- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

R1 RCM 425Business combination disclosure

Filed: 10 Jan 22, 6:17am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 9, 2022

R1 RCM Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-34746 | 02-0698101 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

434 W. Ascension Way Utah | 84123 | |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code (312) 324-7820

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading | Name of each exchange | ||

| Common stock, par value $0.01 per share | RCM | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the to use the extended transition period for complying with any new or revised financial accounting registrant has elected not standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

The Transaction Agreement

On January 9, 2022, R1 RCM Inc. (the “Company”), Project Roadrunner Parent Inc., a wholly owned subsidiary of the Company (“NewR1”), Project Roadrunner Merger Sub Inc., a wholly owned subsidiary of NewR1 (“R1 Merger Sub”), Coyco 1, L.P., a Delaware limited partnership (“Coyco 1”) and Coyco 2, L.P., a Delaware limited partnership (“Coyco 2” and, together with Coyco 1, the “Sellers”) entered into a Transaction Agreement and Plan of Merger (the “Transaction Agreement”), pursuant to which the Company has agreed to purchase the business of the subsidiaries of the Sellers, which includes Cloudmed, a leader in Revenue Intelligence™ solutions for healthcare providers (collectively, the “Cloudmed entities”), through (i) a merger of R1 Merger Sub with and into the Company with the Company as the surviving entity, which will result in the Company becoming a wholly owned subsidiary of NewR1 (the “Holding Company Reorganization”) and (ii) the Sellers contributing 100% of the equity of a blocker parent corporation of the Cloudmed entities in exchange for shares of common stock, par value $0.01 per share of NewR1 (“NewR1 Common Stock”) equal to approximately 30% of the fully diluted shares of R1 Common Stock as of the date of the Transaction Agreement on a pro forma basis after giving effect to the Transaction (as defined below), subject to certain adjustments set forth in the Transaction Agreement (the “Acquisition”, and together with the Holding Company Reorganization, the “Transactions”).

The consummation of the Transactions is subject to certain conditions, including, among other things (a) the expiration or termination of all waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder (“HSR Approval”), (b) the effectiveness of the Registration Statement (as defined below) relating to the Holding Company Reorganization, (c) approval by shareholders of the Company of the issuance of NewR1 Common Stock to the Sellers (the “Issuance”), (d) approval for listing on The Nasdaq Stock Market LLC (“Nasdaq”) of the shares of NewR1 Common Stock, subject to official notice of issuance, (e) approval pursuant to the EU Merger Regulation, Council Regulation (EC) No 139/2004 and (f) other customary closing conditions. The Transaction Agreement may be terminated, among other things, (i) by mutual consent of the Company and the Sellers, (ii) by the Company or the Sellers upon a breach of certain of the representation and warranties in the Transaction Agreement by the other which has not been cured, (iii) if the shareholders of the Company do not approve the issuance of NewR1 Common Stock to the Sellers, (iv) if an order is issued by an applicable governmental authority permanently enjoining the consummation of the Transactions or (v) if the closing of the transaction has not occurred on or prior to July 31, 2022. The Transaction Agreement contains certain representations and warranties and covenants as specified therein, including such provisions as are customary for a transaction of this nature.

The foregoing description of the transaction and the Transaction Agreement does not purport to be complete and is qualified in its entirety by reference to the Transaction Agreement, which will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 2.1.

Holding Company Reorganization

Pursuant to the Transaction Agreement, immediately prior to the completion of the Acquisition, the Company will implement the Holding Company Reorganization, which will result in NewR1 owning all of the capital stock of the Company. NewR1 will initially be a direct, wholly owned subsidiary of the Company. Pursuant to the Holding Company Reorganization, R1 Merger Sub, a newly formed entity and a direct, wholly owned subsidiary of NewR1 and an indirect, wholly owned subsidiary of the Company, will merge with and into the Company, with the Company surviving as a direct, wholly owned subsidiary of NewR1. Each share of the Company’s common stock, par value $0.01 per share (“Company Common Stock”), issued and outstanding immediately prior to the Holding Company Reorganization will automatically be exchanged into an equivalent corresponding share of NewR1 Common Stock, having the same designations, rights, powers and preferences and the qualifications, limitations and restrictions as the corresponding share of Company Common Stock being converted. Accordingly, upon consummation of the Holding Company Reorganization, the Company’s current stockholders will become stockholders of NewR1.

The Holding Company Reorganization will be conducted pursuant to Section 251(g) of the General Corporation Law of the State of Delaware, which provides for the formation of a holding company through a merger without a vote of the stockholders of the constituent corporations. Effective upon the consummation of the Holding Company Reorganization, NewR1 will adopt an amended and restated certificate of incorporation and amended and restated bylaws that are identical to those of the Company immediately prior to the consummation of the Holding Company Reorganization, except for the change of the name of the corporation as permitted by Section 251(g).

Furthermore, the conversion will occur automatically without an exchange of stock certificates. Stock certificates previously representing shares of Company Common Stock will represent the same number of shares of NewR1 Common Stock after the Holding Company Reorganization. Each person entered as the owner in a book entry that, immediately prior to the Holding Company Reorganization, represented any outstanding shares of Company Common Stock will be deemed to have received an equivalent number of shares of NewR1 Common Stock. Following the consummation of the Holding Company Reorganization, the name of NewR1 will be changed to “R1 RCM Inc.”, the name of the Company will be changed to “R1 RCM Holdco Inc.”, and shares of NewR1 Common Stock will continue to trade on The Nasdaq Global Market under the Company’s symbol “RCM”.

Upon consummation of the Holding Company Reorganization, the directors and officers of NewR1 will be the same individuals who are the directors and officers of the Company immediately prior to the Holding Company Reorganization.

Second Amended and Restated Registration Rights Agreement

Simultaneously with the closing of the Transactions, the Company, the Sellers, NewR1, TCP-ASC ACHI Series LLLP, a Delaware limited liability limited partnership (“TCP-ASC”), IHC Health Services, Inc., a Utah non-profit corporation (“IHC”), and Shared Business Services, LLC, a Delaware limited liability company and a subsidiary of LifePoint Health, Inc., a Delaware corporation (“LifePoint”, and together with TCP-ASC, IHC and the Sellers, the “Investors”) will enter into the Second Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”) pursuant to which the Investors will receive certain registration rights covering the resale of shares of NewR1 Common Stock owned by any of the Investors, as well as any shares of NewR1 Common Stock issued by NewR1 upon the exercise of warrants held by certain of the Investors and any securities issued as (or issuable upon the conversion or exercise of any warrant, right or other security that is issued as) a dividend, stock split, recapitalization or other distribution with respect to, or in exchange for, or in replacement of, the shares of NewR1 Common Stock referenced above (collectively, the “Registrable Securities”).

The Registration Rights Agreement provides that (i) IHC may only make one such demand for registration pursuant to a registration statement on Form S-3, (ii) TCP-ASC may only make five demands for registration (of which no more than three may be on a form other than Form S-3) and no more than three demands during any twelve-month period, and (iii) the Sellers may only make four demands for registration (of which no more than one may be on a form other than Form S-3) and no more than three demands during any twelve-month period. The Registration Rights Agreement also provides that whenever NewR1 registers shares of NewR1 Common Stock under the Securities Act of 1933, as amended (the “Securities Act”) (other than on a Form S-4 or Form S-8, or in connection with any employee benefit or dividend reinvestment plan), then each Investor will have the right as specified therein to register its shares of NewR1 Common Stock as part of that registration. The registration rights under the Registration Rights Agreement are subject to certain rights of the managing underwriters, if any, to reduce or exclude certain shares owned by the Investors from an underwritten registration. Except as otherwise provided, the Registration Rights Agreement requires NewR1 to pay for all costs and expenses, other than underwriting discounts, commissions and stock transfer taxes incurred in connection with the registration of the NewR1 Common Stock, provided that NewR1 will only be required to pay the fees and disbursements of one legal counsel to the Investors per registration and only $15,000 of aggregate expenses incurred or otherwise borne by each of IHC and LifePoint. NewR1 will also agree to indemnify the Investors against certain liabilities, including liabilities under the Securities Act.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the form of the Registration Rights Agreement, which will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 4.1.

Amended and Restated Investor Rights Agreement (TCP-ASC)

Simultaneously with the closing of the Transactions, the Company, NewR1 and TCP-ASC will enter into an amended and restated investor rights agreement (the “A&R Investor Rights Agreement”). Under the terms of the A&R Investor Rights Agreement, for so long as TCP-ASC’s “Ownership Threshold” (as that term is defined in the A&R Investor Rights Agreement) is met, TCP-ASC will be entitled to nominate such number of individuals to the board of directors of NewR1 (the “Board”) constituting a majority of the Board (collectively, the “TCP-ASC Designees”) and entitled to designate the chairman of the Board. For so long as the Ownership Threshold is not met but TCP-ASC’s “Ownership Percentage” (as that term is defined in the A&R Investor Rights Agreement) exceeds 10% of NewR1 Common Stock (taking into account the exercise of the warrant held by TCP-ASC), then TCP-ASC will be entitled to nominate the greater of (x) such number of individuals to the Board in relative proportion to the Ownership Percentage (rounded down) and (y) two directors, and for so long as TCP-ASC’s Ownership Percentage is in the aggregate at least 5% but less than 10% of NewR1 Common Stock (in each case, taking into account the exercise of the warrant held by TCP-ASC), then TCP-ASC will be entitled to nominate the greater of (x) such number of individuals to the Board in relative proportion to the Ownership Percentage (rounded down) and (y) one director. Additionally, subject to applicable law and the listing standards of The Nasdaq Global Select Market (or other United States national securities exchange that NewR1 Common Stock is listed upon, if any), NewR1 will offer the TCP-ASC Designees an opportunity to, at TCP-ASC’s option, either sit on each regular committee of the Board in relative proportion to the number of TCP-ASC’s Designees on the Board or attend (but not vote) at the meetings of such committee as an observer.

