Exhibit 99.2 Telenav Q2 FY20 Earnings Announcement February 13, 2020 This presentation supersedes the version the Company previously issued, dated February 6, 2020 . Investors should disregard the previous version. © 2019Exhibit 99.2 Telenav Q2 FY20 Earnings Announcement February 13, 2020 This presentation supersedes the version the Company previously issued, dated February 6, 2020 . Investors should disregard the previous version. © 2019

Forward Looking Statements This supplemental investor presentation contains forward-looking statements that are based on the Company management’s belief and assumptions and on information currently available to its management. Actual events or results may differ materially from those described in this document due to a number of risks and uncertainties. These potential risks and uncertainties include, among others: determine, achieve and accurately recognize revenue under customer engagements, including specifically related to the Company’s transaction with Grab Holdings; the Company's ability to develop and implement products for Ford, GM and Toyota and to support Ford, GM and Toyota and their customers; the impact of Ford’s announcement regarding the elimination of various sedans in North America over the near term; the impact of tariffs on sales of automobiles in the United States and other markets; the Company’s success in extending its contracts for current and new generation of products with its existing automobile manufacturers and tier ones, particularly Ford; the impact of GM’s announcement regarding Google Automotive Services; the impact of Garmin’s announcement that it is providing navigation services to Ford; the Company’s ability to achieve additional design wins and the delivery dates of automobiles including the Company’s products; adoption by vehicle purchasers of Scout GPS Link; the Company’s ability to demonstrate internal controls over financial reporting and disclosures, including as it may relate to our recognition of revenue; the Company’s dependence on a limited number of automobile manufacturers and tier ones for a substantial portion of its revenue and the impact of labor stoppages on those automobile manufacturers’ and tier ones’ ability to produce vehicles; reductions in demand for automobiles; potential impacts of automobile manufacturers and tier ones including competitive capabilities in their vehicles such as Apple CarPlay and Android Auto; the Company’s continued reporting of losses and operating expenses in excess of expectations; the Company’s ability to acquire certification for automotive SPICE and other contractual obligations with customers; failure to reach agreement with customers for awards and contracts on products and services in which the Company has expended resources developing; competition from other market participants who may provide comparable services to subscribers without charge; the timing of new product releases and vehicle production by the Company’s automotive customers, including inventory procurement and fulfillment; possible warranty claims, and the impact on consumer perception of its brand; the Company’s ability to perform under its initiatives with Amazon and Microsoft, and benefit from those initiatives; the potential that the Company may not be able to realize its deferred tax assets and may have to take a reserve against them; the Company’s reliance on its automobile manufacturers for volume and royalty reporting; the impact on revenue recognition and other financial reporting due to the amendment of contracts or changes in accounting standards; the impact of the novel corona virus on business activity and the Company’s operations; the Company’s ability to remediate its material weaknesses in its internal control over financial reporting and disclosures, and timely demonstrate such mitigation, including as it may relate to the Company’s recognition of revenue, including under the Grab Transaction; and macroeconomic and political conditions in the U.S. and abroad, in particular China. The Company discusses these risks in greater detail in “Risk Factors” and elsewhere in its Form 10-K for the fiscal year ended June 30, 2019 and other filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date made. You should review the company’s SEC filings carefully and with the understanding that actual future results may be materially different from what the Company expects. © 2019Forward Looking Statements This supplemental investor presentation contains forward-looking statements that are based on the Company management’s belief and assumptions and on information currently available to its management. Actual events or results may differ materially from those described in this document due to a number of risks and uncertainties. These potential risks and uncertainties include, among others: determine, achieve and accurately recognize revenue under customer engagements, including specifically related to the Company’s transaction with Grab Holdings; the Company's ability to develop and implement products for Ford, GM and Toyota and to support Ford, GM and Toyota and their customers; the impact of Ford’s announcement regarding the elimination of various sedans in North America over the near term; the impact of tariffs on sales of automobiles in the United States and other markets; the Company’s success in extending its contracts for current and new generation of products with its existing automobile manufacturers and tier ones, particularly Ford; the impact of GM’s announcement regarding Google Automotive Services; the impact of Garmin’s announcement that it is providing navigation services to Ford; the Company’s ability to achieve additional design wins and the delivery dates of automobiles including the Company’s products; adoption by vehicle purchasers of Scout GPS Link; the Company’s ability to demonstrate internal controls over financial reporting and disclosures, including as it may relate to our recognition of revenue; the Company’s dependence on a limited number of automobile manufacturers and tier ones for a substantial portion of its revenue and the impact of labor stoppages on those automobile manufacturers’ and tier ones’ ability to produce vehicles; reductions in demand for automobiles; potential impacts of automobile manufacturers and tier ones including competitive capabilities in their vehicles such as Apple CarPlay and Android Auto; the Company’s continued reporting of losses and operating expenses in excess of expectations; the Company’s ability to acquire certification for automotive SPICE and other contractual obligations with customers; failure to reach agreement with customers for awards and contracts on products and services in which the Company has expended resources developing; competition from other market participants who may provide comparable services to subscribers without charge; the timing of new product releases and vehicle production by the Company’s automotive customers, including inventory procurement and fulfillment; possible warranty claims, and the impact on consumer perception of its brand; the Company’s ability to perform under its initiatives with Amazon and Microsoft, and benefit from those initiatives; the potential that the Company may not be able to realize its deferred tax assets and may have to take a reserve against them; the Company’s reliance on its automobile manufacturers for volume and royalty reporting; the impact on revenue recognition and other financial reporting due to the amendment of contracts or changes in accounting standards; the impact of the novel corona virus on business activity and the Company’s operations; the Company’s ability to remediate its material weaknesses in its internal control over financial reporting and disclosures, and timely demonstrate such mitigation, including as it may relate to the Company’s recognition of revenue, including under the Grab Transaction; and macroeconomic and political conditions in the U.S. and abroad, in particular China. The Company discusses these risks in greater detail in “Risk Factors” and elsewhere in its Form 10-K for the fiscal year ended June 30, 2019 and other filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date made. You should review the company’s SEC filings carefully and with the understanding that actual future results may be materially different from what the Company expects. © 2019

