UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment No. 3

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

ALPHAMETRIX MANAGED FUTURES III LLC

(Exact name of registrant as specified in its charter)

DELAWARE (State or other jurisdiction of incorporation or organization) | | 27-1248567 (I.R.S. Employer Identification No.) |

| | | |

c/o ALPHAMETRIX, LLC

181 West Madison

34th Floor

Chicago, Illinois 60602

(Address of principal executive offices) (zip code)

(312) 267-8400

(Registrant’s telephone number, including area code)

__________________________

Copy to:

Mark Borrelli

Sidley Austin llp

One South Dearborn Street

Chicago, Illinois 60603

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act: Units of Limited Liability Company Interest, AlphaMetrix WC Diversified Series

(Title of Class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ___ Accelerated filer ___

Non-accelerated filer ___ Smaller reporting company X

Table of Contents

| Item 1: | Business | 1 |

| Item1A: | Risk Factors | 34 |

| Item 2: | Financial Information | 34 |

| Item 3: | Properties | 34 |

| Item 4: | Security Ownership of Certain Beneficial Owners and Management | 35 |

| Item 5: | Directors and Executive Officers | 35 |

| Item 6: | Executive Compensation | 38 |

| Item 7: | Certain Relationships and Related Transactions | 38 |

| Item 8: | Legal Proceedings | 39 |

| Item 9: | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters. | 39 |

| Item 10: | Recent Sales of Unregistered Securities | 40 |

| Item 11: | Description of Registrant’s Securities to be Registered. | 40 |

| Item 12: | Indemnification of Directors and Executive Officers | 44 |

| Item 13: | Financial Statements and Supplementary Data | 44 |

| Item 14: | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 44 |

| Item 15: | Financial Statements and Exhibits | 45 |

Item 1: BUSINESS

ALPHAMETRIX MANAGED FUTURES III LLC

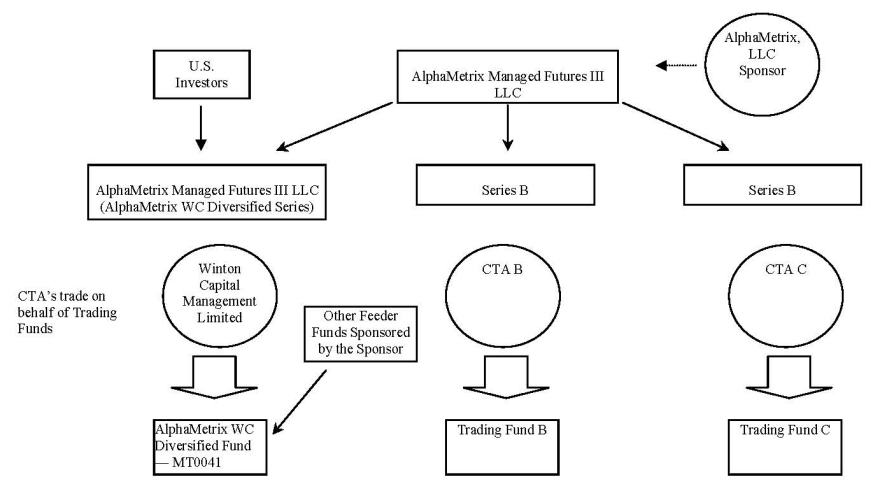

ORGANIZATIONAL CHART

The organizational chart below illustrates the relationships among various service providers. AlphaMetrix, LLC is the sponsor (“AlphaMetrix” or the “Sponsor”) of AlphaMetrix Managed Futures III LLC (the “Platform”) of which AlphaMetrix Managed Futures III LLC (AlphaMetrix WC Diversified Series) (the “WC Diversified Series”) is a “segregated series.” The Platform is hereby registering the units of limited liability company interest of the WC Diversified Series. The WC Diversified Series’ commodity trading advisor (“CTA”), Winton Capital Limited (“Winton”), is not affiliated with the Sponsor or the Platform. However, the WC Diversified Series is an affiliate of the Sponsor and other related affiliates.

______________________________

The WC Diversified Series is the only series of the Platform currently being offered. Although it is intended that other series of the Platform will be offered, there can be no assurance that this will occur. The WC Diversified Series will invest a portion of its assets into AlphaMetrix WC Diversified Fund — MT0041 (the “WC Diversified Master Fund”), a separately incorporated offshore investment vehicle which is advised by Winton and currently trades at 2.5 times leverage. The WC Diversified Series will hold the remainder of its capital for the WC Diversified Series, in an amount necessary to achieve a leverage factor of approximately one. The Sponsor may reduce or increase the leverage of the WC Diversified Master Fun d at any time in its discretion. References herein to the WC Diversified Series also include the WC Diversified Master Fund, unless the context otherwise requires. Other feeder funds sponsored by the Sponsor also invest in the WC Diversified Master Fund.

| (a) | General development of business |

The WC Diversified Series is a “segregated portfolio” of the Platform that utilizes a professional trading advisor to engage in the trading of commodity futures contracts, other commodity interests, options and forward contracts, and certain over-the-counter instruments through its investment in the WC Diversified Master Fund. The WC Diversified Series does not engage in trading of such instruments directly. It is anticipated that the WC Diversified Series will commence operations on January 1, 2010 (or such later date as otherwise determined by the Sponsor). The WC Diversified Master Fund commenced trading in October 2007.

The Platform was formed on September 10, 2009 as a Delaware “series limited liability company” issuing different series (each a “Series”) of units of limited liability company interest (“Units”). The Series are legally segregated from each other such that under Delaware law one Series should not be liable for the obligations of any other Series. As a matter of law, the question as to whether one series of a “series limited liability company” will be liable for the obligations of any other series of the same “series limited liability company” has not been tested in the federal bankruptcy courts. As a result, although the Sponsor believ es that one Series will not be liable for the obligations of another Series, it cannot be certain. The Sponsor’s belief that one Series will not be liable for the obligations of another Series is based on the Platform’s compliance with § 18-215 of the Delaware Limited Liability Company Act, as amended, which states in pertinent part that “in the event that a limited liability company agreement establishes or provides for the establishment of [one] or more series, and if separate and distinct records are maintained for any such series and the assets associated with any such series are held in such separate and distinct records (directly or indirectly, including through a nominee or otherwise) and accounted for in such separate and distinct records separately from the other assets of the limited liability company, or any other series thereof, and if the limited liability company agreement so provides, and if no tice of the limitation on liabilities of a series as referenced in this subsection is set forth in the certificate of formation of the limited liability company, then the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular series shall be enforceable against the assets of such series only, and not against the assets of the limited liability company generally or any other series thereof, and, unless otherwise provided in the limited liability company agreement, none of the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to the limited liability company generally or any other series thereof shall be enforceable against the assets of such series.”

Certain Series will either invest substantially all of their capital in a subsidiary or an existing fund (each a “Trading Fund”) managed by a single professional managed futures advisor (a “Trading Advisor”), or be designed as multi-advisor series and invest substantially all of their assets across multiple Trading Funds, each managed by different Trading Advisors. Each Trading Fund will be sponsored by the Sponsor. If additional Series are offered, investors will invest in each Series, not in the Platform itself.

The Platform is being sponsored by the Sponsor and has been formed with the objective of providing a platform on which sophisticated investors may customize their own managed futures portfolios by allocating capital among the different Series. Investors who invest in a series of the Platform (“Members”) may obtain exposure to the different Trading Advisors.

The WC Diversified Series is the initial Series which has been placed on the Platform, which is the registrant under this Form 10. The Sponsor’s intention is to make a number of additional Series available over time. However, the Sponsor cannot predict how many Series will ultimately be made available, or when such additional Series will become available.

