UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

100 International Drive, Baltimore, MD, 21202

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code:

877-6LM-FUND/656-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

BrandywineGLOBAL - Flexible Bond Fund |  | |

| Class A [LFLAX] | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $46 | 0.93% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

Total Net Assets | $499,876,184 |

Total Number of Portfolio Holdings* | 187 |

Portfolio Turnover Rate | 44% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| BrandywineGLOBAL - Flexible Bond Fund | PAGE 1 | 7207-STSR-0824 |

BrandywineGLOBAL - Flexible Bond Fund |  | |

| Class C [LFLCX] | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $83 | 1.67% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

Total Net Assets | $499,876,184 |

Total Number of Portfolio Holdings* | 187 |

Portfolio Turnover Rate | 44% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| BrandywineGLOBAL - Flexible Bond Fund | PAGE 1 | 7996-STSR-0824 |

BrandywineGLOBAL - Flexible Bond Fund |  | |

| Class I [LFLIX] | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class I | $37 | 0.75% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

Total Net Assets | $499,876,184 |

Total Number of Portfolio Holdings* | 187 |

Portfolio Turnover Rate | 44% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| BrandywineGLOBAL - Flexible Bond Fund | PAGE 1 | 7208-STSR-0824 |

BrandywineGLOBAL - Flexible Bond Fund |  | |

| Class IS [LFLSX] | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class IS | $32 | 0.64% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

Total Net Assets | $499,876,184 |

Total Number of Portfolio Holdings* | 187 |

Portfolio Turnover Rate | 44% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| BrandywineGLOBAL - Flexible Bond Fund | PAGE 1 | 7209-STSR-0824 |

| ITEM 2. | CODE OF ETHICS. |

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| (b) | Not applicable. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Flexible Bond Fund

1 | |

18 | |

20 | |

21 | |

22 | |

26 | |

45 | |

45 | |

45 | |

46 |

Security | Rate | Maturity Date | Face Amount† | Value | |

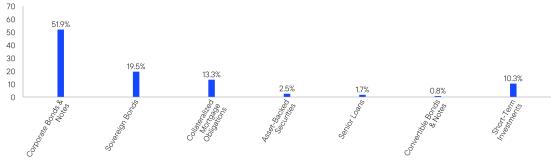

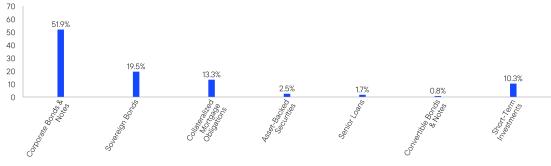

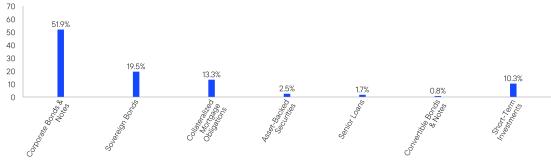

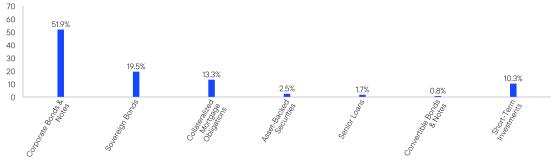

Corporate Bonds & Notes — 51.8% | |||||

Communication Services — 1.6% | |||||

Diversified Telecommunication Services — 0.4% | |||||

Cogent Communications Group Inc./Cogent Communications Finance Inc., Senior Notes | 7.000% | 6/15/27 | 1,260,000 | $1,248,098 (a) | |

Consolidated Communications Inc., Senior Secured Notes | 5.000% | 10/1/28 | 1,065,000 | 882,016 (a) | |

Total Diversified Telecommunication Services | 2,130,114 | ||||

Interactive Media & Services — 0.7% | |||||

TripAdvisor Inc., Senior Notes | 7.000% | 7/15/25 | 3,310,000 | 3,321,989 (a) | |

Media — 0.3% | |||||

Liberty Interactive LLC, Senior Notes | 8.250% | 2/1/30 | 250,000 | 117,441 | |

Nexstar Media Inc., Senior Notes | 4.750% | 11/1/28 | 710,000 | 631,898 (a) | |

Univision Communications Inc., Senior Secured Notes | 6.625% | 6/1/27 | 600,000 | 574,990 (a) | |

Total Media | 1,324,329 | ||||

Wireless Telecommunication Services — 0.2% | |||||

Vmed O2 UK Financing I PLC, Senior Secured Notes | 4.750% | 7/15/31 | 1,495,000 | 1,262,887 (a) | |

Total Communication Services | 8,039,319 | ||||

Consumer Discretionary — 2.8% | |||||

Hotels, Restaurants & Leisure — 2.8% | |||||

Affinity Interactive, Senior Secured Notes | 6.875% | 12/15/27 | 2,670,000 | 2,358,759 (a) | |

Allwyn Entertainment Financing UK PLC, Senior Secured Notes | 7.875% | 4/30/29 | 1,650,000 | 1,705,877 (a) | |

Grupo Posadas SAB de CV, Senior Secured Notes, Step bond (7.000% to 12/30/25 then 8.000%) | 7.000% | 12/30/27 | 3,780,000 | 3,411,450 (b) | |

IRB Holding Corp., Senior Secured Notes | 7.000% | 6/15/25 | 2,080,000 | 2,082,242 (a) | |

Mohegan Tribal Gaming Authority, Secured Notes | 8.000% | 2/1/26 | 3,380,000 | 3,207,705 (a) | |

Viking Cruises Ltd., Senior Notes | 6.250% | 5/15/25 | 1,250,000 | 1,249,874 (a) | |

Total Consumer Discretionary | 14,015,907 | ||||

Consumer Staples — 1.5% | |||||

Food Products — 0.8% | |||||

Minerva Luxembourg SA, Senior Notes | 4.375% | 3/18/31 | 355,000 | 293,088 (a) | |

Minerva Luxembourg SA, Senior Notes | 8.875% | 9/13/33 | 1,180,000 | 1,219,426 (a) | |

Pilgrim’s Pride Corp., Senior Notes | 4.250% | 4/15/31 | 2,400,000 | 2,185,822 | |

Total Food Products | 3,698,336 | ||||

1

Security | Rate | Maturity Date | Face Amount† | Value | |

Tobacco — 0.7% | |||||

Turning Point Brands Inc., Senior Secured Notes | 5.625% | 2/15/26 | 1,570,000 | $1,561,542 (a) | |

Vector Group Ltd., Senior Secured Notes | 5.750% | 2/1/29 | 2,100,000 | 1,969,853 (a) | |

Total Tobacco | 3,531,395 | ||||

Total Consumer Staples | 7,229,731 | ||||

Energy — 15.3% | |||||

Energy Equipment & Services — 0.5% | |||||

Transocean Titan Financing Ltd., Senior Secured Notes | 8.375% | 2/1/28 | 1,500,000 | 1,549,631 (a) | |

Yinson Boronia Production BV, Senior Secured Notes | 8.947% | 7/31/42 | 980,000 | 990,290 (a) | |

Total Energy Equipment & Services | 2,539,921 | ||||

Oil, Gas & Consumable Fuels — 14.8% | |||||

Aethon United BR LP/Aethon United Finance Corp., Senior Notes | 8.250% | 2/15/26 | 960,000 | 971,268 (a) | |

Baytex Energy Corp., Senior Notes | 8.500% | 4/30/30 | 3,210,000 | 3,359,730 (a) | |

California Resources Corp., Senior Notes | 8.250% | 6/15/29 | 2,245,000 | 2,293,202 (a) | |

CITGO Petroleum Corp., Senior Secured Notes | 7.000% | 6/15/25 | 5,740,000 | 5,743,807 (a) | |

Civitas Resources Inc., Senior Notes | 8.375% | 7/1/28 | 1,740,000 | 1,825,397 (a) | |

Devon Energy Corp., Senior Notes | 5.600% | 7/15/41 | 2,480,000 | 2,308,833 | |

Ecopetrol SA, Senior Notes | 8.875% | 1/13/33 | 590,000 | 609,697 | |

Energean Israel Finance Ltd., Senior Secured Notes | 4.875% | 3/30/26 | 2,765,000 | 2,612,649 (b) | |

Energean Israel Finance Ltd., Senior Secured Notes | 5.375% | 3/30/28 | 4,620,000 | 4,107,180 (b) | |

Energy Transfer LP, Junior Subordinated Notes (6.500% to 11/15/26 then 5 year Treasury Constant Maturity Rate + 5.694%) | 6.500% | 11/15/26 | 2,160,000 | 2,135,917 (c)(d) | |

Energy Transfer LP, Senior Notes | 5.600% | 9/1/34 | 3,270,000 | 3,250,371 | |

Geopark Ltd., Senior Notes | 5.500% | 1/17/27 | 650,000 | 591,467 (a) | |

Leviathan Bond Ltd., Senior Secured Notes | 6.125% | 6/30/25 | 2,380,000 | 2,310,480 (b) | |

