UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 877-6LM-FUND/656-3863

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

Annual Report | | September 30, 2022 |

FRANKLIN

GLOBAL MARKET

NEUTRAL FUND

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks long-term capital appreciation.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Franklin Global Market Neutral Fund for the twelve-month reporting period ended September 30, 2022. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Special shareholder notice

Effective June 29, 2022, Vaneet Chadha, CFA, and Sundaram Chettiappan, CFA, joined the Fund’s portfolio management team. Effective June 29, 2022, Russell Shtern is no longer a portfolio manager for the Fund. For more information, please see the Fund’s prospectus supplement dated June 29, 2022.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

October 31, 2022

| | |

II | | Franklin Global Market Neutral Fund |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to provide long-term capital appreciation. The Fund seeks positive returns unrelated to the broad global market by selecting both long and short positions in equity securities from anywhere in the world while applying measures that attempt to control for risk.

We at Franklin Advisers, Inc., the Fund’s subadviser, buy equity securities that we consider to be undervalued (“long positions”) and sell short equity securities that we consider to be overvalued (“short positions”). We use quantitative models to select long and short position sizes that we believe will achieve overall market neutrality, thereby attempting to limit the effects of global stock market movements on overall Fund performance. We view market neutrality to mean that the exposure of the long and short positions should offset one another producing a net equity exposure that is approximately +/- 1% under normal market conditions. Because of the Fund’s market neutral strategy, the Fund is intended to have returns that are generally independent of the returns and direction of the global stock market, although there can be no assurance that it will achieve that result.

Under normal market conditions, the Fund will invest primarily in common stocks, preferred stocks, convertible securities, American depositary receipts, global depository receipts, master limited partnerships (MLPs), real estate investment trusts (REITs), and securities of other investment companies including exchange-traded funds (ETFs). As a global fund, the Fund can seek investment opportunities anywhere in the world, and under normal market conditions, the Fund will invest in or have exposure to at least three countries, which may include the United States. The Fund may invest without limit in securities in any country, including countries with developed or emerging markets. The Fund may invest in issuers of any market capitalization.

When we deem it to be appropriate, the Fund may enter into various derivative transactions as a principal investment strategy using total return swaps, equity futures, options, warrants, and other similar investments. Derivatives may be used by the Fund as a hedging technique in an attempt to manage risk; as a substitute for buying or selling securities; to provide additional exposure to investment types or market factors; to change the characteristics of the Fund’s portfolio; in an attempt to enhance returns; and to manage cash.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Global equity returns were volatile and negative across all regions and virtually all sectors for the twelve-month reporting period ended September 30, 2022, with the MSCI All Country World Index (“MSCI ACWI”)i returning -20.66% for the reporting period.

Global equity markets advanced in U.S. dollar terms during the fourth quarter of 2021, with the MSCI ACWI returning 6.68%. Early in the period, markets were hit by uncertainty around the COVID-19 pandemic and global supply-chain issues. Worries over continued inflation and when this would prompt key developed market central banks to tighten policy

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 1 | |

Fund overview (cont’d)

and raise interest rates also weighed on investors’ minds. In December, the Federal Reserve Board (the “Fed”) announced an acceleration in the pace at which it dials back on bond-buying and indicated it could raise interest rates three times in 2022. The positive quarterly result was largely due to gains in December as fears about the Omicron variant of the coronavirus faded; though appearing to be more contagious, the variant reportedly causing milder symptoms, especially among the vaccinated. Year-end buying may also have supported equity markets.

Global equity markets declined in the first quarter of 2022, pressured by high inflation, tightening monetary policy and geopolitical instability. The MSCI ACWI returned -5.36% in U.S. dollar terms for the quarter. Rebounding consumer demand, alongside continued supply-chain disruptions, drove inflation in many countries to reach the highest levels in decades. In response, some of the world’s central banks tightened monetary policy. Russia’s invasion of Ukraine further tested financial markets, drawing condemnation from many other countries and sanctions aimed largely at Russia’s banks and prominent individuals. These sanctions, potential additional future sanctions and the war itself raised the possibility of trade disruptions, as Russia is a major global producer of oil, gas, palladium and several other important commodities as well as Europe’s largest supplier of oil and natural gas. Brent crude oil prices rose rapidly, touching their highest mark since 2014 amid significant volatility. Global growth stocks, which are typically more sensitive to changing economic conditions, declined significantly, while global value equities decreased slightly. Energy stocks surged along with crude oil prices, and several financial stocks rallied as well, thanks in part to the expectation that higher interest rates will lift profits.

Investor concerns about persistently high inflation, tightening monetary policy, geopolitical instability and slower global economic growth pressured global financial markets in the second quarter of 2022. Record-high inflation in multiple countries—driven by consumer demand and continued supply-chain disruptions—prompted many central banks to raise interest rates. Additionally, the ongoing Russia-Ukraine war and resulting sanctions continued to disrupt trade and pushed crude oil and natural gas prices to record highs, though natural gas prices ended the quarter lower. Recession fears increased along with high inflation, rising interest rates and surging government bond yields, dampening consumer sentiment in many countries. In this environment, the MSCI ACWI returned -15.66% in U.S. dollar terms, the worst quarterly decline since the beginning of the COVID-19 pandemic in early 2020. All major regions posted double-digit percentage losses.

Following a strong rally during the first half of the third quarter of 2022, global equities fell sharply during the remainder of the period, marking a third consecutive quarterly decline. Investors worried that the global economy would weaken further or enter a recession as many central banks tighten monetary policy. Global manufacturing activity contracted in September for the first time since June 2020 as output fell, new orders decreased and international trade contracted. Although inflationary pressures began to ease as the price of many commodities declined, annual inflation rates remained near or at record highs in

| | | | |

2 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

multiple regions, prompting many central banks to continue raising interest rates. The equity rally in the quarter’s first half was fueled by optimism that the Fed would start cutting interest rates in 2023. However, that sentiment vanished after the release of the Fed’s July meeting minutes and hawkish comments made by Fed officials and other central bankers at the Jackson Hole Economic Symposium in late August. The selloff in global stocks intensified in September as the Fed raised rates for the fifth time in 2022 and reiterated its focus on bringing down inflation despite potentially adverse economic effects. In this environment, the MSCI ACWI of stocks returned -6.82% (net returns) in U.S. dollar terms for the third quarter.

Q. How did we respond to these changing market conditions?

A. Given that our process is designed to limit the effects of global stock market movements on overall fund performance, changing market conditions do not necessitate a change in our process.

Performance review

For the twelve months ended September 30, 2022, Class A shares of Franklin Global Market Neutral Fund, excluding sales charges, returned 8.58%. The Fund’s unmanaged benchmark, the FTSE 3-Month U.S. Treasury Bill Indexii, returned 0.63% for the same period. The Lipper Alternative Equity Market Neutral Funds Category Averageiii returned 1.77% over the same time frame.

| | | | | | | | |

| Performance Snapshot as of September 30, 2022 (unaudited) | | | | | | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| Franklin Global Market Neutral Fund: | | | | | | | | |

Class A | | | 2.09 | % | | | 8.58 | % |

Class C | | | 1.64 | % | | | 7.70 | % |

Class I | | | 2.17 | % | | | 8.82 | % |

Class IS | | | 2.16 | % | | | 8.91 | % |

| FTSE 3-Month U.S. Treasury Bill Index | | | 0.59 | % | | | 0.63 | % |

| Lipper Alternative Equity Market Neutral Funds Category Average | | | -1.83 | % | | | 1.77 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.franklintempleton.com.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 3 | |

Fund overview (cont’d)

| | | | |

| Total Annual Operating Expenses (unaudited) | | | | |

As of the Fund’s current prospectus dated January 28, 2022, the gross total annual fund operating expense ratios for Class A, Class C, Class I and Class IS shares were 3.57%, 4.24%, 3.20% and 3.17%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest; brokerage commissions and expenses; fees, costs and expenses associated with any prime brokerage arrangement (including the costs of any securities borrowing arrangement); dividend and interest expenses on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.55% for Class A shares, 2.30% for Class C shares, 1.20% for Class I shares and 1.10% for Class IS shares. In addition, the ratio of total annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares. Total annual fund operating expenses after waiving fees and/or reimbursing expenses exceed the expense limitation (“expense cap”) for each class as a result of acquired fund fees and expenses and dividend and interest expenses on securities sold short. These expense limitation arrangements cannot be terminated prior to December 31, 2023 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual fund operating expenses have fallen to a level below the expense cap in effect at the time the fees were earned, or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual fund operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. The leading contributor to performance was stock selection across all regions and most sectors. At the region level, selection yielded meaningful value in all regions but was especially strong in continental Europe. Selection was mixed at the sector level but strong overall, led by the health care, energy, consumer staples and consumer discretionary sectors. The stock selection model was positive across all dimensions, and especially strong in value, cash flow and earnings growth factors.

