a compound annual growth rate of 9.5%, from $7.6 billion in 2014 to $13.6 billion by 2021.

PDS0103 (MUC-1 expressing cancers) for the treatment of colorectal, breast, ovarian and lung cancers

PDS0103 is based on novel agonist antigens of the mucin-1 (MUC-1) oncogenic C-terminal region developed by the laboratory of Dr. Jeff Schlom, head of Tumor Biology at the NCI. MUC1 is highly expressed in multiple tumor types and has been shown to be associated with drug resistance and poor prognosis for a range of human tumors. The novel agonist peptides, compared to the native peptides, more efficiently enhance production of IFN-γ by peptide activated human T cells, and also more efficiently lyse human tumor cell targets in an MHC-restricted manner. It is also known that high avidity T-cells can lyse targets with 1,000-fold lower peptide-MHC complexes. The enhancer agonist epitopes developed induce higher avidity T-cells than the native antigens and has been demonstrated to be a successful strategy to enhance number and avidity of T-cells for MUC-1 directed immunotherapy.

These MUC-1 antigens have been licensed from the NCI for use with Versamune® in ovarian, breast, colorectal and lung cancers.

We believe that an effective and safe immunotherapy targeting solid tumors expressing MUC-1 will gain rapid acceptance as a monotherapy in early-stage disease and initially as a combination therapy in later stage disease.

Colorectal cancer (CRC): Colorectal or colon cancer, includes cancerous growths in the colon, rectum and appendix. It is the third most common form of cancer and the second leading cause of cancer-related death in the Western world. Global Markets estimates the colorectal cancer market to grow at 3% annually from $8.15 billion in 2015 to $11 billion in 2025 in the eight major markets, US, UK, England, France, Italy, Japan, China and Germany. We believe that there is significant market opportunity for immunotherapy, especially in early stage CRC disease where there is a lack of novel treatments outside chemotherapy.

Breast cancer: Breast cancer is a leading cause of cancer-related mortality among women worldwide. IMS Health reports that sales of breast cancer treatments will increase by an average of 5.8% a year in nine major markets, increasing from a value of $9.8 billion in 2013 to $18.2 billion by 2023.

Ovarian cancer: Ovarian cancer is the most common cause of death from gynecological tumors. Nearly 60,000 cases of ovarian cancer are diagnosed in the following seven major markets (the United States, Japan, Germany, France, Italy, the United Kingdom and Spain) each year. The five-year survival rate of ovarian cancer patients remains below 20%. The American Cancer Society reports that in the US about 22,240 women will receive a new diagnosis of ovarian cancer, and about 14,000 women will die from ovarian cancer in 2018. We believe that there is a significant market opportunity for immunotherapy especially in early stage disease where there is a lack of novel treatments outside chemotherapy.

Non-Small Cell Lung Cancer (NSCLC): NSCLC is the leading cause of cancer-related mortality in the major pharmaceutical markets. There is still a clear unmet need in the treatment of NSCLC despite products such as Alimta®, Avastin®, Iressa® and Tarceva®. The NSCLC treatment market is expected to reach $12.2 billion by 2025. Growth is expected to be driven by novel therapies entering the squamous cell carcinoma market segment, which is currently lacking effective treatment, unlike the non-squamous market segment.

PDS 0104 (TRP2 expressing cancers) for the treatment of melanoma

PDS has performed substantial preclinical work in advanced melanoma tumor models where we have observed the ability of PDS0104 to overcome immune suppression and inhibit growth of B16 melanoma tumors (Vasievich et al, Molecular Pharmaceutics, 2012, 9, 2, 261-268). Preclinical studies have also demonstrated a strong synergy between PDS0104 and checkpoint inhibitors, resulting in dramatically improved antitumor response and prolonged survival.

Melanoma is a malignant tumor of the melanocytes. Melanoma is primarily a skin tumor, although it may also occur less frequently in the melanocytes of the eye. It is currently the seventh most common cancer in the US. Melanoma comprises 5% of all skin cancers. The most common causes are exposure to ultra violet radiation from the sun, leading to damage to the DNA of the melanocytes of the skin, family history, an impaired immune system and atypical moles on the body. The American Cancer Society estimated that there will be about 91,270 new cases of melanoma in 2018, and over 9,000 deaths. No effective therapies existed for advanced cancer until the immunotherapy Yervoy® was approved by the FDA in March of 2011.

A Summary of the Current State-of-the-art

Two approaches, dendritic cell vaccines and CAR T-cell immunotherapies, are the two commercial/FDA approved technologies that have presented the best promise to date in addressing other technologies’ inability to effectively present antigens to the dendritic cells inside the body:

Dendritic Cell Vaccines: Dendritic cell vaccines eliminate the need to target and deliver antigens to dendritic cells in-vivo. In these products, immature dendritic cells or monocyte precursors of the patient’s dendritic cells are removed from the patient’s blood and cultured outside the body. The dendritic cells are then treated with tumor antigens, and matured dendritic cells are re-infused into the patient to present the processed antigen material to the patient’s T-cells.

Recent data reported with Provenge®, a prostate cancer vaccine, suggests that its induced immune responses are long-lived, with strong T-cell responses still observed in most surviving patients at two years after treatment. Nevertheless, this approach does not appear to address the immuno-suppressive environment in tumors, or provide immune activation/stimulation necessary to enhance activity of primed T-cells. Importantly, recent studies have demonstrated that antigen uptake and processing is still suboptimal when dendritic cells are treated ex-vivo.

CAR T-Cell Immunotherapy: CAR T-cell immunotherapy is based on manipulating T-cells collected from patients’ own blood. After collection, T-cells are genetically engineered to produce special receptors on their surface called chimeric antigen receptors (“CARs”). CARs are proteins that allow T-cells to recognize a specific protein (antigen) on tumor cells. These engineered CAR T-cells are then grown in the laboratory until they number in the billions. This expanded population of CAR T-cells is then intravenously infused into the patient. After the infusion, the T-cells are expected to multiply in the patient’s body and, with guidance from their engineered receptor, recognize and kill cancer cells that display the antigen on their surfaces. Two CAR-T therapies have been approved to treat large B-cell lymphoma, Kymriah® and Yescarta®, and others are being tested in clinical studies.

CAR T-cell immunotherapy overcomes the need to perform in-vivo antigen processing and uptake by dendritic cells. Recent data in blood cancers have shown promising results with a high rate of complete remissions. These results confirm the ability or importance of killer T-cells in targeting and killing cancerous cells. Nevertheless, this approach does not appear to address the immuno-suppressive environment in solid tumors, and can cause significant side effects. Perhaps the most troublesome side effect is cytokine-release syndrome. The infused T-cells release cytokines, leading to a rapid and large presence in the bloodstream. This can cause dangerously high fevers and precipitous drops in blood pressure. Relatively high cost and complex manufacturing processes for CAR-T therapies may also limit the broader applicability of CAR T-cell immunotherapies in the long run. High numbers of infused T-cells can result in extremely high and debilitating systemic inflammation. In some recent clinical studies, patient deaths were reported as a result of high numbers of infused T-cells. These clinical studies were then suspended by the FDA.

Other promising approaches under evaluation in clinical studies are:

Live Vectors: This approach uses live vectors, predominantly live viruses or live bacteria, with added copies of a plasmid that encodes the protein antigen DNA sequence. The protein is then secreted by the virus or bacteria once the DNA is successfully transfected into the dendritic cells. Studies have shown this approach can result in successful stimulation of T-cells and antibodies. Systemic toxicities have been reported with some live virus and bacteria technologies administered by intravenous infusion. Certain clinical studies have been suspended due to patient deaths suspected, but not confirmed, to have resulted from treatment-related toxicities.

Antibodies: This approach uses dendritic cell targeting antibodies linked to tumor antigens in order to facilitate dendritic cell uptake of those antigens.

Electroporation: This approach involves generation of electrical pulses through the skin. This technology delivers antigenic DNA into the dendritic cells residing beneath the skin. The protein then has to be secreted by the dendritic cells once the DNA has been successfully delivered and transfected into the dendritic cells. Studies have shown this approach can result in successful stimulation of T-cells and antibodies. Several of the technologies summarized above have not demonstrated the ability to effectively activate the necessary immunological mechanisms required to induce optimal killer T-cell responses. Additionally, many of these approaches do not activate mechanisms to combat or reduce immuno-suppressive cell populations within tumors. These drawbacks may lead to suboptimal responses, and the need to combine them with other technologies in the long run to improve their clinical responses.

Some efforts to address the immuno-suppressive environment have focused on developing antibodies focused on blocking immune checkpoints. These are known as the checkpoint inhibitors. Checkpoint inhibitors have had the most developmental attention and commercial success to date in the field of cancer immunotherapy. The function of checkpoint inhibitors is to block normal proteins on cancer cells, or the proteins on T-cells that respond to them. The result is to make cancer cells more visible to T-cells. This then helps generate a T-cell assault on the cancer. The use of checkpoint inhibitor antibodies to overcome tumor immune suppression is known to present the potential for triggering autoimmune disease. To date, more than six checkpoint inhibitors have received rapid approval from the U.S. Food and Drug Administration, or FDA. These include ipilimumab (Yervoy®), pembrolizumab (Keytruda®), and nivolumab (Opdivo®).

Adjuvant-Based Cancer Vaccines: Adjuvant-based cancer vaccines appear to be quite well tolerated, with the most commonly reported adverse events being injection site reactions and systemic toxicities. These systemic inflammatory immune responses are sometimes caused by the use of the immune activators, known as adjuvants. Such adjuvants may have the potential to induce high cytokine levels in the blood, which can sometimes lead to severe side effects as a result of cytokine storms.

Combination Immunotherapy

One common clinical goal of administration of immunotherapies to cancer patients is to spark a self-sustaining attack against cancer cells by the T cells, thereby producing long-term clinical benefit. Currently, there are approximately 2,000 immunotherapeutic agents in development. Some cancer patients respond better to the immunotherapies than others, due in part to the factors described above.

