UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT 5 to

FORM 10-12g

_____________________

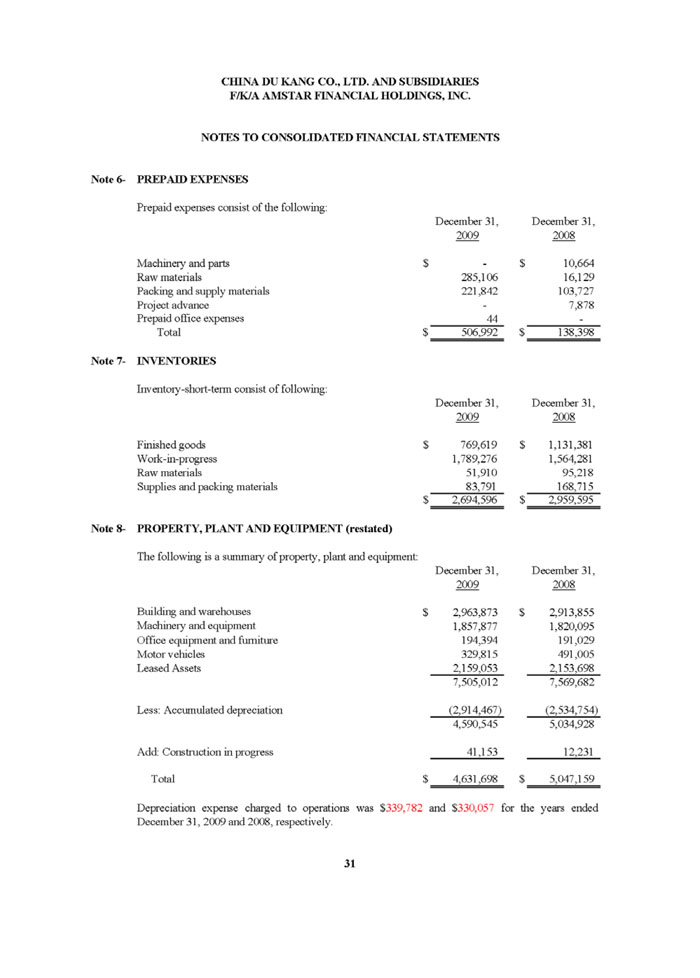

CHINA DU KANG CO., LTD.

_____________________

GENERAL FORM FOR REGISTRATION OF SECURITIES

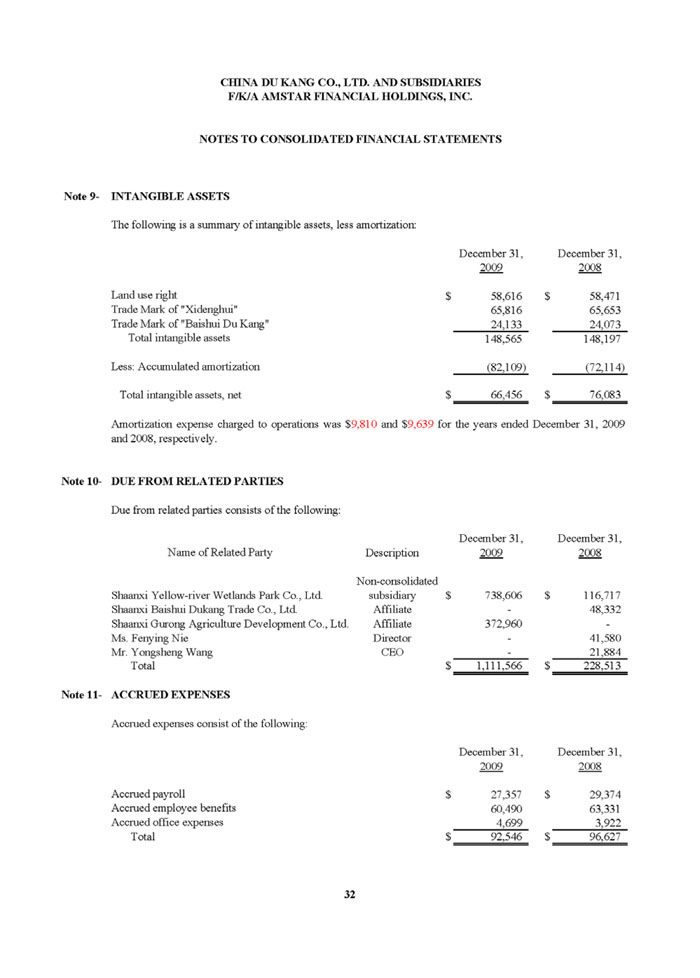

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

| Nevada | 90-0531621 |

| (State of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

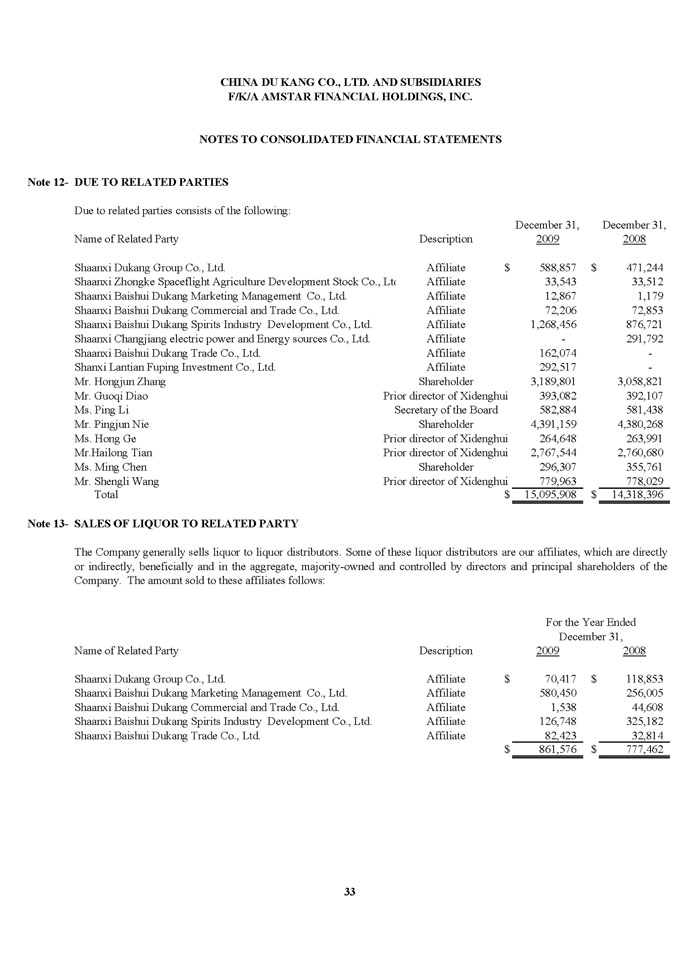

| | |

| | |

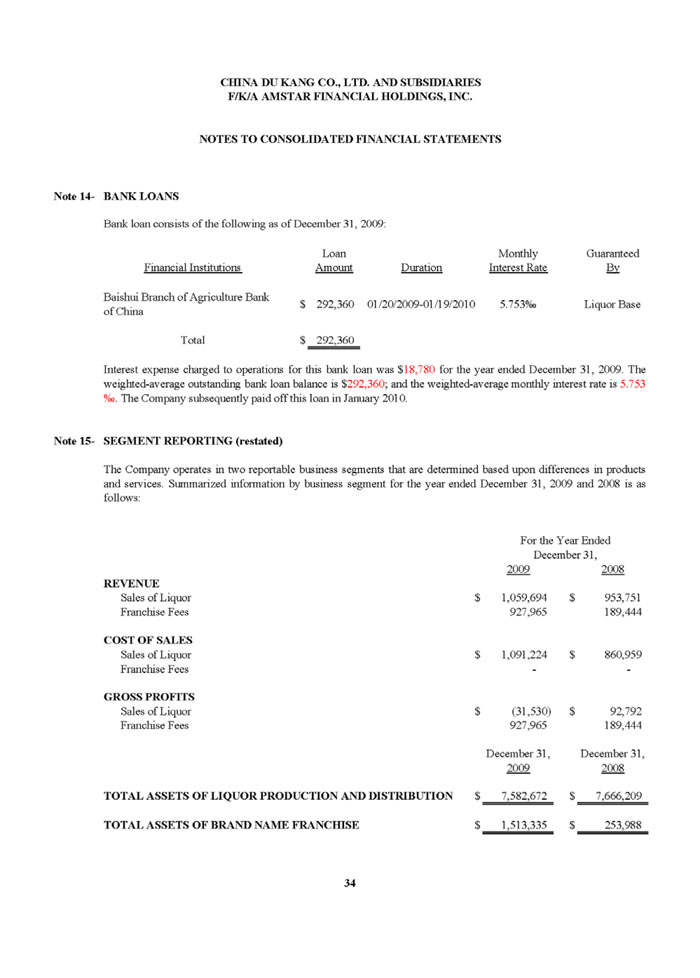

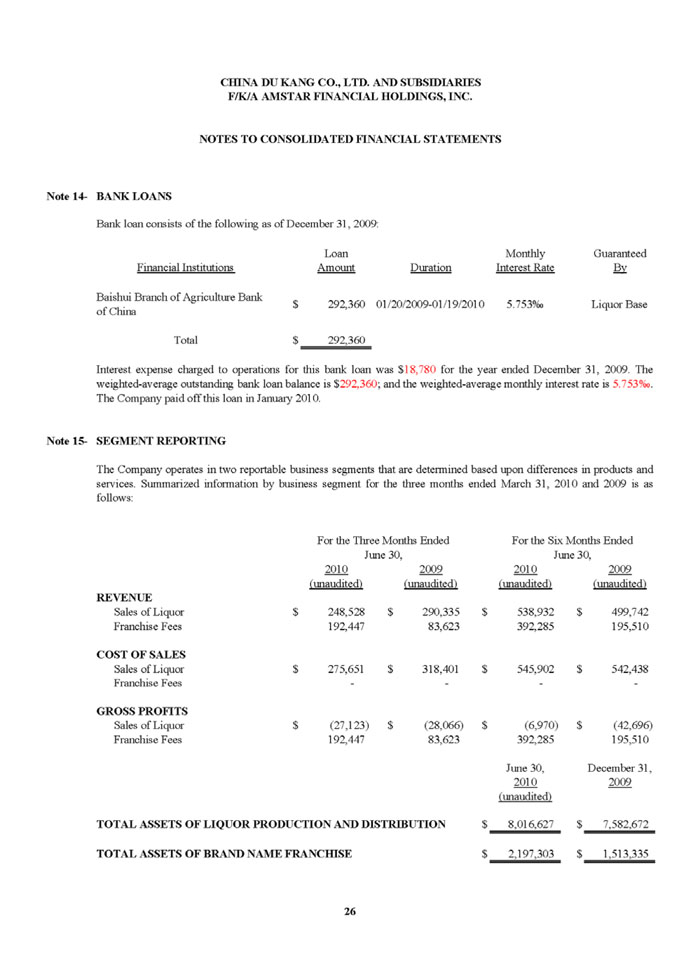

| | |

| Town of Dukang, Baishui County, Shaanxi province, China | |

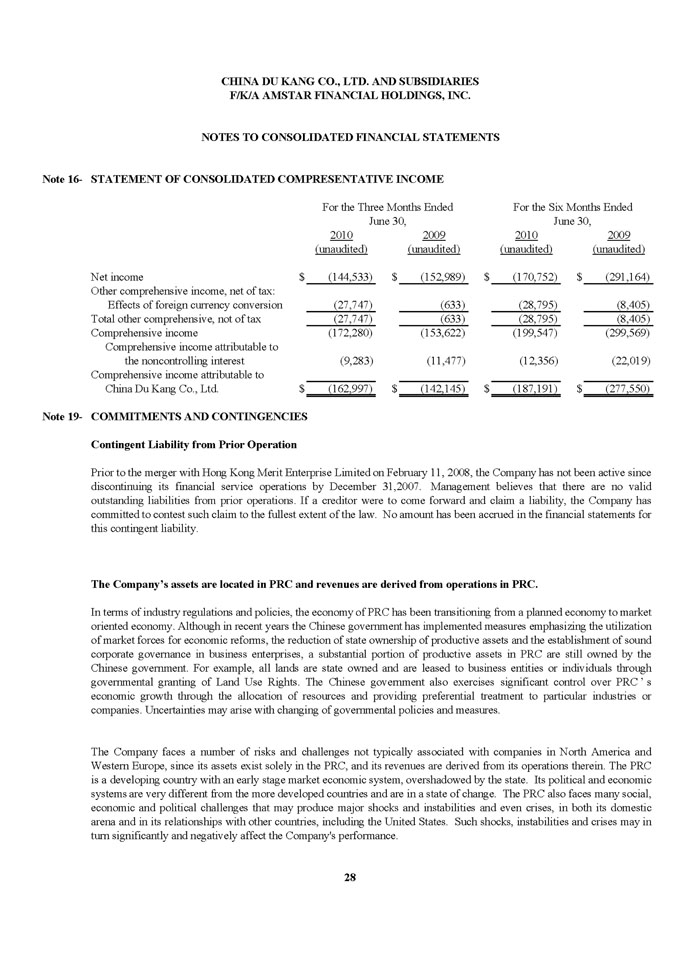

| A-28,Van Metropolis,#35 Tangyan Road, | |

| Xi'an, Shaanxi, PRC, | 710065 |

| Address of Principal Executive Offices | Zip Code |

8629-88830106-822

_____________________

Telephone Number

Copies to:

Charles W. Barkley, Esq.

6201 Fairview Road, Suite 200

Charlotte, NC 28210

(704) 944-4290

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, .001 par value per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company x |

CHINA DU KANG CO., LTD.

___________________________

TABLE OF CONTENTS

| Item No. | | Item Caption | Page |

| 1. | | Business | |

| 1A. | | Risk Factors | |

| 2. | | Financial Information | |

| 3. | | Properties | |

| 4. | | Security Ownership of Certain Beneficial Owners and Management | |

| 5. | | Directors and Executive Officers | |

| 6. | | Executive Compensation | |

| 7. | | Certain Relationships and Related Transactions, and Director Independence | |

| 8. | | Legal Proceedings | |

| 9. | | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | |

| 10. | | Recent Sale of Unregistered Securities | |

| 11. | | Description of Registrant’s Securities to be Registered | |

| 12. | | Indemnification of Directors and Officers | |

| 13. | | Financial Statements and Supplementary Data including the Consolidated Financial Statements | |

| 14. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| 15. | | Financial Statements and Exhibits | |

EXPLANATORY NOTE

We are filing this General Form for Registration of Securities on Form 10 to register our common stock, par value $0.001 per share (the “Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).We intend to be subject to the requirements of Regulation 13A under the Exchange Act, which requires us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we are required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Unless otherwise noted, references in this registration statement to the “Registrant,” the “Company,” “we,” “our” or “us” means China Du Kang Co., Ltd. Our principal place of business is located at A-28,Van Metropolis,#35 Tangyan Road, Xi'an, Shaanxi, PRC,, 710065. Our telephone number is 8629-88830106-822.

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under the section entitled “Risk Factors.” Although management believes that the a ssumptions underlying the forward looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In light of these risks and uncertainties, there can be no assurance th at the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Item 1. Business

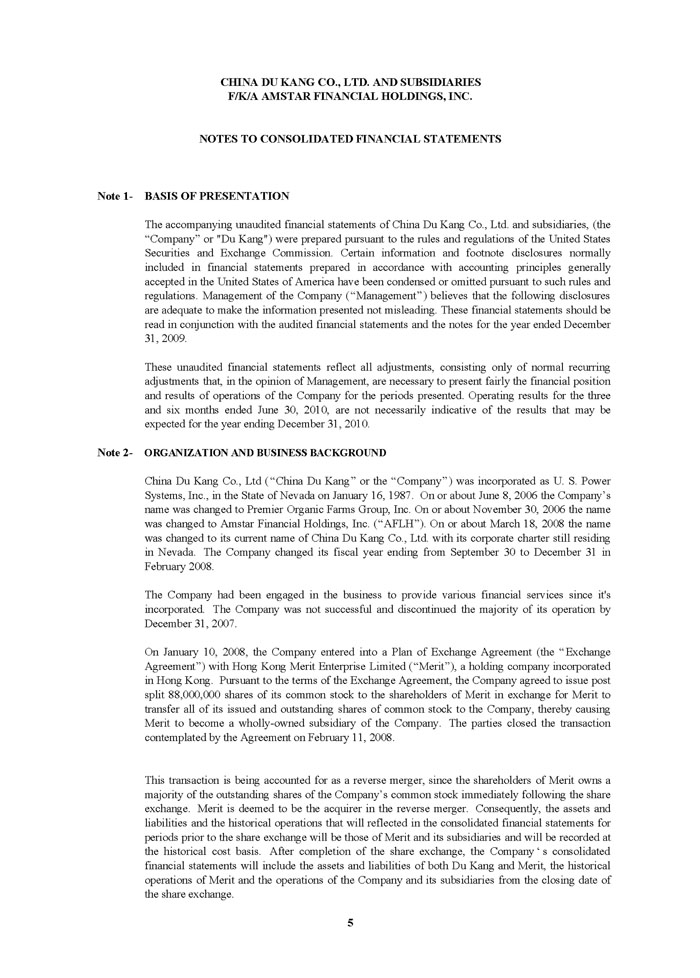

China Du Kang Co., Ltd (“Du Kang” or the “Company”) was incorporated as U. S. Power Systems, Inc., in the State of Nevada on January 16, 1987. On or about June 8, 2006 the Company’s name was changed to Premier Organic Farms Group, Inc. On or about November 30, 2006 the name was changed to Amstar Financial Holdings, Inc. (“AFLH”). On or about March 18, 2008 the name was changed to its current name of China Du Kang Co., Ltd. with its corporate charter still residing in Nevada. The Company changed its fiscal year ending from September 30 to December 31 in February 2008.

