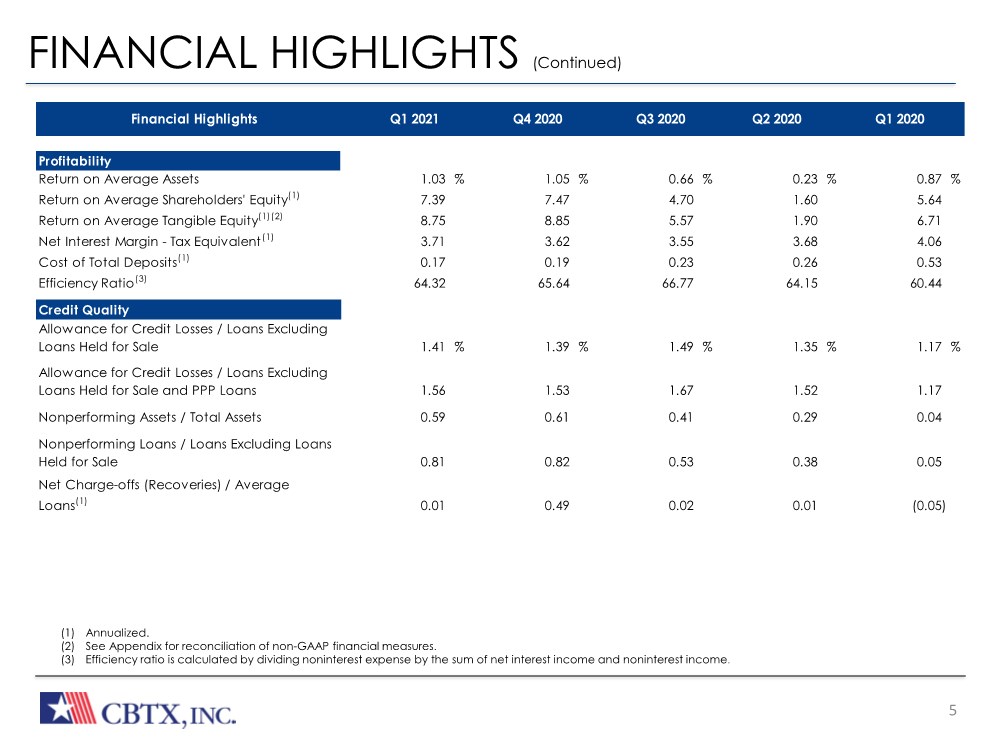

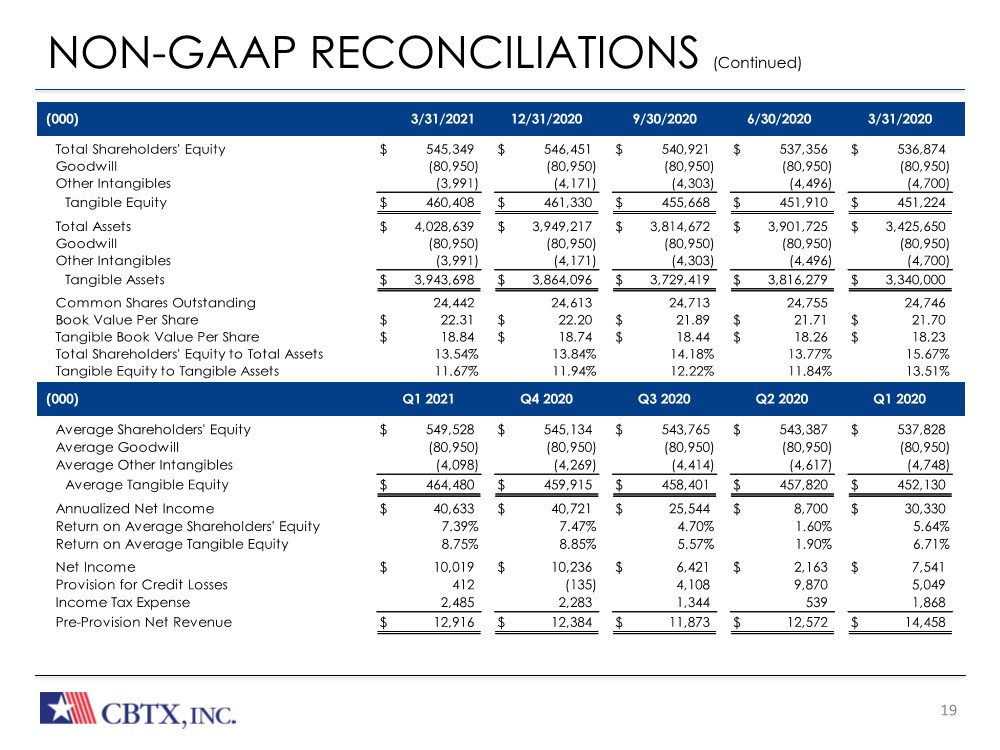

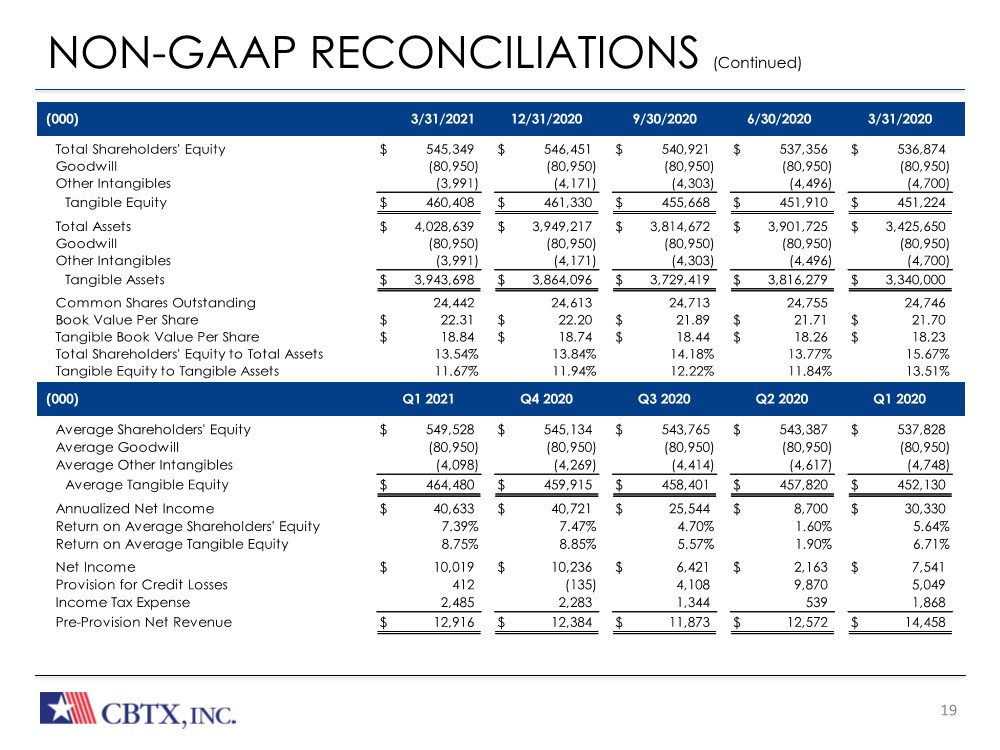

| 19 NON-GAAP RECONCILIATIONS (Continued) (000) Q1 2020 Q2 2020 Q4 2020 Q3 2020 Q1 2021 Total Shareholders' Equity $ 545,349 $ 546,451 $ 540,921 $ 537,356 $ 536,874 Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Other Intangibles (3,991) (4,171) (4,303) (4,496) (4,700) Tangible Equity $ 460,408 $ 461,330 $ 455,668 $ 451,910 $ 451,224 Total Assets $ 4,028,639 $ 3,949,217 $ 3,814,672 $ 3,901,725 $ 3,425,650 Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Other Intangibles (3,991) (4,171) (4,303) (4,496) (4,700) Tangible Assets $ 3,943,698 $ 3,864,096 $ 3,729,419 $ 3,816,279 $ 3,340,000 Common Shares Outstanding 24,442 24,613 24,713 24,755 24,746 Book Value Per Share $ 22.31 $ 22.20 $ 21.89 $ 21.71 $ 21.70 Tangible Book Value Per Share $ 18.84 $ 18.74 $ 18.44 $ 18.26 $ 