Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-187941

PROSPECTUS

CINEMARK USA, INC.

Offer to Exchange

all outstanding 5.125% Senior Notes due 2022

($400,000,000 aggregate principal amount)

for

5.125% Senior Notes due 2022

which have been registered under the Securities Act of 1933, as amended

The exchange offer will expire at 5:00 p.m., New York City time, on May 23, 2013, unless we extend the exchange offer. We do not currently intend to extend the exchange offer.

| • | We are offering to exchange up to $400,000,000 aggregate principal amount of new 5.125% Senior Notes due 2022, or Exchange Notes, which have been registered under the Securities Act of 1933, as amended, or the Securities Act, for an equal principal amount of our outstanding 5.125% Senior Notes due 2022, or Initial Notes, issued in a private offering on December 18, 2012. We refer to the Exchange Notes and the Initial Notes collectively as the Notes. |

| • | We will exchange all Initial Notes that are validly tendered and not validly withdrawn prior to the closing of the exchange offer for an equal principal amount of Exchange Notes that have been registered. |

| • | You may withdraw tenders of Initial Notes at any time prior to the expiration of the exchange offer. |

| • | The terms of the Exchange Notes to be issued are identical in all material respects to the Initial Notes, except for transfer restrictions and registration rights that do not apply to the Exchange Notes, and different administrative terms. |

| • | The Exchange Notes, together with any Initial Notes not exchanged in the exchange offer, will constitute a single class of debt securities under the indenture governing the Notes. |

| • | The exchange of Initial Notes will not be a taxable exchange for United States federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | No public market exists for the Initial Notes. We do not intend to list the Exchange Notes on any securities exchange and, therefore, no active public market is anticipated. |

See “Risk Factors” beginning on page 14 for a discussion of factors that you should consider before tendering your Initial Notes.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The related letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Initial Notes where such Initial Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 12 months after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 25, 2013.

Table of Contents

| 1 | ||||

| 14 | ||||

| 27 | ||||

| 28 | ||||

| 40 | ||||

Selected Historical Consolidated Financial and Operating Data | 41 | |||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 43 | |||

| 64 | ||||

| 77 | ||||

Security Ownership of Certain Beneficial Owners and Management | 109 | |||

| 110 | ||||

| 113 | ||||

| 158 | ||||

| 160 | ||||

| 164 | ||||

| 164 | ||||

| 165 | ||||

| 167 | ||||

| 168 | ||||

| 168 | ||||

| F-1 |

In this prospectus, references to “we,” “us,” “our,” the “issuer,” the “Company” or “Cinemark” are to the combined business of Cinemark USA, Inc. and all of its consolidated subsidiaries unless otherwise indicated or the context requires otherwise.

This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. This information is available without charge to security holders upon written or oral request to Cinemark USA, Inc., 3900 Dallas Parkway, Suite 500, Plano, TX 75093, Attn: Michael D. Cavalier, Corporate Secretary, telephone number (972) 665-1000.IN ORDER TO OBTAIN TIMELY DELIVERY, YOU MUST REQUEST THE INFORMATION NO LATER THAN MAY 16, 2013, WHICH IS FIVE BUSINESS DAYS BEFORE THE EXPIRATION DATE OF THE EXCHANGE OFFER UNLESS WE DECIDE TO EXTEND THE EXPIRATION DATE.

WHERE YOU CAN FIND MORE INFORMATION

You should rely only upon the information contained and incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to exchange these securities in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We and our parent company, Cinemark Holdings, Inc., or Cinemark Holdings, currently file periodic reports and other information under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Under the terms of the indenture governing the Notes, we have agreed that, whether or not we are required to do so by the rules and regulations of the Securities and Exchange Commission, or the Commission, after the exchange offer is completed and for so long as any of the Exchange Notes remain outstanding, we will furnish to the trustee and the holders of the Exchange Notes and, upon written request, to prospective investors, and file with the

ii

Table of Contents

Commission (unless the Commission will not accept such a filing) (i) all quarterly and annual financial information that would be required to be contained in a filing with the Commission on Forms 10-Q and 10-K if we were required to file such reports, including a “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and, with respect to the annual information only, a report thereon by our independent registered public accountant and (ii) all reports that would be required to be filed with the Commission on Form 8-K if we were required to file such reports, in each case within the time period specified in the rules and regulations of the Commission. The Commission maintains an internet site that contains reports, proxy and information statements, and other information at http://www.sec.gov. Our filings with the Commission are available to the public from the Commission’s website. In addition, for so long as any of the Exchange Notes remain outstanding, we have agreed to make available to any holder of the Exchange Notes or prospective purchaser of the Exchange Notes, at their request, the information required by Rule 144A(d)(4) under the Securities Act.

This prospectus contains or incorporates by reference summaries of certain agreements that we have entered into, such as the indenture governing the Notes, the exchange and registration rights agreement, or the registration rights agreement, and the agreements described under “Description of Certain Debt Instruments” and “Certain Relationships and Related Party Transactions.” The descriptions contained in this prospectus of these agreements do not purport to be complete and are subject to, or qualified in their entirety by reference to, the definitive agreements. Copies of the definitive agreements will be made available without charge to you by making a written or oral request to us.

MARKET AND INDUSTRY DATA

Information regarding market share, market position and industry data pertaining to our business contained in this prospectus consists of estimates based on data and reports compiled by industry professional organizations, including the Motion Picture Association of America, or MPAA, industry analysts and our knowledge of our revenues and markets.

We take responsibility for compiling and extracting, but have not independently verified, market and industry data provided by third parties, or by industry or general publications. Similarly, while we believe our internal estimates are reliable, our estimates have not been verified by any independent sources. Although we do not make any representation as to the accuracy of information described in these paragraphs, we believe and act as if the information is accurate.

Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this prospectus include the Cinemark and Century marks, which may be registered in the United States and other jurisdictions. We do not own any trademark, trade name or service mark of any other company appearing in this prospectus.

iii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that are based on our current expectations, assumptions, estimates and projections about our business and our industry. They include statements relating to:

| • | future revenues, expenses and profitability; |

| • | the future development and expected growth of our business; |

| • | projected capital expenditures; |

| • | attendance at movies generally, or in any of the markets in which we operate; |

| • | the number or diversity of popular movies released and our ability to successfully license and exhibit popular films; |

| • | national and international growth in our industry; |

| • | competition from other exhibitors and alternative forms of entertainment; and |

| • | determinations in lawsuits in which we are defendants. |

You can identify forward-looking statements by the use of words such as “may,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future” and “intends” and similar expressions which are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. In evaluating these forward-looking statements, you should carefully consider the risks and uncertainties described in “Risk Factors” and elsewhere included or incorporated by reference in this prospectus. These forward-looking statements reflect our view only as of the date of this prospectus. We do not undertake any obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements and risk factors contained throughout or incorporated by reference in this prospectus.

iv

Table of Contents

This summary contains basic information about us and the exchange offer. This summary may not contain all of the information that is important to you. You should read this summary together with the entire prospectus, including the more detailed information in our consolidated financial statements and related notes and schedules included in this prospectus. Except as otherwise indicated by the context, references in this prospectus to “we,” “us,” “our,” the “issuer” the “Company” or “Cinemark” are to the combined business of Cinemark USA, Inc. and all of its consolidated subsidiaries. Unless otherwise specified, all operating and other statistical data for the United States, or U.S., include one theatre in Canada (that was sold during November 2010). All references to Latin America are to Brazil, Mexico, Argentina, Chile, Colombia, Peru, Ecuador, Honduras, El Salvador, Nicaragua, Costa Rica, Panama and Guatemala. Unless otherwise specified, all operating and other statistical data are as of and for the year ended December 31, 2012.

