PRESS RELEASE

LONCOR PROVIDES UPDATE ON ITS NGAYU PROJECT

• Significant upside potential identified at 1,675,000 oz (20.78 Mt @ 2.5 g/t Au) Imbo Concession since 2014 resource estimate

Toronto, Canada - January 28, 2020 - Loncor Resources Inc. ("Loncor" or the "Company") (TSX: "LN"; OTCQB: "LONCF") is pleased to provide an update on its activities within the Ngayu Greenstone Belt, where the Company has a dominant foot-print through its joint venture with Barrick Gold (Congo) SARL ("Barrick") and on its own majority-owned prospecting licences and exploitation concessions.

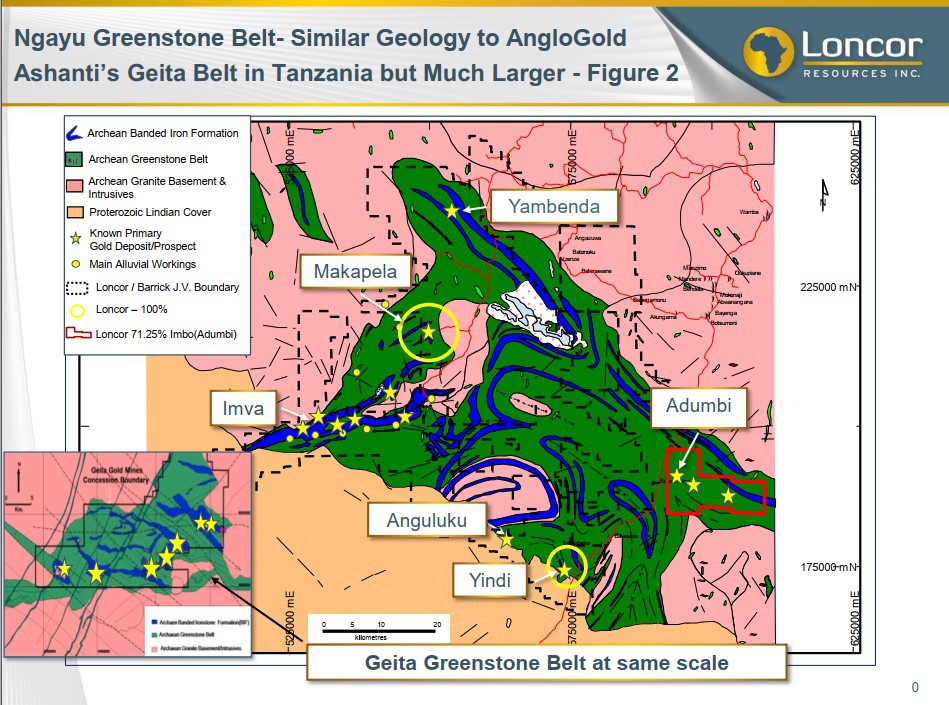

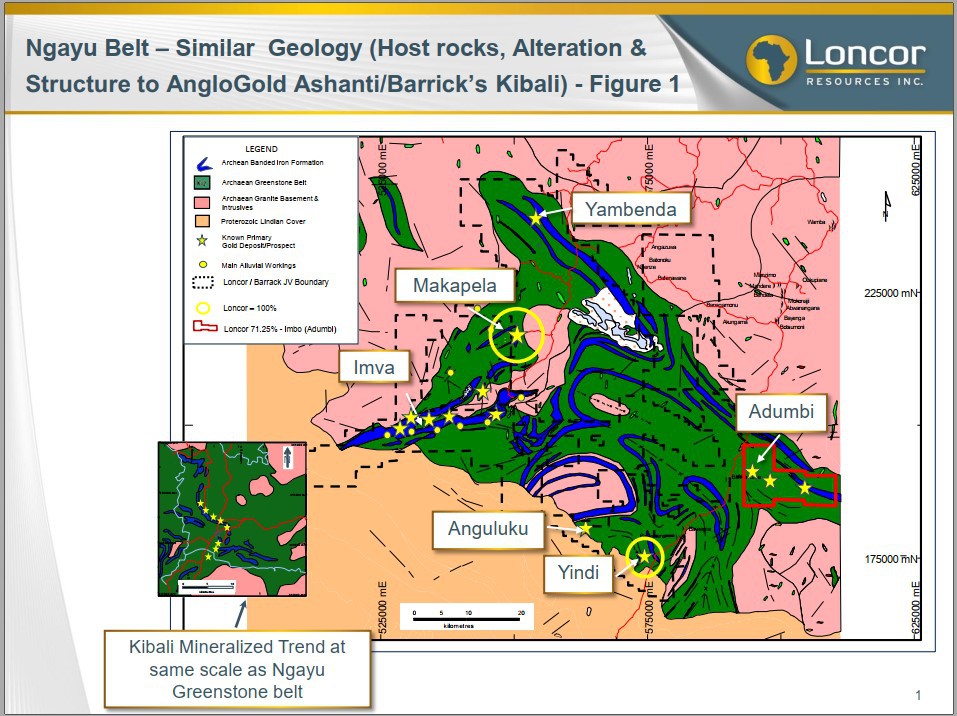

The Ngayu Archean Greenstone Belt of northeastern Democratic Republic of the Congo (the "DRC") is geologically similar to the belts which host the world class gold mines of AngloGold Ashanti/Barrick's Kibali mine in the DRC and AngloGold Ashanti's Geita mine in Tanzania. Gold mineralization at Ngayu is spatially related to Banded Ironstone Formation ("BIF"), which is the case at both Kibali and Geita and is highlighted in Figures 1 and 2 below. The Ngayu belt is significantly larger in extent than the Geita belt

