UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q /A

AMENDMENT NO. 1

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from ______________to__________________.

Commission File No. 333-157281

CHINA DU KANG CO., LTD.

(Exact name of Registrant as Specified in its Charter)

| NEVADA | | 90-0531621 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

Town of Dukang, Baishui County, A-28, Van Metropolis, #35 Tangyan Road, Xi'an, Shaanxi, PRC, 710065 | | 8629-88830106-822 |

| (Address of principal executive offices) | | (Issuer's telephone number) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yeso No x

State the number of shares outstanding of each of the Issuers classes of common stock, as of the latest practicable date: Common, $.001 par value per share; 100,113,791 outstanding as of March 31, 2011

CHINA DU KANG CO., LTD.

TABLE OF CONTENTS

| PART I | | | |

| | | | | |

| ITEM 1 - FINANCIAL STATEMENTS (RESTATED) | | | 3 | |

| ITEM 2 - MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | | | 34 | |

| ITEM 3 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | 38 | |

| ITEM 4 - CONTROLS AND PROCEDURES | | | 38 | |

| | | | | |

| PART II | | | | |

| | | | | |

| ITEM 1 - LEGAL PROCEEDINGS | | | 40 | |

| ITEM 2 - UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | | 40 | |

| ITEM 3 - DEFAULTS UPON SENIOR SECURITIES | | | 40 | |

| ITEM 4 - [Removed and Reserved.] | | | 40 | |

| ITEM 5 – OTHER INFORMATION | | | 40 | |

| ITEM 6 – EXHIBITS | | | 40 | |

| SIGNATURES | | | 41 | |

ITEM 1. Financial Statements

| CHINA DU KANG CO., LTD. AND SUBSIDIARIES |

| F/K/A AMSTAR FINANCIAL HOLDINGS, INC. |

| |

| |

| |

| |

| FINANCIAL REPORT |

| ( R estated) |

| |

| At March 31, 2011 and December 31, 2010 and |

| For the Three Months Ended March 31, 2011 and 2010 |

| |

| |

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

INDEX

| | | PAGE | |

| CONSOLIDATED BALANCE SHEETS | | | 5 | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | | | 6 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | | | 7 | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | | | 8-33 | |

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

( R estated)

| | | March 31, 2011 | | | December 31, 2010 | |

| ASSETS |

| Current Assets: | | | | | | |

| Cash and cash equivalents | | $ | 1,314,259 | | | $ | 1,994,126 | |

| Accounts receivable,net (Note 6) | | | 541,314 | | | | - | |

| Others receivable | | | 1,370 | | | | 74,210 | |

| Prepaid expenses (Note 7) | | | 429,005 | | | | 625,696 | |

| Inventories (Note 8) | | | 3,586,001 | | | | 3,273,993 | |

| Total current assets | | | 5,871,949 | | | | 5,968,025 | |

| Property, Plant and Equipment, net (Note 9) | | | 4,407,002 | | | | 4,424,062 | |

| Intangible assets, net (Note 10) | | | 2,003,396 | | | | 2,003,122 | |

| Long-term investment | | | 1,826,456 | | | | 1,814,937 | |

| Total Assets | | $ | 14,108,803 | | | $ | 14,210,146 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current Liabilities: | | | | | | | | |

| Bank loans (Note 15) | | $ | 761,023 | | | $ | 756,224 | |

| Accounts payable | | | 981,949 | | | | 891,409 | |

| Accrued expenses (Note 12) | | | 222,979 | | | | 160,512 | |

| Others payable | | | 65,968 | | | | 64,136 | |

| Land use right purchase payable | | | - | | | | 1,946,792 | |

| Taxes payable | | | 527,368 | | | | 491,137 | |

| Deferred revenue | | | 1,524,221 | | | | 1,587,115 | |

| Due to related parties (Note 13) | | | 16,161,963 | | | | 17,018,272 | |

| Employee security deposit | | | 44,138 | | | | 43,860 | |

| Lease liability-current | | | 125,147 | | | | 126,314 | |

| Total Current Liabilities | | | 20,414,756 | | | | 23,085,771 | |

| Long-term Liabilities: | | | | | | | | |

| Lease liability-long-term | | | 910,357 | | | | 934,237 | |

| Total Long-term Liabilities | | | 910,357 | | | | 934,237 | |

| Total Liabilities | | | 21,325,113 | | | | 24,020,008 | |

| Commitments and Contingencies (Note 18) | | | - | | | | - | |

| Shareholders' Equity: | | | | | | | | |

| China Du Kang Co., Ltd. Shareholders' Equity | | | | | | | | |

| Preferred stock, par value $0.001, 5,000,000 shares authorized; no shares issued and outstanding as of | | | | | | | | |

| March 31, 2011 and December 31, 2010 | | | - | | | | - | |

| Common stock, par value $0.001, 250,000,000 shares authorized; 100,113,791 shares issued and outstanding as of | | | | | | | | |

| March 31, 2011 and December 31, 2010 | | | 100,114 | | | | 100,114 | |

| Additional paid-in capital | | | 14,962,400 | | | | 14,699,903 | |

| Accumulated deficit | | | (21,681,908 | ) | | | (21,449,649 | ) |

| Accumulated other comprehensive income | | | (731,539 | ) | | | (685,094 | ) |

| Due from related parties (Note 10) | | | - | | | | (2,577,187 | ) |

| Total China Du Kang Co., Ltd. Shareholders' equity (deficit) | | | (7,350,933 | ) | | | (9,911,913 | ) |

| Noncontrolling Interest | | | 134,623 | | | | 102,051 | |

| Total Shareholders' Equity (Deficit) | | | (7,216,310 | ) | | | (9,809,862 | ) |

| Total Liabilities and Shareholders' Equity (Deficit) | | $ | 14,108,803 | | | $ | 14,210,146 | |

See Notes to Consolidated Financial Statements

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

( R estated)

| | | For the Three Months Ended March 31, | |

| | | 2011 (unaudited) | | | 2010 (unaudited) | |

| | | | | | | |

| Sales of Liquor | | $ | 427,679 | | | $ | 290,404 | |

| License Fees | | | 283,817 | | | | 199,838 | |

| Gross Profit | | | 711,496 | | | | 490,242 | |

| Costs of Revenues | | | | | | | | |

| Costs of Liquor Sold | | | 314,451 | | | | 277,449 | |

| Costs of License Fees | | | - | | | | - | |

| Total Costs of Sales | | | 314,451 | | | | 277,449 | |

| Gross Profit | | | 397,045 | | | | 212,793 | |

| Operating Expenses | | | | | | | | |

| Selling Expenses | | | | | | | | |

| Advertising expenses | | | 5,907 | | | | 34,960 | |

| Travel and entertainment | | | 1,734 | | | | 484 | |

| Total Selling Expenses | | | 7,641 | | | | 35,444 | |

| General and administrative expenses | | | | | | | | |

| Payroll | | | 78,288 | | | | 51,255 | |

| Employee benefit and pension | | | 19,080 | | | | 172 | |

| Depreciation and amortization expenses | | | 45,649 | | | | 34,589 | |

| Professional fees and consultancy fees | | | 25,104 | | | | 35,034 | |

| Office expenses | | | 15,842 | | | | 8,684 | |

| Vehicle expenses | | | 9,276 | | | | 7,083 | |

| Loss on physical inventory count | | | 25,687 | | | | - | |

| Travel and entertainment | | | 11,029 | | | | 45,848 | |

| Other general and administrative expenses | | | 33,872 | | | | 1,723 | |

| Total General and Administrative Expenses | | | 263,827 | | | | 184,388 | |

| Total Operating Expenses | | | 271,468 | | | | 219,832 | |

| Income (Loss) from Operation | | | 125,577 | | | | (7,039 | ) |

| Other Income (Expenses) | | | | | | | | |

| Interest income | | | 1,520 | | | | 165 | |

| Interest expenses | | | (18,543 | ) | | | (3,997 | ) |

| Imputed interest | | | (262,497 | ) | | | (236,574 | ) |

| Other income (expense) | | | 100 | | | | 105 | |

| Total other income (expenses) | | | (279,420 | ) | | | (240,301 | ) |

| Income (Loss) before Provision for Income Tax | | | (153,843 | ) | | | (247,340 | ) |

