UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a–12 |

NOVA LIFESTYLE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a–6(i)(1) and 0–11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | |

| | | |

| | (5) | Total fee paid: |

| | |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0–11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | |

| | | |

| | (3) | Filing Party: |

| | |

| | | |

| | (4) | Date Filed: |

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

June 9, 2014

Dear Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Stockholders of Nova LifeStyle, Inc., a Nevada corporation, to be held at the DoubleTree by Hilton Hotel Los Angeles – Commerce located at 5757 Telegraph Road Commerce, CA 90040 on June 30, 2014, at 10:00 a.m. local time.

The Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the annual meeting. Our directors and officers will be present to respond to appropriate questions from stockholders.

Whether or not you plan to attend the meeting, please vote as soon as possible. You can vote by returning the proxy card, via the Internet or by telephone. This will ensure that your shares will be represented and voted at the meeting, even if you do not attend. If you attend the meeting, you may revoke your proxy and personally cast your vote. Attendance at the meeting does not of itself revoke your proxy.

| | /s/ Thanh H. Lam Thanh H. Lam President and Chairperson of the Board of Directors |

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 30, 2014

NOTICE HEREBY IS GIVEN that the 2014 Annual Meeting of Stockholders of Nova LifeStyle, Inc., a Nevada corporation, will be held at the DoubleTree by Hilton Hotel Los Angeles – Commerce located at 5757 Telegraph Road Commerce, CA 90040 on June 30, 2014, at 10:00 a.m. local time, to consider and act upon the following:

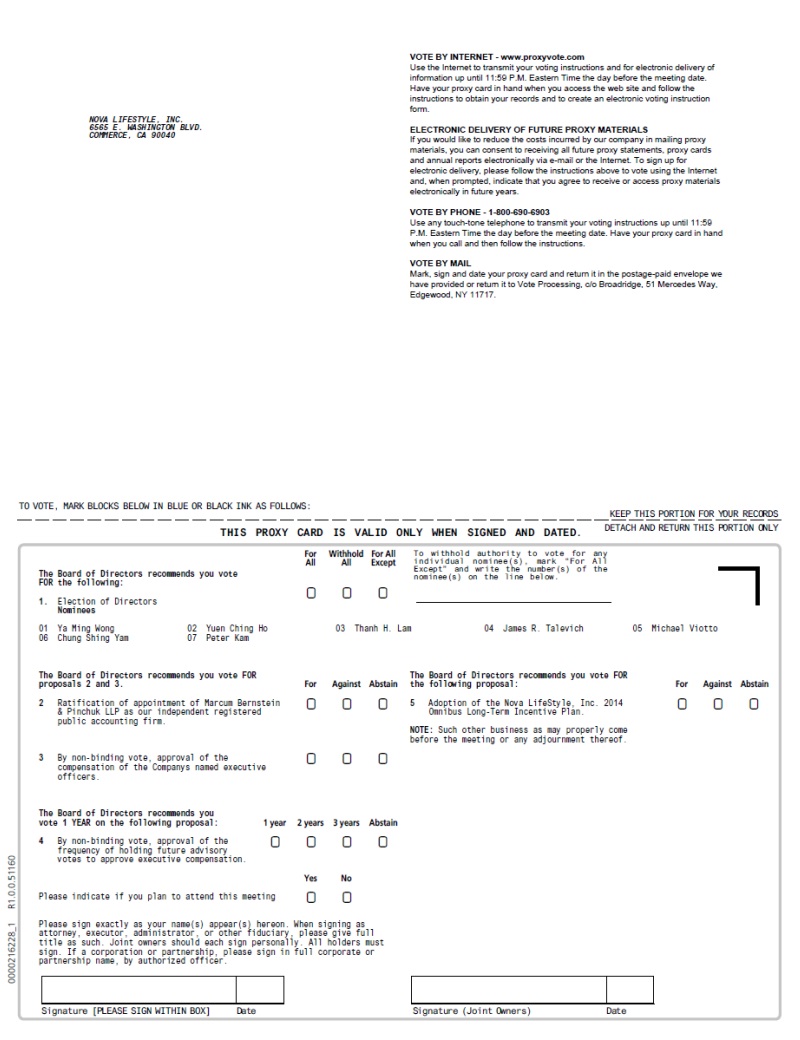

| 1. | To elect seven directors, each to serve until the 2015 Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Marcum Bernstein & Pinchuk LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| 3. | To conduct an advisory vote on the compensation of our named executive officers; |

| 4. | To conduct an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; |

| 5. | To adopt the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan; and |

| 6. | To transact such other business as properly may come before the annual meeting or any adjournments thereof. The Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the annual meeting. |

Stockholders of record at the close of business on June 3, 2014 are entitled to receive notice of and to vote at the 2014 Annual Meeting and any adjournments thereof.

| | By Order of the Board of Directors |

| | /s/ Thanh H. Lam Thanh H. Lam President and Chairperson of the Board of Directors |

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on June 30, 2014:

WHETHER OR NOT YOU PLAN TO ATTEND OUR 2014 ANNUAL MEETING OF STOCKHOLDERS, YOUR VOTE IS IMPORTANT. PLEASE FOLLOW THE INSTRUCTIONS IN THE PROXY MATERIALS TO VOTE YOUR PROXY VIA THE INTERNET OR BY TELEPHONE OR REQUEST AND PROMPTLY COMPLETE, EXECUTE AND RETURN THE PROXY CARD BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU ATTEND OUR 2014 ANNUAL MEETING OF STOCKHOLDERS, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU SO DESIRE.

NOVA LIFESTYLE, INC.

6565 E. Washington Blvd.

Commerce, CA 90040

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 30, 2014

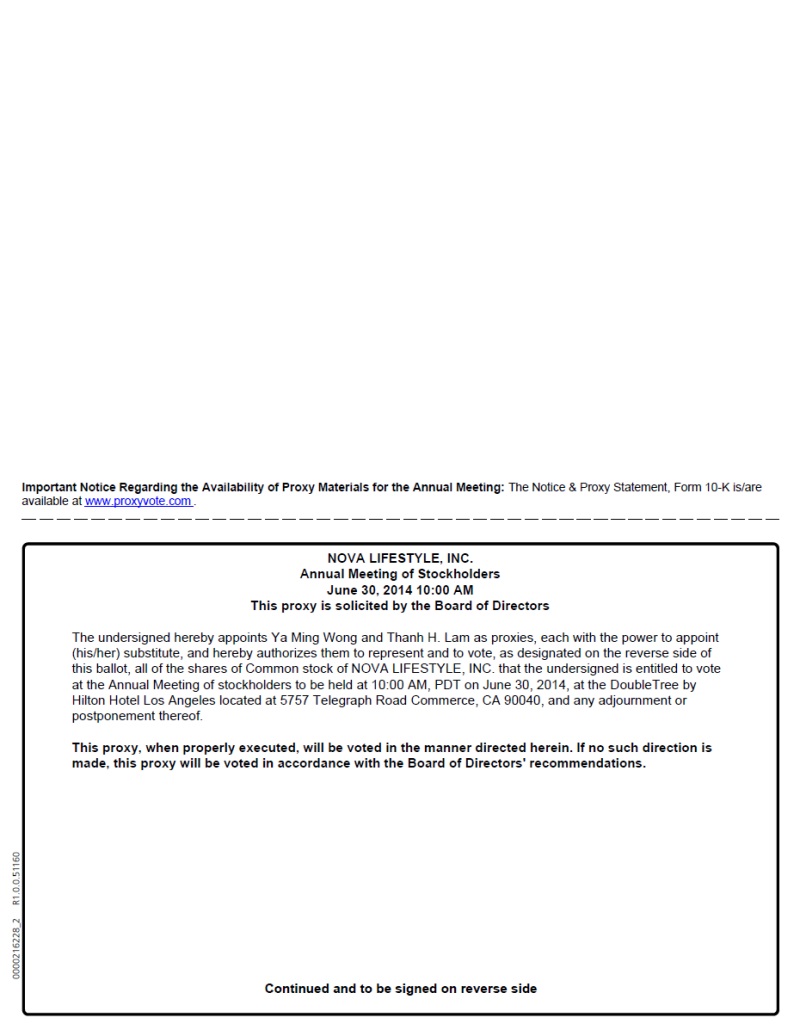

We are furnishing this Proxy Statement to the stockholders of Nova LifeStyle, Inc., a Nevada corporation in connection with the solicitation, by the Board of Directors of Nova LifeStyle, Inc. (the “Board”), of proxies to be voted at our 2014 Annual Meeting of Stockholders to be held at the DoubleTree by Hilton Hotel Los Angeles – Commerce located at 5757 Telegraph Road Commerce, CA 90040 on June 30, 2014, at 10:00 a.m. local time, and at any adjournments or postponements of the meeting.

