China Du Kang Co., Ltd.

| Town of Dukang, Baishui County | 2840 Highway 95 Alt. S, |

| A-28,Van Metropolis,#35 Tangyan Road, | Suite 7 |

| Xi'an, Shaanxi, PRC, 710065 | Silver Springs, NV 89129 |

==================

January 21, 2011

John Reynolds, Assistant Director

Pamela Howell, Staff Attorney

Susann Reilly, Staf Attorney

Office of Beverages, Apparel and

Health Care Services

U.S. Securities and Exchange Commission

Washington, D.C. 20549

| Re: | China Du Kang Co., Ltd. |

Form 10 filed November 10, 2009

Form 10, Amendment 1 filed November 13, 2009

Form 10, Amendment 2 filed December 4, 2009

Form 10, Amendment 3 filed January 21, 2010

File No.: 0-53833

Dear Mr. Reynolds, Ms. Howell and Ms. Reilly:

Thank you for your letter of comment dated December 2, 2010. For the convenience of the staff, we have sent under separate cover copies of the Amended Form 10 "marked to show changes." We have followed the numbering system of the Examiner's comment letter unless noted otherwise. Form 10-12(g), Amendment 5.

Item 1. Business

| 1. | We reissue comment three from our letter dated May 12, 2010. Please file signed distribution agreements. In addition, please discuss in greater detail the distribution of your products, identify your material distributors, and disclose the material terms of the agreements. For instance, state the date agreements were entered into. Please indicate whether any distributor accounted for more than 10% of revenue. If so, clearly state the amount and percent of revenues attributable to the distributor. |

Response: We have added a new discussion in Item 1, Business, Overview entitled “Distribution methods of the products and services.” We have inserted a chart entitled “Summary of Revenue” that summarizes for major customers of each type the revenue and percentage for the years ended December 31, 2008 and December 31, 2009, along with the nine month period ended September 30, 2010. We will file the remaining agreements as exhibits with this amendment.

| 2. | We reissue comment six from our letter dated May 12, 2010. We note the disclosure on page six that you license your trademark to other companies to manufacture and distribute products under the name Bai Shui Du Kang. Please file the licensing agreements as exhibits and disclose the material terms. Please indicate whether any licensee accounted for more than 10% of revenues. If so, Clearly identify the licensee and disclose the amount and percent of revenues attributable to the licensee. Lastly, given the significant increase in revenues attributable to license agreements, please provide the disclosure required by Item 101 (h)(4) of Regulation S-K for this portion of your business. |

Response: We have added a new discussion in Item 1, Business, Overview entitled “Distribution methods of the products and services.” We have inserted a chart entitled “Summary of Revenue” that summarizes for major customers of each type the revenue and percentage for the years ended December 31, 2008 and December 31, 2009, along with the nine month period ended September 30, 2010. We will file the remaining agreements as exhibits with this amendment.

| 3. | Please clarify the reference to agency contracts on page 6. Please disclose the material terms and to the extent material, please file as exhibits. |

Response: As disclosed in Item 1, Business, Overview entitled “Distribution methods of the products and services” section, the company generally enters into three different types of agreements: Distributorship Agreements, Agency Agreements, and Licensing Agreements. All are designed to expand the distribution of the company’s products and services. The material differences among the agreements are as follows:

| 1. | The company’s distribution agreements grant the distributor the exclusive right to distribute the company’s products within a defined territory. The distributor agreements provide a 5-year exclusive territory with liquor distributors subject to performance requirements. |

| 2. | The company’s agency agreements grant the agent the exclusive right to sell the company’s products within a defined territory. The agency agreements grant an agent to exclusively sell particular products of the Company in exchange for a pre-determined royalty. |

| 3. | The company’s licensing agreements grant the licensee a non-exclusive right to use the company’s trademarks, logos, and brand names in connection with the development, marketing, and sale of the licensee’s independently manufactured products. The licensing agreements grant a license to use the Company’s trademarks in exchange for a pre-determined royalty. |

The agreements for major customers are filed as exhibits.

| 4. | We reissue comment four from our letter dated May 12, 2010. The disclosure on page seven does not appear to specify the “parent.” In addition, the beneficial ownership table does not appear to reflect a parent. Please revise the disclosure, including the beneficial ownership table, as appropriate or explain. |

