Table of Contents

As filed with the Securities and Exchange Commission on April 5, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CINEMARK USA, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Texas | 7832 | 75-2206284 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Additional Subsidiary Guarantor Registrants Listed on Following Page

3900 Dallas Parkway, Suite 500 Plano, Texas 75093

(972) 665-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael Cavalier, Executive Vice President — General Counsel

3900 Dallas Parkway, Suite 500

Plano, Texas 75093

(972) 665-1000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With a copy to:

Terry M. Schpok, P.C.

Akin Gump Strauss Hauer & Feld LLP

1700 Pacific Avenue, Suite 4100

Dallas, Texas 75201

Telephone: (214) 969-2800

Approximate date of commencement of proposed sale to the public:As soon as practicable on or after the effective date of this Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-l(d) (Cross Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| ||||||||

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee(1) | ||||

4.875% Senior Notes due 2023 | $225,000,000 | 100% | $225,000,000 | $22,658 | ||||

Guarantees of the 4.875% Senior Notes due 2023(2) | — | — | — | None(3) | ||||

| ||||||||

| ||||||||

| (1) | Calculated pursuant to Rule 457 under the Securities Act of 1933, as amended. |

| (2) | Each of the subsidiaries of Cinemark USA, Inc. that is listed as an Additional Subsidiary Guarantor Registrant on the following page has guaranteed the Exchange Notes being registered pursuant hereto. |

| (3) | Pursuant to Rule 457(n) of the Securities Act of 1933, as amended, no separate fee for the guarantees is payable. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

ADDITIONAL SUBSIDIARY GUARANTOR REGISTRANTS

Exact name of Subsidiary Guarantor(1) | State of Incorporation or Organization | I.R.S. Employer Identification Number | ||

Sunnymead Cinema Corp. | California | 94-2869919 | ||

Cinemark Properties, Inc. | Texas | 75-2297865 | ||

Greeley Holdings, Inc. | Texas | 75-2297693 | ||

Cinemark Partners I, Inc. | Texas | 75-2552022 | ||

CNMK Texas Properties, LLC | Texas | 42-1562935 | ||

Cinemark Concessions, LLC | Florida | 26-4447062 | ||

Century Theatres, Inc. | California | 51-0368667 | ||

Marin Theatre Management, LLC | California | N/A | ||

Century Theatres NG, LLC | California | N/A | ||

Cinearts, LLC | California | N/A | ||

Cinearts Sacramento, LLC | California | N/A | ||

Corte Madera Theatres, LLC | California | N/A | ||

Novato Theatres, LLC | California | N/A | ||

San Rafael Theatres, LLC | California | N/A | ||

Northbay Theatres, LLC | California | N/A | ||

Century Theatres Summit Sierra, LLC | California | N/A | ||

Century Theatres Seattle, LLC | California | N/A | ||

CNMK Investments, Inc. | Delaware | 14-1861725 |

| (1) | The address and phone number for each of the additional subsidiary guarantor registrants is 3900 Dallas Parkway, Plano, TX 75093, (972) 665-1000. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not exchange these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 5, 2016

PRELIMINARY PROSPECTUS

CINEMARK USA, INC.

Offer to Exchange

all outstanding 4.875% Senior Notes due 2023

($225,000,000 aggregate principal amount)

for

4.875% Senior Notes due 2023

which have been registered under the Securities Act of 1933, as amended

The exchange offer will expire at midnight, New York City time, on , 2016, unless we extend the exchange offer. We do not currently intend to extend the exchange offer.

| • | We are offering to exchange up to $225,000,000 aggregate principal amount of new 4.875% Senior Notes due 2023, or Exchange Notes, which have been registered under the Securities Act of 1933, as amended, or the Securities Act, for an equal principal amount of our outstanding 4.875% Senior Notes due 2023, or the 2016 Notes, issued in a private offering on March 21, 2016. |

| • | The 2016 Notes were issued as additional notes under a supplemental indenture, dated as of March 21, 2016, to the indenture, dated as of May 24, 2013, among us, certain subsidiaries party thereto and Wells Fargo Bank, N.A., as trustee. We refer to such indenture and the supplemental indenture as the Indenture. On May 24, 2013, we issued $530,000,000 of our 4.875% Senior Notes due 2023 pursuant to the Indenture, all of which were exchanged for substantially identical notes in the same amount, or the Existing 4.875% Notes, in an offering registered under the Securities Act. We refer to the Existing 4.875% Notes, the 2016 Notes and the Exchange Notes collectively as the Notes. The Exchange Notes, together with any 2016 Notes not exchanged in the exchange offer, will have substantially the same terms as the Existing 4.875% Notes except as otherwise provided herein. |

| • | We will exchange all 2016 Notes that are validly tendered and not validly withdrawn prior to the closing of the exchange offer for an equal principal amount of Exchange Notes that have been registered. |

| • | You may withdraw tenders of 2016 Notes at any time prior to the expiration of the exchange offer. |

| • | The terms of the Exchange Notes to be issued are identical in all material respects to the 2016 Notes, except for transfer restrictions and registration rights that do not apply to the Exchange Notes, and different administrative terms. |

| • | The Exchange Notes, together with any 2016 Notes not exchanged in the exchange offer, and the Existing 4.875% Notes will constitute a single class of debt securities under the Indenture governing the Notes. |

| • | The exchange of 2016 Notes will not be a taxable exchange for United States federal income tax purposes. We will not receive any proceeds from the exchange offer. |

| • | We do not intend to apply for listing of the Exchange Notes on any securities exchange or for inclusion of the Exchange Notes in any automated quotation system. |

See “Risk Factors” beginning on page 16 for a discussion of factors that you should consider before tendering your 2016 Notes.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The related letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for 2016 Notes where such 2016 Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 12 months after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

Table of Contents

| 1 | ||||

| 15 | ||||

| 16 | ||||

| 29 | ||||

| 30 | ||||

| 41 | ||||

SELECTED HISTORICAL CONDENSED CONSOLIDATED FINANCIAL AND OPERATING DATA | 42 | |||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 44 | |||

| 66 | ||||

| 80 | ||||

| 85 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 118 | |||

| 120 | ||||

| 122 | ||||

| 167 | ||||

| 169 | ||||

| 171 | ||||

| 171 | ||||

| 172 | ||||

| 174 | ||||

| 176 | ||||

| 176 | ||||

| F-1 |

In this prospectus, references to “we,” “us,” “our,” the “issuer,” the “Company” or “Cinemark” are to the combined business of Cinemark USA, Inc. and all of its consolidated subsidiaries unless otherwise indicated or the context requires otherwise.

This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. This information is available without charge to security holders upon written or oral request to Cinemark USA, Inc., 3900 Dallas Parkway, Suite 500, Plano, TX 75093, Attn: Michael Cavalier, Corporate Secretary, telephone number (972) 665-1000.IN ORDER TO OBTAIN TIMELY DELIVERY, YOU MUST REQUEST THE INFORMATION NO LATER THAN , 2016, WHICH IS FIVE BUSINESS DAYS BEFORE THE EXPIRATION DATE OF THE EXCHANGE OFFER UNLESS WE DECIDE TO EXTEND THE EXPIRATION DATE.

