Evermore Global Value Fund

Annual Report • December 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Evermore Global Value Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website: www.EVERMOREGLOBAL.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Evermore Global Value Fund electronically at any time by contacting your financial intermediary (such as a broker dealer or bank) or, if your account is held directly with Evermore Global Value Fund, by calling the Fund at 866-EVERMORE (866-383-7667).

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, please contact your financial intermediary to continue receiving paper copies of your shareholder reports. If you invest directly with Evermore Global Value Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling the Evermore Global Value Fund at 866-EVERMORE (866-383-7667). Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary. You must provide separate instructions to each of your financial intermediaries.

Table of Contents

| Shareholder Letter & Management Discussion of Fund Performance (Unaudited) | | | 1 |

| | | | |

| Performance Information (Unaudited) | | | 11 |

| | | | |

| Sector Allocation (Unaudited) | | | 12 |

| | | | |

| Expense Example (Unaudited) | | | 13 |

| | | | |

| Schedule of Investments | | | 14 |

| | | | |

| Statement of Assets and Liabilities | | | 18 |

| | | | |

| Statement of Operations | | | 19 |

| | | | |

| Statements of Changes in Net Assets | | | 20 |

| | | | |

| Financial Highlights | | | 21 |

| | | | |

| Notes to Financial Statements | | | 23 |

| | | | |

| Report of Independent Registered Public Accounting Firm | | | 34 |

| | | | |

| Approval of Investment Advisory Agreement (Unaudited) | | | 35 |

| | | | |

| Trustees and Executive Officers (Unaudited) | | | 36 |

| | | | |

| Additional Information (Unaudited) | | | 38 |

| | | | |

| Privacy Notice (Unaudited) | | | 39 |

Evermore Global Value Fund

Elements of Our Investment Approach

At Evermore Global Advisors, we seek to leverage our deep operating and investing experience, and extensive global relationships to identify and invest in special situations – companies around the world that have compelling valuations and are undergoing strategic changes which we believe will unlock value.

Seeking to Generate Value . . .

| • | Catalyst-Driven Investing. We do more than simply pick undervalued stocks and hope for their prices to rise. We invest in companies where we have determined a series of catalysts exist to unlock value. The catalysts we look for are not broadly recognized, but they are likely to have a significant impact on a stock’s performance over time. Catalysts may include management changes, shareholder activism, and operational and financial restructurings (e.g., cost-cutting, asset sales, breakups, spinoffs, mergers, acquisitions, liquidations, share buybacks, recapitalizations, etc.). |

Supporting Our Active Value Orientation . . .

| • | Original Fact-Based Research. We conduct our own, original fact-based research to validate management’s stated objectives and identify catalysts to unlock value. We also perform detailed business segment analysis on each company we research. |

| • | Business Operating Experience. Our senior team has hands-on business operating experience; including starting and managing businesses, sitting on company boards, and assisting management of multi-national corporations restructure their businesses. We rely on this experience to better evaluate investment opportunities. |

| • | A Global Network of Strategic Relationships. Over the past 25+ years, members of our investment team have developed extensive global networks of strategic relationships, including individuals and families that control businesses, corporate board members, corporate management, regional brokerage firms, press contacts, etc. We leverage these relationships to help generate ideas and better evaluate investment opportunities. |

| • | We Invest Like Owners. When we are interested in an investment opportunity, we get to know the management team of the company, study the company’s business model, evaluate the competitive and regulatory environment, and test and crosscheck everything the management team tells us against our own experience. We ask ourselves if we would want to own the entire company. If the answer is No, we will not invest in the company. |

| • | Not Activists, Often Collaborators. We almost always take the approach of collaborative engagement with management, rather than taking an aggressive activist stance. On limited occasions, when we are not satisfied with the efforts of the incumbent company leadership, we may work with other shareholders to help facilitate change. |

Executing Our Approach . . .

| • | Concentration Maintains Focus. Focused and disciplined investing means knowing our businesses intimately and staying patient as the process of value creation unfolds. We maintain focus by typically investing in 30 to 40 names with a high percentage of investments in our top 10 holdings. |

| • | Investing Across the Capital Structure. We evaluate all components of a company’s capital structure to determine where the best risk-adjusted return potential exists. At times, we may invest in multiple parts of a company’s capital structure (e.g., investing in both a company’s debt and equity). |

| • | Targeting Complex Investment Opportunities. We often research family-controlled holding companies or conglomerates that are often under-researched and/or misunderstood, which can create gaps between price and value. |

| • | Merger Arbitrage and Distressed Companies. We may take advantage of announced merger and acquisition deals where an attractive spread (difference) exists between the market price and the announced deal price for the target company. We also look for opportunities in distressed companies that have filed or may file for bankruptcy, distressed companies involved in reorganizations or financial restructurings, and distressed companies that emerged from bankruptcy or reorganization. |

| • | Tactically Managing Cash Levels. We are not afraid to hold significant cash positions when it makes sense for the Fund. |

Evermore Global Value Fund

A Letter from the Portfolio Manager

David Marcus

Portfolio Manager

"The single greatest edge an investor can have is a long-term orientation." – Seth Klarman

"Twenty years from now you will be more disappointed by the things you didn’t do than by the ones you did do. So, throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover." – Mark Twain

Dear Shareholder:

What a difference a year makes! After coming off a very tough 2018 fourth quarter, and despite continued concerns about tariffs, trade wars, a China slowdown, a global economic slowdown, etc., the Evermore Global Value Fund (the "Fund") rebounded nicely in 2019 with Institutional Class shares returning 25.41% to Fund shareholders.

Many of the stocks that caused the most pain in 2018 were ones that created the most value in 2019. One sector in particular– the marine transport sector – contributed the most to the Fund’s performance in 2019, as Scorpio Tankers, Frontline Ltd., Hapag-Lloyd AG, Star Bulk Carriers, Genco Shipping & Trading, and Scorpio Bulkers all generated significant gains. Atlantic Sapphire, the land-based Salmon farming group, which was a top performer for the Fund in 2018 was once again a top contributor to performance in 2019 as the company continued to achieve its milestones and moves towards initial production of Atlantic Salmon from its Homestead, Florida megaplex sometime around August 2020.

The Fund’s performance in 2019 directly benefitted from taking advantage of the extreme weakness in stock prices in the fourth quarter of 2018 and adding opportunistically to a substantial number of the Fund’s portfolio names. I have always been a strong believer in buying stress, panic, fear, and especially when investors think "this time is different". This is true when there is stress in the overall stock market or when there is stress in a specific company. In the long run, we believe stressful periods of time may create compelling investment opportunities.

As mentioned above, one of the Fund’s big winners in 2019 was Hapag-Lloyd AG, the global container shipping and logistics company. Our investment in Hapag-Lloyd provides a great example of what we like to do at Evermore – take advantage of a stressful, misunderstood special situation. Hapag-Lloyd was one of our first major investments in the maritime sector. In 2015, investment bankers in Europe reached out to us and told us that a 25% shareholder (travel company TUI AG) in Hapag-Lloyd, which at the time was a privately-controlled business, was electing its option to force the initial public offering ("IPO") of the company as a means to exit their position. New management at TUI AG quickly saw there were zero synergies between a travel and tourism service operator and a containership and logistics business. Moving people around, they concluded, was not the same as moving goods around. At the time, the whole maritime sector, including containerships, dry bulk carriers, and tankers, was going through a very stressed downturn.

The bankers were initially contemplating an IPO price in the low €50s1 per share, which we quickly concluded was of no interest to us. We had the opportunity to meet the CEO, Rolf Habben Jansen, who we thought was solid and had an excellent grasp of the company, as well as the entire containership industry and its players. Over the next few months, we continued to meet with management whenever they were doing a roadshow or conference to learn as much as we could about how the industry worked. Even with these regular meetings with institutional investors, the company was unable to get the IPO done at the initial target price range. We told them that if they ever did the deal at around €20 per share we would be interested. Slowly, but surely, the offering was pulled and then re-offered in the market. Eventually months later, the IPO was announced at a revised offering price of €20 per share. Around the same time of the offering, the company was consolidating a previously announced merger with the largest containership group in Chile called CSAV. We initiated our position in Hapag-Lloyd at this offering price. In fact, AP Moller-Maersk, the largest container operator and logistics company, issued a profit warning on the day when Hapag-Lloyd’s IPO launched in the market. The Hapag-Lloyd offering was what we like to call a "cold"IPO.