Under the terms of the A&R Investor Rights Agreement, TCP-ASC must cause all of its NewR1 Common Stock entitled to vote at any meeting of NewR1’s shareholders to be present at such meeting and to vote all such shares in favor of any nominee or director nominated by NewR1’s Nominating and Corporate Governance Committee and against the removal of any director nominated by NewR1’s Nominating and Corporate Governance Committee.

TCP-ASC is subject to customary standstill provisions, which are applicable to purchases of debt as well as equity securities and include prohibitions on hedging activities, until such time as the Investor owns less than 25% of NewR1 Common Stock (taking into account the exercise of the warrant held by TCP-ASC).

For so long as TCP-ASC meets the Ownership Threshold, the A&R Investor Rights Agreement requires NewR1 to obtain the approval of TCP-ASC prior to taking certain actions described therein.

The A&R Investor Rights Agreement requires that if NewR1 proposes to offer any equity or equity linked security to any person, then NewR1 must first offer TCP-ASC the right to purchase a portion of such securities equal to TCP-ASC’s Ownership Percentage. If TCP-ASC does not exercise this purchase right within 30 days of receiving notice of the proposed offering, then NewR1 has 120 days to complete the offering on terms no more favorable than those offered to TCP-ASC.

NewR1 will reimburse TCP-ASC for reasonable, documented, out-of-pocket travel and business expenses in connection with TCP-ASC’s performance under the A&R Investor Rights Agreement, or otherwise relating to the management and oversight of TCP-ASC’s investment in the Company (other than expenses related to filings solely in TCP-ASC’s capacity as a shareholder of the Company) subject to a $100,000 per fiscal year cap.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the A&R Investor Rights Agreement, which will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 4.2.

Investor Rights Agreement (The Sellers)

Simultaneously with the closing of the Transactions, NewR1 and the Sellers will enter into an investor rights agreement (the “Sellers’ Investor Rights Agreement”). Under the terms of the Sellers’ Investor Rights Agreement, for so long as the Sellers’ “Ownership Threshold” (as that term is defined in the Sellers’ Investor Rights Agreement) is met, the Sellers will be entitled to nominate three individuals to the Board (collectively, the “Seller Designees”). For so long as the Ownership Threshold is not met but the Sellers’ “Ownership Percentage” (as that term is defined in the Sellers’ Investor Rights Agreement) exceeds 10% of NewR1 Common Stock (taking into

account the exercise of the warrant held by TCP-ASC), then the Sellers will be entitled to nominate the greater of (x) such number of individuals to the Board in relative proportion to the Ownership Percentage (rounded down) and (y) two directors, and for so long as the Sellers’ Ownership Percentage is in the aggregate at least 5% but less than 10% of NewR1 Common Stock (taking into account the exercise of the warrant held by TCP-ASC), then the Sellers will be entitled to nominate the greater of (x) such number of individuals to the Board in relative proportion to the Ownership Percentage (rounded down) and (y) one director. Additionally, subject to applicable law and the listing standards of The Nasdaq Global Select Market (or other United States national securities exchange that NewR1 Common Stock is listed upon, if any), NewR1 will offer one Seller Designee (to be selected by the Sellers) an opportunity to, at the Sellers’ option, either sit on each regular committee of the Board or attend (but not vote) at the meetings of such committee as an observer.

The Sellers are subject to customary standstill provisions, which are applicable to purchases of debt as well as equity securities and include prohibitions on hedging activities, until the later of (i) such time as the Sellers owns less than 25% of NewR1 Common Stock (taking into account the exercise of the warrant held by TCP-ASC) and (ii) the third anniversary of the closing date.

For so long as the Sellers meets the Ownership Threshold, the Seller Investor Rights Agreement requires NewR1 to obtain the approval of the Sellers prior to taking certain actions described therein.

NewR1 will reimburse the Sellers for reasonable, documented, out-of-pocket travel and business expenses in connection with the Sellers’ performance under the Sellers’ Investor Rights Agreement, or otherwise relating to the management and oversight of the Sellers’ investment in the Company (other than expenses related to filings solely in the Sellers’ capacity as shareholders of the Company) subject to a $100,000 per fiscal year cap.

Under the terms of the Sellers’ Investor Rights Agreement, the Sellers must cause all of their NewR1 Common Stock entitled to vote at any meeting of NewR1’s shareholders to be present at such meeting and to vote all such shares in favor of any nominee or director nominated by NewR1’s Nominating and Corporate Governance Committee and against the removal of any director nominated by NewR1’s Nominating and Corporate Governance Committee.

The Sellers’ Investor Rights Agreement requires that if NewR1 proposes to offer any equity or equity linked security to any person, then NewR1 must first offer the Sellers the right to purchase a portion of such securities equal to the Sellers’ Ownership Percentage. If the Sellers do not exercise this purchase right within 30 days of receiving notice of the proposed offering, then NewR1 has 120 days to complete the offering on terms no more favorable than those offered to the Sellers.

In addition, subject to certain exceptions described therein, the Sellers’ Investor Rights Agreement prohibits the Sellers from, directly or indirectly selling, transferring, pledging, encumbering, assigning or otherwise disposing of any shares of NewR1 Common Stock with NewR1’s prior written consent for a period of eighteen months from the date of the closing of the Transactions, subject to certain exceptions.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Sellers’ Investor Rights Agreement, which will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 4.3.

Voting Agreements

On January 9, 2022, the Company, TCP-ASC and Revint Holdings, LLC, a Delaware limited liability company (“Revint”) entered into a voting agreement (the “Voting Agreement”), pursuant to which, among other things, TCP-ASC agreed to not transfer its shares of Company Common Stock and to vote its shares of Company Common Stock (i) in favor of the Issuance, (ii) in favor of the Transactions (as defined in the Transaction Agreement), (iii) in favor of any proposal to adjourn or postpone such meeting of the Company’s stockholders to a later date made in accordance with the Transaction Agreement, or (iv) against any proposal made in opposition to or in competition with the Issuance and the other transactions contemplated by the Transaction Agreement. The Voting Agreement will terminate upon the earliest to occur of (a) the date on which the Issuance is approved by stockholders of the Company, (b) the date on which the Transaction Agreement is terminated in accordance with its terms and (c) the Effective Time (as defined in the Transaction Agreement).

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Voting Agreement, which will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 10.1.

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

The information in Item 2.02 of this Current Report on Form 8-K of the Company is intended to furnish certain estimated financial and operating results of the Company as of and for the fiscal year ended December 31, 2021 as set forth in Exhibit 99.2 to this Current Report on Form 8-K.

The estimated financial and operating results as of and for the Company’s fiscal year ended December 31, 2021 included in Exhibit 99.2 hereto are preliminary, unaudited and subject to completion, reflect management’s current views, and may change as a result of management’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary results are subject to the finalization of year-end financial and accounting procedures (which have yet to be performed) and should not be viewed as a substitute for full audited annual financial statements prepared in accordance with U.S. generally accepted accounting principles. The actual results may be materially different from the estimated results. See the factors discussed under the caption “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.2 hereto, is being “furnished” to comply with Item 2.02 of Form 8-K and shall not be deemed “filed” by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in any such filing.

ITEM 7.01. REGULATION FD DISCLOSURE.

On January 10, 2022, the Company and the Cloudmed entities issued a joint press release (the “Press Release”) announcing the execution of the Transaction Agreement. The Press Release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Attached as Exhibit 99.2 and incorporated by reference herein is an investor presentation dated January 10, 2022, for use by the Company in meetings with certain of its shareholders as well as other persons with respect to the Transactions, as described in this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information of the information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2.

ITEM 8.01. OTHER EVENTS.

Debt Commitment Letters

Concurrently with the signing of the Transaction Agreement, the Company entered into a debt commitment letter, dated as of January 9, 2022 (the “Commitment Letter”), with JPMorgan Chase Bank, N.A. and Barclays Bank PLC as set forth therein, for a $1,040 million incremental first lien term loan B facility (the “Incremental Term Loan”). The Commitment Letter and the commitments contemplated thereby will terminate on August 5, 2022

(five (5) business days after the termination date with respect to the Agreement). The proceeds of the Incremental Term Loan will be used, together with the Company’s cash on hand, to finance the Transactions (including related fees and expense). The Incremental Term Loan will have terms generally consistent with those of the Company’s existing term loans (the “Initial Term Loans”) under the Credit Agreement, dated as of July 1, 2021 (as amended, restated, amended and restated, supplemented or otherwise modified, the “Credit Agreement”), by and among the Company, certain of its subsidiaries, Bank of America, N.A., as administrative agent, and the lenders named therein, including with respect to customary interest, maturity, amortization and prepayments for an incremental term loan B facility, as set forth in the Commitment Letter.

The commitments set forth in the Commitment Letter are subject to customary conditions contained in the Commitment Letter, including the execution of definitive documentation and the consummation of the Transactions. The representations and warranties, affirmative and negative covenants, indemnity obligations and events of default set forth in the Credit Agreement will apply to the Incremental Term Loan. The Company will pay certain customary fees in connection with the Incremental Term Loan.