When used in this Proxy Statement, the terms “Nova LifeStyle,” “Nova,” the “Company,” “we,” “our” and similar terms refer to Nova LifeStyle, Inc., a Nevada corporation, and its wholly-owned subsidiaries.

You will be eligible to vote your shares electronically via the Internet, by telephone or by mail by following the instructions in these Proxy Materials.

This Proxy Statement, our Annual Report on Form 10-K, for fiscal year ended December 31, 2013, and other proxy materials, including the Proxy Card and the Notice of Annual Meeting, are available free of charge online at www.proxyvote.com. Directions to our 2014 Annual Meeting of Stockholders are available by calling (323) 888-9999 or by written request to Thanh H. Lam, our President, at 6565 E. Washington Blvd., Commerce, CA 90040.

ABOUT THE 2014 ANNUAL MEETING

General: Date, Time and Place

We are providing this Proxy Statement to you in connection with the solicitation, on behalf of our Board, of proxies to be voted at our 2014 Annual Meeting of Stockholders (the “2014 Annual Meeting”) or any postponement or adjournment of that meeting. The 2014 Annual Meeting will be held on June 30, 2014, at 10:00 a.m. local time at the DoubleTree by Hilton Hotel Los Angeles – Commerce located at 5757 Telegraph Road Commerce, CA 90040.

Matters to be Considered and Voted Upon

At the 2014 Annual Meeting, stockholders will be asked to consider and vote (i) to elect the nominees named herein as directors; (ii) to ratify the selection of our independent registered public accounting firm; (iii) to conduct an advisory vote on the compensation of our named executive officers; (iv) to conduct an advisory vote on the frequency of named executive officer compensation advisory votes and (v) to approve the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan. The Board does not know of any matters to be brought before the meeting other than as set forth in the notice of meeting. If any other matters properly come before the meeting, the persons named in the form of proxy or their substitutes will vote in accordance with their best judgment on such matters.

Record Date; Stock Outstanding and Entitled to Vote

Our Board established June 3, 2014 as the record date. Only holders of shares of the Company’s common stock, par value $0.001 per share, as of the record date, are entitled to notice of, and to vote at, the 2014 Annual Meeting. Each share of common stock entitles the holder thereof to one vote per share on each matter presented to our stockholders for approval at the 2014 Annual Meeting. At the close of business on the record date, we had 20,721,316 shares of our common stock outstanding.

Quorum; Required Vote

A quorum of stockholders is required for the transaction of business at the 2014 Annual Meeting. The presence of at least a majority of all of our shares of common stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the meeting. Votes cast by proxy or in person at the 2014 Annual Meeting will be tabulated by an election inspector appointed for the meeting and will be taken into account in determining whether or not a quorum is present. Abstentions and broker non-votes, which occur when a broker has not received customer instructions and indicates that it does not have the discretionary authority to vote on a particular matter on the proxy card, will be included in determining the presence of a quorum at the 2014 Annual Meeting.

Assuming that a quorum is present, our stockholders may take action at the annual meeting with the votes described below.

Election of Directors. Under Nevada law and the Amended and Restated Bylaws of the Company (“Bylaws”), the affirmative vote of a plurality of the votes cast by the holders of our shares of common stock is required to elect each director. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. Stockholders do not have any rights to cumulate their votes in the election of directors. Abstentions and broker non-votes will not be counted toward a nominee's total.

Ratification of the selection of Marcum Bernstein & Pinchuk LLP as our independent registered public accounting firm. The affirmative vote of the holders of a majority of the shares actually voted on the proposal at the Annual Meeting, provided a quorum is present, is required to ratify the selection of Marcum Bernstein & Pinchuk LLP as our independent registered public accounting firm. Abstentions and broker non-votes will not be counted as votes in favor of or against the proposal.

Non-binding advisory vote regarding the compensation of our named executive officers. The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote at the annual meeting is required to approve the compensation of our named executive officers. Abstentions and broker non-votes will not be counted as votes approving the compensation of our named executive officers.

Non-binding advisory vote regarding the frequency of future advisory votes on the compensation of our named executive officer. A stockholder may (i) vote one year, (ii) vote two years, (iii) vote three years or (iv) abstain from voting. The frequency that receives the greatest number of votes will be deemed the choice of the stockholders, even if those votes are less than a majority of shares present and entitled to vote. Abstentions and broker non-votes will not be counted as votes in favor of any frequency alternative (one year, two years, or three years).

Approval of the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan. The affirmative vote of the holders of a majority of the shares actually voted on the proposal at the Annual Meeting, provided a quorum is present, is required to approve the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan. Abstentions and broker non-votes will not be counted as votes in favor of or against the proposal.

Abstentions and Broker Non-Votes

Under applicable regulations, if a broker holds shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. Rules that govern how brokers vote your shares have recently changed. Unless you provide voting instructions to a broker holding shares on your behalf, your broker may no longer use discretionary authority to vote your shares on any of the matters to be considered at the 2014 Annual Meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your vote can be counted.

Voting Procedure; Voting of Proxies; Revocation of Proxies

Stockholders of Record

If your shares are registered directly in your name with our transfer agent, Interwest Transfer Company, Inc., you are considered the “stockholder of record” with respect to those shares. As the stockholder of record, you may vote in person at the 2014 Annual Meeting or vote by proxy using the accompanying proxy card. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the 2014 Annual Meeting and vote in person even if you have already voted by proxy.

By Internet – stockholders may vote on the internet by logging on to www.proxyvote.com and following the instructions given.

By Telephone – stockholders may vote by calling 1-800-690-6903 (toll-free) with a touch tone telephone and following the recorded instructions.

By Mail – stockholders must request a paper copy of the proxy materials to receive a proxy card and follow the instructions given for mailing. A paper copy of the proxy materials may be obtained by logging onto www.proxyvote.com and following the instructions given. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Thanh H. Lam, our President, located at 6565 E. Washington Blvd., Commerce, CA 90040. Our Board has selected each of Ya Ming Wong and Thanh H. Lam to serve as proxies.

If you vote by telephone or via the Internet, you do not need to return your proxy card. Telephone and Internet voting are available 24 hours a day and will close at 11:59 P.M. Eastern Time on Sunday, June 29, 2014.

In Person - stockholders may vote in person at the 2014 Annual Meeting. To vote in person, come to the 2014 Annual Meeting and we will give you a ballot when you arrive. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the 2014 Annual Meeting.