| Provision for Income Tax | | | (46,585 | ) | | | (21,810 | ) |

| Net Income (Loss) | | | (200,428 | ) | | | (269,150 | ) |

| Less: Net income attributable to noncontrolling interest | | | 31,831 | | | | 8,920 | |

| Net Income (Loss) attributable to China Du Kang Co., Ltd. | | $ | (232,259 | ) | | $ | (278,070 | ) |

| Basic and Fully Diluted Earnings per Share | | $ | (0.00 | ) | | $ | (0.00 | ) |

| Weighted average shares outstanding | | | 100,113,791 | | | | 100,113,791 | |

See Notes to Consolidated Financial Statements

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

( R estated)

| | | For the Three Months Ended March 31, | |

| | | 2011 (unaudited) | | | | |

| | | | | | | |

| Net income (loss) including noncontrolling interest | | $ | (200,428 | ) | | $ | (269,150 | ) |

| Adjustments to reconcile net income (loss) including noncontrolling interest to net cash provided (used) by operating activities: | | | | | | | | |

| Imputed interest | | | 262,497 | | | | 236,574 | |

| Depreciation | | | 89,608 | | | | 89,327 | |

| Amortization | | | 12,404 | | | | 2,454 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| (Increase)/Decrease in accounts receivable | | | (539,729 | ) | | | - | |

| (Increase)/Decrease in others receivable | | | 73,096 | | | | 50,993 | |

| (Increase)/Decrease in prepaid expenses | | | 200,075 | | | | 311,938 | |

| (Increase)/Decrease in inventories | | | (290,375 | ) | | | (395,199 | ) |

| Increase/(Decrease) in accounts payable | | | 84,634 | | | | 170,689 | |

| Increase/(Decrease) in accrued expenses | | | 61,268 | | | | 38,079 | |

| Increase/(Decrease) in other payable | | | 1,421 | | | | 6,995 | |

| Increase/(Decrease) in taxes payable | | | 33,017 | | | | (23,750 | ) |

| Increase/(Decrease) in deferred revenue | | | (72,754 | ) | | | 63,531 | |

| Increase/(Decrease) in lease liabilities | | | (31,685 | ) | | | (32,436 | ) |

| Net cash provided (used) by operating activities | | | (316,951 | ) | | | 250,045 | |

| Cash Flows from Investing Activities | | | | | | | | |

| Purchase of fixed assets | | | (77,067 | ) | | | (28,820 | ) |

| Purchase of land use right | | | (1,953,410 | ) | | | - | |

| Advances to related parties | | | (607,080 | ) | | | - | |

| Collections of advances to related parties | | | 303,540 | | | | - | |

| Net cash (used) by investing activities | | | (2,334,017 | ) | | | (28,820 | ) |

| Cash Flows from Financing Activities | | | | | | | | |

| Repayments of bank loans | | | - | | | | (292,567 | ) |

| Proceeds from related parties | | | 1,929,510 | | | | 742,374 | |

| Repayments to related parties | | | (1,520 | ) | | | (1,026,358 | ) |

| Net cash provided (used) by financing activities | | | 1,927,990 | | | | (576,551 | ) |

| Increase (decrease) in cash | | | (722,978 | ) | | | (355,326 | ) |

| Effects of exchange rates on cash | | | 43,111 | | | | 24,881 | |

| Cash at beginning of period | | | 1,994,126 | | | | 619,472 | |

| Cash at end of period | | $ | 1,314,259 | | | $ | 289,027 | |

| | | | | | | | | |

| Supplemental Disclosures of Cash Flow Information: | | | | | | | | |

| Cash paid (received) during year for: | | | | | | | | |

| Interest | | $ | 13,270 | | | $ | 1,402 | |

| Income taxes | | $ | - | | | $ | - | |

See Notes to Consolidated Financial Statements

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1- BASIS OF PRESENTATION

The accompanying unaudited financial statements of China Du Kang Co., Ltd. and subsidiaries, (the “Company” or "Du Kang") were prepared pursuant to the rules and regulations of the United States Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations. Management of the Company (“Management”) believes that the following disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the audited financial statements and the notes for the year ended December 31, 2010.

These unaudited financial statements reflect all adjustments, consisting only of normal recurring adjustments that, in the opinion of Management, are necessary to present fairly the financial position and results of operations of the Company for the periods presented. Operating results for the three months ended March 31, 2011, are not necessarily indicative of the results that may be expected for the year ending December 31, 2011.

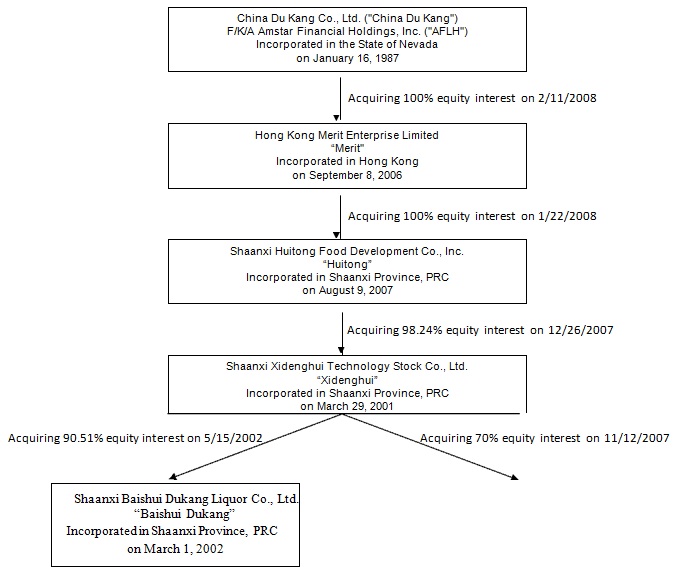

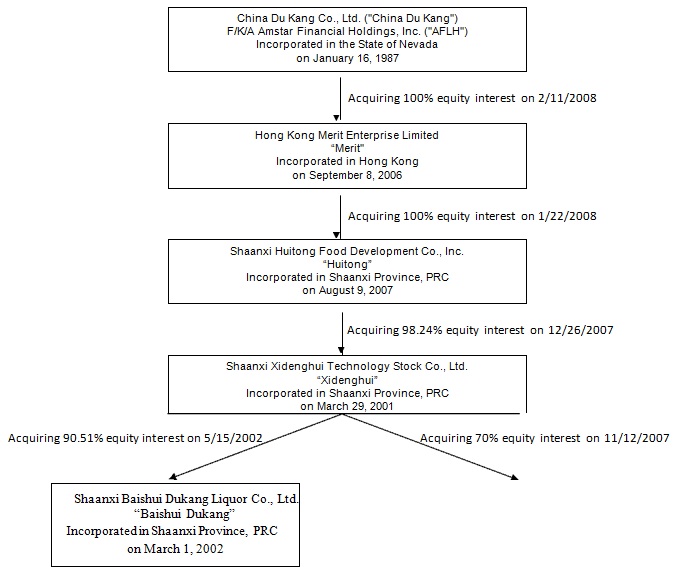

Note 2- ORGANIZATION AND BUSINESS BACKGROUND

China Du Kang Co., Ltd (“China Du Kang” or the “Company”) was incorporated as U. S. Power Systems, Inc., in the State of Nevada on January 16, 1987. On or about June 8, 2006 the Company’s name was changed to Premier Organic Farms Group, Inc. On or about November 30, 2006 the name was changed to Amstar Financial Holdings, Inc. (“AFLH”). On or about March 18, 2008 the name was changed to its current name of China Du Kang Co., Ltd. with its corporate charter still residing in Nevada. The Company changed its fiscal year ending from September 30 to December 31 in February 2008.

