|

Exhibit 99.2

|

Exhibit 99.2

Restatement and Business Update Call

December 30, 2014

©2014 Accretive Health Inc.

1

Safe Harbor

This presentation contains forward-looking statements, including the Company’s ability to continue to achieve operating efficiencies, improve long-term profitability and generate specified levels of cash from contracting activities. All forward-looking statements contained in this press release involve risks and uncertainties. Our actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the possibility that our ongoing restatement could have unanticipated consequences and the factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on December 30, 2014, under the heading “Risk Factors”. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this presentation are expressly qualified in their entirety by these cautionary statements. The Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove correct.

The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

2 ©2014 Accretive Health Inc.

Emad Rizk, M.D.

President & CEO

Introduction

3 ©2014 Accretive Health Inc.

Agenda

CEO Perspectives

Joining Accretive Health

Market dynamics

Accretive Health today

CEO Actions to date

Leadership team

Operational changes

Competitive Differentiators

Financials

Restatement

Financial outlook

Closing Remarks

4 ©2014 Accretive Health Inc.

Market Dynamics

Increasingly complex healthcare delivery system

Migration from fee-for-service to value-based payment models

Hospitals shifting attention to improving revenue cycle

Hospital consolidation is an ongoing trend; we are well positioned to serve complex integrated delivery networks (IDNs)

Three of top 10 IDNs are Accretive Health customers

5 ©2014 Accretive Health Inc.

Our Market Presence

83 hospitals

$17 billion in customers’ net patient revenue (NPR)

2,800 employees in the U.S. and India

Manage over 6,500 FTE’s in the field

Experienced management team with extensive healthcare expertise

Track record of performance:

On average, we have delivered:

10% to 30% reduction in customers’ cost to collect

Greater than 4% revenue yield improvement as contracts mature

6 ©2014 Accretive Health Inc.

CEO Actions since July 2014

Met with customers and prospects

Added experienced healthcare executives to leadership team

Operational changes:

Redeployed PAS, and population health capabilities into RCM

Developed a disciplined operational excellence playbook

Expanding our shared service center capabilities and infrastructure

Increasing IT spend to support growth and help customer migration from fee-for-service to value-based payment models

Investing in better training for our customer-facing workforce

7 ©2014 Accretive Health Inc.

Accretive Health’s Competitive Positioning

Flexible delivery model: on-site teams, and/or remote shared services

Solutions deployed through combination of software and services generate better outcomes

Integrated RCM solution addresses growing interdependency between clinical and financial reimbursement drivers

Proprietary technology serves customer needs, and we automate our operations

Seasoned management team with extensive healthcare experience

Win-win proposition: our success is aligned with customers

Low- or no-cost of entry results in high customer ROI

8 ©2014 Accretive Health Inc.

Peter Csapo

Chief Financial Officer

Financial Discussion

9 ©2014 Accretive Health Inc.

Restatement Focus Areas

Timing of revenue recognition for RCM agreements

Presentation of base fees: Base fees now presented net of costs reimbursed to customers

Software capitalization: Costs associated with development of internal use software expensed rather than capitalized

Other adjustments: Adjustments to goodwill, timing and recording of various accruals, income taxes and other miscellaneous items

Reviewed facts and circumstances related to accounting errors that resulted in the restatement and, based on that review, we are unaware of any fraud

Internal controls: A number of internal controls require remediation

10 ©2014 Accretive Health Inc.

Targeted Timeline

Today: Completed restatement and filed 2013 Form 10-K

First half of 2015: Complete 2014 SEC filings

After 2014 filings are completed: Apply for stock exchange listing

Annual shareholder meeting: ~90 days after 2014 Form 10-K

Ongoing: Improvement in internal controls

11 ©2014 Accretive Health Inc.

Restatement Item #1: Timing of Revenue Recognition

Almost all revenue from RCM agreements is deferred until substantially later than when we deliver services, bill and collect cash from customers

RCM revenue is recognized when we reach agreement with customers on value generated—typically upon contract renewal or at the end of a contract

Applies to both Net Operating Fees and Incentive Fees

Effect on financial statements:

Large variation in GAAP revenue and earnings

Cash flow dynamics unchanged

12 ©2014 Accretive Health Inc.

Restatement Item #2: Net Operating Fees

Base fees are presented as Net Operating Fees

Net Operating Fees consist of invoiced Base Fees, less: costs reimbursed to customers customer portion of shared savings

Effect on financial statements:

Net Operating Fees substantially lower than previously reported Base Fees due to netting of customer costs

Cash flow dynamics unchanged

No change in profitability

13 ©2014 Accretive Health Inc.

