- FAF Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

First American Financial (FAF) DEF 14ADefinitive proxy

Filed: 1 Apr 24, 12:52pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No._ )

Filed by the Registrant

Filed by a party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material under §240.14a-12

FIRST AMERICAN FINANCIAL

CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

No fee required

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

2024 Notice of annual meeting and proxy statement first American financial Corporation

2023 notice of annual meeting and proxy statement

First American Financial Corporation |

|

|

April 1, 2024

Dear Fellow Stockholder,

You are cordially invited to attend our annual meeting of stockholders at 1:00 PM Pacific time, on May 21, 2024. This year’s annual meeting of stockholders will be held in a virtual-only meeting format online via live webcast using a unique link to be provided by email after registering at register.proxypush.com/FAF.

With this letter, we are including the notice for the annual meeting, the proxy statement and the proxy card. We are also including a copy of our 2023 annual report. More information regarding how to vote, participate in, and submit questions for the annual meeting can be found in the proxy statement.

We have made arrangements for you to vote your proxy over the Internet or by telephone, as well as by mail with the traditional proxy card. The proxy card contains instructions on these methods of voting.

Your vote is important. Whether or not you plan on participating in the virtual annual meeting on May 21, 2024, we hope you will vote as soon as possible.

Thank you for your continued support of First American Financial Corporation.

|

|

Dennis J. Gilmore Chairman of the Board | Kenneth D. DeGiorgio Chief Executive Officer |

First American Financial Corporation | NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

| Date |

|

| Matters to be voted on | ||

May 21, 2024 |

|

| Proposal | Board Recommendation | ||

| Time |

|

|

|

|

|

|

| 1 | Election of the three persons named in the accompanying proxy statement to serve as Class II directors on our board of directors for a three-year term expiring on the date of the 2027 annual meeting of stockholders. |

Vote For | ||

1:00 PM Pacific Time | ||||||

| Website |

|

|

|

| |

2 | Approval, on an advisory basis, of our Company’s executive compensation. |

Vote For | ||||

register.proxypush.com/FAF |

|

|

|

|

| |

| 3 | Ratification of the selection of PricewaterhouseCoopers LLP as our Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

| |||

|

|

|

|

|

| |

Who can vote Only stockholders of record at the close of business on March 25, 2024 are entitled to notice of the meeting and an opportunity to vote. |

|

|

|

| ||

|

| At the meeting, we will also transact such other business as may properly come before the meeting or any postponements or adjournments thereof. | ||||

This year’s meeting will be held in a virtual-only meeting format online via live webcast. To participate in the meeting, stockholders must go to register.proxypush.com/FAF with the control number provided on their proxy card or voting instruction form and register by following the instructions. Upon completing registration, a stockholder will receive further instructions via email, including a unique link that will allow that stockholder access to the meeting. During the meeting, stockholders may vote and submit questions. For additional information on voting at or participating in the meeting online, including how to submit questions, please see “Questions and Answers” on page 74.

How to vote your shares before the meeting

Your vote is very important. Please submit your vote by proxy as soon as possible via the Internet, telephone or mail. Brokers are not permitted to vote on certain proposals and may not vote on any of the proposals unless you provide voting instructions. Voting your shares will help to ensure that your interests are represented at the meeting.

| VIA THE INTERNET Visit the website listed on your proxy card, notice or voting instruction form. |

|

|

| BY PHONE Call the phone number listed on your proxy card or voting instruction form. | Y |

|

| BY MAIL Complete, sign, date and return your proxy card or voting instruction form in the envelope provided. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 21, 2024: First American Financial Corporation’s notice of annual meeting and proxy statement, annual report and other proxy materials are available at www.firstam.com/proxymaterials.

Meeting Contingencies

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the meeting, the chair of the meeting will convene the meeting at 2:00 P.M. Pacific Time on the date specified above and at our address, 1 First American Way, Santa Ana, CA 92707, solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of our website at investors.firstam.com.

Lisa W. Cornehl

Senior Vice President, Chief Legal Officer and Secretary

Santa Ana, California

April 1, 2024

Table of Contents |

| Page | |

1 | ||

I. | 2 | |

| 9 | |

| 10 | |

| 11 | |

II. | 12 | |

| 12 | |

| 13 | |

| 15 | |

| Board Leadership Structure; Meetings of Non-Management and Independent Directors | 16 |

| 16 | |

| 16 | |

| 18 | |

| Stockholder and Interested Party Communications with Directors | 18 |

| 18 | |

| 19 | |

| 21 | |

| 21 | |

| 21 | |

| 21 | |

| 22 | |

| 27 | |

| 32 | |

| 34 | |

| 35 | |

| 49 | |

| 50 | |

| 51 | |

| 51 | |

| 52 | |

| 53 | |

| 54 | |

| 54 | |

| 55 | |

First American Financial Corporation 2024 Proxy Statement | i

| Page | |

| 56 | |

| 61 | |

| 62 | |

| 67 | |

| 68 | |

| 70 | |

| 70 | |

| 70 | |

| 70 | |

| Securities Authorized for Issuance under Equity Compensation Plans | 71 |

| Relationship with Independent Registered Public Accounting Firm | 71 |

| 71 | |

| 72 | |

| Stockholder Proposals, Director Nominations and Proxy Access | 72 |

| 72 | |

III. | 73 | |

IV. | 74 | |

V. | 81 | |

A-1 | ||

First American Financial Corporation 2024 Proxy Statement | ii

First American Financial Corporation

PROXY STATEMENT

Solicitation of Proxies by the Board of Directors

First American Financial Corporation's Notice of Annual Meeting, Proxy Statement, Annual Report and other proxy materials are available at www.firstam.com/proxymaterials

|

The board of directors (our “Board”) of First American Financial Corporation, a Delaware corporation (our “Company,” “we” or equivalent terms), is soliciting proxies from holders of our common stock for use at the annual meeting of our stockholders to be held on May 21, 2024, at 1:00 PM Pacific time. The meeting will be held in a virtual-only meeting format online via live webcast using a unique link to be provided by email after registering at register.proxypush.com/FAF. We have included information on how to vote, submit questions, and participate in the virtual meeting in the “Questions and Answers” section on pages 74-80.

We are mailing this proxy statement and the enclosed proxy card, notice of annual meeting, stockholders letter and 2023 annual report to our stockholders on or about April 1, 2024. In lieu of a proxy card, holders of shares held in street name through a bank, broker or other nominee are receiving a voting instruction form from their bank, broker or other nominee. As used herein, references to “proxy” or “proxy card” also refer to the voting instruction form provided to street name holders.

The remainder of this proxy statement has been divided into five sections. You should read all five sections before you vote.

The Compensation Discussion and Analysis section contains certain financial measures that are not presented in accordance with generally accepted accounting principles (“GAAP”). Please see Appendix A for the rationale behind the presentation of these measures and a reconciliation of these amounts to the nearest GAAP financial measures.

First American Financial Corporation 2024 Proxy Statement | 1

I. Proposals |

Information Regarding the Nominees for Election

The following list provides information with respect to the three persons nominated and recommended to be elected as a Class II director by our Board, to serve for a three-year term expiring on the date of the 2027 annual meeting of stockholders. Each of the nominees is currently serving as a director of our Company and was previously elected by stockholders at the 2021 annual meeting of stockholders.

Age: 65 Director since: 2010 Committees: Executive Independent: No |

| DENNIS J. GILMORE

Mr. Gilmore has served as chairman of the Board since February 2022 and as a director since 2010. He served as our chief executive officer from 2010 to 2022. From 1993 to 2010, he served in various managerial roles with The First American Corporation, including as the chief executive officer of its financial services group and as its chief operating officer. As the Company’s former chief executive officer, Mr. Gilmore brings to our Board significant operational and executive management experience specific to our Company’s businesses and our industry. |

Age: 70 Director since: 2015 Committees: Governance (chair) Independent: Yes |

| MARGARET M. MCCARTHY

Ms. McCarthy retired in 2019 as executive vice president of CVS Health Corporation, a health innovation company (NYSE: CVS), supporting the technology integration following the completion of CVS Health’s acquisition of Aetna, Inc. in 2018. She served as executive vice president of operations and technology for Aetna, Inc., a diversified healthcare benefits company, from 2010 until 2018, where she was responsible for innovation, technology, data security, procurement, real estate and service operations. Prior to joining Aetna in 2003, she served in various information technology-related roles, including at CIGNA Healthcare, Catholic Health Initiatives and Andersen Consulting (now Accenture), as well as a consulting partner at Ernst & Young. She is a director of Marriott International, Inc. (NASDAQ: MAR), an operator, franchisor, and licensor of hotel, residential, and timeshare properties worldwide; American Electric Power (NYSE: AEP), an electrical energy company; and Alignment Healthcare, Inc. (NASDAQ GS: ALHC), a tech-enabled Medicare Advantage company. She served as a director of Brighthouse Financial, Inc. (NASDAQ GS: BHF), a life and annuity insurance company from 2018 to 2021. Given her extensive experience managing large groups of employees, complex processes and enterprise-critical technology, Ms. McCarthy brings to the Board valuable insights into areas of critical import to the operations of the Company, including privacy and cybersecurity. |

First American Financial Corporation 2024 Proxy Statement | 2

| I. Proposals |

|

|

Age: 66 Director since: 2018 Committees: Governance Audit Independent: Yes |

| MARTHA B. WYRSCH

Ms. Wyrsch retired in 2019 as executive vice president and general counsel for Sempra Energy, a leading energy services company, where she oversaw the company’s legal affairs and compliance initiatives. Prior to joining Sempra Energy in 2013, Ms. Wyrsch served as the president of Vestas American Wind Technology from 2009 to 2012, where she had direct responsibility for all North American sales, construction, service and maintenance. In addition to her executive leadership roles, she served as a member of the board of directors of Spectra Energy Corporation and SPX Corporation. She currently serves on the board of directors of Quanta Services, Inc. (NYSE: PWR), a specialized contracting services company, and National Grid plc (FTSE:NG; NYSE:NGG), an investor-owned utility managing electric and natural gas assets in the United Kingdom and United States. From 2012 to 2021 she also served as a director of Spectris plc, a publicly traded company listed on the London Stock Exchange, and from 2019 to 2020 as a director of Noble Energy, Inc. (NYSE: NBL), an energy exploration and production company. As an accomplished director for publicly-traded companies, and with deep experience leading intricate businesses, Ms. Wyrsch provides valuable insight into how we can enhance our operations and effectively serve our customers. |

Information Regarding the Other Incumbent Directors

The following lists provide information with respect to the individuals currently serving as Class III directors, whose current term expires at the 2025 annual meeting of stockholders, and Class I directors, whose term expires in 2026. The Class III directors were previously elected by stockholders at the 2022 annual meeting, and the Class I directors were previously elected by stockholders at the 2023 annual meeting.