The Company had been engaged in the business to provide various financial services since it's incorporated. The Company was not successful and discontinued the majority of its operation by December 31, 2007.

On January 10, 2008, the Company entered into a Plan of Exchange Agreement (the “Exchange Agreement”) with Hong Kong Merit Enterprise Limited (“Merit”), a holding company incorporated in Hong Kong. Pursuant to the terms of the Exchange Agreement, the Company agreed to issue post split 88,000,000 shares of its common stock to the shareholders of Merit in exchange for Merit to transfer all of its issued and outstanding shares of common stock to the Company, thereby causing Merit to become a wholly-owned subsidiary of the Company. The parties closed the transaction contemplated by the Agreement on February 11, 2008.

This transaction is being accounted for as a reverse merger, since the shareholders of Merit owns a majority of the outstanding shares of the Company’s common stock immediately following the share exchange. Merit is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will reflected in the consolidated financial statements for periods prior to the share exchange will be those of Merit and its subsidiaries and will be recorded at the historical cost basis. After completion of the share exchange, the Company‘s consolidated financial statements will include the assets and liabilities of both Du Kang and Merit, the historical operations of Merit and the operations of the Company and its subsidiaries from the closing date of the share exchange.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 2- ORGANIZATION AND BUSINESS BACKGROUND (continued)

Merit was incorporated on September 8, 2006 in Hong Kong under the Companies Ordinances as a Limited Liability company. Merit was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship.

On January 22, 2008, Merit entered into a Share Purchase Agreement (the “Purchase Agreement”) with the owners of Shaanxi Huitong Food Co., Inc. ("Huitong"), a limited liability company incorporated in the People's Republic of China ("PRC") on August 9, 2007 with a registered capital of $128,200 (RMB1,000,000). Pursuant to the Purchase Agreement, Merit agreed to purchase 100% of the equity ownership in Huitong for a cash consideration of $136,722 (RMB 1,000,000). The local government approved the transaction on February 1, 2008. Subsequent to the completion of the acquisition, Huitong became a wholly-owned subsidiary of Merit.

Huitong was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship. On December 26, 2007, Huitong executed an acquisition agreement with shareholders of Shaanxi Xidenghui Technology Stock Co., Ltd. ("Xidenghui"), whereby Huitong agreed to acquire 98.24% of the equity ownership of Xidenghui from the shareholders. Subsequent to completion of the acquisition agreement, Xidenghui became a majority-owned subsidiary of Huitong.

Xidenghui was incorporated in Weinan City, Shaanxi Province, PRC on March 29, 2001 under the Company Law of PRC. Xidenghui was engaged in the business of production and distribution of distilled spirit with a brand name of “Xidenghui”. Currently, its principal business is to hold an equity ownership interest in Shannxi Baishui Dukang Liquor Co., Ltd. (“Baishui Dukang”) and Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. (“Brand Management”).

Baishui Dukang was incorporated in Baishui County, Shanxi Province, PRC on March 1, 2002 under the Company Law of PRC. Baishui Dukang was principally engaged in the business of production and distribution of distilled spirit (liquor) with a brand name of “Baishui Du Kang”. On May 15, 2002, Xidenghui invested inventory and fixed assets with a total fair value of $ 4,470,219 (RMB 37,000,000) to Baishui Dukang and owns 90.51% of Baishui Dukang’s equity interest ownership, thereby causing Baishui Dukang to become a majority-owned subsidiary of Xidenghui.

On October 30, 2007, Xidenghui executed an agreement with Mr. Zhang Hongjun, a PRC citizen, to establish a joint venture, Shaanxi Baishui Dukang Liquor Brand Management Co., Ltd. ("Brand Management"). Pursuant to the agreement, Xidenghui contributed cash of $95,704 (RMB 700,000), and owns 70% equity interest ownership therein. Brand Management was subsequently incorporated on November 12, 2007. Upon the completion of incorporation, Brand Management became a majority-owned subsidiary of the Xidenghui. Brand Management is principally engaged in the business of distribution of Baishui Dukang’s liquor and manage the franchise of the “Baishui Du Kang” brand name.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 2- ORGANIZATION AND OPERATIONS (continued)

Baishui Dukang and Brand Management are the two of these affiliated companies that are engaged in business operations. Du Kang, Merit, Huitong, and Xidenghui are holding companies, whose business is to hold an equity ownership interest in Baishui Dukang and Brand Management. All these affiliated companies are hereafter referred to as the "Company". Currently, the Company is principally engaged in the business of production and distribution of distilled spirit with the brand name of “Baishui Dukang”. The Company also licenses the brand name to other liquor manufactures and liquor stores. The Company's structure is summarized in the following chart.

Under the PRC regulations on acquisition of businesses, commonly referred to as "SAFE" regulations (State Administration of Foreign Exchange), which were jointly adopted on August 8, 2006 by six PRC regulatory agencies with jurisdictional Authority, a Chinese entity may not be owned or controlled directly by foreign investors or shareholders but may be acquired in a two-step transaction with a wholly owned foreign enterprise (“WOFE”).

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 2- ORGANIZATION AND OPERATIONS (continued)

China Du Kang is the US holding company for Merit, a Hong Kong entity organized under the Companies Ordinance as a limited liability company. Merit was established as a WOFE corporation for the purpose of effecting an acquisition transaction with Huitong, a WOFE corporation incorporated in PRC. Huitong in turn majority owns Xidenghui, which was a Chinese holding company. Xidenghui had two subsidiaries, Baishui Dukang and Brand Management.

This arrangement provides separate holding companies for the United States, Hong Kong, and PRC. This allows the Company to lawfully conduct operations in China while ownership is represented in shares of the U. S. holding company.

Note 3- CONTROL BY PRINCIPAL OWNERS

The directors, executive officers, their affiliates, and related parties own, directly or indirectly, beneficially and in the aggregate, the majority of the voting power of the outstanding capital of the Company. Accordingly, directors, executive officers and their affiliates, if they voted their shares uniformly, would have the ability to control the approval of most corporate actions, including approving significant expenses, increasing the authorized capital and the dissolution, merger or sale of the Company's assets.

Note 4- GOING CONCERN (restated)

As reflected in the accompanying consolidated financial statements, the Company had an accumulated deficit of $21,681,908 at March 31, 2011 that includes losses of $1,007,604 and $1,321,056 for the year ended December 31, 2010 and 2009, respectively. In addition, The Company had a working capital deficiency of $14,542,807 and a shareholders' deficiency of $7,350,933 at March 31, 2011. These factors raise substantial doubt about its ability to continue as a going concern.