The WC Diversified Master Fund is the Trading Fund for the WC Diversified Series, for which Winton serves as trading advisor. The terms “Trading Fund,” “Trading Advisor,” “Series,” “Units,” and “Members” as used herein shall reference WC Diversified Master Fund, Winton, the WC Diversified Series, the Units of the WC Diversified Series and investors in such Units, respectively, unless the context requires otherwise. The WC Diversified Series and WC Diversified Master Fund are collectively referred to as the “WC Diversified Series,” unless the context requires otherwise.

Following the initial issuance of the Units, the WC Diversified Series will invest a portion of its assets into the Trading Fund and will hold the remainder of its capital at the WC Diversified Series level in a cash account (the “Series Cash Account”). Thereafter, the WC Diversified Series will continue to invest a portion of its assets as required, based upon the leverage of the Trading Fund, into the Trading Fund in order to keep the WC Diversified Series’ overall portfolio at a leverage of approximately one. A portion of such funds may be retained by the WC Diversified Series in order to pay for the WC Diversified Series’ expenses.

Funds may also be retained by the WC Diversified Series as a result of the Trading Advisor’s not accepting further subscriptions at the time the funds are submitted to the WC Diversified Series. Funds invested by the WC Diversified Series into the Trading Fund will generally be deposited by the Trading Fund with Newedge USA, LLC, the WC Diversified Series’ clearing broker (the “Clearing Broker”).

In order to maintain the WC Diversified Series’ overall portfolio at a leverage of approximately one-to-one, approximately 60% of the WC Diversified Series’ assets will be held in the Series Cash Account, as the Trading Fund currently trades at 2.5 times leverage. The Sponsor will maintain the Series Cash Account in a bank account. The Sponsor will rebalance the amounts held in the Series Cash Account and the Trading Fund approximately every two weeks, but may do so more or less often as it deems necessary to keep the WC Diversified Series’ leverage factor at approximately one. The Sponsor maintains discretion to change the leverage level of the Trading Fund and there is no limit on the leverage that may be utilized by the Trading Fund In addition, the Sponsor maintains dis cretion to change the targeted leverage of the WC Diversified Series and there is no limit on such targeted leverage. In the future, the WC Diversified Series may contract with one or more custodians (each, a “Cash Custodian”), and the Series Cash Account may be managed by one or more cash managers (each, a “Cash Manager”) which may include the Sponsor, any of the Cash Custodians and/or any of their respective affiliates. Information relating to the Cash Custodians and Cash Managers that may be used by the Platform will be provided to investors as soon as reasonably practicable following their selection. If Cash Custodians and Cash Managers are utilized in the future they may receive a portion of the interest received by the Series Cash Account and/or such other fees as negotiated at such time.

The capital invested in the Trading Fund is used to margin positions in the futures, forwards and derivatives markets, as well as held in reserve to pay trading losses and expenses at the Trading Fund level. The Trading Fund assets are held in customer segregated accounts at the Clearing Broker in cash or invested in CFTC-authorized investments for customer funds, except for those funds required to margin non-regulated foreign currency positions and certain cash assets held in reserve in banking accounts. The Trading Fund will receive interest income on the cash held on deposit as margin with the Clearing Broker as of the end of each month at a negotiated rate equal to approximately 95% of the short-term U.S. Treasury bill rates. The Clearing Broker will retain all other interest income earned on such c ash held on deposit with it. In the case of trading non-U.S. futures, the Clearing Broker lends to the WC Diversified Series any non-U.S. currency it requires, charging interest at a local short-term rate; on non-U.S. currencies held in the WC Diversified Series’ account, the WC Diversified Series is credited with the same local short-term rate.

The Clearing Broker follows its standard procedures for crediting and charging interest to the Trading Fund. The Clearing Broker is able to generate significant economic benefit from doing so, especially as the Clearing Broker is able to meet the margin requirements at the exchanges based on the net positions held by its customers as a group, whereas each customer must margin its account on a stand-alone basis.

Under the Platform’s Limited Liability Company Operating Agreement and the WC Diversified Series’ Separate Series Agreement (collectively, the “Operating Agreement”), the WC Diversified Series has delegated the exclusive management of all aspects of the business and administration of the WC Diversified Series to the Sponsor, a Delaware limited liability company. The Sponsor may also delegate certain administrative services to an affiliate or third-party administrator. The Sponsor currently has engaged AlphaMetrix 360⁰, LLC (the “Administrator”), an affiliate of AlphaMetrix, to provide certain administrative services to the WC Diversified Series, as delegated by the Sponsor. The material terms of the Operating Agreement are described in Items 11 and 12 of this Form 10, and such information is incorporated by reference herein.

Although Members have no right to participate in the control or management of the WC Diversified Series, they are entitled to: (i) vote on, by a majority of the value of the Units held by Members, or approve certain changes to the Operating Agreement; (ii) remove the Sponsor by a majority vote of the value of the Units held by Members, (iii) receive annual audited financial statements and monthly information as the Commodity Futures Trading Commission (“CFTC”) requires and timely tax information; (iv) inspect the WC Diversified Series’ books and records; and (v) redeem Units as of each month-end, unless redemptions have been suspended pursuant to the Operating Agreement.

The Sponsor may make certain amendments to the Operating Agreement without the need of obtaining Members’ consent including, but not limited to, in any manner that does not materially adversely affect the rights of the Members as a whole. These amendments can also be for clarification of inaccuracies or ambiguities, to avoid certain events as set forth in the Operating Agreement or to include any other changes the Sponsor deems advisable in order to comply with the law or the Operating Agreement. The Sponsor will provide notice of such amendments to Members via either its monthly update letter or other comparable means.

The Sponsor anticipates that the WC Diversified Series should be treated as a separate partnership for federal income tax purposes. Due to the legal uncertainty as to the treatment of the different series of a “series limited liability company,” as discussed above, the Sponsor has not received a legal opinion regarding the WC Diversified Series’ tax treatment.

As of November 30, 2009, the WC Diversified Series had not commenced operations.

| (b) | Financial Information about segments |

The WC Diversified Series’ business constitutes only one segment for financial reporting purposes, i.e. a speculative “commodity pool.” The WC Diversified Series does not engage in sales of goods or services.

| (c) | Narrative description of business |

General

Winton will trade the capital of the Trading Fund according to its Diversified Managed Account Program (the “Diversified Program”). The Diversified Program employs a computer-based system to engage in the speculative trading of approximately 120 instruments including international futures, options and forwards, government securities such as bonds, as well as certain over the counter (“OTC”) instruments, which may include foreign exchange and interest rate forward contracts and swaps, although the WC Diversified Series does not anticipate investing significantly in swaps.

As of December 31, 2009, the Trading Fund’s portfolio allocations were approximately 99.96% futures, 0.01% currency forward contracts and 0.03% options on futures, determined by reference to contract values.

Investment Objective. The investment objective of the Diversified Program is to achieve long-term capital appreciation through compound growth. The Trading Advisor attempts to achieve this goal by pursuing a diversified trading scheme that does not rely upon favorable conditions in any particular market, nor on market direction.

The Trading Advisor uses the Sharpe ratio, which is a measure of risk adjusted return, to compare investments that have different levels of risk, to measure the performance of the Diversified Program, and the performance of component parts of the Diversified Program. The Diversified Program has a preference for only trading highly liquid financial instruments, each of which is expected to have positive but very low Sharpe Ratios. Additionally, the Trading Advisor pursues strategies that result in long term returns that differ from those resulting from investing long only in bonds and stocks, a difference which is measured by correlation. By combining a large number of highly liquid instruments, the Trading Advisor intends for the Diversified Pro gram to have a higher Sharpe ratio than any of the individual markets traded and generally low correlation over the long term to other markets such as equities and fixed income due to portfolio diversification.