The limitations of current immunotherapy technologies as cancer monotherapies are now resulting in increasing testing of multiple cancer drugs in combination. As a result, combination immunotherapy is now generally believed to be the latest frontier in cancer research, and over a thousand such combination therapy clinical studies are currently ongoing. Due to the ability of the checkpoint inhibitors to alter the tumor’s immune suppressive environment by blocking the immune checkpoints, the vast majority of the combination studies involve checkpoint inhibitors. However, due to the known need for CD8+ T-cell induction, checkpoint inhibitors have only generally been proven to be optimally clinically successful in a minority of treated patients to date.

Thus far, nivolumab with ipilimumab, which targets PD-1 and CTLA-4 respectively, is the only checkpoint-inhibitor combination approved for clinical use. It was approved to treat metastatic melanoma by the FDA in 2015. In a published study report, this combination was shown to delay tumor progression in melanoma by a median of 11.5 months, almost twice as long as in those on nivolumab alone, and almost four times as long as in people treated with only ipilimumab (Larkin, J.). Then, in October 2017, in a published study report, researchers demonstrated that this combination extended survival times: people with melanoma lived longer on the combined treatments, with 58% still alive after three years compared with 52% of those treated with nivolumab alone.

However, these improved survival rates were paired with reports of increased toxicity. Almost 60% of people taking the combination experienced severe side effects such as colitis or diarrhea - three times as many as those treated with nivolumab, and twice as many as those treated with ipilimumab.

PDS believes that rational design of combination immunotherapies using agents that promote synergy with each other and reduced potential for compounded toxicity would substantially improve potential for combination therapies to deliver improved clinical benefit for cancer patients. PDS believes that the fact that Versamune® appears to activate the appropriate combination of immunological pathways that promote strong CD8+ T-cell induction, while also altering the tumor’s microenvironment to make the tumor more susceptible to T-cell attack, makes it an ideal complement to the checkpoint inhibitors to enhance their potency. In addition, the differences in mechanism of action between Versamune® and checkpoint inhibitors, as well as the initial demonstrated safety profile of Versamune®, suggests that these combinations may be much better tolerated by patients than many or most other combination therapies involving checkpoint inhibitors.

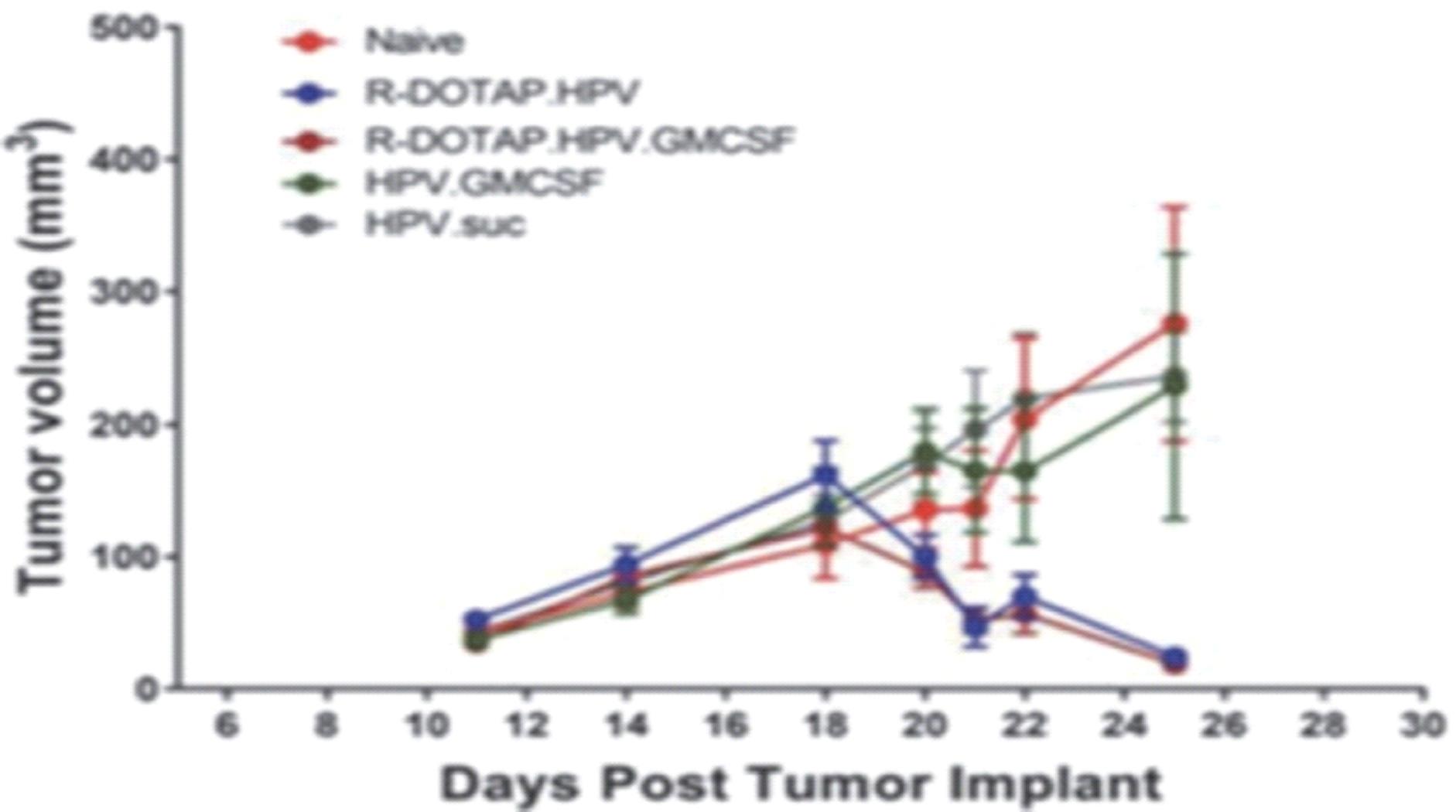

Example 1: Studies to understand the effect of Versamune®-based immunotherapy combined with a checkpoint inhibitor in a difficult-to treat preclinical tumor model:

To determine if checkpoint inhibitors enhanced the anti-tumor response of Versamune®, preclinical studies were performed employing the B16F10 melanoma model. B16F10 is a notoriously difficult tumor to successfully treat with antigen-specific immunotherapy, and monotherapy. One reason is that many of the antigens targeted are self-antigens to which there is some degree of immune tolerance. A previous study performed by PDS demonstrated that TRP2 antigen dose was important in the ability of R-DOTAP to break the tumor’s immune tolerance, and a 75µmol dose was demonstrated to inhibit tumor growth but did not induce regression.