Class III Directors—Term Expiring 2025

Age: 60 Director since: 2017 Committees: Governance Independent: Yes |

| REGINALD H. GILYARD

Mr. Gilyard has been a senior advisor with The Boston Consulting Group, a global management consulting company, since 2012. From 2012 to 2017, he was dean of the Argyros School of Business and Economics at Chapman University. From 1996 to 2012, he held various other positions with The Boston Consulting Group, including as a partner and managing director. He is a director of CBRE Group, Inc. (NYSE: CBRE), a commercial real estate services and investment firm; Realty Income Corporation (NYSE: O), a real estate investment trust; and Orion Office REIT Inc. (NYSE: ONL), a suburban office focused net lease real estate investment trust. He began his career serving in the United States Air Force. With his in-depth understanding of the complexities of large businesses and keen grasp of customer needs across a variety of industry sectors, Mr. Gilyard brings to the Board a unique perspective on how we can make our operations more efficient and serve our customers better. |

First American Financial Corporation 2024 Proxy Statement | 3

| I. Proposals |

|

|

Age: 76 Director since: 2010 Committees: Compensation Executive (chair) Independent: Yes |

| PARKER S. KENNEDY

Mr. Kennedy is our chairman emeritus and lead independent director. He served as chairman of our Board from 2010 to 2022. Mr. Kennedy served as executive chairman of the Company from 2010 to 2012. From 2003 to 2010, he served as chairman and chief executive officer of The First American Corporation, the Company’s prior parent company, and as its president from 1993 to 2004. He served as a director of The First American Corporation and, as renamed in 2010, CoreLogic, Inc., from 1987 to 2011, and was CoreLogic, Inc.’s executive chairman from 2010 to 2011. He is a director of the Automobile Club of Southern California. We believe that Mr. Kennedy, who has worked with us in various capacities for over 40 years, has unparalleled executive experience in our industry. He also brings to the Company an incomparable understanding of our history and culture. |

Age: 69 Director since: 2013 Committees: Audit Compensation Independent: Yes |

| MARK C. OMAN

Mr. Oman retired from Wells Fargo & Company in 2011, after serving it or its predecessors since 1979. He held numerous positions at Wells Fargo, including senior executive vice president (home and consumer finance) from 2005 until his retirement and group executive vice president (home and consumer finance) from 2002 to 2005. Mr. Oman also served as a director and the chief executive officer of Wachovia Preferred Funding Corp. from 2009 to 2011. He is currently involved with several private ventures and serves on a variety of private-company and non-profit boards. Mr. Oman brings to the Board important insights into the mortgage market and working with large mortgage lenders. |

First American Financial Corporation 2024 Proxy Statement | 4

| I. Proposals |

|

|

Class I Directors—Term Expiring 2026

Age: 52 Director since: 2022 Committees: None Independent: No |

| KENNETH D. DEGIORGIO

Mr. DeGiorgio has served as our chief executive officer since February 2022. From 2021 to 2022 he was our president with oversight responsibility for the Company’s operating groups, including its title insurance, specialty insurance and data and analytics businesses. He served as executive vice president from 2010 to 2021, overseeing the Company's international division, trust company and various corporate functions. He serves as a director of Offerpad Solutions Inc. (NYSE:OPAD), a leading tech-enabled real estate company, and Lev Inc., a privately held technology company focused on digitizing commercial real estate financing. With over 24 years of service to our Company in various operational and corporate roles, Mr. DeGiorgio provides our Board with an in-depth understanding of the Company’s businesses, risk profile and competitive landscape. |

Age: 77 Director since: 2010 Committees: Audit (chair) Executive Independent: Yes |

| JAMES L. DOTI

Dr. Doti has been a professor of economics at Chapman University since 1974 and served as Chapman University’s president from 1991 to 2016. He previously served on the boards of The First American Corporation, the Company’s prior parent company, Standard Pacific Corp. and Fleetwood Enterprises, Inc. Given his experience as president of Chapman University and his doctorate in economics from the University of Chicago, Dr. Doti gives our Company insight into the organizational challenges that large companies face and the impact of the economic environment on the Company. |

Age: 78 Director since: 2011 Committees: Compensation (chair) Independent: Yes |

| MICHAEL D. MCKEE

Mr. McKee has served as a principal of The Contrarian Group, a private equity firm, since 2018. He is the chairman of Realty Income Corporation (NYSE: O), a real estate investment trust, and the Tiger Woods Foundation. He served as a director of HCP, Inc. (NYSE: HCP), a publicly traded real estate investment trust, from 1989 to 2018, as executive chairman of HCP from 2016 to 2018 and, during 2016, he also served as interim chief executive officer and president of HCP. From 2010 to 2016, Mr. McKee was chief executive officer of Bentall Kennedy (U.S.), a registered real estate investment advisor. He also served as the chief executive officer and vice chairman of the board of directors of The Irvine Company, a privately-held real estate development and investment company, and as a partner with the law firm of Latham & Watkins LLP. Mr. McKee brings to the Board significant operating and executive management experience. This experience, combined with Mr. McKee’s extensive background in the real estate industry, facilitates the Board’s oversight of the Company’s operations and enhances its ability to assess strategic opportunities. |

First American Financial Corporation 2024 Proxy Statement | 5

| I. Proposals |

|

|

Age: 72 Director since: 2022 Committees: None Independent: No |

| MARSHA A. SPENCE

Ms. Spence served as chairman of the board of Mother Lode Holding Co., a provider of title insurance, underwriting and escrow services for residential and commercial real estate transactions, and a wholly-owned subsidiary of the Company, from 2006 until her retirement in 2023. She joined Placer Title Company, now Mother Lode’s principal subsidiary, in 1977 and had managerial roles involving increased responsibility, including as Mother Lode’s chief executive officer from 2001 to 2021. Ms. Spence served on the California Land Title Association Board of Governors for 10 years, serving as board president from 2005 to 2006. Ms. Spence brings to the Board deep industry knowledge and experience leading a highly successful, multi-brand title business. |

See the section entitled “Security Ownership of Management,” which begins on page 12, for information pertaining to stock ownership of our directors. There are no family relationships among any of the directors or nominees or any of our executive officers. There are no arrangements or understandings between any director and any other person pursuant to which any director was or is to be selected as a director.

First American Financial Corporation 2024 Proxy Statement | 6

| I. Proposals |

|

|

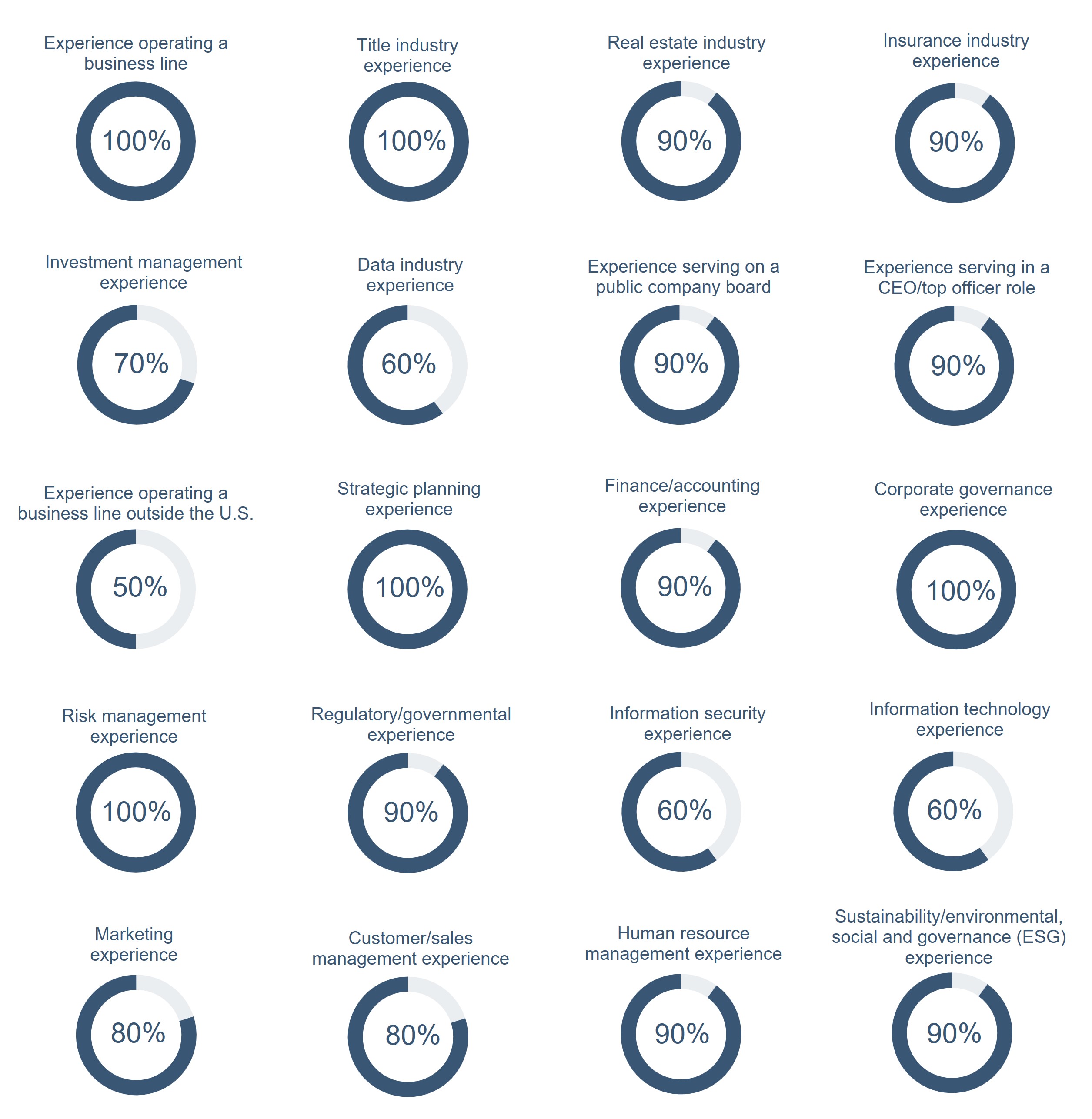

Our Board is composed of directors who possess a mix of skills and experience that we believe align with, and facilitate effective oversight of, the Company’s strategy and risks. The following chart presents the percentage of director nominees and the other incumbent directors who possess substantive skills and have self-reported as being from experienced to highly experienced in these areas.

