QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.3

The JBG Companies

The JBG Companies® is a trade name under which a collection of affiliated entities conducts business. Unless the context requires otherwise, references in this document to "we," "our," "us," "our company" and "JBG" refer to the real estate assets and the strategic capital business assets of the various entities comprising The JBG Companies® that will be contributed in the transaction (the "Combination Transactions") described in the Form 8-K to which this document is an exhibit. A number of terms used throughout this document are defined in the Glossary at the end of this document.

The composition of our portfolio and the nature and amount of our interests in the properties that comprise it are subject to change between now and the completion of the Combination Transactions. We can give no assurance that the Combination Transactions will close and, if it does, whether the properties described herein will be included as set forth herein, or at all.

For a discussion of the risks related to the JBG business, see exhibit 99.3 to this Current Report on Form 8-K (the "JBG Risk Factors").

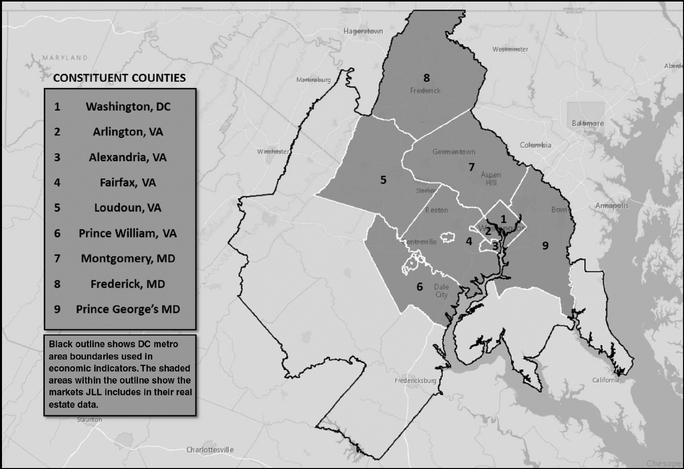

Market Data

We use market data and industry forecasts throughout this document. We have obtained certain market and industry information from market research prepared for us by Jones Lang LaSalle Americas, Inc., or JLL, a nationally recognized real estate consulting firm. In addition, we have obtained certain market data from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers' experience in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information.

Table of Contents

| | | | |

BUSINESS AND PROPERTIES | | | 3 | |

Overview | | | 3 | |

History | | | 4 | |

Our Portfolio Summary | | | 5 | |

All Assets | | | 5 | |

Operating Assets | | | 6 | |

Construction Assets | | | 7 | |

Pre-Development and Land Bank Assets | | | 7 | |

Our Competitive Strengths | | | 8 | |

Business and Growth Strategies | | | 16 | |

Case Studies | | | 27 | |

Our Assets | | | 41 | |

Office Assets | | | 42 | |

Multifamily Assets | | | 44 | |

Retail Assets | | | 46 | |

Land Bank | | | 48 | |

Our Office Assets | | | 51 | |

Office Assets—Government Services Administration | | | 56 | |

Our Multifamily Assets | | | 60 | |

Asset Revenue and Operating Expenses | | | 67 | |

Recent Developments | | | 83 | |

Our Strategic Capital Business | | | 83 | |

Outstanding Indebtedness | | | 86 | |

Our Joint Venture Arrangements | | | 88 | |

Non-Core Excluded Assets | | | 94 | |

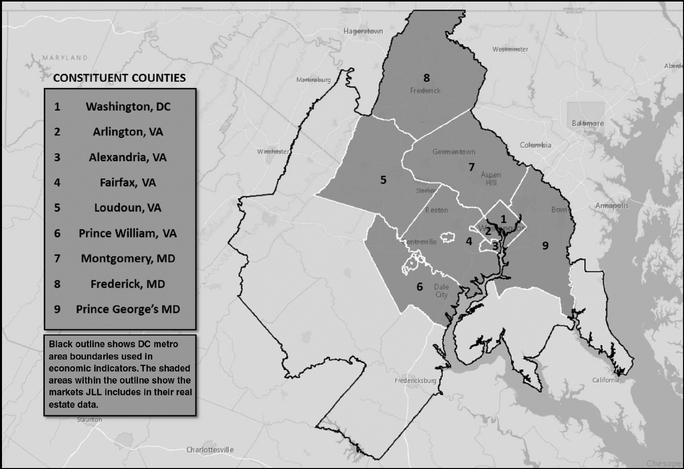

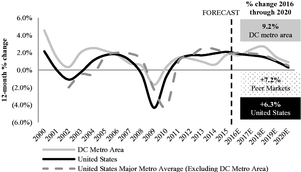

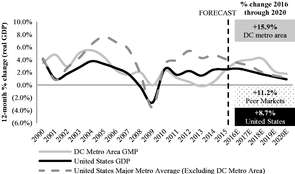

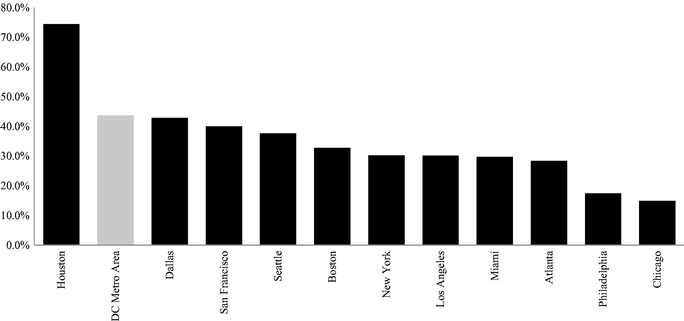

INDUSTRY OVERVIEW AND MARKET OPPORTUNITY | | |

96 | |

JBG MANAGEMENT TEAM | | |

137 | |

GLOSSARY | | |

139 | |

INDEX TO FINANCIAL STATEMENTS | | |

F-1 | |

2

BUSINESS AND PROPERTIES

Overview

We are one of the premier real estate investment companies in the DC Metro area and own one of the largest high-quality portfolios of urban infill office, multifamily and retail assets in the region. We believe that our fully-integrated platform is capable of managing every aspect of real estate ownership, including investment, development, construction management, finance, asset management, property management and leasing. We have significant expertise in the DC Metro area across multiple asset classes and consider office, multifamily and retail to be our core asset classes. Our primary approach to value creation involves a series of complementary disciplines in a process that we call "Placemaking™." Placemaking™ involves strategically mixing high-quality multifamily and commercial buildings with anchor, specialty and neighborhood retail in a high density, thoughtfully planned and curated public space environment. Through this process, we are able to drive synergies across those varied uses and create unique, amenity-rich, walkable neighborhoods that are desirable and create significant tenant and investor demand.

As of March 31, 2016, our operating portfolio consisted of 72 assets with an aggregate of over 16.2 million rentable square feet, or RSF, predominantly located near major transportation nodes in some of the most attractive high-barrier to entry submarkets in the DC Metro area. Our operating portfolio is comprised of 38 office assets totaling over 9.1 million RSF, 19 multifamily assets totaling 6,517 units and over 5.6 million RSF and 15 retail assets totaling approximately 1.5 million RSF. Our office portfolio accounted for 72.2 percent of our share of annualized rent as of March 31, 2016, while our multifamily and retail portfolios accounted for 22.2 percent and 5.6 percent, respectively.

In addition to our operating portfolio, as of March 31, 2016, we controlled (i) a construction pipeline consisting of eight assets totaling approximately 537,000 RSF of office, 1,007 multifamily units and 147,000 RSF of retail with an estimated total development cost of approximately $813.9 million, (ii) a pre-development pipeline consisting of 12 assets totaling approximately 948,000 RSF of office, 932,000 RSF of multifamily and 86,000 RSF of retail with an estimated total development cost of over $1.1 billion and (iii) a land bank comprised of 41 future development parcels with an estimated potential density of approximately 19.5 million square feet. Of the 12 assets in our pre-development pipeline, we believe the majority have substantially completed the entitlement process, and we expect to be in a position to commence construction on six of these assets by March 31, 2017. We hold our interests in 40 of our operating assets, three of our construction assets, eight of our pre-development assets and 27 of our land bank assets through joint venture arrangements. See "—Our Joint Venture Arrangements." In addition to our portfolio, we have a management platform that provides fee-based real estate services to nine real estate investment funds, or the JBG funds, and joint ventures and, in certain limited cases, third parties. See "—Our Strategic Capital Business."

Our strategy is to invest in assets that we anticipate, by virtue of location, physical quality, amenities or other specific features, will possess a sustainable ability to outperform the market and maintain high occupancy levels through all market cycles, attract high-quality tenants and appeal to a broad range of buyers if offered for sale. Our operating portfolio is comprised of high-quality assets that generally share the following key attributes:

- •

- They have been recently constructed or renovated;

- •

- They provide an opportunity to integrate retail and other highly sought after amenities, including Metro access, which differentiates and adds value;

- •

- They are well-leased, with our stabilized portfolio approximately 94 percent leased as of March 31, 2016; and

- •

- They have a strong creditworthy office and retail tenant base.

3

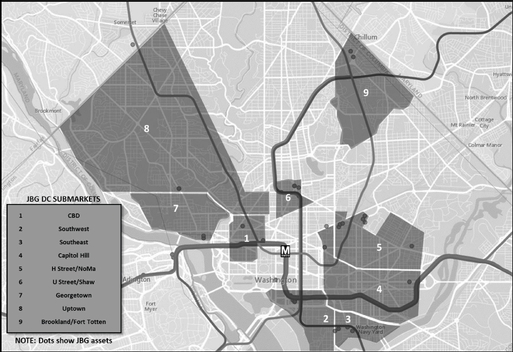

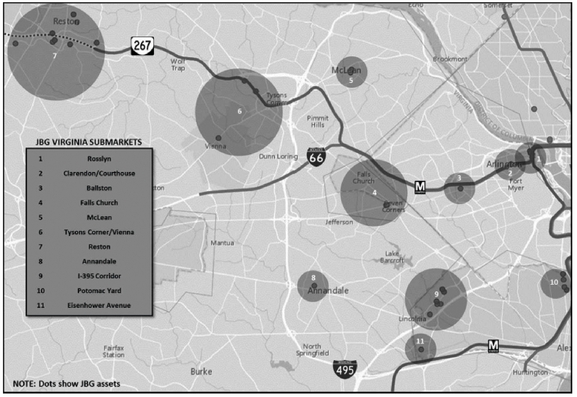

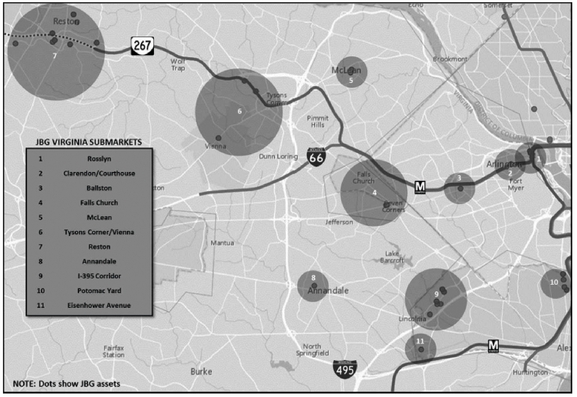

We believe that we have invested in some of the most attractive submarkets within the DC Metro area, which is one of the highest barrier-to-entry markets in the United States. Our portfolio is concentrated in strategic submarkets within the DC Metro area, with over 86 percent of our operating assets, based on rentable square feet as of March 31, 2016, located inside the I-495 loop surrounding Washington, DC, which we refer to as the Beltway, and/or in locations within walking distance of an existing or planned Metro station, which we refer to as Metro-served locations. As of March 31, 2016, all of our construction pipeline and approximately 96 percent of our pre-development pipeline was located inside the Beltway and/or is Metro-served.

