Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Nos. 333-162370 and 333-162370-01

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Preliminary Term Sheet

CenterPoint Energy Restoration Bond Company, LLC

Issuing Entity

$664,859,000*

Senior Secured System Restoration Bonds

Transaction Summary

We, CenterPoint Energy Restoration Bond Company, LLC are issuing up to $664,859,000* of Senior Secured System Restoration Bonds in multiple tranches (the “Bonds”). The Bonds are our senior secured obligations and will be supported by system restoration property which includes the right to a special, irrevocable nonbypassable charge (“system restoration charge”) imposed on retail electric customers served at distribution voltage in the service territory of CenterPoint Energy Houston Electric, LLC (“CenterPoint Houston”), as discussed below. System restoration property is known as “transition property” in the Public Utility Regulatory Act. The securitization provisions of the Public Utility Regulatory Act, as amended by the addition of Chapter 36, Subchapter I in April 2009 (the “System Restoration Amendments”) mandate, and the Public Utility Commission of Texas (the “PUCT”) requires, that system restoration charges be adjusted at least annually, and semi-annually as necessary, to ensure the expected recovery of amounts sufficient to timely provide all scheduled payments of principal, interest and other required amounts and charges in connection with the Bonds (the “true-up mechanism”).

The Public Utility Regulatory Act authorizes the PUCT to issue irrevocable financing orders supporting the issuance of system restoration bonds. The PUCT issued an irrevocable financing order to CenterPoint Houston on August 26, 2009 (the “Financing Order”). Pursuant to the Financing Order, CenterPoint Houston established us as a bankruptcy remote special purpose subsidiary company to issue the Bonds.

In the Financing Order, the PUCT authorized a system restoration charge to be imposed on retail electric customers who purchase electricity at distribution voltage in CenterPoint Houston’s service territory (over 2 million customers as of September 30, 2009) to pay principal and interest on the Bonds and other expenses relating to the Bonds. CenterPoint Houston as servicer will collect system restoration charges on our behalf and remit the system restoration charges daily to the trustee.

In the Financing Order, the PUCT guarantees that it will act pursuant to the Financing Order as expressly authorized by the Public Utility Regulatory Act to ensure that expected system restoration charge revenues are sufficient to pay, on a timely basis, the scheduled principal and interest on the Bonds. The PUCT’s obligations set forth in the Financing Order are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the PUCT.

The Bonds will not be a liability of CenterPoint Houston, CenterPoint Energy, Inc. or any of their affiliates (other than us). The Bonds will not be a debt or obligation of the State of Texas, the PUCT or any other governmental agency or instrumentality, and are not a charge on the full faith and credit or taxing power of the State of Texas or any other governmental agency or instrumentality.

This Preliminary Term Sheet has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any Bonds in any jurisdiction where such offer or sale is prohibited. Please read the important information and qualifications beginning on page 14 of this Preliminary Term Sheet.

Goldman, Sachs & Co. | Citi | |||

Bookrunning Senior Manager | Bookrunner | |||

| Morgan Stanley | RBS | |||

| Co-Manager | Co-Manager |

Loop Capital Markets, LLC

Co-Manager

* Preliminary; subject to change

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

$664,859,000*

CenterPoint Energy Restoration Bond Company, LLC

Senior Secured System Restoration Bonds

Summary of Terms

Anticipated Bond Offering*

Tranche1 | Expected Weighted Average Life (Years) | Size | Scheduled Final | Scheduled Principal Payments Begin | No. of Scheduled Semi-annual Principal Payments | |||||

A-1 | 3.00 | 222,897,000 | 2/15/2015 | 8/15/2010 | 10 | |||||

A-2 | 7.00 | 161,382,000 | 8/15/2018 | 2/15/2015 | 8 | |||||

A-3 | 10.82 | 280,580,000 | 8/15/2022 | 8/15/2018 | 9 | |||||

Issuing Entity and Capital Structure | CenterPoint Energy Restoration Bond Company, LLC. We are a special purpose bankruptcy-remote limited liability company wholly-owned by CenterPoint Houston. We were formed solely to purchase and own the system restoration property (defined in “Credit/Security”), to issue system restoration bonds and to perform activities incidental thereto. |

In addition to the system restoration property, our assets will include a capital investment by CenterPoint Houston in the amount of 0.5% of the Bonds’ initial principal amount. This capital contribution will be held in the capital subaccount. We will also have an excess funds subaccount to retain, until the next payment date, any amounts collected and remaining after all payments on the Bonds have been timely made.

Our relationship with the PUCT | Pursuant to the Financing Order, |

| • | the PUCT or its designated representative has a decision-making role co-equal with CenterPoint Houston with respect to the structuring, marketing and pricing of the Bonds and all matters related to the structuring, marketing and pricing of the Bonds will be determined through a joint decision of CenterPoint Houston and the PUCT or its designated representative, |

| • | CenterPoint Houston is directed to take all necessary steps to ensure that the PUCT or its designated representative is provided sufficient and timely information to allow the PUCT or its designated representative to fully participate in, and exercise its decision making power over, the proposed securitization, and |

| • | the servicer will file periodic adjustments to system restoration charges with the PUCT on our behalf. |

Securities Offered | Senior secured fixed-rate bonds, as listed above, scheduled to pay principal and interest semi-annually and sequentially in accordance with the expected sinking fund schedule. See “Expected Sinking Fund Schedule.” |

Required Ratings | Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively. |

1 Each tranche pays sequentially.

2 The final maturity date (i.e., the date by which the principal must be repaid to prevent a default) of each tranche of the Bonds is 1 year after the scheduled final payment date for such tranche.

| * | Preliminary; subject to change. |

Page 2 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Payment Dates and Interest Accrual | Interest payable semi-annually, February 15 and August 15. Interest will be calculated at a fixed rate on a 30/360 basis. The first scheduled interest and principal payment date is August 15, 2010. |

Interest is due on each payment date and principal is due upon the final maturity date, but is expected to be repaid on the scheduled final payment date for each tranche.

