Third Quarter 2022 Earnings Presentation Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures 2 Certain statements in this press release which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements” for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the merger of CBTX, Inc. (now Stellar Bancorp, Inc.)(the “Company”) and Allegiance Bancshares, Inc. (“Allegiance”), including future financial performance and operating results, the combined company’s plans, business and growth strategies, objectives, expectations and intentions, and other statements that are not historical facts, including projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “scheduled,” “plans,” “intends,” “projects,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” “would,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Stellar to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others: (1) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized; (2) disruption to our business as a result of the merger; (3) the risk that the integration of our operations will be materially delayed or will be more costly or difficult than we expected or that we are otherwise unable to successfully integrate our legacy businesses; (4) the amount of the costs, fees, expenses and charges related to the merger; (5) reputational risk and the reaction of our customers, suppliers, employees or other business partners to the merger; (6) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (7) the dilution caused by Stellar’s issuance of additional shares of its common stock in the merger; (8) general competitive, economic, political and market conditions; and (9) other factors that may affect future results of Stellar including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Texas Department of Banking and legislative and regulatory actions and reforms. Additional factors which could affect the Company’s future results can be found in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K and the Joint Proxy Statement/Prospectus regarding the merger that CBTX filed with the SEC on April 7, 2022 pursuant to Rule 424(b)(3) and Allegiance’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at https:// www.sec.gov. We disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. GAAP Reconciliation of Non-GAAP Financial Measures The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance. The Company believes that these non- GAAP financial measures provide meaningful supplemental information regarding its performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing the Company’s performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, the Company reviews pre-tax, pre-provision income, adjusted pre-tax, pre-provision income, adjusted pre-tax, pre-provision earnings per share, diluted, adjusted efficiency ratio, adjusted noninterest expense / average assets and adjusted pre-tax, pre-provision return on average assets for internal planning and forecasting purposes. The Company has included in this presentation information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures may differ from that of other companies reporting measures with similar names.

Stellar Bancorp, Inc. - A Premier Texas Franchise 3 Combination delivers scale, growth opportunities and talent depth Significant scarcity value in one of the best markets in the U.S Merger-of-equals between of CBTX, Inc. and Allegiance Bancshares, Inc. became effective October 1, 2022, with the combined company renamed Stellar Bancorp, Inc. (NASDAQ: STEL) − Principal banking subsidiary to be renamed Stellar Bank upon system conversion Source: S&P Capital IQ Pro. Positioned to drive significant value creation Combination of the Houston region’s two largest regionally-focused banks

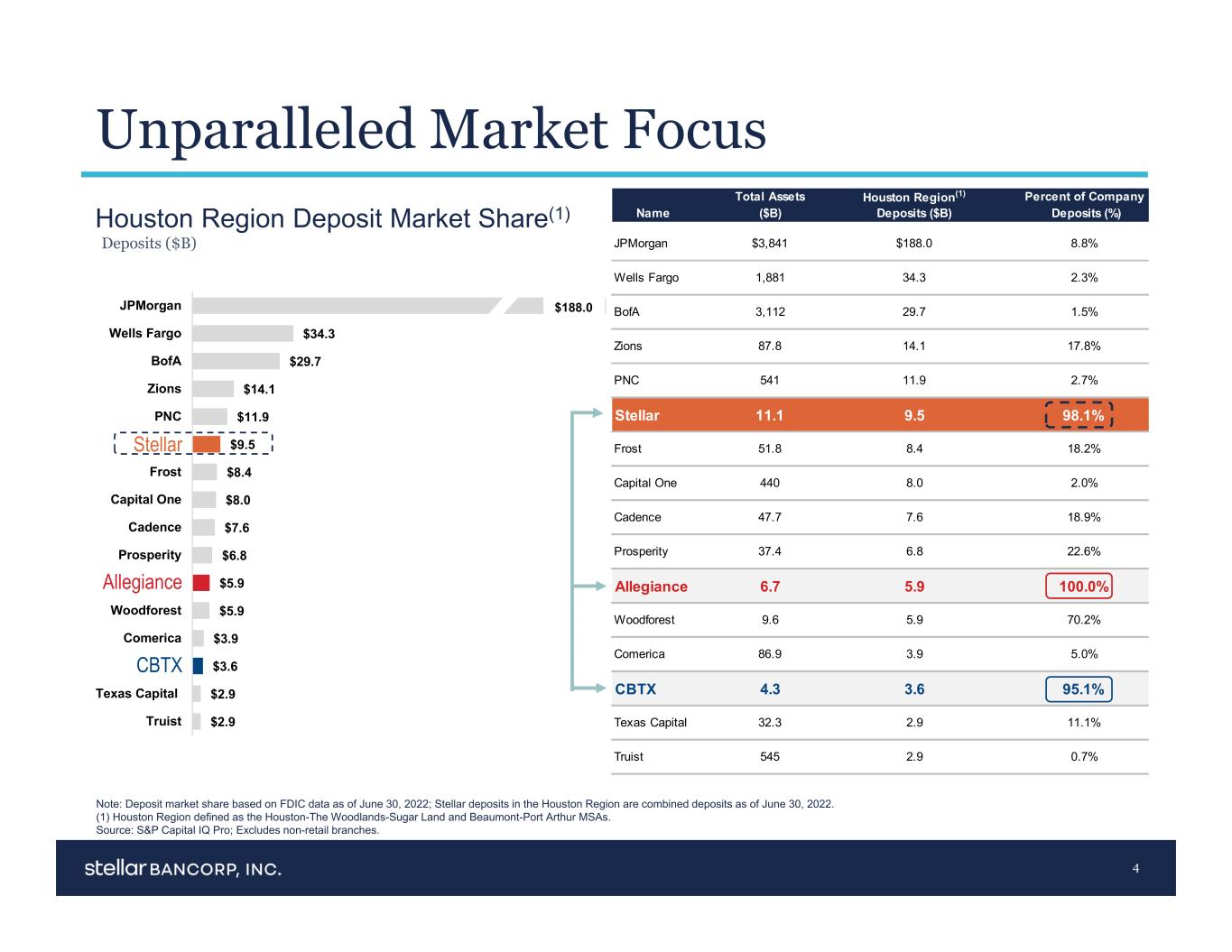

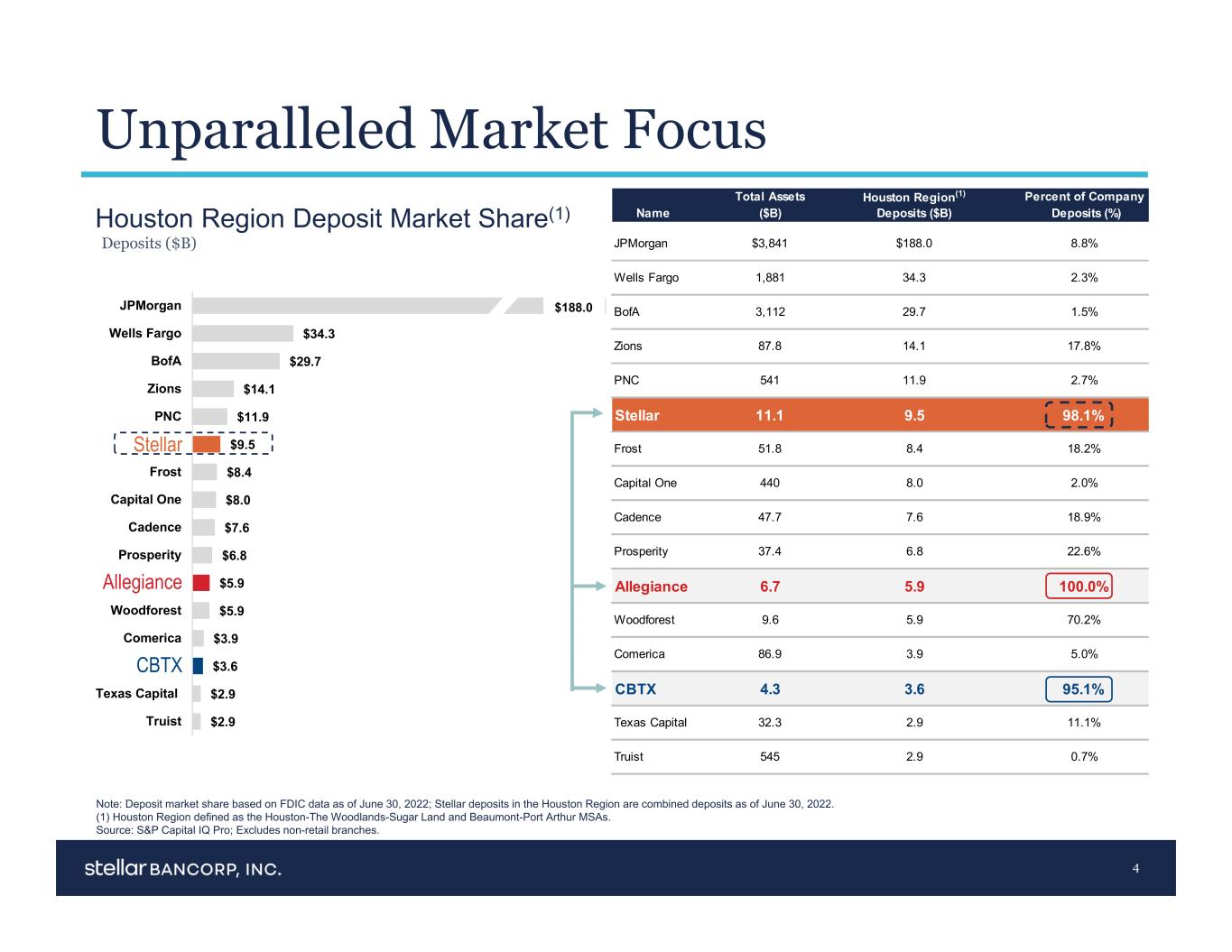

Unparalleled Market Focus 4 Houston Region Deposit Market Share(1) Deposits ($B) $34.3 $29.7 $14.1 $11.9 $9.5 $8.4 $8.0 $7.6 $6.8 $5.9 $5.9 $3.9 $3.6 $2.9 $2.9 JPMorgan Wells Fargo BofA Zions PNC Stellar Frost Capital One Cadence Prosperity Allegiance Woodforest Comerica CBTX Texas Capital Truist $188.0 Total Assets Houston Region(1) Percent of Company Name ($B) Deposits ($B) Deposits (%) JPMorgan $3,841 $188.0 8.8% Wells Fargo 1,881 34.3 2.3% BofA 3,112 29.7 1.5% Zions 87.8 14.1 17.8% PNC 541 11.9 2.7% Stellar 11.1 9.5 98.1% Frost 51.8 8.4 18.2% Capital One 440 8.0 2.0% Cadence 47.7 7.6 18.9% Prosperity 37.4 6.8 22.6% Allegiance 6.7 5.9 100.0% Woodforest 9.6 5.9 70.2% Comerica 86.9 3.9 5.0% CBTX 4.3 3.6 95.1% Texas Capital 32.3 2.9 11.1% Truist 545 2.9 0.7% Stell r Allegianc CBT Note: Deposit market share based on FDIC data as of June 30, 2022; Stellar deposits in the Houston Region are combined deposits as of June 30, 2022. (1) Houston Region defined as the Houston-The Woodlands-Sugar Land and Beaumont-Port Arthur MSAs. Source: S&P Capital IQ Pro; Excludes non-retail branches.

