Harrison, Vickers and Waterman Inc.

11231 U.S. Highway 1, #201

North Palm Beach, Florida 33408

May 2, 2016

| Mr. Jim Allegretto | VIA EDGAR |

| Senior Assistant Chief Accountant | CORRESPODENCE |

| Office of Consumer Products | |

| United States Securities and Exchange Commission | |

| 100 F Street, N.E. | |

| Washington, D.C. 20549 |

Re: Harrison, Vickers and Waterman Inc.

Form 10-K for the Fiscal Year Ended June 30, 2015

Filed September 15, 2015

Form 8-K

Filed April 27, 2015

Response Dated April 11, 2016

File No. 333-162072

Dear Mr. Allegretto:

This letter sets forth additional responses to our previously filed response dated April 11, 2016 for Harrison, Vickers and Waterman Inc. (“HVW” or the “Company”) to the Staff’s comment letter dated March 15, 2016. If the responses below as well as the audited financial statements to be submitted satisfactorily address the comments, we will move forward to include all previous responses as well as this response in the completion of Amendment 1 to the Form 10-K that was previously filed on September 15, 2015 as well as to complete Amendment 1 to the Form 8-K that was previously filed on April 27, 2015. In addition, we will soon thereafter where applicable file Amendment 1 to the Form 10-Q for the period ended September 30, 2015 that was filed on November 16, 2015 and where applicable file Amendment 1 to the Form 10-Q for the period ended December 31, 2015 that was filed on February 16, 2016.

Comment Letter Dated March 15, 2016

Form 10-K for the Fiscal Year Ended June 30, 2015

Note 1 – Organization and Operations, page F-7

2.We note your response to comment 3, specifically the third bullet, that the acquisition was accounted for as a reverse merger (recapitalization) with ABH deemed to the accounting acquirer and the Company deemed to be the legal acquirer. The accounting that should result from a “reverse” recapitalization is that ABH would be reported at its predecessor carrying value for all periods presented as if it were the reporting company and the Company’s book value would be treated as an equity transaction in the financial statements of ABH. HVW’s prior operations would not be presented. In addition, no goodwill would result from the transaction. It does not appear this was the accounting you employed. It appears you accounted for the acquisition of ABH as a “forward” acquisition and recorded it at fair value at the date the acquisition closed with results of ABH brought forward from that date. If our understanding is correct, based on your representation mentioned above, we do not concur with your accounting and presentation hence you should revise your statements to reflect the correct accounting for a reverse recapitalization in an amendment to your Form 10-K.

| 1 |

Response:

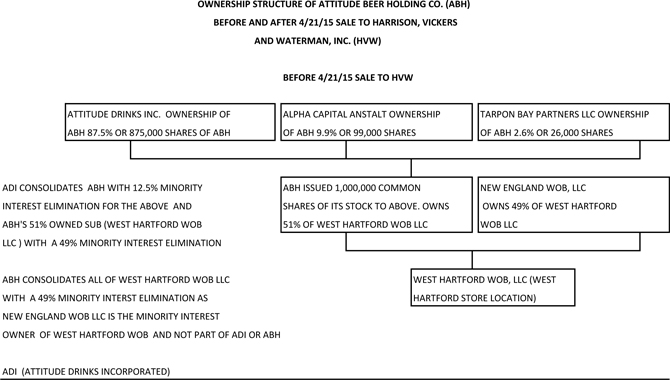

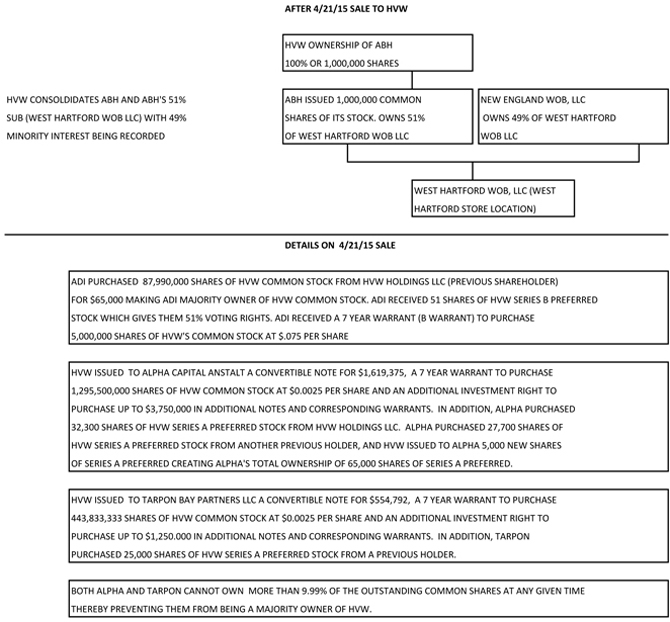

In reviewing the April 21, 2015 sale of ABH from ADI to HVW, please see the table below that defines the ownership of ABH before and after the April 21, 2015 sale date as well as the details of the purchase by HVW of ABH. Normally the acquisition would be accounted between ABH and HVW; however, in this case ADI (seller) still has control of ABH before and after the sale as the definition of acquirer and acquiree will be between ADI and HVW not ABH and HVW. As such, we will change our accounting treatment for this transaction as a reverse acquisition based on the findings described below.

This sale transaction is considered a business combination acquisition. Per ASC 805-10-55-11, the acquirer usually is the entity that transfers the cash or other assets or incurs the liabilities; however, no cash and or other assets were considered in this sale. Per ASC 805-10-55-12, in a business combination effected primarily by exchanging equity interests, the acquirer (HVW) usually is the entity that issues its equity interests. However, in some business combinations, commonly called reverse acquisitions, the issuing entity (HVW) is the acquiree. Per ASC 805-40-30-2 in a reverse acquisition, the accounting acquirer (ADI) usually issues no consideration for the acquiree which is applicable to this sale. Instead the accounting acquiree (HVW) usually issues its equity shares to the owners of the accounting acquirer (ADI), in this case HVW issued 51 shares of Series B Preferred Stock to ADI which gives ADI 51% voting rights of HVW. In addition per ASC 805-10-55-12 a, the relative voting rights in the combined entity after the business combination will determine the acquirer (ADI) as ADI through its ownership of the 51 shares of Series B Preferred Stock has the largest and majority voting rights in the combined entity. In addition at the sale date, ADI was the majority owner of the common stock of HVW. ASC 805-10-55-12 c further supports ADI as being the acquirer because it has the ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity.

As such, HVW will not recognize any goodwill, and ABH will be reported and consolidated into HVW at its 4/21/15 sales date carrying value since ABH is a 100% owned subsidiary of HVW at the 4/2/15 sale date. The Company will eliminate the recording of goodwill, and all expenditures associated with the financing will be recorded as deferred financing costs in the balance sheet and will be amortized over the life of the notes associated with this transaction. As such, here is a table showing the effects for the restated balance sheet and statement of operations that will be included in amendment 1 for the Form 10-K ending June 30, 2015.

| 2 |

| 3 |

| Restated | Previous | |||||||||||

| Balance | Balance | Changes | ||||||||||

| Balance Sheet | ||||||||||||

| Deferred financing costs | 1,007,565 | 67,889 | 939,676 | |||||||||

| Goodwill | - | 4,038,945 | (4,038,945 | ) | ||||||||

| Total Assets | 3,601,610 | 6,700,879 | (3,099,269 | ) | ||||||||

| Additional paid-in capital | 637,267 | 1,667,868 | (1,030,601 | ) | ||||||||

| Non-controlling interest (was previously reported as a liability under minority interest). Now it will be recorded near the stockholders' deficit section | 17,995 | 883,009 | (865,014 | ) | ||||||||

| Statement of Operations | ||||||||||||

| Depreciation and amortization | 131,598 | 31,935 | 99,663 | |||||||||

| Total operating expenses | 688,171 | 588,508 | 99,663 | |||||||||

| Loss before income tax and non-controlling interest | (2,512,777 | ) | (2,413,114 | ) | (99,663 | ) | ||||||

| Non -controlling interest | (34,827 | ) | 1,069,164 | (1,103,991 | ) | |||||||

| Net loss | (2,547,604 | ) | (1,343,950 | ) | (1,203,654 | ) | ||||||

3. We note your response to comment 3, specifically the fifth bullet where you provided the balance sheet of ABH. If you accounted for the acquisition as reverse merger (recapitalization), please explain how this presentation is compliant with the disclosure requirements of ASC 805-20-50-1 which addresses the disclosure requirements of the accounting acquirer (ABH) pertaining to the accounting acquire (HVW).