Our Company

We are one of the leaders in the motion picture exhibition industry. As of December 31, 2012, we operated 465 theatres and 5,240 screens in the U.S. and Latin America and approximately 263.7 million patrons attended our theatres worldwide during the year ended December 31, 2012. Our circuit is the third largest in the U.S. with 298 theatres and 3,916 screens in 39 states. We are the most geographically diverse circuit in Latin America with 167 theatres and 1,324 screens in 13 countries.

We selectively build or acquire new theatres in markets where we can establish and maintain a strong market position. We believe our portfolio of modern theatres provides a preferred destination for moviegoers and contributes to our solid cash flows from operating activities. Our significant presence in the U.S. and Latin America has made us an important distribution channel for movie studios, particularly as they look to capitalize on the expanding worldwide box office. Our market leadership is attributable in large part to our senior executives, whose years of industry experience range from 16 to 54 years and who have successfully navigated us through many industry and economic cycles.

Revenues, operating income and net income attributable to Cinemark USA, Inc. for the year ended December 31, 2012, were $2,473.5 million, $385.9 million and $170.3 million, respectively. At December 31, 2012 we had cash and cash equivalents of $742.1 million and long-term debt of $1,764.0 million. Approximately $250.0 million, or 14%, of our long-term debt accrues interest at variable rates and approximately $9.5 million of our long-term debt matures in 2013.

Currently, 100% of our first-run domestic theatres are fully digital and we continue to convert our international theatres, which are approximately 42% digital. Digital projection technology gives us greater flexibility in programming and facilitates the exhibition of live and pre-recorded alternative entertainment. We also continue to roll out our Cinemark XD Extreme Digital Cinema, or XD, which offers a premium experience auditorium concept utilizing large screens and the latest in digital projection and enhanced custom sound technologies. The XD experience includes wall-to-wall and ceiling-to-floor screens, wrap-around sound, plush seating and a maximum comfort entertainment environment for an intense sensory experience. We charge a premium price for the XD experience. The XD technology does not require special format movie prints, which allows us the flexibility to play any available digital print we choose, including 3-D content, in the XD auditorium. We currently have 109 XD auditoriums in our circuit and have plans to install 40 to 50 more XD auditoriums during 2013.

During 2010, we introduced our NextGen concept, which features wall-to-wall and ceiling-to-floor screens and the latest digital projection and sound technologies in all of the auditoriums of a complex. These theatres generally also have an XD auditorium, which offers the wall-to-wall and ceiling-to-floor screen in a larger

1

Table of Contents

auditorium with enhanced custom sound and plush seating. Most of our future domestic theatres will incorporate this NextGen concept. As of December 31, 2012, 109 screens within nine theatres have the NextGen concept. Eight of these nine theatres also have an XD screen.

Competitive Strengths

We believe the following strengths allow us to compete effectively:

Disciplined Operating Philosophy.We generated operating income and net income attributable to Cinemark USA, Inc. of $385.9 million and $170.3 million, respectively, for the year ended December 31, 2012. Our solid operating performance is a result of our disciplined operating philosophy that centers on building high quality assets, while negotiating favorable theatre level economics, controlling operating costs and effectively reacting to economic and market changes.

Leading Position in Our U.S. Markets.We have a leading market share in the U.S. metropolitan and suburban markets we serve. For the year ended December 31, 2012, we ranked either first or second based on box office revenues in 24 out of our top 30 U.S. markets, including the San Francisco Bay Area, Dallas, Houston, Salt Lake City and Sacramento.

Strategically Located in Heavily Populated Latin American Markets.Since 1993, we have invested throughout Latin America in response to the continued growth of the region. We currently operate 167 theatres and 1,324 screens in 13 countries. Our international screens generated revenues of $777.7 million, or 31.4% of our total revenues, for the year ended December 31, 2012. We have successfully established a significant presence in major cities in the region, with theatres in fourteen of the fifteen largest metropolitan areas. We are the largest exhibitor in Brazil and Argentina. Our geographic diversity makes us an important distribution channel to the movie studios. Approximately 87% of our international screens offer stadium seating. We are well-positioned with our modern, large-format theatres to take advantage of these factors for further growth and diversification of our revenues.

State-of-the-Art Theatre Circuit.We offer state-of-the-art theatres, which we believe makes our theatres a preferred destination for moviegoers in our markets. During 2012, we increased the size of our circuit by adding 129 new state-of-the-art screens worldwide, while closing 41 screens. We currently have commitments to open 287 additional new screens over the next three years. We have installed digital projection technology in 100% of our U.S. first-run auditoriums and approximately 42% of our international auditoriums, with plans to install digital projection technology in 100% of our international auditoriums. Currently, approximately 51% of our U.S. screens and 40% of our international screens are 3-D compatible. We also have eight digital IMAX screens. We currently have 109 XD auditoriums in our theatres and have plans to install 40 to 50 additional XD auditoriums during 2013. Our new NextGen theatre concept provides further credence to our commitment to provide a continuing state-of-the-art movie-viewing experience to our patrons.

Solid Balance Sheet with Significant Cash Flow from Operating Activities. We generate significant cash flow from operating activities as a result of several factors, including a geographically diverse and modern theatre circuit and management’s ability to control costs and effectively react to economic and market changes. Additionally, owning land and buildings for 41 of our theatres is a strategic advantage that enhances our cash flows. We believe our expected level of cash flow generation will provide us with the financial flexibility to continue to pursue growth opportunities, support our debt payments and continue to make dividend payments to our stockholders. In addition, as of December 31, 2012, we owned approximately 18.1 million units of National CineMedia LLC, or NCM, convertible into shares of National CineMedia, Inc. or NCM, Inc., common stock and owned approximately 1.2 million shares of RealD Inc., or RealD, both of which offer us an additional source of cash flows. As of December 31, 2012, we had cash and cash equivalents of $742.1 million.

2

Table of Contents

Experienced Management.Led by Chairman and founder Lee Roy Mitchell, Chief Executive Officer and President, Tim Warner, Chief Financial Officer Robert Copple and President-International Valmir Fernandes, our management team has many years of theatre operating experience, ranging from 16 to 54 years, executing a focused strategy that has led to consistent operating results. This management team has successfully navigated us through many industry and economic cycles.

Our Strategy

We believe our disciplined operating philosophy and experienced management team will enable us to continue to enhance our leading position in the motion picture exhibition industry. Key components of our strategy include:

Establish and Maintain Leading Market Positions.We will continue to seek growth opportunities by building or acquiring modern theatres that meet our strategic, financial and demographic criteria. We focus on establishing and maintaining a leading position in the markets we currently serve. We also monitor economic and market trends to ensure we offer a broad range of products and prices that satisfy our patrons.