Overview

The Company had been engaged in the business to provide various financial services since it's incorporation. The Company was not successful and discontinued the majority of its operation by December 31, 2007.

“We previously were a shell company, therefore the exemption offered pursuant to Rule 144 is not available. Anyone who purchased securities directly or indirectly from us or any of our affiliates in a transaction or chain of transactions not involving a public offering cannot sell such securities in an open market transaction.”

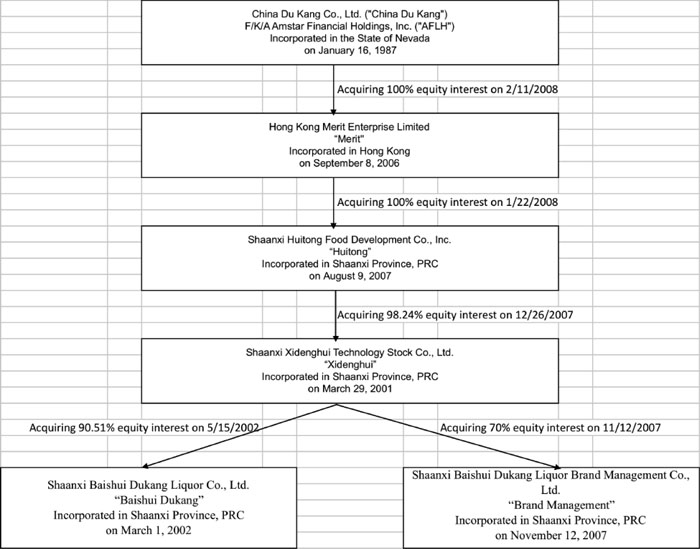

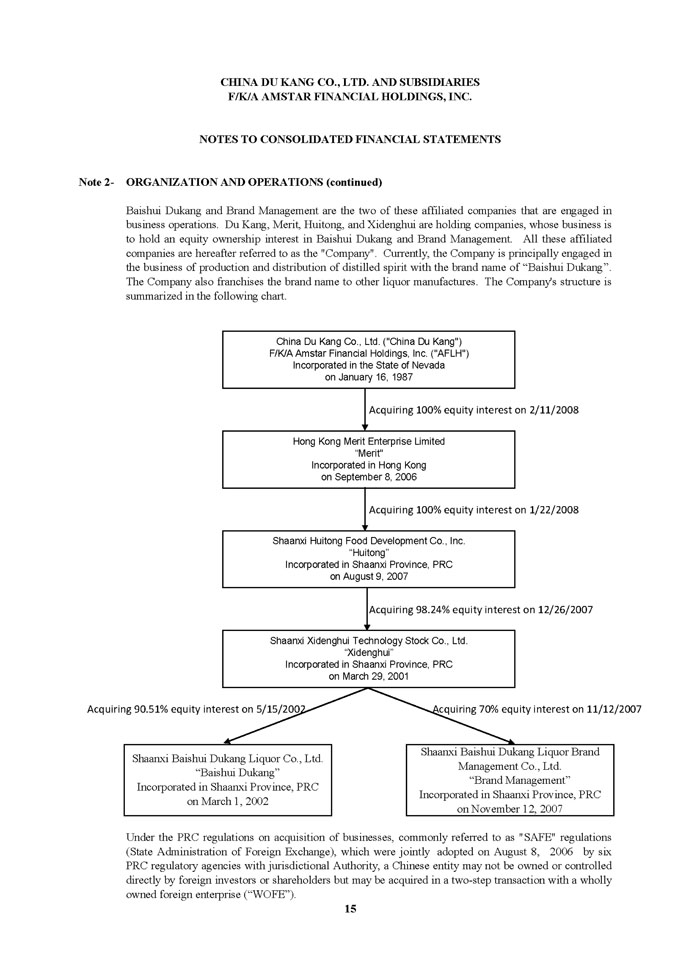

On January 10, 2008, the Company entered into a Plan of Exchange Agreement (the “Agreement”) with Hong Kong Merit Enterprise Limited (“Merit”), a holding company incorporated in Hong Kong. Pursuant to the terms of the Agreement, the Company agreed to issue post split 88,000,000 shares of its common stock to the shareholder(s) of Merit in exchange for Merit to transfer all of its issued and outstanding shares of common stock to the Company, thereby causing Merit to become a wholly-owned subsidiary of the Company. Merit also agreed to pay $260,000 to the Company at closing. The parties closed the transaction contemplated by the Agreement on February 11, 2008.

This transaction is being accounted for as a reverse merger, since the shareholders of Merit owns a majority of the outstanding shares of the Company’s common stock immediately following the share exchange. Merit is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will reflected in the consolidated financial statements for periods prior to the share exchange will be those of Merit and its subsidiaries and will be recorded at the historical cost basis. After completion of the share exchange, the Company‘s consolidated financial statements will include the assets and liabilities of both Du Kang and Merit, the historical operations of Merit and the operations of the Company and its subsidiaries from the closing date of the share exchange.

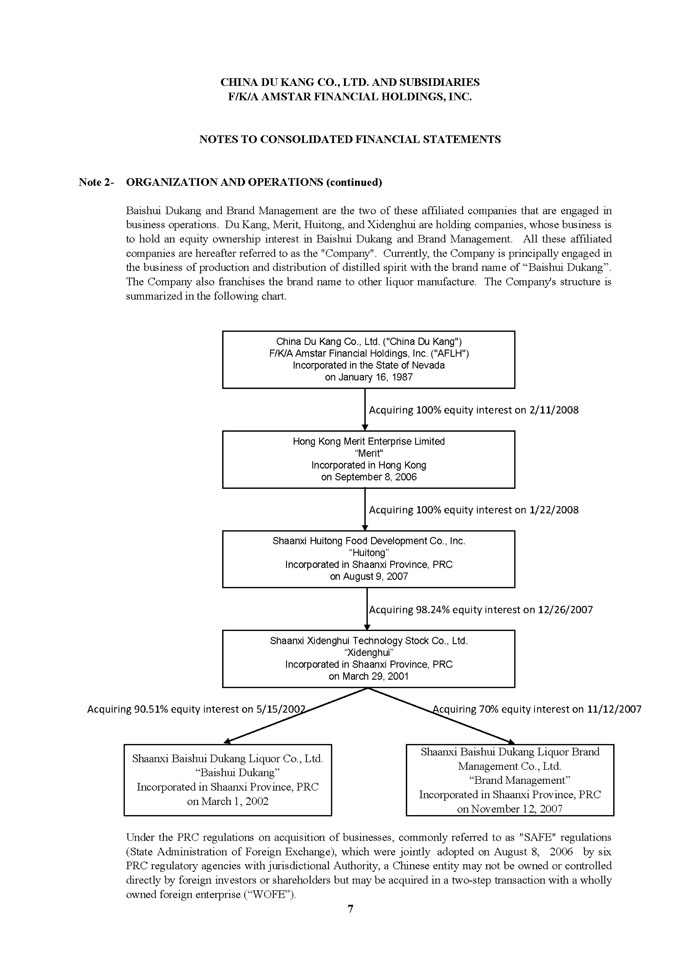

Merit was incorporated on September 8, 2006 in Hong Kong under the Companies Ordinances as a Limited Liability company. Merit was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship..

On January 22, 2008, Merit entered into a Share Purchase Agreement (the “Purchase Agreement”) with the owners of Shaanxi Huitong Food Co., Inc. ("Huitong"), a limited liability company incorporated in the People's Republic of China ("PRC") on August 9, 2007 with a registered capital of $128,200 (RMB1,000,000). Pursuant to the Purchase Agreement, the Merit agreed to purchase 100% of the equity ownership in Huitong for a cash consideration of $136,722 (RMB 1,000,000). Subsequent to the completion of the Agreement, Huitong became a wholly-owned subsidiary of Merit.

Huitong was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship. On December 26, 2007 Huitong executed a share exchange agreement (the "Exchange Agreement") with the owners of Shaanxi Xidenghui Technology Stock Co., Ltd. ("Xidenghui"), whereby Huitong exchanged 100% of its issued and outstanding capital for 98.24% of the equity ownership in Xidenghui. Subsequent to completion of the Share Exchange, Xidenghui became a majority-owned subsidiary of Huitong.

Xidenghui was incorporated in Weinan City, Shaanxi Province, PRC on March 29, 2001 under the Company Law of PRC. Xidenghui was engaged in the business of production and distribution of distilled spirit with a brand name of “Xidenghui”. Currently, its principal business is to hold an equity ownership interest in Shannxi Baishui Dukang Liquor Co., Ltd. (“Baishui Dukang”) and Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. (“Brand Management”).

Baishui Dukang was incorporated in Baishui County, Shaanxi Province, PRC on March 1, 2002 under the Company Law of PRC. Baishui Dukang was principally engaged in the business of production and distribution of distilled spirit with a brand name of “Baishui Dukang”. On May 15, 2002, Xidenghui invested inventory and fixed assets, with a total fair value of $ 4,470,219 (RMB 37,000,000) to Baishui Dukang and owns 90.51% of Baishui Dukang’s equity interest ownership, thereby causing Baishui Dukang to become a majority-owned subsidiary of Xidenghui.

On October 30, 2007, Xidenghui executed an agreement with Mr. Zhang Hongjun, a PRC citizen, to establish a joint venture, Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. ("Brand Management"). Pursuant to the agreement, Xidenghui contributed cash of $769,200 (RMB 700,000), and owns 70% equity interest ownership therein. Brand Management was subsequently incorporated on November 12, 2007. Upon the completion of incorporation, Brand Management became a majority-owned subsidiary of the Xidenghui. Xidenghui is principally engaged in the business of distribution of Baishui Dukang’s liquor and manage the franchise of the “Baishui Dukang” brand name.

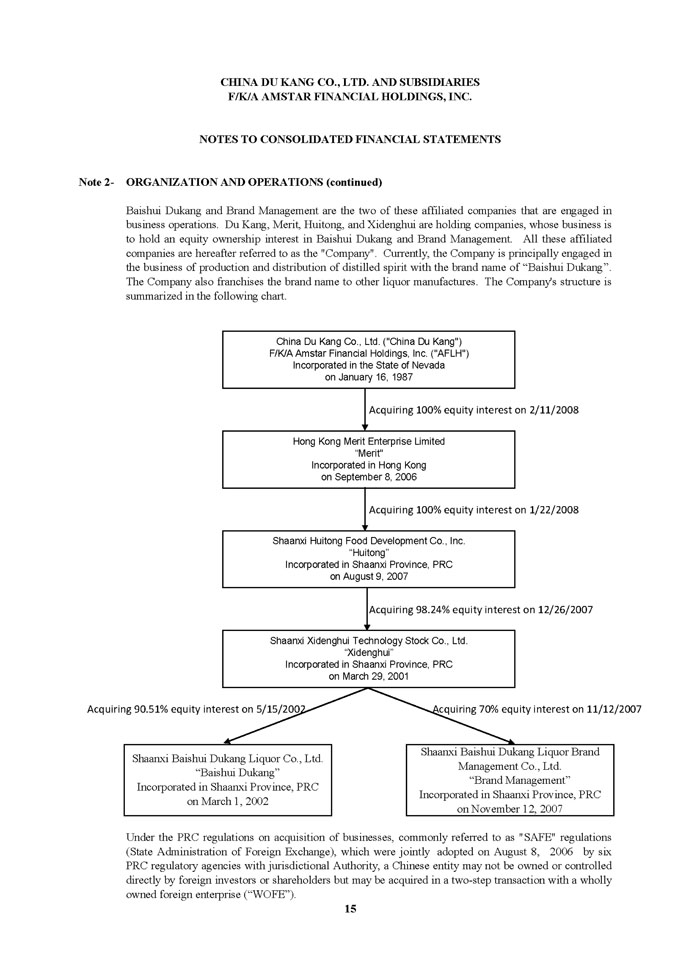

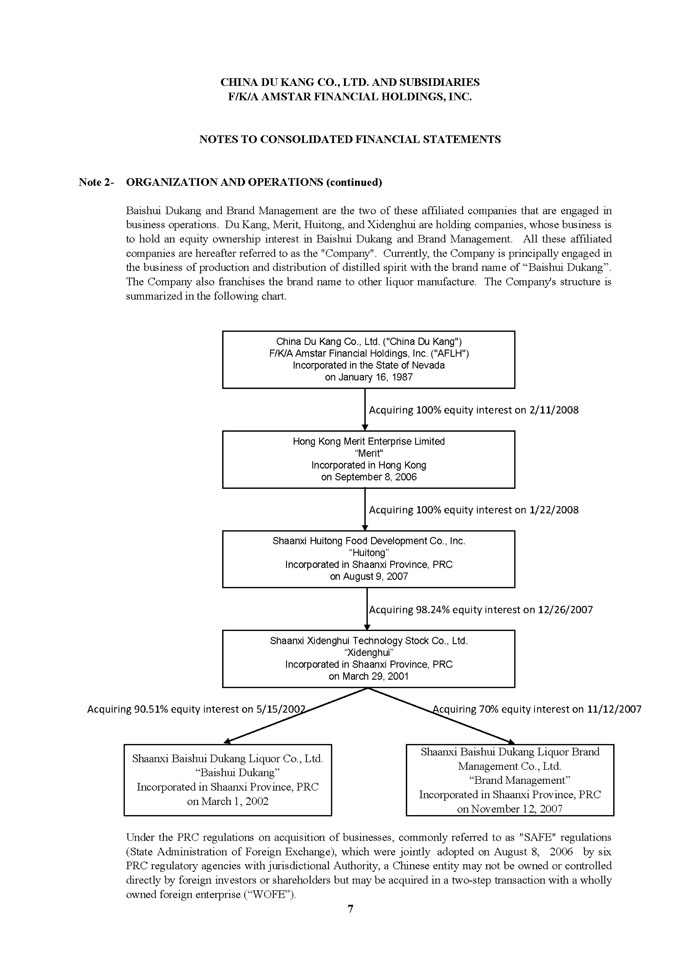

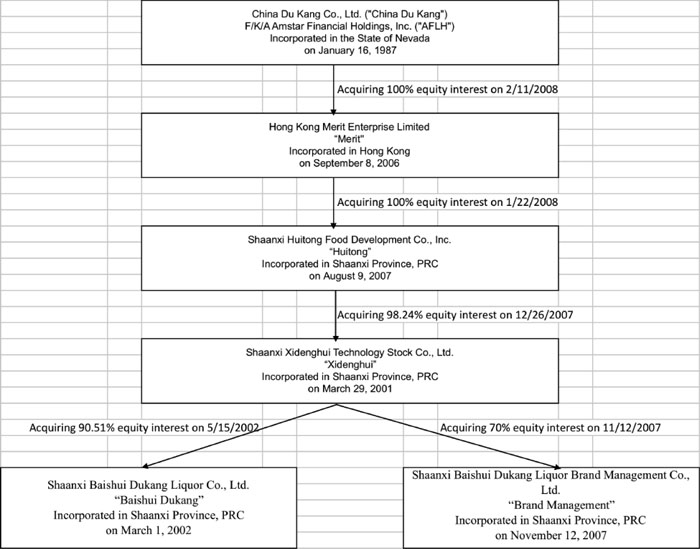

Baishui Dukang and Brand Management are the two of these affiliated companies that are engaged in business operations. Du Kang, Merit, Huitong, and Xidenghui are holding companies, whose business is to hold an equity ownership interest in Baishui Dukang and Brand Management. All these affiliated companies are hereafter referred to as the "Company". Currently, the Company is principally engaged in the business of production and distribution of distilled spirit with the brand name of “Baishui Dukang”. The Company also franchises the brand name to other liquor productors. The Company's structure is summarized in the flow chart found in Item 14. Supplementary Data.

Previous to this, on or about October 25, 2006 a Definitive Agreement was entered into by Premier Organic Farms Group, Inc. and Amstar International, Inc. On or about December 19, 2006, the merger defined in this agreement was closed. In the definitive agreement Amstar International, Inc. was to merge with Premier Organic Farms Group, Inc. (PFOG). Prior to the merger PFOG was to change its name to Amstar Financial Holdings, inc., dilute their shares down to approximately 608,771 shares with 96.12% of the ownership passing to Amstar International Stockholders. In addition, as part of the terms of this agreement a favorable hearing before a judge of competent jurisdiction, regarding a petition of fairness subject to section 3(a)(10) of the Securities Act of 1933 was to be approved. A n order granting this petition of fairness was signed on December 18, 2006 by a judge in State of Nevada, County of Elko, case number CV-C-06-1016. This transaction closed on December 19, 2006, in Phoenix, Arizona.

