UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

| | | | |

| |  Filed by the Registrant Filed by the Registrant | |  Filed by a Party other than the Registrant Filed by a Party other than the Registrant | |

|

| |

| Check the appropriate box: |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to § 240.14a-12 |

BG STAFFING, INC.

|

| | |

| Payment of Filing Fee (Check the appropriate box): |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| | (3) Filing Party: |

| | (4) Date Filed: |

BG STAFFING, INC.

Notice of 2016 Annual Meeting of Stockholders

Tuesday, July 26, 2016

2 P.M. EDT,

BG Staffing, Inc.

5850 Granite Parkway Drive, Suite 730

Plano, Texas 75024

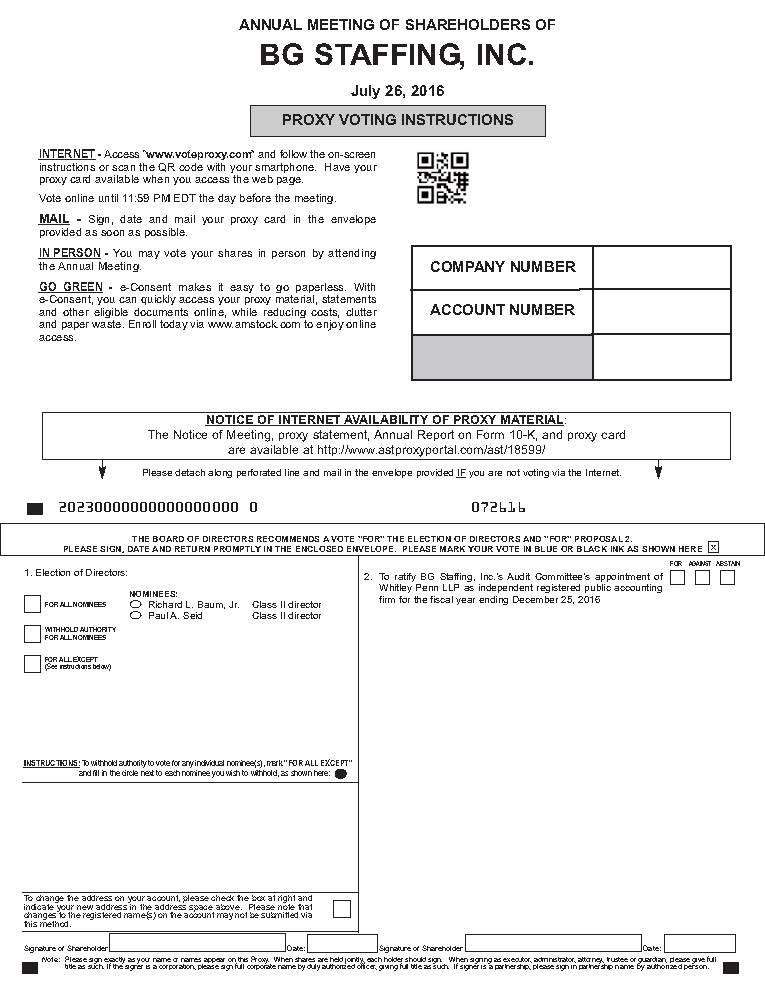

The 2016 Annual Meeting of Stockholders of BG Staffing, Inc. will be held on Tuesday, July 26, 2016, at 2:00 PM EDT, at the principal executive offices of BG Staffing, Inc., 5850 Granite Parkway Drive, Suite 730, Plano, Texas 75024, for the following purposes:

| |

| 1. | To elect Class II directors nominated by the Board of Directors; |

| |

| 2. | To ratify the Audit Committee’s appointment of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 25, 2016; and |

| |

| 3. | To transact other business that properly comes before the meeting. |

Only stockholders of record at the close of business on June 3, 2016, are entitled to receive notice of and to vote at the annual meeting and at any and all adjournments or postponements thereof.

The Notice of Annual Meeting and Proxy Statement for the Annual Meeting is being made available to our stockholders on or about June 16, 2016 on the Internet or, upon request, in printed form by mail. Instructions on how to access and review the proxy materials on the Internet can be found on the proxy card and on the Notice of Internet Availability of Proxy Materials (the “Notice”). The Notice will also include instructions for stockholders on how to access the proxy card to vote over the Internet.

Your vote is important, and whether or not you plan to attend the Annual Meeting, please vote as promptly as possible. We encourage you to vote via the Internet, as it is the most convenient and cost-effective method of voting. You may also vote by mail (if you received paper copies of the proxy materials). Instructions regarding both methods of voting are included in the Notice, the proxy card and the proxy statement.

Thank you in advance for voting and for your support of BG Staffing, Inc.