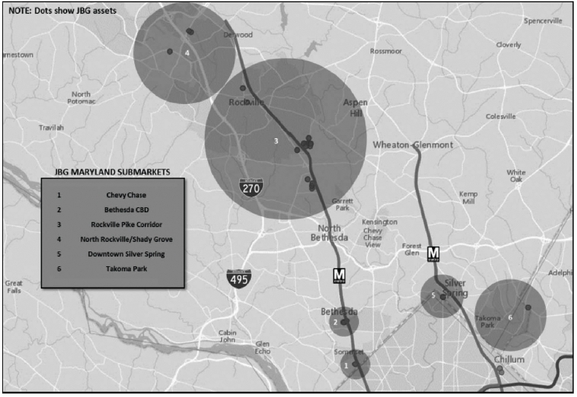

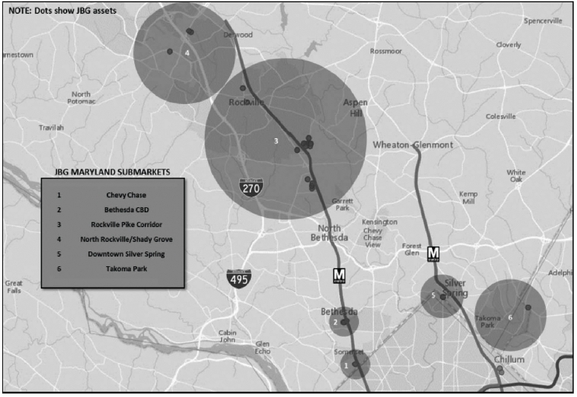

Our assets are located primarily within desirable submarkets such as: the Central Business District, Capitol Hill, Southwest, Southeast, Georgetown, NoMa and U Street/Shaw in Washington, DC; Reston, Rosslyn-Ballston Corridor, the I-395 Corridor and Tysons Corner in Northern Virginia; and Bethesda CBD, the Rockville Pike Corridor and Downtown Silver Spring in Suburban Maryland. Our current and target submarkets generally share the following key attributes that make them highly desirable and create significant tenant and investor demand:

- •

- They are densely populated urban infill submarkets;

- •

- They are Metro-served;

- •

- They exhibit high barriers to new development due to limited available land and/or entitlement constraints; and

- •

- They have a high degree of walkability and feature strong clusters of nearby amenities.

We are led by one of the most seasoned and experienced management teams in the industry. By combining our broad transactional skill sets, multi-asset class experience, deep organizational and financial expertise, and a long and successful track record built over 50 years, we are able to source and execute on a broad array of opportunities. We have developed an intimate knowledge of the DC Metro area and a detailed understanding of many submarkets on a block-by-block basis. We believe that our in-depth market knowledge and extensive network of long-standing relationships with real estate owners, developers, brokers, lenders, general contractors, municipalities, local community organizations, and other market participants provide us with a sustainable competitive advantage and the ability to source and execute on attractive value-creating investment opportunities.

In addition to our core asset classes, we have a history of developing, acquiring and operating other asset classes, including hotels, townhomes and condominiums. We believe that our expertise across multiple asset classes and our focus on Placemaking™ enable us to create valuable assets that outperform the market, diversify our investments, respond to changes in the marketplace, mitigate risk through market cycles and pursue opportunities that provide attractive risk-adjusted returns at any particular time. We believe that there are a limited number of competitors that possess all of these skill sets in-house. We believe that our diverse skill sets, relationships and expertise will enable us to maximize cash flow and real estate value through proactive asset management, completion of our construction pipeline, execution of our pre-development pipeline and pursuit of new investment opportunities.

History

The JBG Companies® is a trade name under which we conduct business. We refer to this group of affiliated entities collectively as JBG. Since JBG's establishment in 1960, it has invested almost exclusively in the DC Metro area and has established investment, development and operations expertise across a wide variety of asset classes and subcategories, including office (private sector trophy, GSA, loft/creative and suburban), residential (multifamily, condominiums, lofts and townhomes), retail (urban big-box, urban street retail, suburban strip center, power center and town center) and hotel (full service, boutique, limited service and extended stay).

4

Our management team is a proven steward of investor capital and has a long track record of creating value for investors through numerous economic cycles. The 22 owners and active managers of JBG possess an average of nearly 21 years of business experience and an average of nearly 14 years with JBG. In 1999, we created our first discretionary investment fund. As of March 31, 2016, we have raised over $3.6 billion of discretionary fund investment capital for nine real estate investment funds and have invested in more than 250 assets on behalf of these JBG funds. During this same period, we have realized 132 investments representing a total invested equity value of approximately $1.1 billion. Our 132 realized investments during this period have generated an aggregate gross levered IRR and equity multiple of 36.6 percent and 2.3x, respectively, while typically employing leverage of approximately 60 percent of gross asset value.

Our Portfolio Summary

The following tables provide information about our portfolio as of March 31, 2016.

All Assets

| | | | | | | | | | | | | |

| | Number of

Assets(1) | | Rentable Square

Feet(2) | | Number of

Units(3) | | Estimated Potential

Density(4) | |

|---|

Wholly Owned | | | | | | | | | | | | | |

Operating | | | 32 | | | 8,325,172 | | | 3,670 | | | — | |

Construction | | | 5 | | | 966,886 | | | 421 | | | — | |

Pre-Development(5) | | | 4 | | | 768,459 | | | — | | | — | |

Land Bank(6) | | | 14 | | | — | | | — | | | 10,151,500 | |

| | | | | | | | | | | | | | |

Total Wholly Owned | | | 55 | | | 10,060,517 | | | 4,091 | | | 10,151,500 | |

| | | | | | | | | | | | | | |

Joint Ventures (at 100 Percent Share) | | | | | | | | | | | | | |

Operating | | | 40 | | | 7,915,773 | | | 2,847 | | | — | |

Construction | | | 3 | | | 625,531 | | | 586 | | | — | |

Pre-Development(5) | | | 8 | | | 1,197,842 | | | — | | | — | |

Land Bank(6) | | | 27 | | | — | | | — | | | 9,344,500 | |

| | | | | | | | | | | | | | |

Total Joint Ventures | | | 78 | | | 9,739,146 | | | 3,433 | | | 9,344,500 | |

| | | | | | | | | | | | | | |

Total Portfolio | | | 133 | | | 19,799,662 | | | 7,524 | | | 19,496,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total Portfolio (at JBG Share)(7) | | | 133 | | | 13,946,916 | | | 5,120 | | | 14,765,485 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- In four mixed-use properties and large developments, we consider the retail space to be an asset separate from the office and/or multifamily spaces.

- (2)

- Refers to, (i) for operating office and retail assets, actual rentable square feet determined consistent with the Building Owners and Managers Association, or BOMA, measurement guidelines when available and management's estimate of approximate rentable square feet when a BOMA measurement is not available, (ii) for operating multifamily assets, management's estimate of actual rentable square feet, or (iii) for construction and pre-development assets, management's estimate of actual rentable square feet based on current design plans as of March 31, 2016.

- (3)

- For construction assets, represents estimated number of multifamily units based on current design plans as of March 31, 2016. Unit count for multifamily pre-development assets is omitted because projects are still in the design process.

- (4)

- Reflects management's estimate of developable square feet based on its current business plans as of March 31, 2016.

- (5)

- Refers to assets on which we expect to be in a position to commence construction within 24 months of March 31, 2016.

- (6)

- Refers to assets that are development opportunities where we (i) have an option to purchase, or enter into a leasehold interest with respect to, land; (ii) are under a long-term conditional contract to purchase land; (iii) control the land through a ground lease or (iv) own the land, and on which we do not expect to commence construction in the 24 months from March 31, 2016. Our land bank includes 11 parcels attached to our existing operating assets that would

5

require a redevelopment of approximately 532,000 office and/or retail square feet and 1,160 multifamily units in order to access approximately total 7.2 million square feet of total estimated potential density.

- (7)

- Reflects our pro rata share of joint venture assets.

Operating Assets

| | | | | | | | | | | | | | | | | | | | | | |

| | Number of

Assets(1) | | Rentable

Square

Feet | | Number of

Units | | Percent

Leased(2) | | Percent

Occupied(3) | | Annualized

Rent(4)

($000s) | | Annualized

Rent Per

Square Foot(5) | |

|---|

Office | | | | | | | | | | | | | | | | | | | | | | |

Stabilized(6) | | | 36 | | | 8,794,088 | | | — | | | 92.9 | % | | 92.1 | % | $ | 291,273 | | $ | 35.95 | |

Recently Acquired/Delivered/Renovated(7) | | | 2 | | | 354,137 | | | — | | | 75.0 | % | | 50.3 | % | | 7,653 | | | 42.94 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 38 | | | 9,148,225 | | | — | | | 92.2 | % | | 90.5 | % | $ | 298,926 | | $ | 36.10 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Multifamily | | | | | | | | | | | | | | | | | | | | | | |

Stabilized—Mid/High-Rise(8) | | | 4 | | | 1,063,564 | | | 1,237 | | | 93.7 | % | | 89.7 | % | $ | 26,738 | | $ | 28.02 | |

Stabilized—Garden-Style(9) | | | 11 | | | 3,542,420 | | | 4,016 | | | 95.7 | % | | 93.7 | % | | 64,201 | | | 19.35 | |

Recently Acquired/Delivered/Renovated(7) | | | 4 | | | 1,002,742 | | | 1,264 | | | 48.4 | % | | 39.2 | % | | 9,539 | | | 24.24 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 19 | | | 5,608,726 | | | 6,517 | | | 86.1 | % | | 82.4 | % | $ | 100,478 | | $ | 19.87 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Retail | | | | | | | | | | | | | | | | | | | | | | |

Stabilized(10) | | | 13 | | | 1,435,435 | | | — | | | 92.9 | % | | 88.7 | % | $ | 38,660 | | $ | 31.99 | |

Recently Acquired/Delivered/Renovated(7) | | | 2 | | | 48,559 | | | — | | | 64.1 | % | | 61.2 | % | | 1,616 | | | 54.39 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 15 | | | 1,483,994 | | | — | | | 91.9 | % | | 87.8 | % | $ | 40,276 | | $ | 32.52 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | 72 | | | 16,240,945 | | | 6,517 | | | 90.1 | % | | 87.5 | % | $ | 439,680 | | $ | 31.21 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Note: Table shown at 100 percent share.

- (1)

- In four mixed-use properties and large developments, we consider the retail space to be an asset separate from the office and/or multifamily spaces.

- (2)

- Based on leases signed as of March 31, 2016, and is calculated as (i) for office assets and retail assets, total rentable square feet less rentable square feet available for lease divided by total rentable square feet, and (ii) for multifamily assets, total units less units available for lease divided by total units, expressed as a percentage. Percent leased may differ from percent occupied because percent leased includes leases that have been signed for space within the building, but that have not yet commenced.

- (3)

- Based on occupied rentable square feet/units as of March 31, 2016 and is calculated as (i) for office and retail assets, total rentable square feet less unoccupied square feet divided by total rentable square feet, or (ii) for multifamily assets, total units less unoccupied units divided by total units, expressed as a percentage.

- (4)

- Based on (i) for multifamily assets, or the multifamily component of mixed-use assets, the base rent before rent abatements for the quarter ended March 31, 2016, multiplied by four; (ii) for office and retail assets, or the retail component of mixed-use assets, the base rent and percentage rent before rent abatements, plus tenant reimbursements for the quarter ended March 31, 2016, multiplied by four. Triple net leases are converted to a gross basis by adding tenant reimbursements to base rent. See "—Our Office Assets—Contractual Rent Abatement in Our Office Portfolio" and "—Our Retail Assets—Contractual Rent Abatement in Our Retail Portfolio" for detail on rent abatements. Annualized rent is not presented for assets that were acquired or delivered in the first quarter of 2016.

- (5)

- Represents annualized rent divided by occupied square feet. Annualized rent per square foot calculation excludes assets that were acquired or delivered in the first quarter of 2016.