Current Operations

Shaanxi Xi Deng Hui Technology Stock Co. Ltd. is holding company which established on March 29, 2001 after being restructured enterprise with added capital. The registered capital is 129,000,000 RMB ($17,793,103 USD). On or about January 31, 2008 Shaanxi Xi Deng Hui Technology Stock Co. Ltd purchased a majority interest in Amstar Financial Holdings, Inc. (formerly AFLH) in a reverse merger. The company’s new name is China Du Kang Company Limited now listed as CDKG.

Shaanxi Xi Deng Hui Stock Co. Ltd., Holds

| 90.51% and controls Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and holds |

| 70% Shaanxi Bai Shui Du Kang Brand Management Co., Ltd.; |

Principal Products

The Company manufactures, sells, licenses and distributes a proprietary line of white wines that are generally known in China under the heading Du Kang. The largest sellers are currently collections called the “Baishui Dukang” series, the Thirteen Dynasties series and Jiu Zu Gong.

Du Kang is a generic description, like “vodka” or “merlot” and is one of the most famous Chinese white wine brands. The Company’s subsidiaries Shaanxi Bai Shui Du Kang Liquor Co. Ltd and Shaanxi Bai Shui Du Kang own the “Bai Shui Du Kang” brand, while another subsidiary, owns three 3 brands:

At present, Du Kang has 6000 ton production capacity per year including (brewing and packaging). Liquor products unit price ranges from $2.00 USD to $150.00 USD. Our Du Kang Liquor products are sold in most cities in China. In northeast, north, south coastal region and middle areas of China we sell liquor through long-term liquor distributors. In Shaanxi province we sell liquor to franchise stores in Xi’an ,Bai Shui, Hua yin, Han Cheng, Fu Ping Pu Cheng, Da Li, Wei Nan city. Throughout China the Du Kang market sales, awareness and brand image is broadening.

Through its subsidiaries in China, the Company sells and develops new and additional liquors, liquor raw materials, deep processing of agricultural and sideline products and research and develop of high-tech products and brewing methods. We were the first company, in cooperation with the Chinese Academy of Sciences, to ship Du Kang yeast and grain aboard #3 and #7 Shenzou spaceflights for a series of scientific experiements designed to improve yield and flavors. No newly developed products have entered the market since 2008. We are currently focusing on expanding distribution of existing brands so we have devoted only minimal resources to research and development activities in the past two years.

Major products include the Baishui Dukang series, Thirteen Dynasties series, Shen Zhou Nectar, Guo Bin Special, and Jiu Zu Gong.

The Company also licenses its Trademark to other companies that it believes adhere to the Company’s production standards. These Companies manufacture and distribute products under the Bai Shui Du Kang name although each product produced by these licensees contains a clear variation in product name from the versions manufactured by the Company. For example,a kind of liquor that produced by the company is called: “Thirteen Dynasties, Bai shui du kang” and the other flavor of the liquor is called “Happy and Auspiciouse, Bai shui du kang” when produced by the licensee, although both are sold under the Bai Shiu du Kang brand. Under the Agreeement, the licensee must obtain and maintain government compliance and provides samples to the Company for its inspection and review..

Distribution methods of the products or services;

The Company set a new sales strategy, including sales territory that covers many counties in China and since July 2007. Du Kang Liquor products previously have been sold mostly in the larger cities in China. In 2008 and 2009, we put in place distributorship agreements in the form of franchises or licensing that now includes the northeast, north, south coastal region and middle areas of China.

The company’s products were sold in the following three ways:

| · | Sales within China by long-term liquor distributors. |

| · | Sales to franchise liquor stores/retailers and |

| · | Our holding company, Shaanxi Bai Shui Du Kang Brand Management Co., Ltd. gave the franchise of using “Baishui Dukang” trademark to make white spirits to manufactures who comply with the liquor (or white spirits) production standard of PRC. |

We have implemented two strategies for retail sales of our producs. First, we have developed exclusive territorial “franchises” in different designated provinces of China – Shaanxi, Guangzdong,Zhejiang,Liaoning,Hunan, Heilongjiang, Shanghai, etc. Secondly, we have developed licensing agreements for the use of our trademarks. There are currently licensing agreements in An Hui and Shaanxi province.

The Company signed 3 Agent contracts and 5 Distributor contracts as follows:

Distributor Contracts

| 1. | Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and Shanghai Yu Ren Co., Ltd. covering Shanghai territory, entered into March 1, 2009; |

| 2. | Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and Xu Yan Co.,covering Da Li, Wei Nan, Shaanxi Province., entered into March 16, 2009; |

| 3. | Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and Yaowu Cao Co.,covering Hu Nan Province., entered into December 28, 2008; |

| 4. | Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and Xu Yan Co.,covering Da Li, Wei Nan, Shaanxi Province., entered into March 16, 2009; |

| 5. | China Du Kang Liquor Co., Ltd., and Hei Longjiang Peng Da Economic and Trade Co., Ltd.,covering Hei Longjiang Province., entered into August 18, 2009; |

Agency Contracts

1. | Shaanxi Bai Shui Du Kang Liquor Co., Ltd., and Shaanxi Du Kang Liquor Group Co., Ltd., entered March 1, 2009. |

The distributor contracts provide a 5-year exclusive territory with liquor distributors subject to performance requirements. The material terms are as follows:

1. During the contract term, Shaanxi Baishui Dukang Spirits Industry Development Co., Ltd. can only act as the distributor of the series products of Baishui Dukang, Thirteen Dynasties and Jiu Zu Gong in the designated provinces including Guangdong, Yunan, Fujian, Henan, Shandong and Hebei, and cannot act as a distributor in any other products of a third party.

2. During the contract term, Shaanxi Baishui Dukang Marketing Management Co., Ltd. can only act as the distributor of the series products of Baishui Dukang and Thirteen Dynasties in the designated provinces including Shaanxi, Hunan, Gansu and Neimeng , and cannot act as a distributor in any other products of the third party.

| 3. During the contract term,Shaanxi Baishui Dukang Liquor Group Co., Ltd. can only act as the distributor of the series products of Baishui Dukang and Thirteen Dynasties in 5 designated provinces including Jiangsu,Zhejiang, Liaoning, Jiling and Heilongjiang, and cannot act as a distributor for any other third party’s products. |

Needs paragraph on Licensing Agreements

In the Shaanxi province we sell products to franchised stores in Xi’an Bai Shui, Hua yin, Han Cheng, Fu Ping,Pu Cheng, Da Li, and the city of Wei NanWe believe our distribution efforts have also raised market awareness and brand image of the Du Kang series.

Competitive Business Conditions

While management is pleased at the progress of the distribution of its Du Kang liquors, it remains a relatively insignificant participant in the liquor and beverage industry. Many of our competitors are larger and have significantly more financial resources. We were recently awarded inclusion in China’s top 500 large and medium sized beverage manufacturers. An article in the April 15, 2009 edition of “The Atlantic” magazine (Risen, The Atlantic, April 15, 2009) reported that “Maotai”, a “baijiu” type of white liquor that is competitive, was the largest selling liquor in the world. The article n otes that Maotai is somewhat expensive – the bottle tested cost $115 USD, smells of ammonia, and has a bitter taste.

Both a February, 2010 issue of the newspaper China Daily (Qingfen and Yue, China Daily, February 2, 2010) also noted that "Moutai and Wuliangye”, two higher end liquors were selling briskly, Both Moutai and Wuliangy are products that compete with the Company’s liquors. The article contained a quote a report from a China investment firm that said,

“in 2010, China's high-end liquor (wine and spirit) consumption will grow by more than "30 percent" from a year earlier, higher than the liquor market as a whole, which will see a "20 to 25" percent rise..”

The Company believes that its Du Kang series is positioned well against the larger sellers and should enjoy increased sales if the liquor market overall improves as expected.

Sources and Availability of Raw Materials

The raw material needed in our production is mainly grain. The company purchases sorghum from farmers in the northeast and other wholesalers. While its price fluctuates in response to market conditions, availability has never been an issue. In addition, the company expects to enter into a contract of quota system for the production by local farmers to purchase some of the other required raw materials such as wheat and corn

Dependence of Major Customers

The company has long-term marketing contract with the following three companies: Shaanxi Baishui Dukang Wine Development Co., Ltd., Shaanxi Baishui Dukang Marketing Management Co., Ltd., Shaanxi Dukang Liquor Group Co., Ltd.. These three companies sell our products in China.

We have begun to expand our distributorship and licensing programs and expect to reduce the dependence on these three distributors over the course of 2010.

Patents, trademarks, licenses, franchises, concessions, royalty agreements or labor contracts, including duration;

The company has received all the certificates required to be issued by the Chinese government pertaining to production and sales of liquor, such as the Production License, Trade Mark Registration Certificate, etc. All these certificates are in force.

We believe we have full rights to the intellectual property required for sales in China. We have been contacted by a U. S. group that indicates that they have a prior right to the name “Du Kang” within the United States.

Regulation.

We are currently regulated People’s Government of Shaanxi Province approved Business License, Organization Code of PRC. We have obtained and maintain China Manufacture Certificate, Sanitation License and Food Security permits to Shaanxi Bai Shui Du Kang Liquor Co., Ltd. On March 1, 2008 which is valid until December 31, 2011 in China, which we believe are all of the necessary legal government approvals if a manufacturer in PRC starts its business and continue its operation.

The greatest impact of government regulation for company’s business is the change of tax policy. In China, white spirit production belongs to a traditionally high tax industry. However, the company’s location, Bai Shui county, is rated as a national level poor county. The company is considered to be a pillar enterprise and major client of taxation in Bai Shui county.

Historically, the company has enjoyed preferential tax treatment on a national and local level. The Company entered into a Tax Abatement Agreement in 2004. Taxes were exempted for the first 2 years of existence of the Agreement and reduced by half for the following 3 years. The Agreement expired as of August, 2009. Management is optimistic that they can work with taxing authorities to continue some level of preferential tax treatment for income of the company.

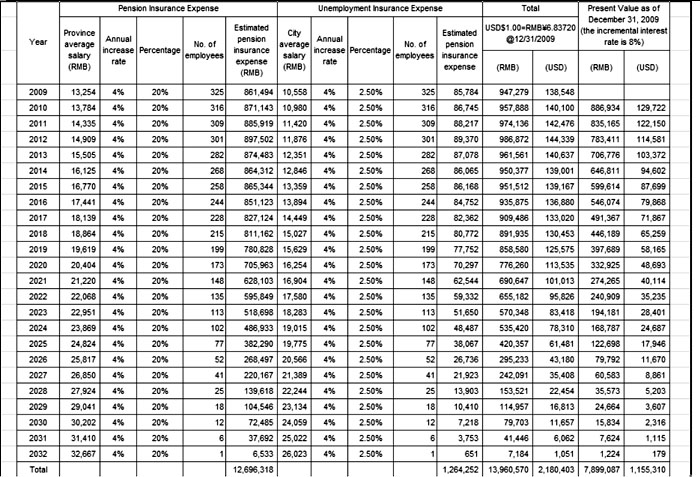

Employees

Company’s production and therefore the number of employees, are seasonal and fluctuate. Therefore, the total number of officer is changed along with the output. Generally, the total number of employees is almost 450 ath the peak season, and 200 in the off-season. The number of full-time employees is 138.

All officers and directors are employed on a full time basis and devote their full time energies to the Company.

Costs and effects of compliance with environmental laws

Company’s main product is liquor, and the raw material for liquor production is grain and water. The water is taken from Dukang spring, a fresh water aquifer that has a history of thousands of years. The company’s manufacturing process meets the national standard for environmental protection. Moreover, the company was commended as a “Manufacturing Enterprise to Recycle Energy” by the government of the Shaanxi province.

In recent years, company has spent over $4400 to refurbish the company’s production equipment, factory, building, boiler, water line, electricity as well as air, to improve its efficiency. In addition, the Company has invested in recovery processing of the distiller’s grains produced in liquor-making, in order to produce the fodder.

Item 1A. Risk Factors

RISK FACTORS

RISKS RELATED TO OUR BUSINESS

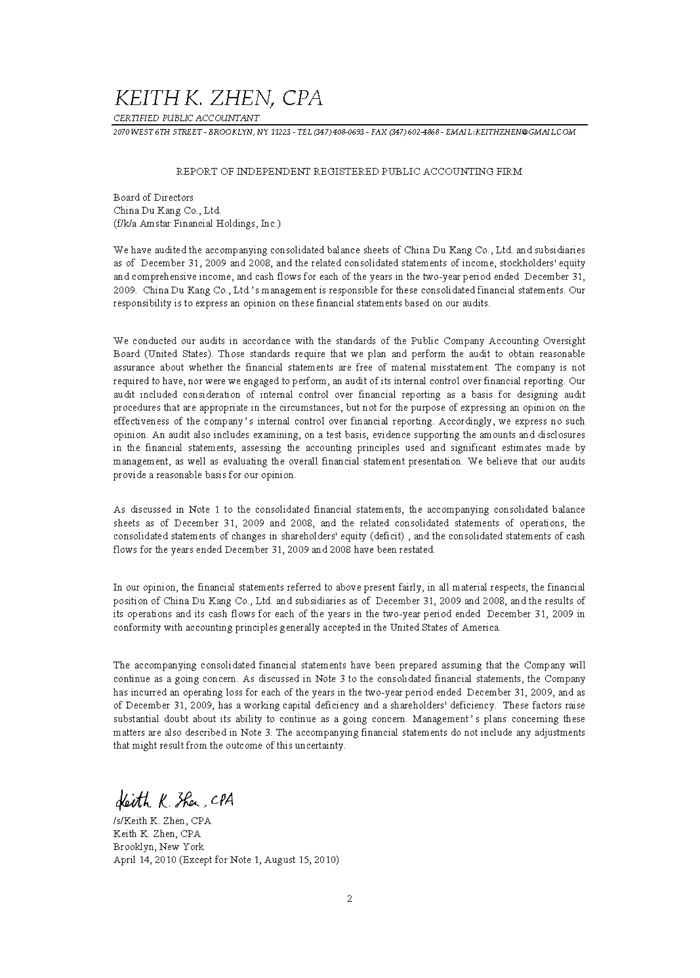

OUR AUDITORS HAVE NOTED THERE IS CERTAIN DOUBT ABOUT OUR ABILITY TO OPERATE AS A GOING CONCERN

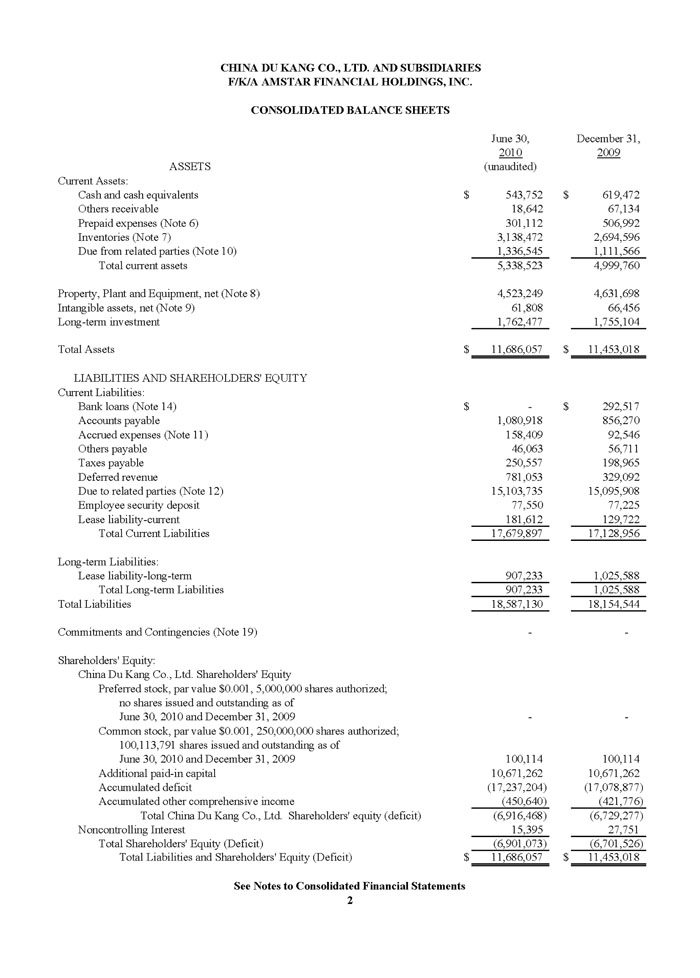

As reflected in the accompanying consolidated financial statements, the Company has an accumulated deficit of $17,078,877 at December 31, 2009 that includes losses of $460,263 and $1,401,815 for the years ended December 31, 2009 and 2008, respectively. In addition, The Company has a working capital deficiency of $12,129,196 and a shareholders' deficiency of $6,701,526 at December 31, 2009. These factors raise certain doubt about its ability to continue as a going concern.