By order of the Board of Directors,

Dan Hollenbach

Chief Financial Officer and Secretary

June 16, 2016

Plano, Texas

|

| | |

| Table of Contents | |

| | |

| QUESTIONS AND ANSWERS ABOUT THE 2016 ANNUAL MEETING AND VOTING PROCEDURES | |

| PROPOSAL ONE: | ELECTION OF DIRECTORS | |

| BOARD INFORMATION | |

| DIRECTOR COMPENSATION | |

| CORPORATE GOVERNANCE | |

PROPOSAL TWO: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

| |

| RELATED PERSON TRANSACTIONS | |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

| OTHER BUSINESS | |

BG STAFFING, INC.

5850 Granite Parkway Drive, Suite 730

Plano, Texas 75024

(Principal Executive Offices)

PROXY STATEMENT

_____________________________________

This Proxy Statement is furnished in connection with the solicitation of proxies by BG Staffing, Inc. ("BG Staffing"), on behalf of its Board of Directors (the “Board”), for the 2016 Annual Meeting of Stockholders. This proxy statement and related proxy materials are being made available to our stockholders on the Internet or, upon request, mailed to our stockholders on or about June 16, 2016.

QUESTIONS AND ANSWERS ABOUT THE 2016 ANNUAL MEETING AND VOTING PROCEDURES

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), we are making this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 27, 2015, as amended (the "Form 10-K") available on the Internet. If you received the Notice by mail and would prefer to receive a printed copy of our proxy materials, please follow the instructions for requesting printed copies included in the Notice. The Notice also contains instructions on how to access and review all of the important information contained in the proxy materials provided on the Internet, including how you may submit your proxy over the Internet.

Who may vote?

Stockholders of record as of the close of business on June 3, 2016, the record date for the annual meeting, may vote at the meeting. Each share of common stock entitles the holder to one vote per share. As of June 3, 2016 there were 8,473,762 shares of our common stock outstanding.

What constitutes a quorum?

The holders of a majority of our outstanding shares of common stock entitled to vote at the annual meeting must be represented at the annual meeting in person or by proxy to have a quorum. Any stockholder present at the annual meeting, either in person or by proxy, but who abstains from voting, will be counted for purposes of determining whether a quorum exists.

How do I vote?

You cannot vote your shares of common stock unless you are present at the meeting or you have previously given your proxy. You can vote by proxy in one of the following two convenient ways:

| |

| • | by mail – if you received your proxy materials by mail, you can vote by mail by completing, signing, dating and returning the proxy card in the enclosed envelope; or |

| |

| • | on the Internet, by visiting the website shown on the Notice or the proxy card and following the instructions. |

BG STAFFING – 2016 Proxy Statement – 1

How will the proxies be voted?

All properly executed proxies, unless revoked as described below, will be voted at the meeting in accordance with your directions on the proxy. If a properly executed proxy does not provide instructions, the shares of common stock represented by your proxy will be voted:

| |

| • | “FOR” the election of Richard L. Baum, Jr. and Paul A. Seid as Class II directors; |

| |

| • | “FOR” the ratification of the Audit Committee’s appointment of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 25, 2016. |

The proxy holders will use their discretion on any other matters that properly come before the meeting. Unless otherwise stated, all shares represented by your completed, returned, and signed proxy will be voted as described above. If you are voting on the Internet, the proxies will be voted in accordance with your voting instructions. If you are voting on the Internet, your voting instructions must be received by 11:59 p.m., Eastern Daylight Time, on July 25, 2016.

How may I revoke my proxy?

You may revoke your proxy at any time before or at the annual meeting (in each case, before the vote at the annual meeting) by:

| |

| • | Delivering a signed, written revocation letter, dated later than the proxy, to Dan Hollenbach, Chief Financial Officer and Secretary, at 5850 Granite Parkway Drive, Suite 730, Plano, Texas 75024; |

| |

| • | Voting at a later time on the Internet, if you previously voted on the Internet; or |

| |

| • | Attending the meeting and voting in person or by proxy. Attending the meeting alone will not revoke your proxy. |

How many votes must each proposal receive to be adopted?

The election of our Class II directors require the affirmative vote of a plurality of the shares of common stock cast at the meeting. You may only vote “FOR” or “WITHHELD” with respect to election of directors, and as a result, there will not be any abstentions on this proposal. Broker non-votes will have no effect on the outcome of this proposal.

A majority of the votes cast is required to ratify Whitley Penn LLP as our independent registered public accounting firm. Broker non-votes and abstentions will have no effect on the outcome of the vote to ratify Whitley Penn LLP.

What are broker non-votes?

Broker non-votes occur when nominees, such as banks and brokers, holding shares on behalf of beneficial owners, or customers, do not receive voting instructions from the customers. Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. In the event that a broker does not receive voting instructions for these matters, a broker may notify us that it lacks voting authority to vote those shares. These broker non-votes refer to votes that could have been cast on the matter in question by brokers with respect to uninstructed shares if the brokers had received their customers’ instructions. These broker non-votes will be included in determining whether a quorum exists.