Restatement Item #3: Software Capitalization

Internally developed software expensed as incurred

Hardware and purchased software costs that advance the company’s technology capabilities will continue to be capitalized

Effect on financial statements:

Higher current period costs

No effect on overall cash flows

14 ©2014 Accretive Health Inc.

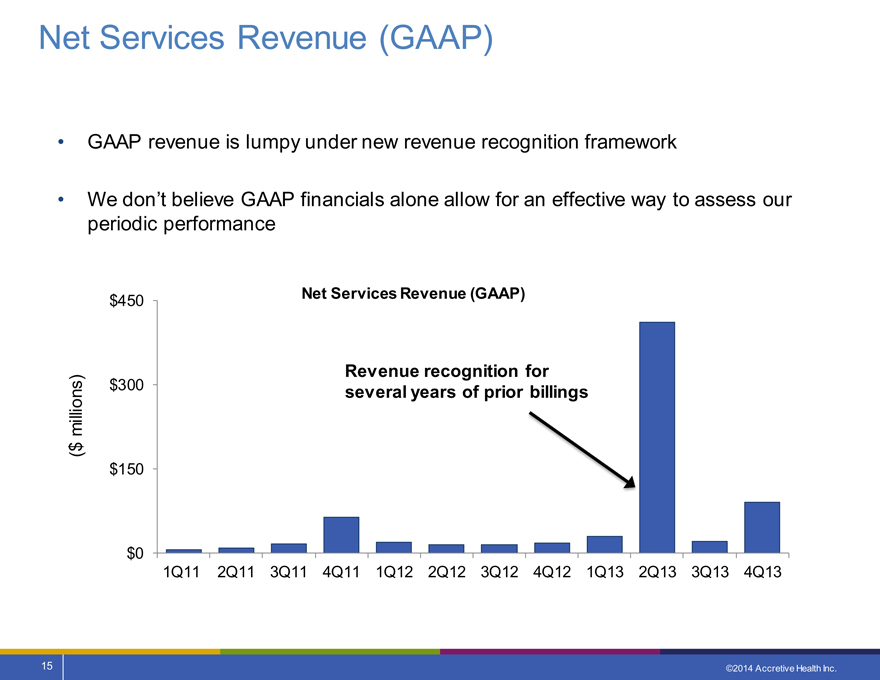

Net Services Revenue (GAAP)

GAAP revenue is lumpy under new revenue recognition framework

We don’t believe GAAP financials alone allow for an effective way to assess our periodic performance

$450

millions) $300 $ ( $150

$0

Net Services Revenue (GAAP)

Revenue recognition for several years of prior billings

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

15 ©2014 Accretive Health Inc.

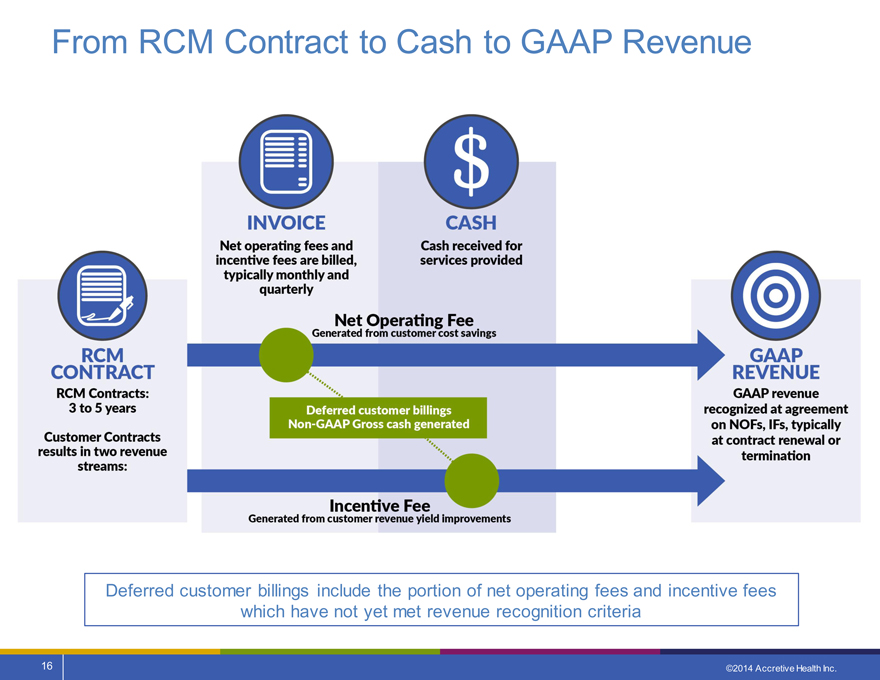

From RCM Contract to Cash to GAAP Revenue

Deferred customer billings include the portion of net operating fees and incentive fees which have not yet met revenue recognition criteria

16 ©2014 Accretive Health Inc.