Q. What were the leading detractors from performance?

A. Stock selection in the communication services sector was a leading detractor from performance. From an allocation perspective, a negative net exposure to Japan was a detractor from performance, as was a negative net exposure to information technology at the sector level. Within the factor library, short term momentum and reversal struggled over the period.

| | | | |

4 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Q. Were there any significant changes to the Fund during the reporting period?

A. There were no significant changes to the Fund during the period.

Thank you for your investment in Franklin Global Market Neutral Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Franklin Advisers, Inc.

October 12, 2022

RISKS: Equity securities are subject to market and price fluctuations. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Foreign investments are subject to special risks including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Emerging market countries tend to have economic, political, and legal systems that are less developed and are less stable than those of more developed countries. The Fund uses short positions in combination with long positions in a market neutral strategy to try to neutralize exposure to the global stock market and capture a positive return, regardless of the direction of the market. The Fund’s market neutral strategy may result in greater losses or lower positive returns than if the Fund held only long positions. Although the subadviser’s models were created to improve performance and to reduce overall portfolio risk, there is no guarantee that these models and the Fund’s market neutral strategy will be successful. The overall performance of the Fund depends on the net performance of its long and short positions, and it is possible for the Fund to experience a net loss across all positions. The Fund may employ leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if the Fund’s investments decline in value. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The Fund may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. There is no assurance strategies used by the Fund will be successful. Active and frequent trading may increase a shareholder’s tax liability and transaction costs, which could detract from Fund performance. Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss. There can be no assurance that the Fund will engage in hedging transactions at any given time, even under volatile market conditions, or that any hedging transactions the Fund engages in will be successful. Hedging transactions involve costs and may reduce gains or result in losses. Additional risks may include those risks associated with REITs, MLPs and investing in securities issued by other investment companies, including ETFs. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 5 | |

Fund overview (cont’d)

Portfolio holdings and breakdowns are as of September 30, 2022 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten long holdings (as a percentage of net assets) as of September 30, 2022 were: Whitehaven Coal Ltd. (0.6%), Wolters Kluwer NV (0.6%), Criteo SA (0.6%), Balfour Beatty PLC (0.6%), Qualys Inc. (0.6%), OCI NV (0.6%), Molina Healthcare Inc. (0.6%), Daito Trust Construction Co. Ltd. (0.6%), BJ’s Wholesale Club Holdings Inc. (0.6%) and McKesson Corp. (0.6%). Please refer to pages 13 through 36 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector long holdings (as a percentage of net assets) as of September 30, 2022 were: industrials (16.3%), financials (12.8%), consumer discretionary (11.3%), information technology (10.9%) and health care (8.0%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The MSCI All Country World Index (“MSCI ACWI”) is a market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 49 country indices comprising 23 developed and 26 emerging market country indices. |

| ii | The FTSE 3-Month U.S. Treasury Bill Index is an unmanaged index generally representative of the average yield of 3-month U.S. Treasury bills. |

| iii | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended September 30, 2022, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 42 funds for the six-month period and among the 40 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| | | | |

6 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Fund at a glance (unaudited)

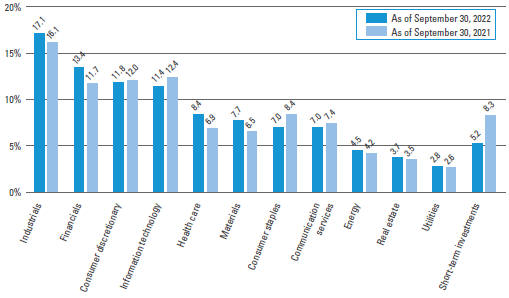

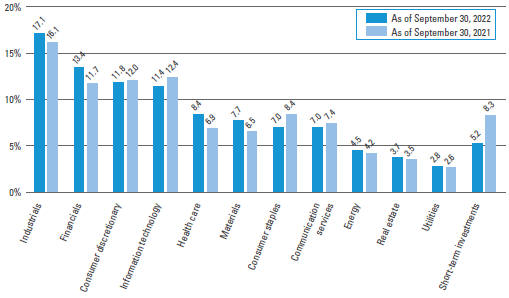

Investment breakdown† (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of September 30, 2022 and September 30, 2021 and does not include derivatives, such as forward foreign currency contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

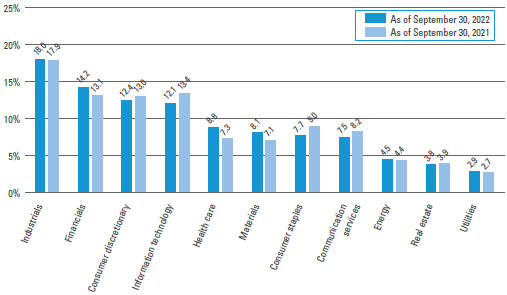

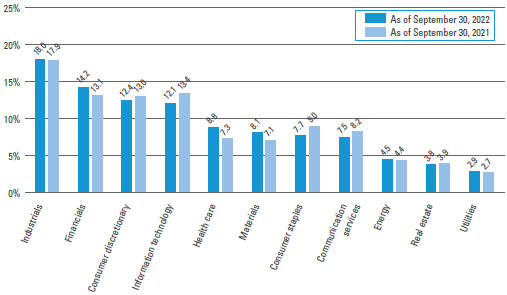

Securities sold short breakdown* (%) as a percent of total securities sold short

| * | The bar graph above represents the composition of the Fund’s investments sold short as of September 30, 2022 and September 30, 2021 and does not include derivatives. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 7 | |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. This example is based on an investment of $1,000 invested on April 1, 2022 and held for the six months ended September 30, 2022.

Actual expenses

The table below titled “Based on actual total return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on hypothetical total return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Based on actual total return1 | | | | | | | | | Based on hypothetical total return1 | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class A | | | 2.09 | % | | $ | 1,000.00 | | | $ | 1,020.90 | | | | 4.03 | % | | $ | 20.42 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,004.86 | | | | 4.03 | % | | $ | 20.25 | |

| Class C | | | 1.64 | | | | 1,000.00 | | | | 1,016.40 | | | | 4.76 | | | | 24.06 | | | | | | | Class C | | | 5.00 | | | | 1,000.00 | | | | 1,001.20 | | | | 4.76 | | | | 23.88 | |

| Class I | | | 2.17 | | | | 1,000.00 | | | | 1,021.70 | | | | 3.94 | | | | 19.97 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,005.31 | | | | 3.94 | | | | 19.81 | |

| Class IS | | | 2.16 | | | | 1,000.00 | | | | 1,021.60 | | | | 3.84 | | | | 19.46 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,005.82 | | | | 3.84 | | | | 19.31 | |

| | | | |

8 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

| 1 | For the six months ended September 30, 2022. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 9 | |

Fund performance (unaudited)

| | | | | | | | | | | | | | | | |

| Average annual total returns | |

| Without sales charges1 | | Class A | | | Class C | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/22 | | | 8.58 | % | | | 7.70 | % | | | 8.82 | % | | | 8.91 | % |

| Five Years Ended 9/30/22 | | | 0.15 | | | | N/A | | | | 0.47 | | | | 0.53 | |

| Inception* through 9/30/22 | | | 0.74 | | | | 0.10 | | | | 1.07 | | | | 1.12 | |

| | | | |

| With sales charges2 | | Class A | | | Class C | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/22 | | | 2.30 | % | | | 6.70 | % | | | 8.82 | % | | | 8.91 | % |

| Five Years Ended 9/30/22 | | | -1.04 | | | | N/A | | | | 0.47 | | | | 0.53 | |

| Inception* through 9/30/22 | | | -0.13 | | | | 0.10 | | | | 1.07 | | | | 1.12 | |

| | | | |

| Cumulative total returns | |

| Without sales charges1 | | | |

| Class A (Inception date of 11/30/15 through 9/30/22) | | | 5.18 | % |

| Class C (Inception date of 7/16/18 through 9/30/22) | | | 0.43 | |

| Class I (Inception date of 11/30/15 through 9/30/22) | | | 7.52 | |

| Class IS (Inception date of 11/30/15 through 9/30/22) | | | 7.92 | |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class C shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.50% (5.75% prior to August 15, 2022). Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| * | Inception date for Class A, I and IS shares is November 30, 2015 and for Class C is July 16, 2018. |

| | | | |

10 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

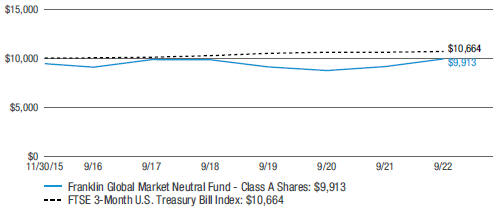

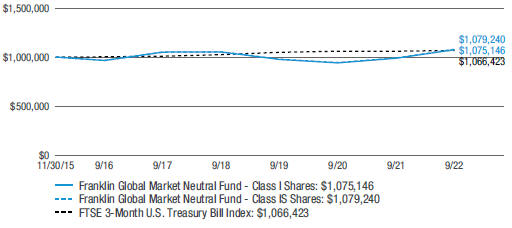

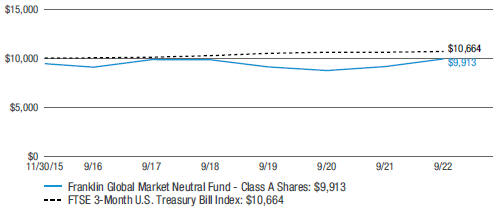

Historical performance

Value of $10,000 invested in

Class A Shares of Franklin Global Market Neutral Fund vs. FTSE 3-Month U.S. Treasury Bill Index† — November 30, 2015 - September 30, 2022

