Third Quarter 2021 Results Conference Call November 2, 2021 Exhibit 99.2

2 Forward‐Looking Statements and Non‐GAAP Financial Measures This presentation includes information that may constitute “forward‐looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward‐looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward‐looking statements contain these identifying words. These forward‐looking statements include, among other things, statements about our strategic initiatives, our capital plans, our costs, our ability to successfully implement new technologies, our future financial performance, and our liquidity. Such forward‐looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward‐looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward‐looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward‐looking statements. All forward‐looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward‐looking statements as a result of various factors, including, but not limited to, our ability to retain existing customers or acquire new customers; our ability to manage our operations effectively; competition within the market; the severity, magnitude and duration of the COVID‐19 pandemic; responses to the pandemic by the government and healthcare providers and the direct and indirect impacts of the pandemic on our customers and personnel; the disruption of national, state, and local economies as a result of the pandemic (including as a result of supply chain interruptions, labor shortages, and inflationary pressures); the impact of the pandemic on our financial results, including possible lost revenue and increased expenses; and the factors discussed under the heading “Risk Factors” in our annual report on Form 10‐K for the year ended December 31, 2020 and any other periodic reports that R1 RCM Inc. (“R1 or the “Company”) files with the Securities and Exchange Commission. This presentation includes the following non‐GAAP financial measures: adjusted EBITDA, non‐GAAP cost of services, non‐GAAP SG&A expense and net debt. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non‐GAAP financial measures to the most directly comparable GAAP financial measures.

