EXHIBIT 99.1

ANNUAL INFORMATION FORM

ANNUAL INFORMATION FORM

for the financial year ended August 31, 2012 (unless otherwise noted)

Dated: November 20, 2012

TABLE OF CONTENTS

Page

| PRELIMINARY NOTES | 1 |

| | Documents Incorporated by Reference | 1 |

| | Date of Information | 1 |

| | Forward Looking Statements | 1 |

| | Mineral Resources and Reserves | 2 |

| | Currency and Exchange Rates | 3 |

| | Metric Equivalents | 4 |

| CORPORATE STRUCTURE | 4 |

| | Name, Address and Incorporation | 4 |

| | Intercorporate Relationships | 5 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 5 |

| | General | 5 |

| | Three-year History | 5 |

| DESCRIPTION OF THE BUSINESS OF THE COMPANY | 11 |

| | General | 11 |

| | Forcasted Consumption Growth | 12 |

| | Green Technology and Key High-Tech Applications | 12 |

| | Rare Earth Common Commercial Uses and Pricing | 13 |

| | Average monthly pricing of select rare earth oxides: 2010-Jan 2011 (US$/kg) | 15 |

| | Employees | 15 |

| | Environmental Protection | 15 |

| | Foreign Operations | 15 |

| | Swedish Mining Laws and Regulations | 15 |

| | Bankruptcy and Similar Procedures | 18 |

| | Social or Environmental Policies | 18 |

| | Mineral Projects | 18 |

| | Risk Factors | 31 |

| | Risks Related to the Business of the Company | 31 |

| | Risks Related to the Common Shares | 34 |

| DIVIDENDS | 35 |

| DESCRIPTION OF CAPITAL STRUCTURE | 35 |

| | Options to Purchase Common Shares | 35 |

| | Share Purchase Warrants | 36 |

| | Other Securities | 36 |

| MARKET FOR SECURITIES | 36 |

| | Trading Price and Volume | 36 |

| | Prior Sales | 37 |

| ESCROWED SECURITIES | 37 |

| DIRECTORS AND EXECUTIVE OFFICERS | 37 |

| | Name, Occupation, Residence and Security Holdings | 37 |

| | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 38 |

| | Conflicts of Interest | 39 |

| AUDIT COMMITTEE | 40 |

| | The Audit Committee’s Charter | 40 |

| | Composition of the Audit Committee | 40 |

| | Relevant Education and Experience | 40 |

| | Audit Committee Oversight | 40 |

| | Reliance on Certain Exemptions | 40 |

| | Pre-Approval Policies and Procedures | 41 |

| | External Auditor Service Fees (By Category) | 41 |

-i-

Page

| LEGAL PROCEEDINGS | 41 |

| | Regulatory Actions | 41 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 41 |

| TRANSFER AGENT AND REGISTRAR | 42 |

| MATERIAL CONTRACTS | 42 |

| INTERESTS OF EXPERTS | 42 |

| | Names of Experts | 42 |

| | Interests of Experts | 43 |

| ADDITIONAL INFORMATION | 43 |

SCHEDULE “A” – AUDIT COMMITTEE CHARTER

-ii-

PRELIMINARY NOTES

All financial information in this Annual Information Form (“AIF”) of Tasman Metals Ltd. (the “Company” or “Tasman”) is prepared in accordance with international financial reporting standards.

In this AIF, unless the context otherwise requires, the terms the “Company” or “Tasman” refer to Tasman Metals Ltd. together with its subsidiary.

All technical information in this AIF not derived from the Norra Kärr PEA Report (as defined herein) has been reviewed and approved by Mark Saxon, President and Chief Executive Officer of the Company, a Fellow of the Australasian Institute of Mining and Metallurgy and Australian Institute of Geoscientists and a Qualified Person, as defined in National Instrument 43-101 – Standards for Disclosure of Mineral Projects (“NI 43-101”).

Documents Incorporated by Reference

Incorporated by reference into this AIF are the following documents:

| (a) | The preliminary economic assessment report titled "Preliminary Economic Assessment NI 43-101 Technical Report for the Norra Kärr (REE - Y - Zr) Deposit, Gränna, Sweden" dated May 11, 2012 (the " Norra Kärr PEA Report") prepared by Messrs. Paul A Gates, Craig F Horlacher and Geoffrey C. Reed of PAH. |

Copies of the above documents may be obtained online at the Company’s profile on (“SEDAR”), the System for Electronic Document Analysis and Retrieval at www.sedar.com and on the Company’s website www.tasmanmetals.com.

Date of Information

All information in this AIF is as of August 31, 2012 unless otherwise indicated.

Forward Looking Statements

This AIF contains forward-looking statements and forward-looking information (collectively, “forward looking statements”) within the meaning of Canadian and United States securities laws relating to the Company that are based on the beliefs and estimates of management as well as assumptions made by and information currently available to the Company. Such forward-looking statements include, but are not limited to statements concerning:

| · | the Company’s plan for its mineral properties; |

| · | the future price of rare earth elements; (“REE”) |

| · | the estimation of mineral reserves and mineral resources; |

| · | estimates of the time and amount of future REE production for specific operations; |

| · | estimated future exploration expenditures and other expenses for specific operations; |

| · | requirements for additional capital; |

| · | currency fluctuations; and |

| · | environmental risks and reclamation costs. |

When used in this AIF, any statements that express or involve discussions with respect to predictions, beliefs, plans, projections, objectives, assumptions or future events of performance (often but not always using words or phrases such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “strategy”, “goals”, “objectives”, “project”,

“potential” or variations thereof or stating that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur, or be achieved, or the negative of any of these terms and similar expressions), as they relate to the Company or management, are intended to identify forward-looking statements.

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance, or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| · | risks relating to the Company’s ability to finance the exploration and development of its mineral properties; |

| · | risks relating to the Company’s exploration and development of its mineral properties and business activities; |

| · | risks and uncertainties relating to the interpretation of exploration results, geology, grade and continuity of the Company’s mineral deposits; |

| · | risks related to title to the Company’s mineral properties; |

| · | risks related to mining operations in Sweden, Finland and Norway; |

| · | commodity price fluctuations; |

| · | risks related to governmental regulations, including environmental regulations and possible changes thereto; |

| · | risks related to possible reclamation activities on the Company’s properties; |

| · | the Company’s ability to attract and retain qualified management and the Company’s dependence upon such management in the development of its mineral properties and potential conflicts of interest involving such management; |

| · | increased competition in the exploration industry; and |

| · | the Company’s lack of cash flow, history of losses and expectation of future losses. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation, those referred to in this document under the heading “Risk Factors” and elsewhere. The forward-looking statements in this AIF are based on the reasonable beliefs, expectations and opinions of management on the date the forward-looking statements are made, and the Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change.

For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

Readers are encouraged to consult the Company’s public filings at www.sedar.com and the Company’s regulatory disclosure on its website www.tasmanmetals.com for further, more detailed information concerning these matters.

Mineral Resources and Reserves

In this AIF and the documents incorporated by reference herein, the definition of “mineral resources” is that used by the Canadian securities administrators and conforms to the definition utilized by CIM in the “CIM Standards on Mineral Resources and Reserves – Definitions and Guidelines” adopted on August 20, 2000 and amended December 11, 2005.

The standards employed in estimating the mineral resources referenced in this AIF differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”) and the resource information reported may not be comparable to similar information reported by United States companies. The term “resources” does not equate to “reserves” and normally may not be included in documents filed with the SEC. “Resources” are sometimes referred to as “mineralization” or “mineral deposits.” While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of an economic analysis, except a preliminary economic assessment provided certain additional disclosure requirements are met. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM. These definitions differ from the definitions in the United States Securities and Exchange Commission Industry Guide 7 (“SEC Industry Guide 7”) under the Securities Act of 1933. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

As such, information contained in this AIF and the documents incorporated by reference herein concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by United States companies in SEC filings.

Currency and Exchange Rates

Unless otherwise indicated herein, references to “$” or “dollars” in this AIF are to Canadian dollars, references to “US$” or “U.S. dollars” are to United States dollars, references to AU$ are to Australian dollars, and references to “SEK” are to Swedish Krona.