Management has taken steps to revise the Company's operating and financial requirements. The Company is actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance owners' investment. However, there can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on the Company's existing stockholders.

The accompanying financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP"). This basis of accounting differs from that used in the statutory accounts of the Company, which are prepared in accordance with the "Accounting Principles of China " ("PRC GAAP"). Certain accounting principles, which are stipulated by US GAAP, are not applicable in the PRC GAAP. The difference between PRC GAAP accounts of the Company and its US GAAP consolidated financial statements is immaterial.

The consolidated financial statements include the accounts of the Company and all its majority-owned subsidiaries which require consolidation. Inter-company transactions have been eliminated in consolidation.

Certain amounts in the prior year's consolidated financial statements and notes have been revised to conform to the current year presentation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results when ultimately realized could differ from those estimates.

Subsequent Events

The Company evaluated subsequent events through the date of issuance of these financial statements. We are not aware of any significant events that occurred subsequent to the balance sheet date but prior to the filing of this report that would have a material impact on our consolidated financial statements.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currencies Translation

The Company maintains its books and accounting records in PRC currency "Renminbi" ("RMB"), which is determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates quoted by the People’s Bank of China (“PBOC”) prevailing at the date of the transactions. Monetary assets and liabilities denominated in currencies other than RMB are translated into RMB using the applicable exchange rates quoted by the PBOC at the balance sheet dates. Exchange differences are included in the statements of changes in owners' equity. Gain and losses resulting from foreign currency transactions are included in operations.

The Company’s financial statements are translated into the reporting currency, the United States Dollar (“US$”). Assets and liabilities of the Company are translated at the prevailing exchange rate at each reporting period end. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from translation of these consolidated financial statements are reflected as accumulated other comprehensive income (loss) in the consolidated statements of changes in shareholders’ equity.

The exchange rates used for foreign currency translation were as follows (USD$1 = RMB):

| Period Covered | | Balance Sheet Date | | | Average Rates | |

| Three months ended March 31, 2011 | | | 6.57010 | | | | 6.58940 | |

| Three months ended March 31, 2010 | | | 6.83610 | | | | 6.83603 | |

| Year ended December 31, 2010 | | | 6.61180 | | | | 6.66103 | |

| Year ended December 31, 2009 | | | 6.83720 | | | | 6.84088 | |

| Statement of Cash Flows | | | | | | | | |

In accordance with FASB ASC 830-230, “Statement of Cash Flows”, cash flows from the Company’s operations is calculated based upon the functional currency. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Revenue Recognition

The Company recognizes revenue when the earnings process is complete, both title and the risks and rewards of ownership are transferred or services have been rendered and accepted, the selling price is fixed or determinable, and collectability is reasonably assured.

(1) Sales of Liquor

The Company generally sells liquor to liquor distributors with which the Company executed an exclusive distributor contract, pursuant to which the distributor cannot act as a distributor for any other products of the third party. The Company recognizes liquor sales revenue when the significant risks and rewards of ownership have been transferred pursuant to PRC law, including such factors as when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, sales and value-added tax laws have been complied with, and collectability is reasonably assured. The Company generally recognizes revenue from sales of liquor when its products are shipped.

The Company does not provide an unconditional right of return, price protection or any other concessions to our customers. Sales returns and other allowances have been immaterial in our operation.

(2) License Fees

(a) License fees from liquor manufactures

We authorize liquor manufacturers who comply with our requirements to use certain sub brand names of “Baishui Dukang” to process the production of liquor and to sell to customers within the designated area in a certain period of time. The amount of license fee varies based on the sales territory and the number of sub brand names. We generally collect the entire license fee when the license agreement is executed, and then recognize license fee revenue over the beneficial period described by the agreement, as the revenue is realized or realizable and earned.

(b) License fees from liquor stores

We also authorize liquor stores who comply with our requirements to exclusively sell certain sub brand names of “Baishui Dukang” products within the designated area in a certain period of time. The amount of license fee varies based on the sales territory and the number of sub brand names. We generally collect the entire license fee when the agency agreement is executed, and then recognize license fee revenue over the beneficial period described by the agreement, as the revenue is realized or realizable and earned.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Deferred Revenue

Deferred revenue consists of prepayments to the Company for products that have not yet been delivered to the customers and franchise fees received upfront for services have not yet been rendered and accepted. Payments received prior to satisfying the Company’s revenue recognition criteria are recorded as deferred revenue.

Cost of License Fees

Costs of franchise fees principally include the costs to prepare the franchise contracts and the payroll to employees who are responsible for inspection and monitoring the franchisees. These expenses are immaterial and therefore included in the general and administrative expenses.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits in banks with maturities of three months or less, and all highly liquid investments which are unrestricted as to withdrawal or use, and which have original maturities of three months or less.

Others Receivable

Others receivable principally includes advance to employees who are working on projects on behalf of the Company. After the work is finished, they will submit expense reports with supporting documents to the accounting department. Upon being properly approved, the expenses are debited into the relevant accounts and the advances are credited out. Cash flows from these activities are classified as cash flows from operating activities.

Concentrations of Credit Risk

Financial instruments that subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company maintains its cash and cash equivalents with high-quality institutions. Deposits held with banks in PRC may not be insured or exceed the amount of insurance provided on such deposits. Generally these deposits may be redeemed upon demand and therefore bear minimal risk.

Fair Value of Financial Instruments

The carrying value of financial instruments including cash and cash equivalents, receivables, prepaid expenses, accounts payable, and accrued expenses, approximates their fair value due to the relatively short-term nature of these instruments.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Inventories

Inventories are stated at the lower of cost or market value. Actual cost is used to value raw materials and supplies. Finished goods and work-in-progress are valued on the weighted-average-cost method. Elements of costs in finished good and work-in-progress include raw materials, direct labor, and manufacturing overhead.

Baishui Dukang, one of our subsidiaries, is engaged in the distillery business. Pursuant to the production requirement, all spirits that are newly distilled from sorghum, so call “liquor base”, must be barrel-aged for several years, so we bottle and sell only a portion of our liquor base inventory each year. We classify barreled liquor base as work-in-progress. Following industry practice, we classify all barreled liquor base as a current asset.

Property, Plant and Equipment

Property, plant and equipment are carried at cost. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized.

When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition.

Depreciation is calculated on a straight-line basis over the estimated useful life of the assets without residual value. The percentages or depreciable life applied are:

Building and warehouses 20 years

Machinery and equipment 7-10 years

Office equipment and furniture 5 years

Motor vehicles 5 years

Leased assets Lease duration

Intangible Assets

Intangible assets are carried at cost. Amortization is calculated on a straight-line basis over the estimated useful life of the assets without residual value. The percentages or amortizable life applied are:

Land use right 50 years

Trade Mark 10 years

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Land Use Right

All land belongs to the State in PRC. Enterprises and individuals can pay the State a fee to obtain a right to use a piece of land for commercial purpose or residential purpose for an initial period of 50 years or 70 years, respectively. The land use right can be sold, purchased, and exchanged in the market. The successor owner of the land use right will reduce the amount of time which has been consumed by the predecessor owner.

The Company owns the right to use three pieces of land, approximately 657 acre, 2.4 acre, and 7.8 acre, located in Weinan City, Shaanxi Province for through February, 2051, March 2055, and May 2059. The costs of these land use rights are amortized over their prospective beneficial period, using the straight-line method with no residual value.

