1 BG Staffing, Inc. Corporate Presentation February 12-13, 2015

2 Forward-Looking Statements This presentation contains forward-looking statements regarding the business, operations and prospects of BG Staffing and industry factors affecting it. These statements are identified by words such as “may,” “will,” “begin,” “look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,” “estimate,” “continue,” “momentum,” and other words referring to events to occur in the future. These statements reflect BG Staffing’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, including: the availability of workers’ compensation insurance coverage at commercially reasonable terms; the availability of qualified temporary personnel; compliance with federal and state labor and employment laws and regulations and changes in such laws and regulations; the ability to compete with new competitors and competitors with superior marketing and financial resources; management team changes; the favorable resolution of current or future litigation; the ability to begin to generate sufficient revenue to produce net profits; the impact of outstanding indebtedness on the ability to fund operations or obtain additional financing; the ability to leverage the benefits of recent acquisitions and successfully integrate newly acquired operations; adverse changes in the economic conditions of the industries, countries or markets that BG Staffing serves; disturbances in world financial, credit, and stock markets; unanticipated changes in national and international regulations affecting the company’s business; a decline in consumer confidence and discretionary spending; the general performance of the U.S. and global economies; economic disruptions resulting from the European debt crisis; and continued or escalated conflict in the Middle East, each of which could cause actual results to differ materially from those projected in the forward-looking statements. BG Staffing is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements, whether as a result of new information, future events or otherwise. This presentation also contains information about BG Staffing’s Adjusted EBITDA and Contribution to Overhead (“COH”), which are not measures derived in accordance with GAAP and which exclude components that are important to understanding BG Staffing’s financial performance. The definition of Adjusted EBITDA is disclosed in BG Staffing’s Forms 10-K and 10-Q filed with the Securities and Exchange Commission. COH is a non-GAAP measure that is derived by subtracting selling expenses from gross profit. Selling expenses are a subcomponent of Selling, General and Administrative costs as disclosed in our financial statements filed on Forms 10-K and 10-Q with the Securities and Exchange Commission. Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States.

3 BG Staffing, Inc. Overview Operational Strategy Management Bios Business Segments How Have We Done US Industry Forecast Financial Information Investment Highlights Agenda

4 BG Staffing, Inc. Overview

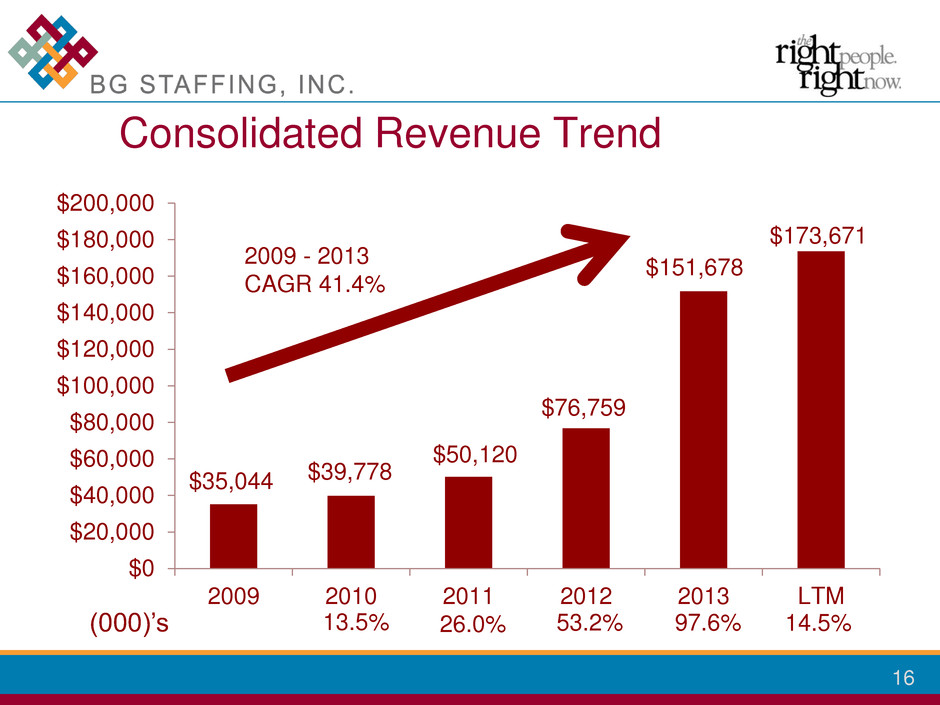

5 National provider of temporary staffing services Since ‘09 management has led on-going growth & geographic/services diversification Acquired and successfully integrated several regional and national brands – set to achieve scalable growth Acquisition philosophy brings financial growth + unique and dedicated talent within the companies Revenue growth to $174 million LTM up from $35 million in 2009 December, 2014 initiated $0.15 quarterly dividend BG Staffing, Inc. (NYSE: MKT: BGSF)

6 Diversify operations: Different skill sets. Different geographies. Maintain centralized back office: Target costs between 2-2.5% of revenue. Grow profitable revenue: Organically. Acquisition-with strong management. Operational Strategy

7 L. ALLEN BAKER, Jr. - President and CEO since 2009. Baker joined the board of directors of BG Staffing in 2008 while serving as the Executive Vice President/CFO of a confections manufacturing company in Colorado. During his tenure at the confections manufacturing company, he led in the acquisition and integration of two other confection manufacturing companies and spearheaded the exit of the company to a private equity buyer. To date, Baker has successfully integrated seven staffing brands under the BGSF umbrella. His previous experience includes 17 years in the staffing industry with a national, privately held staffing company headquartered in the Dallas/Fort Worth area, with operations in 43 states. He has a BS degree in mathematics with a minor in computer information systems from West Texas State University and an MBA from the University of Dallas. MICHAEL A. RUTLEDGE – CFO since 2013. Rutledge has held executive management positions beginning in 2005, having served as the Chief Financial Officer/Vice President of Finance of one public company and three private companies. Rutledge began his career in public accounting at Ernst & Young LLP in Houston. He has a BBA in Accounting from Texas A&M. Management

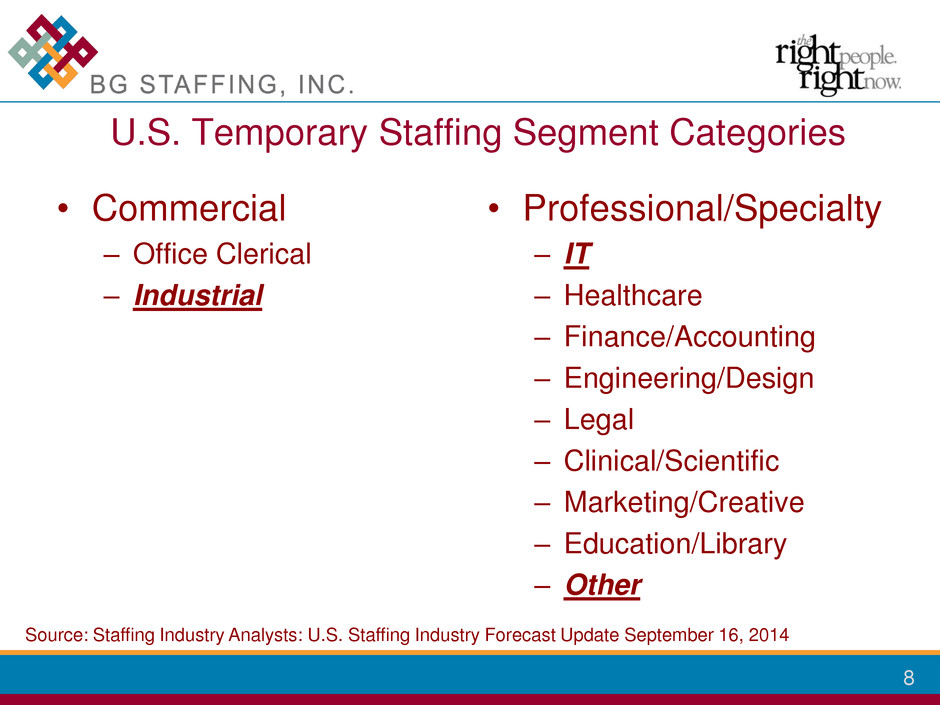

8 • Professional/Specialty – IT – Healthcare – Finance/Accounting – Engineering/Design – Legal – Clinical/Scientific – Marketing/Creative – Education/Library – Other • Commercial – Office Clerical – Industrial U.S. Temporary Staffing Segment Categories Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update September 16, 2014

9 Forklift Drivers Pickers/Packers Production workers Light Assembly Light Manufacturing General Labor Light Industrial Primary Skills Offered

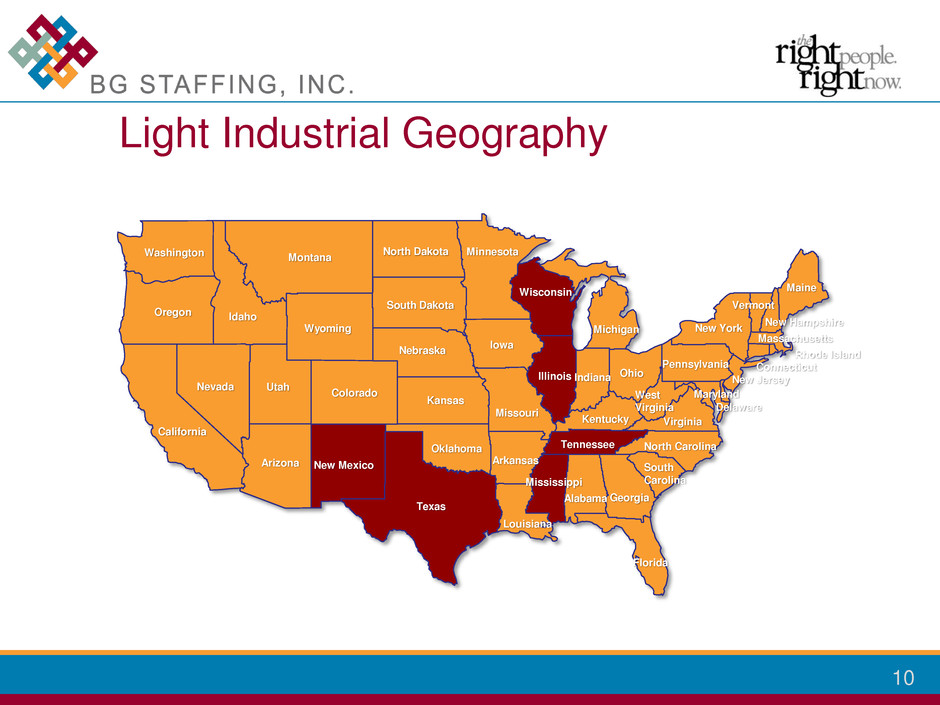

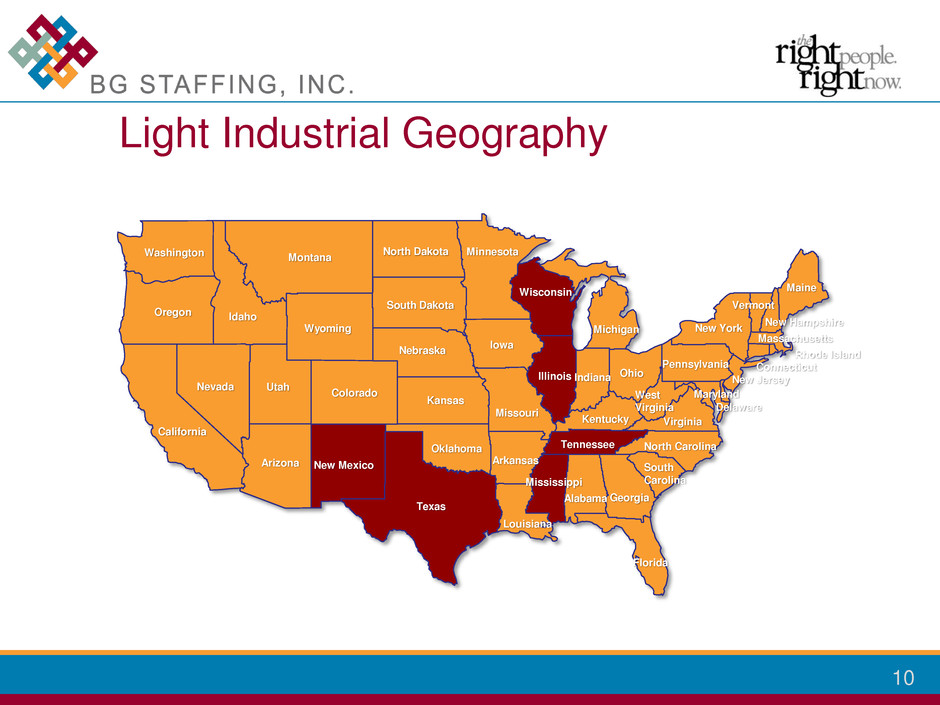

10 Light Industrial Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland

11 Manager Assistant Manager Leasing Agent Bilingual Leasing Agent Maintenance Supervisor Lead (HVAC) Assistant Maker Ready Grounds Keeper Porter Office Multifamily Primary Skills Offered