Response: The reference to “parent” was dropped entirely. The disclosure of the recipient of the sanitation permits is actually on page 8 in the Edgarized version as follows:

“We have obtained and maintain China Manufacture Certificate, Sanitation License and Food Security permits to Shaanxi Bai Shui Du Kang Liquor Co., Ltd. On March 1, 2008 which is valid until December 31, 2011 in China, which we believe are all of the necessary legal government approvals if a manufacturer in PRC starts its business and continue its operation.”

| 5. | We partially reissue comment ten from our letter dated May 12, 2010. Please provide the disclosure required by Item 101 (h)(4)(xi) of Regulation S-K. |

Response:

We have added a sentence to Item 1, Business Employees that states:

“The Company currently has 128 full time employees. During peak seasons the Company hires temporary workers and typically has approximately 250 part time employees during these periods.”

Item 1.A Risk Factors, page 10

| 6. | We note that you conduct substantially all of your operations outside of the United States. In order to enhance our understanding of how you prepare your financial statements and access your internal control over financial reporting, we ask that you provide us with information that will help us answer the following questions: |

How do you maintain your books and records and prepare your financial statements?

Response: We have added a paragraph to Item 2 under Financial Information, Basis of Presentation. The Company initially records in PRC GAAP as set forth in Item 2. See response to Comment 8.

| 7. | If you maintain your books and records in accordance with U.S. GAAP, describe the controls you maintain to ensure that the activities you conduct and the transactions you consummate are recorded in accordance with U.S. GAAP. |

Response: We have added a paragraph to Item 2 under Financial Information, Basis of Presentation. The Company initially records in PRC GAAP as set forth in Item 2. See response to Comment 8.

| 8. | If you do not maintain your books and records in accordance with U.S. GAAP, tell us what basis of according you use and describe the process you go through to convert your books and records to U.S. GAAP for SEC reporting. Describe the controls you maintain to ensure that you have made all necessary and appropriate adjustments in your conversions and disclosures. |

Response: We have added a paragraph to Item 2 under Financial Information, Basis of Presentation. The Company initially records in PRC GAAP as set forth in Item 2. We have added a new paragraph to Item 2, Financial Information, Basis of Presentation that explains the process of conversion of PRC GAAP to US GAAP.

What is the background of the people involved in your financial reporting?

Response: We have added a discussion to Item 2 under Financial Information, Basis of Presentation setting forth the background of the Company’s CFO who is ultimately responsible for the Company’s financial reporting. The disclosure sets forth that she is a Certified Public Accountant in the PRC, in good standing, having passed her examinations in 1990. She has been continuously engaged for the past 20 years in similar accounting roles, including stints with other companies which have employed US GAAP. Each subsidiary has an accounting manager who handles compilation of financial transactions of the subsidiary in the GAAP principles of the PRC. While each of these junior managers are trained and well-versed in PRC GAAP principles, the conversion to US GAAP is the sole responsibility of the CFO.

| 9. | We would like to understand more about the background of the people who are primarily responsible for preparing and supervising the preparation of your financial statements and evaluating the effectiveness of your internal control over financial reporting and their knowledge of U.S. GAAP and SEC rules and regulations. Do not identify people by name, but for each person, please tell us: |

| a) | What role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control: |

Response: See response to Comment 8.

| b) | What relevant education and ongoing training he or she has had relating to U.S. GAAP: |

Response: See response to Comment 8.

| c) | The nature of his or her contractual or other relationship to you: |

Response: She is currently the CFO, serving at the will of the Board of Directors.

| d) | Whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and |

Response: She is a CPA in the PRC.

| e) | About his or her professional experience including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting. |

Response: See response to Comment 8.

| 10. | I f you retain an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, please tell us: |

| a) | The name and address of the accounting firm or organization; |

Response: Not Applicable.

| b) | The qualifications of their employees who perform the services for your company: |

Response: Not Applicable.

| c) | How and why they are qualified to prepare your financial statements or evaluate your internal control over financial reporting: |

Response: Not Applicable.

| d) | How many hours they spent last year performing these services for you; and |

Response: Not Applicable.

| e) | The total amount of fees you paid to each accounting firm or organization in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Response: Not Applicable.

| 11. | If you retain individual who are not your employees and are not employed by an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, do not provide us with their names, but please tell us: |

| a) | Why you believe they are qualified to prepare your financial statements or evaluate your internal control over financial reporting: |

Response: Not Applicable.

| b) | How many hours they spent last year performing these services for you; and |

Response: Not Applicable.

| c) | The total amount of fees you paid to each individual in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Response: Not Applicable.

