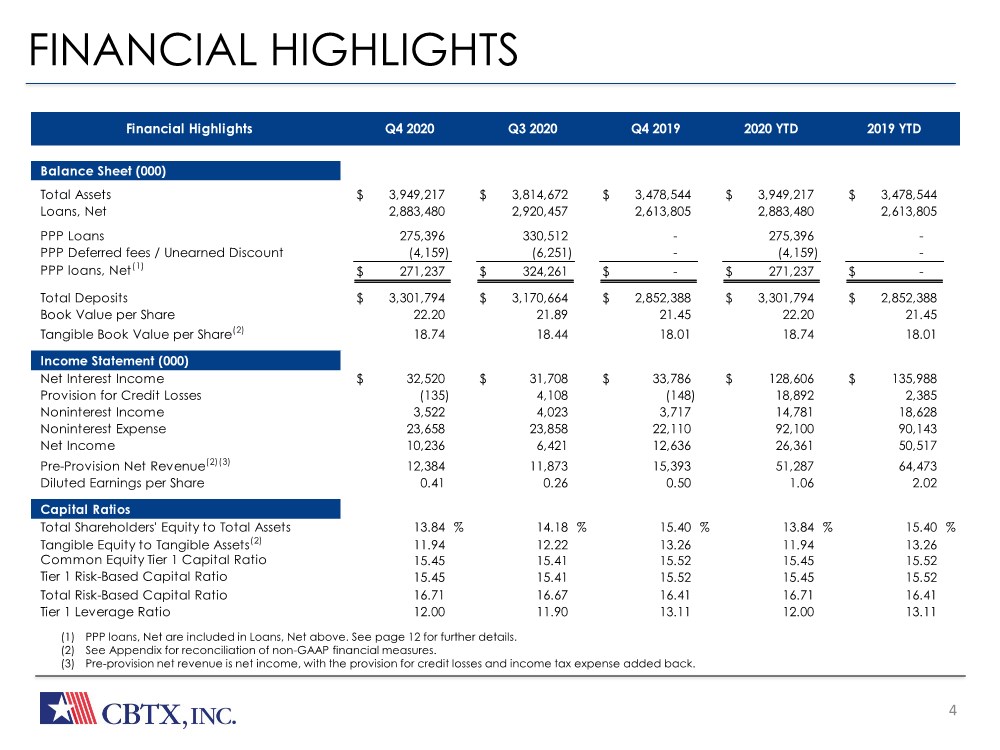

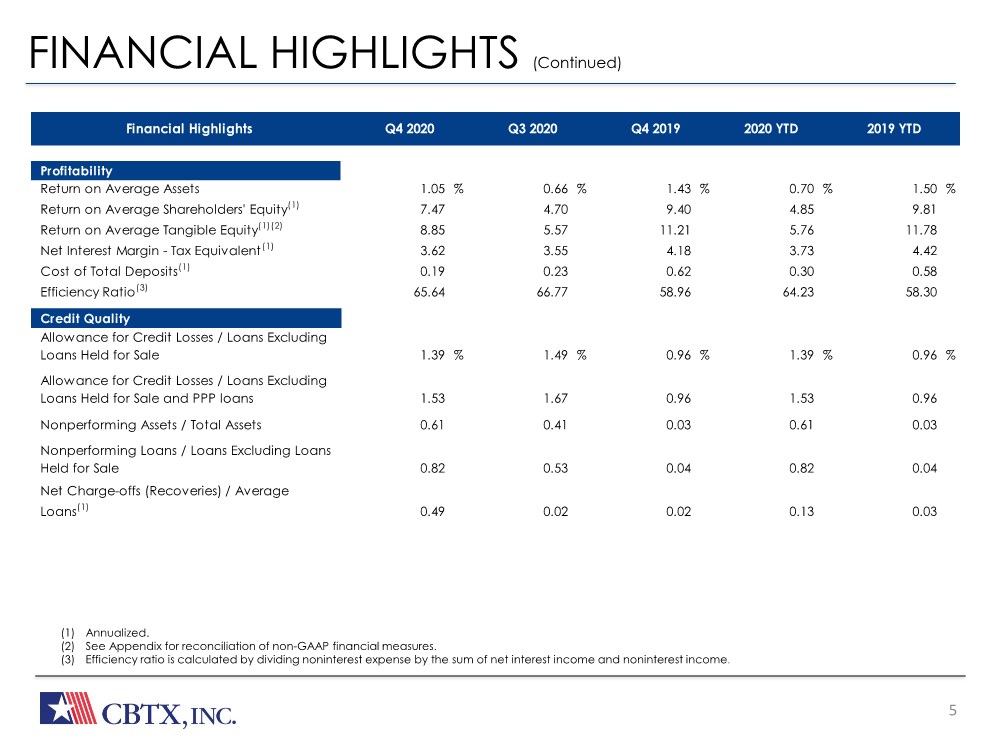

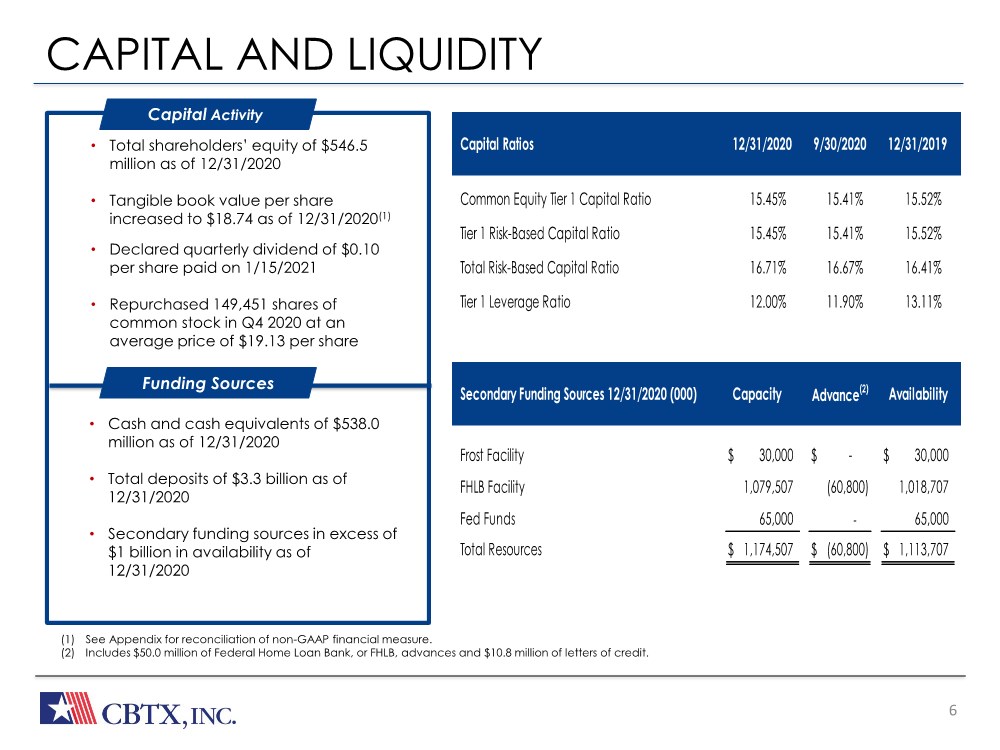

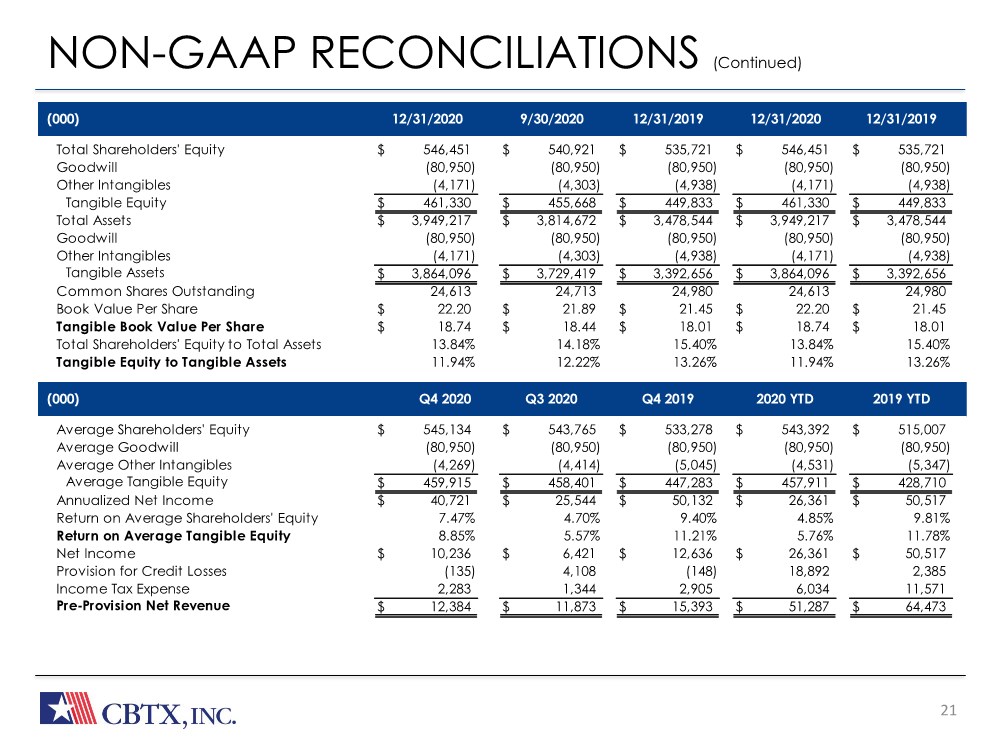

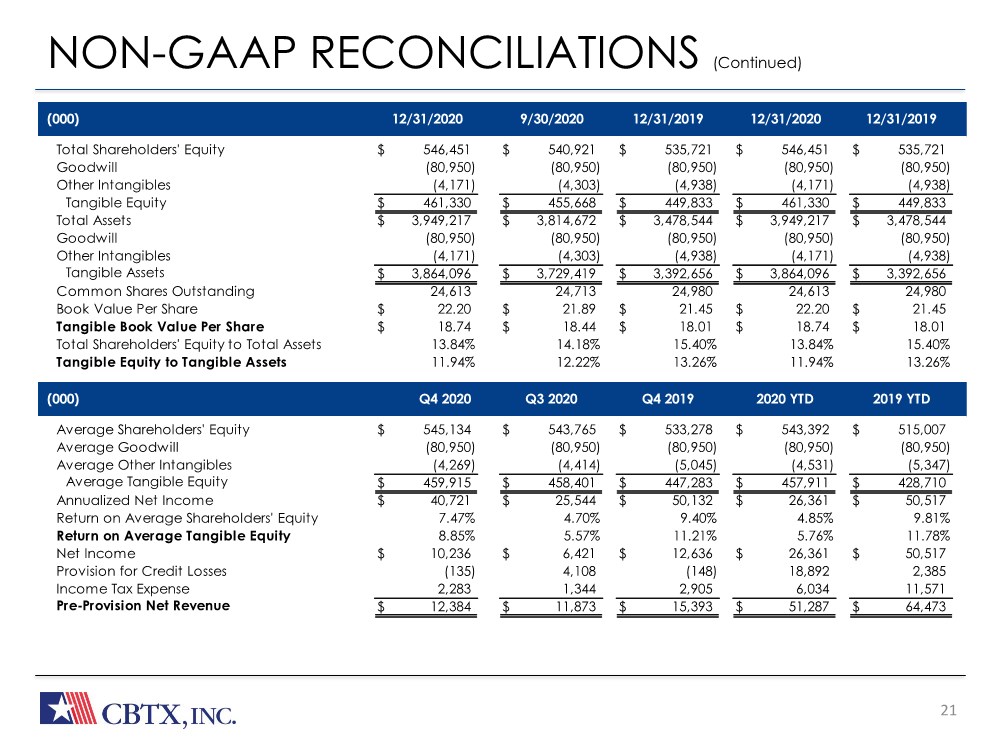

| 21 NON-GAAP RECONCILIATIONS (Continued) (000) 12/31/2020 12/31/2020 12/31/2019 12/31/2019 9/30/2020 (000) 2019 YTD Q4 2020 2020 YTD Q3 2020 Q4 2019 Total Shareholders' Equity $ 546,451 $ 540,921 $ 535,721 $ 546,451 $ 535,721 Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Other Intangibles (4,171) (4,303) (4,938) (4,171) (4,938) Tangible Equity $ 461,330 $ 455,668 $ 449,833 $ 461,330 $ 449,833 Total Assets $ 3,949,217 $ 