Shares of our common stock represented by proxies properly voted that are received by us and are not revoked will be voted at the 2014 Annual Meeting in accordance with the instructions contained therein. If instructions are not given, such proxies will be voted FOR election of each nominee for director named herein, FOR ratification of the selection of Marcum Bernstein & Pinchuk LLP as our independent registered public accounting firm, FOR approval of the compensation of our named executive officers described in this Proxy Statement, FOR the one-year option as to the frequency of the advisory vote on the compensation of our named executive officers and FOR the approval of the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion, on any matters brought before the 2014 Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the Securities and Exchange Commission (“SEC”).

Street Name Stockholders

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you are considered the “beneficial owner” of such shares. Because a beneficial owner is not a stockholder of record, you may not vote these shares in person at the 2014 Annual Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote those shares at the meeting. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the 2014 Annual Meeting.

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you can most conveniently vote by telephone, Internet or mail. Please review the voting instructions on your voting instruction form.

Your proxy is revocable at any time before it is voted at the 2014 Annual Meeting in any of the following three ways:

1. You may submit another properly completed proxy bearing a later date.

2. You may send a written notice that you are revoking your proxy to Thanh H. Lam, our President, located at 6565 E. Washington Blvd., Commerce, CA 90040.

3. You may attend the 2014 Annual Meeting and vote in person. However, simply attending the 2014 Annual Meeting will not, by itself, revoke your proxy.

Dissenters’ Right of Appraisal

Under Nevada General Corporation Law and the Company’s Certificate of Incorporation, stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the 2014 Annual Meeting.

Proxy Solicitation

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Householding

SEC rules permit us to deliver a single copy of our annual report and proxy statement, to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one copy of the annual report and proxy statement, to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. If you received a householded mailing this year and you would like to have additional copies of our annual report and proxy statement mailed to you or you would like to opt out of this practice for future mailings, contact Thanh H. Lam, our President, located at 6565 E. Washington Blvd., Commerce, CA 90040. We agree to deliver promptly, upon written or oral request, a separate copy of this Proxy Statement and annual report to any stockholder at the shared address to which a single copy of those documents were delivered.

For at least ten days prior to the meeting, a list of stockholders entitled to vote at the 2014 Annual Meeting, arranged in alphabetical order, showing the address of and number of shares registered in the name of each stockholder, will be open for examination by any stockholder, for any purpose related to the 2014 Annual Meeting, during ordinary business hours at our principal executive office. The list will also be available for examination at the 2014 Annual Meeting.

The Board is not aware of any other matters to be presented at the 2014 Annual Meeting other than those mentioned in this Proxy Statement and our accompanying Notice of Annual Meeting of Stockholders. If, however, any other matters properly come before the 2014 Annual Meeting, the persons named in the accompanying proxy will vote in accordance with their best judgment.

Proposals of Stockholders for 2015 Annual Meeting

Stockholder proposals will be considered for inclusion in the Proxy Statement for the 2015 Annual Meeting in accordance with Rule 14a-8 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), if they are received by the Company, on or before February 9, 2015.

Stockholder notice shall set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and address, as they appear on our books, of the stockholder proposing such business, (iii) the class and number of shares of Nova LifeStyle, which are beneficially owned by the stockholder, (iv) any material interest of the stockholder in such business and (v) any other information that is required to be provided by the stockholder pursuant to Regulation 14A under the Exchange Act, in his capacity as a proponent to a stockholder proposal.

A stockholder’s notice relating to nomination for directors shall set forth as to each person, if any, whom the stockholder proposes to nominate for election or re-election as a director: (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of Nova LifeStyle, which are beneficially owned by such person, (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person(s) (naming such person(s)) pursuant to which the nominations are to be made by the stockholder and (v) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including without limitation such person’s written consent to being named in our Proxy Statement, if any, as a nominee and to serving as a director if elected).

Proposals and notices of intention to present proposals at the 2015 Annual Meeting should be addressed to Thanh H. Lam, our President, located at 6565 E. Washington Blvd., Commerce, CA 90040.

Voting Results of 2014 Annual Meeting

Voting results will be published in a Current Report on Form 8-K issued by us within four (4) business days following the 2014 Annual Meeting.

PROPOSAL 1— ELECTION OF DIRECTORS

Nominees

Our Bylaws provide that the Board shall consist of not less than one (1) nor more than ten (10) directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors, although vacancies occurring as a result of removal of directors by the Company’s stockholders may only be filled by the stockholders. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the Board) will serve for the remainder of the one year term in which the vacancy occurred and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

Our Board currently consists of seven (7) members. Each of our current directors will stand for re-election at the 2014 Annual Meeting.

If elected as a director at the 2014 Annual Meeting, each of the nominees will serve a one-year term expiring at the 2015 Annual Meeting of Stockholders and until his successor has been duly elected and qualified. Biographical information regarding each of the nominees is set forth below. No family relationships exist among any of our director nominees or executive officers.

Each of the nominees has consented to serve as a director if elected. If any nominee should be unavailable to serve for any reason (which is not anticipated), the Board may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

Executive Officers and Directors

The following table sets forth certain information regarding our executive officers and directors as of June 3, 2014:

| Name | | Age | | Position | | Served From |

| Ya Ming Wong | | 46 | | Chief Executive Officer and Director | | June 2011 |

| Yuen Ching Ho | | 54 | | Chief Financial Officer and Director | | May 2013 |

| Thanh H. Lam | | 46 | | Chairperson, President and Director | | June 2011 |

| James R. Talevich (1) | | 64 | | Director (Independent) | | May 2013 |

| Michael Viotto (1) | | 63 | | Director (Independent) | | May 2013 |

| Chung Shing Yam | | 55 | | Director (Independent) | | May 2013 |

| Peter Kam (1) | | 63 | | Director (Independent) | | May 2013 |

(1) Member of Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee

Biographical Information

Ya Ming Wong was appointed our Chief Executive Officer on June 30, 2011 and a Member of our Board on June 30, 2011. Mr. Wong was one of the two founders of Nova Dongguan, our wholly owned subsidiary, and has served as its Chief Executive Officer since its inception in 2003. Mr. Wong has over 20 years of experience in the furniture industry. Mr. Wong has been appointed the vice-chairman of the Dongguan City Association of Enterprises with Foreign Investment (DGAEFI) since December 2008, the vice-chairman of the Dongguan Furniture Association (DGFA) since April 2003, and the director of The International Furniture and Decoration (Hong Kong) Association since January 2003. From 1991 to 2003, Mr. Wong served as the Chief Executive Officer of Navy Blue Inc., a Macao-based furniture company with manufacturing facilities in Dongguan, China. Prior to that time, from 1988 to 1991, Mr. Wong worked for C&E German Furniture Ltd., a Hong Kong-based furniture company with manufacturing facilities in Dongguan, China, as the design and production manager. Mr. Wong graduated from Hong Kong Tang Shiu Kin Victoria Technical School in 1988. Mr. Wong is the brother of Ah Wan Wong, our Vice President of Marketing. Mr. Wong brings extensive knowledge about business strategy and product development in the furniture industry in China and international markets and of our operations and long-term strategy to the Board. The Board believes that Mr. Wong’s vision, leadership and extensive knowledge about us and the furniture industry is essential to our future growth.

Yuen Ching Ho was appointed our Chief Financial Officer on June 30, 2011 and a Member of our Board on May 28, 2013. Mr. Ho was one of the two founders of Nova Dongguan, our wholly owned subsidiary and has served as its Chief Financial Officer since its inception in 2003. Mr. Ho also was responsible for the administration, finance and marketing of Nova Macao, our wholly owned subsidiary, since its inception in 2006. Mr. Ho has over 20 years of experience in the furniture industry. From 1991 to 2003, Mr. Ho served as the Chief Operating Officer of Navy Blue Inc., a Macao-based furniture company with manufacturing facilities in Dongguan, China. Prior to that time, from 1990 to 1991, Mr. Ho worked as the export administrative staff for C&E German Furniture Ltd., a Hong Kong-based furniture company with manufacturing facilities in Dongguan, China. Mr. Ho received a bachelor’s degree in Commerce from St. Mary’s University in 1984 and obtained his MBA from The Chinese University of Hong Kong in 1990.

