As of April 10, 2017, there were 26,959,865 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Nova LifeStyle, Inc. Proxy Statement for the 2017 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

NOVA LIFESTYLE, INC.

| | | Page |

| PART I |

| | | |

| Item 1. | | 1 |

| Item 1A. | | 8 |

| Item 1B. | | 19 |

| Item 2. | | 20 |

| Item 3. | | 20 |

| Item 4. | | 20 |

| | | |

| PART II |

| | | |

| Item 5. | | 21 |

| Item 6. | | 21 |

| Item 7. | | 21 |

| Item 7A. | | 31 |

| Item 8. | | 31 |

| Item 9. | | 32 |

| Item 9A. | | 32 |

| Item 9B. | | 33 |

| | | |

| PART III |

| | | |

| Item 10. | | 34 |

| Item 11. | | 34 |

| Item 12. | | 34 |

| Item 13. | | 34 |

| Item 14. | | 34 |

| | | |

| PART IV |

| | | |

| Item 15. | | 35 |

| | | F-1 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, regarding our company that include, but are not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict.

These forward-looking statements involve various risks and uncertainties. Although we believe our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Our Business” and other sections in this report. You should read this report and the documents we refer to thoroughly with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this report include additional factors which could adversely impact our business and financial performance.

This report contains statistical data we obtained from various publicly available government publications and industry-specific third party reports. Statistical data in these publications also include projections based on a number of assumptions. The markets for our products may not grow at the rate projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our securities. In addition, the rapidly changing nature of our customers’ industries results in significant uncertainties in any projections or estimates relating to the growth prospects or future condition of our markets. Furthermore, if any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

Unless otherwise indicated, information in this report concerning economic conditions and our industry is based on information from independent industry analysts and publications, as well as our estimates. Except where otherwise noted, our estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. None of the independent industry publication market data cited in this report was prepared on our or our affiliates’ behalf.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this report and the documents we refer to in this report and have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

As used in this report, “Nova LifeStyle,” “Nova,” the “Company,” “we,” “our” and similar terms refer to Nova LifeStyle, Inc. and its subsidiaries, unless the context indicates otherwise.

Our functional currency is the U.S. Dollar, or USD, while the functional currency of our former subsidiaries in China are denominated in Chinese Yuan Renminbi, or RMB, the national currency of the People’s Republic of China, which we refer to as the PRC or China. The functional currencies of our foreign operations are translated into USD for balance sheet accounts using the current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using the average exchange rate during the fiscal year. See Note 2 of the consolidated financial statements included herein.

PART I

Our Company

Nova LifeStyle, Inc. (“Nova LifeStyle” or the “Company”) is a broad based distributor and retailer of contemporary styled residential furniture incorporated into a dynamic marketing and sales platform offering retail as well as online selection and purchase fulfillment globally. We monitor popular trending and work to create design elements that are then integrated into our product lines that can be used as both stand-alone or whole-room and home furnishing solutions. Through our global network, Nova LifeStyle also sells (through an exclusive third party manufacturing partner) a managed variety of high quality bedding foundation components.

Nova LifeStyle’s brand family currently includes Diamond Sofa (www.diamondsofa.com), Colorful World, Giorgio Mobili, and Bright Swallow.

Our customers principally consist of distributors and retailers having specific geographic coverages that deploy middle to high end private label home furnishings having very little competitive overlap within our specific furnishings products or product lines. Nova LifeStyle is constantly seeking to integrate new sources of distribution and manufacturing that are properly aligned with our growth strategy, thus allowing us to continually focus on building both same store sales growth as well as drive the expansion of our overall distribution and manufacturing relationships through a deployment of popular, as well as trend-based furnishing solutions worldwide.

We traditionally generated the majority of our sales serving as a trading company and vertically integrated manufacturer for global furniture distributors and large national retailers. In the U.S. and international markets, we focus on establishing and expanding long term relationships with our customers by providing large scale and cost-effective sourcing in China. Our logistics and delivery capabilities provide our customers with the flexibility to select from our extensive furniture collections in their respective shipments. Our experience developing and marketing products for international markets has enabled us to develop the scale, logistics and marketing efficiencies and design expertise that serves as the foundation for us to expand aggressively into the highly attractive U.S., Canadian, European, Australian and Middle Eastern markets.

Our History

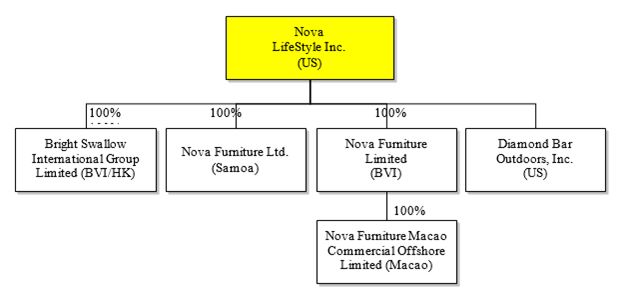

We are a U.S. holding company with no material assets other than the ownership interests of our wholly owned subsidiaries through which we market, design, and sell residential furniture worldwide: Nova Furniture Limited in the British Virgin Islands (“Nova Furniture”), Nova Furniture Limited in Samoa (“Nova Samoa”), Nova Furniture Macao Commercial Offshore Limited (“Nova Macao”), Bright Swallow International Group Limited (“Bright Swallow”), and Diamond Bar Outdoors, Inc. (“Diamond Bar”). Nova Macao was organized under the laws of Macao on May 20, 2006. Nova Macao is a wholly owned subsidiary of Nova Furniture. Diamond Bar, doing business as Diamond Sofa, is a California corporation organized on June 15, 2000, which we acquired pursuant to a stock purchase agreement on August 31, 2011. On April 24, 2013, we acquired all of the outstanding stock of Bright Swallow; the purchase price was $6.5 million in cash and was fully paid at the closing of the acquisition.

On October 24, 2013, Nova Furniture (Dongguan) Co., Ltd. (“Nova Dongguan”) incorporated Dongguan Ding Nuo Household Products Co., Ltd. (“Ding Nuo”) under the laws of the PRC and contributed capital of RMB 1 million ($162,994). Nova Dongguan made an additional capital contribution of RMB 0.1 million ($16,305) on November 27, 2013 through one of Nova Dongguan’s officers, Mr. Gu Xing Chang, who acted as the nominee shareholder of Ding Nuo.

On September 23, 2016, Nova Furniture, a wholly-owned subsidiary of the Company (the “Seller”), entered into a Share Transfer Agreement (the “Agreement”) with Kuka Design Limited, an unrelated company incorporated in British Virgin Islands (“Kuka Design BVI” or “Buyer”). Pursuant to the terms of the Agreement, the Seller sold all of the outstanding equity interests in Nova Dongguan, a wholly owned subsidiary of the Seller, to the Buyer for a total of $8,500,000 (the “Transaction”), which such value was primarily derived from Nova Dongguan and Nova Donguan’s wholly owned subsidiary, Nova Museum, and 90.97% owned subsidiary, Ding Nuo. Upon consummation of the Transaction on October 25, 2016, the Buyer became the sole owner of Nova Dongguan.