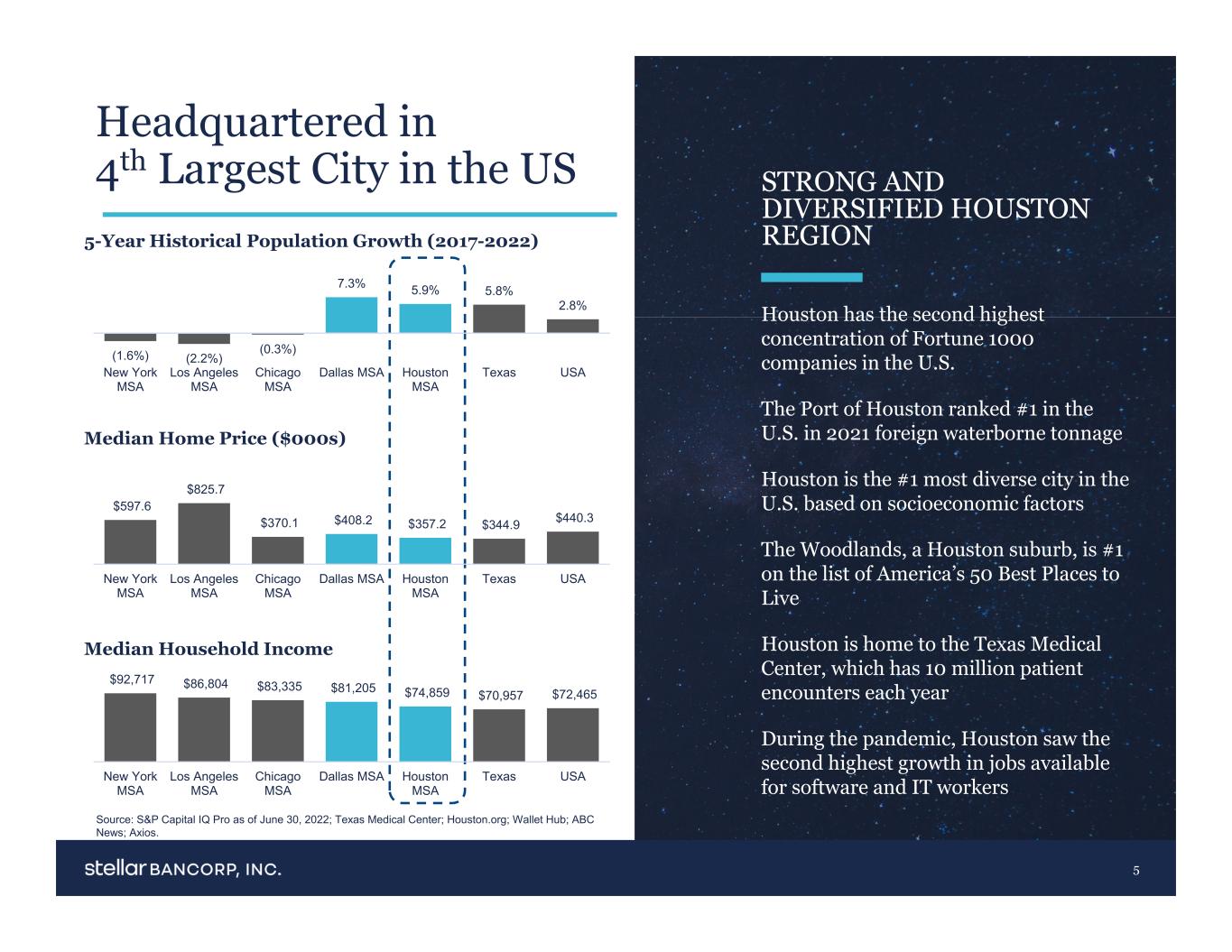

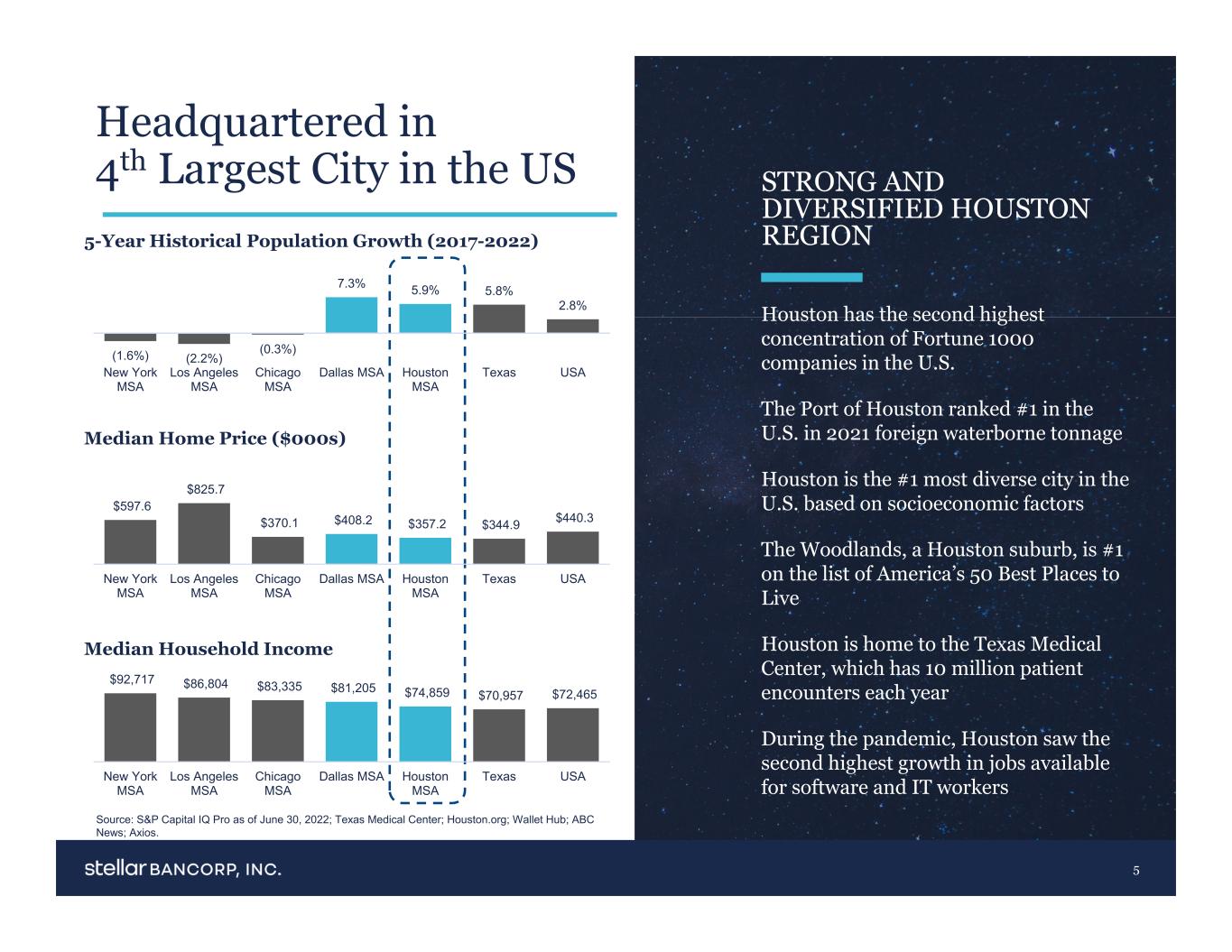

Headquartered in 4th Largest City in the US 5-Year Historical Population Growth (2017-2022) STRONG AND DIVERSIFIED HOUSTON REGION Houston has the second highest concentration of Fortune 1000 companies in the U.S. The Port of Houston ranked #1 in the U.S. in 2021 foreign waterborne tonnage Houston is the #1 most diverse city in the U.S. based on socioeconomic factors The Woodlands, a Houston suburb, is #1 on the list of America’s 50 Best Places to Live Houston is home to the Texas Medical Center, which has 10 million patient encounters each year During the pandemic, Houston saw the second highest growth in jobs available for software and IT workers 5 Median Home Price ($000s) Median Household Income Source: S&P Capital IQ Pro as of June 30, 2022; Texas Medical Center; Houston.org; Wallet Hub; ABC News; Axios. (1.6%) (2.2%) (0.3%) 7.3% 5.9% 5.8% 2.8% New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas USA $597.6 $825.7 $370.1 $408.2 $357.2 $344.9 $440.3 New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas USA $92,717 $86,804 $83,335 $81,205 $74,859 $70,957 $72,465 New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas USA

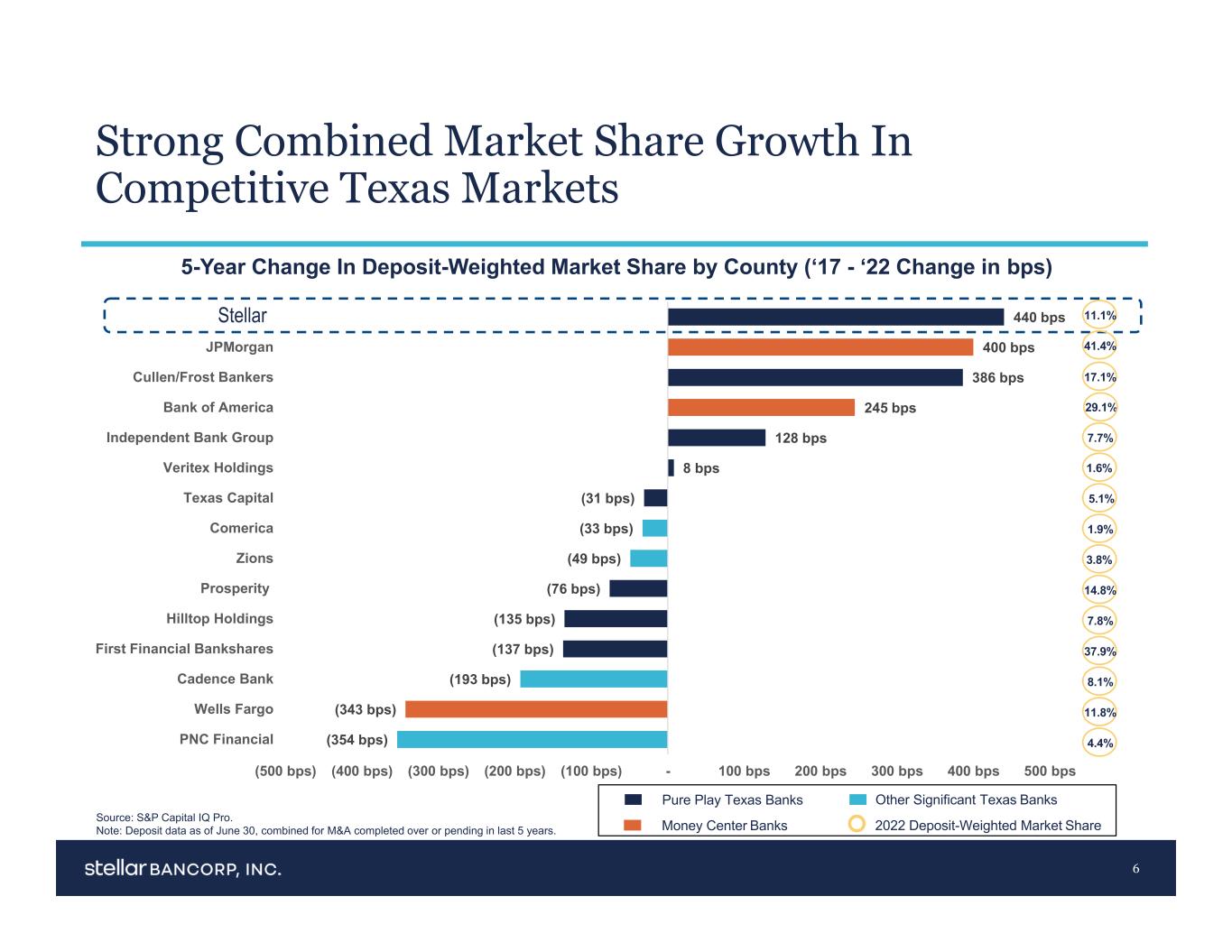

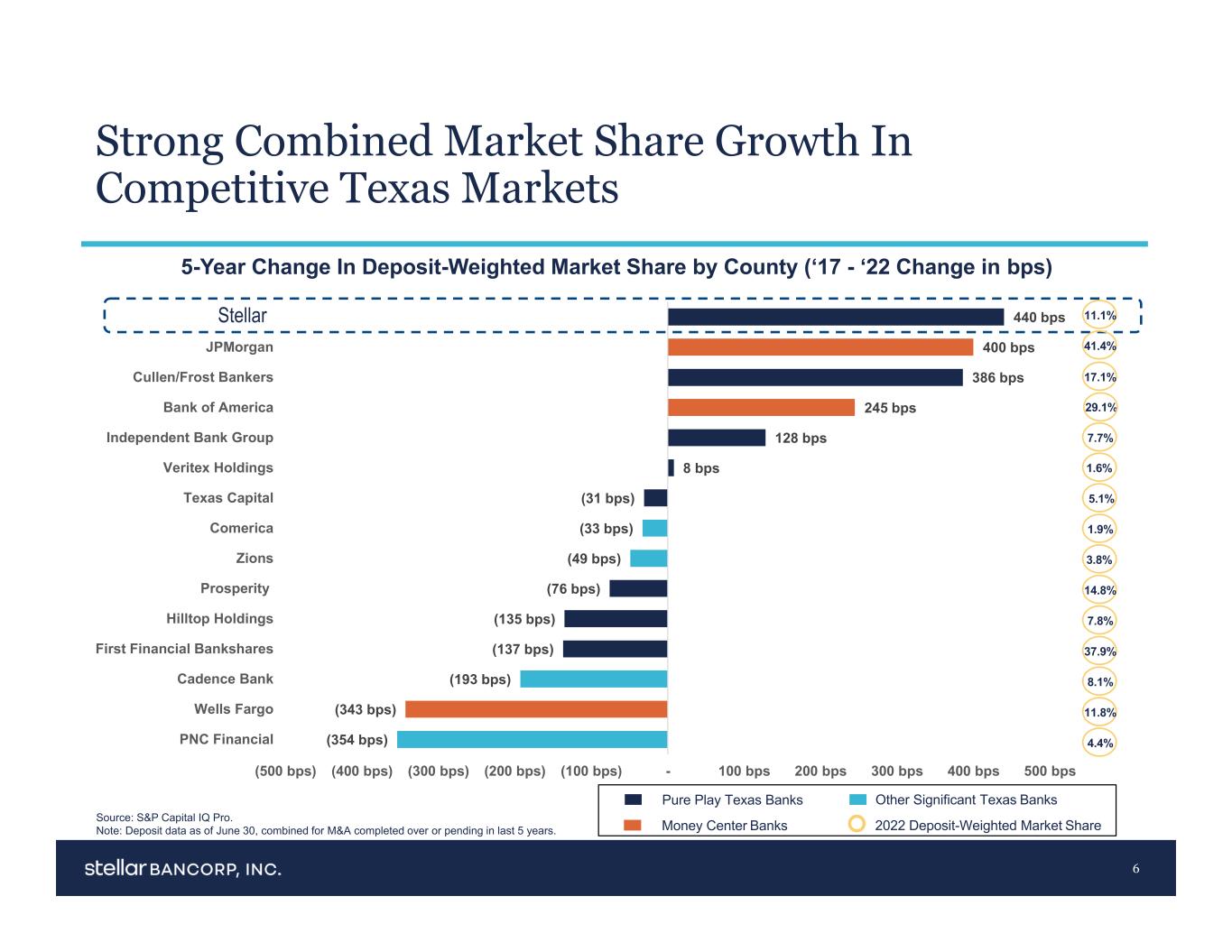

440 bps 400 bps 386 bps 245 bps 128 bps 8 bps (31 bps) (33 bps) (49 bps) (76 bps) (135 bps) (137 bps) (193 bps) (343 bps) (354 bps) (500 bps) (400 bps) (300 bps) (200 bps) (100 bps) - 100 bps 200 bps 300 bps 400 bps 500 bps JPMorgan Cullen/Frost Bankers Bank of America Independent Bank Group Veritex Holdings Texas Capital Comerica Zions Prosperity Hilltop Holdings First Financial Bankshares Cadence Bank Wells Fargo PNC Financial Strong Combined Market Share Growth In Competitive Texas Markets 6 Pure Play Texas Banks Money Center Banks Other Significant Texas Banks 2022 Deposit-Weighted Market Share 11.1% 5-Year Change In Deposit-Weighted Market Share by County (‘17 - ‘22 Change in bps) Source: S&P Capital IQ Pro. Note: Deposit data as of June 30, combined for M&A completed over or pending in last 5 years. 41.4% 17.1% 29.1% 7.7% 1.6% 5.1% 1.9% 3.8% 14.8% 7.8% 37.9% 8.1% 11.8% 4.4% Stellar

