Registration No. 333- 193746

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Nova LifeStyle, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Nevada (State or Other Jurisdiction of Incorporation or Organization) | | 90-0746568 (I.R.S. Employer Identification Number) |

6565 E. Washington Blvd.

Commerce, CA 90040

(323) 888-9999

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Thanh H. Lam

President

Nova LifeStyle, Inc.

6565 E. Washington Blvd.

Commerce, CA 90040

(323) 888-9999

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Thomas Wardell, Esq.

Jeffrey Li, Esq.

McKenna Long & Aldridge LLP

303 Peachtree Street, NE, Suite 5300

Atlanta, Georgia 30308

(404) 527-4000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

Title of Securities To Be Registered(1) | | Amount To Be Registered (1) | | | Proposed Maximum Offering Price Per Share (2) | | | Proposed Maximum Aggregate Offering Price (2) | | | Amount Of Registration Fee (3) | |

| Common Stock, $0.001 par value per share | | | | | | | | | | | | |

| Preferred Stock | | | | | | | | | | | | |

| Warrants | | | | | | | | | | | | |

| Units | | | | | | | | | | | | |

| TOTAL | | $ | 60,000,000 | | | | N/A | | | $ | 60,000,000 | | | $ | 7,728.00 | |

| (1) | We are registering under this Registration Statement such indeterminate number of shares of common stock and preferred stock, such indeterminate number of warrants to purchase common stock, and/or preferred stock, and such indeterminate number of units as may be sold by the registrant from time to time, which together shall have an aggregate initial offering price not to exceed $60,000,000. We may sell any securities we are registering under this Registration Statement separately or as units with the other securities we are registering under this Registration Statement. We will determine, from time to time, the proposed maximum offering price per unit in connection with our issuance of the securities we are registering under this Registration Statement. The securities we are registering under this Registration Statement also include such indeterminate number of shares of common stock and preferred stock as we may issue upon conversion of or exchange for preferred stock that provide for conversion or exchange, upon exercise of warrants or pursuant to the anti-dilution provisions of any of such securities. In addition, pursuant to Rule 416 under the Securities Act of 1933 (the “Securities Act”), the shares we are registering under this Registration Statement include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares we are registering as a result of stock splits, stock dividends or similar transactions. |

(2) | We will determine the proposed maximum aggregate offering price per class of security from time to time in connection with our issuance of the securities we are registering under this Registration Statement and we are not specifying such price as to each class of security pursuant to General Instruction II.D. of Form S-3 under the Securities Act. |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 20 , 2014

PRELIMINARY PROSPECTUS

Nova LifeStyle, Inc.

$60,000,000

Common Stock

Preferred Stock

Warrants

Units

We may offer from time to time shares of our common stock, par value $0.001 (“Common Stock”), preferred stock,, warrants and units that include any of these securities. The aggregate initial offering price of the securities sold under this prospectus will not exceed $60,000,000. We will offer the securities in amounts, at prices and on terms to be determined at the time of the offering.

Our Common Stock is quoted on The NASDAQ Stock Market LLC under the symbol “NVFY.” As of February 19, 2014, the aggregate market value of our outstanding Common Stock held by non-affiliates was approximately $53,436,641 based on 19,338,149 shares of outstanding Common Stock, of which 10,962,500 shares are held by affiliates, and a price of $6.38 per share, which was the last reported sale price of our Common Stock as quoted on The NASDAQ Stock Market LLC on that date. As of the date of this prospectus, we have not offered any securities during the past twelve months pursuant to General Instruction I.B.6 of Form S-3. You are urged to obtain current market quotations of our Common Stock.

Each time we sell securities hereunder, we will attach a supplement to this prospectus that contains specific information about the terms of the offering, including the price at which we are offering the securities to the public. The prospectus supplement may also add, update or change information contained or incorporated in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our securities.

The securities hereunder may be offered directly by us, through agents designated from time to time by us or to or through underwriters or dealers. If any agents, dealers or underwriters are involved in the sale of any securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the section entitled “About This Prospectus” for more information.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 2 of this prospectus. In addition, see “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2012, which has been filed with the Securities and Exchange Commission and is incorporated by reference into this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 20 , 2014.

| | Page |

| 6 |

| 6 |

| 10 |

| 11 |

| 11 |

| 11 |

| 12 |

| 13 |

| 13 |

| 15 |

| 15 |

| 16 |

| 17 |

| 17 |

| 18 |

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe any of these restrictions. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. This prospectus, together with applicable prospectus supplements, any information incorporated by reference, and any related free writing prospectuses we file with the Securities and Exchange Commission (the “SEC”), includes all material information relating to these offerings and securities. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus, including without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, that contained in this prospectus, including in any of the materials that we have incorporated by reference into this prospectus, any accompanying prospectus supplement, and any free writing prospectus prepared or authorized by us. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus supplement.

You should not assume that the information contained in this prospectus and any accompanying supplement to this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying supplement to this prospectus is delivered or securities are sold on a later date. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date hereof or that the information incorporated by reference herein is correct as of any time subsequent to the date of such information.

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may, from time to time, offer and sell any combination of the securities described in this prospectus in one or more offerings. The aggregate initial offering price of all securities sold under this prospectus will not exceed $60,000,000.