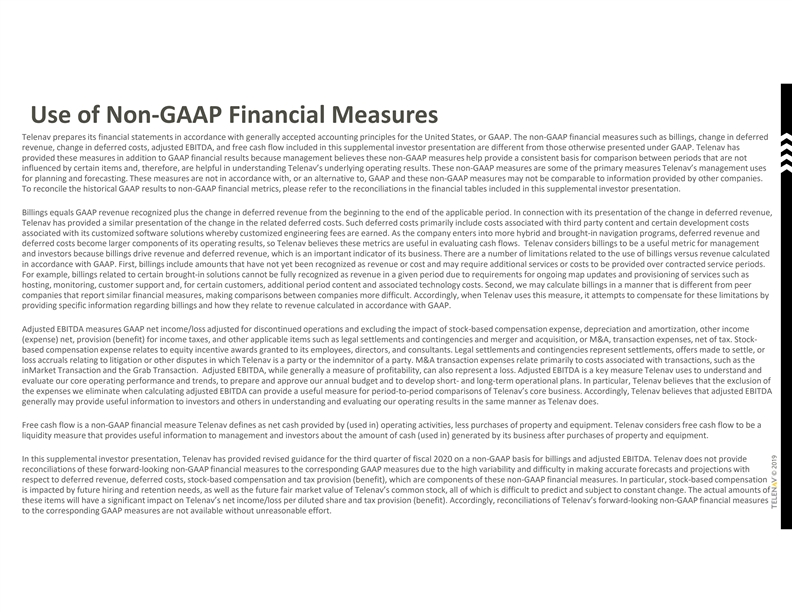

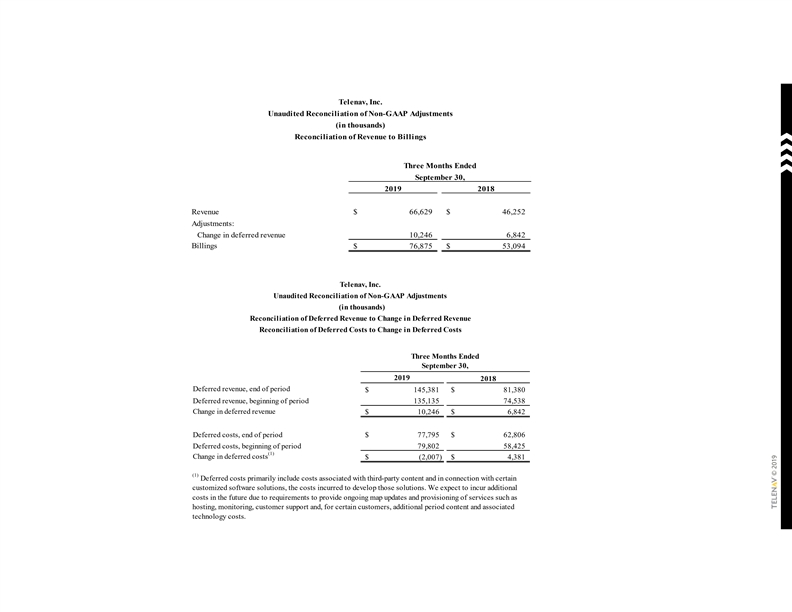

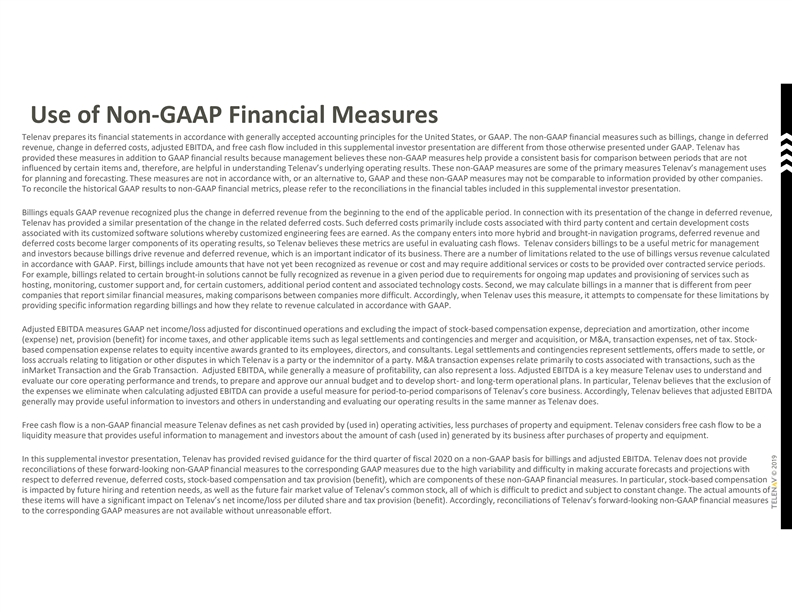

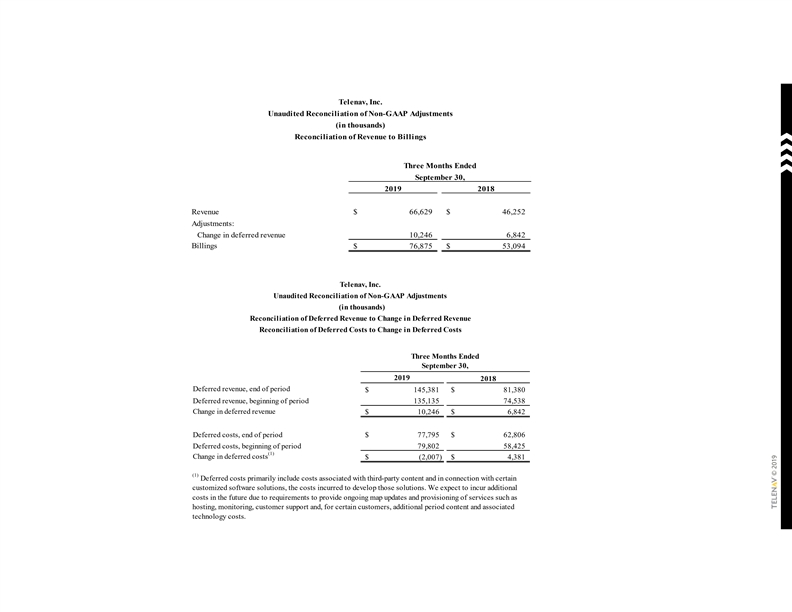

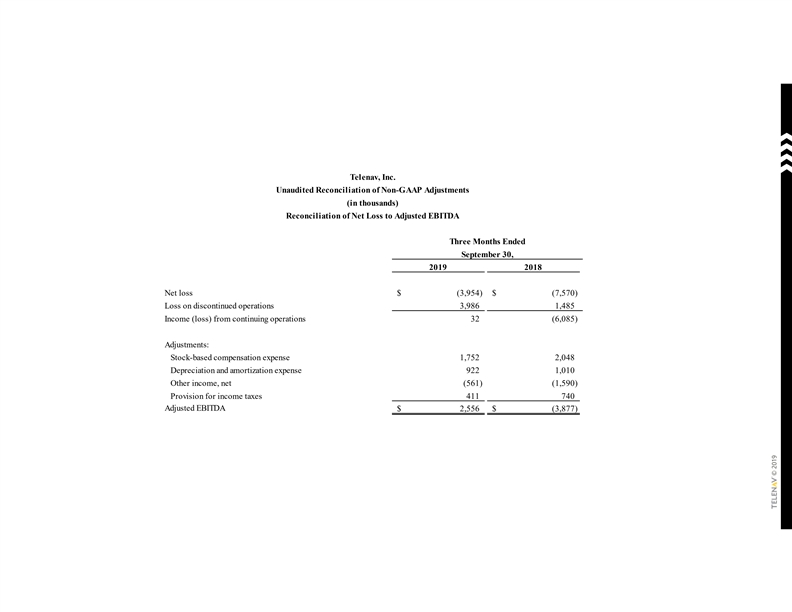

Use of Non-GAAP Financial Measures Telenav prepares its financial statements in accordance with generally accepted accounting principles for the United States, or GAAP. The non-GAAP financial measures such as billings, change in deferred revenue, change in deferred costs, adjusted EBITDA, and free cash flow included in this supplemental investor presentation are different from those otherwise presented under GAAP. Telenav has provided these measures in addition to GAAP financial results because management believes these non-GAAP measures help provide a consistent basis for comparison between periods that are not influenced by certain items and, therefore, are helpful in understanding Telenav’s underlying operating results. These non-GAAP measures are some of the primary measures Telenav’s management uses for planning and forecasting. These measures are not in accordance with, or an alternative to, GAAP and these non-GAAP measures may not be comparable to information provided by other companies. To reconcile the historical GAAP results to non-GAAP financial metrics, please refer to the reconciliations in the financial tables included in this supplemental investor presentation. Billings equals GAAP revenue recognized plus the change in deferred revenue from the beginning to the end of the applicable period. In connection with its presentation of the change in deferred revenue, Telenav has provided a similar presentation of the change in the related deferred costs. Such deferred costs primarily include costs associated with third party content and certain development costs associated with its customized software solutions whereby customized engineering fees are earned. As the company enters into more hybrid and brought-in navigation programs, deferred revenue and deferred costs become larger components of its operating results, so Telenav believes these metrics are useful in evaluating cash flows. Telenav considers billings to be a useful metric for management and investors because billings drive revenue and deferred revenue, which is an important indicator of its business. There are a number of limitations related to the use of billings versus revenue calculated in accordance with GAAP. First, billings include amounts that have not yet been recognized as revenue or cost and may require additional services or costs to be provided over contracted service periods. For example, billings related to certain brought-in solutions cannot be fully recognized as revenue in a given period due to requirements for ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs. Second, we may calculate billings in a manner that is different from peer companies that report similar financial measures, making comparisons between companies more difficult. Accordingly, when Telenav uses this measure, it attempts to compensate for these limitations by providing specific information regarding billings and how they relate to revenue calculated in accordance with GAAP. Adjusted EBITDA measures GAAP net income/loss adjusted for discontinued operations and excluding the impact of stock-based compensation expense, depreciation and amortization, other income (expense) net, provision (benefit) for income taxes, and other applicable items such as legal settlements and contingencies and merger and acquisition, or M&A, transaction expenses, net of tax. Stock- based compensation expense relates to equity incentive awards granted to its employees, directors, and consultants. Legal settlements and contingencies represent settlements, offers made to settle, or loss accruals relating to litigation or other disputes in which Telenav is a party or the indemnitor of a party. M&A transaction expenses relate primarily to costs associated with transactions, such as the inMarket Transaction and the Grab Transaction. Adjusted EBITDA, while generally a measure of profitability, can also represent a loss. Adjusted EBITDA is a key measure Telenav uses to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, Telenav believes that the exclusion of the expenses we eliminate when calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of Telenav’s core business. Accordingly, Telenav believes that adjusted EBITDA generally may provide useful information to investors and others in understanding and evaluating our operating results in the same manner as Telenav does. Free cash flow is a non-GAAP financial measure Telenav defines as net cash provided by (used in) operating activities, less purchases of property and equipment. Telenav considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash (used in) generated by its business after purchases of property and equipment. In this supplemental investor presentation, Telenav has provided revised guidance for the third quarter of fiscal 2020 on a non-GAAP basis for billings and adjusted EBITDA. Telenav does not provide reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections with respect to deferred revenue, deferred costs, stock-based compensation and tax provision (benefit), which are components of these non-GAAP financial measures. In particular, stock-based compensation is impacted by future hiring and retention needs, as well as the future fair market value of Telenav’s common stock, all of which is difficult to predict and subject to constant change. The actual amounts of these items will have a significant impact on Telenav’s net income/loss per diluted share and tax provision (benefit). Accordingly, reconciliations of Telenav’s forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. © 2019Use of Non-GAAP Financial Measures Telenav prepares its financial statements in accordance with generally accepted accounting principles for the United States, or GAAP. The non-GAAP financial measures such as billings, change in deferred revenue, change in deferred costs, adjusted EBITDA, and free cash flow included in this supplemental investor presentation are different from those otherwise presented under GAAP. Telenav has provided these measures in addition to GAAP financial results because management believes these non-GAAP measures help provide a consistent basis for comparison between periods that are not influenced by certain items and, therefore, are helpful in understanding Telenav’s underlying operating results. These non-GAAP measures are some of the primary measures Telenav’s management uses for planning and forecasting. These measures are not in accordance with, or an alternative to, GAAP and these non-GAAP measures may not be comparable to information provided by other companies. To reconcile the historical GAAP results to non-GAAP financial metrics, please refer to the reconciliations in the financial tables included in this supplemental investor presentation. Billings equals GAAP revenue recognized plus the change in deferred revenue from the beginning to the end of the applicable period. In connection with its presentation of the change in deferred revenue, Telenav has provided a similar presentation of the change in the related deferred costs. Such deferred costs primarily include costs associated with third party content and certain development costs associated with its customized software solutions whereby customized engineering fees are earned. As the company enters into more hybrid and brought-in navigation programs, deferred revenue and deferred costs become larger components of its operating results, so Telenav believes these metrics are useful in evaluating cash flows. Telenav considers billings to be a useful metric for management and investors because billings drive revenue and deferred revenue, which is an important indicator of its business. There are a number of limitations related to the use of billings versus revenue calculated in accordance with GAAP. First, billings include amounts that have not yet been recognized as revenue or cost and may require additional services or costs to be provided over contracted service periods. For example, billings related to certain brought-in solutions cannot be fully recognized as revenue in a given period due to requirements for ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs. Second, we may calculate billings in a manner that is different from peer companies that report similar financial measures, making comparisons between companies more difficult. Accordingly, when Telenav uses this measure, it attempts to compensate for these limitations by providing specific information regarding billings and how they relate to revenue calculated in accordance with GAAP. Adjusted EBITDA measures GAAP net income/loss adjusted for discontinued operations and excluding the impact of stock-based compensation expense, depreciation and amortization, other income (expense) net, provision (benefit) for income taxes, and other applicable items such as legal settlements and contingencies and merger and acquisition, or M&A, transaction expenses, net of tax. Stock- based compensation expense relates to equity incentive awards granted to its employees, directors, and consultants. Legal settlements and contingencies represent settlements, offers made to settle, or loss accruals relating to litigation or other disputes in which Telenav is a party or the indemnitor of a party. M&A transaction expenses relate primarily to costs associated with transactions, such as the inMarket Transaction and the Grab Transaction. Adjusted EBITDA, while generally a measure of profitability, can also represent a loss. Adjusted EBITDA is a key measure Telenav uses to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, Telenav believes that the exclusion of the expenses we eliminate when calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of Telenav’s core business. Accordingly, Telenav believes that adjusted EBITDA generally may provide useful information to investors and others in understanding and evaluating our operating results in the same manner as Telenav does. Free cash flow is a non-GAAP financial measure Telenav defines as net cash provided by (used in) operating activities, less purchases of property and equipment. Telenav considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash (used in) generated by its business after purchases of property and equipment. In this supplemental investor presentation, Telenav has provided revised guidance for the third quarter of fiscal 2020 on a non-GAAP basis for billings and adjusted EBITDA. Telenav does not provide reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections with respect to deferred revenue, deferred costs, stock-based compensation and tax provision (benefit), which are components of these non-GAAP financial measures. In particular, stock-based compensation is impacted by future hiring and retention needs, as well as the future fair market value of Telenav’s common stock, all of which is difficult to predict and subject to constant change. The actual amounts of these items will have a significant impact on Telenav’s net income/loss per diluted share and tax provision (benefit). Accordingly, reconciliations of Telenav’s forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. © 2019

Key Messages I Q2 FY20 Delivered another solid quarter & remained focused on executing our connected car strategy for sustainable growth and value creation Solid financial results 1ü $74M in revenue, up 47% Y/Y; a five-year high ü $14M in non-GAAP adjusted EBITDA; also a five-year high $129M cash position represents five-year high even after $4M in share repurchases & equity investments in the quarter 2 ü Equity investments made in multiple companies of approximately $20M ü Cash position and equity investments represents approx. 65% of TNAV’s Market Cap at end of the quarter Approx. $1B in non-GAAP backlog from existing customer engagements 3 ü Growing our share at GM & powering GM’s next generation marquee launch of the Cadillac Escalade ü Strategic relationship with Ford as the preferred Nav. supplier for next gen. Sync in NA, including high volume flagship F150 line Continued to execute on our connected car platform strategy to capitalize on the $500B connected car market q Solid progress in the In-Car Commerce space ü Won first In-Car Commerce (ICC) deal with a Japanese OEM 4 ü Invested in Synq3 to get access to thousands of restaurants & further build our ICC ecosystem q Partnering with Motion Auto on insurance solutions q Closed Grab Transaction & now exploring similar opportunities with other ride-hailing companies across the world - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings © 2019Key Messages I Q2 FY20 Delivered another solid quarter & remained focused on executing our connected car strategy for sustainable growth and value creation Solid financial results 1ü $74M in revenue, up 47% Y/Y; a five-year high ü $14M in non-GAAP adjusted EBITDA; also a five-year high $129M cash position represents five-year high even after $4M in share repurchases & equity investments in the quarter 2 ü Equity investments made in multiple companies of approximately $20M ü Cash position and equity investments represents approx. 65% of TNAV’s Market Cap at end of the quarter Approx. $1B in non-GAAP backlog from existing customer engagements 3 ü Growing our share at GM & powering GM’s next generation marquee launch of the Cadillac Escalade ü Strategic relationship with Ford as the preferred Nav. supplier for next gen. Sync in NA, including high volume flagship F150 line Continued to execute on our connected car platform strategy to capitalize on the $500B connected car market q Solid progress in the In-Car Commerce space ü Won first In-Car Commerce (ICC) deal with a Japanese OEM 4 ü Invested in Synq3 to get access to thousands of restaurants & further build our ICC ecosystem q Partnering with Motion Auto on insurance solutions q Closed Grab Transaction & now exploring similar opportunities with other ride-hailing companies across the world - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings © 2019