Continue to Focus on Operational Excellence.We will continue to focus on achieving operational excellence by controlling theatre operating costs and adequately training our staff while continuing to provide leading customer service. Our margins reflect our track record of operating efficiency.

Selectively Build in Profitable, Strategic Latin American Markets.Our continued international expansion will remain focused primarily on Latin America through construction of modern, state-of-the-art theatres in growing urban markets. We have commitments to build 13 new theatres with 88 screens during 2013 and three new theatres with 21 screens subsequent to 2013, investing an additional $89 million in our Latin American markets. We also plan to install digital projection technology in all of our international auditoriums, which allows us to present 3-D and alternative content in these markets. Approximately 40% of our international auditoriums are 3-D compatible. We have also installed 39 of our proprietary XD auditoriums in our international theatres and have plans to install approximately 20 to 25 additional XD auditoriums internationally during 2013.

Commitment to Digital Innovation. Our commitment to technological innovation has resulted in us being 100% digital in our U.S. first-run auditoriums as of December 31, 2012, approximately 49% of which are 3-D compatible. We also had 553 digital auditoriums in our international markets as of December 31, 2012, 527 of which are 3-D compatible. See further discussion of our digital expansion at “Business—Conversion to Digital Projection Technology.” We are planning to convert 100% of our worldwide circuit to digital projection technology, approximately 40-50% of which will be 3-D compatible. We also plan to expand our XD auditorium footprint in various markets throughout the U.S. and in select international markets, which offers our patrons a premium movie-viewing experience.

Our Industry

Domestic Markets

The U.S. motion picture exhibition industry has a track record of long-term growth, with box office revenues growing at an estimated compound annual growth rate, or CAGR, of 1.7% from 2002 to 2012. Against this background of steady long-term growth, the exhibition industry has experienced periodic short-term increases and decreases in attendance, and consequently box office revenues. According to data published by Motion Picture Association of America, or MPAA, 2012 U.S. box office revenues were approximately $10.8 billion, an approximate 6% increase over 2011, and an all-time industry record.

3

Table of Contents

The following table represents the results of a survey by MPAA published during March 2013, outlining the historical trends in U.S. box office performance for the ten year period from 2003 to 2012:

Year | U.S. Box Office Revenues ($ in billions) | Attendance (in billions) | Average Ticket Price | |||||||||

2003 | $ | 9.2 | 1.52 | $ | 6.03 | |||||||

2004 | $ | 9.3 | 1.50 | $ | 6.21 | |||||||

2005 | $ | 8.8 | 1.38 | $ | 6.41 | |||||||

2006 | $ | 9.2 | 1.40 | $ | 6.55 | |||||||

2007 | $ | 9.6 | 1.40 | $ | 6.88 | |||||||

2008 | $ | 9.6 | 1.34 | $ | 7.18 | |||||||

2009 | $ | 10.6 | 1.42 | $ | 7.50 | |||||||

2010 | $ | 10.6 | 1.34 | $ | 7.89 | |||||||

2011 | $ | 10.2 | 1.28 | $ | 7.93 | |||||||

2012 | $ | 10.8 | 1.36 | $ | 7.96 | |||||||

Films leading the box office during the year ended December 31, 2012 includedThe Avengers, The Dark Knight Rises, The Hunger Games, Skyfall, The Twilight Saga: Breaking Dawn Part 2, The Hobbit: An Unexpected Journey, Dr. Suess’ The Lorax, Madagascar 3: Europe’s Most Wanted, Men in Black 3, Taken 2, Snow White and the Huntsman, Safe House, The Vow, Brave, Prometheus,The Amazing Spider-Man, Ice Age: Continental DriftandThe Bourne Legacy, among other films.

The film slate for 2013 currently includes sequels such asThe Hunger Games: Catching Fire, The Hobbit: The Desolation of Smaug, Iron Man 3, The Hangover 3, Monsters University, Despicable Me 2, Fast & Furious 6andA Good Day to Die Hardand original titles such asMan of Steel, Oz: The Great and Powerful, Oblivion, Pacific Rim, Lone Rangerand World War Z,among other films.

International Markets

International box office revenues continue to grow. According to MPAA, international box office revenues were $23.9 billion for the year ended December 31, 2012, which is a result of strong economies, ticket price increases and new theatre construction. According to MPAA, Latin American box office revenues were $2.8 billion for the year ended December 31, 2012, representing a 6% increase from 2011.

Growth in Latin America is expected to continue to be fueled by a combination of robust economies, growing populations, an emerging middle class, attractive demographics (i.e., a significant teenage population), substantial retail development, and quality product from Hollywood, including an increasing number of 3-D films. In many Latin American countries including, Brazil, Argentina, Mexico, Colombia and Chile, successful local film product can also provide incremental box office growth opportunities.

We believe many international markets for theatrical exhibition have historically been underserved and that certain of these markets, especially those in Latin America, will continue to experience growth as additional modern stadium-styled theatres are introduced, film product offerings continue to expand and the local economies continue to grow.

4

Table of Contents

Drivers of Continued Industry Success

We believe the following market trends will drive the continued growth and strength of our industry:

Importance of Theatrical Success in Establishing Movie Brands and Subsequent Markets.Theatrical exhibition is the primary distribution channel for new motion picture releases. A successful theatrical release which “brands” a film is one of the major factors in determining its success in “downstream” markets, such as digital downloads, DVDs, network and syndicated television, video on-demand, pay-per-view television and the Internet.

Increased Importance of International Markets for Box Office Success. International markets continue to be an increasingly important component of the overall box office revenues generated by Hollywood films, accounting for $22.4 billion, or approximately 69% of 2011 total worldwide box office revenues according to MPAA. With the continued growth of the international motion picture exhibition industry, we believe the relative contribution of markets outside North America will become even more significant. Many of the top U.S. films released recently also performed exceptionally well in international markets. Such films includedThe Avengers, which grossed approximately $892.3 million in international markets, or 59% of its worldwide box office,Ice Age: Continental Drift, which grossed approximately $716.1 million in international markets, or 82% of its worldwide box office, andSkyfall, which grossed approximately $710.6 million in international markets, or 71% of its worldwide box office.

Stable Long-Term Attendance Trends.We believe that long-term trends in motion picture attendance in the U.S. will continue to benefit the industry. Even during the recent recessionary period, attendance levels remained stable as consumers selected the theatre as a preferred value for their discretionary income. With the motion picture exhibition industry’s transition to digital projection technology, the products offered by motion picture exhibitors continue to expand, attracting a broader base of patrons.

Convenient and Affordable Form of Out-Of-Home Entertainment.Movie-going continues to be one of the most convenient and affordable forms of out-of-home entertainment, with an estimated average ticket price in the U.S. of $7.96 in 2012. Average prices in 2012 for other forms of out-of-home entertainment in the U.S., including sporting events and theme parks, range from approximately $27.00 to $78.00 per ticket according to MPAA.

Innovation with Digital Technology. Our industry began its conversion to digital projection technology during 2009, which has allowed exhibitors to expand their product offerings. Digital projection allows the presentation of 3-D content and alternative entertainment such as live and pre-recorded sports programs, concert events, the opera and other special presentations. These additional programming alternatives may expand the industry’s customer base and increase patronage for exhibitors.