- (6)

- When used in connection with an office, multifamily or retail asset refers to an asset that is at or above 90 percent leased or has been an operating asset for longer than 12 months. Includes nine office assets with identified growth opportunities representing approximately 2.1 million rentable square feet that were 80.2 percent leased as of March 31, 2016. See "—Business and Growth Strategies—Drive Incremental Growth through Lease-up of Our Assets" for detail on these assets.

6

- (7)

- Refers to assets that have been acquired or delivered, or are undergoing or have completed significant renovation or redevelopment within the 12 months ended March 31, 2016 and are below 90 percent leased, or will undergo a significant redevelopment or renovation within the 12 months from March 31, 2016. See "—Business and Growth Strategies—Drive Incremental Growth through Lease-up of Our Assets" for detail on these assets.

- (8)

- Refers to multifamily assets that are mid and high-rise apartment communities, typically in urban settings.

- (9)

- Refers to multifamily assets that are garden-style apartment communities, consisting of multistory buildings in landscaped settings.

- (10)

- Includes one retail asset with an identified growth opportunity representing approximately 118,000 rentable square feet that was 66.5 percent leased as of March 31, 2016. See "—Business and Growth Strategies—Drive Incremental Growth through Lease-up of Our Assets" for detail on this asset.

Construction Assets

| | | | | | | | | | | | | |

| | Number of

Assets | | Estimated

Rentable Square Feet | | Estimated Number

of Units | | Percent

Pre-Leased(1) | |

|---|

Construction | | | | | | | | | | | | | |

Office | | | 1 | | | 536,710 | | | — | | | 65.0 | % |

Multifamily—Mid/High-Rise | | | 4 | | | 909,180 | | | 1,007 | | | N/A | |

Retail | | | 3 | | | 146,527 | | | — | | | 8.1 | % |

| | | | | | | | | | | | | | |

Total/Weighted Average | | | 8 | | | 1,592,417 | | | 1,007 | | | 52.8 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Note: Table shown at 100 percent share.

- (1)

- Based on leases signed as of March 31, 2016 and is calculated as the estimated rentable square feet leased divided by total estimated rentable square feet. Weighted average calculation excludes multifamily assets.

Pre-Development and Land Bank Assets

| | | | | | | | | | |

| | Number of

Assets | | Estimated

Rentable Square

Feet | | Estimated

Potential

Density(1) | |

|---|

Pre-Development and Land Bank | | | | | | | | | | |

Pre-Development(2) | | | 12 | | | 1,966,301 | | | — | |

Land Bank(3) | | | 41 | | | — | | | 19,496,000 | |

| | | | | | | | | | | |

Total | | | 53 | | | 1,966,301 | | | 19,496,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Note: Table shown at 100 percent share.

- (1)

- Reflects management's estimate of developable square feet based on its current business plans as of March 31, 2016.

- (2)

- Refers to assets on which we expect to be in a position to commence construction within 24 months of March 31, 2016.

- (3)

- Refers to assets that are development opportunities where we (i) have an option to purchase, or enter into a leasehold interest with respect to, land; (ii) are under a long-term conditional contract to purchase land; (iii) control the land through a ground lease or (iv) own the land, and on which we do not expect to commence construction in the 24 months from March 31, 2016. Our land bank includes 11 parcels attached to our existing operating assets that would require a redevelopment of approximately 532,000 office and/or retail square feet and 1,160 multifamily units in order to access approximately 7.2 million square feet of total estimated potential density.

7

Our Competitive Strengths

We believe that our extensive real estate investment and operating platform and our high-quality, urban infill portfolio provide us with competitive advantages, including the following:

Proven Platform for Value Creation with Investment, Development, Redevelopment and Repositioning Expertise. We have one of the largest real estate platforms in the DC Metro area and a long track record of value creation.

- •

- Integrated Platform with Scale. As one of the premier real estate investment companies in the DC Metro area, we operate a platform that is both vertically integrated across functions, including investment, development, construction management, finance, asset management, property management and leasing, and horizontally integrated across real estate asset classes, focusing primarily on office, multifamily and retail. Our integrated structure enables us to identify value-creation opportunities and realize significant operating efficiencies. Our organization is comprised of 612 employees, including 226 corporate employees in investment, development, construction management, finance, asset management, property management, leasing and other supporting functions. Through our complementary in-house disciplines, we seek to enhance asset value through proactive asset and property management.

- •

- Investment, Development and Leasing Expertise. Our extensive investment, development and leasing infrastructure facilitates our strategy of sourcing, designing, entitling, building, leasing and managing a large portfolio of properties across different asset classes and a variety of types of tenants.

- •

- Since 2000, we have invested in over 250 assets representing approximately $13.0 billion in gross asset value, including over 19.0 million RSF of office, 14,250 multifamily units, 4.0 million RSF of retail, 5,700 hotel rooms, 3,000 for sale residential units and townhomes and 25.0 million square feet of estimated potential land density. This includes the completion of more than 75 development projects with an associated cost of over $5.0 billion, consisting of over 9.5 million RSF of office, 6,100 multifamily units, 1.0 million RSF of retail, 2,100 hotel rooms and 2,000 for sale residential units and townhomes. In recognition of our experience, in 2012, NAIOP, a nationally known commercial real estate development association, named us the National Developer of the Year and recognized us with a Sustainable Development award in 2014.

- •

- Since 2000, we have sold over 90 assets for over $6.0 billion in gross asset value, including over 8.5 million RSF of office, 5,850 multifamily units, 2.0 million RSF of retail, 1,600 hotel rooms, 2,000 for sale residential units and townhomes, and 1.5 million square feet of estimated potential land density.

- •

- Over the three years ended December 31, 2015, we averaged an annual leasing volume of approximately 1.0 million RSF of office space, 7,230 multifamily leases, and approximately 764,000 RSF of retail space across our owned and managed portfolios.

- •

- We are one of the largest landlords to GSA, having developed over $2.0 billion of GSA assets and having completed over 5.2 million RSF of leases with GSA, including build-to-suit developments for the Department of Transportation, Social Security Administration, National Cancer Institute as well as several other agencies. We also have on-staff experts in GSA and government lease and development procurements, which we believe provides us with a competitive advantage in securing GSA leases and developments.

8

See "—Case Studies—51 Louisiana Avenue" on page 35, "—77 H Street" on page 29, "—U.S. Department of Transportation Headquarters" on page 20, "—Waterview" on page 36, "—The Woodley" on page 31 and "—5600 and 5601 Fishers Lane" on page 27.

- •

- Redevelopment and Repositioning Expertise. Our development and asset management teams have significant experience redeveloping and repositioning assets, having completed 40 redevelopment or repositioning projects since 2000, consisting of over 4.0 million RSF of office, 1,600 multifamily units, approximately 232,000 RSF of retail and 3,900 hotel rooms. Our experience owning, operating and managing a range of assets classes gives us a unique capability to identify redevelopment and adaptive reuse opportunities where we can create value.

Strong Management Team with Proven Track Record, Extensive Market Expertise and Interests Aligned with Shareholders. JBG is a fully integrated real estate investment company with over 50 years of single market focus led by a group of 22 owners and active managers with an average of nearly 21 years of business experience and an average of nearly 14 years with JBG. Our management team is a proven steward of investor capital and has a long track record of creating value for investors through numerous economic cycles. Since 1999, JBG has raised and invested nine real estate investment funds with over $3.6 billion of discretionary fund investment capital and has invested in over 250 assets on behalf of these JBG funds. Our 132 realized investments during this period have generated an aggregate gross levered IRR and an equity multiple of 36.6 percent and 2.3x, respectively, while typically employing leverage of approximately 60 percent of gross asset value.

Preqin Ltd., a leading fund management data and intelligence provider covering more than 5,300 private equity funds, has named us as one of the top Consistent Performing Closed-End Private Real Estate Fund Managers every year since 2011, making us the only real estate fund manager to receive this designation in each of the past five years. With 612 employees, 226 of which are in our corporate office, we have a deep and talented pool of real estate professionals. We were named by both the Washington Post in 2014 and the Washington Business Journal in 2015 as the Best Place to Work (Large Company Category) in the DC Metro area.

9

The following table sets forth information regarding the nine real estate investment funds that we have sponsored:

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| | Realized Investments(1) | |

|---|

| |

| | Total

Committed

Equity

($000s) | | Weighted

Average

Estimated

Leverage(3) | |

|---|

JBG Opportunity Fund | | Vintage(2) | | Number of

Investments | | Equity

Invested(4)

($000s) | | Average

Hold

Period(5) | | Gross

Levered

IRR(6) | | Equity

Multiple(7) | |

|---|

Fund I | | | 1999 | | $ | 28,030 | | 75.2% | | | 29 | | $ | 28,692 | | | 4.9 | | | 35.6 | % | | 5.0 | |

Fund II | | | 2002 | | | 28,785 | | 72.6% | | | 9 | | | 21,952 | | | 4.2 | | | 41.3 | % | | 3.4 | |

Fund III | | | 2002 | | | 210,000 | | 64.6% | | | 15 | | | 116,193 | | | 4.2 | | | 46.2 | % | | 4.3 | |

Fund IV | | | 2004 | | | 250,000 | | 66.1% | | | 14 | | | 157,300 | | | 4.4 | | | 31.8 | % | | 2.3 | |

Fund V | | | 2005 | | | 528,000 | | 58.9% | | | 30 | | | 434,044 | | | 2.6 | | | 39.6 | % | | 1.6 | |

Fund VI | | | 2007 | | | 600,000 | | 63.2% | | | 18 | | | 165,297 | | | 5.2 | | | 2.8 | % | | 1.2 | |

Fund VII | | | 2008 | | | 576,485 | | 55.9% | | | 13 | | | 86,517 | | | 4.1 | | | 36.9 | % | | 3.6 | |

Fund VIII | | | 2011 | | | 752,545 | | 55.6% | | | 4 | | | 75,472 | | | 3.1 | | | 34.8 | % | | 2.3 | |

Fund IX | | | 2014 | | | 680,005 | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | $ | 3,653,850 | | 59.7% | | | 132 | | $ | 1,085,469 | | | 4.1 | | | 36.6 | % | | 2.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Please refer to the risk factor captioned "Risk Factors—The historical 'gross levered IRRs' and 'equity multiples' achieved by the JBG funds with respect to investments sold on or before September 30, 2015 are not necessarily indicative of the future performance of our company, any property in our portfolio or an investment in our common shares," in the JBG Risk Factors for a discussion of the factors you should consider when evaluating gross levered IRR and equity multiple as return measures.

- (1)

- Represents investments that were sold by the fund on or before March 31, 2016.

- (2)

- Represents the year in which the fund made its first investment. Funds are generally fully committed within two years of the first investment.

- (3)

- Represents average leverage employed by each fund, observed on a semi-annual basis, weighted by management's estimate of the fair market value of invested equity at that time.

- (4)

- Represents the maximum equity invested by the applicable fund during its life, calculated on a quarterly basis, including only equity associated with a realized investment or realized investments, as the case may be.

- (5)

- Represents the average hold period, in years, of realized investments in each fund.

- (6)

- Represents the levered internal rate of return of a JBG fund's realized investments based on (i) equity invested and (ii) the total distributions from a realized investment or realized investments, as the case may be (including the return of equity investment), received by the applicable fund, less all sales costs, debt service and all other property level fees where applicable, but before deduction of carried interests and asset management fees where applicable. For realized investments that were subject to a joint venture, gross levered IRR reflects the impact of any promote that was either paid or earned. Returns shown relate to realized investments and not the returns of fund investors, which are also affected by asset management fees and carried interest paid by the JBG funds and by the JBG funds' unrealized investments. The returns shown were impacted by national and local economic trends that are unrelated to our management of the investments.