Your bank or broker is not permitted to vote your uninstructed shares in the election of directors on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote, no votes will be cast on your behalf in the election of directors. To be sure your shares are voted in the manner you desire, you should instruct your broker how to vote your shares.

BG STAFFING – 2016 Proxy Statement – 2

Who is soliciting this proxy?

The Board is soliciting this proxy. In addition to the solicitation of proxies by mail, proxies may also be solicited by telephone, electronic mail or personal interview. The Company will bear the cost of any solicitation. We will reimburse banks, brokers, custodians, nominees and fiduciaries for reasonable expenses they incur in sending these proxy materials to you if you are a beneficial holder of our shares.

BG STAFFING – 2016 Proxy Statement – 3

|

| |

| PROPOSAL ONE: | ELECTION OF DIRECTORS |

What is the organizational structure of the Board?

The number of directors currently constituting our entire Board is five. The directors are divided into three classes. In general, directors in each class serve for a term of three years.

How many directors are to be elected?

Two Class II directors are to be elected by our stockholders.

Who is the board nominee?

Our Board, upon recommendation of the Nominating and Corporate Governance Committee, has nominated Richard L. Baum, Jr. and Paul A. Seid to be re-elected as Class II directors by the stockholders. Mr. Baum and Mr. Seid have agreed to stand for re-election. However, should either become unable or unwilling to accept nomination or election, the shares of common stock voted for Mr. Baum or Mr. Seid by proxy will be voted for the election of a substitute nominee whom the proxy holders believe will carry out our present policies. Our Board has no reason to believe that Mr. Baum or Mr. Seid will be unable or unwilling to serve if elected, and, to the knowledge of the Board, both intend to serve the entire term for which election is sought.

We urge you to vote “FOR” Mr. Baum and Mr. Seid as Class II directors.

Richard L. Baum, Jr.

Independent Director

Age: 56

Director Since: 2013

Committees Served: Audit Committee, Compensation Committee (Chair), Nominating and Corporate Governance Committee (Chair)

Richard L. Baum, Jr. served on the board of managers of LTN Acquisition, LLC (the former parent of the predecessor to BG Staffing, Inc.) since its inception and was appointed to serve on the Board in November 2013. Mr. Baum is currently the Chairman of Unique Fabricating, Inc. (NYSE MKT: UFAB) which is an automotive die-cut fabricator of non-metallic materials. Mr. Baum joined Taglich Private Equity LLC in 2005 and currently is an active director with a number of private companies where Taglich Private Equity LLC has an investment. Prior to joining Taglich Private Equity LLC, Mr. Baum led a group that purchased a private equity portfolio from Transamerica Business Credit. From 1998 to 2003, Mr. Baum was a Managing Director in the small business merger and acquisition practices of Wachovia Securities and its predecessor, First Union Securities. From 1988 through 1998, Mr. Baum was a Principal with the Mid-Atlantic Companies, Ltd., a financial services firm acquired by First Union in 1998. Mr. Baum received a Bachelor of Science from Drexel University and a Master of Business Administration from the Wharton School of the University of Pennsylvania. We believe that Mr. Baum should serve as a member of the Board due to the perspective and experience with our ongoing operations and strategy that he has obtained through his prolonged service to the company and due to his ability to assist with the evaluation of potential acquisitions.

BG STAFFING – 2016 Proxy Statement – 4

Paul A. Seid

Independent Director

Age: 68

Director Since: 2014

Committees Served: Compensation Committee, Nominating and Corporate Governance Committee

Since 2010, Mr. Seid has served on the board of directors of BioVentrix, a medical device company. For the past three years he has served as Chief Executive Officer of RST Automation, a hospital instrumentation automation developer which was established 2004. For the past sixteen years he has been President of Strategic Data Marketing, a research and data collection company. He has also founded, bought and/or sold over twenty companies in Asia, Europe, North, and South America. Mr. Seid graduated from Queen’s College, a division of the City University of New York, in 1968 with a Bachelor’s degree in Political Science. Mr. Seid has held numerous other board of directors and consulting positions. We believe that Mr. Seid should serve as a member of the Board due to his extensive experience growing diverse businesses.

Who are the continuing members of the Board?

The terms of the following three members of our Board will continue past the Annual Meeting.

Term to Expire at the 2017 Annual Meeting:

C. David Allen, Jr.

Independent Director

Age: 52

Director Since: 2014

Committees Served: Audit Committee, Compensation Committee

Since 2015, Mr. Allen has served as Chief Financial Officer of Graebel Vanlines Holdings, LLC, a provider of commercial and residential logistics, moving and storage services. Prior to Graebel, from 2009 to 2015, Mr. Allen served as an officer of Snelling Services, LLC, a workforce solutions, contract and temporary staffing services provider. From 2010 to 2015, Mr. Allen served as President and Chief Executive Officer. From 2009 to 2010 he served as Chief Financial Officer. Prior to Snelling, Mr. Allen served for three years as Chief Operating Officer and six years as Chief Financial Officer for Telvista Inc., a business process outsourcer providing customer relationship management solutions. He earned a Master of Business Administration from the Tuck School at Dartmouth College in 1993 and received a Bachelor of Business Administration from Stephen F. Austin State University with honors in 1986. We believe that Mr. Allen should serve as a member of the Board due to his extensive experience in the temporary staffing industry.