Valuation of Long-Lived assets

Long-lived assets and certain identifiable intangibles are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

Long-term Investment

On March 1, 2006, Xidenghui executed an investment agreement with Shaanxi Yichuan Nature Park Co., Inc., pursuant to which, Xidenghui agreed to invest cash of $1,596,254 (RMB 12,000,000) to establish a joint-venture named Shaanxi Yellow-river Wetlands Park Co., Ltd., and owns 7.9% equity ownership interest therein. Shaanxi Yellow-river Wetlands Park Co., Ltd. is engaged in the business of recreation and entertainment.

Xidenghui finished the investment contribution in September 2007. As the project is currently ongoing, the Management believes the amount invested approximates the fair value and uses the cost method to record the investment.

Advertising Costs

The Company expenses advertising costs as incurred or the first time the advertising takes place, whichever is earlier, in accordance with the FASB ASC 720-35, “Advertising Costs”. The advertising costs were $5,907, and $34,960 for the three months ended March 31, 2011 and 2010, respectively.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Research and Development Costs

Research and development costs relating to the development of new products and processes, including significant improvements and refinements to existing products, are expensed when incurred in accordance with the FASB ASC 730, "Research and Development". Research and development costs were immaterial for the year three months March 31, 2011 and 2010, respectively.

Value-added Tax ("VAT")

Sales revenue represents the invoiced value of goods, net of a value-added tax (VAT). All of the Company’s products that are sold in PRC are subject to a Chinese value-added tax at a rate of 17% of the gross sales price or at a rate approved by the Chinese local government. This VAT may be offset by VAT paid on purchase of raw materials included in the cost of producing the finished goods. The Company presents VAT on a net basis.

Sales Tax

Baishui Dukang produces and distributes distilled liquor, which is subject to sales tax in PRC. Sales tax rate is $0.14 (RMB1.00) per kilogram and 10%-20% of gross sales revenue. The Company presents sales tax on a net basis.

Related Parties

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

Due from/to Affiliates

Due from/to affiliates represent temporally short-term loans to/from affiliates, which are directly or indirectly, beneficially and in the aggregate, majority-owned and controlled by directors and principal shareholders of the Company. These loans are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. Cash flows from due from related parties are classified as cash flows from investing activities. Cash flows from due to related parties are classified as cash flows from financing activities.

Loans from Directors and Officers

Loans from directors and officers are temporally short-term loans from our directors and officers to finance the Company’s operation due to lack of cash resources. These loans are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. Cash flows from these activities are classified as cash flows from financing activates.

Imputed Interest

The Company has financed it business operation through short-term borrowings from various related parties. These short-term borrowings are non-secured, non-interest bearing with no fixed repayment date. The imputed interests are assessed as an expense to the business operation and an addition to the paid-in capital. The calculation is performed quarterly based on the average outstanding balance and the market interest rate. The interest rate used in the calculation of imputed interest for the three months ended March 31, 2011 and 2010 was 6.375% and 6.375%, respectively, which approximates the interest rate of our bank loans.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Pension and Employee Benefits

Full time employees of the PRC entities participate in a government mandated multi-employer defined contribution plan pursuant to which certain pension benefits, medical care, unemployment insurance, employee housing fund and other welfare benefits are provided to employees. Chinese labor regulations require the Company to accrue for these benefits based on certain percentages of the employees' salaries. The Management believes full time employees who have passed the probation period are entitled to such benefits. The total provisions for such employee benefits was $17,515 and $5,572 for the three months ended March 31, 2011 and 2010, respectively.

Government Subsidies

The Company records government grants as current liabilities upon reception. A government subsidy revenue is recognized only when there is reasonable assurance that the Company has complied with all conditions attached to the grant. The Company recognized government subsidy of $0 and $0 for the three months ended March 31, 2011 and 2010, respectively.

Income Taxes

The Company accounts for income tax in accordance with FASB ASC 740-10-25, which requires the asset and liability approach for financial accounting and reporting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance related to deferred tax assets is recorded when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Effective January 1, 2007, the Company adopted a new FASB guidance, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. The new FASB guidance prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The new FASB guidance also provides guidance on de-recognition of tax benefits, classification on the balance sheet, interest and penalties, accounting in interim periods, disclosure, and transition. In accordance with the new FASB guidance, the Company performed a self-assessment and concluded that there were no significant uncertain tax positions requiring recognition in its consolidated financial statements.

The Company accounts for income taxes in interim periods in accordance with FASB ASC 740-270, "Interim Reporting". The Company has determined an estimated annual effect tax rate. The rate will be revised, if necessary, as of the end of each successive interim period during the Company's fiscal year to its best current estimate. The estimated annual effective tax rate is applied to the year-to-date ordinary income (or loss) at the end of the interim period.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Statutory Reserves

Pursuant to the applicable laws in PRC, PRC entities are required to make appropriations to three non-distributable reserve funds, the statutory surplus reserve, statutory public welfare fund, and discretionary surplus reserve, based on after-tax net earnings as determined in accordance with the PRC GAAP, after offsetting any prior years’ losses. Appropriation to the statutory surplus reserve should be at least 10% of the after-tax net earnings until the reserve is equal to 50% of the Company's registered capital. Appropriation to the statutory public welfare fund is 5% to 10% of the after-tax net earnings. The statutory public welfare fund is established for the purpose of providing employee facilities and other collective benefits to the employees and is non-distributable other than in liquidation. Beginning from January 1, 2006, enterprise is no more required to make appropriation to the statutory public welfare fund. The Company does not make appropriations to the discretionary surplus reserve fund.

Since the Company has been accumulating deficiency, no contribution has been made to statutory surplus reserve fund and statutory public welfare reserve fund to date. The company will be required to make contribution to the statutory surplus reserve fund and statutory public welfare reserve fund upon the achievement of positive retained earnings, which means elimination of accumulated deficit and making further positive net income.

Comprehensive Income

FASB ASC 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated comprehensive income, as presented in the accompanying statements of changes in owners' equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

Segment Reporting

FASB ASC 820, “Segments Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company currently operates in two principal business segments.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Earnings (Loss) Per Share

The Company reports earnings per share in accordance with FASB ASC 260, “Earnings Per Share”, which requires presentation of basic and diluted earnings per share in conjunction with the disclosure of the methodology used in computing such earnings per share. Basic earnings (loss) per share is computed by dividing income (loss) available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There are no potentially dilutive securities outstanding (options and warrants) for the three months ended March 31, 2011 and 2010, respectively.

Fair Value of Measurements~

Accounting principles generally accepted in the United States define fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. Additionally, the inputs used to measure fair value are prioritized based on a three-level hierarchy. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1: | Unadjusted quoted prices in active markets for identical assets or liabilities. |

| Level 2: | Input other than quoted market prices that are observable, either directly or indirectly, and reasonably available. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the Company. |

| Level 3: | Unobservable inputs. Unobservable inputs reflect the assumptions that the Company develops based on available information about what market participants would use in valuing the asset or liability. |

An asset or liability’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Availability of observable inputs can vary and is affected by a variety of factors. The Company uses judgment in determining fair value of assets and liabilities and Level 3 assets and liabilities involve greater judgment than Level 1 and Level 2 assets or liabilities.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Recent Accounting Pronouncements

In January 2011, the FASB temporarily deferred the disclosures regarding troubled debt restructurings which were included in the disclosure requirements about the credit quality of financing receivables and the allowance for credit losses which was issued in July 2010. In April 2011, the FASB issued additional guidance and clarifications to help creditors in determining whether a creditor has granted a concession, and whether a debtor is experiencing financial difficulties for purposes of determining whether a restructuring constitutes a troubled debt restructuring. The new guidance and the previously deferred disclosures are effective July 1, 2011 applied retrospectively to January 1, 2011. Prospective application is required for any new impairments identified as a result of this guidance. The Management does not expect the adoption of this new guidance will have a material effect on the Company’s financial position and results of operations.