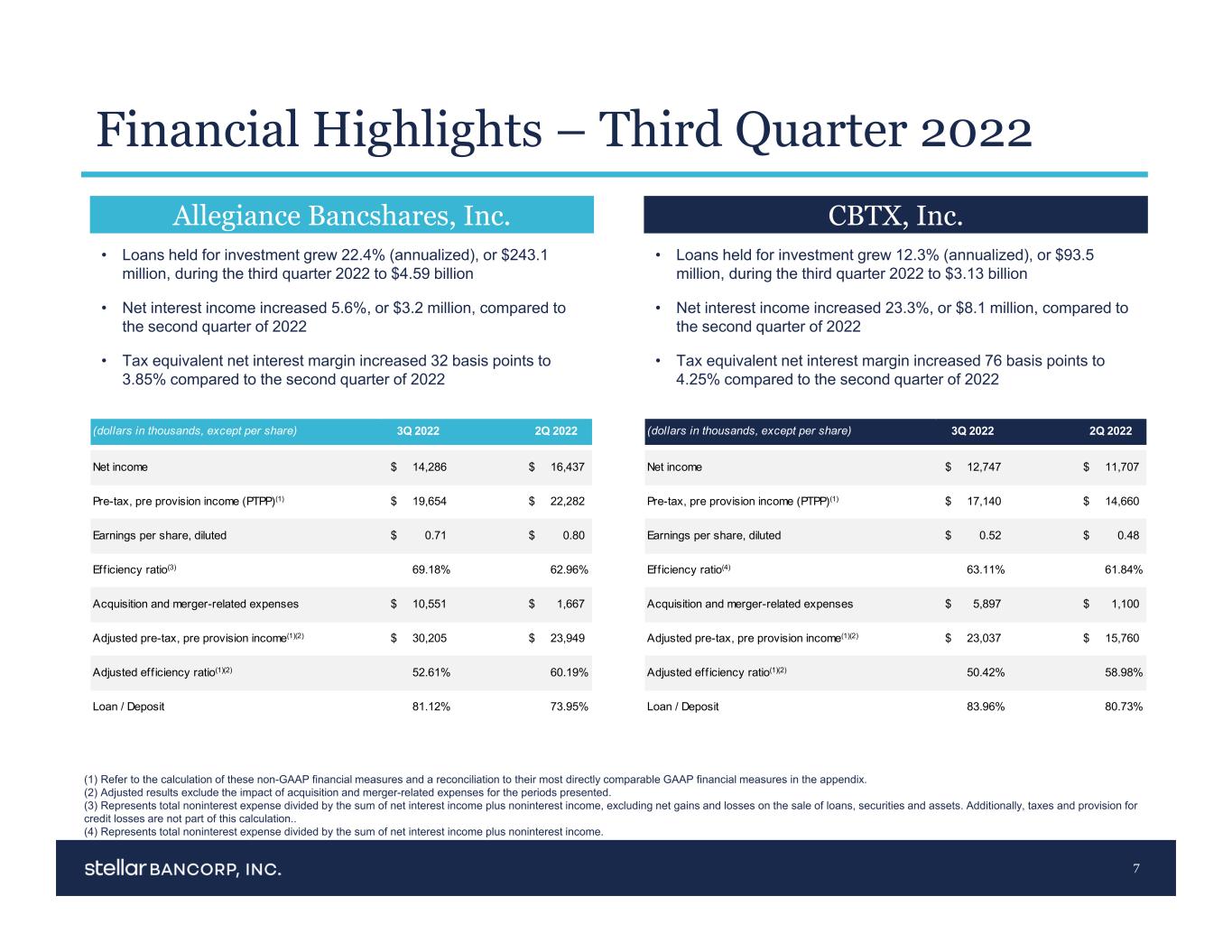

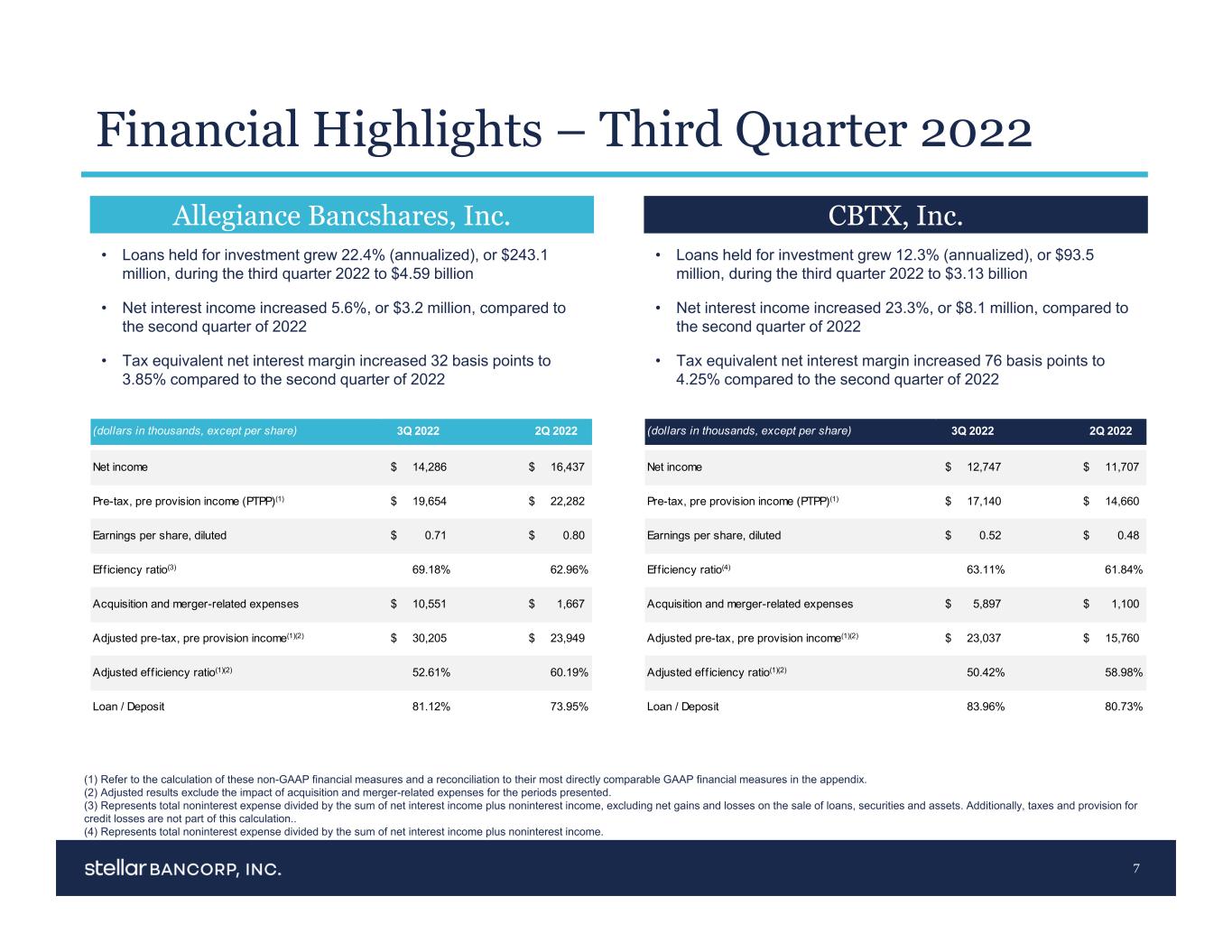

Financial Highlights – Third Quarter 2022 7 (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. (2) Adjusted results exclude the impact of acquisition and merger-related expenses for the periods presented. (3) Represents total noninterest expense divided by the sum of net interest income plus noninterest income, excluding net gains and losses on the sale of loans, securities and assets. Additionally, taxes and provision for credit losses are not part of this calculation.. (4) Represents total noninterest expense divided by the sum of net interest income plus noninterest income. Allegiance Bancshares, Inc. CBTX, Inc. • Loans held for investment grew 22.4% (annualized), or $243.1 million, during the third quarter 2022 to $4.59 billion • Net interest income increased 5.6%, or $3.2 million, compared to the second quarter of 2022 • Tax equivalent net interest margin increased 32 basis points to 3.85% compared to the second quarter of 2022 • Loans held for investment grew 12.3% (annualized), or $93.5 million, during the third quarter 2022 to $3.13 billion • Net interest income increased 23.3%, or $8.1 million, compared to the second quarter of 2022 • Tax equivalent net interest margin increased 76 basis points to 4.25% compared to the second quarter of 2022 (dollars in thousands, except per share) 3Q 2022 2Q 2022 Net income 14,286$ 16,437$ Pre-tax, pre provision income (PTPP)(1) 19,654$ 22,282$ Earnings per share, diluted 0.71$ 0.80$ Efficiency ratio(3) 69.18% 62.96% Acquisition and merger-related expenses 10,551$ 1,667$ Adjusted pre-tax, pre provision income(1)(2) 30,205$ 23,949$ Adjusted eff iciency ratio(1)(2) 52.61% 60.19% Loan / Deposit 81.12% 73.95% (dollars in thousands, except per share) 3Q 2022 2Q 2022 Net income 12,747$ 11,707$ Pre-tax, pre provision income (PTPP)(1) 17,140$ 14,660$ Earnings per share, diluted 0.52$ 0.48$ Efficiency ratio(4) 63.11% 61.84% Acquisition and merger-related expenses 5,897$ 1,100$ Adjusted pre-tax, pre provision income(1)(2) 23,037$ 15,760$ Adjusted eff iciency ratio(1)(2) 50.42% 58.98% Loan / Deposit 83.96% 80.73%