Leviathan Bond Ltd., Senior Secured Notes | 6.500% | 6/30/27 | 3,470,000 | 3,257,773 (b) | |

Leviathan Bond Ltd., Senior Secured Notes | 6.750% | 6/30/30 | 1,075,000 | 962,091 (b) | |

Magnolia Oil & Gas Operating LLC/ Magnolia Oil & Gas Finance Corp., Senior Notes | 6.000% | 8/1/26 | 2,310,000 | 2,289,431 (a) | |

New Fortress Energy Inc., Senior Secured Notes | 6.500% | 9/30/26 | 3,230,000 | 2,974,176 (a) | |

2

Security | Rate | Maturity Date | Face Amount† | Value | |

Oil, Gas & Consumable Fuels — continued | |||||

New Fortress Energy Inc., Senior Secured Notes | 8.750% | 3/15/29 | 1,070,000 | $977,662 (a) | |

Permian Resources Operating LLC, Senior Notes | 8.000% | 4/15/27 | 1,500,000 | 1,535,093 (a) | |

Petroleos Mexicanos, Senior Notes | 5.350% | 2/12/28 | 12,500,000 | 11,241,705 | |

Plains All American Pipeline LP/PAA Finance Corp., Senior Notes | 5.700% | 9/15/34 | 2,510,000 | 2,487,896 | |

SM Energy Co., Senior Notes | 6.625% | 1/15/27 | 1,690,000 | 1,684,544 | |

Teine Energy Ltd., Senior Notes | 6.875% | 4/15/29 | 3,100,000 | 3,046,532 (a) | |

Venture Global LNG Inc., Senior Secured Notes | 8.125% | 6/1/28 | 4,760,000 | 4,907,593 (a) | |

YPF SA, Senior Notes | 8.500% | 7/28/25 | 2,665,000 | 2,629,390 (b) | |

YPF SA, Senior Secured Notes | 9.000% | 2/12/26 | 1,744,615 | 1,754,469 (b) | |

YPF SA, Senior Secured Notes | 9.500% | 1/17/31 | 1,970,000 | 2,003,277 (a) | |

Total Oil, Gas & Consumable Fuels | 73,871,630 | ||||

Total Energy | 76,411,551 | ||||

Financials — 15.2% | |||||

Banks — 0.9% | |||||

Banco Mercantil del Norte SA, Junior Subordinated Notes (5.875% to 1/24/27 then 5 year Treasury Constant Maturity Rate + 4.643%) | 5.875% | 1/24/27 | 260,000 | 244,201 (a)(c)(d) | |

NatWest Group PLC, Junior Subordinated Notes (4.600% to 12/28/31 then 5 year Treasury Constant Maturity Rate + 3.100%) | 4.600% | 6/28/31 | 340,000 | 268,761 (c)(d) | |

Societe Generale SA, Subordinated Notes (7.132% to 1/19/54 then 1 year Treasury Constant Maturity Rate + 2.950%) | 7.132% | 1/19/55 | 3,225,000 | 3,089,274 (a)(d) | |

Texas Capital Bancshares Inc., Subordinated Notes (4.000% to 5/6/26 then 5 year Treasury Constant Maturity Rate + 3.150%) | 4.000% | 5/6/31 | 1,080,000 | 979,205 (d) | |

Total Banks | 4,581,441 | ||||

Capital Markets — 7.1% | |||||

Antares Holdings LP, Senior Notes | 2.750% | 1/15/27 | 645,000 | 586,174 (a) | |

Antares Holdings LP, Senior Notes | 7.950% | 8/11/28 | 2,640,000 | 2,736,779 (a) | |

Ares Capital Corp., Senior Notes | 7.000% | 1/15/27 | 2,930,000 | 2,980,173 | |

Ares Capital Corp., Senior Notes | 2.875% | 6/15/28 | 300,000 | 265,854 | |

Bain Capital Specialty Finance Inc., Senior Notes | 2.950% | 3/10/26 | 1,105,000 | 1,038,904 | |

3

Security | Rate | Maturity Date | Face Amount† | Value | |

Capital Markets — continued | |||||

Blackstone Secured Lending Fund, Senior Notes | 3.625% | 1/15/26 | 3,480,000 | $3,341,025 | |

Blackstone Secured Lending Fund, Senior Notes | 2.850% | 9/30/28 | 250,000 | 219,302 | |

Blue Owl Capital Corp., Senior Notes | 2.625% | 1/15/27 | 365,000 | 333,630 | |

Blue Owl Credit Income Corp., Senior Notes | 3.125% | 9/23/26 | 1,300,000 | 1,205,485 | |

Blue Owl Credit Income Corp., Senior Notes | 7.750% | 9/16/27 | 510,000 | 524,256 | |

Blue Owl Finance LLC, Senior Notes | 3.125% | 6/10/31 | 1,035,000 | 863,063 (a) | |

Blue Owl Technology Finance Corp., Senior Notes | 3.750% | 6/17/26 | 835,000 | 778,747 (a) | |

Charles Schwab Corp., Junior Subordinated Notes, Non Voting Shares (4.000% to 6/1/26 then 5 year Treasury Constant Maturity Rate + 3.168%) | 4.000% | 6/1/26 | 5,150,000 | 4,838,456 (c)(d) | |

FS KKR Capital Corp., Senior Notes | 3.125% | 10/12/28 | 725,000 | 629,751 | |

Golub Capital BDC Inc., Senior Notes | 2.500% | 8/24/26 | 1,080,000 | 993,723 | |

Golub Capital BDC Inc., Senior Notes | 2.050% | 2/15/27 | 65,000 | 58,463 | |

Golub Capital BDC Inc., Senior Notes | 7.050% | 12/5/28 | 2,200,000 | 2,247,429 | |

Golub Capital BDC Inc., Senior Notes | 6.000% | 7/15/29 | 1,320,000 | 1,295,333 | |

Hercules Capital Inc., Senior Notes | 2.625% | 9/16/26 | 1,868,000 | 1,712,860 | |

Main Street Capital Corp., Senior Notes | 3.000% | 7/14/26 | 1,215,000 | 1,137,770 | |

Main Street Capital Corp., Senior Notes | 6.950% | 3/1/29 | 940,000 | 950,885 | |

UBS Group AG, Senior Notes (6.537% to 8/12/32 then SOFR + 3.920%) | 6.537% | 8/12/33 | 4,140,000 | 4,346,736 (a)(d) | |

XP Inc., Senior Notes | 6.750% | 7/2/29 | 2,600,000 | 2,580,500 (a)(e) | |

Total Capital Markets | 35,665,298 | ||||

Consumer Finance — 4.0% | |||||

Ally Financial Inc., Junior Subordinated Notes (4.700% to 5/15/26 then 5 year Treasury Constant Maturity Rate + 3.868%) | 4.700% | 5/15/26 | 2,530,000 | 2,234,282 (c)(d) | |

Ally Financial Inc., Junior Subordinated Notes (4.700% to 5/15/28 then 7 year Treasury Constant Maturity Rate + 3.481%) | 4.700% | 5/15/28 | 3,165,000 | 2,542,290 (c)(d) | |

Capital One Financial Corp., Senior Notes (7.624% to 10/30/30 then SOFR + 3.070%) | 7.624% | 10/30/31 | 1,060,000 | 1,167,295 (d) | |

Credit Acceptance Corp., Senior Notes | 9.250% | 12/15/28 | 2,700,000 | 2,857,032 (a) | |

goeasy Ltd., Senior Notes | 9.250% | 12/1/28 | 4,000,000 | 4,249,512 (a) | |

PRA Group Inc., Senior Notes | 5.000% | 10/1/29 | 3,040,000 | 2,606,353 (a) | |

4

Security | Rate | Maturity Date | Face Amount† | Value | |

Consumer Finance — continued | |||||

Synchrony Financial, Subordinated Notes | 7.250% | 2/2/33 | 2,460,000 | $2,447,597 | |

World Acceptance Corp., Senior Notes | 7.000% | 11/1/26 | 2,000,000 | 1,908,330 (a) | |

Total Consumer Finance | 20,012,691 | ||||

Financial Services — 2.8% | |||||

Burford Capital Global Finance LLC, Senior Notes | 6.250% | 4/15/28 | 1,798,000 | 1,739,976 (a) | |

Freedom Mortgage Corp., Senior Notes | 7.625% | 5/1/26 | 2,115,000 | 2,101,930 (a) | |

Freedom Mortgage Holdings LLC, Senior Notes | 9.250% | 2/1/29 | 860,000 | 860,189 (a) | |

GGAM Finance Ltd., Senior Notes | 7.750% | 5/15/26 | 3,300,000 | 3,369,537 (a) | |

Jane Street Group/JSG Finance Inc., Senior Secured Notes | 7.125% | 4/30/31 | 3,240,000 | 3,325,145 (a) | |

United Wholesale Mortgage LLC, Senior Notes | 5.750% | 6/15/27 | 2,420,000 | 2,364,678 (a) | |