With a very aggressive operational and financial restructuring ahead of them, we would challenge the management whenever we saw them at conferences or analyst events. Impressively, the company kept hitting their announced milestones. They cut hundreds of millions of euros in operating costs, refinanced their debt at lower interest rates, and then announced a merger with one of the largest players in Saudi Arabia, called UASC. While the stock sold off and was eventually down about 30% from the €20 IPO price, we continued to add to the position. We had concluded that Rolf Habben Jansen and the CFO, Nicol‡s Burr, were excellent managers and very under-rated by the market. Over the next three years they transformed the company. We stayed with the investment, added to it as it traded lower, as we believed there was a real accretion of value at the company. Our view was that the underlying business was becoming more valuable, yet the stock price either lingered or went lower. As investors and the markets finally realized what was happening at the company, the stock went through a major revaluation.

The company improved cash flows substantially and worked aggressively to drive down the total debt and interest cost. In spite of no material fundamental improvement in the industry, the stock moved from one where we had a significant loss out of the gate, to one where we had a substantial long-term gain for our investors at our exit during the third quarter of 2019.

Opportunities like Hapag-Lloyd are what the Evermore investment team and I continually look for on our many trips to Europe, attendance at conferences, meetings with management teams, or by voraciously poring through news articles, research reports and company financials.

___________________

1 | At a U.S. Dollar to Euro exchange rate of 0.8915 on December 31, 2019, low €50s would translate to mid-high $50s and a price of €20 would translate to $22.43. |

Year-End Portfolio Highlights

The Fund ended the year with $595 million in net assets, 42 issuer positions and the following region, market capitalization and country exposures (as a % of Fund net assets):

| Region Exposure | | Market Cap Exposure |

| | | |

| | | |

| |  |

| | | |

Country Exposure

Throughout the course of 2019, the Fund initiated 8 new positions and exited 13 portfolio positions. Below is a discussion of several of the Fund’s investments we initiated in 2019.

Modern Times Group (MTGB SS)

The Fund initiated a position Modern Times Group ("MTG") in the first quarter of 2019. Shortly after our purchase of MTG, the company initiated a spin-off of its Esports and gaming assets (and kept the parent company name, MTG), while the legacy broadcasting and Pay TV businesses became Nordic Entertainment Group ("NENT Group"). They started trading as independent standalone companies in April 2019. Interestingly, NENT Group traded up about 50% post the spinoff, and MTG traded down precipitously, only to then recover to only be slightly down for the year.

The CEO of NENT Group, Anders Jensen has done an excellent job in building and growing the group. He has built an excellent management team and has taken advantage of the rapidly changing Nordic media landscape. In late October 2019, NENT Group announced that it would combine its Viasat Pay TV unit with Telenor’s Canal Digital group with each company owning 50% of the new company. NENT Group will manage the merged group. It is expected that the deal will close sometime in 2020. In our opinion, this deal is a game changer as it brings

together two rival businesses and allows for dramatic synergies. This deal was over 15 years in the making as previous management was just not able to make it happen, which is a testament to the leadership of CEO Anders Jensen. With the media sector changing so rapidly, we believe combinations, acquisitions and spin-offs of all kinds are now on the table for NENT Group.

In the case of MTG, the company announced in October 2019 a strategic review of its gaming segment to find the best way to crystalize value for shareholders. We continue to believe that MTG, with its growing Esports and gaming businesses, as well as its net cash of over 30% of its market cap, continues to be misunderstood. We would like to see the company list its shares in the U.S. where a significant percentage of its current business and potential growth lies.

The Walt Disney Company (DIS US)

We initiated our position in The Walt Disney Company ("Disney") in the second quarter of 2019. Disney is an interesting situation (and a bit of an outlier for us as we do not routinely find opportunities among U.S. mega caps), as there were a number of catalysts underway at the company. Following the company’s acquisition of assets from 21st Century Fox in 2018, Disney is today embarking on a major corporate transformation as they go all-in on building out their direct-to-consumer services, including their flagship streaming business, Disney+. After being initially slow to embrace video streaming, the company has changed course and is today being extremely aggressive (Disney’s takeover of Hulu is a good example). We believe the company now understands they can control their own destiny, and in the entertainment industry, no one else has the scale of anything close to that of Disney.

The goal of Disney+ is to be the new core for Disney, enabling the company (for the first time ever) to know exactly who interacts with its content, how frequently, in what categories, and through which characters. In our opinion, the streaming business should increase consumption of Disney’s content, drive additional sales of its other products and experiences, disintermediate its traditional channel partners (like travel agencies, movie ticket sellers, and other retailers) and improve margins across their businesses.

Disney has always been an intellectual property ecosystem play. It’s Theme Parks division, for example, does nearly 100% more revenue than its Studio group, but the latter drives the former. Everything flows together, starting from theatrical releases. Disney’s catalog and character libraries are enormous. In addition to all the Disney and Pixar characters, they own the Marvel Comics universe, they bought Lucasfilm and Star Wars, and so their stable of characters has expanded into the thousands. We envision many opportunities ahead even if Disney uses but a fraction of this character base.

Beyond Disney+, they also have a whole host of other potential new businesses that we are not counting in our valuation, such as co-branded credit cards launched in theme parks, etc. We also expect the company to spinoff assets as they continue to digest and integrate the pieces acquired from 21st Century Fox.

Excluding the approximately $3 billion in fiscal year 2020 costs that Disney will incur in building out Disney+, we acquired our first shares when the stock was trading at less than 15x next year’s expected earnings per share, hardly a rich valuation for perhaps the most dominant name in entertainment. Given the addition of a more subscription-based business model, we believe Disney could follow the same path as others who have gone down a similar road, such as Microsoft and Adobe.

Gamesys Group PLC (GYS LN)

The Fund initiated its position in Gamesys Group PLC in the third quarter of 2019. Gamesys is a $1.0 billion market capitalization UK-based operator of real-money online bingo and casino games worldwide. The Fund initiated its position in July 2019 via an accelerated book build process, in which a bank placed a large block of stock overnight at a sizable discount to that day’s closing price. Prior to its late-September 2019 name change, Gamesys was formerly known as JPJ Group PLC ("JPJ"), and had actually been a subsidiary of privately held Gamesys Limited ("GL") until GL sold the JPJ business in 2015. However, in a deal announced in June 2019 (which closed in September 2019), JPJ acquired its former parent, reuniting the customer-facing components of the business historically performed by JPJ (customer acquisition, retention, and service) with the technology platform (game development and backend information technology) that had been retained by GL. The combination will allow for better data sharing, which is expected to lead to stronger revenue growth as well as margin expansion over time. Through the deal, Gamesys kept the CEO of GL, Lee Fenton, to lead the combined company. Given his rich history in the online gaming space, we believe this represents an upgrade in leadership.

Despite the game-changing acquisition, pessimism rules the day as Gamesys operates in dynamic regulatory and tax environments that have posed some significant challenges in key markets like the U.K. While adding cost and operational complexity to Gamesys and other larger established players, we believe that these industry-wide burdens are already proving to be insurmountable for subscale players in the sector and is leading to a "thinning out"of the competitive landscape. This should ultimately serve to benefit scaled operations like Gamesys, which enjoys high customer loyalty and, in what is a highly scrutinized industry, abides by the highest commitment to responsible gambling standards.

Shares were purchased in the Fund at just 5 times our estimate of next year’s Free Cash Flow ("FCF"), levels we believe are compelling, given this is a growth story. As far as catalysts go, as mentioned, the company just closed on the transformational GL acquisition. Given that the purchase price was partially paid in newly issued shares, the company’s now larger market capitalization is expected to make shares eligible for inclusion in the FTSE 250 index, creating natural demand for shares. Further, the company is expected to rapidly de-lever through a mix of FCF generation and earnings before interest, taxes, depreciation and amortization ("EBITDA") growth. Once financial leverage is brought

down, Gamesys will consider stock buybacks if shares remain materially undervalued. While we never base an investment thesis on the prospect of industry consolidation, we do note that merger and acquisition activity in the sector has been heating up. For instance, on October 2, 2019, Flutter Entertainment announced the acquisition of The Stars Group in a deal worth more than $6 billion.