A Systematic Investment Approach. The Diversified Program employs what is traditionally known as a “systematic” approach to trading financial instruments. In this context, the term

“systematic” implies that the vast majority of the trading decisions are executed, without discretion, either electronically or by a team responsible for the placement of orders (the “Trading Team”), based upon the instructions generated by the Winton Computer Trading System (the “Trading System”). A majority of the trades in the Diversified Program are executed electronically. The Diversified Program blends short-term trading with long-term trend following, using multiple time frames in addition to multiple models. As its name implies, the Diversified Program allocates for maximum diversification. A sophisticated system of risk managem ent is evident in all aspects of the Diversified Program.

Description of the Trading System. The Trading System is a proprietary, computer-based system best described as the “output” of a complex schema of numerous computer programs developed by Winton’s research team. The Trading System is maintained by Winton’s Trading Technology Team, which is responsible for encoding and running the computer programs.

The Trading System instructs the Diversified Program on how to respond to unfolding market events in order to profit from price movements. The Trading System tracks the daily price movements and other data from the markets it follows, and carries out certain computations to determine each day how long or short the portfolio should be to maximize profit within a certain range of risk. The Trading Advisor seeks to control risk both on an individual market level and on a portfolio level. The risk target on a portfolio level is a 10% annualized standard deviation. The risk on an individual market level will vary according to the perceived profit opportunities of the trading system. This individual market risk will fluctuate around a long term average that has been set according to both liquidity and diversification criteria. If rising prices are anticipated, a long position will be established; a short position will be established if prices are expected to fall. As a result of its statistical research, Winton believes that each trade executed by the Diversified Program will have a slight statistical advantage, potentially leading to sustained profits over time.

The Trading Advisor will generally allocate trades to accounts it manages utilizing the Diversified Program (including the WC Diversified Series) using a proprietary algorithm. The aim of this algorithm is to achieve an average price for transactions as close as mathematically possible for each account. This takes the form of an optimization process under which the objective is to minimize the variation in the average traded price for each account. No positions are allocated at the end of the trading day. Positions are allocated either prior to order entry or on trade completion. On complex trades where multiple prices are received in the execution, the allocation is carried out once the order is complete so as to achieve an average price as close to the mean as possible across all accounts.

The Trading Advisor has in the past traded over the counter foreign currency exchange forward (the “OTC Forwards”), including some non-deliverable forwards, on behalf of the Trading Fund. As of the date of this Form 10, the Trading Advisor is not currently trading OTC Forwards but may do so in the future without further notice.

A Technical System Employing Both Trend-Following and Non-Directional Trading. The Diversified Program can be thought of as more “technical” than “fundamental” in nature. The term “technical analysis” is generally used to refer to analysis based on data intrinsic to a market,

such as price and volume. It is often contrasted with “fundamental” analysis that relies upon analysis of factors external to a market, such as crop conditions or the weather.

One feature of a trend-following system is that it attempts to take advantage of the observable tendency of the markets to trend, and to tend to make exaggerated movements in both upward and downward directions. These exaggerated movements can be thought of as resulting from the influence of crowd psychology, or the herd instinct, among market participants.

Trend-following systems are frequently unprofitable for long periods of time in particular markets or market sectors, and sometimes for spells of longer than a year or so, even in large portfolios. However over a span of years such an approach is designed to achieve profits.

The Diversified Program relates the probability of the size and direction of future price movements with certain indicators derived from past price movements to produce algorithms that characterize the degree of trending of each market at any point in time. While all trend-following systems function in this way to some degree, the Trading Advisor believes that the unique edge possessed by the Trading System lies in the quality of the research underlying its algorithms. These are designed to enable Winton’s Trading System to suffer smaller losses during the markets’ inevitable whipsaw periods and to take better advantage of significant trends when they occur. As noted below, Winton is continually seeking to improve upon its models.

In addition to its trend-following models, the Diversified Program contains certain “non-directional” models that derive their forecasts from factors often excluded by technical analysis. In these models the primary input is likely to be information about the yield curve or an economic variable rather than market price. These models work in the same way as those described above, that are based on “traditional” fundamental analysis, except that they use a different set of forecasting variables.

A Trading System Subject to Constant Adaptation. The Trading System instructs and adapts the Diversified Program’s trading exposures automatically and continuously. As is to be expected with any research-driven trading system, the Trading System is dynamic. It is subject to modification over time as new relationships are discovered within Winton’s research. This research may result in the development of additional computer models or revisions to existing models.

Examples of research and investigation that might lead to the modification of the Trading System include research pointing to changes in the liquidity or volatility of markets, the interpretation or meaning of data or the long-term expectation of market interrelationships. Another key factor contributing to change is simply the availability of new data.

In short, the Diversified Program relies not just on a Trading System, but a process.

Inevitably, as a result of research developments, Winton must make decisions about the timing, frequency and size of modifications to the Trading System. Certain changes may occur on a daily basis while others may involve more significant adjustments and therefore occur less frequently. Generally, non-substantive changes may be carried out at the discretion of Winton’s trading principals. However, material changes require the approval of both Winton’s Investment Committee and Managing Director. The Sponsor will receive notice of any changes to the

Trading System from Winton, and will notify Members of any material changes in its monthly report to investors.

Responses to Unusual Circumstances. Occasionally, external, unforeseen or dramatic events may affect the markets. These exceptional market events by their very nature are often difficult to predict and have uncertain consequences. Examples of such exceptional market events include loss of market liquidity, the threat of counterparty risk as presented in the credit crisis of 2008, the closure of an exchange (as occurred after the terrorist attacks of September 2001), the introduction of the Euro, the closure of the tin contract in 1984, the suspension of the Hong Kong Fut ures Exchange in 1987 and the suspension of trading in the Malaysian Ringgit in 1997.

Winton’s trading principals may decide that such events fall entirely outside the scope of the research upon which the Diversified Program is based and when such events occur may determine to exercise some discretion rather than follow the dictates of the Trading System. While discretionary inputs are generally not essential to the effectiveness of a “systematic” trading model, it is nonetheless important to recognize that given the often rapid and unpredictable nature of some market events, not every decision to change the Trading System can be conceived as entirely “systematic”; some may be more “discretionary” in nature. Examples of discretionary actions might include decreasing the margin-to-equity ratio or an account’s p ortfolio, liquidating all positions in certain markets or declining to execute an order generated by the Trading System. Such discretionary decision-making would normally only be taken in order to reduce risk and would generally be temporary in nature. It is important to stress that discretionary acts may not enhance the performance of the DiversifiedProgram over what might have otherwise been achieved without the exercise of such discretion.

The Diversified Program Portfolio

Composition of the Portfolio. The Diversified Program tracks approximately 120 diversified, highly liquid financial instruments. At any point in time, it may be holding long or short positions or hold no position at all in each of the markets it follows. As of the date of this Form 10, the Diversified Program’s portfolio consists mainly of positions in futures on the following underlying interests: stock indices; bonds; short-term interest rates; currencies; precious and base metals; grains; livestock; energy and agricultural products. In addition, the Diversified Program may trade in certain OTC instruments, such as, but not limited to, forward contracts on foreign exchange and interest rates and swaps. In addition, th e Diversified Program may trade in government securities such as bonds and other similar instruments.

Through its research initiatives, Winton is constantly looking for new opportunities to add eligible markets to the portfolio, thus further increasing the portfolio’s diversification.

An Emphasis on Diversification. The Diversified Program strives to maintain a highly diversified portfolio because holding positions in a variety of unrelated markets may, over time, decrease system volatility. Winton’s research has demonstrated that use of a sophisticated and systematic schema for placing orders in a wide array of markets increases the possibility that an overall profit maybe realized after a sufficient period of time.

An Emphasis on Managing Risk

The management of risk is an integral part of the Trading System. Return and risk are two sides of the same coin. It is impossible to achieve a given level of return without accepting a certain amount of risk. Winton's focus within risk management is on targeting, measuring and managing risk. Owing to the leverage inherent in futures trading, position sizes are set according to Winton’s expectation of the risk that such positions will provide rather than the amount of capital required to fund such positions.