Optional Redemption | None. Non-call for the life of the Bonds. |

Average Life | Prepayment is not permitted. Extension risk is possible but is expected to be statistically remote. |

Credit Enhancement/Security | Pursuant to the Financing Order, the irrevocable right to impose, collect and receive nonbypassable electricity consumption-based system restoration charges (the “system restoration property”) payable by over 2 million individuals, corporations and other entities who purchase electricity at distribution voltage in CenterPoint Houston’s service territory. System restoration property is known as “transition property” in the Public Utility Regulatory Act. System restoration charges are set and adjusted to collect amounts expected to be sufficient to pay principal, interest and other required amounts and charges on a timely basis. See also “Issuing Entity and Capital Structure” and “Statutory True-up Mechanism for Payment of Scheduled Principal and Interest.” |

The system restoration property securing the Bonds is not a pool of receivables. It consists of all of CenterPoint Houston’s rights and interests under the Financing Order transferred to us in connection with the issuance of the Bonds, including the irrevocable right to impose, collect and receive nonbypassable system restoration charges and the right to implement the statutory true-up mechanism. System restoration property is a present property right created by the Public Utility Regulatory Act and the Financing Order and is protected by the State Pledge described below.

Nonbypassable System Restoration Charges | The Public Utility Regulatory Act and the PUCT require the imposition on, and collection of system restoration charges from, existing and future retail electric customers served at distribution voltage located within CenterPoint Houston’s service territory, regardless of the retail electric provider serving those customers, and even if those customers choose to operate new on-site generation of greater than ten megawatts or the utility goes out of business and its service area is acquired by another utility or is municipalized. The system restoration charges are applied to retail electric customers served at distribution voltage individually and are adjusted and reallocated among all customers served at distribution voltage as necessary under the statutory true-up mechanism. |

Page 3 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Statutory True-up Mechanism

for Payment of Scheduled

Principal and Interest | The Public Utility Regulatory Act mandates and the irrevocable Financing Order requires that system restoration charges on all retail electric customers served at distribution voltage will be reviewed and adjusted at least annually, and semi-annually as necessary, to ensure the expected recovery of amounts sufficient to timely provide payment of scheduled principal and interest on the Bonds. Pursuant to the Financing Order, adjustments other than the annual adjustment may be made generally not more than once in any six-month period or quarterly in the fourteenth and fifteenth years. In the Financing Order, the PUCT guarantees that it will act pursuant to the Financing Order as expressly authorized by the Public Utility Regulatory Act to ensure that expected system restoration charge revenues are sufficient to timely pay scheduled principal and interest on the Bonds. |

There is no “cap” on the level of system restoration charges that may be imposed on the retail consumers of electricity served at distribution voltage in CenterPoint Houston’s service territory to timely pay scheduled principal and interest on the Bonds.

The Financing Order provides that the statutory true-up mechanism and all other obligations of the State of Texas and the PUCT set forth in the Financing Order are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the State of Texas and the PUCT.

State Pledge | The State of Texas has pledged in the Public Utility Regulatory Act that it will not take or permit any action that would impair the value of the system restoration property, or reduce, alter or impair the system restoration charges until the Bonds are fully repaid or discharged, other than specified true-up adjustments to correct any overcollections or undercollections. |

Tax Treatment | The Bonds will be treated as debt for U.S. federal income and estate tax purposes. |

Type of Offering | SEC registered. |

ERISA Eligible | Yes, as described in the base prospectus. |

Minimum Denomination | $100,000, or integral multiples of $1,000 in excess thereof, except for one Bond of each tranche which may be of a smaller denomination. |

OTHER CONSIDERATIONS

Initial System Restoration

Charge as a Percent of

Customer’s Total Electricity Bill | The initial system restoration charge would represent approximately 1.4% of the total bill received by a 1,000 kWh residential customer of the largest retail electric provider in CenterPoint Houston’s service territory as of September 30, 2009. When combined with the transition charges related to the prior transition bonds (discussed below), the cumulative charges would represent approximately 5.4% of the total bill. |

Continuing Disclosure | The indenture under which the Bonds will be issued requires all of the periodic reports that we file with the Securities and Exchange Commission (the “Commission”), the principal transaction documents and other information concerning the system restoration charges and security relating to the Bonds to be posted on the website associated with our parent company, located atwww.centerpointenergy.com. |

Page 4 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Relationship to the Series 2001-1 Bonds | In October 2001, CenterPoint Energy Transition Bond Company, LLC (fka Reliant Energy Transition Bond Company LLC) (“Transition Bond Company I”), a special purpose wholly owned subsidiary of CenterPoint Houston’s predecessor, issued and sold $749 million of Series 2001-1 Transition Bonds (the “series 2001-1 bonds”) in accordance with a financing order issued by the PUCT on May 31, 2000. Transition Bond Company I will have no obligations under the Bonds, and we will have no obligations under the series 2001-1 bonds. |

The security pledged to secure the Bonds will be separate from the security that is securing the series 2001-1 bonds or that would secure any other series of transition or system restoration bonds.