In addition, on January 9, 2022, the Company entered into a debt financing engagement letter with JPMorgan Chase Bank, N.A. and Barclays Bank PLC to embark on a best efforts process to obtain, (i) a senior secured incremental revolving credit facility in an aggregate principal amount of up to $100,000,000 (the “Incremental Revolving Credit Facility”), (ii) senior secured incremental term A loan facility in an expected principal amount of $500,000,000 (the “Incremental Term Loan A Facility”), and (iii) senior secured incremental delayed-draw term B loan facility in an aggregate principal amount of up to $500,000,000 (the “Incremental Delayed-Draw Term Loan B Facility”, and together with the Incremental Revolving Credit Facility and the Incremental Term Loan A Facility, the “Facilities”), the proceeds of which to be applied to, among other things, (x) to fund the Transaction and to pay the fees, premiums, expenses and other transaction costs incurred in connection therewith, and (y) with respect to the Incremental Revolving Loans, for working capital, general corporate purposes, and any other purposes not prohibited by the Credit Agreement. There can be no assurances that such best efforts financing of the Facilities will be completed. If such best efforts financing is completed as contemplated, the Company will not incur the full amount of the Incremental Term Loans described above.

Additional Information and Where to Find It

This Current Report on Form 8-K relates to a proposed transaction between the Company and the Cloudmed entities. This Current Report on Form 8-K does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The Company intends to file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will include a document that serves as a prospectus and proxy statement of the Company, referred to as a proxy statement / prospectus. A proxy statement / prospectus will be sent to all shareholders of the Company. The Company also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of the Company are urged to read the registration statement, the proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov.

The documents filed by the Company with the SEC also may be obtained free of charge at the Company’s website at https://r1rcm.com/ or upon written request to 434 W. Ascension Way, 6th Floor, Murray, Utah 84123.

Participants in Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction. A list of the names of such

directors and executive officers and information regarding their interests in the Transactions will be contained in the proxy statement / prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

Forward-Looking Statements

This Current Report on Form 8-K includes information that may constitute “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events and relationships, plans, future growth and future performance, including, but not limited to, statements about the expected timing, completion and effects of the proposed transaction, our strategic initiatives, our capital plans, our costs, our ability to successfully implement new technologies, our future financial and operational performance, and our liquidity. These statements are often identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “designed,” “may,” “plan,” “predict,” “project,” “target,” “contemplate,” “would,” “seek,” “see” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the Company’s and Cloudmed’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, assurance, prediction or definitive statement of fact or probability. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks, and changes in circumstances, including but not limited to risk and uncertainties related to: (i) the ability of the parties to consummate the proposed transaction in a timely manner or at all; (ii) satisfaction of the conditions precedent to the consummation of the proposed transaction, including the receipt of required regulatory and shareholder approvals; (iii) the Company’s ability to timely and successfully achieve the anticipated benefits and potential synergies of the proposed transaction, and (iv) the impact of health epidemics, including the COVID-19 pandemic, on our business and any actions that we may take in response thereto. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2020, our quarterly reports on Form 10-Q, the registration statement on Form S-4 and the proxy statement included therein that NewR1 intends to file relating to the transactions described herein and any other periodic reports that we file with the SEC. The foregoing list of factors is not exhaustive. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements.

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transactions.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

| (d) | Exhibits |

| 2.1^ | Transaction Agreement and Plan of Merger, dated as of January 9, 2022 among the Company, NewR1, R1 Merger Sub and the Sellers | |

| 4.1^ | Form of Second Amended and Restated Registration Rights Agreement between the Company, NewR1, TCP-ASC, IHC, LifePoint and the Sellers | |

| 4.2^ | Form of Amended and Restated Investor Rights Agreement between the Company, NewR1 and TCP-ASC | |

| 4.3^ | Form of Investor Rights Agreement between NewR1 and the Sellers | |

| 10.1^ | Voting Agreement, dated as of January 9, 2022, between the Company, Revint and TCP-ASC | |

| 99.1* | Press release dated January 10, 2022 | |

| 99.2* | Investor presentation dated January 10, 2022 | |

| 104 | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document | |

| * | -Filed herewith |

| ^ | -To be filed by amendment |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| R1 RCM Inc. | ||||||

| Date: January 10, 2022 | ||||||

| By: | /s/ Rachel Wilson | |||||

| Name: | Rachel Wilson | |||||

| Title: | Chief Financial Officer | |||||

Exhibit 99.1

R1 RCM to Acquire Cloudmed, Creating the Strategic Revenue Partner for Healthcare Providers

Advances Integrated Technology Strategy Through Enhanced

Revenue Intelligence and Expanded Automation Opportunity

R1 to Host Conference Call Today at 7:00 a.m. ET

MURRAY, Utah and ATLANTA, January 10, 2022 – R1 RCM Inc. (NASDAQ: RCM) (“R1”), a leading provider of technology-driven solutions that transform the patient experience and financial performance of healthcare providers, today announced that it has entered into a definitive agreement to acquire Cloudmed, a leader in Revenue Intelligence™ solutions for healthcare providers, in an all-stock transaction. The transaction values Cloudmed at approximately $4.1 billion, including $857 million of net debt, based on R1’s closing stock price on January 7, 2022.

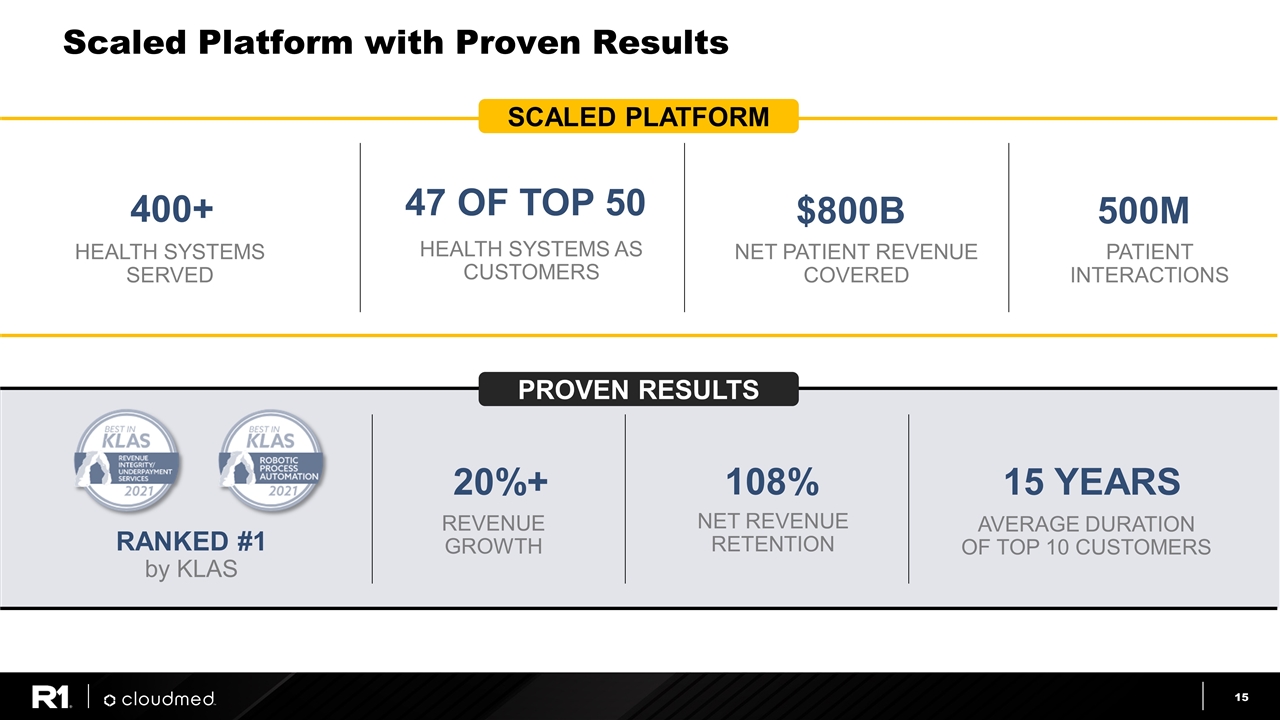

Based in Atlanta, Georgia, Cloudmed, a New Mountain Capital portfolio company, serves more than 400 of the largest health systems in the United States, including 47 of the top 50 hospital systems. Cloudmed’s industry-leading revenue intelligence platform combines cloud-based data architecture and deep domain expertise with intelligent automation to analyze large volumes of medical records, payment data, and complex medical insurance models to identify opportunities to deliver additional revenue to customers. In 2021, Cloudmed recovered more than $1.5 billion of underpaid or unidentified revenue for customers, delivering an average client ROI of 3-5x.

“This transaction accelerates our strategy to build the most scalable, flexible, and integrated platform for the revenue cycle and consumer engagement in healthcare,” said Joe Flanagan, president and chief executive officer of R1. “Our combined solutions, including enhanced automation capabilities, will further transform the patient experience and drive continued improvement in our customers’ financial results. I look forward to working with Cloudmed’s CEO, Lee Rivas, and the entire Cloudmed team whose additive talent and expertise will help us continue to optimize outcomes for healthcare systems and create value for all our stakeholders.”