On November 10, 2016, Nova Furniture (“Assignor”) entered into a Trademark Assignment Agreement with Kuka Design BVI (“Assignee”). Pursuant to the terms of the Trademark Assignment Agreement, Assignor agreed to assign to the Assignee its full right to, and title in, the NOVA trademark in China for $6,000,000 (the “Assignment Fee”). Assignee was to pay the Assignment Fee in two installments: $1,000,000 on or before November 30, 2016, and $5,000,000 on or before December 31, 2016. As of December 31, 2016, $4,750,000 had been received, and the remaining balance of $1,250,000 was received in January 2017.

As a result, the operations of Nova Dongguan, Nova Museum and Ding Nuo are now accounted for as discontinued operations in the accompanying consolidated financial statements for all periods presented.

In the previous reports filed with SEC, the Company erroneously reported that Nova Samoa, another wholly-owned subsidiary entered into the Agreement and the Trademark Assignment Agreement with Kuka Design BVI and sold all of the issued and outstanding shares of Nova Furniture to Kuka Design BVI and assigned the right to, and title in, the NOVA trademark in China to Kuka Design BVI.

Our organizational structure is set forth in the following diagram:

Our Products

We market and develop modern home furniture for today’s middle class, urban consumer in diverse markets worldwide. Our product offerings feature urban contemporary styles offering comfort and functionality in matching furniture collections and upscale luxury pieces appealing to lifestyle-conscious middle and upper middle-income consumers. Many of our products are part of multi-piece lifestyle collections in distinctive styles targeted at the medium and upper-medium price ranges and feature upholstered, wood and metal-based residential furniture pieces. We classify our products by room; or series, including living room, dining room, bedroom and home office, and by category or piece such as sofas, chairs, dining tables, beds, entertainment consoles, cabinets and cupboards. Our largest selling product categories in the year ended December 31, 2016 were sofas, beds and dining tables, which accounted for approximately 61%, 11% and 7% of 2016 sales, respectively. For the year ended December 31, 2015, our largest selling product categories were sofas, dining tables and beds, which accounted for approximately 36%, 15% and 14% of sales, respectively, of 2015 sales. Our products are manufactured primarily from medium-density fiberboard, or MDF board, and particleboard covered with veneers or lacquers and combined with other materials, including steel, glass, marble, leather and fabrics.

Our product offerings consist of a mix of furnishings designed by us and sourced from third party manufacturers. Through market research, customer feedback, and ongoing design development; we identify new trends and customer needs in our target markets for incorporation into new products, collections and brands. Our products and collections are designed to appeal to consumer preferences in specific markets. We develop both individual pieces and collections for entire rooms, which feature matching furniture suites, providing convenient whole-home furnishing options for lifestyle-conscious end consumers. We generally introduce new collections and styles by participating in international furniture exhibitions and through our sample rooms, and support new product launches with promotions, product brochures and online marketing. Our staff works with customers worldwide to design store and showroom layouts that highlight our matching furniture collections by displaying complete and fully accessorized room settings instead of individual furniture pieces. We believe that this style of presentation in stores encourages consumers to purchase an entire room of furniture instead of individual pieces from different brands or manufacturers. We source finished products based on our designs or those of our customers from third party manufacturers to fulfill orders placed by customers in international markets. We believe that our products feature the quality, appearance, functionality and price points sought by today’s middle to upper middle-income consumers in the U.S., Europe, Australia and the Middle East.

International Markets

We sell products to the U.S., Canadian, Australian, European and Middle Eastern markets under the Diamond Sofa brand and as a trading company. The markets in the U.S. and Europe remain challenging because they are experiencing a slower than anticipated recovery from the recent international financial crisis and the Euro-area crisis in particular. We believe that discretionary purchases of furniture by middle to upper middle-income consumers, our target global consumer market, will increase along with the expected growth in the worldwide furniture trade and recovery of housing markets. Furthermore, we believe that furniture featuring modern and contemporary styling such as ours will continue to be in greater demand.

In 2016, our products were sold in over 18 countries worldwide, with North America and Europe our principal international markets, while we expanded our sales in other regions Sales to North America accounted for 62.8% and 83.9% of sales in 2016 and 2015, respectively. Sales to Europe accounted for 13.5% and 11.8% of sales in 2016 and 2015, respectively, with the increase attributed principally to the recovery of the Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. Sales to other regions, primarily in Asia and Australia, accounted for 23.7% and 4.3% of total sales in 2016 and 2015, respectively. As we continue to expand our broad network of distributors, increase direct sales and enter emerging growth markets, we believe that we are well positioned to respond to changing market conditions, allowing us to take advantage of any upturns in the global and local economies of the markets we serve.

Our logistics and delivery capabilities provide our customers with the flexibility to select from our extensive furniture collections in their respective shipments. We design and supply our products for direct sales to private label retailers worldwide and for global furniture distributors and wholesalers that in turn offer our products to retailers under their own brand names, including Actona Company (Denmark), Artemis (Australia), BUT International (France), Dormitienda (Spain) and El Dorado Furniture (United States). We offer a wide selection of stand-alone pieces across a variety of product categories and approximately 20 product collections developed exclusively for international markets. During 2017, we expect to focus on both online and offline sales. We also sell products under the Diamond Sofa brand to distributors and retailers in North America and South America and to end-user consumers in the U.S. market through third-party shopping portals. Our research and development team works with our customers to modify our existing product designs and create new designs and styles for their market’s particular requirements. We believe that we can continue to expand our sales in the U.S. and international markets as we integrate the Diamond Sofa brand and increase our direct sales to retailers and chain stores as we expand and explore new markets worldwide.

Sales and Marketing

Our sales and marketing strategies target middle class, urban consumers, including: (1) increasing direct sales in the U.S. and internationally; (2) internet sales and online marketing; and (3) participation in trade exhibitions.