This prospectus provides certain general information about the securities that we may offer hereunder. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the offering and the offered securities. The prospectus supplement will contain the specific information about the terms of the offering. In each prospectus supplement, we will include the following information:

| | • | the number and type of securities that we propose to sell; |

| | • | the public offering price; |

| | • | the names of any underwriters, agents or dealers through or to which the securities will be sold; |

| | • | any compensation of those underwriters, agents or dealers; |

| | • | any additional risk factors applicable to the securities or our business and operations; and |

| | • | any other material information about the offering and sale of the securities. |

In addition, the prospectus supplement may also add, update or change the information contained or incorporated in this prospectus. The prospectus supplement will supersede this prospectus to the extent it contains information that is different from, or that conflicts with, the information contained or incorporated in this prospectus. You should read and consider all information contained in this prospectus and any accompanying prospectus supplement in making your investment decision. You should also read and consider the information contained in the documents identified under the heading “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” in this prospectus.

Unless the context otherwise requires, the terms “NVFY,” “the Company,” “we,” “us,” and “our” in this prospectus each refer to Nova LifeStyle, Inc., our subsidiaries, and our consolidated entities. “China” and the “PRC” refer to the People’s Republic of China.

Nova LifeStyle, Inc. is a broad based manufacturer of contemporary styled residential furniture incorporated into a dynamic marketing and sales platform offering retail as well as online selection and purchase fulfillment globally. We monitor popular trending and work to create design elements that are then integrated into our product lines that can be used as both stand alone as well as whole room and home furnishing solutions. Through our global network, Nova LifeStyle also sells (through an exclusive third party manufacturing partner) a managed variety of high quality bedding foundation components.

Nova’s LifeStyle brand family currently includes Diamond Sofa (www.diamondsofa.com), Colorful World, Giorgio Mobili, and, starting from April 2013, includes Bright Swallow International Group Limited (Bright Swallow).

Our customers principally consist of distributors and retailers having a specific geographic coverage that deploy middle to high end private label home furnishings having very little competitive overlap within our specific furnishing product or product lines. Nova LifeStyle is constantly seeking to integrate new sources of distribution and manufacturer that are properly aligned with our growth strategy thus allowing us to continually focus on building both same store sales growth as well as drive the expansion of our overall distribution and manufacturing relationships through a deployment of popular as well as trend based furnishing solutions worldwide.

Our acquisition of Bright Swallow International Group Limited, an established furniture company with a global client base was finalized on April 24, 2013 as that purchase becomes an integral part of the Nova LifeStyle brand family. Bright Swallow posted revenues of just over $13 million for FY 2012 and its complementary product line and geographical reach will offer Nova LifeStyle an ideal opportunity to expand its overall global market presence. Bright Swallow’s current client, Canadian based The Brick Limited (www.TheBrick.com) has over 200 locations and provides an excellent example of this exceptional integration opportunity. This new brand also provides Nova LifeStyle with an excellent opportunity to market to existing Bright Swallow partners and increase its sales accordingly. Bright Swallow is a British Virgin Island company with its principal offices relocated to Macao. On October 1, 2013, Bright Swallow moved to a new office in Hong Kong in order to expand the business in there. Nova LifeStyle Inc. has assumed primary management for the operation of Bright Swallow and under the terms all issued and outstanding shares of Bright Swallow have been transferred to Nova by Bright Swallow’s sole owner Mr. Zhu Wei. The purchase price was $6.5 million in cash and was fully paid at the closing of the acquisition.

Our experience developing and marketing products for international markets has enabled us to develop the scale, logistics, marketing, manufacturing efficiencies and design expertise that serves as the foundation for us to expand aggressively into the highly attractive U.S. and China markets.

Our Industry

Consumer demand for furniture in China has continued to grow in recent years, with consumption of furniture in China up 27% in 2012 from 2011, while furniture exports increased 28.7% from 2011, according to the National Bureau of Statistics of China (NBS). The expansion of the retail furniture market in China is due, in part, to the country’s rapid economic growth. According to the China National Furniture Association, domestic consumption will be the principal development driver of furniture production in China going forward. China’s real Gross Domestic Product, or GDP, growth rate was 7.8% in 2012, and has grown an average of 9.8% annually since 2006, according to the International Monetary Fund, or the IMF, “China Economic Outlook” from February 2012, or the IMF China Outlook. China’s GDP is expected to continue to grow at a rate of 8.2% in 2012 despite the recent slowdown in global markets, according to the IMF China Outlook. China has a large population, including a rapidly expanding middle class and young, urban consumer bases, that offers a large pool of potential consumers for our products. Economic growth in China has led to greater levels of personal disposable income and increased spending among China’s expanding middle class consumer base. Furthermore, the economic and social development in China has brought about greater urbanization, with urban residents exceeding 51% of the population in 2011 compared to approximately 36% of the population in 2000, according to the NBS. This urbanization trend and expanding middle class has promoted increased investment in commercial residential buildings and new housing starts in China, which increased 11.4% in 2012. As apartment and homeownership continues to rise in China, we believe that sales in the furniture industry will also improve.