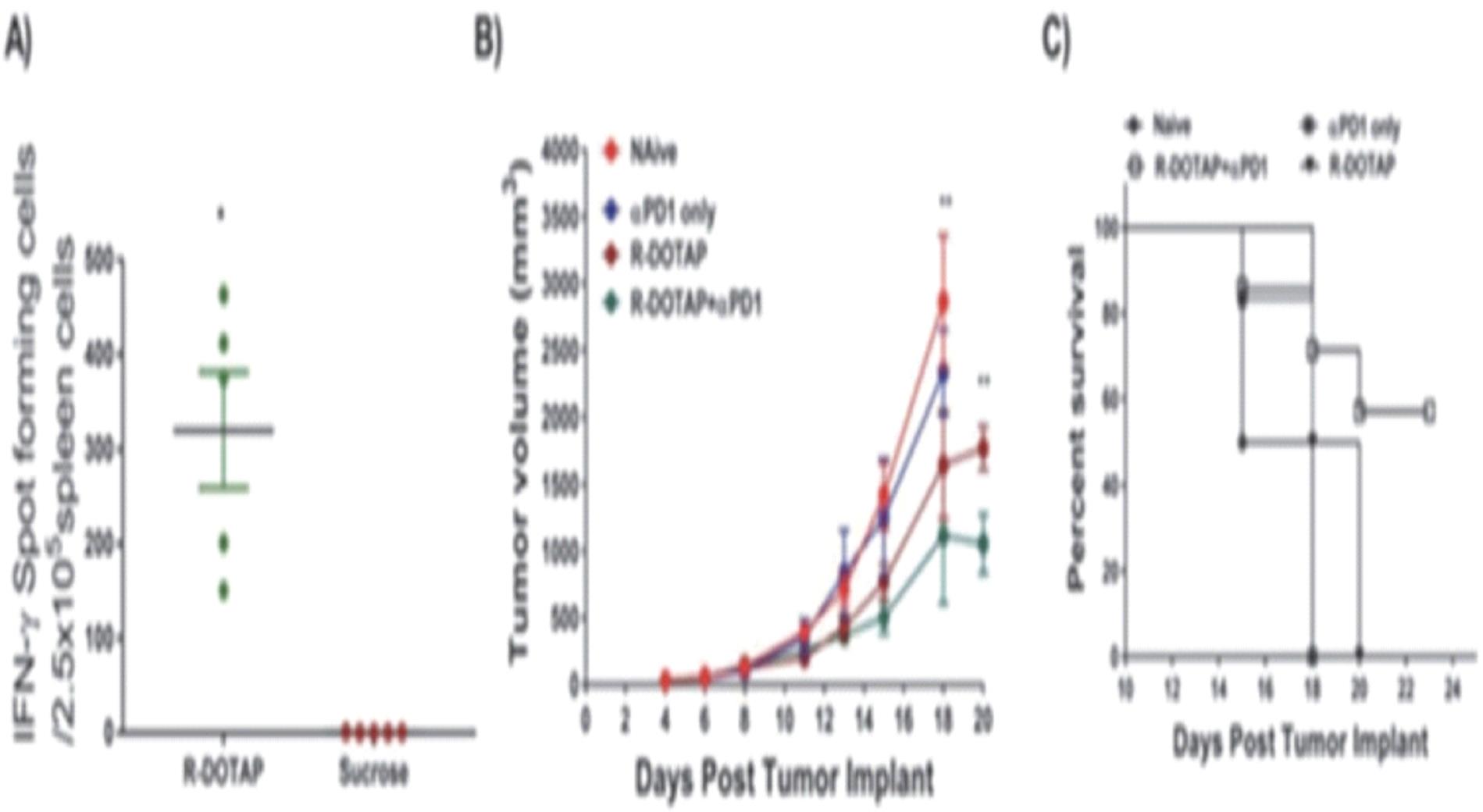

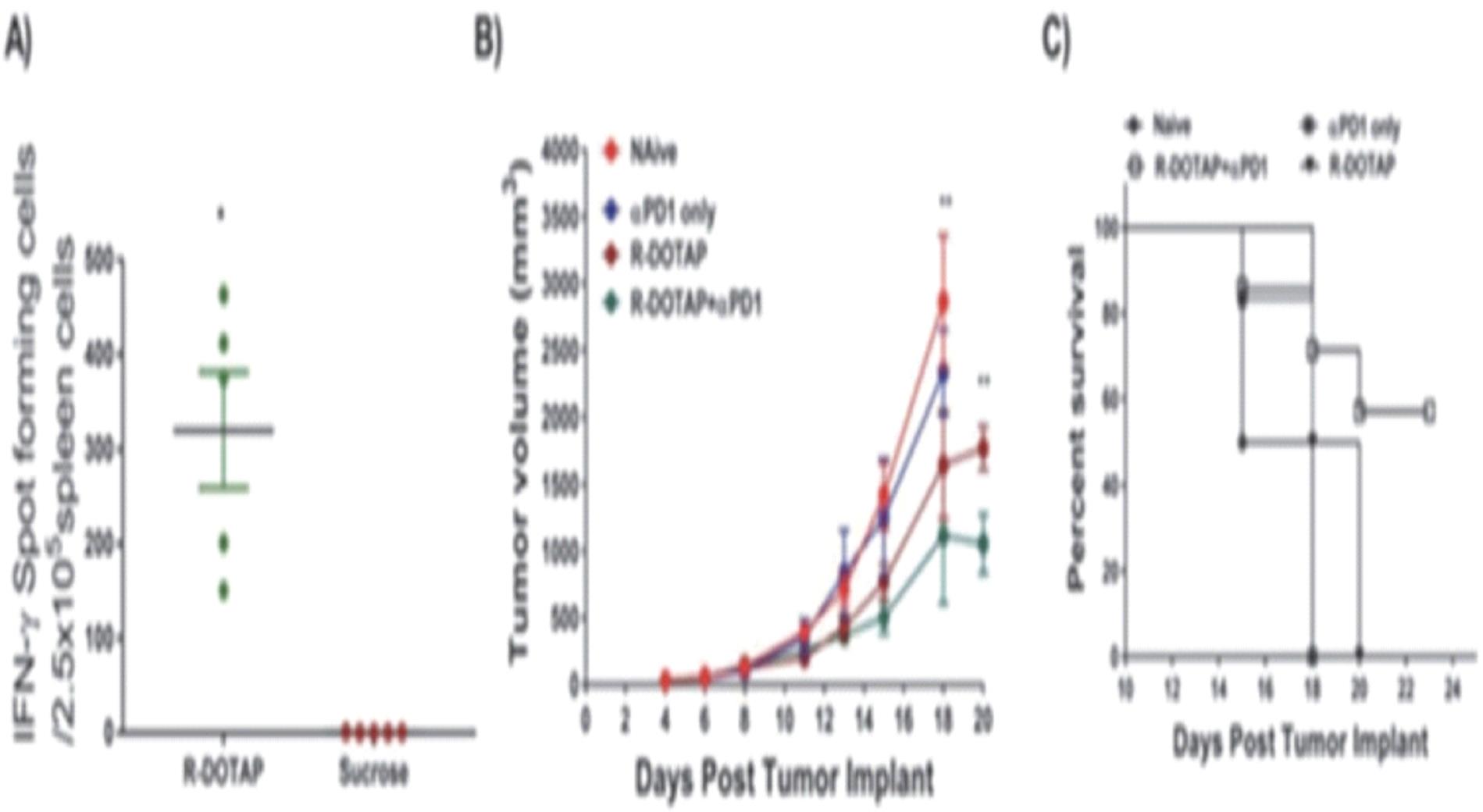

The Versamune® plus Trp2 formulation was shown to induce a strong CD8 T cell response. Trp2 is a 9aa tyrosinase related peptide presented by the H-2Kb molecule (Trp2180-188: SVYDFFVWL). Subcutaneous injection with Versamune® and Trp2 resulted in strong CD8+ T-cell ELISPOT responses whereas Trp2 alone did not elicit any T-cell response (Figure 3). To determine whether anti-PD1 treatment synergized with Versamune® and Trp2 treatment in slowing the growth of B16 melanoma, mice were implanted with B16F10 melanoma and injected with Versamune® and Trp2 when tumors reached a size of 3mm. In addition, some groups received 5 injections of anti-PD1 antibody.

Treatment with Versamune® plus Trp2 (PDS0104 prototype) resulted in significant slowing of tumor growth compared to naïve or anti-PD1 only groups, which demonstrated no impact on tumor growth.

When Versamune® plus Trp2 vaccination was combined with anti-PD1 treatment a synergistic effect was apparent resulting in a more dramatic inhibition of tumor growth and an extension of survival (Figure 16 B-C). Tumor growth rate was observed to increase upon halting the anti-PD1 treatment.

These results strongly suggest an effective immunotherapeutic synergy between the Versamune® T-cell activating platform and the checkpoint inhibitors. Versamune® may therefore potentially be successfully combined with a checkpoint inhibitor in human combination immunotherapy strategies.

Figure 3: Versamune® (R-DOTAP) synergizes with anti-mouse PD1 checkpoint inhibitor treatment to significantly alter B16 melanoma tumor growth in vivo. Groups of C57BL/6J mice (n=5) were treated with the Versamune® plus TRP2 nanoparticles or TRP2 mixed in sucrose buffer on day 0 and boosted on day 7. A) Antigen specific CD8+ T cell responses in spleen were assessed 7 days after the second vaccination by ELISPOT assay. B-C) Mice were implanted subcutaneously with 1 X 105 B16.F10 tumor cells and were subcutaneously injected with two doses of Versamune® plus TRP2 nanoparticles on day 5 and 12 after tumor implant. For anti-mouse PD1 therapy, each mouse received five doses of 200 µg of anti-mouse PD1 antibody delivered i.p. at 3-day intervals starting on day 5 after tumor implant. B) Mean tumor volume ± SEM (n=5) in vaccinated or naïve mice. C) Survival over the course of the study.

Versamune® Mechanisms of Action (MOA)

We believe that the Versamune® platform has a multi-functional mechanism of action, or MOA, which is responsible for its strong antigen-specific T-cell activity, that could potentially lead to clinical confirmation of efficacy (Ghandapudhi et al, J. Immunology, June 15, 2019, 202 (12) 3524-3536). PDS continues to further study and validate some of these detailed molecular signaling mechanisms.

The section below summarizes studies that have been performed to confirm the mechanisms by which the Versamune®-based products elicit strong anti-tumor responses apparently without the toxicities typical of current immunotherapy.

Figure 4: Summary of the versatile and multi-functional mechanism of the Versamune® platform that leads to demonstrated anti-tumor activity

Antigen Uptake

The critical first step in the process of effectively priming T-cells is uptake of disease-related antigens in the formulation. Versamune® exploits the well-studied function of dendritic cells to “take up” particulate matter, and no targeting mechanisms are therefore believed to be required to facilitate this uptake. The positive charge of Versamune® leads to enhanced association with negatively charged cell surfaces, resulting in high internalization by the dendritic cells.

To confirm this effective uptake by dendritic cells, a number of in-vivo confirmatory studies were successfully completed:

| ● | A bio-distribution study in mice demonstrated that, four hours after subcutaneous injection of Versamune®, 80% of dendritic cells in a draining lymph node (where dendritic cells interact with T-cells) had taken up Versamune®. This study also demonstrated that dendritic cells had been effectively activated and matured by Versamune®. |

| ● | Pharmacokinetic and absorption, distribution and excretion studies, in both rats and monkeys, demonstrated an extremely low presence of PDS0101 in the blood circulation (bio-availability 5-6%) after subcutaneous administration. These studies also demonstrated an extremely low presence of PDS0101 in all key organs of the body, with predominant presence in the lymphatic system. These studies confirmed effective uptake of the immunotherapy by the dendritic cells, and a subsequent high presence in the lymphatic system where effective interaction with T-cells can occur. |