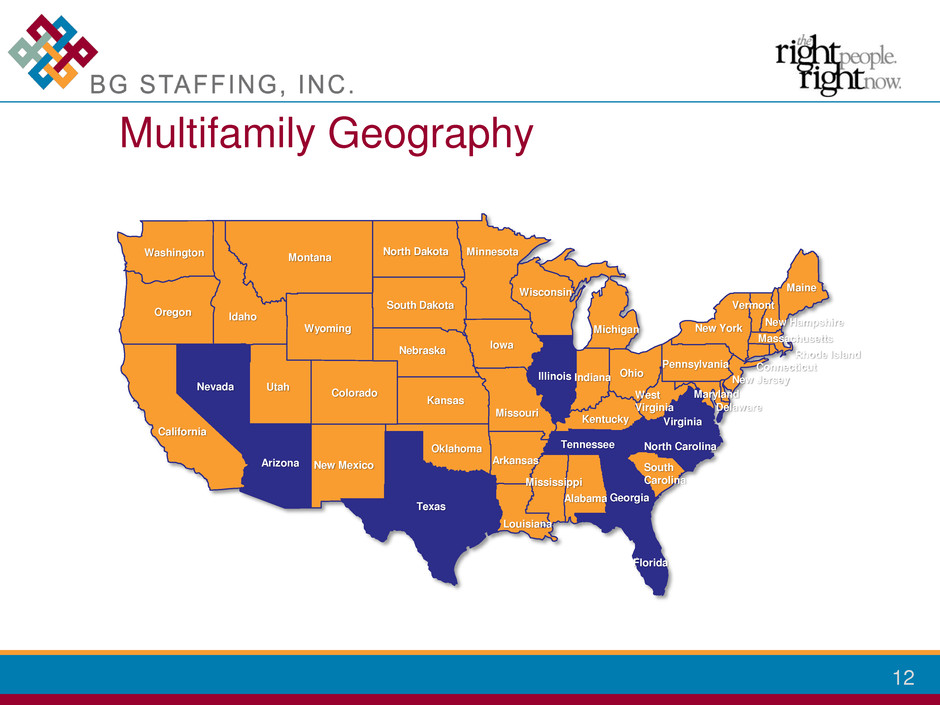

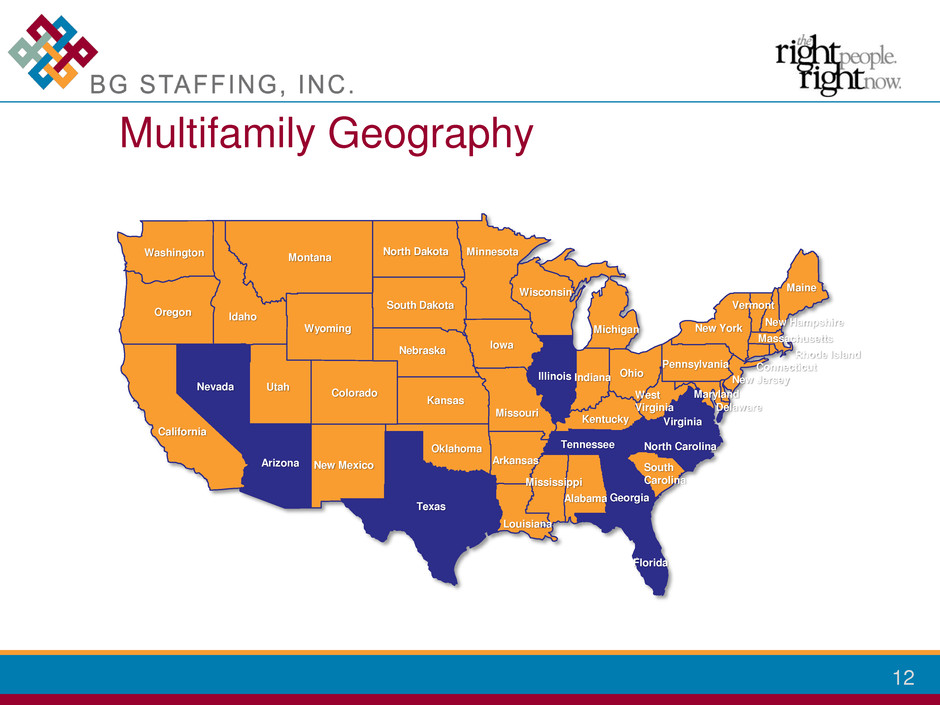

12 Multifamily Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland

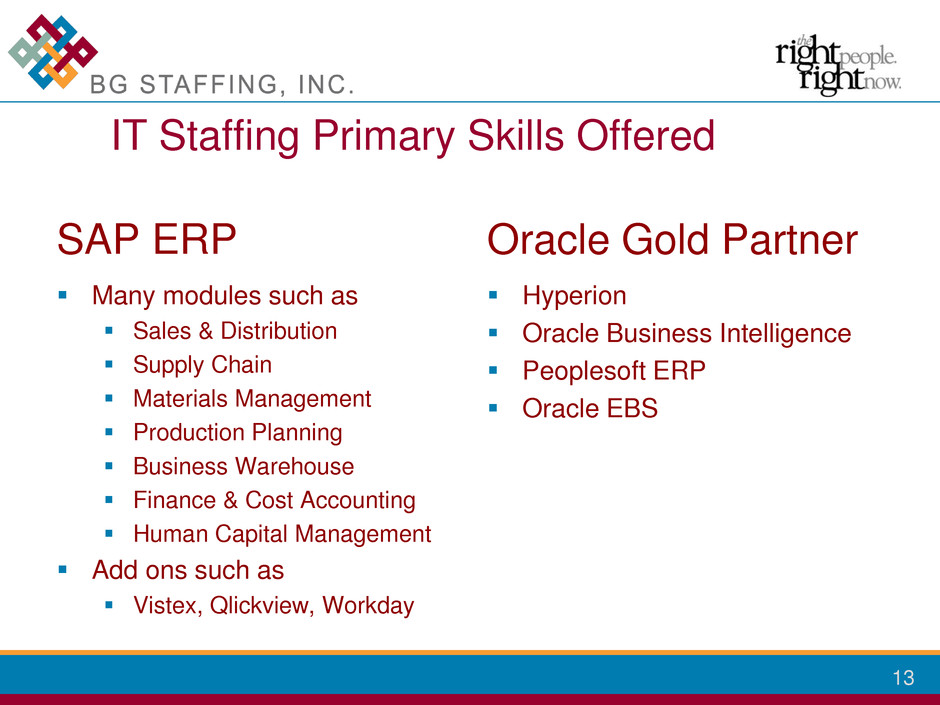

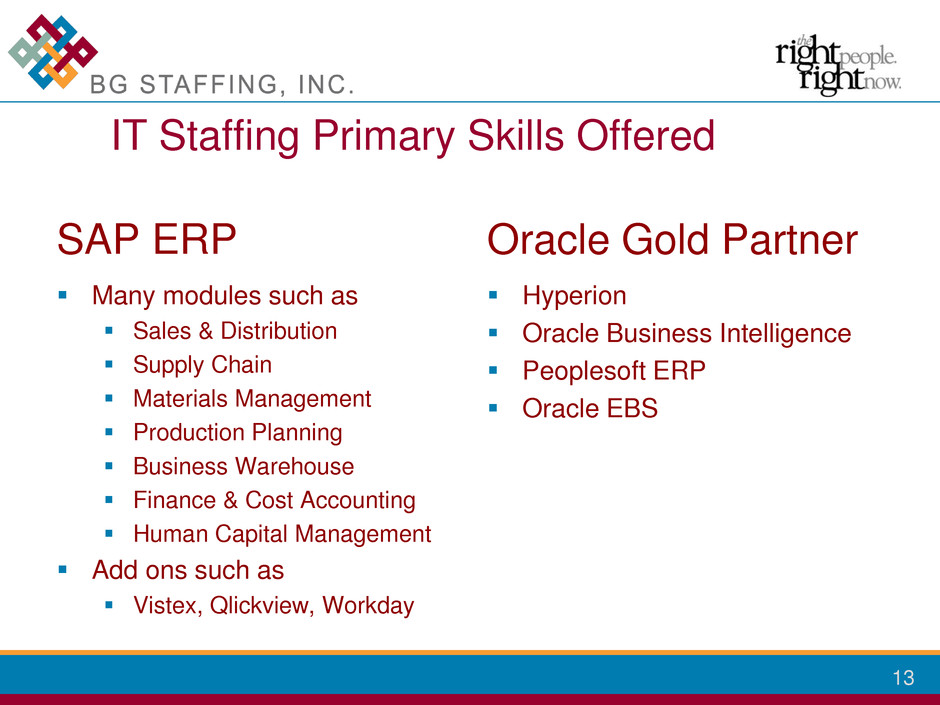

13 Many modules such as Sales & Distribution Supply Chain Materials Management Production Planning Business Warehouse Finance & Cost Accounting Human Capital Management Add ons such as Vistex, Qlickview, Workday Oracle Gold Partner Hyperion Oracle Business Intelligence Peoplesoft ERP Oracle EBS SAP ERP IT Staffing Primary Skills Offered

14 IT Staffing Geography Colorado Kansas New Mexico Arizona California Oklahoma Texas Missouri Louisiana Mississippi Alabama Georgia Florida South Carolina North Carolina Tennessee Kentucky Virginia West Virginia Michigan Ohio Indiana Illinois Iowa Wisconsin Minnesota Arkansas Nebraska Wyoming South Dakota North Dakota Montana Utah Idaho Nevada Oregon Washington Pennsylvania New York Maine New Jersey Rhode Island Connecticut Massachusetts Vermont New Hampshire Delaware Maryland National Practices