We plan to increase our direct sales to retailers and chain stores in the U.S. and international markets as we continue to diversify our customer base from global furniture distributors. In August 2011, we acquired Diamond Bar, a California importer and marketer of modern home furniture in North and South America. Diamond Bar markets and sells products under the Diamond Sofa brand to distributors and retailers principally in the U.S. market. We plan to continue expanding sales of the Diamond Sofa brand in the U.S., Mexico and South America markets through Diamond Bar’s longstanding customer relationships and distribution capabilities. Through our relationship with St. Joyal, a California-based corporation specializing in business development, management and organizational planning and an investor in us and our subsidiary, Nova Furniture, we plan to continue expanding our direct sales and marketing efforts in North America, and in particular the U.S., which historically is the largest market worldwide for sales of imported furniture. St. Joyal has extensive business contacts with U.S. domestic furniture wholesalers and retailers, through which we have been introduced to some of our current customers in the U.S. In addition, we plan to expand our existing presence in the U.S. market as we integrate the business of Diamond Bar, grow our U.S.-based management and sales team and focus on the expansion of our existing showrooms featuring the Diamond Sofa brand. We intend to develop the Diamond Sofa brand and introduce new brands for our direct sales in the U.S. and international markets while continuing to supply products under private label brands to retailers and chain stores.

Our acquisition of Bright Swallow International Group Limited (“Bright Swallow”), an established furniture company with a global client base, was finalized in late April of 2013, and Bright Swallow has become an integral part of the Nova LifeStyle brand family. Bright Swallow posted revenues of just over $6.90 million and $5.92 million for fiscal years 2016 and 2015, respectively, and its complementary product line and geographical reach has offered Nova LifeStyle an ideal opportunity to expand its overall global market presence. One of Bright Swallow’s current clients, Canada-based The Brick Limited (www.TheBrick.com) has over 200 locations and provides an excellent example of this exceptional integration opportunity. Nova LifeStyle has primary management for the operation of Bright Swallow and under the terms all issued and outstanding shares of Bright Swallow were transferred to Nova by Bright Swallow’s sole owner, Mr. Zhu Wei for an aggregate purchase price of $6.5 million in cash.

Diamond Bar currently sells products under the Diamond Sofa brand in the U.S. through third party shopping portals, shipping orders received online direct to the end customer. We believe that our planned direct-to-consumer online sales and marketing strategies will increase our sales in the U.S. by building our brand awareness and acting as an effective advertising vehicle. We also support new product collections and brand launches with print and online advertising campaigns, participation in furniture exhibitions and offering of product brochures and samples. We provide samples and brochures of new products for international markets to distributors and buyers, as is common in the furniture industry.

We generally gain new customers in the international markets and introduce new product collections and styles by participating in and attending international furniture exhibitions throughout the year. We believe this marketing process gives us greater insight into developing tastes and trends in the marketplace and helps us better understand the challenges facing the distributors and buyers with whom we do the majority of our international business. Historically, we have exhibited our products at the International Famous Furniture Fair (3F) in Dongguan, China and the China International Furniture Exhibition in Shanghai, China. We have also shown our products under the Diamond Sofa brand at the Las Vegas Market (U.S.) and High Point Market (U.S.) and at furniture exhibitions worldwide in connection with our customers Actona Company at IMM Cologne (Germany) and Yeh Brothers at Interiors Birmingham (United Kingdom). We anticipate attending and exhibiting at additional furniture exhibitions to meet new distributors and buyers as we expand and explore emerging international markets, such as the Middle East. We maintain showrooms to highlight our latest collections at Diamond Bar’s headquarters in California and at High Point Market and Las Vegas Market.

Suppliers and Manufacturers

We source finished goods from third-party manufacturers to fulfill orders placed by customers through Nova Macao and Diamond Bar for the U.S. and international markets. Our principal suppliers of finished goods in 2016 were Zhejiang Luxury Trading Company Limited, Kuka Design Ltd. and Yin Tong Furniture Limited accounting for approximately 22.0%, 18.5% and 16.5% of our total purchases, respectively. By maintaining relationships with multiple suppliers, we benefit from a more stable supply chain and more competitive prices. If a change of suppliers is necessary, we believe that we can quickly fulfill our requirements from other suppliers without impacting order fulfillment. We monitor our suppliers’ ability to meet our product needs and we participate in quality assurance activities to reinforce adherence to our quality standards. Our third-party manufacturing contracts are generally of annual or shorter duration, or manufactured products are sourced on the basis of individual purchase orders. Our manufacturing relationships are non-exclusive, and we are permitted to procure our products from other sources at our discretion. None of our manufacturing contracts include production volume or purchase commitments on the part of either party. Our third-party manufacturers are responsible for the sourcing of raw materials and producing parts and finished products to our specifications. We hold our suppliers to strict quality and delivery specifications. Our quality control procedures include quality assurance of raw materials used in the production of our products, which includes an evaluation and selection of established and reputable suppliers.

Customers

Our target end customer is the middle and upper middle-income consumer of residential furniture. In the U.S. and international markets, our sales principally are to furniture distributors and retailers who in turn offer our products under their own brands or under our Diamond Sofa brand. Our largest customers in 2016 were Shanxi Wanqing Senior Care Service, Group and Actona Company A/S, a global furniture distributor, which accounted for 10.8% and 9.7% of our total sales in 2016, respectively. Our two largest customers in 2015 were Actona Company A/S and Encore Sofa Inc., which in total accounted for 11.8% of our sales in 2015. No other individual customer accounted for greater than 10% of our sales in 2016 or 2015. We plan to increase direct sales to retailers and chain stores worldwide as we continue to diversify our customer base from global furniture distributors.

We are focusing on establishing and growing long-term relationships with our customers. We believe that the majority of our customers view us as a strategic long-term supplier and value the quality of our products, our timely delivery and design capabilities. We generally negotiate renewable supplier agreements with firm pricing on our products, typically for a term of one year, as is customary in the furniture industry, with individual orders made on standard purchase orders. Our sales to customers outside of China were $82.64 million in 2016, as compared to $89.94 million in 2015, accounting for 89% of sales in 2016 and 100% in 2015. In 2016, we sold products into approximately 18 countries worldwide, with North America and Europe as our principal international markets, while we expanded our sales in other regions. Sales to North America accounted for 63% and 84% of sales in 2016 and 2015, respectively. Sales to Europe accounted for 13% and 12% of sales in 2016 and 2015, respectively, with the decrease attributed principally to the challenging Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. Sales to other regions, primarily in Asia and Australia, accounted for 24% and 4% of our total sales in 2016 and 2015, respectively. We expect that a majority of our sales will continue to come from our sales to the U.S. and international markets. We acquired Diamond Bar in August 2011, which has driven expansion of our sales to the U.S., Mexico, and South America through Diamond Bar’s longstanding customer relationships and distribution capabilities. It should be noted that Diamond Bar accounted for 53.7% and 43.5% of Nova Lifestyle’s total sales in 2016 and 2015, respectively, and Nova Macao’s revenues accounted for 38.8% and 49.9% of Nova Lifestyle’s total sales in 2016 and 2015, respectively. In addition, we anticipate increasing internet sales under the Diamond Sofa brand through third-party shopping portals. We believe that as we expand our broad network of distributors and increase direct sales, our exposure to regional recessions will be reduced and allow us to better capitalize on emerging market trends.