The following tables set forth:

| · | the rates of exchange on years ended August 31, in effect at the end of each of the periods indicated; |

| · | the average exchange rates in effect on the last business day of each month during such periods; and |

| · | the high and low exchange rate during such periods; |

in each case in the table below based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars:

| | 2012 | 2011 | 2010 | 2009 | 2008 |

| Rate at end of period | 1.0139 | 1.0221 | 0.9399 | 0.9118 | 0.9411 |

| Average rate during period | 0.9909 | 1.0109 | 0.9572 | 0.8448 | 0.9937 |

| High for period | 1.0254 | 1.0583 | 1.0039 | 0.9623 | 1.0905 |

| Low for period | 0.9430 | 0.9506 | 0.9038 | 0.7692 | 0.9365 |

in each case in the table below based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into Australian dollars:

| | 2012 | 2011 | 2010 | 2009 | 2008 |

| Rate at end of period | 0.9813 | 0.9551 | 1.0549 | 1.0807 | 1.0991 |

| Average rate during period | 0.9642 | 0.9926 | 1.0708 | 1.1695 | 1.0928 |

| High for period | 1.0027 | 1.0511 | 1.1583 | 1.3291 | 1.1696 |

| Low for period | 0.9299 | 0.9518 | 1.0180 | 1.0680 | 1.0181 |

and in each case in the table below based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into Swedish Krona:

| | 2012 | 2011 | 2010 | 2009 | 2008 |

| Rate at end of period | 6.7114 | 6.4641 | 6.9300 | 6.4857 | 6.0680 |

| Average rate during period | 6.7373 | 6.5993 | 6.9349 | 6.6336 | 6.1961 |

| High for period | 7.1124 | 7.0423 | 7.6805 | 7.2150 | 6.8729 |

| Low for period | 6.3939 | 6.2854 | 6.3492 | 6.0241 | 5.7637 |

Metric Equivalents

For ease of reference, the following factors for converting imperial measurements into metric equivalents are provided:

| To convert from imperial | To metric | Multiply by |

| | | |

| Acres | Hectares | 0.404686 |

| Feet | Metres | 0.30480 |

| Miles | Kilometres | 1.609344 |

| Tons | Tonnes | 0.907185 |

| Ounces (troy)/ton | Grams/Tonne | 34.2857 |

CORPORATE STRUCTURE

Name, Address and Incorporation

Pursuant to an amalgamation agreement dated June 30, 2009 (the “Amalgamation Agreement”) on October 22, 2009, Tasman Metals Ltd. (“PrivateCo”), a private company, amalgamated with Ausex Capital Corp. (“Ausex”) and Lumex Capital Corp. (“Lumex”), both TSX Venture Exchange (“TSXV”) listed companies, in accordance with the provisions of the Business Corporations Act (British Columbia) (the “BCBCA”), to form the Company under the name “Tasman Metals Ltd.” (the “Amalgamation”).

Ausex was incorporated pursuant to the provisions of the BCBCA on August 31, 2007, Lumex was incorporated pursuant to the provisions of the BCBCA on January 9, 2007 and PrivateCo was incorporated pursuant to the provisions of the BCBCA on August 27, 2007.

The head office and registered and records office of Tasman is Suite 1305, 1090 West Georgia Street, Vancouver, British Columbia, V6E 3V7.

Intercorporate Relationships

TasMet AB, incorporated pursuant to the laws of Sweden, is the Company’s only subsidiary. The Company owns 100% of TasMet AB. TasMet AB has an administrative office in Bollnas, Sweden.

See “General Development of the Business – General” and “Description of the Business of the Company – Three Year History.”

GENERAL DEVELOPMENT OF THE BUSINESS

General

The Company is a junior resource company engaged in the acquisition and exploration of unproven REE properties in Scandinavia.

Lumex completed its initial public offering on June 7, 2007. Ausex completed its initial public offering on January 25, 2008. Prior to the completion of the Amalgamation, Ausex was a Capital Pool Company as such term is defined in TSXV Policy 2.4 – Capital Pool Companies (“CPC”) with no tangible assets, Lumex was a CPC with no tangible assets and PrivateCo was a private company, at arm’s length to Ausex and Lumex, with its material assets in Sweden. The Amalgamation of PrivateCo, Ausex and Lumex served as the “qualifying transaction” for both Ausex and Lumex under the policies of the TSXV (the “Qualifying Transaction”).

The Company’s principal asset is the 100% owned Norra Kärr REE-Zirconium (“Zr”) project in Sweden (the “Norra Kärr project”). The Norra Kärr project is located in southern Sweden, 300 kilometres (“KM”) southwest of the capital Stockholm and lies in mixed farming and forestry land. See “Description of the Business of the Company – Mineral Projects, Norra Kärr Project, Sweden”.

Tasman’s common shares are listed on the TSXV and trade under the symbol of “TSM”. Tasman is a Tier 1 issuer on the TSXV. On December 2, 2011, the Company’s common shares were listed for trading on the NYSE MKT under the symbol “TAS”.

See “Description of the Business”.

Three-year History

Year ended August 31, 2010

On September 10, 2009, Ausex and Lumex announced that PrivateCo had applied for three exploration claims totalling 4,446 hectares in Sweden, three claim reservations totalling 2,633 hectares in Finland and one claim of 30 hectares in Norway. One such project for which an application was made at that time was the Norra Kärr project.

On October 29, 2009, Tasman obtained conditional acceptance for the Qualifying Transaction, being the Amalgamation in accordance with TSXV requirements and received final acceptance to begin trading on the TSXV with Tier 2 status on November 3, 2009.

On the same date, Tasman announced that, in conjunction with its Qualifying Transaction, it completed two non-brokered financings, the first being a non-brokered private placement of 6,000,000 common shares at $0.10 per common share and the second being a non-brokered private placement of 7,000,000 units at a price of $0.25 per unit, with each unit consisting of one common share and one share purchase warrant (a “2009 Warrant”). Each 2009 Warrant was exercisable for two years to purchase a further common share of Tasman at an exercise price of $0.40 per common share during the first year and $0.50 per common share during the second year. These financings combined raised proceeds to the Company of $2,350,000 less transaction costs, including cash finders’ fees. In connection with the private placements, the Company also issued 452,000 common share purchase warrants exercisable for two years at $0.10 as a finder’s fee and 566,000 compensation options, each compensation option exercisable at $0.25 for a period of two years to acquire a further common share and share purchase warrant having

the same terms as the 2009 Warrants. The proceeds of the private placements were used for exploration expenditures on the Company’s mineral projects and general working capital.

On November 16, 2009, Tasman announced that it was preparing to drill at the Nora Kärr project. It was also disclosed that an independent qualified geologist had been engaged to visit and complete a NI 43-101 compliant technical report on the Norra Kärr project.

On December 3, 2009, Tasman announced that the NI 43-101 compliant technical report on the Norra Karr project entitled “Report on the Geology, Mineralization and Exploration Potential of the Norra Karr Zirconium - REE Deposit, Granna, Sweden” dated November 13, 2009 (the “2009 Norra Karr Report”) had been received. Based on the results of the 2009 Norra Kärr Report, Tasman disclosed that it would focus its exploration efforts on the Norra Kärr project. On December 10, 2009, Tasman announced that it had received approval from Swedish land management authorities to drill at the Norra Kärr project. On December 16, 2009, Tasman announced that, further to its previous announcement, drilling at the Norra Kärr project was underway as of December 16, 2009.

On March 8, 2010, Tasman announced that it had arranged a non-brokered private placement for up to 5,000,000 units, at a price of $0.60 per unit, to raise gross proceeds of up to $3,000,000. Each unit consisted of one common share and one-half of one share purchase warrant (a “March 2010 Warrant”). Each whole March 2010 Warrant was exercisable to purchase an additional common share for a period of two years at a price of $0.80 per common share during the first year and $1.00 per common share during the second year. The private placement closed on March 29, 2010. In connection with the private placement, the Company paid a cash fee of $126,105 and issued 210,175 warrants having the same terms as the March 2010 Warrants as a finder’s fee. The proceeds of the private placement were used for exploration on the Company’s REE properties and for general working purposes.

On March 31, 2010, Tasman announced that it was expanding its drilling program at the Norra Kärr project. Following the success of the first five drill holes, the original 15-hole drilling program was expanded to a 26-hole drilling program.

Effective April 6, 2010, Tasman common shares were listed on the Frankfurt Stock Exchange under the trading symbol “T61”.

On March 23, 2010, Tasman signed a binding option and joint venture agreement to acquire a 90% interest in the Bastnäs REE project in south central Sweden. The project vendor (the “Vendor”) was an arm’s-length Swedish geological consulting group who would provide future technical assistance to Tasman. The Company terminated the Bastnäs option agreement in April 2011.

On April 26, 2010, Tasman announced that it had staked the Otanmäki REE project in central Finland and acquired a 100% interest in three adjoining claim reservations, Otanmäki 1, 2, and 3, which total 2,626 hectares and lie in a historic mining district 450 km north of Helsinki (the “Otanmäki project”).