Board of Directors Skills and Experience |

First American Financial Corporation 2024 Proxy Statement | 7

| I. Proposals |

|

|

Our Board believes that a diverse board is better able to effectively oversee the Company’s management and strategy and better positions the Company to deliver long-term value for our stockholders. As outlined on page 15, our Board utilizes a broad conception of diversity, recognizing that gender, race, ethnicity and other factors add to the overall mix of perspectives of our Board as a whole. The following graph presents self-reported information regarding the gender, race and ethnic diversity profile of our directors.

Directors Self-Reporting Diversity | ||||||||||

Male |

|

|

|

|

|

| 70% |

|

|

|

Female |

|

| 30% |

|

|

|

|

|

|

|

African American | 10% |

|

|

|

|

|

|

|

|

|

Caucasian |

|

|

|

|

|

|

|

| 90% |

|

Overall Diversity |

|

|

| 40% |

|

|

|

|

|

|

First American Financial Corporation 2024 Proxy Statement | 8

| I. Proposals |

|

|

Item 1. Election of Class II Directors

Our certificate of incorporation provides for a classified Board. Each person elected as a Class II director at the annual meeting of stockholders will serve for a three-year term expiring on the date of the 2027 annual meeting and until his or her successor in office is elected and qualified. Our Board has nominated the following individuals for election as Class II directors:

Dennis J. Gilmore

Margaret M. McCarthy

Martha B. Wyrsch

Unless otherwise specified by you in your proxy card, the proxies solicited by our Board will be voted “FOR” the election of each of the Class II director nominees. If any nominee should become unable or unwilling to serve as a director, the proxies will be voted for such substitute nominee(s) as shall be designated by our Board. Our Board presently has no knowledge that any of the nominees will be unable or unwilling to serve.

Our Board recommends that you vote "FOR" each of these Class II director nominees.

|

First American Financial Corporation 2024 Proxy Statement | 9

| I. Proposals |

|

|

Item 2. Advisory Vote to Approve Executive Compensation

Pursuant to Section 14A of the Securities Exchange Act of 1934 and Securities and Exchange Commission (“SEC”) rules, we are seeking the advice of our stockholders on the compensation of our named executive officers (“NEOs”) as presented in the “Executive Compensation” section of this proxy statement commencing on page 21. Specifically, we are seeking stockholder approval of the following resolution:

“RESOLVED, that the stockholders of First American Financial Corporation approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in the Proxy Statement for the Company’s 2024 annual meeting of stockholders.”

We refer to this proposal as a “Say on Pay” proposal. As part of its process in determining executive compensation levels for 2023, the Compensation Committee has reviewed the results of last year’s Say on Pay proposal, in which approximately 95% of our Company’s shares present and entitled to vote approved, on an advisory basis, 2022 executive compensation. The stockholder support for the prior Say on Pay proposal reinforces the Compensation Committee’s belief that it should continue its practice of implementing and overseeing executive compensation programs that provide for a substantial portion of the executive officers’ total compensation to be related to our Company’s consolidated financial performance. It also reinforces the Compensation Committee’s view that, for executive officers, the mix of compensation should be weighted heavily toward at-risk pay and should include a substantial portion payable in equity. This is consistent with the overall philosophy of maintaining a pay mix that results fundamentally in a pay-for-performance orientation and a strong alignment between the interests of executive officers and long-term stockholders.

The results of the 2023 executive compensation program are included in the section entitled “Compensation Discussion and Analysis” commencing on page 21. As a whole, executive compensation was down for the second consecutive year in 2023 amidst historically difficult market conditions and a cybersecurity incident that occurred in December 2023 which materially impacted the Company's operations and, consequently, our fourth quarter financial results. These factors directly impacted executive compensation levels for the year, as reflected in the metric results for annual incentive plan compensation being at 60% of target for 2023 (subject to the Discretionary Adjustment, as described in the Compensation Discussion and Analysis) compared to a 77% of target payout for 2022. Stockholders are urged to read the Compensation Discussion and Analysis as well as the Summary Compensation Table and related compensation tables and narrative, appearing on pages 51 through 61, in their entirety.

While this vote to approve executive compensation is not binding, the Compensation Committee intends to review the results of the vote in connection with its ongoing analysis of our Company’s compensation programs. We expect to include a Say on Pay proposal in our proxy materials on an annual basis and, thus, we expect that the next Say on Pay proposal will occur at our 2025 annual meeting, taking into consideration the results of the Say on Frequency vote.

Our Board recommends that you vote "FOR" the approval, on an advisory basis, of our Company's executive compensation.

|

First American Financial Corporation 2024 Proxy Statement | 10

| I. Proposals |

|

|

Item 3. Ratification of Selection of Independent Auditor

The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Representatives of PwC are expected to participate in the annual meeting and will have an opportunity to make a statement and be available to respond to appropriate questions.

Selection of our independent registered public accounting firm is not required to be submitted for stockholder approval, but the Audit Committee is seeking ratification of its selection of PwC from our stockholders as a matter of good corporate governance. If the stockholders do not ratify this selection, the Audit Committee will reconsider its selection of PwC and will either continue to retain this firm or appoint a new independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our Company’s best interests and those of our stockholders.

Our Board recommends that you vote "FOR" the foregoing proposal to ratify the selection of PwC as our Company's independent registered public accounting firm.

|

First American Financial Corporation 2024 Proxy Statement | 11

II. Required Information |

Security Ownership of Management

The following table sets forth the total number of our shares of common stock beneficially owned and the percentage of the outstanding shares so owned as of the record date by:

Unless otherwise indicated in the notes following the table, the stockholders listed in the table are the beneficial owners of the listed shares with sole voting and investment power (or, in the case of individual stockholders, shared power with such individual’s spouse) over the shares listed. Shares subject to rights exercisable within 60 days after the record date are treated as outstanding when determining the amount and percentage beneficially owned. None of the directors or officers included in the table below have the right to acquire any shares within 60 days of the record date.

Stockholders | Number of | Percent | ||||

Directors |

|

|

|

|

|

|

Kenneth D. DeGiorgio |

| 219,558 |

|

| — |

|

James L. Doti |

| 68,842 |

|

| — |

|

Dennis J. Gilmore |

| 593,755 |

|

| — |

|

Reginald H. Gilyard |

| 16,286 |

|

| — |

|

Parker S. Kennedy |

| 2,653,094 | (1) |

| 2.6% |

|

Margaret M. McCarthy |

| 23,238 |

|

| — |

|

Michael D. McKee |

| 48,342 |

|

| — |

|

Mark C. Oman |

| 45,673 |

|

| — |

|

Marsha A. Spence |

| — |

|

| — |

|

Martha B. Wyrsch |

| 13,385 |

|

| — |

|

Named executive officers who are not directors |

|

|

|

|

|

|

Mark E. Seaton |

| 133,100 |

|

| — |

|

Lisa W. Cornehl |

| 6,897 |

|

| — |

|

Matthew F. Wajner |

| 23,743 |

|

| — |

|

Steven A. Adams |

| 2,449 |

|

| — |

|

All directors, named executive officers and other executive officers as a group (14 persons) |

| 3,848,362 |

|

| 3.7% |

|

First American Financial Corporation 2024 Proxy Statement | 12

| II. Required Information |

|

|

Board and Committee Meetings

Our Board held twelve meetings during 2023. No incumbent director attended less than 75% of the aggregate of all meetings of the Board and the committees (if any) on which the director served. From time to time, our Board and its committees may act by unanimous written consent as permitted by the laws of the State of Delaware. Our Board’s standing committees include an audit, compensation, nominating and corporate governance and executive committee. The roles and responsibilities of the audit, compensation and nominating and corporate governance committee are set forth below. The executive committee may meet from time to time in between Board meetings and may exercise the authority of the Board. The following table reflects the composition of each of the standing committees as of the date of this proxy statement.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Executive Committee | ||||||||

Number of Meetings in 2023 | 6 |

|

| 5 |

|

| 3 |

|

| 0 | ||

Independent Directors |

|

|

|

|

|

|

|

|

|

| ||

Dr. James L. Doti | O |

|

|

|

|

|

|

|

|

|

| |

Reginald H. Gilyard |

|

|

|

|

|

|

|

|

|

|

|

|

Parker S. Kennedy |

|

|

|

|

|

|

|

|

|

| ||

Margaret M. McCarthy |

|

|

|

|

|

|

|

|

|

|

|

|

Michael D. McKee |

|

|

|

|

|

|

|

|

|

|

|

|

Mark C. Oman |

|

|

|

|

|

|

|

|

|

|

|

|

Martha B. Wyrsch |

|

|

|

|

|

|

|

|

|

|

|

|

Inside Directors |

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth D. DeGiorgio |

|

|

|

|

|

|

|

|

|

|

|

|

Dennis J. Gilmore |

|

|

|

|

|

|

|

|

|

| ||

Marsha A. Spence |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Audit Committee

The functions performed by the Audit Committee include:

First American Financial Corporation 2024 Proxy Statement | 13

| II. Required Information |

|

|

The Audit Committee’s charter is posted in the corporate governance section of our website at www.firstam.com. Our Board has determined that Messrs. Doti and Oman are audit committee financial experts and Ms. Wyrsch is financially literate within the meaning of the SEC’s rules and regulations.

Compensation Committee

The Compensation Committee establishes compensation rates and procedures with respect to our executive officers, including the determination of their annual bonus awards, monitors our equity compensation plans, assesses risk with respect to our compensation programs and makes recommendations to the Board regarding director compensation. The Compensation Committee’s charter is posted in the corporate governance section of our website at www.firstam.com.