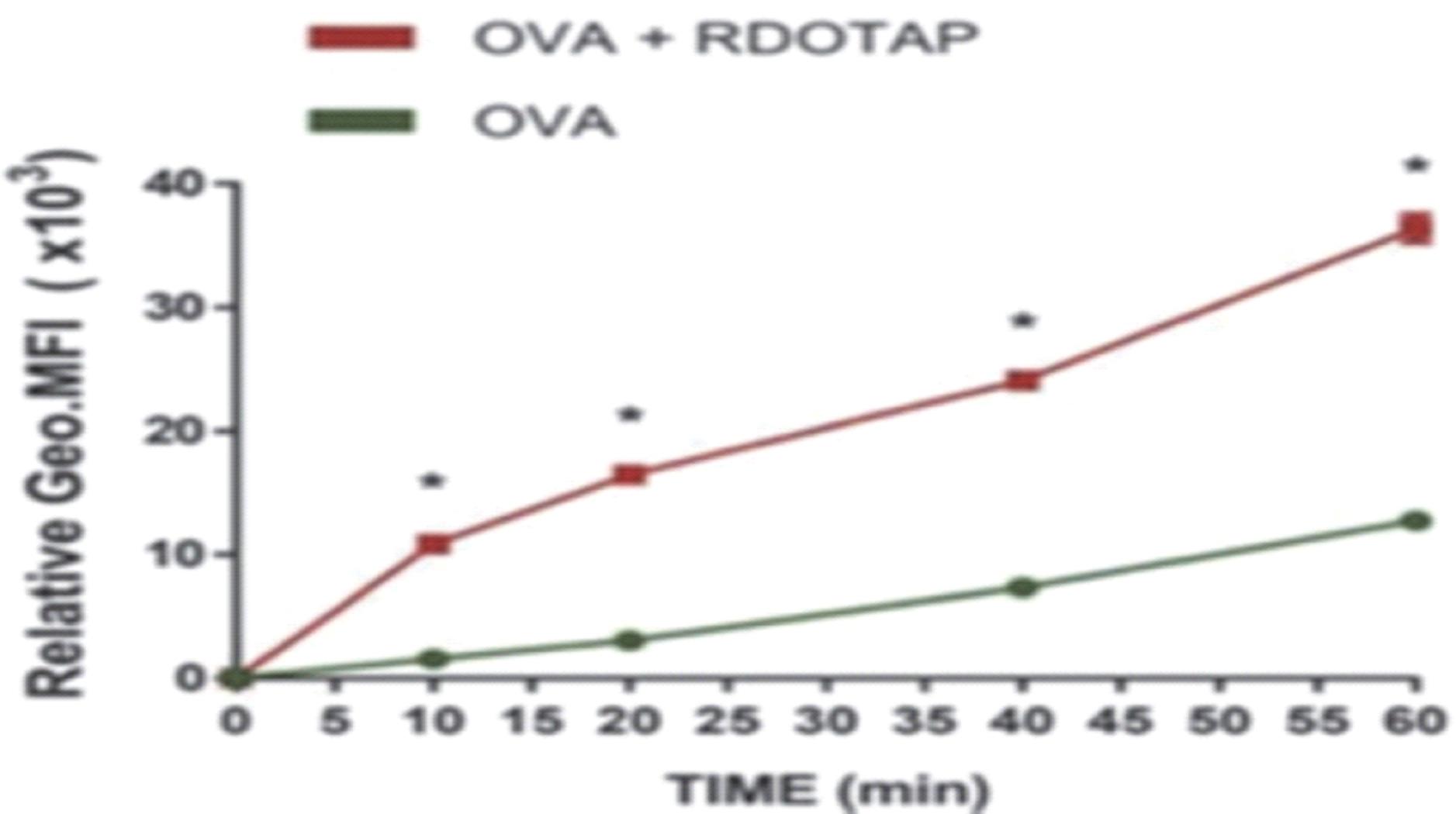

Example 2: In-vitro studies performed to examine the ability of Versamune® to promote antigen uptake and processing by bone marrow-derived dendritic cells (BMDC):

The protein ovalbumin (OVA) was used as a model antigen. Uptake of OVA into BMDC was visualized using Alexa 647-OVA. BMDC were incubated for various times with Versamune® and Alexa 647-OVA or Alexa 647 OVA alone followed by measurement of Alexa 647-OVA fluorescence by flow cytometry. Although some Alexa 647-OVA uptake was observed in BMDC incubated with Alexa 647-OVA alone, uptake was dramatically enhanced in the presence of Versamune®. Notably, Versamune® facilitated significant uptake within the first 10 minutes and continued throughout the hour (Figure 4).

Presumably, OVA uptake mediated by Versamune® would deliver OVA into acidic endosomes where OVA processing would be expected to occur. To evaluate processing, PDS utilized DQ-OVA, which is a heavily fluorescent OVA that self- quenches in the intact molecule, but fluoresces when degraded. Incubation of BMDC with DQ-OVA and Versamune® resulted in a significant shift to red fluorescence indicative of extensive processing and endosomal accumulation. Incubation of BMDC with DQ-OVA and the potent adjuvant LPS did not result in enhanced processing (Figure 5). Thus, in this study, Versamune® promoted rapid protein uptake and processing in BMDC, presumably in the endosomal compartments.

Figure 5: Versamune® enhances protein uptake by dendritic cells

Bone marrow derived dendritic cells were incubated with Alexa-647 conjugated ovalbumin admixed with sucrose or Versamune® (R-DOTAP) nanoparticles for indicated times and the association of ovalbumin with BMDCs was represented as mean fluorescence intensity.

Figure 6: Versamune® enhances processing of antigen by dendritic cells

Bone marrow derived dendritic cells were incubated with DQ conjugated ovalbumin admixed with sucrose or Versamune® nanoparticles or LPS (1µg/ml) for indicated times and the association of ovalbumin with BMDCs was represented as mean fluorescence intensity.

DQ-Ovalbumin processing at 60 minutes was measured by assessing the fluorescence in the FITC channel (FL1H) and the fluorescence in the PE-channel (FL2H) which represents the ovalbumin processing.