Douglas E. Hailey

Independent Director

Age: 54

Director Since: 2013

Committees Served: Audit Committee (Chair), Nominating and Corporate Governance Committee

Douglas E. Hailey served on the board of managers of LTN Acquisition, LLC (the former parent of the predecessor to BG Staffing, Inc.) since its inception and was appointed to our board of directors in November 2013. Mr. Hailey is the managing director of Taglich Private Equity LLC. Mr. Hailey joined Taglich Brothers, Inc. in 1994 as Head of Investment Banking and is an employee, not a partner, director, shareholder or executive officer. Taglich Brothers, Inc. is not an affiliate of Taglich Private Equity LLC. He co-led the private equity initiative in 2001 and currently participates in evaluating and executing new investments. Prior to joining Taglich Brothers, Mr. Hailey spent five years with Weatherly Financial Group, assisting in sponsoring leveraged buyouts and five years in structured finance lending at Heller Financial and the Bank of New York. He received a Bachelor of Business Administration from Eastern New Mexico University and a Master of Business Administration in Finance from the University of Texas. We believe that Mr. Hailey should serve as a member

BG STAFFING – 2016 Proxy Statement – 5

of the Board due to the perspective and experience with our ongoing operations and strategy that he has obtained through his prolonged service to the company and due to his ability to assist with the evaluation of potential acquisitions.

Term to Expire at the 2018 Annual Meeting:

L. Allen Baker, Jr.

President and Chief Executive Officer

Age: 66

Director Since: 2013

L. Allen Baker, Jr. joined the board of managers of LTN Acquisition, LLC (the former parent of the predecessor to BG Staffing, Inc.) in 2008 while serving as the Executive Vice President/Chief Financial Officer of Impact Confections, Inc., a confections manufacturing company in Colorado, a position Mr. Baker held from 2002 through 2009 and was appointed to the Board in November 2013. He began serving as President and Chief Executive Officer of BG Staffing in 2009. From 1985 to 2002, Mr. Baker served as Executive Vice President and Chief Financial Officer of Piping Design Services, Inc. d/b/a PDS Technical Services, a national, privately held staffing company headquartered in the Dallas/Fort Worth area, with operations in 43 states. Prior to this position, he worked at Core Laboratories, Inc. as the Corporate Controller from 1980 to 1985 and as Data Processing Manager from 1976 to 1980. Mr. Baker held several computer programmer positions prior to joining Core Laboratories, Inc. He has a Bachelor of Science in Mathematics with a minor in Computer Information Systems from West Texas State University and an Master of Business Administration from the University of Dallas. We believe that Mr. Baker should serve as a member of the Board due to his extensive experience in the temporary staffing industry.

BG STAFFING – 2016 Proxy Statement – 6

BOARD INFORMATION

Independent Directors

Our Board has determined that the following directors are “independent” as defined under the rules of the NYSE MKT: Richard L. Baum, Jr., Paul A. Seid, C. David Allen, Jr., and Douglas E. Hailey. The table below includes a description of categories or types of transactions, relationships or arrangements considered by our Board in reaching its determination that the directors are independent.

|

| | |

| Name | Independent | Transactions/Relationships/Arrangements |

| | | |

| C. David Allen, Jr. | Yes | None |

| Richard L. Baum, Jr. | Yes | See “Related Person Transactions” |

| Douglas E. Hailey | Yes | See “Related Person Transactions” |

| Paul A. Seid | Yes | None |

Board Meetings

During 2015, our Board met four times, including regularly scheduled and special meetings, and acted five times by unanimous written consent. Each director attended all meetings of the Board during his or her service as a director. All of our directors attended more than 75% of the aggregate of the total number of meetings of the Board (during the period during which such director served) and the total number of meetings of the Board committees on which they serve (during the period during which such director served).

Board Leadership and Role in Risk Oversight

Meetings of our Board are presided over by L. Allen Baker, Jr. Our Board does not have a chairperson. Our Board believes that L. Allen Baker, Jr. is currently best situated to preside over meetings of our Board because of his familiarity with our business and ability to effectively identify strategic priorities and lead the discussion and execution of strategy.

Our Board oversees the risk management activities designed and implemented by our management. Our Board executes its oversight responsibility for risk management both directly and through its committees. The full Board also considers specific risk topics, including risks associated with our strategic plan, business operations and capital structure. In addition, our Board receives detailed regular reports from members of our senior management and other personnel that include assessments and potential mitigation of the risks and exposures involved with their respective areas of responsibility.