Non-GAAP Measures

We are introducing two non-GAAP measures to provide a more accurate view of our operations:

Gross Cash Generated from Customer Contracting Activities

GAAP revenue plus change in deferred customer billings

Net Cash Generated from Customer Contracting Activities

GAAP net income less interest, taxes, depreciation and amortization expense, share-based compensation, and one-time costs, plus change in deferred customer billings

17 ©2014 Accretive Health Inc.

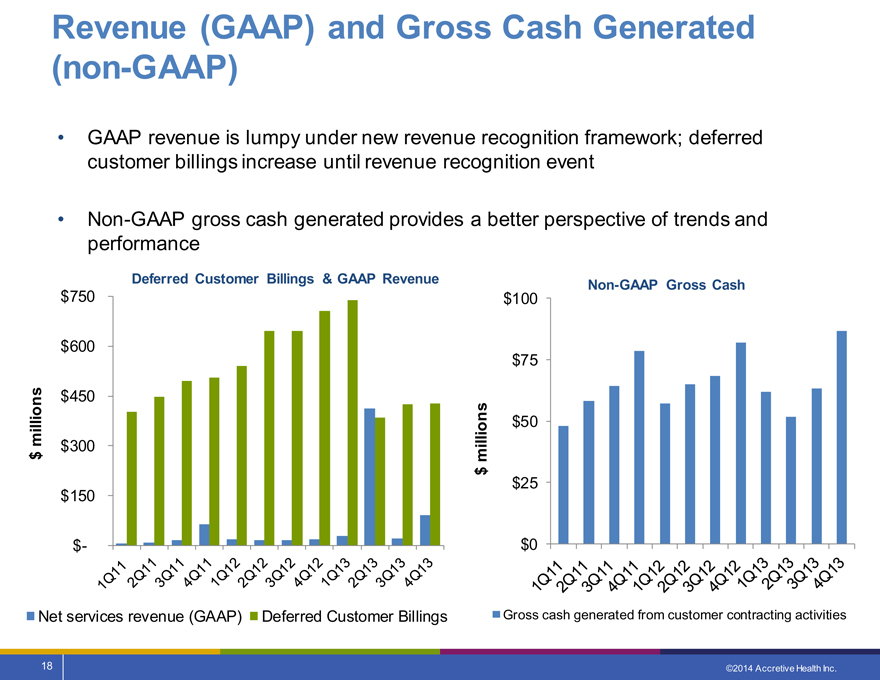

Revenue (GAAP) and Gross Cash Generated (non-GAAP)

GAAP revenue is lumpy under new revenue recognition framework; deferred customer billings increase until revenue recognition event

Non-GAAP gross cash generated provides a better perspective of trends and performance

Deferred Customer Billings & GAAP Revenue Non-GAAP Gross Cash

$750

$600

millions $450 $ $300 $150

$-

$100

$75

millions $50 $ $25

$0

Net services revenue (GAAP) Deferred Customer Billings Gross cash generated from customer contracting activities

18 ©2014 Accretive Health Inc.

2011 – 2013 Performance

19 ©2014 Accretive Health Inc.

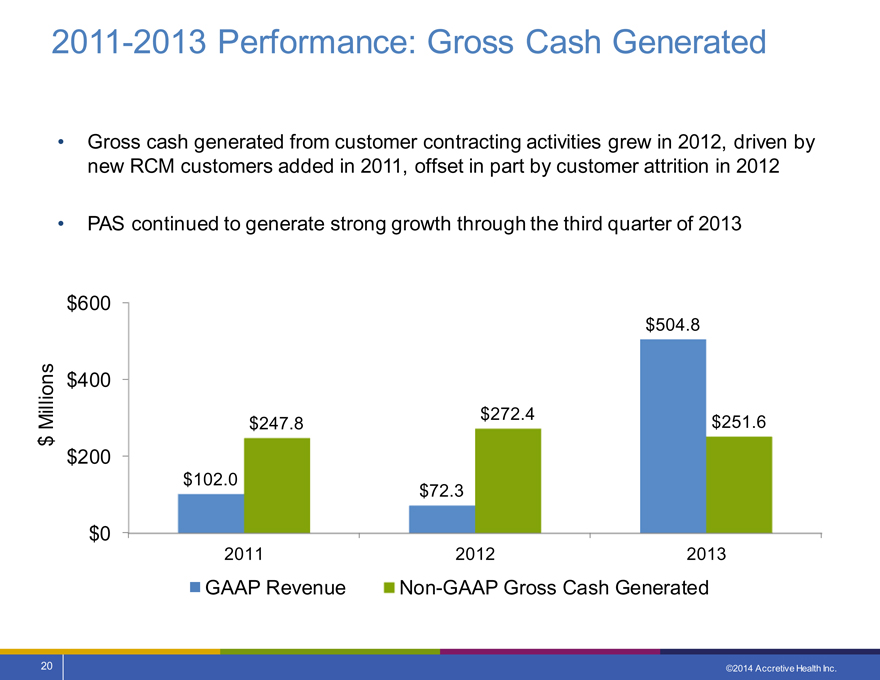

2011-2013 Performance: Gross Cash Generated

Gross cash generated from customer contracting activities grew in 2012, driven by new RCM customers added in 2011, offset in part by customer attrition in 2012