IAC/Interactive Corp. (IAC US)

IAC/InterActive Corp. ("IAC") is the majority owner of both Match Group ("MTCH") (78% ownership) and ANGI Homeservices ("ANGI") (84% ownership), and the owner-operator of several other internet-based businesses. The company was formed in 1995, when Barry Diller took a controlling stake in Silver King Communications, an owner of 12 UHF television stations. Since then, the entity has followed a tried-and-true playbook for its portfolio companies: buy, build, scale, and ultimately spinoff. Along with ANGI and MTCH, several other notable companies have emerged from IAC including Expedia (EXPE US), TripAdvisor (TRIP US), Home Shopping Network (today Qurate Retail – ticker: QRTEA US), and TicketMaster (today Live Nation – ticker: LYV US).

In the fourth quarter of 2019, we initiated a long position in the IAC "stub"– that is, a long position in IAC and short positions in both MTCH and ANGI (commensurate to IAC’s ownership in those two stocks). While we are not at all looking to express a negative investment thesis on either MTCH or ANGI, we believe the value of the "stub"assets is clearly not recognized by the market and have structured the trade accordingly. Below are highlights of several businesses represented in the "stub":

| | – | Vimeo – With over 1.2 million paying subscribers, Vimeo is the leading professional video platform for editors and small/medium sized businesses to upload, share, and manage their content across the internet. Through both internal initiatives and M&A this business has undergone a major transformation over the last several years, and growth has accelerated. We expect more than $200 million in sales in fiscal year ("FY") 2020. |

| | – | Dotdash – With more than 90 million visitors per month, Dotdash is comprised of a host of content-based websites such as Verywell, Lifewire, Investopedia, and Brides. This business has seen growth accelerate meaningfully in recent years under new leadership and generated approximately $40 million in EBITDA in fiscal year 2019. |

| | – | Mosaic Group – The key growth driver of IAC’s Applications segment, Mosaic, operates more than 40 mobile apps, including Apalon products, Daily Burn fitness collective, leading translation app iTranslate and top spam-blocking app RoboKiller. Mosaic has almost 4 million paying subscribers and generated approximately $200 million in sales in fiscal year 2019. |

| | – | Turo – IAC purchased a minority stake in this business for $250 million in 2019. Turo is a car sharing marketplace where travelers can rent cars from a community of local car owners. Along with IAC (who is the company’s largest shareholder), investors include Daimler and BMW iVentures. |

| | – | Care.com (CRCM US) – IAC announced its intentions to purchase CRCM in December 2019 for an enterprise value of about $500 million. CRCM is the world’s largest online marketplace for finding and managing family care. Consensus estimates are calling for CRCM sales to grow at a double-digit compound annual growth rate ("CAGR") through 2022. |

We believe this investment is timely given that IAC will fully separate its remaining stake in MTCH with a spinoff slated for the second quarter of 2020. After adjusting for the moving parts of the transaction (namely a debt transfer from IAC to MTCH and a probable $1.5 billion secondary sale of MTCH shares by IAC prior to separation), we estimate MTCH represents about 70% of IAC’s market cap. With that, we expect that this spinoff will help highlight the value that remains at IAC.

As for ANGI, management has chosen to keep this business inside of the IAC complex for the time being. Nonetheless, IAC management has indicated time and again their aim is not to build empires, and in the reasonable future we expect ANGI to fully separate from IAC.

At year-end, we estimate that the "stub"assets are trading at a negative $6 per IAC share after accounting for net cash. Conservatively, we derive a $40 per share value for these assets. With a pending catalyst in the upcoming separation of MTCH, we believe IAC shares will begin to reflect this hidden value in the coming quarters. Moreover, at this time, we expect to remain IAC shareholders for years to come, as management has a demonstrated history of long and successful capital allocation, business development, and corporate restructuring. We believe post MTCH separation, IAC will be left with an enormous net cash position; when all is said and done, we estimate IAC will have about $4 billion of cash and virtually no debt at June 30, 2020. While we fully expect management to continue executing M&A deals, we would also expect substantial share buybacks when IAC’s share price is materially undervalued.

Although this investment was initially established as an arbitrage trade, we believe it will evolve into a long-term opportunity that will compound attractively given Barry Diller’s history of creating significant value for shareholders.

The Case for Focusing on Europe

While we are a global value investor, the fact is that we have had a very high focus on Europe since the inception of the firm. And in spite of Europe being a tomorrow story for so many years (some would say decades), our special situations focus has helped us find and invest in an extremely broad range of investment cases in the region since the inception of the Fund.

The punchline is that while we have been talking about "Why Now?"for Europe for years, it was always based on various break-ups, spin-offs, various restructurings at an ever-accelerating pace across the region. We believe the stars are lining up for European special situations like never before based on the confluence of the following factors:

| | • | Valuation gap – European equities are trading at a huge discount to their global counterparts, but especially to U.S. equities (see chart below) |

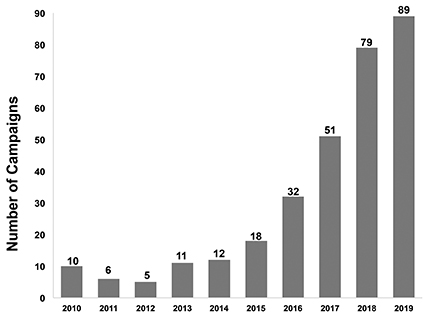

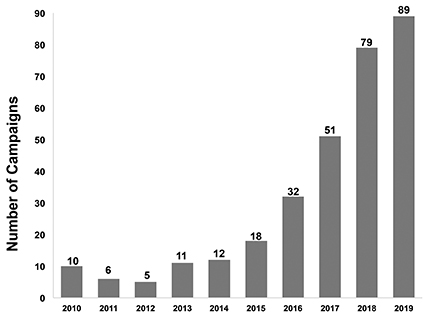

| | • | Shareholder activism – was previously largely hit or miss in terms of effectiveness, but now is accelerating and actually seeing results as activist investors have finally realized that Europe is different from the U.S.; activists are working their way onto boards and nomination committees to help effect change from the board level; it is still early days, but the steadily increasing number of campaigns over the last few years and the early signs of results are encouraging (see chart below) |

| | • | Private equity – Record levels of capital raised by private equity specifically for investments in Europe (see chart below) |

| | • | Low/negative interest rates – companies have been continuously refinancing balance sheets at lower and lower rates; the reality is that companies going through strategic change generally are not debt financed at the lowest rates; however, as their financials improve, they keep coming back to restructure their debt, which transforms their cash generation |

| | • | Strategic buyers are gobbling up competitors or buying companies to bolster existing product lines or service offerings – in what has been a low/no growth environment, companies are buying growth |

|

|

|

| |

| Source: Bloomberg |

| Total Number of Activist Campaigns in Europe | | Private Equity Activity in Europe |

| | | |

| | | |

| |  |

| | | |

| | | |

| Source: Bloomberg | | Source: Pitchbook – 2019 Annual PE Breakdown |

Bottom Line

We believe the Fund is well positioned heading into 2020. At year-end, 67.4% of the Fund’s portfolio was invested in European special situations and we think that several tailwinds exist to help drive performance next year. First, and most important, our portfolio positions continue to trade at significant discounts to our estimates of their intrinsic values and have catalysts at work that we believe can create meaningful value for shareholders in the coming quarters and years. Second, as discussed above, with European stocks trading at historically low valuations relative to the S&P 500, we believe that an improving economic environment and a continuing trend of positive central bank moves will make European companies more attractive to investors and therefore begin to help narrow the aforementioned valuation gap, which should accrue to the benefit of our European positions. Finally, a significant portion of the Fund’s portfolio remains invested in European shipping stocks. As the new International Maritime Organization ("IMO") 2020 sulfur emission regulations for shipping transportation companies went into effect on January 1, 2020, we believe that our shipping stocks are poised to perform extremely well in this new regulatory environment, especially when accompanied by rising commodity prices.

Year-end 2019 marked the 10-year anniversary since we started the Fund and almost 11 years since the idea for Evermore Global Advisors was hatched by Eric LeGoff and me over a lunch in Summit, New Jersey during the depths of the financial crisis. We have come a long way, yet we are a young firm and believe that we are barely in the early innings of the opportunity for us to continue to build and grow the firm on the simple foundation of creating value for our investors.

Thank you for your continued support and confidence.

Wishing you a healthy, happy and prosperous New Year!