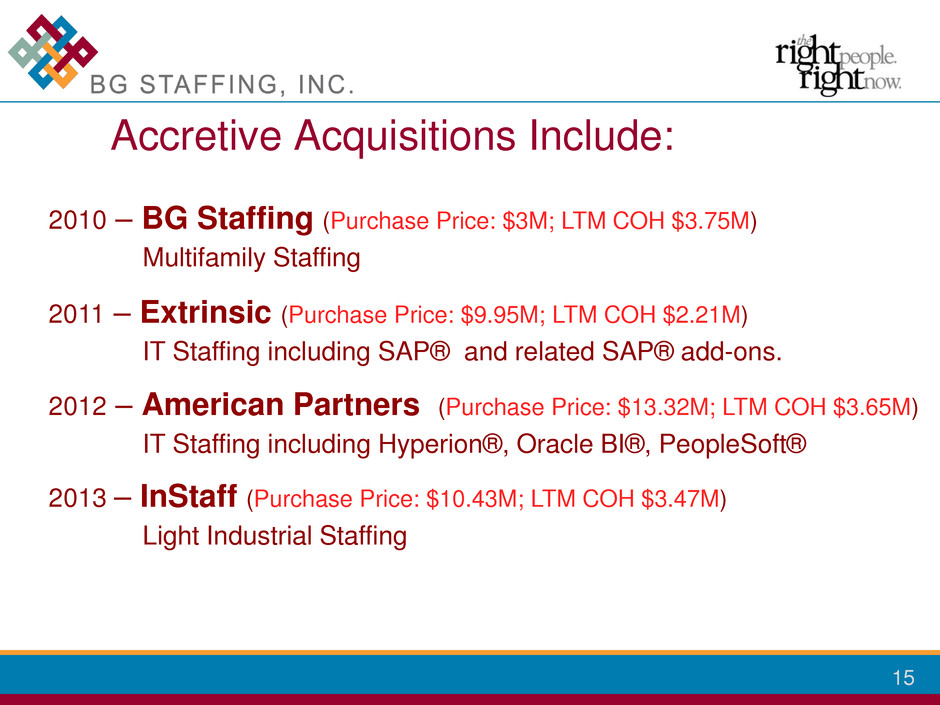

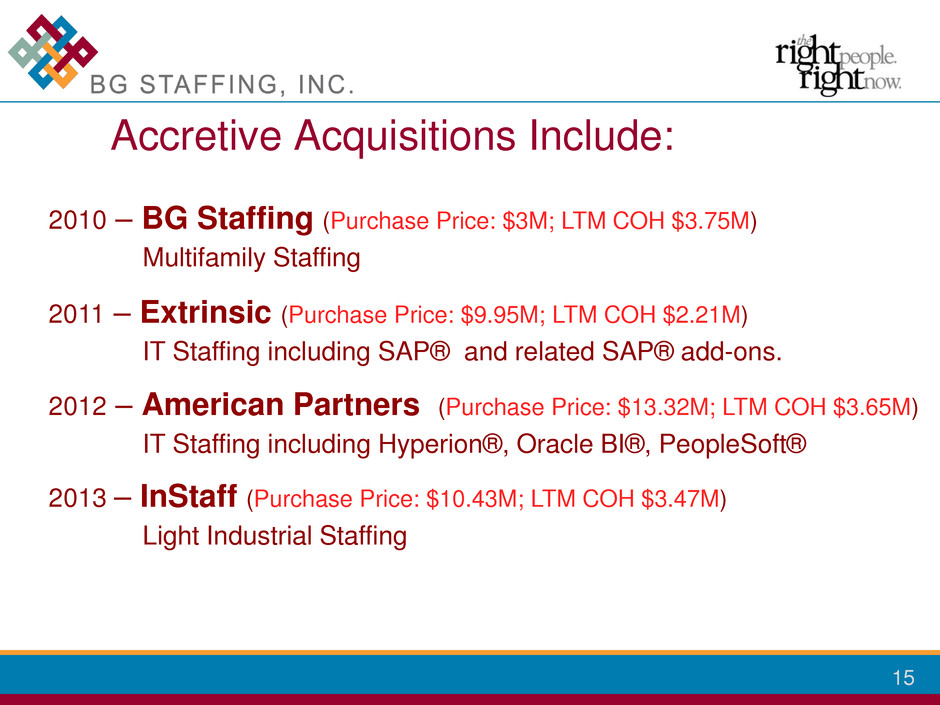

15 Accretive Acquisitions Include: 2010 – BG Staffing (Purchase Price: $3M; LTM COH $3.75M) Multifamily Staffing 2011 – Extrinsic (Purchase Price: $9.95M; LTM COH $2.21M) IT Staffing including SAP® and related SAP® add-ons. 2012 – American Partners (Purchase Price: $13.32M; LTM COH $3.65M) IT Staffing including Hyperion®, Oracle BI®, PeopleSoft® 2013 – InStaff (Purchase Price: $10.43M; LTM COH $3.47M) Light Industrial Staffing

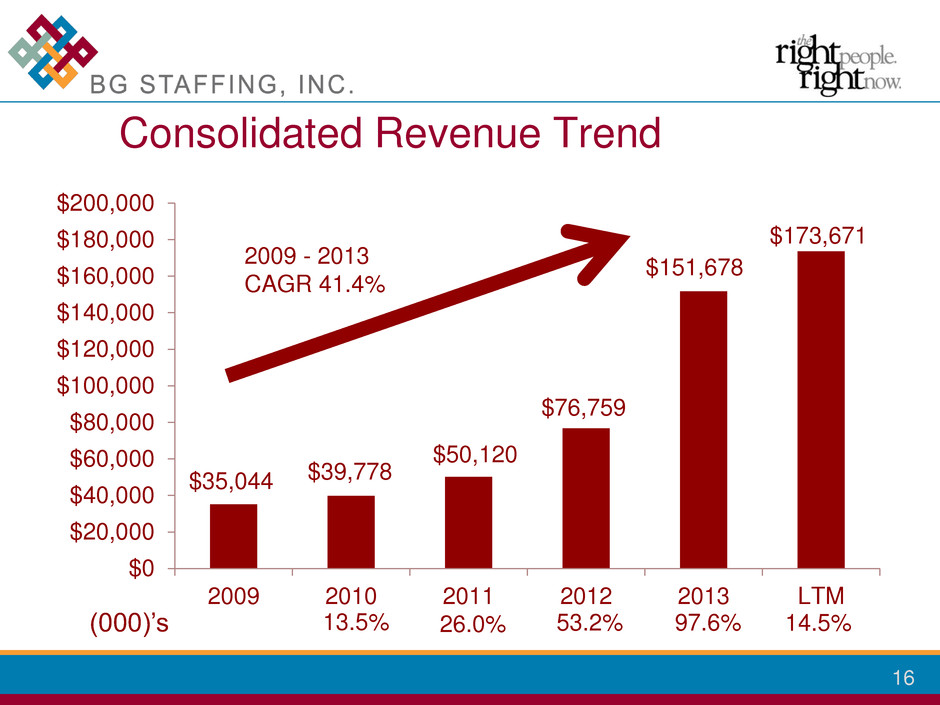

16 $35,044 $39,778 $50,120 $76,759 $151,678 $173,671 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 2009 2010 2011 2012 2013 LTM Consolidated Revenue Trend 13.5% 26.0% 53.2% 97.6% (000)’s 14.5% 2009 - 2013 CAGR 41.4%

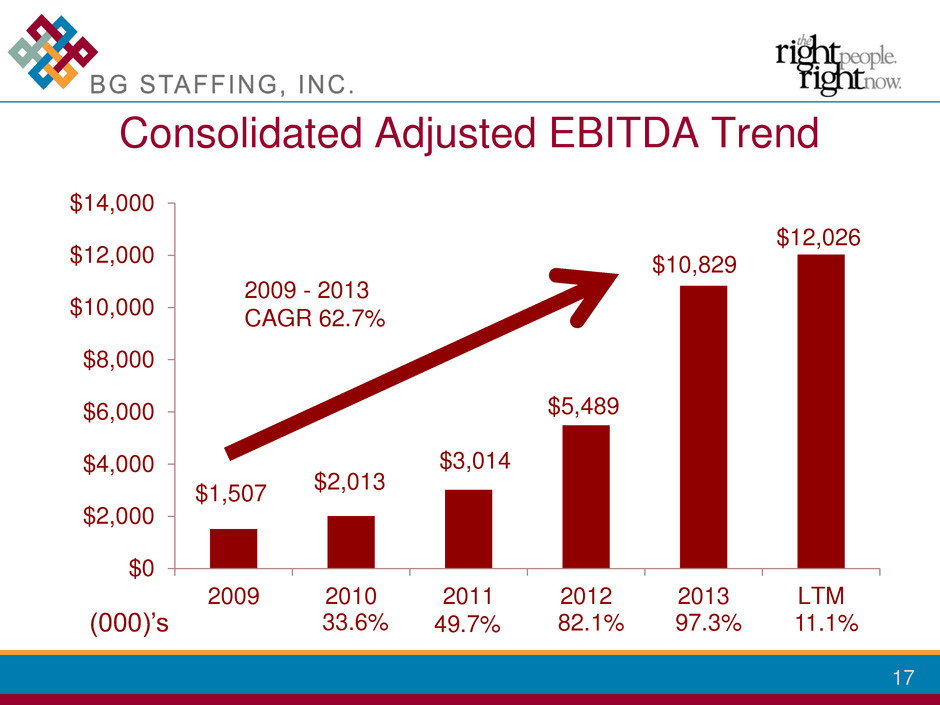

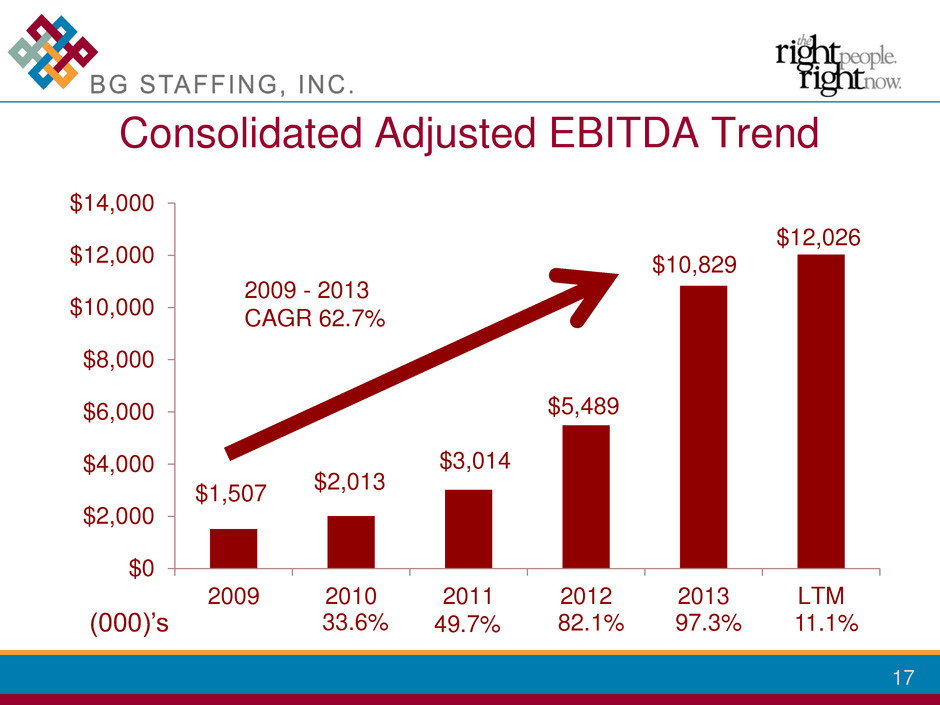

17 $1,507 $2,013 $3,014 $5,489 $10,829 $12,026 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 2009 2010 2011 2012 2013 LTM Consolidated Adjusted EBITDA Trend 33.6% 49.7% 82.1% 97.3% 11.1% (000)’s 2009 - 2013 CAGR 62.7%

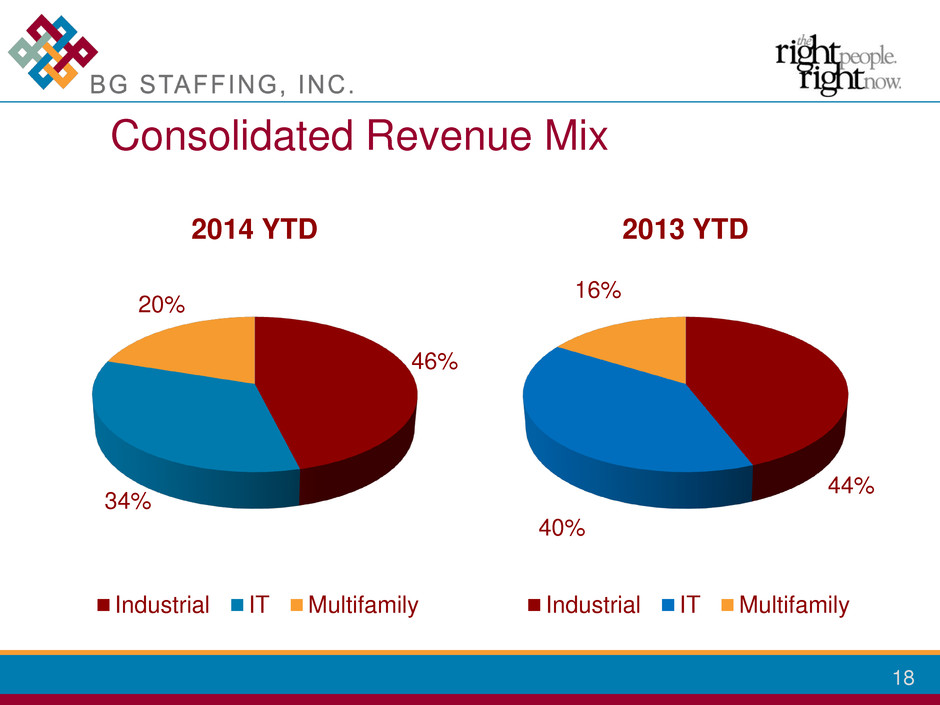

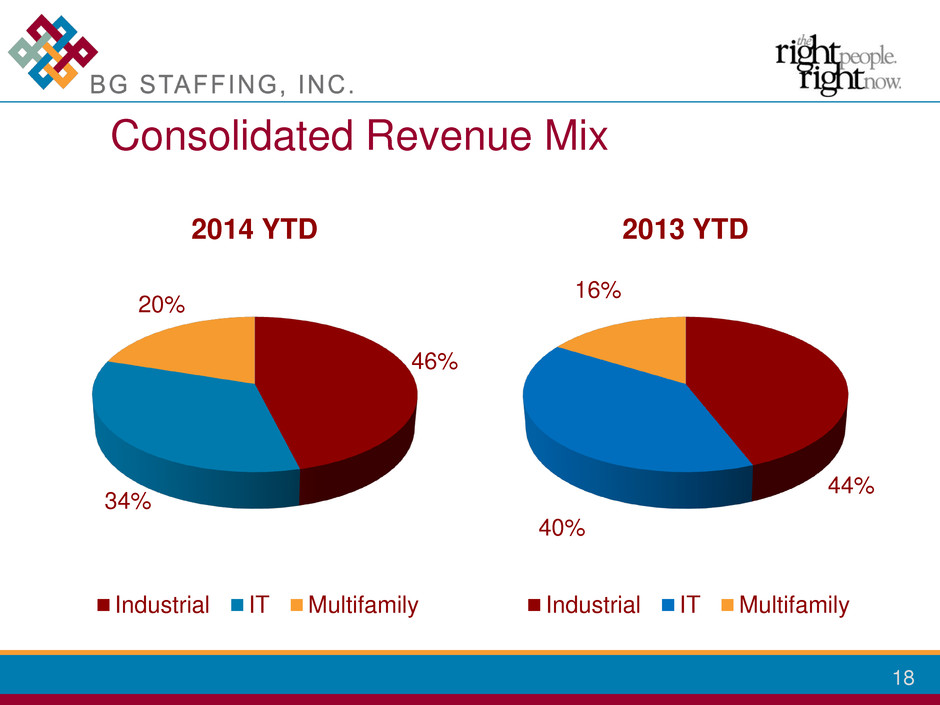

18 46% 34% 20% 2014 YTD Industrial IT Multifamily 44% 40% 16% 2013 YTD Industrial IT Multifamily Consolidated Revenue Mix