PAS continued to generate strong growth through the third quarter of 2013

$600

Millions $400 $ $200

$0

$504.8

$272.4 $247.8 $251.6

$102.0 $72.3

2011 2012 2013

GAAP Revenue Non-GAAP Gross Cash Generated

20 ©2014 Accretive Health Inc.

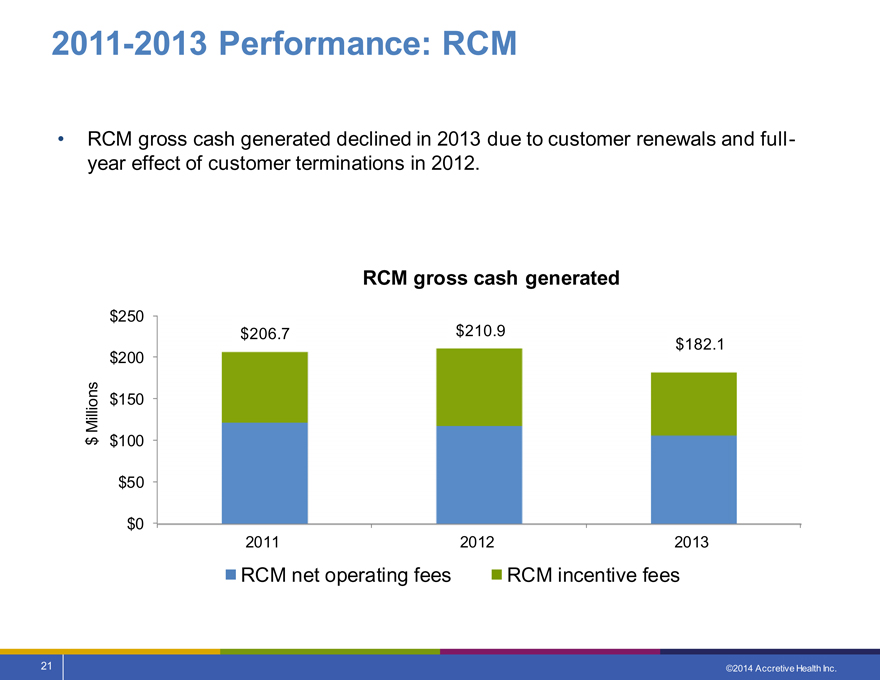

2011-2013 Performance: RCM

RCM gross cash generated declined in 2013 due to customer renewals and full-year effect of customer terminations in 2012.

RCM gross cash generated

$250

$200

Millions $150 $ $100

$50

$0

$206.7 $210.9 $182.1

2011 2012 2013

RCM net operating fees RCM incentive fees

21 ©2014 Accretive Health Inc.