In order to capture this residential furniture market opportunity for the middle and upper middle-income consumer in China, we have established distinct furniture brands designed specifically for the consumer preferences of the China market. We feature a wide selection of product categories and styles under our brands, each piece part of a collection bearing a distinctive style, design theme and selection of materials and finishes. We anticipate developing new collections semi-annually for each brand. Our sales to China, including sales to our franchise network and to wholesalers and agents for domestic retailers and distributors for the export market, were $17.15 million in 2012, a 66% increase over 2011, and accounted for 26% of sales in 2012 compared to 24% of sales in 2011. We expect that a significant portion of our sales will continue to come from sales to China. We intend to continue developing the China retail market aggressively, building awareness brand awareness by increasing our general marketing efforts as well as strategically expanding both our internet presence as well as our growing franchise store network. We believe that our brands and sales through our franchise store network in China will grow significantly as consumer demand for quality and stylish furniture increases in China in combination with increased living standards.

We sell products to the U.S. and international markets under the Diamond Sofa brand and as a trading company and vertically integrated manufacturer under ODM and OEM agreements for global furniture distributors and large national retailers. Worldwide GDP increased 3.8% in 2011, according to the IMF “World Economic Outlook Update” from January 2012, or the IMF World Outlook, and global furniture production reached an estimated $376 billion in 2011, according to the Centre for Industrial Studies, or the CSIL, “World Furniture Outlook 2012,” or CSIL World Outlook. The IMF anticipates further worldwide GDP growth of 3.3% in 2012, with much of the real growth expected in emerging economies. The markets in the U.S. and Europe remain challenging because they are experiencing a slower than anticipated recovery from the recent international financial crisis and the Euro-area crisis in particular. However, real growth in furniture demand in 2012 is forecasted to grow 3.3% in the world’s top 70 countries, according to the CSIL World Outlook. We believe that discretionary purchases of furniture by middle to upper middle-income consumers, our target global consumer market, will increase along with the expected growth in the worldwide furniture trade and recovery of housing markets. Furthermore, we believe that furniture featuring modern and contemporary styling such as ours will continue to be in greater demand.

In 2012, our products were sold in over 35 countries worldwide, with North America and Europe our principal international markets. Our sales to the U.S. and international markets were $49.1 million in 2012 and accounted for 74% of sales in 2012 compared to 76% of sales in 2011. We expect that a majority of our sales will continue to come from sales to customers outside of China, and in particular the North American and European markets. Sales to North America accounted for 45.9% and 44.3% of sales in 2012 and 2011, respectively, with the significant increase attributed principally to our expansion in the U.S. market and acquisition of the Diamond Sofa brand in 2011. Sales to Europe accounted for 22% and 25% of sales in 2012 and 2011, respectively, with the decrease attributed principally to the challenging Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. As we continue to expand our broad network of distributors, increase direct sales and enter emerging growth markets, we believe that we are well positioned to respond to changing market conditions, allowing us to take advantage of any upturns in the global and local economies of the markets we serve.

Our History

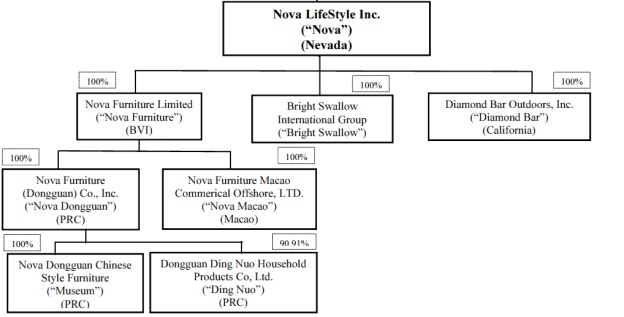

We are a U.S. holding company with no material assets other than the ownership interests of our subsidiaries through which we market, design, manufacture and sell residential furniture worldwide: Nova Furniture Limited (“Nova Furniture”), Bright Swallow, Nova Furniture (Dongguan) Co., Ltd. (“Nova Dongguan”), Nova Furniture Macao Commercial Offshore Limited (“Nova Macao”), Nova Dongguan Chinese Style Furniture Museum (“Nova Museum”), Diamond Bar Outdoors, Inc. (“Diamond Bar”), and Dongguan Ding Nuo Household Products Co., Ltd. (“Ding Nuo”). Nova Dongguan is a wholly foreign-owned enterprise, or WFOE, and was incorporated under the laws of the PRC on June 6, 2003. Nova Macao was organized under the laws of Macao on May 20, 2006. Nova Dongguan and Nova Macao are wholly owned subsidiaries of Nova Furniture, our wholly owned subsidiary organized under the laws of the British Virgin Islands, or the BVI. Nova Dongguan organized Nova Museum on March 17, 2011, as a non-profit organization under the laws of the PRC engaged in the promotion of the culture and history of furniture in China. Diamond Bar, doing business as Diamond Sofa, was incorporated in California on June 15, 2000. Nova Dongguan markets and sells our products in China to stores in our franchise network and to wholesalers and agents for domestic retailers and exporters. Nova Dongguan also provides the design expertise and facilities to manufacture our branded products and products for international markets under original design manufacturer and original equipment manufacturer agreements, or ODM and OEM agreements. Nova Macao is a trading company, importing, marketing and selling products designed and manufactured by Nova Dongguan and third party manufacturers for the U.S. and international markets. As of January, 2013 Nova Macao manages all aspects of Nova Dongguan’s export market. Diamond Bar markets and sells products manufactured by us and third party manufacturers under the Diamond Sofa brand to distributors and retailers principally in the U.S. market. To service our Ikea relationship, in order to meet certain customer service and other requirements of Ikea different from those of other customers of ours, we formed Ding Nuo as a new subsidiary in 2013, which is held 90.91% by Nova Furniture and 9.09% by Mr. Gu Xingchang, a longtime employee of ours who is a Chinese citizen with direct responsibilities for the Ikea relationship, in order to satisfy certain local regulatory requirements and to expedite the registration process of the new company in China. Nova Furniture contributed RMB 1,000,000 (approximately $ 166,667) of registered capital to Ding Nuo and owns 90.91% of the equity of Ding Nuo. Mr. Gu contributed RMB 100,000 (approximately $16,667) to Ding Nuo, which he obtained through a loan from Nova Furniture, and owns 9.09% of the equity of Ding Nuo. Mr. Gu’s share was put in escrow and trust with Nova Furniture. Therefore, Nova Furniture effective controls 100% of Ding Nuo. All profits of Ding Nuo will be distributed to Nova Furniture. On December 5, 2013, the local State Administration of Commerce and Industry issued new business license for Ding Nuo.