“Cloudmed solves a critical problem in the healthcare system by helping healthcare providers get paid for the services they deliver,” said Lee Rivas, chief executive officer of Cloudmed. “By combining with R1, we will be creating a best-in-class platform with market-leading capabilities to drive improved outcomes for our customers, among the leading healthcare providers in the country. R1 shares our values and focus on innovation, which is why we are so excited about joining them to drive value for healthcare providers.”

“We believe the combination of Cloudmed and R1 creates a clear market leader for technology and data powered revenue management for healthcare providers,” said Matt Holt, managing director and president, private equity of New Mountain Capital. “We are excited to support the long-term vision of the combined company to modernize the U.S. healthcare sector. We look forward to working with Joe, Lee, and the management teams to fulfill this mission.”

Strategic and Financial Benefits

| • | Advances Revenue Intelligence and Automation Capabilities: The combination creates a scaled leader across both end-to-end revenue cycle management and technology-driven revenue intelligence. Cloudmed brings market-leading capabilities in revenue integrity with a focus on the middle revenue cycle and the #1 KLAS rating in the Revenue Integrity/Underpayment Services Provider category in 2021. Together, R1 and Cloudmed will have enhanced offerings that unite decades of coding, charging, and reimbursement expertise to drive further client digitization through automation and AI. |

| • | Accelerates Value Proposition and Commercial Engine to Drive Growth: This transaction will enable R1 to further its ability to deliver transformative value to healthcare providers through a more fulsome platform of differentiated capabilities. With increased commercial capacity, R1 will drive growth in modular revenue at SaaS equivalent margins. In addition, the combined company will have a diversified customer base with well-established relationships across 50 states, including 47 of the top 50 healthcare systems. |

| • | Creates Significant Financial Benefits: The transaction is expected to be accretive to R1’s earnings per share in the first full year post-closing. R1 expects to unlock cost synergies of $85 million by the end of year three and $98 million at full run-rate, as well as significant revenue synergies over time. R1 expects to have approximately 2.7x net leverage upon closing of the transaction and anticipates strong cash flow generation post-close. |

Transaction Details

Upon closing of the transaction, current R1 shareholders will own approximately 70% of the combined company on a fully diluted basis and Cloudmed equity holders will own approximately 30%. Cloudmed equity holders will enter into an 18-month lockup agreement, subject to partial early release after six months under certain circumstances.

The transaction, which has been unanimously approved by the Boards of Directors of both companies, is expected to close in the second quarter of 2022, subject to approval of the stock issuance by R1 shareholders, the effectiveness of a registration statement on Form S-4, receipt of regulatory approvals and the satisfaction of other customary closing conditions.

Joe Flanagan, CEO of R1, will serve as CEO of the combined company, and Lee Rivas, chief executive officer of Cloudmed, will serve as president of the combined company. Upon closing of the transaction, R1 will increase the size of its Board of Directors to include three new board members nominated by New Mountain Capital.

Conference Call

R1 will host a conference call today at 7:00 a.m. ET to discuss details of the transaction. To participate, please dial 888-330-2022 (646-960-0690 outside the U.S. and Canada) using conference code number 5681952. A live webcast and replay of the call will be available at the Investor Relations section of the Company’s website at ir.r1rcm.com.

Advisors

Centerview Partners LLC acted as lead financial advisor to R1. J.P. Morgan Securities LLC also acted as a financial advisor to R1, and Kirkland & Ellis LLP acted as legal counsel. Barclays acted as financial advisor and Ropes & Gray LLP acted as legal counsel to Cloudmed. Wachtell, Lipton, Rosen & Katz and Covington & Burling LLP served as legal advisors to TowerBrook and Ascension, respectively.

About R1 RCM

R1 is a leading provider of technology-driven solutions that transform the patient experience and financial performance of hospitals, health systems, and medical groups. R1’s proven and scalable operating models seamlessly complement a healthcare organization’s infrastructure, quickly driving sustainable improvements to net patient revenue and cash flows while reducing operating costs and enhancing the patient experience. To learn more, visit: r1rcm.com.

About Cloudmed

Cloudmed partners with over 3,100 healthcare providers in the United States and recovers over $1.5 billion of underpaid or unidentified revenue for its clients annually. We are unique in our ability to utilize industry-leading expertise and the powerful CloudmedAI™ Platform to help providers boost productivity and increase revenue. Cloudmed was awarded 2021 Best In KLAS: Revenue Integrity/Underpayment Services and Robotic Process Automation. Its solution suites have HFMA Peer Review status and are HITRUST certified. For more information, visit www.cloudmed.com.

Participants in the Solicitation

R1 and its directors and executive officers may be deemed to be participants in the solicitation of proxies from R1’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction will be contained in the proxy statement / prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Important Information About the Transaction and Where to Find It

This press release includes information regarding the proposed transaction between R1 and Cloudmed, a leader in Revenue Intelligence™ solutions for healthcare providers. R1 intends to file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will include a document that serves as a prospectus and proxy statement of the Company, referred to as a proxy statement / prospectus. A proxy statement / prospectus will be sent to all shareholders of R1. R1 also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of R1 are urged to read the registration statement, the proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders may obtain free copies of the registration statements, the proxy statement / prospectus (when available) and all other relevant documents filed or that will be filed with the SEC by R1 through the web site maintained by the SEC at www.sec.gov. The documents filed by R1 with the SEC also may be obtained free of charge at R1’s website at https://r1rcm.com or upon written request to 434 W. Ascension Way, 6th Floor, Murray Utah 84123.

Forward-Looking Statements

This press release includes information that may constitute “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events and relationships, plans, future growth and future performance, including, but not limited to, statements about the expected timing, completion and effects of the proposed transaction, our strategic initiatives, our capital plans, our costs, our ability to successfully implement new technologies, our future financial and operational performance, and our liquidity. statements regarding. These statements are often identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “designed,” “may,” “plan,” “predict,” “project,” “target,” “contemplate,” “would,” “seek,” “see” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of R1’s and Cloudmed’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, assurance, prediction or definitive statement of fact or probability. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks, and changes in circumstances, including but not limited to risk and uncertainties related to: (i) the ability of the parties to consummate the proposed transaction in a timely manner or at all; (ii) satisfaction of the conditions precedent to the consummation of the proposed transaction, including the receipt of required regulatory and shareholder approvals; (iii) R1’s ability to timely and successfully achieve the anticipated benefits and potential synergies of the proposed transaction, and (iv) the impact of health epidemics, including the COVID-19 pandemic, on our business and any actions that we may take in response thereto. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2020, our quarterly reports on Form 10-Q, the registration statement on Form S-4 and the proxy statement included therein that R1 intends to file relating to the transactions described herein and any other periodic reports that we file with the SEC. The foregoing list of factors is not exhaustive. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. R1 assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements.

Contacts

R1:

R1 RCM Inc.

Investor Relations:

Atif Rahim

312.324.5476

investorrelations@r1rcm.com

Media Relations:

Laura Kelly

312.719.3257

media@r1rcm.com

Andrew Brimmer / Andrea Rose

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

ABrimmer@joelefrank.com / arose@joelefrank.com

Cloudmed

Sarah Arvin

CMO, Cloudmed

pr@cloudmed.com

Carina Davidson / Dana Gorman

Abernathy MacGregor

(212) 371-5999

ccd@abmac.com / dtg@abmac.com

JANUARY 10, 2022 The Strategic Partner to the Provider Industry Exhibit 99.2

Forward-Looking Statements This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events and relationships, plans, future growth and future performance, including, but not limited to, statements about our strategic initiatives, our capital plans, our costs, our ability to successfully implement new technologies, our future financial and operational performance, our liquidity and the expected timing, completion and effects of the proposed transaction. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “designed,” “may,” “plan,” “predict,” “project,” “target,” “contemplate,” “would,” “seek,” “see” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of R1’s and Cloudmed’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, assurance, prediction or definitive statement of fact or probability. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks, and changes in circumstances, including but not limited to risks and uncertainties related to: (i) our ability to retain existing customers or acquire new customers; (ii) our ability to manage our operations effectively; (iii) competition within the market; (iv) the severity, magnitude and duration of the COVID-19 pandemic; (v) responses to the pandemic by the government and healthcare providers and the direct and indirect impacts of the pandemic on our customers and personnel; (vi) the disruption of national, state, and local economies as a result of the pandemic (including as a result of supply chain interruptions, labor shortages, and inflationary pressures); (vii) the impact of the pandemic on our financial results, including possible lost revenue and increased expenses; (viii) the ability of the parties to consummate the proposed transaction in a timely manner or at all; (ix) satisfaction of the conditions precedent to the consummation of the proposed transaction, including the receipt of required regulatory and shareholder approvals; and (x) R1’s ability to timely and successfully achieve the anticipated benefits and potential synergies of the proposed transaction. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2020, our quarterly reports on Form 10-Q, the registration statement on Form S-4 and the proxy statement included therein that R1 intends to file relating to the transactions described herein and any other periodic reports that we file with the SEC. The foregoing list of factors is not exhaustive. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. R1 assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements.