On May 16, 2010, Tasman negotiated a joint venture with Scandinavian Resources Ltd. (“Scandinavian Resources”) (ASX:SCR) whereby Scandinavian Resources was granted the right to acquire up to a 90% interest in four iron claims held by Tasman in the Kiruna district of Sweden (the “Joint Venture”). The Joint Venture covers the Sautusvaara nr 1, Vieto nr 1, Harrejaure nr 1, Laukujarvi nr 3 exploration claims (the “Claims”) that total 7,078 hectares, which lie within the Kiruna iron district. The terms of the Joint Venture were as follows:

| · | Scandinavian Resources issued to Tasman 588,236 fully paid ordinary shares and paid to Tasman the sum of AU$33,333; |

| · | Within ten business days of the renewal of claim Sautusvaara nr 1, Scandinavian Resources agreed to issue to Tasman fully-paid ordinary shares having a value of AU$50,000, which resulted in the issuance of 294,118 Scandinavian Resources shares, pay to Tasman the sum of AU$16,667 and reimburse Tasman for the Mining Inspectorate renewal fees for Sautusvaara nr 1. |

| · | Scandinavian Resources is required to spend a minimum of AU$175,000, within 12 months prior to being entitled to withdraw. Should Scandinavian Resources withdraw after meeting the minimum expenditure, it will have no further interest in the Claims; |

| · | Tasman granted to Scandinavian Resources the exclusive right to earn a 51% interest in the Claims by spending AU$750,000 on exploration prior to June 30, 2013; |

| · | Scandinavian Resources may earn a further 24% interest in the Claims by spending a further $500,000 on exploration prior to June 30, 2014; |

| · | Scandinavian Resources may earn a further 15% interest in the Claims by sole funding a feasibility study on at least one Claim prior to June 30, 2018, including a minimum spend of $100,000 per annum. |

During fiscal 2012, Hannans Reward Limited ("Hannans") acquired Scandinavian Resources and Tasman's holdings in Scandinavian Resources shares were exchanged on a 3 Hannans shares for 1 Scandinavian Resources share basis. As at the date of this AIF, Tasman holds 2,647,062 Hannans shares.

On July 5, 2010, Tasman negotiated a sale and royalty agreement (the “Beowulf Agreement”) with Beowulf Mining plc (AIM:BEM) (“Beowulf”) covering three iron claims held by Tasman in Sweden. The Beowulf Agreement ensured exploration continued on these projects, realized immediate value for Tasman through share payments and provided for a royalty should future production take place. The Beowulf Agreement transferred 100% ownership of the Nakerivaara nr 1, Parkijaure nr 1 and Parkijaure nr 2 claims, that total 1,203 hectares, to Beowulf. In consideration for the sale, Tasman received 691,921 ordinary shares in Beowulf (equivalent to approximately $40,000 at the time of transaction). Tasman agreed not to trade such shares for a period of 12 months following their date of issue. In addition, Tasman retained a 1.5% net smelter returns royalty on any future production in the three permit areas. Under the Beowulf Agreement, Beowulf will be responsible for all expenditures on the three claims, including any required statutory payments.

During fiscal 2011, Tasman sold the Beowulf shares for a gain of $565,978.

On August 5, 2010, Tasman announced assay results from the final six holes drilled as part of the Phase 2 program completed at the Norra Kärr project. Once again, all six holes intersected REE-Zr mineralization, with a maximum mineralized width of 138 metres (“m”). Tasman successfully intersected mineralization in all drill holes completed during this first drill program at the Norra Kärr project.

On August 31, 2010, Tasman announced the signing of a contract with Pinock Allen & Holt (“PAH”)/Minarco-Mineconsult (“MM”) (both subsidiaries of Runge Ltd.) to complete an independent mineral resource estimation of the Nora Kärr project, the first calculated on the project. On November 30, 2010, Tasman announced that the NI 43-101 compliant independent resource estimate for the Norra Kärr project was completed and that PAH/MM recommends that the deposit merits additional drilling, metallurgical research and economic investigation. See “Description of the Business of the Company – Mineral Projects, Norra Kärr Project, Sweden”.

Year ended August 31, 2011

On September 14, 2010, Tasman announced that it had increased its claim holding at the Otanmäki project by acquiring a 100% interest in additional claim applications and claim reservation applications, such that the Otanmäki project then totalled 10,954 hectares in size.

On October 29, 2010, Tasman announced a non-brokered private placement of up to 5,000,000 units at a price of $1.50 per unit, with each unit consisting of one common share and one-half share purchase warrant (an “October 2010 Warrant”). Each whole October 2010 Warrant is exercisable to acquire one additional common share at a price of $1.85 per share. The first tranche of the private placement closed on November 18, 2010 and the Company issued 3,333,334 units for gross proceeds of $5,000,000. A finder’s fee of $193,575 was paid in cash and 129,050 agent warrants were issued having the same terms as the October 2010 Warrants. On November 26, 2010, the Company closed the final tranche of the private placement and issued 1,666,666 units to one strategic investor, for

gross proceeds of $2,500,000. The proceeds from the private placement were used to fund Tasman’s exploration programs and for general working capital.

On November 16, 2010, Tasman announced that it had begun metallurgical testing on material from the Company’s Norra Kärr project.

On December 15, 2010, Tasman announced that it had received support and all necessary approvals from the private landowners and government authorities to undertake a third phase of drilling at the Norra Kärr project.

On January 19, 2011, Tasman announced that a third phase drill program was then underway at the Norra Kärr project.

On January 27, 2011, Tasman filed the NI 43-101 compliant technical report on the Norra Karr project entitled “NI 43-101 Technical Report, Norra Karr – Zirconium Deposit, Granna, Sweden” dated January 20, 2011(the “2011 Norra Kärr Report”) on SEDAR. The report recommended that the deposit at the Norra Karr project merited additional drilling, metallurgical research and economic investigation. Mineral resources were modeled by PAH applying five different total rare earth oxide (“TREO”) cut-off grades, with a base-case resource estimated using a TREO cut-off of 0.4%. At this cut-off, the Norra Kärr project hosts an inferred mineral resource of 60.5 million tonnes grading 0.54% and 1.72% zirconium dioxide (“ZrO2”) with 53.7% of the TREO being the higher value heavy rare earth element oxide (“HREO”).

On March 24, 2011, Tasman graduated to Tier 1 status on the TSXV.

On March 25, 2011, the Company filed a registration statement on Form 40-F with the SEC.

On April 12, 2011, Tasman announced that a first phase drilling program had begun at the Company’s Otanmäki project. The short program was completed with the aim to confirm the quality and extent of mineralization encountered during historic drilling and test a range of new targets identified by deep till and rock chip sampling, and Tasman’s 2010 magnetic/radio metric survey. Samples from this 9 hole drilling were sent to the laboratory for analysis. Results confirmed previous drill intersections, and no new zones of mineralization were discovered.

On April 26, 2011, the Company announced assay results from the first six holes drilled as part of the Phase 3 program completed at the Norra Kärr project during winter/spring 2011. All six holes intersected REE-Zr mineralization, with a maximum mineralized width of 160.85 m. A highlight of these new results is NKA11032 which lies on infill section EF, that intersected 160.85 m at 0.62 % TREO, 1.57 % ZrO2, with 47.9% of the TREO being the higher value HREO, being the thickest intersection of heavy rare earth element (“HREE”) on the project to date. Of further note is NKA10028, which intersected the highest ZrO2 values discovered thus far at Norra Kärr. Drill widths quoted approximate the true width of mineralization.

Following the encouraging results achieved at that point in the Phase 3 drilling program at the Norra Kärr project, on April 28, 2011, the Company announced an extension to the program with an additional 11 holes for a total of 33 drill holes to better define internal boundaries to mineralization, plus deepen holes that were finished in mineralization during the Phase 1 and 2 programs completed in 2009/2010.

On May 2, 2011, the Company announced assay results from an additional three holes drilled as part of the Phase 3 program. Thickness of REE–Zr mineralization at Norra Kärr has been expanded significantly by this set of drill holes. The highlight is NKA11033 which intersected 221.4 m of mineralization at an REE grade 17% higher than the grade of the base case of the NI 43-101 compliant inferred mineral resource in the 2011 Norra Kärr Report. NKA11033 lay on infill section EF, 80 m west of NKA11032 and intersected 221.4 m @ 0.63% TREO, with 47.9% HREO and 1.60% ZrO2.

The twenty-second hole (NKA11048) of the expanded Phase 3 program was then underway. The objective of this drill program was to infill sections to 100 m spacing, test the depth extension of the mineralized intrusion and obtain additional drill core for ongoing metallurgical testing. Drilling was proceeding well with the REE mineralized intrusion having been intersected in all drill holes. The mineralized intrusion was drill tested to a maximum

down-hole depth of 298.8 m in drill hole NKA11040 (assays were still pending as at May 2, 2011), which ended in the intrusion at the limit of the available drill rods. This hole extended the depth of intrusion approximately 100 m below the lower limit of the NI 43-101 compliant inferred resource set out in the 2011 Norra Kärr Report.