Thanh H. Lam was appointed our President and a member of our Board on June 30, 2011, and was elected as Chairperson of the Board on June 4, 2013, following Ya Ming Wong's resignation as Chairman of the Board. Ms. Lam was a co-founder of the Diamond Sofa brand and previously was the Chief Executive Officer of Diamond Bar in Commerce, California, our wholly owned subsidiary acquired by the Company in August 2011. Ms. Lam has pioneered the Diamond Sofa brand since 1992 and, prior to our acquisition of the Diamond Sofa brand, was in charge of its product development and merchandising for the U.S. market and managed its national sales force and oversaw distribution. In 2005, Ms. Lam was featured in a Furniture Today “Fresh Faces” profile, one of the highest honors bestowed to exceptional and talented young entrepreneurs in the furniture industry. Ms. Lam received her Bachelor of Science degree in Business Administration and Finance from the California State University of Los Angeles. Ms. Lam brings to the Board 21 years of experience in developing a furniture brand and marketing to the U.S. furniture industry. The Board believes that Ms. Lam’s in-depth knowledge of the U.S. furniture market and knowledge of our business through her work with the Diamond Sofa brand will assist us in our future growth and expansion plans.

James R. Talevich became a director on May 28, 2013, and currently serves as a member of the Executive Committee and Advisory Council of the SEC Financial Reporting Institute at the USC Marshall School of Business, as well as Vice President of the UCLA Anderson School of Management Alumni Board and Executive Committee, and as a member of the Concordia University Healthcare Management Advisory Board. Mr. Talevich served as Chief Financial Officer of I-Flow Corporation, a NASDAQ-listed medical technology company, from 2000 to 2009, Chief Financial Officer of Gish Biomedical, a NASDAQ-listed manufacturing company, from 1999 to 2000, and Chief Financial Officer of Tectrix Fitness Equipment from 2005 to 2009. Previously, he held financial management positions with Mallinckrodt Group Inc., Fiat S.p.A, Pfizer Inc., SensorMedics Corporation, Baxter International Inc., and KPMG. Mr. Talevich previously served on the Board of Directors of AcryMed, Inc., a developer of antimicrobial nanoparticle technologies, from 2008 to 2009. Mr. Talevich received a B.A. in physics from California State University, Fullerton in 1973 and an MBA from the UCLA Anderson School of Management in 1975. He is licensed as a Certified Public Accountant.

Michael J. Viotto was appointed a member of our Board on May 28, 2013, and currently serves as a Business Development Agent at Coface North America, and has served in that role since 2009. During 2008 and 2009, Mr. Viotto served as a Senior Wholesale Account Executive at Bank of America. From 2002 to 2008, he was a Senior Wholesale Account Executive for Washington Mutual, Inc. in California. Mr. Viotto received his B.S. in Business Administration from California Polytechnic University in Pomona, California in March, 1985. He is licensed as a Salesperson by the State of California Department of Real Estate. Mr. Viotto is also licensed as a Casualty and Property Broker-Agent by the California Department of Insurance.

Chung Shing Yam was appointed a member of our Board on May 28, 2013, and currently serves as the sole investor and developer of Kang Hu Village, a private housing estate located in the Dongguan area of the People’s Republic of China. Through Kang Hu Village, Mr. Yam also provides real estate agent and management services. Mr. Yam serves as a director of the Asian Knowledge Management Association, and is the Board Chairman of the Politic and Commerce Association, Dongguan city, Guangdong province, as well as the permanent Honorary President and Vice Chief Director of the Overseas Association in Dongguan. He is also the Deputy Chairman of the Dongguan City Association of Enterprises with Foreign Investment. Mr. Yam graduated from The Hong Kong Polytechnic University in 1981 with a major in Business and received his Master of Business Administration (MBA) from The Hong Kong Polytechnic University in 1987.

Peter Kam was appointed a member of our Board on May 28, 2013, and is currently involved in various business ventures. From 1977 through the present, Mr. Kam has owned and served as the President of his dental practice, Peter M. Kam, D.D.S. Inc. From 1992 to the present, he has owned and served as President of Titan Properties, Inc. Since 2000, Mr. Kam has been the sole owner of his law practice, the Law Offices of Peter M. Kam. Since 2006, he has served as a director of Pacific Alliance Bank, and currently serves as Chairman of the Loan Committee. Mr. Kam is also a charter member and shareholder of Green Tree Inn, a hotel chain in China with over 400 hotels. Mr. Kam received his B.S. in Physics from the University of California Los Angeles (“UCLA”) in 1971 and his M.S. in physics from UCLA in 1973. Mr. Kam attended the UOP School of Dentistry, and received his DDS Degree in 1977. Mr. Kam was admitted to practice dentistry by the California Board of Dental Examiner in 1977. Mr. Kam later attended the Southwestern School of Law, and earned his JD degree in 1999, and was admitted to the California Bar in 2000.

All directors hold office until the next annual meeting of stockholders and until their successors have been duly elected and qualified. There are no membership qualifications for directors. There are no arrangements or understandings pursuant to which our directors are selected or nominated.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT.

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee, in accordance with its charter and authority delegated to it by the Board, has appointed Marcum Bernstein & Pinchuk LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2014, and the Board has directed that such appointment be submitted to our stockholders for ratification at the 2014 Annual Meeting. Marcum Bernstein & Pinchuk LLP has served as our independent registered public accounting firm since June 30, 2011, and is considered by our Audit Committee to be well qualified. We are asking our stockholders to ratify the selection of Marcum Bernstein & Pinchuk LLP as our independent registered public accountants. If the stockholders do not ratify the appointment of Marcum Bernstein & Pinchuk LLP, the Audit Committee will reconsider the appointment. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. Representatives of Marcum Bernstein & Pinchuk LLP will be present, by phone or in person, at the 2014 Annual Meeting.

THE BOARD, UPON THE RECOMMENDATION OF THE AUDIT COMMITTEE, RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL AND RATIFICATION OF MARCUM BERNSTEIN & PINCHUK LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR ENDING DECEMBER 31, 2013.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit and Non-Audit Fees

The following table represents the aggregate fees from our principal accountant, Marcum Bernstein & Pinchuk LLP for the years ended December 31, 2013 and 2012 respectively:

In the above table, “audit fees” are fees billed for services provided related to the audit of our annual financial statements, quarterly reviews of our interim financial statements and services normally provided by the independent accountant in connection with statutory and regulatory filings or engagements for those fiscal periods. “Audit-related fees” are fees not included in audit fees that are billed by the independent accountant for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, which include audits in connection with acquisitions. “Tax fees” are fees billed by the independent accountant for professional services rendered for tax compliance, tax advice and tax planning. “All other fees” are fees billed by the independent accountant for products and services not included in the foregoing categories.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Accountant

Prior to June 4, 2013, our Board acted as and performed the functions of our audit committee, including the pre-approval of all audit and permissible non-audit services provided by our independent accountants. Beginning on June 4, 2013, our audit committee performed these functions. These services may include audit services, audit-related services, tax services and other services. In the past, our Board generally pre-approved, and currently our audit committee generally pre-approves, services for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, in the past, the Board and, currently, the audit committee, as applicable, may have pre-approved or may pre-approve particular services on a case-by-case basis. For each proposed service, the independent accountant is required to provide detailed back-up documentation at the time of approval. This pre-approval policy for services provided by the independent accountants is set forth in the governing charter for the audit committee.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report any pre-approval decisions to the Audit Committee at its next scheduled meeting.