In December 2010, FASB issued an amendment to the disclosure of supplementary pro forma information for business combinations. The amendments in this ASU specify that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. The amendments also expand the supplemental pro forma disclosures to include a description of the nature and amount of material, nonrecurring pro forma adjustments directly attributable to the business combination included in the reported pro forma revenue and earnings. The amendments are effective prospectively for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2010. Early adoption is permitted. The adoption of this new guidance did not have a material effect on the Company’s financial position and results of operations.

In December 2010, FASB issued an amendment to goodwill impairment test. The amendments modify Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating that impairment may exist. The qualitative factors are consistent with the existing guidance and examples, which require that goodwill of a reporting unit be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. The amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. Early adoption is not permitted. The adoption of this new guidance did not have a material effect on the Company’s financial position and results of operations.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5- SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements (continued)

In April 2010, FASB issued an amendment to Stock Compensation. The amendment clarifies that an employee stock-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity shares trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity would not classify such an award as a liability if it otherwise qualifies as equity. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. The adoption of this new guidance did not have a material effect on the Company’s financial position and results of operations.

In January 2010, the FASB issued additional disclosure requirements for fair value measurements. The guidance requires previous fair value hierarchy disclosures to be further disaggregated by class of assets and liabilities. A class is often a subset of assets or liabilities within a line item in the statement of financial position. In addition, significant transfers between Levels 1 and 2 of the fair value hierarchy are required to be disclosed. These additional requirements became effective January 1, 2010 for quarterly and annual reporting. The adoption of this new guidance did not have a material effect on the Company’s financial position and results of operations. In addition, the fair value disclosure amendments also require more detailed disclosures of the changes in Level 3 instruments. These changes are effective beginning January 1, 2011.The adoption of these new guidances did not have a material effect on the Company’s financial position and results of operations.

In October 2009, the FASB issued ASU No. 2009-13, Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force, that provides amendments to the criteria for separating consideration in multiple-deliverable arrangements. As a result of these amendments, multiple-deliverable revenue arrangements will be separated in more circumstances than under existing U.S. GAAP. The ASU does this by establishing a selling price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence if available, third-party evidence if vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific objective evidence nor third-party evidence is available. A vendor will be required to determine its best estimate of selling price in a manner that is consistent with that used to determine the price to sell the deliverable on a standalone basis. This ASU also eliminates the residual method of allocation and will require that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method, which allocates any discount in the overall arrangement proportionally to each deliverable based on its relative selling price. Expanded disclosures of qualitative and quantitative information regarding application of the multiple-deliverable revenue arrangement guidance are also required under the ASU. The ASU does not apply to arrangements for which industry specific allocation and measurement guidance exists, such as long-term construction contracts and software transactions. The ASU is effective beginning January 1, 2011. The adoption of this new guidance did not have a material effect on the Company’s financial position and results of operations.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 6- ACCOUNTS RECEIVABLE

| | Accounts receivable consists of the following: | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | 2011 | | | 2010 | |

| | | | (unaudited) | | | | |

| | Accounts receivable | | $ | 541,314 | | | $ | - | |

| | Less: Allowance for doubtful accounts | | | - | | | | - | |

| | Accounts receivable, net | | $ | 541,314 | | | $ | - | |

| | | | | | | | | | |

| | Bad debt expense charged to operations was $0 and $0 for the three months ended March 31, 2011 and 2010, respectively. | | | | | | | | |

Note 7-PREPAID EXPENSES

| | | | | | |

| | Prepaid expenses consist of the following: | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | 2011 | | | 2010 | |

| | | | (unaudited) | | | | |

| | Machinery and parts | | $ | 38,204 | | | $ | 39,626 | |

| | Raw materials | | | 324,908 | | | | 485,372 | |

| | Packing and supply materials | | | 56,244 | | | | 96,626 | |

| | Office expenses | | | 9,649 | | | | 4,072 | |

| | Total | | $ | 429,005 | | | $ | 625,696 | |

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 8-INVENTORIES | | | | | | | | |

| | | | | | | | | | |

| | Inventories consist of following: | | | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | | 2011 | | | | 2010 | |

| | | | (unaudited) | | | | | |

| | Finished goods | | $ | 987,989 | | | $ | 948,300 | |

| | Work-in-progress | | | 2,176,344 | | | | 1,985,260 | |

| | Raw materials | | | 55,696 | | | | 102,934 | |

| | Supplies and packing materials | | | 365,972 | | | | 237,499 | |

| | | | $ | 3,586,001 | | | $ | 3,273,993 | |

Note 9-PROPERTY, PLANT AND EQUIPMENT | | | | | | | | |

| | The following is a summary of property, plant and equipment: | | | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | | 2011 | | | | 2010 | |

| | | | (unaudited) | | | | | |

| | Building and warehouses | | $ | 3,191,180 | | | $ | 3,171,057 | |

| | Machinery and equipment | | | 2,031,088 | | | | 2,015,433 | |

| | Office equipment and furniture | | | 183,448 | | | | 182,278 | |

| | Motor vehicles | | | 343,223 | | | | 341,059 | |

| | Leased assets | | | 2,314,875 | | | | 2,300,810 | |

| | Total | | | 8,063,814 | | | | 8,010,637 | |

| | Less: Accumulated depreciation | | | (3,996,104 | ) | | | (3,849,240 | ) |

| | | | | 4,067,710 | | | | 4,161,397 | |

| | Add: Construction in progress | | | 339,292 | | | | 262,665 | |

| | Total | | $ | 4,407,002 | | | $ | 4,424,062 | |

Depreciation expense charged to operations was $89,608 and $89,327 for the three months ended March 31, 2011 and 2010, respectively.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 10- INTANGIBLE ASSETS

The following is a summary of intangible assets, less amortization: | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2011 | | | 2010 | |

| | | (unaudited) | | | | |

| Land use right | | $ | 2,020,148 | | | $ | 2,007,407 | |

| Trade Mark of "Xidenghui" | | | 68,492 | | | | 68,060 | |

| Trade Mark of "Baishui Du Kang" | | | 25,114 | | | | 24,955 | |

| Total intangible assets | | | 2,113,754 | | | | 2,100,422 | |

| Less: Accumulated amortization | | | (110,358 | ) | | | (97,300 | ) |

| Total intangible assets, net | | $ | 2,003,396 | | | $ | 2,003,122 | |

Amortization expense charged to operations was $12,404 and $2,454 for the three months ended March 31, 2011 and 2010, respectively.

Note 11- DUE FROM RELATED PARTIES

| | Due from related parties consists of the following: | | | | | | | |

| | | | | March 31, | | | December 31, | |

| | | | | 2011 | | | 2010 | |

| | Name of Related Party | Description | | (unaudited) | | | | |

| | | Non-consolidated, | | | | | | | | |

| | Shaanxi Yellow-river Wetlands Park Co., Ltd. | 7.9% owned subsidiary | | $ | - | | | $ | 1,777,125 | |

| | Shaanxi Gurong Agriculture Development Co., Ltd. | Affiliate 9 | | | - | | | | 385,674 | |

| | Shaanxi Zhongke Spaceflight Agriculture | | | | | | | | | |

| | Development Stock Co., Ltd. | Affiliate 2 | | | - | | | | 15,102 | |

| | Shaanix Mining New Energy Co., Ltd. | Affiliate 10 | | | - | | | | 399,286 | |

| | Total | | | $ | - | | | $ | 2,577,187 | |

Affiliate 9--The sole director of the Company is a director of Shaanxi Gurong Agriculture Development Co., Ltd., and has significant influence on the operations therein.