The outstanding series 2001-1 bonds are currently rated Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively.

Relationship to the 2005 Senior

Secured Transition Bonds,

Series A | In December 2005, CenterPoint Energy Transition Bond Company II, LLC (“Transition Bond Company II”), a special purpose wholly owned subsidiary of CenterPoint Houston, issued and sold $1.851 billion of Senior Secured Transition Bonds, Series A (the “2005 series A bonds”) in accordance with a financing order issued by the PUCT on March 16, 2005. Transition Bond Company II will have no obligations under the Bonds, and we will have no obligations under the 2005 series A bonds. |

The security pledged to secure the Bonds will be separate from the security that is securing the 2005 series A bonds or that would secure any other series of transition or system restoration bonds.

The outstanding 2005 series A bonds are currently rated Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively.

Relationship to the 2008 Senior

Secured Transition Bonds | In February 2008, CenterPoint Energy Transition Bond Company III, LLC (“Transition Bond Company III”), a special purpose wholly owned subsidiary of CenterPoint Houston, issued and sold $488.5 million of 2008 Senior Secured Transition Bonds (the “2008 transition bonds”) in accordance with a financing order issued by the PUCT on September 18, 2007. Transition Bond Company III will have no obligations under the Bonds, and we will have no obligations under the 2008 transition bonds. |

The security pledged to secure the Bonds will be separate from the security that is securing the 2008 transition bonds or that would secure any other series of transition or system restoration bonds.

The outstanding 2008 transition bonds are currently rated Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively.

Seller, Sponsor and Initial

Servicer of the System

Restoration Property | CenterPoint Houston is a regulated electric transmission and distribution utility wholly-owned indirectly by CenterPoint Energy, Inc. CenterPoint Houston is engaged in the transmission and distribution of electric energy in a 5,000 square-mile area of the Texas Gulf Coast that includes Houston. |

CenterPoint Houston, acting as the initial servicer, will service the system restoration property securing the Bonds under a servicing agreement with us. Neither CenterPoint Houston nor CenterPoint Energy, Inc. nor any other affiliate (other than us) is an obligor on the Bonds.

Bookrunning Senior Manager | Goldman, Sachs & Co. |

Bookrunner | Citigroup Global Markets Inc. |

Page 5 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Co-Managers | Morgan Stanley & Co. Incorporated, RBS Securities Inc. and Loop Capital Markets, LLC |

SETTLEMENT

Trustee | Deutsche Bank Trust Company Americas |

Expected Settlement | November 25, 2009, settling flat. DTC, Clearstream and Euroclear. |

Use of Proceeds | Used to pay the expenses of the issuance and sale of the Bonds and to purchase the system restoration property from CenterPoint Houston. We may not use such proceeds for general corporate purposes. In accordance with the Financing Order, CenterPoint Houston will use the proceeds it receives from the sale of the system restoration property to reduce its recoverable distribution-related system restoration costs. |

More Information | For a complete discussion of the proposed transaction, please read the definitive base prospectus and the accompanying prospectus supplement when available. |

Page 6 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

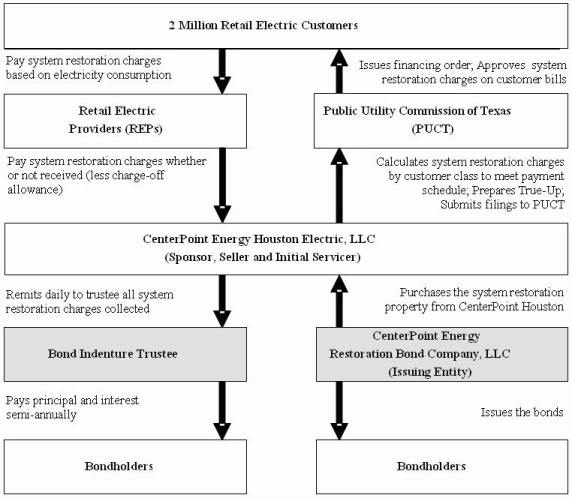

Parties to Transaction and Responsibilities

Page 7 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Flow of Funds to Bondholders

| * | During the twelve months ended September 30, 2009, approximately 43% of CenterPoint Houston’s total deliveries at distribution voltage were to customers, approximately 37% were to commercial customers and approximately 20% were to small industrial and other customers. |

Page 8 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Key Questions and Answers on Statutory True-Up Mechanism

Q1:Could the Financing Order be rescinded or altered or the PUCT fail to act to implement the true-up mechanism?

A: No. The Financing Order is irrevocable. The Financing Order provides that the true-up mechanism and all other obligations of the State of Texas and the PUCT set forth in the Financing Order are direct, explicit, irrevocable and unconditional upon issuance of the Bonds, and are legally enforceable against the State of Texas and the PUCT.