On May 4, 2011, the Company announced advancements made in the metallurgical processing research being carried out on REE-Zr mineralization from the Norra Kärr project by SGS Minerals Services (“SGS”). This first stage of metallurgical test work demonstrated that:

| · | 90% of REE mineralization at Norra Kärr is hosted by zirconosilicates that liberate effectively and have high surface area exposure, making them available for attack by acid; |

| · | Greater than 90% of REEs have been recovered from the Norra Kärr mineralization during leach testing, by applying a pre-leach at room temperature, followed by an acid roast and leach. |

On May 26, 2011, the Company announced that its registration statement on Form 40-F, filed with the SEC, became effective on May 24, 2011. Tasman filed the registration on Form 40-F as part of the process to seek approval to list its common shares on the NYSE MKT.

On June 17, 2011, the Company announced the completion of the winter/spring drilling program undertaken at the Norra Kärr project. Twenty-three new drill holes were completed and six existing drill holes were extended for a total of 4,734 m of drilling. The thickness of REE-Zr mineralization at the Norra Kärr project has been expanded significantly by this drilling program. At the time, assays were awaited for much of this drilling program. With this substantial increase in drilling data, the Company contracted independent consultants PAH to update the existing NI 43-101 resource calculation to define an “in-pit” resource and incorporate more than twice the drilling data that was used in the initial calculation. This resource formed the basis for the then planned preliminary economic assessment on the Norra Kärr project.

On June 29, 2011, the Company announced results from an additional four holes drilled as part of the Phase 3 program that was recently completed at the Norra Kärr project. Those drill holes again intersected REE-Zr mineralization with both increased grade and thickness. The highlight is NKA11038 which intersected 241.3 m of mineralization at an REE grade 26% higher than the grade of the base case of the NI 43-101 compliant inferred mineral resource in the 2011 Norra Kärr Report . NKA11038 is the westernmost hole on infill section EF, 80m west of NKA11033 and intersected 241.3m @ 0.68% TREO, with 55.0% HREO and 1.85% ZrO2.

On July 6, 2011, the Company reported that the Swedish Geological Survey (“SGU”), following consultation with local government authorities, declared the Norra Kärr project a “National Interest” under the Swedish Environment Act. The Company welcomed the recognition given to the Norra Kärr project as a “National Interest” project as it protects the Norra Kärr project from any land use that may compete with future mining.

On July 18, 2011, the Company announced the appointment of Mr. Jim Powell as Vice President, Corporate Development of the Company.

On August 9, 2011, the Company reported that it had retained PAH for the preliminary economic assessment of the Norra Kärr project.

Year ended August 31, 2012

On September 16, 2011, the Company announced the appointment of Mr. Gillyeard (Gil) Leathley as a director of Tasman effective September 13, 2011.

On October 13, 2011, the Company announced the acquisition of a 100% interest in a new heavy REE project in southern Sweden (the “Olserum project”). The Olserum project is located only 100 km east of the Norra Kärr project and was purchased outright from Norrsken Energy Ltd., a private UK registered company, for total consideration of 37,746 common shares of Tasman.

The Olserum project is located approximately 10 km from the Baltic coast, 30 km north of the town of Västervik and 200 km SSW of Stockholm. The project is secured by a granted exploration claim 1,100 hectares in size, and a surrounding exploration claim application 7,800 hectares in size.

The REE potential of the Olserum region was first identified by the SGU in the early 1990s, when a number of REE anomalous samples were collected and assayed from several locations. The presence of yttrium (“Y”) enriched outcrops associated with historic iron prospects was noted. In 2003, the Swedish exploration company IGE Resources AB (“IGE”) claimed the area, concentrating on the iron workings at Olserum. During 2004 and 2005, a total of 27 diamond drill holes were drilled by IGE, 24 of which targeted the REE potential.

On November 30, 2011, the Company announced that it had been approved to list its common shares on the NYSE MKT beginning on December 2, 2011, under the ticker symbol “TAS”.

On January 13, 2012, the Company announced the start of the Phase 4 drill program at Norra Kärr to infill the resource area to 50 m section spacing, and acquire up to eight tonnes of mineralized rock for metallurgical test work. and to advance the NI43-101 compliant inferred mineral resource in the 2011 Norra Kärr Report towards indicated and measured status, with larger diameter drill core to supply bulk material for a pilot plant scale test of Tasman's metallurgical process.

In addition, extensive geotechnical data was collected under the guidance of an independent consultant to provide a basis for pit design in Tasman's planned pre-feasibility study.

On February 9, 2012, the Company announced the results from the progress made in development of a processing flow sheet for the Norra Kärr project.

Highlights included:

| · | Preparation of a mineral concentrate with high REE recovery using wet magnetic separation; |

| · | Successful use of flotation to further upgrade this mineral concentrate; |

| · | High recoveries and low sulphuric acid consumption achieved when leaching the mineral concentrate in an ambient temperature and atmospheric pressure environment; |

| · | Processing flow sheet now well defined for inclusion in the then ongoing preliminary economic assessment; and |

| · | Potentially saleable nepheline/feldspar co-product with low iron content separated during physical concentrate preparation. |

On March 8, 2012, the Company announced the results of the annual general meeting of the shareholders (“the AGM”) held on March 7, 2012. At the AGM, Messrs. Mark Saxon, Michael Hudson, David Henstridge, Nick DeMare, Gil Leathley and Robert Atkinson were re-elected as directors. In addition, Mr. James Hutton was appointed as a director of the Company.

On March 21, 2012, the Company announced the technical and financial results achieved from the preliminary economic assessment on the Norra Kärr project which demonstrated the strong economics of this highly strategic project, with the majority of the projected cash flow sourced from the production of the critical heavy REE, dysprosium, terbium and yttrium.

On June 11, 2012, the Company announced the signing of an agreement to acquire a 100% interest in three new REE exploration properties in central Finland. The Korsnäs South, Siilinjärvi and Laivajoki projects were acquired from an arm's length private Finnish company, Magnus Minerals Oy ("Magnus") for consideration including 60,000 common shares of the Company. In addition to this transaction, Magnus has been retained to manage exploration on the Company's entire Finnish exploration portfolio. A summer work program of surface sampling and mapping was started. As at the date of this AIF, the transaction with Magnus has not closed.

On June 26, 2012, the Company announced the resignation of Mr. Hutton as director of the Company due to an expanded role in other businesses that prevented him from serving as a contributing member of the Company's Board of Directors.

On July 11, 2012, the Company announced the submission of an application for a Mining Lease ("ML") covering the Norra Kärr project which process is anticipated to take approximately six months. The filing of this ML application required that Tasman complete extensive environmental monitoring, flora and fauna surveys, anthropological and social impact studies, ground water testing, leach testing of waste rock, community and stakeholder meetings and basic infrastructure planning for the Norra Kärr project site. A granted ML under the Swedish Mining Act is valid for 25 years, when it is available for renewal.

DESCRIPTION OF THE BUSINESS OF THE COMPANY

General

The Company is in the mineral acquisition and exploration business. The Company is the 100% owner of 124 claims and claim applications for strategic metals, including REE in Sweden, Finland and Norway.