Total Financial Services | 13,761,455 | ||||

Insurance — 0.2% | |||||

RenaissanceRe Holdings Ltd., Senior Notes | 5.750% | 6/5/33 | 860,000 | 861,499 | |

Mortgage Real Estate Investment Trusts (REITs) — 0.2% | |||||

Starwood Property Trust Inc., Senior Notes | 7.250% | 4/1/29 | 1,180,000 | 1,194,126 (a) | |

Total Financials | 76,076,510 | ||||

Health Care — 1.2% | |||||

Health Care Equipment & Supplies — 0.2% | |||||

Embecta Corp., Senior Secured Notes | 5.000% | 2/15/30 | 1,440,000 | 1,187,280 (a) | |

Health Care Providers & Services — 0.2% | |||||

Star Parent Inc., Senior Secured Notes | 9.000% | 10/1/30 | 1,120,000 | 1,177,284 (a) | |

Pharmaceuticals — 0.8% | |||||

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | 7.125% | 1/31/25 | 3,810,000 | 3,822,935 | |

Total Health Care | 6,187,499 | ||||

Industrials — 7.6% | |||||

Air Freight & Logistics — 0.3% | |||||

Cargo Aircraft Management Inc., Senior Notes | 4.750% | 2/1/28 | 1,310,000 | 1,216,631 (a) | |

Building Products — 0.9% | |||||

AmeriTex HoldCo Intermediate LLC, Senior Secured Notes | 10.250% | 10/15/28 | 930,000 | 980,530 (a) | |

Masterbrand Inc., Senior Notes | 7.000% | 7/15/32 | 3,580,000 | 3,622,873 (a) | |

Total Building Products | 4,603,403 | ||||

5

Security | Rate | Maturity Date | Face Amount† | Value | |

Commercial Services & Supplies — 0.1% | |||||

Enviri Corp., Senior Notes | 5.750% | 7/31/27 | 395,000 | $375,844 (a) | |

Construction & Engineering — 0.6% | |||||

ATP Tower Holdings LLC/Andean Tower Partners Colombia SAS/Andean Telecom Par, Senior Secured Notes | 4.050% | 4/27/26 | 1,390,000 | 1,317,596 (a) | |

MasTec Inc., Senior Notes | 4.500% | 8/15/28 | 1,763,000 | 1,682,691 (a) | |

Total Construction & Engineering | 3,000,287 | ||||

Electrical Equipment — 0.1% | |||||

Regal Rexnord Corp., Senior Notes | 6.300% | 2/15/30 | 310,000 | 317,065 | |

Regal Rexnord Corp., Senior Notes | 6.400% | 4/15/33 | 310,000 | 317,374 | |

Total Electrical Equipment | 634,439 | ||||

Ground Transportation — 0.8% | |||||

Uber Technologies Inc., Senior Notes | 8.000% | 11/1/26 | 1,760,000 | 1,777,209 (a) | |

Uber Technologies Inc., Senior Notes | 7.500% | 9/15/27 | 1,960,000 | 2,000,100 (a) | |

Total Ground Transportation | 3,777,309 | ||||

Passenger Airlines — 2.8% | |||||

Air Canada, Senior Secured Notes | 3.875% | 8/15/26 | 2,030,000 | 1,933,193 (a) | |

Air Canada Pass-Through Trust | 3.600% | 3/15/27 | 2,812,367 | 2,672,415 (a) | |

Air Canada Pass-Through Trust | 5.250% | 4/1/29 | 876,085 | 865,606 (a) | |

Air Canada Pass-Through Trust | 3.300% | 1/15/30 | 287,360 | 263,096 (a) | |

Allegiant Travel Co., Senior Secured Notes | 7.250% | 8/15/27 | 2,260,000 | 2,153,241 (a) | |

Continental Airlines Pass-Through Trust | 4.000% | 10/29/24 | 1,610,395 | 1,610,270 | |

Hawaiian Brand Intellectual Property Ltd./ HawaiianMiles Loyalty Ltd., Senior Secured Notes | 5.750% | 1/20/26 | 1,250,000 | 1,190,620 (a) | |

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd., Senior Secured Notes | 6.500% | 6/20/27 | 921,000 | 923,571 (a) | |

United Airlines Pass-Through Trust | 4.875% | 1/15/26 | 2,520,000 | 2,484,267 | |

Total Passenger Airlines | 14,096,279 | ||||

Trading Companies & Distributors — 1.8% | |||||

AerCap Holdings NV, Senior Notes (5.875% to 10/10/24 then 5 year Treasury Constant Maturity Rate + 4.535%) | 5.875% | 10/10/79 | 2,385,000 | 2,375,487 (d) | |

6

Security | Rate | Maturity Date | Face Amount† | Value | |

Trading Companies & Distributors — continued | |||||

Air Lease Corp., Junior Subordinated Notes, Non Voting Shares (4.125% to 12/15/26 then 5 year Treasury Constant Maturity Rate + 3.149%) | 4.125% | 12/15/26 | 2,057,000 | $1,864,595 (c)(d) | |

Aircastle Ltd., Junior Subordinated Notes (5.250% to 9/15/26 then 5 year Treasury Constant Maturity Rate + 4.410%) | 5.250% | 6/15/26 | 5,000,000 | 4,845,705 (a)(c)(d) | |

Total Trading Companies & Distributors | 9,085,787 | ||||

Transportation Infrastructure — 0.2% | |||||

Aeropuertos Dominicanos Siglo XXI SA, Senior Secured Notes | 7.000% | 6/30/34 | 990,000 | 1,003,564 (a)(e) | |

Total Industrials | 37,793,543 | ||||

Information Technology — 1.0% | |||||

Communications Equipment — 0.8% | |||||

Connect Finco SARL/Connect US Finco LLC, Senior Secured Notes | 6.750% | 10/1/26 | 2,100,000 | 2,028,623 (a) | |

Viasat Inc., Senior Secured Notes | 5.625% | 4/15/27 | 2,430,000 | 2,176,970 (a) | |

Total Communications Equipment | 4,205,593 | ||||

Technology Hardware, Storage & Peripherals — 0.2% | |||||

Seagate HDD Cayman, Senior Notes | 4.125% | 1/15/31 | 1,000,000 | 894,093 | |

Total Information Technology | 5,099,686 | ||||

Materials — 4.7% | |||||

Chemicals — 1.3% | |||||

Braskem Idesa SAPI, Senior Secured Notes | 7.450% | 11/15/29 | 1,080,000 | 880,150 (a) | |

Braskem Idesa SAPI, Senior Secured Notes | 6.990% | 2/20/32 | 1,095,000 | 831,449 (b) | |

Braskem Netherlands Finance BV, Senior Notes | 8.500% | 1/12/31 | 2,310,000 | 2,361,271 (a) | |

Mativ Holdings Inc., Senior Notes | 6.875% | 10/1/26 | 2,445,000 | 2,432,011 (a) | |

Total Chemicals | 6,504,881 | ||||

Containers & Packaging — 0.2% | |||||

Graham Packaging Co. Inc., Senior Notes | 7.125% | 8/15/28 | 1,030,000 | 974,094 (a) | |

Metals & Mining — 3.2% | |||||

Corp. Nacional del Cobre de Chile, Senior Notes | 6.440% | 1/26/36 | 820,000 | 848,714 (a) | |

CSN Resources SA, Senior Notes | 8.875% | 12/5/30 | 2,045,000 | 2,033,109 (a) | |

ERO Copper Corp., Senior Notes | 6.500% | 2/15/30 | 2,095,000 | 2,037,094 (a) | |

First Quantum Minerals Ltd., Senior Notes | 6.875% | 10/15/27 | 2,705,000 | 2,645,642 (a) | |

Mineral Resources Ltd., Senior Notes | 8.125% | 5/1/27 | 690,000 | 696,018 (a) | |

Mineral Resources Ltd., Senior Notes | 9.250% | 10/1/28 | 3,450,000 | 3,625,198 (a) | |

7

Security | Rate | Maturity Date | Face Amount† | Value | |

Metals & Mining — continued | |||||

Taseko Mines Ltd., Senior Secured Notes | 8.250% | 5/1/30 | 2,550,000 | $2,611,886 (a) | |

Vale Overseas Ltd., Senior Notes | 6.400% | 6/28/54 | 1,680,000 | 1,662,696 | |

Total Metals & Mining | 16,160,357 | ||||

Total Materials | 23,639,332 | ||||

Real Estate — 0.3% | |||||

Diversified REITs — 0.3% | |||||

Trust Fibra Uno, Senior Notes | 4.869% | 1/15/30 | 1,030,000 | 904,745 (b) | |

VICI Properties LP/VICI Note Co. Inc., Senior Notes | 4.625% | 6/15/25 | 460,000 | 454,370 (a) | |

Total Real Estate | 1,359,115 | ||||

Utilities — 0.6% | |||||

Electric Utilities — 0.1% | |||||

AES Panama Generation Holdings SRL, Senior Secured Notes | 4.375% | 5/31/30 | 825,187 | 718,152 (a) | |