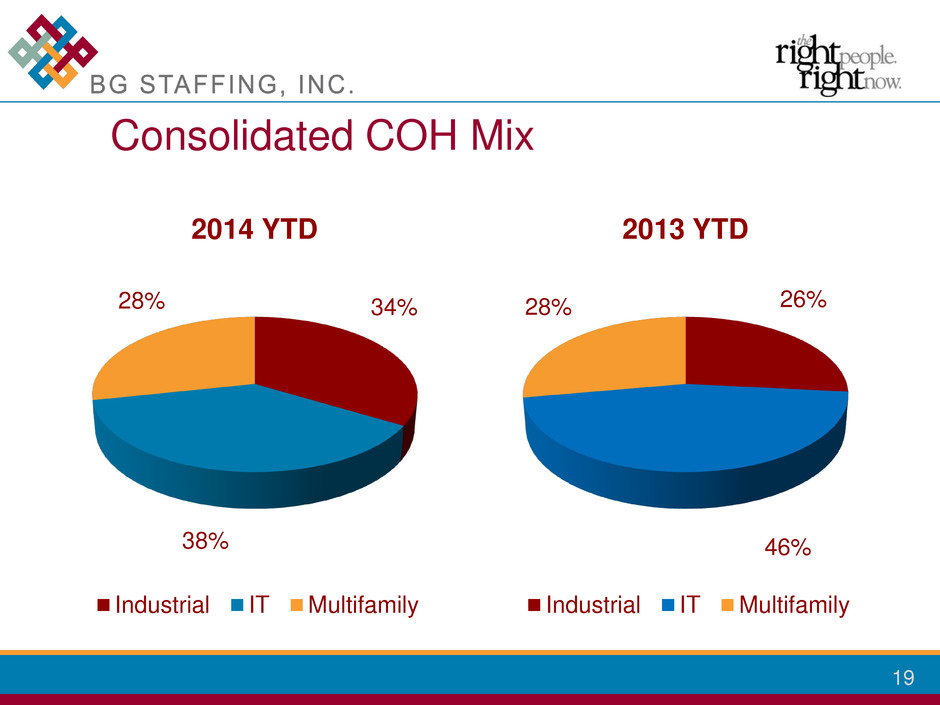

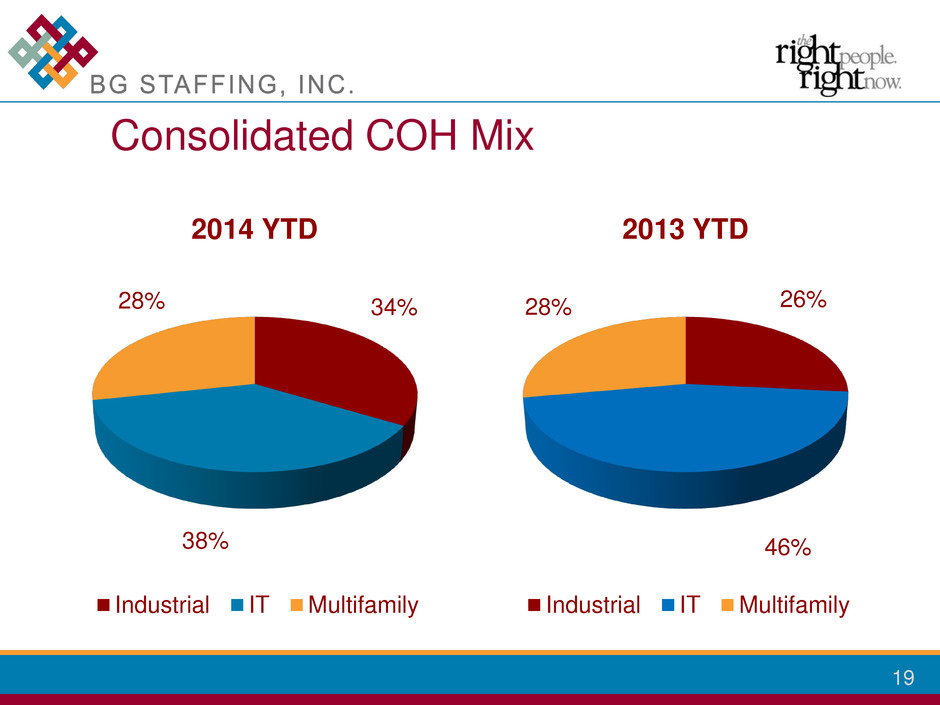

19 34% 38% 28% 2014 YTD Industrial IT Multifamily 26% 46% 28% 2013 YTD Industrial IT Multifamily Consolidated COH Mix

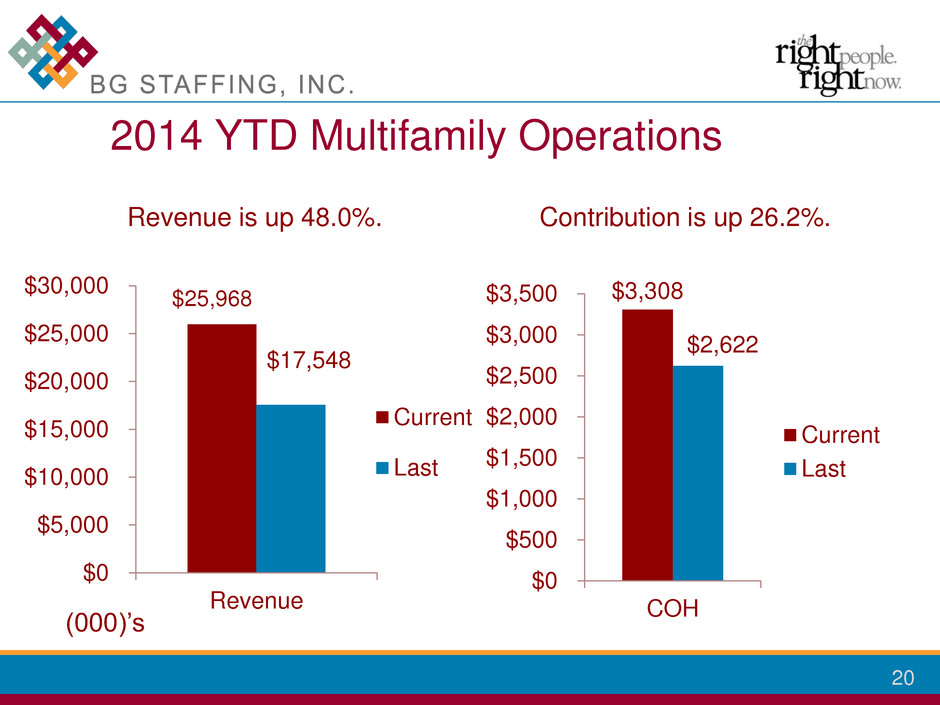

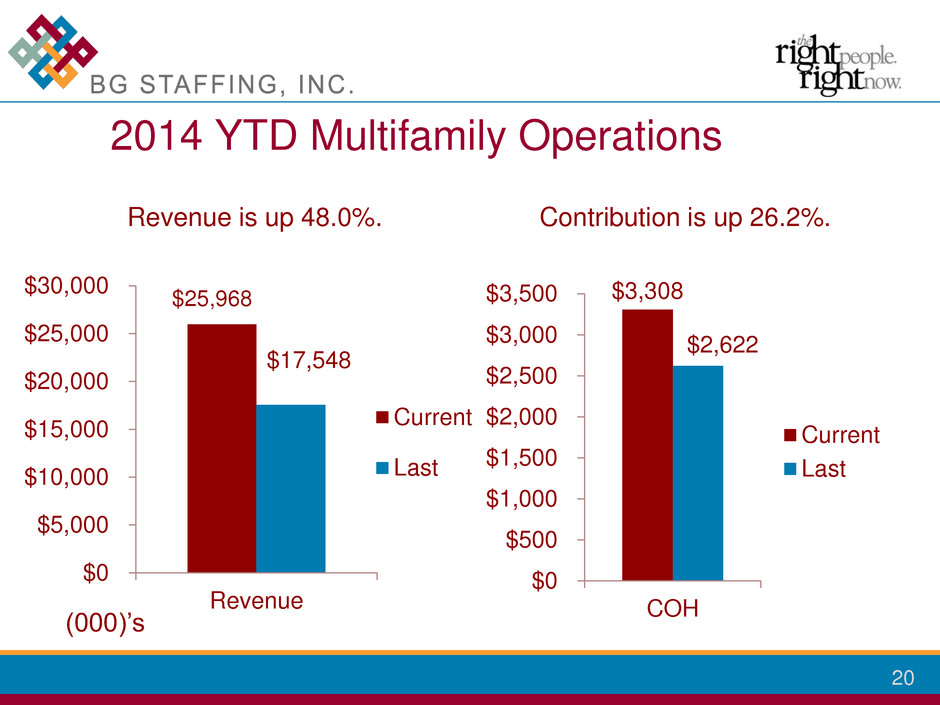

20 Revenue is up 48.0%. $25,968 $17,548 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Revenue Current Last Contribution is up 26.2%. $3,308 $2,622 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 COH Current Last 2014 YTD Multifamily Operations (000)’s