Management has taken steps to revise the Company's operating and financial requirements. The Company is actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance owners' investment. However, there can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance tha t any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on the Company's existing stockholders.

The accompanying financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

WE HAVE HAD LOSSES FROM OPERATIONS AND ANTICIPATE LOSSES FOR THE FORESEEABLE FUTURE.

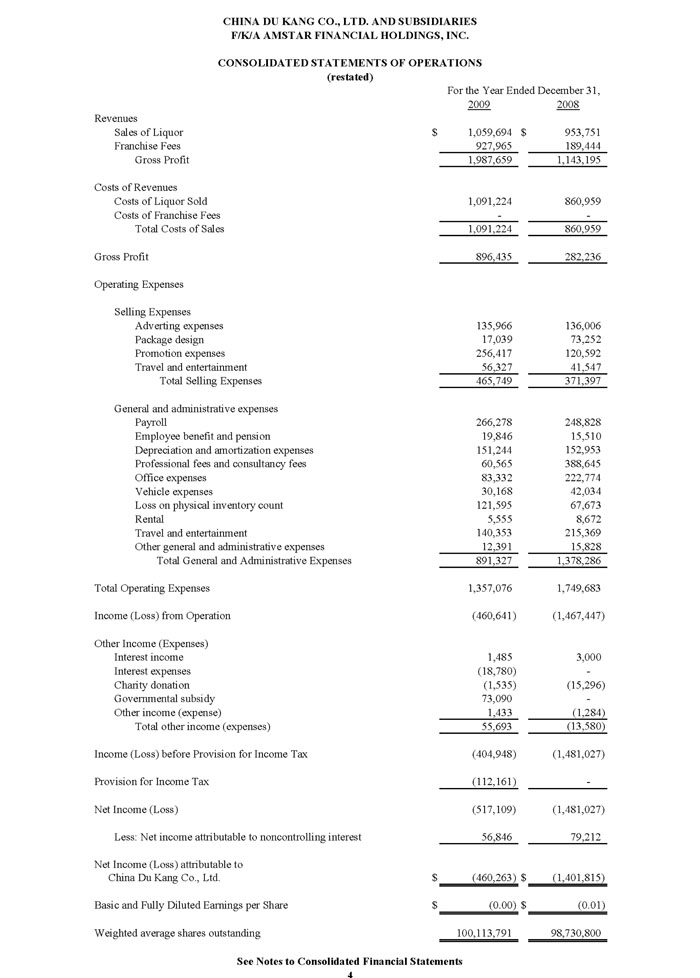

Since inception we have had limited revenues from operation. Revenues for the year ended December 31, 2009 totaled $ 1,987,659as compared to $1,143,195 for the year ended 2008. For the year ended December 31, 2009 we experienced a loss from operations of $(460,641) as compared to a loss of $(1,467,447) for the prior year..We have not achieved profitability. We expect to incur significant operating expenses and, as a result, will need to generate significant revenues to achieve profitability, which may not occur. Even if we do achieve profitability, we may be unable to sustain or increase profitability on an ongoing basis.

OUR CURRENT SHAREHOLDERS CONTROL OUR BUSINESS AFFAIRS IN WHICH CASE YOU WILL HAVE LITTLE OR NO PARTICIPATION IN OUR BUSINESS.

Our principal stockholders own a majority of our common stock. As a result, they will have control over all matters requiring approval by our stockholders without the approval of minority stockholders. In addition, they will also be able to elect all of the members of our Board of Directors, which will allow they to control our affairs and management. They will also be able to affect most corporate matters requiring stockholder approval by written consent, without the need for a duly noticed and duly-held meeting of stockholders. As a result, they will have significant influence and control over all matters requiring approval by our stockholders. Accordingly, you will be limited in your ability to affect change in how we conduct our business.

WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.

We expect to incur significant costs associated with our public company reporting requirements, costs associated with applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. While we have no experience as a public company, we estimate that these additional costs will total approximately $60,000 per year. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the s ame or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

RISKS RELATING TO OUR SECURITIES

WE HAVE NEVER PAID DIVIDENDS ON OUR COMMON STOCK AND YOU MAY NEVER RECEIVE DIVIDENDS. THERE IS A RISK THAT AN INVESTOR IN OUR COMPANY WILL NEVER SEE A RETURN ON INVESTMENT AND THE STOCK MAY BECOME WORTHLESS.

We have never paid dividends on our common stock. We intend to retain earnings, if any, to finance the development and expansion of our business. Future dividend policy will be at the discretion of the Board of Directors and will be contingent upon future earnings, if any, our financial condition, capital requirements, general business conditions and other factors. Future dividends may also be affected by covenants contained in loan or other financing documents, which may be executed by us in the future. Therefore, there can be no assurance that cash dividends of any kind will ever be paid. If you are counting on a return on your investment in the common stock, the shares are a risky investment.

THERE IS CURRENTLY NO SUBSTANTIAL MARKET FOR OUR COMMON STOCK AND NO ASSURANCE THAT ONE WILL DEVELOP.

There is currently on an extremely limited trading market for our shares of Common Stock, under the symbol “CDKG.” We have provided no public information and our symbol contains a “skull and crossbones” insignia on the pink sheets until this filing. We currently have a “stop sign” insignia. We are filing this information partly to provide such information to the public although there can be no assurance that a more substantial market will ever develop or be maintained. Any market price for shares of our Common Stock is likely to be very volatile, and numerous factors beyond our control may have a significant adverse effect. In addition, the stock markets generally have experienced, and continue to experience, extreme price and volume fluctuations which have affected the market pric e of many small capital companies and which have often been unrelated to the operating performance of these companies. These broad market fluctuations, as well as general economic and political conditions, may also adversely affect the market price of our Common Stock. Further, there is no correlation between the present limited market price of our Common Stock and our revenues, book value, assets or other established criteria of value. The present limited quotations of our Common Stock should not be considered indicative of the actual value of the Company or our Common Stock.

Future sales of our common stock could put downward selling pressure on our shares, and adversely affect the stock price. There is a risk that this downward pressure may make it impossible for an investor to sell his shares at any reasonable price.

Future sales of substantial amounts of our common stock in the public market, or the perception that such sales could occur, could put downward selling pressure on our shares, and adversely affect the market price of our common stock. Such sales could be made pursuant to Rule 144 under the Securities Act of 1933, as amended, as shares become eligible for sale under the Rule.

BECAUSE OUR SHARES ARE DEEMED HIGH RISK “PENNY STOCKS,” YOU MAY HAVE DIFFICULTY SELLING THEM IN THE SECONDARY TRADING MARKET.

The Commission has adopted regulations which generally define a "penny stock" to be any equity security that has a market price (as therein defined) less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. Additionally, if the equity security is not registered or authorized on a national securities exchange, the equity security also constitutes a "penny stock." As our common stock falls within the definition of penny stock, these regulations require the delivery, prior to any transaction involving our common stock, of a risk disclosure schedule explaining the penny stock market and the risks associated with it. These regulations generally require broker-dealers who sell penny stocks to persons other than established customers and accredited investors to deliver a disclosure schedule explaining the penny stock market and the risks associated with that market. Disclosure is also required to be made about compensation payable to both the broker-dealer and the registered representative and current quotations for the securities. These regulations also impose various sales practice requirements on broker-dealers. In addition, monthly statements are required to be sent disclosing recent price information for the penny stocks. The ability of broker/dealers to sell our common stock and the ability of shareholders to sell our common stock in the secondary market is limited. As a result, the market liquidity for our common stock is severely and adversely affected. We can provide no assurance that trading in our common stock will not be subject to these or other regulations in the future, which would negatively affect the market for our common stock.

IF A MARKET DEVELOPS FOR OUR SECURITIES THE COULD BE VOLATILE AND MAY NOT APPRECIATE IN VALUE.

If a market should develop for our securities, of which we have no assurance, the market price is likely to fluctuate significantly. Fluctuations could be rapid and severe and may provide investors little opportunity to react. Factors such as changes in results from our operations, and a variety of other factors, many of which are beyond the control of the Company, could cause the market price of our common stock to fluctuate substantially. Also, stock markets in penny stock shares tend to have extreme price and volume volatility. The market prices of shares of many smaller public companies securities are subject to volatility for reasons that frequently unrelated to the actual operating performance, earnings or other recognized measurements of value. This volatility may cause declines including very sudden and sharp declines in the marke t price of our common stock. We cannot assure investors that the stock price will appreciate in value, that a market will be available to resell your securities or that the shares will retain any value at all.

RISKS RELATING TO DOING BUSINESS IN THE PEOPLE'S REPUBLIC OF CHINA

WE ARE SUBJECT TO THE POLITICAL AND ECONOMIC POLICIES OF THE PEOPLES REPUBLIC OF CHINA, AND GOVERNMENT REGULATION COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR INTENDED BUSINESS.

All of our assets and operations are in the PRC. As a result our operating results and financial performance as well as the value of our securities could be affected by any changes in economic, political and social conditions in China.

The Chinese government adopted an “open door” policy to transition from a planned economy to a market driven economy in 1978. Since then the economy of the PRC has undergone rapid modernization although the Chinese government still exerts a dominant force in the nation’s economy. There has historically been a substantial market in liquor consumption in China.

The Chinese government operates the economy in many industries through various five-year plans and even annual plans. A large degree of uncertainty is associated with potential changes in these plans. Since the economic reforms have no precedent, there can be no assurance that future changes will not create materially adverse conditions on our business.

Due to the limited effectiveness of judicial review, public opinion and popular voting there are few avenues available if the governmental action has a negative effect. Any adverse changes in the economic conditions, in government policies, or in laws and regulations in China could have a material adverse effect on the overall economic growth, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business.

THERE ARE RISKS INHERENT IN DOING BUSINESS IN CHINA OVER WHICH WE HAVE NO CONTROL.

The political and economic systems of the PRC are very different from the United States and more developed countries. China remains volatile in its social, economic and political issues which could lead to revocation or adjustment of reforms. There are also issues between China and the United States that could result in disputes or instabilities. Both domestically and internationally the role of China and its government remain in flux and could suffer shocks, or setbacks that may adversely affect our business.

THE CHINESE LEGAL SYSTEM IS MUCH DIFFERENT FROM THAT OF THE UNITED STATES WITH CONSIDERABLY LESS PROTECTION FOR INVESTORS, AND IT MAY BE EXTREMELY DIFFICULT FOR INVESTORS TO SEEK LEGAL REDRESS IN CHINA AGAINST US OR OUR OFFICERS AND DIRECTORS, INCLUDING CLAIMS THAT ARE BASED UPON U.S. SECURITIES LAWS.

All of our current operations are conducted in China. All of our current directors and officers are nationals or residents of China. It may be difficult for shareholders to serve us with service of process in legal actions. All of the assets of these persons are located outside the United States in China. The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. As a result there is no established body of law that has precedential value as is the case in most western legal systems. Differences in interpretations and rulings can occur with little or no opportunity for redress or appeal.

As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon our officers and directors. Even if service of process was successful, considerable uncertainty exists as to whether Chinese courts would enforce U. S. laws or judgments obtained in the United States. Federal and state securities laws in the U. S. confer substantial rights to investors and shareholders that have no equivalent in China. Therefore a claim against us or our officers and/or directors or even a final judgment in the U. S. based on U. S. may not be heard or enforced by the Chinese courts.

In 1979, the PRC began to adopt a complex and comprehensive system legal system and has approved many laws regulating economic and business practices in the PRC including foreign investment. Currently many of the approvals required for our business can be obtained at a local or provincial level. We believe that it is generally easier and faster to obtain provincial approval than central government approval. Changes to existing laws that repeal or alter the local regulatory authority and replacements by national laws could negatively affect our business and the value of our securities.

NEW CHINESE LAWS MAY RESTRICT OUR ABILITY TO CONTINUE TO MAKE ACQUISITIONS OF BUSINESSES IN CHINA.

New regulations on the acquisition of businesses commonly referred to as “SAFE” regulations (State Administration of Foreign Exchange) were jointly adopted on August 8, 2006 by six Chinese regulatory agencies with jurisdictional authority. Known as the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors the new Rule requires creation of offshore Special Purpose Ventures, or SPVs, for overseas listing purposes. Acquisitions of domestic Chinese companies require approval prior to listing securities on foreign exchanges.

We obtained the approvals that we believe are required in making the acquisitions that formed the present company. Nonetheless, our growth has largely been by acquisition and we intend to continue to make acquisitions of Chinese businesses. Since the “SAFE” rules are very recent there are many ambiguities and uncertainties as to interpretation and requirements. These uncertainties and any changes or revisions to the regulations could limit or eliminate our ability to make new acquisitions of Chinese businesses in the future.

WE MAY BE AFFECTED BY RECENT CHANGES TO CHINA’S FOREIGN INVESTMENT POLICY, WHICH WILL CHANGE THE INCOME TAX RATE FOR FOREIGN ENTERPRISES.

On January 1, 2008 a new Enterprise Income Tax Law will take effect. The new law revises income tax policy and sets a unified income tax rate for domestic and foreign companies at 25 percent. It also abolishes favorable treatment for foreign invested enterprises. When the new law takes effect, foreign invested enterprises will no longer receive favorable tax treatment. Any earnings we may obtain may be adversely affected by the new law.

CHINA CONTROLS THE CURRENCY CONVERSION AND EXCHANGE RATE OF ITS CURRENCY, WHICH COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

The Chinese government imposes control over the conversion of the Chinese currency, the Renminbi, into foreign currencies, although recent pronouncements indicate that this policy may be relaxed. Under the current system, the People's Bank of China publishes a daily exchange rate based on the prior day's activity which controls the inter-bank foreign exchange market. Financial institutions are permitted a narrow range above or below the exchange rate based on then current market conditions. Since 1997, the State Council has prohibited restrictions on certain international payments or transfers for current account items. The regulations also permit conversion for distributions of dividends to foreign investors. Investment in securities, direct investment, and loans, and security investment, are still subject to certain restrictions.

For more than a decade the exchange rate for the Renminbi (“RMB”) was pegged against the United States dollar leaving the exchange rates relatively stable at roughly 8 RMB for 1 US Dollar. The Chinese government announced in 2005 that it would begin pegging the Renminbi exchange rate against a basket of currencies, instead of relying solely on the U.S. dollar. This has recently caused the dollar to depreciate as against the RMB. As of December 31, 2009, the rate was 6.837 RMB for 1 US Dollar. Since all of our expected operations are in China, significant fluctuations in the exchange rate may materially and adversely affect our revenues, cash flow and overall financial condition.

CHINESE LAW REQUIRES APPROVAL BY CHINESE GOVERNMENT AGENCIES AND COULD LIMIT OR PROHIBIT THE PAYMENT OF DIVIDENDS FROM ANY PROCEEDS OBTAINED FROM LIQUIDATION OF OUR ASSETS.

All of our assets are located inside the Peoples Republic of China. Chinese law governs the distributions that can be made in the event of liquidation of assets of foreign invested enterprises. While dividend distribution is allowed it is subject to governmental approval. Liquidation proceeds would also be subject to foreign exchange control. We are unable to predict the outcome in the event of liquidation insofar as it affects dividend payment to non- Chinese nationals.

CHINA HAS BEEN THE LOCALE FOR THE OUTBREAK OF VARIOUS DISEASES AND A PANDEMIC CAUSED BY DISEASES SUCH AS SARS, THE AVIAN FLU, OR SIMILAR DISEASES COULD HAVE A MATERIALLY ADVERSE EFFECT ON OUR WORKERS AND EVEN THE CHINESE ECONOMY IN GENERAL, WHICH MAY ADVERSELY AFFECT BUSINESS.

The World Health Organization reported in 2004 that large scale outbreaks of avian flu throughout most of Asia, including China, had nearly caused a pandemic that would have resulted in high mortality rates and which could cause wholesale civil and societal disruption. There have also been several potential outbreaks of similar pathogens in China with the potential to cause large scale disruptions, such as SARS, pneumonia and influenza. Any future outbreak which infiltrates the areas of our operations would likely have an adverse effect on our ability to conduct normal business operations.

Item 2. Financial Information

MANAGEMENT'S DISCUSSION AND ANALYSIS

For

CHINA DU KANG CO., LTD.,

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

The discussion contained in this prospectus contains "forward-looking statements" that involve risk and uncertainties. These statements may be identified by the use of terminology such as "believes", "expects", "may", or "should", or "anticipates", or expressing this terminology negatively or similar expressions or by discussions of strategy. The cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements wherever they appear in this prospectus. Our actual results could differ materially from those discussed in this prospectus. Important factors that could cause or contribute to such differences include those discussed under the caption entitled "risk factors," as well as those discussed elsewhere in this prospectus.

Cautionary statement identifying important factors that could cause actual results to differ from those projected in forward looking statements.