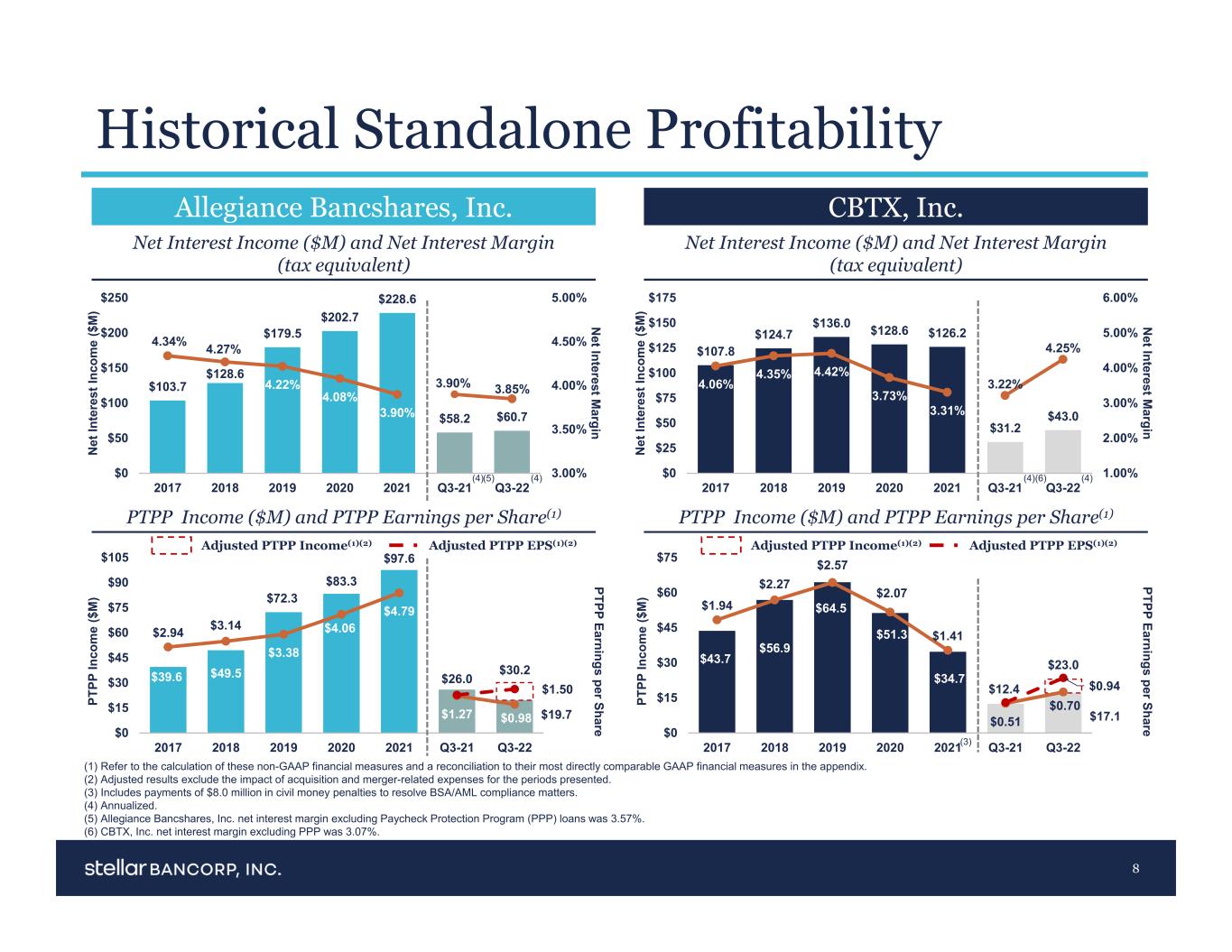

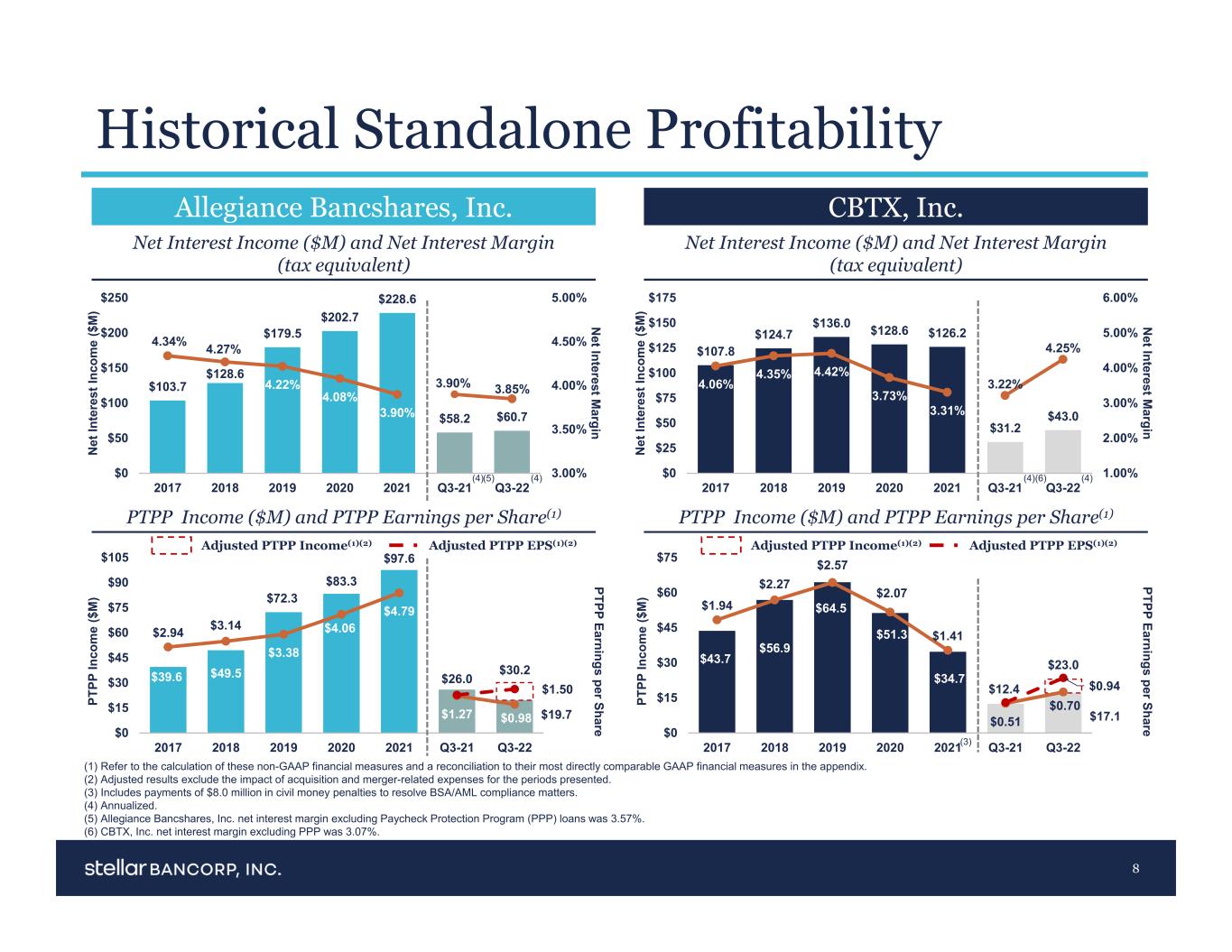

$39.6 $49.5 $72.3 $83.3 $97.6 $26.0 $19.7 $30.2 $2.94 $3.14 $3.38 $4.06 $4.79 $1.27 $0.98 $1.50 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $0 $15 $30 $45 $60 $75 $90 $105 2017 2018 2019 2020 2021 Q3-21 Q3-22 PTPP Earnings per Share PT PP In co m e ($ M ) $43.7 $56.9 $64.5 $51.3 $34.7 $12.4 $17.1 $23.0 $1.94 $2.27 $2.57 $2.07 $1.41 $0.51 $0.70 $0.94 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $0 $15 $30 $45 $60 $75 2017 2018 2019 2020 2021 Q3-21 Q3-22 PTPP Earnings per Share PT PP In co m e ($ M ) $107.8 $124.7 $136.0 $128.6 $126.2 $31.2 $43.0 4.06% 4.35% 4.42% 3.73% 3.31% 3.22% 4.25% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $0 $25 $50 $75 $100 $125 $150 $175 2017 2018 2019 2020 2021 Q3-21 Q3-22 N et Interest M argin N et In te re st In co m e ($ M ) $103.7 $128.6 $179.5 $202.7 $228.6 $58.2 $60.7 4.34% 4.27% 4.22% 4.08% 3.90% 3.90% 3.85% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $50 $100 $150 $200 $250 2017 2018 2019 2020 2021 Q3-21 Q3-22 N et Interest M argin N et In te re st In co m e ($ M ) Historical Standalone Profitability 8 Allegiance Bancshares, Inc. CBTX, Inc. Net Interest Income ($M) and Net Interest Margin (tax equivalent) Net Interest Income ($M) and Net Interest Margin (tax equivalent) PTPP Income ($M) and PTPP Earnings per Share(1) PTPP Income ($M) and PTPP Earnings per Share(1) (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. (2) Adjusted results exclude the impact of acquisition and merger-related expenses for the periods presented. (3) Includes payments of $8.0 million in civil money penalties to resolve BSA/AML compliance matters. (4) Annualized. (5) Allegiance Bancshares, Inc. net interest margin excluding Paycheck Protection Program (PPP) loans was 3.57%. (6) CBTX, Inc. net interest margin excluding PPP was 3.07%. Adjusted PTPP Income(1)(2) Adjusted PTPP EPS(1)(2) Adjusted PTPP Income(1)(2) Adjusted PTPP EPS(1)(2) (5)(4) (4)(4) (6) (4) (3)

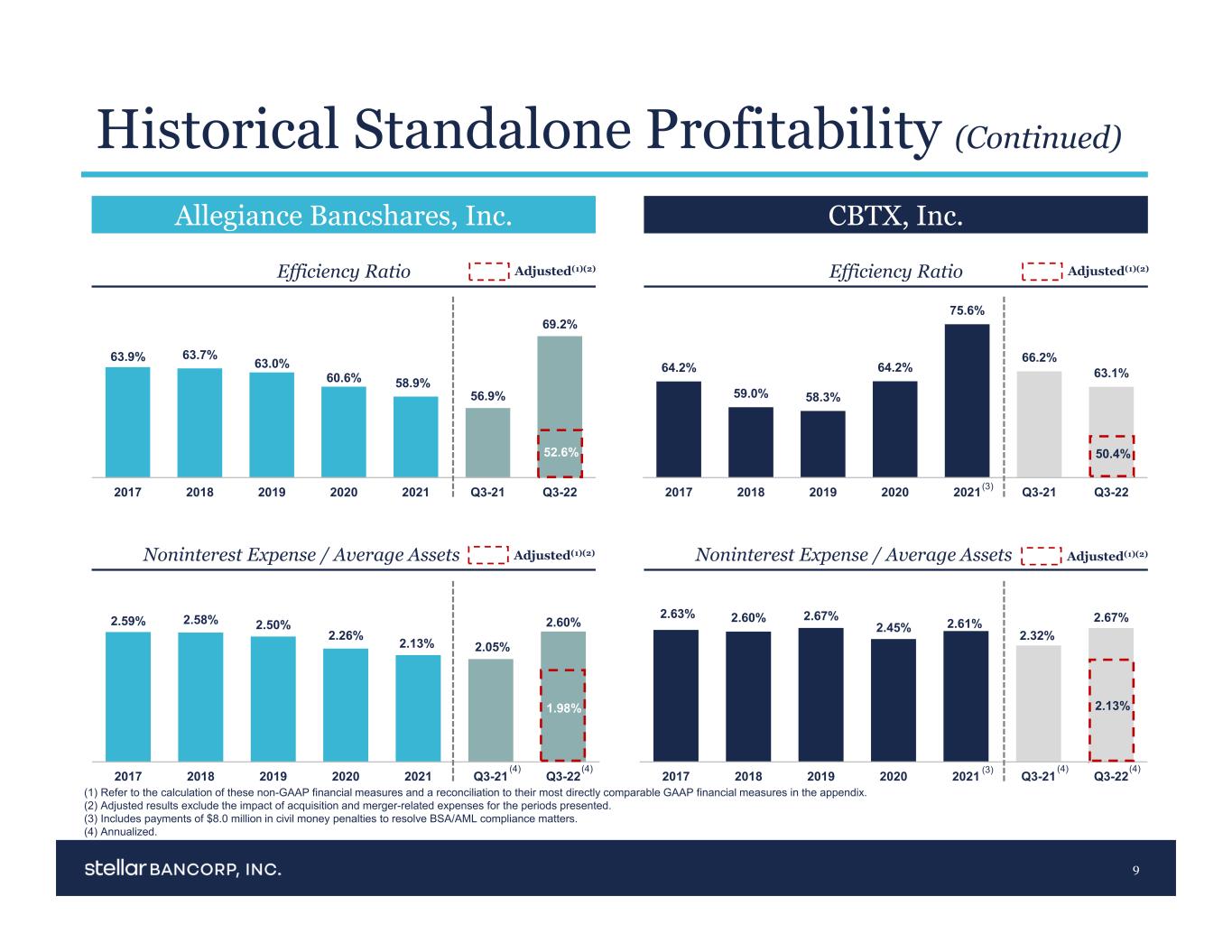

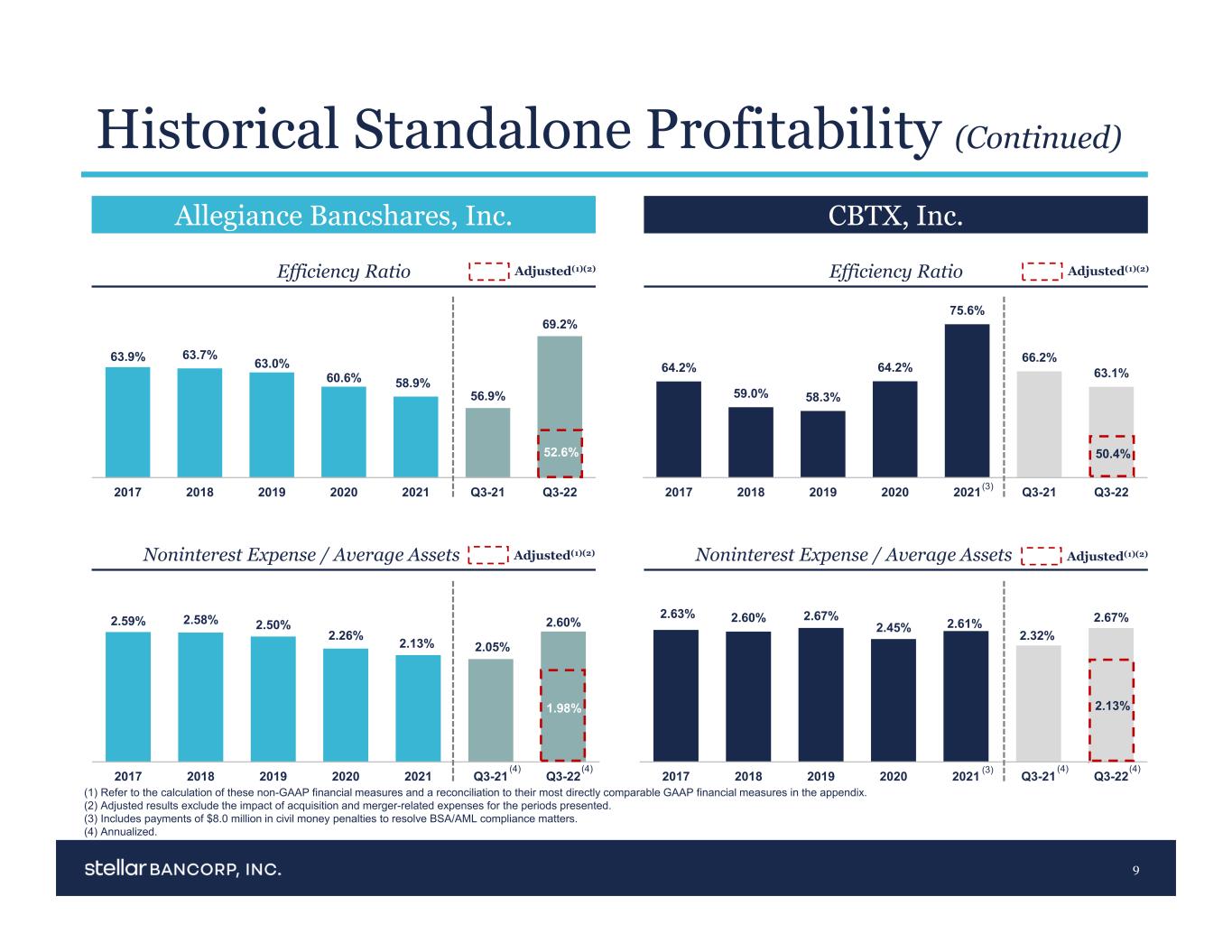

2.63% 2.60% 2.67% 2.45% 2.61% 2.32% 2.67% 2017 2018 2019 2020 2021 Q3-21 Q3-22 2.59% 2.58% 2.50% 2.26% 2.13% 2.05% 2.60% 2017 2018 2019 2020 2021 Q3-21 Q3-22 63.9% 63.7% 63.0% 60.6% 58.9% 56.9% 69.2% 2017 2018 2019 2020 2021 Q3-21 Q3-22 64.2% 59.0% 58.3% 64.2% 75.6% 66.2% 63.1% 2017 2018 2019 2020 2021 Q3-21 Q3-22 Historical Standalone Profitability (Continued) 9 Efficiency Ratio Efficiency Ratio Noninterest Expense / Average Assets Noninterest Expense / Average Assets 52.6% 50.4% Allegiance Bancshares, Inc. CBTX, Inc. (3) (3) Adjusted(1)(2)Adjusted(1)(2) 1.98% 2.13% Adjusted(1)(2)Adjusted(1)(2) (4) (4) (4) (4) (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. (2) Adjusted results exclude the impact of acquisition and merger-related expenses for the periods presented. (3) Includes payments of $8.0 million in civil money penalties to resolve BSA/AML compliance matters. (4) Annualized.