Do you have an audit committee financial expert?

Response: No.

| 12. | If you do not identify an audit committee financial expert in your filings, please describe the extent of the audit committee’s U.S. GAAP Knowledge. If you do not have a separately created audit committee, please describe the extent of the Board of Directors’ Knowledge of U.S. GAAP and internal control over financial reporting. |

Response: The only financial expert on the Board of Directors with knowledge of U.S. GAAP is the Company’s CFO, who has exclusive and plenary control over financial reporting and internal controls.

Management’s Discussion and Analysis, page 14

| 13. | Please provide the basis for the statement that “gradually, liquor company becomes the major contributor of tax and profit pursued by local government.” “as a major contributor of tax and profit, the company endeavors and enjoys the related preferential policy as much as possible.” And “Management believes that they can consult with local tax department and continue to enjoy the preferential treatment in taxation.” Also, please discuss the reference to the tax cut agreement. Please file this agreement as an exhibit. Lastly, clarify whether the reference to strategic partner to the licensing agreements. |

Response: We have eliminated these statements along with the reference to the tax cut agreement. We have added a disclosure that we had such an agreement prior to 2009, but the agreement has now expired and it does not currently appear that there will be any further agreement.

| 14. | Please revise the overview to discuss in greater detail the material challenges, risks and material trends, events and uncertainties. |

Response: In Item 2, Financial Information, Overview, we have added a discussion regarding management’s views as to the challenges, risks and material trends, events, and uncertainties as follows:

Regarding material challenges, risks and material trends affecting the Company, Management believes the primary risk is the potential for raw material prices to fluctuate, affecting the Company’s profitability. The Company requires approximately 2,000 tons of grain each year. Thus far the Company has not faced shortages from suppliers but has little control over pricing. The Company expects to enter into supply contracts in 2011 with designated suppliers to streamline the ups and downs of pricing.

Secondly, the Company expects the continued expansion of distributors to require additional supervisory and marketing personnel. The Company hopes to expand its marketing staff to provide close supervision and support to the network of resellers.

Finally, management believes that our current manufacturing capacity is sufficient for the next year or so, we may begin to examine expansion of our facility and our manufacturing capacity as we continue to expand our network of resellers.

| 15. | We reissue comment 14 from one letter dated May 12, 2010. Please provide the reason(s) for each material change in financial information. For instance, provide a more detailed discussion as to the reason(s) for the various decreases in general and administrative expenses. |

Response: In Item 2, Financial Information, Results from Operations, we have added disclosures in the sections Revenues, Income/Loss, and General and Administrative Expenses setting forth a more detailed discussion of the reasons for the financial changes.

| 16. | We note on page 7 that Sanjiu ceased operations when you executed the lease agreement. Please expand your discussion and analysis to explain the business reasons for entering into the lease only to cease operations of the lease facilities upon execution of the lease. |

Response: The Sanjiu assets were leased by the Company for use in its operations. The operations of Sanjiu had ceased well prior to the Company’s execution of the lease agreement. We have added discussion in Item 2, Financial Information, Overview, as follows:

Baishui Dukang Liquor Factory (“Dukang Liquor Factory”) was built as a State owned enterprise in the middle of 1970s with about 400 employees. By the early 1990’s it was no longer profitable and Dukang Liquor Factory stopped manufacturing in the early 90’s. Sanjiu Dukang Liquor Production Co., Ltd ("Sanjiu") acquired Dukang Liquor Factory in 1995, restarted and attempted to operate for one year. Unable to attain profitability, the Sanjiu closed the facility in 1998 and it remained closed until Baishui Dukang leased the facility on March 4, 2002.