Independent Power and Renewable Electricity Producers — 0.5% | |||||

Vistra Corp., Junior Subordinated Notes (7.000% to 12/15/26 then 5 year Treasury Constant Maturity Rate + 5.740%) | 7.000% | 12/15/26 | 1,310,000 | 1,299,868 (a)(c)(d) | |

Vistra Corp., Junior Subordinated Notes (8.000% to 10/15/26 then 5 year Treasury Constant Maturity Rate + 6.930%) | 8.000% | 10/15/26 | 1,095,000 | 1,105,256 (a)(c)(d) | |

Total Independent Power and Renewable Electricity Producers | 2,405,124 | ||||

Total Utilities | 3,123,276 | ||||

Total Corporate Bonds & Notes (Cost — $257,902,203) | 258,975,469 | ||||

Sovereign Bonds — 19.4% | |||||

Colombia — 3.6% | |||||

Colombian TES, Bonds | 7.000% | 3/26/31 | 87,810,000,000 COP | 17,820,481 | |

Mexico — 6.4% | |||||

Mexican Bonos, Bonds | 7.500% | 5/26/33 | 313,500,000 MXN | 14,759,604 | |

Mexican Bonos, Bonds | 8.000% | 7/31/53 | 290,400,000 MXN | 12,825,219 | |

Mexican Bonos, Senior Notes | 7.750% | 11/23/34 | 90,500,000 MXN | 4,260,648 | |

Total Mexico | 31,845,471 | ||||

Panama — 1.9% | |||||

Panama Government International Bond, Senior Notes | 3.870% | 7/23/60 | 8,280,000 | 4,741,398 | |

Panama Government International Bond, Senior Notes | 4.500% | 1/19/63 | 7,815,000 | 5,014,394 | |

Total Panama | 9,755,792 | ||||

8

Security | Rate | Maturity Date | Face Amount† | Value | |

Spain — 2.7% | |||||

Spain Government Bond, Senior Notes | 1.900% | 10/31/52 | 19,330,000 EUR | $13,592,581 (b) | |

United Kingdom — 4.8% | |||||

United Kingdom Gilt, Senior Notes | 3.750% | 10/22/53 | 22,250,000 GBP | 24,067,611 (b) | |

Total Sovereign Bonds (Cost — $98,045,281) | 97,081,936 | ||||

Collateralized Mortgage Obligations(f) — 13.3% | |||||

Bellemeade Re Ltd., 2023-1 M1B (30 Day Average SOFR + 4.250%) | 9.585% | 10/25/33 | 1,680,000 | 1,758,844 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2020-HQA4 B1 (30 Day Average SOFR + 5.364%) | 10.700% | 9/25/50 | 552,136 | 619,220 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2020-HQA5 B1 (30 Day Average SOFR + 4.000%) | 9.335% | 11/25/50 | 4,630,000 | 5,217,312 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2021-DNA5 B1 (30 Day Average SOFR + 3.050%) | 8.385% | 1/25/34 | 1,935,000 | 2,070,376 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA3 M1B (30 Day Average SOFR + 2.900%) | 8.235% | 4/25/42 | 1,800,000 | 1,872,930 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA3 M2 (30 Day Average SOFR + 4.350%) | 9.685% | 4/25/42 | 1,950,000 | 2,085,249 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA4 M1B (30 Day Average SOFR + 3.350%) | 8.685% | 5/25/42 | 1,500,000 | 1,576,746 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA4 M2 (30 Day Average SOFR + 5.250%) | 10.585% | 5/25/42 | 4,750,000 | 5,197,275 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA5 M1B (30 Day Average SOFR + 4.500%) | 9.835% | 6/25/42 | 2,740,000 | 2,975,696 (a)(d) | |

9

Security | Rate | Maturity Date | Face Amount† | Value | |

Collateralized Mortgage Obligations(f) — continued | |||||

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA5 M2 (30 Day Average SOFR + 6.750%) | 12.085% | 6/25/42 | 5,230,000 | $5,938,819 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA6 M2 (30 Day Average SOFR + 5.750%) | 11.085% | 9/25/42 | 1,860,000 | 2,081,870 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-DNA7 M1B (30 Day Average SOFR + 5.000%) | 10.335% | 3/25/52 | 1,890,000 | 2,085,592 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2022-HQA2 M2 (30 Day Average SOFR + 6.000%) | 11.335% | 7/25/42 | 990,000 | 1,100,938 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2023-DNA1 B1 (30 Day Average SOFR + 8.150%) | 13.485% | 3/25/43 | 2,940,000 | 3,396,147 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) REMIC, Structured Agency Credit Risk Debt Notes, 2023-HQA3 M2 (30 Day Average SOFR + 3.350%) | 8.685% | 11/25/43 | 2,560,000 | 2,716,749 (a)(d) | |

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2018-HQA2 M2B (30 Day Average SOFR + 2.414%) | 7.750% | 10/25/48 | 4,700,000 | 4,860,062 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2023-R07 2M2 (30 Day Average SOFR + 3.250%) | 8.585% | 9/25/43 | 2,680,000 | 2,821,009 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2017-C02 2M2C (30 Day Average SOFR + 3.764%) | 9.100% | 9/25/29 | 845,000 | 891,348 (d) | |

Federal National Mortgage Association (FNMA) — CAS, 2017-C06 2M2 (30 Day Average SOFR + 2.914%) | 8.250% | 2/25/30 | 520,368 | 538,813 (d) | |

Federal National Mortgage Association (FNMA) — CAS, 2020-R01 1B1 (30 Day Average SOFR + 3.364%) | 8.700% | 1/25/40 | 1,450,000 | 1,512,603 (a)(d) | |

10

Security | Rate | Maturity Date | Face Amount† | Value | |

Collateralized Mortgage Obligations(f) — continued | |||||

Federal National Mortgage Association (FNMA) — CAS, 2020-SBT1 1M2 (30 Day Average SOFR + 3.764%) | 9.100% | 2/25/40 | 2,920,000 | $3,105,708 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2021-R02 2B1 (30 Day Average SOFR + 3.300%) | 8.635% | 11/25/41 | 2,260,000 | 2,342,761 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2022-R02 2B1 (30 Day Average SOFR + 4.500%) | 9.835% | 1/25/42 | 870,000 | 917,035 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2023-R02 1B1 (30 Day Average SOFR + 5.550%) | 10.885% | 1/25/43 | 1,640,000 | 1,818,031 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2023-R04 1B1 (30 Day Average SOFR + 5.350%) | 10.685% | 5/25/43 | 2,200,000 | 2,429,702 (a)(d) | |

Federal National Mortgage Association (FNMA) — CAS, 2023-R07 2B1 (30 Day Average SOFR + 4.500%) | 9.835% | 9/25/43 | 4,340,000 | 4,629,954 (a)(d) | |

Total Collateralized Mortgage Obligations (Cost — $65,666,991) | 66,560,789 | ||||

Asset-Backed Securities — 2.5% | |||||

Allegro CLO Ltd., 2022-1A D (3 mo. Term SOFR + 3.650%) | 8.975% | 7/20/35 | 2,550,000 | 2,554,610 (a)(d) | |

Bain Capital Credit CLO Ltd., 2023-3A D (3 mo. Term SOFR + 5.250%) | 10.573% | 7/24/36 | 2,880,000 | 2,986,417 (a)(d) | |

BlueMountain CLO Ltd., 2021-28A D (3 mo. Term SOFR + 3.162%) | 8.490% | 4/15/34 | 1,160,000 | 1,145,598 (a)(d) | |

Frontier Issuer LLC, 2024-1 A2 | 6.190% | 6/20/54 | 1,080,000 | 1,083,195 (a)(e) | |

OHA Credit Funding Ltd., 2018-1A D1R (3 mo. Term SOFR + 3.600%) | 8.913% | 4/20/37 | 2,560,000 | 2,596,865 (a)(d) | |

TCW CLO Ltd., 2021-1A D1 (3 mo. Term SOFR + 3.262%) | 8.586% | 3/18/34 | 2,130,000 | 2,141,231 (a)(d) | |

Total Asset-Backed Securities (Cost — $12,496,320) | 12,507,916 | ||||

Senior Loans — 1.7% | |||||

Energy — 0.8% | |||||

Oil, Gas & Consumable Fuels — 0.8% | |||||

New Fortress Energy Inc., Initial Term Loan (3 mo. Term SOFR + 5.000%) | 10.330% | 10/30/28 | 3,980,000 | 3,882,988 (d)(g)(h) | |

11

Security | Rate | Maturity Date | Face Amount† | Value | |

Health Care — 0.2% | |||||

Health Care Providers & Services — 0.2% | |||||

Star Parent Inc., Term Loan B (3 mo. Term SOFR + 3.750%) | 9.085% | 9/27/30 | 1,147,125 | $1,147,578 (d)(g)(h) | |

Industrials — 0.5% | |||||

Passenger Airlines — 0.5% | |||||

WestJet Loyalty LP, Initial Term Loan (3 mo. Term SOFR + 3.750%) | 9.048% | 2/14/31 | 2,300,000 | 2,313,225 (d)(g)(h) | |