We typically experience stronger fourth and first calendar quarters as our product sales are subject to the seasonality and fluctuations typical of the furniture industry. This industry-based seasonality generally is caused by shipping lead-times to international markets combined with the real estate market slowdown and decrease in furniture consumption commonly experienced during the summer months in the Northern Hemisphere markets in which the majority of our customers are located and our products sell at retail. In addition, we believe that consumer demand for furniture generally reflects sensitivity to overall economic conditions, including, but not limited to, unemployment rates, housing market conditions and consumer confidence.

Competition

The residential furniture industry is highly competitive, consisting of a large number of manufacturers, distributors and retailers, none of which dominates the fragmented and diverse market. Our products principally compete in the U.S., China, Europe and Australia. The primary competitive factors in these markets for our product price points and target consumers are price, quality, style, marketing, functionality and availability.

In the U.S. and international markets, we compete against other furniture distributors and wholesalers, most of which are located in China and other Southeast Asian countries, and against traditional distributors in North America and Europe. We believe that we are competitive with North American and European distributors because we have a history of prompt delivery of quality products and offer approximately 30 distinct product collections that we developed for international markets at comparable prices and with styles and functionality similar to those offered by our competitors. We coordinate the efforts of our sales and marketing team to receive feedback from customers as part of our ongoing research and design of products. This research process allows us to develop and modify products to meet the varied and changing stylistic and functional demands of our customers worldwide. We believe that our experience and proven performance provides us with a competitive edge over other manufacturers for the U.S. and international markets. In addition to our design and logistical capabilities, we believe that our ability and experience at sourcing products for distributors to the U.S. and international markets are significant competitive advantages. We expanded our presence in the North American market through our acquisitions of Diamond Bar in August 2011 and Bright Swallow in 2013, whereby we anticipate further increasing our direct sales to North American retailers through Diamond Bar’s and Bright Swallow’s longstanding customer relationships and distribution capabilities.

Environmental and Regulatory Matters

Our operations are subject to various laws and regulations both domestically and abroad. In the U.S., federal, state and local regulations impose standards on our workplace and our relationship with the environment. For example, the U.S. Environmental Protection Agency, Occupational Safety and Health Administration and other federal agencies have the authority to promulgate regulations that may impact our operations. In particular, we are subject to legislation placing restrictions on our generation, emission, treatment, storage and disposal of materials, substances and wastes. Such legislation includes: the Toxic Substances Control Act; the Resource Conservation and Recovery Act; the Clean Air Act; the Clean Water Act; the Safe Drinking Water Act; and the Comprehensive Environmental Response and the Compensation and Liability Act (also known as Superfund). We are also subject to the requirements of the Consumer Product Safety Commission and the Federal Trade Commission, in addition to regulations concerning employee health and safety matters. Although compliance with federal, state, local and international environmental legislation has not had a material adverse effect on our financial condition or results of operations or cash flows in the past, there can be no assurance that material costs or liabilities will not be incurred in connection with such environmental matters in the future.

Intellectual Property

We rely on the patent and trademark protection laws in the U.S. to protect our intellectual property and maintain our competitive position in the marketplace. We and our subsidiaries hold two trademarks registered in the U.S. related to the Diamond Sofa brand. We acquired all rights, title and interest in the two registered U.S. trademarks pursuant to a trademark purchase and assignment agreement dated August 31, 2011, from St. Joyal for $0.2 million paid in full at the closing. In addition, we have registered and maintain numerous internet domain names related to our business, including “novalifestyle.com” and “diamondsofa.com”. Collectively, the trademarks and domain names that we and our subsidiaries hold are of material importance to us.

Research and Development

We believe that the development of new product designs and functionality is important to our continued success. We actively seek to protect our product designs and brand names under the patent and trademark protection laws in the U.S. and China, but the copying of a product’s appearance is a common and ongoing issue in the furniture industry as manufacturers seek to capitalize on popular designs and features by copying those of their competitors and making subtle changes to avoid infringement claims. To remain competitive, we believe that we must innovate continuously, and we have developed a design process that we believe enables us to better manage the short product life cycle for furniture designs by anticipating and responding quickly to changing consumer preferences. We attend furniture exhibitions worldwide, conduct market research and solicit customer feedback to help us identify new trends and customer needs in our target markets for incorporation into new product designs. We plan to introduce new product collections annually for the U.S. and international markets. We anticipate introducing new products under the Diamond Sofa brand on a quarterly basis for the U.S. market. We assess the success of each product and product collection at least annually in consideration of whether to continue production.

We currently perform all design and development related work for our products in-house using computer-aided modeling systems. We have used independent designers in the past for product design work, from which we build prototype furniture pieces for further refinement and testing. In 2016 and 2015, we invested $95,877 and $139,869, respectively, on research and development expense. We may increase future investments in research and development based on our growth and available capital.

Furniture Industry Regulations and Standards

We and our products are subject to PRC, U.S. and international regulations related to the furniture industry.

China has a series of national standards, or the GB and QB standards, that govern certain technical, safety and quality requirements for furniture manufactured in and exported from China. The Standardization Administration of the PRC, or SAC, and the China Chamber of Commerce for Import and Export of Light Industrial Products and Art-Crafts, or the CCCLA, develop and revise these national standards relating to the structure, material, size and quality requirements for the many varied categories and classifications of upholstered, wood and metal-based furniture. Many of these standards are not compulsory, but manufacturers typically follow all applicable recommended standards.

Our products are also subject to the mandatory and voluntary furniture test standards of the U.S. and international markets in which our products are distributed to end consumers, including those developed by the American National Standards Institute, or ANSI, Business and Institutional Furniture Manufacturer’s Association, or BIFMA, ASTM International, California Air Resources Board, or CARB, Furniture Industry Research Association, or FIRA, and the International Organization for Standardization, or ISO. These environmental, ecological and formaldehyde emission standards and source of origin labeling requirements are national or international, with the U.S. and European Union typically having the strictest standards for their markets. We manufacture all products to customer specifications and we believe that our products meet all currently applicable national and international furniture test standards.

Export Laws and Regulations

We may be subject from time to time to various PRC governmental regulations related to exportation, including the Customs Law of the PRC and the Regulation of the PRC on the Administration of the Import and Export of Goods. These laws and regulations set out standards and requirements for various aspects of the export and import of goods, customs registration, sanitary registration and inspection. Failure to comply with these laws and regulations may result in the confiscation of our products for export and proceeds from the sales of non-compliant products, orders for correction, fines, revocation of licenses and, in extreme cases, criminal liabilities. We believe we are in material compliance with all applicable PRC laws and regulations related to the exports of our products.

Foreign Currency Regulations

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, the RMB, the national currency of the PRC, is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, unless the prior approval of the State Administration of Foreign Exchange, or the SAFE, is obtained and prior registration with the SAFE is made.