David E. Marcus

Portfolio Manager

Management’s Discussion of Fund Performance

After a very tough fourth quarter of 2018, and despite continued investor concerns regarding trade wars, tariffs and a China/global economic slowdown, the Fund posted strong performance in 2019, as some of the stocks that were the largest detractors to Fund performance in 2018 became the biggest contributors to Fund performance in 2019. This was certainly the case with many of our maritime sector positions. For the year ended December 31, 2019, Institutional Class shares of the Evermore Global Value Fund (the "Fund") were up 25.41%, the MSCI All Country World Index ex USA ("MSCI ACWI ex USA") was up 21.51%, the MSCI All Country World Index ("MSCI ACWI") was up 26.60% and the HFRX Event Driven Index ("HFRX ED") was up 9.96%.

Four of the top five contributors to Fund performance in 2019 were European companies (two of which were Norwegian); one was an Asian position. All five of the top five detractors to Fund performance were European companies (four of which were Norwegian). The Fund’s foreign currency forward contract positions contributed to Fund performance in 2019. The largest contributors (aside from forward contract positions) and detractors to Fund performance for the year were:

Top Contributors to Fund Performance | Top Detractors From Fund Performance |

| Scorpio Tankers Inc. (Monaco) | Codere SA (Spain) |

| Atlantic Sapphire AS (Norway) | Ice Group ASA (Norway) |

| Frontline Ltd. (Norway) | Northern Drilling Ltd. (Norway) |

| MagnaChip Semiconductor Corp. (South Korea) | Magseis Fairfield ASA (Norway) |

| Constellium SE (France) | Borr Drilling Ltd. (Norway) |

Please find a discussion below about the two largest contributors and two largest detractors to Fund performance in 2019.

Scorpio Tankers Inc. (STNG US)

Scorpio Tankers Inc. was the largest contributor to the Fund’s investment performance in 2019. With a market cap of $2.3 billion, Scorpio Tankers is one of the largest product tanker operators in the world and has one of the youngest fleets entirely comprised of product tanker assets (over 100 vessels).

Throughout the year, incremental oil demand continued to be strong in the U.S., which was a net exporter of seaborne crude. There was also a confluence of events (i.e. drone attacks on the Saudi oil installments, sanctions on China’s state-owned shipping group COSCO and Iran) that occurred in the late third quarter/early fourth quarter of 2019, which resulted in crude tanker (VLCC) spot rates to skyrocket from $30,000 per day to $300,000 per day. As a result, the product tanker market has started to see the benefit of spillover effects from the crude tanker market.

The product tanker market also improved significantly during the third and fourth quarters of 2019 as the prolonged refinery maintenance finally came to an end. In late September 2019, Scorpio Tankers increased its tanker market exposure through the acquisition of Trafigura’s 19 product tankers. The company also maintained its quarterly $0.10 dividend per share, or 1% annualized yield, and has approximately $122 million remaining in the share buyback program.

Lastly, impacts of the International Maritime Organization ("IMO") 2020 regulatory changes are now starting to be felt by the broader market including 1) widening spread between low and high sulphur fuels; 2) shortage of compliant fuels; 3) longer delays retrofitting scrubbers; and 4) historically low order book. In our view, we believe Scorpio Tankers is well positioned to be a beneficiary of one of the best long-term tanker setups that we have observed in the last 20 years.

Atlantic Sapphire (ASAME NO)

Atlantic Sapphire ("Sapphire") was the second largest contributor to Fund performance in 2019, with its shares appreciating approximately 87%. Shares have performed well as the company continues to make significant progress at its Homestead, Florida "Bluehouse"facility. Once fully online (the first harvest is slated for August 2020) the company will be the only scale player in the fledgling land-based salmon farming industry.

It appears the world is fast approaching its natural limits of Atlantic salmon farming volumes under traditional net pen systems. Nevertheless, demand growth continues unabated, with markets such as the United States and China leading the demand creation. A tight supply situation, along with increasing costs to fight sea lice and disease at traditional farms, have pushed salmon prices higher. As a result, the rationale for land-based is extremely robust. Once Homestead comes online, we believe it will be able to sell its fish at a heathy premium to peers. Not only will its product be free of antibiotics and microplastics but given Sapphire’s proximity to its US-based customers, its fish will also be 5-7 days fresher, on average, than competing products in the marketplace. In addition to a higher selling price, we expect the company should have real cost advantages once ramped. For one, it will get to capture the inherent transportation costs embedded in landed salmon prices from Norway and Chile. Furthermore, Sapphire should not see the same direct and indirect costs competitors must expend to fight unfavorable biological developments (sea lice, disease, algae blooms, etc.).

The year was quite eventful for Sapphire. Notable developments included: (1) continued strong biological performance across the fish placed into its Homestead facility; (2) uninterrupted progress on the next stages of facility construction; (3) an equity raise of approximately $90 million to accelerate further stages of capacity growth at Homestead; (4) the establishment of a joint venture to help capture value from salmon byproducts; (5) the signing of a long term feed supply contract; (6) the demonstration of stable biological key performance indicators and more consistent commercial harvest levels at Sapphire’s Danish test facility; and (7) the appointment of Runar Vatne, a well-regarded Norwegian businessman, to Sapphire’s board of directors. Ultimately, despite shares having appreciated considerably since the Fund’s first purchases, we continue to believe they do not reflect the significant levels of free cash flow the company should be able to generate in coming years.

Codere SA (CDR SM)

Codere SA was the largest detractor to the Fund’s investment performance in 2019. The Fund owns the restricted shares of the company, which are subject to a shareholders’ agreement and, as a result, infrequently trade amongst other shareholders that are also subject to said agreement.

Codere is a $326 million market cap gaming company headquartered in Spain with operations in Europe and Latin America. Founded in 1980, the company primarily operates gaming machines, bingo halls, casinos, racetracks and sports betting locations in Spain, Italy and Latin America.

In October 2019, the company announced that it discovered accounting inconsistencies relating to its subsidiaries in Panama, Mexico and Colombia. An independent specialized consultant, Alvarez & Marsal, was retained to further assess the situation. In November 2019, the forensic investigation concluded the impact was isolated to the first half of 2019 resulting in a total negative impact of €16.5 ($18.5) million. No other geographies or periods were affected. The employees that were involved with the accounting inconsistencies are no longer with the company. The internal controls were enhanced, and additional layers of protection were immediately implemented. As a result of this issue, the company’s year-end EBITDA guidance was revised downward to €250 – €255 ($280.4 – $286.0) million for 2019.

Despite the underperformance in Codere listed shares and Codere restricted shares, there were some notable positive developments throughout 2019. The company started to report its nascent Online segment on a standalone basis in the first quarter of 2019, as the full commercial launch for Mexico started in the first quarter of 2019 and for Colombia started in the second quarter of 2019. In addition, the Company continued to successfully implement its business plan, which included the acquisition of slot route operations in Spain and the recent renewal of its partnership with football club Real Madrid through 2022 with an extension option for an additional two years.

Ice Group ASA (ICE NO)

Ice Group ASA was the Fund’s second largest detractor from performance in 2019, with its shares declining 60% during the period. Ice Group is the third largest telecom operator in Norway, operating from a low-cost "challenger"position. Despite the weak stock market performance, operationally, the company has performed reasonably well against its business plan, having recently reached more than a 10% market share in Norway. With high customer satisfaction rates, low-prices, and an extremely supportive regulator that wants to foster competition, we believe in management’s ability to drive the company to its stated 20% market share target over time.

Unfortunately, though certainly as expected, the company is not yet in a self-financing position and has debt on its balance sheet. We believe the depressed stock price has more to do with shares being less liquid in combination with the expectation of future capital raises, rather than the company’s intrinsic value. While we are frustrated with the share price development, we remain steadfast in our belief in the long-term value of a number 3 player within the Norwegian wireless landscape.

As of December 31, 2019, the Fund’s ten largest issuer positions were as follows:

| Security | Country | Sector | Weight | |

| Atlantic Sapphire ASA | Norway | Consumer Staples | 6.37% | |

| Scorpio Tankers Inc. | Monaco | Industrials | 5.72% | |

| MagnaChip Semiconductor Corp. | South Korea | Information Technology | 4.11% | |

| Nordic Entertainment Group | Sweden | Communication Services | 4.04% | |

| Modern Times Group – B Shares | Sweden | Communication Services | 4.01% | |

| Frontline Ltd. | Norway | Industrials | 3.97% | |

| Fagron | Belgium | Health Care | 3.92% | |

| Constellium SE – Class A | France | Materials | 3.87% | |

| Vivendi SA | France | Communication Services | 3.39% | |

| S&T AG | Austria | Information Technology | 3.31% | |

At year-end 2019, the Fund’s cash position stood at approximately 0.3%.