All services rendered by Marcum Bernstein & Pinchuk LLP to the Company are permissible under any applicable laws and regulations. During fiscal year 2013, all services performed by Marcum Bernstein & Pinchuk LLP were approved in advance by the Audit Committee or, if before June 4, 2013, the Board in accordance with the pre-approval policy.

PROPOSAL NO. 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that we provide our stockholders a non-binding, advisory vote to approve the compensation of our named executive officers. This vote is sometimes referred to as a “say-on-pay vote.” Although this advisory vote is nonbinding, the Compensation Committee of our Board will review and consider the voting results when making future decisions regarding our named executive officer compensation and related executive compensation programs.

As described in more detail below and in our Annual Report on Form 10-K, our executive compensation program is comprised principally of salary, equity and performance-based cash compensation, designed to: (i) attract, motivate and retain key executives who are critical to our success, (ii) align the interests of our executives with stockholder value and our financial performance and (iii) achieve a balanced package that would attract and retain highly qualified senior officers and appropriately reflect each such officer’s individual performance and contributions. In addition, the Company regularly reviews its compensation program and the overall compensation package paid to each of its senior executives to assess risk and to confirm that the structure is still aligned with the Company's long-term strategic goals.

Before you vote on the resolution below, please read the entire “Executive Compensation” section, including the tables, together with the related narrative disclosure and footnotes, beginning on page 26 of this Proxy Statement as well as the disclosures in our Annual Report on Form 10-K. Note, as a “smaller reporting company,” we are obligated to provide compensation disclosures pursuant to Item 402 (m) through (q) of Regulation S-K promulgated under the Securities Exchange Act of 1934 (“Regulation S-K”). Even though, as a smaller reporting company, we are exempt from compensation discussion and analysis by the executive compensation requirements of Item 402(b) of Regulation S-K, we continue to elect to provide information regarding our objectives and practices regarding executive compensation in order to give our stockholders transparency into our compensation philosophy and practices.

For the reasons provided, the Board is asking stockholders to cast a non-binding, advisory vote FOR the following resolution:

“RESOLVED, that stockholders approve the compensation paid to our named executive officers as disclosed in this Proxy Statement pursuant to Item 402 (m) through (q) of Regulation S-K (which includes the compensation tables and related narrative discussion).”

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERSAS DESCRIBED IN THIS PROXY STATEMENT.

PROPOSAL NO. 4 – ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are providing our stockholders with the opportunity to vote, on a non-binding, advisory basis, for their preference on the frequency of future advisory votes to approve the compensation of our named executive officers as reflected in Proposal 3 above. Stockholders may indicate whether they prefer that we conduct future advisory votes to approve the compensation of our named executive officers every one, two or three years. Shareholders also may abstain from casting a vote on this proposal.

The Board has determined that holding an advisory vote on the compensation of our named executive officers every year is the most appropriate policy at this time, and recommends that future advisory votes to approve the compensation of our named executive officers occur once every year. We believe that holding this advisory vote annually will provide us with timely and appropriate feedback on compensation decisions for our named executive officers.

Stockholders will be able to specify one of four choices for this proposal on the proxy card: one year, two years, three years, or abstain. Although this advisory vote on the frequency of future advisory votes on the compensation of our named executive officers is non-binding, the Board and the Compensation Committee will carefully review the voting results when determining the frequency of future advisory votes on the compensation of our named executive officers.

The Board is asking stockholders to cast a non-binding, advisory vote for the ONE-YEAR option on the following resolution:

“RESOLVED, that the stockholders of the Company recommend, in a non-binding vote, whether an advisory vote to approve the compensation of our named executive officers should occur every one, two or three years.”

The Board believes that say-on-pay votes should be conducted every year so that stockholders may annually express their views on our executive compensation program. This vote, like the say-on-pay vote itself, is non-binding.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE “ONE-YEAR” OPTION AS TO THE FREQUENCY OF THE ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL NO. 5 – APPROVAL OF THE NOVA LIFESTYLE, INC.

2014 OMNIBUS LONG-TERM INCENTIVE PLAN

Our stockholders are being asked to consider and vote on this proposal to approve the Nova LifeStyle, Inc. 2014 Omnibus Long-Term Incentive Plan, which we refer to as the “Plan.” The Plan was approved by the Board and became effective on May 13, 2014, subject to stockholder approval.

The Board believes that stock ownership enhances the Company’s ability to attract and retain highly qualified officers, directors, key employees and other persons. Stock ownership also motivates such officers, directors, key employees and other persons to serve the Company and to expend maximum effort to improve the business results and earnings of the Company, by providing to them an opportunity to acquire or increase a direct proprietary interest in the operations and future success of the Company. Accordingly, the Board recommends that our stockholders approve the Plan.

Some of the key terms of the Plan that stockholders are being asked to approve include:

| · | An aggregate share reserve of 4,000,000 shares of our common stock; |

| · | A limit on awards granted to any one grantee in any calendar year of 100,000 shares of common stock. |

| · | Total payments under awards that are intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) to any one grantee in any calendar year not to exceed $200,000; and |

| · | Business criteria under the Plan that are intended to comply with Code Section 162(m). The Board recommends that stockholders approve the business criteria under the Plan so that certain awards granted under the Plan may qualify as exempt performance-based compensation under Code Section 162(m). Code Section 162(m) generally disallows the corporate tax deduction for certain compensation paid in excess of $1,000,000 annually to each of the chief executive officer and the three other most highly paid executive officers (other than the chief financial officer). If stockholders do not approve these business criteria, then certain awards granted under the Plan will not qualify as exempt performance-based compensation under Code Section 162(m) and may not be deductible by the Company. |

The following is a summary of the principal provisions of the Plan. This summary does not purport to be complete and is qualified in its entirety by reference to the text of the Plan, a copy of which is attached to this proxy statement as Appendix A.

Description of the Plan

Administration. The Plan is administered by the Compensation Committee or such other committee designated by the Board (referred to as the “Committee”), but if no Committee exists which has been delegated the authority to administer the Plan, the Committee will be the Board. The Committee will: (i) to the extent required, consist of two or more “non-employee directors” (as defined in Rule 16b-3 of the Exchange Act) and “outside directors” (as defined in Code Section 162(m)); and (ii) satisfy the applicable requirements of any stock exchange on which the common stock is listed. If for any reason the Committee does not meet the requirements of Code Section 162(m), the validity of the awards, grants, interpretation or other actions of the Committee will not be affected. The Committee, among other things, has the full authority to select those individuals eligible to receive awards and the amount and type of awards.

Shares Subject to the Plan. A maximum of 4,000,000 shares of common stock may be issued under the Plan, with no more than 100,000 shares awarded to any one grantee during any calendar year, subject to adjustment as provided in the Plan. All such shares are available for issuance pursuant to incentive stock options (“ISOs”). Stock issued under the Plan will be authorized but unissued shares or to the extent permitted by applicable law, issued shares that have been reacquired by the Company. If an award under the Plan is canceled, expired, forfeited, settled in cash, settled by issuance of fewer shares of common stock than the number underlying the award, or otherwise terminated without delivery of shares of common stock to the grantee, the shares retained by or returned to the Company will again be available for issuance under the Plan. If the exercise price, base price of a stock appreciation right (“SAR”) or tax withholding obligations are satisfied by tendering shares of common stock to the Company or by withholding shares of common stock, the number of shares of stock so tendered or withheld will not be available again for issuance under the Plan.