Our Board delegates to the Audit Committee oversight of our risk management process. Our other Board committees also consider and address risk as they perform their respective committee responsibilities. All committees report to the full board of directors as appropriate, including when a matter rises to the level of a material or enterprise level risk.

Committees of the Board of Directors

The standing committees of our board of directors consist of an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each of the committees reports to our Board as they deem appropriate and as our Board may request. The composition, duties and responsibilities of these committees are set forth below.

Audit Committee

The Audit Committee is responsible for, among other matters: (1) appointing, retaining and evaluating our independent registered public accounting firm and approving all services to be performed by them; (2) overseeing our independent registered public accounting firm’s qualifications, independence and performance; (3) overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; (4) reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; (5) establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting,

BG STAFFING – 2016 Proxy Statement – 7

internal controls or auditing matters; and (6) reviewing and approving related person transactions; and (7) overseeing the risk management process.

Our Audit Committee consists of C. David Allen, Jr., Richard L. Baum, Jr. and Douglas E. Hailey. We believe that each qualifies as independent directors according to the rules and regulations of the SEC and NYSE MKT with respect to audit committee membership. We also believe that Mr. Hailey qualifies as our “audit committee financial expert,” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K. Our Board has adopted a written charter for the Audit Committee, which is available on our corporate website under the investor relations tab at www.bgstaffing.com. The information on our website is not part of this Proxy Statement.

The Audit Committee held five meetings in 2015.

Compensation Committee

The Compensation Committee is responsible for, among other matters: (1) reviewing key employee compensation goals, policies, plans and programs; (2) reviewing and approving the compensation of our directors, president and chief executive officer and other executive officers; (3) reviewing and approving employment agreements and other similar arrangements between us and our executive officers; and (4) administering our stock plans and other incentive compensation plans, including our 2013 Long-Term Incentive Plan (the "2013 Plan"). The Committee has the authority to delegate any of its responsibilities, along with the authority to take action in relation to such responsibilities, to one or more subcommittees as the committee may deem appropriate in its sole discretion. The Compensation Committee may invite such members of management to its meetings as it deems appropriate. However, the Compensation Committee meets regularly without such members present, and in all cases no officer may be present at meetings at which such officer’s compensation or performance is discussed or determined. The Committee has the authority, in its sole discretion, to select, retain and obtain the advice of a compensation consultant as necessary to assist with the execution of its duties and responsibilities. Neither the Compensation Committee nor management engaged a compensation consultant with respect to the 2015 fiscal year.

Our Compensation Committee consists of C. David Allen, Jr., Richard L. Baum, Jr. and Paul A. Seid. Our Board has adopted a written charter for the Compensation Committee, which is available on our corporate website under the investor relations tab at www.bgstaffing.com. The information on our website is not part of this Proxy Statement.

The Compensation Committee held two meetings and acted by unanimous written consent one time in 2015.

Nominating and Corporate Governance Committee

We have a Nominating and Corporate Governance Committee, which identifies, evaluates and recommends qualified nominees to serve on our Board, develops and oversees our internal corporate governance processes and maintains a management succession plan. Our Nominating and Corporate Governance Committee charter defines the committee’s primary duties. The Nominating and Corporate Governance Committee will evaluate nominees for director, including nominees recommended by stockholders, using all relevant criteria, including diversity of experience and background. The Nominating and Corporate Governance Committee will consider any director candidates recommended by the Company’s stockholders provided that the notice and information requirements specified by Section 2.06(b)–(c) of the Bylaws (relating to direct stockholder nominations) are complied with.

Our Nominating and Corporate Governance Committee consists of Richard L. Baum, Jr., Douglas E. Hailey, and Paul A. Seid. A copy of the Nominating and Corporate Governance Committee’s charter is posted on our website at www.bgstaffing.com. The information on our website is not part of this Proxy Statement.

The Nominating and Corporate Governance Committee held one meeting in 2015.

Other Committees

Our Board may establish other committees as it deems necessary or appropriate from time to time.

BG STAFFING – 2016 Proxy Statement – 8

Family Relationships

There are no family relationships among any of our executive officers or any of our directors.

BG STAFFING – 2016 Proxy Statement – 9

DIRECTOR COMPENSATION

Set forth below is a summary of the components of compensation payable to our non-management directors.

Cash Compensation

We reimburse each member of our Board for all reasonable out-of-pocket expenses incurred in connection with their attendance at meetings of our Board and any committees thereof, including, without limitation, reasonable travel, lodging and meal expenses. Each director who is not also an employee or officer of the Company is also entitled to (i) annual retainer of $15,000 for their service on our Board, (ii) an annual retainer of $5,000 for each committee on which the director serves, and (iii) an annual retainer of $25,000 for audit and $10,000 for all other committee chairs on which the director serves.