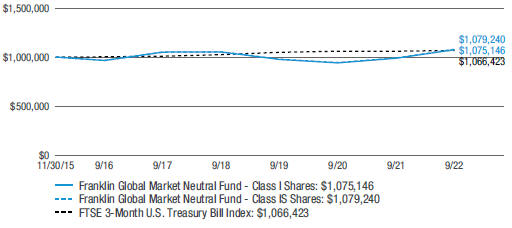

Value of $1,000,000 invested in

Class I and IS Shares of Franklin Global Market Neutral Fund vs. FTSE 3-Month U.S. Treasury Bill Index† — November 30, 2015 - September 30, 2022

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 11 |

Fund performance (unaudited) (cont’d)

| † | Hypothetical illustration of $10,000 invested in Class A shares and $1,000,000 invested in Class I and IS shares of Franklin Global Market Neutral Fund on November 30, 2015 (inception date), assuming the deduction of the maximum initial sales charge of 5.50% (5.75% prior to August 15, 2022) at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2022. The hypothetical illustration also assumes a $10,000 or $1,000,000 investment, as applicable, in the FTSE 3-Month U.S. Treasury Bill Index. The FTSE 3-Month U.S. Treasury Bill Index (the “Index”) is an unmanaged market index generally representative of the average yield of 3-month U.S. Treasury bills. The Index is unmanaged and not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. The performance of the Fund’s other class may be greater or less than the Class A, I and IS shares’ performance indicated on these charts, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other class. |

| | | | |

12 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Schedule of investments

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 90.5% | | | | | | | | | | | | | | | | |

| Communication Services — 6.7% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 0.4% | | | | | | | | | | | | | | | | |

Orange SA | | | | | | | | | | | 17,300 | | | $ | 156,470 | (a) |

Entertainment — 0.8% | | | | | | | | | | | | | | | | |

Daiichikosho Co. Ltd. | | | | | | | | | | | 4,800 | | | | 135,292 | (a) |

G5 Entertainment AB | | | | | | | | | | | 3,295 | | | | 55,875 | (a) |

GungHo Online Entertainment Inc. | | | | | | | | | | | 8,400 | | | | 129,038 | (a) |

Total Entertainment | | | | | | | | | | | | | | | 320,205 | |

Interactive Media & Services — 2.0% | | | | | | | | | | | | | | | | |

Alphabet Inc., Class C Shares | | | | | | | | | | | 1,505 | | | | 144,706 | *(b) |

Auto Trader Group PLC | | | | | | | | | | | 30,743 | | | | 174,346 | (a) |

Meta Platforms Inc., Class A Shares | | | | | | | | | | | 656 | | | | 89,006 | *(b) |

Rightmove PLC | | | | | | | | | | | 31,702 | | | | 169,127 | (a) |

Yelp Inc. | | | | | | | | | | | 5,972 | | | | 202,510 | *(b) |

Total Interactive Media & Services | | | | | | | | | | | | | | | 779,695 | |

Media — 3.1% | | | | | | | | | | | | | | | | |

Criteo SA, ADR | | | | | | | | | | | 8,605 | | | | 232,593 | *(b) |

Fuji Media Holdings Inc. | | | | | | | | | | | 19,600 | | | | 143,951 | (a) |

Nippon Television Holdings Inc. | | | | | | | | | | | 14,700 | | | | 117,790 | (a) |

Pearson PLC | | | | | | | | | | | 12,700 | | | | 121,280 | (a) |

Sinclair Broadcast Group Inc., Class A Shares | | | | | | | | | | | 6,748 | | | | 122,071 | (b) |

SKY Perfect JSAT Holdings Inc. | | | | | | | | | | | 55,400 | | | | 198,361 | (a) |

ValueCommerce Co. Ltd. | | | | | | | | | | | 5,800 | | | | 88,728 | (a) |

Vivendi SE | | | | | | | | | | | 25,000 | | | | 193,915 | (a) |

Total Media | | | | | | | | | | | | | | | 1,218,689 | |

Wireless Telecommunication Services — 0.4% | | | | | | | | | | | | | | | | |

Freenet AG | | | | | | | | | | | 9,400 | | | | 178,144 | (a) |

Total Communication Services | | | | | | | | | | | | | | | 2,653,203 | |

| Consumer Discretionary — 11.3% | | | | | | | | | | | | | | | | |

Auto Components — 0.9% | | | | | | | | | | | | | | | | |

Linamar Corp. | | | | | | | | | | | 3,200 | | | | 124,655 | |

NGK Spark Plug Co. Ltd. | | | | | | | | | | | 11,900 | | | | 211,053 | (a) |

Total Auto Components | | | | | | | | | | | | | | | 335,708 | |

Automobiles — 0.4% | | | | | | | | | | | | | | | | |

Bayerische Motoren Werke AG | | | | | | | | | | | 2,120 | | | | 143,688 | (a) |

Distributors — 0.3% | | | | | | | | | | | | | | | | |

Inchcape PLC | | | | | | | | | | | 16,858 | | | | 127,649 | (a) |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 13 |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Hotels, Restaurants & Leisure — 0.6% | | | | | | | | | | | | | | | | |

InterContinental Hotels Group PLC | | | | | | | | | | | 2,289 | | | $ | 110,242 | (a) |

Trainline PLC | | | | | | | | | | | 34,458 | | | | 121,463 | * |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 231,705 | |

Household Durables — 2.0% | | | | | | | | | | | | | | | | |

Crest Nicholson Holdings PLC | | | | | | | | | | | 54,109 | | | | 109,811 | (a) |

Forbo Holding AG, Registered Shares | | | | | | | | | | | 131 | | | | 141,643 | (a) |

PulteGroup Inc. | | | | | | | | | | | 5,017 | | | | 188,138 | (b) |

Redrow PLC | | | | | | | | | | | 26,781 | | | | 117,921 | (a) |

Sumitomo Forestry Co. Ltd. | | | | | | | | | | | 9,100 | | | | 138,525 | (a) |

Tama Home Co. Ltd. | | | | | | | | | | | 6,400 | | | | 103,840 | (a) |

Total Household Durables | | | | | | | | | | | | | | | 799,878 | |

Leisure Products — 0.7% | | | | | | | | | | | | | | | | |

Sega Sammy Holdings Inc. | | | | | | | | | | | 10,700 | | | | 145,729 | (a) |

Spin Master Corp. | | | | | | | | | | | 4,300 | | | | 129,403 | (b) |

Total Leisure Products | | | | | | | | | | | | | | | 275,132 | |

Multiline Retail — 1.4% | | | | | | | | | | | | | | | | |

Dillard’s Inc., Class A Shares | | | | | | | | | | | 715 | | | | 195,023 | (b) |

Dollarama Inc. | | | | | | | | | | | 2,500 | | | | 143,519 | |

J Front Retailing Co. Ltd. | | | | | | | | | | | 14,500 | | | | 117,991 | (a) |

Next PLC | | | | | | | | | | | 2,015 | | | | 106,948 | (a) |

Total Multiline Retail | | | | | | | | | | | | | | | 563,481 | |

Specialty Retail — 2.2% | | | | | | | | | | | | | | | | |

Advance Auto Parts Inc. | | | | | | | | | | | 742 | | | | 116,004 | |

AutoZone Inc. | | | | | | | | | | | 101 | | | | 216,335 | *(b) |

Industria de Diseno Textil SA | | | | | | | | | | | 6,032 | | | | 124,480 | (a) |

Lowe’s Cos. Inc. | | | | | | | | | | | 1,074 | | | | 201,708 | (b) |

Penske Automotive Group Inc. | | | | | | | | | | | 1,283 | | | | 126,286 | (b) |

United Arrows Ltd. | | | | | | | | | | | 8,200 | | | | 103,413 | (a) |

Total Specialty Retail | | | | | | | | | | | | | | | 888,226 | |

Textiles, Apparel & Luxury Goods — 2.8% | | | | | | | | | | | | | | | | |

Burberry Group PLC | | | | | | | | | | | 9,564 | | | | 191,046 | (a) |

Deckers Outdoor Corp. | | | | | | | | | | | 596 | | | | 186,315 | *(b) |

Gildan Activewear Inc. | | | | | | | | | | | 6,200 | | | | 175,271 | |

Goldwin Inc. | | | | | | | | | | | 2,600 | | | | 137,440 | (a) |

Hermes International | | | | | | | | | | | 131 | | | | 154,072 | (a) |

Pandora A/S | | | | | | | | | | | 2,846 | | | | 133,097 | (a) |

Swatch Group AG, Bearer Shares | | | | | | | | | | | 685 | | | | 153,850 | (a) |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 1,131,091 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 4,496,558 | |