Rare Earth Market Overview

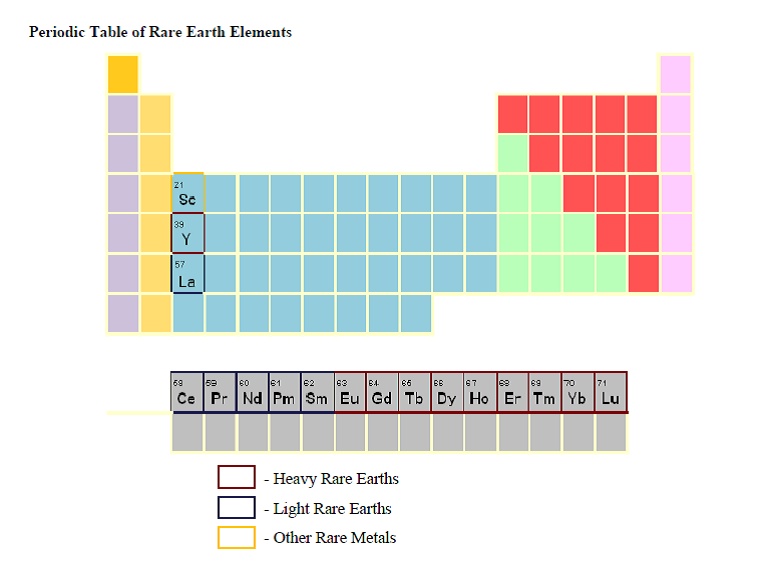

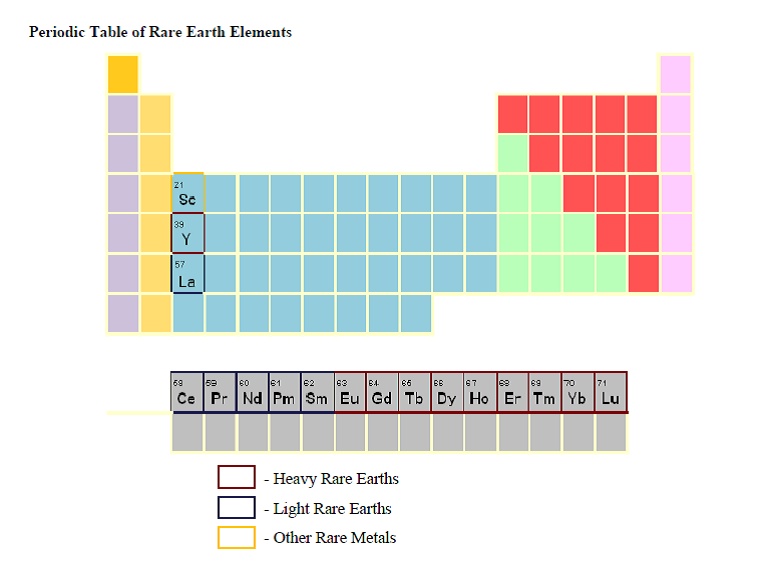

“Rare earths” is a term commonly used to describe the 15 chemically similar, lanthanide elements which appear together towards the bottom of the Periodic Table. Two other elements, yttrium and scandium, which have similar chemical properties, are often also referred to as “rare earths”. The oxide produced from processing rare earths are collectively referred to as the rare earth oxides (“REO”).

Rare earths often do not occur in high enough concentrations in the earth’s crust to make their extraction economic. The oxides that are produced from processing the REE constitute the basic material that can be sold to the market or further processed into metals or alloys. Rare earths are generally characterized as either light rare earths or heavy rare earths and both are found to varying degrees in all known rare earth deposits. Rare earths are typically recovered together from the mining of rare earth bearing deposits and processed before sequential separation into individual REO. Rare earths are typically sold as processed oxides but can be sold as concentrate as well with prices for individual rare earths in pure oxide form varying significantly. It is generally the case that heavy rare earths command a higher price per unit.

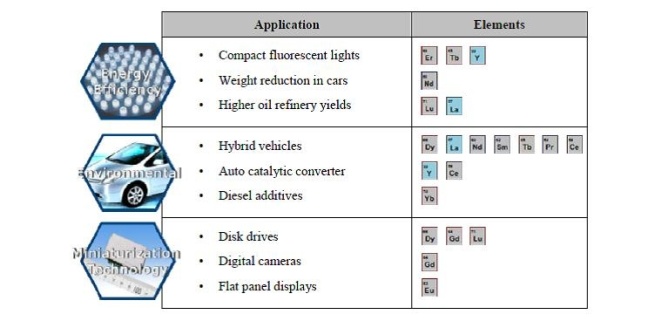

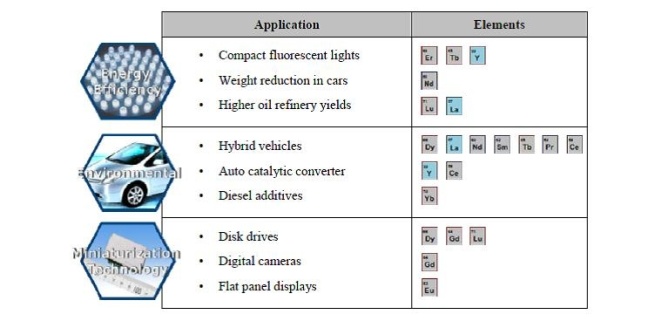

Rare earths possess certain chemical and physical properties which when synthesized, make them indispensable in a number of industries including many green energy technologies and high-tech applications. They are widely recognized as being among the most valuable and strategically important minerals for the continued development of a modern technological society. Among the unique properties of rare earths are their high thermal and electrical conductivity, magnetism, luminosity, catalytic and optical properties. In several industrial sectors, traditional materials are approaching their technological limits and product development engineers are increasingly turning to new materials, such as rare earths, to maintain the current pace of high-tech advancement within increasingly stringent environmental and energy efficiency guidelines. Current rare earth applications include hybrid and battery powered plug-in vehicles, cellular telephones, personal digital devices including hard drives, wind power turbines, fiber optics and compact fluorescent lighting. Those rare earths used in high-strength magnets (Neodymium, Praseodymium, Dysprosium and Terbium) are in particularly high demand.

Forecasted Consumption Growth

| Application | Forecast Consumption (tonnes REO) | Rate of Growth (2010 – 2015) |

| 2010 | 2015 |

| Catalysts | 24,500 | 28,500 | 3–5% |

| Glass | 11,000 | 11,000 | 0% |

| Polishing | 19,000 | 30,500 | 8-10% |

| Metal Alloys | 22,000 | 35,000 | 8-12% |

| Magnets | 26,000 | 48,000 | 10-15% |

| Phosphors | 8,500 | 13,000 | 6-10% |

| Ceramics | 7,000 | 9,500 | 6-8% |

| Other | 7,000 | 9,500 | 6-8% |

| Totals | 125,000 | 185,000 | 6-10% |

Source: Industrial Minerals Company of Australia Pty Ltd, 2010

Green Technology and Key High-Tech Applications

The rare earths market fundamentals have weakened during the past 12 month period, due to concerns over a global economic slow down. Prices for the heavy rare earth elements, to which Tasman is most exposed have stabilized at levels well above the long term average for these metals. As no new supply is forecast, management believes that prices will remain stable for the medium term. Demand for rare earths is estimated to have grown at approximately 12% per annum in the last part of the decade. The growth has principally been driven by the ever-increasing range of applications utilizing rare earths across consumer electronics, clean energy technologies, high-tech and defence applications, as traditional materials reach their operational performance limits. Roskill Information Services Ltd. and Industrial Minerals Company of Australia Pty Ltd. forecast global consumption growth from an estimated 125,000 tonnes in 2010 to approximately 185,000 tonnes in 2015 representing a 6% to 10% per annum growth rate. Acceleration in demand growth is forecast between 2015 and 2020 with demand estimated at approximately 280,000 tonnes per annum.

Rare earth prices vary significantly by element and have increased significantly over the past five years.

Rare Earth Common Commercial Uses and Pricing

| Rare Earth Element | Commercial Uses | Price (US$/Kg) |

| Scandium | Stadium lights | n/a |

| Yttrium | Lasers | $58.00 |

| Lanthanum | Electric car batteries | $14.00 |

| Cerium | Lens polishes | $15.00 |

| Praseodymium | Searchlights, aircraft parts | $81.00 |

| Neodymium | High strength magnets | $82.00 |

| Promethium | Portable X-ray units | n/a |

| Samarium | Glass | $31.00 |

| Europium | Compact fluorescent bulbs | $1800.00 |

| Gadolinium | Neutron radiography | $85.00 |

| Terbium | High strength magnets | $1400.00 |

| Dysprosium | High strength magnets | $750.00 |

| Holmium | Glass tint | n/a |

| Erbium | Metal alloys | n/a |

| Thulium | Lasers | n/a |

| Ytterbium | Stainless steel | n/a |

| Lutetium | None | n/a |

Source: Metal Pages October 2012.

Approximately 96% of rare earths production currently takes place in China. Chinese policy with respect to the export of rare earths, more stringent environmental standards, and the closure of small unsafe mining operations in China has had, and is expected to have, a significant impact on the market for rare earths. China’s dominance in the rare earths market and their increasing significance in technological applications has given strategic significance to promising rare earths projects located outside of China.

Chinese government policy expected to impact the rare earths market include:

| · | The introduction of a Chinese government-controlled unified pricing system for light rare earths; |

| · | The shutting down of small unsafe and illegal mining operations; |

| · | A reduction in the number of rare earths mining and processing facilities; |

| · | Increasingly tighter rare earths export quotas and the imposition of export tariffs ranging from 15-25%; and |

| · | Chinese government is considering the build-up of national strategic rare earths mineral reserves. |

China has imposed increasingly restrictive export quotas on rare earths year-over-year from 2005 to 2010, as shown in the table below:

| Year | Annual Export Quota (tonnes REO) | Total | Change in Total |

| Domestic Companies | Foreign Companies |

| 2005 | 48,040 | 17,659 | 65,609 | n/a |

| 2006 | 45,752 | 16,069 | 61,821 | -5.80% |

| 2007 | 43,574 | 16,069 | 59,643 | -3.50% |

| 2008 | 40,987 | 15,834 | 56,939 | -4.50% |

| 2009 | 33,300 | 16,845 | 50,145 | -11.90% |

| 2010 | 22,512 | 7,746 | 30,258 | -39.70% |

Source: Industrial Minerals Company of Australia Pty Ltd. 2011.