- (7)

- Represents the sum of the total contributions and distributions from a realized investment or realized investments, as the case may be, received by the applicable fund, calculated on a quarterly basis, only including such contributions and distributions from the realized investment or realized investments, as the case may be, plus the equity invested divided by the equity invested. Returns shown are not the returns of fund investors, which are also affected by asset management fees and carried interest paid by the JBG funds and by the JBG funds' unrealized investments. The returns shown were impacted by national and local economic trends that are unrelated to our management of the investments.

Premier Portfolio of Diversified, High-Quality Assets in Attractive Submarkets. Our diversified portfolio of high-quality assets is primarily located within urban infill and transit-oriented environments in some of the most attractive submarkets of the DC Metro area, one of the highest barrier-to-entry markets in the United States. As of March 31, 2016, our portfolio consists of 72 operating assets with an aggregate of over 16.2 million RSF, eight construction assets with an aggregate of approximately 1.6 million RSF, 12 pre-development assets with an aggregate of approximately

10

2.0 million RSF and 41 land parcels with an estimated potential density of approximately 19.5 million square feet. Our strategy is to invest in assets that we anticipate, by virtue of location, physical quality, amenities or other specific features, will possess a sustainable ability to outperform the market and maintain high occupancy levels through all market cycles, attract high-quality tenants and appeal to a broad range of buyers when offered for sale. We believe that given current market rents, construction costs and the lack of competitive development sites, our portfolio could not be replicated today on a cost competitive basis, if at all. As of March 31, 2016, our portfolio was comprised of the following:

- •

- 38 office assets totaling approximately 9.2 million RSF, including 36 stabilized assets that were 92.9 percent leased

- •

- 19 multifamily assets totaling 6,517 units and over 5.6 million RSF, including 15 stabilized assets that were 95.2 percent leased (based on units)

- •

- 15 retail assets totaling approximately 1.5 million RSF, including 13 stabilized assets that were 92.9 percent leased

- •

- One office asset totaling approximately 537,000 RSF, which was 65.0 percent pre-leased

- •

- Four mid/high-rise multifamily assets totaling 1,007 units and over 909,000 RSF

- •

- Three retail assets totaling approximately 147,000 RSF, which were 8.1 percent pre-leased

- •

- Four office assets totaling approximately 948,000 RSF

- •

- Six mid/high-rise multifamily assets totaling over 932,000 RSF

- •

- Two retail assets totaling over 86,000 RSF, which were 35.4 percent pre-leased

- •

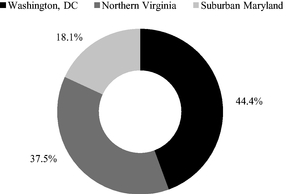

- 10 land parcels in Washington, DC representing an estimated potential density of over 3.9 million square feet

- •

- 20 land parcels in Northern Virginia representing an estimated potential density of over 11.3 million square feet

- •

- 11 land parcels in Suburban Maryland representing an estimated potential density of approximately 4.3 million square feet

- •

- Of the above, our land bank includes 11 parcels that are attached to our existing operating assets that would require redevelopment of approximately 532,000 office and/or retail square feet and 1,160 multifamily units in order to access approximately 7.2 million square feet of estimated potential density

Our portfolio is comprised of high-quality assets, most which have been recently constructed or renovated and generally include a variety of services and amenities that are highly sought after by tenants. On average, based on rentable square feet, our portfolio was built or renovated within the last nine years, and excluding assets held for redevelopment, approximately 79 percent of operating rentable square feet was built or renovated since 2005. Furthermore, by the end of 2019, we expect to deliver all eight of our construction pipeline assets and 11 of our 12 pre-development pipeline assets, representing approximately 3.3 million RSF of new deliveries.

11

We believe that the young age and overall quality of our diversified portfolio across multiple asset classes, together with our experience and fully integrated in-house capabilities to own, develop and manage these assets, has enabled us to achieve strong leasing levels and tenant quality and diversity. As of March 31, 2016 our stabilized portfolio was approximately 94 percent leased, with our stabilized office assets being 92.9 percent leased, our stabilized multifamily assets being 95.2 percent leased and our stabilized retail assets being 92.9 percent leased. Moreover, we believe that we have a strong, creditworthy tenant base, with the U.S. government representing 56.6 percent of our share of the total annualized rent of our office portfolio and 51.3 percent of our share of the total annualized rent of our combined office and retail portfolio as of March 31, 2016. No other tenant accounted for more than 2.2 percent of our share of the total annualized rent of our combined office and retail portfolio as of March 31, 2016. We believe we have a high credit quality tenant base not only because the U.S. government represents over half of the annualized rent of our combined office and retail portfolio, but also because we evaluate a prospective tenant's creditworthiness by reviewing its financial statements, inquiring about trends in its revenues and expenses, making inquiries to the tenant's creditors and current landlords and, if available, credit ratings issued by credit agencies and other publicly available material. Once a lease is signed, we continue to monitor a tenant's credit quality through similar processes outlined above, the frequency of which we determine based on market trends within the relevant asset class, our knowledge of the particular tenant and the significance of investment or size of lease.

The majority of our non-GSA office and retail leases, and our largest GSA lease, contain contractual rent escalators based on increases in CPI or a fixed percentage, generally ranging from 2.0 to 3.0 percent per year. In addition, in our office portfolio, we benefit from high-quality long-term leases with a weighted average lease term (including leases signed but not commenced) of 7.0 years and the weighted average lease term of our build-to-suit GSA leases is 9.2 years.

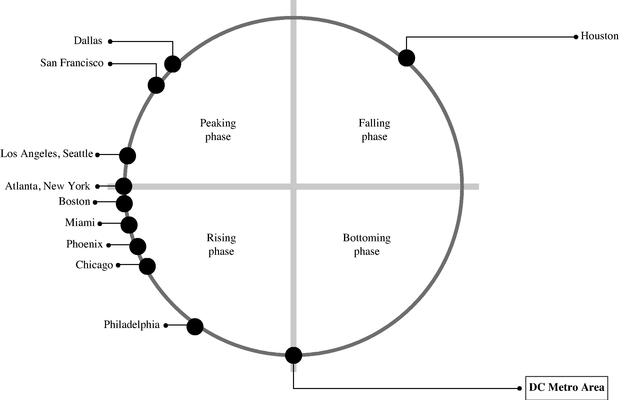

We believe that we have invested in some of the most attractive submarkets within the DC Metro area. Our assets are generally located in submarkets which are high barrier to entry Metro-served locations, have a high degree of walkability and feature strong clusters of nearby amenities. Based on rentable square feet as of March 31, 2016, over 86 percent of our operating portfolio and approximately 98 percent of our construction and pre-development assets are located inside the Beltway and/or in Metro-served locations. This concentration of assets positions us well to capitalize on improving real estate market fundamentals, with over 93 percent of DC Metro area office leasing activity in 2015 and the first quarter of 2016, within 0.75 miles of a current or planned Metro station, according to JLL.