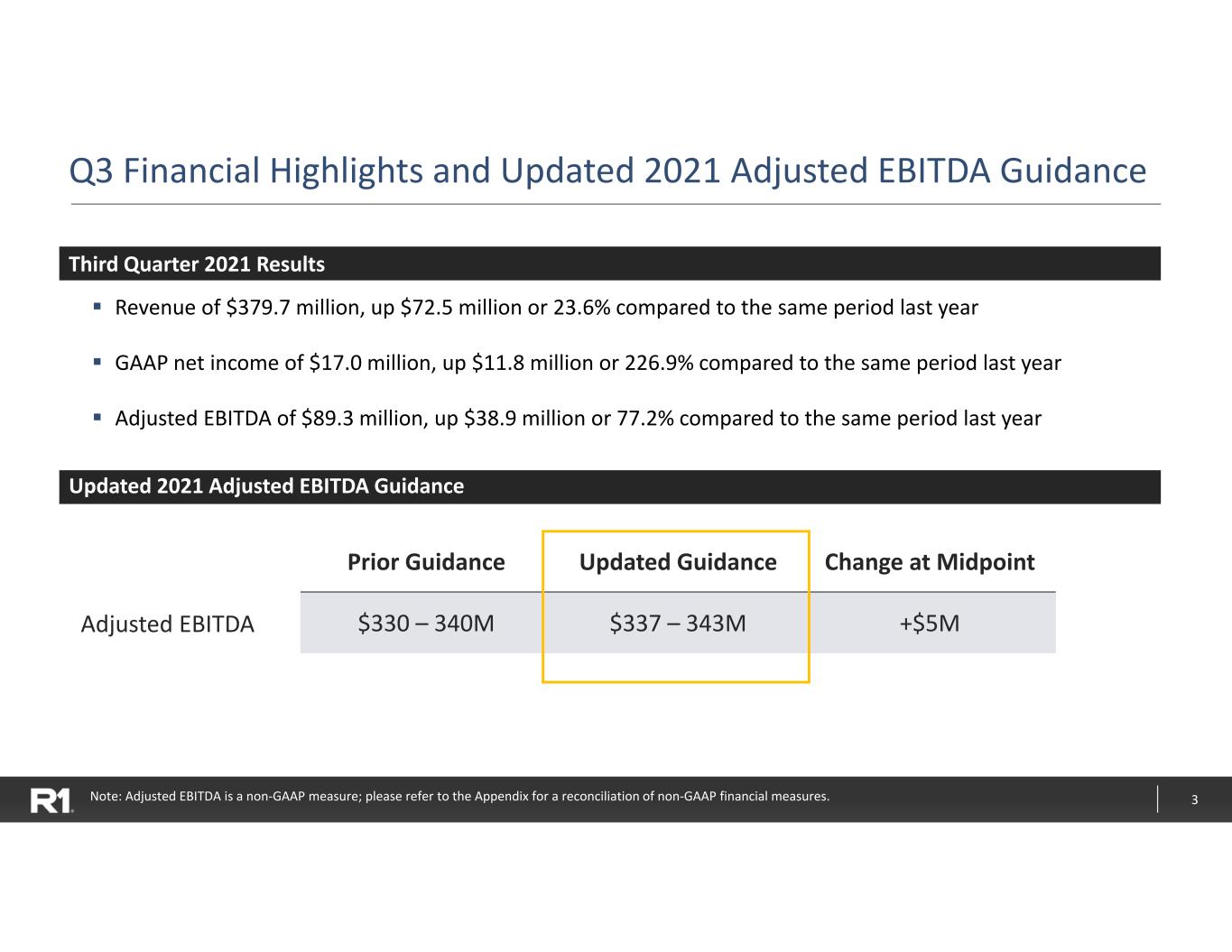

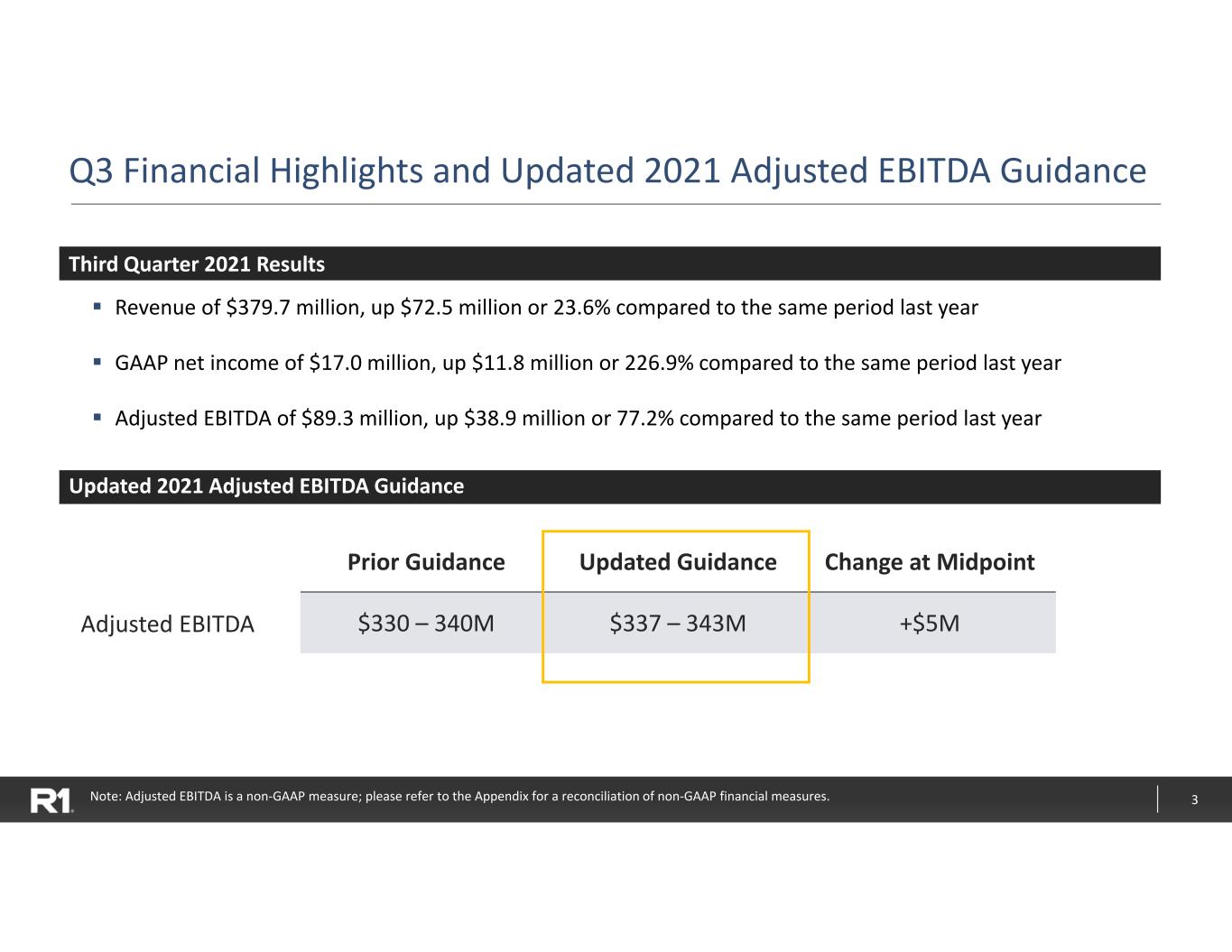

3 Q3 Financial Highlights and Updated 2021 Adjusted EBITDA Guidance Third Quarter 2021 Results Revenue of $379.7 million, up $72.5 million or 23.6% compared to the same period last year GAAP net income of $17.0 million, up $11.8 million or 226.9% compared to the same period last year Adjusted EBITDA of $89.3 million, up $38.9 million or 77.2% compared to the same period last year Updated 2021 Adjusted EBITDA Guidance Note: Adjusted EBITDA is a non‐GAAP measure; please refer to the Appendix for a reconciliation of non‐GAAP financial measures. Adjusted EBITDA Prior Guidance Updated Guidance Change at Midpoint $330 – 340M $337 – 343M +$5M