Opinions expressed are those of Evermore Global Advisors and are subject to change, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Earnings growth is not representative of the Fund’s future performance.

Cash Flow – the total amount of money being transferred into an out of a business, especially as affecting liquidity.

Return on Equity – A measure of the profitability of a business in relation to the equity.

While the Fund is no load, management fees and other expenses still apply. Please refer to the prospectus for further details.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investing in smaller companies involves additional risks such as limited liquidity and greater volatility. The Fund may make short sales of securities, which involve the risk that losses may exceed the original amount invested in the securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated, non-rated and distressed securities presents a greater risk of loss to principal and interest than higher-rated securities. Due to the focused portfolio, the fund may have more volatility and more risk than a fund that invests in a greater number of securities. Additional special risks relevant to the fund involve derivatives and hedging. Please refer to the prospectus for further details. This report is not authorized for distribution to prospective investors unless accompanied or proceeded by a current Evermore Global Value Fund summary prospectus or prospectus which contains more complete information about the Fund’s investment objectives, risks, fees and expenses.

Please refer to the Schedules of Investments for complete holdings information. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The MSCI All-Country World ex-US Index (MSCI AWCI ex USA) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets, excluding the US. The Index consists of 45 developed and emerging market countries. The Index is net of foreign withholding taxes on dividends.

The MSCI All-Country World Index (MSCI AWCI) is an unmanaged index comprised of 48 country indices, including 23 developed and 25 emerging market country indices, and is calculated with dividends reinvested after deduction of holding tax. The index is a trademark of Morgan Stanley Capital International and is not available for direct investment.

Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. The HFR Event-Driven (Total) Index is being used under license from Hedge Fund Research, Inc. which does not approve or endorse Fund.

The FTSE 250 Index is a capitalization-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange. Promotions and demotions to and from the index occur quarterly in March, June, September, and December. The Index is calculated in real-time and published every minute. The index is a trademark of the Financial Times and Stock Exchange.

Morningstar World Stock Category – an international fund having more than 20% of stocks invested in the United States.

It is not possible to invest directly in an index.

Past performance does not guarantee future results.

"EBITDA" is the acronym for earnings before interest, taxes, depreciation and amortization. "Market Cap"is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share. "Free cash flow"is earnings before depreciation, amortization, and non-cash charges minus maintenance capital expenditures.

Must be preceded or accompanied by a prospectus.

From its inception through December 31, 2019, the Evermore Global Value Fund was distributed by Quasar Distributors, LLC. Quasar Distributors, LLC is affiliated with U.S. Bancorp Fund Services, LLC and U.S. Bank N.A. Effective January 1, 2020, the Evermore Global Value Fund is being distributed by Compass Distributors, LLC. Compass Distributors, LLC is an affiliate of Foreside Financial Group, LLC.

Evermore Global Value Fund

| PERFORMANCE INFORMATION (Unaudited) |

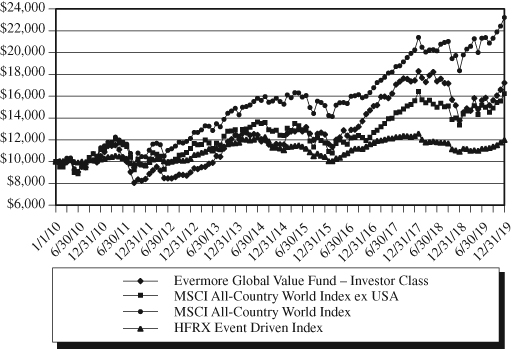

Value of $10,000 vs. MSCI All-Country World Index ex USA,

MSCI All-Country World Index & HFRX Event Driven Index

Average Annual Total Returns For the Periods Ended December 31, 2019:

| | | | | Since | Value of |

| | | | | Inception | $10,000 |

| | 1 Year | 3 Year | 5 Year | (1/1/2010) | (12/31/2019) |

| Investor Class | 25.05% | 5.43% | 8.27% | 5.58% | $17,216 |

| Institutional Class | 25.41% | 5.68% | 8.53% | 5.84% | $17,638 |

| MSCI All-Country World Index ex USA | 21.51% | 9.87% | 5.51% | 4.97% | $16,236 |

| MSCI All-Country World Index | 26.60% | 12.44% | 8.41% | 8.79% | $23,217 |

| HFRX Event Driven Index | 9.96% | 1.13% | 1.34% | 1.84% | $12,002 |

This chart illustrates the performance of a hypothetical $10,000 investment made in the Investor Class shares on January 1, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends for a fund and dividends for an index. Index returns do not reflect the effects of fees and expenses. It is not possible to invest directly in an index.

Evermore Global Value Fund

| SECTOR ALLOCATION* as a Percentage of Total Portfolio at December 31, 2019 (Unaudited) |

| * | Data is expressed as a percentage of total portfolio. Data expressed excludes collateral on loaned securities, written options, short securities and forward foreign currency contracts. Please refer to the Schedule of Investments, Schedule of Securities Sold Short and Schedule of Forward Foreign Currency Contracts for more details on the Fund’s individual holdings. |

Evermore Global Value Fund

| EXPENSE EXAMPLE for the Six Months Ended December 31, 2019 (Unaudited) |

As a shareholder of the Evermore Global Value Fund (the "Fund"), you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including investment advisory fees, distribution fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/19 – 12/31/19).

Actual Expenses

The first line of the table below provides information about actual account values based on actual returns and actual expenses. You will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, the Fund’s transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2% of the net amount of the redemption if you redeem shares less than 90 calendar days after you purchase them. An Individual Retirement Account ("IRA") will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds may vary. These expenses are not included in the example below. The example below includes, but is not limited to, investment advisory fees, shareholder servicing fees, fund accounting fees, custody fees and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period"to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During the Period |

| | 7/1/19 | 12/31/19 | 7/1/19 – 12/31/19* |

| Investor Class Actual* | $1,000 | $1,102.60 | $7.79 |

| Investor Class Hypothetical (5% annual return before expenses) | $1,000 | $1,017.80 | $7.48 |

| | | | |

| Institutional Class Actual* | $1,000 | $1,104.00 | $6.47 |

| Institutional Class Hypothetical (5% annual return before expenses) | $1,000 | $1,019.06 | $6.21 |

| * | Expenses are equal to the Fund’s annualized expense ratios for the most recent six-month period of 1.47% for Investor Class shares and 1.22% for Institutional Class shares multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period). |

Evermore Global Value Fund

| SCHEDULE OF INVESTMENTS at December 31, 2019 |

| Shares | | | | Value | |

| COMMON STOCKS – 97.1% | |

| | |

| Aerospace & Defense – 2.4% | |

| | 9,464,953 | | Bombardier, Inc. – Class B (Canada)(1) | | $ | 14,067,506 | |

| | | | | | | | |

| Capital Markets – 5.3% | |

| | 290,314 | | AURELIUS Equity | | | | |

| | | | Opportunities SE & Co. KGaA (Germany)(2) | | | 12,700,220 | |

| | 353,600 | | KKR & Co., Inc. – Class A (United States) | | | 10,314,512 | |

| | 341,270 | | Tikehau Capital SCA (France) | | | 8,421,694 | |

| | | | | | | 31,436,426 | |

| Chemicals – 6.4% | |

| | 676,856 | | Kraton Corp. (United States)(1)(4) | | | 17,137,994 | |

| | 143,433 | | DuPont de Nemours, Inc. (United States) | | | 9,208,399 | |

| | 136,999 | | Dow, Inc. (United States) | | | 7,497,955 | |

| | 143,433 | | Corteva, Inc. (United States) | | | 4,239,879 | |

| | | | | | | 38,084,227 | |

| Consumer Finance – 0.6% | |

| | 16,710,000 | | Emergent Capital, Inc. (United States)(1)(5)(8) | | | 3,325,791 | |

| | | | | | | | |

| Diversified Telecommunication Services – 1.3% | |

| | 2,812,289 | | ICE Group AS (Norway)(1) | | | 6,278,503 | |

| | 7,087,431 | | Net1 International Holdings AS (Norway(1)(3)(8)(10) | | | 1,210,933 | |