In the experience of Winton’s management, efforts to preserve capital have a greater effect on rate of return than does the identification of profitable trading opportunities. It is far easier to give back profits than to make them in the first place. The following serve as examples, but do not begin to describe the many efforts Winton makes to attempt to limit risk. However, there is no assurance that any of these efforts will succeed in lessening the possibility or size of a loss.

The Setting of Volatility Estimates and Gearing (Leverage). Each day, the Trading System sets volatility parameters, known as the “instantaneous forecast standard deviation,” for each position held in the Diversified Program’s portfolio. The purpose of these parameters is to estimate the likely size of a market shift, whether up or down, over the next 24 hours, in much the same way as the futures exchanges estimate the likely market shift when deciding how to set the initial margin for a future or the daily price limits for a market.

The primary determinant of the daily volatility parameters is the amount of leverage, also known as the level of “gearing,” used by the Diversified Program. The leverage or gearing is measured in terms of the Diversified Program’s margin-to-equity ratio. This ratio is calculated by dividing the amount of margin posted with the futures commission merchant by the value of the portfolio.

The level of gearing typically used by the Diversified Program is normally determined by targeting a long-term daily standard deviation of between 0.6% and 0.9% of the value of the portfolio. The long-term standard deviation refers to the long-term volatility that Winton expects over a number of months. However, it should be noted that the Diversified Program’s instantaneous forecast standard deviation (defined as the instantaneous standard deviation Winton expects within the next 24 hours) will still vary outside these limits. In order to maintain a given level of long-term risk, the instantaneous risk is allowed to fluctuate within a range around the long-term risk target.

Additionally, from time to time, the long-term standard deviation may also be above or below these limits, thereby having an impact upon the level of gearing used by the Diversified Program. For example, in the event that exceptional market conditions arise, such as the threat of closure of an exchange or other loss of liquidity, it may be determined to operate the Diversified Program at a lower level of gearing.

Monitoring Slippage. “Slippage” refers to the difference between the market price at the time an order is placed to purchase or sell a contract and the actual price paid to make the purchase or sale. One of the main causes of slippage is attempting to fill an order that is too large to be absorbed easily by the market. Winton monitors slippage primarily to make prompt adjustment in position size and thereby avoid having to give up potential profits.

Use of Stress Testing. Winton conducts frequent stress testing of its models by utilizing proprietary simulation software which attempts to measure risk from several perspectives.

There is no assurance that the WC Diversified Series’ investment program will achieve its objective, and the WC Diversified Series’ actual investment results may vary substantially from its investment objective. Winton may engage in investment strategies not described herein that it considers appropriate. For example, Winton may systematically trade certain agricultural futures based on recent weather data or engage in a systematic “carry” strategy, whereby a currency with a relatively low interest rate is sold to finance the purchase of a currency yielding a higher interest rate with the purpose of capturing the interest rate differential between the two currencies. Upon being notified by Winton of any material change to the Diversified Program, including the addition of a sign ificant new strategy, the Sponsor will send written notice to investors informing them of such changes.

The WC Diversified Series’ investment program is speculative and involves substantial risks. The use of futures, forwards and other investment techniques that Winton may employ from time to time can substantially increase the risk to which the WC Diversified Series’ investment portfolio is subject. Accordingly, the WC Diversified Series’ activities could result in substantial losses.

The WC Diversified Series accesses the Diversified Program through the Trading Fund.

The Sponsor

AlphaMetrix, LLC, a Delaware limited liability company is the sponsor and commodity pool operator of the Platform. AlphaMetrix was formed in May 2005, and its principal office is located at 181 W. Madison St., 34th Floor, Chicago, Illinois 60602; telephone: (312) 267-8400. AlphaMetrix has been registered as a commodity pool operator (“CPO”) and CTA with the CFTC, and has been a member of the National Futures Association (“NFA”), since July 6, 2005. AlphaMetrix became registered with the Securities and Exchange Commission (“SEC”) as a transfer agent on October 1, 2008 and as an investment adviser on August 26, 2009, although it does not provide securities-related investment advice to the WC Diversified Series. AlphaMetrix Group, LLC, which was initially formed as an Illinois limited liability company in September 2005 and is currently a Delaware limited liability company after a merger with a Delaware limited liability company of the same name in June 2008, is a principal, and is the sole managing member, of AlphaMetrix, and Aleks Kins is the sole manager of AlphaMetrix Group, LLC. The main business of AlphaMetrix Group, LLC is the management of the Sponsor. Although AlphaMetrix has served and currently serves as the CPO and sponsor of numerous exempt commodity pools, substantially all such commodity pools are traded by unaffiliated third-party managers.

The duties of the Sponsor include the administration and management of the WC Diversified Series, the negotiation of service provider agreements and all other management activities related to the WC Diversified Series. The Members do not retain approval rights regarding any of the management activities of the Sponsor, except for material changes to the Operating Agreements. The Sponsor does not anticipate changing the trading advisor of the WC Diversified Series and would likely undertake the orderly liquidation and dissolution of the WC Diversified Series

should the Trading Advisor no longer serve as the trading advisor to the WC Diversified Series, as the WC Diversified Series was created specifically to provide qualified investors access to the Trading Advisor’s expertise. The Sponsor will exercise its authority to change the allocation of the assets between the Series Cash Account and the Trading Fund based upon its business judgment regarding economic conditions, the WC Diversified Series’ continued operations and the appropriate leverage for the WC Diversified Series.

The principals of AlphaMetrix are not currently invested in the Units and do not intend to invest in the Units, although they may do so in the future. AlphaMetrix may invest $10,000 in the WC Diversified Series in order to qualify as the “tax matters partner” of the WC Diversified Series.

AlphaMetrix and its respective affiliates, principals and related persons (collectively, “AlphaMetrix Parties”) may trade in commodities and securities for their own accounts as well as for the accounts of their clients, although employees and principals of AlphaMetrix and its affiliates are restricted from trading commodities (but not securities) for their personal accounts. Records of this trading will not be available for inspection by Members. Such persons may take positions which are the same as or opposite to those held by the WC Diversified Series.

The Administrator

The Administrator provides certain administrative services to the WC Diversified Series as delegated by the Sponsor. The Administrator offers middle and back office outsourcing, administration, and custom investor and customer relationship management solutions to hedge funds and funds of funds.

The WC Diversified Series has entered into an administrative services agreement with the Administrator (the “Administration Agreement”). The Administrator’s services to the WC Diversified Series will generally include: (a) maintaining the principal financial records of the Platform, the WC Diversified Series and the Trading Fund; (b) calculating any management fees and performance fees; (c) providing registrar and transfer agent services in connection with the issuance, transfer and redemption of the shares with regard to any offshore vehicles; (d) receiving and processing subscriptions and redemptions; (e) providing other clerical and administrative services in connection with the day-to-day administration of the Platform, the WC Diversified Series an d the Trading Fund, and (f) calculating the Net Asset Value of the Platform, the WC Diversified Series and the Trading Fund, among other funds sponsored by the Sponsor.