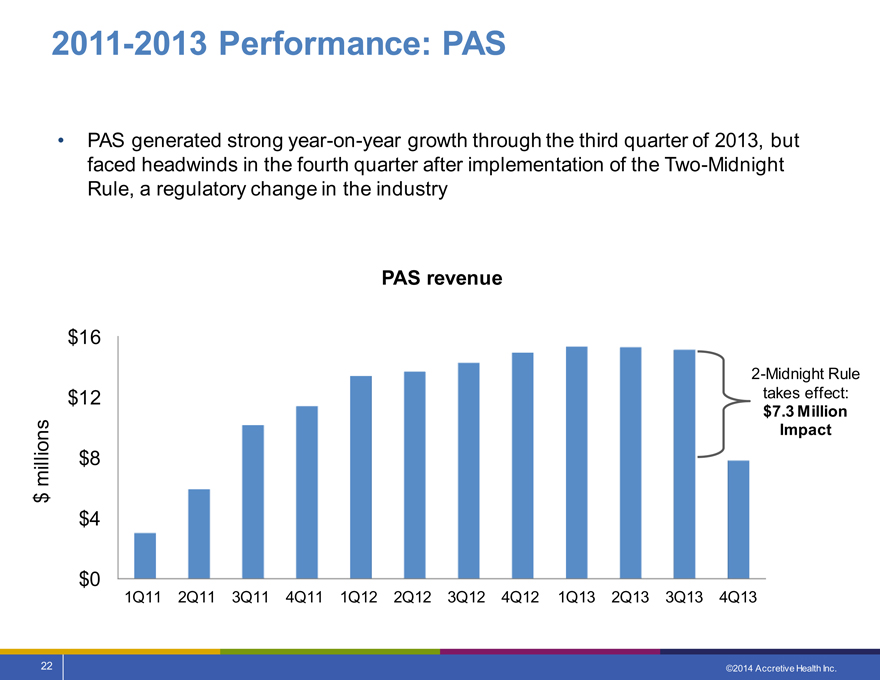

2011-2013 Performance: PAS

PAS generated strong year-on-year growth through the third quarter of 2013, but faced headwinds in the fourth quarter after implementation of the Two-Midnight Rule, a regulatory change in the industry

PAS revenue

$16

$12 millions $8 $ $4

$0

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

2-Midnight Rule takes effect: $7.3 Million Impact

22 ©2014 Accretive Health Inc.

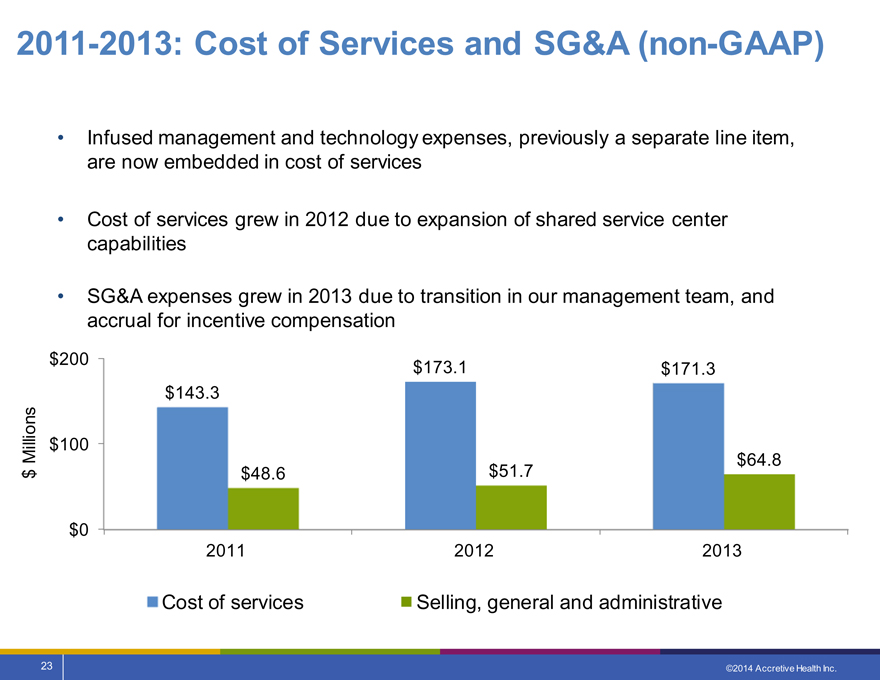

2011-2013: Cost of Services and SG&A (non-GAAP)

Infused management and technology expenses, previously a separate line item, are now embedded in cost of services

Cost of services grew in 2012 due to expansion of shared service center capabilities

SG&A expenses grew in 2013 due to transition in our management team, and accrual for incentive compensation

$200

Millions $100 $

$0

$173.1 $171.3 $143.3

$64.8 $48.6 $51.7

2011 2012 2013

Cost of services Selling, general and administrative

23 ©2014 Accretive Health Inc.

Financial Outlook

2014 and 2015

24 ©2014 Accretive Health Inc.

Financial Outlook

2014 Expectations

Gross cash generated: $223 million to $233 million

Net cash generated: $5 million to $10 million

25 ©2014 Accretive Health Inc.

Financial Outlook

2015 Preliminary expectations

Gross cash generated: $225 million to $235 million

Net cash generated: $30 million to $40 million

26 ©2014 Accretive Health Inc.

Emad Rizk, M.D.

President & CEO

27 ©2014 Accretive Health Inc.

2015 Strategic Priorities

1. Continue to roll out our disciplined operational excellence model

2. Focus on growing NPR

3. Continue to invest in our technology infrastructure

28 ©2014 Accretive Health Inc.

Questions and Answers

29 ©2014 Accretive Health Inc.

Appendix

30 ©2014 Accretive Health Inc.

Use of Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by Accretive Health’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which are included in this press release. These include gross and net cash generated from customer contracting activities, and adjusted EBITDA.