4 Q3 Commercial Update Commercial Update End‐to‐end pipeline has grown by ~50% since Q2 2021; tighter labor market conditions are driving increased interest In contracting stage with prospective customers for end‐to‐end agreements; expect to exceed $4 billion NPR target if contracts are signed by year‐end Strong traction across full spectrum of offerings: Value‐based reimbursement: Selected by VillageMD and Archwell Health to drive revenue cycle performance while supporting their rapid growth Entri (including VisitPay): Selected by Memorial Sloan Kettering Cancer Care Center and Department of Veterans Affairs for patient payment and patient intake solutions Physician: Simplified and extended contract with American Physician Partners (APP) for a 10‐year term

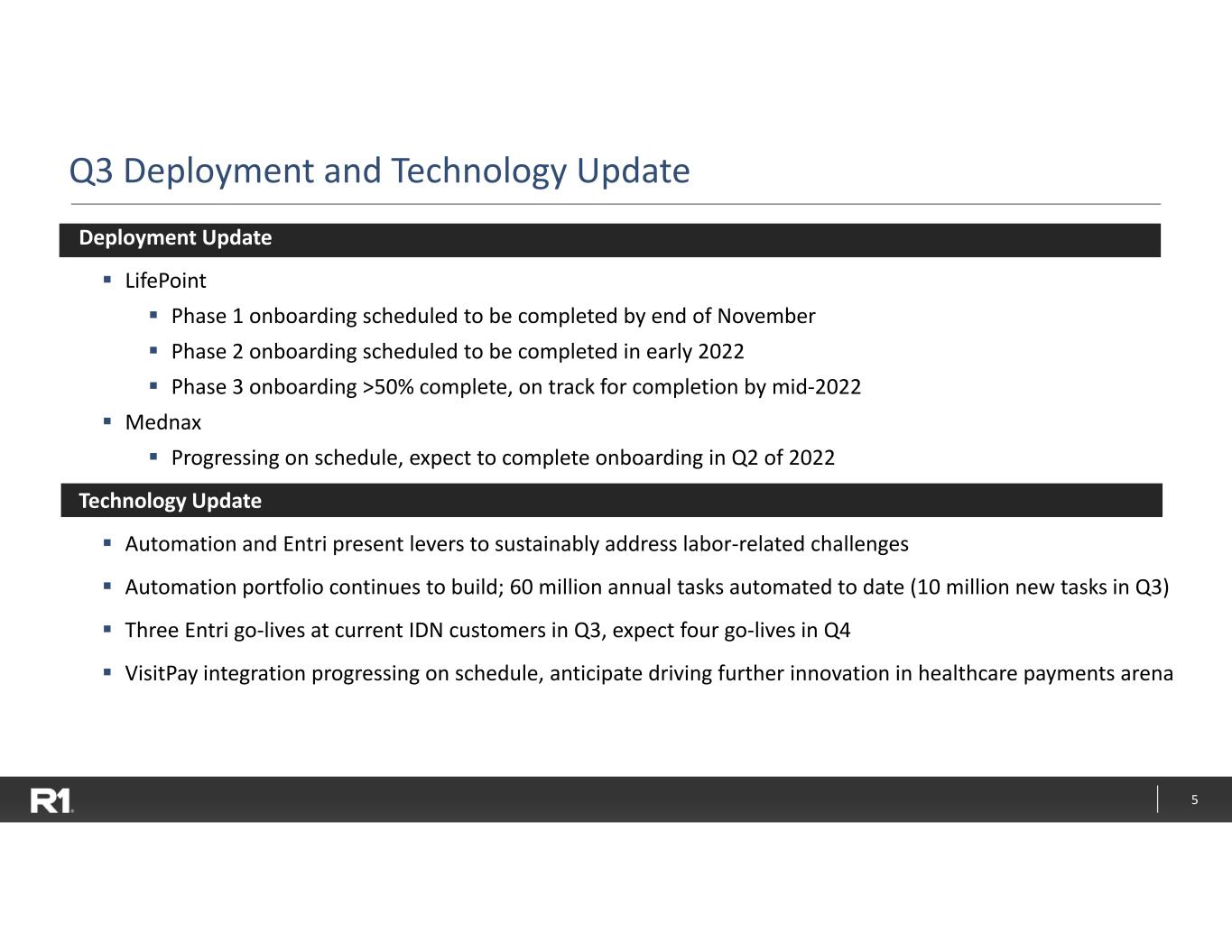

5 Q3 Deployment and Technology Update Deployment Update LifePoint Phase 1 onboarding scheduled to be completed by end of November Phase 2 onboarding scheduled to be completed in early 2022 Phase 3 onboarding >50% complete, on track for completion by mid‐2022 Mednax Progressing on schedule, expect to complete onboarding in Q2 of 2022 Technology Update Automation and Entri present levers to sustainably address labor‐related challenges Automation portfolio continues to build; 60 million annual tasks automated to date (10 million new tasks in Q3) Three Entri go‐lives at current IDN customers in Q3, expect four go‐lives in Q4 VisitPay integration progressing on schedule, anticipate driving further innovation in healthcare payments arena