See Notes to Financial Statements.

| | | | |

14 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Consumer Staples — 6.7% | | | | | | | | | | | | | | | | |

Beverages — 0.6% | | | | | | | | | | | | | | | | |

Heineken Holding NV | | | | | | | | | | | 2,300 | | | $ | 157,455 | (a) |

Takara Holdings Inc. | | | | | | | | | | | 12,800 | | | | 93,500 | (a) |

Total Beverages | | | | | | | | | | | | | | | 250,955 | |

Food & Staples Retailing — 3.7% | | | | | | | | | | | | | | | | |

Alimentation Couche-Tard Inc. | | | | | | | | | | | 2,800 | | | | 112,722 | |

BJ’s Wholesale Club Holdings Inc. | | | | | | | | | | | 3,078 | | | | 224,109 | *(b) |

Empire Co. Ltd., Class A Shares | | | | | | | | | | | 5,000 | | | | 124,371 | |

George Weston Ltd. | | | | | | | | | | | 1,700 | | | | 177,993 | (b) |

Jeronimo Martins SGPS SA | | | | | | | | | | | 10,042 | | | | 187,016 | (a) |

Kesko oyj, Class B Shares | | | | | | | | | | | 5,017 | | | | 93,602 | (a) |

Kroger Co. | | | | | | | | | | | 2,927 | | | | 128,056 | (b) |

Lawson Inc. | | | | | | | | | | | 3,600 | | | | 117,777 | (a) |

Loblaw Cos. Ltd. | | | | | | | | | | | 2,200 | | | | 174,204 | (b) |

Tesco PLC | | | | | | | | | | | 58,580 | | | | 134,445 | (a) |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 1,474,295 | |

Food Products — 1.4% | | | | | | | | | | | | | | | | |

Kellogg Co. | | | | | | | | | | | 2,120 | | | | 147,679 | |

Morinaga Milk Industry Co. Ltd. | | | | | | | | | | | 4,000 | | | | 117,265 | (a) |

Tyson Foods Inc., Class A Shares | | | | | | | | | | | 1,696 | | | | 111,817 | |

Viscofan SA | | | | | | | | | | | 3,005 | | | | 164,271 | (a) |

Total Food Products | | | | | | | | | | | | | | | 541,032 | |

Personal Products — 0.7% | | | | | | | | | | | | | | | | |

L’Oreal SA | | | | | | | | | | | 616 | | | | 196,961 | (a) |

USANA Health Sciences Inc. | | | | | | | | | | | 1,731 | | | | 97,023 | *(b) |

Total Personal Products | | | | | | | | | | | | | | | 293,984 | |

Tobacco — 0.3% | | | | | | | | | | | | | | | | |

British American Tobacco PLC | | | | | | | | | | | 3,181 | | | | 114,063 | (a) |

Total Consumer Staples | | | | | | | | | | | | | | | 2,674,329 | |

| Energy — 4.3% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 4.3% | | | | | | | | | | | | | | | | |

BP PLC | | | | | | | | | | | 38,759 | | | | 185,206 | (a) |

Cosmo Energy Holdings Co. Ltd. | | | | | | | | | | | 6,000 | | | | 154,801 | (a) |

Eni SpA | | | | | | | | | | | 14,691 | | | | 156,146 | (a) |

Imperial Oil Ltd. | | | | | | | | | | | 4,000 | | | | 173,193 | |

Inpex Corp. | | | | | | | | | | | 16,400 | | | | 152,964 | (a) |

Marathon Petroleum Corp. | | | | | | | | | | | 1,969 | | | | 195,581 | (b) |

Parex Resources Inc. | | | | | | | | | | | 9,200 | | | | 134,335 | (b) |

Repsol SA | | | | | | | | | | | 13,390 | | | | 153,854 | (a) |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 15 |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Suncor Energy Inc. | | | | | | | | | | | 6,300 | | | $ | 177,413 | |

Whitehaven Coal Ltd. | | | | | | | | | | | 40,926 | | | | 237,447 | (a) |

Total Energy | | | | | | | | | | | | | | | 1,720,940 | |

| Financials — 12.8% | | | | | | | | | | | | | | | | |

Banks — 3.9% | | | | | | | | | | | | | | | | |

Associated Banc-Corp. | | | | | | | | | | | 5,832 | | | | 117,107 | |

Banco Bilbao Vizcaya Argentaria SA | | | | | | | | | | | 37,863 | | | | 169,848 | (a) |

Banco de Sabadell SA | | | | | | | | | | | 260,381 | | | | 173,638 | (a) |

Comerica Inc. | | | | | | | | | | | 2,089 | | | | 148,528 | (b) |

First BanCorp | | | | | | | | | | | 9,755 | | | | 133,448 | |

Lloyds Banking Group PLC | | | | | | | | | | | 208,341 | | | | 94,168 | (a) |

Natwest Group PLC | | | | | | | | | | | 61,920 | | | | 154,225 | (a) |

Nishi-Nippon Financial Holdings Inc. | | | | | | | | | | | 25,500 | | | | 132,428 | (a) |

Societe Generale SA | | | | | | | | | | | 6,786 | | | | 134,201 | (a) |

Washington Federal Inc. | | | | | | | | | | | 5,733 | | | | 171,875 | (b) |

Zions Bancorp NA | | | | | | | | | | | 2,173 | | | | 110,519 | |

Total Banks | | | | | | | | | | | | | | | 1,539,985 | |

Capital Markets — 2.0% | | | | | | | | | | | | | | | | |

3i Group PLC | | | | | | | | | | | 9,555 | | | | 114,731 | (a) |

Azimut Holding SpA | | | | | | | | | | | 8,403 | | | | 119,854 | (a) |

Bank of New York Mellon Corp. | | | | | | | | | | | 2,915 | | | | 112,286 | (b) |

Canaccord Genuity Group Inc. | | | | | | | | | | | 22,000 | | | | 107,822 | (b) |

Intermediate Capital Group PLC | | | | | | | | | | | 12,000 | | | | 129,450 | (a) |

Investec PLC | | | | | | | | | | | 27,726 | | | | 112,407 | |

UBS Group AG, Registered Shares | | | | | | | | | | | 6,868 | | | | 99,641 | (a) |

Total Capital Markets | | | | | | | | | | | | | | | 796,191 | |

Consumer Finance — 0.8% | | | | | | | | | | | | | | | | |

Acom Co. Ltd. | | | | | | | | | | | 47,100 | | | | 101,133 | (a) |

Ally Financial Inc. | | | | | | | | | | | 3,642 | | | | 101,357 | (b) |

Synchrony Financial | | | | | | | | | | | 4,241 | | | | 119,554 | (b) |

Total Consumer Finance | | | | | | | | | | | | | | | 322,044 | |

Diversified Financial Services — 1.1% | | | | | | | | | | | | | | | | |

Fuyo General Lease Co. Ltd. | | | | | | | | | | | 2,200 | | | | 120,099 | (a) |

Jackson Financial Inc., Class A Shares | | | | | | | | | | | 5,076 | | | | 140,859 | (b) |

Plus500 Ltd. | | | | | | | | | | | 10,570 | | | | 193,379 | (a) |

Total Diversified Financial Services | | | | | | | | | | | | | | | 454,337 | |

Insurance — 3.9% | | | | | | | | | | | | | | | | |

American Financial Group Inc. | | | | | | | | | | | 848 | | | | 104,245 | |

American International Group Inc. | | | | | | | | | | | 2,807 | | | | 133,276 | (b) |

Arch Capital Group Ltd. | | | | | | | | | | | 2,986 | | | | 135,982 | *(b) |

See Notes to Financial Statements.

| | | | |

16 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Insurance — continued | | | | | | | | | | | | | | | | |

Aviva PLC | | | | | | | | | | | 29,899 | | | $ | 128,232 | (a) |

Axis Capital Holdings Ltd. | | | | | | | | | | | 3,494 | | | | 171,730 | (b) |

Hartford Financial Services Group Inc. | | | | | | | | | | | 1,961 | | | | 121,464 | |

Japan Post Holdings Co. Ltd. | | | | | | | | | | | 30,100 | | | | 199,419 | (a) |