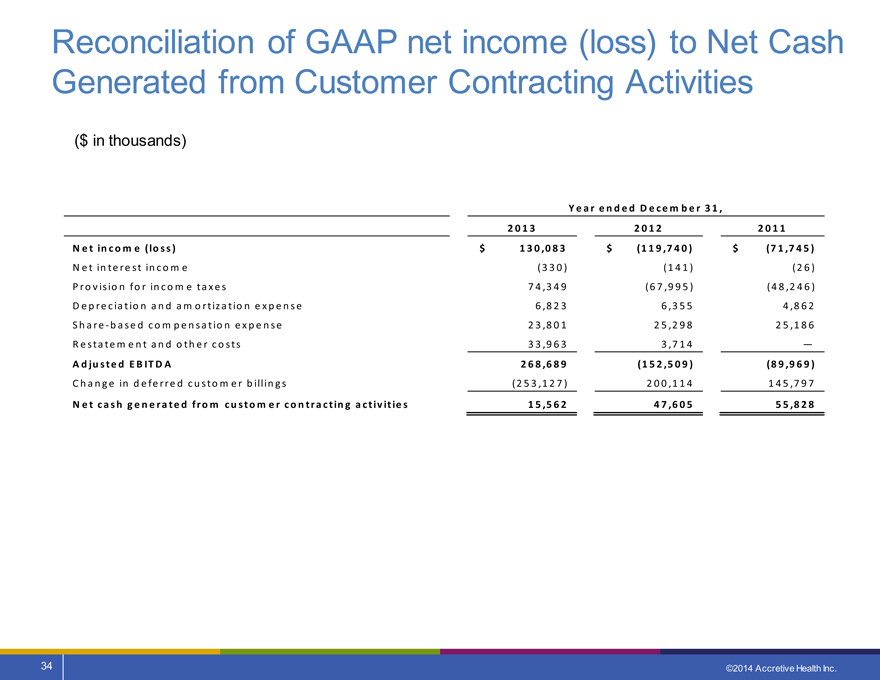

Gross cash generated from customer contracting activities reflects GAAP net services revenue and the change in deferred customer billings. Net cash generated from customer contracting activities reflects non-GAAP adjusted EBITDA and the change in deferred customer billings.

Adjusted EBITDA is defined as net income before net interest income, provision for income taxes, depreciation and amortization expense, share-based compensation and certain non-recurring, or one-time, items. The use of adjusted EBITDA to measure financial and operating performance is limited in that under GAAP, net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately match corresponding cash flows from customer contracting activities. As a result, the Company uses gross cash and net cash generated from customer contracting activities to better compare cash flows to operating performance.

Deferred customer billings include the portion of both invoiced net operating fees and cash collections related to incentive fees that, in each case, have not met the Company’s revenue recognition criteria. Deferred customer billings are included in the detail of the customer liabilities account in the consolidated balance sheet available on the Company’s Annual Report on Form 10-K.

Slide 33 presents a reconciliation of GAAP revenue to gross cash generated from customer contracting activities, and slide 34 presents a reconciliation of GAAP net income (loss), the most comparable GAAP measure, to adjusted EBITDA and net cash generated from customer contracting activities, in each case, for each of the periods indicated. These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP.

31 ©2014 Accretive Health Inc.

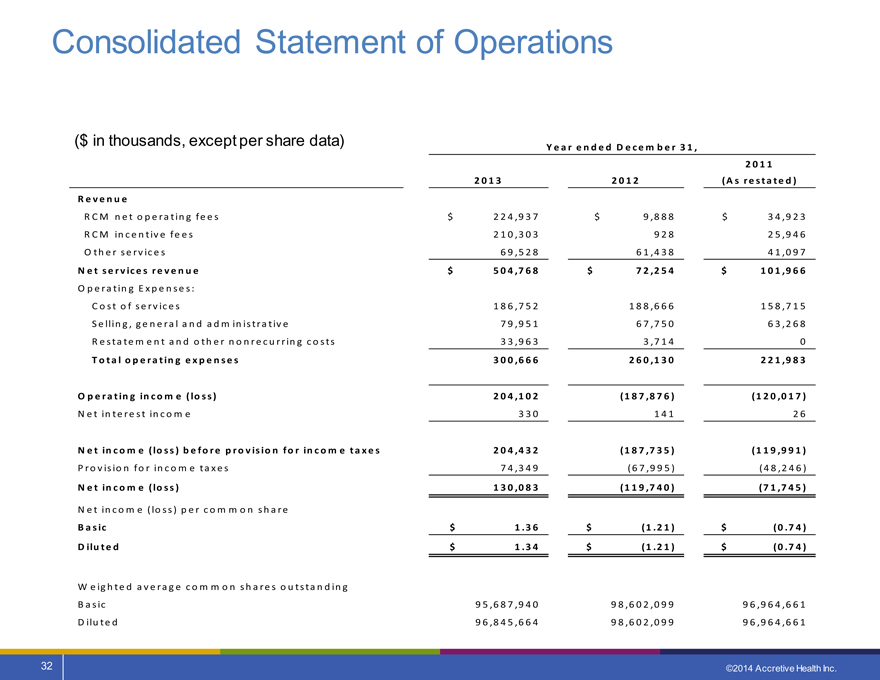

Consolidated Statement of Operations

($ in thousands, except per share data)