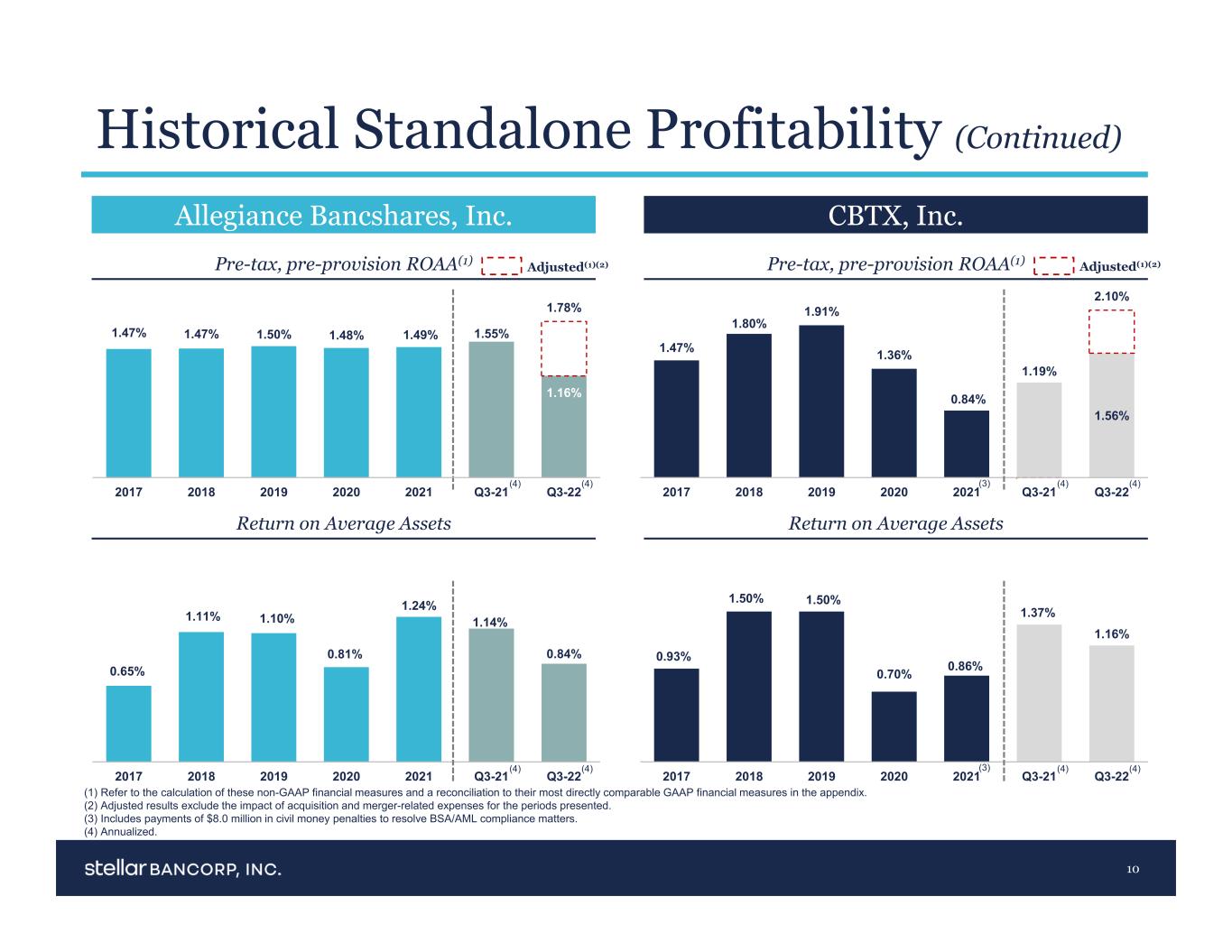

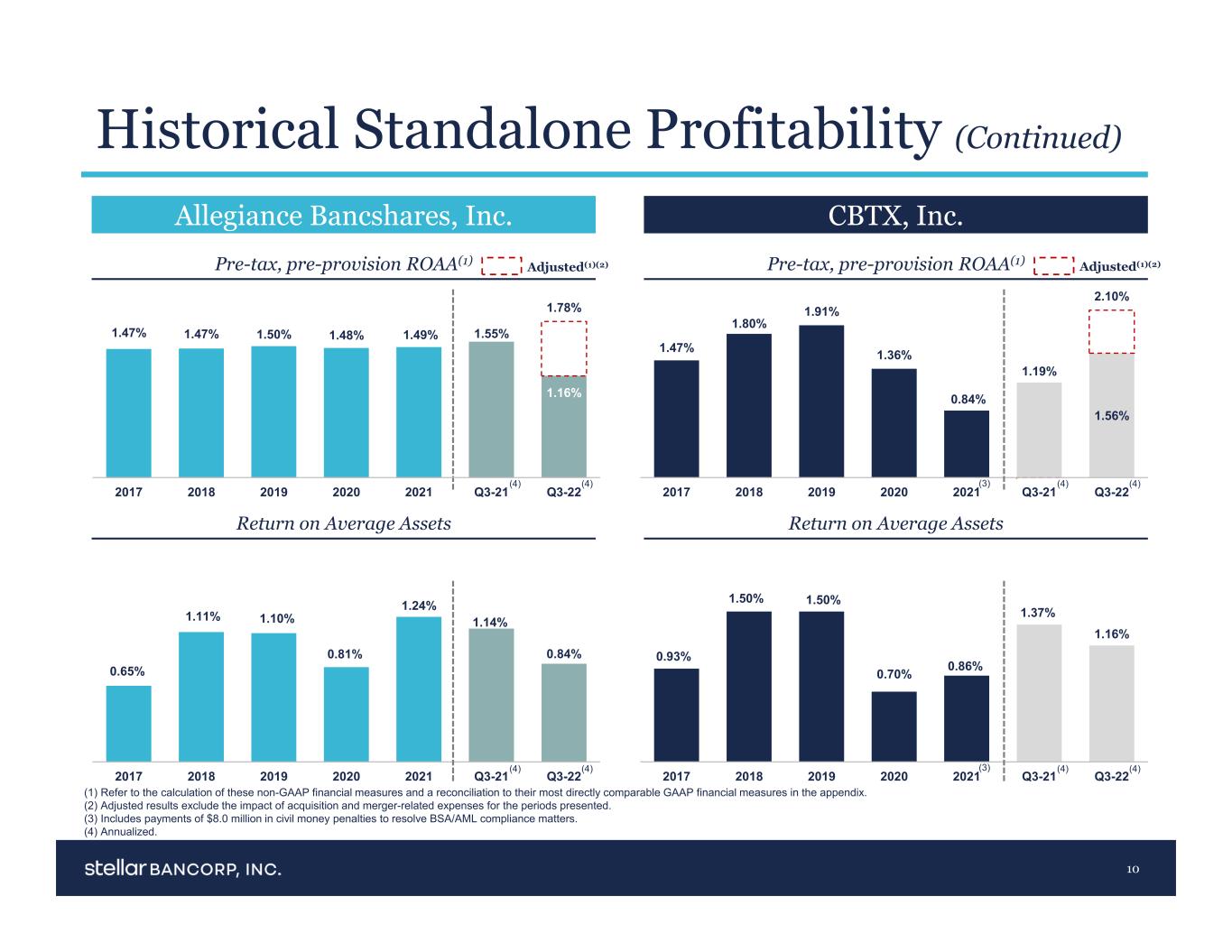

1.47% 1.80% 1.91% 1.36% 0.84% 1.19% 1.56% 2.10% 2017 2018 2019 2020 2021 Q3-21 Q3-22 0.93% 1.50% 1.50% 0.70% 0.86% 1.37% 1.16% 2017 2018 2019 2020 2021 Q3-21 Q3-22 0.65% 1.11% 1.10% 0.81% 1.24% 1.14% 0.84% 2017 2018 2019 2020 2021 Q3-21 Q3-22 Historical Standalone Profitability (Continued) 10 (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. (2) Adjusted results exclude the impact of acquisition and merger-related expenses for the periods presented. (3) Includes payments of $8.0 million in civil money penalties to resolve BSA/AML compliance matters. (4) Annualized. Allegiance Bancshares, Inc. CBTX, Inc. Return on Average Assets Return on Average Assets Pre-tax, pre-provision ROAA(1) Pre-tax, pre-provision ROAA(1) (3) (3) Adjusted(1)(2)Adjusted(1)(2) 1.47% 1.47% 1.50% 1.48% 1.49% 1.55% 1.16% 1.78% 2017 2018 2019 2020 2021 Q3-21 Q3-22 (4) (4) (4) (4) (4) (4) (4) (4)