Legal & General Group PLC | | | | | | | | | | | 38,581 | | | | 92,092 | (a) |

MetLife Inc. | | | | | | | | | | | 2,985 | | | | 181,428 | (b) |

SCOR SE | | | | | | | | | | | 9,914 | | | | 143,331 | (a) |

Unum Group | | | | | | | | | | | 3,882 | | | | 150,622 | (b) |

Total Insurance | | | | | | | | | | | | | | | 1,561,821 | |

Thrifts & Mortgage Finance — 1.1% | | | | | | | | | | | | | | | | |

Essent Group Ltd. | | | | | | | | | | | 4,180 | | | | 145,757 | (b) |

MGIC Investment Corp. | | | | | | | | | | | 10,285 | | | | 131,854 | |

Radian Group Inc. | | | | | | | | | | | 8,480 | | | | 163,579 | (b) |

Total Thrifts & Mortgage Finance | | | | | | | | | | | | | | | 441,190 | |

Total Financials | | | | | | | | | | | | | | | 5,115,568 | |

| Health Care — 8.0% | | | | | | | | | | | | | | | | |

Health Care Equipment & Supplies — 0.5% | | | | | | | | | | | | | | | | |

Inmode Ltd. | | | | | | | | | | | 6,627 | | | | 192,912 | *(b) |

Health Care Providers & Services — 2.9% | | | | | | | | | | | | | | | | |

Alfresa Holdings Corp. | | | | | | | | | | | 13,400 | | | | 156,171 | (a) |

BML Inc. | | | | | | | | | | | 4,500 | | | | 101,577 | (a) |

Cardinal Health Inc. | | | | | | | | | | | 2,544 | | | | 169,634 | |

CVS Health Corp. | | | | | | | | | | | 1,484 | | | | 141,529 | |

Humana Inc. | | | | | | | | | | | 318 | | | | 154,290 | |

McKesson Corp. | | | | | | | | | | | 656 | | | | 222,955 | (b) |

Molina Healthcare Inc. | | | | | | | | | | | 685 | | | | 225,940 | *(b) |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 1,172,096 | |

Life Sciences Tools & Services — 0.8% | | | | | | | | | | | | | | | | |

Mettler-Toledo International Inc. | | | | | | | | | | | 155 | | | | 168,038 | *(b) |

Waters Corp. | | | | | | | | | | | 596 | | | | 160,640 | *(b) |

Total Life Sciences Tools & Services | | | | | | | | | | | | | | | 328,678 | |

Pharmaceuticals — 3.8% | | | | | | | | | | | | | | | | |

Bayer AG, Registered Shares | | | | | | | | | | | 2,121 | | | | 97,724 | (a) |

Chugai Pharmaceutical Co. Ltd. | | | | | | | | | | | 7,900 | | | | 197,366 | (a) |

Hisamitsu Pharmaceutical Co. Inc. | | | | | | | | | | | 7,200 | | | | 169,017 | (a) |

Indivior PLC | | | | | | | | | | | 61,213 | | | | 194,085 | *(a) |

Ipsen SA | | | | | | | | | | | 1,500 | | | | 138,825 | (a) |

Laboratorios Farmaceuticos Rovi SA | | | | | | | | | | | 3,923 | | | | 168,594 | (a) |

Novo Nordisk A/S, Class B Shares | | | | | | | | | | | 1,940 | | | | 193,259 | (a) |

See Notes to Financial Statements.

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 17 | |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Pharmaceuticals — continued | | | | | | | | | | | | | | | | |

Ono Pharmaceutical Co. Ltd. | | | | | | | | | | | 6,500 | | | $ | 151,832 | (a) |

Roche Holding AG | | | | | | | | | | | 589 | | | | 191,739 | (a) |

Total Pharmaceuticals | | | | | | | | | | | | | | | 1,502,441 | |

Total Health Care | | | | | | | | | | | | | | | 3,196,127 | |

| Industrials — 16.3% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 1.0% | | | | | | | | | | | | | | | | |

BAE Systems PLC | | | | | | | | | | | 13,996 | | | | 122,975 | (a) |

Bombardier Inc., Class B Shares | | | | | | | | | | | 7,220 | | | | 129,258 | *(b) |

Lockheed Martin Corp. | | | | | | | | | | | 424 | | | | 163,787 | |

Total Aerospace & Defense | | | | | | | | | | | | | | | 416,020 | |

Air Freight & Logistics — 0.4% | | | | | | | | | | | | | | | | |

Expeditors International of Washington Inc. | | | | | | | | | | | 1,999 | | | | 176,532 | (b) |

Airlines — 1.0% | | | | | | | | | | | | | | | | |

Delta Air Lines Inc. | | | | | | | | | | | 4,537 | | | | 127,308 | *(b) |

Qantas Airways Ltd. | | | | | | | | | | | 52,801 | | | | 169,445 | *(a) |

Southwest Airlines Co. | | | | | | | | | | | 3,703 | | | | 114,200 | *(b) |

Total Airlines | | | | | | | | | | | | | | | 410,953 | |

Building Products — 1.8% | | | | | | | | | | | | | | | | |

AGC Inc. | | | | | | | | | | | 4,200 | | | | 130,754 | (a) |

AO Smith Corp. | | | | | | | | | | | 2,807 | | | | 136,364 | (b) |

Cie de Saint-Gobain | | | | | | | | | | | 3,923 | | | | 140,269 | (a) |

Lennox International Inc. | | | | | | | | | | | 417 | | | | 92,854 | (b) |

Masco Corp. | | | | | | | | | | | 4,180 | | | | 195,164 | (b) |

Total Building Products | | | | | | | | | | | | | | | 695,405 | |

Commercial Services & Supplies — 0.4% | | | | | | | | | | | | | | | | |

Serco Group PLC | | | | | | | | | | | 90,000 | | | | 156,107 | (a) |

Construction & Engineering — 0.6% | | | | | | | | | | | | | | | | |

Balfour Beatty PLC | | | | | | | | | | | 67,856 | | | | 232,143 | |

Industrial Conglomerates — 0.4% | | | | | | | | | | | | | | | | |

Smiths Group PLC | | | | | | | | | | | 10,179 | | | | 169,551 | (a) |

Machinery — 3.4% | | | | | | | | | | | | | | | | |

Allison Transmission Holdings Inc. | | | | | | | | | | | 4,029 | | | | 136,019 | |

Amada Co. Ltd. | | | | | | | | | | | 27,600 | | | | 187,539 | (a) |

Bucher Industries AG, Registered Shares | | | | | | | | | | | 520 | | | | 162,226 | (a) |

DMG Mori Co. Ltd. | | | | | | | | | | | 16,000 | | | | 182,738 | (a) |

Ebara Corp. | | | | | | | | | | | 4,600 | | | | 149,892 | (a) |

GEA Group AG | | | | | | | | | | | 3,750 | | | | 121,361 | (a) |

Krones AG | | �� | | | | | | | | | 1,400 | | | | 123,033 | (a) |

See Notes to Financial Statements.

| | | | |

18 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Machinery — continued | | | | | | | | | | | | | | | | |

NGK Insulators Ltd. | | | | | | | | | | | 15,700 | | | $ | 195,414 | (a) |

OKUMA Corp. | | | | | | | | | | | 3,000 | | | | 103,021 | (a) |

Total Machinery | | | | | | | | | | | | | | | 1,361,243 | |

Marine — 1.8% | | | | | | | | | | | | | | | | |

A.P. Moller - Maersk A/S, Class B Shares | | | | | | | | | | | 96 | | | | 174,454 | (a) |

Kuehne + Nagel International AG, Registered Shares | | | | | | | | | | | 880 | | | | 179,196 | (a) |

Mitsui OSK Lines Ltd. | | | | | | | | | | | 8,000 | | | | 143,141 | (a) |

Nippon Yusen KK | | | | | | | | | | | 8,800 | | | | 149,370 | (a) |

ZIM Integrated Shipping Services Ltd. | | | | | | | | | | | 2,568 | | | | 60,348 | (b) |

Total Marine | | | | | | | | | | | | | | | 706,509 | |

Professional Services — 2.6% | | | | | | | | | | | | | | | | |

JAC Recruitment Co. Ltd. | | | | | | | | | | | 10,500 | | | | 160,779 | (a) |

ManpowerGroup Inc. | | | | | | | | | | | 1,851 | | | | 119,741 | (b) |

McMillan Shakespeare Ltd. | | | | | | | | | | | 19,812 | | | | 163,059 | (a) |

Meitec Corp. | | | | | | | | | | | 12,500 | | | | 197,778 | (a) |

Robert Half International Inc. | | | | | | | | | | | 2,089 | | | | 159,808 | (b) |

Wolters Kluwer NV | | | | | | | | | | | 2,390 | | | | 232,723 | (a) |

Total Professional Services | | | | | | | | | | | | | | | 1,033,888 | |

Road & Rail — 0.8% | | | | | | | | | | | | | | | | |

ArcBest Corp. | | | | | | | | | | | 1,643 | | | | 119,495 | |

Ryder System Inc. | | | | | | | | | | | 2,507 | | | | 189,254 | (b) |

Total Road & Rail | | | | | | | | | | | | | | | 308,749 | |

Trading Companies & Distributors — 1.4% | | | | | | | | | | | | | | | | |

Howden Joinery Group PLC | | | | | | | | | | | 33,000 | | | | 184,356 | (a) |

Marubeni Corp. | | | | | | | | | | | 12,800 | | | | 111,686 | (a) |

Mitsui & Co. Ltd. | | | | | | | | | | | 6,500 | | | | 138,319 | (a) |

Russel Metals Inc. | | | | | | | | | | | 6,500 | | | | 120,932 | |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 555,293 | |