Disclaimer Additional Information and Where to Find It In connection with the proposed transaction and plan of merger (the “Transaction Agreement”) by and among R1 RCM, Inc. (“R1”), Project Roadrunner Parent Inc., a wholly owned subsidiary of R1 (“New Pubco”), Project Roadrunner Merger Sub Inc., a wholly owned subsidiary of New Pubco (“R1 Merger Sub”), Coyco 1, L.P. (“Coyco 1”) and Coyco 2, L.P. (“Coyco 2”, and together with Coyco 1, the “Sellers”) and other parties thereto, pursuant to which R1 Merger Sub will merge with and into R1, with R1 surviving as a direct, wholly-owned subsidiary of New Pubco, and Sellers will contribute equity in their subsidiaries constituting the Cloudmed business (“Cloudmed”) to New Pubco in exchange for shares of New Pubco common stock, R1 will file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will constitute a prospectus and proxy statement of R1. The proxy statement/prospectus described above will contain important information about R1, the Cloudmed business, the proposed transaction and related matters. A proxy statement/prospectus will be sent to all shareholders of R1. R1 also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of R1 are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of these documents, and other documents filed with the SEC, by R1 through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of these documents from R1 by visiting its website at https://r1rcm.com/, or upon written request to 434 W. Ascension Way, 6th Floor, Murray, Utah 84123. No Offer or Sale of Securities This presentation is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. No representations or warranties, express or implied, are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances with R1, the Sellers, Cloudmed or any of their respective subsidiaries, equityholders, affiliates, representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith.

Disclaimer Financial Projections All financial projections in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond R1’s control. No independent registered public accounting firm has audited, reviewed, compiled or performed any procedures with respect to the combined financial information of R1 contained herein, and, accordingly R1 expresses no opinion or otherwise provides any form of assurance with respect thereto for the purposes of this presentation. Such information may not be included, may be adjusted or may be presented differently in, any registration statement or proxy statement or other relevant documents to be filed by R1 with the SEC. The inclusion of projections in this presentation should not be regarded as an indication that R1, or its representatives, considered or consider the projections to be a reliable prediction of future events. Non-GAAP Financial Information Some of the financial information and data contained in this presentation, including Adjusted EBITDA (and related measures), have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. This non-GAAP financial measure should not be considered in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure. Participants in the Solicitation The directors and executive officers of R1 may be deemed to be participants in the solicitation of proxies from R1’s shareholders. Information regarding R1’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, in respect of the transaction described herein will be included in the proxy statement/prospectus described above.

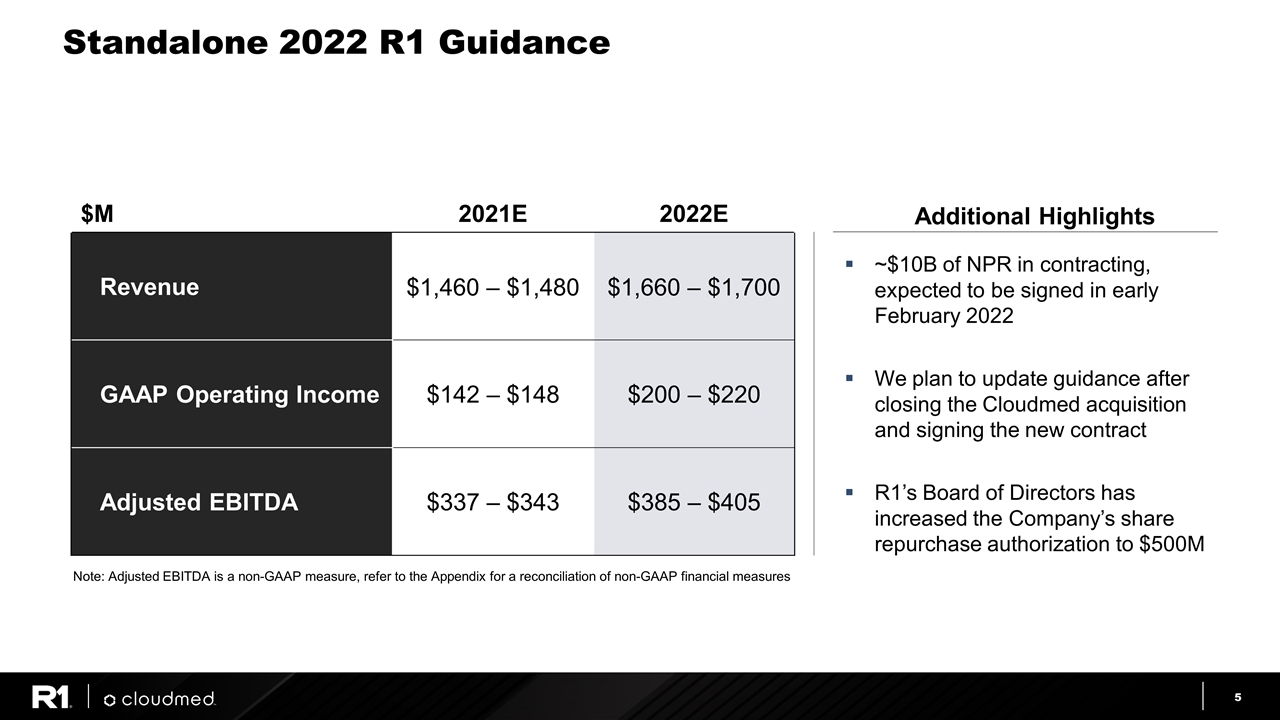

~$10B of NPR in contracting, expected to be signed in early February 2022 We plan to update guidance after closing the Cloudmed acquisition and signing the new contract R1’s Board of Directors has increased the Company’s share repurchase authorization to $500M Standalone 2022 R1 Guidance $M 2021E 2022E Revenue $1,460 – $1,480 $1,660 – $1,700 GAAP Operating Income $142 – $148 $200 – $220 Adjusted EBITDA $337 – $343 $385 – $405 Additional Highlights Note: Adjusted EBITDA is a non-GAAP measure, refer to the Appendix for a reconciliation of non-GAAP financial measures

Lee Rivas Chief Executive Officer Presenters Joseph Flanagan President Chief Executive Officer Rachel Wilson Executive Vice President Chief Financial Officer & Treasurer

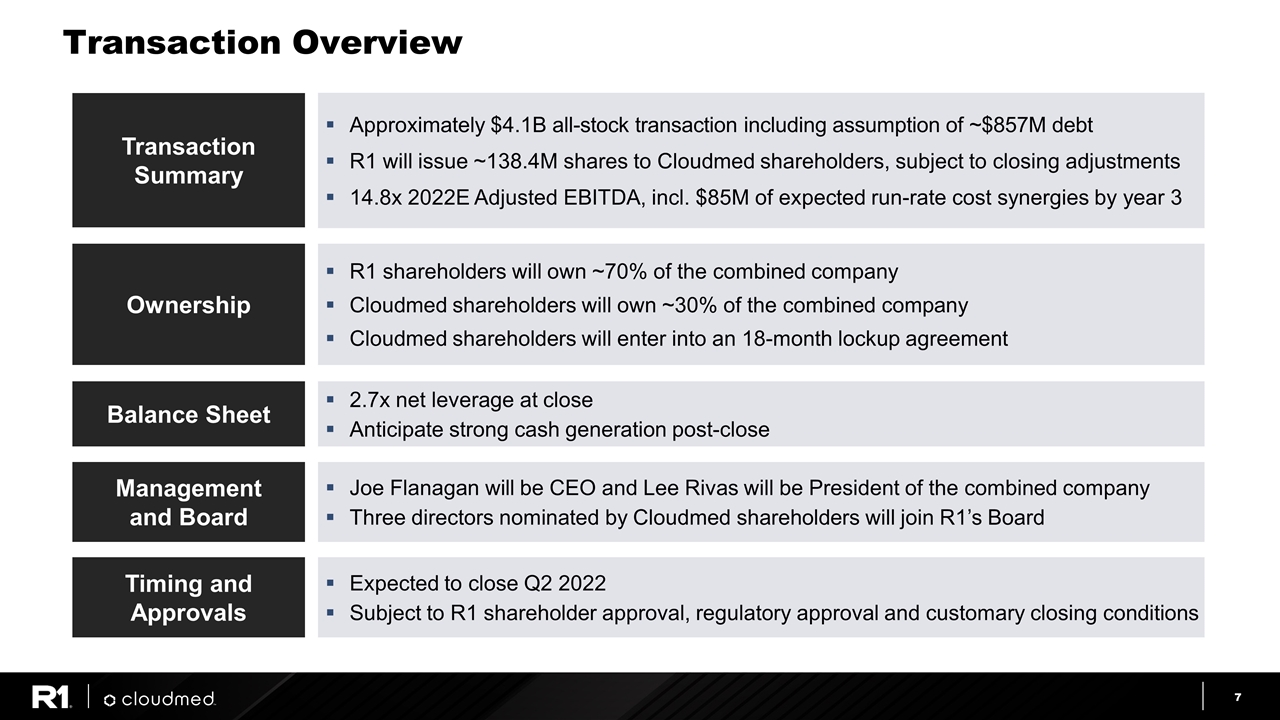

Timing and Approvals Expected to close Q2 2022 Subject to R1 shareholder approval, regulatory approval and customary closing conditions Management and Board Joe Flanagan will be CEO and Lee Rivas will be President of the combined company Three directors nominated by Cloudmed shareholders will join R1’s Board Ownership R1 shareholders will own ~70% of the combined company Cloudmed shareholders will own ~30% of the combined company Cloudmed shareholders will enter into an 18-month lockup agreement Transaction Summary Approximately $4.1B all-stock transaction including assumption of ~$857M debt R1 will issue ~138.4M shares to Cloudmed shareholders, subject to closing adjustments 14.8x 2022E Adjusted EBITDA, incl. $85M of expected run-rate cost synergies by year 3 Balance Sheet 2.7x net leverage at close Anticipate strong cash generation post-close Transaction Overview