We were incorporated in the State of Nevada on September 9, 2009, under the name Stevens Resources, Inc., as an exploration stage company with no revenues and no operations engaged in the search for mineral deposits or reserves.

Effective as of June 27, 2011, in anticipation of the Share Exchange Agreement and related transactions described below, we changed our name to Nova LifeStyle, Inc. through a merger with our wholly owned, non-operating subsidiary established solely to change our name pursuant to Nevada law. Concurrently with this action, we authorized a 5-for-1 forward split of our common stock effective June 27, 2011. Prior to the forward split, we had 2,596,000 shares of our common stock outstanding, and after giving effect to the forward split and immediately prior to the Share Exchange Agreement and related transactions described below, we had 12,980,000 shares of our common stock outstanding. We authorized the forward stock split to provide a sufficient number of shares to accommodate the trading of our common stock in the OTC marketplace after our acquisition of Nova Furniture.

We acquired the ordinary shares of Nova Furniture pursuant to the terms of a Share Exchange Agreement and Plan of Reorganization, dated June 30, 2011, or the Share Exchange Agreement, entered into by and between us, Nova Furniture and the four shareholders of Nova Furniture Holdings Limited, or Nova Holdings, and St. Joyal, which were the two shareholders of Nova Furniture. Our Chief Executive Officer, Ya Ming Wong, and Chief Financial Officer, Yuen Ching Ho, are the two shareholders of Nova Holdings, and Jun Jiang and Steven Liu are the two shareholders of St. Joyal; we collectively refer to these four shareholders as the Nova Furniture Shareholders. Pursuant to the Share Exchange Agreement, we issued 11,920,000 shares of our common stock to the Nova Furniture Shareholders in exchange for their 10,000 ordinary shares of Nova Furniture, consisting of all of its issued and outstanding capital stock. Of the 11,920,000 shares of our common stock issued pursuant to the Share Exchange Agreement, Messrs. Wong and Ho each received 4,842,500 shares and Messrs. Jiang and Liu each received 1,117,500 shares. Concurrently with the Share Exchange Agreement and as a condition thereof, we entered into an agreement with Alex Li, our former president and director, pursuant to which he returned 10,000,000 shares of our common stock to us for cancelation in exchange for $80,000. Upon completion of the foregoing transactions, we had 14,900,000 shares of our common stock issued and outstanding. For accounting purposes, the Share Exchange Agreement and concurrent transactions described above were treated as a reverse acquisition and recapitalization of Nova Furniture because, prior to the transactions, we were a non-operating public shell and, subsequent to the transactions, the Nova Furniture Shareholders owned a majority of our outstanding common stock and exercise significant influence over the operating and financial policies of the consolidated entity.

On August 31, 2011, we acquired all the outstanding capital stock of Diamond Bar from its sole shareholder, Jun Zhang, pursuant to a stock purchase agreement for $0.45 million paid in full at closing.

Our organizational structure is set forth in the following diagram:

Corporate Information

Our principal executive offices are located at 6565 E. Washington Blvd., Commerce, CA 90040. Our telephone number is (323) 888-9999 and our website address is www.novalifestyle.com. The information contained on our website is not part of this prospectus.

An investment in our securities involves a high degree of risk. Before making any investment decision, you should carefully consider the risk factors set forth below, under the caption “Risk Factors” in any applicable prospectus supplement and under the caption “Risk Factors” in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q, which are incorporated by reference in this prospectus, as well as in any applicable prospectus supplement, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These risks could materially affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

Risks Related to Our Securities and the Offering

Future sales or other dilution of our equity could depress the market price of our Common Stock.

Sales of our Common Stock, preferred stock, warrants, units, or any combination of the foregoing in the public market, or the perception that such sales could occur, could negatively impact the price of our Common Stock. If one or more of our shareholders were to sell large portions of their holdings in a relatively short time, for liquidity or other reasons, the prevailing market price of our Common Stock could be negatively affected.