Transportation Infrastructure — 0.7% | | | | | | | | | | | | | | | | |

Mitsubishi Logistics Corp. | | | | | | | | | | | 4,700 | | | | 110,767 | (a) |

Sumitomo Warehouse Co. Ltd. | | | | | | | | | | | 11,200 | | | | 152,181 | (a) |

Total Transportation Infrastructure | | | | | | | | | | | | | | | 262,948 | |

Total Industrials | | | | | | | | | | | | | | | 6,485,341 | |

| Information Technology — 10.9% | | | | | | | | | | | | | | | | |

Communications Equipment — 1.0% | | | | | | | | | | | | | | | | |

F5 Inc. | | | | | | | | | | | 821 | | | | 118,824 | * |

Nokia oyj, ADR | | | | | | | | | | | 37,460 | | | | 159,954 | (b) |

Telefonaktiebolaget LM Ericsson, Class B Shares | | | | | | | | | | | 19,403 | | | | 113,419 | (a) |

Total Communications Equipment | | | | | | | | | | | | | | | 392,197 | |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 19 |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Electronic Equipment, Instruments & Components — 2.1% | | | | | | | | | | | | | | | | |

Amano Corp. | | | | | | | | | | | 6,100 | | | $ | 102,495 | (a) |

Arrow Electronics Inc. | | | | | | | | | | | 1,351 | | | | 124,549 | *(b) |

Celestica Inc. | | | | | | | | | | | 16,000 | | | | 134,825 | *(b) |

Hirose Electric Co. Ltd. | | | | | | | | | | | 900 | | | | 118,030 | (a) |

Horiba Ltd. | | | | | | | | | | | 3,300 | | | | 127,993 | (a) |

Murata Manufacturing Co. Ltd. | | | | | | | | | | | 2,500 | | | | 115,068 | (a) |

Topcon Corp. | | | | | | | | | | | 9,500 | | | | 105,949 | (a) |

Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | 828,909 | |

IT Services — 1.5% | | | | | | | | | | | | | | | | |

Alten SA | | | | | | | | | | | 1,431 | | | | 157,252 | (a) |

Amdocs Ltd. | | | | | | | | | | | 1,802 | | | | 143,169 | |

Indra Sistemas SA | | | | | | | | | | | 15,374 | | | | 117,067 | (a) |

Reply SpA | | | | | | | | | | | 1,749 | | | | 182,174 | (a) |

Total IT Services | | | | | | | | | | | | | | | 599,662 | |

Semiconductors & Semiconductor Equipment — 2.2% | | | | | | | | | | | | | | | | |

Applied Materials Inc. | | | | | | | | | | | 1,880 | | | | 154,028 | (b) |

ASML Holding NV | | | | | | | | | | | 411 | | | | 170,269 | (a) |

Melexis NV | | | | | | | | | | | 2,279 | | | | 154,180 | (a) |

ON Semiconductor Corp. | | | | | | | | | | | 2,226 | | | | 138,746 | *(b) |

SCREEN Holdings Co. Ltd. | | | | | | | | | | | 2,200 | | | | 119,370 | (a) |

Silicon Laboratories Inc. | | | | | | | | | | | 954 | | | | 117,762 | * |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | 854,355 | |

Software — 2.0% | | | | | | | | | | | | | | | | |

Check Point Software Technologies Ltd. | | | | | | | | | | | 1,790 | | | | 200,516 | *(b) |

Fortinet Inc. | | | | | | | | | | | 2,439 | | | | 119,828 | * |

Qualys Inc. | | | | | | | | | | | 1,650 | | | | 229,994 | *(b) |

Splunk Inc. | | | | | | | | | | | 1,484 | | | | 111,597 | * |

Teradata Corp. | | | | | | | | | | | 4,538 | | | | 140,950 | *(b) |

Total Software | | | | | | | | | | | | | | | 802,885 | |

Technology Hardware, Storage & Peripherals — 2.1% | | | | | | | | | | | | | | | | |

Apple Inc. | | | | | | | | | | | 1,014 | | | | 140,135 | (b) |

Dell Technologies Inc., Class C Shares | | | | | | | | | | | 4,032 | | | | 137,773 | (b) |

HP Inc. | | | | | | | | | | | 4,240 | | | | 105,661 | (b) |

NetApp Inc. | | | | | | | | | | | 2,448 | | | | 151,409 | (b) |

Pure Storage Inc., Class A Shares | | | | | | | | | | | 6,256 | | | | 171,226 | *(b) |

Seagate Technology Holdings PLC | | | | | | | | | | | 2,634 | | | | 140,208 | (b) |

Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | | | | | 846,412 | |

Total Information Technology | | | | | | | | | | | | | | | 4,324,420 | |

See Notes to Financial Statements.

| | | | |

20 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Materials — 7.3% | | | | | | | | | | | | | | | | |

Chemicals — 4.0% | | | | | | | | | | | | | | | | |

CF Industries Holdings Inc. | | | | | | | | | | | 1,134 | | | $ | 109,147 | (b) |

Chemours Co. | | | | | | | | | | | 4,241 | | | | 104,541 | |

Huntsman Corp. | | | | | | | | | | | 4,897 | | | | 120,172 | (b) |

K+S AG, Registered Shares | | | | | | | | | | | 11,027 | | | | 208,818 | (a) |

Kuraray Co. Ltd. | | | | | | | | | | | 21,100 | | | | 147,515 | (a) |

Methanex Corp. | | | | | | | | | | | 3,700 | | | | 117,856 | (b) |

Mosaic Co. | | | | | | | | | | | 2,969 | | | | 143,492 | |

Nutrien Ltd. | | | | | | | | | | | 1,800 | | | | 150,114 | |

OCI NV | | | | | | | | | | | 6,210 | | | | 227,358 | (a) |

Tokyo Ohka Kogyo Co. Ltd. | | | | | | | | | | | 3,500 | | | | 146,039 | (a) |

Yara International ASA | | | | | | | | | | | 3,075 | | | | 107,918 | (a) |

Total Chemicals | | | | | | | | | | | | | | | 1,582,970 | |

Metals & Mining — 3.0% | | | | | | | | | | | | | | | | |

Acerinox SA | | | | | | | | | | | 19,500 | | | | 155,072 | (a) |

Alcoa Corp. | | | | | | | | | | | 2,969 | | | | 99,937 | (b) |

Coronado Global Resources Inc. | | | | | | | | | | | 120,339 | | | | 134,350 | (a) |

Evraz PLC | | | | | | | | | | | 66,007 | | | | 0 | (a)(c)(d) |

Hudbay Minerals Inc. | | | | | | | | | | | 31,200 | | | | 125,582 | (b) |

Iluka Resources Ltd. | | | | | | | | | | | 19,933 | | | | 115,400 | (a) |

Outokumpu oyj | | | | | | | | | | | 33,796 | | | | 115,732 | (a) |

South32 Ltd. | | | | | | | | | | | 69,336 | | | | 164,597 | (a) |

Sumitomo Metal Mining Co. Ltd. | | | | | | | | | | | 5,000 | | | | 143,283 | (a) |

Teck Resources Ltd., Class B Shares | | | | | | | | | | | 4,900 | | | | 149,020 | (b) |

Total Metals & Mining | | | | | | | | | | | | | | | 1,202,973 | |

Paper & Forest Products — 0.3% | | | | | | | | | | | | | | | | |

Louisiana-Pacific Corp. | | | | | | | | | | | 2,807 | | | | 143,690 | (b) |

Total Materials | | | | | | | | | | | | | | | 2,929,633 | |

| Real Estate — 3.5% | | | | | | | | | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 2.9% | | | | | | | | | | | | | | | | |

Dexus | | | | | | | | | | | 30,642 | | | | 152,431 | (a) |

Dream Industrial Real Estate Investment Trust | | | | | | | | | | | 12,800 | | | | 99,427 | |

EPR Properties | | | | | | | | | | | 3,817 | | | | 136,878 | (b) |

Host Hotels & Resorts Inc. | | | | | | | | | | | 10,709 | | | | 170,059 | (b) |

Inmobiliaria Colonial Socimi SA | | | | | | | | | | | 14,691 | | | | 70,931 | (a) |

Kilroy Realty Corp. | | | | | | | | | | | 2,900 | | | | 122,119 | |

Klepierre SA | | | | | | | | | | | 10,179 | | | | 176,965 | (a) |

Simon Property Group Inc. | | | | | | | | | | | 1,463 | | | | 131,304 | |

Stockland | | | | | | | | | | | 55,970 | | | | 117,135 | (a) |

Total Equity Real Estate Investment Trusts (REITs) | | | | | | | | | | | | | | | 1,177,249 | |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 21 |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Real Estate Management & Development — 0.6% | | | | | | | | | | | | | | | | |