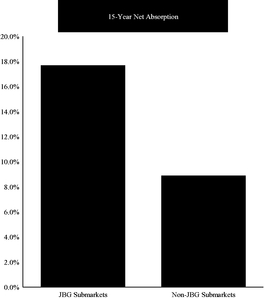

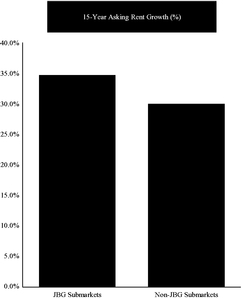

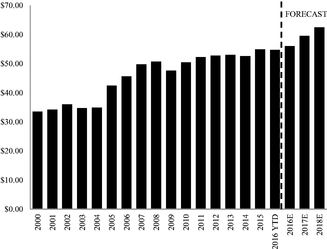

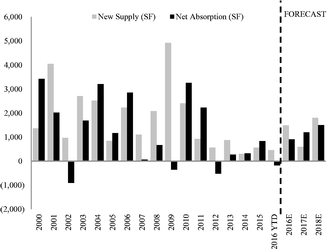

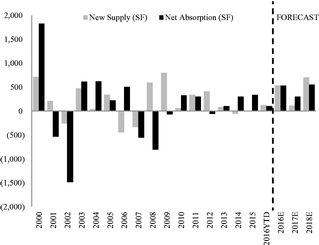

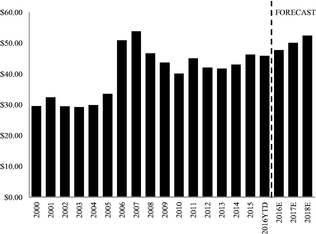

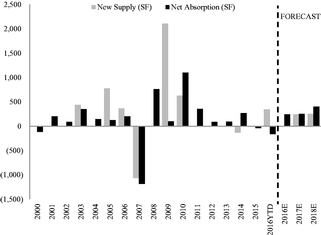

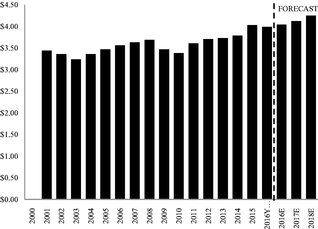

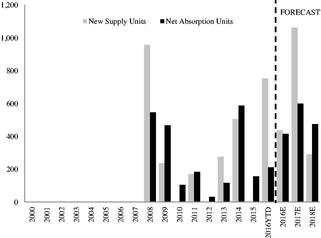

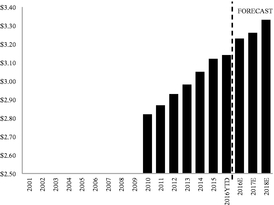

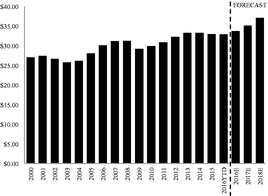

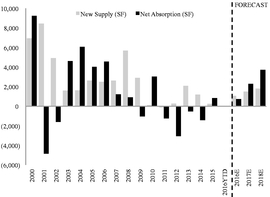

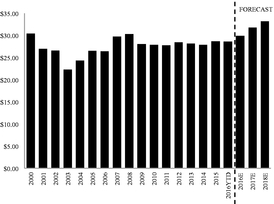

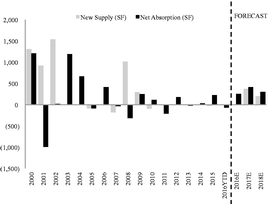

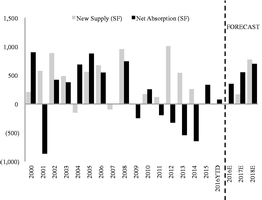

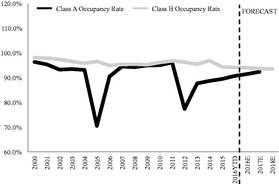

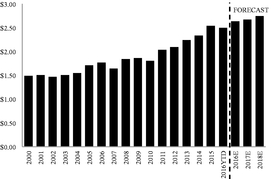

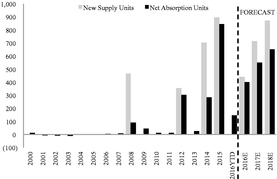

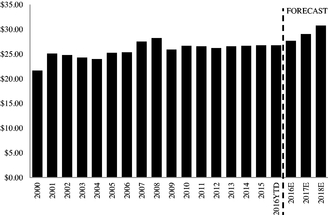

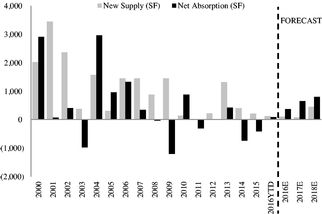

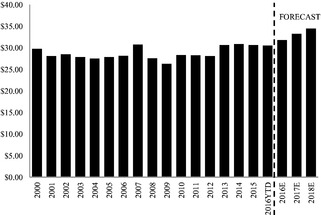

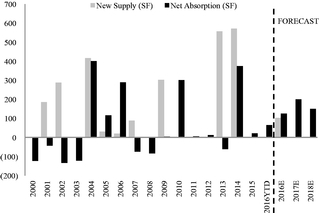

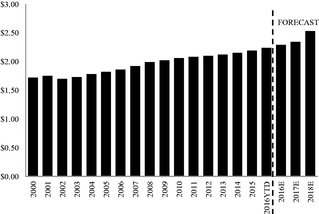

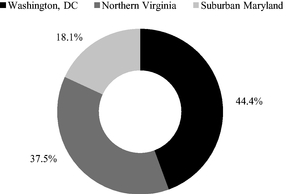

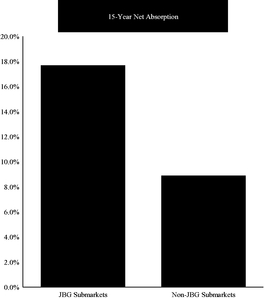

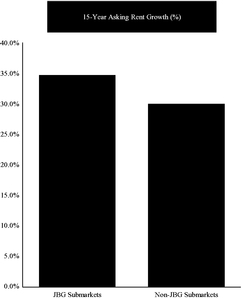

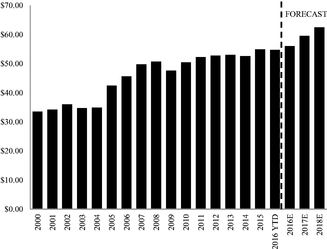

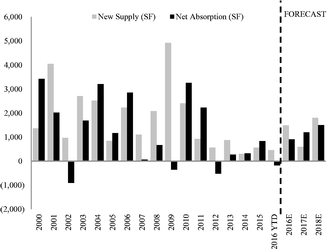

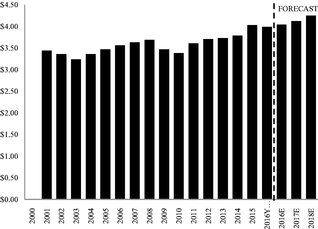

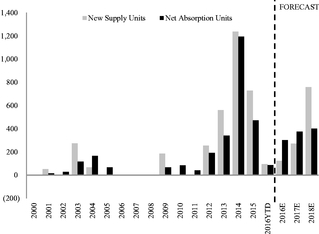

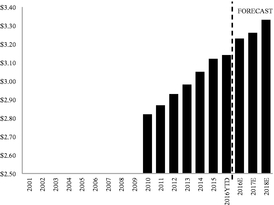

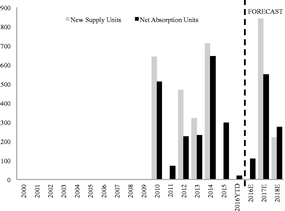

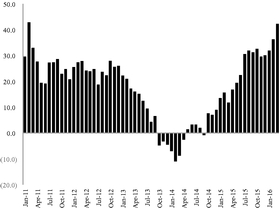

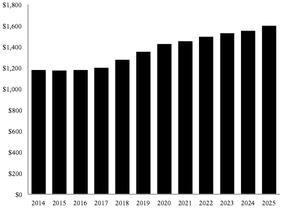

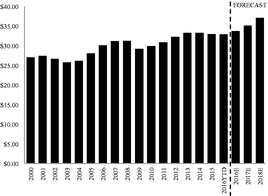

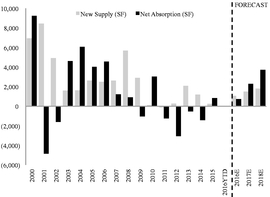

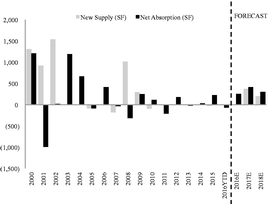

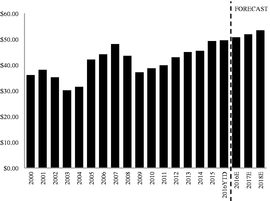

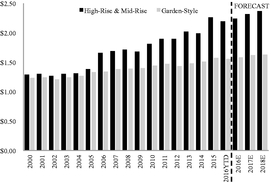

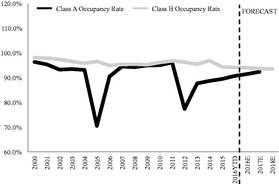

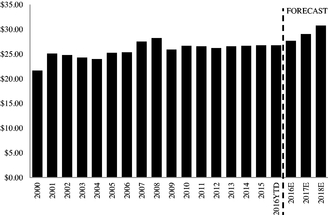

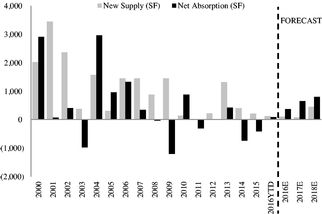

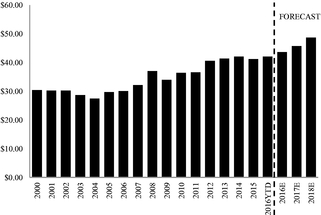

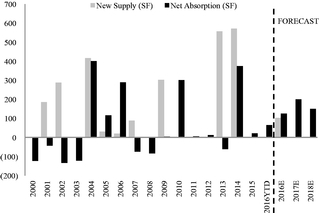

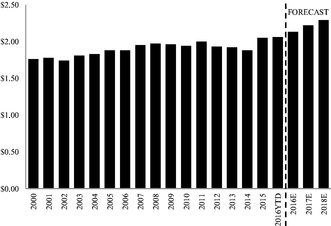

The office and multifamily submarkets in which we operate have historically outperformed other DC Metro area submarkets as evidenced by the following key metrics. According to JLL, the 15-year net absorption rate through the first quarter of 2016 for all classes of office space in our submarkets was 17.7 percent compared to 8.9 percent for other DC Metro area submarkets. Net absorption refers to the change in physically occupied space from one period to another period of time and takes into account newly constructed buildings and the conversion or demolition of buildings. We believe this metric is a key indicator of demand and that a high level of absorption in our submarkets may indicate robust demand for space from tenants. In addition, according to JLL, over the past 15 years ending with the first quarter of 2016, the asking rents for all classes of office space in our submarkets have grown nearly five percent more than the asking rents in other DC Metro area markets, growing 34.7 percent over that time period compared to 30.0 percent for other submarkets.