|

| | | | | | | | | | | | | | | | | | |

| Name | Board Member ($) | Audit Committee ($) | Compensation Committee

($) | Nominating & Governance Committee ($) | Chairman of the Board ($) | Total

($) |

| | | | | | | |

| C. David Allen, Jr. | $ | 15,000 |

| $ | 5,000 |

| $ | 5,000 |

| $ | — |

| $ | — |

| $ | 25,000 |

|

| Richard L. Baum, Jr. | $ | 15,000 |

| $ | 5,000 |

| $ | 15,000 |

| $ | 15,000 |

| $ | — |

| $ | 50,000 |

|

| Douglas E. Hailey | $ | 15,000 |

| $ | 30,000 |

| $ | — |

| $ | 5,000 |

| $ | — |

| $ | 50,000 |

|

| Paul A. Seid | $ | 15,000 |

| $ | — |

| $ | 5,000 |

| $ | 5,000 |

| $ | — |

| $ | 25,000 |

|

Equity Compensation

On June 9, 2015, the Compensation Committee granted nonqualified stock options to the following directors of the Company: Douglas E. Hailey (3,750 options with a $11.00 exercise price per share), Paul A. Seid (3,750 options with a $11.00 exercise price per share), C. David Allen, Jr. (3,750 options with a $11.00 exercise price per share) and Richard L. Baum, Jr. (3,750 options with a $11.00 exercise price per share). The nonqualified stock options will expire on June 9, 2025, one-fifth of the non-qualified stock options vested on each of June 9, 2015 and June 9, 2016 and the remainder of the nonqualified stock options will vest in three equal annual increments beginning on June 9, 2017. Each option is subject to the condition that the optionee will have remained as a director through such vesting dates, and each option is subject to the terms and conditions set forth in the 2013 Plan and in the Nonqualified Stock Option Agreement between the Company and each optionee.

Director Compensation for 2015

The table below sets forth the compensation payable to our non-management directors for service during 2015 fiscal year.

|

| | | | | | | | | | | | | | | | | | | | | |

| Name | Fees earned or paid in cash

($) | Stock awards

($) | Option awards

($) (*) | Non-equity incentive plan

compensation

($) | Nonqualified deferred

compensation earnings

($) | All other compensation

($) | Total

($) |

| | | | | | | | |

| C. David Allen, Jr. | $ | 25,000 |

| $ | — |

| $ | 6,852 |

| $ | — |

| $ | — |

| $ | — |

| $ | 31,852 |

|

| Richard L. Baum, Jr. | $ | 50,000 |

| $ | — |

| $ | 6,852 |

| $ | — |

| $ | — |

| $ | — |

| $ | 56,852 |

|

| Douglas E. Hailey | $ | 50,000 |

| $ | — |

| $ | 6,852 |

| $ | — |

| $ | — |

| $ | — |

| $ | 56,852 |

|

| Paul A. Seid | $ | 25,000 |

| $ | — |

| $ | 6,852 |

| $ | — |

| $ | — |

| $ | — |

| $ | 31,852 |

|

| |

| * | The amounts reflects the dollar amounts recognized for financial statement reporting purposes in accordance with FASB ASC Topic 718. The assumptions used in the calculation of these amounts are included in Note 13 Share-based Compensation to the audited consolidated financial statements included in the Form 10-K. |

BG STAFFING – 2016 Proxy Statement – 10

CORPORATE GOVERNANCE

General

Our Board has established corporate governance practices designed to serve the best interests of the Company and our stockholders. In this regard, our Board has, among other things, adopted:

| |

| • | a code of business conduct and ethics applicable to all of our Board members, as well as all of our employees, including our President and Chief Executive Officer and Chief Financial Officer and Secretary; |

| |

| • | procedures regarding stockholder communications with our Board and its committees; |

| |

| • | a policy for the submission of complaints or concerns relating to accounting, internal accounting controls or auditing matters; |

| |

| • | provisions in our Bylaws regarding director candidate nominations and other proposals by stockholders; and |

| |

| • | written charters for its Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. |

Our Board intends to monitor developing standards in the corporate governance area and, if appropriate, modify our policies and procedures with respect to such standards. In addition, our Board will continue to review and modify our policies and procedures as appropriate to comply with any new requirements of the Securities and Exchange Commission or NYSE MKT.

Code of Ethics

We have adopted a Code of Ethics that applies to all of our employees, including our chief executive officer and our chief financial officer (who is our principal accounting officer). Our Code of Ethics is available on our website at www.bgstaffing.com. If we amend or grant a waiver of one or more of the provisions of our Code of Ethics, we intend to satisfy the requirements under Item 5.05 of Item 8-K regarding the disclosure of amendments to or waivers from provisions of our Code of Ethics that apply to our principal executive, financial and accounting officers by posting the required information on our website at the above address. The information included in our website is not part of this Proxy Statement.

Stockholder Communications with the Board

Stockholders may contact the Board or any committee of the Board by any one of the following methods:

|

| | | |

| | | |

By telephone:

972-692-2400 | By mail:

BG Staffing, Inc.