Daito Trust Construction Co. Ltd. | | | | | | | | | | | 2,400 | | | $ | 224,501 | (a) |

Total Real Estate | | | | | | | | | | | | | | | 1,401,750 | |

| Utilities — 2.7% | | | | | | | | | | | | | | | | |

Electric Utilities — 0.7% | | | | | | | | | | | | | | | | |

NRG Energy Inc. | | | | | | | | | | | 3,703 | | | | 141,714 | (b) |

Origin Energy Ltd. | | | | | | | | | | | 36,579 | | | | 121,368 | (a) |

Total Electric Utilities | | | | | | | | | | | | | | | 263,082 | |

Gas Utilities — 0.3% | | | | | | | | | | | | | | | | |

Nippon Gas Co. Ltd. | | | | | | | | | | | 8,500 | | | | 121,061 | (a) |

Independent Power and Renewable Electricity Producers — 0.3% | | | | | | | | | | | | | | | | |

Electric Power Development Co. Ltd. | | | | | | | | | | | 7,000 | | | | 98,990 | (a) |

Multi-Utilities — 1.4% | | | | | | | | | | | | | | | | |

AGL Energy Ltd. | | | | | | | | | | | 38,519 | | | | 168,036 | (a) |

Atco Ltd., Class I Shares | | | | | | | | | | | 3,300 | | | | 101,412 | |

Centrica PLC | | | | | | | | | | | 236,224 | | | | 185,366 | *(a) |

Engie SA | | | | | | | | | | | 10,603 | | | | 122,039 | (a) |

Total Multi-Utilities | | | | | | | | | | | | | | | 576,853 | |

Total Utilities | | | | | | | | | | | | | | | 1,059,986 | |

Total Investments before Short-Term Investments (Cost — $40,064,708) | | | | 36,057,855 | |

| | | | |

| | | | | | Rate | | | | | | | |

| Short-Term Investments — 5.0% | | | | | | | | | | | | | | | | |

Invesco Treasury Portfolio, Institutional Class (Cost — $1,971,919) | | | | | | | 2.846% | | | | 1,971,919 | | | | 1,971,919 | |

Total Investments — 95.5% (Cost — $42,036,627) | | | | | | | | | | | | | | | 38,029,774 | |

Other Assets in Excess of Liabilities — 4.5% | | | | | | | | | | | | | | | 1,808,310 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 39,838,084 | |

| * | Non-income producing security. |

| (a) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| (b) | All or a portion of this security is held at the broker as collateral for open securities sold short. |

| (c) | Security is valued using significant unobservable inputs (Note 1). |

| (d) | Value is less than $1. |

| | |

Abbreviation(s) used in this schedule: |

| |

| ADR | | — American Depositary Receipts |

See Notes to Financial Statements.

| | | | |

22 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

| | | | |

| Summary of Investments by Country** (unaudited) | | | |

| United States | | | 32.0 | % |

| Japan | | | 19.5 | |

| United Kingdom | | | 10.1 | |

| Canada | | | 7.6 | |

| France | | | 5.1 | |

| Australia | | | 4.1 | |

| Spain | | | 3.4 | |

| Germany | | | 2.3 | |

| Netherlands | | | 2.1 | |

| Switzerland | | | 1.9 | |

| Denmark | | | 1.3 | |

| Italy | | | 1.2 | |

| Israel | | | 1.2 | |

| Finland | | | 1.0 | |

| Portugal | | | 0.5 | |

| Sweden | | | 0.4 | |

| Belgium | | | 0.4 | |

| Puerto Rico | | | 0.4 | |

| Brazil | | | 0.3 | |

| Russia | | | 0.0 | ‡ |

| Short-Term Investments | | | 5.2 | |

| | | | 100.0 | % |

| ** | As a percentage of total investments. Please note that the Fund holdings are as of September 30, 2022 and are subject to change. |

| ‡ | Represents less than 0.1%. |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 23 |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

| Securities Sold Short — (90.7)% | | | | | | | | |

| Common Stocks — (90.7)% | | | | | | | | |

| Communication Services — (6.9)% | | | | | | | | |

Diversified Telecommunication Services — (2.5)% | | | | | | | | |

Cellnex Telecom SA | | | (4,373 | ) | | $ | (134,892 | ) (a) |

Deutsche Telekom AG, Registered Shares | | | (8,540 | ) | | | (145,365 | ) (a) |

Elisa oyj | | | (2,438 | ) | | | (110,463 | ) (a) |

Infrastrutture Wireless Italiane SpA | | | (16,005 | ) | | | (139,636 | ) (a) |

Telecom Italia SpA | | | (705,000 | ) | | | (130,402 | ) *(a) |

TELUS Corp. | | | (9,505 | ) | | | (188,753 | ) |

Vantage Towers AG | | | (6,200 | ) | | | (160,394 | ) (a) |

Total Diversified Telecommunication Services | | | | | | | (1,009,905 | ) |

Entertainment — (1.6)% | | | | | | | | |

Embracer Group AB | | | (18,926 | ) | | | (112,178 | ) *(a) |

Liberty Media Corp.-Liberty Formula One, Class C Shares | | | (1,908 | ) | | | (111,618 | ) * |

Manchester United PLC, Class A Shares | | | (11,706 | ) | | | (155,339 | ) |

Take-Two Interactive Software Inc. | | | (1,325 | ) | | | (144,425 | ) * |

Toho Co. Ltd. | | | (2,700 | ) | | | (98,179 | ) (a) |

Total Entertainment | | | | | | | (621,739 | ) |

Interactive Media & Services — (1.0)% | | | | | | | | |

Adevinta ASA | | | (23,643 | ) | | | (140,858 | ) *(a) |

Domain Holdings Australia Ltd. | | | (55,347 | ) | | | (113,907 | ) (a) |

Z Holdings Corp. | | | (43,700 | ) | | | (115,834 | ) (a) |

Total Interactive Media & Services | | | | | | | (370,599 | ) |

Media — (1.5)% | | | | | | | | |

Future PLC | | | (7,500 | ) | | | (108,427 | ) (a) |

ITV PLC | | | (166,887 | ) | | | (105,315 | ) (a) |

Kadokawa Corp. | | | (6,700 | ) | | | (122,844 | ) (a) |

Shaw Communications Inc., Class B Shares | | | (6,200 | ) | | | (150,764 | ) |

Viaplay Group AB | | | (3,826 | ) | | | (74,326 | ) *(a) |

Total Media | | | | | | | (561,676 | ) |

Wireless Telecommunication Services — (0.3)% | | | | | | | | |

SoftBank Group Corp. | | | (3,800 | ) | | | (128,786 | ) (a) |

Total Communication Services | | | | | | | (2,692,705 | ) |

| Consumer Discretionary — (11.0)% | | | | | | | | |

Auto Components — (1.2)% | | | | | | | | |

ARB Corp. Ltd. | | | (4,877 | ) | | | (86,649 | ) (a) |

Autoliv Inc., SDR | | | (2,150 | ) | | | (145,105 | ) (a) |

Dana Inc. | | | (8,421 | ) | | | (96,252 | ) |

Sumitomo Electric Industries Ltd. | | | (17,000 | ) | | | (172,576 | ) (a) |

Total Auto Components | | | | | | | (500,582 | ) |

See Notes to Financial Statements.

| | | | |

24 | | | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Automobiles — (0.3)% | | | | | | | | |