This document contains both statements of historical facts and forward looking statements. Forward looking statements are subject to certain risks and uncertainties, which could cause actual result to differ materially from those indicated by the forward looking statements. Examples of forward looking statements include, but are not limited to, (i) projection of revenues, income or loss, earnings per share, capital expenditures, dividends, capital structure, and other financial items, (ii) statements of our plans and objectives with respect to business transactions and enhancement of shareholder value, (iii) statements of future economic performance, and (iv) statements of assumptions underlying other statements and statements about our business prospects. This document also identifies important factors that could cause actual results to differ materially from those indicated by the forward looking statement. These risks and uncertainties include the factors discussed under the heading "Risk Factors" beginning at page 6 of this Prospectus.

The section "Management's Discussion and Analysis of Financial Condition and Results of Operations" should be read in conjunction with our audited consolidated or un-audited condensed consolidated financial statements and the notes thereto appearing elsewhere in this prospectus.

OVERVIEW

China Du Kang Co., Ltd (“China Du Kang” or the “Company”) was incorporated as U. S. Power Systems, Inc., in the State of Nevada on January 16, 1987. On or about June 8, 2006 the Company’s name was changed to Premier Organic Farms Group, Inc. On or about November 30, 2006 the name was changed to Amstar Financial Holdings, Inc. (“AFLH”). On or about March 18, 2008 the name was changed to its current name of China Du Kang Co., Ltd. with its corporate charter still residing in Nevada. The Company changed its fiscal year ending from September 30 to December 31 in February 2008.

The Company’ operations currently consist of sales of a line of proprietary liquors known generally in China as the Baishui Dukang series. These are clear liquors sold under a variety of trade names including Thirteen Dynasty, Jiu Zu Gong and Baishui. The Company’s products are sold mostly in larger urban areas in China through three long term marketing agreements.

On January 10, 2008, the Company entered into a Plan of Exchange Agreement (the “Exchange Agreement”) with Hong Kong Merit Enterprise Limited (“Merit”), a holding company incorporated in Hong Kong. Pursuant to the terms of the Exchange Agreement, the Company agreed to issue post split 88,000,000 shares of its common stock to the shareholders of Merit in exchange for Merit to transfer all of its issued and outstanding shares of common stock to the Company, thereby causing Merit to become a wholly-owned subsidiary of the Company. The parties closed the transaction contemplated by the Agreement on February 11, 2008.

This transaction is being accounted for as a reverse merger, since the shareholders of Merit owns a majority of the outstanding shares of the Company’s common stock immediately following the share exchange. Merit is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will reflected in the consolidated financial statements for periods prior to the share exchange will be those of Merit and its subsidiaries and will be recorded at the historical cost basis. After completion of the share exchange, the Company‘s consolidated financial statements will include the assets and liabilities of both Du Kang and Merit, the historical operations of Merit and the operations of the Company and its subsidiaries from the closing date of the share exchange.

Merit was incorporated on September 8, 2006 in Hong Kong under the Companies Ordinances as a Limited Liability company. Merit was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship

On January 22, 2008, Merit entered into a Share Purchase Agreement (the “Purchase Agreement”) with the owners of Shaanxi Huitong Food Co., Inc. ("Huitong"), a limited liability company incorporated in the People's Republic of China ("PRC") on August 9, 2007 with a registered capital of $128,200 (RMB1,000,000). Pursuant to the Purchase Agreement, Merit agreed to purchase 100% of the equity ownership in Huitong for a cash consideration of $136,722 (RMB 1,000,000). The local government approved the transaction on February 1, 2008. Subsequent to the completion of the acquisition, Huitong became a wholly-owned subsidiary of Merit.

Huitong was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship. On December 26, 2007, Huitong executed an acquisition agreement with shareholders of Shaanxi Merithui Technology Stock Co., Ltd. ("Xidenghui"), whereby Huitong agreed to acquire 98.24% of the equity ownership of Xidenghui from the shareholders. Subsequent to completion of the acquisition agreement, Xidenghui became a majority-owned subsidiary of Huitong.

Xidenghui was incorporated in Weinan City, Shannxi Province, PRC on March 29, 2001 under the Company Law of PRC. Xidenghui was engaged in the business of production and distribution of distilled spirit with a brand name of “Xidenghui”. Currently, its principal business is to hold an equity ownership interest in Shannxi Baishui Dukang Liquor Co., Ltd. (“Baishui Dukang”) and Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. (“Brand Management”).

Baishui Dukang was incorporated in Baishui County, Shanxi Province, PRC on March 1, 2002 under the Company Law of PRC. Baishui Dukang was principally engaged in the business of production and distribution of distilled spirit with a brand name of “Baishui Du Kang”. On May 15, 2002, Xidenghui invested inventory and fixed assets, with a total fair value of $ 4,470,219 (RMB 37,000,000) to Baishui Dukang and owns 90.51% of Baishui Dukang’s equity interest ownership, thereby causing Baishui Dukang to become a majority-owned subsidiary of Xidenghui.

We manufacture product for distribution under certain labels that are proprietary to the Company and which are also distributed through agencies. We also permit third parties to manufacture under similar products under distinguishable names.

We authorize liquor manufacturers who comply with our requirements to use certain sub brand names of “Baishui Dukang” to process the production of liquor and to sell to customers within the designated area in a certain period of time. The amount of franchise fee varies based on the sales territory and the number of sub brand names. We generally collect the entire franchise fee when the franchise contract is executed, and then recognize franchise fee revenue over the beneficial period described by the contract, as the revenue is realized or realizable and earned. We also authorize liquor stores who comply with our requirements to exclusively sell certain sub brand names of “Baishui Dukang” products within the designated area in a certain period of time. The amount of franchise fee varies based on the sales territory and the number of sub brand names. We generally collect the entire franchise fee when the franchise contract is executed, and then recognize franchise fee revenue over the beneficial period described by the contract, as the revenue is realized or realizable and earned

The company’s annual income increased from $1,143,195 in 2008 to $1,987,659 in 2009, which the growth rate is 73.9%. The biggest increase is the revenue in franchise fees, which increased from $189,444 in 2008 to $927,965 in 2009, an improvement of 390%. The increase in brand name franchise is mainly because the participation of company’s strategic partner sand the royalties from strategic partner.s In addition, in 2008 and 2009, the sales of liquor also increased slightly from $953,751 to $1,059,694, which the growth is $105,943.

The company adjusts its sales policy from 2008 and increases the strategic partner. Moreover, the expansion of “Bai Shui Du Kang” brand influence and the collection of royalties bring the good benefit for the company.

In China, drinking liquor has a very long history, even can be traced back to 5000 years ago. There is Chinese saying goes as follows: Not a banquet without liquor. The sales of liquor steadily increased along with the improvement of people’s living standard. Gradually, liquor company becomes the major contributor of tax and profit pursued by local government.

China has a vast territory and a large population. Every enterprise will seek for the total occupation of their products in all Chinese market. As a liquor enterprise with small production scale and not longer period of operation, it is difficult for the company to occupy the national market in a short period of time. Therefore, according to company’s actual situation, under the precondition of meeting current production capacity and ensuring the sales of products, the company’s management want to look for the enterprise (in the region our products have not reached yet) which meet the PRC liquor production standard as our strategic partner to expand the sales territory, promote the brand influence, and increase company’s income. Practice has proved that it is a v ery effective strategy. Some well-known company also adopt this strategic and have many successful cases. Firstly, it can make up company’s deficiency that production capacity can not meet the actual need. Secondly, it can save a large amount of funds for expansion of reproduction scale. Thirdly, it can expand the influence of company and market share, raise the brand value. Fourthly, it can accelerate the speed of products into market, and reduce the production and transportation cost. Fifthly, it can maximize the profit, and increase company’s income along with the improvement of brand influence and royalties. All of above will lay a good foundation for next step of company’s development.

The current situation is an opportunity as well as a challenge for company’s development.

I. High requirements for inner management and market management have been put forward along with the company’s development. The company will further deepen the internal reform, strengthen the implementation of target responsibility system, implement the tasks, ascertain the responsibility, reduce the energy consumption, improve the efficiency, guarantee the quality, improve management’s ability of scientific and programmed decision-making, and decrease operation cost.

II. The company will increase scientific research input, intensify the development of new product. Based on retaining the sales of matured product in existing market, the company will strive for annually putting two or three new product on the market, in order to suit varying customer needs. As income increases, china began to form a middle class. Therefore, company’s goal is to satisfy the high-end products needed by middle class consumer groups.

III. As the expansion of sales territory and participation of strategic partner, it becomes more and more difficult to regulate the market. Further, company will increase the number of lawyer and market regulators, strengthen the supervision, send more officers to resident in strategic partner enterprise, implement rigid control on quality and sales territory, and strictly crack down on violations.

IV. The company will expand the market method, gradually reduce our reliance on three agents, purchase or set up our own marketing team in due course, and instruct the relevant department to conduct the marketing research and feasibility analysis.

V. Liquor industry is a high tax industry, which is a higher risk on increase in profit. The company located in Bai Shui County, Shaanxi Province. As a major contributor of tax and profit, the company endeavors and enjoys the related preferential policy as much as possible. In 2004, the company began to execute the tax cut agreement. According to the agreement, the taxation of company will be exempt in the first two years and be halved in the follow-up three years. This agreement will be effective in August, 2009. Management believes that they can consult with local tax department and continue to enjoy the preferential treatment in taxation.

VI. The principal raw materials for liquor-making are grain. Because the price of grain will be fluctuated with the influence of climate, it will increase the cost of production and further affect the corporate profit.

(i )The company will sign the Contract of Ordering Needed Grain with local farmers, that is to say, purchasing from designated person. In this way, the interest of farmers will be protected and also price risk of grain will be minimized.

(ii)There are almost 2000 tons of stocks of wine base, which absolutely can guarantee the demand for one-year regular production. Therefore, the company will purchase when the food prices is low, and will not purchase when the food prices is high.

(iii)Partial profit of the company is from strategic partner. Accordingly, the fluctuation of food price will have no effect on this part of revenue.

On October 30, 2007, Xidenghui executed an agreement with Mr. Zhang Hongjun, a PRC citizen, to establish a joint venture, Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. ("Brand Management"). Pursuant to the agreement, Xidenghui contributed cash of $95,704 (RMB 700,000), and owns 70% equity interest ownership therein. Brand Management was subsequently incorporated on November 12, 2007. Upon the completion of incorporation, Brand Management became a majority-owned subsidiary of the Xidenghui. Brand Management is principally engaged in the business of distribution of Baishui Dukang’s liquor and manage the franchise of the “Baishui Du Kang” brand name.

Baishui Dukang and Brand Management are the two of these affiliated companies that are engaged in business operations. Du Kang, Merit, Huitong, and Xidenghui are holding companies, whose business is to hold an equity ownership interest in Baishui Dukang and Brand Management. All these affiliated companies are hereafter referred to as the "Company". Currently, the Company is principally engaged in the business of production and distribution of distilled spirit with the brand name of “Baishui Dukang”. The Company also franchises the brand name to other liquor manufactures. The Company's structure is summarized in the following chart.

RESULTS OF OPERATIONS

COMPARISON OF THE YEARS ENDED DECEMBER 31 2008 AND DECEMBER 31, 2009

REVENUES

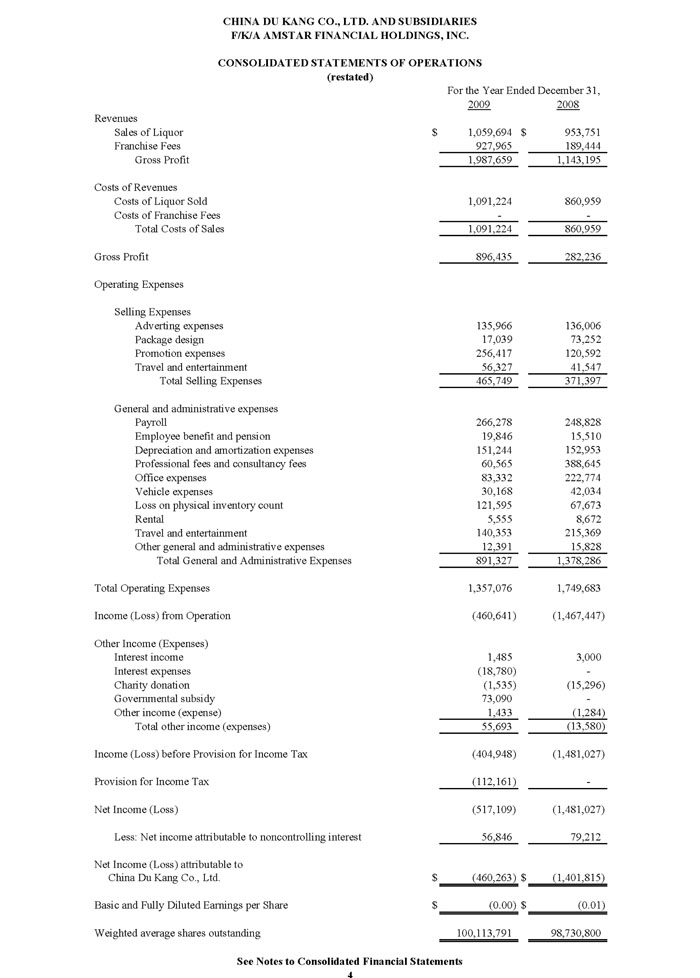

Gross revenues were $1,987,659 and $1,143,195 for the years ended December 31,2009 and 2008 respectively due primarily to the sales of liquor and the sale of franchise fees. We recognize revenue when the earning process is complete which generally occurs when products are shipped, both title and the risks and rewards of ownership are transferred, or services have been rendered and accepted, the selling price is fixed or determinable, and collectability is reasonably assured.. We do not provide unconditional rights of return and other concessions to our customers. Sales returns and other allowances have been immaterial in our operation.

Revenues increased from $1,143,195 in the year ended December 31, 2008 to $1,987,659 for the year ended December 31, 2009. Most of the increase was attributable to an increase in franchise fees from $189,444 to $927,965 from the year ended 2008 to the year ended 2009, representing an increase of $738,521.Franchise fees includes fees payable by our distributors and agents. In 2009 we significantly altered our distribution process and de-emphasized sales by Company owned retail outlets in favor of a network of distributors and agents. We added four distributors in 2009 and 3 agents. The Company expects to continue to expand its network of third party distributors and agents throughout 2010. Increase in franchise fees resulted from additions to our strategic partners. We expected our franchise fees will increase in 2010 as we implement our s ales strategy to sell additional distributorships and to increase sales generated by distributors. Sales of liquor also increased slightly from $953,751 in 2008 to $1,059,694 in 2009, an increase of $105,943.

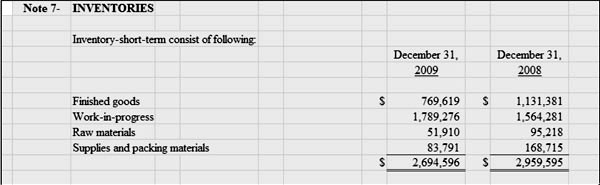

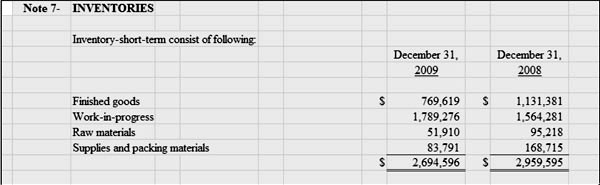

Inventory

Our inventory is aged to improve the taste and smoothness of the finished product. Total storage time is approximately three (3) years, so our inventory turnover rate typically exceeds 1,000 days. We believe our practices are standard in the liquor industry in China. The base wine of our liquors goes through a production process that includes weighing, measuring, sampling and tasting, and chromatographic analysis of the production microcomponents before the finished goods come off the production line. When the base wine comes off the production line, the product is extremely bitter and is generally not smooth enough for sale.

Some finished goods will be stored for 3 years in total, initially through a 2-year storage in wooden containers and then a 1-year jar storage. This storage process creates a chemical process for the stored wine that goes into flavor blending before packaging. After packaging, the products will also be stored for 3 months. We then conduct random inspection and testing before releasing the production run for the market.

We experience an extended time for inventory turnover, as good quality base wine are stored for several decades for flavor blending. At present, national liqour industry performance is subject to PRC National Standard GB/T14867-2007 Feng-flavor Chinese Spirit, GB/T10781.1-2006 Strong Aromatic Chinese Spirits, and business standards Q/SBDJ01-2002 Mixed-Flavor (Feng, Strong Aromatic and Jiang) Chinese Spirits and Q/SBDJ03-2002 Feng and Strong Aromatic Flavor Chinese Spirits. These requirements set forth the minimum storage requirements for truthful labeling and sale. In short, the more years base wine stored for, the higher its market price will be.

Further, the storage of a certain quantity of base wine also assists in smoothing the fluctuations in grain price which can keep the productions cost competitive and dealing with peak and off peak seasonality.