WHERE YOU CAN FIND MORE INFORMATION

You should rely only upon the information contained and incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to exchange these securities in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We and our parent company, Cinemark Holdings, Inc., or Cinemark Holdings, currently file periodic reports and other information under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Under the

i

Table of Contents

terms of the Indenture, we have agreed that, whether or not we are required to do so by the rules and regulations of the Securities and Exchange Commission, which we refer to as the SEC or the Commission, after the exchange offer is completed and for so long as any of the Exchange Notes remain outstanding, we will furnish to the trustee and the holders of the Exchange Notes and, upon written request, to prospective investors, and file with the Commission (unless the Commission will not accept such a filing) (i) all quarterly and annual financial information that would be required to be contained in a filing with the Commission on Forms 10-Q and 10-K if we were required to file such reports, including a “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and, with respect to the annual information only, a report thereon by our independent registered public accountant and (ii) all reports that would be required to be filed with the Commission on Form 8-K if we were required to file such reports, in each case within the time period specified in the rules and regulations of the Commission. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically at http://www.sec.gov. Our filings with the Commission are available to the public from the Commission’s website. The public may read and copy and materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, for so long as any of the Exchange Notes remain outstanding, we have agreed to make available to any holder of the Exchange Notes or prospective purchaser of the Exchange Notes, at their request, the information required by Rule 144A(d)(4) under the Securities Act.

This prospectus contains or incorporates by reference summaries of certain agreements that we have entered into, such as the Indenture, the exchange and registration rights agreement, or the registration rights agreement, and the agreements described under “Description of Certain Debt Instruments,” “Description of Exchange Notes” and “Certain Relationships and Related Party Transactions.” The descriptions contained in this prospectus of these agreements do not purport to be complete and are subject to, or qualified in their entirety by reference to, the definitive agreements. Copies of the definitive agreements will be made available without charge to you by making a written or oral request to us.

MARKET AND INDUSTRY DATA

Information regarding market share, market position and industry data pertaining to our business contained in this prospectus consists of estimates based on data and reports compiled by industry professional organizations, including the Motion Picture Association of America, or MPAA, industry analysts and our knowledge of our revenues and markets.

We take responsibility for compiling and extracting, but have not independently verified, market and industry data provided by third parties, or by industry or general publications. Similarly, while we believe our internal estimates are reliable, our estimates have not been verified by any independent sources. Although we do not make any representation as to the accuracy of information described in these paragraphs, we believe and act as if the information is accurate. As of the date of this prospectus, 2015 industry data was not yet available.

Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this prospectus include the Cinemark and Century marks, which may be registered in the United States and other jurisdictions. We do not own any trademark, trade name or service mark of any other company appearing in this prospectus.

ii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that are based on our current expectations, assumptions, estimates and projections about our business and our industry. They include statements relating to:

| • | future revenues, expenses and profitability; |

| • | the future development and expected growth of our business; |

| • | projected capital expenditures; |

| • | attendance at movies generally, or in any of the markets in which we operate; |

| • | the number or diversity of popular movies released and our ability to successfully license and exhibit popular films; |

| • | national and international growth in our industry; |

| • | competition from other exhibitors and alternative forms of entertainment; and |

| • | determinations in lawsuits in which we are defendants. |

You can identify forward-looking statements by the use of words such as “may,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “anticipates,” “believes,” “plans,” “expects,” “future” and “intends” and similar expressions which are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. In evaluating these forward-looking statements, you should carefully consider the risks and uncertainties described in “Risk Factors” and elsewhere included or incorporated by reference in this prospectus. These forward-looking statements reflect our view only as of the date of this prospectus. We do not undertake any obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements and risk factors contained throughout or incorporated by reference in this prospectus.

iii

Table of Contents

This summary contains basic information about us and the exchange offer. This summary may not contain all of the information that is important to you. You should read this summary together with the entire prospectus, including the more detailed information in our consolidated financial statements and related notes and schedules appearing elsewhere in this prospectus. Except as otherwise specified or indicated by the context, references in this prospectus to “we,” “us,” “our,” the “Company” or “Cinemark” are to the combined business of Cinemark USA, Inc. and all of its consolidated subsidiaries. All references to North America are to the United States, or the U.S., and Canada, and all references to Latin America are to Brazil, Mexico (sold during November 2013), Argentina, Chile, Colombia, Peru, Ecuador, Honduras, El Salvador, Nicaragua, Costa Rica, Panama, Guatemala, Bolivia and Curaçao. Unless otherwise specified, all operating data is as of and for the year ended December 31, 2015.

Our Company

We are one of the leaders in the motion picture exhibition industry. As of December 31, 2015, we operated 513 theatres and 5,796 screens in the U.S. and Latin America and approximately 280 million patrons attended our theatres worldwide during the year ended December 31, 2015. We are one of the most geographically diverse worldwide exhibitors, with theatres in fifteen countries as of December 31, 2015. As of December 31, 2015, our U.S. circuit had 337 theatres and 4,518 screens in 41 states and our international circuit had 176 theatres and 1,278 screens.

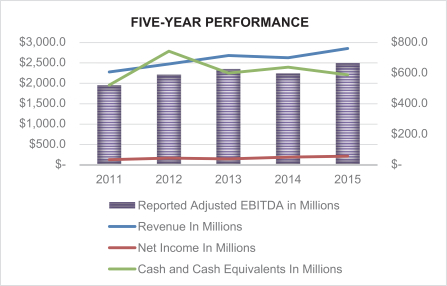

Revenues, operating income and net income attributable to Cinemark USA, Inc. for the year ended December 31, 2015, were $2,852.6 million, $425.8 million and $218.5 million, respectively. At December 31, 2015 we had cash and cash equivalents of $588.5 million and total long-term debt of $1,814.6 million. Approximately $579.0 million, or 32%, of our long-term debt accrues interest at variable rates and approximately $8.4 million of our long-term debt matures in 2016.

We selectively build or acquire new theatres in markets where we can establish and maintain a strong market position. During the year ended December 31, 2015, we built 22 new theatres with 182 screens and acquired three theatres with 19 screens.

We believe our portfolio of modern high-quality theatres with multiple platforms provides a preferred destination for moviegoers and contributes to our solid and consistent cash flows from operating activities. Our significant and diverse presence in the U.S. and Latin America has made us an important distribution channel for movie studios, particularly considering the expanding worldwide box office.

We continue to develop and expand new platforms and market adaptive concepts for our theatre circuit, such as XD, Movie Bistro, Cinemark Reserve, Luxury Lounger reclining seats, D-BOX seating, CinèArts and other premium concepts.

Our XD screens represent the largest private label premium large format footprint in the industry. Our XD auditorium offers a premium experience utilizing the latest in digital projection and enhanced custom sound, including a Barco Auro 11.1 sound system or Dolby Atmos in select locations. The XD experience includes wall-to-wall and ceiling-to-floor screens, wrap-around sound, plush seating and a maximum comfort entertainment environment for an immersive experience. The exceptional XD technology does not require special format movie prints, which allows us the flexibility to play any available digital print we choose, including 3-D content, in the XD auditorium without any print enhancements required. As of December 31, 2015, we had 210 XD auditoriums in our worldwide circuit with plans to install 15 to 20 more XD auditoriums during 2016.