6 3Q'21 Non‐GAAP Results – Q/Q and Y/Y Comparison ($ in millions) 3Q'21 2Q'21 3Q'20 Key Change Driver(s) Revenue $379.7 $353.4 $307.2 Q/Q: Continued recovery in patient volumes and higher incentive fees Y/Y: Recovery in patient volumes, new customers onboarded in the last twelve months, and the RevWorks and VisitPay acquisitions Adjusted Cost of Services1 $267.5 $254.5 $236.2 Q/Q: VisitPay acquisition and costs associated with new customer onboarding Y/Y: Costs associated with onboarding new customers, the RevWorks and VisitPay acquisitions, and productivity improvements from automation Adjusted SG&A expense1 $22.9 $20.1 $20.6 Q/Q: VisitPay acquisition Y/Y: VisitPay acquisition, and higher healthcare claims and compensation costs Adjusted EBITDA1 $89.3 $78.8 $50.4 Q/Q: Continued recovery in patient volumes, and productivity improvements Y/Y: Recovery in patient volumes, higher incentive fees, and productivity improvements from automation Note1: Adjusted cost of services, adjusted SG&A expense and adjusted EBITDA are non‐GAAP measures. A reconciliation of non‐GAAP to GAAP measures is provided in the Appendix of this presentation.