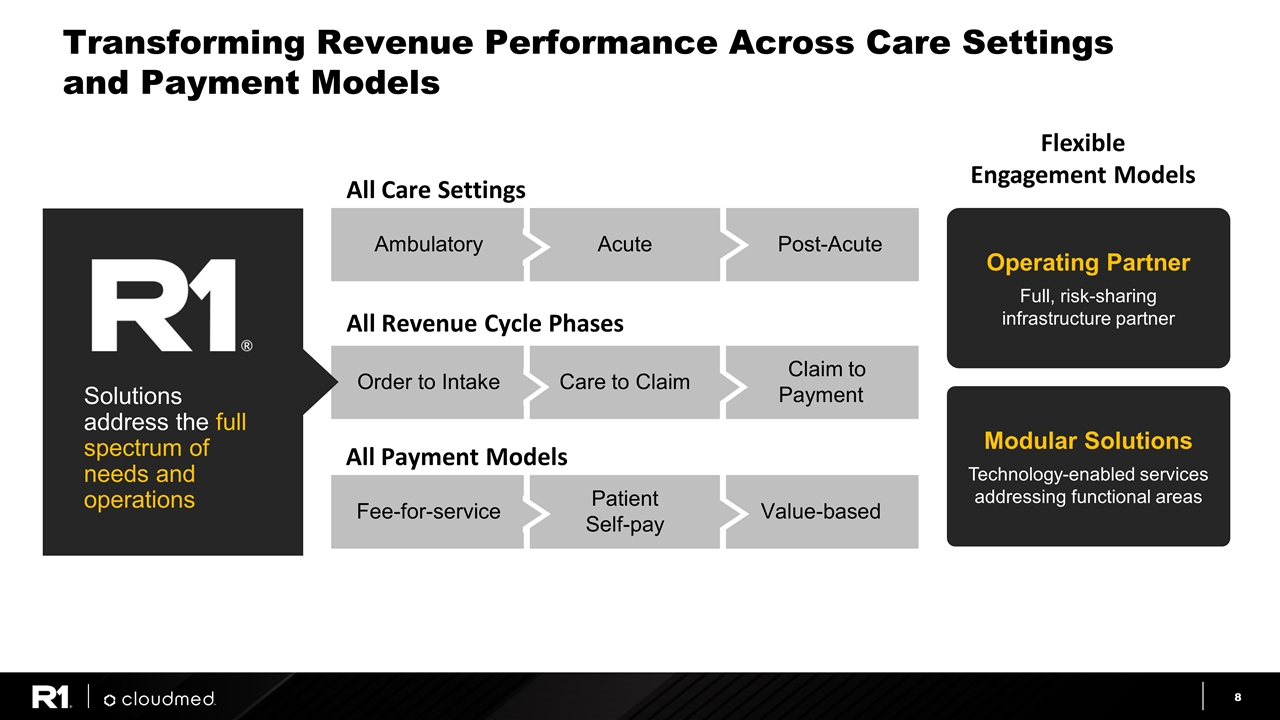

All Revenue Cycle Phases Order to Intake Care to Claim Claim to Payment All Payment Models Fee-for-service Patient Self-pay Value-based All Care Settings Ambulatory Acute Post-Acute Transforming Revenue Performance Across Care Settings and Payment Models Solutions address the full spectrum of needs and operations Operating Partner Full, risk-sharing infrastructure partner Modular Solutions Technology-enabled services addressing functional areas Flexible Engagement Models

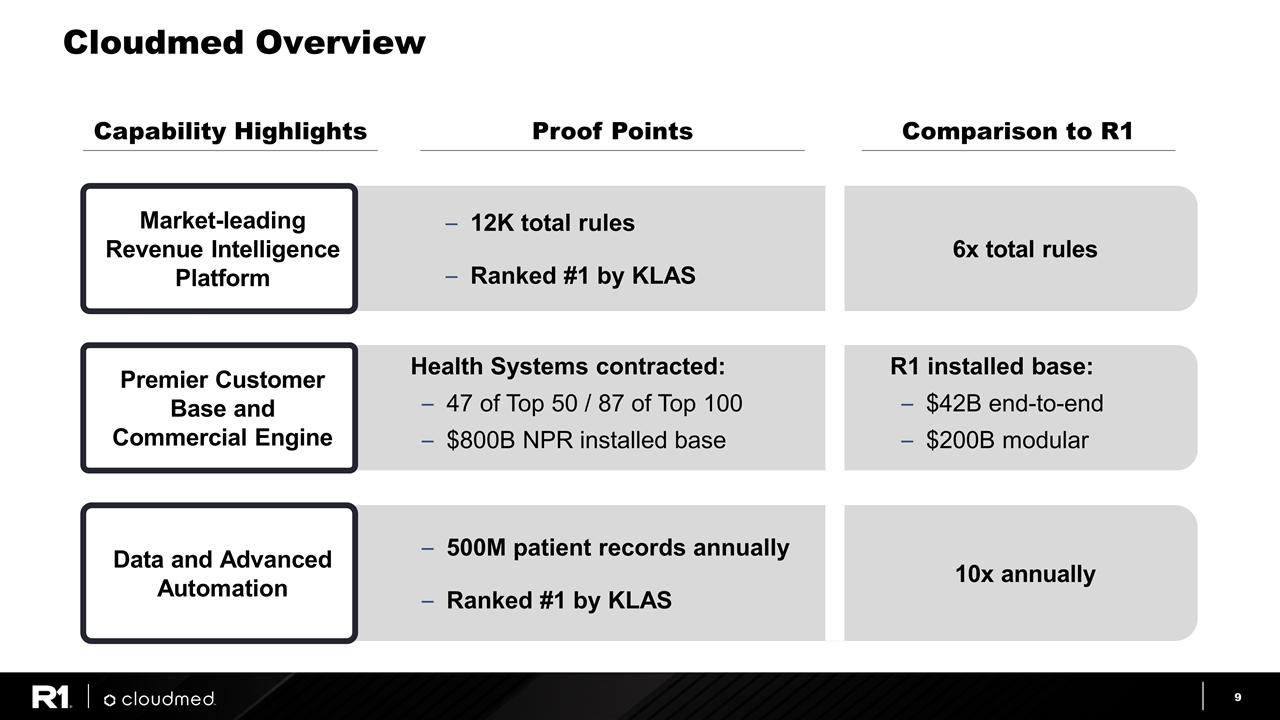

Cloudmed Overview Proof Points Comparison to R1 Capability Highlights 500M patient records annually Ranked #1 by KLAS Health Systems contracted: 47 of Top 50 / 87 of Top 100 $800B NPR installed base 10x annually 6x total rules 12K total rules Ranked #1 by KLAS R1 installed base: $42B end-to-end $200B modular Market-leading Revenue Intelligence Platform Premier Customer Base and Commercial Engine Data and Advanced Automation

Leading data and analytics-driven revenue intelligence platform Leading E2E technology-driven platform to manage healthcare provider revenue Powerful Combination of Market-leading Platforms Market-leading tech-enabled platform Strategic partner of choice to providers Unlocks significant TAM & accelerates growth Automation leader, positioned for innovation in and around data Strategic Highlights Early Stages of a Significant Market Growth Opportunity

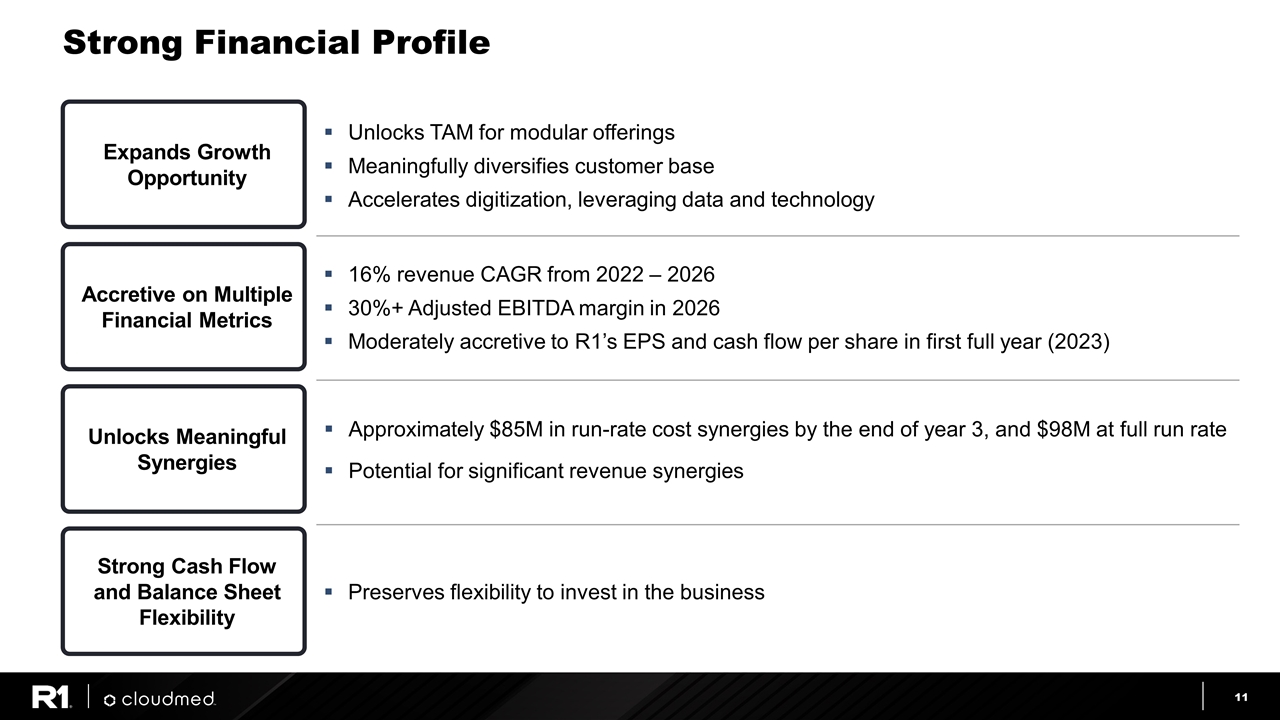

Unlocks TAM for modular offerings Meaningfully diversifies customer base Accelerates digitization, leveraging data and technology Preserves flexibility to invest in the business 16% revenue CAGR from 2022 – 2026 30%+ Adjusted EBITDA margin in 2026 Moderately accretive to R1’s EPS and cash flow per share in first full year (2023) Approximately $85M in run-rate cost synergies by the end of year 3, and $98M at full run rate Potential for significant revenue synergies Strong Financial Profile Expands Growth Opportunity Accretive on Multiple Financial Metrics Unlocks Meaningful Synergies Strong Cash Flow and Balance Sheet Flexibility