1

Table of Contents

The Movie Bistro locations offer in-theatre dining with expanded food offerings, such as fresh wraps, hot sandwiches, burgers, and gourmet pizzas, and a selection of beers, wines, and frozen cocktails, all of which can be enjoyed in the comfort of the auditoriums. We currently have three domestic theatres and one international theatre with the bistro concept and we plan to expand this premium concept to two new domestic locations during 2016.

During 2014, we opened our first Cinemark Reserve theatre in the U.S., which features a VIP area with luxury recliner seating and other amenities, along with a wide variety of food and beverage products. We opened our second Cinemark Reserve theatre in the U.S. during 2015. We have a similar VIP concept offering recliner seating in five other domestic locations and in 22 of our international theatres, referred to locally as either Cinemark Premiere or Cinemark Prime. We plan to continue to incorporate this concept in four of our new domestic and international theatres and convert three of our existing locations during 2016.

We have incorporated Luxury Lounger reclining seats in the majority of our new domestic builds and have also repositioned some of our existing domestic theatres to offer this premium seating feature. We currently feature Luxury Loungers in 31 of our domestic theatres, representing 422 screens. We plan to offer the Luxury Loungers in approximately 20% of our domestic circuit by the end of 2016.

We currently have auditoriums throughout our worldwide circuit that offer seats with immersive cinematic motion, called D-BOX. These seats are programmed in harmony with the audio and video content of the film and make the viewer feel as if they are part of the movie itself. We offer D-BOX seating in 106 auditoriums throughout our worldwide circuit. We expect to add D-BOX seating to 35 additional locations during 2016.

Our CinèArts locations provide moviegoers with the best selection of art and independent cinema in a captivating, unique environment and have set the industry standard for providing distinct, acclaimed and award-winning films. We currently have 14 domestic theatres that are dedicated to art and independent content and 57 of our other domestic theatres also offer art and independent films on a limited basis.

Competitive Strengths

We believe the following strengths allow us to compete effectively:

Experienced Management. Led by Chairman and founder Lee Roy Mitchell, Chief Executive Officer Mark Zoradi, Chief Financial Officer Sean Gamble, and President-International Valmir Fernandes, our operational management team has many years of industry experience. Each of our international offices is led by general managers that are local citizens familiar with cultural, political and economic factors impacting each country. Our worldwide management team has successfully navigated us through many industry and economic cycles.

Disciplined Operating Philosophy. We generated operating income and net income attributable to Cinemark USA, Inc. of $425.8 million and $218.5 million, respectively, for the year ended December 31, 2015. Our solid operating performance is a result of our disciplined operating philosophy that centers on building high-quality theatres, while maintaining favorable theatre-level economics, controlling operating costs and effectively reacting to economic and market changes.

Leading Position in Our U.S. Markets. We have a leading market share in most of the U.S. markets we serve, which includes a presence in 41 states. For the year ended December 31, 2015, we ranked either first or second, based on box office revenues, in 22 out of our top 30 U.S. markets, including the San Francisco Bay Area, Dallas, Houston, Salt Lake City, Sacramento, Cleveland and Austin.

2

Table of Contents

Located in Top Latin American Markets. We have continued to invest throughout Latin America. As of December 31, 2015, we operated 176 theatres and 1,278 screens in 14 countries. Our international screens generated revenues of $728.7 million, or 25.5% of our total revenues, for the year ended December 31, 2015. We have successfully established a significant presence in major cities in the region, with theatres in thirteen of the fifteen largest metropolitan areas in South America as of December 31, 2015. We are the largest exhibitor in Brazil and Argentina. Our geographic diversity makes us an important distribution channel for the movie studios.

State-of-the-Art Theatre Circuit. We offer state-of-the-art theatres, which we believe makes our theatres a preferred destination for moviegoers in our markets. During 2015, we built 182 new screens worldwide. We currently have commitments to open 191 additional new screens over the next three years. We have installed digital projection technology in all of our worldwide auditoriums. Currently, approximately 55% of our U.S. screens and 65% of our international screens are 3-D compatible. We currently have 14 digital IMAX screens. As of December 31, 2015, we had the industry-leading private label premium large format circuit with 210 XD auditoriums in our theatres. We have plans to install 15 to 20 additional XD auditoriums during 2016. We also continue to develop new market-adaptive theatre concepts in various markets. We believe we offer the brightest picture in the industry, with our Doremi servers and Barco digital projectors, and custom surround sound in our auditoriums. We have also established a centralized theatre support center that monitors and responds to projection performance and theatre network connectivity issues across our worldwide circuit on real-time basis.

Disciplined and Targeted Growth Strategy. We continue to grow organically as well as through the acquisition of high-quality theatres in select markets. Our growth strategy has centered around achieving a target return on investment while also complementing our existing theatre circuit. We continue to generate significant cash flows from operating activities, which demonstrates the success of our growth strategy. We believe a combination of our strong balance sheet and our expected level of cash flows will continue to provide us with the financial flexibility to pursue further growth opportunities, while also allowing us to efficiently service our debt obligations.

Our Strategy

We believe our disciplined operating philosophy and experienced operational management team will enable us to continue to enhance our leading position in the motion picture exhibition industry. Key components of our strategy include:

Focus on Operational Excellence and Customer Satisfaction. We continue to focus on achieving operational excellence by controlling theatre operating costs and training and motivating our staff all while focusing on making each of our customer’s experiences memorable. We strive for first-rate customer service and focus on driving attendance. Our consistent industry-leading margins reflect our ability to deliver the highest quality presentation to our patrons while also managing changes in product and consumer preferences.

Growth in Existing and New Markets. We continue to seek growth opportunities by building or acquiring high-quality theatres that meet our strategic, financial and demographic criteria. We added 25 new theatres with 201 screens to our worldwide circuit during the year ended December 31, 2015. We also monitor economic and market trends to ensure our existing theatres offer a broad range of products, prices and platforms that satisfy our patrons and to develop new concepts to adapt to changes in preferences. During 2014, we acquired one theatre in Alabama, a new state for us and we opened our first theatre in Bolivia. During 2015, we opened our first theatre in Curaçao, adding another new country to our diverse circuit. We have plans to open a theatre in Paraguay, another new country, in 2016.

Commitment to Technological and Product Innovation. Our commitment to technological innovation has resulted in us being 100% digital in our worldwide circuit as of December 31, 2015. In the U.S., 100% of our

3

Table of Contents

projectors are networked with satellite infrastructure and our Latin American theatres will be 100% capable by the end of 2016. We continue to expand our worldwide XD auditorium footprint. We are also committed to developing and expanding our new market-adaptive theatres. With our technological innovations, we have broadened the range of entertainment options offered at our theatres by expanding content to include concert events, e-sports gaming events and other special presentations. Approximately 57% of our worldwide screens are 3-D compatible. We are also committed to developing and expanding our market-adaptive concepts. Our concession and food offerings are progressing to selectively include upscale options, hot prepared food, offerings tailored to local demographics, alcoholic beverages, and healthy snack alternatives in addition to our more standard concession products. Theatre amenities we provide to our customers may include our private-label premium large format XD screens, Luxury Lounger reclining seats, VIP lounge areas, reserved seating, and seats with cinematic motion.