Connected Car Platform Strategy I Build, Acquire & Partner Building momentum via our flywheel strategy with laser focus on three pillars to capitalize on a +$500B TAM T E L E N A V C O N N E C T E D C A R P L A T F O R M » Location Based Intelligence (LBI) » Big Data + AI Margin Expansion with Higher v Quality Service v — Proprietary and Confidential © 2019 © 2019Connected Car Platform Strategy I Build, Acquire & Partner Building momentum via our flywheel strategy with laser focus on three pillars to capitalize on a +$500B TAM T E L E N A V C O N N E C T E D C A R P L A T F O R M » Location Based Intelligence (LBI) » Big Data + AI Margin Expansion with Higher v Quality Service v — Proprietary and Confidential © 2019 © 2019

1 Key Metrics| Q2 FY20 Grew revenue, expanded gross margin, generated cash, and grew installed base 1 4 7 2 3 4 Billings OPEX Total Cash on Hand 38% of Rev $73M $129M -13 pts YoY +28% YoY +50% YoY -7 pts QoQ -5% QoQ +6% QoQ 2 8 3 5 2 Revenue Adjusted EBITDA Connected Cars 17M $74M $14M +47% YoY +$15M YoY +46% YoY +11% QoQ +$12M QoQ +8% QoQ 3 6 9 3 2 Gross Margin % FCF Total Installed Base 54% 27M $12M +12 pts YoY +$7M YoY +28% YoY +10 pts QoQ -$10M QoQ +6% QoQ 1 Adjusted for discontinued operations for all periods 2 Non-GAAP measure – see Financial Tables for reconciliation of GAAP to Non-GAAP 3 GAAP measure - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings 4 Includes cash, cash equivalents, and short-term investments © 20191 Key Metrics| Q2 FY20 Grew revenue, expanded gross margin, generated cash, and grew installed base 1 4 7 2 3 4 Billings OPEX Total Cash on Hand 38% of Rev $73M $129M -13 pts YoY +28% YoY +50% YoY -7 pts QoQ -5% QoQ +6% QoQ 2 8 3 5 2 Revenue Adjusted EBITDA Connected Cars 17M $74M $14M +47% YoY +$15M YoY +46% YoY +11% QoQ +$12M QoQ +8% QoQ 3 6 9 3 2 Gross Margin % FCF Total Installed Base 54% 27M $12M +12 pts YoY +$7M YoY +28% YoY +10 pts QoQ -$10M QoQ +6% QoQ 1 Adjusted for discontinued operations for all periods 2 Non-GAAP measure – see Financial Tables for reconciliation of GAAP to Non-GAAP 3 GAAP measure - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings 4 Includes cash, cash equivalents, and short-term investments © 2019

1 Performance Overview Breakdown| Q2 FY20 Grew both product and services revenue Services Telenav Total Company Revenue Mix 17% Revenue Gross profit $73.9 million $40.2 million +47% y/y, +11% q/q 54% of revenue,+12.0 pts y/y, +9.7 pts q/q 83% Product Product Key Highlights Revenue Gross profit Ø Delivered a record revenue quarter while expanding gross margins $61.5 million $35.1 million Ø Total revenue of $73.9M, up 47% Y/Y; GM% of 54% up +45% y/y, +10% q/q 57% of revenue,+16.0 pts y/y, +14.2pts q/q 12.0pts Y/Y Ø Product revenue of $61.5M, up 45% Y/Y; GM% of 57% up Services 16.0pts Y/Y Ø Services revenue of $12.3M up 59% Y/Y; GM% of 41% down Revenue Gross profit 9.0pts Y/Y Ø Services business represented 17% of the overall revenue mix $12.3 million $5.0 million +59% y/y, +16% q/q 41% of revenue, -9.0 pts y/y, -13.4 pts q/q All measures above are GAAP 1 Adjusted for discontinued operations for all periods - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings © 20191 Performance Overview Breakdown| Q2 FY20 Grew both product and services revenue Services Telenav Total Company Revenue Mix 17% Revenue Gross profit $73.9 million $40.2 million +47% y/y, +11% q/q 54% of revenue,+12.0 pts y/y, +9.7 pts q/q 83% Product Product Key Highlights Revenue Gross profit Ø Delivered a record revenue quarter while expanding gross margins $61.5 million $35.1 million Ø Total revenue of $73.9M, up 47% Y/Y; GM% of 54% up +45% y/y, +10% q/q 57% of revenue,+16.0 pts y/y, +14.2pts q/q 12.0pts Y/Y Ø Product revenue of $61.5M, up 45% Y/Y; GM% of 57% up Services 16.0pts Y/Y Ø Services revenue of $12.3M up 59% Y/Y; GM% of 41% down Revenue Gross profit 9.0pts Y/Y Ø Services business represented 17% of the overall revenue mix $12.3 million $5.0 million +59% y/y, +16% q/q 41% of revenue, -9.0 pts y/y, -13.4 pts q/q All measures above are GAAP 1 Adjusted for discontinued operations for all periods - Please refer to the financial tables at the back of this presentation and Telenav’s Investor Relations website for the latest SEC filings © 2019

Key Financial Metrics | YoY, QoQ Five-year high in revenue, with significant growth across all financial metrics reflected $76.9 $73.9 $72.7 $66.6 $56.6 $50.2 Revenue ($m) Billings ($m) - Revenue is a GAAP measure - Billings is a non-GAAP measure - Adjusted for discontinued operations for all periods Q2 FY19 Q1 FY20 Q2 FY20 Q2 FY19 Q1 FY20 Q2 FY20 $129.0 $121.8 $21.7 Total Cash on Hand ($m) Free Cash Flow ($m) $85.9 $11.7 - Both charts represent Non-GAAP measures $5.2 - Total Cash on Hand includes cash, cash equivalents, and short- term investments -Adjusted for discontinued operations for all periods - Q1 FY20 benefits from $12.5M one-time - Please refer to the financial tables at the back of this presentation and cash collection associated with Grab licensing Telenav’s Investor Relations website for the latest SEC filings 8 Q2 FY19 Q1 FY20 Q2 FY20 Q2 FY19 Q1 FY20 Q2 FY20 © 2019Key Financial Metrics | YoY, QoQ Five-year high in revenue, with significant growth across all financial metrics reflected $76.9 $73.9 $72.7 $66.6 $56.6 $50.2 Revenue ($m) Billings ($m) - Revenue is a GAAP measure - Billings is a non-GAAP measure - Adjusted for discontinued operations for all periods Q2 FY19 Q1 FY20 Q2 FY20 Q2 FY19 Q1 FY20 Q2 FY20 $129.0 $121.8 $21.7 Total Cash on Hand ($m) Free Cash Flow ($m) $85.9 $11.7 - Both charts represent Non-GAAP measures $5.2 - Total Cash on Hand includes cash, cash equivalents, and short- term investments -Adjusted for discontinued operations for all periods - Q1 FY20 benefits from $12.5M one-time - Please refer to the financial tables at the back of this presentation and cash collection associated with Grab licensing Telenav’s Investor Relations website for the latest SEC filings 8 Q2 FY19 Q1 FY20 Q2 FY20 Q2 FY19 Q1 FY20 Q2 FY20 © 2019

Backlog From Existing Customer Engagements Provides line of sight into sustainable revenue streams Expect to convert approx. 75% of backlog from H2FY20 through FY23 into revenue Does not include Ø Any new OEMs that are in the pipeline Ø Increase in share of wallet within existing OEMs ~$1B Ø In-Car Commerce Ø VIVID offerings including aftermarket play Ø Any new business models such as auto insurance - Backlog figures are Non-GAAP, and are based upon management estimates of future vehicle shipments with Telenav solutions for current contracted programs being delivered or contracted for future delivery to our customers - Backlog are subject to several factors, including but not limited to, the number and timing of vehicles our customers ship with Telenav solutions, potential terminations or changes in scope of our customer relationships and several macro and micro economic factors - Estimates do not include new programs with existing customers, new programs with new customers nor new products or business models such as VIVID, ICC or any aftermarket offerings - Management estimates as of February 13, 2020 © 2019Backlog From Existing Customer Engagements Provides line of sight into sustainable revenue streams Expect to convert approx. 75% of backlog from H2FY20 through FY23 into revenue Does not include Ø Any new OEMs that are in the pipeline Ø Increase in share of wallet within existing OEMs ~$1B Ø In-Car Commerce Ø VIVID offerings including aftermarket play Ø Any new business models such as auto insurance - Backlog figures are Non-GAAP, and are based upon management estimates of future vehicle shipments with Telenav solutions for current contracted programs being delivered or contracted for future delivery to our customers - Backlog are subject to several factors, including but not limited to, the number and timing of vehicles our customers ship with Telenav solutions, potential terminations or changes in scope of our customer relationships and several macro and micro economic factors - Estimates do not include new programs with existing customers, new programs with new customers nor new products or business models such as VIVID, ICC or any aftermarket offerings - Management estimates as of February 13, 2020 © 2019

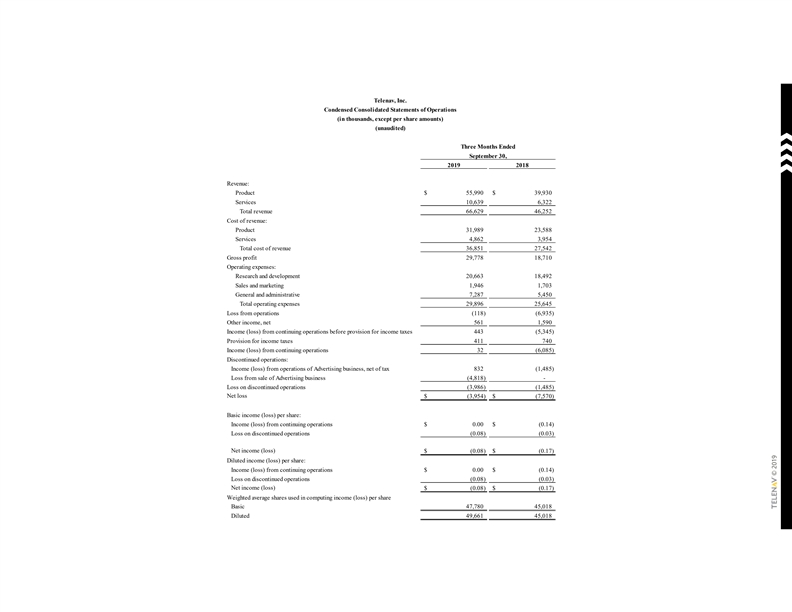

Q1 FY20 Financial Statement | Restatement Bridge Additional +$2.2M of revenue, +$2.2M of net income, +$2.2M of AEBITDA Impact of adjustments recorded • Revenue of $66.6M, an increase of +$2.2M from the previously reported first quarter of fiscal 2020 • Revenue growth of 44% over the first quarter of fiscal 2019 • Net loss of ($4.0), an improvement of +$2.2M from the previously reported first quarter of fiscal 2020 • Non-GAAP Adjusted EBITDA of $2.6M, an increase of +$2.2M from the previously reported first quarter of fiscal 2020 As Reported Sept 30, 2019 Form 10-Q Adjustments As Restated Q1 FY20 (dollars in millions) Revenue $64.5 +$2.2 $66.6 * Billings $76.6 +$0.3 $76.9 Gross profit $27.6 +$2.2 $29.8 Net income (loss) ($6.1) +$2.2 ($4.0) * Adjusted EBITDA $0.4 +$2.2 $2.6 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019Q1 FY20 Financial Statement | Restatement Bridge Additional +$2.2M of revenue, +$2.2M of net income, +$2.2M of AEBITDA Impact of adjustments recorded • Revenue of $66.6M, an increase of +$2.2M from the previously reported first quarter of fiscal 2020 • Revenue growth of 44% over the first quarter of fiscal 2019 • Net loss of ($4.0), an improvement of +$2.2M from the previously reported first quarter of fiscal 2020 • Non-GAAP Adjusted EBITDA of $2.6M, an increase of +$2.2M from the previously reported first quarter of fiscal 2020 As Reported Sept 30, 2019 Form 10-Q Adjustments As Restated Q1 FY20 (dollars in millions) Revenue $64.5 +$2.2 $66.6 * Billings $76.6 +$0.3 $76.9 Gross profit $27.6 +$2.2 $29.8 Net income (loss) ($6.1) +$2.2 ($4.0) * Adjusted EBITDA $0.4 +$2.2 $2.6 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019