In addition, the issuance of additional shares of our Common Stock, securities convertible into or exercisable for our Common Stock, other equity-linked securities, including preferred stock or warrants, or any combination of the securities pursuant to this prospectus will dilute the ownership interest of our common shareholders and could depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities.

We may need to seek additional capital. If this additional financing is obtained through the issuance of equity securities, or options or warrants to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance, conversion or exercise of such securities.

Our management will have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from any offerings under this prospectus, and you will be relying on the judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking statements are expressed differently.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and in the “Risk Factors” section of this prospectus.

Except as may be stated in the applicable prospectus supplement, we intend to use the net proceeds we receive from the sale of the securities offered by this prospectus for general corporate purposes, which may include, among other things, repayment of debt, repurchases of common stock, capital expenditures, the financing of possible acquisitions or business expansions, increasing our working capital and the financing of ongoing operating expenses and overhead.

The following is a summary of our capital stock and certain provisions of our certificate of incorporation and bylaws. This summary does not purport to be complete and is qualified in its entirety by the provisions of our Articles of Incorporation, as amended, our Amended and Restated Bylaws, and applicable provisions of the Nevada Revised Statutes (the “NRS”).

See “Where You Can Find More Information” elsewhere in this prospectus for information on where you can obtain copies of our Certificate of Incorporation and Amended and Restated Bylaws, which have been filed with and are publicly available from the SEC.

Our authorized capital stock consists of 75,000,000 shares of Common Stock, par value $0.001 per share. Currently, we have no other authorized class of stock.

As of February 19 , 2014, 390,348 shares of our common stock are reserved for issuance upon the exercise of warrants outstanding. The warrants are immediately exercisable, expire on the third anniversary of their issuance and entitle their holders to purchase up to 390,348 shares of our common stock of which (i) warrants issued in connection with a private placement that closed on August 18, 2011, to purchase 828,180 shares of common stock have an exercise price of $2.00 per share, or the August 2011 Warrants, (ii) warrants issued in connection with a private placement that closed on January 13, 2012, to purchase 155,100 shares of common stock have an exercise price of $4.50 per share, or the January 2012 Warrants and (iii) a warrant issued to a consultant as consideration for consulting services on July 15, 2013, to purchase 50,000 shares of common stock with an exercise price of $4.00 per share. We may call the August 2011 Warrants at $4.00 per share, the January 2012 Warrants at $5.00 per share and the July 2013 warrant at $8.00 per share at any time after: (i) a registration statement registering the common stock underlying the warrants becomes effective; (ii) the common stock is listed on a national securities exchange; and (iii) the closing price of the common stock equals or exceeds $4.00 for the August 2011 Warrants, $5.00 for the January 2012 warrants and $8.00 for the July 2013 warrant.

As of February 19 , 2014, there were 19,338,149 shares of our Common Stock outstanding, held by approximately 75 stockholders of record.

Our Common Stock is currently traded on The NASDAQ Stock Market LLC under the symbol “NVFY.”

The holders of our Common Stock are entitled to one vote per share. Our Articles of Incorporation do not provide for cumulative voting. The holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors out of legally available funds; however, the current policy of our board of directors is to retain earnings, if any, for operations and growth. Upon liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share ratably in all assets that are legally available for distribution. The holders of our Common Stock have no preemptive, subscription, redemption or conversion rights.

All issued and outstanding shares of Common Stock are fully paid and nonassessable. Shares of our Common Stock that may be offered for resale, from time to time, under this prospectus will be fully paid and nonassessable.

Anti-Takeover Effects of Certain Provisions of Nevada Law

As a Nevada corporation, we are also subject to certain provisions of the NRS that have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including an acquisition in which the stockholders might otherwise receive a premium for their shares. As a result, stockholders who might desire to participate in such a transaction may not have the opportunity to do so.

The NRS provides that specified persons who, with or through their affiliates or associates, own, or affiliates and associates of the subject corporation at any time within two years own or did own, 10% or more of the outstanding voting stock of a corporation cannot engage in specified business combinations with the corporation for a period of two years after the date on which the person became an interested stockholder, unless: (i) the combination or transaction by which such person first became an interested stockholder was approved by the board of directors before they first became an interested stockholder; or (ii) such combination is approved by: (x) the board of directors; and (y) at an annual or special meeting of the stockholders (not by written consent), the affirmative vote of stockholders representing at least 60% of the outstanding voting power not beneficially owned by such interested stockholder. The law defines the term “business combination” to encompass a wide variety of transactions with or caused by an interested stockholder, including mergers, asset sales and other transactions in which the interested stockholder receives or could receive a benefit on other than a pro rata basis with other stockholders.

The Control Share Acquisition Statute generally applies only to Nevada corporations with at least 200 stockholders of record, including at least 100 stockholders of record who are Nevada residents, and which conduct business directly or indirectly in Nevada. This statute generally provides that any person that acquires a “controlling interest” acquires voting rights in the control shares, as defined, only as conferred by the disinterested stockholders of the corporation at a special or annual meeting. A person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the NRS, would enable that person to exercise (1) one-fifth or more, but less than one-third, (2) one-third or more, but less than a majority or (3) a majority or more, of all of the voting power of the corporation in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares.” In the event control shares are accorded full voting rights and the acquiring person has acquired at least a majority of all of the voting power, any stockholder of record who has not voted in favor of authorizing voting rights for the control shares is entitled to demand payment for the fair value of its shares.