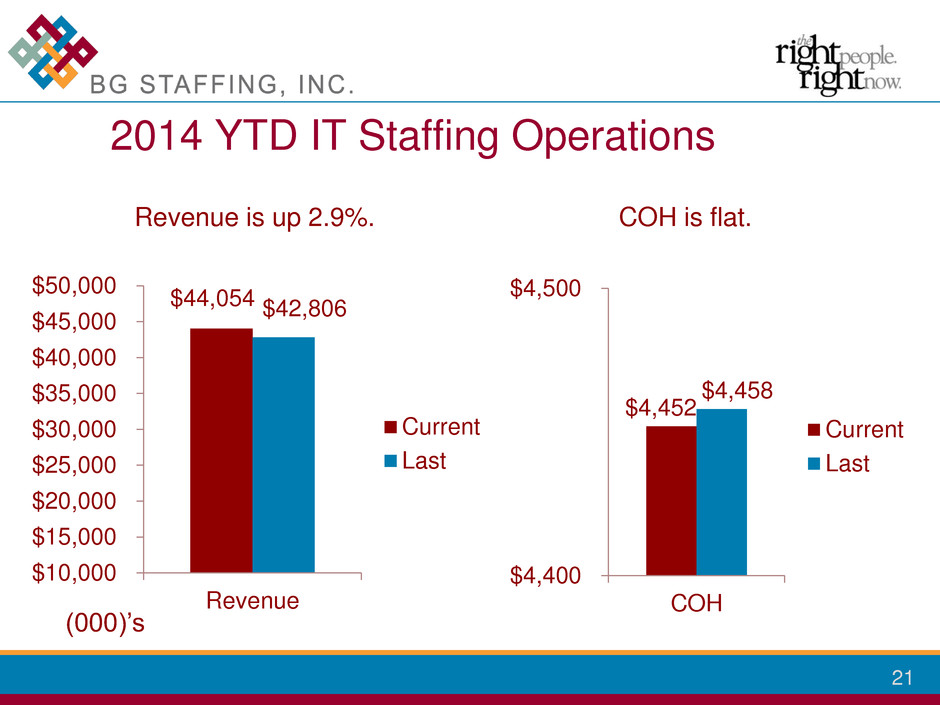

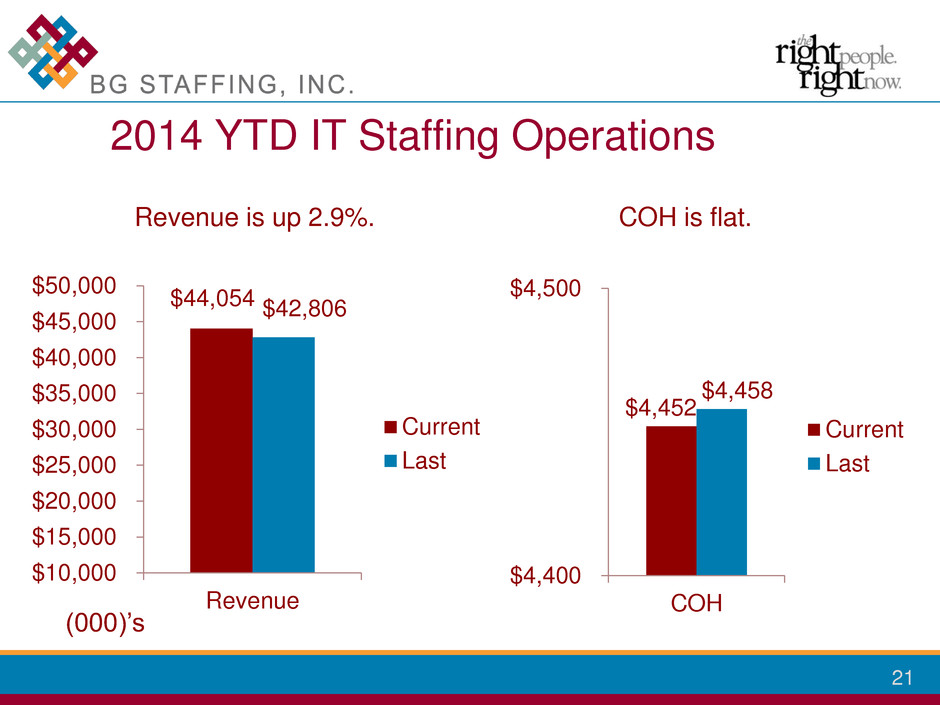

21 Revenue is up 2.9%. $44,054 $42,806 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 Revenue Current Last COH is flat. $4,452 $4,458 $4,400 $4,500 COH Current Last 2014 YTD IT Staffing Operations (000)’s

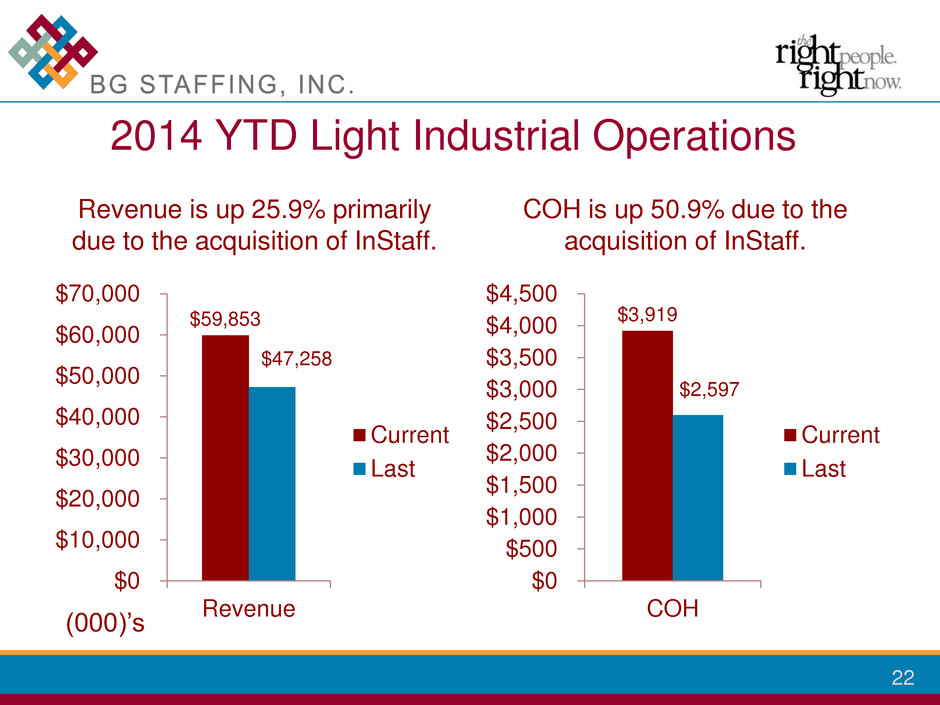

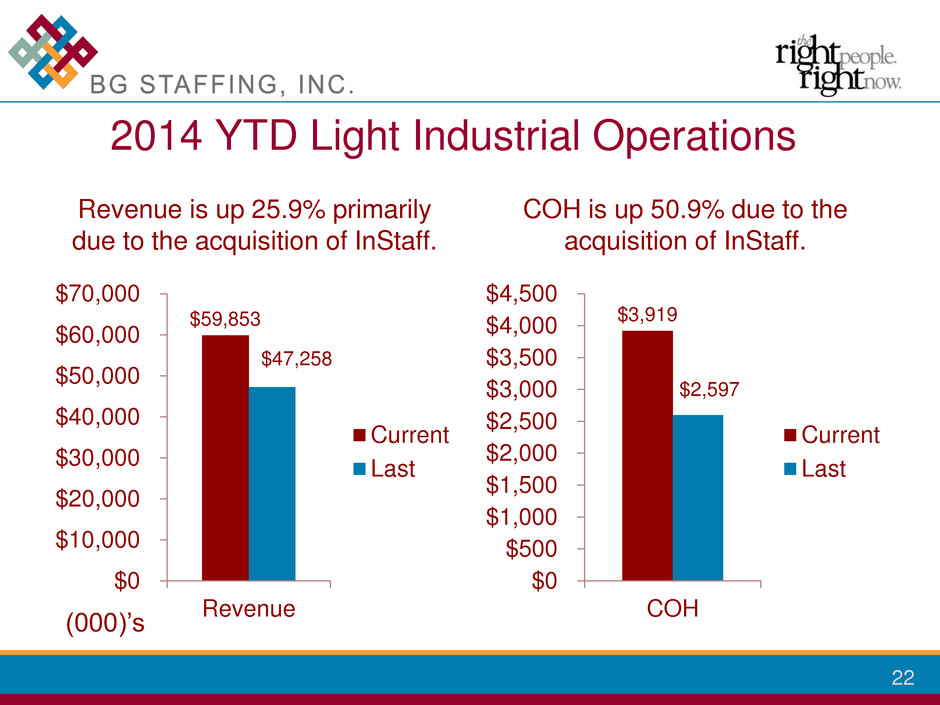

22 Revenue is up 25.9% primarily due to the acquisition of InStaff. $59,853 $47,258 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 Revenue Current Last COH is up 50.9% due to the acquisition of InStaff. $3,919 $2,597 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 COH Current Last 2014 YTD Light Industrial Operations (000)’s

23 US Staffing Industry Forecast

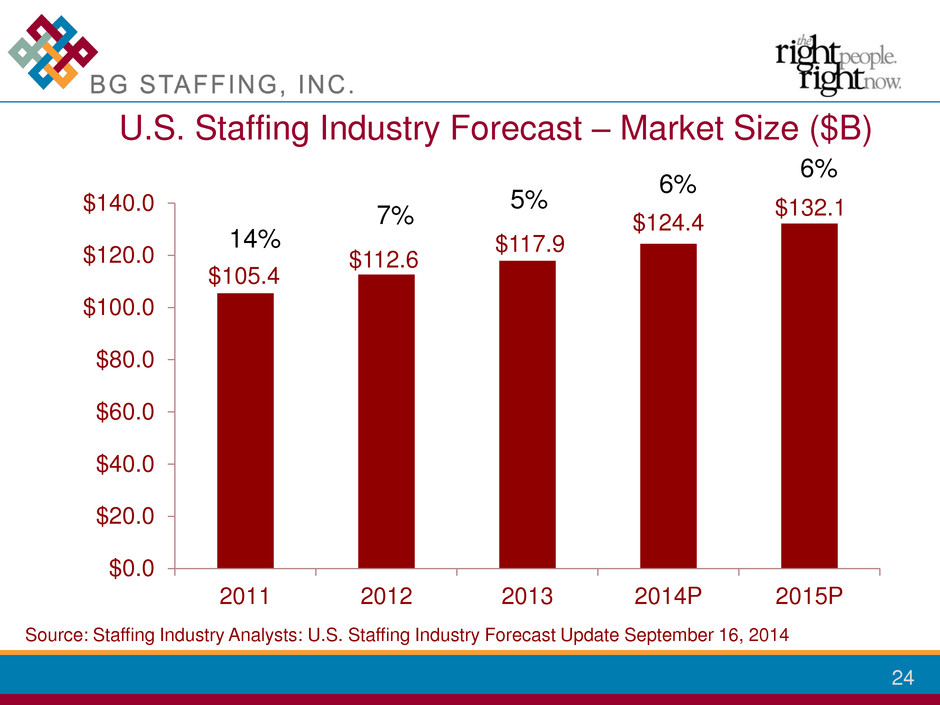

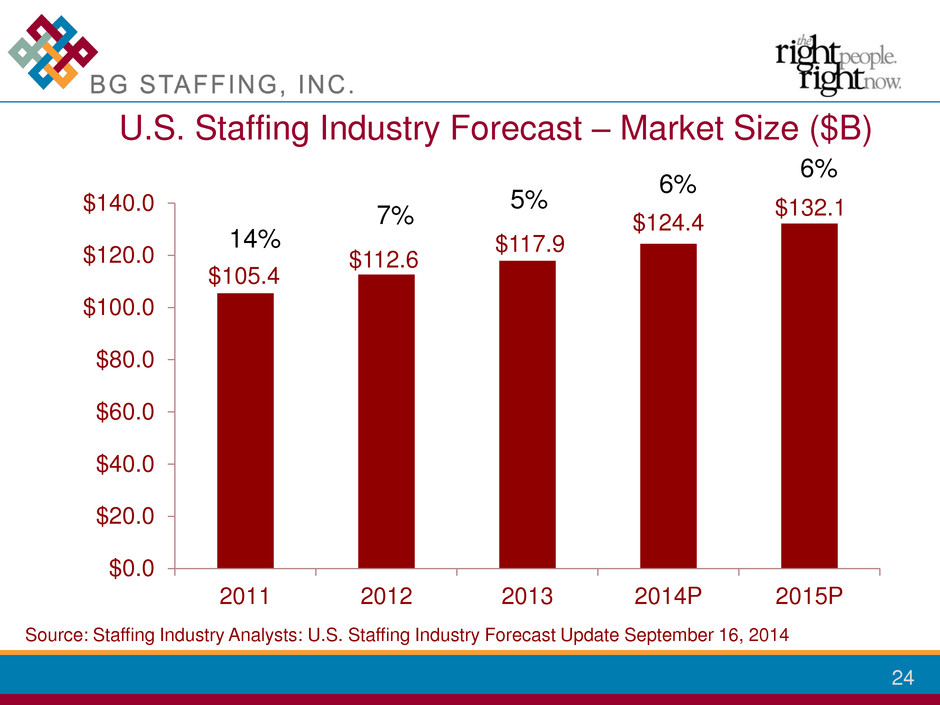

24 $105.4 $112.6 $117.9 $124.4 $132.1 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2011 2012 2013 2014P 2015P U.S. Staffing Industry Forecast – Market Size ($B) Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update September 16, 2014 6% 6% 5% 7% 14%