Response:

Please refer to the above footnote for further clarification which defines the acquirer and the acquiree. Since this transaction is defined as reverse acquisition and per ASC 805-20-50-1 c, the carrying value representing the assets acquired and liabilities assumed of ABH will be consolidated into the overall results of HVW. We will provide the audited 4/21/15 full set of financial statements for ABH in amendment 1 of Form 10-K for June 30, 2015 which also is the same set of financial statements that will be included in amendment 1 to the Form 8-K that was previously filed on April 27, 2015. See response 4 below for more information.

| 4 |

Form 8-K filed April 27, 2015

4 .Based on your responseto comment 5, it does not appear you intend to provide financial statements for ABH as required by Item 9.01(a) of Form 8-K. In accordance with the requirements, the financial statements of ABH were required no later than 71 calendar days after the 8-K was filed or July 13, 2015. As of such date, the required financials of ABH had not been filed and are considered delinquent. Assuming ABH is a smaller reporting company, the periods required are governed by Rule 8-04(b)of Regulation S-X and must include the two most recent fiscal years (audited) and any interim periods specified in Rule 8-03 of Regulation S-X. The subsequent filing of the June 30, 2015 balance sheets after the acquisition and after the 71 day requirement does not relieve you from having to comply with the stated initial requirement. Additionally we note your response did not address your intent with respect to providing an income statement, statements of cash flows or statement of stockholders’ equity, all of which are required by the above Item. With regards to the pro forma information required by Item 9.01(b) of Form 8-K, we note you intend to include June 30, 2015, historical balance sheets, including HVW that appear to already reflect the acquisition of ABH. The purpose of the pro forma financial information is to show how the acquisition of ABH would have affected the historical financials had it been consummated prior to its inclusion in the June 30, 2015 balance sheet. We also note your response did not address whether you will provide a pro forma income statement. Pro forma financial information is governed by Article 11 of Regulation S-X and should be in columnar form showing condensed historical statements, pro forma adjustments, pro forma results and accompanying explanatory notes. We believe the periods required are a pro forma balance sheet as of March 31, 2015 with adjustments showing the impact of the acquisition and the pro forma results and pro forma statements of income for the periods as required by Article 11-02(c). Please file the required Item 9.01 financial statements and pro forma information required as stated above.

Response:

Our independent auditing firm has completed its audit of the required financial statements for ABH as required by Item 9.01(a) of Form 8-K. We will include the audited Balance Sheet, State of Operations, Statement of Cash Flows and Statement of Stockholders’ Deficit for Attitude Beer Holding Co. which will serve as the required Pro-forma Financial Statements for the acquisition date of April 21, 2015 as amendment 1 to the April 27, 2015 Form 8-K as soon as your approval is received. Please note there are no prior year financial statements as Attitude Beer Holding Co. was formed in December 2014. No interim financials are required after April 21, 2015 as the next set of filed financials was for the audited fiscal year end results that ended June 30, 2015. The financial statements are as follows:

| 5 |

BALANCE SHEET FOR ATTITUDE

BEER HOLDING CO UNDER ADI OWNERSHIP

AT 4/21/15

| WEST | ATTITUDE | CONSOLIDATED | ||||||||||||||||||

| HARTFORD | BEER | ATTITUDE BEER | CONSOLIDATION | CONSOLIDATED | ||||||||||||||||

| WOB-ADI | HOLDING CO | HOLDING CO | ENTRIES | TOTALS | ||||||||||||||||

| ASSETS | ||||||||||||||||||||

| CURRENT ASSETS: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 183,562 | $ | 20,005 | $ | 203,567 | $ | - | $ | 203,567 | ||||||||||