Q2:Could the securitization provisions of the Public Utility Regulatory Act be repealed or altered in a manner that will impair the value of the security or prevent timely repayment of the Bonds?

A: No. The Public Utility Regulatory Act provides that the State of Texas cannot take or permit any action that impairs the value of the security or the timely repayment of the Bonds.

Q3:Are there any circumstances, or any reason, in which the statutory true-up mechanism would not be applied to customer bills, e.g., economic recession, temporary power shortages, blackouts, bankruptcy of the parent company?

A: No. Once the Bonds are issued, the provisions of the irrevocable Financing Order that relate to the Bonds (including the statutory true-up mechanism) are unconditional. If collections differ or are projected to differ from forecasted revenues, regardless of the reason,CenterPoint Houston is required to submit to the PUCT an adjustment to the system restoration charges as necessary to ensure expected recovery of amounts sufficient to provide timely payment of principal and interest on the Bonds. The PUCT will confirm the mathematical accuracy of the submission and approve the imposition of the adjusted system restoration charges within 15 days. After this approval, the adjusted charges will immediately be reflected in the customer’s next bill. Any errors identified by the PUCT will be corrected in the next true-up adjustment.

Q4:Can customers avoid paying system restoration charges if they switch electricity providers?

A: No. The Public Utility Regulatory Act provides that the system restoration charges are nonbypassable. Nonbypassable means that these charges are collected from existing and future retail customers served at distribution voltage of a utility located within the utility’s historical certificated service area as it existed on August 26, 2009, subject to certain limitations specified in the Public Utility Regulatory Act and the Financing Order. We are generally entitled to collect system restoration charges from the retail electric providers serving those customers even if those customers elect to purchase electricity from another supplier or choose to operate new on-site-generation equipment of greater than ten megawatts, or if the utility goes out of business and its service area is acquired by another utility or is municipalized.

Q5:Is there any cap or limit on the amount of system restoration charges that may be imposed on any customer served at distribution voltage in CenterPoint Houston’s service territory?

A: No. In no event, however, may system restoration charges be imposed on customers for electricity delivered after the fifteenth anniversary of the date of issuance of the Bonds.

Page 9 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Expected Sinking Fund Schedule*

| Tranche A-1 | Tranche A-2 | Tranche A-3 | ||||||||||||

Tranche Size | $ | 222,897,000 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

Date | ||||||||||||||

8/15/2010 | $ | 19,618,131 | $ | — | $ | — | ||||||||

2/15/2011 | $ | 24,851,470 | $ | — | $ | — | ||||||||

8/15/2011 | $ | 18,369,431 | $ | — | $ | — | ||||||||

2/15/2012 | $ | 25,611,687 | $ | — | $ | — | ||||||||

8/15/2012 | $ | 19,133,912 | $ | — | $ | — | ||||||||

2/15/2013 | $ | 26,381,250 | $ | — | $ | — | ||||||||

8/15/2013 | $ | 19,489,493 | $ | — | $ | — | ||||||||

2/15/2014 | $ | 26,753,971 | $ | — | $ | — | ||||||||

8/15/2014 | $ | 20,121,474 | $ | — | $ | — | ||||||||

2/15/2015 | $ | 22,566,184 | $ | 4,886,769 | $ | — | ||||||||

8/15/2015 | $ | — | $ | 20,833,676 | $ | — | ||||||||

2/15/2016 | $ | — | $ | 28,401,696 | $ | — | ||||||||

8/15/2016 | $ | — | $ | 21,993,270 | $ | — | ||||||||

2/15/2017 | $ | — | $ | 29,664,923 | $ | — | ||||||||

8/15/2017 | $ | — | $ | 23,260,679 | $ | — | ||||||||

2/15/2018 | $ | — | $ | 31,061,465 | $ | — | ||||||||

8/15/2018 | $ | — | $ | 1,279,523 | $ | 23,405,396 | ||||||||

2/15/2019 | $ | — | $ | — | $ | 32,712,834 | ||||||||

8/15/2019 | $ | — | $ | — | $ | 26,374,414 | ||||||||

2/15/2020 | $ | — | $ | — | $ | 34,531,056 | ||||||||

8/15/2020 | $ | — | $ | — | $ | 28,047,402 | ||||||||

2/15/2021 | $ | — | $ | — | $ | 36,311,246 | ||||||||

8/15/2021 | $ | — | $ | — | $ | 29,751,093 | ||||||||

2/15/2022 | $ | — | $ | — | $ | 38,143,261 | ||||||||

8/15/2022 | $ | — | $ | — | $ | 31,303,297 | ||||||||

Total Payments | $ | 222,897,000 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

| * | Preliminary; subject to change. Totals may not add due to rounding. |

Page 10 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Expected Amortization Schedule*

| Tranche A-1 | Tranche A-2 | Tranche A-3 | ||||||||||||

| Tranche Size | $ | 222,897,000 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

Date | ||||||||||||||

11/25/2009 (Closing Date) | $ | 222,897,000 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

8/15/2010 | $ | 203,278,869 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

2/15/2011 | $ | 178,427,400 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

8/15/2011 | $ | 160,057,969 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

2/15/2012 | $ | 134,446,282 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

8/15/2012 | $ | 115,312,371 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