It is believed that China’s increased protectionist stance on the export of rare earths is in order to maintain a long-term domestic supply for domestic manufacturing and force foreign companies to set up and manufacture goods domestically. China’s largest rare earths mine, Bayan Obo, which currently provides 50% of the world’s annual rare earths production as a by-product of iron mining operations, is at capacity and is expected to see declines in rare earths production rates as future ore selection is expected to contain lower grades of rare earths. Several of China’s other rare earths mines present environmental or technical problems as a result of over exploitation or the mining method selected.

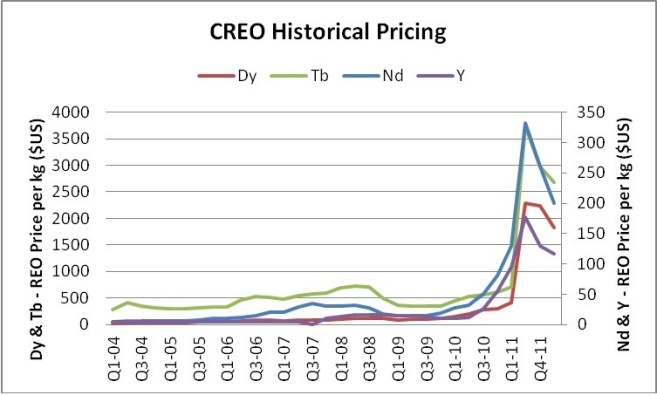

Historical rare earth pricing has been volatile in recent years.

Source: data acquired from Metal Pages and other sources to March 2012

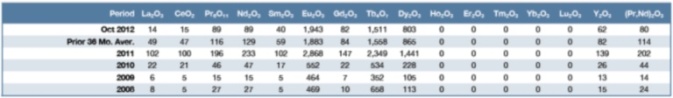

Average annual pricing of select rare earth oxides: 2008-October 2012 (US$ / kilogram (“kg”))

Source: Technology Metals Research, October 2012.

Sweden

Tasman holds 20 claims in Sweden considered prospective for REEs. The Norra Kärr project, the principal asset of the Company, is located in southern Sweden. See “Description of the Business of the Company – Mineral Projects, Norra Kärr Project, Sweden”. On October 13, 2011, the Company announced the acquisition of the Olserum project located 100 km east of the Norra Kärr project.

Finland

In Finland, Tasman has 96 claim applications. The 100% owned claim applications cover and surround the historic Korsnäs mine operated as a mixed open pit and underground operation from 1959 and closed in 1972 due to falling Pb prices. The Company also has claim holdings at Otanmäki which lies in a historic mining district 450 km north of the capital Helsinki, and various other claims securing early stage prospects

Norway

In Norway, Tasman has been granted seven claims covering 208 hectares considered prospective for REEs.

Employees

As at August 31, 2012 the Company had seven full-time employees and employed eight part-time contractors.

Environmental Protection

The current and future operations of Tasman, including development activities on the properties or areas in which it has an interest, are subject to laws and regulations governing exploration, development, tenure, production, taxes, labour standards, occupational health, waste disposal, protection and remediation of the environment, reclamation, site and mine safety, toxic substances and other matters. Environmental protection requirements did not have a material effect on the capital expenditures, and competitive position of Tasman in the financial year ended August 31, 2012.

Foreign Operations

Tasman’s principal exploration and development properties are located in Sweden.

A summary of the regulatory regime material to the business of the Company in Sweden is as follows:

Swedish Mining Laws and Regulations

The following is a summary of Swedish mining laws and regulations. In addition, rules and regulations pertaining to mining exploration in Sweden are set forth in the “Guide to Mineral Legislation and Regulations in Sweden”, which is available from the offices of the SGU or on their website at www.sgu.se.

The Mining Inspectorate of Sweden (“Bergsstaten”) is the agency responsible for the administration of mineral resources in Sweden. The Bergsstaten provides clear directives for conducting mineral exploration, which are available from the Bergsstaten website (www.bergsstaten.se). The Bergsstaten comes under the authority of the Ministry of Industry, Employment and Communications in Sweden, and reports to, and receives administrative and other support from, the SGU. The director of the Bergsstaten is the Chief Mining Inspector, appointed by the government of Sweden. The functions of the Bergsstaten are to issue permits under the Minerals Act for the exploration and exploitation of mineral deposits and to ensure compliance with the Minerals Act.

Principal acts and ordinances of Sweden which govern the exploitation of minerals include:

| · | The Act on the Continental Shelf. |

| · | The Continental Shelf Ordinance. |

| · | The Certain Peat Deposits Act. |

| · | The Certain Peat Deposits Ordinance. |

Approval Process for Mining in Sweden

The following stages (and approvals) sets out the process and requirements to be followed in order to proceed from exploration through to final approval of mining in Sweden:

| | Steps | | Approval Required |

| 1. | Exploration permit (undersökningstillstånd) (survey of the bedrock) | | Mining Inspector |

2. | Exploration work (undersökningsarbete) (when the environment or land use is affected) | | County Administrative Board etc; Landowner |

3. | Exploitation concession (bearbetningskoncession) (with environmental impact assessment and approval under chapters 3–4 of the Environmental Code) | | Mining Inspector; County Administrative Board etc or Government in case of disagreement) |

4. | Permission under the Environmental Code (Chapter 9 of the Code) | | Environmental Court |

5. | Designation of land (markanvisning) | | Landowner; Mining Inspector |

6. | Building permit under the Planning and Building Act | | Local authority |

Exploration Permits

Exploration permits are granted for specified areas that are judged by the Bergsstaten to be of suitable shape and size that are capable of being explored in “an appropriate manner”. The current rules do not require annual minimum expenditures on claims, but a land fee is due upon first application for an exploration permit in the amount of SEK20/hectare, covering an initial period of three years. If a claim or part of a claim is abandoned within 11 or 23 months of its granting date SEK16 or SEK10, respectively (of the original SEK20 fee) per abandoned hectare becomes refundable.

It is possible to extend the time a claim is held to a total of 15 years after the date of the original granting, but the annual fees per hectare increase substantially: SEK21/year/hectare for years four to six, SEK50/year/hectare for years 7 to 10, and SEK100/year/hectare for years 11 to 15. No further extension of mineral exploration permits is allowed after year 15. The high fees in the later years discourage excessive claim holdings deemed to be of little value by the holder. An exploitation concession (mining permit) can be applied for at any time while a claim is in good standing, and may be granted for a period of up to 25 years. An exploration report, with results (raw data), must be submitted to the Bergsstaten.

An exploration permit gives the holder a preferential right to an exploitation concession and access to land for exploration work that does not damage the environment or land use. An exploration permit does not entitle the holder to undertake exploration work that damages the environment (as assessed by the County Administrative Board), or land use (the consent of the landowner is required if no security is provided).

If security for compensation for encroachment has not been given, and the landowner has not given consent, exploration work is not permitted, or is permitted only on the basis of an exemption.

Contact with landowners in connection with exploration under the Minerals Act:

| · | Every landowner in the area is to be notified of the decision to grant a permit. |

| · | The permit holder must give at least two weeks' notice of the exploration work. |

| · | Right to full compensation for damage and encroachment - the authorities are to decide if agreement cannot be reached. |

| · | The permit holder must provide security for compensation unless otherwise agreed by the landowner. |

| · | No exploration work closer than 100 m to a site with a building; otherwise the landowner must be asked for permission. |

The Minerals Act relates to the exploration and exploitation of certain mineral deposits on land, regardless of the ownership of the land. Applications for permits are made to the Bergsstaten. The Minerals Act sets out which mineral substances its provisions apply to; these are known as concession minerals. Concession minerals are divided into three categories, being traditional ores, certain industrial minerals, and finally oil, gas and diamonds. Other minerals and other kinds of rock, gravel and sand are excluded from the Minerals Act and are normally referred to as landowner minerals.

An exploration permit (“Undersökningstillstånd”) gives access to the land and an exclusive right to explore within the permit area. It does not entitle the holder to undertake exploration work in contravention of any environmental regulations that apply to the area. Applications for exemptions are normally made to the County Administrative Board.