| Inventories | 78,983 | - | 78,983 | - | 78,983 | |||||||||||||||

| TOTAL CURRENT ASSETS | 262,545 | 20,005 | 282,550 | - | 282,550 | |||||||||||||||

| FIXED ASSETS, NET | 986,421 | - | 986,421 | - | 986,421 | |||||||||||||||

| OTHER ASSETS: | ||||||||||||||||||||

| Capitalized assets, net | 202,314 | - | 202,314 | - | 202,314 | |||||||||||||||

| Investment in World of Beer West Hartford | - | 1,154,500 | 1,154,500 | (1,154,500 | ) | - | ||||||||||||||

| Deposits and other | 6,455 | - | 6,455 | - | 6,455 | |||||||||||||||

| TOTAL OTHER ASSETS | 208,769 | 1,154,500 | 1,363,269 | (1,154,500 | ) | 208,769 | ||||||||||||||

| TOTAL ASSETS | $ | 1,457,735 | $ | 1,174,505 | $ | 2,632,240 | $ | (1,154,500 | ) | $ | 1,477,740 | |||||||||

| LIABILITIES AND STOCKHOLDERS' (DEFICIT) | ||||||||||||||||||||

| CURRENT LIABILITIES: | ||||||||||||||||||||

| Accounts payable | $ | 82,238 | $ | - | $ | 82,238 | $ | - | $ | 82,238 | ||||||||||

| Accrued liabilities | 93,876 | 25,384 | 119,260 | - | 119,260 | |||||||||||||||

| Accrued employee salary | 40,982 | - | 40,982 | - | 40,982 | |||||||||||||||

| Sales tax payable | 12,874 | - | 12,874 | - | 12,874 | |||||||||||||||

| Loans payable to related parties | 50,182 | - | 50,182 | - | 50,182 | |||||||||||||||

| TOTAL CURRENT LIABILITIES | 280,152 | 25,384 | 305,536 | - | 305,536 | |||||||||||||||

| LONG-TERM LIABILITIES: | ||||||||||||||||||||

| Convertible notes payable | - | 1,204,500 | 1,204,500 | - | 1,204,500 | |||||||||||||||

| LONG-TERM LIABILITIES | - | 1,204,500 | 1,204,500 | - | 1,204,500 | |||||||||||||||

| STOCKHOLDERS' (DEFICIT): | ||||||||||||||||||||

| Common Stock, par vale $0.00001, 50,000,000 shares authorizedand 1,000,000 shares issued and outstanding at April 21, 2015 | - | 10 | 10 | - | 10 | |||||||||||||||

| Additional paid-in capital | - | 90 | 90 | - | 90 | |||||||||||||||

| New England Wolrd of Beer capital | (44,300 | ) | - | (44,300 | ) | 44,300 | - | |||||||||||||

| Attitude Beer Holding Co. capital | 1,154,500 | - | 1,154,500 | (1,154,500 | ) | - | ||||||||||||||

| Accumulated equity through 3/31/15 | 55,765 | (48,438 | ) | 7,327 | (27,332 | ) | (20,005 | ) | ||||||||||||

| Net income through 4/21/15 | 11,618 | (7,041 | ) | 4,577 | (5,336 | ) | (759 | ) | ||||||||||||

| TOTAL STOCKHOLDERS' (DEFICIT) | 1,177,583 | (55,379 | ) | 1,122,204 | (1,142,868 | ) | (20,664 | ) | ||||||||||||

| NON-CONTROLLING INTEREST | - | - | - | (11,632 | ) | (11,632 | ) | |||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' (DEFICIT) | $ | 1,457,735 | $ | 1,174,505 | $ | 2,632,240 | $ | (1,154,500 | ) | $ | 1,477,740 | |||||||||

| 6 |

ATTITUDE BEER HOLDING CO.