| | | | | | | 7,489,436 | |

| Energy Equipment & Services – 2.1% | |

| | 833,470 | | Borr Drilling Ltd. (Norway)(1)(2) | | | 7,306,743 | |

| | 6,631,815 | | Magseis Fairfield ASA (Norway)(1) | | | 4,381,275 | |

| | 448,862 | | Northern Drilling, Ltd. (Norway)(1) | | | 1,055,779 | |

| | | | | | | 12,743,797 | |

| Food Products – 8.7% | |

| | 2,580,616 | | Atlantic Sapphire AS (Norway)(1) | | | 37,918,679 | |

| | 1,836,917 | | Salmones Camanchaca SA (Chile) | | | 14,102,287 | |

| | | | | | | 52,020,966 | |

| Hotel, Restaurants & Leisure – 5.1% | |

| | 1,411,906 | | Gamesys Group Plc (United Kingdom)(1) | | | 13,222,475 | |

| | 294,373 | | Universal Entertainment Corp. (Japan) | | | 10,064,845 | |

| | 2,561,942 | | Codere SA Restricted (Spain) | | | | |

| | | | (Acquired 08/03/2016 through | | | | |

| | | | 12/03/2019, cost $19,315,625)(1)(3)(8)(9)(10) | | | 7,057,913 | |

| | | | | | | 30,345,233 | |

| Industrial Conglomerates – 7.8% | |

| | 241,960 | | EXOR NV (Netherlands) | | | 18,748,846 | |

| | 3,477,413 | | Bollore SA (France) | | | 15,173,457 | |

| | 209,252 | | Lifco AB – B Shares (Sweden) | | | 12,778,953 | |

| | | | | | | 46,701,256 | |

| Life Sciences Tools & Services – 1.4% | |

| | 3,165,125 | | Enzo Biochem, Inc. (United States)(1)(5) | | | 8,324,279 | |

| | | | | | | | |

| Marine – 19.4% | |

| | 865,369 | | Scorpio Tankers, Inc. (Monaco) | | | 34,043,610 | |

| | 1,837,476 | | Frontline, Ltd. (Norway)(2)(4) | | | 23,629,941 | |

| | 2,851,002 | | Scorpio Bulkers, Inc. (Monaco) | | | 18,160,883 | |

| | 1,186,661 | | Genco Shipping & Trading, Ltd. (United States) | | | 12,602,340 | |

| | 898,200 | | Star Bulk Carriers Corp. (Greece)(2) | | | 10,607,742 | |

| | 478,597 | | Navios Maritime Partners LP (Greece) | | | 8,911,476 | |

| | 3,630,223 | | Navios Maritime Containers LP (Greece)(1)(5) | | | 7,804,979 | |

| | | | | | | 115,760,971 | |

| Media – 14.4% | |

| | 743,480 | | Nordic Entertainment Group AB – | | | | |

| | | | Class B (Sweden) | | | 24,035,590 | |

| | 2,002,021 | | Modern Times Group MTG AB – | | | | |

| | | | B Shares (Sweden) | | | 23,864,755 | |

| | 696,783 | | Vivendi SA (France)(4) | | | 20,180,524 | |

| | 92,700 | | Walt Disney Co. (United States) | | | 13,407,201 | |

| | 18,600 | | IAC InterActive Corp. (United States)(1) | | | 4,633,446 | |

| | | | | | | 86,121,516 | |

| Metals & Mining – 3.9% | |

| | 1,719,936 | | Constellium SE (France)(1) | | | 23,047,142 | |

| | | | | | | | |

| Oil, Gas & Consumable Fuels – 2.7% | |

| | 681,650 | | Par Pacific Holdings, Inc. (United States)(1) | | | 15,841,546 | |

| | | | | | | | |

| Pharmaceuticals – 3.9% | |

| | 1,074,392 | | Fagron NV (Belgium)(1) | | | 23,295,566 | |

| | | | | | | | |

| Professional Services – 2.9% | |

| | 743,343 | | AF POYRY AB (Sweden) | | | 17,348,784 | |

| | | | | | | | |

| Semiconductors & | |

| Semiconductor Equipment – 5.5% | |

| | 2,107,539 | | MagnaChip Semiconductor Corp. | | | | |

| | | | (South Korea)(1)(5) | | | 24,468,527 | |

| | 437,353 | | Xperi Corp. (United States)(4) | | | 8,091,030 | |

| | | | | | | 32,559,557 | |

| Technology Hardware, | |

| Storage & Peripherals – 3.3% | |

| | 824,910 | | S&T AG (Austria)(2) | | | 19,690,505 | |

| | | | | | | | |

| TOTAL COMMON STOCKS | |

| (Cost $491,962,554) | | | 578,204,504 | |

| | | | | | | | |

| Principal | | | | | | |

| Amount | | | | | | |

| CORPORATE OBLIGATIONS – 2.1% | |

| | |

| Consumer Finance – 2.1% | |

| $ | 12,916,710 | | Emergent Capital, Inc. | | | | |

| | | | 8.500%, 7/15/2021 (United States)(8)(12) | | | 12,550,693 | |

| TOTAL CORPORATE OBLIGATIONS | |

| (Cost $12,542,759) | | | 12,550,693 | |

| | | | | | | | |

Shares

| | | | | | |

| WARRANTS – 0.1% | |

| | |

| Consumer Finance – 0.1% | |

| | 4,344,786 | | Emergent Capital, Inc., | | | | |

| | | | Expiration: July, 2025, | | | | |

| | | | Exercise Price $0.20 | | | | |

| | | | (United States)(1)(3)(8)(10) | | | 441,939 | |

| TOTAL WARRANTS | |

| (Cost $0) | | | 441,939 | |

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| SCHEDULE OF INVESTMENTS at December 31, 2019, Continued |

| | | | Notional | | | | |

Contracts(6) | | | Value | | | Value | |

| CALL OPTIONS PURCHASED – 0.3% | |

| | 3,650 | | Frontline Ltd., | | | | | |

| | | | Expiration: February, 2020, | | | | | |

| | | | Strike Price $12.00 | | | | | |

| | | | (United States) | $ | 4,693,900 | | | $ | 520,125 | |

| | 1,100 | | KKR & Co., Inc., | | | | | | | |

| | | | Expiration: January, 2021, | | | | | | | |

| | | | Strike Price $27.00 | | | | | | | |

| | | | (United States) | | 3,208,700 | | | | 500,500 | |

| | 435 | | Walt Disney Co., | | | | | | | |

| | | | Expiration: March, 2020, | | | | | | | |

| | | | Strike Price $140.00 | | | | | | | |

| | | | (United States) | | 6,291,405 | | | | 379,538 | |

| | 1,000 | | Scorpio Tankers, Inc., | | | | | | | |

| | | | Expiration: January, 2020, | | | | | | | |

| | | | Strike Price $40.00 | | | | | | | |

| | | | (United States) | | 3,934,000 | | | | 157,500 | |

| | 500 | | Scorpio Tankers, Inc., | | | | | | | |

| | | | Expiration: January, 2020, | | | | | | | |

| | | | Strike Price $39.00 | | | | | | | |

| | | | (United States) | | 1,967,000 | | | | 106,250 | |

| | 900 | | CBOE VIX Futures Index, | | | | | | | |

| | | | Expiration: January, 2020, | | | | | | | |

| | | | Strike Price $16.00 | | | | | | | |

| | | | (United States) | | 1,240,200 | | | | 92,250 | |

| | 435 | | DuPont de Nemours, Inc., | | | | | | | |

| | | | Expiration: April, 2020, | | | | | | | |

| | | | Strike Price $70.00 | | | | | | | |

| | | | (United States) | | 2,792,700 | | | | 68,295 | |

| | 675 | | Walt Disney Co., | | | | | | | |

| | | | Expiration: January, 2020, | | | | | | | |

| | | | Strike Price $150.00 | | | | | | | |

| | | | (United States) | | 9,762,525 | | | | 39,150 | |

| | |

| TOTAL CALL OPTIONS PURCHASED | |

| (Cost $2,320,136) | | | | 1,863,608 | |

| | | | | | | | | | | |

PUT OPTIONS PURCHASED – 0.0%(11) | |

| | 2,500 | | iShares MSCI Emerging Markets ETF, | | | | | | | |

| | | | Expiration: January, 2020, | | | | | | | |

| | | | Strike Price $39.73 | | | | | | | |

| | | | (United States) | | 11,217,500 | | | | 5,000 | |

| | | | | | | | | | | |

| TOTAL PUT OPTIONS PURCHASED | |

| (Cost $155,575) | | | | 5,000 | |

| Shares | | Value | |

| SHORT-TERM INVESTMENT – 0.5% | |

| | |

| Money Market Fund – 0.5% | |

| | 2,883,809 | | First American Treasury Obligations Fund – | | | |

| | | | Class X, 1.53%(7) | | | 2,883,809 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENT | |

| (Cost $2,883,809) | | | 2,883,809 | |

| | | | | | | | |

| SECURITIES HELD AS COLLATERAL ON | |

| LOANED SECURITIES – 7.6% | |

| | |

| Money Market Funds – 7.6% | |

| | 23,874,883 | | First American Government Obligations Fund – | | | | |

| | | | Class Y, 1.20%(7) | | | 23,874,883 | |

| | 21,207,691 | | Dreyfus Government Cash Management – | | | | |

| | | | Investor Class, 1.51%(7) | | | 21,207,691 | |

| | | | | | | | |

| TOTAL SECURITIES HELD AS COLLATERAL ON | |

| LOANED SECURITIES | |

| (Cost $45,082,574) | | | 45,082,574 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES – 107.7% | |

| (Cost $554,947,407) | | | 641,032,127 | |

| Liabilities in Excess of Other Assets – (7.7)% | | | (46,005,288 | ) |

| TOTAL NET ASSETS – 100.0% | | $ | 595,026,839 | |

Percentages are stated as a percent of net assets.

| | (1) | Non-income producing security. |

| | (2) | All or a portion of this security is on loan. At December 31, 2019 the total value of securities on loan was $43,663,544, which represents 7.3% of total net assets. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

| | (3) | These securities were fair valued in good faith by the Adviser’s Valuation Committee. The aggregate value of these securities at December 31, 2019 were $8,710,785, which represents 1.5% of net assets. |

| | (4) | All or a portion of this security was segregated as collateral for written options. Written options are collateralized with fully paid securities and cash with a value of $14,191,197 and $2,962,614 respectively at December 31, 2019. |

| | (5) | Affiliated company as defined by the Investment Company Act of 1940. Please refer to Note 6 for further disclosures related to these affiliated securities. |

| | (6) | 100 shares per contract. |

| | (7) | Seven-day yield as of December 31, 2019. |

| | (8) | The Advisor has deemed a portion of these securities as illiquid. These securities have a value of $24,587,270, which represents 4.1% of total net assets at December 31, 2019. |

| | (9) | This security is restricted. This security has a value of $7,057,913, which represents 1.2% of total net assets at December 31, 2019. |

| | (10) | Value determined using significant unobservable inputs. |

| | (11) | Less than 0.1%. |

| | (12) | The coupon rate represents the rate as of December 31, 2019. The security accrued in-kind interest of $1,058,678 at a rate of 11.5% from January 1, through September 15, 2019. The in-kind interest is included in the Statement of Operations within interest, unaffiliated securities. |

The Global Industry Classification Standard (GICS¨) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC ("S&P"). GICS¨ is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services ("Fund Services").

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| SCHEDULE OF INVESTMENTS at December 31, 2019, Continued |

| COUNTRY ALLOCATION for Investments in Securities at December 31, 2019 |

| Country | Long Exposure |

| United States^ | 29.8% |

| Norway | 13.7% |

| Sweden | 13.1% |

| France | 11.3% |

| Monaco | 8.8% |

| Greece | 4.6% |

| South Korea | 4.1% |

| Belgium | 3.9% |

| Austria | 3.3% |

| Netherlands | 3.1% |

| Chile | 2.4% |

| Canada | 2.4% |

| United Kingdom | 2.2% |

| Germany | 2.1% |

| Japan | 1.7% |

| Spain | 1.2% |

| Total | 107.7% |

Percentages are stated as a percent of net assets.

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 0.5% and Securities Held as Collateral on Loaned Securities of 7.6% |

| SCHEDULE OF SECURITIES SOLD SHORT as of December 31, 2019 |

The amount of $3,578,559 in cash was segregated with Interactive Brokers, LLC to cover the following securities sold short at December 31, 2019 and is disclosed as a portion of "Due from Broker"on the Fund’s Statement of Assets and Liabilities. Interactive Brokers, LLC is the counterparty to the below securities sold short.

| Shares | | | | Value | |

| Common Stock – (0.7)% | |

| Media – (0.7%) | |

| | 90,210 | | ANGI Homeservices, Inc. – | | | |

| | | | Class A (United States)(1) | | $ | (764,079 | ) |

| | 39,990 | | Match Group, Inc. (United States)(1) | | | (3,283,579 | ) |

| | |

| TOTAL SECURITIES SOLD SHORT | |

| (Proceeds $3,578,567) | | $ | (4,047,658 | ) |

(1)

| Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| SCHEDULE OF INVESTMENTS at December 31, 2019, Continued |

| SCHEDULE OF FORWARD FOREIGN CURRENCY CONTRACTS at December 31, 2019 |

As of December 31, 2019, the Fund had the following forward currency contracts outstanding:

| | | Currency to be Received | | | Currency to be Delivered | | | | |

| | | | | | | USD Value at | | | | | | | USD Value at | | | Net Unrealized | |

| | | | | | | December 31, | | | | | | | December 31, | | | Appreciation | |

| Settlement Date | | Amount | | Currency | | 2019 | | | Amount | | Currency | | 2019 | | | (Depreciation) | |

| 3/13/20 | | | 12,019,818 | | USD | | $ | 12,019,818 | | | | 1,297,900,000 | | JPY | | $ | 11,994,995 | | | $ | 24,823 | (a) |

| 3/13/20 | | | 200,000,000 | | JPY | | | 1,848,370 | | | | 1,845,614 | | USD | | | 1,845,614 | | | | 2,756 | (a) |

| 3/13/20 | | | 12,815,542 | | USD | | | 12,815,542 | | | | 9,715,000 | | GBP | | | 12,894,463 | | | | (78,921 | )(a) |

| 3/13/20 | | | 14,164,777 | | USD | | | 14,164,777 | | | | 18,740,000 | | CAD | | | 14,435,235 | | | | (270,458 | (a) |

| 3/13/20 | | | 72,848,935 | | USD | | | 72,848,935 | | | | 690,994,000 | | SEK | | | 74,034,482 | | | | (1,185,547 | )(a) |

| 3/13/20 | | | 28,582,087 | | USD | | | 28,582,087 | | | | 261,306,000 | | NOK | | | 29,770,472 | | | | (1,188,385 | )(a) |

| 3/13/20 | | | 126,083,538 | | USD | | | 126,083,538 | | | | 113,305,000 | | EUR | | | 127,677,940 | | | | (1,594,402 | (a) |

| | | | | | | | $ | 268,363,067 | | | | | | | | $ | 272,653,201 | | | $ | (4,290,134 | ) |

| CAD | Canadian Dollar |

| EUR | Euro |

| GBP | British Pound |

| JPY | Japanese Yen |

| NOK | Norwegian Krone |

| SEK | Swedish Krona |

| USD | U.S. Dollars |

(a) Counterparty: forward foreign currency contracts outstanding with Bank of New York Mellon.

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| STATEMENT OF ASSETS AND LIABILITIES at December 31, 2019 |

| ASSETS | |

Investments in unaffiliated securities, at value (cost $505,432,764)(1) (Note 2) | | $ | 597,108,551 | |

| Investments in affiliated securities, at value (cost $49,514,643) (Notes 2 and 6) | | | 43,923,576 | |

| Unrealized appreciation on forward foreign currency contracts | | | 27,579 | |

| Receivables: | | | | |

| Investment securities sold | | | 186,271 | |

| Fund shares sold | | | 462,028 | |

| Dividends and interest, net of foreign withholding taxes | | | 130,468 | |

| Dividend withholding tax reclaims | | | 1,005,539 | |

| Due from broker | | | 6,539,973 | |

| Securities lending income | | | 26,834 | |

| Prepaid expenses | | | 65,904 | |

| Total assets | | | 649,476,723 | |

| | | | | |

| LIABILITIES | |

| Unrealized depreciation on forward foreign currency contracts | | | 4,317,713 | |

| Securities sold short (proceeds $3,578,567) | | | 4,047,658 | �� |

| Payables: | | | | |

| Fund shares redeemed | | | 285,435 | |

| Collateral for securities out on loan, at value | | | 45,082,574 | |

| Investment advisory fees | | | 474,782 | |

| Administration fees | | | 50,001 | |

| Custody fees | | | 13,610 | |

| Distribution fees – Investor Class | | | 13,683 | |

| Fund accounting fees | | | 1,803 | |

| Transfer agent fees | | | 27,819 | |

| Trustee fees | | | 16,741 | |

| Other accrued fees | | | 118,065 | |

| Total liabilities | | | 54,449,884 | |

| NET ASSETS | | $ | 595,026,839 | |

| | | | | |

| COMPONENTS OF NET ASSETS | |

| Paid-in capital | | $ | 510,026,935 | |

| Total distributable earnings | | | 84,999,904 | |

| Net assets | | $ | 595,026,839 | |

| | | | | |

| Investor Class: | | | | |

| Net assets | | $ | 61,295,620 | |

| Shares issued and outstanding (unlimited number of shares authorized without par value) | | | 4,298,861 | |

| Net asset value | | $ | 14.26 | |

| | | | | |

| Institutional Class: | | | | |

| Net assets | | $ | 533,731,219 | |

| Shares issued and outstanding (unlimited number of shares authorized without par value) | | | 37,201,747 | |

| Net asset value | | $ | 14.35 | |

(1)

| The market value of securities out on loan was $43,663,544 as of December 31, 2019. |