These laws may have a chilling effect on certain transactions if our Articles of Incorporation or Bylaws are not amended to provide that these provisions do not apply to us or to an acquisition of a controlling interest, or if our disinterested stockholders do not confer voting rights in the control shares.

As of February 19 , 2014, no shares of preferred stock had been issued or were outstanding and we are not authorized to issue any shares of preferred stock; however, it is possible that we could amend our Articles of Incorporation to authorize the issuance of shares of preferred stock.

We will file as an exhibit to the Registration Statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation or amendment to our Articles of Incorporation that describes the terms of any series of preferred stock we are offering before the issuance of that series of preferred stock. This description will include, but not be limited to, the following: (i) the title and stated value, (ii) the number of shares we are offering, (iii) the liquidation preference per share, (iv) the purchase price, (v) the dividend rate, period and payment date and method of calculation for dividends, (vi) whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate, (vii) the provisions for a sinking fund, if any, (viii) the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights, (ix) whether the preferred stock will be convertible into our Common Stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period, (x) whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period, (xi) voting rights, if any, of the preferred stock, (x) preemptive rights, if any, (xi) restrictions on transfer, sale or other assignment, if any, (xii) a discussion of any material United States federal income tax considerations applicable to the preferred stock, (xiii) the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs, (xiv) any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs and (xv) any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

We may issue warrants for the purchase of Common Stock and/or preferred stock in one or more series. We may issue warrants independently or together with Common Stock and/or preferred stock, and the warrants may be attached to or separate from these securities. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular terms of any series of warrants in more detail in the applicable prospectus supplement. The terms of any warrants offered under a prospectus supplement may differ from the terms described below.

We will file as exhibits to the Registration Statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant agreement, including a form of warrant certificate, that describes the terms of the particular series of warrants we are offering before the issuance of the related series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject to, and qualified in their entirety by reference to, all the provisions of the warrant agreement and warrant certificate applicable to the particular series of warrants that we may offer under this prospectus. We urge you to read the applicable prospectus supplements related to the particular series of warrants that we may offer under this prospectus, as well as any related free writing prospectuses, and the complete warrant agreements and warrant certificates that contain the terms of the warrants.

General

We will describe in the applicable prospectus supplement the terms of the series of warrants being offered, including:

| | • | | the offering price and aggregate number of warrants offered; |

| | | | |

| | • | | the currency for which the warrants may be purchased; |

| | | | |

| | • | | if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each such security or each principal amount of such security; |

| | | | |

| | • | | if applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| | | | |

| | • | | in the case of warrants to purchase Common Stock or preferred stock, the number of shares of Common Stock or preferred stock, as the case may be, purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| | • | | the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreements and the warrants; |

| | | | |

| | • | | the terms of any rights to redeem or call the warrants; |

| | • | | any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants; |

| | | | |

| | • | | the dates on which the right to exercise the warrants will commence and expire; |

| | | | |

| | • | | the manner in which the warrant agreements and warrants may be modified; |

| | | | |

| | • | | a discussion of any material or special United States federal income tax consequences of holding or exercising the warrants; |

| | | | |

| | • | | the terms of the securities issuable upon exercise of the warrants; and |

| | | | |

| | • | | any other specific terms, preferences, rights or limitations of or restrictions on the warrants. |

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including the right to receive dividends, if any, or payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any.

Exercise of Warrants

Each warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus supplement. Holders of the warrants may exercise the warrants at any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with specified information, and paying the required amount to the warrant agent in immediately available funds, as provided in the applicable prospectus supplement. We will set forth on the reverse side of the warrant certificate and in the applicable prospectus supplement the information that the holder of the warrant will be required to deliver to the warrant agent.

If fewer than all of the warrants represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants. If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

As specified in the applicable prospectus supplement, we may issue, in one more series, units consisting of Common Stock, preferred stock, and/or warrants for the purchase of Common Stock and/or preferred stock in any combination. The applicable prospectus supplement will describe:

| | • | | the securities comprising the units, including whether and under what circumstances the securities comprising the units may be separately traded; |

| | | | |

| | • | | the terms and conditions applicable to the units, including a description of the terms of any applicable unit agreement governing the units; and |

| | | | |

| | • | | a description of the provisions for the payment, settlement, transfer or exchange of the units. |

The securities covered by this prospectus may be offered and sold from time to time pursuant to one or more of the following methods:

| | • | | to or through underwriters; |

| | • | | to or through broker-dealers (acting as agent or principal); |

| | • | | in “at the market offerings” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market, on an exchange, or otherwise; |

| | • | | directly to purchasers, through a specific bidding or auction process or otherwise; or |

| | • | | through a combination of any such methods of sale. |

Agents, underwriters or broker-dealers may be paid compensation for offering and selling the securities. That compensation may be in the form of discounts, concessions or commissions to be received from us, from the purchasers of the securities or from both us and the purchasers. Any underwriters, dealers, agents or other investors participating in the distribution of the securities may be deemed to be “underwriters,” as that term is defined in the Securities Act, and compensation and profits received by them on sale of the securities may be deemed to be underwriting commissions, as that term is defined in the rules promulgated under the Securities Act.