Sustained Investment in Existing Circuit. While we continue to grow our theatre circuit with new builds and acquisitions, we also remain committed to investing in our existing theatres to ensure they provide our customers with a comfortable, high-quality entertainment experience. We spent approximately $140 million and $199 million on capital expenditures for existing theatres during the years ended December 31, 2014 and 2015, respectively. Our efforts during 2015 included remodeling some of our existing theatres to include reclining seats and expanded concession offerings, the purchase of our corporate headquarters building in Plano, TX and routine improvements to ensure our theatres offer the highest quality guest experience.

Our Industry

Technology Platform

The motion picture exhibition industry began its conversion to digital projection technology during 2009. Digital projection technology allows filmmakers the ability to showcase imaginative works of art exactly as they were intended, with incredible realism and detail. A digitally produced or digitally converted movie can be distributed to theatres via satellite, physical media, or fiber optic networks. The digitized movie is stored on a computer/server which “serves” it to a digital projector for each screening of the movie. This format enables us to more efficiently move titles between auditoriums within a theatre to appropriately address demand for each title.

Currently, all of our first-run domestic and international theatres are fully digital. Digital projection allows us to present 3-D content and alternative entertainment such as live and pre-recorded sports programs, concert events, the Metropolitan Opera, gaming events and other special presentations. Three-dimensional technology offers a premium experience with crisp, bright, ultra-realistic images. According to MPAA, approximately 17% and 13% of domestic box office for 2013 and 2014, respectively, was generated by 3-D tickets.

During 2013, through a joint venture named Digital Cinema Distribution Coalition, or DCDC, the motion picture exhibition industry developed a content delivery network that allows for delivery of all digital content to U.S. theatres via satellite. Delivery of content via satellite reduces film transportation costs for both distributors and exhibitors, as a portion of the costs to produce and ship hard drives has been eliminated.

We have started to expand satellite delivery technology into some of our Latin American markets, initially for live event presentations. As of December 31, 2015, approximately 59 of our international theatres had capabilities to receive live event feeds via satellite, with some of these locations also able to receive film content via satellite.

4

Table of Contents

Domestic Markets

The U.S. motion picture exhibition industry set an all-time box office record during 2015 with an estimated $11.1 billion in revenues. This represents an increase of approximately 7% over 2014 and an increase of 2% over box office revenues for the previous record set during 2013. The following table represents the results of a survey by MPAA published during March 2015, outlining the historical trends in U.S. box office performance for the ten year period from 2005 to 2014:

Year | U.S. Box Office Revenues | Attendance | Average Ticket Price | |||||||||

| ($ in billions) | (in billions) | |||||||||||

2005 | $ | 8.8 | 1.38 | $ | 6.41 | |||||||

2006 | $ | 9.2 | 1.40 | $ | 6.55 | |||||||

2007 | $ | 9.6 | 1.40 | $ | 6.88 | |||||||

2008 | $ | 9.6 | 1.34 | $ | 7.18 | |||||||

2009 | $ | 10.6 | 1.42 | $ | 7.50 | |||||||

2010 | $ | 10.6 | 1.34 | $ | 7.89 | |||||||

2011 | $ | 10.2 | 1.28 | $ | 7.93 | |||||||

2012 | $ | 10.8 | 1.36 | $ | 7.96 | |||||||

2013 | $ | 10.9 | 1.34 | $ | 8.13 | |||||||

2014 | $ | 10.4 | 1.27 | $ | 8.17 | |||||||

Films leading the box office during the year ended December 31, 2015 includedStar Wars: The Force Awakens,Jurassic World,Avengers: Age of Ultron,Hunger Games: Mockingjay Part II,Furious 7,American Sniper,50 Shades of Grey,Inside Out,Minions,Spectre andMission: Impossible 5, among other films.

Films scheduled for release during 2016 include well-known franchise films such asCaptain America: Civil War,Batman V Superman: Dawn Of Justice,Finding Dory,Star Trek Beyond, andX-Men: Apocalypse; action films such asDeadpool; family films such asThe Secret Life Of Pets,Zootopia,Alice Through The Looking Glass, andSing; and spin-off films such asRogue One: A Star Wars Story and the Harry Potter spin-offFantastic Beasts And Where To Find Them, among other films.

International Markets

According to MPAA, international box office revenues were $26.0 billion for the year ended December 31, 2014, representing a 4% increase over 2013. International box office growth is a result of strong economies, ticket price increases and new theatre construction. According to MPAA, Latin American box office revenues were $3.0 billion for the year ended December 31, 2014, consistent with 2013 performance.

Growth in Latin America continues to be fueled by a combination of growing populations, attractive demographics (i.e., a significant teenage population), continued retail development, and quality product from Hollywood, including 3-D and alternative content offerings. In many Latin American countries, including Brazil, Argentina, Colombia, Peru and Chile, successful local film product can also provide incremental box office growth opportunities.

We believe many international markets will continue to experience growth as new theatre technologies and platforms are introduced, as film and other product offerings continue to expand and as ancillary revenue opportunities grow.

5

Table of Contents

Drivers of Continued Industry Success

We believe the following market trends will drive the continued strength of our industry:

Importance of Theatrical Success in Establishing Movie Brands. Theatrical exhibition has long been the primary distribution channel for new motion picture releases. A successful theatrical release “brands” a film and is one of the major contributors to a film’s success in “downstream” markets, such as digital downloads, video on-demand, pay-per-view television, DVDs, and network and syndicated television.

Increased Importance of International Markets for Box Office Success. International markets continue to be an increasingly important component of the overall box office revenues generated by Hollywood films, accounting for $26.0 billion, or approximately 72%, of 2014 total worldwide box office revenues according to MPAA. With the continued growth of the international motion picture exhibition industry, we believe the relative contribution of markets outside North America will become even more significant. Many of the top U.S. films released during 2015 also performed exceptionally well in international markets. Such films includedFurious 7, which grossed approximately $1,162.0 million in international markets, or approximately 77% of its worldwide box office,Avengers: Age of Ultron, which grossed approximately $946.0 million in international markets, or approximately 67% of its worldwide box office, andJurassic World, which grossed approximately $1,014.0 million in international markets, or approximately 61% of its worldwide box office.

Stable Box Office Levels. Over the past ten years, industry statistics have shown slight increases and decreases in attendance from one year to another, however domestic box office revenues have remained relatively stable during this period. The industry has not experienced highly volatile results, even during recessionary periods, demonstrating the stability of the industry and its continued ability to attract consumers.

Convenient and Affordable Form of Out-Of-Home Entertainment. Movie going continues to be one of the most convenient and affordable forms of out-of-home entertainment, with an estimated average ticket price in the U.S. of $8.17 in 2014. Average prices in 2014 for other forms of out-of-home entertainment in the U.S., including sporting events and theme parks, ranged from approximately $28.00 to $84.00 per ticket according to MPAA.

Innovation Using Digital and Satellite Technology. Our industry began converting to digital projection technology during 2009. Our domestic circuit also converted to satellite technology during 2014 and our international circuit has started to implement satellite technology as a means to receive film and other content. Digital projection combined with satellite delivery allows exhibitors to expand their product offerings, including the presentation of 3-D content and alternative entertainment. Alternative entertainment may include pre-recorded programs as well as live sports programs, concert events, the Metropolitan Opera, e-sports gaming events and other special presentations. New and enhanced programming alternatives expand the industry’s offerings to attract a broader customer base.