Recent Developments

On November 16, 2012, we entered into an asset purchase agreement with Rave Real Property Holdco, LLC and certain of its subsidiaries, Rave Cinemas, LLC and RC Processing, LLC, which we refer to collectively herein as Rave, pursuant to which we will acquire 32 theatres located in 12 states, representing 483 screens, which we refer to herein as the Rave Acquisition. The assets to be acquired also include seven IMAX screens and nine premium large format auditoriums. The purchase price, subject to certain closing date adjustments, is expected to be approximately $240 million in cash plus the assumption of certain liabilities, including certain lease obligations.

5

Table of Contents

Completion of the Rave Acquisition is subject to the satisfaction of customary closing conditions for transactions of this type, including Department of Justice and Federal Trade Commission antitrust approval. We anticipate that we will complete the Rave Acquisition in the second quarter of 2013. We will use a portion of the net proceeds from the Initial Notes to fund a portion of the Rave Acquisition purchase price.

Additional Information

We were incorporated under the laws of the State of Texas in 1987. We are a direct, wholly-owned subsidiary of Cinemark Holdings, a public company traded on the New York Stock Exchange, or the NYSE, under the symbol “CNK.” Our corporate headquarters is located at 3900 Dallas Parkway, Suite 500, Plano, Texas 75093. Our telephone number is (972) 665-1000. Our web site address is www.cinemark.com. The information on our web site does not constitute part of this prospectus.

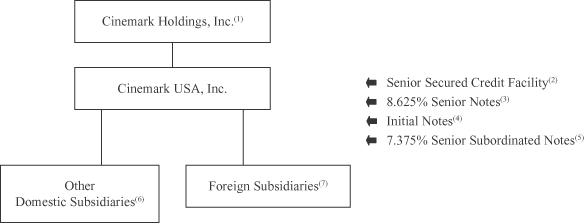

Corporate Structure

The chart below shows our corporate structure and our principal indebtedness as of December 31, 2012.

| (1) | Cinemark Holdings is a Delaware corporation and a public company listed on The New York Stock Exchange. |

| (2) | Our senior secured credit facility includes a $700.0 million term loan and $100.0 million available for borrowing under a revolving credit line. |

| (3) | As of December 31, 2012, approximately $470.0 million aggregate principal amount of our 8.625% senior notes (excluding any unamortized discount at which our 8.625% senior notes were issued) was outstanding. |

| (4) | As of December 31, 2012, approximately $400.0 million aggregate principal amount of the Initial Notes was outstanding. |

| (5) | As of December 31, 2012, approximately $200.0 million aggregate principal amount of our 7.375% senior subordinated notes was outstanding. |

| (6) | Certain of our domestic subsidiaries guarantee our senior secured credit facility, our 8.625% senior notes, our 7.375% senior subordinated notes and the Notes. |

| (7) | As of December 31, 2012, one of our Argentina subsidiaries had approximately $2.5 million outstanding under a bank loan. Our foreign subsidiaries do not guarantee our senior secured credit facility, our 8.625% senior notes, our 7.375% senior subordinated notes or the Notes. |

6

Table of Contents

Summary of the Terms of the Exchange Offer

The Exchange Offer | We are offering to exchange up to $400,000,000 aggregate principal amount of our 5.125% Senior Notes due 2022 that have been registered under the Securities Act for up to $400,000,000 aggregate principal amount of our 5.125% Senior Notes due 2022 issued on December 18, 2012. You may exchange your Initial Notes only by following the procedures described elsewhere in this prospectus under “The Exchange Offer — Procedures for Tendering Initial Notes.” |

Registration Rights Agreement | We issued the Initial Notes on December 18, 2012. In connection with the issuance of the Initial Notes, we entered into the registration rights agreement with the initial purchasers of the notes, or the initial purchasers, which provides, among other things, for this exchange offer. |

Resale of Exchange Notes | Based upon interpretive letters written by the Commission, we believe that the Exchange Notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | You are acquiring the Exchange Notes in the ordinary course of your business; |

| • | You are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; and |

| • | You are not our “affiliate”, as that term is defined for the purposes of Rule 144A under the Securities Act. |

| If any of the foregoing are not true and you transfer any Exchange Note without registering the Exchange Note and delivering a prospectus meeting the requirements of the Securities Act, or without an exemption from registration of your Exchange Notes from such requirements, you may incur liability under the Securities Act. We do not assume any responsibility for, and will not indemnify you for, any such liability. |

| Each broker-dealer that receives Exchange Notes for its own account in exchange for Initial Notes that were acquired by such broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the Exchange Notes. A broker-dealer may use this prospectus for an offer to resell, a resale or any other retransfer of the Exchange Notes. See “Plan of Distribution.” |

Consequences of Failure to Exchange Initial Notes | Initial Notes that are not tendered or that are tendered but not accepted will, following the completion of the exchange offer, continue to be subject to existing restrictions upon transfer. The |

7

Table of Contents

trading market for Initial Notes not exchanged in the exchange offer may be significantly more limited than at present. Therefore, if your Initial Notes are not tendered and accepted in the exchange offer, it may become more difficult for you to sell or transfer your Initial Notes. Furthermore, you will no longer be able to compel us to register the Initial Notes under the Securities Act and we will not be required to pay additional interest as described in the registration rights agreement. In addition, you will not be able to offer or sell the Initial Notes unless they are registered under the Securities Act (and we will have no obligation to register them, except for some limited exceptions), or unless you offer or sell them under an exemption from the requirements of, or a transaction not subject to, the Securities Act. |

Expiration of the Exchange Offer | The exchange offer will expire at 5:00 p.m., New York City time, on May 23, 2013, unless we decide to extend the expiration date. |

Conditions to the Exchange Offer | The exchange offer is not subject to any condition other than certain customary conditions, which we may, but are not required to, waive. We currently anticipate that each of the conditions will be satisfied and that we will not need to waive any conditions. We reserve the right to terminate or amend the exchange offer at any time before the expiration date if any such condition occurs. In the event of a material change in the exchange offer, including the waiver of a material condition, we will extend, if necessary, the expiration date of the exchange offer such that at least five business days remain in the exchange offer following notice of the material change. For additional information regarding the conditions to the exchange offer, see “The Exchange Offer — Conditions to the Exchange Offer.” |

Procedures for Tendering Initial Notes | If you wish to accept the exchange offer, you must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal, and transmit it together with all other documents required by the letter of transmittal (including the Initial Notes to be exchanged) to Wells Fargo Bank, N.A., as exchange agent, at the address set forth on the cover page of the letter of transmittal. In the alternative, you can tender your Initial Notes by following the procedures for book-entry transfer, as described in this prospectus. There is no procedure for guaranteed late delivery of Initial Notes. For more information on accepting the exchange offer and tendering your Initial Notes, see “The Exchange Offer — Procedures for Tendering Initial Notes” and “— Book-Entry Transfer.” |

Special Procedure for Beneficial Holders | If you are a beneficial holder whose Initial Notes are registered in the name of a broker, dealer, commercial bank, trust company, or other nominee and you wish to tender your Initial Notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender your Initial Notes on your behalf. If you are a beneficial holder and you wish to tender your Initial Notes on your own behalf, you must, prior to delivering the letter of |