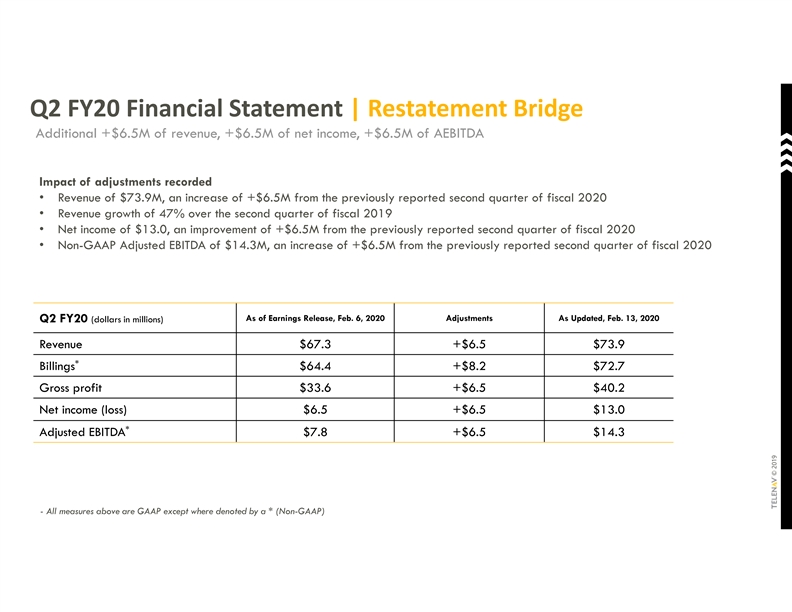

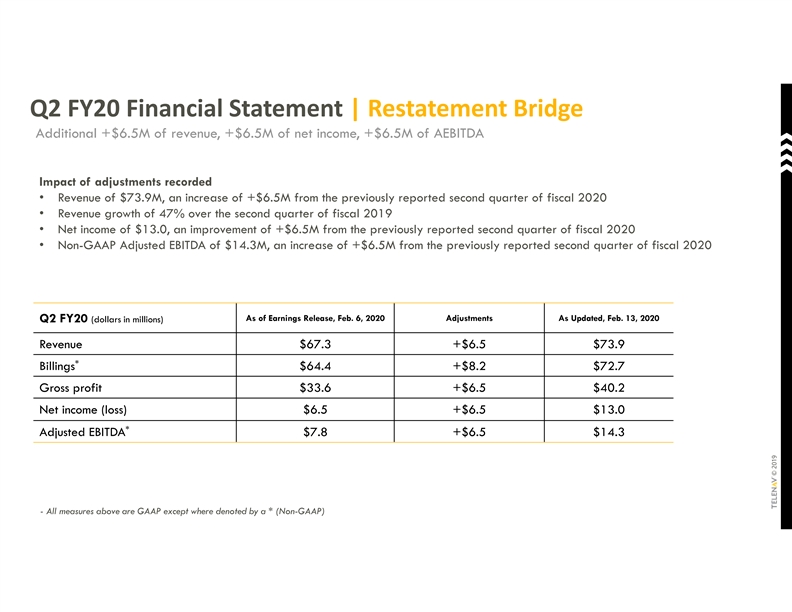

Q2 FY20 Financial Statement | Restatement Bridge Additional +$6.5M of revenue, +$6.5M of net income, +$6.5M of AEBITDA Impact of adjustments recorded • Revenue of $73.9M, an increase of +$6.5M from the previously reported second quarter of fiscal 2020 • Revenue growth of 47% over the second quarter of fiscal 2019 • Net income of $13.0, an improvement of +$6.5M from the previously reported second quarter of fiscal 2020 • Non-GAAP Adjusted EBITDA of $14.3M, an increase of +$6.5M from the previously reported second quarter of fiscal 2020 As of Earnings Release, Feb. 6, 2020 Adjustments As Updated, Feb. 13, 2020 Q2 FY20 (dollars in millions) Revenue $67.3 +$6.5 $73.9 * Billings $64.4 +$8.2 $72.7 Gross profit $33.6 +$6.5 $40.2 Net income (loss) $6.5 +$6.5 $13.0 * Adjusted EBITDA $7.8 +$6.5 $14.3 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019Q2 FY20 Financial Statement | Restatement Bridge Additional +$6.5M of revenue, +$6.5M of net income, +$6.5M of AEBITDA Impact of adjustments recorded • Revenue of $73.9M, an increase of +$6.5M from the previously reported second quarter of fiscal 2020 • Revenue growth of 47% over the second quarter of fiscal 2019 • Net income of $13.0, an improvement of +$6.5M from the previously reported second quarter of fiscal 2020 • Non-GAAP Adjusted EBITDA of $14.3M, an increase of +$6.5M from the previously reported second quarter of fiscal 2020 As of Earnings Release, Feb. 6, 2020 Adjustments As Updated, Feb. 13, 2020 Q2 FY20 (dollars in millions) Revenue $67.3 +$6.5 $73.9 * Billings $64.4 +$8.2 $72.7 Gross profit $33.6 +$6.5 $40.2 Net income (loss) $6.5 +$6.5 $13.0 * Adjusted EBITDA $7.8 +$6.5 $14.3 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019

Q3 FY20 Outlook © 2019Q3 FY20 Outlook © 2019

Q3 FY20 Outlook Guidance for operational metrics remains unchanged compared with February 6, 2020. Only Net income is revised Guidance (as of February 13, 2020) (dollars in millions) Revenue $61.5 to $63.5 * Billings $62.5 to $64.5 Gross margin % 42% to 44% Operating expenses $29 to $31 Net income ($5) to ($3) * Adjusted EBITDA ($1.5) to $0.5 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019Q3 FY20 Outlook Guidance for operational metrics remains unchanged compared with February 6, 2020. Only Net income is revised Guidance (as of February 13, 2020) (dollars in millions) Revenue $61.5 to $63.5 * Billings $62.5 to $64.5 Gross margin % 42% to 44% Operating expenses $29 to $31 Net income ($5) to ($3) * Adjusted EBITDA ($1.5) to $0.5 - All measures above are GAAP except where denoted by a * (Non-GAAP) © 2019

Q2 FY20 Financial Tables © 2019Q2 FY20 Financial Tables © 2019

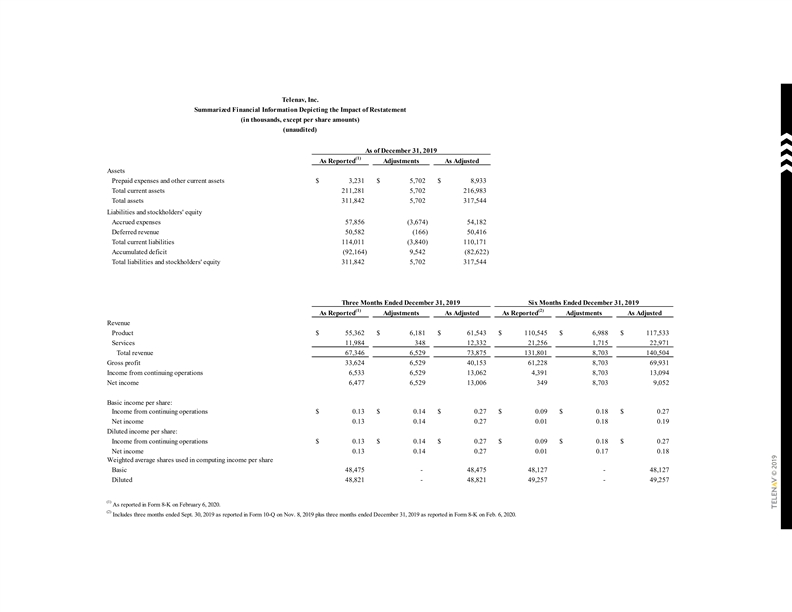

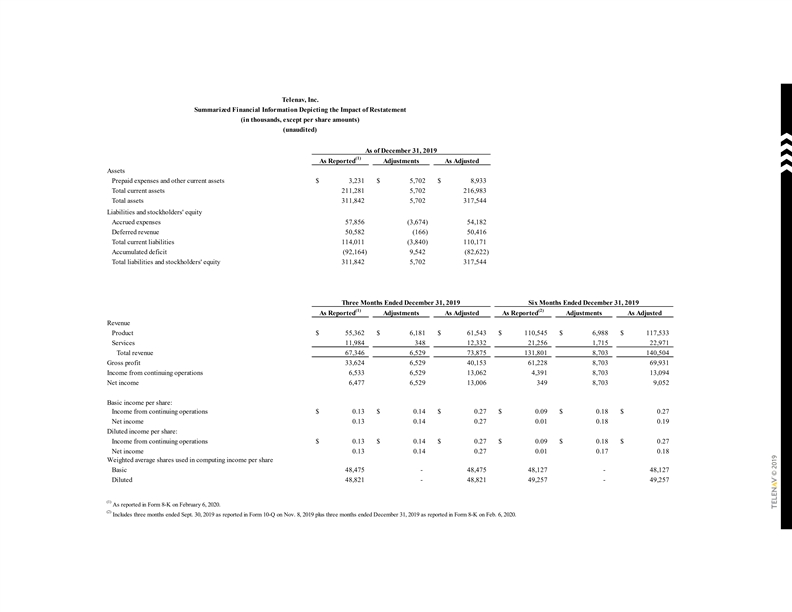

Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement (in thousands, except per share amounts) (unaudited) As of December 31, 2019 (1) As Reported Adjustments As Adjusted Assets Prepaid expenses and other current assets $ 3,231 $ 5,702 $ 8,933 Total current assets 211,281 5,702 216,983 Total assets 311,842 5,702 317,544 Liabilities and stockholders' equity Accrued expenses 57,856 (3,674) 54,182 Deferred revenue 50,582 (166) 50,416 Total current liabilities 114,011 (3,840) 110,171 Accumulated deficit (92,164) 9,542 (82,622) Total liabilities and stockholders' equity 311,842 5,702 317,544 Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Revenue Product $ 55,362 $ 6,181 $ 61,543 $ 110,545 $ 6,988 $ 117,533 Services 11,984 348 12,332 21,256 1,715 22,971 Total revenue 67,346 6,529 73,875 131,801 8,703 140,504 Gross profit 33,624 6,529 40,153 61,228 8,703 69,931 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Net income 6,477 6,529 13,006 349 8,703 9,052 Basic income per share: Income from continuing operations $ 0.13 $ 0.14 $ 0.27 $ 0.09 $ 0.18 $ 0.27 Net income 0.13 0.14 0.27 0.01 0.18 0.19 Diluted income per share: Income from continuing operations $ 0.13 $ 0.14 $ 0.27 $ 0.09 $ 0.18 $ 0.27 Net income 0.13 0.14 0.27 0.01 0.17 0.18 Weighted average shares used in computing income per share Basic 48,475 - 48,475 48,127 - 48,127 Diluted 48,821 - 48,821 49,257 - 49,257 (1) As reported in Form 8-K on February 6, 2020. (2) Includes three months ended Sept. 30, 2019 as reported in Form 10-Q on Nov. 8, 2019 plus three months ended December 31, 2019 as reported in Form 8-K on Feb. 6, 2020. © 2019Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement (in thousands, except per share amounts) (unaudited) As of December 31, 2019 (1) As Reported Adjustments As Adjusted Assets Prepaid expenses and other current assets $ 3,231 $ 5,702 $ 8,933 Total current assets 211,281 5,702 216,983 Total assets 311,842 5,702 317,544 Liabilities and stockholders' equity Accrued expenses 57,856 (3,674) 54,182 Deferred revenue 50,582 (166) 50,416 Total current liabilities 114,011 (3,840) 110,171 Accumulated deficit (92,164) 9,542 (82,622) Total liabilities and stockholders' equity 311,842 5,702 317,544 Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Revenue Product $ 55,362 $ 6,181 $ 61,543 $ 110,545 $ 6,988 $ 117,533 Services 11,984 348 12,332 21,256 1,715 22,971 Total revenue 67,346 6,529 73,875 131,801 8,703 140,504 Gross profit 33,624 6,529 40,153 61,228 8,703 69,931 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Net income 6,477 6,529 13,006 349 8,703 9,052 Basic income per share: Income from continuing operations $ 0.13 $ 0.14 $ 0.27 $ 0.09 $ 0.18 $ 0.27 Net income 0.13 0.14 0.27 0.01 0.18 0.19 Diluted income per share: Income from continuing operations $ 0.13 $ 0.14 $ 0.27 $ 0.09 $ 0.18 $ 0.27 Net income 0.13 0.14 0.27 0.01 0.17 0.18 Weighted average shares used in computing income per share Basic 48,475 - 48,475 48,127 - 48,127 Diluted 48,821 - 48,821 49,257 - 49,257 (1) As reported in Form 8-K on February 6, 2020. (2) Includes three months ended Sept. 30, 2019 as reported in Form 10-Q on Nov. 8, 2019 plus three months ended December 31, 2019 as reported in Form 8-K on Feb. 6, 2020. © 2019

Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement of Non-GAAP Adjustments (in thousands, except per share amounts) (unaudited) Reconciliation of Revenue to Billings Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Revenue $ 67,346 $ 6,529 $ 73,875 $ 131,801 $ 8,703 $ 140,504 Adjustments: Change in deferred revenue (2,920) 1,710 (1,210) 9,202 (166) 9,036 Billings $ 64,426 $ 8,239 $ 72,665 $ 1 41,003 $ 8,537 $ 1 49,540 Reconciliation of Net Income to Adjusted EBITDA Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Net income $ 6,477 $ 6,529 $ 13,006 $ 349 $ 8,703 $ 9,052 Loss on discontinued operations 56 - 56 4,042 - 4,042 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Adjustments: Stock-based compensation expense 1,478 - 1,478 3,230 - 3,230 Depreciation and amortization expense 934 - 934 1,856 - 1,856 Other income, net (596) - (596) (1,157) - (1,157) Provision for income taxes 205 - 205 616 - 616 Equity in net income of equity method investees (797) - (797) (797) - (797) Adjusted EBITDA $ 7,757 $ 6,529 $ 14,286 $ 8,139 $ 8,703 $ 16,842 Reconciliation of Net Income to Free Cash Flow Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Net income $ 6,477 $ 6,529 $ 13,006 $ 349 $ 8,703 $ 9,052 Loss on discontinued operations 56 - 56 4,042 - 4,042 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Adjustments to reconcile net income to net cash provided by operating activities: (3) Change in deferred revenue (3,019) 1,710 (1,309) 9,202 (166) 9,036 (4) Change in deferred costs (3,940) - (3,940) (1,961) - (1,961) Changes in other operating assets and liabilities 10,479 (8,239) 2,240 17,259 (8,537) 8,722 (5) Other adjustments 2,291 - 2,291 5,622 - 5,622 Net cash provided by operating activities 12,344 - 12,344 34,513 - 34,513 Less: Purchases of property and equipment (617) - (617) (1,078) - (1,078) Free cash flow $ 11,727 $ - $ 11,727 $ 33,435 $ - $ 33,435 (1) As reported in Form 8-K on February 6, 2020. (2) Includes three months ended Sept. 30, 2019 as reported in Form 10-Q on Nov. 8, 2019 plus three months ended December 31, 2019 as reported in Form 8-K on Feb. 6, 2020. (3) Consists of product royalties, customized software development fees, service fees and subscription fees. (4) Consists primarily of third party content costs and customized software development expenses. (5) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash items. © 2019Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement of Non-GAAP Adjustments (in thousands, except per share amounts) (unaudited) Reconciliation of Revenue to Billings Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Revenue $ 67,346 $ 6,529 $ 73,875 $ 131,801 $ 8,703 $ 140,504 Adjustments: Change in deferred revenue (2,920) 1,710 (1,210) 9,202 (166) 9,036 Billings $ 64,426 $ 8,239 $ 72,665 $ 1 41,003 $ 8,537 $ 1 49,540 Reconciliation of Net Income to Adjusted EBITDA Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Net income $ 6,477 $ 6,529 $ 13,006 $ 349 $ 8,703 $ 9,052 Loss on discontinued operations 56 - 56 4,042 - 4,042 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Adjustments: Stock-based compensation expense 1,478 - 1,478 3,230 - 3,230 Depreciation and amortization expense 934 - 934 1,856 - 1,856 Other income, net (596) - (596) (1,157) - (1,157) Provision for income taxes 205 - 205 616 - 616 Equity in net income of equity method investees (797) - (797) (797) - (797) Adjusted EBITDA $ 7,757 $ 6,529 $ 14,286 $ 8,139 $ 8,703 $ 16,842 Reconciliation of Net Income to Free Cash Flow Three Months Ended December 31, 2019 Six Months Ended December 31, 2019 (1) (2) As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Net income $ 6,477 $ 6,529 $ 13,006 $ 349 $ 8,703 $ 9,052 Loss on discontinued operations 56 - 56 4,042 - 4,042 Income from continuing operations 6,533 6,529 13,062 4,391 8,703 13,094 Adjustments to reconcile net income to net cash provided by operating activities: (3) Change in deferred revenue (3,019) 1,710 (1,309) 9,202 (166) 9,036 (4) Change in deferred costs (3,940) - (3,940) (1,961) - (1,961) Changes in other operating assets and liabilities 10,479 (8,239) 2,240 17,259 (8,537) 8,722 (5) Other adjustments 2,291 - 2,291 5,622 - 5,622 Net cash provided by operating activities 12,344 - 12,344 34,513 - 34,513 Less: Purchases of property and equipment (617) - (617) (1,078) - (1,078) Free cash flow $ 11,727 $ - $ 11,727 $ 33,435 $ - $ 33,435 (1) As reported in Form 8-K on February 6, 2020. (2) Includes three months ended Sept. 30, 2019 as reported in Form 10-Q on Nov. 8, 2019 plus three months ended December 31, 2019 as reported in Form 8-K on Feb. 6, 2020. (3) Consists of product royalties, customized software development fees, service fees and subscription fees. (4) Consists primarily of third party content costs and customized software development expenses. (5) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash items. © 2019

Telenav, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (unaudited) December 31, June 30, December 31, June 30, 2019 2019 2019 2019 Assets Liabilities and stockholders’ equity Current assets: Current liabilities: Cash and cash equivalents $ 26,347 $ 27,275 Trade accounts payable $ 1,113 $ 16,061 Short-term investments 102,603 72,203 Accrued expenses 54,182 48,899 Accounts receivable, net of allowances of $7 and $7 at December 31, 2019 and June 30, 2019, respectively 44,463 69,781 Operating lease liabilities 3,532 - Restricted cash 1,520 1,950 Deferred revenue 50,416 31,270 Deferred costs 33,117 18,752 Income taxes payable 928 800 Prepaid expenses and other current assets 8,933 3,784 Liabilities of discontinued operations - 3,373 Assets of discontinued operations, non-current - 6,330 Total current liabilities 110,171 100,403 Total current assets 216,983 200,075 Deferred rent, non-current - 1,266 Property and equipment, net 5,215 5,583 Operating lease liabilities, non-current 6,459 - Operating lease right-of-use assets 8,749 - Deferred revenue, non-current 93,755 103,865 Deferred income taxes, non-current 1,401 998 Other long-term liabilities 678 811 Goodwill and intangible assets, net 15,265 15,701 Liabilities of discontinued operations, non-current 30 Deferred costs, non-current 48,646 61,050 Commitments and contingencies - - Other assets 21,285 1,414 Stockholders’ equity: Assets of discontinued operations, non-current - 12,194 Preferred stock, $0.001 par value: 50,000 shares authorized; no shares issued or outstanding - - Common stock, $0.001 par value: 600,000 shares authorized; 48,151 and 46,911 shares Total assets $ 3 17,544 $ 2 97,015 issued and outstanding at December 31, 2019 and June 30, 2019, respectively 48 47 Additional paid-in capital 190,593 182,349 Accumulated other comprehensive loss (1,538) (1,477) Accumulated deficit (82,622) (90,279) Total stockholders’ equity 106,481 90,640 Total liabilities and stockholders’ equity $ 3 17,544 $ 2 97,015 © 2019Telenav, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (unaudited) December 31, June 30, December 31, June 30, 2019 2019 2019 2019 Assets Liabilities and stockholders’ equity Current assets: Current liabilities: Cash and cash equivalents $ 26,347 $ 27,275 Trade accounts payable $ 1,113 $ 16,061 Short-term investments 102,603 72,203 Accrued expenses 54,182 48,899 Accounts receivable, net of allowances of $7 and $7 at December 31, 2019 and June 30, 2019, respectively 44,463 69,781 Operating lease liabilities 3,532 - Restricted cash 1,520 1,950 Deferred revenue 50,416 31,270 Deferred costs 33,117 18,752 Income taxes payable 928 800 Prepaid expenses and other current assets 8,933 3,784 Liabilities of discontinued operations - 3,373 Assets of discontinued operations, non-current - 6,330 Total current liabilities 110,171 100,403 Total current assets 216,983 200,075 Deferred rent, non-current - 1,266 Property and equipment, net 5,215 5,583 Operating lease liabilities, non-current 6,459 - Operating lease right-of-use assets 8,749 - Deferred revenue, non-current 93,755 103,865 Deferred income taxes, non-current 1,401 998 Other long-term liabilities 678 811 Goodwill and intangible assets, net 15,265 15,701 Liabilities of discontinued operations, non-current 30 Deferred costs, non-current 48,646 61,050 Commitments and contingencies - - Other assets 21,285 1,414 Stockholders’ equity: Assets of discontinued operations, non-current - 12,194 Preferred stock, $0.001 par value: 50,000 shares authorized; no shares issued or outstanding - - Common stock, $0.001 par value: 600,000 shares authorized; 48,151 and 46,911 shares Total assets $ 3 17,544 $ 2 97,015 issued and outstanding at December 31, 2019 and June 30, 2019, respectively 48 47 Additional paid-in capital 190,593 182,349 Accumulated other comprehensive loss (1,538) (1,477) Accumulated deficit (82,622) (90,279) Total stockholders’ equity 106,481 90,640 Total liabilities and stockholders’ equity $ 3 17,544 $ 2 97,015 © 2019