The Administration Agreement is for an initial term of one year, and thereafter may generally be terminated annually by any party upon sixty (60) days’ prior written notice. The Administration Agreement may also be terminated by either party for material breach not cured within 30 days of notice of such breach, as well as for failure to agree on new rates at the end of any term, provided the Sponsor gives notice of such termination within 30 days of receiving any proposed new fee structure. The Administration Agreement provides that to the extent the Administrator follows directions of the Platform, the WC Diversified Series or the Trading Fund, in the absence of gross negligence or intentional unlawful misconduct the Administrator will have no liability arising from its following such directions. ;The Administration Agreement provides that the Administrator will indemnify the Platform, the WC Diversified Series and the Trading Fund for claims arising from the Administrator’s gross negligence or intentional unlawful conduct in its

performance of the Administration Agreement. In any case, the Administrator’s liability under the Administration Agreement may not exceed twelve times the average monthly fees received by the Administrator during the current one-year term, except regarding indemnity obligations with respect to damages required to be paid to a third party, and the Administrator shall not be liable for any consequential damages. The Administrator will not be responsible for any tax basis reporting to Members. The WC Diversified Series and/or the Trading Fund have agreed to indemnify the Administrator against any and all third party claims arising from: (i) the Administrator’s provisions of services under the Administration Agreement; (ii) the directions of the Sponsor, the Trading Fund or the WC Diversified Se ries; (iii) the Administrator’s reliance on prices of securities provided by the Sponsor, the Trading Fund or the WC Diversified Series or any third-party vendor providing such prices at the direction of the Sponsor, the Trading Fund or the WC Diversified Series or (iv) the Sponsor’s, the WC Diversified Series’ or the Trading Fund’s gross negligence or intentional unlawful conduct.

The Administrator will be paid an administrative fee, as may be negotiated from time to time, for its services. The WC Diversified Series pays to the Sponsor a Service Provider Fee, out of which the Sponsor pays the administrative fee. If additional Series are offered, each Series will be responsible for its pro rata portion of the Service Provider Fee. It should be noted that in providing its services, the Administrator does not act as a guarantor of the Units herein described.

The Trading Advisor

The WC Diversified Series will have a single trading advisor.

Winton Capital Management Limited, a limited liability company registered in England and Wales, became registered with the CFTC as a CTA in January 1998 and as a CPO in December 1998. It is also a member of the NFA and is authorized and regulated by the Financial Services Authority in the United Kingdom (“FSA”). Winton is not registered as an investment adviser with the SEC.

Winton has its principal office and maintains all books and records at 1-5 St. Mary Abbot’s Place, London W8 6LS, United Kingdom. Its telephone number is 011-44-20-7610-5350 and its fax number is 011-44-20-7610-5301.

Winton’s principals are David W. Harding, Martin J. Hunt, Anthony H. Daniell, Gurpreet Jauhal, Matthew Beddall, Rajeev Patel, Osman Murgian and two of his family-owned companies, Amur (Jersey) Limited and Samur (Jersey) Limited. Biographical information for Mr. Harding and Mr. Beddall, who are responsible for making the trading decisions for the Diversified Portfolio, follows.

David Winton Harding, Managing Director and Head of Research. Mr. Harding has been associated with Winton since he founded the firm in February 1997. In February 1987, Mr. Harding co-founded Adam, Harding & Lueck Ltd. (“AHL”), a computer-driven, research-based CTA. In 1989, ED&F Man PLC (“Man”), acquired a 51% stake of AHL, purchasing the remainder in 1994. Mr. Harding remained with the Man group for a further two years, running Man Quantitative Research, an in-house advanced statistical research team. Mr. Harding has

been registered with NFA as a principal and as an associated person of the Trading Advisor since January 29, 1998.

Matthew David Beddall, Chief Investment Officer. Mr. Beddall has been Chief Investment Officer of the Trading Advisor since 2008. He initially joined the Trading Advisor in 2000 as a summer intern. Mr. Beddall’s responsibilities as Chief Investment Officer are principally focused on managing the investment process behind the diversified program and the oversight of a large part of the Trading Advisor’s research department. Mr. Beddall has also been a registered principal of the Trading Advisor since January 28, 2009 and a registered associated person of the Trading Advisor since February 13, 2009.

On July 31, 2007, a company affiliated with Goldman Sachs International purchased a 9.99 per cent shareholding interest in Winton. This shareholding is currently held by Goldman Sachs Petershill Non-U.S. Master Fund, L.P. (the “GS Shareholder”), a fund managed by Goldman Sachs Asset Management International. The GS Shareholder is not involved in the day-to-day management of Winton but, pursuant to a shareholders agreement, has the right to approve certain limited matters relating to Winton’s operations.

The Trading Fund and the Trading Advisor are parties to a trading management agreement (the “Trading Management Agreement”) which will continue and remain in force until terminated by either the Sponsor or the Trading Fund upon not less than ten (10) days’ prior written notice. In certain circumstances (for example, the insolvency of either party or in the event all trading for the applicable Trading Fund by the Trading Advisors is suspended), the Trading Management Agreement may be terminated immediately by either party. There are no additional fees required to be paid in connection with the termination of the Trading Management Agreement, although any earned, but unpaid, management fees or incentive allocations, each as described below, mu st be paid.

Subject to applicable law, the Trading Advisor, its affiliates and their respective owners, principals, directors, officers or employees (collectively, “Trading Advisor Parties”) shall not be liable to the WC Diversified Series, the Platform, the board of directors of the Trading Fund, the Trading Fund, any Member, or any former Member or otherwise except for any loss, claim, damages, liabilities, costs or expenses resulting from conduct that constitutes gross negligence or willful misconduct or a material breach of the Trading Management Agreement and shall be indemnified against any losses arising out of or otherwise related to the Trading Management Agreement, transactions contemplated thereby or the fact that the Trading Advisor is or was trading advisor to the Tra ding Fund except for any loss, claim, damages, liabilities, costs or expenses resulting from conduct that constitutes gross negligence or willful misconduct or a material breach of the Trading Management Agreement. The Trading Advisor agrees to indemnify the Trading Fund against losses which it become subject to as a direct result of the Trading Advisor’s failure to meet the standard of liability described above. Information regarding the fees paid to the Trading Advisor and how they are calculated is contained in this Item 1 under the heading “Description of Current Charges.”

The WC Diversified Series has been formed with the specific purpose of giving Members access to an investment vehicle managed by the Trading Advisor. Pursuant to the Operating Agreement, the WC Diversified Series will be terminated only upon the occurrence of one of the

following events: the determination of the Sponsor to do so for any reason; as required by law (including the entry of a decree of judicial termination under Section 18-215 of the Delaware Limited Liability Company Act); or the dissolution of the Platform. In the event of a termination of the Trading Management Agreement, the WC Diversified Series will itself dissolve. Such dissolution will take place pursuant to Section 5.1 of the Operating Agreement.

The Trading Advisor and its respective principals will not invest in the Units.

The WC Diversified Series

The WC Diversified Master Fund is the Trading Fund for the WC Diversified Series, the first Series being offered by the Platform. The terms of the WC Diversified Series are governed by the Operating Agreement.

Following the initial issuance of the Units, in order to keep the leverage of the WC Diversified Series at an approximately one-to-one ratio, a percentage of the funds submitted to the WC Diversified Series by investors as required, based upon the leverage of the Trading Fund, will be invested into the Trading Fund without the use of an escrow account, except that a portion of such funds may be retained by the WC Diversified Series in order to pay for the WC Diversified Series’ expenses or as the result of the Trading Advisor not accepting further subscriptions at the time the funds are submitted to the WC Diversified Series. Funds invested by the WC Diversified Series into the Trading Fund will be deposited with the Clearing Broker.

In order to maintain the WC Diversified Series’ overall portfolio at a leverage of approximately one-to-one, a portion of the WC Diversified Series’ assets will be held in the Series Cash Account, as the Trading Fund currently trades at 2.5 times leverage. The Sponsor my reduce or increase the leverage of the Trading Fund at any time in its sole discretion. The Sponsor will maintain the Series Cash Account in a bank account. The Sponsor may rebalance the amounts held in the Series Cash Account and the Trading Fund approximately every two weeks, but may do so more or less often as it deems necessary to keep the WC Diversified Series’ leverage factor at approximately one. In the future, the WC Diversified Series may contract with one or more Cash Custodians, and the Series Ca sh Account may be managed by one or more Cash Managers which may include the Sponsor, any of the Cash Custodians and/or any of their respective affiliates. Information relating to the Cash Custodians and Cash Managers that may be used by the Platform will be provided to investors as soon as reasonably practicable following their selection. If Cash Custodians and Cash Managers are utilized in the future they may receive a portion of the interest received by the Series Cash Account as negotiated at such time.