Introduction of New Platforms and Product Offerings. The motion picture exhibition industry continues to develop new movie theatre platforms and concepts to respond to varying and changing consumer preferences. In addition to changing the overall style of, and amenities offered in some theatres, concession product offerings have continued to expand to more than just traditional popcorn and candy items. Some locations now offer hot foods, adult beverages and/or healthier snack options for patrons.

Redemption of 7.375% Senior Subordinated Notes due 2021

We used the proceeds from the issuance of the 2016 Notes to redeem all of our outstanding 7.375% senior subordinated notes due 2021, or the 7.375% senior subordinated notes. We refer to the redemption of all of our 7.375% senior subordinated notes herein as the 7.375% senior subordinated notes redemption. The offering of the 2016 Notes, the 7.375% senior subordinated notes redemption and the payment of fees and expenses in connection therewith are collectively referred to as the Refinancing Transactions. We do not expect the Refinancing Transactions to materially impact our future results of operations.

6

Table of Contents

Additional Information

Cinemark USA, Inc. was incorporated under the laws of Texas and is a direct, wholly-owned subsidiary of Cinemark Holdings, Inc., or Cinemark Holdings, a public company traded on The New York Stock Exchange, or the NYSE, under the symbol “CNK.” Our corporate headquarters is located at 3900 Dallas Parkway, Suite 500, Plano, Texas 75093. Our telephone number is (972) 665-1000. Our website address iswww.cinemark.com. The information on, or accessible through, our website does not constitute part of this prospectus.

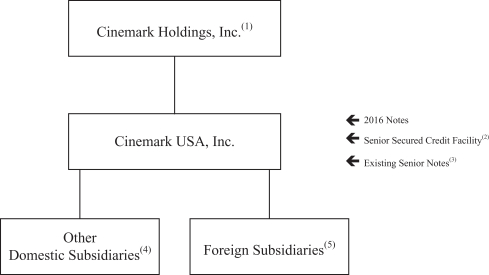

Corporate Structure

The chart below shows our corporate structure and our principal indebtedness after giving effect to the Refinancing Transactions.

| (1) | Cinemark Holdings is a Delaware corporation and a public company listed on the NYSE. |

| (2) | Our senior secured credit facility, or the Senior Secured Credit Facility, currently includes a seven-year $700.0 million term loan and a five-year $100.0 million revolving credit line. At December 31, 2015, there was $679.0 million outstanding under the term loan and no borrowings outstanding under the revolving credit line. We have $100.0 million in available borrowing capacity on the revolving credit line. |

| (3) | As of December 31, 2015, $530.0 million aggregate principal amount of the Existing 4.875% Notes and $400.0 million aggregate principal amount of our 5.125% senior notes due 2022, or the 5.125% Senior Notes, and, together with the Existing 4.875% Notes, the Existing Senior Notes, were outstanding. |

| (4) | Our subsidiaries that guarantee our Senior Secured Credit Facility and the Existing Senior Notes will guarantee the Exchange Notes on a senior unsecured basis. |

| (5) | Our foreign subsidiaries do not guarantee our Senior Secured Credit Facility or the Existing Senior Notes, and will not guarantee the Exchange Notes. |

7

Table of Contents

Summary of the Terms of the Exchange Offer

The Exchange Offer | We are offering to exchange up to $225,000,000 aggregate principal amount of our 4.875% Senior Notes due 2023 that have been registered under the Securities Act for up to $225,000,000 aggregate principal amount of our 4.875% Senior Notes due 2023 issued on March 21, 2016, 2013, which we refer to herein as the exchange offer. You may exchange your 2016 Notes only by following the procedures described elsewhere in this prospectus under “The Exchange Offer — Procedures for Tendering 2016 Notes.” |

Registration Rights Agreement | We issued the 2016 Notes on March 21, 2016. In connection with the issuance of the 2016 Notes, we entered into the registration rights agreement with the initial purchasers of the notes, or the initial purchasers, which provides, among other things, for the exchange offer. |

Resale of Exchange Notes | Based upon interpretive letters written by the Commission, we believe that the Exchange Notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | You are acquiring the Exchange Notes in the ordinary course of your business; |

| • | You are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; and |

| • | You are not our “affiliate”, as that term is defined for the purposes of Rule 144A under the Securities Act. |

| If any of the foregoing are not true and you transfer any Exchange Note without registering the Exchange Note and delivering a prospectus meeting the requirements of the Securities Act, or without an exemption from registration of your Exchange Notes from such requirements, you may incur liability under the Securities Act. We do not assume any responsibility for, and will not indemnify you for, any such liability. |

| Each broker-dealer that receives Exchange Notes for its own account in exchange for 2016 Notes that were acquired by such broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the Exchange Notes. A broker-dealer may use this prospectus for an offer to resell, a resale or any other retransfer of the Exchange Notes. See “Plan of Distribution.” |

Consequences of Failure to Exchange 2016 Notes | 2016 Notes that are not tendered or that are tendered but not accepted will, following the completion of the exchange offer, continue to be subject to existing restrictions upon transfer. The trading market for |

8

Table of Contents

2016 Notes not exchanged in the exchange offer may be significantly more limited than at present. Therefore, if your 2016 Notes are not tendered and accepted in the exchange offer, it may become more difficult for you to sell or transfer your 2016 Notes. Furthermore, you will no longer be able to compel us to register the 2016 Notes under the Securities Act and we will not be required to pay additional interest as described in the registration rights agreement. In addition, you will not be able to offer or sell the 2016 Notes unless they are registered under the Securities Act (and we will have no obligation to register them, except for some limited exceptions), or unless you offer or sell them under an exemption from the requirements of, or a transaction not subject to, the Securities Act. |

Expiration of the Exchange Offer | The exchange offer will expire at midnight, New York City time, on , 2016, unless we decide to extend the expiration date. |

Conditions to the Exchange Offer | The exchange offer is not subject to any condition other than certain customary conditions, which we may, but are not required to, waive. We currently anticipate that each of the conditions will be satisfied and that we will not need to waive any conditions. We reserve the right to terminate or amend the exchange offer at any time before the expiration date if any such condition occurs. In the event of a material change in the exchange offer, including the waiver of a material condition, we will extend, if necessary, the expiration date of the exchange offer such that at least five business days remain in the exchange offer following notice of the material change. For additional information regarding the conditions to the exchange offer, see “The Exchange Offer — Conditions to the Exchange Offer.” |

Procedures for Tendering 2016 Notes | If you wish to accept the exchange offer, you must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal, and transmit it together with all other documents required by the letter of transmittal (including the 2016 Notes to be exchanged) to Wells Fargo Bank, N.A., as exchange agent, at the address set forth on the cover page of the letter of transmittal. In the alternative, you can tender your 2016 Notes by following the procedures for book-entry transfer, as described in this prospectus. There is no procedure for guaranteed late delivery of 2016 Notes. For more information on accepting the exchange offer and tendering your 2016 Notes, see “The Exchange Offer — Procedures for Tendering 2016 Notes” and “— Book-Entry Transfer.” |