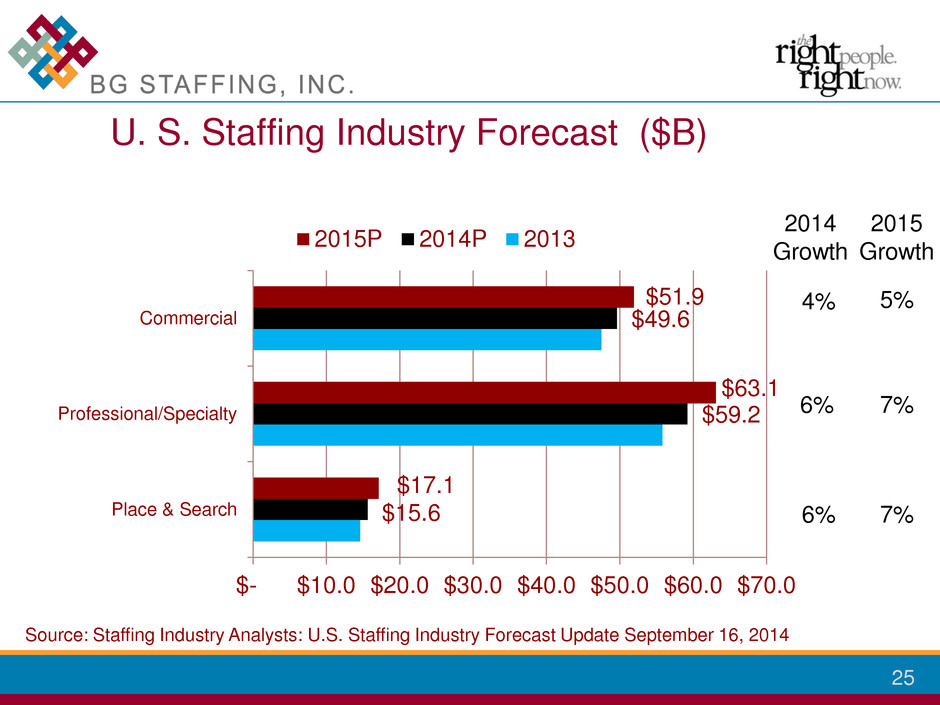

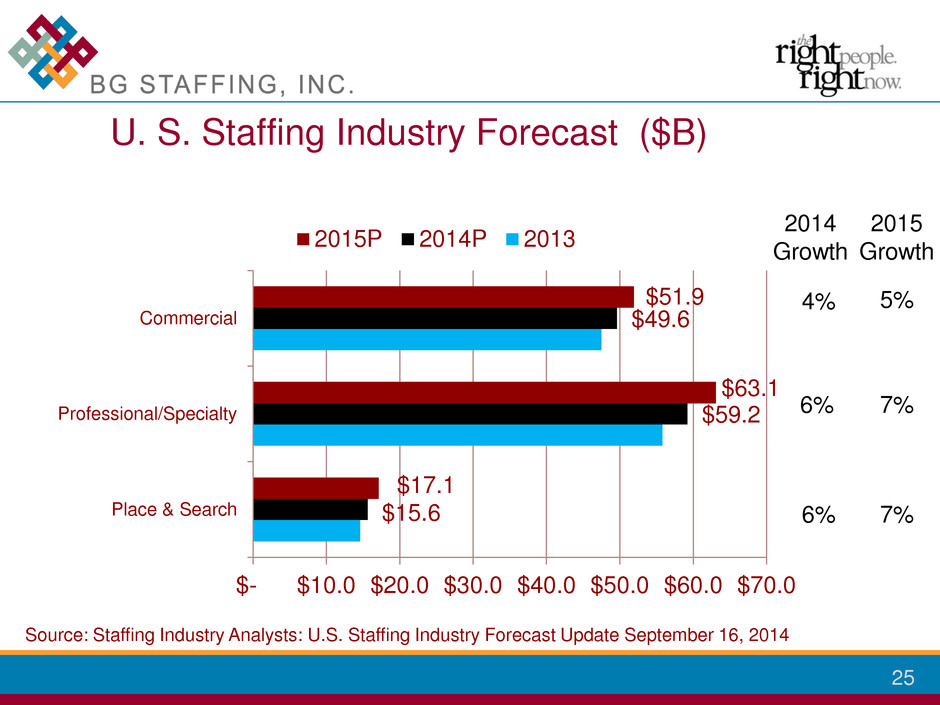

25 $15.6 $59.2 $49.6 $17.1 $63.1 $51.9 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Place & Search Professional/Specialty Commercial 2015P 2014P 2013 U. S. Staffing Industry Forecast ($B) 5% 2014 Growth 2015 Growth Source: Staffing Industry Analysts: U.S. Staffing Industry Forecast Update September 16, 2014 4% 7% 7% 6% 6%

26 “Growth in the staffing industry is strongly correlated with GDP growth,” according to research from Staffing Industry Analysts (October 30, 2014). Correlation of Economy and Staffing

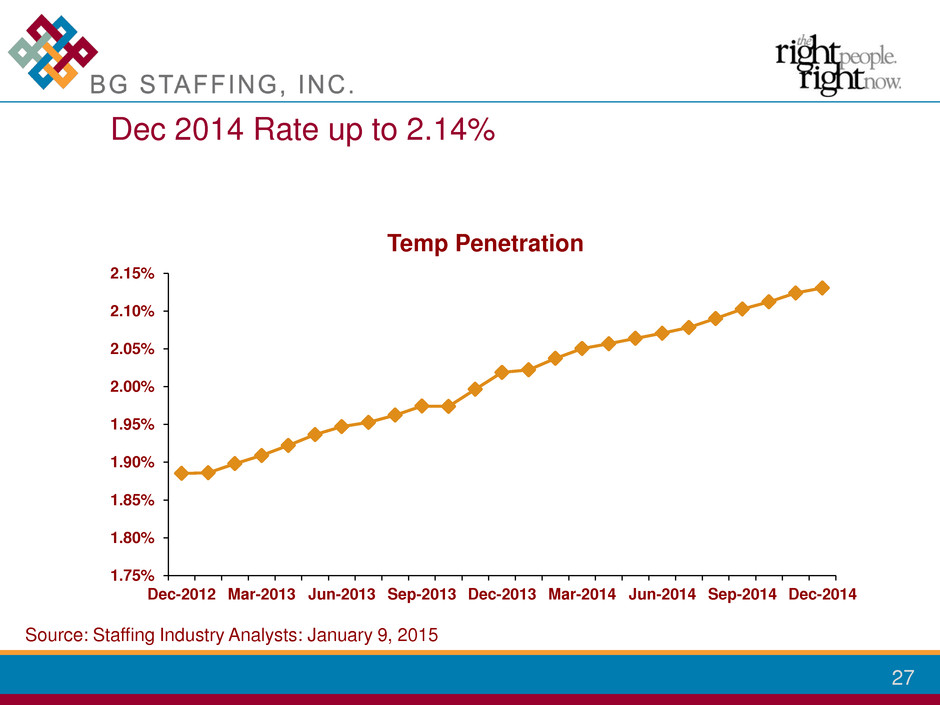

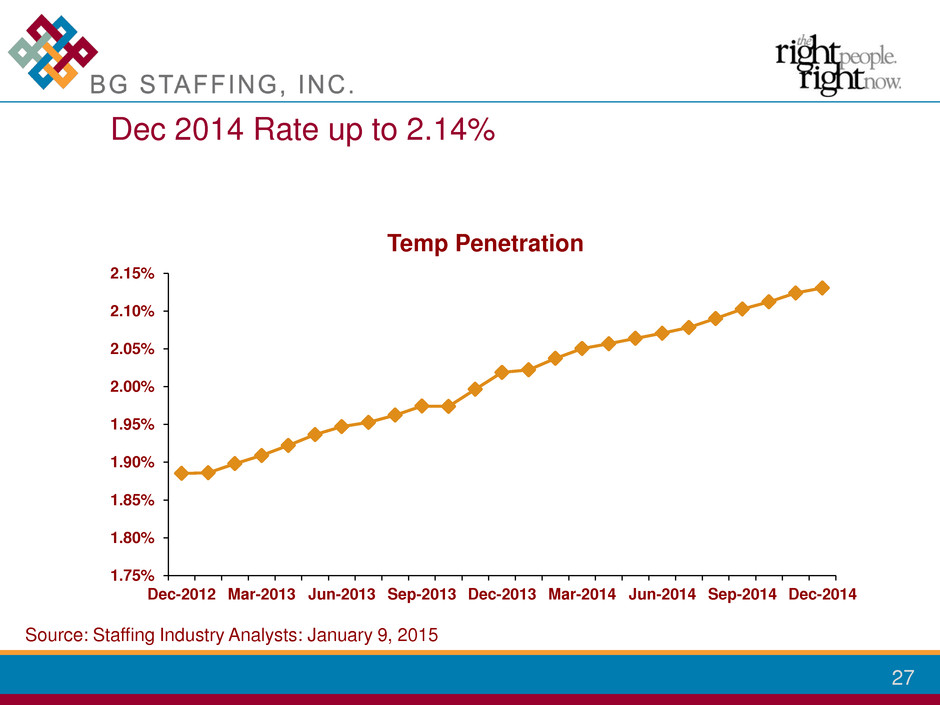

27 Dec 2014 Rate up to 2.14% 1.75% 1.80% 1.85% 1.90% 1.95% 2.00% 2.05% 2.10% 2.15% Dec-2012 Mar-2013 Jun-2013 Sep-2013 Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 Temp Penetration Source: Staffing Industry Analysts: January 9, 2015

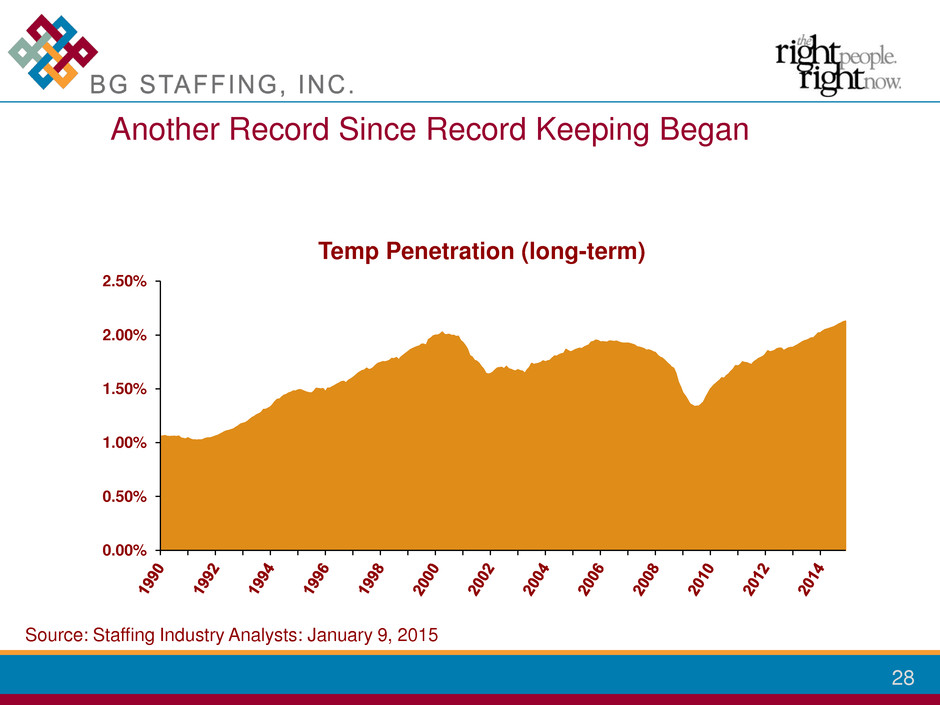

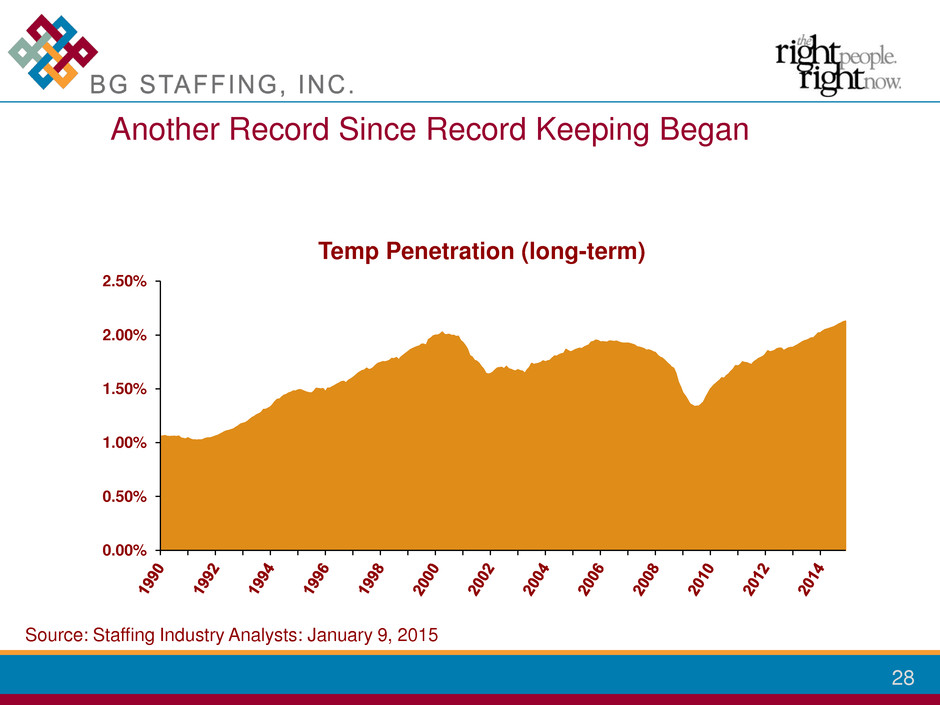

28 Another Record Since Record Keeping Began 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% Temp Penetration (long-term) Source: Staffing Industry Analysts: January 9, 2015