Each time securities are offered by this prospectus, the prospectus supplement, if required, will set forth:

| | • | | the name of any underwriter, dealer or agent involved in the offer and sale of the securities; |

| | • | | the terms of the offering; |

| | • | | any discounts concessions or commissions and other items constituting compensation received by the underwriters, broker-dealers or agents; |

| | • | | any over-allotment option under which any underwriters may purchase additional securities from us; and |

| | • | | any initial public offering price. |

The securities may be sold at a fixed price or prices, which may be changed, at market prices prevailing at the time of sale, at prices relating to the prevailing market prices or at negotiated prices. The distribution of securities may be effected from time to time in one or more transactions, by means of one or more of the following transactions, which may include cross or block trades:

| | • | | transactions on The NASDAQ Stock Market LLC or any other organized market where the securities may be traded; |

| | • | | in the over-the-counter market; |

| | • | | in negotiated transactions; |

| | • | | under delayed delivery contracts or other contractual commitments; or |

| | • | | a combination of such methods of sale. |

If underwriters are used in a sale, securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions. Our securities may be offered to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. If an underwriter or underwriters are used in the sale of securities, an underwriting agreement will be executed with the underwriter or underwriters at the time an agreement for the sale is reached. This prospectus and the prospectus supplement will be used by the underwriters to resell the shares of our securities.

In compliance with the guidelines of the Financial Industry Regulatory Authority, or “FINRA,” the aggregate maximum discount, commission or agency fees or other items constituting underwriting compensation to be received by any FINRA member or independent broker-dealer will not exceed 8% of the offering proceeds from any offering pursuant to this prospectus and any applicable prospectus supplement.

If 5% or more of the net proceeds of any offering of our securities made under this prospectus will be received by a FINRA member participating in the offering or affiliates or associated persons of such FINRA member, the offering will be conducted in accordance with FINRA Rule 5121.

To comply with the securities laws of certain states, if applicable, the securities offered by this prospectus will be offered and sold in those states only through registered or licensed brokers or dealers.

Agents, underwriters and dealers may be entitled under agreements entered into with us to indemnification by us against specified liabilities, including liabilities incurred under the Securities Act, or to contribution by us to payments they may be required to make in respect of such liabilities. The prospectus supplement will describe the terms and conditions of such indemnification or contribution. Some of the agents, underwriters or dealers, or their respective affiliates may be customers of, engage in transactions with or perform services for us in the ordinary course of business. We will describe in the prospectus supplement naming the underwriter the nature of any such relationship.

Certain persons participating in the offering may engage in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. We make no representation or prediction as to the direction or magnitude of any effect that such transactions may have on the price of the securities. For a description of these activities, see the information under the heading “Underwriting” in the applicable prospectus supplement.

The validity of the securities offered in this prospectus will be passed upon for us by McKenna Long & Aldridge LLP.

Our consolidated financial statements for the years ended December 31, 2012 and 2011, appearing in this Prospectus and Registration Statement have been audited by Marcum Bernstein & Pinchuk LLP, independent registered public accounting firm, as set forth in their report thereon, appearing elsewhere herein, and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them into this prospectus. This means that we can disclose important information about us and our financial condition to you by referring you to another document filed separately with the SEC instead of having to repeat the information in this prospectus. The information incorporated by reference is considered to be part of this prospectus and later information that we file with the SEC will automatically update and supersede this information. This prospectus incorporates by reference any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, between the date of the initial registration statement and prior to effectiveness of the registration statement and the documents listed below that we have previously filed with the SEC:

| | • | | our Annual Report on Form 10-K for the year ended December 31, 2012; |

| | | | |

| | • | | our Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2013, June 30, 2013 and September 30, 2013; and |

| | | | |

| | • | | our Current Reports on Form 8-K filed on March 20, 2013, March 26, 2013, May 9, 2013, June 3, 2013, June 10, 2013, August 1, 2013 and November 12, 2013. |

We also incorporate by reference all documents that we file with the SEC on or after the effective time of this prospectus pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act and prior to the sale of all the securities registered hereunder or the termination of the registration statement. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of the filings incorporated herein by reference, including exhibits to such documents that are specifically incorporated by reference, at no cost, by writing or calling us at the following address or telephone number:

Nova LifeStyle, Inc.

6565 E. Washington Blvd.

Commerce, CA 90040

Attention: Thanh H. Lam

(323) 888-9999

Statements contained in this prospectus as to the contents of any contract or other documents are not necessarily complete, and in each instance you are referred to the copy of the contract or other document filed as an exhibit to the registration statement or incorporated herein, each such statement being qualified in all respects by such reference and the exhibits and schedules thereto.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC registering the securities that may be offered and sold hereunder. The registration statement, including exhibits thereto, contains additional relevant information about us and these securities that, as permitted by the rules and regulations of the SEC, we have not included in this prospectus. A copy of the Registration Statement can be obtained at the address set forth below or at the SEC’s website as noted below. You should read the registration statement, including any applicable prospectus supplement, for further information about us and these securities.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http:/www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Because our Common Stock is listed on The NASDAQ Stock Market LLC, you may also inspect reports, proxy statements and other information at the offices of The NASDAQ Stock Market LLC.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution. |