Adumbi Deposit

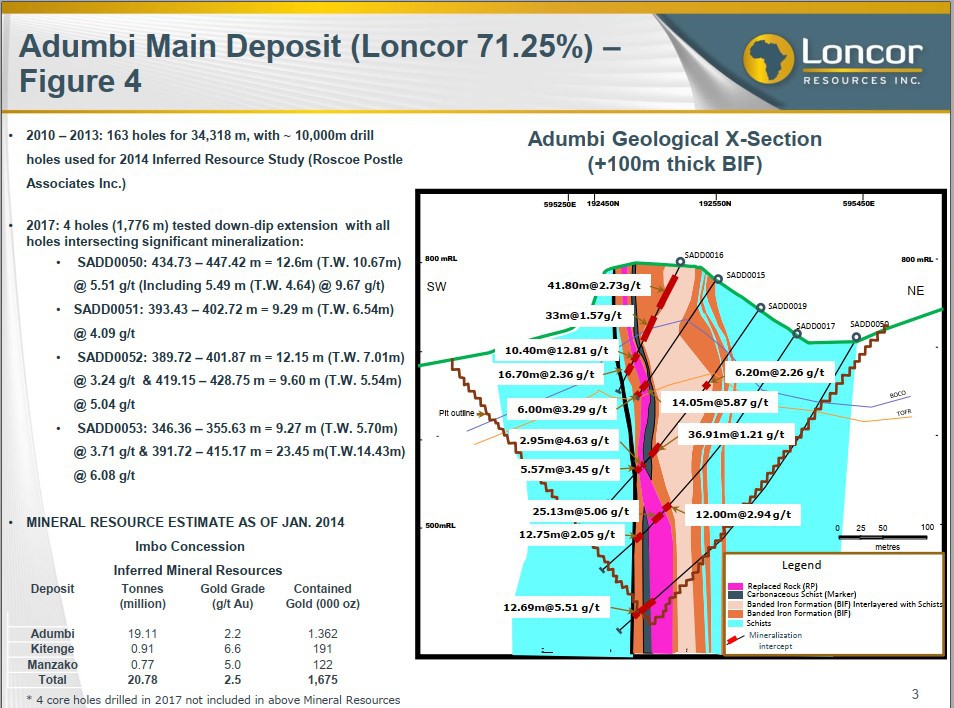

Since the Company's acquisition of 71.25% of the KGL-Somituri gold project from Kilo Goldmines Ltd. in September 2019, Loncor has focussed on the Imbo exploitation concession in the east of the Ngayu belt where an Inferred Mineral Resource of 1.675 million ounces of gold (20.78 million tonnes grading 2.5 g/t Au, with 71.25% of this Inferred Mineral Resource being attributable to Loncor via its 71.25% interest) was outlined in January 2014 by independent consultants Roscoe Postle Associates Inc ("RPA") on three separate deposits, Adumbi, Kitenge and Manzako (see Figures 3 and 4 below). In this study, RPA made a number of recommendations on Adumbi, which were subsequently undertaken during the period 2014-18. The Company's geological consultants Minecon Resources and Services Limited ("Minecon") has been assessing the implications of this additional exploration data on Adumbi, which are summarised below.