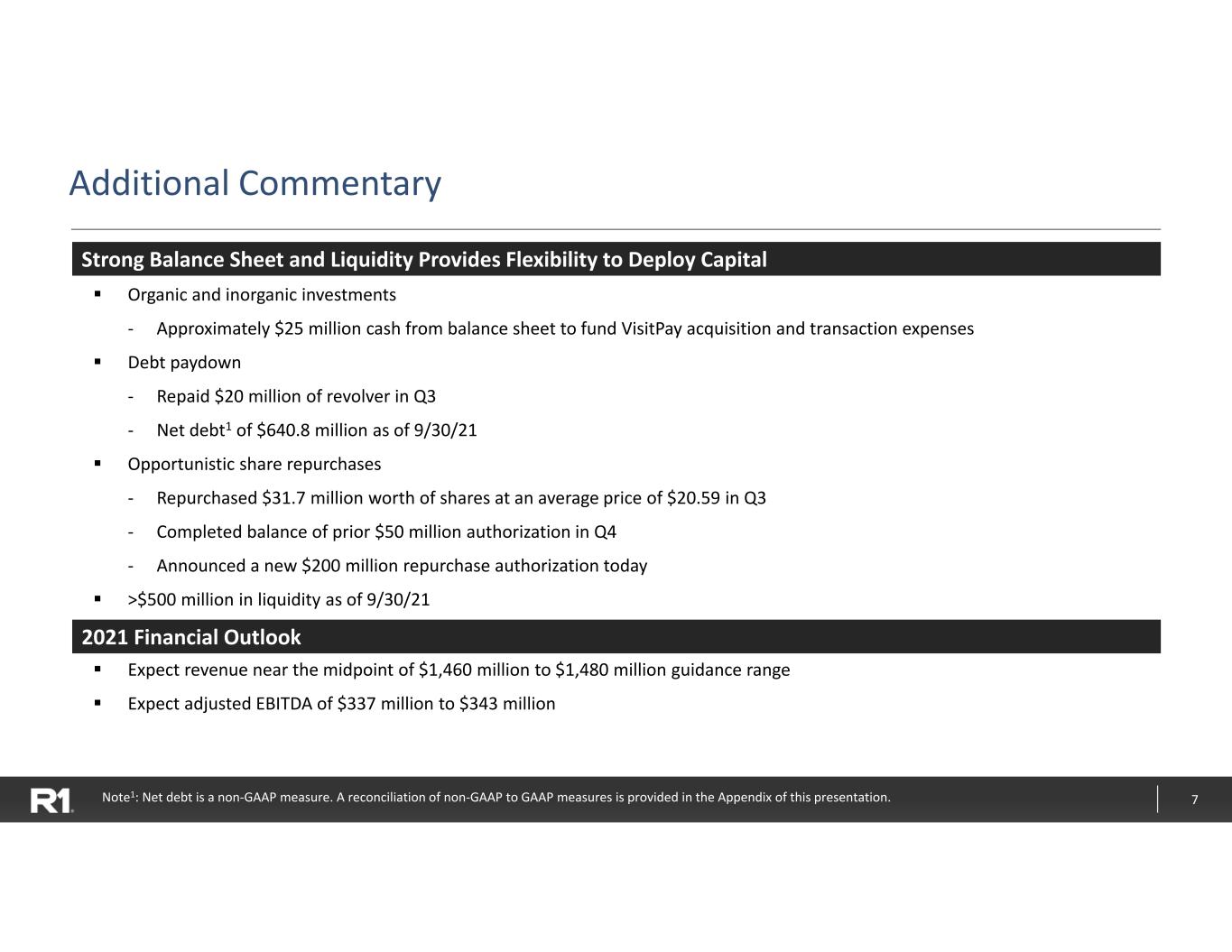

7 Additional Commentary Organic and inorganic investments ‐ Approximately $25 million cash from balance sheet to fund VisitPay acquisition and transaction expenses Debt paydown ‐ Repaid $20 million of revolver in Q3 ‐ Net debt1 of $640.8 million as of 9/30/21 Opportunistic share repurchases ‐ Repurchased $31.7 million worth of shares at an average price of $20.59 in Q3 ‐ Completed balance of prior $50 million authorization in Q4 ‐ Announced a new $200 million repurchase authorization today >$500 million in liquidity as of 9/30/21 Expect revenue near the midpoint of $1,460 million to $1,480 million guidance range Expect adjusted EBITDA of $337 million to $343 million Note1: Net debt is a non‐GAAP measure. A reconciliation of non‐GAAP to GAAP measures is provided in the Appendix of this presentation. Strong Balance Sheet and Liquidity Provides Flexibility to Deploy Capital 2021 Financial Outlook

8 Appendix Reconciliation of GAAP to Non‐GAAP Financials

9 Use of Non‐GAAP Financial Measures In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non‐GAAP financial measures, including adjusted EBITDA, non‐GAAP cost of services, non‐GAAP selling, general and administrative expenses, and net debt. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share‐based compensation expense, strategic initiatives costs, and certain other items. Non‐GAAP cost of services is defined as GAAP cost of services less share‐based compensation expense and depreciation and amortization expense attributed to cost of services. Non‐GAAP selling, general and administrative expenses is defined as GAAP selling, general and administrative expenses less share‐based compensation expense and depreciation and amortization expense attributed to selling, general and administrative expenses. Net debt is defined as debt less cash and cash equivalents, inclusive of restricted cash. Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. A reconciliation of GAAP net income to non‐GAAP adjusted EBITDA, GAAP cost of services to non‐GAAP cost of services, GAAP SG&A expense to non‐GAAP SG&A expense and total debt to net debt is provided on the following slides. Adjusted EBITDA, adjusted cost of services, adjusted SG&A expense and net debt should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP.