Special Procedure for Beneficial Holders | If you are a beneficial holder whose 2016 Notes are registered in the name of a broker, dealer, commercial bank, trust company, or other nominee and you wish to tender your 2016 Notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender your 2016 Notes on your behalf. If you are a beneficial holder and you wish to tender your 2016 Notes on your own behalf, you must, prior to delivering the letter of transmittal |

9

Table of Contents

and your 2016 Notes to the exchange agent, either make appropriate arrangements to register ownership of your 2016 Notes in your own name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

Withdrawal Rights | You may withdraw the tender of your 2016 Notes at any time prior to midnight, New York City time, on the expiration date. To withdraw, you must send a written or facsimile transmission of your notice of withdrawal to the exchange agent at its address set forth in this prospectus under “The Exchange Offer — Withdrawal of Tenders” by midnight, New York City time, on the expiration date. |

Acceptance of 2016 Notes and Delivery of Exchange Notes | Subject to certain conditions, we will accept all 2016 Notes that are properly tendered in the exchange offer and not withdrawn prior to midnight, New York City time, on the expiration date. We will deliver the Exchange Notes promptly after the expiration date. 2016 Notes will be validly tendered and not validly withdrawn if they are tendered in accordance with the terms of the exchange offer as detailed under “The Exchange Offer — Procedures for Tendering 2016 Notes” and not withdrawn in accordance with the terms of the exchange offer as detailed under “The Exchange Offer — Withdrawal of Tenders.” |

United States Federal Tax Consequences | We believe that the exchange of 2016 Notes for Exchange Notes generally will not be a taxable exchange for federal tax purposes, but you should consult your tax adviser about the tax consequences of this exchange. See “Certain United States Federal Tax Consequences.” |

Exchange Agent | Wells Fargo Bank, N.A., the trustee under the Indenture, is serving as exchange agent in connection with the exchange offer. The mailing address of the exchange agent is set forth on the cover page of the letter of transmittal. |

Fees and Expense | We will bear all expenses related to consummating the exchange offer and complying with the registration rights agreement. |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Exchange Notes. We received net proceeds of approximately $223.3 million from the issuance of the 2016 Notes. We used the net proceeds to fund the Refinancing Transactions and for general corporate purposes. |

Regulatory Approvals | Other than the federal securities laws, there are no federal or state regulatory requirements that we must comply with and there are no approvals that we must obtain in connection with the exchange offer. |

10

Table of Contents

Summary Description of the Exchange Notes

The terms of the Exchange Notes are identical in all material respects to those of the 2016 Notes except for transfer restrictions and registration rights that do not apply to the Exchange Notes. The Exchange Notes will evidence the same debt as the 2016 Notes, and the same Indenture will govern the Exchange Notes as the 2016 Notes and the Existing 4.875% Notes. The summary below describes the principal terms of the Exchange Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the Exchange Notes.

Issuer | Cinemark USA, Inc. |

Exchange Notes Offered | $225,000,000 aggregate principal amount of 4.875% of Senior Notes due 2023, registered under the Securities Act. The Exchange Notes offered hereby will be issued as additional notes under the Indenture pursuant to which, on May 24, 2013, we issued $530,000,000 aggregate principal amount of the Existing 4.875% Notes. The Exchange Notes offered hereby will be treated as a single series with the Existing 4.875% Notes under the Indenture and will have substantially the same terms as the Existing 4.875% Notes. Holders of the Exchange Notes offered hereby and the Existing 4.875% Notes will vote as one series under the Indenture. |

Maturity Date | June 1, 2023. |

Interest Rate | The Exchange Notes will bear interest at the rate of 4.875% per annum, accruing from December 1, 2015, the last day interest was paid on the Existing 4.875% Notes. Accrued interest on the Exchange Notes was paid by purchasers of the 2016 Notes from December 1, 2015, to the date of the issuance of the 2016 Notes. |

Interest Payment Dates | Interest on the Exchange Notes will be payable on June 1 and December 1 of each year, beginning on June 1, 2016. |

CUSIP and ISIN Numbers | Upon the consummation of the exchange offer, the CUSIP and ISIN numbers for the Exchange Notes will be automatically merged with the CUSIP and ISIN numbers for the Existing 4.875% Notes, at which point we expect that the Exchange Notes will be fungible with the Existing 4.875% Notes. |

Guarantees | The Exchange Notes will be fully and unconditionally guaranteed on a joint and several senior unsecured basis by certain of our subsidiaries that guarantee, assume or in any other manner become liable with respect to any of our or our guarantors’ other debt. If we cannot make payments on the Exchange Notes when they are due, our guarantors must make them instead. Subject to certain customary release provisions, the guarantees may be released without action by, or the consent of, the holders of the Exchange Notes. See “Description of Exchange Notes — Subsidiary Guarantees.” |

11

Table of Contents

Ranking | The Exchange Notes and the guarantees will be our and our guarantors’ senior unsecured obligations and they will: |

| • | rank equally in right of payment to our and our guarantors’ existing and future senior debt, including borrowings under our Senior Secured Credit Facility, and the Existing Senior Notes; |

| • | rank senior in right of payment to our and our guarantors’ future subordinated debt; |

| • | be effectively subordinated to all of our and our guarantors’ existing and future secured debt, to the extent of the value of the collateral securing such debt, including our obligations under our Senior Secured Credit Facility; and |

| • | be structurally subordinated to all existing and future debt and other liabilities of our non-guarantor subsidiaries (other than indebtedness and other liabilities owed to us). |

| As of December 31, 2015, on an as adjusted basis, after giving effect to the Refinancing Transactions, the Exchange Notes would have been: |

| • | effectively subordinated to $679.0 million of our senior secured debt; and |

| • | structurally subordinated to $261.6 million of debt and other liabilities (excluding indebtedness and other liabilities owed to us) of our non-guarantor subsidiaries. |

| For the year ended December 31, 2015, our non-guarantor subsidiaries generated in the aggregate $764.6 million, or 26.8%, of our consolidated revenues. As of December 31, 2015, our nonguarantor subsidiaries accounted for $1,239.1 million, or 30.0%, of our consolidated total assets and their indebtedness and other liabilities (excluding indebtedness and other liabilities owed to us) were $261.6 million in the aggregate. |

Optional Redemption | Prior to June 1, 2018, we may redeem all or any part of the Exchange Notes at our option at 100% of the principal amount plus a make-whole premium. We may redeem all or a part of the Exchange Notes at any time on or after June 1, 2018 at the redemption prices described in this prospectus. In addition, prior to June 1, 2016, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes with funds in an amount equal to the net proceeds of certain equity offerings at 104.875% of the principal amount thereof. See “Description of Exchange Notes — Optional Redemption.” |

Change of Control | If we or Cinemark Holdings experience specific kinds of changes of control, we must offer to repurchase all of the Exchange Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. |

Covenants | The Exchange Notes will be issued under the Indenture pursuant to which we issued the Existing 4.875% Notes on May 24, 2013. The |

12

Table of Contents

Indenture contains restrictive covenants that restrict our and our restricted subsidiaries ability to take certain actions. For a more detailed description, please see “Description of Exchange Notes —Certain Covenants.” |

For a discussion of certain risks that should be considered in connection with an investment in the Exchange Notes, see “Risk Factors” beginning on page 16.