Information Technology — 0.2% | |||||

IT Services — 0.2% | |||||

Sabre GLBL Inc., 2022 Term Loan B2 (1 mo. Term SOFR + 5.100%) | 10.444% | 6/30/28 | 1,426,476 | 1,312,586 (d)(g)(h) | |

Total Senior Loans (Cost — $8,449,997) | 8,656,377 | ||||

Convertible Bonds & Notes — 0.9% | |||||

Communication Services — 0.5% | |||||

Media — 0.5% | |||||

DISH Network Corp., Senior Notes | 3.375% | 8/15/26 | 3,949,000 | 2,468,757 | |

Industrials — 0.4% | |||||

Air Freight & Logistics — 0.4% | |||||

Air Transport Services Group Inc., Senior Notes | 3.875% | 8/15/29 | 2,000,000 | 1,701,930 (a) | |

Total Convertible Bonds & Notes (Cost — $5,386,178) | 4,170,687 | ||||

Total Investments before Short-Term Investments (Cost — $447,946,970) | 447,953,174 | ||||

Short-Term Investments — 10.3% | |||||

Sovereign Bonds — 4.0% | |||||

Egypt Treasury Bills | 26.407% | 10/22/24 | 230,500,000 EGP | 4,461,273 (i) | |

Egypt Treasury Bills | 26.590% | 12/17/24 | 412,800,000 EGP | 7,703,074 (i) | |

Egypt Treasury Bills | 26.210% | 3/11/25 | 450,000,000 EGP | 7,971,523 (i) | |

Total Sovereign Bonds (Cost — $19,812,248) | 20,135,870 | ||||

Shares | |||||

Money Market Funds — 6.3% | |||||

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares (Cost — $31,169,100) | 5.235% | 31,169,100 | 31,169,100 (j)(k) | ||

Total Short-Term Investments (Cost — $50,981,348) | 51,304,970 | ||||

Total Investments — 99.9% (Cost — $498,928,318) | 499,258,144 | ||||

Other Assets in Excess of Liabilities — 0.1% | 618,040 | ||||

Total Net Assets — 100.0% | $499,876,184 | ||||

12

† | Face amount denominated in U.S. dollars, unless otherwise noted. |

(a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

(b) | Security is exempt from registration under Regulation S of the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

(c) | Security has no maturity date. The date shown represents the next call date. |

(d) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

(e) | Securities traded on a when-issued or delayed delivery basis. |

(f) | Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments on underlying collateral to different series or classes of the obligations. The interest rate may change positively or inversely in relation to one or more interest rates, financial indices or other financial indicators and may be subject to an upper and/or lower limit. |

(g) | Interest rates disclosed represent the effective rates on senior loans. Ranges in interest rates are attributable to multiple contracts under the same loan. |

(h) | Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. |

(i) | Rate shown represents yield-to-maturity. |

(j) | Rate shown is one-day yield as of the end of the reporting period. |

(k) | In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Fund ownership of at least 5% of the outstanding voting securities of an issuer, or a company which is under common ownership or control with the Fund. At June 30, 2024, the total market value of investments in Affiliated Companies was $31,169,100 and the cost was $31,169,100 (Note 8). |

Abbreviation(s) used in this schedule: | ||

CAS | — | Connecticut Avenue Securities |

CLO | — | Collateralized Loan Obligation |

COP | — | Colombian Peso |

EGP | — | Egyptian Pound |

EUR | — | Euro |

GBP | — | British Pound |

MXN | — | Mexican Peso |

REMIC | — | Real Estate Mortgage Investment Conduit |

SOFR | — | Secured Overnight Financing Rate |

13

Number of Contracts | Expiration Date | Notional Amount | Market Value | Unrealized Appreciation | |

Contracts to Buy: | |||||

U.S. Treasury Ultra 10-Year Notes | 277 | 9/24 | $30,971,807 | $31,448,156 | $476,349 |

Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||

CLP | 6,580,000,000 | USD | 7,341,128 | HSBC Securities Inc. | 7/17/24 | $(350,033 ) |

USD | 7,105,064 | CLP | 6,580,000,000 | HSBC Securities Inc. | 7/17/24 | 113,970 |

BRL | 49,020,000 | USD | 9,519,186 | HSBC Securities Inc. | 7/19/24 | (772,148 ) |

USD | 4,549,457 | BRL | 23,770,000 | HSBC Securities Inc. | 7/19/24 | 307,981 |

USD | 4,748,026 | BRL | 25,250,000 | HSBC Securities Inc. | 7/19/24 | 242,462 |

MXN | 18,900,000 | USD | 1,013,985 | Citibank N.A. | 7/29/24 | 14,036 |

MXN | 155,600,000 | USD | 8,614,724 | Citibank N.A. | 7/29/24 | (151,226 ) |

MXN | 251,500,000 | USD | 14,571,854 | Citibank N.A. | 7/29/24 | (892,100 ) |

USD | 4,916,551 | MXN | 87,000,000 | Citibank N.A. | 7/29/24 | 184,390 |

USD | 8,893,324 | MXN | 164,000,000 | Citibank N.A. | 7/29/24 | (27,073 ) |

USD | 15,917,592 | MXN | 276,600,000 | Citibank N.A. | 7/29/24 | 872,583 |

USD | 18,173,423 | MXN | 307,000,000 | Citibank N.A. | 7/29/24 | 1,474,877 |

COP | 35,620,000,000 | USD | 8,656,031 | JPMorgan Chase & Co. | 7/30/24 | (124,606 ) |

USD | 17,170,971 | COP | 68,580,000,000 | JPMorgan Chase & Co. | 7/30/24 | 745,223 |

USD | 13,420,565 | EUR | 12,510,000 | JPMorgan Chase & Co. | 8/7/24 | (3,216 ) |

USD | 23,215,393 | GBP | 18,150,000 | Citibank N.A. | 9/10/24 | 259,381 |

USD | 576,043 | GBP | 450,000 | HSBC Securities Inc. | 9/10/24 | 6,886 |

Net unrealized appreciation on open forward foreign currency contracts | $1,901,387 | |||||

Abbreviation(s) used in this table: | ||

BRL | — | Brazilian Real |

CLP | — | Chilean Peso |

COP | — | Colombian Peso |

EUR | — | Euro |

GBP | — | British Pound |

MXN | — | Mexican Peso |

USD | — | United States Dollar |

14

CENTRALLY CLEARED CREDIT DEFAULT SWAPS ON CREDIT INDICES — SELL PROTECTION1 | ||||||

Reference Entity | Notional Amount2* | Termination Date | Periodic Payments Received by the Fund† | Market Value3 | Upfront Premiums Paid (Received) | Unrealized Appreciation |

Markit CDX.NA.IG.34 Index | 14,685,000 | 6/20/25 | 1.000% quarterly | $122,191 | $30,422 | $91,769 |

Markit iTraxx Europe Index | 295,000EUR | 12/20/24 | 1.000% quarterly | 1,411 | 10 | 1,401 |

Markit iTraxx Europe Index | 5,150,000EUR | 6/20/25 | 1.000% quarterly | 46,555 | 31,771 | 14,784 |

Total | $170,157 | $62,203 | $107,954 | |||

OTC CREDIT DEFAULT SWAPS ON SOVEREIGN ISSUES - SELL PROTECTION1 | |||||||

Swap Counterparty (Reference Entity) | Notional Amount2 | Termination Date | Implied Credit Spread at June 30, 20244 | Periodic Payments Received by the Fund† | Market Value | Upfront Premiums Paid (Received) | Unrealized Depreciation |

Barclays Bank PLC (Panama Government International Bond, 8.875%, due 9/30/ 27) | $2,940,000 | 12/20/28 | 1.622% | 1.000% quarterly | $(72,684) | $(70,970) | $(1,714) |

JPMorgan Chase & Co. (Panama Government International Bond, 8.875%, due 9/30/ 27) | 2,880,000 | 12/20/28 | 1.622% | 1.000% quarterly | (71,201) | (70,899) | (302) |

Total | $5,820,000 | $(143,885) | $(141,869) | $(2,016) | |||

15

1 | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

2 | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

3 | The quoted market prices and resulting values for credit default swap agreements on asset-backed securities and credit indices serve as an indicator of the current status of the payment/performance risk and represent the likelihood of an expected loss (or profit) for the credit derivative had the notional amount of the swap agreement been closed/sold as of the period end. Decreasing market values (sell protection) or increasing market values (buy protection), when compared to the notional amount of the swap, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. |

4 | Implied credit spreads, utilized in determining the market value of credit default swap agreements on corporate or sovereign issues as of period end, serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