2/15/2013 | $ | 88,931,121 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

8/15/2013 | $ | 69,441,628 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

2/15/2014 | $ | 42,687,658 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

8/15/2014 | $ | 22,566,184 | $ | 161,382,000 | $ | 280,580,000 | ||||||||

2/15/2015 | $ | — | $ | 156,495,231 | $ | 280,580,000 | ||||||||

8/15/2015 | $ | — | $ | 135,661,555 | $ | 280,580,000 | ||||||||

2/15/2016 | $ | — | $ | 107,259,859 | $ | 280,580,000 | ||||||||

8/15/2016 | $ | — | $ | 85,266,589 | $ | 280,580,000 | ||||||||

2/15/2017 | $ | — | $ | 55,601,666 | $ | 280,580,000 | ||||||||

8/15/2017 | $ | — | $ | 32,340,987 | $ | 280,580,000 | ||||||||

2/15/2018 | $ | — | $ | 1,279,523 | $ | 280,580,000 | ||||||||

8/15/2018 | $ | — | $ | — | $ | 257,174,604 | ||||||||

2/15/2019 | $ | — | $ | — | $ | 224,461,770 | ||||||||

8/15/2019 | $ | — | $ | — | $ | 198,087,356 | ||||||||

2/15/2020 | $ | — | $ | — | $ | 163,556,300 | ||||||||

8/15/2020 | $ | — | $ | — | $ | 135,508,897 | ||||||||

2/15/2021 | $ | — | $ | — | $ | 99,197,651 | ||||||||

8/15/2021 | $ | — | $ | — | $ | 69,446,558 | ||||||||

2/15/2022 | $ | — | $ | — | $ | 31,303,297 | ||||||||

8/15/ 2022 | $ | — | $ | — | $ | — | ||||||||

| * | Preliminary; subject to change. Totals may not add due to rounding. |

Page 11 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Statutory True-up Mechanism for Payment of Scheduled Principal and Interest

The Public Utility Regulatory Act mandates and the irrevocable Financing Order requires that system restoration charges be reviewed and adjusted at least annually, and semi-annually as necessary, to ensure the expected recovery of amounts sufficient to timely provide payment of scheduled principal and interest on the Bonds.

The following describes the mechanics for implementing the statutory true-up mechanism. (See also “Key Questions and Answers on Statutory True-Up Mechanism” on page 8.)

MANDATORY ANNUAL TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

| STEP 1: | Each year, CenterPoint Houston computes the total dollar requirement for the Bonds for the coming year, which includes scheduled principal and interest payments and all other permitted costs of the transaction, including the retail electric providers’ allowance for customer charge-offs, adjusted to correct any prior undercollection or overcollection. |

| STEP 2: | CenterPoint Houston allocates this total dollar requirement among specific customer classes. |

| STEP 3: | CenterPoint Houston forecasts consumption by each customer class. |

| STEP 4: | CenterPoint Houston divides the total dollar requirement for each customer class by the forecasted consumption to determine the system restoration charge for that customer class. |

| STEP 5: | CenterPoint Houston must make a true-up filing with the PUCT, specifying such adjustments to the system restoration charges as may be necessary, regardless of the reason for the difference between forecasted and required collections. The PUCT will approve the adjustment within 15 days and adjustments to the system restoration charges are reflected in customer bills on the effective date specified by CenterPoint Houston’s filings. |

MANDATORY INTERIM TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

CenterPoint Houston must seek an interim true-up once every six months (or quarterly in the fourteenth and fifteenth years):

(i) if the servicer expects, at the next payment date, more than a 5% variation in absolute value between (a) the actual principal balance of the Bonds, taking into account amounts on deposit in the excess funds subaccount, and (b) the outstanding principal balance on the expected amortization schedule of the Bonds;

(ii) as needed to meet any rating agency requirement that the Bonds be paid in full at scheduled final payment date; or

(iii) to correct any undercollection or overcollection of system restoration charges, regardless of cause, in order to assure timely payment of the Bonds based on rating agency and bondholder considerations.

STABLE AVERAGE LIFE

Weighted Average Life Sensitivity

| WAL | ||||||||||

| Expected | 5% | 15% | ||||||||

| Tranche | Weighted Avg. Life (“WAL”) (yrs) | WAL (yrs) | Change (days) | WAL (yrs) | Change (days) | |||||

| A-1 | 3.00 | 3.00 | 0 | 3.00 | 0 | |||||

| A-2 | 7.00 | 7.00 | 0 | 7.00 | 0 | |||||

| A-3 | 10.82 | 10.82 | 0 | 10.82 | 0 | |||||

For purposes of preparing the chart above, the following assumptions, among others, have been made: (i) the forecast error stays constant over the life of the Bonds and is equal to an overestimate of electricity consumption for all customer classes served at distribution voltage of 5% or 15% as stated in the chart above (i.e., actual electricity consumption is 100/105ths or 100/115ths of the forecast at issuance of the Bonds), (ii) the Servicer makes timely and accurate filings to true-up the system restoration charges on a semi-annual basis (and, in each case, reforecasts electricity consumption to reflect actual experience), (iii) customer charge-off rates are held constant at 1.98% for the residential class and 0.27% for all other classes of customers served at distribution voltage, (iv) retail electric providers remit all system restoration charges 35 days after such charges are billed, (v) actual operating expenses are equal to projections, (vi) there is no acceleration of the final maturity date of the Bonds, and (vii) a permanent loss of all customers has not occurred. There can be no assurance that the weighted average lives of the various tranches of the Bonds will be as shown above.