12

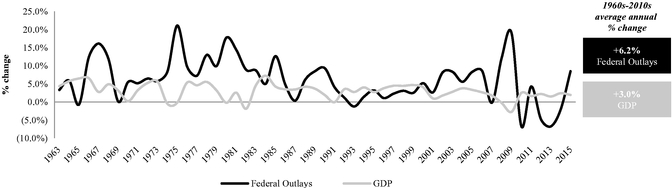

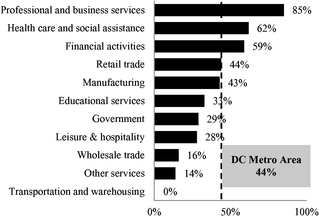

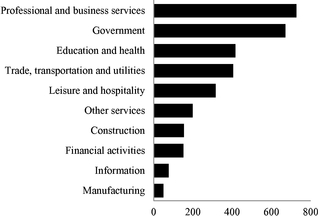

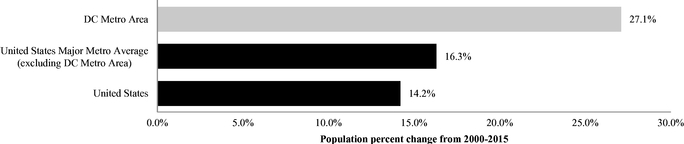

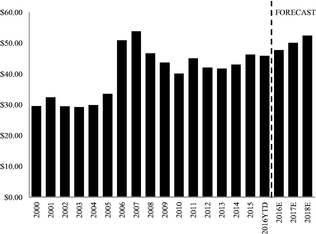

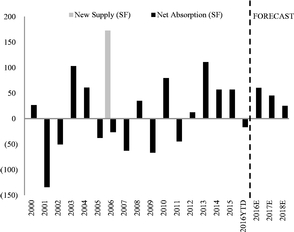

JBG's portfolio has outperformed the DC Metro office market

| | |

| |

|

| | |

| Source: JLL Research (data represents 2010-Q1 2016) | | |

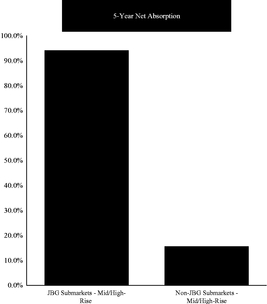

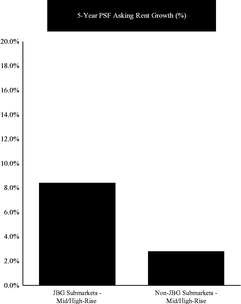

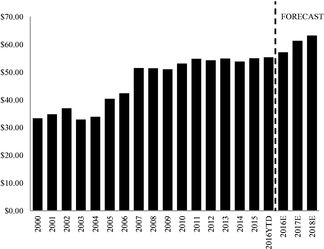

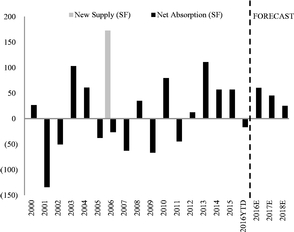

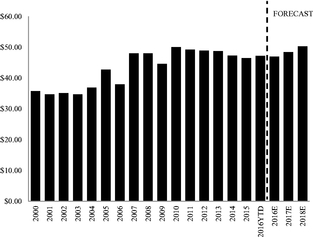

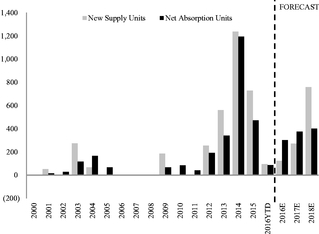

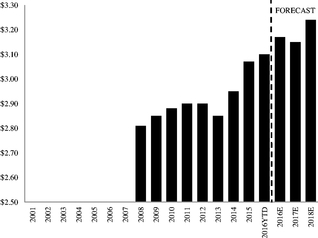

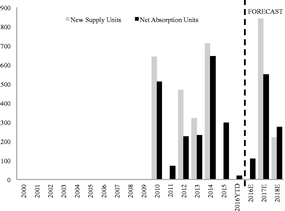

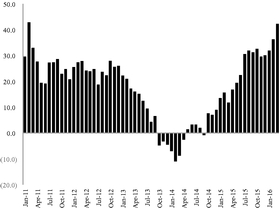

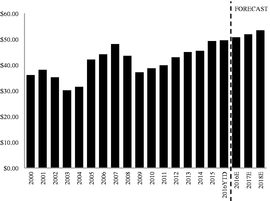

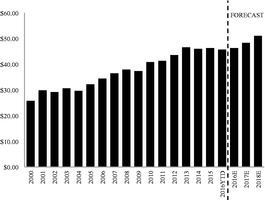

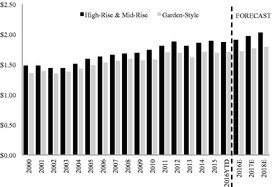

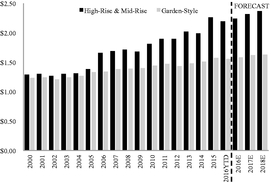

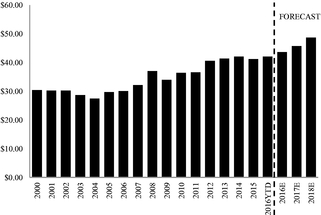

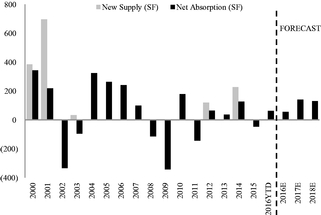

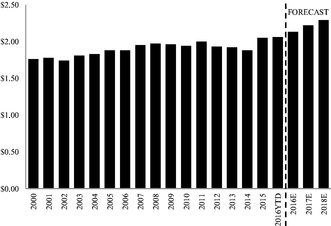

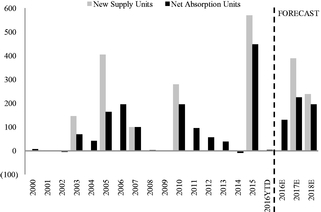

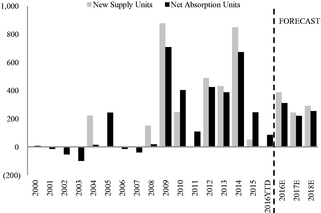

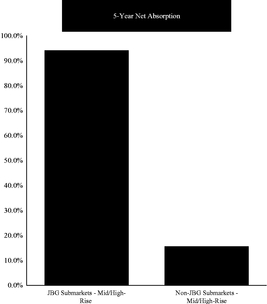

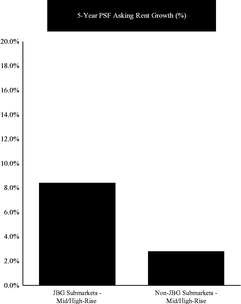

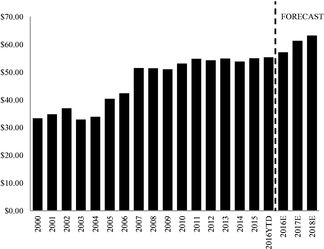

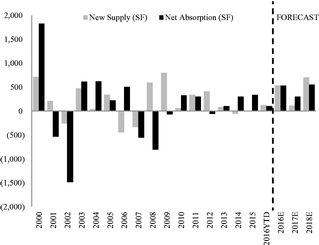

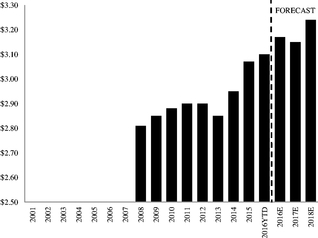

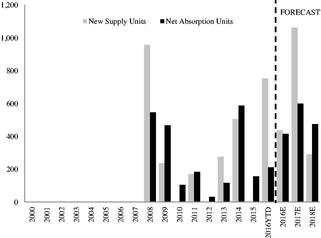

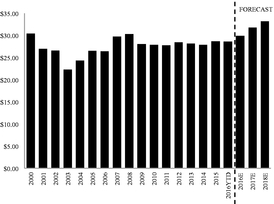

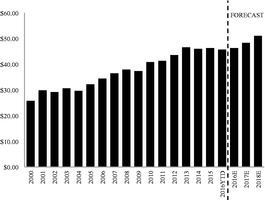

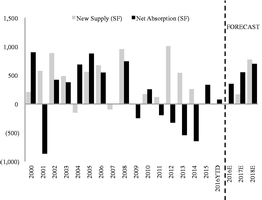

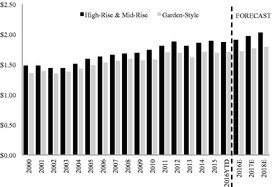

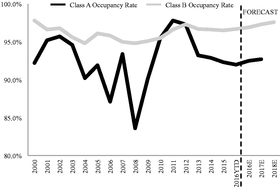

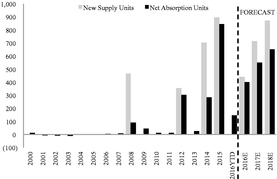

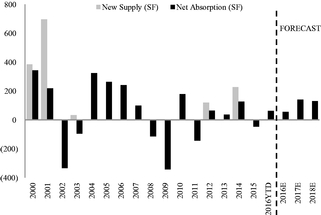

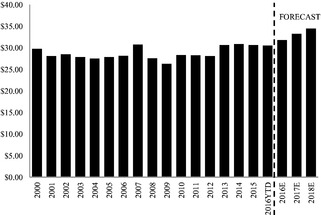

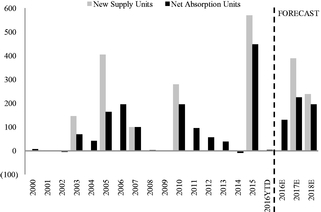

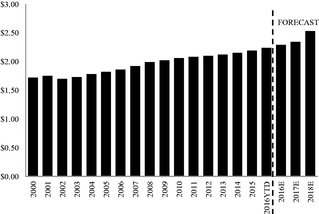

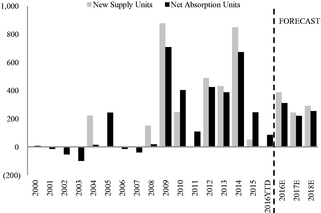

Similarly, our submarkets have outperformed other DC Metro area submarkets in key multifamily statistics. According to JLL, the five year net absorption rate through the first quarter of 2016 for mid/high-rise multifamily units in our submarkets was 94.1 percent compared to 15.6 percent for the other DC Metro area submarkets. In addition, according to JLL, over the past five years ending with the first quarter of 2016, our submarkets have experienced an 8.4 percent increase in asking rents for mid/high-rise units compared to a 2.8 percent increase in other DC Metro area submarkets.

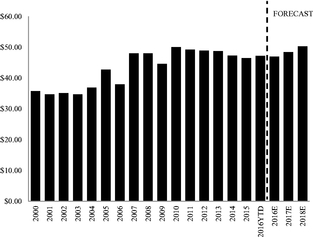

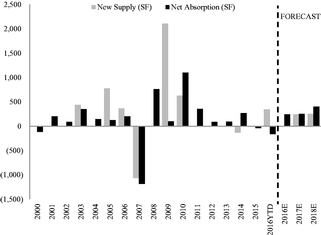

JBG's portfolio has outperformed the DC Metro multifamily market

| | |

| |

|

| | |

| Source: JLL Research (data represents 2010-Q1 2016) | | |

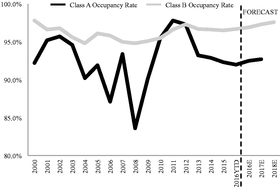

We believe vacancy rates are a more appropriate metric for comparing our garden-style buildings' performance to market than absorption because there have been no new deliveries and

13

minimal net new absorption in this category. According to JLL, over the past five years ending with the first quarter of 2016, the submarkets where our garden-style assets are located have shed 1.3 percentage points of vacancy compared to 0.8 percentage points in non-JBG submarkets. As of March 31, 2016, JBG garden-style submarkets posted a point-in-time vacancy rate of 3.3 percent relative to 3.2 percent in the broader market according to JLL.

Ability to Create Value through Placemaking™. Our primary approach to creating the highest value for our assets is comprised of a series of complementary disciplines in a process that we call "Placemaking™." Placemaking™ involves strategically mixing high-quality multifamily and commercial buildings with anchor, specialty and neighborhood retail in a high-density, thoughtfully planned and curated public space environment. This approach is facilitated by our extensive proprietary research platform and deep understanding of submarket dynamics.

Through this process, we are able to drive synergies across varied uses and create unique, amenity-rich, walkable neighborhoods that are desirable and create significant tenant and investor demand. As part of this process, we build high-quality, distinctive and unique assets that allow the user experience to extend beyond street level into the building itself. As a result, we believe this approach leads to stronger office, multifamily and retail demand, leading to higher rents, stronger leasing velocity and, ultimately, greater asset values. We believe that our approach has helped mitigate the impact of new competitive supply on our projects and has allowed us to scale our success across neighborhoods.

We have successfully developed a number of differentiated projects that achieve top-of-market rental rates and sales prices, while also attracting a diverse group of sought-after retailers as tenants. We believe our Placemaking™ efforts can benefit entire neighborhoods, creating value across a broad base of assets and accelerating the transformation of submarkets into desirable environments for tenants and residents.

See "—Case Studies—77 H Street" on page 29, "—Waterview" on page 36, "—CEB Tower at Central Place" on page 37, "—RTC-West" on page 40 and "—Mark Center Portfolio" on page 33.

Extensive Market Knowledge and Long-Standing Relationships. With over 50 years of experience in the DC Metro area, our team possesses a deep and detailed understanding of our submarkets and has influenced the development of these communities through our Placemaking™ approach. Our primary focus is on developing, acquiring and operating assets in the DC Metro area, where our organization has significant expertise and relationships and our market knowledge is both broad and deep. Having developed or acquired over 19.0 million RSF of office, 14,250 multifamily units, over 4.0 million RSF of retail, 5,700 hotel rooms and 3,000 for sale residential units and townhomes in the region since 2000, representing approximately $13.0 billion in gross asset value, we believe that our significant expertise and relationships serve as a competitive advantage. Our in-depth market knowledge and extensive network of long-standing relationships with a broad range of real estate owners, developers, brokers, lenders, general contractors, municipalities, local community organizations and other market participants has consistently provided us with access to an ongoing pipeline of attractive acquisition and investment opportunities in our core submarkets that may not be available to our competitors. We believe that our reputation for performance and execution provides us with a competitive advantage over other market participants.

Additionally, we focus on establishing strong relationships with our tenants in order to understand their long-term business needs, which we believe enhances our ability to retain quality tenants, facilitates our leasing efforts and maximizes cash flow from our assets. Our senior management and our leasing team members have deep and long-standing relationships with key office and retail tenants and their representatives, which allows us to aggressively lease-up vacant space and identify pre-lease tenants for our buildings. For example, our relationship with a publicly-listed company and its representative, and previous experience building a corporate headquarters building for that tenant, facilitated us securing a pre-lease for 65.0 percent of CEB Tower at Central Place, which created

14

significant value and mitigated speculative development risk. Our leasing team has averaged an annual leasing volume of approximately 1.0 million RSF of office over the past three years. Furthermore, our team includes individuals with experience winning multiple competitive GSA lease procurements and building GSA-tenanted buildings. This experience, coupled with our experience delivering facilities that meet the needs of GSA tenants, helps to position us to compete for future GSA leasing business. In addition to our office and GSA leasing experience, our retail leasing teams have strong and deep retailer relationships with key anchor tenants that enhance our Placemaking™ activities, including Whole Foods Market, Starbucks, Harris Teeter, Trader Joe's, Walmart and multiple other local, regional and national tenants. These relationships have contributed to our average annual leasing volume over the past three years of approximately 764,000 RSF of retail space across our owned and managed portfolio.

See "—Case Studies—51 Louisiana Avenue" on page 35, "—CEB Tower at Central Place" on page 37, "—77 H Street" on page 29, "—Sky House" on page 30 and "—The Woodley" on page 31.

Experienced Capital Allocation Capabilities. We have a proven track record of managing our risk, cost of capital and capital sources by utilizing various capital allocation strategies across investment opportunities. We believe that we have the ability and expertise to use not only our own balance sheet but also to deploy capital from strategic third-party investors or through joint ventures. We have longstanding relationships and a long track record of success with many partners.

While we intend to use our own capital as our primary source of capital, we may continue to partner with such third parties in order to deliver mixed-use projects or access other opportunities. Additionally, we may in the future consider pursuing opportunities in the investment fund business to the extent that our management sees attractive opportunities. In addition to sources of equity capital, we have a variety of relationships with debt capital providers that we will continue to utilize.

We also use various capital allocation strategies to manage risks associated with our development activities. For example, we often use capital to option, rather than purchase, raw land positions until the property has received appropriate entitlements, allowing us to pre-lease these development projects prior to or soon after closing on the land.

See "—Case Studies—Waterview" on page 36, "—CEB Tower at Central Place" on page 37, "—The Woodley" on page 31, "—16th & I Street" on page 38 and "—5600 and 5601 Fishers Lane" on page 27.