Attn: Corporate Secretary 5850 Granite Parkway, Suite 730, Plano, Texas 75024 | By e-mail:

InvesterRelations@BGStaffing.com | |

BG STAFFING – 2016 Proxy Statement – 11

Director Attendance at Annual Meeting of Stockholders

Our Board has not adopted a formal policy stating that each member of the Board should attend our annual meeting of stockholders. However, we anticipate that each director will attend. At the 2015 Annual Meeting of Stockholders, all directors were present.

BG STAFFING – 2016 Proxy Statement – 12

|

| |

| PROPOSAL TWO: | RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee appointed Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 25, 2016 and Whitley Penn LLP has served in this capacity since 2013. Our Board has further directed that we submit the selection of our independent registered public accounting firm for ratification by our stockholders at the 2016 annual meeting.

Representatives of Whitley Penn LLP will attend the annual meeting and available to respond to appropriate questions and, although the firm has indicated that no statement will be made, an opportunity for a statement will be provided.

The Audit Committee reviews and pre-approves both audit and all permissible non-audit services provided by our independent registered public accounting firm, and accordingly, all services and fees in 2015 and 2014 provided by Whitley Penn LLP were pre-approved by the Audit Committee. The Audit Committee has considered whether the provision of services, other than services rendered in connection with the audit of our annual financial statements, is compatible with maintaining Whitley Penn LLP’s independence. The Audit Committee has determined that the rendering of non-audit services by Whitley Penn LLP during the fiscal year ended December 27, 2015 and during the fiscal year ended December 28, 2014 was compatible with maintaining the firm’s independence.

Stockholder ratification of the selection of Whitley Penn LLP as our independent registered public accounting firm is not required by our Bylaws or otherwise. However, our Board is submitting the selection of Whitley Penn LLP to the stockholders for ratification as a matter of good corporate practice. The Audit Committee believes it to be in the best interests of our stockholders to retain, and has retained, Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 25, 2016. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to continue the retention of Whitley Penn LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in our best interests and those of our stockholders. The Audit Committee annually reviews the performance of our independent registered public accounting firm and the fees charged for their services. Based upon the Audit Committee’s analysis of this information, the Audit Committee will determine which registered independent public accounting firm to engage to perform our annual audit each year.

Our Board of Directors recommends that you vote “FOR” the proposal to ratify the selection of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 25, 2016.

BG STAFFING – 2016 Proxy Statement – 13

Principal Accountant Fees and Services

Aggregate fees billed or incurred related to the following fiscal years for professional services rendered by Whitley Penn LLP for the fiscal years ended December 27, 2015 and December 28, 2014 are set forth below.

|

| | | | | | | | |

| | | 2015 | | 2014 |

| | | | | |

Audit Fees (1) | | $ | 237,962 |

| | $ | 177,236 |

|

Audit-Related Fees (2) | | 121,735 |

| | 27,117 |

|

| Tax Fees | | — |

| | — |

|

| All Other Fees | | — |

| | — |

|

| Total | | $ | 359,697 |

| | $ | 204,353 |

|

|

| |

| (1) | Audit fees consist principally of fees for the audit of our consolidated financial statements, review of our interim consolidated financial statements and services related to our acquisitions.

|

| (2) | These fees consist principally of fees related to the preparation of SEC registration statements and U.S. Department of Labor filings.

|

BG STAFFING – 2016 Proxy Statement – 14

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the Board, the Audit Committee assists the Board in fulfilling its oversight responsibilities by, among other things, reviewing the financial reports and other financial information provided by the Company to any governmental body or the public.

In discharging its oversight responsibilities, the Audit Committee obtained from the independent registered public accounting firm a formal written statement describing all relationships between the firm and the Company that might bear on the auditors’ independence consistent with the applicable requirements of the Public Company Accounting Standards Board, discussed with the independent auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors’ independence. The Audit Committee also discussed with management and the independent auditors the integrity of the Company’s financial reporting processes, including the Company’s internal accounting systems and controls, and reviewed with management and the independent auditors the Company’s significant accounting principles and financial reporting issues, including judgments made in connection with the preparation of the Company’s financial statements. The Audit Committee also reviewed with the independent auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed with the independent auditors the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board, and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the consolidated financial statements of the Company.

The Audit Committee reviewed and discussed the audited consolidated financial statements of the Company as of and for the fiscal year ended December 27, 2015 with management and the independent auditors. Management is responsible for the Company’s financial reporting process, including its system of internal control over financial reporting (as defined in Rule 13a-15(f) promulgated under the Securities Exchange Act of 1934, as amended), and for the preparation of the Company’s consolidated financial statements in accordance with generally accepted accounting principles. The independent auditor is responsible for auditing those financial statements, and expressing an opinion on the effectiveness of internal control over financial reporting. The Audit Committee’s responsibility is to monitor and review these processes. The members of the Audit Committee are “independent” as defined by SEC and NYSE MKT rules, and our Board has determined that Douglas E. Hailey is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their respective audits. The Audit Committee periodically meets with the Company’s independent auditors, with and without management present, and in private sessions with members of senior management to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee also periodically meets in executive session.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board subsequently approved the recommendation) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 27, 2015, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Douglas E. Hailey, Chair

C. David Allen

Richard L. Baum, Jr.