The Offering

All Units are being offered through the Selling Agents (as defined hereinafter). All Units will be issued at $1,000 per Unit at the end of the initial offering period, which is anticipated to occur in January 2010, subject to the limitations discussed herein, and thereafter at the net asset value (as described below, “Net Asset Value”) per Unit on the first business day of each month. Fractional Units will be issued, rounded to a maximum of three decimal places.

Two sub-series of Units are being offered initially in the WC Diversified Series, which will differ in their fee structures and investor eligibility requirements, consisting of the Sub-Series B-

2 Units of limited liability company interests (“B-2 Units”) and the Sub-Series B-0 Units of limited liability company interests (“B-0 Units”).

The minimum initial subscription for B-2 Units is $10,000, and the minimum additional investment in B-2 Units which may be made by an existing Member is $5,000. Amounts invested in addition to these minimums may be made in whole increments of $1,000.

The minimum initial subscription for B-0 Units is $25,000, and the minimum additional investment in B-0 Units which may be made by an existing Member is $5,000. Amounts invested in addition to these minimums may be made in whole increments of $1,000.

The Sponsor may waive or reduce the initial and subsequent minimum investment, as well as the minimum increment, requirements for certain Members without entitling any other Member to any such waiver or reduction.

Members’ accounts will be debited on or about the issuance date of Units and the debit amount will be invested directly in the WC Diversified Series. No interest will be payable in respect of any such subscriptions.

There is no maximum number of Units that the WC Diversified Series may offer to investors (although the WC Diversified Series may offer Units only to the extent that the Trading Advisor is prepared to accept additional capital under management from the Trading Fund).

Once the WC Diversified Series has begun operations, there is no minimum dollar amount of additional Units which must be sold as of the beginning of any calendar month for the Units to be sold.

The Units of the WC Diversified Series are currently being offered, and it is anticipated that the WC Diversified Series will begin operating in January 2010 (or such later date as otherwise determined by the Sponsor). Thereafter, Units generally will be available as of the beginning of each calendar month, and there is currently no maximum aggregate subscription amount that may be contributed to the WC Diversified Series.

The Units are being privately offered on a continuous basis under Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 thereunder.

Selling Agents

The Units are being offered through third-party selling agents, (such selling agents duly selected by the Sponsor collectively, the “Selling Agents” and individually, as applicable, the “Selling Agent”). The Selling Agents may also retain one or more affiliates as sub-agents in connection with the distribution of the Units.

Clearing Broker

The Clearing Broker and Newedge Alternative Strategies Inc. (“NAST”) are subsidiaries of Newedge Group SA, which was formed on January 2, 2008 as a joint venture by Société Générale and Calyon to combine the brokerage activities previously carried by their respective

subsidiaries which comprised the Fimat Group and the Calyon Financial Group of affiliated entities. The Clearing Broker is a futures commission merchant and broker dealer registered with the CFTC and the SEC, and is a member of NFA and the Financial Industry Regulatory Authority, Inc. (“FINRA”). The Clearing Broker is a clearing member of all principal equity, option, and futures exchanges located in the United States as well as a member of the Options Clearing Corporation and Government Securities Clearing Corporation. NAST is an eligible swap participant that is not registered or required to be registered with the CFTC or the SEC, and is not a member of any exchange. The Clearing Broker neither will act in any supervisory c apacity with respect to the Sponsor nor participate in the management of the Sponsor, the Platform or the WC Diversified Series.

Subscription Procedures

Completed AlphaMetrix Managed Futures III LLC Subscription Agreements should be received by the Selling Agents no later than seven calendar days prior to the first day of any month in which a Member intends to invest. The Sponsor may, however, accept subscriptions at other times in its sole discretion. Existing Members may make an additional investment by completing, and submitting to the appropriate Selling Agent, a short-form Subscription Agreement, as provided by the Sponsor. The Sponsor, in its sole discretion and for any reason, may decline to accept the subscription of any prospective subscriber.

Exchanges

If multiple Series of the Platform are established, Members may exchange the Units of different Series. Subject to the conditions discussed below, exchanges will be allowed as of the end of each calendar month, provided that requests for such exchanges are received prior to the 15th day of such calendar month or the following business day if the 15th is not a business day. Exchanges (as well as subscriptions and redemptions) will be rejected if a selected Series is either not available for investment or is not permitting redemptions, as the case may be. In addition, such exchanges will be made betw een Units at their respective Net Asset Values as of the applicable dates and may be made into a Series in $10,000 minimums.

If Series are formed with multiple sub-series (“Sub-Series”), exchanges will be permitted between Sub-Series, and from one Sub-Series into Units or Sub-Series of Units of a different Series, subject to the conditions described above and the further condition that the exchanging Member satisfies the eligibility requirements, if any, applicable to a particular Sub-Series.

If more Series are offered and the Sponsor allows exchanges, the ability to engage in such exchanges may be restricted or terminated in the sole discretion of the Sponsor at any time. No one should invest in the WC Diversified Series in reliance on the ability to exchange Units of the WC Diversified Series. The Sponsor is under no obligation to permit exchanges.

Units acquired in an exchange are indistinguishable from Units acquired with a new subscription. If the net trading profits of a Series out of which a Member exchanges are below such Series’ High Water Mark, as defined below, the reduction of performance fees otherwise due in respect to future profits will be forfeited and will have no effect on the calculation of the performance

fee due in respect of the WC Diversified Series into which such Member exchanges. Any accrued performance fees will be assessed when a Member exchanges out of a Series.

No placement fees, redemption or exchange charges will be assessed on any exchange (other than payment of any accrued performance fees or described above). Exchanges will be treated as redemptions from the WC Diversified Series from which Units are exchanged and subscriptions into the WC Diversified Series into which Units are exchanged. Only whole Units may be exchanged. Any dollar amounts exchanged which cannot be reinvested into whole Units will be credited to an exchanging Member. However, if a Member exchanges all of the Units of a particular Series owned by such Member, fractional Units may be exchanged, rounded to a maximum of three decimal places, and the $10,000 minimum exchange requirement will not apply, at the discretion of the Sp onsor.

Members may make exchanges by completing, and submitting, a short-form Exchange Agreement as provided by the Sponsor.

Exchanges will be exempt from registration under the Securities Act pursuant to Regulation D of the Securities Act and Rule 506 thereunder.

Custody of Assets

A substantial amount of the WC Diversified Series’ assets are held in customer accounts at the Clearing Broker, although it may be held at other affiliates of the Clearing Broker or other third-party clearing brokers selected by the Sponsor.

All assets held at the Clearing Broker are in CFTC-regulated “segregated funds” accounts except for those funds required to margin non-regulated foreign currency positions. “Segregated funds” accounts are insulated from liability for any claims against a broker other than those of other customers. Any of the Trading Fund’s capital that is not held in segregation is held in custody or other client accounts maintained by affiliates of the Clearing Broker. Subject to any applicable regulatory restrictions, these affiliates may make use of such capital, which is treated as a liability or deposit owed by such affiliates to the Trading Fund. However, if such an affiliate were to incur financial difficulties, the Trading Fund’s assets could be lost (the Trading Fu nd becoming only a general creditor of such affiliate) and, even if not lost, could be unavailable to the Trading Fund for an extended period.

The Sponsor considers the Clearing Broker’s policies regarding the safekeeping of the Trading Fund’s assets to be fully consistent with industry practices. However, the WC Diversified Series’ capital may be subject to the risk of its custodians’ insolvency.