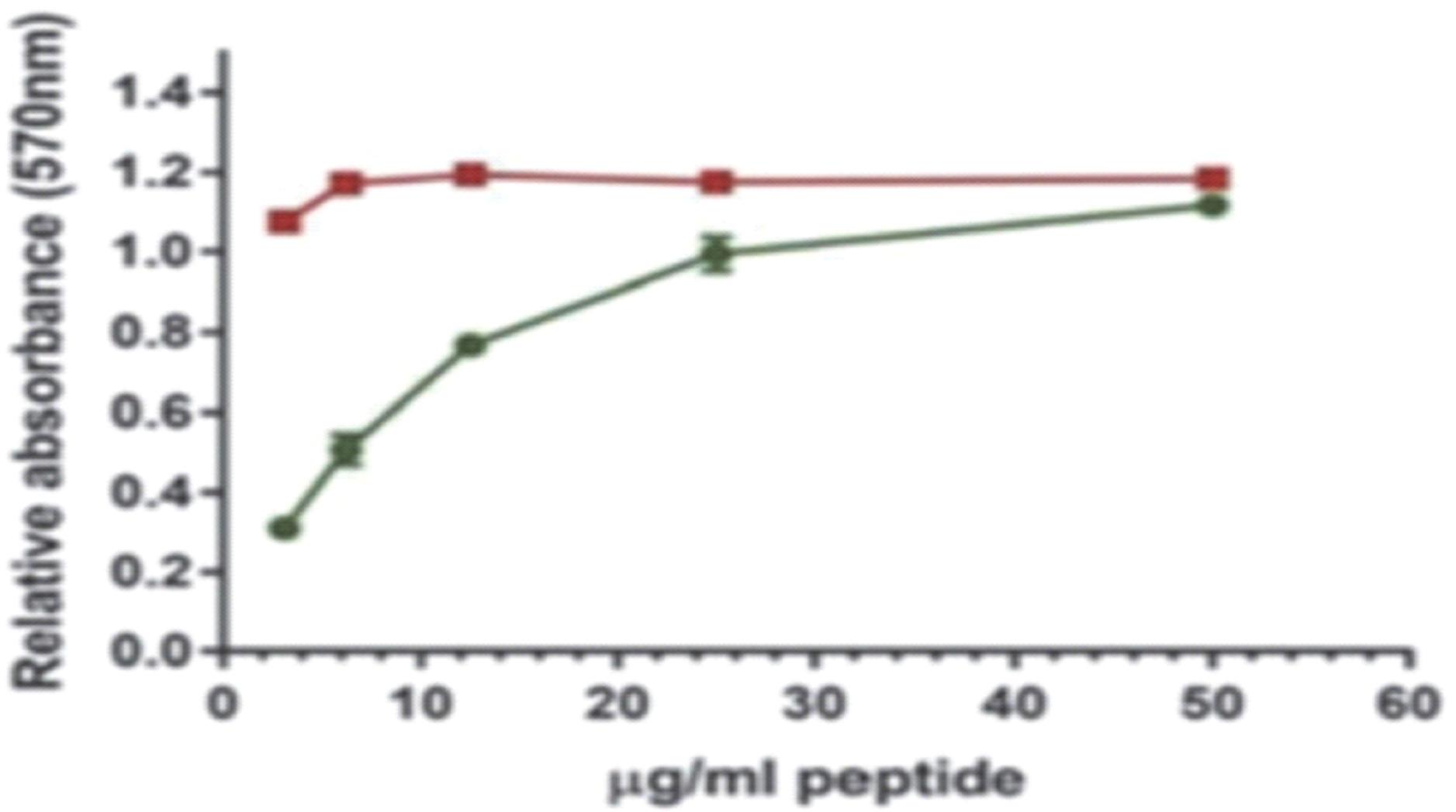

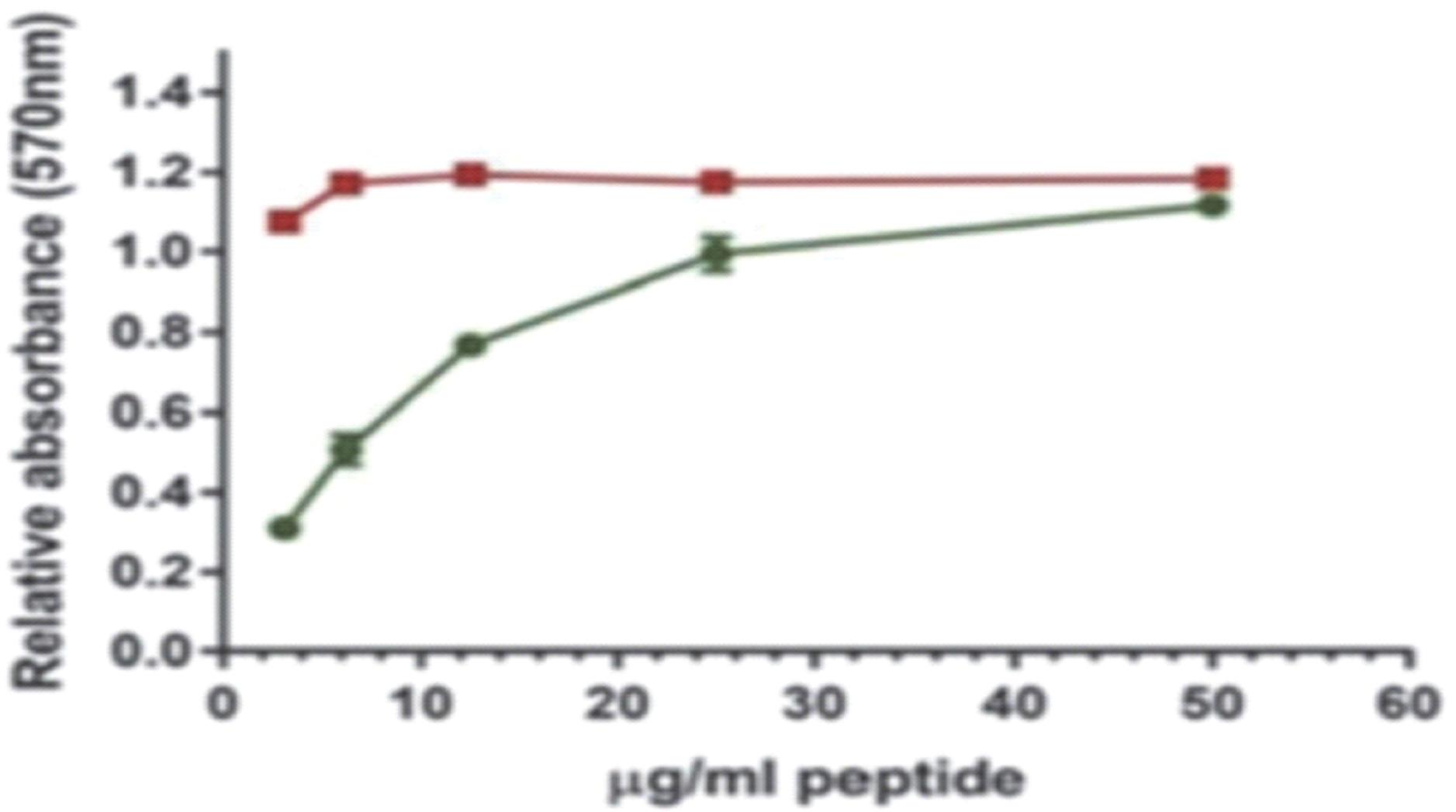

To further examine the ability of Versamune® to influence cross presentation of antigens to killer T-cells (CD8+) by dendritic cells, studies were performed utilizing the B3Z T cell hybridoma, which expresses a T-cell receptor specific for the CD8-specific SL9 peptide of ovalbumin presented by H-2Kb. B3Z cells express a reporter lacZ gene under the control of the nuclear factor of activated T cells (NFAT) promoter providing a rapid and sensitive assay for the processing and presentation of SL9 antigen by dendritic cells. BMDCs were incubated with a long ovalbumin peptide (OVA241-270) containing the SL9 epitope formulated with Versamune® nanoparticles or sucrose buffer for 1hr at 37oC to load the peptide on to BMDCs. Excess peptide was removed by washing and BMDCs were then co-cultured with B3Z cells overnight. The efficiency of SL9 peptide cross presentation by BMDCs was measured using a colorimetric lacZ detection assay. While incubation of BMDC with peptide alone resulted in some cross presentation to B3Z cells, the addition of Versamune® nanoparticles resulted in maximal stimulation with approximately 100-fold less peptide (Figure 6). These results suggested that Versamune® dramatically enhances cross presentation of antigens to CD8+ T-cells.

Figure 7: Versamune® promotes antigen cross-presentation to killer T-cells (CD8+) in-vitro

BMDCs were pulsed for 10 minutes with indicated concentrations of OVA (241-270) peptide admixed with sucrose (green) or Versamune® (red) and co-cultured with B3Z cells overnight and lacZ production by OVA peptide-stimulated B3Z was measured using lacZ colorimetric assay.

Overall the studies summarized in Example 1 demonstrate the ability of Versamune® to potentially overcome a significant limitation of current immunotherapeutic approaches. This critical limitation is the sub-optimal uptake, processing and cross-presentation of antigens resulting in weak induction of tumor-targeting killer T-cells.

Antigen Presentation

One of the most important characteristics of the Versamune®-based lipids is their ability to facilitate entry of antigens into the cytoplasm of dendritic cells, and subsequent efficient presentation to T-cells leading to effective T-cell priming. This characteristic is expected to help the Versamune®-based products overcome one of the most significant obstacles facing the field of cancer immunotherapy.

The use of cationic lipids in cancer and infectious disease immunotherapy has gained significant attention due to the work of Prof. Leaf Huang and the unique properties of these lipid particles in delivering their content effectively into antigen presenting cells such as dendritic cells.

To confirm that Versamune® facilitates antigen presentation to CD8+ (killer) and CD4+ (helper) T-cells via MHC Class I and Class II, respectively, a number of in-vivo and in-vitro confirmatory studies were performed.

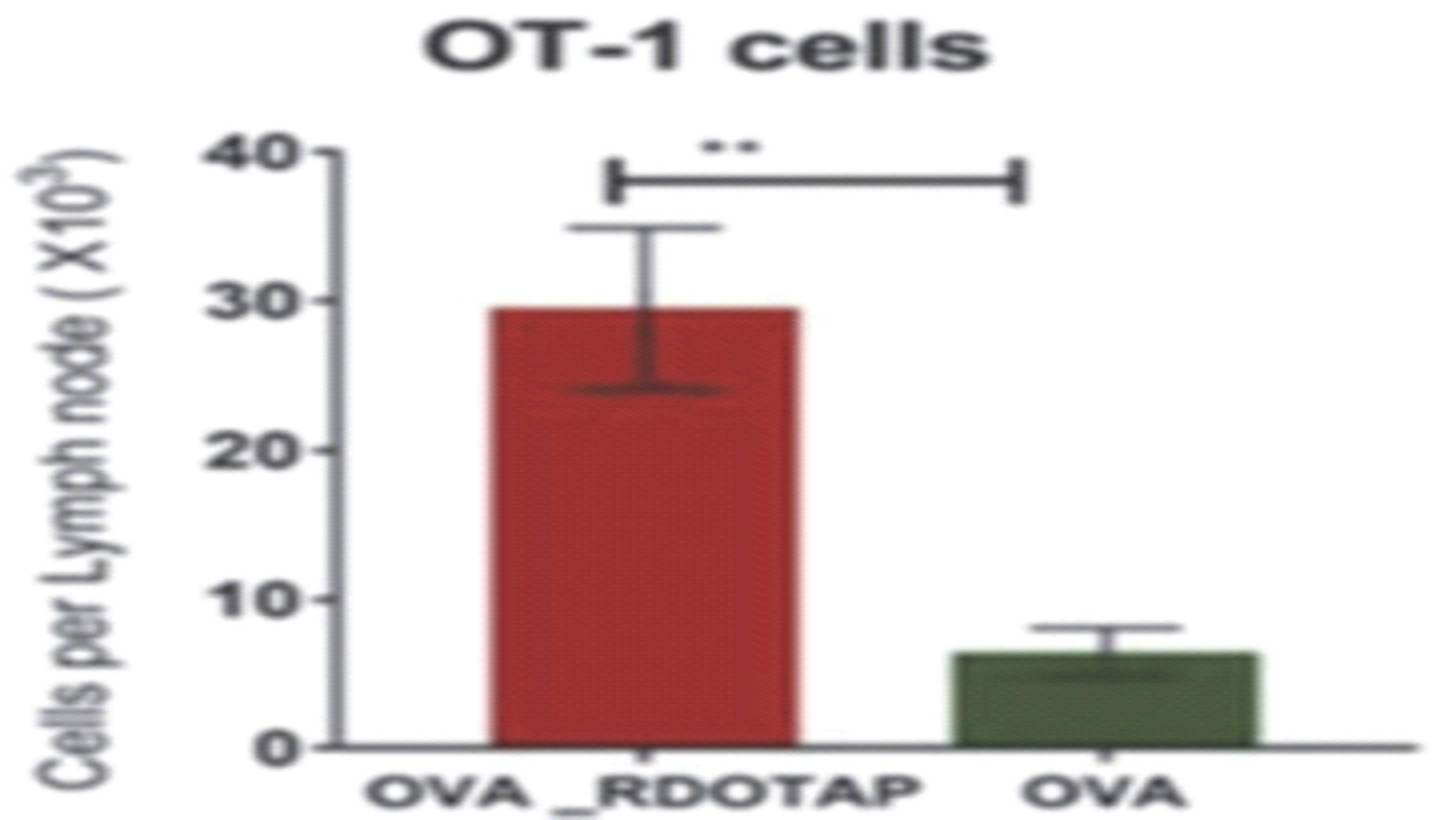

Example 2: In-vivo studies to confirm the ability of Versamune® to perform cross presentation to CD8+ T-cells

To directly examine cross presentation in vivo following Versamune® administration with antigen, these studies utilized an adoptive transfer model in which OT-I T-cell receptor (TCR) transgenic T cells specific for the CD8 epitope SL9 of ovalbumin (OVA) used as a model antigen and presented by H-2Kb were labeled with carboxy fluorescein succinimidyl ester (CFSE), a fluorescent cell staining dye and transferred into normal C57BL/6 mice.

Activation and proliferation of OT-1 cells in the adoptive transfer mice requires in-vivo processing of whole OVA into the SL9 epitope and presentation on the H-2Kb MHC class I molecule, i.e. cross presentation. Mice were then injected in the footpad with 1μg of whole OVA admixed with either sucrose or Versamune®. Proliferation of the transgenic T cells in the draining popliteal lymph node was assessed by flow cytometry measuring CFSE dilution in the transgenic T cells.

The draining lymph nodes (DLN) draining the Versamune® + OVA footpads were noticeably enlarged, and this was reflected in an increased total cell number isolated per lymph node. There was also a significant increase in total OT-1, both divided and undivided in the Versamune® + OVA-treated mice compared to OVA alone (Figure 7).

Thus, Versamune® facilitated processing and MHC class I cross presentation of whole protein to CD8+ T cells in the draining lymph node when administered subcutaneously. Similar results were obtained utilizing class-II OVA-specific transgenic T-cells demonstrating that Versamune® facilitated MHC class II presentation of whole protein to CD4+ T cells in the draining lymph node when administered subcutaneously.

Figure 7: Versamune® (R-DOTAP) promotes antigen cross presentation in-vivo leading to superior proliferation of OT-1 CD8+ T-cells

Total number of antigen specific cells in the draining popliteal lymph nodes in each vaccinated mouse were enumerated using hemocytometer and antigen specific CD8 T cell expansion was measured by CFSE dilution assay and total number of OT-1 CD8T cells.

Immune Activation

The ability of certain structurally-specific cationic lipids to act as potent immune activators was first reported by Prof. Leaf Huang. Subsequent studies have identified the fact that the cationic lipids activate (or upregulate) the type I interferon genes. The type I interferon signaling pathway is well documented to be highly important in activation and proliferation of killer T-cells. PDS’s studies have demonstrated that cationic lipids utilize certain pathways to upregulate type I interferons.

To better understand how the cationic lipids induce potent immune activation without the typically observed inflammatory toxic side effects, a number of further studies were performed.