An exploration permit is granted for a specific area where a successful discovery is likely to be made. It should be of a suitable shape and size and no larger than may be expected to be explored by the permit holder in an appropriate manner. Normally, permits for areas larger than a total of 100 hectares are not granted to private individuals. A permit would be granted if there is reason to believe that exploration in the area may lead to the discovery of a concession mineral. An exploration permit is initially valid for a period of 3 years, after which it can be extended up to a total of 15 years if special conditions are met. Compensation must be paid by the permit holder for damage or encroachment caused by exploration work. When an exploration permit expires without an exploitation concession being granted, the results of the exploration work undertaken must be reported to the Bergsstaten.

Exploitation Concessions

An exploitation concession (“Bearbetningskoncession”) gives the holder the right to exploit a proven, extractable mineral deposit for a period of 25 years, which may be extended. Permits and concessions under the Minerals Act may be transferred with the permission of the Bergsstaten.

An exploitation concession relates to a distinct area, and as designated on the basis of the location and extent of a proven mineral deposit. A concession may be granted when a mineral deposit is discovered which is probable technically and economically recoverable during the period of the concession, and if the nature and position of the deposit does not make it inappropriate to grant a concession. Special provisions apply to concessions relating to oil and gaseous hydrocarbons.

Under the provisions of the Environmental Code, an application for an exploitation concession is to be accompanied by an environmental impact assessment. Applications are considered in consultation with the County Administrative Board, taking into account whether the site is acceptable from an environmental point of view. A special environmental impact assessment for the mining operation must always be submitted to the Environmental Court, which examines the impact of the operation on the environment in a broad sense. The Environmental Court also stipulates certain conditions, if any, which the operation must meet.

Mining companies in Sweden (limited companies) pay corporations tax at a rate of 28% under the same rules as every other company. Accordingly, there are no special taxation rules for such companies. A royalty is paid on the value of minerals produced at a rate of 0.2%, which is shared between the landholder and the Swedish government, each receiving 0.15% and 0.05% respectively. The application fee for an exploration permit is SEK500 for each area of 2,000 hectares or part thereof. The exploration fee varies for different concession minerals and for different periods of validity. The application fee for an exploitation concession is SEK6,000 per area.

Bankruptcy and Similar Procedures

There are no proceedings against Tasman or its subsidiaries in the nature of bankruptcy, receivership or similar proceedings, or any voluntary bankruptcy, receivership or similar proceedings by Tasman within the three most recently completed financial years and up to the date of this AIF.

Social or Environmental Policies

Tasman is committed to conducting its business activities in a manner that promotes sustainable development and improvement of social welfare in the regions in which it operates. Tasman makes efforts to limit the impact of its activities on the natural environment and the surrounding communities. Tasman strives to conduct its business responsibly and in a way intended to protect its representatives, consultants, contractors, the community and the environment. Tasman is committed to conducting its business in a manner that provides a safe and healthy workplace and environment for its employees, contractors and representatives.

Mineral Projects

As of the date of this AIF, the Company is the 100% owner of 124 claims and claim applications for strategic metals, including REE in Sweden, Finland and Norway, and the owner of various interests in four iron exploration claims in the Kiruna district of Sweden. As of the date of this AIF, the Company’s principal mineral project is the Norra Kärr project. For a detailed description of the projects of the Company refer to the documents incorporated by reference herein.

Norra Kärr Project, Sweden

The following is an excerpt of the summary of the Norra Kärr PEA Report which is incorporated by reference herein. Readers are directed to review the Norra Kärr PEA Report in its entirety which is available under the Company's profile on SEDAR at www.sedar.com or on the Company's website at www.tasmanmetals.com for detailed disclosure relating to the Norra Kärr project. The Norra Kärr PEA

Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The Norra Kärr PEA Report contains the expression of the professional opinions of Qualified Persons (as defined in NI 43-101) upon information available at the time of preparation of the Norra Kärr PEA Report. The disclosure below, excerpted from the Norra Kärr PEA Report, is subject to the assumptions and qualifications contained in the Norra Kärr PEA Report.

1.1 Property

Located in south-central Sweden, approximately 300 km southwest of Stockholm the Norra Kärr project lays approximately 15 km northeast of the small town of Granna in a rural agrarian setting. The Norra Kärr project consists of four claims, Norra Kärr No. 1, Norra Kärr No. 2, Norra Kärr No. 3 and Norra Kärr No. 4, comprising approximately 5,079 hectares.

The Norra Kärr project occurs along the border of two counties (Lan), the Jonkopings Lan in the south and the Ostergotlans Lan in the north. The Norra Kärr property is an intermediate stage exploration project whose surface has been disturbed only by exploration drilling, trenching and sampling.

Tasman holds its mineral properties indirectly through its 100 percent owned subsidiary, Tasmet AB. Tasmet AB holds a 100 percent interest in the four exploration claims that together form the Norra Kärr project.

1.2 Geology

The Norra Kärr peralkaline nepheline-syenite complex is N-S elongated, approximately 1,300 m long and up to 460 m wide with a total surface area of approximately 380,000 m2 (38 hectares). It intrudes a suite of Proterozoic gneisses and granites referred to as the Vaxjo Granite which belongs to the Trans Scandinavian Igneous belt (1.85-1.65 Ga).

The contacts between the Norra Kärr intrusive and the surrounding Vaxjo Granite are west dipping. Tasmam's diamond drilling has shown that the contact dips west at 35-45¢X except in the southernmost part where the dip is steeper.

1.3 REE-Zr Mineralization

Collectively the Norra Kärr intrusive complex is classified as a nepheline syenite, Nepheline belongs to the feldspathoid mineral group which is lacking in silica and often occurs in undersaturated alkaline intrusions. Mineralization is associated with several textural types of grennaite that range from non-migmatitic to migmatitic. The highest TREO and Zr grades are associated with increasing proportions of pegmatitic material that has invaded the grennaite. Typical grades (ZrO2% : %TREO) in drill core for these lithologies are: Grennaite (GT), fine-grained (0.48% : 0.278%); Grennaite, migmatitic (GTM) (1.58% : 0.494%); Grennaite, pegmatitic (PGT) (2.2% : 0.663%) and nepheline. syenite (2.02% : 0.617%).

The rock units comprising the Norra Kärr peralkaline intrusion are uncommon on a global scale, and include minerals that are composed of or associated with REE's, Zr, Nb, Y and Hf.

While previous academic work at Norra Kärr has reported other accessory minerals which potentially carry REEs, mineral liberation analyses and microprobe studies have demonstrated that a majority of the REEs are contained in eudialyte, a zirconosilicate which is consistently present in the mineralized rock units. The dominant zirconium bearing minerals at Norra Kärr are catapleiite and eudialyte both of which are abundant in grennaites on the property.

1.4 Project History

The first exploration permit was applied for on June 12, 2009 and granted on August 31, 2009. Prior to staking claims, Tasman had re-sampled reference samples from the Boliden trenches stored at the Swedish Geological Survey (SGU) archive in Mala, Sweden.

The recent diamond drilling in combination with earlier work has shown that about 85 percent of the surface area is composed of varieties of a green grey, aegirine-eudialyte-catapleite bearing nepheline syenite named by earlier workers Grennaite in reference to the local village. The remaining 15 percent is occupied by coarser grained alkaline rocks which previously were named Kaxtorpite, Lakarpite and Pulaskite.

In November 2009, Mr. John Nebocat of Pacific Geological Services prepared an NI 43-101 field report summarizing the exploration potential of Norra Kärr. On the basis of this report, Tasman decided to commence diamond drilling in December 2009. A total of 26 diamond drill holes totaling 3275.7m were drilled between December 2009 and May 2010.

PAH reviewed documentation for the sampling procedures, preparation, analysis, and security of Tasman's work during their site visit in September 2010. From the review of the literature and documentation on the Norra Kärr project, PAH finds acceptable the results from analytical work completed by the current and previous operators who collected their samples according to high standards and accepted practices at the time of the campaigns.

Data has been reviewed by PAH by visiting 23 of the drilled locations in the field, relogging and resampling drill core, and evaluating the reported results against the mineralized rock observed in the field and core. PAH accepts that the work carried out by Tasman meets acceptable resource evaluation and due diligence standards for international mining ventures under NI 43-101 Technical Standards.

1.5 Exploration

At the beginning of Tasman's exploration program in 2009, the Company selected various samples for assay from a suite of rock specimens collected and archived by Boliden in the 1970s.

Of the 30 samples analyzed by Tasman, 27 came from Norra Kärr intrusion. The total rare earth oxide values (TREO) for these 27 samples ranged from 0.09 per cent to 0.70 per cent, and the percentage of the heavy rare earth oxide (HREO) contained within these samples ranged from 20 to 69 per cent, averaging 54 per cent. This is a high ratio of HREO to LREO; most REE deposits contain 1 to 3 per cent HREO in the TREO.