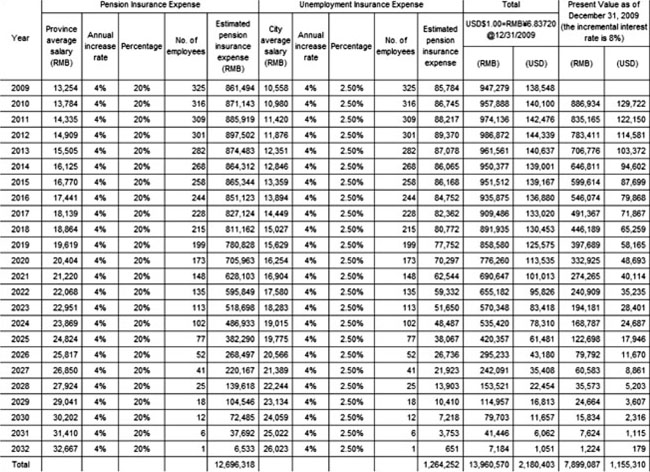

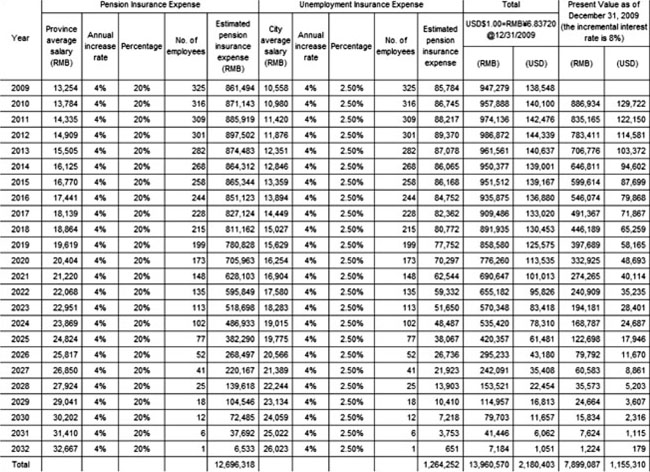

On March 4, 2002, Baishui Dukang signed a lease agreement with Sanjiu, pursuant to which Baishui Dukang agreed to lease the liquor production facility of Sanjiu, including all the fixed assets and the piece of land that the fixed assets attached, for a period of 20 years, which was latterly extended to 30 year. On February 3, 2005, Sanjiu was acquired by Shannxi Baishui Dukang Liquor Development Co., Ltd,, an affiliate of the Company. On April 30, 2005, Baishui Dukang signed a complementary lease agreement with Shannxi Baishui Dukang Liquor Development Co., Ltd, pursuant to which Baishui Dukang agreed to continue to lease the liquor production facility for the rest of the original 30-year period. Baishui Dukang also agreed to pay $362,450 (RMB 3,000,000) to the local government to continue the lease and to absorb the pension and unemployment insurance expenses of Sanjiu's original employees. All the pension and unemployment insurance payments were to be made directly to the local China Social Security Administration to satisfy all of the pension and unemployment insurance expenses that were required in connection with the original Sanjiu employees.

| 17. | We reissue comment 18 from our letter dated may 12, 2010. Please disclose the material terms of each related party loan. In addition, we note the response to our prior comment that the agreements are not in writing. Please file a written description of the contract. For guidance, see Question 146.04 of the Compliance and Disclosure interpretations at http://www.see.gov/divisions/corplin/giudance/regs-kinterp.htm |

Response: We have added disclosure to Item 2, Financial Information, Liquidity and Capital Resources, that sets out the terms of the loans. The loans are open-ended demand loans, on an interest-free basis, with no defined repayment terms. We have prepared a loan agreement which will be filed as an exhibit.

Security ownership of Certain Beneficial Owners and management, page 32

| 18. | The disclosure in this section is not consistent with the disclosure in the risk factor on page nine, which indicates that the principal stockholders own the majority of the common stock. Please reconcile the disclosure. To the extent such control is no longer in place due to sales by the principal stockholders, please discuss the transactions that resulted in the loss of control of the company and the exemption relied upon. In addition, as previously requested in comment 21 from our letter dated may 12, 2010, please confirm that you have provided the disclosure required by item 403 of regulation S-K. |

Response: We have removed the risk factor entitled “Our current shareholders control our business affairs, in which case you will have little or no participation in our business,” entirely. As indicated in Item 4, the principal shareholders control less than 18% of the company, which is the same percentage since the acquisition. None of the officers, directors, or control persons have sold any shares, and the risk factor was a drafting error ab initio.

| 19. | We reissue comment 22 from our letter dated May 12, 2010. Please disclose the amount of time each officer devotes to your business, in addition to the percent of time. |

Response: In Item 5, Directors and Executive Officers, we have bolstered the disclosure that “All of the officers and directors devote full-time energies to the company,” to “All of the officers and directors devote 100% of their energies to the company, which equals 40 hours or more to the work-week.”