On July 4, 2014, the SAFE issued Circular 37, the Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Corporate Financing and Roundtrip Investment through Offshore Special Purpose Vehicles, which became effective as of July 4, 2014. Please refer to “Risk Factors – Risks Related to Business in China – PRC regulations relating to the registration requirements for PRC resident shareholders owning shares in offshore companies may subject our PRC resident shareholders to personal liability and adversely affect our business” for a discussion of Circular 37.

On August 29, 2008, the SAFE promulgated Circular 142, the Notice on Perfecting Practices Concerning Foreign Exchange Settlement Regarding the Capital Contribution by Foreign-invested Enterprises, regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting how the converted RMB may be used. Please refer to “Risk Factors – Risks Related to Business in China – Restrictions on currency exchange may limit our ability to receive and use our revenues effectively” for a discussion of Circular 142.

Taxation

We are subject to transfer pricing regulations in the U.S. because we are subject to income taxes in the U.S. and conduct operations worldwide through our PRC subsidiaries. We assess our potential transfer pricing-related liabilities arising from transactions with Nova Macao on a quarterly basis, and we have taken an additional income tax expense as a reserve based on management’s analysis for estimated tax principal, interest and penalties under U.S. transfer pricing regulations.

Employees

As of December 31, 2016, we had 31 full time employees worldwide. Our U.S. corporate office and operations employed 28 full-time employees and our locations in Macau and Hong Kong employed a total of 3 full-time employees. We believe that relations with our employees are satisfactory. We have no collective bargaining agreements with our employees.

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our securities. Many of these events are outside of our control. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to Our Business

Changes in economic conditions in the industries and markets served by our customers could adversely affect demand for our products.

The furniture industry is subject to cyclical variations in the global economy and to uncertainty regarding future economic prospects. Our business is affected by the number of orders we are able to secure from our customers, which is determined by the level of our customers’ business activity. Our customers’ level of business activity is in turn determined by the level of consumer spending in the markets our customers serve. Home furnishings generally are considered a postponeable purchase by most consumers. Economic downturns could affect discretionary consumer spending habits by decreasing the overall demand for home furnishings. Any significant or prolonged decline of the economy in China, the U.S. or other international markets in which our products are sold will affect disposable income and spending by consumers in these markets, and may lead to a decrease in demand for consumer products. To the extent that such decrease in demand for consumer products translates into a decline in the demand for home furnishings, our sales and financial performance could be adversely affected. Any economic downturn also could negatively impact our primary customers, furniture wholesalers, distributors and retailers, possibly resulting in a decrease in our sales or earnings. Changes in interest rates, consumer confidence, new housing starts, existing home sales, the availability of consumer credit and geopolitical factors could have particularly significant effects on our consolidated financial condition, results of operations and cash flows. Any decline in economic activity and conditions in the industries and markets served by our customers and in which we operate may reduce demand for our products and could adversely affect our financial condition and results of operations.

We historically have derived a substantial part of our sales from a limited number of customers. If we lose any of these customers, or any of these customers reduce the amount of business they do with us, our sales may be adversely affected.

Historically, a substantial part of our sales was attributed to a limited number of customers. No major customer accounted for over 10% of our total sales in 2015. Sales to our largest customer constituted 11% of our total sales in 2016, primarily to markets in China. If the demand for our products decreases in one or more of the markets in the United States supplied by our largest customer, or if there are any material social or regulatory changes in these markets, our sales could decline and we could lose market share, any of which could materially harm our business. We do not foresee relying on these same customers for sales generation as we expand our business to increase our internet sales and direct sales to the U.S. and other international markets. We cannot assure you, however, that we will be able to successfully implement these plans.

If we lose our key personnel, or are unable to attract and retain additional qualified personnel, the quality of our services may decline and our business may be adversely affected.

We rely heavily on the expertise, experience and continued services of our senior management, including our Chief Executive Officer, President, Director and Chairperson, Ms. Lam, and our Chief Financial Officer, Mr. Ho. Loss of their services could adversely affect our ability to achieve our business objectives. Ms. Lam and Mr. Ho are key factors in our success at establishing relationships within the furniture industry in the U.S. and international market because of their extensive industry experience and reputation. The continued development of our business depends upon their continued employment. We have entered into employment agreements with Ms. Lam and Mr. Ho that include provisions for non-competition and confidentiality.

We believe our future success will depend upon our ability to retain key employees and our ability to attract and retain other skilled personnel. We cannot guarantee that any employee will remain employed by us for any period of time or that we will be able to attract, train or retain qualified personnel in the future. Such loss of personnel could have a material adverse effect on our business and company. Furthermore, we will need to employ additional personnel to expand our business. Qualified employees are in great demand and may be unavailable in the time frame required to satisfy our customers’ requirements. There is no assurance we will be able to attract and retain sufficient numbers of highly skilled employees in the future. The loss of personnel or our inability to hire or retain sufficient personnel at competitive rates could impair the growth of our business.

We may not be able to keep pace with competition in our industry, which could adversely affect our market share and result in a decrease in our future sales and earnings.

The furniture industries in the U.S. and international markets are very competitive and fragmented. Our business is subject to risks associated with competition from new or existing industry participants who may have more resources and better access to capital. Many of our competitors and potential competitors may have substantially greater financial and government support, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition and more established relationships in the industry than we do. Among other things, these industry participants compete with us based upon price, quality, style, functionality and availability. We cannot be sure we will have the resources or expertise to compete successfully in the future. Some of our competitors may also be able to provide customers with additional benefits at lower overall costs to increase market share. We cannot be sure we will be able to match cost reductions by our competitors or that we will be able to succeed in the face of current or future competition. Also, due to the large number of competitors and their wide range of product offerings, we may not be able to continue to differentiate our products through value, styling or functionality from those of our competitors. In addition, some of our customers are also performing more manufacturing services themselves. We may face competition from our customers as they seek to become more vertically integrated. As a result, we are continually subject to the risk of losing market share, which may lower our sales and earnings.

We will face different market dynamics and competition as we develop new products to expand our presence in our target markets. In some markets, our future competitors may have greater brand recognition and broader distribution than we currently enjoy. We may not be as successful as our competitors in generating revenues in those markets due to the lack of recognition of our brands, lack of customer acceptance, lack of product quality history and other factors. As a result, any new expansion efforts could be more costly and less profitable than our efforts in our existing markets. If we are not as successful as our competitors are in our target markets, our sales could decline, our margins could be impacted negatively and we could lose market share, any of which could materially harm our business.

We may lose U.S. market share due to competition and our dependence on production facilities located outside the U.S., which would result in a decrease in our future sales and earnings.