The maximum amount that can be paid in any calendar year to any grantee pursuant to a Performance Award (defined below) denominated in dollars that is intended to qualify as “performance-based compensation” within the meaning of Code Section 162(m) is $200,000.

The Committee will make appropriate and proportional adjustments to the number and kind of shares available for awards, the exercise price and/or base price to reflect any change in our capital structure by reason of recapitalization, reclassification, stock split, reverse split, combination of shares, exchange of shares, stock dividend or other distribution payable in capital stock, or other increase or decrease in such shares effected without receipt of consideration by the Company.

Eligibility. Awards may be granted to our employees, directors, consultants and advisors, and employees, consultants and advisors of our affiliates (“Service Providers”). However, nonqualified stock options and SARs may only be granted to Service Providers of the Company or our subsidiaries, and ISOs may only be granted to employees of the Company or our subsidiaries. As of June 3, 2014, approximately 365 individuals (consisting of three executive officers, four directors who are not executive officers, approximately 350 employees who are not executive officers, and approximately 8 consultants or advisors) are eligible to receive awards under the Plan. The closing price of our common stock on NASDAQ was $4.08 per share as of June 3, 2014.

Types of Awards. The Plan provides for the grant of the following types of awards to eligible Service Providers: stock options, SARs, restricted stock, restricted stock units (“RSUs”), unrestricted stock, and performance awards. Each award is subject to an award agreement approved by the Committee reflecting the terms and conditions of the award.

Stock Options. Options may be in the form of nonqualified stock options or ISOs. The Committee will determine the number of shares, the term (not to exceed ten years, or five years if an ISO is granted to a 10% stockholder) the exercise price, the vesting schedule and the other material terms of the option. No stock option may have an exercise price less than the “fair market value” (as defined in the Plan) of the common stock at the time of grant (or 110%, if an ISO is granted to a 10% stockholder).

Except as otherwise provided in an award agreement: (i) an option will vest 20% on the first five anniversaries of the grant date, provided that the grantee remains in continuous service during such time, (ii) upon a grantee’s separation from service due to death or “disability” (as defined in the Plan), options will remain exercisable for 12 months after such separation (but in no event after the term of the option), (iii) upon a grantee’s separation from service for “cause” (as defined in the Plan), options, whether vested or unvested, will terminate on such separation, (iv) upon a grantee’s separation from service for any other reason, options will remain exercisable for three months after such separation (but in no event after the term of the option), and (v) all options that are not exercisable at the time of a grantee’s separation from service will terminate on his or her separation.

The exercise price of an option may be paid in cash or cash equivalents acceptable by the Company, or the Committee may approve payment by an alternative method including: (i) delivery of an irrevocable direction to a securities broker to sell shares of stock and to deliver to us payment of the exercise price and any withholding taxes, (ii) in the form of shares of common stock already owned by the grantee, (iii) net exercise, or (iv) any combination of the foregoing.

SARs. The Committee may grant a SAR, which is a right to receive upon exercise, an amount equal to the excess of: (i) the fair market value of one share of common stock on the date of exercise over (ii) the per share base price of the SAR established in connection with the grant of a SAR. The Committee will determine the number of shares, the term (which will not exceed ten years), the per share base price, the vesting schedule and the other material terms, of a SAR. If no vesting schedule is specified in an award agreement, a SAR will vest and remain exercisable following a separation from service in the same manner as set forth above for stock options.

Upon exercise of a SAR, a grantee is entitled to receive payment from the Company, equal to: (i) the difference between the fair market value of a share of common stock on the date of exercise over the per share base price; multiplied by (ii) the number of whole shares of common stock with respect to which the SAR is exercised. SARs may be settled in cash, common stock, or a combination thereof, as determined by the Committee but if no form of payment is specified in an award agreement, settlement is made in cash. The Committee may provide at the time of grant that the payment due upon the exercise of a SAR will not exceed a specified amount.

Restricted Stock and RSUs. The Committee may award restricted stock and RSUs. The Committee will determine the number of shares, the vesting schedule or other substantial risk of forfeiture (a “restricted period”), and the other material terms of the award. If no restricted period is specified in an award agreement, the restricted period will lapse as to 20% of the award on the first five anniversaries of the grant date, provided that the grantee remains in continuous service during such time. The Committee may set a purchase price at or above par value when making an award of restricted stock.

An award agreement will set forth the time when the RSUs are settled. RSUs are generally settled in common stock immediately following the date they vest.

Unless otherwise provided in an award agreement, upon a grantee’s separation from service, any restricted stock or RSUs that are not vested or are still subject to a restricted period, will immediately be forfeited.

Unrestricted Stock Awards. The Committee may grant (or sell at or above par value) an award of stock pursuant to which a grantee may receive shares of common stock free of any restrictions (“Unrestricted Stock”). Awards of Unrestricted Stock may be granted or sold as compensation for past services and other valid consideration, or in lieu of, or in addition to, any cash compensation due to a grantee.

Performance Awards. The grant, exercise, vesting or settlement of any award may be subject to performance conditions specified by the Committee. If the Committee determines that an award (other than an option or SAR) to be granted to a grantee who is likely a “covered employee” (within the meaning of Code Section 162(m)) should qualify as “performance-based compensation” for purposes of Code Section 162(m), the grant, exercise, vesting and/or settlement of the award will be contingent upon achievement of pre-established performance goals and other terms (a “Performance Award”). The Committee also may make an award of a cash bonus to any grantee under the Plan and designate such award as a Performance Award in order to qualify such award as “performance-based compensation” under Code Section 162(m).

The performance goals will consist of one or more business criteria set forth below and a targeted level or levels of performance with respect to each of such business criteria, as specified by the Committee. One or more of the following business criteria, measured on a consolidated basis and/or as to specified subsidiaries or business units of the Company or an affiliate, will be used in establishing performance goals for Performance Awards: (i) total stockholder return; (ii) such total stockholder return as compared to total return (on a comparable basis) of a publicly available index such as, but not limited to, the Standard & Poor’s 500 Stock Index; (iii) net income; (iv) pretax earnings; (v) earnings before interest expense, taxes, depreciation and amortization; (vi) pretax operating earnings after interest expense and before bonuses, service fees, and extraordinary or special items; (vii) operating margin; (viii) earnings per share; (ix) return on equity; (x) return on capital; (xi) return on investment; (xii) operating earnings; (xiii) working capital; (xiv) ratio of debt to stockholders’ equity; (xv) revenue; (xvi) revenue growth rate; (xvii) gross margin and (xviii) reduction in costs or debts. Only to the extent permitted under Code Section 162(m), the Committee may: (i) designate additional business criteria on which the business criteria may be based or (ii) adjust, modify or amend the business criteria.

For Performance Awards that are intended to qualify under Code Section 162(m), the Committee must certify attainment of the performance goals before any payout of the Performance Award is made and may decrease (but not increase) the payment under the Performance Award.

Performance Awards are settled in cash, common stock, other awards or other property, in the discretion of the Committee, on a date specified in an award agreement. Unless otherwise specified in an award agreement, if a grantee separates from service prior to the end of a performance period or prior to settlement of a Performance Award, any cash Performance Award shall be cancelled and forfeited.

Term. The Plan is effective May 13, 2014, subject to stockholder approval, and will terminate on May 13, 2024. Awards (other than stock options and SARs) granted to a “covered employee” (within the meaning of Code Section 162(m)) that are intended to be “performance-based” under Code Section 162(m) will not be made on or after the five year anniversary of stockholder approval of the Plan, unless the business criteria are reapproved (or other designated business criteria are approved) by stockholders every five years as required by Code Section 162(m).