18.23 Total Shareholders' Equity to Total Assets 13.54% 13.84% 14.18% 13.77% 15.67% Tangible Equity to Tangible Assets 11.67% 11.94% 12.22% 11.84% 13.51% Average Shareholders' Equity $ 549,528 $ 545,134 $ 543,765 $ 543,387 $ 537,828 Average Goodwill (80,950) (80,950) (80,950) (80,950) (80,950) Average Other Intangibles (4,098) (4,269) (4,414) (4,617) (4,748) Average Tangible Equity $ 464,480 $ 459,915 $ 458,401 $ 457,820 $ 452,130 Annualized Net Income $ 40,633 $ 40,721 $ 25,544 $ 8,700 $ 30,330 Return on Average Shareholders' Equity 7.39% 7.47% 4.70% 1.60% 5.64% Return on Average Tangible Equity 8.75% 8.85% 5.57% 1.90% 6.71% Net Income $ 10,019 $ 10,236 $ 6,421 $ 2,163 $ 7,541 Provision for Credit Losses 412 (135) 4,108 9,870 5,049 Income Tax Expense 2,485 2,283 1,344 539 1,868 Pre-Provision Net Revenue $ 12,916 $ 12,384 $ 11,873 $ 12,572 $ 14,458 (000) 6/30/2020 3/31/2020 9/30/2020 12/31/2020 3/31/2021 |