Y e a r e n d e d D e c e m b e r 3 1 ,

R e v e n u e

R C M n e t o p e ra tin g fe e s R C M in c e n tiv e fe e s O th e r se rv ic e s

N e t s e rv ic e s re v e n u e

O p e ra tin g E x p e n se s:

C o st o f se rv ic e s

S e llin g , g e n e ra l a n d a d m in istra tiv e

R e sta te m e n t a n d o th e r n o n r e c u r rin g c o sts

T o ta l o p e ra tin g e x p e n s e s

O p e ra tin g in c o m e (lo s s )

N e t in te re st in c o m e

N e t in c o m e (lo s s ) b e fo re p ro v is io n fo r in c o m e ta x e s

P ro v isio n fo r in c o m e ta x e s

N e t in c o m e (lo s s )

N e t in c o m e (lo ss) p e r c o m m o n sh a re

B a s ic

D ilu te d

W e ig h te d a v e ra g e c o m m o n sh a re s o u tsta n d in g B a sic D ilu te d

2 0 1 3

$ 2 2 4 ,9 3 7

2 1 0 ,3 0 3

6 9 ,5 2 8

$ 5 0 4 ,7 6 8

1 8 6 ,7 5 2

7 9 ,9 5 1

3 3 ,9 6 3

3 0 0 ,6 6 6

2 0 4 ,1 0 2

3 3 0

2 0 4 ,4 3 2

7 4 ,3 4 9

1 3 0 ,0 8 3

$ 1 .3 6

$ 1 .3 4

9 5 ,6 8 7 ,9 4 0

9 6 ,8 4 5 ,6 6 4

2 0 1 2

$ 9 ,8 8 8

9 2 8

6 1 ,4 3 8

$ 7 2 ,2 5 4

1 8 8 ,6 6 6

6 7 ,7 5 0

3 ,7 1 4

2 6 0 ,1 3 0

(1 8 7 ,8 7 6 )

1 4 1

(1 8 7 ,7 3 5 )

(6 7 ,9 9 5 )

(1 1 9 ,7 4 0 )

$ (1 .2 1 )

$ (1 .2 1 )

9 8 ,6 0 2 ,0 9 9

9 8 ,6 0 2 ,0 9 9

2 0 1 1 (A s re s ta te d )

$ 3 4 ,9 2 3

2 5 ,9 4 6

4 1 ,0 9 7

$ 1 0 1 ,9 6 6

1 5 8 ,7 1 5

6 3 ,2 6 8 0

2 2 1 ,9 8 3

(1 2 0 ,0 1 7 )

2 6

(1 1 9 ,9 9 1 )

(4 8 ,2 4 6 )

(7 1 ,7 4 5 )

$ (0 .7 4 )

$ (0 .7 4 )

9 6 ,9 6 4 ,6 6 1

9 6 ,9 6 4 ,6 6 1

©2014 Accretive Health Inc.