8

Table of Contents

transmittal and your Initial Notes to the exchange agent, either make appropriate arrangements to register ownership of your Initial Notes in your own name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

Withdrawal Rights | You may withdraw the tender of your Initial Notes at any time prior to 5:00 p.m., New York City time, on the expiration date. To withdraw, you must send a written or facsimile transmission of your notice of withdrawal to the exchange agent at its address set forth in this prospectus under “The Exchange Offer — Withdrawal of Tenders” by 5:00 p.m., New York City time, on the expiration date. |

Acceptance of Initial Notes and Delivery of Exchange Notes | Subject to certain conditions, we will accept all Initial Notes that are properly tendered in the exchange offer and not withdrawn prior to 5:00 p.m., New York City time, on the expiration date. We will deliver the Exchange Notes promptly after the expiration date. Initial Notes will be validly tendered and not validly withdrawn if they are tendered in accordance with the terms of the exchange offer as detailed under “The Exchange Offer — Procedures for Tendering Initial Notes” and not withdrawn in accordance with the terms of the exchange offer as detailed under “The Exchange Offer — Withdrawal of Tenders.” |

United States Federal Tax Consequences | We believe that the exchange of Initial Notes for Exchange Notes generally will not be a taxable exchange for federal tax purposes, but you should consult your tax adviser about the tax consequences of this exchange. See “Certain United States Federal Tax Consequences.” |

Exchange Agent | Wells Fargo Bank, N.A., the trustee under the indenture governing the Notes, is serving as exchange agent in connection with the exchange offer. The mailing address of the exchange agent is set forth on the cover page of the letter of transmittal. |

Fees and Expense | We will bear all expenses related to consummating the exchange offer and complying with the registration rights agreement. |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Exchange Notes. We received net proceeds of approximately $394.8 million from the sale of the Initial Notes. We used a portion of the proceeds to refinance the term loan outstanding under our senior secured credit facility and will use the remainder to fund a portion of the Rave Acquisition purchase price. |

Regulatory Approvals | Other than the federal securities laws, there are no federal or state regulatory requirements that we must comply with and there are no approvals that we must obtain in connection with the exchange offer. |

9

Table of Contents

Summary Description of Exchange Notes

The terms of the Exchange Notes are identical in all material respects to those of the Initial Notes except for transfer restrictions and registration rights that do not apply to the Exchange Notes. The Exchange Notes will evidence the same debt as the Initial Notes, and the same indenture will govern the Exchange Notes as the Initial Notes. The summary below describes the principal terms of the Exchange Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the Exchange Notes.

Issuer | Cinemark USA, Inc. |

Exchange Notes Offered | $400,000,000 aggregate principal amount of 5.125% of Senior Notes due 2022, registered under the Securities Act. |

Maturity Date | December 18, 2022. |

Interest Rate and Payment Dates | The Exchange Notes will bear interest at the rate of 5.125% per annum, payable on June 15 and December 15 of each year, beginning on June 15, 2013. |

Guarantees | The Exchange Notes will be fully and unconditionally guaranteed on a joint and several senior subordinated unsecured basis by our subsidiaries that guarantee, assume or become liable with respect to any of our or a guarantor’s debt. If we cannot make payments on the Exchange Notes when they are due, the guarantors must make them instead. Under certain circumstances, the guarantees may be released without action by, or the consent of, the holders of the Notes. See “Description of Exchange Notes—Subsidiary Guarantees.” |

Ranking | The Exchange Notes and the guarantees will be our and our guarantors’ senior unsecured obligations and they will: |

| • | rank equally in right of payment to our and our guarantors’ existing and future senior debt, including borrowings under our senior secured credit facility and our 8.625% senior notes due 2019, which we refer to as the 8.625% Senior Notes; |

| • | rank senior in right of payment to our and our guarantors’ existing and future subordinated debt, including our 7.375% senior subordinated notes due 2012, which we refer to as the Senior Subordinated Notes; |

| • | be effectively subordinated to all of our and our guarantors’ existing and future secured debt, to the extent of the value of the collateral securing such debt, including our obligations under our senior secured credit facility; and |

| • | be structurally subordinated to all existing and future debt and other liabilities of our non-guarantor subsidiaries (other than indebtedness and other liabilities owed to us). |

10

Table of Contents

| As of December 31, 2012, the Exchange Notes would have been: |

| • | effectively subordinated to $1,170.0 million of our senior secured debt; and |

| • | structurally subordinated to $323.8 million of debt and other liabilities of our non-guarantor subsidiaries. |

| For the year ended December 31, 2012, our non-guarantor subsidiaries generated in the aggregate $803.1 million, or 32%, of our consolidated revenues. As of December 31, 2012, our non-guarantor subsidiaries accounted for $1,096.4 million, or 28%, of our consolidated total assets. |

Optional Redemption | Prior to December 15, 2017, we may redeem all or any part of the Exchange Notes at our option at 100% of the principal amount plus a make-whole premium. We may redeem the Exchange Notes in whole or in part at any time on or after December 15, 2017 at the redemption prices described in this prospectus. In addition, prior to December 15, 2015, we may redeem up to 35% of the aggregate principal amount of Exchange Notes from the net proceeds of certain equity offerings at the redemption price set forth in this prospectus. See “Description of Exchange Notes—Optional Redemption.” |

Change of Control | If we or Cinemark Holdings experience specific kinds of changes in control, we must offer to repurchase all of the Exchange Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. |

Covenants | The indenture governing the Notes contains restrictive covenants that restrict our and our restricted subsidiaries ability to take certain actions. For a more detailed description, please see “Description of Exchange Notes—Certain Covenants.” |

For a discussion of certain risks that should be considered in connection with an investment in the Exchange Notes, see “Risk Factors” beginning on page 14.

11

Table of Contents

Summary Historical Condensed Consolidated Financial and Operating Data

The following tables set forth our summary historical condensed consolidated financial and operating data as of and for the periods indicated. Our summary historical condensed consolidated financial data as of and for the years ended December 31, 2010, 2011 and 2012 are derived from our audited consolidated financial statements included elsewhere in this prospectus.

You should read the summary historical condensed consolidated financial and operating data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2010 | 2011 | 2012 | ||||||||||