We compete in the U.S. market principally through our sales under the Diamond Sofa brand, which we acquired on August 31, 2011. The furniture industry in the U.S. is very competitive and fragmented. We compete with many domestic U.S. and international residential furniture sources, including national department stores, regional or independent specialty stores, dedicated franchises of furniture manufacturers and retailers marketing products through catalogs and over the internet. There are few barriers to entry in the U.S. furniture market, and new competitors may enter this market at any time. Some of our competitors have greater financial resources than we have and often offer extensively advertised and well-recognized branded products. We may not be able to meet price competition or otherwise respond to competitive pressures in the U.S. market. We also may not be able to continue to differentiate our products from those of our competitors in the U.S. through value, styling and functionality because of the large number of competitors and their wide range of product offerings. In addition, our operations in the U.S. also depend primarily on our sourcing of products through Nova Macao, which is subject to increased risks of delays in shipments to the U.S. not typically encountered for domestically sourced furniture, such as shipment delays caused by customs, export and tariff issues, decreased availability of shipping containers and the inability to secure space aboard shipping vessels to transport our products. Our failure to fill customer orders in a timely manner during an extended business interruption for Nova Macao, or due to transportation issues, could negatively impact our existing customer relationships in the U.S. market and result in decreased sales and earnings. Furthermore, some large furniture retailers in the U.S. are sourcing products directly from furniture manufacturers located in China and other Southeast Asian countries instead of through distributors like us. Over time, this practice may expand to smaller retailers in the U.S. Accordingly; we are continually subject to the risk of losing U.S. market share, which may decrease our future sales and earnings.

Failure to anticipate or timely respond to changes in fashion and consumer preferences could adversely impact our business.

Furniture is a styled product and is subject to rapidly changing fashion trends and consumer preferences, as well as to increasingly shorter product life cycles. We believe our past performance has been based on, and our future success will depend, in part, upon our ability to continue to improve our existing products through product innovation and to develop, market and produce new products. We cannot assure you that we will be successful in introducing, marketing and producing any new products or product innovations, or that we will develop and introduce in a timely manner innovations in our existing products that satisfy customer needs or achieve market acceptance. Our success also depends upon our ability to anticipate and respond in a timely manner to fashion trends related to residential furniture. If we fail to identify and respond to these changes, our sales could decline and we could lose market share, any of which could materially harm our business.

If we are unable to manage our growth, we may not continue to be profitable.

Our continued success depends, in part, upon our ability to manage and expand our operations and facilities in the face of continued growth. This planned growth includes the expansion of our internet sales and diversifying our international sales by expanding our broad network of distributors, increasing direct sales in the U.S., Europe and other international markets and entering emerging growth markets. The growth in our operations has placed, and may continue to place, significant demands on our management, operational and financial infrastructure. If we do not manage our growth effectively, the quality of our products and services could suffer, which could negatively affect our operating results. To manage this growth effectively, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. We cannot assure you that we will be able to fulfill our staffing requirements for our business, successfully train and assimilate new employees, or expand our management base and enhance our operating and financial systems. Failure to achieve any of these goals will prevent us from managing our growth in an effective manner and could have a material adverse effect on our business, financial condition or results of operations.

We may need additional capital to execute our business plan and fund operations and may not be able to obtain such capital on acceptable terms or at all.

In connection with the development and expansion of our business, we may incur significant capital and operational expenses. We believe that we can increase our sales and net income by implementing a growth strategy that focuses on (i) increasing online sales and (ii) diversifying our international sales. We plan to increase and diversify our sales to the U.S., Europe and international markets by further integrating the Bright Swallow brand family and establishing new brands for the international markets and to increase our online sales presence.

Management anticipates that our existing capital resources, cash flows from operations, collection of our accounts receivable, and loan facilities that we entered into in 2012, any proceeds from any possible equity financings related to the shelf registration statement on Form S-3 we filed in February 2014, which became effective on March 7, 2014, and the aggregate gross proceeds to the Company of $8.95 million and $4.00 million from the closing of the transactions contemplated under each of those certain Securities Purchase Agreements, dated as of April 14, 2014 and May 28, 2015, respectively, and described in greater detail herein, will satisfy the liquidity requirements of our business for the next 12 months. However, if available funds are not sufficient to meet our plans for expansion, our plans include pursuing alternative financing arrangements, including additional bank loans based on our good credit rating or funds raised through additional offerings of our equity or debt, if and when we determine such offerings are required. Our ability to obtain additional capital on acceptable terms or at all is subject to a variety of uncertainties, including:

| ● | Investors’ perceptions of, and demand for, companies in our industry; |

| ● | Investors’ perceptions of, and demand for, companies operating in China; |

| ● | Conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| ● | Our future results of operations, financial condition and cash flows; |

| ● | Governmental regulation of foreign investment in companies in particular countries; |

| ● | Economic, political and other conditions in the U.S., China, and other countries; and |

| ● | Governmental policies relating to foreign currency borrowings. |

There is no assurance we will be successful in locating a suitable financing transaction in a timely fashion or at all. In addition, there is no assurance we will obtain the capital we require by any other means. Future financings through equity investments are likely to be dilutive to our existing shareholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly-issued securities may include preferences or superior voting rights, be combined with the issuance of warrants or other derivative securities, or be the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Furthermore, we may incur substantial costs in pursuing future capital and financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition. If we cannot raise additional funds on favorable terms or at all, we may not be able to carry out all or parts of our strategy to maintain our growth and competitiveness.

Our accounts receivable remain outstanding for a significant period of time, which has a negative impact on our cash flow and liquidity.

Our standard payment term for accounts receivable is 30 - 120 days. We give an extended payment term to certain of our major customers of up to 180 days. Our sales to customers in the U.S. and international markets typically are made through letters of credit, but for some long-term, high volume customers, we accept payment by telegraphic transfer with a payment term of 15 days after delivery. We remain subject to negative impacts on our cash flow and liquidity due to the significant period of time our accounts receivable remain outstanding with respect to sales made under the longer payment terms. In 2015, we had accounts receivable turnover of 2.29 on an annualized basis, with sales outstanding of 159 days. In 2016, we had accounts receivable turnover of 2.10 on an annualized basis, with sales outstanding of 174 days. As of December 31, 2016, we had gross accounts receivable of $45,122,692, of which $22,541,201 was not yet past due, $9,029,988 was less than 90 days past due, $7,250,188 was over 90 days but within 180 days past due and $6,301,315 over 180 days past due. We had an allowance for bad debt of $3,019,931 for accounts receivables. The increase in gross accounts receivable was due to, among other things, a 3.0% increase in sales in the year ended December 31, 2016 to $92.65 million, compared to $89.94 million in 2015. Additionally, we have been more lenient towards the collection of accounts receivable from certain major customers to maintain good relationships and to attract new major accounts. While historically our collections have been reasonably assured, delays in collections and the significant period of time our accounts receivable remain outstanding may result in pressure on our cash flow and liquidity. We recognized a loss of $2,603,745 from bad debts from continuing operations during the year ended December 31, 2016. This loss primarily resulted from the inability to collect accounts receivable from Nova Macao’s customers on time. We are working on a study of our receivables management process and based upon the resulting recommendations intend to adopt additional protocols during this annual period to insure we are optimizing our collections as well as general management efficiencies. We expect our bad debt expense will decrease after adoption of the improved receivable management process.