13

Table of Contents

Summary Historical Condensed Consolidated Financial and Operating Data

The following tables set forth our summary historical consolidated financial and operating data as of and for the periods indicated. Our summary historical consolidated financial data as of December 31, 2014 and 2015 and for the years ended December 31, 2013, 2014 and 2015 are derived from our audited consolidated financial statements included elsewhere in this prospectus. Our summary historical consolidated financial data as of December 31, 2013 are derived from our audited consolidated financial statements not included or incorporated by reference in this prospectus.

You should read the summary historical consolidated financial and operating data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2013 | 2014 | 2015 | ||||||||||

Statement of Operations Data (in thousands): | ||||||||||||

Revenues: | ||||||||||||

Admissions | $ | 1,706,145 | $ | 1,644,169 | $ | 1,765,519 | ||||||

Concession | 845,168 | 845,376 | 936,970 | |||||||||

Other | 131,581 | 137,445 | 150,120 | |||||||||

|

|

|

|

|

| |||||||

Total revenues | $ | 2,682,894 | $ | 2,626,990 | $ | 2,852,609 | ||||||

Cost of Operations: | ||||||||||||

Film rentals and advertising | 919,511 | 883,052 | 976,590 | |||||||||

Concession supplies | 135,715 | 131,985 | 144,270 | |||||||||

Salaries and wages | 269,353 | 273,880 | 301,099 | |||||||||

Facility lease expense | 307,851 | 317,096 | 319,761 | |||||||||

Utilities and other | 305,703 | 308,445 | 324,851 | |||||||||

General and administrative expenses | 163,134 | 148,588 | 154,052 | |||||||||

Depreciation and amortization | 163,970 | 175,656 | 189,206 | |||||||||

Impairment of long-lived assets | 3,794 | 6,647 | 8,801 | |||||||||

(Gain) loss on sale of assets and other | (3,845 | ) | 15,715 | �� | 8,143 | |||||||

|

|

|

|

|

| |||||||

Total cost of operations | $ | 2,265,186 | $ | 2,261,064 | $ | 2,426,773 | ||||||

|

|

|

|

|

| |||||||

Operating income | $ | 417,708 | $ | 365,926 | $ | 425,836 | ||||||

|

|

|

|

|

| |||||||

Other expense: | ||||||||||||

Interest expense | $ | 124,714 | $ | 113,698 | $ | 112,741 | ||||||

|

|

|

|

|

| |||||||

Net income | $ | 151,921 | $ | 195,769 | $ | 220,391 | ||||||

|

|

|

|

|

| |||||||

Net income attributable to Cinemark USA, Inc. | $ | 149,843 | $ | 194,380 | $ | 218,532 | ||||||

|

|

|

|

|

| |||||||

Other Financial Data (in thousands, except for ratios): | ||||||||||||

Ratio of earnings to fixed charges(1) | 2.24x | 2.42x | 2.69x | |||||||||

Cash flow provided by (used for): | ||||||||||||

Operating activities | $ | 309,362 | $ | 454,128 | $ | 455,225 | ||||||

Investing activities | $ | (364,701 | ) | $ | (253,339 | ) | $ | (328,122 | ) | |||

Financing activities | $ | (75,346 | ) | $ | (146,320 | ) | $ | (150,509 | ) | |||

Capital expenditures | $ | (259,670 | ) | $ | (244,705 | ) | $ | (331,726 | ) | |||

14

Table of Contents

| As of and for the Year Ended December 31, | ||||||||||||

| 2013 | 2014 | 2015 | ||||||||||

Balance Sheet Data (in thousands): | ||||||||||||

Cash and cash equivalents | $ | 599,894 | $ | 638,841 | $ | 588,503 | ||||||

Theatre properties and equipment, net | $ | 1,427,190 | $ | 1,450,812 | $ | 1,505,069 | ||||||

Total assets(2) | $ | 4,107,480 | $ | 4,133,116 | $ | 4,127,632 | ||||||

Total long-term debt and capital lease obligations, including current portion(5) | $ | 2,012,508 | $ | 1,791,578 | $ | 1,781,335 | ||||||

Equity | $ | 1,104,281 | $ | 1,136,723 | $ | 1,113,251 | ||||||

Operating Data (attendance in thousands): | ||||||||||||

United States | ||||||||||||

Theatres operated (at period end) | 334 | 335 | 337 | |||||||||

Screens operated (at period end) | 4,457 | 4,499 | 4,518 | |||||||||

Total attendance | 177,156 | 173,864 | 179,601 | |||||||||

International | ||||||||||||

Theatres operated (at period end) | 148 | 160 | 176 | |||||||||

Screens operated (at period end) | 1,106 | 1,177 | 1,278 | |||||||||

Total attendance | 99,402 | 90,009 | 100,499 | |||||||||

Worldwide | ||||||||||||

Theatres operated (at period end) | 482 | 495 | 513 | |||||||||

Screens operated (at period end) | 5,563 | 5,676 | 5,796 | |||||||||

Total attendance | 276,558 | 263,873 | 280,100 | |||||||||

| (1) | For the purposes of calculating the ratio of earnings to fixed charges, earnings consist of income from continuing operations before income taxes plus fixed charges excluding capitalized interest. Fixed charges consist of interest expense, capitalized interest, amortization of debt issue costs and that portion of rental expense which we believe to be representative of the interest factor. |

| (2) | Effective December 31, 2015, the Company adopted Accounting Standards Update 2015-03 Interest —Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs (“ASU2015-03”), which resulted in the presentation of debt issuance costs as a contra-account to the related debt instruments. The revised presentation was applied for all periods presented. See Note 2 to the consolidated financial statements included elsewhere in this prospectus for additional information. |

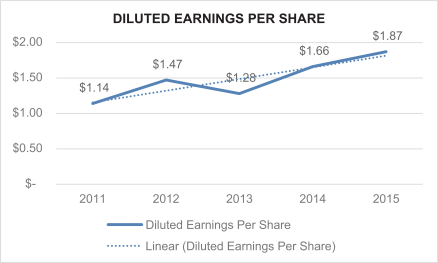

RATIO OF EARNINGS TO FIXED CHARGES

Our ratio of earnings to fixed charges for the years ended December 31, 2011, 2012, 2013, 2014, and 2015 was 2.02, 2.45, 2.24, 2.42 and 2.69, respectively. For the purposes of calculating the ratio of earnings to fixed charges, earnings consist of income from continuing operations before taxes plus fixed charges excluding capitalized interest. Fixed charges consist of interest expense, capitalized interest, amortization of debt issue costs and that portion of rental expense which we believe to be representative of the interest factor.

15

Table of Contents

You should consider carefully the following risks and other information included in this prospectus, including our financial statements and related notes and schedules, before you decide to participate in this exchange offer. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of the Exchange Notes could decline, perhaps significantly, and our ability to pay principal and interest on the Exchange Notes could be adversely affected.

Risks Related to the Exchange Notes and this Exchange Offer

Your failure to participate in the exchange offer may have adverse consequences.