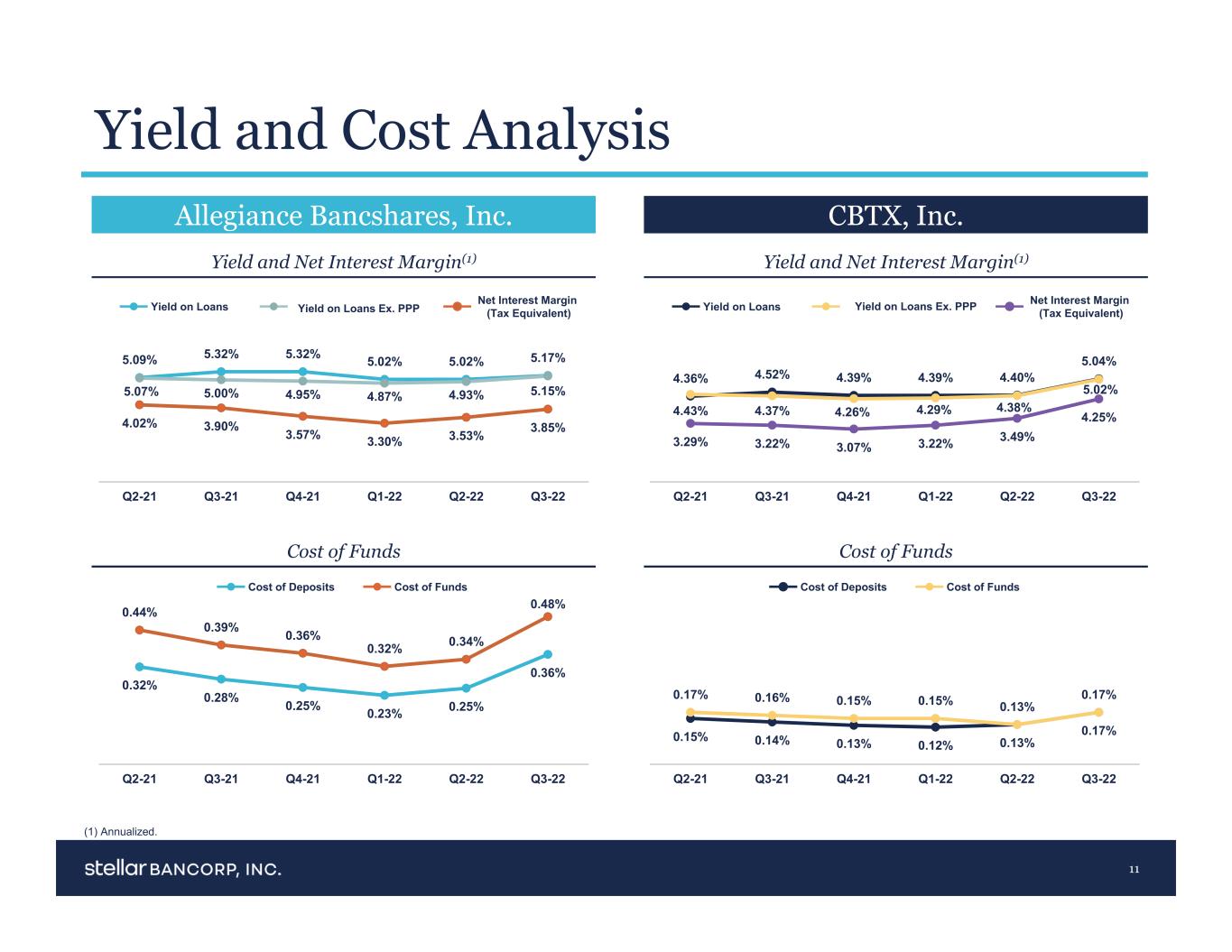

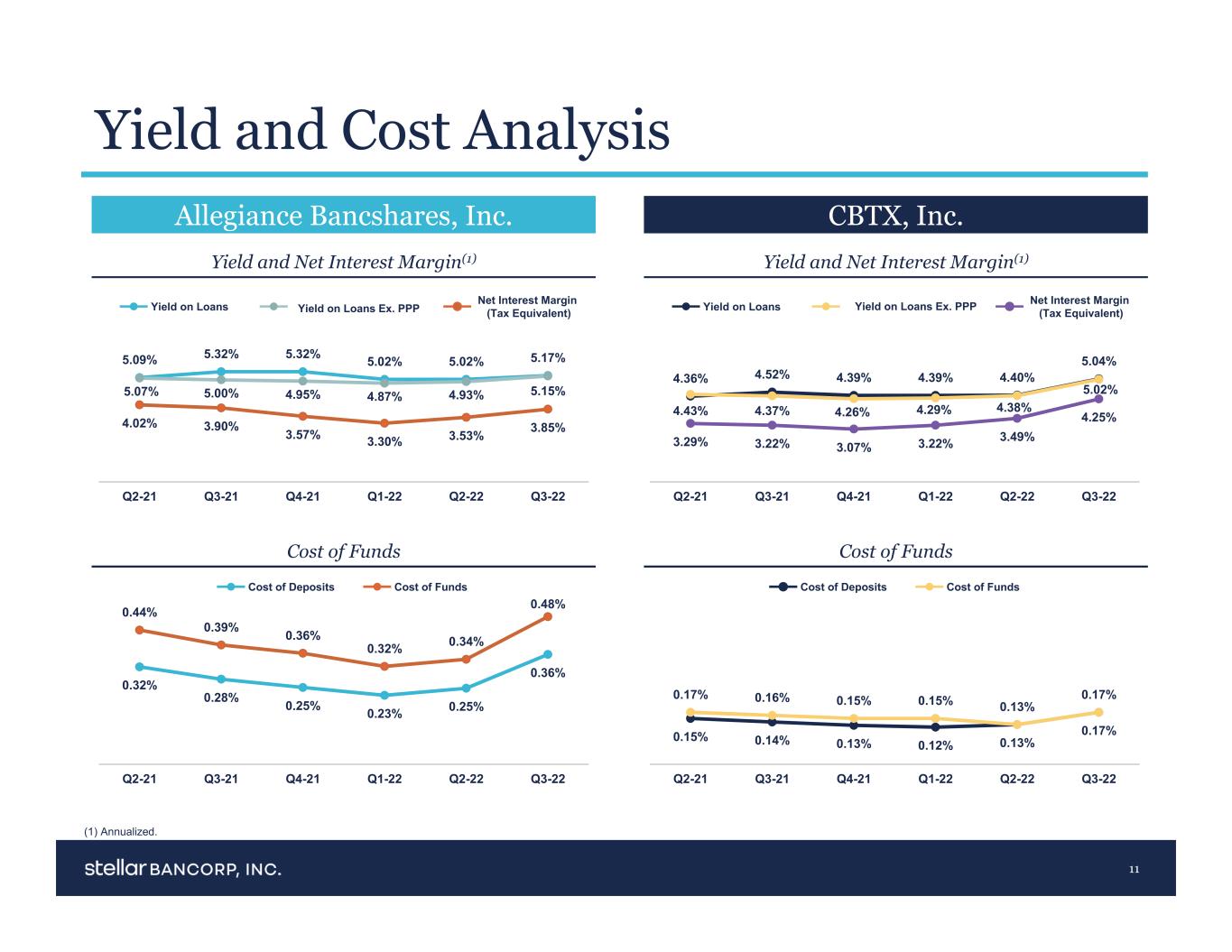

5.09% 5.32% 5.32% 5.02% 5.02% 5.17% 5.07% 5.00% 4.95% 4.87% 4.93% 5.15% 4.02% 3.90% 3.57% 3.30% 3.53% 3.85% Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 Q3-22 4.36% 4.52% 4.39% 4.39% 4.40% 5.04% 4.43% 4.37% 4.26% 4.29% 4.38% 5.02% 3.29% 3.22% 3.07% 3.22% 3.49% 4.25% Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 Q3-22 0.32% 0.28% 0.25% 0.23% 0.25% 0.36% 0.44% 0.39% 0.36% 0.32% 0.34% 0.48% Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 Q3-22 0.15% 0.14% 0.13% 0.12% 0.13% 0.17% 0.17% 0.16% 0.15% 0.15% 0.13% 0.17% Q2-21 Q3-21 Q4-21 Q1-22 Q2-22 Q3-22 Yield and Cost Analysis 11 Allegiance Bancshares, Inc. CBTX, Inc. Yield and Net Interest Margin(1) Yield and Net Interest Margin(1) Cost of Funds Cost of Funds Yield on Loans Net Interest Margin (Tax Equivalent) Yield on Loans Net Interest Margin (Tax Equivalent) Cost of Deposits Cost of Funds Cost of Deposits Cost of Funds Yield on Loans Ex. PPP Yield on Loans Ex. PPP (1) Annualized.

0.59% 0.89% 0.72% 0.64% 0.57% 0.47% 2017 2018 2019 2020 2021 Q3-22 0.33% 0.14% 0.04% 0.82% 0.79% 0.72% 2017 2018 2019 2020 2021 Q3-22 0.36% 0.06% 0.07% 0.18% 0.05% (0.02%) 2017 2018 2019 2020 2021 Q3-22 0.00% (0.03%) 0.03% 0.13% (0.02%) 0.00% 2017 2018 2019 2020 2021 Q3-22 Strong Asset Quality 12 Net Charge Offs (Recoveries) / Average Loans (1) Excludes loans held for sale. (2) Annualized. Allegiance Bancshares, Inc. CBTX, Inc. Nonperforming Loans / Loans Nonperforming Loans / Loans(1) Net Charge Offs (Recoveries) / Average Loans (2) (2)

324.1% 678.9% 2,587.5% 169.2% 138.9% 145.4% 2017 2018 2019 2020 2021 Q3-22 1.04% 0.71% 0.75% 1.18% 1.14% 1.14% 2017 2018 2019 2020 2021 Q3-22 1.07% 0.97% 0.96% 1.39% 1.09% 1.04% 2017 2018 2019 2020 2021 Q3-22 177.4% 79.9% 103.8% 184.0% 198.7% 242.0% 2017 2018 2019 2020 2021 Q3-22 Strong Asset Quality (Continued) 13 Allowance / Nonperforming Loans (1) Excludes loans held for sale. (2) Not to scale. Allegiance Bancshares, Inc. CBTX, Inc. Allowance / Loans Allowance / Loans(1) Allowance / Nonperforming Loans(1) (2)

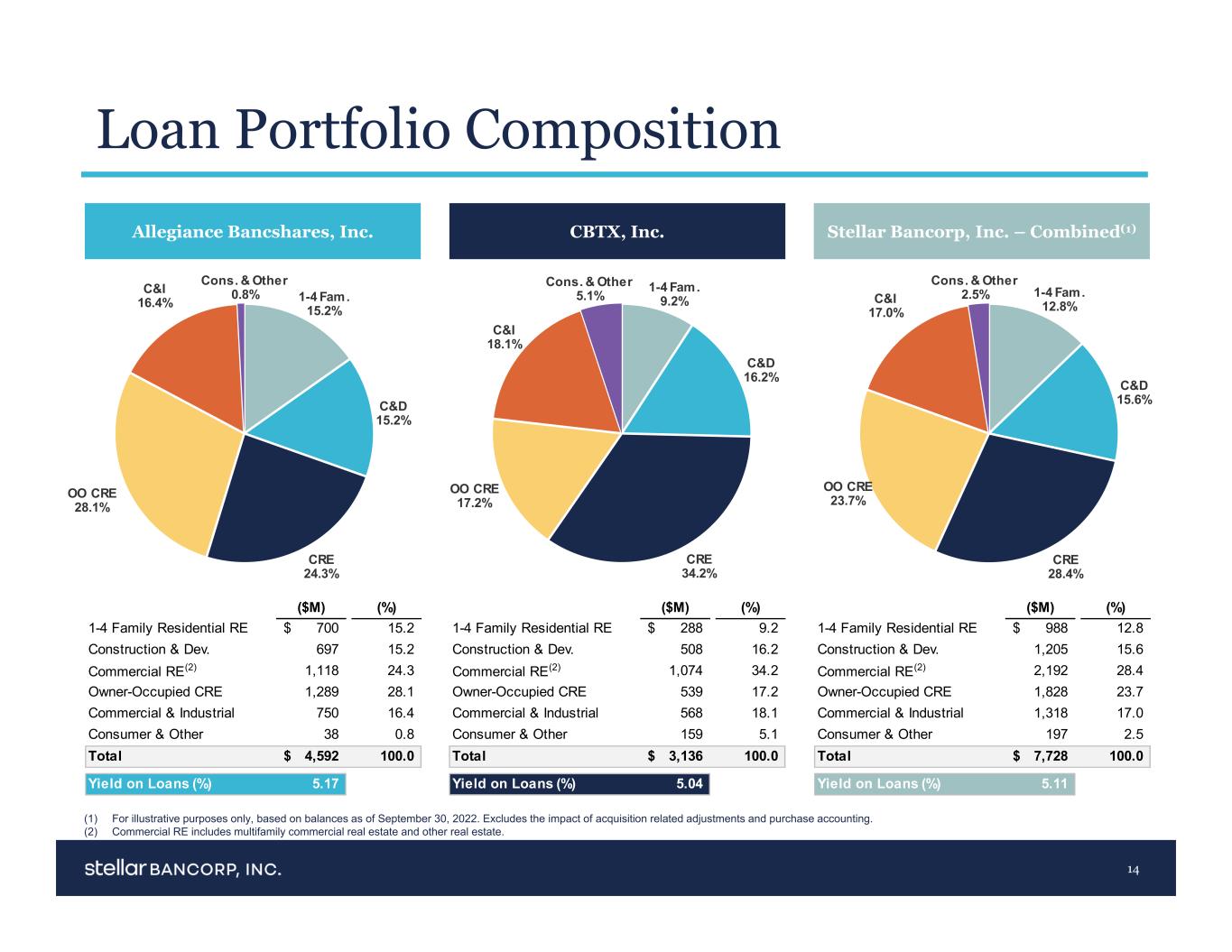

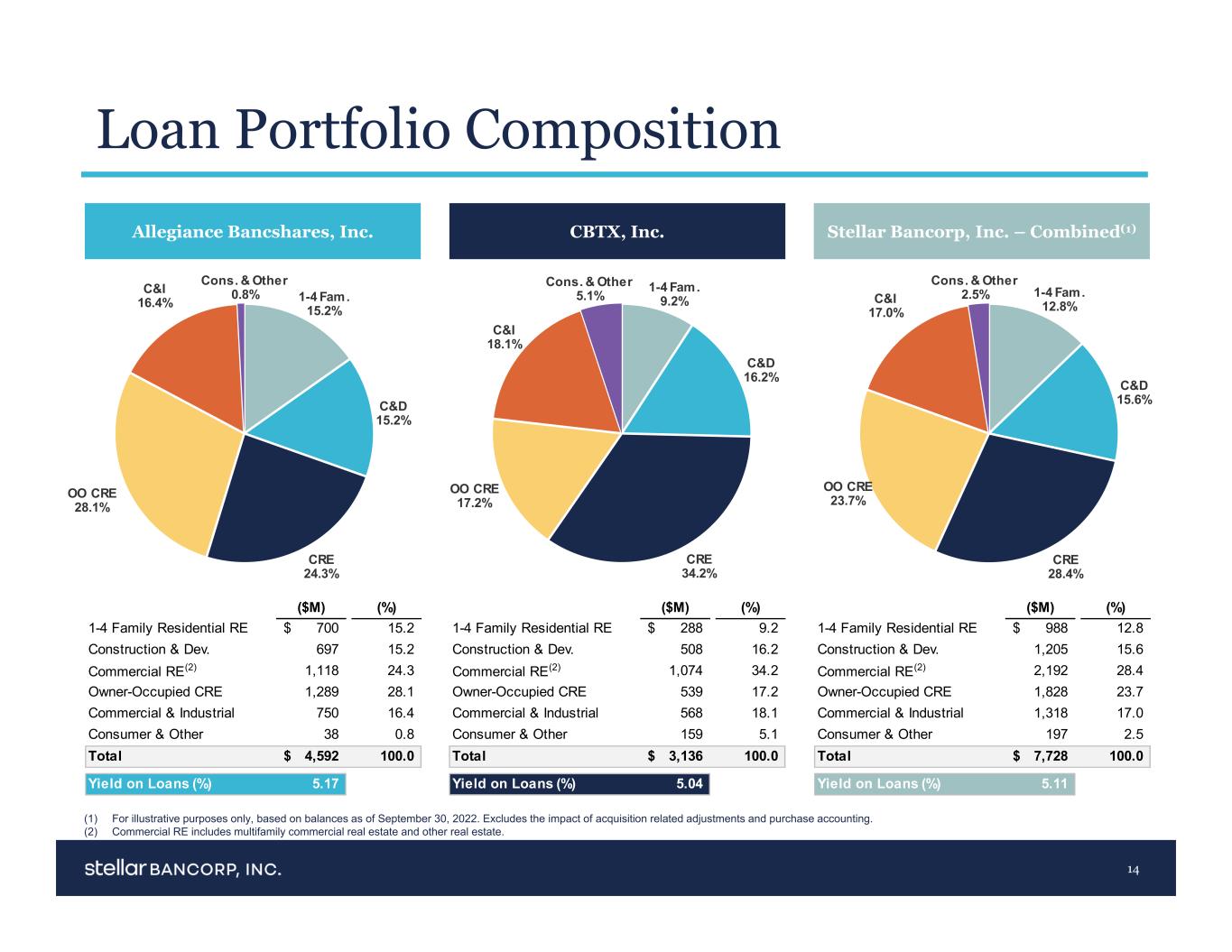

Loan Portfolio Composition 14 (1) For illustrative purposes only, based on balances as of September 30, 2022. Excludes the impact of acquisition related adjustments and purchase accounting. (2) Commercial RE includes multifamily commercial real estate and other real estate. Allegiance Bancshares, Inc. CBTX, Inc. Stellar Bancorp, Inc. – Combined(1) ($M) (%) 1-4 Family Residential RE 700$ 15.2 Construction & Dev. 697 15.2 Commercial RE(2) 1,118 24.3 Owner-Occupied CRE 1,289 28.1 Commercial & Industrial 750 16.4 Consumer & Other 38 0.8 Total 4,592$ 100.0 Yield on Loans (%) 5.17 ($M) (%) 1-4 Family Residential RE 288$ 9.2 Construction & Dev. 508 16.2 Commercial RE(2) 1,074 34.2 Owner-Occupied CRE 539 17.2 Commercial & Industrial 568 18.1 Consumer & Other 159 5.1 Total 3,136$ 100.0 Yield on Loans (%) 5.04 ($M) (%) 1-4 Family Residential RE 988$ 12.8 Construction & Dev. 1,205 15.6 Commercial RE(2) 2,192 28.4 Owner-Occupied CRE 1,828 23.7 Commercial & Industrial 1,318 17.0 Consumer & Other 197 2.5 Total 7,728$ 100.0 Yield on Loans (%) 5.11 1-4 Fam. 15.2% C&D 15.2% CRE 24.3% OO CRE 28.1% C&I 16.4% Cons. & Other 0.8% 1-4 Fam. 9.2% C&D 16.2% CRE 34.2% OO CRE 17.2% C&I 18.1% Cons. & Other 5.1% 1-4 Fam. 12.8% C&D 15.6% CRE 28.4% OO CRE 23.7% C&I 17.0% Cons. & Other 2.5%