Cloudmed Overview

Strategic Partner to Providers We help healthcare providers get paid for the care they deliver COMPLEX PROBLEM PERSISTENT CHALLENGES POWERFUL SOLUTION Up to 5% revenue leakage $100B problem Large scale data problem Reimbursement complexity Business model aligned with customer success 3-5x customer ROI MISSION:

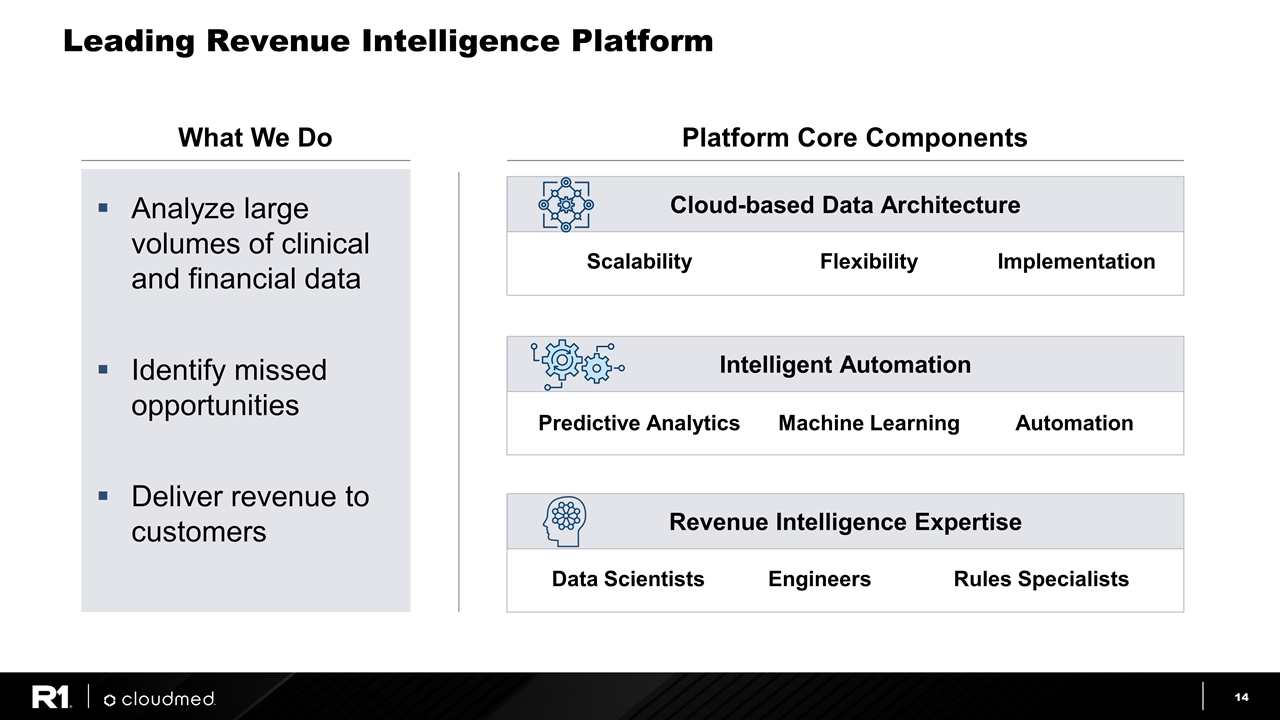

Leading Revenue Intelligence Platform Analyze large volumes of clinical and financial data Identify missed opportunities Deliver revenue to customers What We Do Platform Core Components Scalability Cloud-based Data Architecture Flexibility Implementation Predictive Analytics Intelligent Automation Machine Learning Automation Data Scientists Revenue Intelligence Expertise Engineers Rules Specialists

Scaled Platform with Proven Results Ranked #1 by KLAS REVENUE GROWTH 20%+ NET REVENUE RETENTION 108% Average duration Of top 10 customers 15 YEARS HEALTH SYSTEMS AS CUSTOMERS 47 OF TOP 50 NET PATIENT REVENUE COVERED $800B PATIENT INTERACTIONS 500M SCALED PLATFORM PROVEN RESULTS HEALTH SYSTEMS SERVED 400+

Summary Highlights

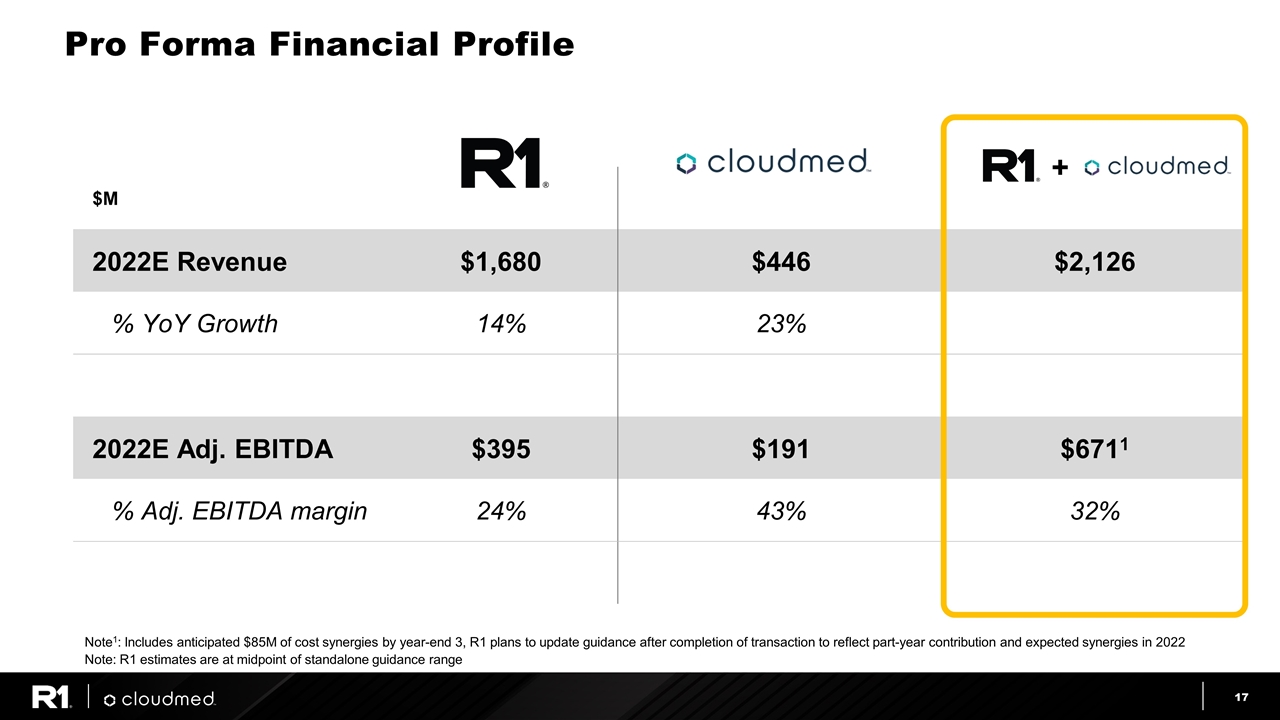

Pro Forma Financial Profile $M 2022E Revenue $1,680 $446 $2,126 % YoY Growth 14% 23% 2022E Adj. EBITDA $395 $191 $6711 % Adj. EBITDA margin 24% 43% 32% Note1: Includes anticipated $85M of cost synergies by year-end 3, R1 plans to update guidance after completion of transaction to reflect part-year contribution and expected synergies in 2022 Note: R1 estimates are at midpoint of standalone guidance range +