Additional information concerning the Compensation Committee’s processes and procedures surrounding non-employee director compensation is included in the section entitled “Director Compensation,” which begins on page 68. Additional information concerning the executive compensation policies and objectives established by the Compensation Committee, the Compensation Committee’s processes and procedures for consideration and determination of executive compensation, and the role of executive officers and the Compensation Committee’s compensation consultant in determining executive compensation is included in the section entitled “Compensation Discussion and Analysis,” which begins on page 21, under the subsection entitled “Compensation Decision Process,” which begins on page 34.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become directors of our Company; recommending to the Board nominees for directorships to be filled by the Board or by the stockholders; developing, recommending to the Board and periodically reviewing the corporate governance principles applicable to our Company; overseeing our Company’s succession plan for the chief executive officer and the succession planning process for other key employees; and overseeing sustainability matters material to our Company’s business. This committee’s charter is posted in the corporate governance section of our website at www.firstam.com. The committee’s charter outlines the procedures by which certain stockholders of our Company may recommend director nominees to the Board. In particular, the committee will accept and consider, in its discretion, director recommendations from any stockholder holding in excess of five percent of our Company’s outstanding shares of common stock. Such recommendations must include the name and credentials of the recommended nominee, along with all other information required under our Bylaws, and should be timely submitted to the secretary of our Company at 1 First American Way, Santa Ana, California 92707. The committee will evaluate director candidates recommended by stockholders for election to our Board in the same manner and using the same criteria as used for any other director candidate (as described below). If the committee determines that a stockholder-recommended candidate is suitable for membership on our Board, it will include the candidate in the pool of candidates to be considered for nomination upon the occurrence of the next vacancy on our Board or in connection with the next annual meeting of stockholders.

Our Bylaws also provide for proxy-access, which is described in the section “Stockholder Proposals, Director Nominations and Proxy Access” on page 72. In 2022, in response to stockholder feedback, we amended our Bylaws to implement majority voting in uncontested elections of directors. In contested elections, where the number of nominees exceeds the number of directors to be elected, plurality voting will continue to apply. Our Bylaws also require that any director who does not receive a majority of the votes cast will promptly tender his or her resignation for consideration by the Nominating and Corporate Governance Committee and the Board.

First American Financial Corporation 2024 Proxy Statement | 14

| II. Required Information |

|

|

As stated in the corporate governance guidelines, the committee takes into account all factors it considers appropriate in identifying and evaluating candidates for membership on the Board, including some or all of the following: strength of character, an inquiring and independent mind, practical wisdom, mature judgment, career specialization, relevant technical skills, reputation in the community, diversity and the extent to which the candidate would fill a present need on the Board. This committee makes recommendations to the full Board as to whether or not incumbent directors should stand for re-election. However, if our Company is legally required by contract or otherwise to provide third parties with the ability to nominate directors, the selection and nomination of such directors generally is not subject to the committee process for identifying and evaluating nominees for director. The committee conducts all necessary and appropriate inquiries into the background and qualifications of possible candidates and may engage a search firm to assist in identifying and evaluating potential candidates for nomination.

Our corporate governance guidelines set forth a policy for the consideration of diversity in identifying nominees for director. The policy recognizes the benefits associated with a diverse board and, as indicated above, requires that the Nominating and Corporate Governance Committee consider diversity as a factor when identifying and evaluating candidates for membership on the Board. The policy utilizes a broad conception of diversity, including professional and educational background, prior experience on other boards, political and social perspectives, as well as race, national origin, gender and sexual orientation. The Nominating and Corporate Governance Committee assessed the effectiveness of the Board diversity policy by considering, among other factors, self-assessed director skills and experience; the race, national origin, gender and sexual orientation of Board members; and the practices of the Board and the committee when identifying and evaluating candidates for membership on the Board.

Utilizing the factors and in recognition of the legal requirements described above, the committee makes recommendations, as it deems appropriate, regarding the composition and size of the Board. The priorities and emphasis of the committee and of the Board may change from time to time to take into account changes in business and other trends and the portfolio of skills and experience of current and prospective Board members.

Our corporate governance guidelines also contain a mandatory retirement policy, which provides that no person is eligible for election as a director if on January 1 of the year of the election he or she is age 77 or older. The Board has not granted any waivers or exemptions to this policy.

Independence of Directors

The Board has affirmatively determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, as well as each other member of the Board, except Kenneth D. DeGiorgio, Dennis J. Gilmore and Marsha A. Spence, is “independent” as that term is defined in the corporate governance rules of the New York Stock Exchange for listed companies and in accordance with our Company’s corporate governance guidelines. In addition, each member of the Audit Committee and the Compensation Committee is independent under the additional standards applicable to the respective committee under the Securities Exchange Act of 1934, as amended, and the New York Stock Exchange listing standards. In making these determinations, the Board considered the following relationships between directors and our Company: Messrs. Gilyard and McKee are affiliated with entities that do business with, or that represent clients that do business with, us in the ordinary course from time to time (and the amounts involved in each case are significantly less than 2% of such entity’s consolidated gross revenues); each of Messrs. Doti and Kennedy is or recently was affiliated with one or more nonprofit organizations to which our Company and/or our management has made donations from time to time (and the amounts in each case are significantly less than $1 million and 2% of the nonprofit organization’s consolidated gross revenues); and Mr. Kennedy receives standard board fees for his service as a director of our Company’s trust subsidiary, as further described in the section entitled “Director Compensation,” which begins on page 68. Each of the relationships above, while considered by the Board, falls within our categorical independence standards contained in the Board’s corporate governance guidelines, which are available on the corporate governance section of our website at www.firstam.com. The Board also considered the following relationships between Mr. Kennedy and our Company: he was employed as our executive chairman until his retirement in February 2012; for serving

First American Financial Corporation 2024 Proxy Statement | 15

| II. Required Information |

|

|

as chairman of the Board until February 9, 2022 and as lead independent director of the Board since then, he receives Company-provided office space, mobile devices, computer, other office equipment and administrative support as set forth in the section entitled “Director Compensation,” which begins on page 68; and his son is employed by a subsidiary of our Company as further described in the section entitled “Transactions and Litigation with Management and Others” on page 18.

Board Leadership Structure; Meetings of Non-Management and Independent Directors

Our Board believes it is important to select our Company’s chairman and our Company’s chief executive officer in the manner it considers in the best interests of our Company at any given point in time. Accordingly, the chairman and chief executive officer positions may be filled by one individual or by two different individuals. Our Board has determined at this time that it is appropriate to separate the roles of chairman and chief executive officer and these positions are currently held by different individuals, Mr. Gilmore and Mr. DeGiorgio, respectively.

In addition to a chairman, we also have a lead independent director, Mr. Kennedy. The lead director is responsible for chairing and coordinating the agenda for the executive sessions of non-management and independent directors. In 2023, the non-management directors met four times in executive session and the independent directors met one time in executive session. In addition, the lead director may provide advice to the chairman with respect to the following: (i) establishing an appropriate schedule for Board meetings; (ii) preparing agendas for the meetings of the Board and its committees; (iii) the retention of consultants who report directly to the Board; (iv) the Nominating and Corporate Governance Committee’s oversight and implementation of our corporate governance policies; and (v) the Compensation Committee’s oversight of the implementation of and compliance with our Company’s policies and procedures for evaluating and undertaking executive and incentive-based compensation.

Our Board believes this to be the most effective leadership structure for our Company because it effectively allocates authority, responsibility, and oversight between management, the chairman of the Board and the lead director and capitalizes on the experience and strengths of our current management team. It does this by giving primary responsibility for the operational leadership and strategic direction of our Company to our chief executive officer, enabling the lead director to facilitate our Board’s independent oversight of management and consideration of key governance matters, and allowing our chairman to promote communication between management and our Board. The Board believes that its programs for overseeing risk, as described under the Risk Oversight section below, would be effective under a variety of leadership frameworks. Accordingly, the Board’s risk oversight function did not significantly impact its selection of the current leadership structure.

Annual Performance Evaluation

The Board and each of its committees conduct an annual self-evaluation to determine whether the Board and its committees are functioning effectively. In connection with this annual evaluation, directors are given an opportunity to evaluate the effectiveness of each other and to evaluate their own personal effectiveness. The results of the evaluation are reported to the Board and each committee.

Risk Oversight

The Board’s responsibilities in overseeing our Company’s management and business to maximize long-term stockholder value include oversight of our Company’s key risks and management’s processes and controls to manage those risks appropriately. Management, in turn, is responsible for the day-to-day management of risk and implementation of appropriate risk management controls and procedures.

First American Financial Corporation 2024 Proxy Statement | 16

| II. Required Information |

|

|

Although risk oversight permeates many elements of the work of the full Board and the committees, the Audit Committee has the most direct and systematic responsibility for overseeing risk management and has been designated by the Board as its risk oversight committee. To that end, the Audit Committee charter provides for a variety of regular and recurring responsibilities relating to risk, including:

In performing these functions, the committee regularly receives reports from management and internal and external auditors regarding our Company’s:

Separately, the Compensation Committee oversees our Company’s compensation policies and practices and has assessed whether our Company’s compensation policies encourage excessive risk taking. The Compensation Committee has concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on our Company. In arriving at that conclusion, the Compensation Committee considered, among other factors, our Company’s review and approval processes surrounding certain compensatory arrangements; the metrics used to determine variable compensation, including the performance measures selected by the Compensation Committee and performance ranges associated with the metrics; the Compensation Committee’s oversight of inclusion or exclusion of extraordinary items in the financial results upon which certain compensatory arrangements are based; the inclusion of overall Company performance in the determination of divisional leader compensation; the portion of variable compensation paid in restricted stock units ("RSUs"), which generally vest over three to four years; the extent to which qualitative judgments are involved in the compensatory arrangements; the amount of compensation paid as sales commissions, management’s review of such compensation paid and the localized nature of the commission payments; controls, such as underwriting and approval controls; and the extent to which compensatory arrangements can be changed if circumstances evidence increased risk associated with such arrangements.

First American Financial Corporation 2024 Proxy Statement | 17

| II. Required Information |

|

|

Director Attendance at Annual Meetings

Our directors are expected to attend the annual meetings of our stockholders. At last year’s annual meeting, each of our Company’s directors attended the virtual meeting.

Stockholder and Interested Party Communications with Directors

Stockholders and other interested parties may communicate directly with members of the Board, including the chairman, lead director or any of the other non-management directors of our Company (individually or as a group), by writing to such director(s) at our Company’s principal executive offices, 1 First American Way, Santa Ana, California 92707. In general, stockholder communications delivered to our Company for forwarding to Board members about bona fide issues and concerning our Company related to the duties and responsibilities of the Board will be forwarded in accordance with the stockholder’s instructions. Directors receiving such communications will respond as such directors deem appropriate, including the possibility of referring the matter to management of our Company, to our Company’s internal audit department, to the full Board or to an appropriate committee of the Board.

The Audit Committee has established procedures to receive, retain and address complaints regarding accounting, internal accounting controls or auditing matters, and for the submission by our employees of concerns regarding questionable accounting or auditing matters. Our 24-hour, toll-free hotline is available for the submission of such concerns or complaints at 1-866-921-6714. To the extent required by applicable law, individuals wishing to remain anonymous or to otherwise express their concerns or complaints confidentially are permitted to do so.