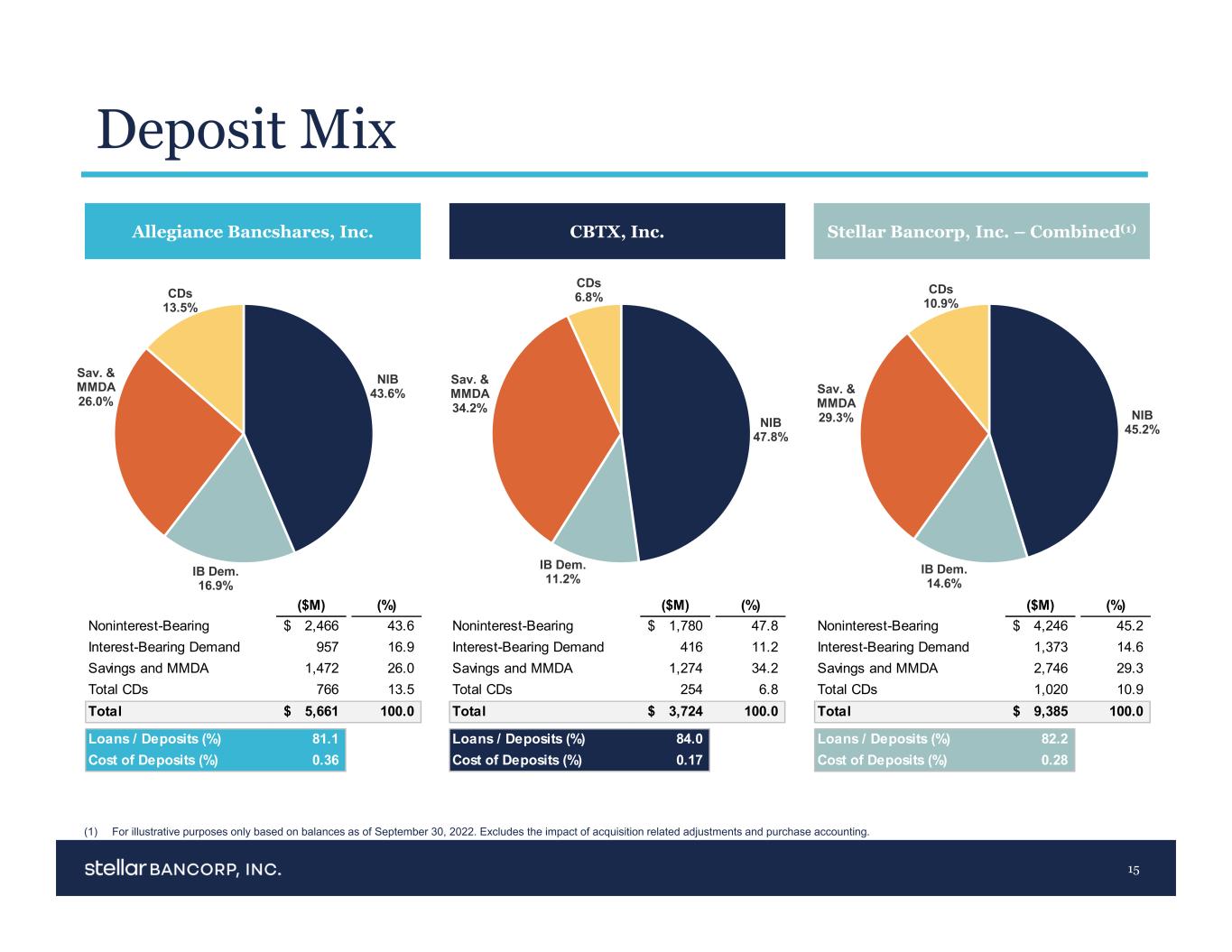

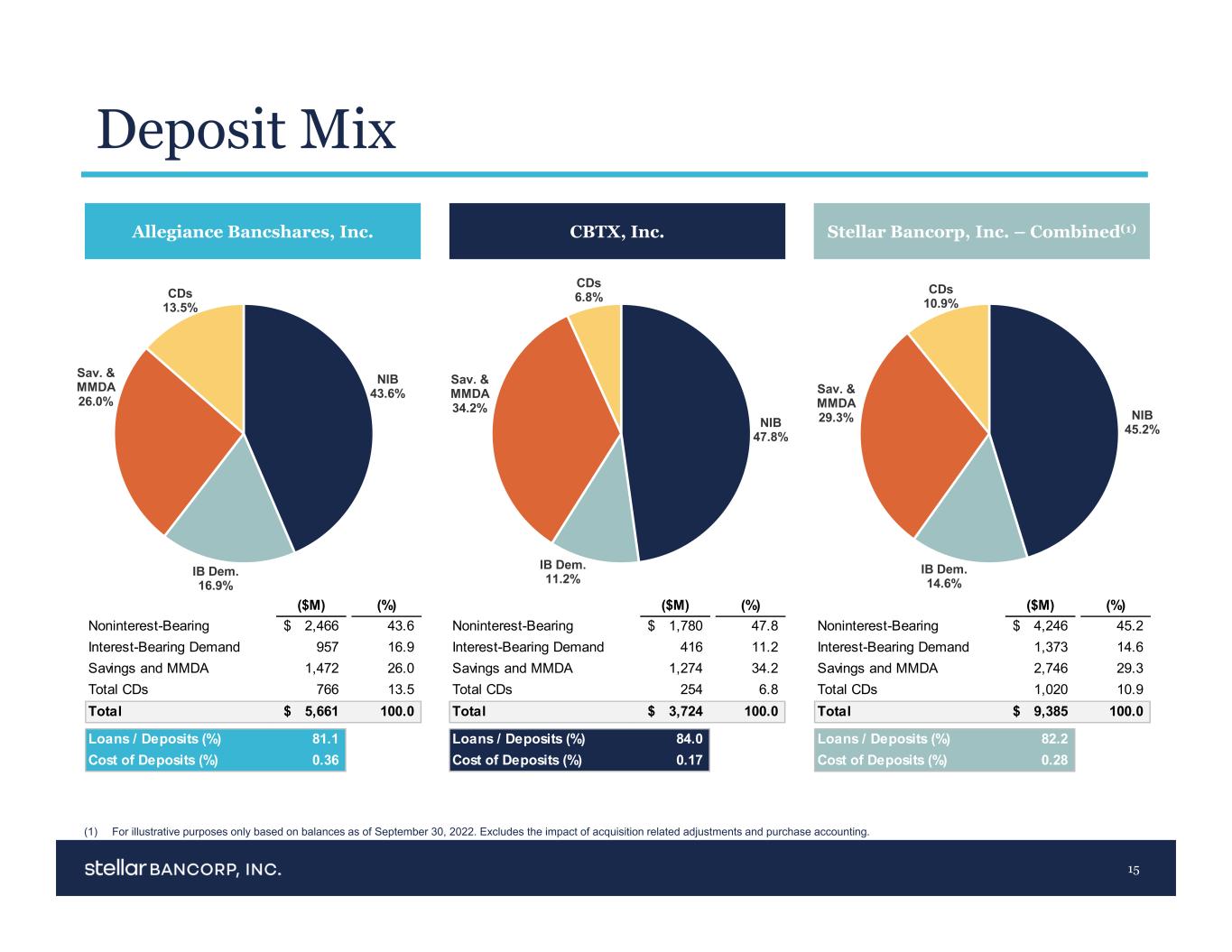

Deposit Mix 15 Allegiance Bancshares, Inc. CBTX, Inc. Stellar Bancorp, Inc. – Combined(1) NIB 43.6% IB Dem. 16.9% Sav. & MMDA 26.0% CDs 13.5% NIB 47.8% IB Dem. 11.2% Sav. & MMDA 34.2% CDs 6.8% NIB 45.2% IB Dem. 14.6% Sav. & MMDA 29.3% CDs 10.9% ($M) (%) Noninterest-Bearing 2,466$ 43.6 Interest-Bearing Demand 957 16.9 Savings and MMDA 1,472 26.0 Total CDs 766 13.5 Total 5,661$ 100.0 Loans / Deposits (%) 81.1 Cost of Deposits (%) 0.36 ($M) (%) Noninterest-Bearing 1,780$ 47.8 Interest-Bearing Demand 416 11.2 Savings and MMDA 1,274 34.2 Total CDs 254 6.8 Total 3,724$ 100.0 Loans / Deposits (%) 84.0 Cost of Deposits (%) 0.17 ($M) (%) Noninterest-Bearing 4,246$ 45.2 Interest-Bearing Demand 1,373 14.6 Savings and MMDA 2,746 29.3 Total CDs 1,020 10.9 Total 9,385$ 100.0 Loans / Deposits (%) 82.2 Cost of Deposits (%) 0.28 (1) For illustrative purposes only based on balances as of September 30, 2022. Excludes the impact of acquisition related adjustments and purchase accounting.