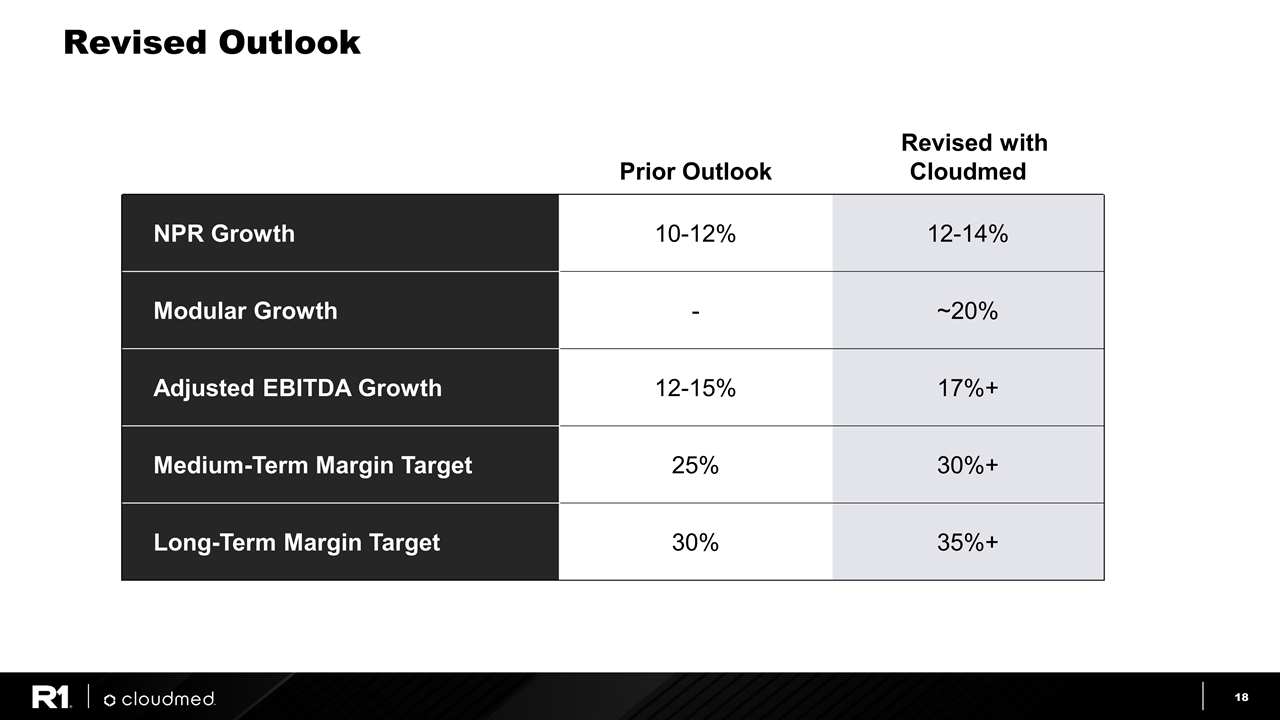

Revised Outlook Prior Outlook Revised with Cloudmed NPR Growth 10-12% 12-14% Modular Growth - ~20% Adjusted EBITDA Growth 12-15% 17%+ Medium-Term Margin Target 25% 30%+ Long-Term Margin Target 30% 35%+

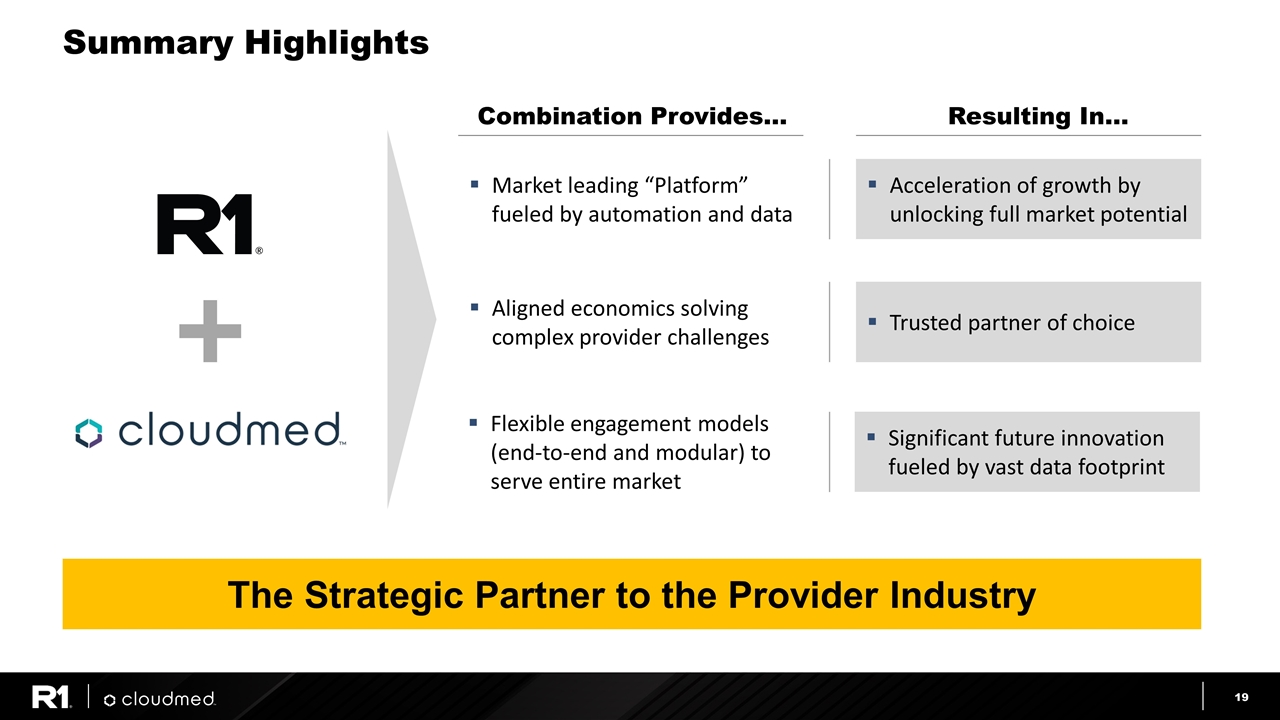

Summary Highlights Combination Provides… Market leading “Platform” fueled by automation and data Resulting In… Acceleration of growth by unlocking full market potential Aligned economics solving complex provider challenges Trusted partner of choice Flexible engagement models (end-to-end and modular) to serve entire market Significant future innovation fueled by vast data footprint The Strategic Partner to the Provider Industry

Appendix

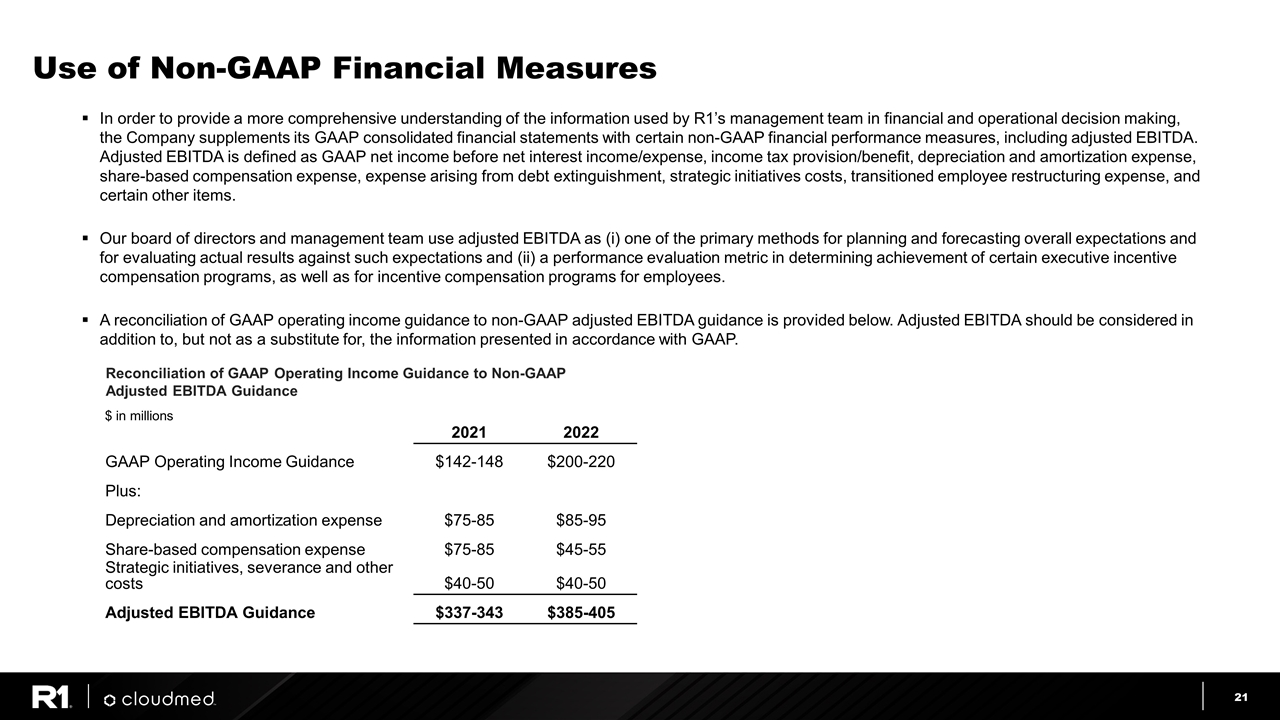

Use of Non-GAAP Financial Measures In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, expense arising from debt extinguishment, strategic initiatives costs, transitioned employee restructuring expense, and certain other items. Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. A reconciliation of GAAP operating income guidance to non-GAAP adjusted EBITDA guidance is provided below. Adjusted EBITDA should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP. 2021 2022 GAAP Operating Income Guidance $142-148 $200-220 Plus: Depreciation and amortization expense $75-85 $85-95 Share-based compensation expense $75-85 $45-55 Strategic initiatives, severance and other costs $40-50 $40-50 Adjusted EBITDA Guidance $337-343 $385-405 Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance $ in millions