3,814,672 $ 3,478,544 $ 3,949,217 $ 3,478,544 Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Other Intangibles (4,171) (4,303) (4,938) (4,171) (4,938) Tangible Assets $ 3,864,096 $ 3,729,419 $ 3,392,656 $ 3,864,096 $ 3,392,656 Common Shares Outstanding 24,613 24,713 24,980 24,613 24,980 Book Value Per Share $ 22.20 $ 21.89 $ 21.45 $ 22.20 $ 21.45 Tangible Book Value Per Share $ 18.74 $ 18.44 $ 18.01 $ 18.74 $ 18.01 Total Shareholders' Equity to Total Assets 13.84% 14.18% 15.40% 13.84% 15.40% Tangible Equity to Tangible Assets 11.94% 12.22% 13.26% 11.94% 13.26% Average Shareholders' Equity $ 545,134 $ 543,765 $ 533,278 $ 543,392 $ 515,007 Average Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Average Other Intangibles (4,269) (4,414) (5,045) (4,531) (5,347) Average Tangible Equity $ 459,915 $ 458,401 $ 447,283 $ 457,911 $ 428,710 Annualized Net Income $ 40,721 $ 25,544 $ 50,132 $ 26,361 $ 50,517 Return on Average Shareholders' Equity 7.47% 4.70% 9.40% 4.85% 9.81% Return on Average Tangible Equity 8.85% 5.57% 11.21% 5.76% 11.78% Net Income $ 10,236 $ 6,421 $ 12,636 $ 26,361 $ 50,517 Provision for Credit Losses (135) 4,108 (148) 18,892 2,385 Income Tax Expense 2,283 1,344 2,905 6,034 11,571 Pre-Provision Net Revenue $ 12,384 $ 11,873 $ 15,393 $ 51,287 $ 64,473 |