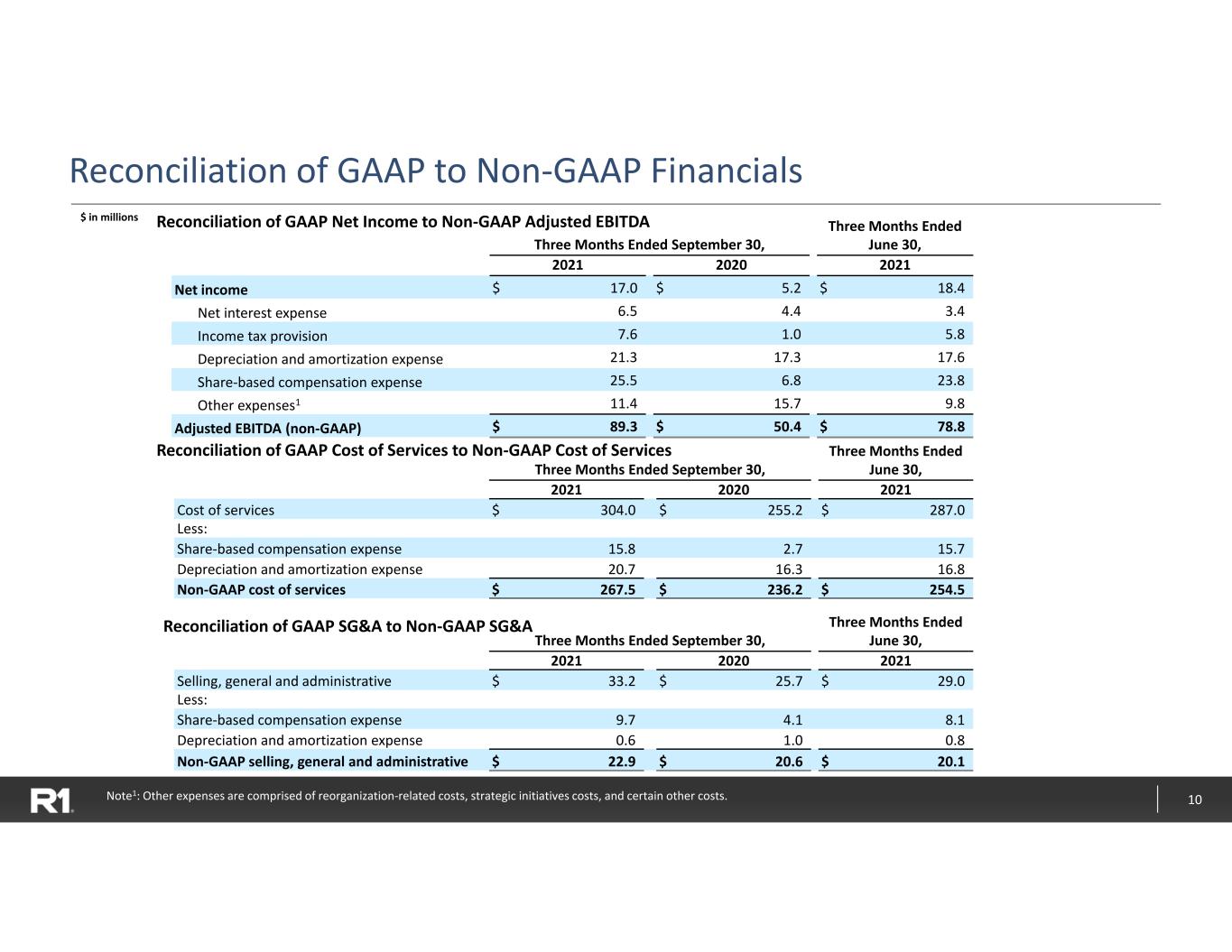

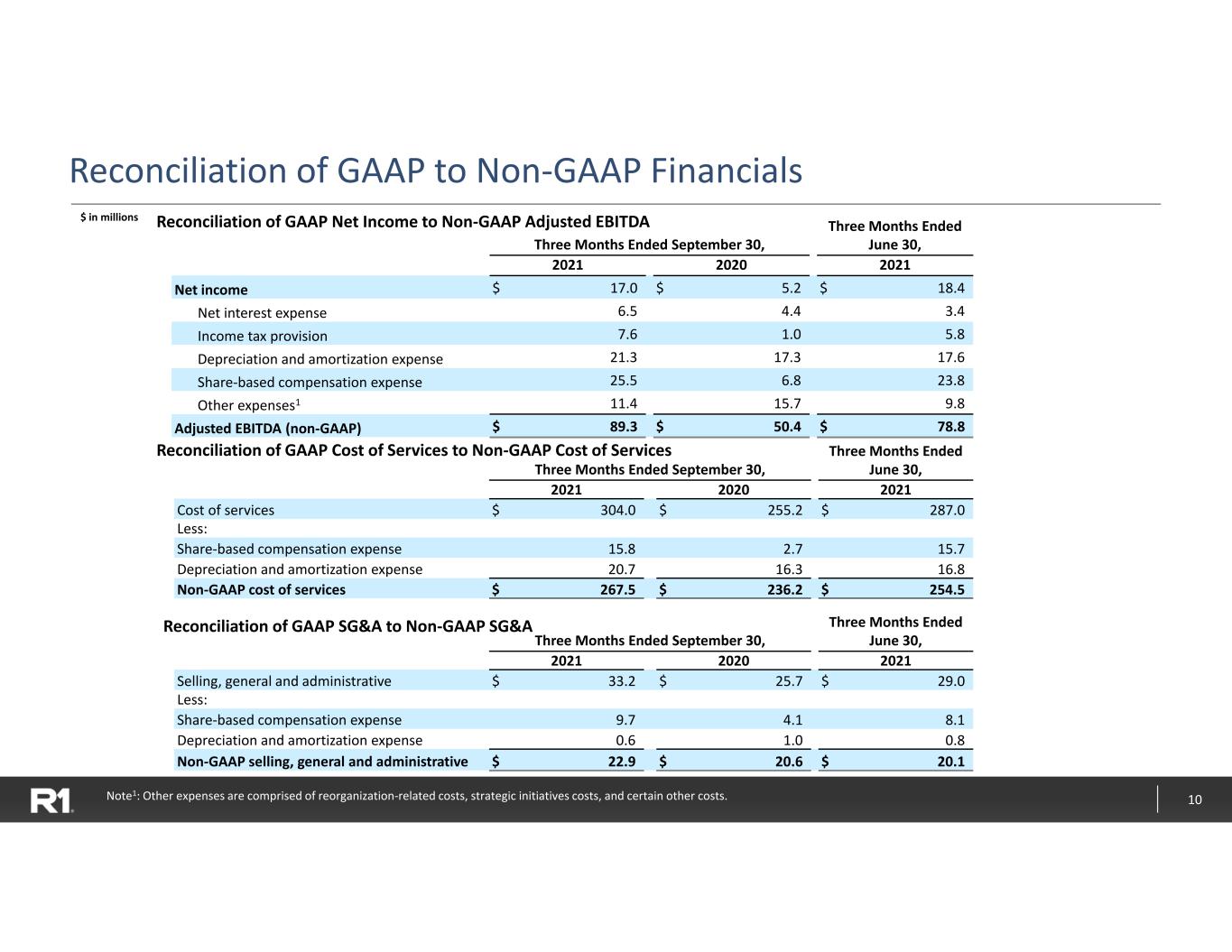

10 Reconciliation of GAAP to Non‐GAAP Financials Note1: Other expenses are comprised of reorganization‐related costs, strategic initiatives costs, and certain other costs. Three Months Ended September 30, Three Months Ended June 30, 2021 2020 2021 Cost of services $ 304.0 $ 255.2 $ 287.0 Less: Share‐based compensation expense 15.8 2.7 15.7 Depreciation and amortization expense 20.7 16.3 16.8 Non‐GAAP cost of services $ 267.5 $ 236.2 $ 254.5 Three Months Ended September 30, Three Months Ended June 30, 2021 2020 2021 Selling, general and administrative $ 33.2 $ 25.7 $ 29.0 Less: Share‐based compensation expense 9.7 4.1 8.1 Depreciation and amortization expense 0.6 1.0 0.8 Non‐GAAP selling, general and administrative $ 22.9 $ 20.6 $ 20.1 Reconciliation of GAAP SG&A to Non‐GAAP SG&A Reconciliation of GAAP Cost of Services to Non‐GAAP Cost of Services Reconciliation of GAAP Net Income to Non‐GAAP Adjusted EBITDA$ in millions Three Months Ended September 30, Three Months Ended June 30, 2021 2020 2021 Net income $ 17.0 $ 5.2 $ 18.4 Net interest expense 6.5 4.4 3.4 Income tax provision 7.6 1.0 5.8 Depreciation and amortization expense 21.3 17.3 17.6 Share‐based compensation expense 25.5 6.8 23.8 Other expenses1 11.4 15.7 9.8 Adjusted EBITDA (non‐GAAP) $ 89.3 $ 50.4 $ 78.8