† | Percentage shown is an annual percentage rate. |

* | Notional amount denominated in U.S. dollars, unless otherwise noted. |

Abbreviation(s) used in this table: | ||

EUR | — | Euro |

16

Summary of Investments by Country# | |

United States | 45.6 % |

Mexico | 9.9 |

United Kingdom | 5.5 |

Canada | 4.9 |

Colombia | 3.8 |

Israel | 3.4 |

Spain | 2.7 |

Brazil | 2.6 |

Panama | 2.1 |

Cayman Islands | 1.7 |

Argentina | 1.3 |

Ireland | 1.2 |

Switzerland | 0.9 |

Australia | 0.9 |

France | 0.6 |

Jersey | 0.6 |

Zambia | 0.5 |

Bermuda | 0.5 |

Chile | 0.4 |

Czech Republic | 0.4 |

Dominican Republic | 0.2 |

Short-Term Investments | 10.3 |

100.0 % | |

# | As a percentage of total investments. Please note that the Fund holdings are as of June 30, 2024 and are subject to change. |

17

Assets: | |

Investments in unaffiliated securities, at value (Cost — $467,759,218) | $468,089,044 |

Investments in affiliated securities, at value (Cost — $31,169,100) | 31,169,100 |

Foreign currency, at value (Cost — $1,003) | 999 |

Cash | 1,037,957 |

Interest receivable | 6,526,941 |

Unrealized appreciation on forward foreign currency contracts | 4,221,789 |

Receivable for securities sold | 2,791,364 |

Deposits with brokers for open futures contracts | 857,496 |

Receivable for Fund shares sold | 854,508 |

Deposits with brokers for OTC derivatives | 270,000 |

Deposits with brokers for centrally cleared swap contracts | 163,366 |

Dividends receivable from affiliated investments | 150,254 |

Receivable from brokers — net variation margin on centrally cleared swap contracts | 50,494 |

Receivable for open OTC swap contracts | 1,779 |

Prepaid expenses | 15,565 |

Total Assets | 516,200,656 |

Liabilities: | |

Payable for securities purchased | 10,289,876 |

Unrealized depreciation on forward foreign currency contracts | 2,320,402 |

Payable for Fund shares repurchased | 2,254,171 |

Deposits from brokers for OTC derivatives | 560,000 |

Investment management fee payable | 227,249 |

Distributions payable | 211,540 |

OTC swaps, at value (premiums received — $141,869) | 143,885 |

Payable to brokers — net variation margin on open futures contracts | 134,173 |

Accrued foreign capital gains tax | 52,034 |

Service and/or distribution fees payable | 15,612 |

Trustees’ fees payable | 5,316 |

Accrued expenses | 110,214 |

Total Liabilities | 16,324,472 |

Total Net Assets | $499,876,184 |

Net Assets: | |

Par value (Note 7) | $525 |

Paid-in capital in excess of par value | 540,390,268 |

Total distributable earnings (loss) | (40,514,609 ) |

Total Net Assets | $499,876,184 |

18

Net Assets: | |

Class A | $56,054,847 |

Class C | $5,216,545 |

Class I | $325,403,106 |

Class IS | $113,201,686 |

Shares Outstanding: | |

Class A | 5,895,535 |

Class C | 552,868 |

Class I | 34,182,841 |

Class IS | 11,874,668 |

Net Asset Value: | |

Class A (and redemption price) | $9.51 |

Class C* | $9.44 |

Class I (and redemption price) | $9.52 |

Class IS (and redemption price) | $9.53 |

Maximum Public Offering Price Per Share: | |

Class A (based on maximum initial sales charge of 3.75%) | $9.88 |

* | Redemption price per share is NAV of Class C shares reduced by a 1.00% CDSC if shares are redeemed within one year from purchase payment (Note 2). |

19

Investment Income: | |

Interest | $18,131,748 |

Dividends from affiliated investments | 538,988 |

Less: Foreign taxes withheld | (39,764 ) |

Total Investment Income | 18,630,972 |

Expenses: | |

Investment management fee (Note 2) | 1,275,170 |

Transfer agent fees (Notes 2 and 5) | 164,127 |

Service and/or distribution fees (Notes 2 and 5) | 87,302 |

Registration fees | 48,161 |

Fees recaptured by investment manager (Note 2) | 44,074 |

Fund accounting fees | 39,103 |

Audit and tax fees | 23,036 |

Custody fees | 20,125 |

Legal fees | 17,599 |

Shareholder reports | 15,802 |

Trustees’ fees | 14,125 |

Commitment fees (Note 9) | 1,907 |

Insurance | 1,632 |

Miscellaneous expenses | 6,951 |

Total Expenses | 1,759,114 |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | (8,913 ) |

Net Expenses | 1,750,201 |

Net Investment Income | 16,880,771 |

Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): | |

Net Realized Gain (Loss) From: | |

Investment transactions in unaffiliated securities | (2,720,697 )† |

Futures contracts | 194,512 |

Swap contracts | 103,401 |

Forward foreign currency contracts | 1,630,213 |

Foreign currency transactions | 3,665 |

Net Realized Loss | (788,906 ) |

Change in Net Unrealized Appreciation (Depreciation) From: | |

Investments in unaffiliated securities | (8,369,953 )‡ |

Futures contracts | (4,008,441 ) |

Swap contracts | (42,452 ) |

Forward foreign currency contracts | 725,423 |

Foreign currencies | (168,075 ) |

Change in Net Unrealized Appreciation (Depreciation) | (11,863,498 ) |

Net Loss on Investments, Futures Contracts, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions | (12,652,404 ) |

Increase in Net Assets From Operations | $4,228,367 |

† | Net of foreign capital gains tax of $29,097. |

‡ | Net of change in accrued foreign capital gains tax of $52,034. |

20

For the Six Months Ended June 30, 2024 (unaudited) and the Year Ended December 31, 2023 | 2024 | 2023 |

Operations: | ||

Net investment income | $16,880,771 | $21,985,915 |

Net realized loss | (788,906 ) | (23,312,741 ) |

Change in net unrealized appreciation (depreciation) | (11,863,498 ) | 31,663,700 |

Increase in Net Assets From Operations | 4,228,367 | 30,336,874 |

Distributions to Shareholders From (Notes 1 and 6): | ||

Total distributable earnings | (16,200,035 ) | (21,900,060 ) |

Decrease in Net Assets From Distributions to Shareholders | (16,200,035 ) | (21,900,060 ) |

Fund Share Transactions (Note 7): | ||

Net proceeds from sale of shares | 148,152,688 | 394,294,251 |

Reinvestment of distributions | 15,871,043 | 21,617,765 |

Cost of shares repurchased | (75,951,771 ) | (224,373,612 ) |

Increase in Net Assets From Fund Share Transactions | 88,071,960 | 191,538,404 |

Increase in Net Assets | 76,100,292 | 199,975,218 |

Net Assets: | ||

Beginning of period | 423,775,892 | 223,800,674 |

End of period | $499,876,184 | $423,775,892 |

21

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||||

Class A Shares1 | 20242 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $9.75 | $9.41 | $10.89 | $11.09 | $10.01 | $9.59 |

Income (loss) from operations: | ||||||

Net investment income | 0.34 | 0.53 | 0.28 | 0.27 | 0.29 | 0.25 |

Net realized and unrealized gain (loss) | (0.27 ) | 0.31 | (1.48 ) | (0.18 ) | 1.18 | 0.75 |

Total income (loss) from operations | 0.07 | 0.84 | (1.20) | 0.09 | 1.47 | 1.00 |

Less distributions from: | ||||||

Net investment income | (0.31 ) | (0.50 ) | (0.24 ) | (0.27 ) | (0.30 ) | (0.46 ) |

Net realized gains | — | — | — | (0.02 ) | (0.09 ) | (0.12 ) |

Return of capital | — | — | (0.04 ) | — | — | — |

Total distributions | (0.31 ) | (0.50 ) | (0.28 ) | (0.29 ) | (0.39 ) | (0.58 ) |

Net asset value, end of period | $9.51 | $9.75 | $9.41 | $10.89 | $11.09 | $10.01 |

Total return3 | 0.76 % | 9.33 % | (11.15 )% | 0.79 % | 14.84 % | 10.41 % |

Net assets, end of period (000s) | $56,055 | $45,310 | $23,467 | $20,721 | $18,028 | $165 |

Ratios to average net assets: | ||||||

Gross expenses | 0.94 %4 | 0.98 % | 1.10 % | 1.07 % | 1.97 % | 4.05 % |

Net expenses5,6 | 0.93 4 | 0.97 | 1.04 | 0.95 | 0.96 | 0.98 |

Net investment income | 7.11 4 | 5.55 | 2.81 | 2.41 | 2.73 | 2.45 |

Portfolio turnover rate | 44 % | 138 % | 122 % | 55 % | 104 % | 356 % |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

4 | Annualized. |

5 | Reflects fee waivers and/or expense reimbursements. |

6 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend and interest expense on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class A shares did not exceed 1.10%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