Page 12 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

Glossary

“System Restoration Charges” | System restoration charges are statutorily-created, nonbypassable, consumption-based per kilowatt hour, per kilowatt or per kilovolt-Amperes charges. System restoration charges are irrevocable and payable, through retail electric providers, by retail electric customers, as long as they continue to use electricity at distribution voltage at any facilities located within CenterPoint Houston’s service territory even if such electricity is self-generated using new on-site generation, subject to limited exceptions. | |

| “Security” | All assets held by the Trustee for the benefit of the holders of the Bonds. Our principal asset securing the Bonds is the system restoration property. The system restoration property securing the Bonds is not a pool of receivables. It is the irrevocable right to impose, collect and receive nonbypassable system restoration charges and is a present property right created by the Public Utility Regulatory Act and the Financing Order, and expressly protected by the pledge of the State of Texas, not to take or permit any action that would impair its value. | |

“Principal Payments” | Principal will be paid sequentially. No tranches will receive principal payments until all tranches with earlier expected maturity dates have been paid in full unless there is an acceleration of the Bonds following an event of default in which case principal will be paid to all tranches on a pro-rata basis. Please see “Expected Sinking Fund Schedule.” | |

“Legal Structure” | The Public Utility Regulatory Act provides, among other things, that the system restoration property is a present property right created pursuant to such Act and the Financing Order. The Financing Order includes affirmative findings to the effect that (i) the Financing Order is final and not subject to PUCT rehearing, (ii) our right to collect system restoration charges is a property right against which bondholders will have a perfected lien upon execution and delivery of a security agreement and the filing of notice with the Secretary of State, and (iii) the State of Texas has pledged not to take or permit any action that would impair the value of the system restoration property, or, reduce, alter or impair the system restoration charges to be imposed, collected and remitted to bondholders, except for the periodic true-up, until the Bonds have been paid in full. The Financing Order is final and is no longer subject to further appeal or review by the PUCT or the courts. | |

| “Ratings” | A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. No person is obligated to maintain the rating on any Bond, and, accordingly, there can be no assurance that the ratings assigned to any tranche of the Bonds upon initial issuance will not be revised or withdrawn by a rating agency at any time thereafter. | |

Page 13 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

We and CenterPoint Houston have filed a registration statement (including a prospectus and prospectus supplement) (Registration Nos. 333-162370 and 333-162370-01) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. You can also obtain copies of the registration statement from the SEC upon payment of prescribed charges, or you can examine the registration statement free of charge at the SEC’s offices at 100 F Street, N.E., Washington, D.C. 20549. Alternatively, we, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and prospectus supplement if you request it by calling toll free at (1-866-471-2526).

This Preliminary Term Sheet is not required to contain all information that is required to be included in the prospectus and prospectus supplement that have been prepared and provided to you for the securities offering to which this Preliminary Term Sheet relates. The prospectus and prospectus supplement contain material information not contained herein, and the prospective purchasers are referred to the prospectus and prospectus supplement, including the final prospectus and prospectus supplement. The prospectus and prospectus supplement contain all material information in respect of the Bonds. This Preliminary Term Sheet is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

The information in this Preliminary Term Sheet is preliminary, and may be superseded by an additional term sheet provided to you prior to the time you enter into a contract of sale. This Preliminary Term Sheet is being delivered to you solely to provide you with information about the offering of the Bonds referred to herein. The Bonds are being offered when, as and if issued. In particular, you are advised that these securities are subject to modification or revision (including, among other things, the possibility that one or more tranches of Bonds may be split, combined or eliminated), at any time prior to the availability of a final prospectus.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded to the extent inconsistent with any legends or other information contained herein. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

Neither the SEC nor any state securities commission has approved or disapproved of the Bonds or determined if this Preliminary Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

Price and availability of the Bonds are subject to change without notice.

Neither the State of Texas nor the PUCT is acting as an agent for us or our affiliates in connection with the proposed transaction.

Page 14 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

OFFERING RESTRICTIONS IN CERTAIN JURISDICTIONS

NOTICE TO RESIDENTS OF SINGAPORE

EACH UNDERWRITER ACKNOWLEDGES THAT THIS PRELIMINARY TERM SHEET HAS NOT BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE. ACCORDINGLY, EACH UNDERWRITER REPRESENTS, WARRANTS AND AGREES THAT IT HAS NOT OFFERED OR SOLD ANY BONDS OR CAUSED THE BONDS TO BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, AND WILL NOT OFFER OR SELL ANY BONDS OR CAUSE THE BONDS TO BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, AND HAS NOT CIRCULATED OR DISTRIBUTED, NOR WILL IT CIRCULATE OR DISTRIBUTE THIS PRELIMINARY TERM SHEET OR ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF BONDS, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN (I) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE (THE “SFA”), OR ANY PERSON PURSUANT TO SECTION 275(1A), AND IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA OR (II) TO A RELEVANT PERSON PURSUANT TO SECTION 275(1) OR ANY PERSON PURSUANT TO SECTION 275(1A) OF THE SFA, AND IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA OR (III) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SFA.