Transactions and Litigation with Management and Others

The Board has adopted a written policy regarding related party transactions, which generally requires the Nominating and Corporate Governance Committee’s review and approval of transactions involving amounts in excess of $120,000 between our Company and/or our affiliates, on the one hand, and, on the other hand, any of our Company’s directors, director-nominees, executive officers, stockholders beneficially owning in excess of 5% of our Company’s common stock or any of their immediate family members that have a direct or indirect material interest in the transaction. If the proposed transaction involves $1,000,000 or less, then the chair of the Nominating and Corporate Governance Committee may approve the transaction.

Certain transactions, including compensatory arrangements reported in this proxy statement for executive officers and directors of our Company, are deemed to be pre-approved by the Nominating and Corporate Governance Committee under the terms of the policy. In cases where the potential transaction would involve the executive officer, director, large stockholder or any of their immediate family members only in an indirect fashion, the policy does not apply where such indirect interest results solely from ownership of less than 10% of, or being a director of, the entity entering into the transaction with our Company.

Mr. Kennedy’s son is employed by a subsidiary of our Company as a managing director, agency division. His base salary in 2023 was $225,000, his cash bonus for 2023 (paid in 2024) was $290,200 and the dollar value of restricted stock units granted to him in 2023 (in connection with 2022 performance) was $218,500. He received standard employee benefits and participated in the standard, performance-based incentive compensation program available to similarly-situated employees of his level and experience.

Mr. Gilmore’s daughter is employed by a subsidiary of our Company as a vice president, division area manager. Her base salary in 2023 was $130,000 and her cash bonus for 2023 (paid in 2024) was $30,600. In addition, she received standard employee benefits and participated in the standard, performance-based incentive compensation program available to similarly-situated employees of her level and experience.

Ms. Spence served as the chairman of Mother Lode Holding Co. (“MLHC”), a subsidiary of our Company that was acquired on May 2, 2022, until her retirement in 2023. In connection with the acquisition, Ms.

First American Financial Corporation 2024 Proxy Statement | 18

| II. Required Information |

|

|

Spence entered into an employment agreement to continue as chairman of MLHC for one year after the closing of the acquisition. Ms. Spence was employed by our Company for a partial year of service in 2023 for which she was paid a prorated salary of approximately $63,700 and provided standard employee benefits available to similarly-situated employees. In addition, Ms. Spence was the beneficiary of a legacy Supplemental Executive Retirement Plan (“MLHC SERP”) and Deferred Compensation Plan (“MLHC DCP”) that MLHC offered prior to the acquisition by our Company. Although those plans were frozen at the time of the acquisition, our Company assumed the obligations under those plans that were then in place, including the obligations under Ms. Spence’s MLHC SERP contract and with respect to her DCP contributions. MLHC was also a lessee under seven lease agreements with respect to properties beneficially owned by a trust to which Ms. Spence and her husband are beneficiaries. Three of those lease arrangements terminated during 2023, with four remaining in place as of December 31, 2023. Our Company paid approximately $860,000 in rent payments under the leases during 2023. These leases were included in the acquisition and were determined by our Company’s corporate real estate team at the time to be at fair market value rates.

For information on transactions involving our Company and persons or groups of stockholders who are known to us to be the beneficial owners of more than 5% of our common stock, see the footnotes to the table in the section “Who are the largest principal stockholders outside of management?” on page 79.

Executive Officers

The following provides information regarding our Company’s current executive officers:

Name | Position(s) Held | Age |

Kenneth D. DeGiorgio | Chief Executive Officer | 52 |

Mark E. Seaton | Executive Vice President, Chief Financial Officer | 46 |

Lisa W. Cornehl | Senior Vice President, Chief Legal Officer, Secretary | 45 |

Matthew F. Wajner | Vice President, Treasurer | 48 |

Steven A. Adams | Vice President, Chief Accounting Officer | 54 |

All officers of our Company are appointed annually by the Board on the day of the annual meeting of stockholders.

First American Financial Corporation 2024 Proxy Statement | 19

| II. Required Information |

|

|

First American Financial Corporation 2024 Proxy Statement | 20

Executive Compensation |

|

Compensation Discussion and Analysis

CD&A Contents | Page | ||

| 21 |

| |

| 21 |

| |

| 22 |

| |

| 27 |

| |

| 32 |

| |

| 34 |

| |

| 35 |

| |

| 49 |

| |

Introduction

In this section, we describe our executive compensation program for our named executive officers (generally referred to in the Executive Compensation section of this proxy statement as our "executive officers"). Our Company’s executive officers for 2023 were:

Name | Principal Position | Tenure with Company (years) |

Kenneth D. DeGiorgio | Chief Executive Officer | 25 |

Mark E. Seaton | Executive Vice President, Chief Financial Officer | 18 |

Lisa W. Cornehl | Senior Vice President, Chief Legal Officer | 13 |

Matthew F. Wajner | Vice President, Treasurer | 14 |

Steven A. Adams | Vice President, Chief Accounting Officer | 4 |

Executive Summary

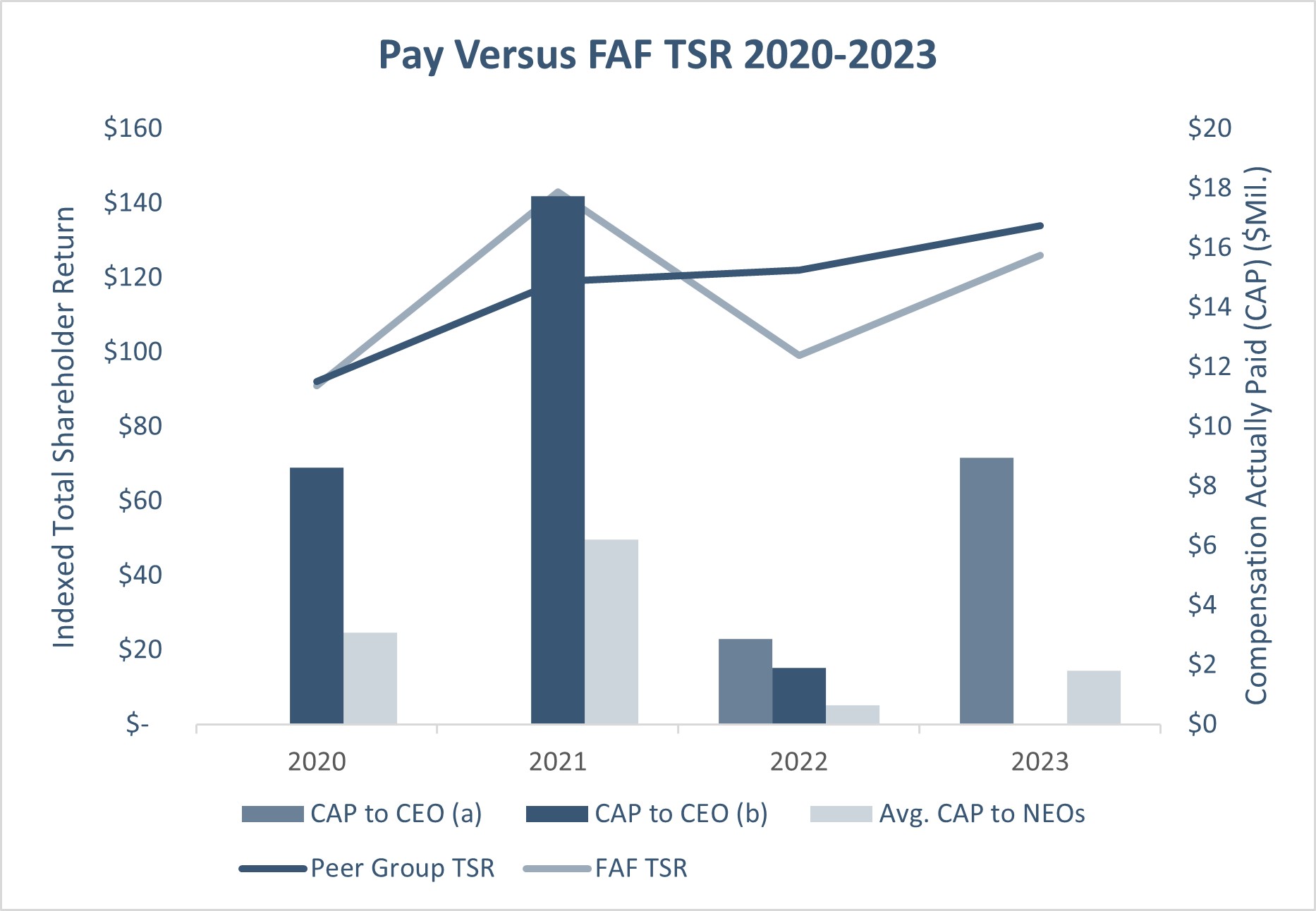

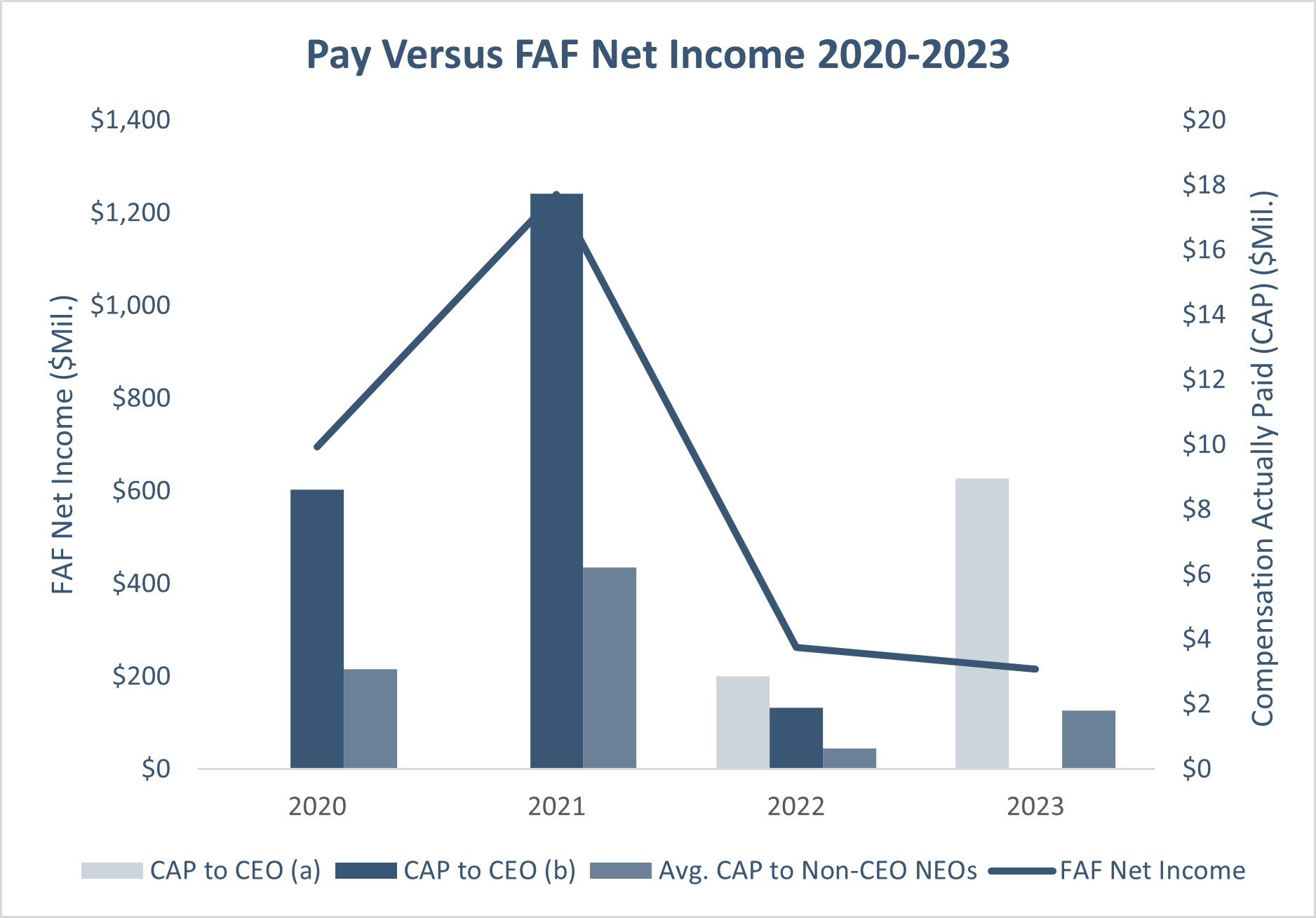

The Compensation Committee (referred to in the Executive Compensation section of this proxy statement as the "Committee") believes that the Company's management team performed at a high level in 2023 amidst historically difficult market conditions that resulted in the lowest level of existing home sales since the global financial crisis and sales volumes in the commercial market reverting to pandemic-low levels. This strong performance was exemplified by the management team's achievements in expense and risk management and management of the circumstances that arose from the cybersecurity incident the Company experienced in December 2023. In the face of these obstacles, the Committee believes management's effectiveness is reflected in the Company's sustained financial performance (despite the financial impact of the cybersecurity incident), which delivered a 27.6% |

|

|

total shareholder return, $6.0 billion in total revenue, and $494.0 million in pretax earnings for the year. It was also evidenced by their execution against strategic objectives, such as increasing the Company's domestic title insurance market share and continued investing in strategic initiatives that support the Company's long-term growth, to name a few.

With the Company maintaining high performance standards through difficult market conditions, executive compensation as a whole was down for the second consecutive year in 2023. Metric results for annual incentive compensation were at 60% of target for 2023 (subject to the Discretionary Adjustment, as described below) compared to a 77% payout for 2022. As further explained below, at management's

First American Financial Corporation 2024 Proxy Statement | 21

| Compensation Discussion and Analysis |

|

|

request, the Committee exercised its discretion to apply a Discretionary Adjustment that increased the 2023 payouts for three of our five executive officers to 72% of target, a level which the Committee determined to reflect these executive officers' performance before the adverse financial impact of the cybersecurity incident. Additionally at management's request, as part of the Company's broader expense management efforts, the Committee did not apply the Discretionary Adjustment to the payouts for our chief executive officer or chief financial officer, notwithstanding the Committee's positive view of their individual performance. The Committee believes that the overall compensation paid to management by our Company is commensurate with its performance and consistent with our Company's pay-for-performance philosophy.

The Committee has structured the Company's executive compensation program utilizing several key pay elements to create a strong alignment between the interests of executive officers and long-term stockholders. Based on the positive support the Company has received from stockholder outreach efforts and the results of last year’s Say on Pay proposal, in which approximately 95% of the Company’s shares present and entitled to vote on the proposal approved, on an advisory basis, 2022 executive compensation, the Committee maintained the program's overall structure for 2023. The Committee believes that this structure continues to represent a well-proportioned mix of stock-based compensation, retention value and at-risk compensation that produces desirable short-term and long-term performance incentives and rewards

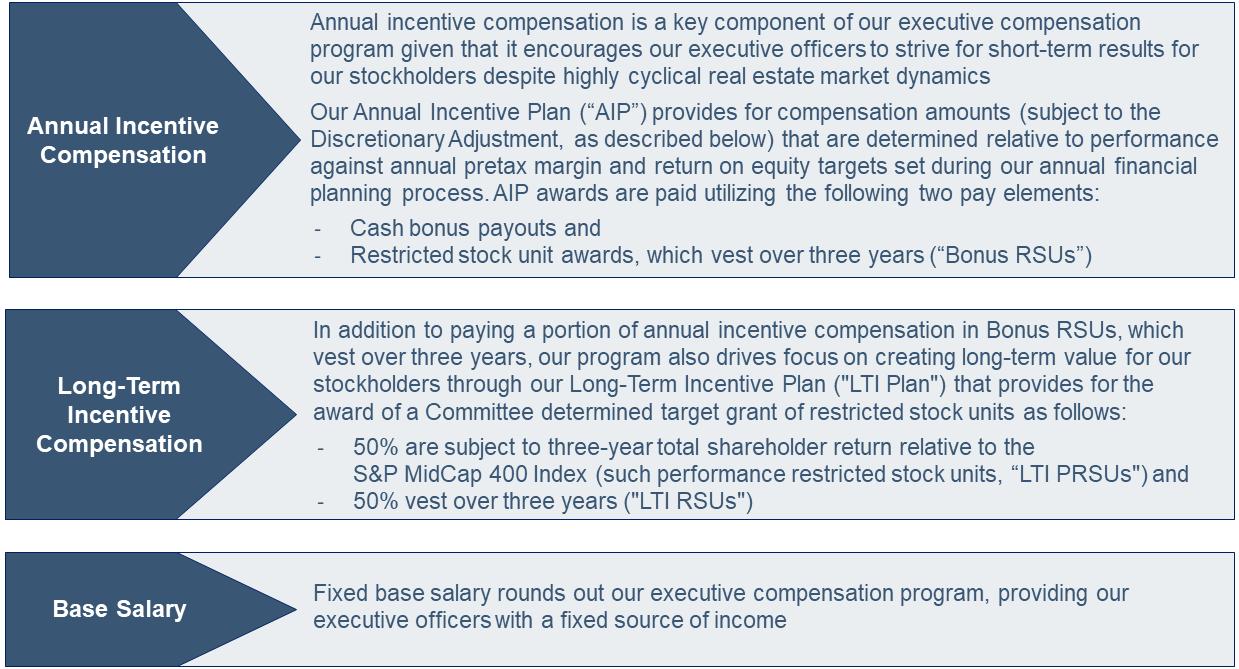

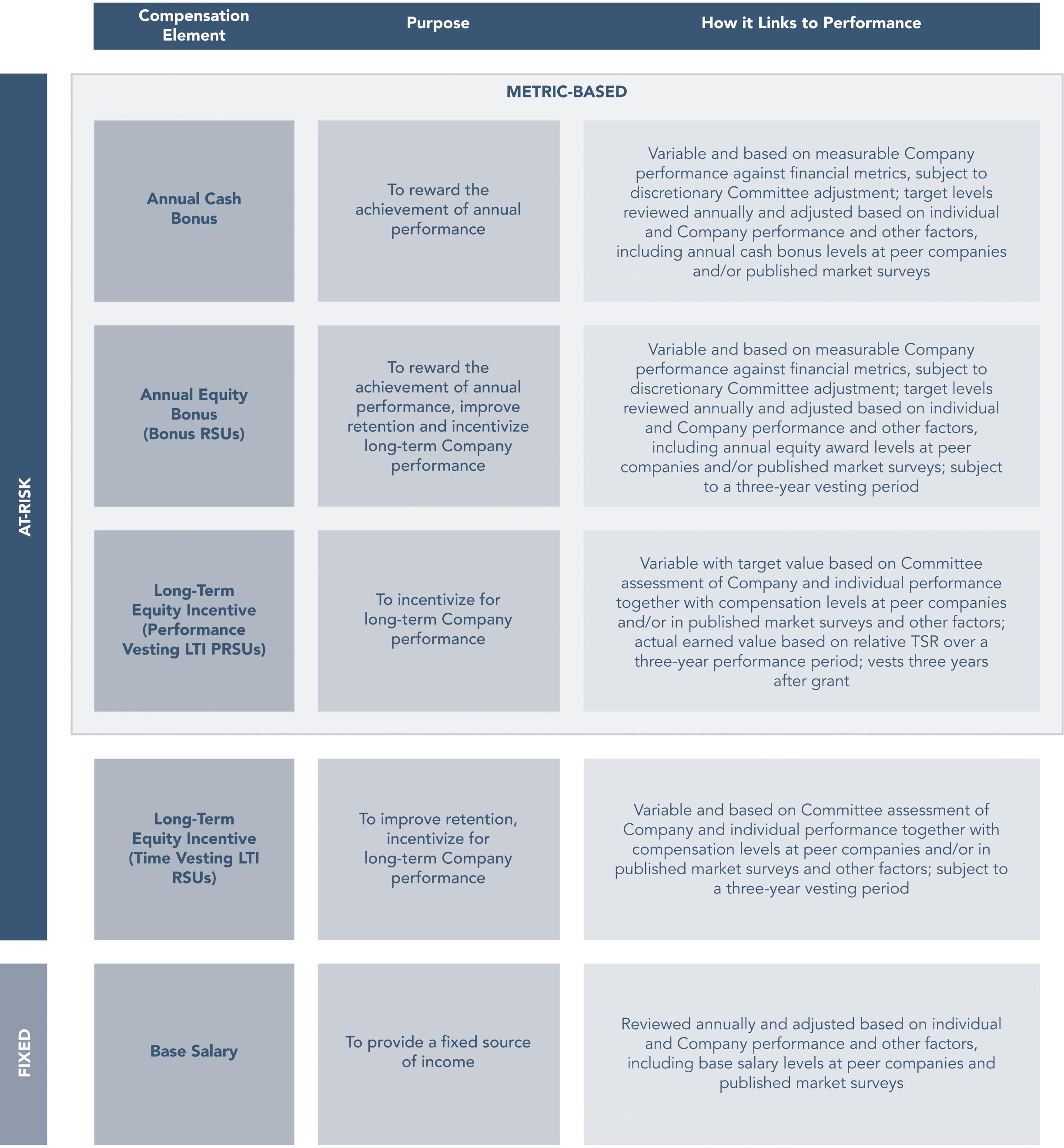

The key pay elements for our executive compensation program, which are further described in the "Pay Elements and Practices" section below, are as follows:

Performance Overview

Our Company's financial performance is largely realized through providing title insurance, settlement services and related products and services in support of real estate transactions. This links our performance to broader trends in the real estate market, which is highly cyclical. Fluctuations in interest rates, real estate inventory levels, real estate pricing and general economic conditions, among other factors, impact the real estate market and, therefore, demand for our products and services.