Amendment and Termination. The Board may, at any time and from time to time, amend, suspend, or terminate the Plan as to any awards which have not been made. However, no amendment, suspension, or termination of the Plan will, without the consent of the grantee, impair rights or obligations under any award granted or cause an option or SAR to become subject to Code Section 409A. An amendment will be contingent on approval of the Company’s stockholders to the extent stated by the Board, required by applicable law or stock exchange listing requirements, or if it reduces the exercise price or base price or would be treated as a re-pricing of an outstanding option or SAR under the rules of the exchange upon which the Company’s common stock trades. No Awards will be made after termination of the Plan, but the termination of the Plan will not affect the Board’s or Committee’s ability to exercise its powers with respect to awards that were granted prior to such termination.

Corporate Transaction; Change in Control. Upon a corporate transaction, including a “change in control” (as defined in the Plan), the Committee may make appropriate adjustments to the shares available for awards, the exercise price and/or base price and other actions it deems appropriate including, without limitation, providing that awards will be: (i) substituted for equivalent awards, (ii) upon reasonable prior written notice, terminated without payment if not exercised within a certain period (for options and SARs) or terminated if not accepted within a certain period (for restricted stock, RSUs and Unrestricted Stock), (iii) terminated in exchange for payment, (iv) become fully vested and exercisable, and/or (v) with respect to Performance Awards, settled based on the higher of the actual attainment of the performance targets or the grantee’s target award (but if the award is intended to comply with Code Section 162(m), it will be settled in a manner that complies with Code Section 162(m)).

Rights of Holders; Transferability. Unless otherwise provided in an award agreement, a grantee will have none of the rights of a stockholder (including the right to receive dividends or dividend equivalents) until the common stock covered by the award is paid or issued to him. Although awards will generally be nontransferable (except by will or the laws of descent and distribution), the Committee may determine in an award agreement that a nonqualified stock option is transferable to certain family members.

Certain U.S. Federal Income Tax Consequences

The rules concerning the federal income tax consequences with respect to awards pursuant to the Plan are highly technical. In addition, the applicable statutory provisions are subject to change and their application may vary in individual circumstances. Therefore, the following is designed to provide a general understanding of the federal income tax consequences as of the date of this proxy statement; it does not set forth any state or local income tax or estate tax consequences that may be applicable.

The following summary is included for general information only and does not purport to address all the tax considerations that may be relevant. Each grantee is urged to consult his or her own tax advisor as to the specific tax consequences of any award to such grantee.

Incentive Stock Options. A grantee will generally have no tax consequences when he or she receives the grant of an ISO. In most cases, a grantee also will not have income tax consequences when he or she exercises an ISO. A grantee may have income tax consequences when exercising an ISO if the aggregate fair market value of the shares of the common stock subject to the ISO that first become exercisable in any one calendar year exceeds $100,000. If this occurs, the excess shares (the number of shares the fair market value of which exceeds $100,000 in the year first exercisable) will be treated as though they are nonqualified stock options instead of ISOs. Additionally, subject to certain exceptions for death or disability, if an employee grantee exercises an ISO more than three months after termination of employment, the exercise of the option will be taxed as the exercise of nonqualified stock options. Any shares recharacterized as nonqualified stock options will have the tax consequences described below with respect to the exercise of nonqualified stock options.

A grantee recognizes income when selling or exchanging the shares acquired from the exercise of an ISO in the amount of the difference between the fair market value at the time of the sale or exchange and the exercise price the grantee paid for those shares. This income will be taxed at the applicable capital gains rate if the sale or exchange occurs after the expiration of the requisite holding periods. Generally, the required holding periods expire two years after the date of grant of the ISO and one year after the date the common stock is acquired by the exercise of the ISO. Further, the amount by which the fair market value of a share of the common stock at the time of exercise of the ISO exceeds the exercise price will likely be included in determining a grantee’s alternative minimum taxable income and may cause the grantee to incur an alternative minimum tax liability in the year of exercise.

If a grantee disposes of the common stock acquired by exercising an ISO before the holding periods expire, the grantee will recognize compensation income. The amount of income will equal the difference between the option exercise price and the lesser of (i) the fair market value of the shares on the date of exercise and (ii) the price at which the shares are sold. This amount will be taxed at ordinary income rates and be subject to employment taxes. If the sale price of the shares is greater than the fair market value on the date of exercise, the grantee will recognize the difference as gain and will be taxed at the applicable capital gains rate. If the sale price of the shares is less than the exercise price, the grantee will recognize a capital loss equal to the excess of the exercise price over the sale price.

Using shares acquired by exercising an ISO to pay the exercise price of another option (whether or not it is an ISO) will be considered a disposition of the shares for federal tax purposes. If this disposition occurs before the expiration of the required holding periods, the grantee will have the same tax consequences as are described above in the preceding paragraph. If the grantee transfers any of these shares after holding them for the required holding periods or transfers shares acquired by exercising a nonqualified stock option or on the open market, he or she generally will not recognize any income upon exercise. Whether or not the transferred shares were acquired by exercising an ISO and regardless of how long the option holder has held those shares, the basis of the new shares received from the exercise will be calculated in two steps. In the first step, a number of new shares equal to the number of older shares tendered (in payment of the option’s exercise) is considered exchanged under Code Section 1036 and the related rulings; these new shares receive the same holding period and the same basis the grantee had in the old tendered shares, if any, plus the amount included in income from the deemed sale of the old shares and the amount of cash or other nonstock consideration paid for the new shares, if any. In the second step, the number of new shares received by the grantee in excess of the old tendered shares receives a basis of zero, and the grantee’s holding period with respect to such shares commences upon exercise.

There will be no tax consequences to the Company when we grant an ISO or, generally, when a grantee exercises an ISO. However, to the extent that a grantee recognizes ordinary income when he or she exercises, as described above, we generally will have a tax deduction in the same amount and at the same time.

Nonqualified Stock Options. A grantee generally has no income tax consequences from the grant of nonqualified stock options. Generally, in the tax year when the grantee exercises the nonqualified stock option, he or she recognizes ordinary income in the amount by which the fair market value of the shares at the time of exercise exceeds the exercise price for the shares, and that amount will be subject to employment taxes.

If a grantee exercises a nonqualified stock option by paying the exercise price with previously-acquired common stock, he or she will have federal income tax consequences (relative to the new shares received) in two steps. In the first step, a number of new shares equivalent to the number of older shares tendered (in payment of the nonqualified stock options exercised) is considered to have been exchanged in accordance with Code Section 1036 and related rulings, and no gain or loss is recognized. In the second step, with respect to the number of new shares acquired in excess of the number of old shares tendered, the grantee recognizes income on those new shares equal to their fair market value less any non-stock consideration tendered. The new shares equal to the number of the old shares tendered will have the same basis the grantee had in the old shares and the holding period with respect to the tendered older shares will apply to the new shares. The excess new shares received will have a basis equal to the amount of income recognized on exercise, increased by any non-stock consideration tendered. The holding period begins on the exercise of the option.

The gain, if any, realized at the later disposition of the common stock will either be short- or long-term capital gain, depending on the holding period.

There will be no tax consequences to the Company when granting a nonqualified stock option. We generally will have a tax deduction in the same amount and at the same time as the ordinary income recognized by the grantee.

Stock Appreciation Rights. Neither the grantee nor the Company has income tax consequences from the issuance of a SAR. The grantee recognizes taxable income at the time the SAR is exercised in an amount equal to the amount by which the cash and/or the fair market value of the shares of the common stock received upon that exercise exceeds the base price. The income recognized on exercise of a SAR will be taxable at ordinary income tax rates and be subject to employment taxes. We generally will be entitled to a tax deduction with respect to the exercise of a SAR in the same amount and at the same time as the ordinary income recognized by the grantee.