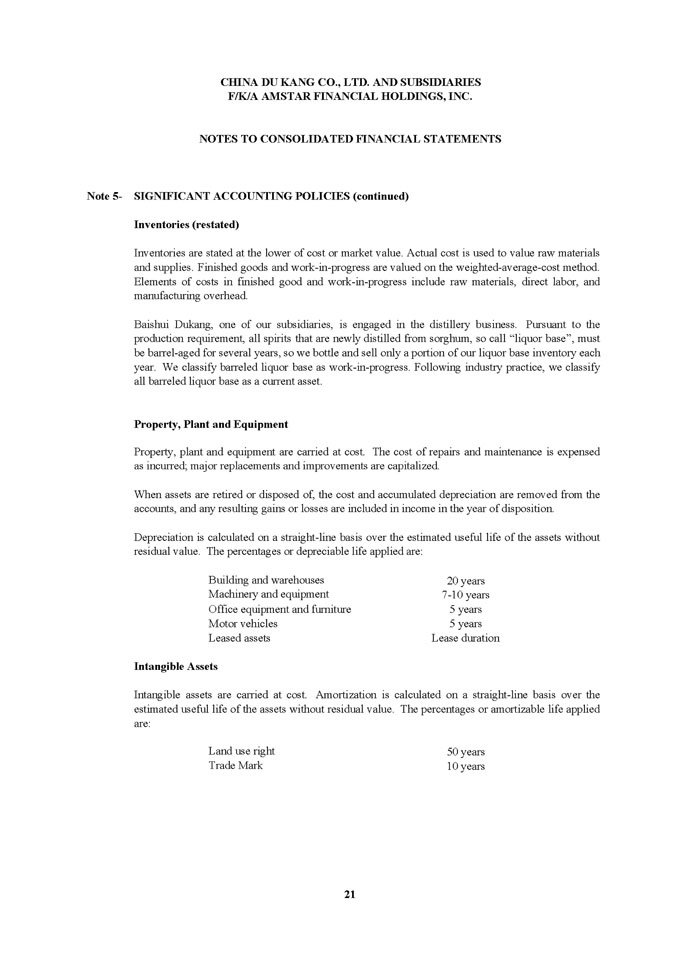

Inventories are stated at the lower of cost or market value. Actual cost is used to value raw materials and supplies. Finished goods and work-in-progress are valued on the weighted-average-cost method. Elements of costs in finished good and work-in-progress include raw materials, direct labor, and manufacturing overhead.

INCOME/LOSS

The company experienced a loss from operations of $(460,263) in the year ended December 31, 2009, which reflects an improvement of $941,552 from $(1,401,815) in the year ended December 31, 2008, The improvement was attributable to an increase in gross profit and a decrease in operation expenses.

OPERATING EXPENSES

Total operating expenses decreased from $1,749,683 in the year ended December 31, 2008 to $1,357,076 for the year ended December 31, 2009, representing an improvement of $392,607, or approximately 26.8%. The decrease in operating expenses was largely due to the decrease in general and administrative expenses, which was offset by the increase in selling expenses.

GENERAL AND ADMINISTRATIVE EXPENSES

Our general and administrative expenses reduced from $1,378,286 in the year ended December 31, 2008 to $891,327 for the year ended December 31, 2009, reflecting a 35% improvement. The decrease was largely attributed to the decrease of $328,080 in the professional fees and consultant fees from $388,645 in the year ended December 31, 2008 to $60,565 for the same period in 2009. The large professional and consultant fees in 2008 were related to our efforts for going public. Our office expenses also decreased from $222,774 in the year ended December 31, 2008 to $83,332 for the same period in 2009. Our travel and entertainment expense decreased $75,016 from $215,369 in the year ended December 31, 2008 to $140,353 in the same period in 2009 due to less overseas travel for going public.

Payroll increased from $248,828 in the year ended December 31 2008 to $266,278 at December 31, 2009. For those same periods, employee benefits and pension increased from $15,510 to $19,846; depreciation and amortization decreased from $152,953 to $151,244; vehicle expenses decreased from $42,034 to $30,168; rental decreased from $8,672 to $5,555 and other general and administrative costs declined from $15,828 to $12, 391. Loss on physical inventory count increased substantially from $67,673 to $121, 595. Thisis attributed largely to the disposal of our packing materials due to the changes in the label requirement and the changes in our product line.

The elimination of the expenses of becoming a public company incurred last year along with the reduced expenses enjoyed by the change in our distribution methods are the primary reasons that the general and administrative costs were significantly reduced this year. Some increase in administrative costs is expected going forward as we implement and expand the licensing and third party distribution methods.

SELLING EXPENSES

Selling expenses increased $94,352 from $371,397 in the year ended December 31, 2008 to $465,749 for the year ended December 31, December 31, 2009. The increase is due to an increase in promotion expenses from $120,592 in the year ended December 31, 2008 to $256,417 for the same period in 2009, a difference of $135,825. This is partly due to the costs of the conference that we attended to promote our products and the increased promotion necessary for the agency and third party distributors. We also increased our travel and entertainment expenses from $41,547 to $56,327 for the same periods due to the inspection of our franchisees. Package design decreased by $56,213, from $73,252 in the year ended December 31, 2008 to $17,039 for the year ended December 31, 2009, as we finished most of the package design for our products in 200 8.

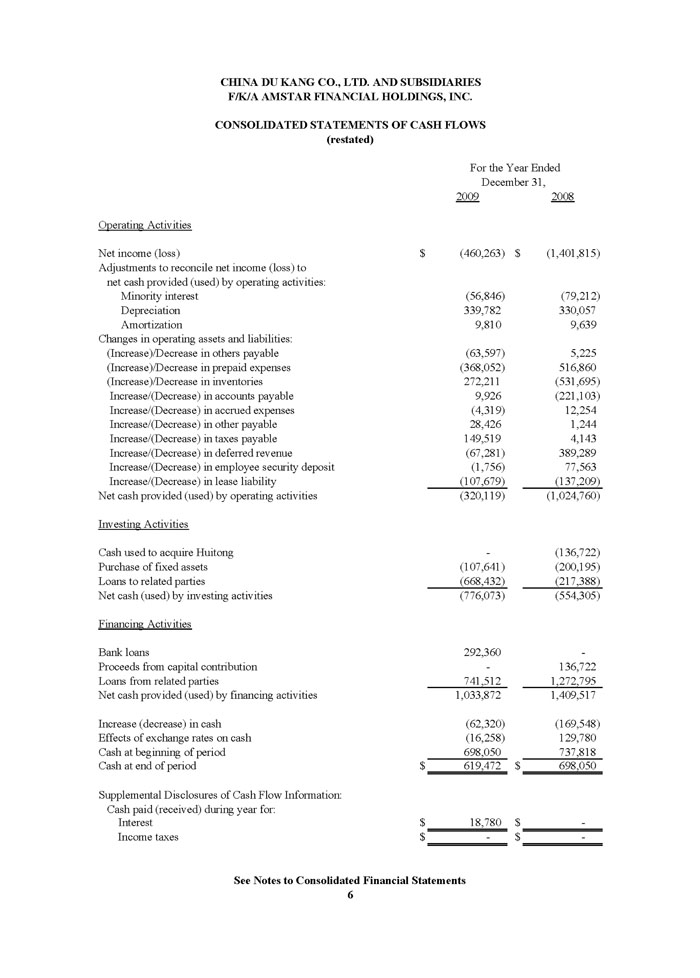

LIQUIDITY AND CAPITAL RESOURCES

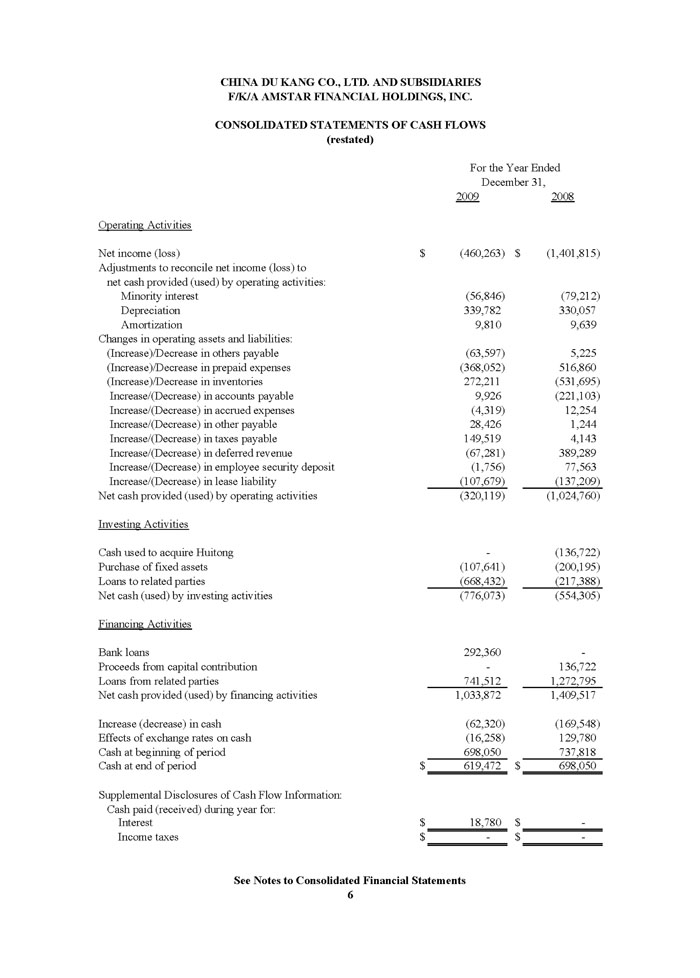

Net cash used by operating activities for years ended December 31, 2008 and 2009 were $(1,024,760) to $(320,119) respectively, an improvement of 68%. The decrease in net cash used by operating activities were primarily due to the improvement in the net loss from $ (1,401,815) to $(460,263); and the decrease in inventory, as well as the increase in accounts payable, which was offset by the increase in prepaid expense and decrease of in deferred revenue.

Cash flows used in investment activities were $(776,073) to $(554,304) for the years ended December 31, 2009 and December 2008, respectively. The increase was due primarily to the loans that we made to our non-consolidated subsidiary, Shaanxi Yellow-river Wetlands Park Co., Ltd. Loans to related parties increased from $228,513 as of December 31, 2008 to $1,111,566 as of December 31, 2009.

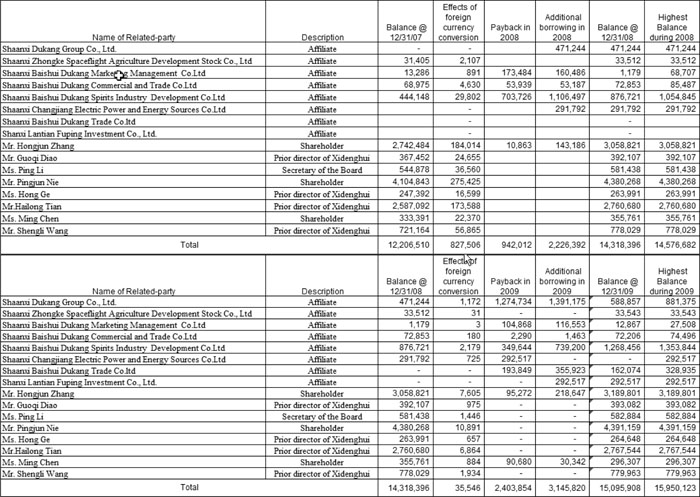

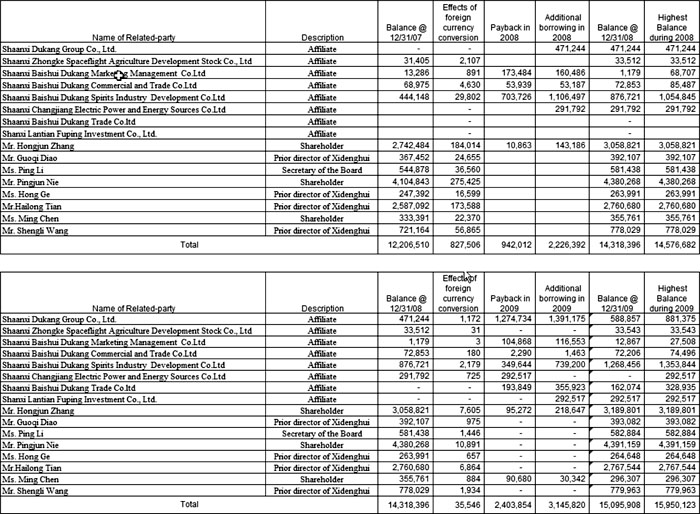

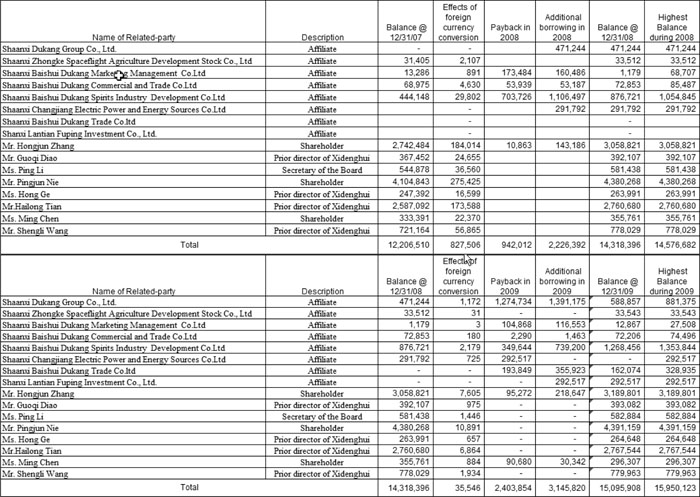

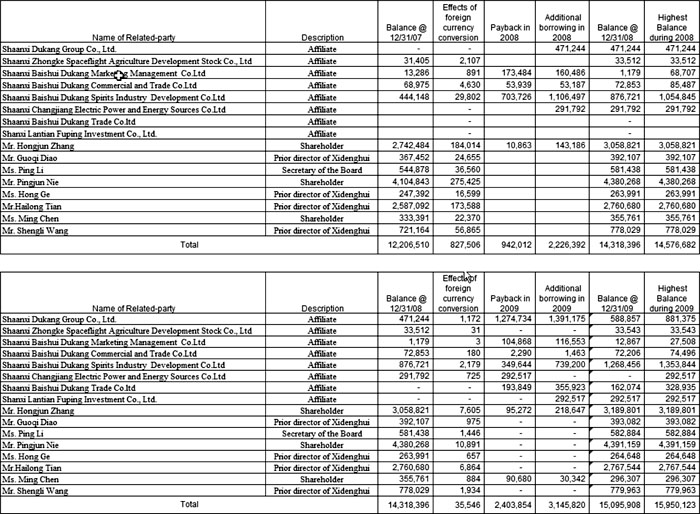

Net cash used by financing activities for the years ended December 31, 2009 and 2008 were $1,033,872 and $1,409,517 respectively. The majority of the decrease was attributed to our less borrowing from our affiliates in the current.period. Instead, we borrowed $292,360 from a local bank, and we paid back this loan in January 2010. The loans from related parties was $15,095,908 as of December 31, 2009, as compared to $14,318,396 as of December 31, 2008.

We have historically funded our cash needs through a series of debt a transactions, primarily with related parties. Our officers and directors and related parties have assured us that they will continue to provide capital infusions sufficient to fund operations over the next 12 months as needed, but they are under no legal obligation to do so. If our related parties are unable or unwilling to provide additional capital infusions we would likely require additional financing which would likely be on more unfavorable terms. If we are unable to attain additional capital there would likely be a material adverse affect on our operations and financial condition.

The related-parties include affiliates and individuals. Affiliates are companies which are directly or indirectly, beneficially and in the aggregate, majority-owned and controlled by directors, officers, and principal shareholders of the Company. Individuals include our officers, shareholders, and prior directors of subsidiaries .

Loans from related-parties are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. Accordingly, we have not paid any interest on these loans. Cash flows from due from related parties are classified as cash flows from investing activities. Cash flows from due to related parties are classified as cash flows from financing activities.

We have cash of $698,050 at the beginning of the 2009 period and cash of $619.472 at the end of the period. We have cash sufficient to fund operations for approximately 12 months assuming that sales and margins remain constant.

Our liquidity is dependent upon the continuation of and expansion of our operations, receipt of revenues and additional infusions of capital provided by equity and debt financing. Management believes that the current program of sales through distributorship agreements will improve throughout 2010 and that margins overall will continue to improve thereby. Demand for our products is dependent on market acceptance of our liquor and conditions in the liquor and general beverage markets, and general economic conditions. All of our products are currently sold in the Peoples Republic of China and are heavily dependent on the economy, exchange rates, and consumption habits within the Peoples Republic of China. Many of these factors are cyclical and beyond the control of management.

CAPITAL RESOURCES

General

Access to short and long term sources of cash is important to the continuation of our research and development and commencement of our operations. Our ability to operate is limited by our financial capacity to obtain cash and additional lines of credit in the future.