First American Financial Corporation 2024 Proxy Statement | 22

| Compensation Discussion and Analysis |

|

|

The downward phase of the real estate cycle that began early in 2022 continued into 2023, which saw high mortgage rates, rising prices and low inventory drive housing affordability to its lowest point in over three decades, resulting in the lowest level of existing home sales since the global financial crisis. The rapid increase in interest rates, while bolstering the Company's investment income, also drove a significant decrease in transaction volumes in the commercial real estate market. The Company was performing well in a challenging market ahead of the cybersecurity incident that occurred in December 2023. To address the incident, the Company elected to take its systems offline, which materially impacted the Company's operations and, consequently, our fourth quarter financial results. Amidst the challenges presented by these obstacles, the Committee believes the management team performed well in 2023, with their effectiveness being reflected in the Company's sustained financial performance (despite the financial impact of the cybersecurity incident) and execution against strategic objectives.

Execution on Company Strategy Our Company continued executing on our strategic goals this year against a difficult economic backdrop. The Company's accomplishments continue to validate our Company's strategy, including our efforts to digitally transform the process of transacting real estate, and vision to be the premier title insurance and services company. Highlights for 2023 include: |

|

Financial Results | • Maintained total revenues of over $6.0 billion, or $6.2 billion adjusted for net investment losses • Generated pretax earnings in the title insurance and services segment of $494.0 million, or $532.2 million adjusted for net investment losses, despite continuing market headwinds • Achieved an 8.6% pretax margin in the title insurance and services segment, or 9.2% adjusted for net investment losses • Delivered a return on equity of 4.5%, or 6.6% adjusted to exclude net gains/losses from the investment portfolio and net gains/losses from the venture investment portfolio • Generated earnings per share of $2.07, or $3.53 per share adjusted to exclude $1.46 per share of net investment losses • Increased investment income in the title insurance and services segment to $540.2 million, up 50.4% on a year-over-year basis • Home Warranty segment achieved a pretax margin of 13.0%, or 14.2% adjusted for net investment losses |

Execution on Strategic Objectives | • Profitably grew our domestic title insurance market share by 1.3% on a trailing twelve month basis as of the third quarter of 2023 • Significantly mitigated the impact of historically difficult market conditions, largely through disciplined expense management |

First American Financial Corporation 2024 Proxy Statement | 23

| Compensation Discussion and Analysis |

|

|

| efforts and continued growth in title insurance and services segment investment income • Launched new initiatives that improve the customer experience, make our business more efficient and mitigate risk • Maintained leadership in title data coverage in all data asset categories, including leveraging our proprietary data extraction technology to increase our title plant footprint to include over 1,800 counties • Continued investing in innovation, including in progress on our digital title and settlement effort and achieving significant advancements with our instant title decisioning initiative for purchase transactions • Successfully executed on compliance and risk management efforts, including effective management of underwriting risk, legal and regulatory compliance |

Environmental, Social and Governance ("ESG") Initiatives | • Named to the Fortune 100 Best Companies to Work For® list for the eighth consecutive year and Fortune Best Workplaces for Women® list for the eighth consecutive year • Named to People® Magazine's Companies that Care list for the third consecutive year • Awarded a score of 100 on the Human Rights Campaign Foundation's Corporate Equality Index (CEI), the nation's leading benchmarking survey measuring corporate policies and practices relating to LGBTQ+ equality, for the sixth consecutive year • Remained committed to our diversity, equity and inclusion strategy through our Company's Diversity, Equity and Inclusion (DEI) Council, which is focused on the development of employee-centered actions to enhance the recruitment, engagement, development, and retention of diverse employees, and the growing number of employee resource groups formed by the DEI Council • Published our 2022 annual sustainability report, which was aligned to Sustainability Accounting Standards Board (SASB) standards and which, among other highlights, indicates that our Company decreased our energy consumption by 15.0% year-over-year for our United States owned facilities |

Stockholder Outcomes | • Delivered a 27.6% total shareholder return in 2023, along with a 11.4% and 11.2% total shareholder return for the three- and five-year periods ending December 31, 2023, respectively, compared to the total shareholder return of the S&P MidCap 400 Index of 16.4%, 8.1%, and 12.6% for the one-, three-, and five-year periods, respectively • Raised the quarterly dividend by 1.9%, returning $216.6 million to stockholders through dividends in 2023 |

First American Financial Corporation 2024 Proxy Statement | 24

| Compensation Discussion and Analysis |

|

|

| • Returned $72.7 million to stockholders through the repurchase of 1.3 million shares at an average price of $55.18 |

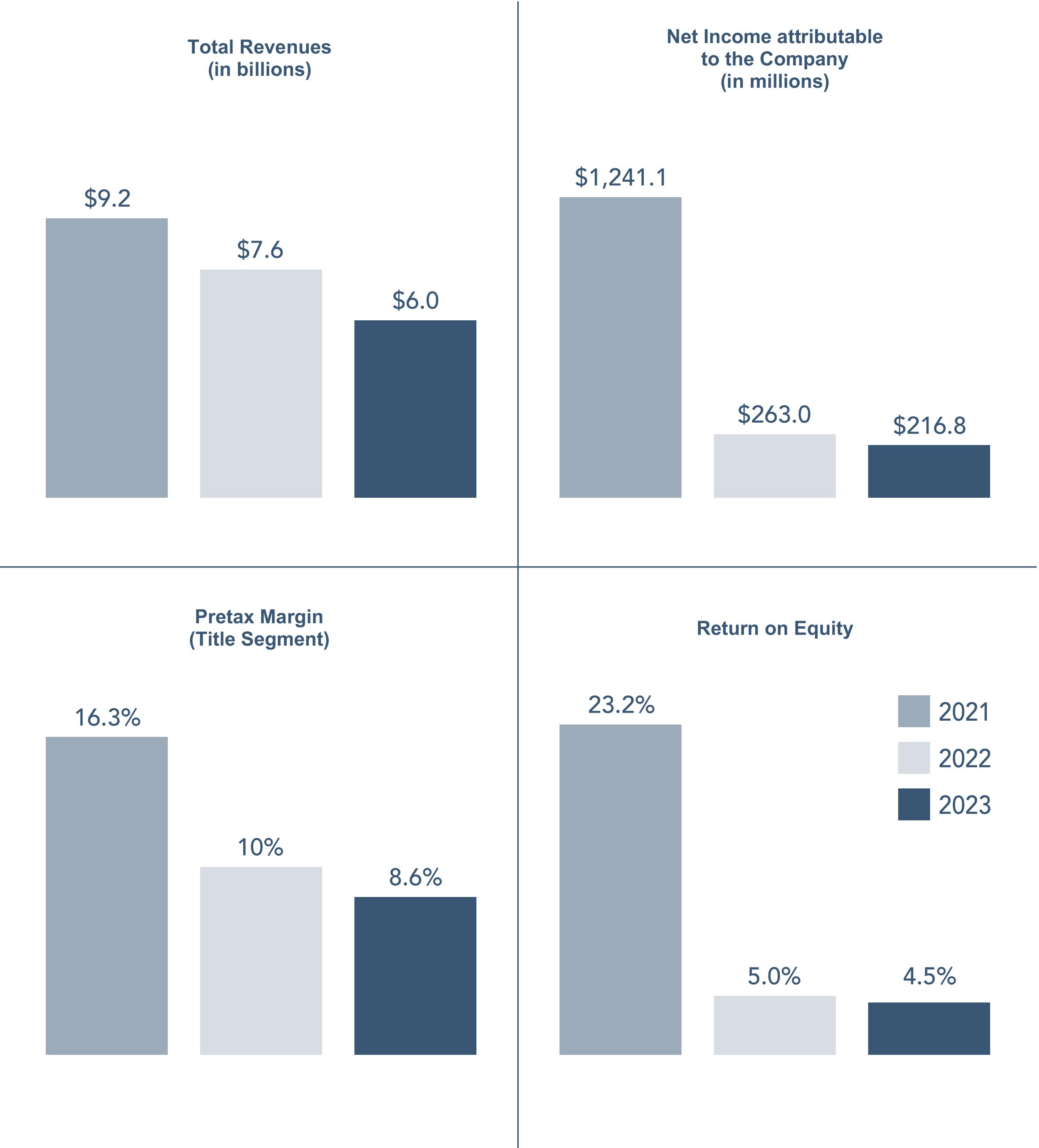

The charts below reflect certain GAAP financial results of the Company for the year, along with the two preceding years.

Total Revenues (in billions) $6.2 $7.1 $9.2 Net income attributable to the Company $707 $696 $1241 Pretax Margin (Title Segment) 16.1% 15.7% 16.3% Return on Equity 17.3% 14.9% 23.2% 2019 2020 2021

Note: The charts above reflect Company results under GAAP. The Committee makes certain non-GAAP adjustments in connection with its compensation programs, which are further described below.

2023 Performance Metric Results

First American Financial Corporation 2024 Proxy Statement | 25

| Compensation Discussion and Analysis |

|

|

The executive officer's AIP cash and equity bonuses paid out at 60% of target for Messrs. DeGiorgio and Seaton and at 72% of target for Ms. Cornehl and Messrs. Adams and Wajner for the year. These payout amounts reflect the results of the two financial metrics utilized by the Committee: return on equity and pretax margin. Target and actual results of these metrics for 2023, as modified by the Discretionary Adjustment, were as follows.

| Target | Actual 2023 Results | ||||||

Pretax Margin(1) | 10.0% | 7.7% | ||||||

Return on Equity(1) | 9.0% | 6.8% | ||||||

Performance Total |

| — |

|

|

| 60% |

|

|

Discretionary Adjustment |

| — |

|

|

| 12% (2) |

|

|

Total |

| 100% |

|

|

| 72% |

|

|

(1) The Committee’s definitions of pretax margin and return on equity are described on page 38 below. Actual results set forth above have been adjusted to exclude current year net investment gains/losses from the investment portfolio and certain current year net investment gains/losses from our Company’s venture investment portfolio. Return on equity also excludes accumulated other comprehensive income/loss and noncontrolling interests. These are non-GAAP financial measures. Please see Appendix A for the rationale behind the presentation of these measures and a reconciliation of these amounts to the nearest GAAP financial measures.