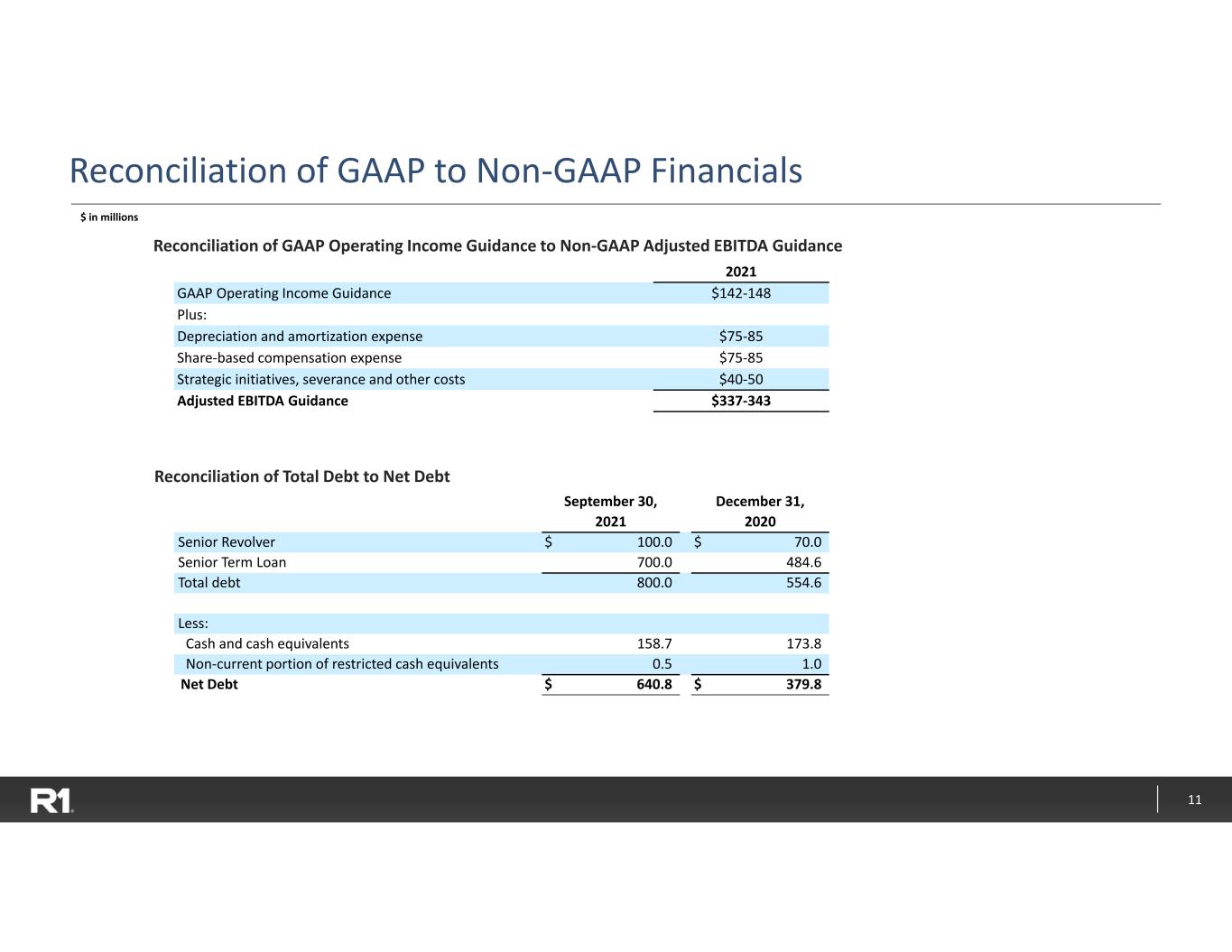

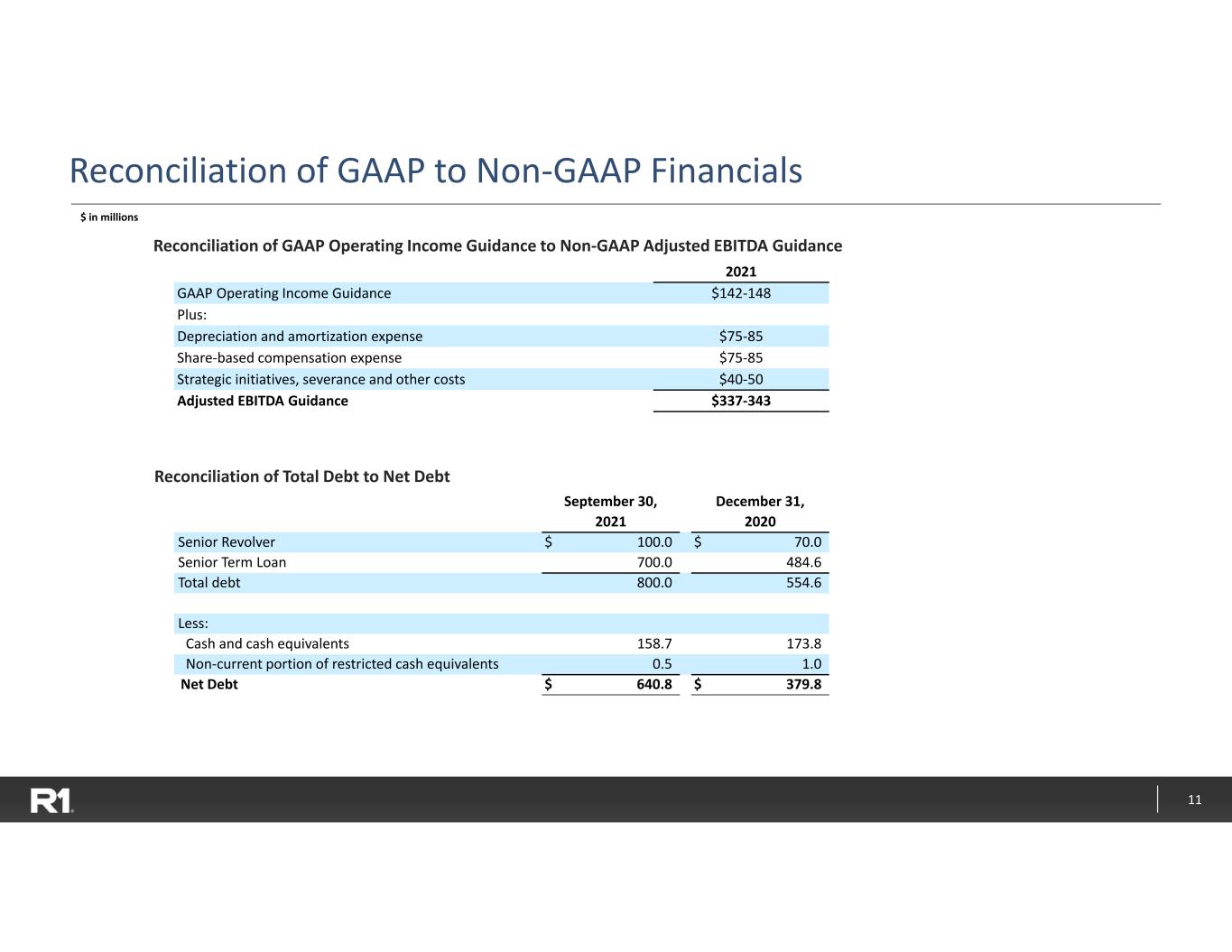

11 Reconciliation of GAAP to Non‐GAAP Financials Reconciliation of GAAP Operating Income Guidance to Non‐GAAP Adjusted EBITDA Guidance 2021 GAAP Operating Income Guidance $142‐148 Plus: Depreciation and amortization expense $75‐85 Share‐based compensation expense $75‐85 Strategic initiatives, severance and other costs $40‐50 Adjusted EBITDA Guidance $337‐343 Reconciliation of Total Debt to Net Debt September 30, December 31, 2021 2020 Senior Revolver $ 100.0 $ 70.0 Senior Term Loan 700.0 484.6 Total debt 800.0 554.6 Less: Cash and cash equivalents 158.7 173.8 Non‐current portion of restricted cash equivalents 0.5 1.0 Net Debt $ 640.8 $ 379.8 $ in millions