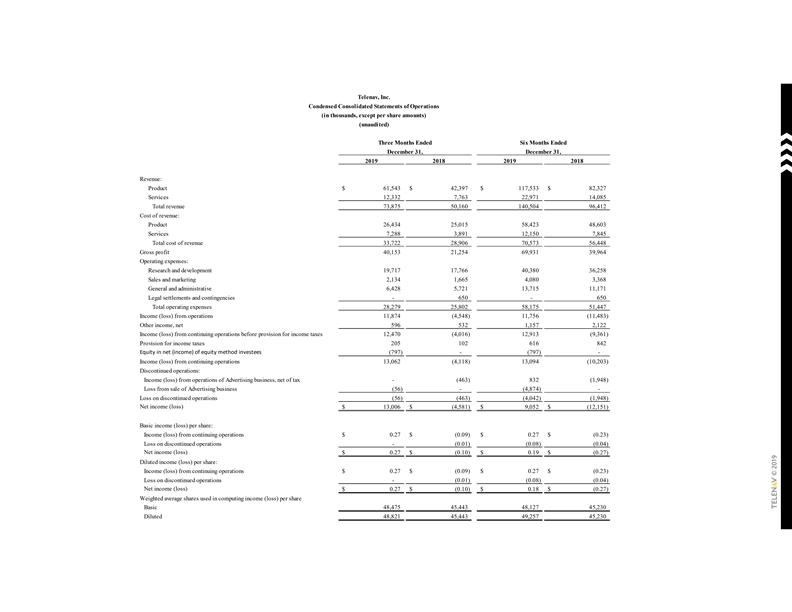

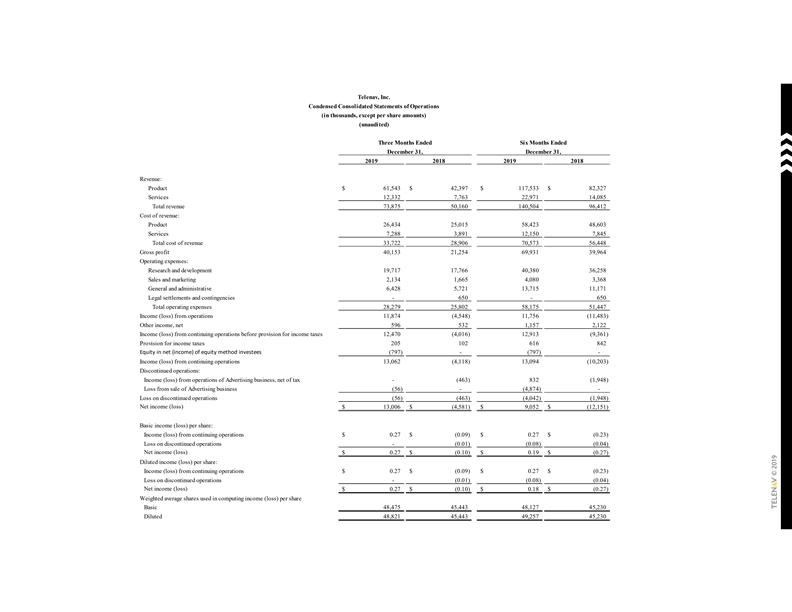

Telenav, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share amounts) (unaudited) Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Revenue: Product $ 61,543 $ 42,397 $ 117,533 $ 82,327 Services 12,332 7,763 22,971 14,085 Total revenue 73,875 50,160 140,504 96,412 Cost of revenue: Product 26,434 25,015 58,423 48,603 Services 7,288 3,891 12,150 7,845 Total cost of revenue 33,722 28,906 70,573 56,448 Gross profit 40,153 21,254 69,931 39,964 Operating expenses: Research and development 19,717 17,766 40,380 36,258 Sales and marketing 2,134 1,665 4,080 3,368 General and administrative 6,428 5,721 13,715 11,171 Legal settlements and contingencies - 650 - 650 Total operating expenses 28,279 25,802 58,175 51,447 Income (loss) from operations 11,874 (4,548) 11,756 (11,483) Other income, net 596 532 1,157 2,122 Income (loss) from continuing operations before provision for income taxes 12,470 (4,016) 12,913 (9,361) Provision for income taxes 205 102 616 842 Equity in net (income) of equity method investees (797) - (797) - Income (loss) from continuing operations 13,062 (4,118) 13,094 (10,203) Discontinued operations: Income (loss) from operations of Advertising business, net of tax - (463) 832 (1,948) Loss from sale of Advertising business (56) - (4,874) - Loss on discontinued operations (56) (463) (4,042) (1,948) Net income (loss) $ 13,006 $ ( 4,581) $ 9,052 $ (12,151) Basic income (loss) per share: Income (loss) from continuing operations $ 0.27 $ (0.09) $ 0.27 $ (0.23) Loss on discontinued operations - (0.01) (0.08) (0.04) Net income (loss) $ 0.27 $ (0.10) $ 0.19 $ (0.27) Diluted income (loss) per share: Income (loss) from continuing operations $ 0.27 $ (0.09) $ 0.27 $ (0.23) Loss on discontinued operations - (0.01) (0.08) (0.04) Net income (loss) $ 0.27 $ (0.10) $ 0.18 $ (0.27) Weighted average shares used in computing income (loss) per share Basic 48,475 45,443 48,127 45,230 Diluted 48,821 45,443 49,257 45,230 © 2019Telenav, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share amounts) (unaudited) Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Revenue: Product $ 61,543 $ 42,397 $ 117,533 $ 82,327 Services 12,332 7,763 22,971 14,085 Total revenue 73,875 50,160 140,504 96,412 Cost of revenue: Product 26,434 25,015 58,423 48,603 Services 7,288 3,891 12,150 7,845 Total cost of revenue 33,722 28,906 70,573 56,448 Gross profit 40,153 21,254 69,931 39,964 Operating expenses: Research and development 19,717 17,766 40,380 36,258 Sales and marketing 2,134 1,665 4,080 3,368 General and administrative 6,428 5,721 13,715 11,171 Legal settlements and contingencies - 650 - 650 Total operating expenses 28,279 25,802 58,175 51,447 Income (loss) from operations 11,874 (4,548) 11,756 (11,483) Other income, net 596 532 1,157 2,122 Income (loss) from continuing operations before provision for income taxes 12,470 (4,016) 12,913 (9,361) Provision for income taxes 205 102 616 842 Equity in net (income) of equity method investees (797) - (797) - Income (loss) from continuing operations 13,062 (4,118) 13,094 (10,203) Discontinued operations: Income (loss) from operations of Advertising business, net of tax - (463) 832 (1,948) Loss from sale of Advertising business (56) - (4,874) - Loss on discontinued operations (56) (463) (4,042) (1,948) Net income (loss) $ 13,006 $ ( 4,581) $ 9,052 $ (12,151) Basic income (loss) per share: Income (loss) from continuing operations $ 0.27 $ (0.09) $ 0.27 $ (0.23) Loss on discontinued operations - (0.01) (0.08) (0.04) Net income (loss) $ 0.27 $ (0.10) $ 0.19 $ (0.27) Diluted income (loss) per share: Income (loss) from continuing operations $ 0.27 $ (0.09) $ 0.27 $ (0.23) Loss on discontinued operations - (0.01) (0.08) (0.04) Net income (loss) $ 0.27 $ (0.10) $ 0.18 $ (0.27) Weighted average shares used in computing income (loss) per share Basic 48,475 45,443 48,127 45,230 Diluted 48,821 45,443 49,257 45,230 © 2019

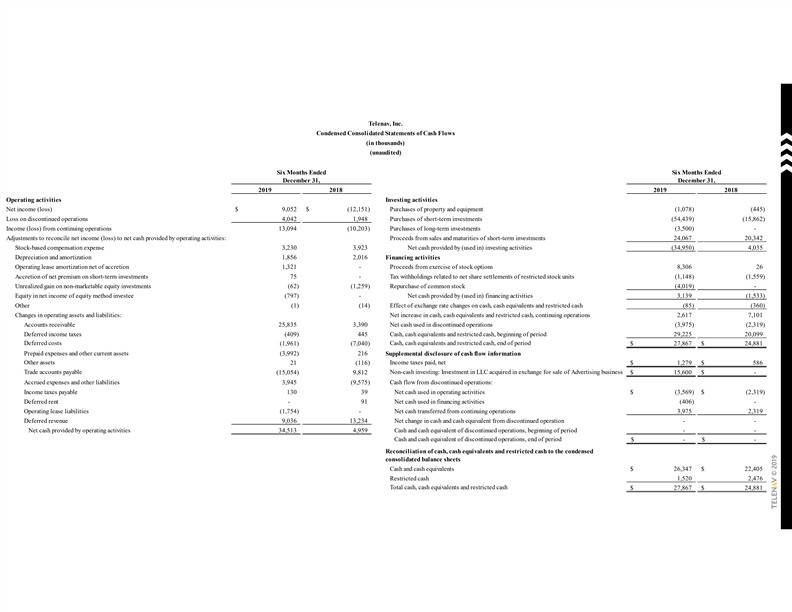

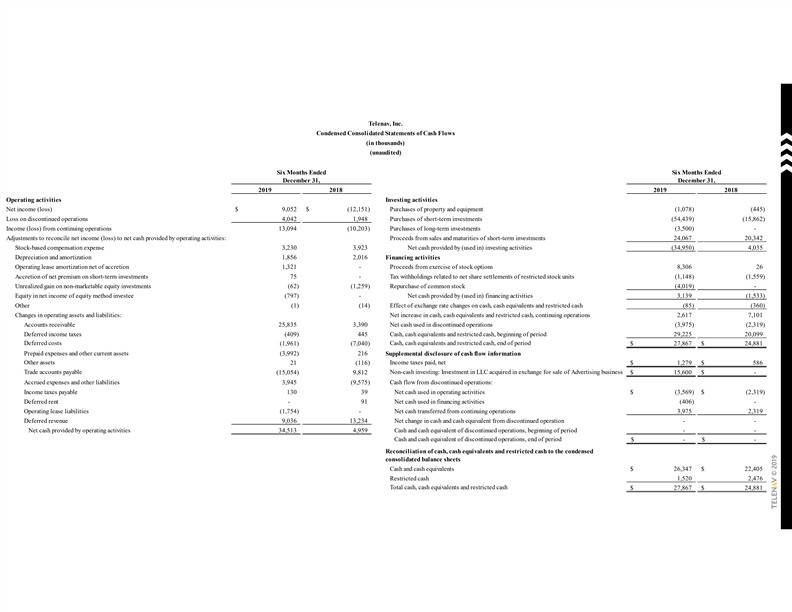

Telenav, Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Operating activities Investing activities Net income (loss) $ 9,052 $ (12,151) Purchases of property and equipment (1,078) (445) Loss on discontinued operations 4,042 1,948 Purchases of short-term investments (54,439) (15,862) Income (loss) from continuing operations 13,094 (10,203) Purchases of long-term investments (3,500) - Adjustments to reconcile net income (loss) to net cash provided by operating activities: Proceeds from sales and maturities of short-term investments 24,067 20,342 Stock-based compensation expense 3,230 3,923 Net cash provided by (used in) investing activities (34,950) 4,035 Depreciation and amortization 1,856 2,016 Financing activities Operating lease amortization net of accretion 1,321 - Proceeds from exercise of stock options 8,306 26 Accretion of net premium on short-term investments 75 - Tax withholdings related to net share settlements of restricted stock units (1,148) (1,559) Unrealized gain on non-marketable equity investments (62) (1,259) Repurchase of common stock (4,019) - Equity in net income of equity method investee (797) - Net cash provided by (used in) financing activities 3,139 (1,533) Other (1) (14) Effect of exchange rate changes on cash, cash equivalents and restricted cash (85) (360) Changes in operating assets and liabilities: Net increase in cash, cash equivalents and restricted cash, continuing operations 2,617 7,101 Accounts receivable 25,835 3,390 Net cash used in discontinued operations (3,975) (2,319) Deferred income taxes (409) 445 Cash, cash equivalents and restricted cash, beginning of period 29,225 20,099 Deferred costs Cash, cash equivalents and restricted cash, end of period (1,961) (7,040) $ 27,867 $ 24,881 Prepaid expenses and other current assets (3,992) 216 Supplemental disclosure of cash flow information Other assets Income taxes paid, net 21 (116) $ 1,279 $ 586 Trade accounts payable (15,054) 9,812 Non-cash investing: Investment in LLC acquired in exchange for sale of Advertising business $ 15,600 $ - Accrued expenses and other liabilities 3,945 (9,575) Cash flow from discontinued operations: Income taxes payable 130 39 Net cash used in operating activities $ (3,569) $ (2,319) Deferred rent - 91 Net cash used in financing activities (406) - Operating lease liabilities (1,754) - Net cash transferred from continuing operations 3,975 2,319 Deferred revenue 9,036 13,234 Net change in cash and cash equivalent from discontinued operation - - Net cash provided by operating activities 34,513 4,959 Cash and cash equivalent of discontinued operations, beginning of period - - Cash and cash equivalent of discontinued operations, end of period $ - $ - Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets Cash and cash equivalents $ 26,347 $ 22,405 Restricted cash 1,520 2,476 Total cash, cash equivalents and restricted cash $ 27,867 $ 24,881 © 2019Telenav, Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Operating activities Investing activities Net income (loss) $ 9,052 $ (12,151) Purchases of property and equipment (1,078) (445) Loss on discontinued operations 4,042 1,948 Purchases of short-term investments (54,439) (15,862) Income (loss) from continuing operations 13,094 (10,203) Purchases of long-term investments (3,500) - Adjustments to reconcile net income (loss) to net cash provided by operating activities: Proceeds from sales and maturities of short-term investments 24,067 20,342 Stock-based compensation expense 3,230 3,923 Net cash provided by (used in) investing activities (34,950) 4,035 Depreciation and amortization 1,856 2,016 Financing activities Operating lease amortization net of accretion 1,321 - Proceeds from exercise of stock options 8,306 26 Accretion of net premium on short-term investments 75 - Tax withholdings related to net share settlements of restricted stock units (1,148) (1,559) Unrealized gain on non-marketable equity investments (62) (1,259) Repurchase of common stock (4,019) - Equity in net income of equity method investee (797) - Net cash provided by (used in) financing activities 3,139 (1,533) Other (1) (14) Effect of exchange rate changes on cash, cash equivalents and restricted cash (85) (360) Changes in operating assets and liabilities: Net increase in cash, cash equivalents and restricted cash, continuing operations 2,617 7,101 Accounts receivable 25,835 3,390 Net cash used in discontinued operations (3,975) (2,319) Deferred income taxes (409) 445 Cash, cash equivalents and restricted cash, beginning of period 29,225 20,099 Deferred costs Cash, cash equivalents and restricted cash, end of period (1,961) (7,040) $ 27,867 $ 24,881 Prepaid expenses and other current assets (3,992) 216 Supplemental disclosure of cash flow information Other assets Income taxes paid, net 21 (116) $ 1,279 $ 586 Trade accounts payable (15,054) 9,812 Non-cash investing: Investment in LLC acquired in exchange for sale of Advertising business $ 15,600 $ - Accrued expenses and other liabilities 3,945 (9,575) Cash flow from discontinued operations: Income taxes payable 130 39 Net cash used in operating activities $ (3,569) $ (2,319) Deferred rent - 91 Net cash used in financing activities (406) - Operating lease liabilities (1,754) - Net cash transferred from continuing operations 3,975 2,319 Deferred revenue 9,036 13,234 Net change in cash and cash equivalent from discontinued operation - - Net cash provided by operating activities 34,513 4,959 Cash and cash equivalent of discontinued operations, beginning of period - - Cash and cash equivalent of discontinued operations, end of period $ - $ - Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets Cash and cash equivalents $ 26,347 $ 22,405 Restricted cash 1,520 2,476 Total cash, cash equivalents and restricted cash $ 27,867 $ 24,881 © 2019