Large and Successful Strategic Capital Business. Since 1999, JBG has served as the general partner and managing member of nine real estate investment funds for institutional investors and high net worth individuals with over $3.6 billion of discretionary fund investment capital and has invested in more than 250 assets on behalf of the JBG funds. The JBG strategic capital platform provides fee-based real estate services to the JBG funds. Although the majority of the JBG funds' assets and interests in assets will be contributed in the Combination Transactions, the JBG funds will retain certain assets that are primarily non-core and which we refer to collectively as non-core excluded assets. With respect to these non-core excluded assets and for most assets that we hold through joint ventures, we will continue to provide the same asset management, property management, construction management, leasing and other services that we currently provide and will continue to earn fees in connection with providing such services. We also expect to earn such fees from joint venture assets acquired in the future and any future funds that we establish. For the three months ended March 31, 2016 and the year ended December 31, 2015, including the revenue generated by the retail portion of our strategic capital business (which was acquired in January 2016), our strategic capital business generated approximately $23.9 million and $115.1 million of revenue, respectively. After elimination of the fee streams earned for management of assets which will be consolidated in the combined company's financial statements on a going forward basis, we would have earned approximately $9.8 million and $49.0 million in revenue from such fees for the three months ended March 31, 2016 and the year

15

ended December 31, 2015, respectively. We expect to earn similar fees in the future from the JBG funds and our joint venture arrangements currently in place, as well as any future joint ventures or funds that we establish. We expect that the fees we continue to earn in connection with providing such services will enhance our overall returns, and that our existing investment relationships will continue to provide potential capital sources and new investment opportunities. See "—Our Strategic Capital Business."

Business and Growth Strategies

Our primary business objectives are to maximize cash flow and generate strong risk-adjusted returns for our shareholders. We intend to pursue these objectives through the following business and growth strategies.

Drive Incremental Growth through Lease-up of Our Assets. As of March 31, 2016, we had 46 signed but not yet commenced leases totaling over $42.0 million ($35.4 million on a pro rata basis) of annualized rent, 37 of which are estimated to commence by March 31, 2017. In addition, we believe that we are well positioned to achieve significant internal growth through lease-up of our recently acquired, recently developed and recently renovated assets, given current strong tenant demand for high-quality space in our submarkets. Additionally, there are ten assets in our operating portfolio that we believe present embedded growth opportunities through the leasing up of vacant space generated through normal course lease expirations. As of March 31, 2016, these embedded growth and lease-up opportunities by asset type were as follows:

- •

- One office asset that was delivered in the first quarter of 2016 and one office asset that will undergo a significant renovation estimated to be completed within the next 15 months, totaling over 354,000 RSF, which were 75.0 percent leased, resulting in approximately 89,000 RSF available for lease.

- •

- Nine operating office assets totaling approximately 2.1 million RSF, which were on average 80.2 percent leased, resulting in over 410,000 RSF available for lease.

- •

- Four mid/high-rise multifamily assets that were recently delivered in 2015, totaling 1,264 units, which were on average 48.4 percent leased, resulting in 652 multifamily units available for lease.

- •

- One retail asset that was delivered in the third quarter of 2015 and one retail asset that was acquired in the second quarter of 2015, totaling approximately 49,000 RSF, which were on average 64.1 percent leased, resulting in over 17,000 RSF available for lease.

- •

- One operating retail asset totaling approximately 118,000 RSF, which was 66.5 percent leased, resulting in over 39,000 RSF available for lease.

We have experienced strong leasing velocity across our owned and managed portfolios for the twelve months ended March 31, 2016, leasing approximately 710,000 RSF of office, 9,112 multifamily units, and 491,000 RSF of retail. Based on current market demand in our submarkets and the efforts of our dedicated in-house leasing teams, we expect to increase our occupancy and revenue significantly across our portfolio generally, and in our lease-up properties in particular. For example, if we were able to lease-up these assets to their respective market comparable level percentages and rental rates, as estimated by management and JLL, then we estimate that we could generate incremental annualized

16

rent of approximately $13.8 million ($8.8 million on a pro rata basis) and over $15.7 million ($6.8 million on a pro rata basis) on our office and multifamily opportunities, respectively. If we are able to lease-up the retail assets identified in the table below to the market average percentage leases at the current weighted average in-place rent, we estimate that we could generate incremental annualized rent of approximately $2.2 million ($1.6 million on a pro rata basis). The total estimated incremental annualized rent from these office, multifamily and retail opportunities is approximately $31.7 million ($17.1 million on a pro rata basis).

See "—Case Studies—Jefferson Court and The Foundry" on page 39 and "—RTC West" on page 40.

The following table sets forth information with respect to our incremental and embedded lease-up opportunities.

Office Lease-up Opportunities

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Office Asset | | Submarket | | Percent

Ownership | | Delivery/

Renovation

Completion

Date(1) | | Rentable

Square

Feet | | Percent

Leased | | Submarket

Percentage

Leased(2) | | Weighted

Average

Comp Set

Rent Per

Square

Foot(3) | | Potential

Incremental

Annualized

Rent(4) | | Estimated

Cost to

Stabilize(5) | |

|---|

Recently Acquired/Delivered/Renovated | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Foundry(6) | | Georgetown | | | 9.9 | % | | Q2 2017 | | | 233,855 | | | 76.2 | % | | 89.8 | % | $ | 49.37 | | $ | 1,571,003 | | $ | 2,077,505 | |

16th & I Street(7) | | CBD | | | 71.9 | % | | Q1 2016 | | | 120,282 | | | 72.5 | % | | 89.1 | % | | 77.83 | | | 1,550,698 | | | 1,723,073 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 354,137 | | | 75.0 | % | | 89.6 | % | $ | 60.32 | | $ | 3,121,701 | | $ | 3,800,578 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Embedded Growth Opportunities | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RTC—West(8) | | Reston | | | 100.0 | % | | | | | 495,348 | | | 83.0 | % | | 90.9 | % | $ | 32.80 | | $ | 1,275,802 | | $ | 2,389,419 | |

L'Enfant Plaza Office—East | | Southwest | | | 49.0 | % | | | | | 437,954 | | | 88.1 | % | | 97.0 | % | | 43.53 | | | 1,706,093 | | | 2,606,777 | |

800 North Glebe Road | | Ballston | | | 100.0 | % | | | | | 306,456 | | | 79.1 | % | | 85.9 | % | | 55.81 | | | 1,167,004 | | | 1,334,518 | |

L'Enfant Plaza Office—North(9) | | Southwest | | | 49.0 | % | | | | | 304,132 | | | 63.4 | % | | 97.0 | % | | 43.53 | | | 4,457,759 | | | 6,811,080 | |

1233 20th Street | | CBD | | | 100.0 | % | | | | | 154,584 | | | 88.8 | % | | 92.6 | % | | 50.57 | | | 291,573 | | | 454,936 | |

2121 Wisconsin Avenue | | Uptown | | | 100.0 | % | | | | | 110,241 | | | 88.2 | % | | 89.4 | % | | 41.81 | | | 56,133 | | | 87,660 | |

6862 Elm Street | | McLean | | | 100.0 | % | | | | | 103,556 | | | 79.7 | % | | 94.1 | % | | 34.73 | | | 518,014 | | | 990,101 | |

Reston Arboretum | | Reston | | | 100.0 | % | | | | | 95,666 | | | 81.8 | % | | 90.9 | % | | 32.80 | | | 285,029 | | | 533,835 | |

Old Dominion | | McLean | | | 100.0 | % | | | | | 66,826 | | | 55.8 | % | | 94.1 | % | | 34.73 | | | 888,264 | | | 1,697,767 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 2,074,763 | | | 80.2 | % | | 92.7 | % | $ | 41.31 | | $ | 10,645,671 | | $ | 16,906,093 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 2,428,900 | | | 79.5 | % | | 92.2 | % | $ | 44.49 | | $ | 13,767,372 | | $ | 20,706,671 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- (1)

- Future dates represent estimated renovation completion dates.

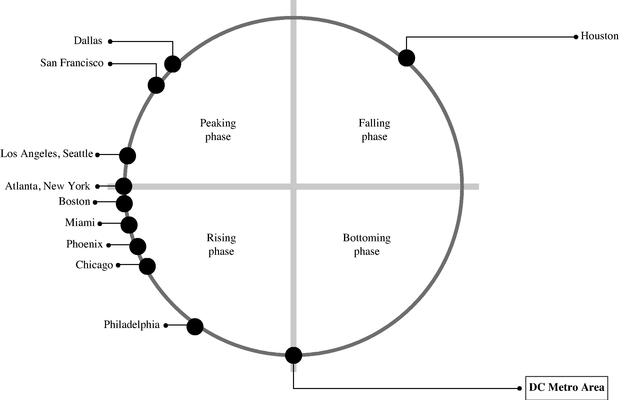

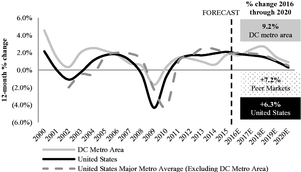

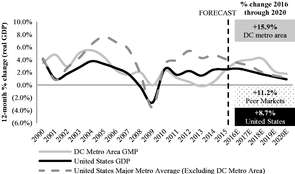

- (2)

- Source: JLL. Represents 10 year historical submarket average through March 31, 2016, except for 800 North Glebe, which is based on a competitive set of applicable Ballston, Rosslyn, and Clarendon office buildings. We believe the prior 10 years is an appropriate period over which to benchmark vacancy given JLL's view that the DC metro area is in the early stage of the recovery cycle and the long-term nature of our typical office leases.

- (3)

- Source: JLL. Represents the weighted average asking market rent per square foot as of March 31, 2016 based on a competitive set designated for each building by JLL. Triple net leases are converted to a gross basis by adding tenant reimbursements to base rent. We believe weighted average asking rents for the competitive set provides an appropriate data set against which to benchmark rental rates because we believe the competitive set, which is more narrow than submarket data, is representative of the quality and age of these office assets, which we believe are among the primary factors impacting rental rates for office assets, particularly in the submarkets in which these assets are located.

17

- (4)

- Calculated as the product of incremental square feet available for lease up to the submarket percentage leased and weighted average competitive set rent per square foot. Excludes potential revenue from leases signed but not commenced. See "—Our Office Assets—Signed But Not Commenced Leases in Our Office Portfolio" for detail on signed but not commenced leases.

- (5)

- Source: JLL. Represents submarket average tenant improvement allowance and typical tenant representation commission as estimated by JLL. Tenant improvement allowance figures based on lease comparables within the designated submarket for relocations of 10 years or longer, excluding renewals and subleases.

- (6)

- The Foundry was acquired in December 2014. We are in the planning and design stages of a $11.0 million renovation of the asset with an estimated completion date in the second quarter of 2017.

- (7)

- 16th & I Street delivered in the first quarter of 2016.

- (8)

- RTC—West was acquired in November 2012. In the first quarter of 2014, we completed a $6.4 million renovation of the asset. RTC—West is comprised of three neighboring office buildings. RTC—West was an operating office asset as of March 31, 2016; however, our development plan contemplates redeveloping approximately 19,500 square feet of the existing asset to construct the RTC—West Retail construction asset.

- (9)

- L'Enfant Plaza Office—North was acquired in November 2003. In the fourth quarter of 2014, we completed a $13.5 million renovation of the asset.