Additional Drilling

RPA recommended additional drilling at Adumbi to test the down dip/plunge extent of the mineralization. In 2017, four deeper core holes were drilled below the previously outlined RPA inferred resource over a strike length of 400 metres and to a maximum depth of 450 metres below surface. All four holes intersected significant gold mineralization in terms of widths and grade and are summarised below:

Borehole | From(m) | To(m) | Intercept Width(m) | True Width(m) | Grade (g/t) Au |

SADD50 | 434.73 | 447.42 | 12.69 | 10.67 | 5.51 |

|

|

|

|

|

|

SADD51 | 393.43 | 402.72 | 9.29 | 6.54 | 4.09 |

|

|

|

|

|

|

SADD52 | 389.72 | 401.87 | 12.15 | 7.01 | 3.24 |

| 419.15 | 428.75 | 9.60 | 5.54 | 5.04 |

|

|

|

|

|

|

SADD53 | 346.36 | 355.63 | 9.27 | 5.70 | 3.71 |

| 391.72 | 415.17 | 23.45 | 14.43 | 6.08 |

The above drilling results which are shown on the longtitudinal section (see Figure 5 below), indicate that the gold mineralization is open along strike and at depth. The drilling of an additional 12 core holes has the potential to significantly increase the Adumbi mineral resource as highlighted on the longitudinal section.

Survey and Georeferencing

The Adumbi drill hole collars, trenches, and accessible adits/portals have now been accurately surveyed and the data appropriately georeferenced. In addition, all accessible underground excavations and workings have been accurately surveyed. The new and improved quality of the exploration data will have positive implications on potential future classification of the mineral resources.

Re-logging of All Drill Holes

The re-logging of drill holes after the RPA study has defined the presence of five distinct geological domains in the central part of the Adumbi deposit where the BIF unit attains a thickness of up to 130 metres (see Figure 4 below). From northeast to southwest:

- Hanging wall schists: dominantly quartz carbonate schist, with interbedded carbonaceous schist.

- Upper BIF Sequence: an interbedded sequence of BIF and chlorite schist, 45 to 130 metres in thickness.

- Carbonaceous Marker: a distinctive 3 to 17 metre thick unit of black carbonaceous schist with pale argillaceous bands.

- Lower BIF Sequence: BIF interbedded with quartz carbonate, carbonaceous and/or chlorite schist in a zone 4 to 30 metres wide.

- Footwall Schists: similar to the hanging wall schist sequence.

In the central part of Adumbi, three main zones of gold mineralization are present. These include mineralisation:

- Within the Lower BIF Sequence.

- In the lower part of the Upper BIF Sequence. Zones 1 and 2 are separated by the Carbonaceous Marker, which is essentially unmineralized.

- A weaker zone in the upper part of the Upper BIF Sequence.

The lack of a detailed geological model in the previous resource estimates resulted in wireframes being constructed using only assay values with little regard to geological domains. This has resulted in wireframes cross-cutting the geology which could have resulted in underestimating the previous resource estimate.

Relative Density ("RD") Measurements

The increase in the sample population coupled with the application of a more rigid RD determination procedure based on recommendations from the RPA resource study, indicates that the new RD measurements from both mineralized and unmineralized material and from the various material types and lithologic units have improved the confidence in the relative RD determination to be applied to any future resource estimates. Relative to the 6 oxide RD measurements used for tonnage estimation in the RPA model, 297 oxide RD measurements within the mineralised domain were undertaken during the review work. For the transition and fresh material, equal number of determinations relative to the previous RD sample volumes were undertaken with the review process employing more rigid RD determination procedures.

Table 1 below indicates significate positive variance between the previous model RD and the reviewed work for the oxide and transition materials.

Table 1: Summary of Previous and Reviewed Mineralised Average RD Measurements

Material Type | RD used in Previous RPA Model | Additional RD Determinations | RD Variance (%) |

Oxide | 1.80 | 2.45 | 36.1 |

Transition | 2.20 | 2.82 | 28.2 |

Fresh | 3.00 | 3.05 | 1.7 |

Oxidation and Fresh Rock Surfaces

The re-logging of the core as per the RPA recommendations identified major differences between the depths of Base of Complete Oxidation (BOCO) and Top of Fresh Rock (TOFR), and the depths used by RPA in the 2014 model. In the RPA model, the BOCO was negligible and the TOFR corresponded approximately to the re-logged BOCO. The deeper levels of oxidation that were observed during the re-logging exercise should have positive implications for the Adumbi project with respect to ore type classification and associated metallurgical recoveries and mining and processing cost estimates.

Adit Sampling and Georeferencing

Following the accurate surveying of the 10 historical adits and appropriately georeferencing, the 796 adit samples (1,121 metres in total) when applied should have positive implications on the data spacing and classification of any future mineral resources.

In summary, most of the previous recommendations from the 2014 RPA mineral resource study on Adumbi have been undertaken. In addition, the previously recommended LIDAR survey by RPA was completed this month over Adumbi by Southern Mapping of South Africa.