CONSOLIDATED STATEMENT OF OPERATIONS TO

DATE RESULTS FROM INCEPTION UNTIL APRIL 21, 2015

| West Hartford | Attitude Beer | Consolidation | Consolidated | |||||||||||||

| WOB | Holding Co. | Entries | Total | |||||||||||||

| REVENUES: | ||||||||||||||||

| Net revenues - World of Beer | $ | 942,148 | $ | - | $ | - | $ | 942,148 | ||||||||

| COSTS OF GOODS SOLD: | ||||||||||||||||

| Food and beverage costs - World of Beer | 265,544 | - | - | 265,544 | ||||||||||||

| GROSS PROFIT | 676,604 | - | - | 676,604 | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Professional fees | - | 30,000 | - | 30,000 | ||||||||||||

| Compensation | 431,352 | - | - | 431,352 | ||||||||||||

| Depreciation and amortization | 43,120 | - | - | 43,120 | ||||||||||||

| General and administrative expense | 129,874 | 95 | - | 129,969 | ||||||||||||

| Total Operating Expenses | 604,346 | 30,095 | - | 634,441 | ||||||||||||

| LOSS FROM OPERATIONS | 72,258 | (30,095 | ) | - | 42,163 | |||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||

| Interest and other financing costs | (4,875 | ) | (25,384 | ) | - | (30,259 | ) | |||||||||

| Total Other Income (Expense) | (4,875 | ) | (25,384 | ) | - | (30,259 | ) | |||||||||

| Income (Loss) Before Provision for Income Tax | 67,383 | (55,479 | ) | - | 11,904 | |||||||||||

| Non-controlling interest | - | - | (32,668 | ) | (32,668 | ) | ||||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| NET INCOME (LOSS) | $ | 67,383 | $ | (55,479 | ) | $ | (32,668 | ) | $ | (20,764 | ) | |||||

| 7 |

ATTITUDE BEER HOLDING CO.

CONSOLDIATED STATEMENT OF CASH FLOWS

| December | ||||

| 2015 to | ||||

| April 21, | ||||

| 2015 | ||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||

| Net (loss)/income | $ | (20,764 | ) | |

| Adjustment to reconcile net (loss)/income to net cash used in operating activities: | ||||

| Depreciation and amortization | 43,120 | |||

| Non -controlling interest | 32,668 | |||

| Changes in operating assets and liabilities: | ||||

| Inventories | (78,983 | ) | ||

| Deposits and other assets | (6,455 | ) | ||

| Accounts payable and accrued liabilities | 211,154 | |||

| Net cash provided/ in operating activities | 180,740 | |||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||

| Purchase of Property, Plant and Equipment and other capitalized costs | (1,231,855 | ) | ||

| Net cash (used) in investing activities | (1,231,855 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||

| Issuance of notes payable-investors | 1,204,500 | |||

| Amounts received from related party | 50,182 | |||

| Net cash provided by financing activities | 1,254,682 | |||

| NET (DECREASE) IN CASH AND CASH EQUIVALENTS | 203,567 | |||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | - | |||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 203,567 | ||

| 8 |

ATTITUDE BEER HOLDING CO.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' (DEFICIT)

DATE RESULTS FROM INCEPTION UNTIL APRIL 21, 2015

| Common Stock Par value $0.00001 | Total | |||||||||||||||||||

| Number of | Additional Paid- | Accumulated | Stockholders' | |||||||||||||||||

| Shares | $ Amount | In Capital | Deficit | (Deficit) | ||||||||||||||||

| Formation Date of December 1, 2014 | 1,000,000 | $ | 10 | $ | 90 | $ | - | $ | 100 | |||||||||||

| Net loss from inception through April 21, 2015 | - | - | - | (20,764 | ) | (20,764 | ) | |||||||||||||

| Stockholders' Deficit at April 21, 2015 | 1,000,000 | $ | 10 | $ | 90 | $ | (20,764 | ) | $ | (20,664 | ) | |||||||||

We also acknowledge that:

- The Company is responsible for the adequacy and accuracy of the disclosure in the filing;

- Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

- the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you should have any more questions or require any further information, please call the undersigned at 561-227-2727 or email me attommy@attitudedrinks.com.

Harrison, Vickers and Waterman Inc.

| By: | /s/ Tommy E. Kee | |

| Name: | Tommy E. Kee | |

| Title: | Chief Financial Officer and Principal Accounting Officer | |

| 9 |