Certain Relationships and Related Transactions

| 20. | Please provide the disclosure required by item 404(a)(5) of regulation S-K. In addition, clarify the relationship with each related party listed in this section. |

Response: we provided a detailed chart in Item 7 to disclose these related-party loans, which are unsecured, non-interest bearing and payable on demand. Since these loans are interest free, the entire amount of these loans is deemed to be principle.

Recent Sales of Unregistered Securities

| 21. | Please disclose section of Regulation D relied upon as an exemption from registration and the facts supporting reliance upon such exemption. In addition, we are unable to locate a Form D filed on Edgar. Please advise. |

Response: We believe that Section 506 of Regulation D was relied upon by prior management as one of the exemptions from registration. We have reinserted the discussion regarding the recent sales of securities. We located one Form D that was filed by the Company’s predecessor, Premier Organic Farms Corp., on July 23, 2007. We cannot access the Form D through Edgar, and it was not provided to us by prior management.

| 22. | In addition, we note your response to comment 25 from our letter dated May 12, 2010, which states that you have removed outdated information. Please revise to add back such information. The disclosure requirements of Item 701 cover the past three years from the date of the filing, of the initial Form 10. |

Response: We have reinserted the prior discussion regarding recent sales of unregistered securities dating back to November 2006.

Item 13. Financial Statements and Supplementary Data Including the Consolidated Financial Statements

| 23. | We note your response to comment 27 in our letter dated February 17, 2010 and we do not see the revised disclosure. In your response please include the page numbers in your amended filing where you have revised disclosure to address each of the three bulleted points in our previous comment. |

Response: We have added a segment reporting chart to Item 1, Business, Segment Reporting, which lists five major customers whose sales approximated 5% or more of Total Sales, and eight major suppliers with whom we made purchases of approximately 5% or more of the Company’s Total Purchases for the year ended December 31, 2008 and December 31, 2009. For each category, we have shown the dollar amount and percentage of total.

| l | In management's discussion and analysis, |

discuss and quantify how the concentrations of business volume with your major customers make the entity vulnerable to a reduction in liquidity or income from operations. See Item 303(A) of Regulation S-K.

Response: We have added a discussion to Management’s Discussion and Analysis setting forth the business volume with major customers and the attendant vulnerabilities and risks associated with such concentrations of revenue.

| l | Quantify and discuss in your footnotes the nature and extent of concentration risk in business volume, revenue, geographic areas. See FASB ASC 275-10-50-16 through 50-22. |

Response: The “Note 15-Segment Reporting (restated)” in the financial statements included in the Form 10-12G/A filed on November 3, 2010 disclosed the Company operates in two reportable business segments, “sales of liquor” and collection of “franchise fees”, and the revenue, costs of sales, and gross profit from these two segments.

| l | Disclose in your footnotes any reliance on a single customer from which 10% or more revenue is derived, the amount of revenue and the impacted segment(s). We remind you that entities under common control are considered a single customer. See FASB ASC 280-10-50-42. |

Response: The “Note 15-Segment Reporting (restated)” in the financial statements included in the Form 10-12G/A filed on November 3, 2010 disclosed the major customers who made sales approximately 5% of more of the Company’s total sales.

| 24. | Please present the disclosure and tabular information in Note 5 related to unemployment insurance expense that includes all of the discourses required for termination benefits pursuant to FASB ASC 710-12-50-1. |

Response: While we cannot find ASC 710-12-50-1, we find ASC 712-10-50-10 relates to “termination benefit”, which further outlines the disclosure requirements in ASC 715-20-50-1. It appears that ASC 715-20-50-1 relates to defined benefit plans. As we disclosed in Note 5, we believe the contributions that we make for Sanjiu’s original employees are a defined contribution plan and not a defined benefit plan.. The contributions are made under the laws of the PRC which require the Company to pay to the local labor bureau a monthly contribution at a stated contribution rate based on the monthly basic compensation of the employees.. Therefore, we believe the disclosures in Note 5 are accurate, but await further discussions with the Staff.