Interest

Following the initial issuance of the Units, in order to keep the leverage of the WC Diversified Series at an approximately one-to-one ratio, a portion of the funds submitted to the WC Diversified Series by investors as required, based upon the leverage of the Trading Fund, will be invested into the Trading Fund without the use of an escrow account, except that a portion of such funds may be retained by the WC Diversified Series in order to pay for the WC Diversified Series’ expenses or as the result of the Trading Advisor not accepting further subscriptions at the

time the funds are submitted to the WC Diversified Series. Funds invested by the WC Diversified Series into the Trading Fund will be deposited with the Clearing Broker.

The Trading Fund currently trades on a leveraged basis of approximately 2.5-to-one, i.e. at a level equal to 2.5 times the amount of capital in the Trading Fund. In order to maintain the WC Diversified Series’ overall portfolio at a leverage of approximately one-to-one, approximately 60% of the WC Diversified Series’ capital will be held in the Series Cash Account, as opposed to being invested into the Trading Fund. The Sponsor will maintain the Series Cash Account in a bank account. The Sponsor will rebalance the amounts held in the Series Cash Account and the Trading Fund approximately every two weeks, but may do so more or less often as it deems necessary to keep the WC Diversified Series’ leverage factor at approximately one time. In the future, the WC Diversified Serie s may contract with one or more Cash Custodians, and the Series Cash Account may be managed by one or more Cash Managers which may include the Sponsor, any of the Cash Custodians and/or any of their respective affiliates. Information relating to the Cash Custodians and Cash Managers that may be used by the Platform will be provided to investors as soon as reasonably practicable following their selection. If Cash Custodians and Cash Managers are utilized in the future they may receive a portion of the interest received by the Series Cash Account and/or such other fees as negotiated at such time.

The capital invested in the Trading Fund is used to margin positions in the futures, forwards and derivatives markets, as well as held in reserve to pay trading losses and expenses. The Trading Fund assets are held in customer segregated accounts at the Clearing Broker in cash or invested in CFTC-authorized investments for customer funds, except for those funds required to margin non-regulated foreign currency positions and certain cash assets held in reserve in banking accounts. The Trading Fund will receive interest income on the cash held on deposit as margin with the Clearing Broker as of the end of each month at a negotiated rate equal to approximately 95% of the short-term U.S. Treasury bill rates. The Clearing Broker will retain all other interest income earned on such cash held on deposit with i t. In the case of trading non-U.S. futures, the Clearing Broker lends to the WC Diversified Series any non-U.S. currency it requires, charging interest at a local short-term rate; on non-U.S. currencies held in the WC Diversified Series’ account, the WC Diversified Series is credited with the same local short-term rate. The Clearing Broker will receive and/or retain certain interest and other economic benefits from possession of the Trading Fund’s assets, including any interest it receives on the Trading Fund’s assets while holding such assets.

The Trading Fund generally earns interest on the cash actually held by it, which includes any unrealized gain and loss marked to market daily on the Trading Fund’s open positions (“Cash Assets”). The Trading Fund does not earn interest income on its gains or losses on open forward, commodity option and certain non-U.S. futures positions, as such gains and losses are not collected or paid until such positions are closed out. Interest is earned only on monies actually held in the Trading Fund’s account.

The Clearing Broker, in the course of acting as commodity broker for the Trading Fund, may lend certain currencies, charging interest at a local short-term rate, to, and hold certain non-U.S. currency balances on behalf of the Trading Fund.

The Clearing Broker follows its standard procedures for crediting and charging interest to the Trading Fund. The Clearing Broker is able to generate significant economic benefit from doing so, especially as the Clearing Broker is able to meet the margin requirements at the exchanges based on the net positions held by its customers as a group, whereas each customer must margin its account on a stand-alone basis.

The Sponsor or an affiliate may negotiate the Trading Fund’s interest income arrangements with the Clearing Broker. There are no regulatory limitations on the terms of such interest arrangements — in fact, the Clearing Broker would be permitted to retain all such interest if that is what is agreed to with the client.

Net Asset Value

To the extent possible, each Series is accounted for as if it were a separate company (and no Series should be liable for the obligations of any other Series). The Sponsor, or the Administrator on its behalf, calculates the Net Asset Value per Unit as of the close of business on the last business day of each calendar month and such other dates as the Sponsor may determine in its discretion. The “Net Asset Value” of the WC Diversified Series for purposes other than financial reporting as of any such date generally will equal the value of the WC Diversified Series’ assets under the management of its Trading Advisor as of such date (or in the case of a Sub-Series, the Sub-Series’ pro rata share of such assets), plus any other assets held by the WC Diversified Series (or in the case of a Sub-Series, the Sub-Series’ pro rata share of such assets), minus accrued brokerage commissions and ongoing Sales Commissions and Sponsor’s, Service Provider, Management and Performance Fees (each as defined below), organizational expense amortization, the reimbursement of the Sponsor for operating costs paid by it and other liabilities of the WC Diversified Series (or in the case of a Sub-Series, the Sub-Series’ pro rata share of such liabilities). The WC Diversified Series’ Net Asset Value per Unit then will be calculated by dividing the Net Asset Value of the WC Diversified Series by the number of Units outstanding in the WC Diversified Series. For financial reporting purposes the Net Asset Value is computed as listed above, but the organizational costs are expensed when incurred.

The managed futures positions of the WC Diversified Series will be valued in accordance with the principles described below. The liquidating value of a commodity futures contract or option on a commodity futures contract is based upon the settlement price on the futures exchange on which the particular commodity futures contract or option is traded; provided that, if a contract or option cannot be liquidated on the day with respect to which Net Asset Value is being determined, the basis for determining the liquidating value of such contract or option shall be such value as the Sponsor may deem fair and reasonable. The process used to estimate a fair value for an investment may include a single technique or, where appropriate, multiple valuation techniques, and may include (without limitation and in the discretion of the Sponsor) the consideration of one or more of the following factors (to the extent relevant): the cost of the investment to the WC Diversified Series, a review of comparable sales (if any), a discounted cash flow analysis, an analysis of cash flow multiples, a review of third-party appraisals, other material developments in the investment (even if subsequent to the valuation date) and other factors.

The liquidating value of a futures, forward or options contract not traded on a U.S. exchange is its liquidating value, determined based upon policies established by the Sponsor, on a basis consistently applied for each different variety of contract.

The Net Asset Value of the WC Diversified Series is determined in U.S. dollars, and any positions denominated in other currencies are translated at prevailing exchange rates as determined by the Sponsor or the Administrator on its behalf.

Any other assets held by the WC Diversified Series are valued in such manner as the Sponsor may determine to reflect fair market value and the accrual of interest.

The Sponsor, or the Administrator on its behalf, is authorized to make all Net Asset Value determinations and calculations (including, without limitation, for purposes of determining redemption payments and calculating sponsor’s, administration and service provider fees) on the basis of estimated numbers. For example, the Sponsor may estimate interest income for a particular month if the Net Asset Value determination is made prior to the Sponsor’s receiving a statement from the clearing broker or a bank at which the WC Diversified Series maintains a cash account. The Sponsor does not (unless otherwise determined) make retroactive adjustments in order to reflect the difference between estimated and final numbers, but rather reflects such differences (including, for purposes of calculating redemption pay ments and Sponsor’s, administration and service provider fees) in the accounting period when such differences are determined. The Sponsor does not expect any such differences to be material.

The Sponsor may suspend the calculation of the Net Asset Value of the WC Diversified Series’ Units during any period for which it is unable to value a material portion of the corresponding Trading Fund’s positions. The Sponsor will give notice of any such suspension to Members invested in the WC Diversified Series.

Redemptions shall, after the date thereof (as the same may be suspended as described herein), be deemed to have been paid out of the WC Diversified Series as of such date, and shall no longer be included in either the Platform’s or the WC Diversified Series’ assets or liabilities (irrespective of when actually paid out).

Net Asset Values will be provided to investors via the WC Diversified Series’ monthly reports.