As referenced above, in 2009 Tasman also contracted Mr. John Nebocat of Pacific Geological Services to prepare an NI 43-101 technical report. This report summarized the pre-drilling history of the property, recommended further exploration, and encouraged Tasman to continue advancement of the Norra Kärr project.

In keeping with the recommendations of Mr. Nebocat, Tasman initiated drilling at the Norra Kärr project site during the winter of 2009 continuing until spring 2010. Tasman drilled 26 diamond drill holes totaling 3,275.74 m in five E-W orientated profiles across the Norra Kärr intrusion. These 26 holes were used within the first Mineral Resource calculation completed by Mr. Geoff Reed of PAH in November 2011. From January 2011 to August 2011, an additional 23 diamond holes were drilled for a total of 4,100.6 meters.

1.6 Drilling

Tasman's 2011 drilling program further confirmed the grade and continuity of the REE-Zr mineralization in the Norra Kärr peralkaline intrusive complex. A total of 7,376 m in 49 holes have now been completed and were available to support the new resource estimate of April 2012. Drilling sections are on east-west sections were completed on intervals of 100 meters.

From the drilling perspective, PAH believes that the drilling density, core recovery, and drill hole location surveying are industry standard and acceptable for use in resource estimation.

1.7 Sample Quality

PAH believes that the sampling methods and approach employed by Tasman are reasonable for this style of mineralization and consistent with industry standards. The samples are representative and there appears to be no discernible sample biases introduced during sampling.

All drilling samples were prepared by ALS Chemex in Ojebyn and analyzed by ALS Chemex in Vancouver, Canada. This laboratory is ISO accredited (ISO/IEC 17025) and, in addition, has been accredited by Standards Council of Canada as a proficiency testing provider for specific mineral analysis parameters by successful participation in proficiency tests.

All samples taken during Tasman's 2009 to 2011 diamond drilling programs at the Norra Kärr project were analyzed at ALS Chemex in Vancouver, Canada, by inductively coupled plasma - mass spectrometry for which the internal Chemex code is ME-MS81. In this method a sample (0.2 gr) is fused with a lithium metaborate flux after which the resulting bead is dissolved in a weak hydrochloric: nitric acid solution before being analyzed in the ICP-MS. Zirconium rich samples that exceeded the reporting limit of the ME-MS81 method (> 1 percent) were assayed by XRF method (ME-XRF10). About 55 percent of the samples were re-analyzed for Zr.

Analysis of certified standards by ALS-Chemex allowed Tasman to monitor the quality of assays during the drilling program. PAH graphically reviewed the standard data from 2009 to 2011 drilling. Plots of the data show that the accuracy and precision of data were adequate during the drilling programs and that no regular bias is present in the data. Any slight assay bias suggests an under reporting of grade rather than over reporting.

In addition, ALS Chemex routinely inserts standard and blank samples into every sample batch. This QC data was supplied to Tasman, and subsequently to PAH. PAH reviewed the blank sample analyses by ALS-Chemex and did not observe any sample cross contamination issues or inconsistency in sample quality.

PAH has discussed core and sample handling procedures with key geological and technical personnel. On the basis of these discussions, PAH believes that all split core was well and securely packed and stored prior to transportation to the laboratory for processing. As a result PAH considers sample security to be adequate.

PAH also understands that at no time was an officer, director or associate of Tasman involved in the sample preparation or analytical work and an independent laboratory was employed for sample preparation and analysis. It is therefore PAH's belief that it is highly unlikely that an officer, director or associate would have had the opportunity to manipulate the samples.

All QA/QC data for the Norra Kärr project has been deemed acceptable for the purposes of the Mineral Resource estimation.

1.8 Data Verification

Mr. Geoff Reed, Senior Consulting Geologist with PAH and QP under NI 43-101, travelled to the Norra Kärr project with representatives from Tasman in September 2010. During this visit, a thorough validation of 23 hole collar positions was undertaken using GPS. Key geological features were surveyed during this visit such as a eudialyte-rich outcrop and grennaite outcrop.

Mr. Reed of PAH also travelled to the core archive facilities of the Swedish Geological Survey where Tasman's core is securely stored. Six holes were selected by PAH for re-logging, which were laid out in their entirety and logged. The re-logging of these holes confirmed the correlation of the higher grade zones with zones of stronger eudialyte mineralization which subsequently assisted in the interpretation of the high-grade domains within the broader resource area. PAH checked a random amount of printed logsheets against the data provided in the database. These did not indicate any issue with data integrity.

PAH completed a full review of Tasman's drill hole database which included a review of all available assay certificates, drill logs, samples books and historical database. PAH found robust records allowing easy data auditing. A comparison was made between assay certificates for the 26 holes available at the time of the site visit.

During this review and audit by PAH, a number of observations were noted, these include:

| · | Field checking of drill holes locations demonstrated accuracy in all cases; |

| | |

| · | At the time of the visit, down hole survey certificates were not available, as holes had not been surveyed. Field checking, original drill logs, and database were all consistent with appropriate angle and inclination of the drill holes. Since the site visit 46 of the 49 holes have been re-entered, surveyed and the results correctly entered into the data base; |

| | |

| · | Sample intervals were correct for assays entered. PAH noted only one error in the updated database caused by typographical error; |

| | |

| · | The assay certificates, drill logs and sample sheets were available for all drill holes; |

| | |

| · | Loading of assay data from laboratory certificates was correct; |

| | |

| · | During the 2009 - 2011 drilling program, Tasman assayed all intervals for REE and Zr by the same analytical methods at the same laboratory; |

| | |

| · | During the 2009 - 2011 drilling programs approximately 356 m out of the total 7,374 m of the drilling was not sampled, as they were drilled into the host granite; |

| | |

| · | During this audit, no issues with the conversion of the database were identified; |

| | |

| · | Tasman has documented its duplicate-assay and analytical control program and demonstrated that there is no evidence of major systematic errors or bias in that data. |

1.9 Assessment of Project Database

The audit of Tasman's data collection procedures and resultant database by PAH has resulted in a digital database that is supported by verified certified assay certificates, original drill logs and sample books. PAH has high confidence that the REE and Zr assays used in the Mineral Resource Calculation are consistent with information in drill logs and sample books. A comparison of the assay certificates and drill hole logs show consistency for the 2009 - 2011 drill holes, PAH believes there is sufficient data to enable their use in a Mineral Resource estimate and resultant classification following NI 43-101.

Based on data supplied, PAH believes that the analytical data has sufficient accuracy for use in resource estimation for the Norra Kärr deposit.

1.10 Check Sampling by PAH

PAH independently checked 51 sample assays by directly acquiring previously prepared residue samples from the ALS Chemex preparation laboratory in Pitea, and resubmitted them as check assays using the sample analytical methods as Tasman. Final results were received on November 4, 2010. A scatter plot showed excellent correlation of original and check assays for Zr and Y as evidenced by the high correlation coefficients posted to the plots.

All QA/QC data for the Norra Kärr project has been deemed acceptable for the purposes of estimation.

1.11 Mineral Processing and Metallurical Testing

This conceptual process and flowsheet for the Norra Kärr project was developed by J.E. Litz and Associates, LLC of Golden, Colorado, USA, based, in part, on test work completed by SGS-Lakefield of Ontario, Canada, the Geological Survey of Finland (GTK) and Mr. Litz¡¦s own bench test work.

In early 2011, Lakefield conducted the first leach tests on samples of whole ore. Their test work was subsequently stopped to allow the beneficiation work to proceed, as this work directly impacts leaching and acid consumption.

The beneficiation portion of the flow sheet, encompassing flotation and magnetic separation, was developed during five months of test work later in 2011 by the GTK. The results of the GTK test work are given in an internal report to Tasman entitled Metallurgical Tests on the Norra Kärr Ore by T. Maksimainen, dated 12 January 2012.

In February 2012, J.E. Litz and Associates began investigating the response of various minerals in the deposit to the acid addition.

1.11.1 Metallurgical Sample

Beneficiation and leaching test work performed by the GTK in 2011 utilized a large composite sample of drill core, of approximately 100 kg, provided by Tasman. GTK prepared the metallurgical samples, apportioned them into 1.5 kg and 5 kg process samples. The head composition was determined by the average of three samples. Portions of the material prepared by the GTK was distributed to J.E. Litz and Associates for use in test work.

To evaluate the representivity of the composited bulk sample used in the metallurgical testing, PAH compared the average grades of the metallurgical sample to grades reported from the Block Model Mineral Inventory at a cutoff grade of 0.4 percent TREO. PAH observed a high degree of correlation between the analyses of metallurgical samples with the estimated block grades in the model (R-squared = 0.998). PAH believes that the core samples composited by Tasman and prepared into metallurgical samples by GTK are reasonably representative of the deposit and therefore suitable for the on-going metallurgical test work.

1.11.2 Deleterious Elements