| 25. | Please tell is the amount of the termination benefit obligation recorded as a correction to the revised financial statements and where the amount is presented. Tell us how the amount reconciles with the obligation presented in the table presented in Note 5. |

Response: The most right and bottom cell in the table presented in Note 5 indicated the present value of total lease payment obligation was $1,155,310 as of December 31, 2009. The table also appears in MDA. This amount o is separated into a current portion of $129,722 and a long-term portion of $1,025,588. These amounts are presented in the balance sheet as of December 31, 2009.

| 26. | Please tell us how you considered the previous of Item 4.02 of Form 8-K in determining whether the restatements described in note 1 constitute a nonreliance of previously issued financial statements. If so, please file a Form 8-K to provide the discourses under Item 4.02. |

Response: After considering Item 4.02 of Form 8-K, the Company has decided to file a Form 8-K with the following disclosures:

| Item 4.02 | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

On management’s recommendation and in consultation with Keith H. Zhen, CPA (“Zhen”), our independent registered public accounting firm, we concluded on December 28, 2010 that the financial statements for the fiscal year ended December 31, 2009, as presented in our Annual Report on Form 10-K, should no longer be relied upon due to the accounting issues set forth below.

The accounting issues relate to the following acquisition. On March 4, 2002, Baishui Dukang signed a lease agreement with Shaanxi Sanjiu Dukang Liquor Production Co., Ltd ("Sanjiu"), pursuant to which Baishui Dukang agreed to lease the liquor production facility of Sanjiu, including all the fixed assets and the piece of land that the fixed assets attached, for a period of 20 years, which was latterly extended to 30 year. On February 3, 2005, Sanjiu was acquired by Shannxi Baishui Dukang Liquor Development Co., Ltd, a related party of the Company. On April 30, 2005, Baishui Dukang signed a complementary lease agreement with Shannxi Baishui Dukang Liquor Development Co., Ltd, pursuant to which Baishui Dukang agreed to continue to lease the liquor production facility for the rest of the original 30-year period. Baishui Dukang also agreed to pay $362,450 (RMB 3,000,000) to continue the lease and to absorb the pension and unemployment insurance expenses of Sanjiu's original employees. The $362,450 (RMB 3,000,000) was paid directly to the local government. The remaining payments were to be made directly to the governmental authority to satisfy all of the pension and unemployment insurance payments that were required in connection with the Sanjui employees. Since May 2005, all payments have been made directly to the China Social Security Administration.

In considering FASB ASC 810-10-25 (FIN 46R) management has determined that the Company should have consolidated Sanjiu we undertook the 30-year lease and assumed the pension obligations for Sanjiu's employees. Because Sanjiu had ceased operation when we executed the lease agreement in 2002, we will consolidate the assets leased and the lease payment obligation (including the payments that were to be made directly to the China Social Security Administration to satisfy all of the pension and unemployment insurance payments that were required in connection with the Sanjui employees) in our balance sheet.

Accordingly, the Company will restate its financial statements for the fiscal year ended December 31, 2009 by disclosing the effect of these accounting issues in an amended Form 10-K for the fiscal year ended December 31, 2009.

Our Board of Directors and executive officers have discussed the above matters with Zhen.

Item 3. Properties, page 30

| 27. | In your amended filing please revise this disclosure to be consistent with the disclosure throughout your filing. For example, the paragraph under the heading Property, Plant and Equipment refers to property shown in the chart but you omitted the property chart from this filing. You also disclose Baishui Dukang agreed to pay $362,450 to absorb the Sanjiu pension and unemployment expense and the table on page 31 reflects the obligation to be approximately $2.2 million. Please revise as applicable. |

Response: We have rewritten this item and added a PP&E chart to Item 3. Property and revise other information to avoid confusion. The revised Item 3 follows:

Item 3. Properties

Property, Plant and Equipment

Depreciation expense charged to operations was $339,782 and $330,057 for the year ended December 31, 2009 and 2008, respectively. The property, plant and equipment shown in the following chart are those held directly by the Company and the remaining properties are owned per a capital lease.