The results of all the above tasks coupled with the higher current gold price compared with the previous study in 2014 indicate significant upside at Adumbi. Minecon is undertaking further studies to better quantify this significant upside. At present and subject to the Company securing the necessary financing, the Company is planning to drill the additional 12 deeper holes at Adumbi and then commence a preliminary economic assessment when an updated mineral resource study will be undertaken.

Ongoing studies are also continuing by Minecon on further assessing the data elsewhere on the Imbo exploitation concession including Kitenge and Manzako.

As announced in November 2019, joint venture partner and operator Barrick has identified a number of priority drill targets within the 1,894 square kilometre joint venture land package (the "JV Areas") at Ngayu and that are planned to be drilled during the current dry season. Drill targets include Bakpau, Lybie-Salisa and Itali in the Imva area as well as Anguluku in the southwest of the Ngayu belt and Yambenda in the north. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration on the JV Areas at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Subject to the DRC's free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focused on two projects in the DRC - the Ngayu and North Kivu projects. Both projects have historic gold production. Exploration at the Ngayu project is currently being undertaken by Loncor's joint venture partner Barrick Gold Corporation through its DRC subsidiary Barrick Gold (Congo) SARL ("Barrick"). The Ngayu project is 200 kilometres southwest of the Kibali gold mine, which is operated by Barrick and in 2018 produced approximately 800,000 ounces of gold. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Subject to the DRC's free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

Certain parcels of land within the Ngayu project surrounding and including the Makapela and Yindi prospects have been retained by Loncor and do not form part of the joint venture with Barrick. Barrick has certain pre-emptive rights over these two areas. Loncor's Makapela prospect has an Indicated Mineral Resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an Inferred Mineral Resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au). Loncor also recently acquired a 71.25% interest in the KGL-Somituri gold project in the Ngayu gold belt which has an Inferred Mineral Resource of 1.675 million ounces of gold (20.78 million tonnes grading 2.5 g/t Au), with 71.25% of this resource being attributable to Loncor via its 71.25% interest.

Resolute Mining Limited (ASX/LSE: "RSG") owns 27% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering. Newmont Goldcorp Corporation (NYSE: "NEM"; TSX: "NGT") owns 7.8% of Loncor's outstanding shares.

Additional information with respect to Loncor and its projects can be found on Loncor's website at www.loncor.com.

Qualified Person

Peter N. Cowley, who is President of Loncor and a "qualified person" as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Technical Reports

Certain additional information with respect to the Company's Ngayu project is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled "Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo". A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Certain additional information with respect to the Company's recently acquired KGL-Somituri project is contained in the technical report of Roscoe Postle Associates Inc. dated February 28, 2014 and entitled "Technical Report on the Somituri Project Imbo Licence, Democratic Republic of the Congo". A copy of the said report, which was prepared for, and filed on SEDAR by, Kilo Goldmines Ltd., can be obtained from SEDAR at www.sedar.com. To the best of the Company's knowledge, information and belief, there is no new material scientific or technical information that would make the disclosure of the KGL-Somituri mineral resource set out in this press release inaccurate or misleading.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (the "SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Certain terms are used by the Company, such as "Indicated" and "Inferred" "Resources", that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in the Company's Form 20-F annual report, File No. 001- 35124, which may be secured from the Company, or from the SEC's website at http://www.sec.gov/edgar.shtml.

Cautionary Note Concerning Forward-Looking Information

This press release contains forward-looking information. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential mineral resource increases, exploration results, mineral resource estimates, future drilling and other future exploration, potential gold discoveries and future development) are forward-looking information. This forward-looking information reflects the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking information is subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking information, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things, the possibility that the planned drilling programs (by both Barrick and the Company) will be delayed, uncertainties relating to the availability and costs of financing needed in the future, risks related to the exploration stage of the Company's properties, the possibility that future exploration (including drilling) or development results will not be consistent with the Company's expectations, failure to establish estimated mineral resources (the Company's mineral resource figures are estimates and no assurances can be given that the indicated levels of gold will be produced), changes in world gold markets or equity markets, political developments in the DRC, gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production), fluctuations in currency exchange rates, inflation, changes to regulations affecting the Company's activities, delays in obtaining or failure to obtain required project approvals, the uncertainties involved in interpreting drilling results and other geological data and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual report on Form 20-F dated April 1, 2019 filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Forward-looking information speaks only as of the date on which it is provided and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

For further information, please visit our website at www.loncor.com, or contact: Arnold Kondrat, CEO, Toronto, Ontario, Tel: + 1 (416) 366 7300.