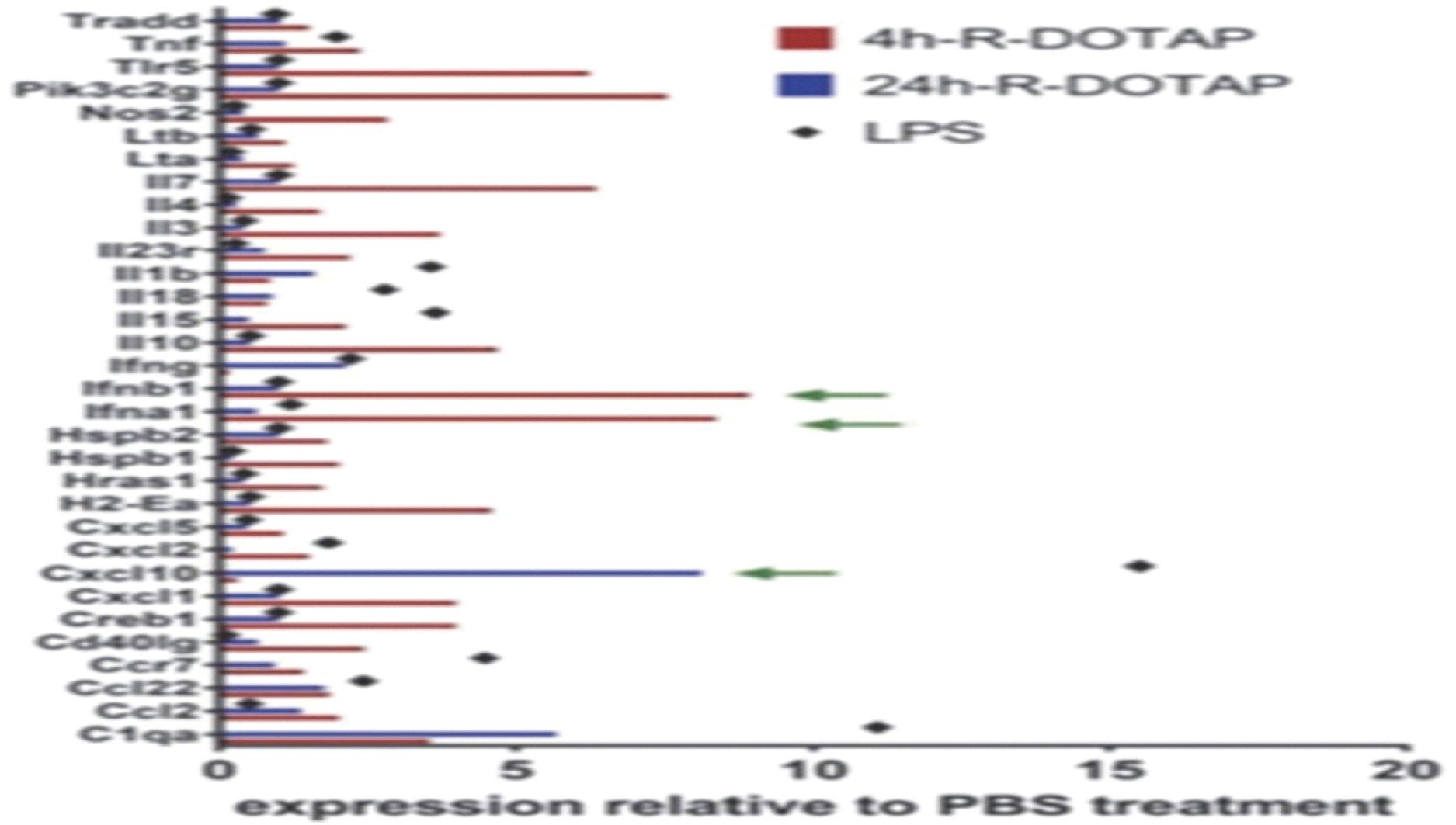

Example 3: Studies to understand the immunological effects of Versamune® and resulting T-cell responses

To examine the immunostimulatory effect of Versamune® in the draining lymph node, mice were injected with Versamune® nanoparticles in the footpad and inflammatory gene expression was monitored in purified CD11c dendritic cells from the draining or non-draining popliteal lymph nodes after 4h or 24h by Nanostring multiplex analysis.

Among the inflammatory genes examined, the strongest genes up-regulated were those involved in the type I interferon pathway. These included IFNα, IFNβ, CXCL10, and Stat 1. No induction of classical NFκB dependent cytokines was observed (Figure 8). This result suggested that Versamune® is capable of inducing type I IFN in dendritic cells.

To directly examine type I IFN production by dendritic cells, BMDC were incubated with Versamune® or LPS as a positive control for 18h and type I IFN was measured in the B16-Blue bioassay. There was a significant dose dependent induction of type I IFN in BMDC by Versamune®.

Figure 8: Versamune® (R-DOTAP) administration induces in-vivo lymph node production of Type I interferons known to be critical for CD8+ T-cell activation.

Mice were injected with Versamune® or sucrose in the foot pad and draining popliteal lymph nodes were harvested from each mouse and CD11c cells from pooled lymph nodes were sort purified. Relative gene expression from sort purified CD11c cells from Versamune® or LPS injected mice were analyzed using Nano string technology.

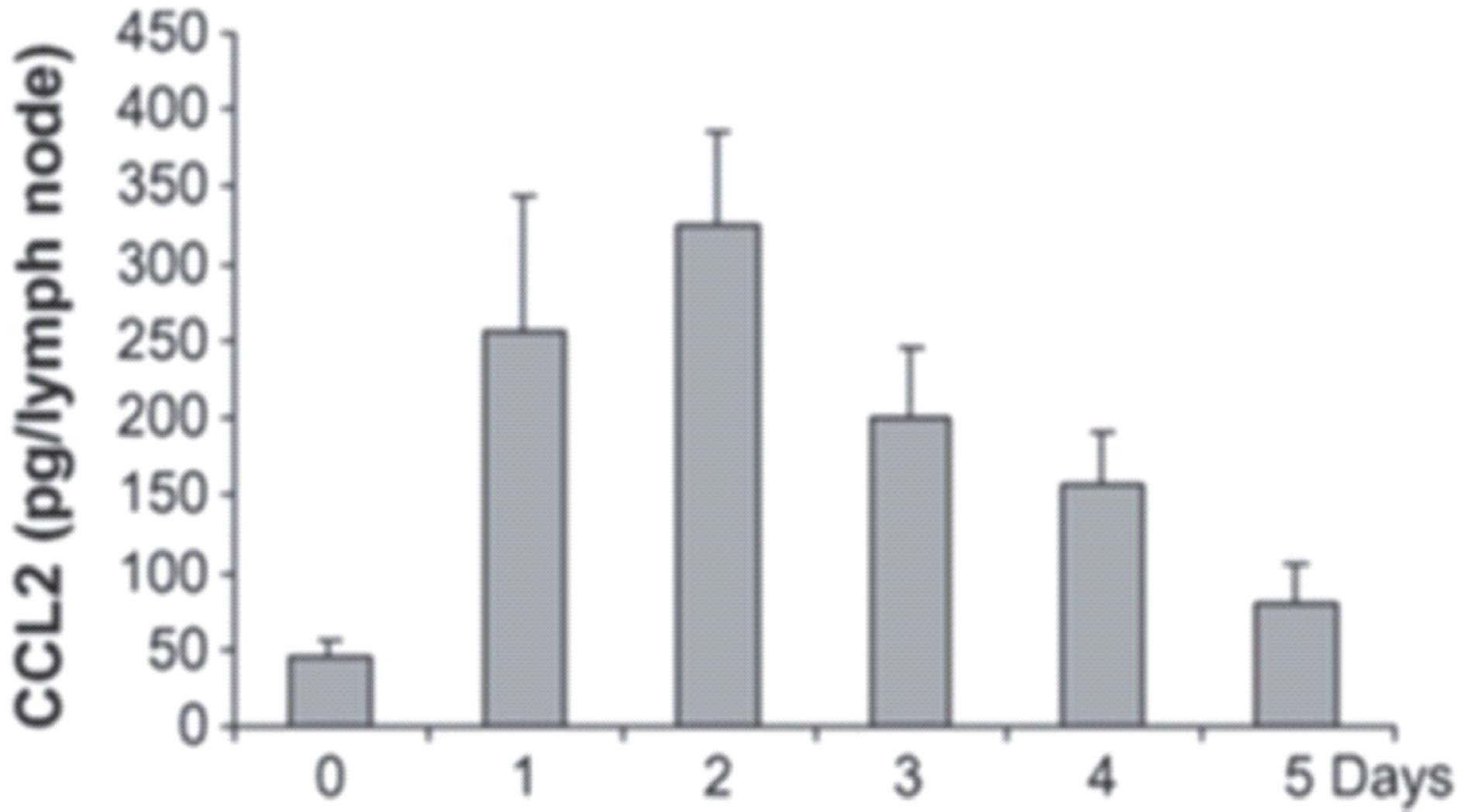

Cytokine/Chemokine Induction:

In preclinical studies, cytokine and chemokine induction were observed within lymph nodes within 24 hours of a single subcutaneous injection, and persisted for at least 5 days. This is important as cytokines and chemokines are known to be important in the activation and proliferation of T-cells (Figure 9). A separate study performed to evaluate the effect of Versamune® on induction of 20 key cytokines and chemokines demonstrated that, unlike a traditional T-cell activating immunotherapy used as a positive control, that Versamune® injection led to negligible increase in blood cytokine levels above normal baseline levels. This finding was important for 2 reasons:

| 1. | Localized cytokine induction within the lymph nodes at the site of required T-cell activation could enhance activation of primed T-cells. |

| 2. | Localized induction of cytokines within the lymph node with negligible presence in the blood circulation minimizes potential for systemic toxicities, and improves clinical tolerability of the immunotherapy. |

Figure 9: Single subcutaneous injection of PDS0101 leads to sustained and elevated levels of the important CD8+ T-cell activating chemokine CCL2 (MCP-1).

On day 0, mice (n=3) were injected with PDS0101formulation.

On the indicated days, the mice were sacrificed and the draining lymph nodes collected.