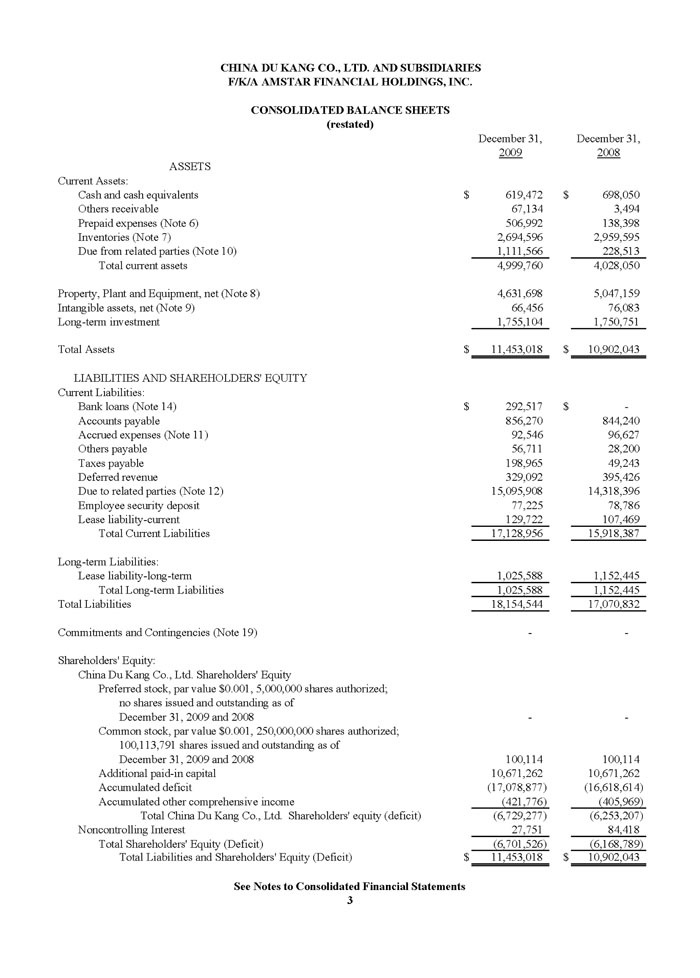

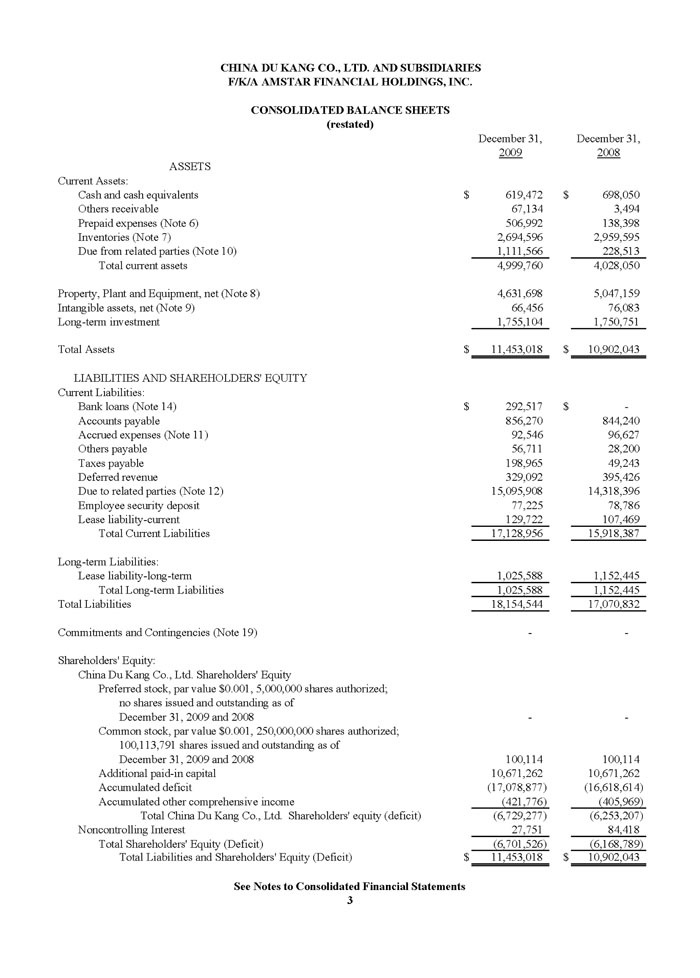

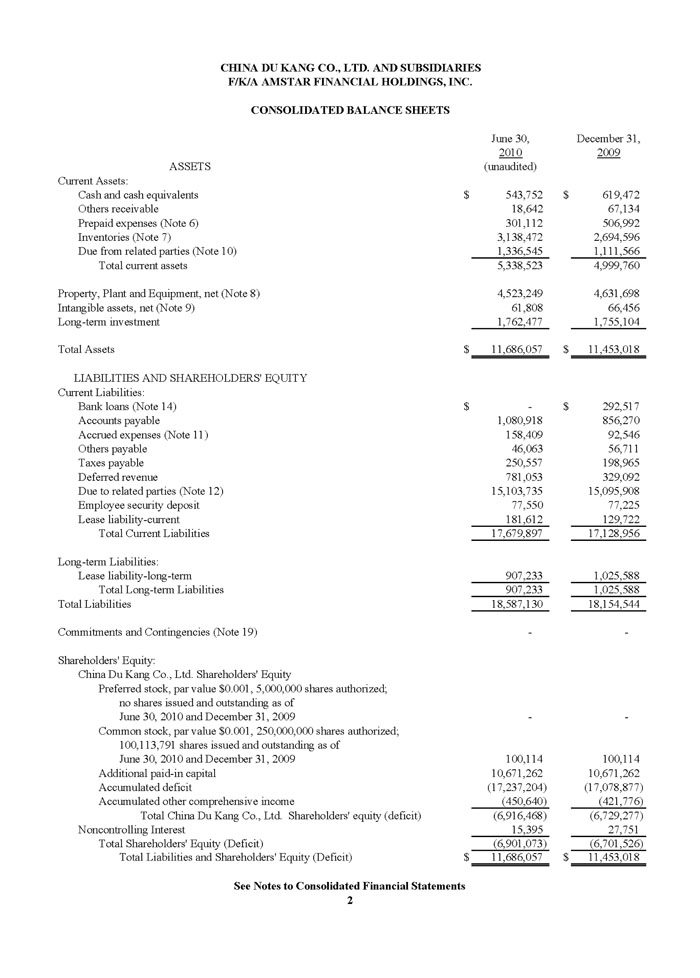

Total assets for the periods ending 2009 and 2008 were $11,453,018 and $10,902,043 respectively. Total current assets increased for the same periods from $4,028,050 to $4,999,760, which was primarily attributable to the increase of loans from related-parties, which increased from $228,513 at December 31, 2008 to $1,111,566 at December 31, 2009; and the increase in prepaid expense to purchase raw materials.which increased from $138,398 to $506,992 for the same respective periods.

Property, plant and equipment declined from $5,047,159 at December 31, 2008 to $4,631,698 at December 31, 2009, due to a disposal of vehicles. For the same respective periods long term investment increased slightly from $1,750,751 to $1,755,104 due to the changes in currency exchange rate. Liabilities increased from December 31, 2008 to December 31, 2009 from $15,918,387 to $17,128,956 We had bank loans of $292,517 at December 31, 2009. Accounts payable were $856,270 at December 31, 2009 as compared to $844,240 at December 31, 2008. Amounts due to related parties were the most significant change of current liabilities increasing from $14,318,396 at December 31, 2008 to $15,095,908 at December 31, 2009, as we obtained more loans from related-parties. Taxes payables increased from $49,243 to $198,965 d uring the same periods.

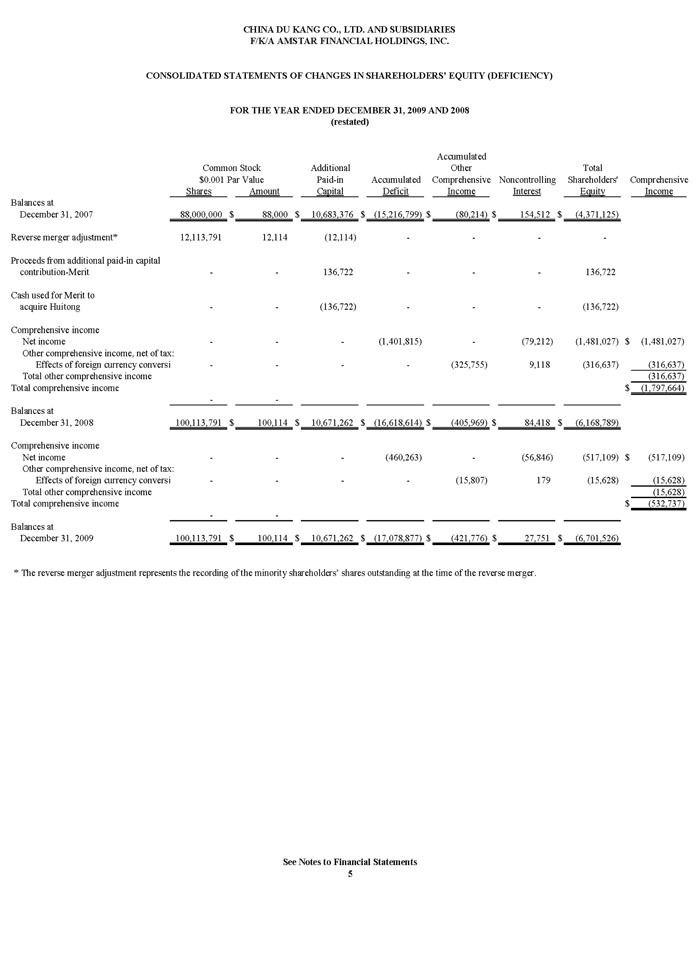

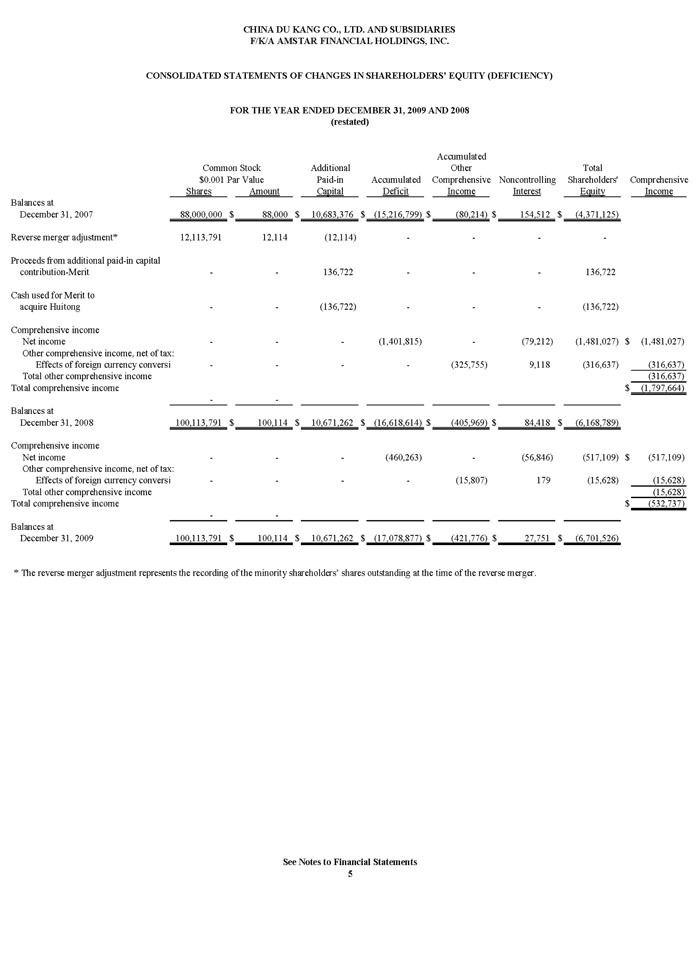

Shareholder Equity

Shareholders equity for the periods ending December 31, 2009 and December 31, 2008 were $(6,701,526 and $(6,168,789) respectively. The increase in shareholders’ deficit was due to the loss in the year ended December 31, 2009. The accumulated deficit was $(17,078,877) at December 31, 2009 as compared to $(16,618,614 at December 31, 2008. The shareholders’ deficit for China Du Kang was $(6,729,277) and $(6,253,207) for those same periods.

LIQUIDITY AND CAPITAL RESOURCES AND RESULTS OF OPERATIONS AS OF JUNE 30, 2010 AND FOR THE SIX MONTHS THEN ENDED (UNAUDITED)