Statement of Operations Data (in thousands): | ||||||||||||

Revenues: | ||||||||||||

Admissions | $ | 1,405,389 | $ | 1,471,627 | $ | 1,580,401 | ||||||

Concession | 642,326 | 696,754 | 771,405 | |||||||||

Other | 93,429 | 111,232 | 121,725 | |||||||||

|

|

|

|

|

| |||||||

Total revenues | $ | 2,141,144 | $ | 2,279,613 | $ | 2,473,531 | ||||||

Film rentals and advertising | 769,698 | 798,606 | 845,107 | |||||||||

Concession supplies | 97,484 | 112,122 | 123,471 | |||||||||

Salaries and wages | 221,246 | 226,475 | 247,468 | |||||||||

Facility lease expense | 255,717 | 276,278 | 281,615 | |||||||||

Utilities and other | 239,470 | 259,703 | 280,670 | |||||||||

General and administrative expenses | 107,015 | 125,428 | 146,442 | |||||||||

Depreciation and amortization | 143,508 | 154,449 | 147,675 | |||||||||

Impairment of long-lived assets | 12,538 | 7,033 | 3,031 | |||||||||

(Gain) loss on sale of assets and other | (431 | ) | 8,792 | 12,168 | ||||||||

|

|

|

|

|

| |||||||

Total cost of operations | 1,846,245 | 1,968,886 | 2,087,647 | |||||||||

|

|

|

|

|

| |||||||

Operating income | $ | 294,899 | $ | 310,727 | $ | 385,884 | ||||||

|

|

|

|

|

| |||||||

Interest expense | $ | 112,444 | $ | 123,102 | $ | 123,665 | ||||||

|

|

|

|

|

| |||||||

Net income | $ | 150,930 | $ | 133,953 | $ | 172,784 | ||||||

|

|

|

|

|

| |||||||

Net income attributable to Cinemark USA, Inc. | $ | 147,387 | $ | 131,928 | $ | 170,313 | ||||||

|

|

|

|

|

| |||||||

| Year Ended December 31, | ||||||||||||

| 2010 | 2011 | 2012 | ||||||||||

Other Financial Data (in thousands, except ratios): | ||||||||||||

Ratio of earnings to fixed charges | 2.11x | 2.02x | 2.45x | |||||||||

Cash flow provided by (used for): | ||||||||||||

Operating activities | $ | 266,230 | $ | 390,884 | $ | 394,633 | ||||||

Investing activities | (136,067 | ) | (247,067 | ) | (234,311 | ) | ||||||

Financing activities | (108,162 | ) | (78,020 | ) | 63,582 | |||||||

Capital expenditures | (156,102 | ) | (184,819 | ) | (220,727 | ) | ||||||

12

Table of Contents

| As of December 31, | ||||||||

| 2011 | 2012 | |||||||

Balance Sheet Data (in thousands): | ||||||||

Cash and cash equivalents | $ | 521,253 | $ | 742,095 | ||||

Theatre properties and equipment, net | 1,238,850 | 1,304,958 | ||||||

Total assets | 3,522,253 | 3,862,412 | ||||||

Total long-term debt and capital lease obligations, including current portion | 1,713,393 | 1,914,181 | ||||||

Equity | 1,025,293 | 1,096,212 | ||||||

| As of and For Year Ended December 31, | ||||||||||||

| Operating Data (attendance in thousands): | 2010 | 2011 | 2012 | |||||||||

United States(1) | ||||||||||||

Theatres operated (at period end) | 293 | 297 | 298 | |||||||||

Screens operated (at period end) | 3,832 | 3,878 | 3,916 | |||||||||

Total attendance | 161,174 | 158,486 | 163,639 | |||||||||

International(2) | ||||||||||||

Theatres operated (at period end) | 137 | 159 | 167 | |||||||||

Screens operated (at period end) | 1,113 | 1,274 | 1,324 | |||||||||

Total attendance | 80,026 | 88,889 | 100,084 | |||||||||

Worldwide(1)(2) | ||||||||||||

Theatres operated (at period end) | 430 | 456 | 465 | |||||||||

Screens operated (at period end) | 4,945 | 5,152 | 5,240 | |||||||||

Total attendance | 241,200 | 247,375 | 263,723 | |||||||||

| (1) | The data excludes certain theatres operated by us in the U.S. pursuant to management agreements that are not part of our consolidated operations. |

| (2) | The data excludes certain theatres operated by us internationally through our affiliates that are not part of our consolidated operations. |

Ratio of Earnings to Fixed Charges

Our ratio of earnings to fixed charges for years ended December 31, 2008, 2009, 2010, 2011 and 2012 was 1.11, 2.28, 2.11, 2.02, and 2.45, respectively. For purposes of calculating the ratio of earnings to fixed charges, earnings consist of pre-tax income from continuing operations before adjustments for income or loss from equity investees, fixed charges, amortization of capitalized interest, and distributed income of equity investees. Fixed charges consist of interest expense, capitalized interest, amortization of debt issue costs and that portion of rental expense which we believe to be representative of the interest factor.

13

Table of Contents

Before you invest in the notes, you should understand the high degree of risk involved. You should consider carefully the following risks and other information included in this prospectus, including our financial statements and related notes and schedules, before you decide to participate in this exchange offer. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also adversely impact our business operations. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of the Exchange Notes could decline, perhaps significantly, and our ability to pay principal and interest on the Exchange Notes could be adversely affected.

Risks Related to the Exchange Notes and this Exchange Offer

Your failure to participate in the exchange offer may have adverse consequences.

If you do not exchange your Initial Notes for Exchange Notes pursuant to the exchange offer, you will continue to be subject to the restrictions on transfer of your Initial Notes, as set forth in the legend on your Initial Notes. The restrictions on transfer of your Initial Notes arise because we sold the Initial Notes in private offerings. In general, the Initial Notes may not be offered or sold, unless registered under the Securities Act or pursuant to an exemption from, or in a transaction not subject to, such requirements.

After completion of the exchange offer, holders of Initial Notes who do not tender their Initial Notes in the exchange offer will no longer be entitled to any exchange or registration rights under the registration rights agreement, except under limited circumstances. The tender of Initial Notes under the exchange offer will reduce the principal amount of the currently outstanding Initial Notes. Due to the corresponding reduction in liquidity, this may have an adverse effect upon, and increase the volatility of, the market price of any currently outstanding Initial Notes that you continue to hold following completion of the exchange offer. See “The Exchange Offer.”

You must comply with the exchange offer procedures in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for Initial Notes tendered and accepted for exchange pursuant to the exchange offer will be made provided the procedures for tendering the Initial Notes are followed. We are not required to notify you of defects or irregularities in tenders of Initial Notes for exchange. See “The Exchange Offer.”

Some holders who exchange their Initial Notes may be deemed to have received restricted securities, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your Initial Notes in the exchange offer for the purpose of participating in a distribution of the Exchange Notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

An active trading market for the Exchange Notes may not develop.

There is no existing market for the Exchange Notes. The Exchange Notes will not be listed on any securities exchange. There can be no assurance that a trading market for the Exchange Notes will ever develop or will be maintained. Further, there can be no assurance as to the liquidity of any market that may develop for the Exchange Notes, your ability to sell your Exchange Notes or the price at which you will be able to sell your Exchange Notes. Future trading prices of the Exchange Notes will depend on many factors, including prevailing

14

Table of Contents

interest rates, our financial condition and results of operations, the then-current ratings assigned to the Exchange Notes, the market for similar securities and the results of our competitors. In addition, if a large amount of Initial Notes are not tendered or are tendered improperly, the limited amount of Exchange Notes that would be issued and outstanding after we consummate this exchange offer would reduce liquidity and could lower the market price of those Exchange Notes.

Any trading market that develops would be affected by many factors independent of and in addition to the foregoing, including:

| • | our operating performance and financial condition; |

| • | time remaining to the maturity of the Notes; |

| • | outstanding amount of the Notes; |

| • | the terms related to optional redemption of the Notes; and |

| • | level, direction and volatility of market interest rates generally. |

We have substantial long-term lease and debt obligations, which may restrict our ability to fund current and future operations and that restrict our ability to enter into certain transactions.