| | | December 31, | | | December 31, | |

| | | 2009 | | | 2008 | |

| | | | | | | |

| Building and warehouses | | $ | 2,963,873 | | | $ | 2,913,855 | |

| Machinery and equipment | | | 1,857,877 | | | | 1,820,095 | |

| Office equipment and furniture | | | 194,394 | | | | 191,029 | |

| Motor vehicles | | | 329,815 | | | | 491,005 | |

| Leased Assets* | | | 2,159,053 | | | | 2,153,698 | |

| | | | 7,505,012 | | | | 7,569,682 | |

| | | | | | | | | |

| Less: Accumulated depreciation | | | (2,914,467 | ) | | | (2,534,754 | ) |

| | | | 4,590,545 | | | | 5,034,928 | |

| | | | | | | | | |

| Add: Construction in progress | | | 41,153 | | | | 12,231 | |

| | | | | | | | | |

| Total | | $ | 4,631,698 | | | $ | 5,047,159 | |

Leased Assets*

On March 4, 2002, Baishui Dukang signed a lease agreement with Shaanxi Sanjiu Dukang Liquor Production Co., Ltd ("Sanjiu"), pursuant to which Baishui Dukang agreed to lease the liquor production facility of Sanjiu, including all the fixed assets and the piece of land that the fixed assets attached, for a period of 20 years, which was latterly extended to 30 year. On February 3, 2005, Sanjiu was acquired by Shannxi Baishui Dukang Liquor Development Co., Ltd, an affiliate of the Company. On April 30, 2005, Baishui Dukang signed a complementary lease agreement with Shannxi Baishui Dukang Liquor Development Co., Ltd, pursuant to which Baishui Dukang agreed to continue to lease the liquor production facility for the rest of the original 30-year period. Baishui Dukang also agreed to pay $362,450 (RMB 3,000,000) to the local government to continue the lease and to absorb the pension and unemployment insurance expenses of Sanjiu's original employees. All the pension and unemployment insurance payments were to be made directly to the local China Social Security Administration to satisfy all of the pension and unemployment insurance expenses that were required in connection with the original Sanjiu employees.

Pursuant to the lease agreement, Baishui Dukang is required to absorb the pension and unemployment insurance expenses of Sanjiu's original employees until they all reach their retirement age. Pursuant to the applicable laws in PRC, male employees retire when they reach 60 years old, while female employees retire when they reach 55 years old. Accordingly, Sanjiu’s original employees will gradually retire until Year 2032. The pension and unemployment insurance expenses are based on a certain percentage of the employees’ gross payroll. The percentage may be changed as the applicable law is amended. In practice, the expenses can be based on the local average salary published by the local government. Over the life of the lease, the Management anticipates the percentage will remain the same while the local average salary will increase 4% annually. The number of employees that we need to absorb their pension and unemployment insurance expenses will gradually decrease as Sanjiu’s original employees reach their retirement ages. To the best of our estimation, we anticipate the future payment for pension and unemployment insurance expenses for Sanjiu’s original employees as rental payment follows:

Consolidated Statements of Cash Flows, page 6

| 28. | We note your response to comment 32 in our letter dated May 12, 2010 and we reissue our comment. The current presentation nets all related parties, affiliates, shareholders, prior directors, and other related parties into one line item. You are not permitted to net borrowings and repayments of debt you owe to one party with other parties unless you have the express valid right by contract or otherwise. See FASB ASC 210-20-15. |

Response: We believe there is some misunderstanding regarding the offsetting. This comment says ”You are not permitted to net borrowing and repayments of debt you owe to one party with other parties unless…”. We do not offset borrowing and repayment of ONE party with OTHER parties. We only net the borrowing and the repayment of the SAME related-party during an accounting period. If it is a net borrowing from a particular party (such as Party A), we reflect a cash inflow from this related-party (Party A) in the financing activities section. On the other hand, if it is a net payment to a particular party (such as Party B), we reflect a cash outflow to this related-party (Party B) in the investing activities section. We do not net the borrowing from Party A with payment to Part B into one line item. We do combine all net borrowings from related-parties (that means all Part As) into one line item in the financing section. On the other hand, we combine all net payment to related-parties (that means all Party Bs) into one line item in the investing activities section.

Notice to Consolidated Financial Statements, page 7

| 29. | Please remove the first two sentences in the introductory paragraph to this footnote. Specifically, remove the sentences beginning with the statement the Company’s previously issued financial statements were reviewed by the United Sates Securities and Exchange Commission. |

Response: We have deleted the first two sentences in the introductory paragraph. The revised introductory paragraph will look like following:

”The United States Securities and Exchange Commission (the "Commission") issued comment letters on the Company’s previously issued financial statements. We provided responses and amended our financial statements per such comments. Management also believes such restatements reflect corrections of errors and omissions of material disclosures in the historical financial statements, in accordance with US GAAP.”