Affiliate 2--This company is indirectly, majority owned, and controlled by the Company's sole director's siblings.

Affiliate 10--The Company's sole director's spouse is a director of Shaanxi Mining New Energy Co., Ltd., and has significant influence on the operation therein.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 12- ACCRUED EXPENSES

| Accrued expenses consist of the following: | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2011 | | | 2010 | |

| | | (unaudited) | | | | |

| Accrued payroll | | $ | 30,972 | | | $ | 26,448 | |

| Accrued employee benefits | | | 59,688 | | | | 59,312 | |

| Accrued pension and employee benefit | | | 87,178 | | | | 69,824 | |

| Accrued office expenses | | | 45,141 | | | | 4,928 | |

| Total | | $ | 222,979 | | | $ | 160,512 | |

Note 13- DUE TO RELATED PARTIES

| Due to related parties consists of the following: | | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | 2011 | | | 2010 | |

| Name of Related Party | Description | | (unaudited) | | | | |

| Shaanxi Dukang Group Co., Ltd. | Affiliate 1 | | $ | 1,900,111 | | | $ | 3,354,548 | |

| Shaanxi Baishui Dukang Marketing Management Co., Ltd. | Affiliate 3 | | | 13,390 | | | | 13,306 | |

| Shaanxi Baishui Dukang Commercial and Trade Co., Ltd. | Affiliate 4 | | | 75,141 | | | | 74,668 | |

| Shaanxi Baishui Dukang Spirits Industry Development Co., Ltd. | Affiliate 5 | | | 1,319,799 | | | | 865,303 | |

| Shaanxi Baishui Shiye Co., Ltd.(F/K/A Shaanxi Baishui | | | | | | | | | |

| Dukang Trade Co., Ltd.) | Affiliate 6 | | | 386,965 | | | | 399,649 | |

| Shaanxi Lantian Fuping Investment Co., Ltd. | Affiliate 7 | | | 304,409 | | | | 302,489 | |

| Shaanxi Changjiang Petrol Co., Ltd. | Affiliate 8 | | | 254,182 | | | | 252,579 | |

| Mr. Hongjun Zhang | Shareholder | | | 2,412,147 | | | | 2,095,957 | |

| Mr. Guoqi Diao | Prior director of Xidenghui | | | 13,330 | | | | 406,482 | |

| Ms. Ping Li | Secretary of the Board | | | 606,581 | | | | 602,755 | |

| Mr. Pingjun Nie | Shareholder | | | 4,554,761 | | | | 4,526,035 | |

| Ms. Hong Ge | Prior director of Xidenghui | | | 275,407 | | | | 273,670 | |

| Mr.Hailong Tian | Prior director of Xidenghui | | | 2,880,055 | | | | 2,861,891 | |

| Ms. Ming Chen | Shareholder | | | 354,013 | | | | 182,387 | |

| Mr. Shengli Wang | Prior director of Xidenghui | | | 811,672 | | | | 806,553 | |

| Total | | | $ | 16,161,963 | | | $ | 17,018,272 | |

The nature of the affiliation of each related party is as follows:

Affiliate 1--The CEO of the Company is a director of Shaanxi Dukang Group Co., Ltd. and has significant influence on the operations therein.

Affiliate 3--This company is wholly owned and controlled by the Company's sole director's siblings.

Affiliate 4--The CEO of the Company is the sole director of Shaanxi Baishui Dukang Commercial and Trade Co., Ltd. and has significant influence on the Affiliate 5--This company is wholly owned and controlled by the Company's sole director's siblings.

Affiliate 6--The CEO of the Company is the sole director of Shaanxi Baishui Shiye Co., Ltd. and has significant influence on the operations therein.

Affiliate 7--This company is majority owned and controlled by the Company's sole director's siblings.

Affiliate 8--The Company's sole director's spouse is a director of Shaanxi Changjiang Petrol Co., Ltd., and has significant influence on the operation therein.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 14- SALES OF LIQUOR TO RELATED PARTY

The Company generally sells liquor to liquor distributors. Some of these liquor distributors are our affiliates, which are directly or indirectly, beneficially and in the aggregate, majority-owned and controlled by directors and principal shareholders of the Company. The price will be different if we sell liquor to third parties. The amount sold to these affiliates follows:

| | | | For the Three Months Ended March 31, | |

| Name of Related Party | Description | | 2011 | | | 2010 | |

| | | | (unaudited) | | | (unaudited) | |

| Shaanxi Dukang Group Co., Ltd. | Affiliate 1 | | $ | 358,244 | | | $ | 218,969 | |

| Shaanxi Baishui Dukang Commercial and Trade Co., Ltd. | Affiliate 4 | | | - | | | | 56,167 | |

| Shaanxi Baishui Shiye Co., Ltd.(F/K/A Shaanxi Baishui | | | | | | | | | |

| Dukang Trade Co., Ltd.) | Affiliate 6 | | | 67,803 | | | | - | |

| | | | $ | 426,047 | | | $ | 275,136 | |

| | Bank loan consists of the following as of March 31, 2011: |

| | | | Loan | | | | Monthly | | Guaranteed |

| | Financial Institutions | | Amount | | Duration | | Interest Rate | | By |

| | Baishui Branch of Agriculture Bank of China | | $ | 761,023 | | 08/02/2010-08/01/2011 | | | 6.372 | % | Buildings |

| | Total | | $ | 761,023 | | | | | | | |

Interest expense charged to operations for this bank loan was $13,270 for the three months ended March 31, 2011. The weighted-average outstanding bank loan balance is $761,023; and the weighted-average monthly interest rate is 5.829%o.

Bank loan consists of the following as of December 31, 2010:

| | | | Loan | | | | Annual | | Guaranteed |

| | Financial Institutions | | Amount | | Duration | | Interest Rate | | By |

| | Baishui Branch of Agriculture Bank of China | | $ | 756,224 | | 08/02/2010-08/01/2011 | | | 6.372 | % | Buildings |

| | Total | | $ | 756,224 | | | | | | | |

Interest expense charged to operations for this bank loan was $20,124 for the year ended December 31, 2010. The weighted-average outstanding bank loan balance is $305,144; and the weighted-average monthly interest rate is 5.49%o.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 16- SEGMENT REPORTING