We have, and will continue to have, significant long-term debt service obligations and long-term lease obligations. As of December 31, 2012, we had $1,764.0 million in long-term debt obligations, $150.2 million in capital lease obligations and $1,889.2 million in long-term operating lease obligations. We incurred interest expense of $123.7 million for the year ended December 31, 2012. We incurred $281.6 million of facility lease expense under operating leases for the year ended December 31, 2012 (the terms under these operating leases, excluding optional renewal periods, range from one to 25 years). Our substantial lease and debt obligations pose risk to you by:

| • | making it more difficult for us to satisfy our obligations with respect to the Exchange Notes; |

| • | requiring us to dedicate a substantial portion of our cash flow to payments on our lease and debt obligations, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other corporate requirements and to pay dividends; |

| • | impeding our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions and general corporate purposes; |

| • | subjecting us to the risk of increased sensitivity to interest rate increases on our variable rate debt, including our borrowings under our senior secured credit facility; and |

| • | making us more vulnerable to a downturn in our business and competitive pressures and limiting our flexibility to plan for, or react to, changes in our industry or the economy. |

We may incur substantial additional indebtedness, including additional secured debt.

Subject to the restrictions in the indenture governing the Notes and in other instruments governing our other outstanding debt, we and our subsidiaries may incur substantial additional debt in the future, including substantial secured debt. Although the indenture governing the Notes and the instruments governing certain of our other outstanding debt (including our senior secured credit facility and the indentures governing the 8.625% Senior Notes and the Senior Subordinated Notes) contain restrictions on the incurrence of additional debt, these restrictions are subject to a number of significant qualifications and exceptions, and debt (including secured debt) incurred in compliance with these restrictions could be substantial. To the extent new debt is added to our current debt levels, the substantial leverage-related risks described above would increase. As of December 31, 2012, there were no borrowings outstanding under the revolving credit line of our senior secured credit facility. If we or any of our subsidiaries that is a guarantor of the Exchange Notes incur any additional debt that ranks equally with

15

Table of Contents

the Exchange Notes (or with the guarantee thereof), including trade payables, the holders of that debt will be entitled to share ratably with holders of Exchange Notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us or such guarantor. If we or any of our subsidiaries that is a guarantor of the Exchange Notes incur any additional secured debt, the holders of that debt will have recourse to the assets securing that debt prior to any distribution to unsecured creditors, including the holders of the Exchange Notes. Accordingly, additional debt, and in particular, additional secured debt, may reduce the amount of proceeds paid to holders of the Exchange Notes in connection with such a distribution.

To service our indebtedness, we will require a significant amount of cash, and our ability to generate cash flow depends on many factors beyond our control.

Our ability to make scheduled payments of principal and interest with respect to our indebtedness, including the Exchange Notes, will depend on our ability to generate cash flow and on our future financial results. Similarly, the ability of our guarantors to make payments on and refinance their indebtedness will depend on their ability to generate cash in the future. Our ability to generate cash flow is subject to general economic, financial, competitive, regulatory and other factors that are beyond our control. We and our guarantors cannot assure you that we will continue to generate cash flow at current levels, or that future borrowings will be available under our senior secured credit facility in an amount sufficient to enable any of us to pay our indebtedness, including the Exchange Notes. If our cash flows and capital resources are insufficient to fund our lease and debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the Exchange Notes. We may not be able to take any of these actions, and these actions may not be successful or permit us to meet our scheduled debt service obligations and these actions may not be permitted under the terms of our existing or future debt agreements, including our senior secured credit facility, the indentures governing the 8.625% Senior Notes and the Senior Subordinated Notes and the indenture governing the Notes. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our senior secured credit facility and the indenture governing the 8.625% Senior Notes restrict our ability to dispose of assets and use the proceeds from the disposition. We may not be able to consummate those dispositions or to obtain the proceeds which we could realize from them and these proceeds may not be adequate to meet any debt service obligations then due.

If we fail to make any required payment under the agreements governing our leases and indebtedness or fail to comply with the financial and operating covenants contained in them, we would be in default and, as a result, our debt holders would have the ability to require that we immediately repay our outstanding indebtedness and the lenders under our senior secured credit facility could terminate their commitments to lend us money and foreclose against the assets securing their borrowings and we could be forced into bankruptcy or liquidation, which could result in the loss of your investment in the Exchange Notes. The acceleration of our indebtedness under one agreement may permit acceleration of indebtedness under other agreements that contain cross-default and cross- acceleration provisions. If our indebtedness is accelerated, we may not be able to repay our indebtedness or borrow sufficient funds to refinance it. Even if we are able to obtain new financing, it may not be on commercially reasonable terms or on terms that are acceptable to us. If our debt holders require immediate payment, we may not have sufficient assets to satisfy our obligations under the Exchange Notes, our senior secured credit facility, the 8.625% Senior Notes, the Senior Subordinated Notes and our other indebtedness.

Your right to receive payments on the Exchange Notes is effectively junior to the right of lenders who have a security interest in our assets to the extent of the value of those assets.

Our obligations under the Exchange Notes and our guarantors’ obligations under their guarantees of the Exchange Notes will be unsecured, but our obligations under our senior secured credit facility and each guarantor’s obligations under its guarantee of our indebtedness under our senior secured credit facility are secured by a security interest in substantially all of our domestic tangible and intangible assets, including the stock of substantially all of our wholly-owned domestic subsidiaries. If we are declared bankrupt or insolvent, or

16

Table of Contents

if we are in default under our secured debt, the amounts owed thereunder, together with any accrued interest, could become immediately due and payable. If we were unable to repay such indebtedness, the holders of our secured debt could foreclose on the pledged assets to the exclusion of holders of the Exchange Notes, even if an event of default exists under the indenture governing the Notes at such time, and the assets that secure the secured debt will not be available to pay our obligations under the Exchange Notes unless and until payment in full of our secured debt. In any such event, because the Exchange Notes are not secured, it is possible that there would be no assets from which your claims could be satisfied or, if any assets existed, they might be insufficient to satisfy your claims in full.

The guarantees of the Exchange Notes will have a similar ranking with respect to secured and unsecured debt of our guarantors as the Exchange Notes do with respect to our secured and unsecured debt.

As of December 31, 2012, we had $700.0 million outstanding under our senior secured credit facility. Subject to the limits set forth in our senior secured credit facility and the indentures governing the Notes, the 8.625% Senior Notes, the Senior Subordinated Notes, we may also incur additional secured debt.

Our ability to repay our debt, including the Exchange Notes, is affected by the cash flow generated by our subsidiaries.

Our subsidiaries own some of our assets and conduct some of our operations. Accordingly, repayment of our indebtedness, including the Exchange Notes, will be dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are guarantors, our subsidiaries will not have any obligation to pay amounts due on the Exchange Notes or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the Exchange Notes. Each subsidiary is a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. While the indenture governing the Notes limits the ability of our non-guarantor subsidiaries to incur consensual encumbrances and restrictions on their ability to pay dividends and make other intercompany payments to us, these limitations are subject to certain qualifications and exceptions. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the Exchange Notes.

We have capacity to make substantial restricted payments.