Toyota Motor Corp. | | | (10,700 | ) | | $ | (139,854 | ) (a) |

Diversified Consumer Services — (0.7)% | | | | | | | | |

ADT Inc. | | | (25,841 | ) | | | (193,549 | ) |

Mister Car Wash Inc. | | | (9,387 | ) | | | (80,540 | ) * |

Total Diversified Consumer Services | | | | | | | (274,089 | ) |

Hotels, Restaurants & Leisure — (3.1)% | | | | | | | | |

Aramark | | | (5,614 | ) | | | (175,157 | ) |

Basic-Fit NV | | | (4,510 | ) | | | (135,424 | ) *(a) |

Flutter Entertainment PLC | | | (1,433 | ) | | | (157,962 | ) *(a) |

Food & Life Cos. Ltd. | | | (6,500 | ) | | | (99,685 | ) (a) |

Fuji Kyuko Co. Ltd. | | | (4,800 | ) | | | (142,169 | ) (a) |

Genius Sports Ltd. | | | (28,204 | ) | | | (103,509 | ) * |

Oriental Land Co. Ltd. | | | (1,100 | ) | | | (149,192 | ) (a) |

Wingstop Inc. | | | (1,075 | ) | | | (134,827 | ) |

Zensho Holdings Co. Ltd. | | | (6,900 | ) | | | (170,590 | ) (a) |

Total Hotels, Restaurants & Leisure | | | | | | | (1,268,515 | ) |

Household Durables — (1.1)% | | | | | | | | |

Fujitsu General Ltd. | | | (5,900 | ) | | | (122,773 | ) (a) |

Garmin Ltd. | | | (1,378 | ) | | | (110,667 | ) |

Iida Group Holdings Co. Ltd. | | | (8,200 | ) | | | (110,998 | ) (a) |

Nagawa Co. Ltd. | | | (1,300 | ) | | | (66,706 | ) (a) |

Total Household Durables | | | | | | | (411,144 | ) |

Internet & Direct Marketing Retail — (3.1)% | | | | | | | | |

Amazon.com Inc. | | | (1,433 | ) | | | (161,929 | ) * |

Auction Technology Group PLC | | | (12,087 | ) | | | (95,567 | ) *(a) |

BHG Group AB | | | (15,101 | ) | | | (19,321 | ) *(a) |

Delivery Hero SE | | | (3,643 | ) | | | (133,068 | ) *(a) |

DoorDash Inc., Class A Shares | | | (2,120 | ) | | | (104,834 | ) * |

Etsy Inc. | | | (1,000 | ) | | | (100,130 | ) * |

Farfetch Ltd., Class A Shares | | | (16,328 | ) | | | (121,644 | ) * |

Just Eat Takeaway.com NV | | | (6,785 | ) | | | (105,247 | ) *(a) |

Mercari Inc. | | | (7,200 | ) | | | (96,035 | ) *(a) |

Prosus NV | | | (3,180 | ) | | | (165,445 | ) (a) |

Rakuten Group Inc. | | | (25,500 | ) | | | (109,127 | ) (a) |

THG PLC | | | (181,594 | ) | | | (75,841 | ) *(a) |

Total Internet & Direct Marketing Retail | | | | | | | (1,288,188 | ) |

Leisure Products — (0.3)% | | | | | | | | |

Thule Group AB | | | (5,161 | ) | | | (102,758 | ) (a) |

See Notes to Financial Statements.

| | | | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | | 25 | |

Schedule of investments (cont’d)

September 30, 2022

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Multiline Retail — (0.4)% | | | | | | | | |

B&M European Value Retail SA | | | (17,678 | ) | | $ | (60,127 | ) (a) |

Wesfarmers Ltd. | | | (4,029 | ) | | | (110,147 | ) (a) |

Total Multiline Retail | | | | | | | (170,274 | ) |

Specialty Retail — (0.1)% | | | | | | | | |

Carvana Co. | | | (1,045 | ) | | | (21,214 | ) * |

Textiles, Apparel & Luxury Goods — (0.7)% | | | | | | | | |

Crocs Inc. | | | (1,802 | ) | | | (123,725 | ) * |

EssilorLuxottica SA | | | (1,194 | ) | | | (162,292 | ) (a) |

Total Textiles, Apparel & Luxury Goods | | | | | | | (286,017 | ) |

Total Consumer Discretionary | | | | | | | (4,462,635 | ) |

| Consumer Staples — (7.1)% | | | | | | | | |

Beverages — (1.6)% | | | | | | | | |

Anheuser-Busch InBev SA/NV | | | (3,500 | ) | | | (158,538 | ) (a) |

Boston Beer Co. Inc., Class A Shares | | | (477 | ) | | | (154,381 | ) * |

Ito En Ltd. | | | (3,700 | ) | | | (149,665 | ) (a) |

Monster Beverage Corp. | | | (1,696 | ) | | | (147,484 | ) * |

Total Beverages | | | | | | | (610,068 | ) |

Food & Staples Retailing — (2.5)% | | | | | | | | |

Aeon Co. Ltd. | | | (9,300 | ) | | | (173,664 | ) (a) |

Endeavour Group Ltd. | | | (27,779 | ) | | | (124,843 | ) (a) |

J Sainsbury PLC | | | (65,737 | ) | | | (127,305 | ) (a) |

Kobe Bussan Co. Ltd. | | | (4,500 | ) | | | (108,258 | ) (a) |

Kusuri no Aoki Holdings Co. Ltd. | | | (3,400 | ) | | | (160,267 | ) (a) |

MatsukiyoCocokara & Co. | | | (2,900 | ) | | | (124,390 | ) (a) |

Ocado Group PLC | | | (17,176 | ) | | | (89,134 | ) *(a) |

Shop Apotheke Europe NV | | | (1,802 | ) | | | (72,444 | ) *(a) |

Zur Rose Group AG | | | (709 | ) | | | (20,914 | ) *(a) |

Total Food & Staples Retailing | | | | | | | (1,001,219 | ) |

Food Products — (1.8)% | | | | | | | | |

Bakkafrost P/F | | | (2,756 | ) | | | (109,689 | ) (a) |

Dole PLC | | | (10,514 | ) | | | (76,752 | ) |

Freshpet Inc. | | | (2,031 | ) | | | (101,733 | ) * |

J & J Snack Foods Corp. | | | (866 | ) | | | (112,121 | ) |

Kagome Co. Ltd. | | | (5,800 | ) | | | (120,811 | ) (a) |

Premium Brands Holdings Corp. | | | (1,500 | ) | | | (92,301 | ) |

Salmar ASA | | | (2,200 | ) | | | (74,154 | ) (a) |

Total Food Products | | | | | | | (687,561 | ) |

Household Products — (0.3)% | | | | | | | | |

Unicharm Corp. | | | (3,600 | ) | | | (118,098 | ) (a) |

See Notes to Financial Statements.

| | |

26 | | Franklin Global Market Neutral Fund 2022 Annual Report |

Franklin Global Market Neutral Fund

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Personal Products — (0.9)% | | | | | | | | |

Kose Corp. | | | (1,200 | ) | | $ | (123,725 | ) (a) |

Olaplex Holdings Inc. | | | (8,400 | ) | | | (80,220 | ) * |

Unilever PLC, ADR | | | (4,000 | ) | | | (175,360 | ) |

Total Personal Products | | | | | | | (379,305 | ) |

Total Consumer Staples | | | | | | | (2,796,251 | ) |

| Energy — (4.0)% | | | | | | | | |

Energy Equipment & Services — (0.8)% | | | | | | | | |

ChampionX Corp. | | | (6,534 | ) | | | (127,870 | ) |

John Wood Group PLC | | | (71,039 | ) | | | (100,323 | ) *(a) |

Worley Ltd. | | | (13,465 | ) | | | (109,776 | ) (a) |

Total Energy Equipment & Services | | | | | | | (337,969 | ) |

Oil, Gas & Consumable Fuels — (3.2)% | | | | | | | | |

Enbridge Inc. | | | (4,100 | ) | | | (152,027 | ) |

Enviva Inc. | | | (1,612 | ) | | | (96,817 | ) |

Iwatani Corp. | | | (3,100 | ) | | | (116,731 | ) (a) |

Kinetik Holdings Inc. | | | (3,498 | ) | | | (113,965 | ) |

New Fortress Energy Inc. | | | (2,866 | ) | | | (125,273 | ) |

NexGen Energy Ltd. | | | (36,400 | ) | | | (132,282 | ) * |

Parkland Corp. | | | (6,900 | ) | | | (147,855 | ) |

PrairieSky Royalty Ltd. | | | (12,600 | ) | | | (162,454 | ) |

TC Energy Corp. | | | (3,500 | ) | | | (140,978 | ) |

Tellurian Inc. | | | (35,834 | ) | | | (85,643 | ) * |

Total Oil, Gas & Consumable Fuels | | | | | | | (1,274,025 | ) |

Total Energy | | | | | | | (1,611,994 | ) |

| Financials — (12.8)% | | | | | | | | |

Banks — (4.8)% | | | | | | | | |

Bank of Kyoto Ltd. | | | (4,600 | ) | | | (168,938 | ) (a) |

CaixaBank SA | | | (49,091 | ) | | | (158,116 | ) (a) |

First Financial Bankshares Inc. | | | (4,180 | ) | | | (174,849 | ) |

Glacier Bancorp Inc. | | | (2,756 | ) | | | (135,402 | ) |

Home BancShares Inc. | | | (5,089 | ) | | | (114,553 | ) |

Huntington Bancshares Inc. | | | (11,586 | ) | | | (152,704 | ) |

Mitsubishi UFJ Financial Group Inc. | | | (22,000 | ) | | | (99,663 | ) (a) |

Mitsubishi UFJ Financial Group Inc., ADR | | | (25,300 | ) | | | (113,850 | ) |

National Australia Bank Ltd. | | | (7,178 | ) | | | (132,906 | ) (a) |

Pacific Premier Bancorp Inc. | | | (3,710 | ) | | | (114,862 | ) |

Prosperity Bancshares Inc. | | | (2,687 | ) | | | (179,169 | ) |

ServisFirst Bancshares Inc. | | | (1,484 | ) | | | (118,720 | ) |

Shiga Bank Ltd. | | | (4,800 | ) | | | (86,870 | ) (a) |

See Notes to Financial Statements.

| | | | |

| Franklin Global Market Neutral Fund 2022 Annual Report | | | | 27 |