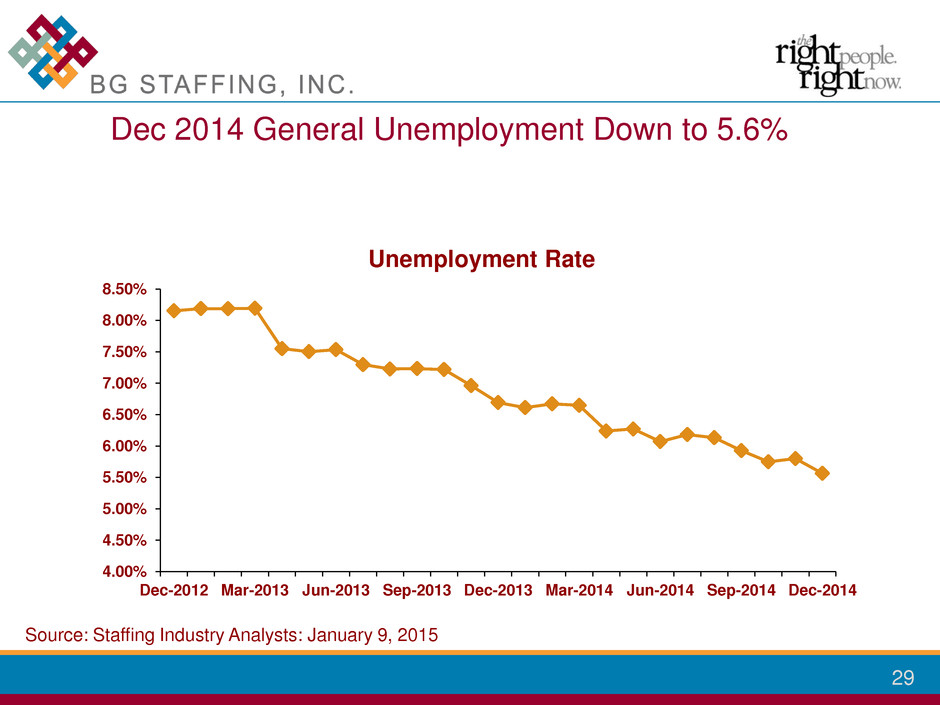

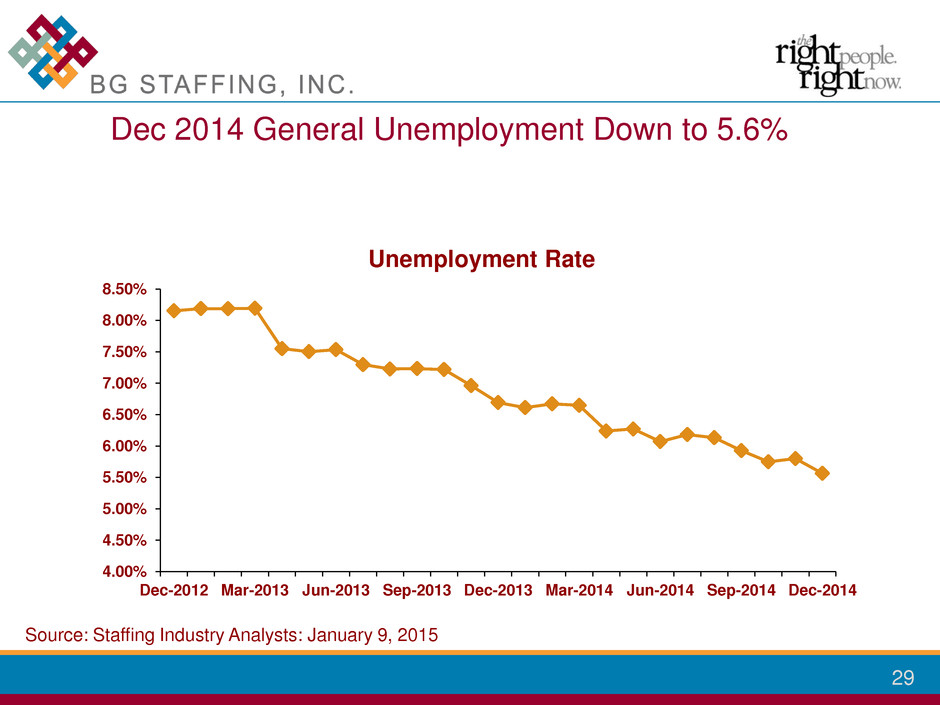

29 Dec 2014 General Unemployment Down to 5.6% Source: Staffing Industry Analysts: January 9, 2015 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% Dec-2012 Mar-2013 Jun-2013 Sep-2013 Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 Unemployment Rate

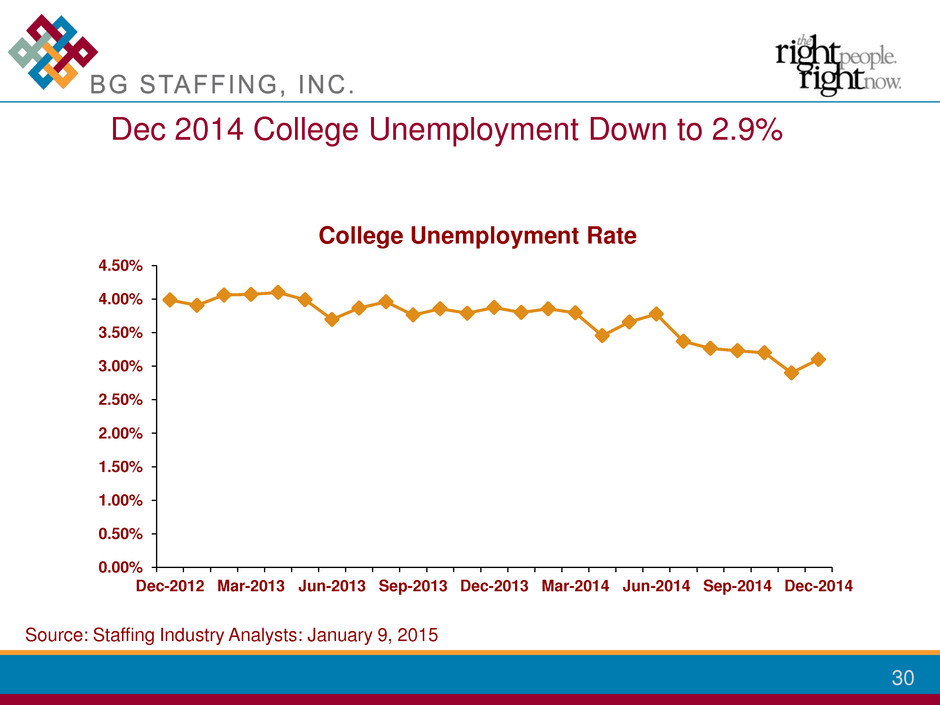

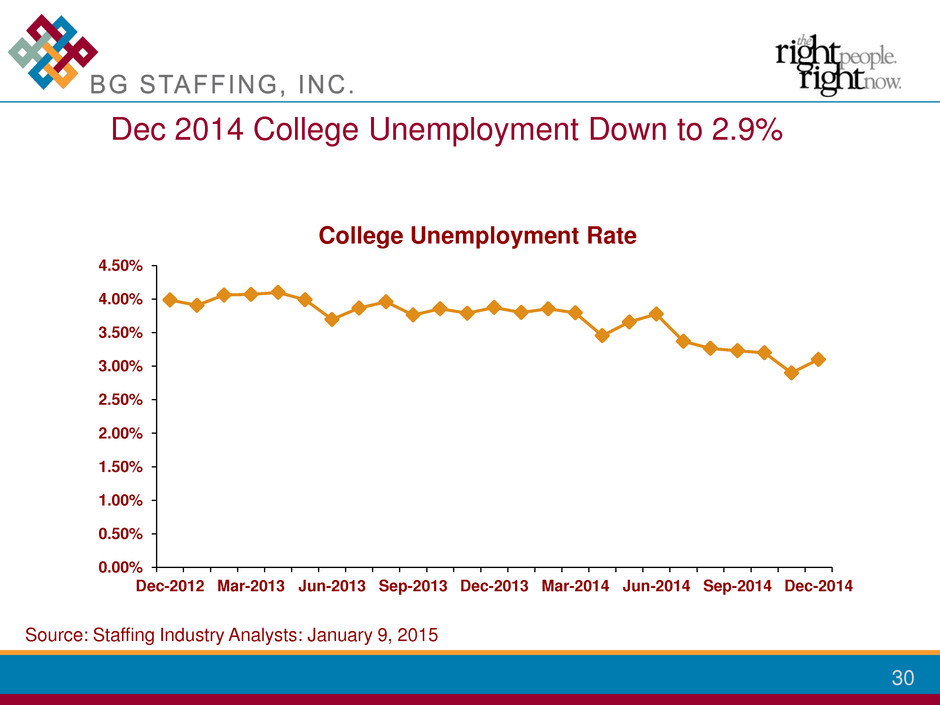

30 Dec 2014 College Unemployment Down to 2.9% Source: Staffing Industry Analysts: January 9, 2015 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% Dec-2012 Mar-2013 Jun-2013 Sep-2013 Dec-2013 Mar-2014 Jun-2014 Sep-2014 Dec-2014 College Unemployment Rate