WHERE THE BONDS ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 BY A RELEVANT PERSON WHICH IS:

A) A CORPORATION (WHICH IS NOT AN ACCREDITED INVESTOR (AS DEFINED IN SECTION 4A OF THE SFA)) THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR

B) A TRUST (WHERE THE TRUSTEE IS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY OF THE TRUST IS AN INDIVIDUAL WHO IS AN ACCREDITED INVESTOR,

SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST (HOWSOEVER DESCRIBED) IN THAT TRUST SHALL NOT BE TRANSFERRED WITHIN 6 MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED THE BONDS PURSUANT TO AN OFFER MADE UNDER SECTION 275 EXCEPT:

1) TO AN INSTITUTIONAL INVESTOR (FOR CORPORATIONS, UNDER SECTION 274 OF THE SFA) OR TO A RELEVANT PERSON DEFINED IN SECTION 275(2) OF THE SFA, OR TO ANY PERSON PURSUANT TO AN OFFER THAT IS MADE ON TERMS THAT SUCH RIGHTS OR INTEREST ARE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION, WHETHER SUCH AMOUNT IS TO BE PAID FOR IN CASH OR BY EXCHANGE OF SECURITIES OR OTHER ASSETS, AND FURTHER FOR CORPORATIONS, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA;

2) WHERE NO CONSIDERATION IS OR WILL BE GIVEN FOR THE TRANSFER; OR

3) WHERE THE TRANSFER IS BY OPERATION OF LAW. THE PROSPECTUS RELATING TO THE BONDS (“PROSPECTUS”) WILL, PRIOR TO ANY SALE OF SECURITIES PURSUANT TO THE PROVISIONS OF SECTION 106D OF THE COMPANIES ACT (CAP.50), BE LODGED, PURSUANT TO SAID SECTION 106D, WITH THE REGISTRAR OF COMPANIES IN SINGAPORE, WHICH WILL TAKE NO RESPONSIBILITY FOR ITS CONTENTS. HOWEVER, NEITHER THIS PRELIMINARY TERM SHEET NOR THE PROSPECTUS HAS BEEN AND NOR WILL THEY BE REGISTERED AS A PROSPECTUS WITH THE REGISTRAR OF COMPANIES IN SINGAPORE. ACCORDINGLY, THE BONDS MAY NOT BE OFFERED, AND NEITHER THIS PRELIMINARY TERM SHEET NOR ANY OTHER OFFERING DOCUMENT OR MATERIAL RELATING TO THE BONDS MAY BE CIRCULATED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, TO THE PUBLIC OR ANY MEMBER OF THE PUBLIC IN SINGAPORE OTHER THAN TO INSTITUTIONAL INVESTORS OR OTHER PERSONS OF THE KIND SPECIFIED IN SECTION 106C AND SECTION 106D OF THE COMPANIES ACT OR ANY OTHER APPLICABLE EXEMPTION INVOKED UNDER DIVISION 5A OF PART IV OF THE COMPANIES ACT. THE FIRST SALE OF SECURITIES ACQUIRED UNDER A SECTION 106C OR SECTION 106D EXEMPTION IS SUBJECT TO THE PROVISIONS OF SECTION 106E OF THE COMPANIES ACT.

Page 15 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

NOTICE TO RESIDENTS OF THE PEOPLE’S REPUBLIC OF CHINA

THE BONDS HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES LAW OF THE PEOPLE’S REPUBLIC OF CHINA (AS THE SAME MAY BE AMENDED FROM TIME TO TIME) AND ARE NOT TO BE OFFERED OR SOLD TO PERSONS WITHIN THE PEOPLE’S REPUBLIC OF CHINA (EXCLUDING THE HONG KONG AND MACAU SPECIAL ADMINISTRATIVE REGIONS).

NOTICE TO RESIDENTS OF JAPAN

THE BONDS HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES AND EXCHANGE LAW OF JAPAN (THE “SEL”), AND MAY NOT BE OFFERED OR SOLD IN JAPAN OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, ANY RESIDENT OF JAPAN OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, ANY RESIDENT OF JAPAN OR TO OTHERS FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, ANY RESIDENT OF JAPAN, EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE SEL, AND IN COMPLIANCE WITH THE OTHER RELEVANT LAWS AND REGULATIONS OF JAPAN. AS USED IN THIS PARAGRAPH, “RESIDENT OF JAPAN” MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN.

NOTICE TO RESIDENTS OF HONG KONG

EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT:

IT HAS NOT OFFERED OR SOLD AND WILL NOT OFFER OR SELL IN HONG KONG, BY MEANS OF ANY DOCUMENT, ANY BONDS OTHER THAN (A) TO PERSONS WHOSE ORDINARY BUSINESS IS TO BUY OR SELL SHARES OR DEBENTURES (WHETHER AS PRINCIPAL OR AGENT); OR (B) TO PROFESSIONAL INVESTORS WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) OF THE LAWS OF HONG KONG AND ANY RULES MADE THEREUNDER; OR (C) IN CIRCUMSTANCES THAT DO NOT RESULT IN THE DOCUMENT BEING A “PROSPECTUS” AS DEFINED IN THE COMPANIES ORDINANCE (CAP. 32) OF THE LAWS OF HONG KONG OR THAT DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THAT ORDINANCE; AND

IT HAS NOT ISSUED OR HAD IN ITS POSSESSION FOR THE PURPOSE OF ISSUE, AND WILL NOT ISSUE OR HAVE IN ITS POSSESSION FOR THE PURPOSE OF ISSUE, WHETHER IN HONG KONG OR ELSEWHERE ANY ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE BONDS, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE SECURITIES LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO BONDS THAT ARE INTENDED TO BE DISPOSED OF ONLY TO PERSONS OUTSIDE HONG KONG OR ONLY TO “PROFESSIONAL INVESTORS” AS DEFINED UNDER THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) OF THE LAWS OF HONG KONG AND ANY RULES MADE UNDER THAT ORDINANCE.