Financial Terms

Tax Allocations

Each fiscal year, each Series will be treated as if it were a separate business entity under applicable regulations of the Department of the Treasury and/or the Internal Revenue Service (the “IRS”). The Sponsor generally allocates items of income, gain, loss, expense, deduction and credit determined for income tax reporting purposes (“Tax Items”) among the Units of the WC Diversified Series in a manner as to reflect equitably amounts credited or debited to each Unit’s capital account for the current and prior fiscal years (or relevant portions thereof) and pursuant to relevant regulations. For the avoidance of doubt, the Sponsor allocates Tax Items to the greatest extent pos sible so as to equalize the tax basis and capital accounts of the Units of the WC Diversified Series. To the extent permitted by applicable regulations, the Sponsor may

make adjustments to the method in which allocations are made by the WC Diversified Series among the Units of the WC Diversified Series as the Sponsor may deem reasonable. See the relevant provisions of the Platform’s Operating Agreement.

The following is a summary of the fees and expenses applicable to the WC Diversified Series:

Description of Current Charges.

| Recipient | Nature of Payment | Amount of Payment |

| The Sponsor | Sponsor’s Fee | The Sponsor will receive a flat-rate monthly sponsor fee of 0.042 of 1% (a 0.50% annual rate) of the WC Diversified Series’ Net Asset Value after deducting the Management Fee and accrued Performance Fee (as defined hereinafter), if any, and organizational and offering expenses, but before deducting the sponsor’s fee and Sales Commission, if any, for such month (the “Sponsor’s Fee”). |

| | | The Sponsor may waive or reduce the Sponsor’s Fee for certain Members without entitling any other Member to any such waiver or reduction. The Sponsor may waive or reduce the Sponsor’s Fee for certain Members without entitling any other Member to any such waiver or reduction. Such waivers or reductions will be enacted by way of a rebate of the Sponsor’s Fee paid to the Members granted such terms. Other Members will not be required to pay additional sums due to the granting of any such waivers or reductions. |

| Recipient | Nature of Payment | Amount of Payment |

| The Sponsor | Service Provider Fee | The Sponsor will receive a monthly service provider fee equal to 0.025% of 1% (equivalent to an annual rate of approximately 0.30%) of the Net Asset Value of the WC Diversified Series. Operating costs paid for by the Sponsor out of the Service Provider Fee generally include: certain ongoing offering expenses; administrative, transfer, exchange and redemption processing costs; legal, regulatory, reporting, filing, tax, audit, escrow and accounting; the fees of the Trading Fund’s directors; and any other operating or administrative expenses related to accounting, research, due diligence or reporting. An administrative fee will be paid to the Administrator by the Sponsor out of the Service Provider Fee. If additional Series are offered, each Series will be responsible for its pro rata portion of the Service Provider Fee. |

| Various Service Providers | Ongoing Offering Expenses | The ongoing offering expenses payable by the WC Diversified Series are not expected to exceed 0.15% of the Net Asset Value of the WC Diversified Series per year. The on-going offering expenses that are not covered by the Service Provider Fee include, but are not limited to, printing, fulfillment expenses and costs associated with periodic required filings under the Exchange Act. |

| Clearing Broker | Brokerage Commissions | The WC Diversified Series’ brokerage commissions will be paid on the completion or liquidation of one-half of a trade and are referred to as “per-side” commissions, which cover either the initial purchase (or sale) or the subsequent offsetting sale (or purchase) of a single commodity futures contract, and be incurred and paid at the Trading Fund level. If 100 contracts are included in a single trade, 200 per side commissions are accrued; 100 are paid when the position is acquired and 100 are paid when the position is liquidated. |

| | | The “per side” commissions for U.S. markets paid by the WC Diversified Series will be approximately $2 per side plus fees, except in the case of certain non-U.S. contracts on which the rates may be as |

| Recipient | Nature of Payment | Amount of Payment |

| | | high as $50 per side plus fees due, in part, to the large size of the contracts traded. In general, the Sponsor estimates that aggregate brokerage commission charges (including F/X spreads — see below) will equal approximately 0.25% per annum of the WC Diversified Series’ average month-end assets. Aggregate brokerage commissions could exceed this estimate but are not expected to exceed 1.50% per annum of the WC Diversified Series’ average month-end assets. |

| Clearing Broker or Other Currency Dealers | Currency (F/X) Dealer Spreads | Many of the WC Diversified Series’ currency trades are executed in the spot and forward foreign exchange markets (the “F/X Markets”) in which there are no direct execution costs. Instead, the banks and dealers in the F/X Markets take a “spread” between the prices at which they are prepared to buy and sell a particular currency, and such spreads are built into the pricing of the spot or forward contracts with the WC Diversified Series. |

| | | Should the WC Diversified Series engage in exchange of futures for physical (“EFP”) trading, the WC Diversified Series would acquire cash currency positions through banks and dealers. The WC Diversified Series would pay a spread when it exchanges these positions for futures. This spread would reflect, in part, the different settlement dates of the cash and the futures contracts, as well as prevailing interest rates, but also would include a pricing spread in favor of the dealer. |

| The Trading Advisor | Management Fees (asset-based) | The Trading Advisor is entitled to a management fee (the “Management Fee”), which is paid at the WC Diversified Series level. The Management Fee is based on the Net Asset Value of the WC Diversified Series. For purposes of calculating the Management Fee payable to the Trading Advisor, the Net Asset Value of the WC Diversified Series is determined before reduction for any Management Fees, Performance Fees, Service Provider Fees, Sponsor’s Fees, ongoing Sales Commissions or extraordinary fees accrued, including Performance Fees, as defined below, accrued in a prior month, and before giving |

| Recipient | Nature of Payment | Amount of Payment |

| | | effect to any capital contributions made as of the beginning of the month immediately following such month-end and before any distributions or redemptions accrued during or as of such month-end, but after all other expenses as of such month-end. |

| | | The B-2 and B-0 Units pay a Management Fee equal to 2.25% on an annual basis. |

| | | The Trading Advisor has agreed to share 1.25% of the Management Fee with the Selling Agent for B-2 and B-0 Units. |

| The Trading Advisor | Performance Fees | The “Performance Fee” will equal 20% of the New Net Trading Profits (as defined below) of the WC Diversified Series for each quarter. |

| Recipient | Nature of Payment | Amount of Payment |

| | | “New Net Trading Profits” during each quarter means the excess, if any, of the cumulative level of net trading profits attributable to the WC Diversified Series at the end of such quarter over the highest level of cumulative net trading profits as of the end of any preceding quarter (the “High Water Mark”). Performance Fees do not, while losses do, reduce cumulative net trading profits. New Net Trading Profits do not include interest income. |

| | | To the extent that any redemptions are made from the WC Diversified Series, the High Water Mark is proportionately reduced and a proportionate Performance Fee paid (if accrued). |

| | | For example, if an investor had a high water mark of $20,000, and the investor’s units had a value of $19,000 at the beginning of the period for which the Performance Fee is being calculated and a value of $22,000 at the end, the Performance Fee would equal 20% of $2,000, or $400, and the investor’s new high water mark would equal $22,000. |

| | | The Sponsor will receive the Management Fee and the Performance Fee, and will pay over such fees to the Trading Advisor, although the Selling Agents may receive a portion of such fees of the Trading Advisor. |

| The Sponsor | Organizational and Initial Offering Costs | The Sponsor intends to advance expenses in connection with the organization and initial offering of Units, estimated to be approximately $100,000. The WC Diversified Series will reimburse the Sponsor for these costs from the proceeds of the initial issuance of the WC Diversified Series’ Units, provided that the initial offering is successful. Any reimbursed costs will be amortized against the Net Asset Value of the WC Diversified Series in 60 monthly installments, beginning with the first month-end after the initial issuance of Units. The amortization of such costs will reduce the Net Asset Value of the Units for purposes of determining subscriptions, redemptions and any fees based on the Units’ Net Asset Value and for performance |

| Recipient | Nature of Payment | Amount of Payment |