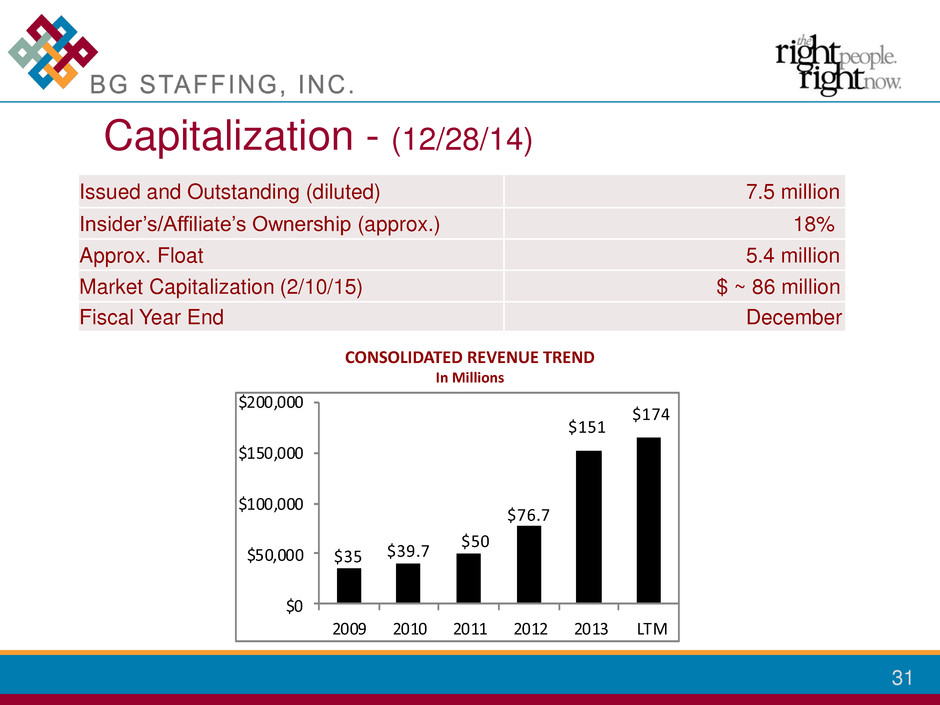

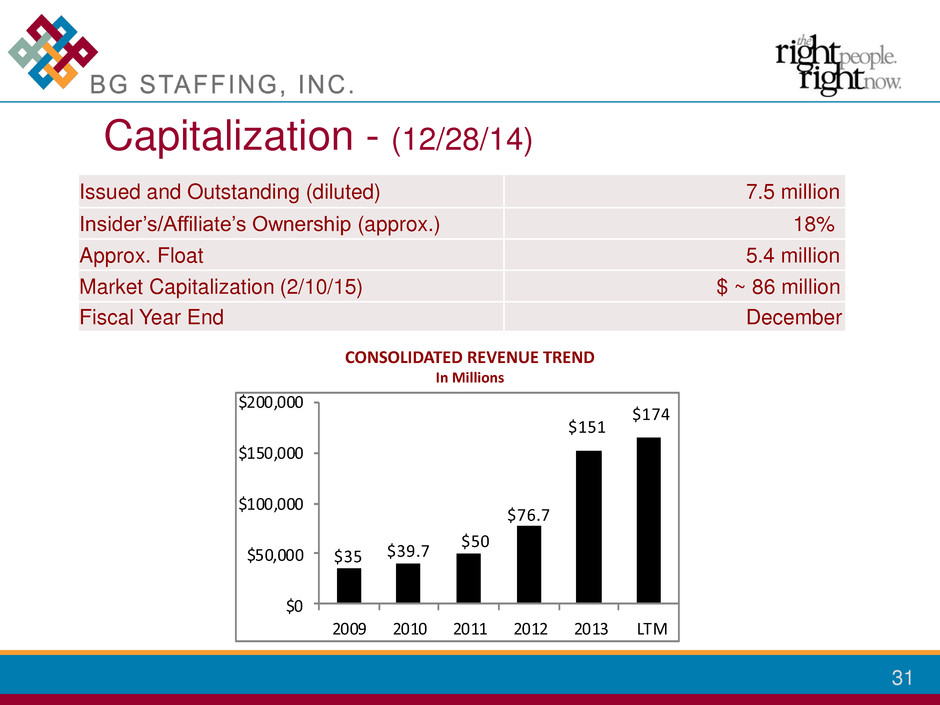

31 Issued and Outstanding (diluted) 7.5 million Insider’s/Affiliate’s Ownership (approx.) 18% Approx. Float 5.4 million Market Capitalization (2/10/15) $ ~ 86 million Fiscal Year End December Capitalization - (12/28/14) $35 $39.7 $50 $76.7 $151 $174 $0 $50,000 $100,000 $150,000 $200,000 2009 2010 2011 2012 2013 LTM CONSOLIDATED REVENUE TREND In Millions

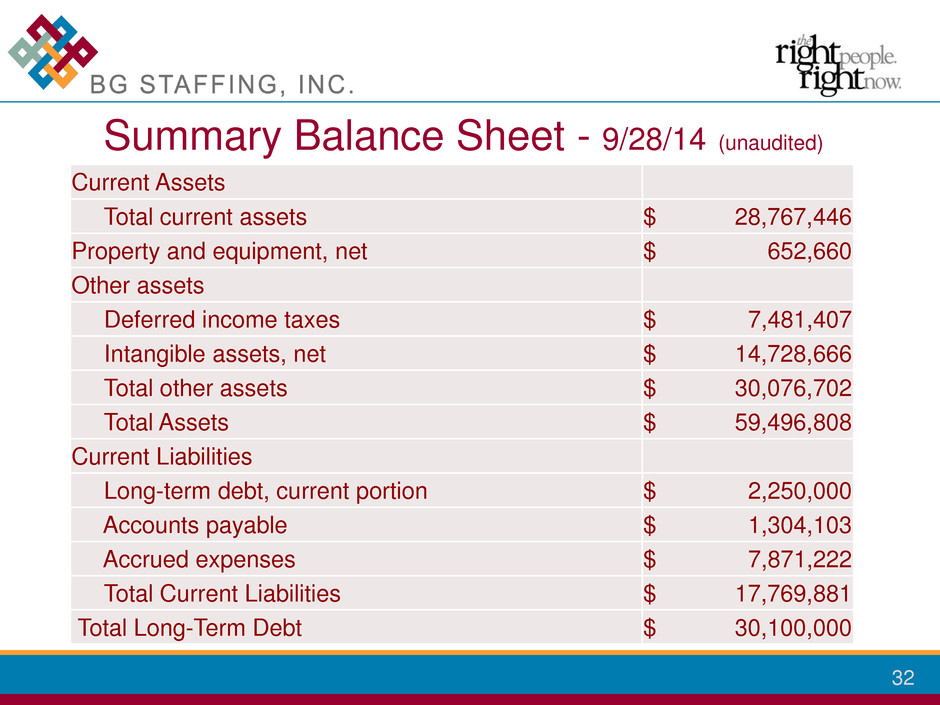

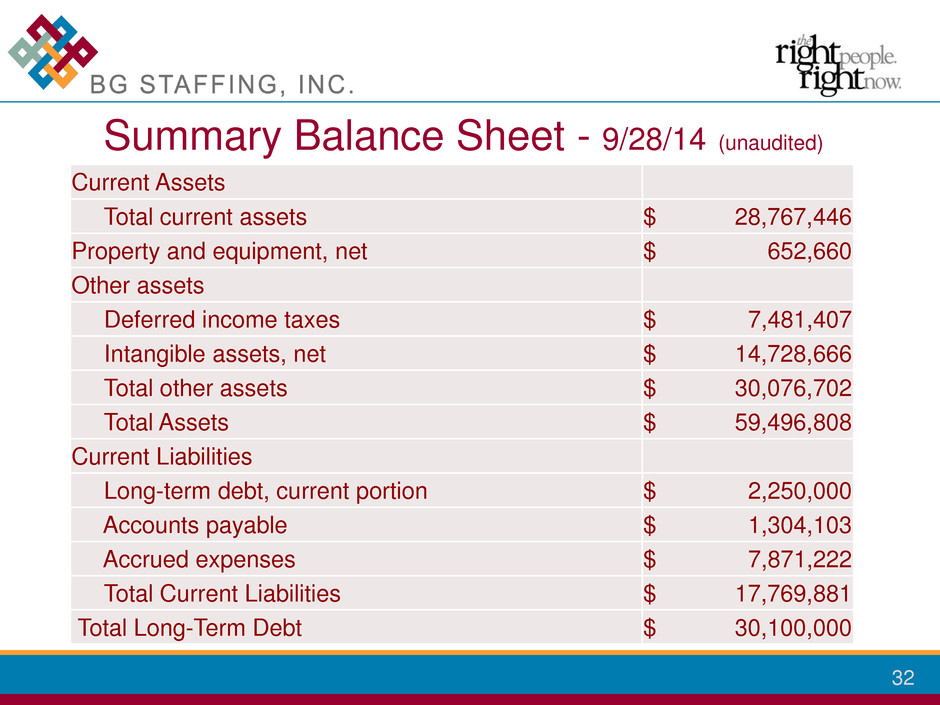

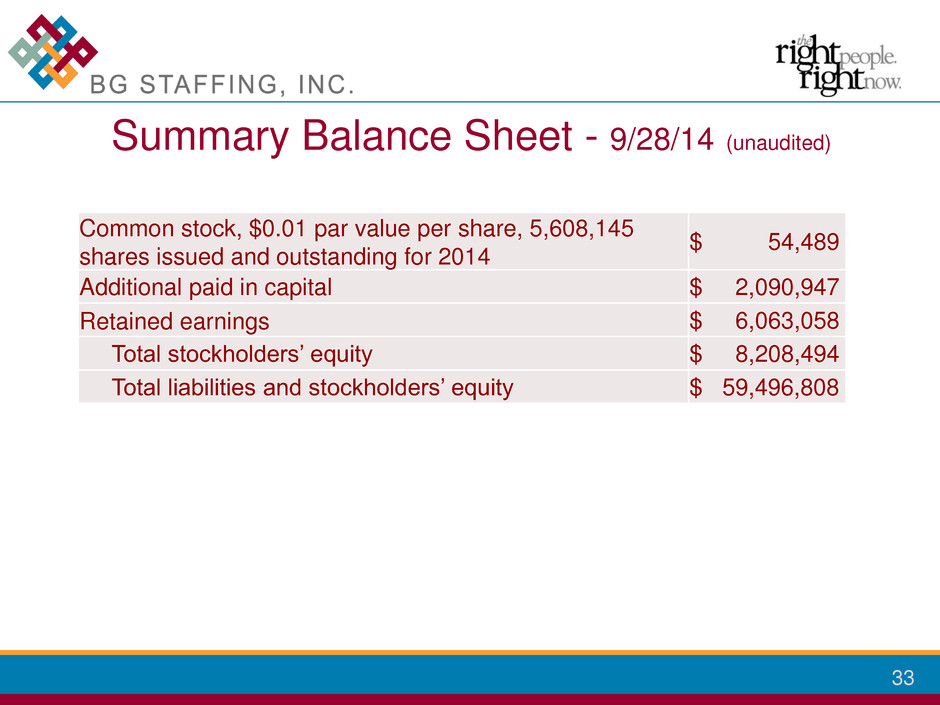

32 Current Assets Total current assets $ 28,767,446 Property and equipment, net $ 652,660 Other assets Deferred income taxes $ 7,481,407 Intangible assets, net $ 14,728,666 Total other assets $ 30,076,702 Total Assets $ 59,496,808 Current Liabilities Long-term debt, current portion $ 2,250,000 Accounts payable $ 1,304,103 Accrued expenses $ 7,871,222 Total Current Liabilities $ 17,769,881 Total Long-Term Debt $ 30,100,000 Summary Balance Sheet - 9/28/14 (unaudited)

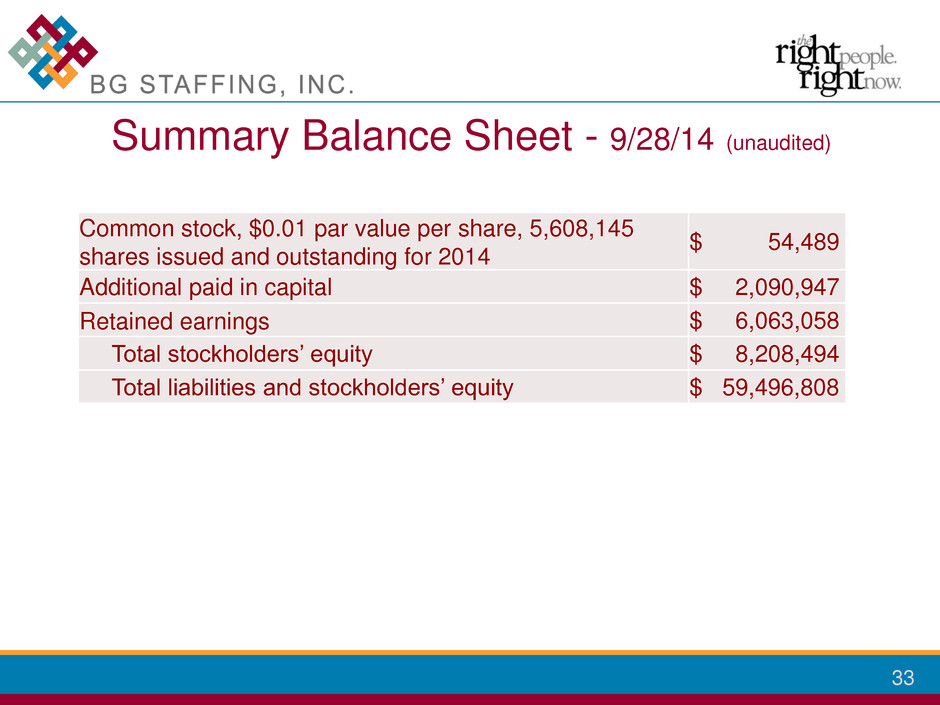

33 Common stock, $0.01 par value per share, 5,608,145 shares issued and outstanding for 2014 $ 54,489 Additional paid in capital $ 2,090,947 Retained earnings $ 6,063,058 Total stockholders’ equity $ 8,208,494 Total liabilities and stockholders’ equity $ 59,496,808 Summary Balance Sheet - 9/28/14 (unaudited)

34 Experienced, successful management focused on continuing to execute proven business model -- organic growth + accretive niche acquisitions Targeting mostly private companies with EBITDA under $5 million Seek to increase $0.15 quarterly dividend Historic EBITDA CAGR over the past five years = 63% Recent $9.4 million equity financing strengthens balance sheet for continued growth Presently valued at approx. a 12% discount to industry average multiple to EBITDA Investment Highlights

35 Contacts Investor Relations: Terri MacInnis, VP of IR Bibicoff + MacInnis, Inc. 818-379-8500 terri@bibimac.com Company: Michael Rutledge, CFO BG Staffing, Inc. 972-692-2422 mrutledge@bgstaffing.com