We may experience material disruptions to our ability to acquire sufficient inventory from third-party suppliers that could result in material delays, quality control issues, increased costs and loss of business opportunities, which may negatively impact our sales and financial results.

We rely upon our third-party suppliers to produce our products and maintain sufficient inventory to meet customer demand. A material disruption at our suppliers’ manufacturing facilities could prevent us from meeting customer demand, reduce our sales and negatively impact our financial results. We may also experience quality control issues as we seek out new suppliers or are forced to contract with new suppliers to meet increased customer demand. Any such material disruption may prevent us from shipping our products on a timely basis, reduce our sales and market share and negatively impact our financial results. Our third-party supplier contracts are generally of annual or shorter duration, or manufactured products are sourced on the basis of individual purchase orders. There is no assurance that we will be able to maintain our current relationships with these parties or, if necessary, establish future arrangements with other third-party suppliers on commercially reasonable terms. Further, while we maintain an active quality control program, we cannot assure that their manufacturing and quality control processes will be maintained at a level sufficient to meet our inventory needs or prevent the inadvertent sale of substandard products. While we believe that products manufactured by our current third-party suppliers could generally be procured from alternative sources, temporary or permanent loss of services from a significant manufacturer could cause disruption in our supply chain and operations.

Our dependence on foreign suppliers and our increased global operations subject us to a variety of risks and uncertainties that could impact our operations and financial results.

In 2017, we anticipate that the majority of our products will be purchased from foreign suppliers and manufacturers, predominantly in Asia. Our dependence on foreign suppliers means that we may be affected by changes in the value of the U.S. dollar relative to other foreign currencies. For example, any upward valuation in the Chinese yuan, the euro, or any other foreign currency against the U.S. dollar may result in higher costs to us for those goods. Declines in foreign currencies and currency exchange rates might negatively affect the profitability and business prospects of one or more of our foreign suppliers. This, in turn, might cause such foreign vendors to demand higher prices for products in their effort to offset any lost profits associated with any currency devaluation, delay product shipments to us, or discontinue selling to us, any of which could ultimately reduce our sales or increase our costs.

We, and our foreign suppliers, are also subject to other risks and uncertainties associated with changing economic and political conditions worldwide. These risks and uncertainties include import duties and quotas, compliance with anti-dumping regulations, work stoppages, economic uncertainties and adverse economic conditions (including inflation and recession), government regulations, employment and labor matters, wars and fears of war, political unrest, natural disasters, public health issues, regulations to address climate change and other trade restrictions. We cannot predict whether any of the countries from which our raw materials or products are sourced, or in which our products are currently manufactured or may be manufactured in the future, will be subject to trade restrictions imposed by the U.S. or foreign governments or the likelihood, type or effect of any such restrictions. Any event causing a disruption or delay of imports from foreign suppliers, including labor disputes resulting in work disruption, the imposition of additional import restrictions, restrictions on the transfer of funds and/or increased tariffs or quotas, or both, could increase the cost, reduce the supply of merchandise available to us, or result in excess inventory if merchandise is received after the planned or appropriate selling season, all of which could adversely affect our business, financial condition and operating results.

A delay in getting non-U.S.-sourced products through port operations and customs in a timely manner could result in reduced sales, canceled sales orders and unanticipated inventory accumulation.

Our business depends on our ability to source and distribute products in a timely manner. As a result, we rely on the free flow of goods through open and operational ports worldwide. Labor disputes or other disruptions at ports create significant risks for our business, particularly if work slowdowns, lockouts, strikes or other disruptions occur during our peak importing seasons. Any of these factors could result in reduced sales, canceled sales orders and unanticipated inventory accumulation and have a material adverse effect on our operating results, financial position and cash flows.

We are subject to warranty claims for our products, which could result in unexpected expense.

Many of our products carry warranties for defects in quality and workmanship. Historically, the amount for return of products, the discount provided to the customers and cost for the replacement parts has been immaterial. However, we may experience significant expense as the result of future product quality issues, product recalls or product liability claims which may have a material adverse effect on our business. The actual costs of servicing future warranty claims may exceed our expectations and have a material adverse effect on our results of operations, financial condition and cash flows.

We may not be able to protect our product designs and other proprietary rights adequately, which could adversely affect our competitive position and reduce the value of our products and brands, and litigation to protect our intellectual property rights may be costly.

We attempt to strengthen and differentiate our product portfolio by developing new and innovative brands and product designs and functionality. As a result, our patents, trademarks and other intellectual property rights are important assets to our business. Our success will depend in part on our ability to obtain and protect our products, methods, processes and other technologies, to preserve our trade secrets, and to operate without infringing on the proprietary rights of third parties in China, the U.S. and other international markets. Despite our efforts, any of the following may reduce the value of our owned and used intellectual property:

| ● | Issued patents and trademarks that we own or have the right to use may not provide us with any competitive advantages; |

| ● | Our efforts to protect our proprietary rights may not be effective in preventing misappropriation of our intellectual property or that of those from whom we license our rights to use; |

| ● | Our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we use or develop; or |

| ● | Another party may obtain a blocking patent and we or our licensors would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products. |

Effective protection of intellectual property rights may be unavailable or limited in China or certain other countries. Policing the unauthorized use of our proprietary technology can be difficult and expensive. Litigation might be necessary to protect our intellectual property rights, which may be costly and may divert our management’s attention away from our core business. Furthermore, there is no guarantee that litigation would result in an outcome favorable to us. If we are unable to protect our proprietary rights adequately, it would have a negative impact on our operations.

We, or the owners of the intellectual property rights licensed to us, may be subject to claims that we or such licensors have infringed the proprietary rights of others, which could require us and our licensors to obtain a license or change designs.

Although we do not believe any of our products infringe upon the proprietary rights of others, there is no assurance that infringement or invalidity claims (or claims for indemnification resulting from infringement claims) will not be asserted or prosecuted against us or those from whom we have licenses or that any such assertions or prosecutions will not have a material adverse effect on our business. Regardless of whether any such claims are valid or can be asserted successfully, defending against such claims could cause us to incur significant costs and could divert resources away from our other activities. In addition, assertion of infringement claims could result in injunctions that prevent us from distributing our products. If any claims or actions are asserted against us or those from whom we have licenses, we may seek to obtain a license to the intellectual property rights that are in dispute. Such a license may not be available on reasonable terms, or at all, which could force us to change our designs.