The Company operates in two reportable business segments that are determined based upon differences in products and services. Summarized information by business segment for the year ended December 31, 2010 and 2009 is as follows:

| | | | For the Three Months Ended | |

| | | | March 31, | |

| | | | 2011 | | | 2010 | |

| | | | (unaudited) | | | (unaudited) | |

| | REVENUE | | | | | | |

| | Sales of Liquor | | $ | 427,679 | | | $ | 290,404 | |

| | Franchise Fees | | | 283,817 | | | | 199,838 | |

| | | | | | | | | | |

| | COST OF SALES | | | | | | | | |

| | Sales of Liquor | | $ | 314,451 | | | $ | 277,449 | |

| | Franchise Fees | | | - | | | | - | |

| | | | | | | | | | |

| | GROSS PROFITS | | | | | | | | |

| | Sales of Liquor | | $ | 113,228 | | | $ | 12,955 | |

| | Franchise Fees | | | 283,817 | | | | 199,838 | |

| | | | | | | | | | |

| | | | March 31, | | | December 31, | |

| | | | | 2011 | | | | 2010 | |

| | | | (unaudited) | | | | | |

| | | | | | | | | | |

| | TOTAL ASSETS OF LIQUOR PRODUCTION AND DISTRIBUTION | | $ | 12,507,829 | | | $ | 12,314,784 | |

| | | | | | | | | | |

| | TOTAL ASSETS OF BRAND NAME FRANCHISE | | $ | 4,718,292 | | | $ | 3,576,180 | |

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 16- SEGMENT REPORTING (continued)

Major Customers

There were nine major customers who made sales approximately 5% or more of the Company’s total sales as summarized in the following:

| | | | | For the Three Months Ended March 31, | |

| | | | | 2011 | | | 2010 | |

| | | | | (unaudited) | | | (unaudited) | |

| | | | | | | | | | | | | | | |

| | Major | Type of | | | | | Percentage of | | | | | | Percentage of | |

| | Customer | Customer | | Revenue | | | Total Revenue | | | Revenue | | | Total Revenue | |

| | Shaanxi Dukang Group Co., Ltd. | Distributor | | $ | 358,244 | | | | 50.35 | % | | $ | 218,969 | | | | 44.67 | % |

| | Shaanxi Baishui Dukang Shiye Co., Ltd. | Distributor | | | 67,803 | | | | 9.53 | % | | | 56,167 | | | | 11.46 | % |

| | Mr. Jincai Bai' | Licensee | | | 43,203 | | | | 6.07 | % | | | - | | | | - | |

| | Ms. Xiaoyan Shi | Agent | | | 50,403 | | | | 7.08 | % | | | - | | | | - | |

| | Mr. Anxian Xie | Agent | | | 43,203 | | | | 6.07 | % | | | 48,381 | | | | 9.87 | % |

| | Ms. Xiaoli Du | Agent | | | 36,002 | | | | 5.06 | % | | | - | | | | - | |

| | Ms. Sue Dong | Agent | | | 36,002 | | | | 5.06 | % | | | 45,616 | | | | 9.30 | % |

| | Total | | | $ | 634,860 | | | | 89.23 | % | | $ | 369,133 | | | | 75.30 | % |

Major Suppliers

There were six major customers who made sales approximately 5% or more of the Company’s total sales as summarized in the following:

| | | | For the Three Months Ended March 31, | |

| | | | 2011 | | | 2010 | |

| | | | (unaudited) | | | (unaudited) | |

| | Major | | | | | Percentage of | | | | | | Percentage of | |

| | Suppliers | | Purchase | | | Total Purchase | | | Purchase | | | Total Purchase | |

| | Sichuan Yibingong Mould Factory Co., Ltd. | | | | | $ | | | | $ | 26,985 | | | | 30.37 | % |

| | Hunan Xinshiji Taochi Co., Ltd. | | | 61,871 | | | | 25.42 | % | | | - | | | | - | |

| | Hunan Fengling Liangyou China Co., Ltd. | | | 27,426 | | | | 11.27 | % | | | 43,003 | | | | 48.39 | % |

| | Wenxi Hongye Glass CO.,Ltd. | | | - | | | | - | | | | 11,253 | | | | 12.66 | % |

| | Shanxi Wenxiyingfa Glass Co., Ltd. | | | 68,097 | | | | 27.98 | % | | | 6,527 | | | | 7.34 | % |

| | Sichuan Guangan Defeng Glass Co., Ltd. | | | 13,879 | | | | 5.70 | % | | | - | | | | - | |

| | Yuncheng Aofeng Glass Co., Ltd. | | | 50,799 | | | | 21 | % | | | - | | | | - | |

| | Total | | $ | 222,072 | | | | 91.24 | % | | $ | 87,766 | | | | 98.78 | % |

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 17- STATEMENT OF CONSOLIDATED COMPRESENTATIVE INCOME

| | | For the Three Months Ended | |

| | | March 31, | |

| | | 2011 | | | 2010 | |

| | | (unaudited) | | | (unaudited) | |

| | | | | | | |

| Net income | | $ | (200,428 | ) | | $ | (269,150 | ) |

| Other comprehensive income, net of tax: | | | | | | | | |

| Effects of foreign currency conversion | | | (45,704 | ) | | | (1,102 | ) |

| Total other comprehensive, not of tax | | | (45,704 | ) | | | (1,102 | ) |

| Comprehensive income | | | (246,132 | ) | | | (270,252 | ) |

Comprehensive income attributable to the noncontrolling interest | | | 532,572 | | | | 8,920 | |

Comprehensive income attributable to China Du Kang Co., Ltd. | | $ | (278,704 | ) | | $ | (279,172 | ) |

Note 18- COMMITMENTS AND CONTINGENCIES

Contingent Liability from Prior Operation

Prior to the merger with Hong Kong Merit Enterprise Limited on February 11, 2008, the Company has not been active since discontinuing its financial service operations by December 31,2007. Management believes that there are no valid outstanding liabilities from prior operations. If a creditor were to come forward and claim a liability, the Company has committed to contest such claim to the fullest extent of the law. No amount has been accrued in the financial statements for this contingent liability.

The Company’s assets are located in PRC and revenues are derived from operations in PRC.

In terms of industry regulations and policies, the economy of PRC has been transitioning from a planned economy to market oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reforms, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in PRC are still owned by the Chinese government. For example, all lands are state owned and are leased to business entities or individuals through governmental granting of Land Use Rights. The Chinese government also exercises significant control over PRC’s economic growth through the allocation of resources and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures.

The Company faces a number of risks and challenges not typically associated with companies in North America and Western Europe, since its assets exist solely in the PRC, and its revenues are derived from its operations therein. The PRC is a developing country with an early stage market economic system, overshadowed by the state. Its political and economic systems are very different from the more developed countries and are in a state of change. The PRC also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationships with other countries, including the United States. Such shocks, instabilities and crises may in turn significantly and negatively affect the Company's performance.

Lease

On March 4, 2002, Baishui Dukang signed a lease agreement with Shaanxi Sanjiu Dukang Liquor Production Co., Ltd ("Sanjiu"), pursuant to which Baishui Dukang agreed to lease the liquor production facility of Sanjiu, including all the fixed assets and the piece of land that the fixed assets attached, for a period of 20 years, which was latterly extended to 30 year. On February 3, 2005, Sanjiu was acquired by Shannxi Baishui Dukang Liquor Development Co., Ltd, an affiliate of the Company. On April 30, 2005, Baishui Dukang signed a complementary lease agreement with Shannxi Baishui Dukang Liquor Development Co., Ltd, pursuant to which Baishui Dukang agreed to continue to lease the liquor production facility for the rest of the original 30-year period. Baishui Dukang also agreed to pay $362,450 (RMB 3,000,000) to the local government to continue the lease and to absorb the pension and unemployment insurance expenses of Sanjiu's original employees. All the pension and unemployment insurance payments were to be made directly to the local China Social Security Administration to satisfy all of the pension and unemployment insurance expenses that were required in connection with the original Sanjiu employees.

CHINA DU KANG CO., LTD. AND SUBSIDIARIES

F/K/A AMSTAR FINANCIAL HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 18- COMMITMENTS AND CONTINGENCIES (continued)