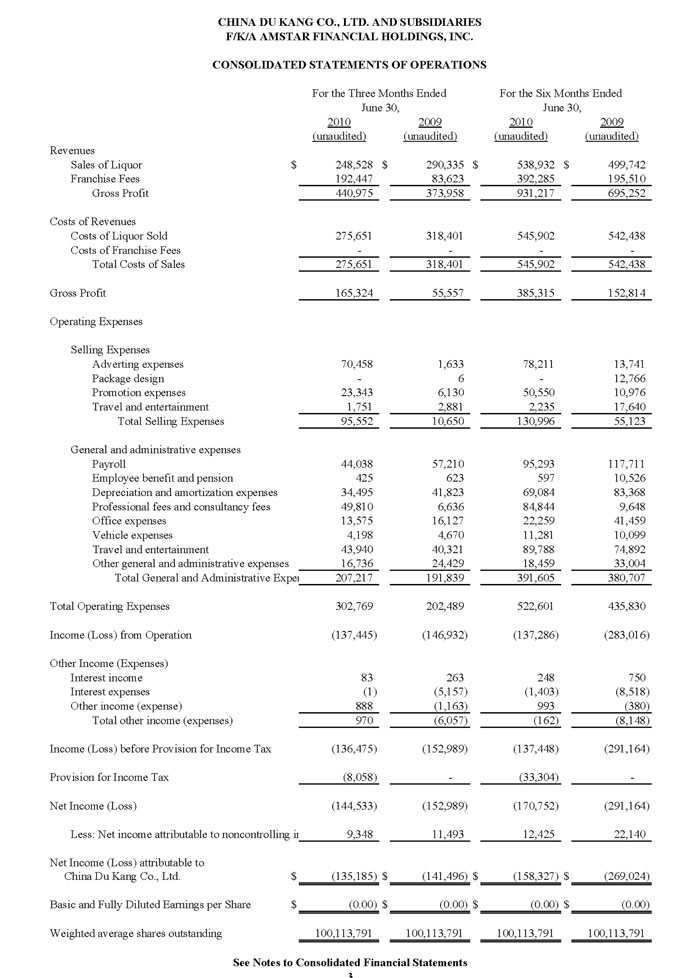

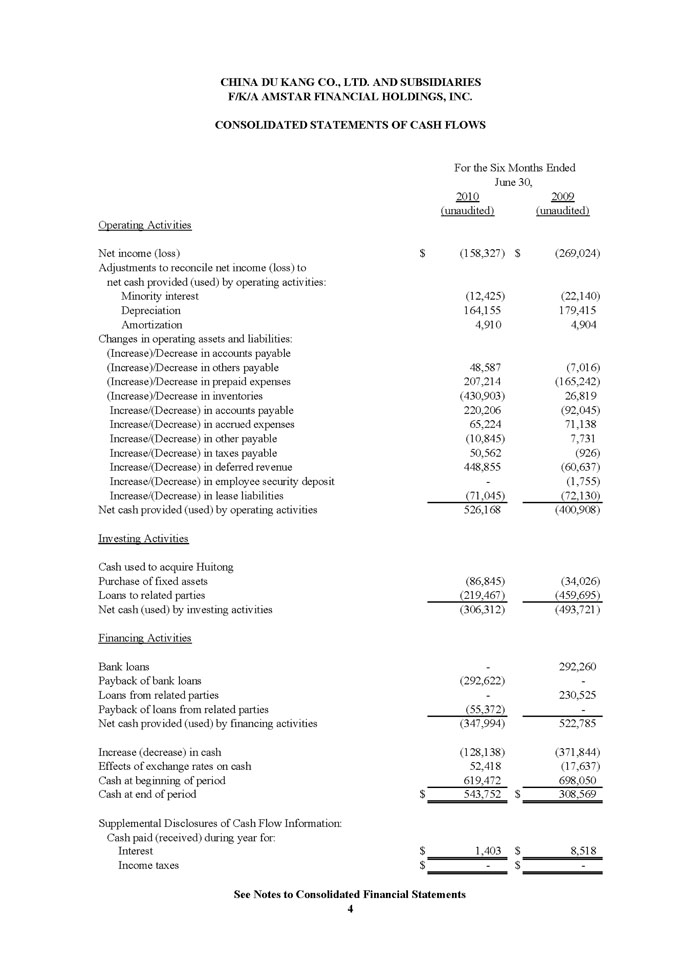

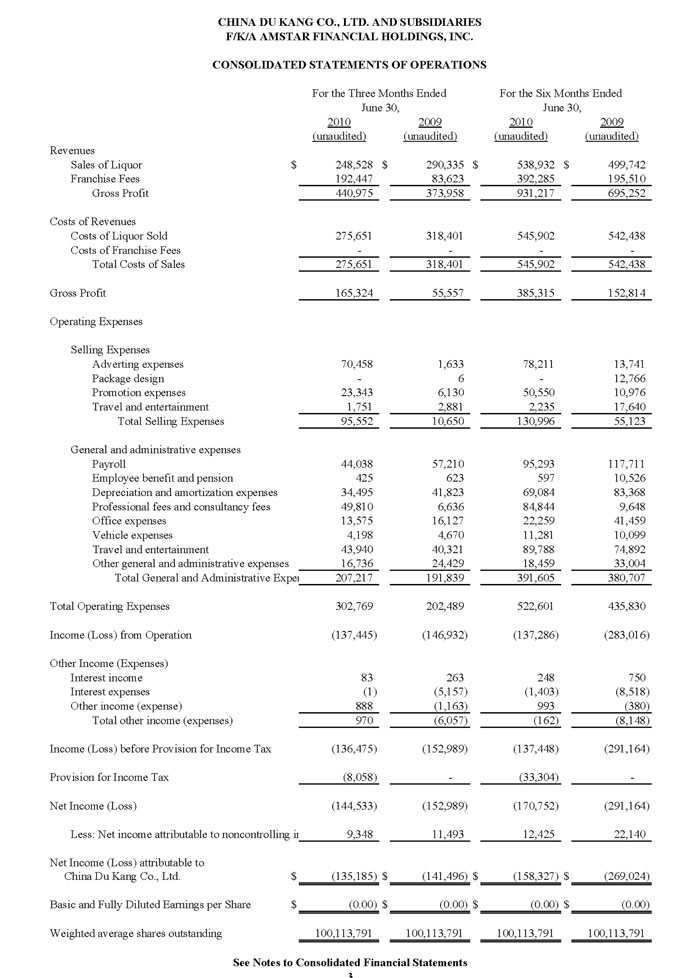

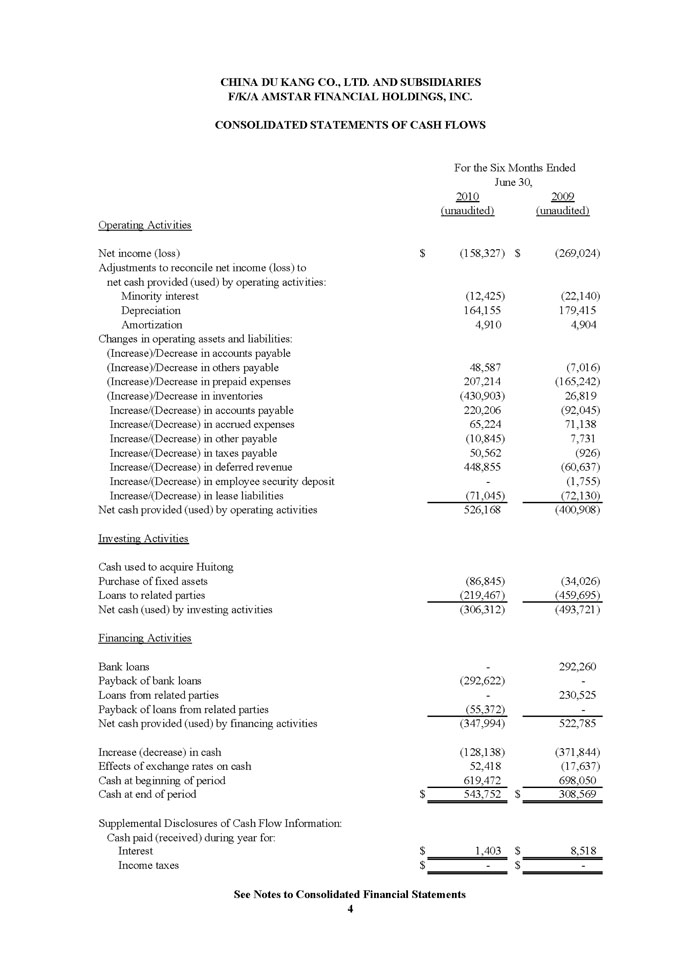

We experienced a net loss of $(144,533) for the six months ended June 30, 2010 as compared to a loss of $(152,989) for the same period of 2009. Adjustments to reconcile the net loss to cash provided by operating activities included $(12,425) for minority interest for the six months ended June 30, 2010 as compared to $(22,140) for the same period of 2009. Depreciation decreased to $164,155 from $179,415 for the same respective periods. Also, amortization increased negligibly to $4,910 from $4,904.

Changes in operating assets and liabilities included an increase in others payable from $(7,016)for the six months ended June 30, 2009 to $48,587 for the same period in 2010. Prepaid expenses increased from $(165,242) for the six month period ended June 30, 2009 to $207,214 for the same period ended June 30, 2010. Inventories for the same periods decreased from $26,819 to $(430,903). Accounts payable increased for the same periods from $(92,045) to $220,206. Accrued expenses decreased from $71,138 to $65,224 for the respective period, as did other payables from $7,731 to $(10,845) and deferred revenue from $(60,637) to $448,855. Taxes payable for the same periods were $(926) as compared to $50,562 for the six months ended June 30, 2010. Overall, net cash used by operating activities improved from $(400,908) for the six months ended June 30, 2009 to $526,168 for the same period of 2010.

Purchase of fixed assets for the six months ended June 30, 2009 were $(34,026) as compared to $(86,845) for the same period of 2010. The payback of loans to related parties accounted for $(459,695) for the six months ended June 30, 2009 and $(219,467)for the same period of 2010. The net cash used by investing activities were $(493,721) and $(306,312) for the six months ended June 30, 2009 and 2010 respectively.

Net cash used by financing activities changed from $522,785 for the six months ended June 30, 2009 to $(347,994) for the same period of 2010. The change was attributable to loans from related parties in the period of 2009. Payback of loans from related parties went from $0 at June 30, 2009 to $(55,372) for the same period of 2010. Bank loans were $292,260 for the six months ended June 30, 2009 and $0 for the same period of 2010. Payback of loans from related parties was $230,525 and $0 for the same respective periods. The change in cash declined from $698,050for the six months ended June 30, 2009 to $619,472for the six months ended June 30, 2010. Cash at the end of the period for the six months ended June 30, 2009 was $308,569 and $543,752 for the same period of 2010.

RESULTS OF OPERATIONS FOR THE SIX MONTHS ENDED JUNE 30, 2010

Revenue

Revenues continued to improve as the Company’s revised distribution plans for its products continued. For the six month period ended June 30, 2010 total revenues were $931,217 as compared to $695,252 for the same period of 2009. These include sales of liquor, which were $538,932 for the period ended June 30, 2010 and $499,742 for the same period of 2009. The largest increase was in franchise fees which improved in the period ended June 30, 2010 to $392,285 from $195,510 for the same period of 2009.

Costs of Revenues remained essentially flat for the six months ended June 30, 2010 $542,902 as compared to $542,438 for the same period of 2009.

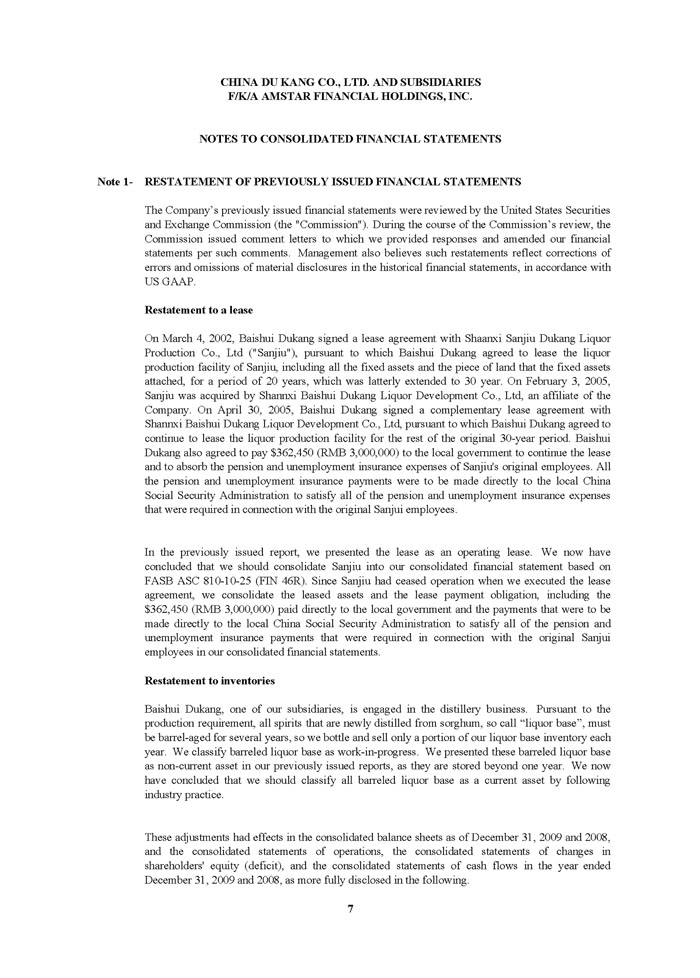

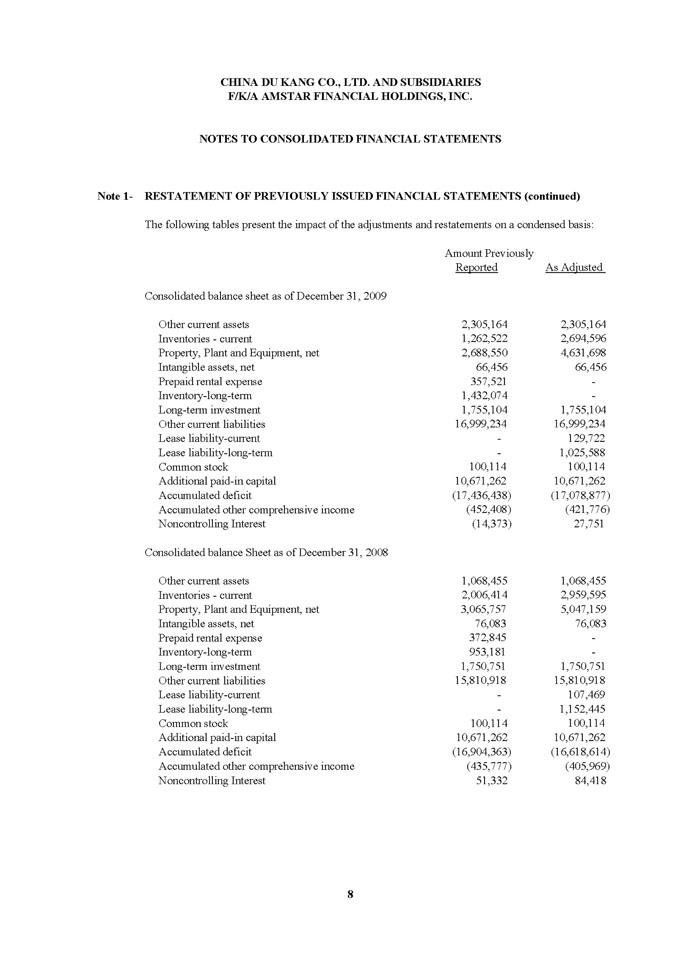

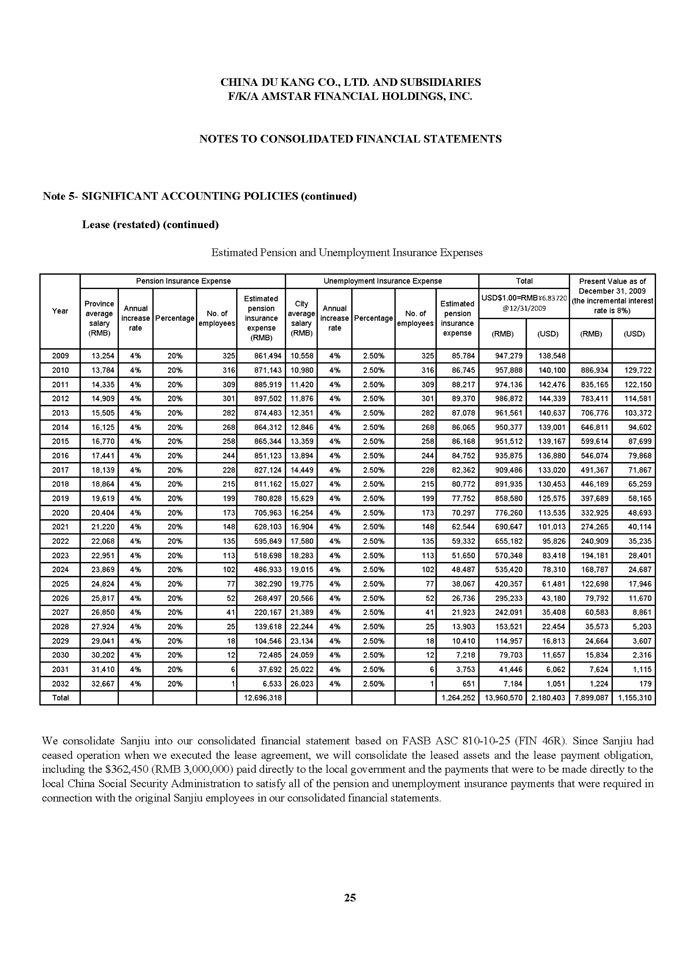

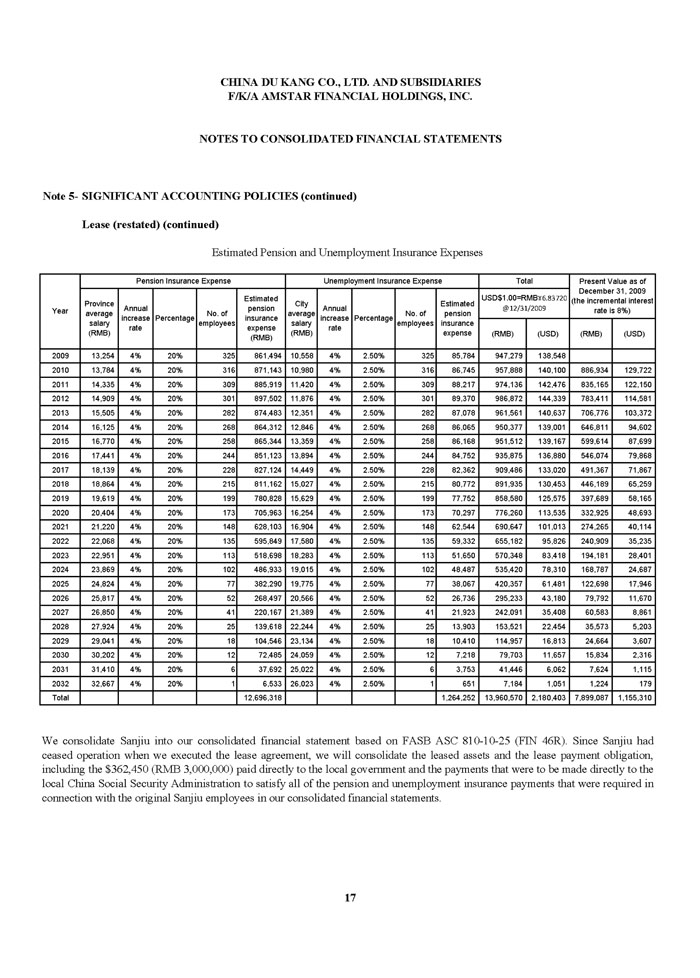

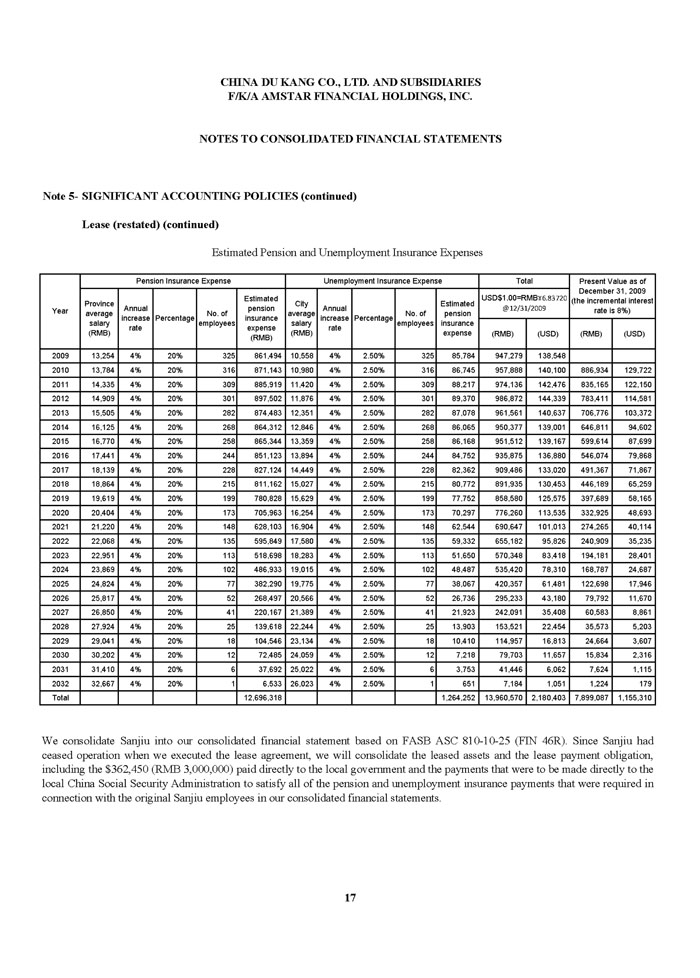

Operating Expenses