We incur significant costs as a result of our operating as a public company and our management is required to devote substantial time to compliance with the regulatory requirements placed on a public company.

As a public company with substantial operations, we incur significant legal, accounting and other expenses. The costs of preparing and filing annual, quarterly and current reports, proxy statements and other information with the SEC and furnishing audited reports to shareholders is time-consuming and costly.

It has also been time-consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and this remains an ongoing process. Certain members of our management have limited or no experience operating a company whose securities are listed on a national securities exchange or with the rules and reporting practices required by the federal securities laws as applied to a publicly traded company. We have needed to recruit, hire, train and retain additional financial reporting, internal control and other personnel in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, we may not be able to obtain the independent accountant certifications required by the Sarbanes-Oxley Act.

If we fail to establish and maintain an effective system of internal controls, we may not be able to report our financial results accurately. Any inability to report and file our financial results accurately and timely could harm our business and adversely affect the trading price of our common stock.

We are required to establish and maintain internal controls over financial reporting and disclosure controls and procedures and to comply with other requirements of the Sarbanes-Oxley Act and the rules promulgated by the SEC. At present, we have instituted internal controls, but, as discussed below, we are in the process of correcting certain material weaknesses in our internal controls. Our management, including our Chief Executive Officer and Chief Financial Officer, cannot guarantee that our internal controls and disclosure controls and procedures will prevent all possible errors. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the possibility that judgments in decision-making can be faulty and subject to simple error or mistake. Furthermore, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management override of the controls. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, measures of control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

Prior to becoming parts of a public company, Nova Furniture and its subsidiaries, Diamond Bar and Bright Swallow, were private operating companies with no experience operating as a public company or establishing the level of internal control over financial reporting required by the Sarbanes-Oxley Act, and Nova LifeStyle, the U.S. parent company, was a non-operating public shell. Prior to June 4, 2013, our Board of Directors lacked independent directors and an audit committee, and we lacked, and currently lack, sufficient accounting personnel with appropriate understanding of the generally accepted accounting principles in the U.S., or U.S. GAAP, and SEC reporting requirements. We have taken, and are taking, certain actions intended to remediate this issue regarding our internal control over financial reporting. For example, we previously engaged an outside Sarbanes-Oxley Act consultant in March 2012 to assist in testing and improving our internal controls and to assist with the design of effective documented financial accounting policies and procedures for our U.S. parent company and all subsidiaries. As of the date of this filing and during the year ended December 31, 2016, we have taken certain actions to remediate other identified material weaknesses related to our lack of independent directors and an audit committee, particularly with respect to our continued search for an appropriate candidate for Vice President of Finance, as discussed in greater detail herein. We have added independent directors and established an audit committee as a separately designated committee of the Board of Directors with a written charter, as of June 4, 2013. Mr. Bin Liu, an independent director elected to the Board of Directors at our annual meeting of shareholders held on May 19, 2015, serves as the chair of the Audit Committee and as an “audit committee financial expert” as defined under Item 407(d)(5) of Regulation S-K. We are still searching for appropriate candidates for a Vice President of Finance position, which requires the candidate to have experience in U.S. GAAP and SEC financial reporting. We are still in the process of searching for an acceptable candidate. In addition, we plan to provide additional training to our accounting personnel on U.S. GAAP, and other regulatory requirements regarding the preparation of financial statements. Until such time as we hire qualified accounting personnel with the requisite U.S. GAAP knowledge and experience and train our current accounting personnel, we have engaged an outside CPA with U.S. GAAP knowledge and experience to supplement our current internal accounting personnel and assist us in the preparation of our financial statements to ensure that our financial statements are prepared in accordance with U.S. GAAP. However, the measures we have taken may not be sufficient to mitigate the foregoing risks associated with the lack of sufficient accounting personnel with appropriate understanding of U.S. GAAP and SEC reporting requirements. We anticipate that these actions have had, and will have, a material impact on our internal control over financial reporting in 2016, and in future periods.

Our accounting personnel who are primarily responsible for the preparation and supervision of the preparation of our financial statements under generally accepted accounting principles in the U.S. have limited relevant education and training in U.S. GAAP and SEC rules and regulations pertaining to financial reporting, which could impact our ability to prepare our financial statements and convert our books and records to U.S. GAAP.

Our manufacturing operations were in China and we historically have maintained the books and records of our subsidiaries outside of the United States in accordance with generally accepted accounting principles in the PRC, or PRC GAAP. Our accounting personnel outside the United States who have the primary responsibilities of preparing and supervising the preparation of financial statements under U.S. GAAP have limited relevant education and training in U.S. GAAP and related SEC rules and regulations. As such, they may be unable to identify potential accounting and disclosure issues that may arise upon the conversion of our books and records from PRC GAAP to U.S. GAAP, which could affect our ability to prepare our financial statements in accordance with U.S. GAAP. We have taken steps to ensure that our financial statements are prepared in accordance with U.S. GAAP, including our hiring of a U.S. accounting firm to work with our accounting personnel and management outside of the United States to convert our books and records to U.S. GAAP and prepare our financial statements. Until such time as we hire qualified accounting personnel or train our current accounting personnel with the requisite U.S. GAAP and SEC reporting experience, however, the measures we have taken may not be sufficient to mitigate the foregoing risks associated with the limited education and training of our accounting personnel in U.S. GAAP and related SEC rules and regulations.

We are a holding company that depends on cash flow from our wholly owned subsidiaries to meet our obligations, and any inability of our subsidiaries to pay us dividends or make other payments to us when needed could disrupt or have a negative impact on our business.

We are a holding company with no material assets other than the stock of our wholly owned subsidiaries, Bright Swallow, Diamond Bar, Nova Furniture and Nova Samoa. We rely on dividends paid by our subsidiaries for our cash needs, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. If our subsidiaries are unable to pay us dividends and make other payments to us when needed because of regulatory restrictions or otherwise, we may be materially and adversely limited in our ability to make investments or acquisitions that could be beneficial to our business, pay dividends or otherwise fund and conduct our business.

We may not be able to attract the attention of major brokerage firms because we became public by means of a share exchange, which could limit our ability to obtain future capital and financing.

There may be risks associated with our becoming public by means of a share exchange, or reverse merger with a public shell company that had no revenues, operations or material assets prior to the time of the share exchange. Analysts of major brokerage firms may not provide coverage for our company because there is no incentive for brokerage firms to recommend the purchase of our common stock. Furthermore, we can give no assurance that brokerage firms will, in the future, want to conduct any secondary offerings on our behalf, which could limit our ability to obtain future capital and financing.

Risks Related to Business in China

If relations between the U.S. and China worsen, our business could be adversely affected and investors may be unwilling to hold or buy our stock and our stock price may decrease.