The draining lymph nodes were homogenized in 100 μl ELISA buffer (10% FBS in PBS) and then analyzed by ELISA assay.

Activation and Proliferation of T-Cells:

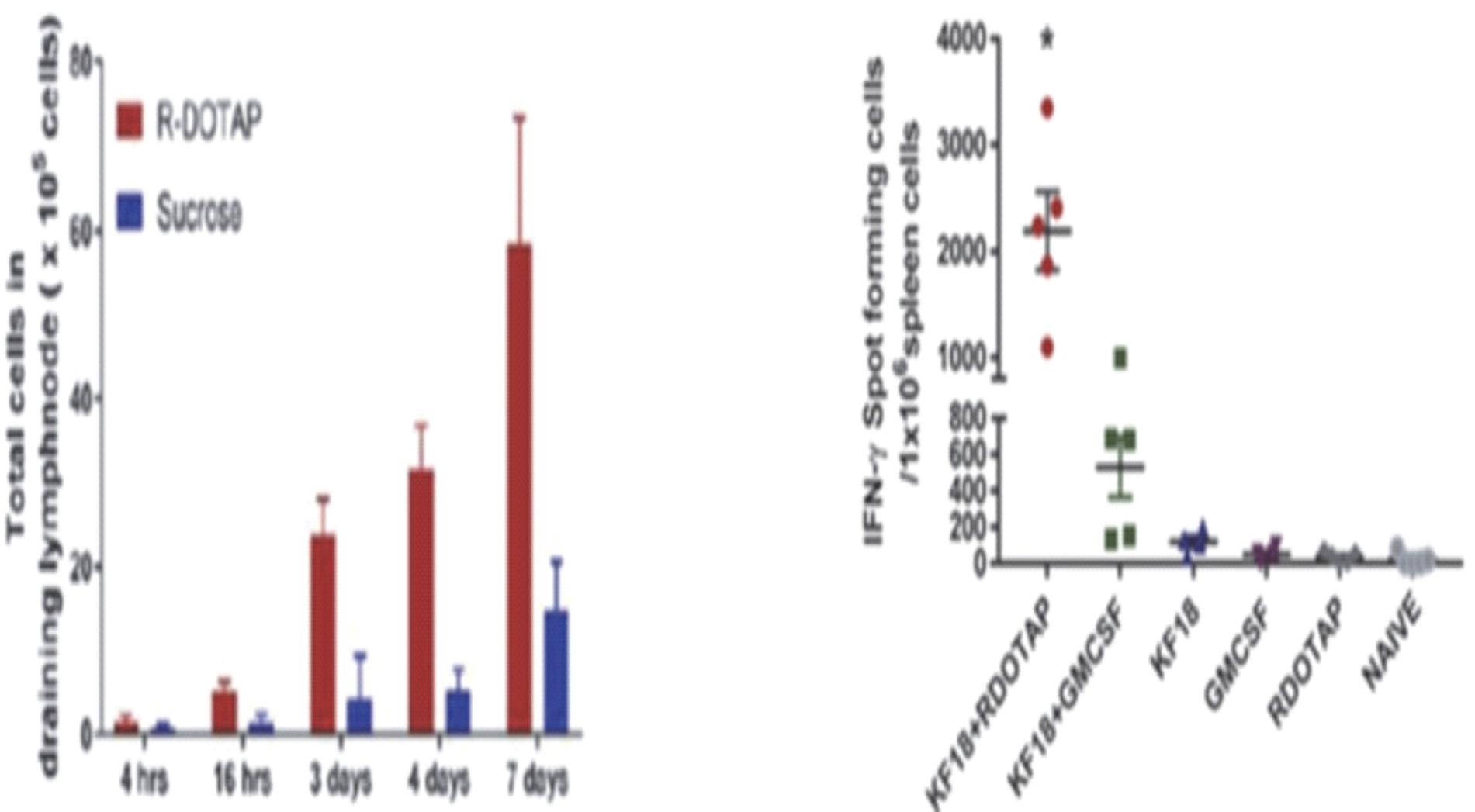

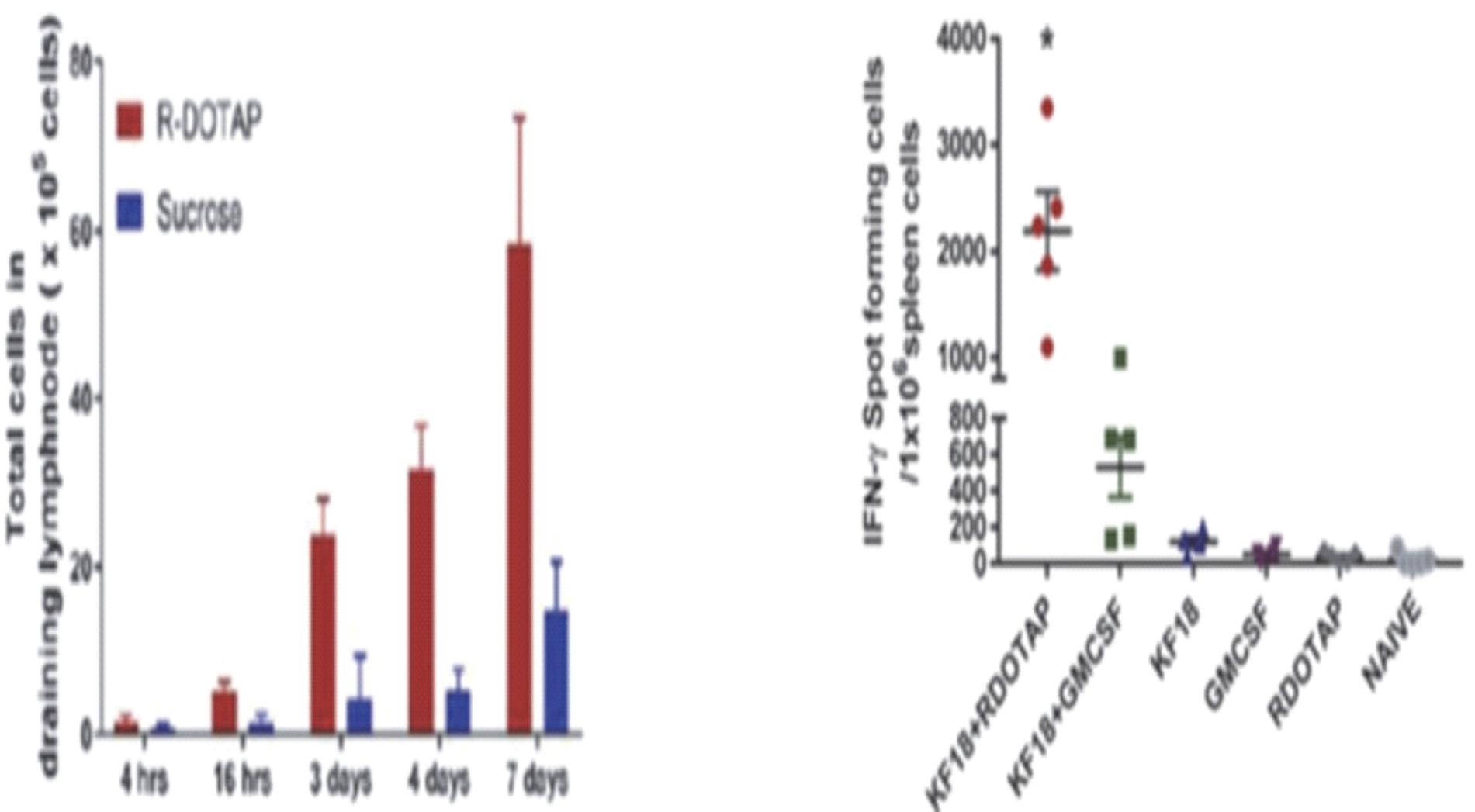

As noted above, Versamune® was demonstrated to induce production of various chemokines in lymph nodes. Chemokines play a major role in selectively recruiting monocytes, neutrophils, and T-cells. It was demonstrated that, within a few hours of administering Versamune®, significant T-cell infiltration into the lymph nodes results.

Administration of Versamune® resulted in a visible increase in draining lymph node (DLN) size of wild type mice and this was due to a steady increase in total cell number over a seven-day period (Figure 10). This increase in total cell number was found to be dependent on the ability of Versamune® to induce type I IFN signaling, as this effect was greatly reduced in IFNαR knock-out mice which are devoid of type I interferons.

Type I IFN is known to inhibit lymphocyte egress from lymphoid organs through the up-regulation of CD69, which in turn, inhibits the sphingosine 1 phosphate receptor required for lymphocyte egress. It has now been demonstrated that administration of Versamune® induces type I IFN in the lymph nodes, which in turn, up-regulates CD69 in T cells and natural killer cells resulting in their accumulation in the lymph nodes. This effect facilitates effective interaction of T-cells with dendritic cells leading to effective priming of T-cells.

When Versamune® is administered together with an antigen, strong T-cell priming to recognize the particular antigen, activation and proliferation is facilitated. Figure 11 shows a comparison of T-cell activation between Versamune® and the potent immune activator GM-CSF, demonstrating higher levels of CD8+ T-cell induction by Versamune®.