We have capacity to make substantial restricted payments, which include dividends, stock and subordinated debt repurchases and minority investments. Our direct parent, Cinemark Holdings, relies on distributions from us to make dividend payments to its stockholders and for other ongoing operating expenses. As of December 31, 2012, we would have been able to make approximately $1,118.5 million of restricted payments under the formula set forth in the covenant described under the caption “Description of Exchange Notes—Certain Covenants—Restricted Payments,” subject to other limitations set forth in that covenant and in the covenants governing our other indebtedness, and limitations imposed by applicable law. In addition, the indenture governing the Notes will permit us to make substantial other restricted payments and substantial permitted investments.

Claims of noteholders will be structurally subordinated to claims of creditors of our non-guarantor subsidiaries.

We conduct some of our operations through our subsidiaries, and certain of our subsidiaries will not guarantee the Exchange Notes. You will not have a claim as a creditor against any of our subsidiaries that are not guarantors of the Exchange Notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those non-guarantor subsidiaries (other than indebtedness and liabilities owed to us) will be structurally senior to your claims as a noteholder. Subject to certain limitations, the indenture governing the Notes permits us to form or acquire additional subsidiaries that are not guarantors of the Exchange Notes and to

17

Table of Contents

permit such non-guarantor subsidiaries to acquire and incur additional indebtedness. Noteholders would not have any claim as a creditor against any of our non-guarantor subsidiaries to the assets and earnings of those non-guarantor subsidiaries. The claims of the creditors of those non-guarantor subsidiaries, including their trade creditors, banks and other lenders, would have priority over any of our claims or those of our other subsidiaries as equity holders of our non-guarantor subsidiaries. Consequently, in any insolvency, liquidation, reorganization, dissolution or other winding-up of any of our non-guarantor subsidiaries, creditors of those subsidiaries would be paid before any amounts would be distributed to us or to any of our guarantors as equity, and thus be available to satisfy our obligations under the Exchange Notes and other claims against us or our guarantors.

For the year ended December 31, 2012, our non-guarantor subsidiaries generated in the aggregate $803.1 million, or 32%, of our consolidated revenues. As of December 31, 2012, our non-guarantor subsidiaries accounted for $1,096.4 million, or 28%, of our consolidated total assets and their indebtedness and other liabilities (excluding indebtedness and other liabilities owed to us) were $323.8 million in the aggregate. The indenture governing the Notes will permit these subsidiaries to incur significant additional debt.

The guarantees of the Exchange Notes may be released in a variety of circumstances.

Any guarantee of the Exchange Notes may be released without action by, or consent of, any holder of the Exchange Notes or the trustee under the indenture governing the Notes if a guarantor is no longer a guarantor or otherwise liable with respect to any of our and our guarantors’ other indebtedness, including the indebtedness under our senior secured credit facility. A guarantee of the Exchange Notes may be released if the board of directors declares a subsidiary guarantor unrestricted as defined in the indenture governing the Notes. In addition, a guarantee of the Exchange Notes will be released upon the sale of capital stock of a guarantor or the sale or other disposition of all or substantially all of the assets of a guarantor in transactions that comply with the terms of the indenture governing the Notes and in certain other circumstances. See “Description of Exchange Notes—Subsidiary Guarantees.” You will not have a claim as a creditor against any subsidiary that is no longer a guarantor of the Exchange Notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those non-guarantor subsidiaries (other than indebtedness and liabilities owed to us) will be structurally senior to your claims.

If we default on our obligations to pay our other indebtedness, we may not be able to make payments on the Exchange Notes.

If we are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we otherwise fail to comply with the various covenants under the agreements governing our indebtedness, including any financial and operating covenants, we could be in default under the terms of such agreements and as a result, we may not be able to make payments on the Exchange Notes. In the event of any such default:

| • | the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, if any; |

| • | the lenders under our senior secured credit facility could elect to terminate their commitments, cease making further loans and commence foreclosure proceedings against our assets; and |

| • | we could be forced into bankruptcy or liquidation. |

If we breach our covenants under our senior secured credit facility and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under our senior secured credit facility, the lenders could exercise their rights, as described above, and we could be forced into bankruptcy or liquidation.

18

Table of Contents

Restrictive covenants in our debt agreements may adversely affect us.

Our senior secured credit facility and other instruments governing our other outstanding debt, including the indentures governing the Notes, the 8.625% Senior Notes and the Senior Subordinated Notes, contain certain restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. For example, these covenants significantly restrict our and certain of our subsidiaries’ ability to:

| • | borrow money; |

| • | pay dividends or make other distributions; |

| • | repurchase or redeem capital stock or subordinated indebtedness and make investments; |

| • | create liens; |

| • | incur dividend or other payment restrictions affecting non-guarantor subsidiaries; |

| • | transfer or sell assets, including capital stock of subsidiaries; |

| • | merge or consolidate with other entities or transfer all or substantially all of our assets; |

| • | engage in certain business activities; and |

| • | enter into transactions with affiliates. |

These covenants are subject to a number of important exceptions and qualifications. These restrictions could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities. Events beyond our control can affect our ability to comply with these covenants. Failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debt. If an event of default occurs, we cannot assure you that we would have sufficient assets to repay all of our obligations. In addition, under our senior secured credit facility, when the revolver is drawn or letters of credit are outstanding, we are required to satisfy a consolidated net senior secured leverage ratio covenant as determined in accordance with our senior secured credit facility. You should read the discussions under the heading “Description of Certain Debt Instruments” in this prospectus for further information about the covenants contained in our senior secured credit facility and the indentures governing the 8.625% Senior Notes and the Senior Subordinated Notes.

Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Certain of our borrowings, primarily borrowings under our senior secured credit facility, are at variable interest rates and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income would decrease. Although we have entered into, and may continue to enter into, interest rate swaps, involving the exchange of floating for fixed rate interest payments, to reduce interest volatility, we cannot assure you we will or will be able to continue to do so nor can we assure you that any interest rate swaps would be beneficial to us.

Under insolvency and fraudulent conveyance laws, a court could void obligations under the Exchange Notes and the guarantees.

Federal and state fraudulent transfer and conveyance statutes may apply to the issuance of the Exchange Notes and the incurrence of the guarantees. Under the federal bankruptcy laws and comparable provisions of state fraudulent transfer and conveyance laws, a court could void obligations under the Exchange Notes or the guarantees, subordinate those obligations to more junior obligations or require holders of the Exchange Notes to repay any payments made under the Exchange Notes or pursuant to the guarantees if an unpaid creditor or representative of creditors, such as a trustee in bankruptcy or the Company as a debtor-in-possession, claims that the Exchange Notes or guarantees constituted a fraudulent conveyance. For this claim to succeed, the claimant must generally show that (1) we paid the consideration, or any guarantor issued its guarantee, with the intent of

19

Table of Contents

hindering, delaying or defrauding creditors or (2) we, or any of our guarantors, received less than reasonably equivalent value or fair consideration in return for paying the consideration or issuing their respective guarantees, and, in the case of (2) above only, one of the following is also true:

| • | we or any of our guarantors were insolvent or rendered insolvent by reason of the incurrence of the indebtedness; |

| • | payment of the consideration left us or any of our guarantors with an unreasonably small amount of capital to carry on the business; or |

| • | we or any of our guarantors intended to, or believed that we or it would, incur debts beyond our or its ability to pay as they mature. |