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| STATEMENT OF OPERATIONS for the Year Ended December 31, 2019 |

| INVESTMENT INCOME | |

| Income | | | |

| Dividends (net of $867,897 foreign withholding taxes) | | | |

| Unaffiliated securities | | $ | 9,447,864 | |

| Interest, unaffiliated securities | | | 1,607,128 | |

| Securities lending income | | | 1,109,965 | |

| Total investment income | | | 12,164,957 | |

| | | | | |

| EXPENSES (Note 3) | |

| Investment advisory fees | | | 5,647,699 | |

| Administration fees | | | 308,308 | |

| Legal fees | | | 260,012 | |

| Transfer agent fees | | | 242,556 | |

| Distribution fees – Investor Class | | | 162,616 | |

| Custody fees | | | 88,941 | |

| Trustee fees | | | 85,539 | |

| Audit and tax fees | | | 78,292 | |

| Registration fees | | | 64,403 | |

| Chief Compliance Officer fees | | | 53,138 | |

| Shareholder reporting fees | | | 33,315 | |

| Insurance fees | | | 31,483 | |

| Miscellaneous fees | | | 30,568 | |

| Fund accounting fees | | | 10,615 | |

| Interest expense | | | 1,732 | |

| Total expenses | | | 7,099,217 | |

| Net investment income | | | 5,065,740 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCIES, | |

| FORWARD FOREIGN CURRENCY CONTRACTS, SECURITIES SOLD SHORT & WRITTEN OPTIONS | |

| Net realized gain (loss) on: | | | | |

| Investments in unaffiliated securities | | | (11,633,297 | ) |

| Investments in affiliated securities | | | (6,264,344 | ) |

| Foreign currencies | | | (289,037 | ) |

| Forward foreign currency contracts | | | 18,306,893 | |

| Written options | | | 5,595,595 | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investments in unaffiliated securities | | | 108,367,075 | |

| Investments in affiliated securities | | | 14,671,259 | |

| Foreign currencies | | | (17,688 | ) |

| Forward foreign currency contracts | | | (5,210,023 | ) |

| Securities sold short | | | (469,091 | ) |

| Written options | | | (1,017,954 | ) |

| Net realized and unrealized gain (loss) on investments, foreign currencies, | | | | |

| forward foreign currency contracts, securities sold short & written options | | | 122,039,388 | |

| Net increase in net assets resulting from operations | | $ | 127,105,128 | |

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2019 | | | 2018 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | |

| | |

| OPERATIONS | |

| Net investment income | | $ | 5,065,740 | | | $ | 3,728,387 | |

| Net realized gain on investments, foreign currency transactions, forward foreign | | | | | | | | |

| currency contracts, & written options | | | 5,715,810 | | | | 31,146,268 | |

| Change in unrealized appreciation (depreciation) on investments, foreign currency | | | | | | | | |

| transactions, forward foreign currency contracts, securities sold short & written options | | | 116,323,578 | | | | (180,708,140 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 127,105,128 | | | | (145,833,485 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (NOTE 5) | |

| Investor Class | | | (1,510,343 | ) | | | (1,213,232 | ) |

| Institutional Class | | | (14,602,798 | ) | | | (10,827,022 | ) |

| Total distributions to shareholders | | | (16,113,141 | ) | | | (12,040,254 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | |

| Net increase (decrease) in net assets derived from net change in outstanding shares – | | | | | | | | |

| Investor Class | | | (15,128,035 | ) | | | 5,848,834 | |

| Net increase (decrease) in net assets derived from net change in outstanding shares – | | | | | | | | |

| Institutional Class | | | (8,325,084 | ) | | | 52,471,448 | |

| Total increase (decrease) in net assets from capital share transactions | | | (23,453,119 | ) | | | 58,320,282 | |

| Total increase (decrease) in net assets | | | 87,538,868 | | | | (99,553,457 | ) |

| | | | | | | | | |

| NET ASSETS | |

| Beginning of year | | | 507,487,971 | | | | 607,041,428 | |

| End of year | | $ | 595,026,839 | | | $ | 507,487,971 | |

| | | | | | | | | |

| | Summary of capital share transactions is as follows: | | | | | | |

| | | | | | | | |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2019 | | | December 31, 2018 | |

| | Investor Class | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 1,040,687 | | | $ | 13,446,400 | | | | 1,927,474 | | | $ | 28,351,558 | |

| | Shares issued in reinvestment of distributions | | | 102,560 | | | | 1,411,232 | | | | 87,770 | | | | 1,130,481 | |

| | Shares redeemed1 | | | (2,280,470 | ) | | | (29,985,667 | ) | | | (1,668,783 | ) | | | (23,633,205 | ) |

| | Net increase (decrease) | | | (1,137,223 | ) | | $ | (15,128,035 | ) | | | 346,461 | | | $ | 5,848,834 | |

| | | | | | | | | | | | | | | | | | |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2019 | | | December 31, 2018 | |

| | Institutional Class | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 8,376,165 | | | $ | 108,584,456 | | | | 11,578,120 | | | $ | 172,239,782 | |

| | Shares issued in reinvestment of distributions | | | 1,011,605 | | | | 14,000,619 | | | | 807,428 | | | | 10,464,265 | |

| | Shares redeemed2 | | | (9,900,079 | ) | | | (130,910,159 | ) | | | (9,554,844 | ) | | | (130,232,599 | ) |

| | Net increase (decrease) | | | (512,309 | ) | | $ | (8,325,084 | ) | | | 2,830,704 | | | $ | 52,471,448 | |

| | 1 | Net of redemption fees of $5,596 and $10,609, respectively. |

| | 2 | Net of redemption fees of $14,033 and $30,513, respectively. |

The accompanying notes are an integral part of these financial statements.

Evermore Global Value Fund

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout the year |

Investor Class*

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Net asset value, beginning of year | | $ | 11.70 | | | $ | 15.08 | | | $ | 13.03 | | | $ | 11.18 | | | $ | 10.52 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS | |

| Net investment income (loss)** | | | 0.09 | | | | 0.06 | | | | (0.04 | ) | | | 0.11 | | | | 0.04 | |

| Net realized and unrealized gain (loss) on investments | | | 2.83 | | | | (3.16 | ) | | | 2.48 | | | | 1.86 | | | | 0.79 | |

| Total from investment operations | | | 2.92 | | | | (3.10 | ) | | | 2.44 | | | | 1.97 | | | | 0.83 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS | |

| From net investment income | | | (0.10 | ) | | | (0.06 | ) | | | (0.03 | ) | | | (0.11 | ) | | | (0.11 | ) |

| Net realized gains | | | (0.26 | ) | | | (0.22 | ) | | | (0.36 | ) | | | (0.01 | ) | | | (0.06 | ) |

| Total distributions | | | (0.36 | ) | | | (0.28 | ) | | | (0.39 | ) | | | (0.12 | ) | | | (0.17 | ) |

| Paid-in capital from redemption fees | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

| Net asset value, end of year | | $ | 14.26 | | | $ | 11.70 | | | $ | 15.08 | | | $ | 13.03 | | | $ | 11.18 | |

| Total return | | | 25.05 | % | | | (21.07 | )% | | | 18.72 | % | | | 17.68 | % | | | 7.88 | % |

| | | | | | | | | | | | | | | | | | | | | |