Multifamily Lease-up Opportunities

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Multifamily Asset | | Submarket | | Percent

Ownership | | Delivery

Date | | Units | | Rentable

Square

Feet(1) | | Percent

Leased | | Comp Set

Percentage

Leased(2) | | Weighted

Average

Comp Set

Rent Per

Unit(3) | | Potential

Incremental

Annualized

Rent(4) | |

|---|

Recently Acquired/Delivered/Renovated | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mid/High-Rise | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Galvan(5) | | Rockville Pike Corridor | | | 1.8 | % | | Q4 2015 | | | 356 | | | 295,472 | | | 33.1 | % | | 94.3 | % | $ | 2,013 | | $ | 5,255,608 | |

Fort Totten Square(6) | | Brookland/Fort Totten | | | 99.4 | % | | Q2 2015 | | | 345 | | | 254,292 | | | 62.3 | % | | 94.8 | % | | 1,917 | | | 2,580,133 | |

Atlantic Plumbing | | U Street/Shaw | | | 64.0 | % | | Q4 2015 | | | 310 | | | 245,604 | | | 37.4 | % | | 94.4 | % | | 2,821 | | | 5,981,248 | |

Notch 8(7) | | Potomac Yard | | | 14.7 | % | | Q4 2015 | | | 253 | | | 207,374 | | | 64.4 | % | | 96.0 | % | | 1,999 | | | 1,913,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 1,264 | | | 1,002,742 | | | 48.4 | % | | 94.8 | % | $ | 2,236 | | $ | 15,730,330 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Table shown at 100 percent share. As of March 31, 2016, there were no embedded growth opportunity multifamily assets.

- (1)

- Includes multifamily and retail square feet, unless otherwise noted.

- (2)

- Source: JLL. Represents percent leased as of March 31, 2016 for competitive set designated for each building by JLL. Includes stabilized assets only. We believe a competitive set data set as of March 31, 2016 is an appropriate time at which to benchmark vacancy given the short-term nature of our typical multifamily leases. In addition, we believe that the competitive set, which is more narrow than submarket data, is the appropriate data set against which to benchmark vacancy because it is representative of the quality and age of these multifamily assets, which we believe are among the primary factors impacting vacancy rates for multifamily assets, particularly in the submarkets in which these assets are located.

- (3)

- Source: JLL. Represents weighted average monthly asking rent per unit as of March 31, 2016 of competitive set designated for each building by JLL. Includes both stabilized assets and properties in lease-up. We believe weighted average asking rents for the competitive set provides an appropriate data set against which to benchmark rental rates because we believe the competitive set, which is more narrow than submarket data, is representative of the quality and age of these multifamily assets, which we believe are among the primary factors impacting rental rates for multifamily assets, particularly in the submarkets in which these assets are located.

- (4)

- Calculated as the product of incremental units available for lease up to the competitive set percentage leased and weighted average competitive set rent per unit, multiplied by 12. Excludes potential revenue from the lease up of retail space in these multifamily assets. See "—Our Retail Assets—Signed But Not Commenced Leases in Our Retail Portfolio" for detail on signed but not commenced leases.

- (5)

- Galvan is part of a mixed-use property that includes the Galvan Retail operating retail asset.

- (6)

- Fort Totten Square is part of a mixed-use property that includes the Fort Totten Square Retail operating retail asset. We are currently in negotiations with our joint venture partner to recapitalize the asset and increase our ownership to 100 percent.

- (7)

- Notch 8 is part of a mixed-use property that includes the Notch 8 Retail operating retail asset.

18

Retail Lease-up Opportunities

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retail Asset | | Submarket | | Percent

Ownership | | Acquisition/

Delivery

Date | | Rentable

Square

Feet | | Percent

Leased | | Submarket

Percentage

Leased(1) | | Weighted

Average

In-Place

Rent Per

Square

Foot(2) | | Potential

Incremental

Annualized

Rent(3) | | Estimated

Cost to

Stabilize(4) | |

|---|

Recently Acquired/Delivered/Renovated | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pikesville Walgreens(5) | | Pikesville | | | 99.0 | % | | Q2 2015 | | | 25,476 | | | 78.0 | % | | 93.2 | % | $ | 40.31 | | $ | 156,006 | | $ | 218,409 | |

275 N. Washington(6) | | Rockville Pike Corridor | | | 100.0 | % | | Q3 2015 | | | 23,083 | | | 48.7 | % | | 94.1 | % | | 79.29 | | | 830,590 | | | 1,162,825 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 48,559 | | | 64.1 | % | | 93.6 | % | $ | 68.78 | | $ | 986,596 | | $ | 1,381,234 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Embedded Growth Opportunities | | | | | | | | | | | | | | | | | | | | | | | | | | | |

L'Enfant Plaza Retail—West(7) | | Southwest | | | 49.0 | % | | | | | 117,610 | | | 66.5 | % | | 97.1 | % | $ | 33.41 | | $ | 1,200,556 | | $ | 1,680,779 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 117,610 | | | 66.5 | % | | 97.1 | % | $ | 33.41 | | $ | 1,200,556 | | $ | 1,680,779 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | | | | | | | | | | 166,169 | | | 65.8 | % | | 96.1 | % | $ | 43.50 | | $ | 2,187,152 | | $ | 3,062,013 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Table shown at 100 percent share.

- (1)

- Source: JLL. Represents 10 year historical submarket average through March 31, 2016. We believe the prior 10 years is an appropriate period over which to benchmark vacancy given JLL's view that the DC Metro area is in the early stage of the recovery cycle and the long-term nature of our typical retail leases.

- (2)

- Based on leases signed as of March 31, 2016 and calculated as annualized base rent and percentage rent before abatements divided by total leased square feet. Triple net leases are converted to a gross basis by adding tenant reimbursements to base rent. See "—Our Retail Assets—Contractual Rent Abatement in Our Retail Portfolio" for detail on rent abatements. We believe our weighted average in-place rents provide an appropriate data set against which to benchmark rental rates given the limited availability of representative submarket or competitive set data and that in-place rents of our retail assets are representative of the quality and positioning of these retail assets, which we believe are among the primary factors impacting rental rates for retail assets, particularly in the submarkets in which they are located.

- (3)

- Calculated as the product of incremental square feet available for lease up to the competitive set percentage leased and weighted average in-place rent per square foot. Excludes potential revenue from leases signed but not commenced. See "—Our Retail Assets—Signed But Not Commenced Leases in Our Retail Portfolio" for detail on signed but not commenced leases.

- (4)

- Source: JLL. Represents submarket average tenant improvement allowance and typical tenant representation commission as estimated by JLL. Tenant improvement allowance figures based on lease comparables within the designated submarket for relocations of 10 years or longer, excluding renewals and subleases.

- (5)

- Pikesville Walgreens was acquired in the second quarter of 2015. We are currently in negotiations with our joint venture partner to recapitalize the asset and increase our ownership to 100 percent.

- (6)

- 275 N. Washington delivered in the third quarter of 2015.

- (7)

- L'Enfant Plaza Retail—West was acquired in November 2003. In the second quarter of 2014, we completed a $30.0 million renovation of the asset.

Deliver Our Assets under Construction. As of March 31, 2016, we had eight high-quality assets under construction with an estimated total cost of approximately $813.3 million and an estimated $492.4 million of remaining cost to complete. Our construction pipeline consists of approximately 537,000 RSF of office space, 1,007 multifamily units, and approximately 147,000 RSF of retail space, all of which is inside the Beltway and/or in Metro-served locations. Four of these projects are scheduled to be completed in the next 24 months. We are targeting initial full year stabilized NOI yields-on-cost from these assets in the range of 7.1 - 7.6 percent, based on internal underwriting estimates. We believe these projects provide significant potential for value creation. As of March 31, 2016, approximately 349,000 RSF, or 65.0 percent, of our office construction pipeline was pre-leased and approximately 12,000 RSF, or 8.1 percent, of our retail construction pipeline was pre-leased.

19

We employ a strategy of pre-leasing space to anchor tenants to mitigate risk and generate demand, while leasing up high value space closer to or after delivery, when the space can be physically shown to the market. We also have mitigated our financial risks by executing guaranteed maximum price construction contracts with respect to each of these assets to mitigate potential cost overruns. The following tables provide information about our office, multifamily and retail assets under construction as of March 31, 2016.

See "Case Studies—CEB Tower at Central Place" on page 37, "—16th & I Street" on page 38 and "—13th and U Street" on page 32.

Office Assets Under Construction

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| | Weighted

Average

Pre-lease

Rent

Per

Square

Foot(3) | |

| |

| |

| |

| |

| |

| |

|

|---|

| |

| |

| |

| |

| |

| | Schedule | | Estimated

Remaining

Cost to

Complete(6)

($000s) | |

| |

|

|---|

| |

| |

| |

| | Estimated

Rentable

Square

Feet(1) | |

| | Estimated

Total

Cost(7)

($000s) | | Targeted

NOI

Yield

Range(8) |

|---|

Office Asset | | Location | | Submarket | | Percent

Ownership | | Percent

Pre-

leased(2) | | Initial

Control

Date(4) | | Construction

Start Date | | Estimated

Completion

Date | | Estimated

Stabilization

Date(5) |

|---|

Office—Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CEB Tower at Central Place | | Arlington, VA | | Rosslyn | | | 100.0 | % | | 536,710 | | | 65.0 | % | $ | 62.00 | | | Q2 2003 | | | Q4 2014 | | | Q2 2018 | | | Q4 2019 | | $ | 219,719 | | $ | 340,930 | | 7.7% - 8.2% |

Note: Table shown at 100 percent share.

- (1)

- Includes office and retail square feet, unless otherwise noted.

- (2)

- Based on leases signed as of March 31, 2016 and is calculated as the total estimated rentable square feet leased divided by total estimated rentable square feet, expressed as a percentage.

- (3)

- Based on leases signed as of March 31, 2016 and is calculated as base rent before abatements, plus tenant reimbursements for the month in which the lease commences, multiplied by 12. Triple net leases are converted to a gross basis by adding tenant reimbursements to base rent. See "—Our Office Assets—Contractual Rent Abatement in Our Office Portfolio" for detail on rent abatements.

- (4)

- Represents the first quarter in which JBG controlled the land parcel, either through a contract, leasehold or fee simple ownership.

- (5)

- Represents management's estimate of the first quarter of operations in which the asset may be stabilized.

- (6)

- Based on management's estimates as of March 31, 2016 and includes all acquisition costs, hard costs, soft costs, tenant improvements and leasing costs to develop and stabilize the asset.

- (7)

- Represents management's estimate of cost incurred to date, plus the estimated remaining cost to complete the asset as of March 31, 2016. Management's estimate of cost incurred to date is based on the most recent transaction value, which may differ from JBG's original acquisition basis.

- (8)

- Represents our underwritten initial full year stabilized net operating income (NOI) as a percent of estimated total cost. We estimate a construction office asset's initial full year stabilized NOI as part of our standard development underwriting process and calculate it by subtracting our estimate of the asset's initial full year stabilized operating expenses (before interest, income taxes (if any), depreciation and amortization and related party management fees) from our estimate of its initial full year stabilized cash revenue. Actual initial full year stabilized NOI yield ranges may vary from the targeted NOI yield ranges based on the actual total cost to complete the asset and its actual initial full year stabilized NOI.

Multifamily Assets Under Construction

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| | Schedule | | Estimated

Remaining

Cost to

Complete(2)

($000s) | |

| |

|

|---|

| |

| |

| |

| | Estimated

Rentable

Square

Feet(1) | |

| | Estimated

Total

Cost(3)

($000s) | | Targeted

NOI

Yield

Range(4) |

|---|

Multifamily Asset | | Location | | Submarket | | Percent

Ownership | | Estimated

Number

of Units | | Initial

Control

Date | | Construction

Start

Date | | Estimated

Completion

Date | | Estimated

Stabilization

Date |

|---|

Multifamily—Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mid/High-Rise | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reston Heights—Phase I(5) | | Reston, VA | | Reston | | | 10.0 | % | | 327,163 | | | 386 | | | Q1 2006 | | | Q4 2015 | | | Q2 2018 | | | Q3 2019 | | $ | 72,680 | | $ | 94,037 | | 8.1% - 8.6% |

1244 South Capitol Street | | Washington, DC | | Southeast | | | 100.0 | % | | 226,283 | | | 291 | | | Q4 2013 | | | Q4 2015 | | | Q2 2018 | | | Q3 2019 | | | 76,631 | | | 105,938 | | 7.3% - 7.8% |