(2) For 2023, the Committee elected to make a Discretionary Adjustment increasing the payouts for Ms. Cornehl and Messrs. Adams and Wajner, with payout amounts remaining at metric levels for Messrs. DeGiorgio and Seaton.

The AIP gives the Committee discretion to adjust the metric-driven payout amounts by up to 30 percentage points to account for unanticipated external factors, performance against strategic initiatives designed to create long-term stockholder value, or ESG actions or initiatives (the "Discretionary Adjustment"), which factors and their application are further described in the Annual Incentive Compensation section beginning on page 37 below. For 2023, at management's request, the Committee elected to make a Discretionary Adjustment to increase the payouts for Ms. Cornehl and Messrs. Adams and Wajner by 12 percentage points from 60% to 72% of target, a level which the Committee determined to reflect the Company's and these executive officers' performance before the adverse financial impact of the cybersecurity incident. Additionally at management's request, as part of the Company's broader expense management efforts, the Committee did not apply the Discretionary Adjustment to the payouts for Messrs. DeGiorgio or Seaton, notwithstanding the Committee's positive view of their individual performance.

First American Financial Corporation 2024 Proxy Statement | 26

| Compensation Discussion and Analysis |

|

|

Pay Philosophy

Pay Objectives

Our Company’s executive compensation program, which is administered by the Committee, is designed to encourage achievement of strong short-term financial results in the face of cyclical and unpredictable real estate market dynamics, while maintaining focus on enhancing long-term stockholder value. This is accomplished by tying a meaningful portion of the executive officers' total compensation to our Company's annual consolidated financial performance, a portion of which is payable in the form of performance- and time-based equity that vests over three years, with a lesser portion being driven by qualitative assessments of the contribution of each individual executive officer. The Committee believes that there is value in consistency in our compensation program. As a result, while target performance metrics change from year to year as a reflection of the cyclicality in our business, and target pay levels are adjusted to reflect the market and individual performance and contributions, the general structure of the program typically remains consistent from year to year. From time to time, however, the Committee makes adjustments to the compensation program based on stockholder feedback, changes in market compensation practices or to better accomplish the Committee’s objectives.

Our Company’s approach is designed to develop and administer programs that will achieve the following objectives:

|

| |

OUR KEY COMPENSATION OBJECTIVES | ||

|

|

|

|

| |

• Motivate executive officers to deliver long-term stockholder value without taking excessive risk. • Encourage achievement of strong short-term results through cyclical real estate market dynamics. • Support the attraction, retention and motivation of a highly capable leadership team critical to creating long-term value for our stockholders. • Provide compensation levels that are competitive with significant competitors and other companies in our Company's peer group. | ||

Compensation Mix

The Committee utilizes the particular elements of compensation described below because it believes they represent a well-proportioned mix of stock-based compensation, retention value and at-risk compensation that result fundamentally in a pay-for-performance orientation that produces desirable short-term and long-term performance incentives and rewards. By following this portfolio approach, the Committee endeavors to provide our executive officers with a competitive and retentive pay level that includes a measure of security with respect to their minimum level of compensation, while also motivating each executive officer to focus on the business metrics that will produce a high level of shorter-term performance for our Company with corresponding increases in long-term stockholder value.

First American Financial Corporation 2024 Proxy Statement | 27

| Compensation Discussion and Analysis |

|

|

The following chart summarizes certain primary features of our executive compensation program's key pay elements:

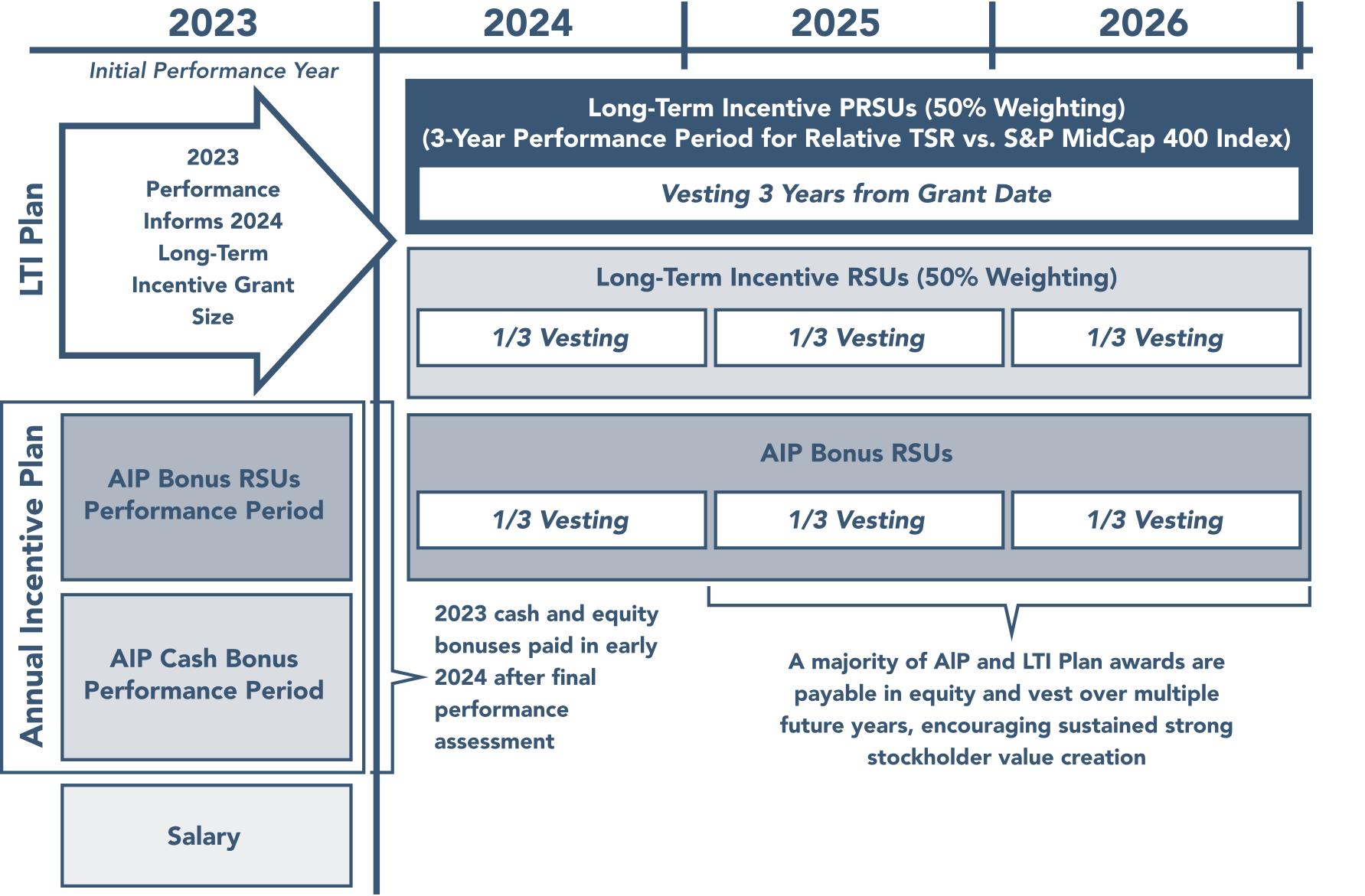

Note: Long-term incentive PRSU awards vest and become earned on the third anniversary of the grant date. Long-term incentive RSU and AIP Bonus RSU awards vest at a rate of 33 1/3% per year on each anniversary of the grant date. The equity awards granted to executive officers in 2024 in connection with 2023 performance were granted on February 22, 2024 pursuant to our Company’s policy of granting RSUs to executive officers on the second day on which the New York Stock Exchange is open for trading following the submission of the Annual Report on Form 10-K.

First American Financial Corporation 2024 Proxy Statement | 28

| Compensation Discussion and Analysis |

|

|

With this structure, our executive compensation program's mix of compensation is weighted heavily toward at-risk pay. In fact, approximately 88% of our CEO’s target pay is at risk (approximately 73%, on average, for our other executive officers). This is consistent with our overall philosophy of maintaining a pay mix that results fundamentally in a pay-for-performance orientation. The graphic below reflects the percentage of our executive officers’ 2023 target compensation that was fixed versus performance-based, as well as the percentage of performance metric-based RSUs versus strictly time-based RSUs. |

|

Target Compensation(1)

|

|

CEO Base Salary 11% LTI Awards 44% Target AIP Bonus RSUs 25% Target AIP Cash Bonus 20% Metric Based Equity as a Percentage of all RSUs 52% Average of Other NEOs Base Salary 20% LTI Awards 41% Target AIP Bonus RSUs 19% Target AIP Cash Bonus 20% Metric Based Equity as a Percentage of all RSUs

First American Financial Corporation 2024 Proxy Statement | 29

| Compensation Discussion and Analysis |

|

|

The following chart reflects the actual performance-based compensation and metric-based compensation percentages of the executive officers for 2023.

Actual Compensation

| Actual 2023 Compensation | |||||

| Performance-Based(1) | Metric-Based RSUs(2) | ||||

Named Executive Officer | (% of Total Compensation) | (% of Total RSUs Awarded) | ||||

DeGiorgio, K. |

| 86% |

|

| 63% |

|

Seaton, M. |

| 80% |

|

| 61% |

|

Cornehl, L. |

| 66% |

|

| 59% |

|

Wajner, M. |

| 53% |

|

| 61% |

|

Adams, S. |

| 49% |

|

| 63% |

|

(1) Includes actual AIP cash bonus and all RSUs awarded. The AIP cash bonus and all RSU awards were made in the subsequent year in connection with the prior year’s performance (i.e., awarded in 2024 in connection with 2023 performance).

(2) Metric-based RSUs include all Bonus RSUs granted for the specified year and all LTI PRSUs granted in connection with 2023 performance.

Say on Pay Results and Stockholder Outreach