Restricted Stock. A grantee receiving restricted stock will not recognize income at the time of the award, unless he or she specifically makes an election to do so under Code Section 83(b) within thirty days of such award. Unless the grantee has made such an election, he or she will realize ordinary income and be subject to employment taxes in an amount equal to the fair market value of the shares on the date the restrictions on the shares lapse, reduced by the amount, if any, he or she paid for such stock. We will generally be entitled to a corresponding deduction in the same amount and at the same time as the grantee recognizes ordinary income. Upon the otherwise taxable disposition of the shares awarded after ordinary income has been recognized, the grantee will realize a capital gain or loss (which will be long-term or short-term depending upon how long the shares are held after the restrictions lapse).

If the grantee made a timely election under Code Section 83(b), he or she will recognize ordinary income for the taxable year in which an award of restricted stock is received in an amount equal to the fair market value of the restricted stock (even if the shares are subject to forfeiture). That income will be taxable at ordinary income tax rates. At the time of disposition of the shares, if such an election was made, the grantee will recognize gain in an amount equal to the difference between the sales price and the fair market value of the shares at the time of the award. Such gain will be taxable at the applicable capital gains rate. The Company will generally be entitled to a tax deduction in the same amount and at the same time as the ordinary income recognized by the grantee.

Restricted Stock Units. A grantee receiving RSUs generally will not recognize income at the time of the award. Upon delivery of the cash or shares due upon settlement of an RSU, a grantee will realize ordinary income and be subject to employment taxes in an amount equal to the fair market value of the shares distributed. We will generally be entitled to a corresponding tax deduction in the same amount and at the same time as the grantee recognizes income. When the grantee later disposes of his or her shares, the difference between the amount realized on sale and the amount recognized by the grantee upon settlement of the RSU will be a capital gain or loss (which will be long-term or short-term depending upon how long the shares are held).

Unrestricted Stock. A grantee of Unrestricted Stock will realize ordinary income and be subject to employment taxes in an amount equal to the fair market value of the Unrestricted Shares granted reduced by the amount, if any, he or she paid for such stock. We will generally be entitled to a corresponding tax deduction in the same amount and at the same time as the grantee recognizes income. When the grantee later disposes of his or her shares, the difference between the amount realized on sale and the amount recognized by the grantee upon grant of the Unrestricted Stock will be a capital gain or loss (which will be long-term or short-term depending upon how long the shares are held).

Performance Awards. A grantee receiving a Performance Awards will generally recognize ordinary income and be subject to employment taxes in the year a payment of Performance Award under the Plan is received. Similarly, we will generally recognize a tax deduction in the same amount and at the same time.

Effect of Code Section 162(m). Code Section 162(m) imposes a $1,000,000 limit on the amount of compensation that may be deducted by us in any tax year with respect to our chief executive officer and each of the next three most highly paid executive officers (other than our chief financial officer). Compensation that is “qualifying performance-based compensation” is not taken into account in determining whether the limit has been exceeded. Certain awards under the Plan, such as stock options and SARs granted at fair market value, are treated as qualifying performance-based compensation. As such, any applicable deduction by us related to the exercise of such awards may not be subject to the deductibility limit imposed by Code Section 162(m).

All other awards made under the Plan would not be treated as qualifying performance-based compensation, except to the extent they are designed as “performance-based awards,” as described above, and performance goals are attained. In addition, your approval of this Proposal 5 will be considered shareholder approval of the business criteria upon which “qualifying performance-based compensation” may be based, the annual per-participant limit on performance-based awards and the class of employees eligible to receive performance-based awards.

Effect of Code Section 280G. Code Section 280G limits the deductibility of certain payments that are contingent upon a change of control if the total amount of such payments equals or exceeds three times the individual's “base amount” (i.e., generally, annualized five-year W-2 compensation). If payment or settlement of an award is accelerated upon a change of control, a portion of such payment attributable to the value of the acceleration is considered a payment that is contingent upon a change of control. In addition, the affected individual must pay an excise tax (in addition to any income tax) equal to 20% of such amount.

Impact of Code Section 409A. Code Section 409A provides that all amounts deferred under a nonqualified deferred compensation plan are includible in a service provider's gross income to the extent such amounts are not subject to a substantial risk of forfeiture, unless certain requirements are satisfied. If the requirements are not satisfied, in addition to current income inclusion, interest at the underpayment rate plus 1% will be imposed on the service provider's underpayments that would have occurred had the deferred compensation been includible in gross income for the taxable year in which first deferred or, if later, the first taxable year in which such deferred compensation is not subject to a substantial risk of forfeiture. The amount required to be included in income is also subject to an additional 20% tax. While most awards under the Plan are anticipated to be exempt from the requirements of Code Section 409A, awards not exempt from Code Section 409A are intended to comply with Code Section 409A.

Certain Other Tax Consequences. Any of our officers that are subject to restrictions on sale of stock under Section 16(b) of the Exchange Act may be able to delay income taxation of their awards to the extent that they are restricted by such section from selling their stock.

Other Information. Subject to the terms and provisions of the Plan, the individuals that receive awards and the terms and conditions of such awards are determined at the discretion of the Committee. Since no such determination regarding awards or grants has yet been made, the benefits or amounts that will be received by or allocated to our executive officers and other Service Providers cannot be determined at this time.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE NOVA LIFESTYLE, INC. 2014 OMNIBUS LONG-TERM INCENTIVE PLAN.

CORPORATE GOVERNANCE

Leadership Structure and Role in Risk Oversight

Thanh H. Lam has served as Chairperson of the Board since June 2013 and as our President and a member of our Board since June 2011. Prior to Ms. Lam’s appointment as Chairperson of the Board, Ya Ming Wong served as Chairman of the Board from June 2011 until June 2014. Mr. Wong continues to serve as our Chief Executive Officer and as a director, both of which he has served as since June 2011. Our Board continues to believe there are important advantages to Ms. Lam serving as both Chairperson and President at this time. Ms. Lam is the director most familiar with our business and industry and is best situated to propose Board agendas and lead Board discussions on important matters. Ms. Lam provides a strong link between management and the Board, which promotes clear communication and enhances strategic planning and implementation of corporate strategies. Further, four of our seven current Board members have been deemed to be independent by our Board; therefore, we believe our board structure provides sufficient independent oversight of our management.

Our Board is responsible for oversight of the Company’s risk management practices while management is responsible for the day-to-day risk management processes. In the Board’s opinion, this division of responsibilities is the most effective approach for addressing the risks facing the Company. The Board receives periodic reports from management regarding the most significant risks facing the Company. In addition, the Audit Committee assists the Board in its oversight of our risk assessment and risk management policies. Our Audit Committee is empowered to appoint and oversee our independent registered public accounting firm, monitor the integrity of our financial reporting processes and systems of internal controls and provide an avenue of communication among our independent auditors, management, our internal auditing department and our Board.

The Board has not named a lead independent director.

The Board does not have a formal policy with respect to Board nominee diversity. However, in recommending proposed nominees to the full Board, the Nominating and Corporate Governance Committee considers diversity in the context of the Board as a whole and considers the diversity of background and experience, including with respect to age, gender, international background, race, and specialized experience of current and prospective directors as important factors in identifying and evaluating potential director nominees.

Director Independence

Our Board reviews each nominee’s relationship with the Company in order to determine whether a director nominee is independent pursuant to the listing rules of NASDAQ. Our Board has determined that each of James Talevich, Michael Viotto and Peter Kam meets the independence requirements and standards currently established by NASDAQ. All of the members of each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are independent as defined in NASDAQ Rule 5605(a)(2).