32

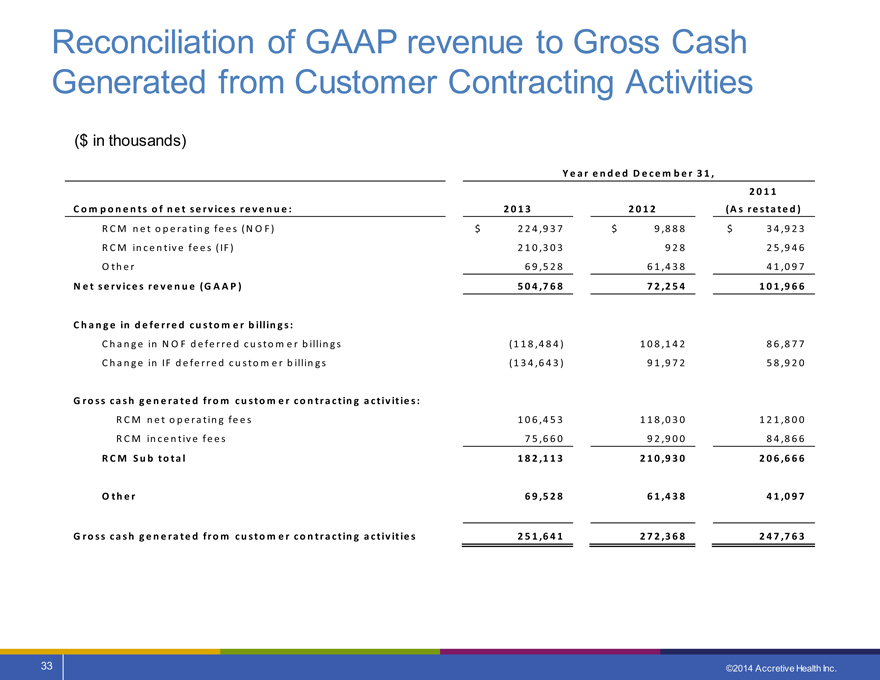

Reconciliation of GAAP revenue to Gross Cash Generated from Customer Contracting Activities

($ in thousands)

C o m p o n e n ts o f n e t se rv ice s re v e n u e :

R C M n e t o p e ra tin g fe e s (N O F ) R C M in c e n tiv e fe e s (IF ) O th e r

N e t se rv ice s re v e n u e (G A A P )

C h a n g e in d e fe rre d cu sto m e r b illin g s:

C h a n g e in N O F d e fe rre d c u sto m e r b illin g s

C h a n g e in IF d e fe rre d c u sto m e r b illin g s

G ro ss ca sh g e n e ra te d fro m cu sto m e r co n tra ctin g a ctiv itie s:

R C M n e t o p e ra tin g fe e s

R C M in c e n tiv e fe e s

R C M S u b to ta l

O th e r

G ro ss ca sh g e n e ra te d fro m cu sto m e r co n tra ctin g a ctiv itie s

Y e a r e n d e d D e ce m b e r 3 1 ,

2 0 1 3

$ 2 2 4 ,9 3 7

2 1 0 ,3 0 3

6 9 ,5 2 8

5 0 4 ,7 6 8

(1 1 8 ,4 8 4 )

(1 3 4 ,6 4 3 )

1 0 6 ,4 5 3

7 5 ,6 6 0

1 8 2 ,1 1 3

6 9 ,5 2 8

2 5 1 ,6 4 1

2 0 1 2

$ 9 ,8 8 8

9 2 8

6 1 ,4 3 8

7 2 ,2 5 4

1 0 8 ,1 4 2

9 1 ,9 7 2

1 1 8 ,0 3 0

9 2 ,9 0 0

2 1 0 ,9 3 0

6 1 ,4 3 8

2 7 2 ,3 6 8

2 0 1 1 (A s re sta te d )

$ 3 4 ,9 2 3

2 5 ,9 4 6

4 1 ,0 9 7

1 0 1 ,9 6 6

8 6 ,8 7 7

5 8 ,9 2 0

1 2 1 ,8 0 0

8 4 ,8 6 6

2 0 6 ,6 6 6

4 1 ,0 9 7

2 4 7 ,7 6 3

33 ©2014 Accretive Health Inc.

Reconciliation of GAAP net income (loss) to Net Cash Generated from Customer Contracting Activities

($ in thousands)

Y e a r e n d e d D e ce m b e r 3 1 ,

N e t in c o m e (lo ss )

N e t in te re st in c o m e

P ro v isio n fo r in c o m e ta x e s

D e p re c ia tio n a n d a m o rtiz a tio n e x p e n s e S h a re -b a se d c o m p e n sa tio n e x p e n se R e sta te m e n t a n d o th e r c o sts

A d ju ste d E B IT D A

C h a n g e in d e fe rre d c u sto m e r b illin g s

N e t ca sh g e n e ra te d fro m cu sto m e r co n tra ctin g a ctiv itie s

2 0 1 3

$ 1 3 0 ,0 8 3

(3 3 0 )

7 4 ,3 4 9

6 ,8 2 3

2 3 ,8 0 1

3 3 ,9 6 3

2 6 8 ,6 8 9

(2 5 3 ,1 2 7 )

1 5 ,5 6 2

2 0 1 2

$ (1 1 9 ,7 4 0 )

(1 4 1 )

(6 7 ,9 9 5 )

6 ,3 5 5

2 5 ,2 9 8

3 ,7 1 4

(1 5 2 ,5 0 9 )

2 0 0 ,1 1 4

4 7 ,6 0 5

2 0 1 1

$ (7 1 ,7 4 5 )

(2 6 )

(4 8 ,2 4 6 )

4 ,8 6 2

2 5 ,1 8 6

—

(8 9 ,9 6 9 )

1 4 5 ,7 9 7

5 5 ,8 2 8

34 ©2014 Accretive Health Inc.