22

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||

Class C Shares1 | 20242 | 2023 | 2022 | 20213 |

Net asset value, beginning of period | $9.68 | $9.35 | $10.88 | $11.03 |

Income (loss) from operations: | ||||

Net investment income | 0.30 | 0.46 | 0.28 | 0.03 |

Net realized and unrealized gain (loss) | (0.26 ) | 0.32 | (1.56 ) | (0.10 ) |

Total income (loss) from operations | 0.04 | 0.78 | (1.28) | (0.07) |

Less distributions from: | ||||

Net investment income | (0.28 ) | (0.45 ) | (0.18 ) | (0.06 ) |

Net realized gains | — | — | — | (0.02 ) |

Return of capital | — | — | (0.07 ) | — |

Total distributions | (0.28 ) | (0.45 ) | (0.25 ) | (0.08 ) |

Net asset value, end of period | $9.44 | $9.68 | $9.35 | $10.88 |

Total return4 | 0.41 % | 8.54 % | (11.79 )% | (0.68 )% |

Net assets, end of period (000s) | $5,217 | $4,483 | $1,280 | $43 |

Ratios to average net assets: | ||||

Gross expenses | 1.68 %5 | 1.70 % | 1.86 %6 | 2.05 %5 |

Net expenses7,8 | 1.67 5 | 1.70 | 1.80 6 | 1.85 5 |

Net investment income | 6.36 5 | 4.92 | 2.91 | 1.07 5 |

Portfolio turnover rate | 44 % | 138 % | 122 % | 55 %9 |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | For the period September 30, 2021 (inception date) to December 31, 2021. |

4 | Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

5 | Annualized. |

6 | Reflects recapture of fees waived and/or expenses reimbursed from prior fiscal years. |

7 | Reflects fee waivers and/or expense reimbursements. |

8 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend and interest expense on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class C shares did not exceed 1.85%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

9 | For the year ended December 31, 2021. |

23

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||||

Class I Shares1 | 20242 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $9.76 | $9.41 | $10.90 | $11.10 | $10.01 | $9.59 |

Income (loss) from operations: | ||||||

Net investment income | 0.35 | 0.55 | 0.31 | 0.28 | 0.36 | 0.28 |

Net realized and unrealized gain (loss) | (0.27 ) | 0.32 | (1.49 ) | (0.16 ) | 1.13 | 0.75 |

Total income (loss) from operations | 0.08 | 0.87 | (1.18) | 0.12 | 1.49 | 1.03 |

Less distributions from: | ||||||

Net investment income | (0.32 ) | (0.52 ) | (0.26 ) | (0.30 ) | (0.31 ) | (0.49 ) |

Net realized gains | — | — | — | (0.02 ) | (0.09 ) | (0.12 ) |

Return of capital | — | — | (0.05 ) | — | — | — |

Total distributions | (0.32 ) | (0.52 ) | (0.31 ) | (0.32 ) | (0.40 ) | (0.61 ) |

Net asset value, end of period | $9.52 | $9.76 | $9.41 | $10.90 | $11.10 | $10.01 |

Total return3 | 0.84 % | 9.54 % | (10.86 )% | 1.05 % | 15.00 % | 10.84 % |

Net assets, end of period (000s) | $325,403 | $282,910 | $150,839 | $115,293 | $22,371 | $126 |

Ratios to average net assets: | ||||||

Gross expenses | 0.75 %4,5 | 0.75 % | 0.85 % | 0.82 % | 1.69 % | 3.75 % |

Net expenses6,7 | 0.75 4,5 | 0.75 | 0.75 | 0.70 | 0.68 | 0.68 |

Net investment income | 7.29 4 | 5.76 | 3.16 | 2.55 | 3.30 | 2.75 |

Portfolio turnover rate | 44 % | 138 % | 122 % | 55 % | 104 % | 356 % |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

4 | Annualized. |

5 | Reflects recapture of fees waived and/or expenses reimbursed from prior fiscal years. |

6 | Reflects fee waivers and/or expense reimbursements. |

7 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend and interest expense on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 0.75%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

24

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||||

Class IS Shares1 | 20242 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $9.78 | $9.42 | $10.91 | $11.11 | $10.02 | $9.59 |

Income (loss) from operations: | ||||||

Net investment income | 0.36 | 0.56 | 0.30 | 0.29 | 0.32 | 0.28 |

Net realized and unrealized gain (loss) | (0.28 ) | 0.33 | (1.47 ) | (0.17 ) | 1.18 | 0.76 |

Total income (loss) from operations | 0.08 | 0.89 | (1.17) | 0.12 | 1.50 | 1.04 |

Less distributions from: | ||||||

Net investment income | (0.33 ) | (0.53 ) | (0.28 ) | (0.30 ) | (0.32 ) | (0.49 ) |

Net realized gains | — | — | — | (0.02 ) | (0.09 ) | (0.12 ) |

Return of capital | — | — | (0.04 ) | — | — | — |

Total distributions | (0.33 ) | (0.53 ) | (0.32 ) | (0.32 ) | (0.41 ) | (0.61 ) |

Net asset value, end of period | $9.53 | $9.78 | $9.42 | $10.91 | $11.11 | $10.02 |

Total return3 | 0.79 % | 9.74 % | (10.77 )% | 1.09 % | 15.12 % | 10.87 % |

Net assets, end of period (000s) | $113,202 | $91,073 | $48,214 | $106,752 | $27,676 | $6,140 |

Ratios to average net assets: | ||||||

Gross expenses | 0.64 %4,5 | 0.65 % | 0.71 % | 0.77 % | 1.66 % | 3.73 %5 |

Net expenses6,7 | 0.64 4,5 | 0.65 | 0.65 | 0.65 | 0.65 | 0.65 5 |

Net investment income | 7.40 4 | 5.80 | 2.96 | 2.65 | 2.99 | 2.78 |

Portfolio turnover rate | 44 % | 138 % | 122 % | 55 % | 104 % | 356 % |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

4 | Annualized. |

5 | Reflects recapture of fees waived and/or expenses reimbursed from prior fiscal years. |

6 | Reflects fee waivers and/or expense reimbursements. |

7 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, dividend and interest expense on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class IS shares did not exceed 0.65%. In addition, the ratio of total annual fund operating expenses for Class IS shares did not exceed the ratio of total annual fund operating expenses for Class I shares. These expense limitation arrangements cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

25

26

27

ASSETS | ||||

Description | Quoted Prices (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total |

Long-Term Investments†: | ||||

Corporate Bonds & Notes | — | $258,975,469 | — | $258,975,469 |

Sovereign Bonds | — | 97,081,936 | — | 97,081,936 |

Collateralized Mortgage Obligations | — | 66,560,789 | — | 66,560,789 |

Asset-Backed Securities | — | 12,507,916 | — | 12,507,916 |

Senior Loans | — | 8,656,377 | — | 8,656,377 |

Convertible Bonds & Notes | — | 4,170,687 | — | 4,170,687 |

Total Long-Term Investments | — | 447,953,174 | — | 447,953,174 |

Short-Term Investments†: | ||||

Sovereign Bonds | — | 20,135,870 | — | 20,135,870 |

Money Market Funds | $31,169,100 | — | — | 31,169,100 |

Total Short-Term Investments | 31,169,100 | 20,135,870 | — | 51,304,970 |

Total Investments | $31,169,100 | $468,089,044 | — | $499,258,144 |

Other Financial Instruments: | ||||

Futures Contracts†† | $476,349 | — | — | $476,349 |

Forward Foreign Currency Contracts†† | — | $4,221,789 | — | 4,221,789 |

Centrally Cleared Credit Default Swaps on Credit Indices — Sell Protection†† | — | 107,954 | — | 107,954 |

Total Other Financial Instruments | $476,349 | $4,329,743 | — | $4,806,092 |

Total | $31,645,449 | $472,418,787 | — | $504,064,236 |

28

LIABILITIES | ||||

Description | Quoted Prices (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total |

Other Financial Instruments: | ||||

Forward Foreign Currency Contracts†† | — | $2,320,402 | — | $2,320,402 |

OTC Credit Default Swaps on Sovereign Issues — Sell Protection | — | 143,885 | — | 143,885 |

Total | — | $2,464,287 | — | $2,464,287 |

† | See Schedule of Investments for additional detailed categorizations. |

†† | Reflects the unrealized appreciation (depreciation) of the instruments. |

29

30

31

32

33

34

35

36

During the six months ended June 30, 2024, fees waived and/or expenses reimbursed amounted to $8,913, all of which was an affiliated money market fund waiver.