Note-5 – Significant Accounting Policies, page

Inventories (restated)

| 30. | We note that you classify all barreled liquor as a current asset. Please disclose the length of your operating cycle |

Response: We classify all barreled liquor as work-in-progress, a current asset ,following industry practice. For the purpose of identifying the current asset and current liability, we define our operating cycle as one year for our current assets and current liabilities, except the work-in-progress.

Baishui Dukang, one of our subsidiaries, is engaged in the distillery business. Pursuant to the production requirement, all spirits that are newly distilled from sorghum, so call “liquor base”, must be barrel-aged for several years, so we bottle and sell only a portion of our liquor base inventory each year. We classify barreled liquor base as work-in-progress. Following industry practice, we classify all barreled liquor base as a current asset.

Exhibits

| 31. | We reissue comments 44 and 45 from our letter dated may 12, 2010. Please file the original lease entered into in March 2002 as referenced in Exhibit 10.3. Also, please file validly executed agreements as exhibits. |

Response: We have updated our Exhibit filings.

Form 10-K for the Year Ended December 31. 2009

| 32. | Please amend your Form 10-K as necessary to comply with the comments issued in connection with your Form 10/A filed on November 3, 2010. |

Response: We have amended Form 10-K to conform to the amended Form 10, Amendment 6.

| 33. | We reissue comment 48 from our letter dated May 12, 2010. Refer to your first paragraph on page 2. We note your statement that the report includes forward-looking statements subject to the safe harbor of the Private Securities Litigation Reform Act of 1995. Be advised that Section 27A(b)(1)(C) of the Securities Act and Section 21E(b)(1)(C) of the Securities Exchange Act expressly state that the safe harbor for forward looking statements does not apply to statements made by companies that issue penny stock. Please explain supplementally or either: |

| · | Delete any references to the Private Securities Litigation Reform Act; or |

| · | Make clear, each time you refer to the Litigation Reform Act, that the safe harbor does not apply to your company. |

Response: We have deleted all references to the Private Securities Litigation Reform Act

| 34. | Please provide the disclosure required by Item 401(e) of Regulation S-K for each director regarding the specific experience, qualification, attributes or skills that led to the conclusion that each person should serve as a director. |

Response: We have expanded the discussion in Item 10 setting forth the rationale for electing each person as director of the Company.

| 35. | Please provide the disclosure required by Item 407(a) of regulation S-K regarding director independence. |

Response: We have added disclosures that none of the current directors are independent as determined by the current rules of the NASDAQ stock exchange. The Company is currently engaged in a search for directors that will meet the independence requirements.

| 36. | Please revise your list of exhibits to identify all of those exhibits required to be included as set forth in the exhibit table of Item 601 of Regulation S-K. See for guidance Compliance and Disclosure Interpretation Question 146.02. |

Response: We have filed a revised Exhibit list.

| 37. | Please include the signatures as required by Form 10-K. |

Response: We have included the signatures as required by Form 10-K.

Forms 10-Q for the Quarters Ended March 31, June 30 and September 30, 2010

| 38. | Please amend your Forms 10-Q as necessary to comply with the comments issued in connection with your Form 10/A filed on November 3, 2010. |

Response: We have made the appropriate changes to the Risk Factors and elsewhere in the Form 10-Q to conform with Form 10, Amendment 6.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

China Du Kang Co., Ltd.;

By (Signature and Title)*

Date

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ Wang Yongsheng

Chief Executive Officer (Principal

Executive Officer), President, and Director

Date November 2, 2010

By /s/ Liu Su Ying

Chief Financial Officer (Principal

Financial Officer)

Date November 2, 2010

The Company has endeavored to comply and adequately respond to reach of the Staff’s comments. Further, the Company notes that it is aware of its responsibilities under state and federal securities laws and intends to fully comply with its obligations thereunder.

Should you require anything further, please let us know.

Thanks in advance,

Yours very truly,

China Du Kang Co., Ltd.

Wang Youngsheng

WYS/js

enclosures