If you do not exchange your 2016 Notes for Exchange Notes pursuant to the exchange offer, you will continue to be subject to the restrictions on transfer of your 2016 Notes, as set forth in the legend on your 2016 Notes. The restrictions on transfer of your 2016 Notes arise because we sold the 2016 Notes in private offerings. In general, the 2016 Notes may not be offered or sold, unless registered under the Securities Act or pursuant to an exemption from, or in a transaction not subject to, such requirements.

After completion of the exchange offer, holders of 2016 Notes who do not tender their 2016 Notes in the exchange offer will no longer be entitled to any exchange or registration rights under the registration rights agreement, except under limited circumstances. The tender of 2016 Notes under the exchange offer will reduce the principal amount of the currently outstanding 2016 Notes. Due to the corresponding reduction in liquidity, this may have an adverse effect upon, and increase the volatility of, the market price of any currently outstanding 2016 Notes that you continue to hold following completion of the exchange offer.

In addition, we expect that the Exchange Notes will share a single CUSIP and ISIN number with the Existing 4.875% Notes and we expect that such Exchange Notes and the Existing 4.875% Notes will thereafter be fungible. If you do not exchange your 2016 Notes for Exchange Notes pursuant to the exchange offer, your 2016 Notes will continue to trade under separate CUSIP and ISIN numbers and will not be fungible with the Existing 4.875% Notes, which may adversely affect the liquidity of such notes and cause such notes to trade at different prices than the Exchange Notes and the Existing 4.875% Notes. See “The Exchange Offer.”

You must comply with the exchange offer procedures in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for 2016 Notes tendered and accepted for exchange pursuant to the exchange offer will be made provided the procedures for tendering the 2016 Notes are followed. We are not required to notify you of defects or irregularities in tenders of 2016 Notes for exchange. See “The Exchange Offer.”

Some holders who exchange their 2016 Notes may be deemed to have received restricted securities, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your 2016 Notes in the exchange offer for the purpose of participating in a distribution of the Exchange Notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

An active trading market for the Exchange Notes may not develop.

The Exchange Notes will not be listed on any securities exchange or included in any automated quotation system. There can be no assurance that a trading market for the Exchange Notes will be maintained. Further,

16

Table of Contents

there can be no assurance as to the liquidity of any market that may develop for the Exchange Notes, your ability to sell your Exchange Notes or the price at which you will be able to sell your Exchange Notes. Future trading prices of the Exchange Notes will depend on many factors, including prevailing interest rates, our financial condition and results of operations, the then-current ratings assigned to the Exchange Notes, the market for similar securities and the results of our competitors. Any trading market that develops would be affected by many factors independent of and in addition to the foregoing, including:

| • | time remaining to the maturity of the Notes; |

| • | outstanding amount of the Notes; |

| • | the terms related to optional redemption of the Notes; and |

| • | level, direction and volatility of market interest rates generally. |

Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the Exchange Notes. The market, if any, for the Exchange Notes may not be free from similar disruptions, and any such disruptions may adversely affect the prices at which you may sell your Exchange Notes. You may not be able to sell your Exchange Notes at a particular time, and the price that you receive when you sell may not be favorable.

We have substantial long-term lease and debt obligations, which may restrict our ability to fund current and future operations and that restrict our ability to enter into certain transactions.

We have, and will continue to have, significant long-term debt service obligations and long-term lease obligations. As of December 31, 2015, on an as adjusted basis after giving effect to the Refinancing Transactions, we would have had $1,839.6 million in long-term debt obligations (which includes the 5.125% Senior Notes and the Notes), $227.7 million in capital lease obligations and $1,699.9 million in long-term operating lease obligations. Our substantial lease and debt obligations pose risk by:

| • | requiring us to dedicate a substantial portion of our cash flows to payments on our lease and debt obligations, thereby reducing the availability of our cash flows from operations to fund working capital, capital expenditures, acquisitions and other corporate requirements and to pay dividends; |

| • | impeding our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions and general corporate purposes; |

| • | subjecting us to the risk of increased sensitivity to interest rate increases on our variable rate debt, including our borrowings under our Senior Secured Credit Facility; |

| • | limiting our ability to invest in innovations in technology and implement new platforms or concepts in our theatres; and |

| • | making us more vulnerable to a downturn in our business and competitive pressures and limiting our flexibility to plan for, or react to, changes in our industry or the economy. |

Our ability to make scheduled payments of principal and interest with respect to our indebtedness will depend on our ability to generate positive cash flows and on our future financial results. Our ability to generate positive cash flows is subject to general economic, financial, competitive, regulatory and other factors that are beyond our control. We may not be able to continue to generate cash flows at current levels, or guarantee that future borrowings will be available under our Senior Secured Credit Facility, in an amount sufficient to enable us to pay our indebtedness. If our cash flows and capital resources are insufficient to fund our lease and debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We may not be able to take any of these actions, and these actions may not be successful or permit us to meet our scheduled debt service obligations and these actions may be restricted under the terms of our existing or future debt agreements, including our Senior Secured Credit Facility and the indentures governing the Notes and the 5.125% Senior Notes.

17

Table of Contents

If we fail to make any required payment under the agreements governing our leases and indebtedness or fail to comply with the financial and operating covenants contained in them, we would be in default, and as a result, our debt holders would have the ability to require that we immediately repay our outstanding indebtedness and the lenders under our Senior Secured Credit Facility could terminate their commitments to lend us money and foreclose against the assets securing their borrowings. We could be forced into bankruptcy or liquidation. The acceleration of our indebtedness under one agreement may permit acceleration of indebtedness under other agreements that contain cross-default and cross-acceleration provisions. If our indebtedness is accelerated, we may not be able to repay our indebtedness or borrow sufficient funds to refinance it. Even if we are able to obtain new financing, it may not be on commercially reasonable terms or on terms that are acceptable to us. If our debt holders require immediate payment, we may not have sufficient assets to satisfy our obligations under our indebtedness

We may incur substantial additional indebtedness, including additional secured debt.

Subject to the restrictions in our Senior Secured Credit Facility, our indentures governing the Notes and the 5.125% Senior Notes, and instruments governing our other outstanding debt, we and our subsidiaries may incur substantial additional debt in the future, including substantial secured debt. Although such debt instruments contain restrictions on the incurrence of additional debt, these restrictions are subject to a number of significant qualifications and exceptions, and debt (including secured debt) incurred in compliance with these restrictions could be substantial. To the extent new debt is added to our current debt levels, the substantial leverage-related risks described above would increase. As of December 31, 2015, there was $679.0 million outstanding under the term loan and no borrowings outstanding under the revolving credit line of our Senior Secured Credit Facility. If we or any of our subsidiaries that is a guarantor of the Notes incur any additional debt that ranks equally with the Notes (or with the guarantee thereof), including trade payables, the holders of that debt will be entitled to share ratably with holders of Notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us or such guarantor. If we or any of our subsidiaries that is a guarantor of the notes incur any additional secured debt, the holders of that debt will have recourse to the assets securing that debt prior to any distribution to unsecured creditors, including the holders of the Notes. Accordingly, additional debt, and in particular, additional secured debt, may reduce the amount of proceeds paid to holders of the Notes in connection with such a distribution.

To service our indebtedness, we will require a significant amount of cash, and our ability to generate cash flow depends on many factors beyond our control.