The following table sets forth all expenses payable by us in connection with the offering of our securities being registered hereby. All amounts shown are estimates except the SEC registration fee.

| SEC registration fee | | $ | 7,728 | |

| | | | | |

| Legal fees and expenses | | | | |

| | | | | |

| Accounting fees and expenses | | | | |

| | | | | |

| Printing and miscellaneous expenses | | | | |

| | | | | |

| Total expenses | | $ | 7,728 | |

| Item 15. | Indemnification of Directors and Officers. |

Section 78.138 of the NRS provides that a director or officer is not individually liable to the corporation or its shareholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (1) the director’s or officer’s act or failure to act constituted a breach of his fiduciary duties as a director or officer and (2) his or her breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

This provision is intended to afford directors and officers protection against and to limit their potential liability for monetary damages resulting from suits alleging a breach of the duty of care by a director or officer. As a consequence of this provision, shareholders of our Company will be unable to recover monetary damages against directors or officers for action taken by them that may constitute negligence or gross negligence in performance of their duties unless such conduct falls within one of the foregoing exceptions. The provision, however, does not alter the applicable standards governing a director’s or officer’s fiduciary duty and does not eliminate or limit the right of our company or any shareholder to obtain an injunction or any other type of non-monetary relief in the event of a breach of fiduciary duty.

Our Articles of Incorporation and Amended and Restated Bylaws provide, among other things, that a director, officer, employee or agent of the corporation may be indemnified against expenses (including attorneys’ fees inclusive of any appeal), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such claim, action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best of our interests, and with respect to any criminal action or proceeding, such person had no reasonable cause to believe that such person’s conduct was unlawful.

Insofar as indemnification for liabilities arising under the Securities Act may be provided for directors, officers, employees, agents or persons controlling an issuer pursuant to the foregoing provisions, the opinion of the SEC is that such indemnification is against public policy as expressed in the Securities Act, and is therefore unenforceable. In the event that a claim for indemnification by such director, officer or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

At the present time, there is no pending litigation or proceeding involving a director, officer, employee or other agent of ours in which indemnification would be required or permitted. We are not aware of any threatened litigation or proceeding, which may result in a claim for such indemnification.

See the Exhibit Index attached to this registration statement and incorporated herein by reference.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That, for the purposes of determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at the time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of a Registrant under the Securities Act to any purchaser in the initial distribution of the securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) the portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(6) The undersigned registrant hereby undertakes that:

(i) For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(ii) For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the indemnification provisions described herein, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Amendment No. 1 to the registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in City of Commerce, State of California on the 20th day of February, 2014.

| | NOVA LIFESTYLE, INC. | |

| | | | |

| | By: | /s/ Ya Ming Wong | |

| | | Ya Ming Wong | |

| | | Chief Executive Officer (Principal Executive Officer) | |

| | | | |

Pursuant to the requirements of the Securities Act of 1933, this Amendment No. 1 to the registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | | Title | | Date |

| | | | | |

| /s/ Ya Ming Wong | | Chief Executive Officer (Principal Executive Officer) | | |

| Ya Ming Wong | | | | |

| | | | | |

| /s/Yuen Ching Ho * | | Director and Chief Financial Officer (Principal Financial and Accounting Officer) | | |

| Yuen Ching Ho | | | | |

| | | | | |

| /s/Thanh H. Lam | | Chairperson and President | | |

| Thanh H. Lam | | | | |

| | | | | |

| /s/James R. Talevich * | | Director | | |

| James R. Talevich | | | | |

| | | | | |

| /s/Michael Viotto * | | Director | | |

| Michael Viotto | | | | |

| | | | | |

| /s/Chung Shing Yam * | | Director | | |

| Chung Shing Yam | | | | |

| | | | | |

| /s/Peter Kam * | | Director | | |

| Peter Kam | | | | |

*Signed by Ya Ming Wong as pursuant to his power-of-attorney

EXHIBIT INDEX

Exhibit Number | | Description |

| | | |

| 1.1 | | Form of Underwriting Agreement.* |

| 3.1 | | Articles of Incorporation (Incorporated herein by reference to Exhibit 3.1 to the Company’ s Registration Statement on Form S-2, dated November 10, 2009; File No. 333-163019). |

| 3.2 | | Certificate of Amendment to Articles of Incorporation (Incorporated herein by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K (File No. 333-163019) filed on June 30, 2011). |

| 3.3 | | Amended and Restated Bylaws (Incorporated herein by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K (File No. 333-163019) filed on June 30, 2011). |

| 4.1 | | Specimen Stock Certificate (Incorporated herein by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K (File No. 333-163019) filed on June 30, 2011). |

| 4.2 | | Form of Warrant Agreement, including form of Warrant.* |

| 4.3 | | Form of Unit Agreement.* |

| 5.1 | | |

| 23.1 | | Consent of Independent Registered Public Accounting Firm.** |

| 23.2 | | Consent of McKenna Long & Aldridge LLP (included in legal opinion filed as Exhibit 5.1).** |

| 24.1 | | Powers of Attorney (included on signature page). *** |

* We will file as an exhibit (i) any underwriting agreement relating to securities offered hereby, or (ii) the instruments setting forth the terms of any preferred stock, warrants or units.

** Filed herewith.