Figure 10:

| | Figure 11:

|

| | | |

Versamune® administration induces production of chemoattractant chemokines leading to infusion of T-cells into the draining lymph nodes in-vivo. | | Versamune® induces high levels of HPV-specific CD8+ T-cells in-vivo. |

B6 mice were injected with Versamune® or sucrose and draining lymph nodes were harvested from each mouse, and enzymatically digested lymph nodes were assessed for the total cell number at indicated times. Total infiltrating T cells are shown. | | Groups of C57BL/6J mice (n=5) were treated with the indicated formulation containing HPV CD8 T cell epitopes mixed with Versamune, GMCSF, or sucrose on day 0 and boosted on day 7. Antigen specific CD8 T cell responses in spleen were assessed 7 days after the second injection by ELISPOT assay. |

Quality of induced T-Cells:

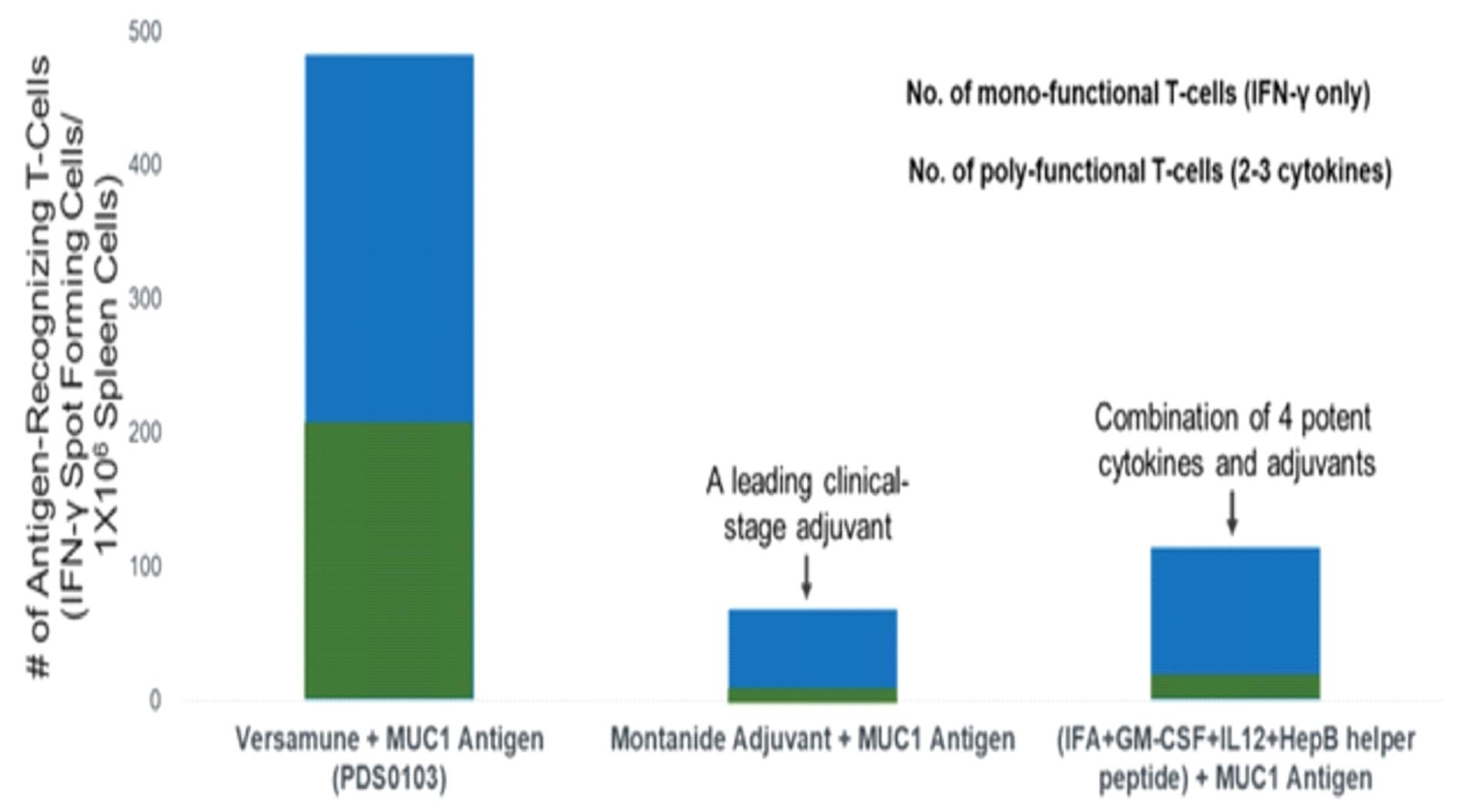

A qualitative factor now known to be highly important in the ability of T-cells to lyse, or kill, infected cells is the quality or potency of T-cells. T-cell quality is directly related to its polyfunctionality, or its ability to induce more than one cytokine. In order to better understand the strength of Versamune®-induced immune responses and their clinical relevance, head-to-head comparisons were made with promising adjuvant-based therapeutic vaccine formulations which had shown promise in preclinical and clinical studies.

We first compared a prototype Versamune®-MUC1 formulation (PDS0103) to two emulsion-based adjuvants in clinical development. Montanide is a proprietary emulsion adjuvant currently being used in peptide-based cancer vaccines. Another potent emulsion-based combination adjuvant formulation specifically designed to induce strong in-vivo CD8 T cell responses consists of the 4-adjuvant combination of incomplete Freund’s adjuvant, IL-12, GM-CSF, and HBV128-140 helper epitope (IFA-Cyt). Mice receiving PDS0103 showed strong responses to both V1A and V2A CD8+ stimulatory. In contrast IFA-Cyt generated an equivalent strong response only to V2A, and Montanide induced responses were significantly lower for both V1A and V2A peptides.

Next, the polyfunctionality (ability to produce multiple cytokines) of induced antigen specific CD8 T cells was assessed by measuring their ability to produce cytokines interferon-gamma (IFN-γ), tumor necrosis factor-alpha (TNF-α) or interleukin-2 (IL-2) by intracellular cytokine staining. In this assay, it was observed that Versamune®-based formulations stimulated the highest percentages of polyfunctional antigen specific CD8 T cells compared to the other two tested emulsion-based lipid formulations (Figure 13), suggesting that Versamune® may induce not only a higher number of CD8 T-cells in-vivo, but also potentially qualitatively superior T cells (higher potency) compared to other typical immunotherapy approaches.

Figure 11: Versamune® (R-DOTAP) formulations containing multiple MUC-1 tumor associated antigens (PDS0103) induce quantitatively superior CD8 T cells responses.

Groups of AAD mice (n=6) were injected with the indicated formulations containing MUC-1 CD8 T cell epitope antigens on day 0 and boosted on day 7. MUC-1 specific CD8 T cell responses in the spleen were assessed 7 days after the second injection by ELISPOT assay. (A) Number of V1A, V2A, C1A, and C2A specific IFN-γ producing cells in spleens from mice injected with Human MUC-1 peptides. (C) Number of V1A, and V2A specific IFN-γ producing cells in spleen from mice vaccinated with Versamune®, IFN-Cyt or Montanide formulations containing Human MUC-1 peptides. Versamune induces approximately a 10 fold higher number of polyfunctional (the most potent) T-Cells then other leading therapies.

Figure 12: Versamune® (R-DOTAP) formulations containing multiple MUC-1 tumor associated antigens (PDS0103) induce qualitatively superior CD8 T cells responses.

Groups of AAD mice (n=6) were injected with the indicated formulations containing MUC-1 CD8 T cell epitope antigens on day 0 and boosted on day 7. Fraction of V1A or PMA/Ionomycin (positive control) stimulated cells in spleen producing multi-cytokine (IFN-γ, TNF-α, and IL-2) among the IFN-γ producing cells. PMA/Ionomycin is a commonly used in-vitro stimulant used to induce cytokine production by T-cells for research purposes.

Enantiomeric Specificity of the Cationic Lipids: Cationic lipids exist as 50:50 racemic mixtures of two asymmetric molecules, each called an enantiomer. Enantiomers are referred to as chiral, meaning they have identical physical and chemical structure and are mirror images of each other. Each of the enantiomers can be regarded as separate chemical entities if they can be demonstrated to possess different biological activity. PDS discovered that the R-enantiomer of the cationic lipid DOTAP is the immuno-active component of the mixture, with the S-enantiomer having weaker immune activating capability. R-DOTAP is the active ingredient now used in Versamune®. PDS’s products are the first pharmaceutical products to contain a pure cationic lipid enantiomer, and its use in cancer immunotherapy is protected by several issued patents.

Altering the Tumor Microenvironment to Overcome Immune Suppression

The demonstrated ability of Versamune® to induce effective regression of established tumors strongly suggested that cationic lipids, such as R-DOTAP, could facilitate an altering of the tumor micro-environment sufficient to break tumor immune tolerance and induce killing of tumor cells.

Example 4: Studies to understand the effect of the Versamune®-based immunotherapy on the tumor’s microenvironment:

To better understand Versamune®-induced changes within the tumor microenvironment, TC-1 tumor bearing B6 mice were subcutaneously injected on day 0 and day 7 with a Versamune®-based formulation containing a multi-epitope HPV peptide antigen (KF18) and assessed the effector (T-cell) and suppressor T cell (immune suppressive regulatory T-cells) recruitment to the tumor microenvironment on day 26. For comparison, a GMCSF adjuvant-based formulation that has been shown to induce strong CD8+ T cell immune responses in vivo in a clinical setting was also evaluated for comparative purposes. ELISPOT analysis (Figure 11) of CD8+ specific T cells (RF9) showed that tumor-bearing mice treated with the Versamune®-based formulation induced a superior sIFN-γ ELISPOT response to the RF9 CD8 T cell epitope detected in the spleens 7 days after the second injection.

Mice treated with GMCSF + KF18 stimulated a modest antigen specific T cell ELISPOT response, while, as expected, no response was observed with KF18 antigen alone, GMCSF, or Versamune® alone. To evaluate the tumor microenvironment during Versamune® induced tumor regression, groups of mice were treated with Versamune® + an HPV multi-peptide mixture containing KF18, with or without GMCSF.

To assess the cell types present within the tumor after various treatments, tumors were removed, enzymatically digested and cell populations analyzed by flow cytometry. CD4 helper T-cells, RF9-specific CD8 killer T-cells, FOXP3+ immune suppressive regulatory T-cells (Treg) were analyzed.

Versamune® + HPV peptide treated mice showed the highest percentage of CD8+ T cells within the tumor, and about 50% of these cells were RF9 specific. GMCSF and antigen, or antigen alone did not induce significant CD8 or CD8-RF9 specific T cell infiltration into the tumors. The CD8/CD4 ratio was highest in the Versamune® + HPV mix group and the Treg/RF9 specific T cell ratio within the tumors was dramatically lower in the Versamune® and HPV mix groups (Figure 14).

These data collectively suggest that Versamune®-based formulations induced a quantitatively superior antigen specific T cell response and the cells were actively recruited to the tumors in large numbers promoting anti-tumor responses and eventually alter the tumor’s microenvironment to promote regression and elimination of established tumors.

Figure 13: Versamune® efficiently alters effector T-cell to immune suppressor T cell ratio within the tumor, therefore promoting tumor regression.