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Revenue to Billings Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Revenue $ 73,875 $ 50,160 $ 140,504 $ 96,412 Adjustments: Change in deferred revenue (1,210) 6,392 9,036 13,234 Billings $ 72,665 $ 56,552 $ 1 49,540 $ 1 09,646 Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Deferred Revenue to Change in Deferred Revenue Reconciliation of Deferred Costs to Change in Deferred Costs Three Months Ended Six Months Ended December 31, December 31, 2019 2019 2018 2018 Deferred revenue, end of period $ 144,171 $ 87,772 $ 144,171 $ 87,772 Deferred revenue, beginning of period 145,381 81,380 135,135 74,538 Change in deferred revenue $ (1,210) $ 6,392 $ 9,036 $ 13,234 Deferred costs, end of period $ 81,763 $ 65,465 $ 81,763 $ 65,465 Deferred costs, beginning of period 77,795 62,806 79,802 58,425 (1) Change in deferred costs $ 3,968 $ 2,659 $ 1,961 $ 7,040 (1) Deferred costs primarily include costs associated with third-party content and in connection with certain customized software solutions, the costs incurred to develop those solutions. We expect to incur additional costs in the future due to requirements to provide ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs. © 2019Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Revenue to Billings Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Revenue $ 73,875 $ 50,160 $ 140,504 $ 96,412 Adjustments: Change in deferred revenue (1,210) 6,392 9,036 13,234 Billings $ 72,665 $ 56,552 $ 1 49,540 $ 1 09,646 Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Deferred Revenue to Change in Deferred Revenue Reconciliation of Deferred Costs to Change in Deferred Costs Three Months Ended Six Months Ended December 31, December 31, 2019 2019 2018 2018 Deferred revenue, end of period $ 144,171 $ 87,772 $ 144,171 $ 87,772 Deferred revenue, beginning of period 145,381 81,380 135,135 74,538 Change in deferred revenue $ (1,210) $ 6,392 $ 9,036 $ 13,234 Deferred costs, end of period $ 81,763 $ 65,465 $ 81,763 $ 65,465 Deferred costs, beginning of period 77,795 62,806 79,802 58,425 (1) Change in deferred costs $ 3,968 $ 2,659 $ 1,961 $ 7,040 (1) Deferred costs primarily include costs associated with third-party content and in connection with certain customized software solutions, the costs incurred to develop those solutions. We expect to incur additional costs in the future due to requirements to provide ongoing map updates and provisioning of services such as hosting, monitoring, customer support and, for certain customers, additional period content and associated technology costs. © 2019

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Net income (loss) $ 13,006 $ (4,581) $ 9,052 $ (12,151) Loss on discontinued operations 56 463 4,042 1,948 Income (loss) from continuing operations 13,062 (4,118) # 13,094 (10,203) Adjustments: Legal settlement and contingencies - 650 - 650 Stock-based compensation expense 1,478 1,875 3,230 3,923 Depreciation and amortization expense 934 1,006 1,856 2,016 Other income, net (596) (532) (1,157) (2,122) Provision for income taxes 205 102 616 842 Equity in net income of equity method investees (797) - (797) - Adjusted EBITDA $ 14,286 $ ( 1,017) $ 16,842 $ (4,894) © 2019Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Net income (loss) $ 13,006 $ (4,581) $ 9,052 $ (12,151) Loss on discontinued operations 56 463 4,042 1,948 Income (loss) from continuing operations 13,062 (4,118) # 13,094 (10,203) Adjustments: Legal settlement and contingencies - 650 - 650 Stock-based compensation expense 1,478 1,875 3,230 3,923 Depreciation and amortization expense 934 1,006 1,856 2,016 Other income, net (596) (532) (1,157) (2,122) Provision for income taxes 205 102 616 842 Equity in net income of equity method investees (797) - (797) - Adjusted EBITDA $ 14,286 $ ( 1,017) $ 16,842 $ (4,894) © 2019

Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Income (Loss) to Free Cash Flow Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Net income (loss) $ 13,006 $ (4,581) $ 9,052 $ (12,151) Loss on discontinued operations 56 463 4,042 1,948 Income (Loss) from continuing operations 13,062 (4,118) 13,094 (10,203) Adjustments to reconcile net loss to net cash provided by operating activities: (1) Change in deferred revenue (1,309) 6,392 9,036 13,234 (2) Change in deferred costs (3,940) (2,659) (1,961) (7,040) Changes in other operating assets and liabilities 2,240 3,036 8,722 4,302 (3) Other adjustments 2,291 2,862 5,622 4,666 Net cash provided by operating activities 12,344 5,513 34,513 4,959 Less: Purchases of property and equipment (617) (346) (1,078) (445) Free cash flow $ 11,727 $ 5,167 $ 3 3,435 $ 4,514 (1) Consists of product royalties, customized software development fees, service fees and subscription fees. (2) Consists primarily of third party content costs and customized software development expenses. (3) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash items. © 2019Telenav, Inc. Unaudited Reconciliation of Non-GAAP Adjustments (in thousands) Reconciliation of Net Income (Loss) to Free Cash Flow Three Months Ended Six Months Ended December 31, December 31, 2019 2018 2019 2018 Net income (loss) $ 13,006 $ (4,581) $ 9,052 $ (12,151) Loss on discontinued operations 56 463 4,042 1,948 Income (Loss) from continuing operations 13,062 (4,118) 13,094 (10,203) Adjustments to reconcile net loss to net cash provided by operating activities: (1) Change in deferred revenue (1,309) 6,392 9,036 13,234 (2) Change in deferred costs (3,940) (2,659) (1,961) (7,040) Changes in other operating assets and liabilities 2,240 3,036 8,722 4,302 (3) Other adjustments 2,291 2,862 5,622 4,666 Net cash provided by operating activities 12,344 5,513 34,513 4,959 Less: Purchases of property and equipment (617) (346) (1,078) (445) Free cash flow $ 11,727 $ 5,167 $ 3 3,435 $ 4,514 (1) Consists of product royalties, customized software development fees, service fees and subscription fees. (2) Consists primarily of third party content costs and customized software development expenses. (3) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash items. © 2019

Q1 FY20 Financial Tables © 2019Q1 FY20 Financial Tables © 2019

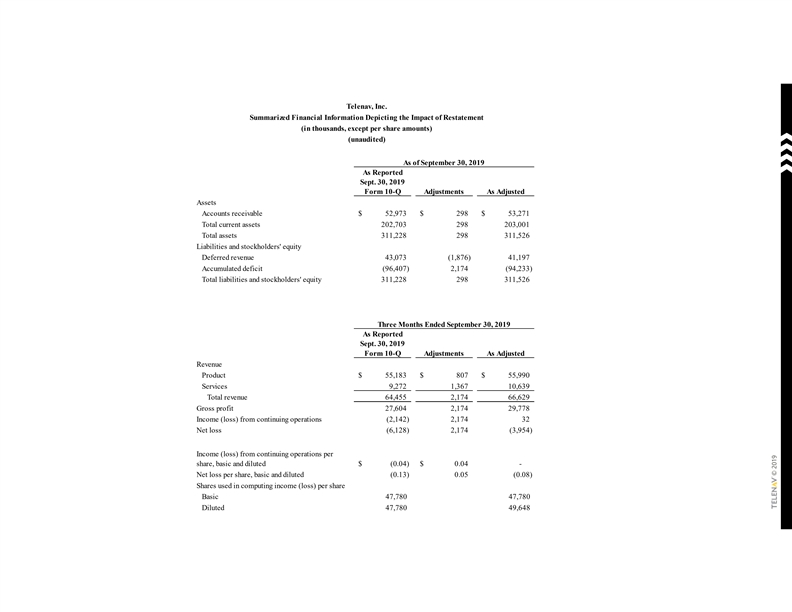

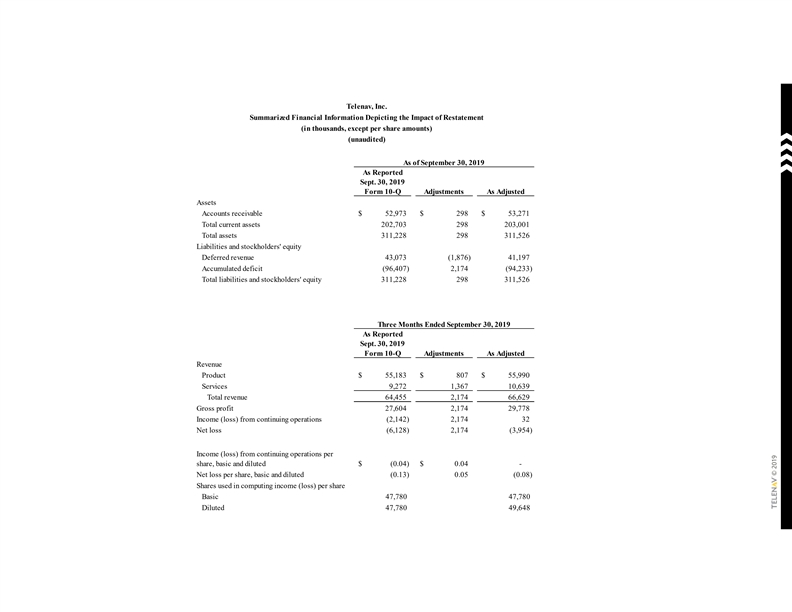

Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement (in thousands, except per share amounts) (unaudited) As of September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Assets Accounts receivable $ 5 2,973 $ 298 $ 5 3,271 Total current assets 202,703 298 203,001 Total assets 311,228 298 311,526 Liabilities and stockholders' equity Deferred revenue 43,073 (1,876) 41,197 Accumulated deficit (96,407) 2,174 (94,233) Total liabilities and stockholders' equity 311,228 298 311,526 Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Revenue Product $ 5 5,183 $ 807 $ 5 5,990 Services 9,272 1,367 10,639 Total revenue 64,455 2,174 66,629 Gross profit 27,604 2,174 29,778 Income (loss) from continuing operations (2,142) 2,174 32 Net loss (6,128) 2,174 (3,954) Income (loss) from continuing operations per share, basic and diluted $ (0.04) $ 0.04 - Net loss per share, basic and diluted (0.13) 0.05 (0.08) Shares used in computing income (loss) per share Basic 47,780 47,780 Diluted 47,780 49,648 © 2019Telenav, Inc. Summarized Financial Information Depicting the Impact of Restatement (in thousands, except per share amounts) (unaudited) As of September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Assets Accounts receivable $ 5 2,973 $ 298 $ 5 3,271 Total current assets 202,703 298 203,001 Total assets 311,228 298 311,526 Liabilities and stockholders' equity Deferred revenue 43,073 (1,876) 41,197 Accumulated deficit (96,407) 2,174 (94,233) Total liabilities and stockholders' equity 311,228 298 311,526 Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Revenue Product $ 5 5,183 $ 807 $ 5 5,990 Services 9,272 1,367 10,639 Total revenue 64,455 2,174 66,629 Gross profit 27,604 2,174 29,778 Income (loss) from continuing operations (2,142) 2,174 32 Net loss (6,128) 2,174 (3,954) Income (loss) from continuing operations per share, basic and diluted $ (0.04) $ 0.04 - Net loss per share, basic and diluted (0.13) 0.05 (0.08) Shares used in computing income (loss) per share Basic 47,780 47,780 Diluted 47,780 49,648 © 2019