Class A | Class C | Class I | Class IS | |

Expires December 31, 2024 | $24,266 | $7 | $65,710 | $50,591 |

Expires December 31, 2025 | 15,712 | 315 | 103,473 | 40,156 |

Expires December 31, 2026 | — | — | 6,545 | — |

Expires December 31, 2027 | — | — | — | — |

Total fee waivers/expense reimbursements subject to recapture | $39,978 | $322 | $175,728 | $90,747 |

37

Class I | Class IS | |

FTFA recaptured | $39,734 | $4,340 |

Class A | Class C | |

Sales charges | $1,964 | — |

CDSCs | 98 | $200 |

38

Investments | U.S. Government & Agency Obligations | |

Purchases | $214,757,780 | $42,118,991 |

Sales | 161,582,885 | 26,699,722 |

Cost/Premiums Paid (Received) | Gross Unrealized Appreciation | Gross Unrealized Depreciation | Net Unrealized Appreciation | |

Securities | $498,928,318 | $9,479,739 | $(9,149,913) | $329,826 |

Futures contracts | — | 476,349 | — | 476,349 |

Forward foreign currency contracts | — | 4,221,789 | (2,320,402) | 1,901,387 |

Swap contracts | (79,666) | 107,954 | (2,016) | 105,938 |

ASSET DERIVATIVES1 | ||||

Interest Rate Risk | Foreign Exchange Risk | Credit Risk | Total | |

Futures contracts2 | $476,349 | — | — | $476,349 |

Forward foreign currency contracts | — | $4,221,789 | — | 4,221,789 |

Centrally cleared swap contracts3 | — | — | $107,954 | 107,954 |

Total | $476,349 | $4,221,789 | $107,954 | $4,806,092 |

LIABILITY DERIVATIVES1 | |||

Foreign Exchange Risk | Credit Risk | Total | |

Forward foreign currency contracts | $2,320,402 | — | $2,320,402 |

OTC swap contracts4 | — | $143,885 | 143,885 |

Total | $2,320,402 | $143,885 | $2,464,287 |

39

1 | Generally, the balance sheet location for asset derivatives is receivables/net unrealized appreciation and for liability derivatives is payables/net unrealized depreciation. |

2 | Includes cumulative unrealized appreciation (depreciation) of futures contracts as reported in the Schedule of Investments. Only net variation margin is reported within the receivables and/or payables on the Statement of Assets and Liabilities. |

3 | Includes cumulative unrealized appreciation (depreciation) of centrally cleared swap contracts as reported in the Schedule of Investments. Only net variation margin is reported within the receivables and/or payables on the Statement of Assets and Liabilities. |

4 | Values include premiums paid (received) on swap contracts which are shown separately in the Statement of Assets and Liabilities. |

AMOUNT OF NET REALIZED GAIN (LOSS) ON DERIVATIVES RECOGNIZED | ||||

Interest Rate Risk | Foreign Exchange Risk | Credit Risk | Total | |

Futures contracts | $194,512 | — | — | $194,512 |

Swap contracts | — | — | $103,401 | 103,401 |

Forward foreign currency contracts | — | $1,630,213 | — | 1,630,213 |

Total | $194,512 | $1,630,213 | $103,401 | $1,928,126 |

CHANGE IN NET UNREALIZED APPRECIATION (DEPRECIATION) ON DERIVATIVES RECOGNIZED | ||||

Interest Rate Risk | Foreign Exchange Risk | Credit Risk | Total | |

Futures contracts | $(4,008,441 ) | — | — | $(4,008,441 ) |

Swap contracts | — | — | $(42,452 ) | (42,452 ) |

Forward foreign currency contracts | — | $725,423 | — | 725,423 |

Total | $(4,008,441 ) | $725,423 | $(42,452 ) | $(3,325,470 ) |

Average Market Value | |

Futures contracts (to buy) | $43,277,201 |

Forward foreign currency contracts (to buy) | 25,675,225 |

Forward foreign currency contracts (to sell) | 68,654,023 |

Average Notional Balance | |

Credit default swap contracts (sell protection) | $23,897,148 |

40

Counterparty | Gross Assets Subject to Master Agreements1 | Gross Liabilities Subject to Master Agreements1 | Net Assets (Liabilities) Subject to Master Agreements | Collateral Pledged (Received)2,3 | Net Amount4,5 |

Barclays Bank PLC | — | $(72,684) | $(72,684) | — | $(72,684) |

Citibank N.A. | $2,805,267 | (1,070,399) | 1,734,868 | — | 1,734,868 |

HSBC Securities Inc. | 671,299 | (1,122,181) | (450,882) | $270,000 | (180,882) |

JPMorgan Chase & Co. | 745,223 | (199,023) | 546,200 | (560,000) | (13,800) |

Total | $4,221,789 | $(2,464,287) | $1,757,502 | $(290,000) | $1,467,502 |

1 | Absent an event of default or early termination, derivative assets and liabilities are presented gross and not offset in the Statement of Assets and Liabilities. |

2 | Gross amounts are not offset in the Statement of Assets and Liabilities. |

3 | In some instances, the actual collateral received and/or pledged may be more than the amount shown here due to overcollateralization. |

4 | Net amount may also include forward foreign currency exchange contracts that are not required to be collateralized. |

5 | Represents the net amount receivable (payable) from (to) the counterparty in the event of default. |

Service and/or Distribution Fees | Transfer Agent Fees | |

Class A | $62,974 | $14,087 |

Class C | 24,328 | 1,126 |

Class I | — | 147,587 |

Class IS | — | 1,327 |

Total | $87,302 | $164,127 |

41

Waivers/Expense Reimbursements | |

Class A | $968 |

Class C | 93 |

Class I | 6,042 |

Class IS | 1,810 |

Total | $8,913 |

Six Months Ended June 30, 2024 | Year Ended December 31, 2023 | |

Net Investment Income: | ||

Class A | $1,725,019 | $2,074,445 |

Class C | 147,669 | 158,486 |

Class I | 10,787,507 | 13,464,813 |

Class IS | 3,539,840 | 6,202,316 |

Total | $16,200,035 | $21,900,060 |

Six Months Ended June 30, 2024 | Year Ended December 31, 2023 | |||

Shares | Amount | Shares | Amount | |

Class A | ||||

Shares sold | 1,614,700 | $15,590,046 | 3,196,857 | $30,553,833 |

Shares issued on reinvestment | 176,899 | 1,697,295 | 214,484 | 2,035,729 |

Shares repurchased | (542,513 ) | (5,243,585 ) | (1,260,070 ) | (11,831,520 ) |

Net increase | 1,249,086 | $12,043,756 | 2,151,271 | $20,758,042 |

Class C | ||||

Shares sold | 144,311 | $1,383,011 | 524,871 | $4,972,114 |

Shares issued on reinvestment | 15,453 | 147,200 | 16,767 | 157,845 |

Shares repurchased | (70,036 ) | (672,234 ) | (215,370 ) | (2,007,349 ) |

Net increase | 89,728 | $857,977 | 326,268 | $3,122,610 |

42

Six Months Ended June 30, 2024 | Year Ended December 31, 2023 | |||

Shares | Amount | Shares | Amount | |

Class I | ||||

Shares sold | 10,192,981 | $98,663,524 | 22,612,011 | $216,101,285 |

Shares issued on reinvestment | 1,091,811 | 10,493,379 | 1,391,828 | 13,226,587 |

Shares repurchased | (6,080,647 ) | (58,864,204 ) | (11,050,871 ) | (104,782,191 ) |

Net increase | 5,204,145 | $50,292,699 | 12,952,968 | $124,545,681 |

Class IS | ||||

Shares sold | 3,346,067 | $32,516,107 | 14,719,978 | $142,667,019 |

Shares issued on reinvestment | 367,432 | 3,533,169 | 648,772 | 6,197,604 |

Shares repurchased | (1,155,598 ) | (11,171,748 ) | (11,169,464 ) | (105,752,552 ) |

Net increase | 2,557,901 | $24,877,528 | 4,199,286 | $43,112,071 |

Affiliate Value at December 31, 2023 | Purchased | Sold | |||

Cost | Shares | Proceeds | Shares | ||

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | $12,658,328 | $193,922,788 | 193,922,788 | $175,412,016 | 175,412,016 |

(cont’d) | Realized Gain (Loss) | Dividend Income | Net Increase (Decrease) in Unrealized Appreciation (Depreciation) | Affiliate Value at June 30, 2024 |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | — | $538,988 | — | $31,169,100 |

43

44

45

46

47

48

49

50

Chair

Services, LLC

3344 Quality Drive

Rancho Cordova, CA 95670-7313

Baltimore, MD

Legg Mason Funds

100 International Drive

Baltimore, MD 21202

Your Privacy Is Our Priority

https://www.franklintempleton.com/help/privacy-policy or contact us for a copy at (800) 632-2301.

| ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 9. | PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 10. | REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 11. | STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 12. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 13. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 14. | PURCHASES OF SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 15. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable.

| ITEM 16. | CONTROLS AND PROCEDURES. |

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a- 3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the 1940 Act and 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are likely to materially affect the registrant’s internal control over financial reporting. |

| ITEM 17. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 18. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION. |

| (a) | Not applicable. |

| (b) | Not applicable. |

| ITEM 19. | EXHIBITS. |

| (a) (1) Not applicable. | |

| Exhibit 99.CODE ETH | |

| (a) (2) Certifications pursuant to section 302 of the Sarbanes-Oxley Act of 2002 attached hereto. | |

| Exhibit 99.CERT | |

| (b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto. | |

| Exhibit 99.906CERT |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this Report to be signed on its behalf by the undersigned, there unto duly authorized.

Legg Mason Global Asset Management Trust

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer | ||

| Date: | August 20, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer | ||

| Date: | August 20, 2024 |

| By: | /s/ Christopher Berarducci | |

| Christopher Berarducci | ||

| Principal Financial Officer | ||

| Date: | August 20, 2024 |