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

IN RELATION TO EACH MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”), THE UNDERWRITER HAS REPRESENTED AND AGREED THAT WITH EFFECT FROM AND INCLUDING THE DATE ON WHICH THE PROSPECTUS DIRECTIVE IS IMPLEMENTED IN THAT RELEVANT MEMBER STATE (THE “RELEVANT IMPLEMENTATION DATE”) IT HAS NOT MADE AND WILL NOT MAKE AN OFFER OF BONDS TO THE PUBLIC IN THAT RELEVANT MEMBER STATE PRIOR TO THE PUBLICATION OF A PROSPECTUS IN RELATION TO THE BONDS WHICH HAS BEEN APPROVED BY THE COMPETENT AUTHORITY IN THAT RELEVANT MEMBER STATE OR, WHERE APPROPRIATE, APPROVED IN ANOTHER RELEVANT MEMBER STATE AND NOTIFIED TO THE COMPETENT AUTHORITY IN THAT RELEVANT MEMBER STATE, ALL IN ACCORDANCE WITH THE PROSPECTUS DIRECTIVE, EXCEPT THAT IT MAY, WITH EFFECT FROM AND INCLUDING THE RELEVANT IMPLEMENTATION DATE, MAKE AN OFFER OF BONDS TO THE PUBLIC IN THAT RELEVANT MEMBER STATE AT ANY TIME:

(A) TO LEGAL ENTITIES WHICH ARE AUTHORIZED OR REGULATED TO OPERATE IN THE FINANCIAL MARKETS OR, IF NOT SO AUTHORIZED OR REGULATED, WHOSE CORPORATE PURPOSE IS SOLELY TO INVEST IN SECURITIES;

Page 16 of 17

CENTERPOINT ENERGY RESTORATION BOND COMPANY, LLC

| PRELIMINARY TERM SHEET

| NOVEMBER 16, 2009

|

(B) TO ANY LEGAL ENTITY WHICH HAS TWO OR MORE OF (1) AN AVERAGE OF AT LEAST 250 EMPLOYEES DURING THE LAST FINANCIAL YEAR; (2) A TOTAL BALANCE SHEET OF MORE THAN €43,000,000 AND (3) AN ANNUAL NET TURNOVER OF MORE THAN €50,000,000, EACH AS SHOWN IN ITS LAST ANNUAL OR CONSOLIDATED ACCOUNTS;

(C) TO FEWER THAN 100 NATURAL OR LEGAL PERSONS (OTHER THAN QUALIFIED INVESTORS AS DEFINED IN THE PROSPECTUS DIRECTIVE); OR

(D) IN ANY OTHER CIRCUMSTANCES WHICH DO NOT REQUIRE THE PUBLICATION BY THE ISSUING ENTITY OF A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE.

FOR THE PURPOSES OF THIS PROVISION, THE EXPRESSION AN “OFFER OF BONDS TO THE PUBLIC” IN RELATION TO ANY BONDS IN ANY RELEVANT MEMBER STATE MEANS THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE BONDS TO BE OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE OR SUBSCRIBE THE BONDS, AS THE SAME MAY BE VARIED IN THAT MEMBER STATE BY ANY MEASURE IMPLEMENTING THE PROSPECTUS DIRECTIVE IN THAT MEMBER STATE AND THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EC AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN EACH RELEVANT MEMBER STATE.

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

THE UNDERWRITER HAS REPRESENTED AND AGREED THAT:

(A) IT HAS ONLY COMMUNICATED OR CAUSED TO BE COMMUNICATED AND WILL ONLY COMMUNICATE OR CAUSE TO BE COMMUNICATED AN INVITATION OR INDUCEMENT TO ENGAGE IN INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”)) RECEIVED BY IT IN CONNECTION WITH THE ISSUE OR SALE OF THE BONDS IN CIRCUMSTANCES IN WHICH SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE ISSUING ENTITY; AND

(B) IT HAS COMPLIED AND WILL COMPLY WITH ALL APPLICABLE PROVISIONS OF THE FSMA WITH RESPECT TO ANYTHING DONE BY IT IN RELATION TO THE BONDS IN, FROM OR OTHERWISE INVOLVING THE UNITED KINGDOM.

THIS OFFERING DOCUMENT IS DIRECTED ONLY AT PERSONS WHO (I) ARE OUTSIDE THE UNITED KINGDOM OR (II) ARE INVESTMENT PROFESSIONALS FALLING WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 AS AMENDED (THE “ORDER”) OR (III) ARE HIGH NET WORTH ENTITIES FALLING WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER OR (IV) SUCH OTHER PERSONS TO WHOM IT MAY LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS”). THIS OFFERING DOCUMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS OFFERING DOCUMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

Page 17 of 17