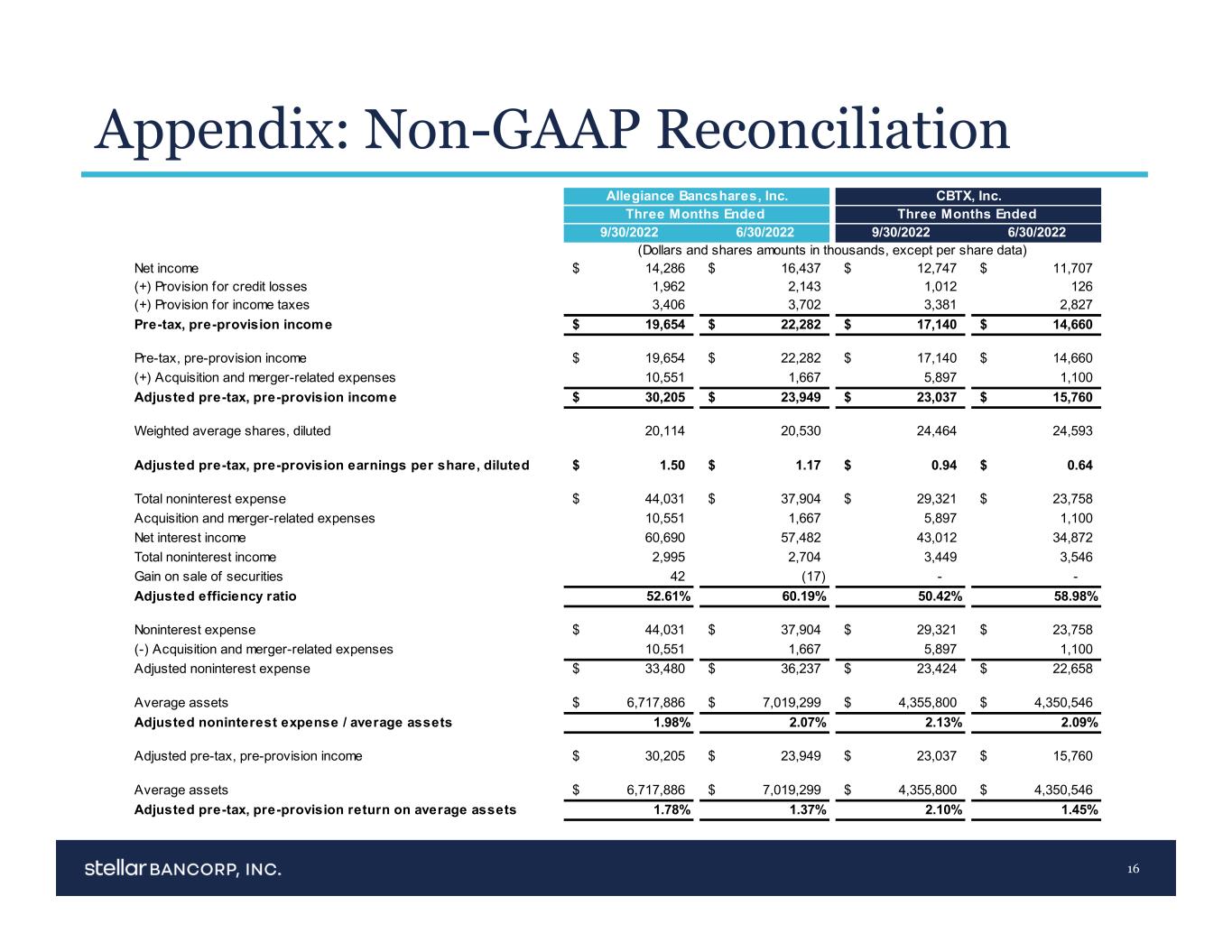

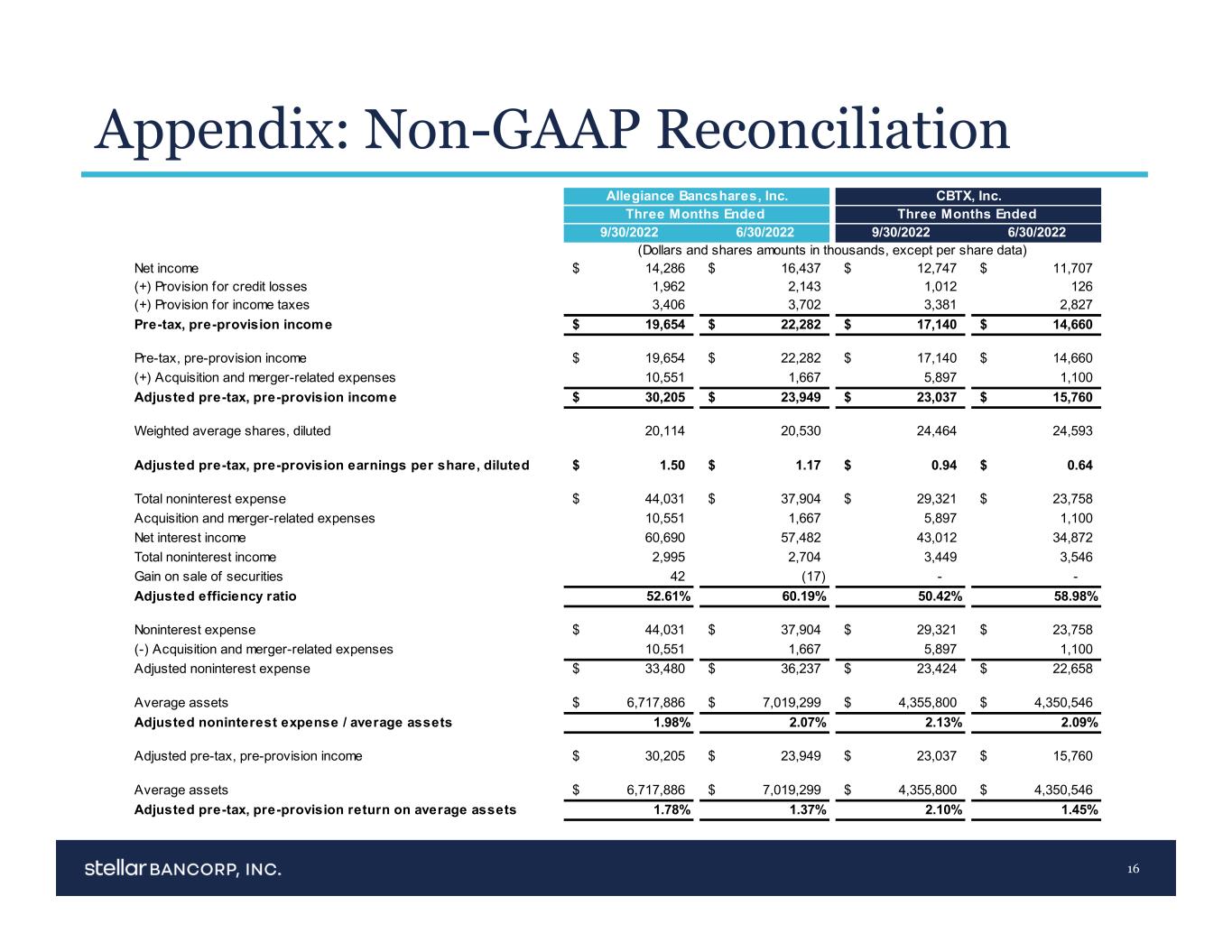

Appendix: Non-GAAP Reconciliation 16 Allegiance Bancshares, Inc. CBTX, Inc. Three Months Ended Three Months Ended 9/30/2022 6/30/2022 9/30/2022 6/30/2022 Net income 14,286$ 16,437$ 12,747$ 11,707$ (+) Provision for credit losses 1,962 2,143 1,012 126 (+) Provision for income taxes 3,406 3,702 3,381 2,827 Pre-tax, pre-provision income 19,654$ 22,282$ 17,140$ 14,660$ Pre-tax, pre-provision income 19,654$ 22,282$ 17,140$ 14,660$ (+) Acquisition and merger-related expenses 10,551 1,667 5,897 1,100 Adjusted pre-tax, pre-provision income 30,205$ 23,949$ 23,037$ 15,760$ Weighted average shares, diluted 20,114 20,530 24,464 24,593 Adjusted pre-tax, pre-provision earnings per share, diluted 1.50$ 1.17$ 0.94$ 0.64$ Total noninterest expense 44,031$ 37,904$ 29,321$ 23,758$ Acquisition and merger-related expenses 10,551 1,667 5,897 1,100 Net interest income 60,690 57,482 43,012 34,872 Total noninterest income 2,995 2,704 3,449 3,546 Gain on sale of securities 42 (17) - - Adjusted efficiency ratio 52.61% 60.19% 50.42% 58.98% Noninterest expense 44,031$ 37,904$ 29,321$ 23,758$ (-) Acquisition and merger-related expenses 10,551 1,667 5,897 1,100 Adjusted noninterest expense 33,480$ 36,237$ 23,424$ 22,658$ Average assets 6,717,886$ 7,019,299$ 4,355,800$ 4,350,546$ Adjusted noninterest expense / average assets 1.98% 2.07% 2.13% 2.09% Adjusted pre-tax, pre-provision income 30,205$ 23,949$ 23,037$ 15,760$ Average assets 6,717,886$ 7,019,299$ 4,355,800$ 4,350,546$ Adjusted pre-tax, pre-provision return on average assets 1.78% 1.37% 2.10% 1.45% (Dollars and shares amounts in thousands, except per share data)

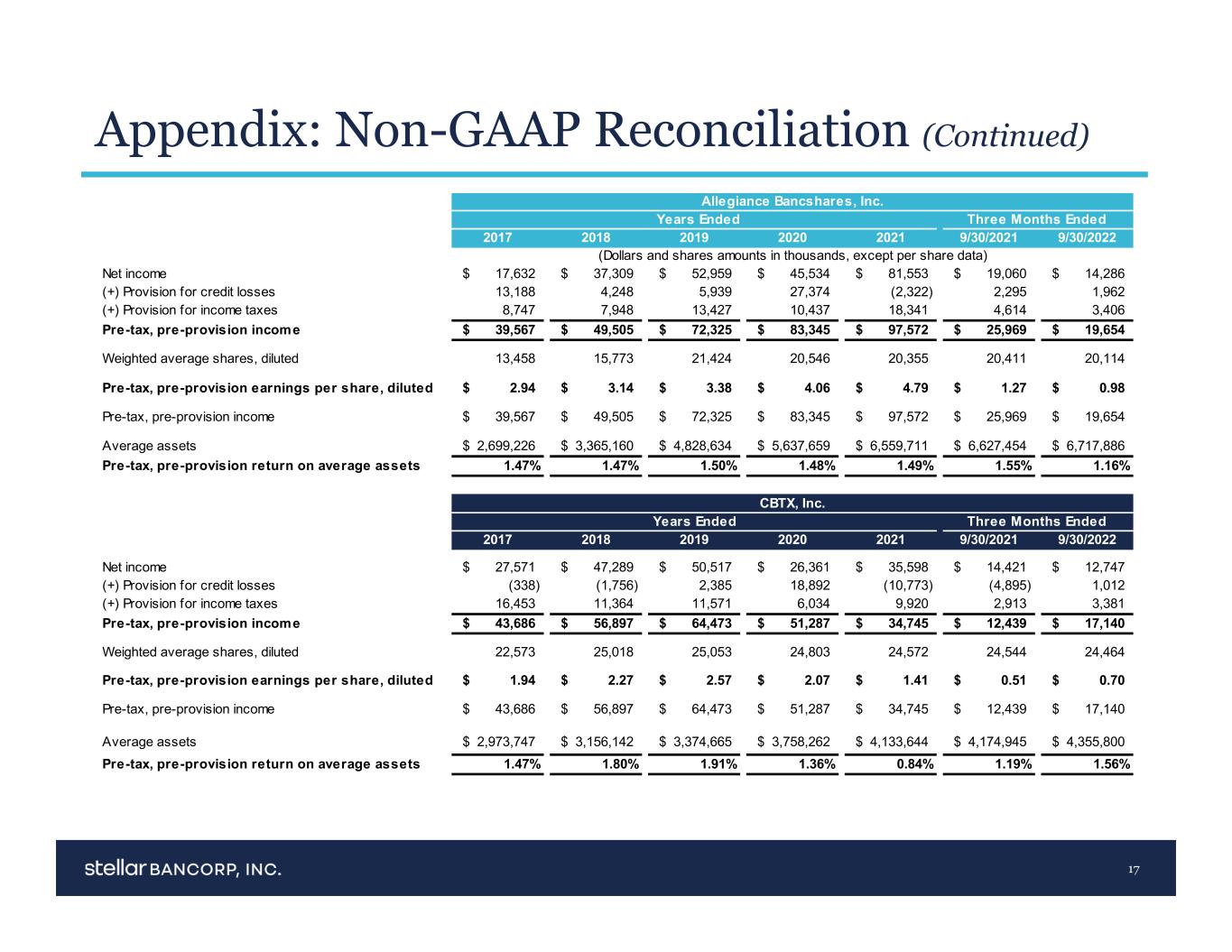

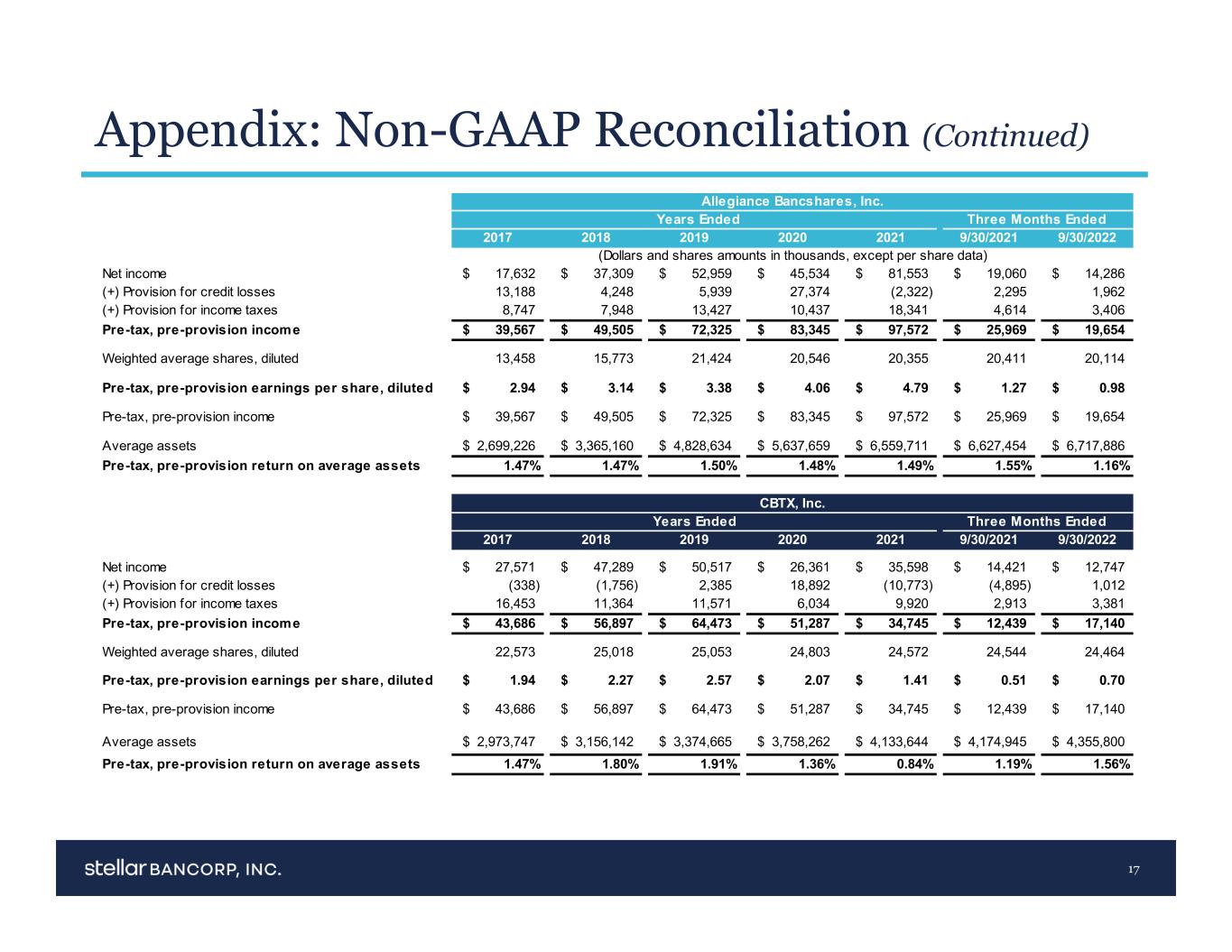

Appendix: Non-GAAP Reconciliation (Continued) 17 Allegiance Bancshares, Inc. Years Ended Three Months Ended 2017 2018 2019 2020 2021 9/30/2021 9/30/2022 Net income 17,632$ 37,309$ 52,959$ 45,534$ 81,553$ 19,060$ 14,286$ (+) Provision for credit losses 13,188 4,248 5,939 27,374 (2,322) 2,295 1,962 (+) Provision for income taxes 8,747 7,948 13,427 10,437 18,341 4,614 3,406 Pre-tax, pre-provision income 39,567$ 49,505$ 72,325$ 83,345$ 97,572$ 25,969$ 19,654$ Weighted average shares, diluted 13,458 15,773 21,424 20,546 20,355 20,411 20,114 Pre-tax, pre-provision earnings per share, diluted 2.94$ 3.14$ 3.38$ 4.06$ 4.79$ 1.27$ 0.98$ Pre-tax, pre-provision income 39,567$ 49,505$ 72,325$ 83,345$ 97,572$ 25,969$ 19,654$ Average assets 2,699,226$ 3,365,160$ 4,828,634$ 5,637,659$ 6,559,711$ 6,627,454$ 6,717,886$ Pre-tax, pre-provision return on average assets 1.47% 1.47% 1.50% 1.48% 1.49% 1.55% 1.16% Three Months Ended 2017 2018 2019 2020 2021 9/30/2021 9/30/2022 Net income 27,571$ 47,289$ 50,517$ 26,361$ 35,598$ 14,421$ 12,747$ (+) Provision for credit losses (338) (1,756) 2,385 18,892 (10,773) (4,895) 1,012 (+) Provision for income taxes 16,453 11,364 11,571 6,034 9,920 2,913 3,381 Pre-tax, pre-provision income 43,686$ 56,897$ 64,473$ 51,287$ 34,745$ 12,439$ 17,140$ Weighted average shares, diluted 22,573 25,018 25,053 24,803 24,572 24,544 24,464 Pre-tax, pre-provision earnings per share, diluted 1.94$ 2.27$ 2.57$ 2.07$ 1.41$ 0.51$ 0.70$ Pre-tax, pre-provision income 43,686$ 56,897$ 64,473$ 51,287$ 34,745$ 12,439$ 17,140$ Average assets 2,973,747$ 3,156,142$ 3,374,665$ 3,758,262$ 4,133,644$ 4,174,945$ 4,355,800$ Pre-tax, pre-provision return on average assets 1.47% 1.80% 1.91% 1.36% 0.84% 1.19% 1.56% Years Ended CBTX, Inc. (Dollars and shares amounts in thousands, except per share data)

NASDAQ: STEL 18