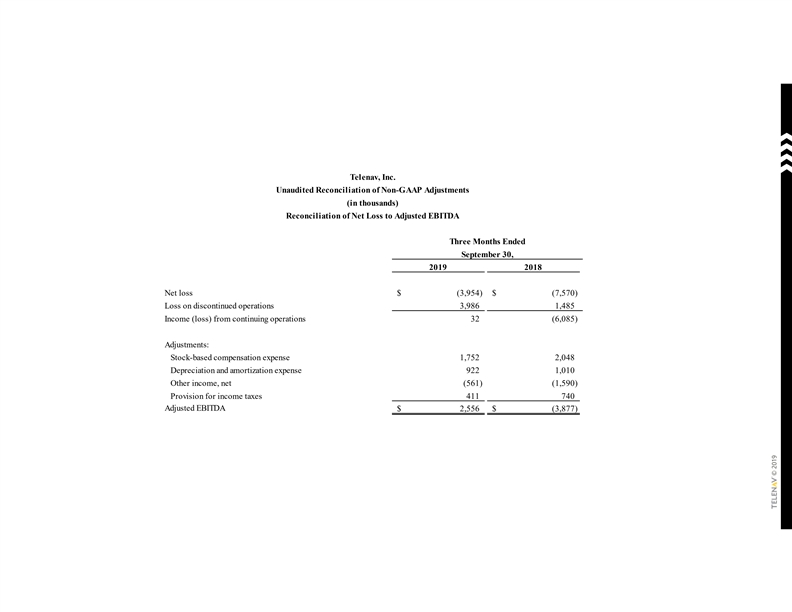

Summarized Financial Information Depicting the Impact of Restatement of Non-GAAP Adjustments (in thousands, except per share amounts) (unaudited) Reconciliation of Revenue to Billings Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Revenue Adjustments: $ 64,455 $ 2,174 $ 66,629 Change in deferred revenue 12,122 (1,876) 10,246 Billings $ 76,577 $ 298 $ 76,875 Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Net income (loss) $ (6,128) $ 2,174 $ (3,954) Loss on discontinued operations 3,986 - 3,986 Income (loss) from continuing operations (2,142) 2,174 32 Adjustments: Stock-based compensation expense 1,752 - 1,752 Depreciation and amortization expense 922 - 922 Other income, net (561) - (561) Provision for income taxes 411 - 411 Adjusted EBITDA $ 382 $ 2,174 $ 2,556 Reconciliation of Net Income (Loss) to Free Cash Flow Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Net income (loss) $ (6,128) $ 2,174 $ (3,954) Loss on discontinued operations 3,986 - 3,986 Income (Loss) from continuing operations (2,142) 2,174 32 Adjustments to reconcile net loss to net cash provided by operating activities: (1) Change in deferred revenue 12,221 (1,876) 10,345 (2) Change in deferred costs 1,979 - 1,979 Changes in other operating assets and liabilities 6,780 (298) 6,482 (3) Other adjustments 3,331 - 3,331 Net cash provided by operating activities 22,169 - 22,169 Less: Purchases of property and equipment (461) - (461) Free cash flow $ 21,708 $ - $ 21,708 (1) Consists of product royalties, customized software development fees, service fees and subscription fees. (2) Consists primarily of third party content costs and customized software development (3) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash © 2019Summarized Financial Information Depicting the Impact of Restatement of Non-GAAP Adjustments (in thousands, except per share amounts) (unaudited) Reconciliation of Revenue to Billings Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Revenue Adjustments: $ 64,455 $ 2,174 $ 66,629 Change in deferred revenue 12,122 (1,876) 10,246 Billings $ 76,577 $ 298 $ 76,875 Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Net income (loss) $ (6,128) $ 2,174 $ (3,954) Loss on discontinued operations 3,986 - 3,986 Income (loss) from continuing operations (2,142) 2,174 32 Adjustments: Stock-based compensation expense 1,752 - 1,752 Depreciation and amortization expense 922 - 922 Other income, net (561) - (561) Provision for income taxes 411 - 411 Adjusted EBITDA $ 382 $ 2,174 $ 2,556 Reconciliation of Net Income (Loss) to Free Cash Flow Three Months Ended September 30, 2019 As Reported Sept. 30, 2019 Form 10-Q Adjustments As Adjusted Net income (loss) $ (6,128) $ 2,174 $ (3,954) Loss on discontinued operations 3,986 - 3,986 Income (Loss) from continuing operations (2,142) 2,174 32 Adjustments to reconcile net loss to net cash provided by operating activities: (1) Change in deferred revenue 12,221 (1,876) 10,345 (2) Change in deferred costs 1,979 - 1,979 Changes in other operating assets and liabilities 6,780 (298) 6,482 (3) Other adjustments 3,331 - 3,331 Net cash provided by operating activities 22,169 - 22,169 Less: Purchases of property and equipment (461) - (461) Free cash flow $ 21,708 $ - $ 21,708 (1) Consists of product royalties, customized software development fees, service fees and subscription fees. (2) Consists primarily of third party content costs and customized software development (3) Consist primarily of depreciation and amortization, stock-based compensation expense and other non-cash © 2019

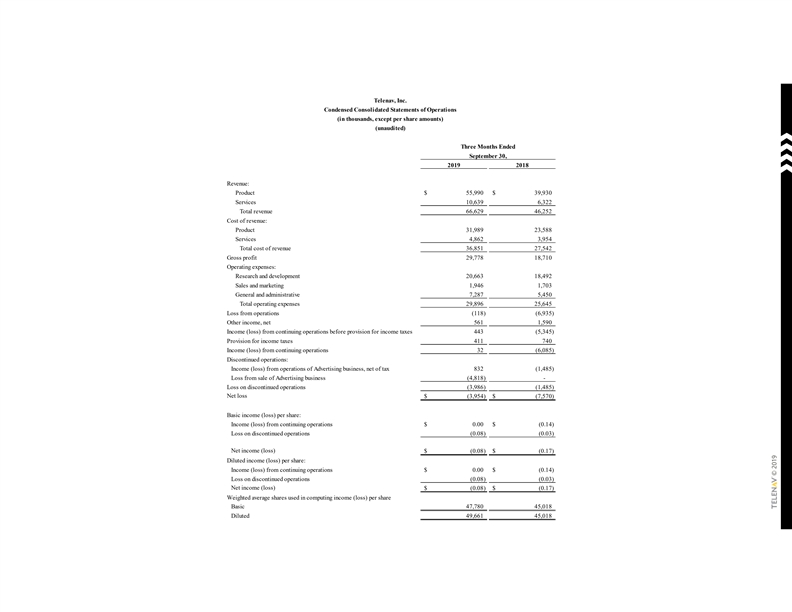

Telenav, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (unaudited) September 30, June 30, September 30, June 30, 2019 2019 2019 2019 Assets Liabilities and stockholders’ equity Current assets: Current liabilities: Cash and cash equivalents $ 19,278 $ 27,275 Trade accounts payable $ 17,804 $ 16,061 Short-term investments 102,515 72,203 Accrued expenses 38,365 48,899 Accounts receivable, net of allowances of $7 and $7 at September 30, 2019 and June 30, 2019, respectively 53,271 69,781 Operating lease liabilities 3,566 - Restricted cash 2,452 1,950 Deferred revenue 41,197 31,270 Deferred costs 19,416 18,752 Income taxes payable 635 800 Prepaid expenses and other current assets 4,281 3,784 Liabilities of discontinued operations 1,876 3,373 Assets of discontinued operations, non-current 1,788 6,330 Total current liabilities 103,443 100,403 Total current assets 203,001 200,075 Deferred rent, non-current - 1,266 Property and equipment, net 5,304 5,583 Operating lease liabilities, non-current 7,011 - Operating lease right-of-use assets 9,325 - Deferred revenue, non-current 104,184 103,865 Deferred income taxes, non-current 798 998 Other long-term liabilities 639 811 Goodwill and intangible assets, net 15,483 15,701 Liabilities of discontinued operations, non-current 107 30 Deferred costs, non-current 58,379 61,050 Commitments and contingencies - - Other assets 18,977 1,414 Stockholders’ equity: Assets of discontinued operations, non-current 259 12,194 Preferred stock, $0.001 par value: 50,000 shares authorized; no shares issued or outstanding - - Common stock, $0.001 par value: 600,000 shares authorized; 48,566 and 46,911 shares Total assets $ 3 11,526 $ 2 97,015 issued and outstanding at September 30, 2019 and June 30, 2019, respectively 49 47 Additional paid-in capital 192,055 182,349 Accumulated other comprehensive loss (1,729) (1,477) Accumulated deficit (94,233) (90,279) Total stockholders’ equity 96,142 90,640 Total liabilities and stockholders’ equity $ 3 11,526 $ 2 97,015 © 2019Telenav, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (unaudited) September 30, June 30, September 30, June 30, 2019 2019 2019 2019 Assets Liabilities and stockholders’ equity Current assets: Current liabilities: Cash and cash equivalents $ 19,278 $ 27,275 Trade accounts payable $ 17,804 $ 16,061 Short-term investments 102,515 72,203 Accrued expenses 38,365 48,899 Accounts receivable, net of allowances of $7 and $7 at September 30, 2019 and June 30, 2019, respectively 53,271 69,781 Operating lease liabilities 3,566 - Restricted cash 2,452 1,950 Deferred revenue 41,197 31,270 Deferred costs 19,416 18,752 Income taxes payable 635 800 Prepaid expenses and other current assets 4,281 3,784 Liabilities of discontinued operations 1,876 3,373 Assets of discontinued operations, non-current 1,788 6,330 Total current liabilities 103,443 100,403 Total current assets 203,001 200,075 Deferred rent, non-current - 1,266 Property and equipment, net 5,304 5,583 Operating lease liabilities, non-current 7,011 - Operating lease right-of-use assets 9,325 - Deferred revenue, non-current 104,184 103,865 Deferred income taxes, non-current 798 998 Other long-term liabilities 639 811 Goodwill and intangible assets, net 15,483 15,701 Liabilities of discontinued operations, non-current 107 30 Deferred costs, non-current 58,379 61,050 Commitments and contingencies - - Other assets 18,977 1,414 Stockholders’ equity: Assets of discontinued operations, non-current 259 12,194 Preferred stock, $0.001 par value: 50,000 shares authorized; no shares issued or outstanding - - Common stock, $0.001 par value: 600,000 shares authorized; 48,566 and 46,911 shares Total assets $ 3 11,526 $ 2 97,015 issued and outstanding at September 30, 2019 and June 30, 2019, respectively 49 47 Additional paid-in capital 192,055 182,349 Accumulated other comprehensive loss (1,729) (1,477) Accumulated deficit (94,233) (90,279) Total stockholders’ equity 96,142 90,640 Total liabilities and stockholders’ equity $ 3 11,526 $ 2 97,015 © 2019