BG STAFFING – 2016 Proxy Statement – 15

EXECUTIVE OFFICERS

Our Board appoints our executive officers and updates the executive officer positions as needed throughout the fiscal year. Each executive officer serves at the behest of our Board and until their successors are appointed, or until the earlier of their death, resignation or removal.

The following table sets forth certain information with respect to our executive officers as of the date of this Proxy Statement:

|

| | |

| Name | Age | Position |

| | | |

| L. Allen Baker, Jr. | 66 | President and Chief Executive Officer |

| Dan Hollenbach | 60 | Chief Financial Officer and Secretary |

L. Allen Baker, Jr. joined the board of managers of LTN Acquisition, LLC (the former parent of the predecessor to BG Staffing, Inc.) in 2008 while serving as the Executive Vice President/Chief Financial Officer of Impact Confections, Inc., a confections manufacturing company in Colorado, a position Mr. Baker held from 2002 through 2009 and was appointed to our Board in November 2013. He began serving as President and Chief Executive Officer of BG Staffing in 2009. From 1985 to 2002, Mr. Baker served as Executive Vice President and Chief Financial Officer of Piping Design Services, Inc. d/b/a PDS Technical Services, a national, privately held staffing company headquartered in the Dallas/Fort Worth area, with operations in 43 states. Prior to this position, he worked at Core Laboratories, Inc. as the Corporate Controller from 1980 to 1985 and as Data Processing Manager from 1976 to 1980. Mr. Baker held several computer programmer positions prior to joining Core Laboratories, Inc. He has a Bachelor of Science in Mathematics with a minor in Computer Information Systems from West Texas State University and a Master of Business Administration from the University of Dallas.

Dan Hollenbach joined as Chief Financial Officer and Secretary on August 24, 2015. Prior to joining the Company, Mr. Hollenbach was the CFO of Cybergy Holdings, Inc. (OTC: CYBG), an advisory service and products company for the federal and state governments, and commercial clients, from May 2014 to August 2015. Prior to this position, he led the consulting practice for Robert Half Management Resources in Colorado from June 2010 to May 2014. From August 2004 to July 2009, Dan was the CFO for Global Employment Holdings (OTC: GEYH), a national staffing, consulting and professional employer organization company. Mr. Hollenbach began his career in the Audit and Assurance Services practice of EY before entering the corporate world. He has over three decades of experience in corporate accounting and finance, including expertise in initial public offerings, SEC reporting, mergers and acquisitions, Sarbanes-Oxley, treasury management, process improvement, and all phases of audit, tax, and reporting. Additionally, he has served on audit committees and led negotiations of multiple senior debt restructurings. He is a CPA in State of Texas, holds a Chartered Global Management Accountant certification, and received his Bachelor of Business Administration in Accounting from Texas Tech University.

Named Executive Officers

Our named executive officers for 2015 and the positions they held with the company as of December 27, 2015 are:

| |

| • | L. Allen Baker, Jr., our President and Chief Executive Officer; |

| |

| • | Dan Hollenbach, our Chief Financial Officer and Secretary; and |

| |

| • | Michael A. Rutledge, who served as our Chief Financial Officer and Secretary until August 2015. |

Throughout this section, the term “named executive officer” is intended to refer to the individuals identified above. During 2015, we had only three executive officers, each of whom is set forth above.

BG STAFFING – 2016 Proxy Statement – 16

Summary Compensation Table

The following table presents compensation information for our named executive officers with respect to 2015 and 2014.

|

| | | | | | | | | | | | | | | | | | | | |

Name and

Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock

Awards ($) (*) | | Option

Awards ($) (*) | | Non-equity

incentive plan

compensation ($) | | Non-qualified

deferred

compensation

earnings ($) | | All Other

Compensation

($) | | Total ($) |

| | | | | | | | | | | | | | | | | | | | | |

L. Allen Baker, Jr.(1) President and Chief Executive Officer | | 2015 | | $325,000 | | $278,750 | (2) | | $— | | $54,814 | | $— | | $— | | $19,733 | (3) | | $678,297 |

| | 2014 | | $325,000 | | $32,500 | (4) | | $509 | | $929,683 | | $— | | $— | | $20,925 | (5) | | $1,308,617 |

| | | | | | | | | | | | | | | | | | | | | |

| Michael A. Rutledge Chief Financial Officer and Secretary | | 2015 | | $142,152 | | $— | | | $— | | $— | | $— | | $— | | $57,106 | (6) | | $199,258 |

| | 2014 | | $210,000 | | $— | | | $549 | | $149,568 | | $— | | $— | | $20,134 | (7) | | $380,251 |

| | | | | | | | | | | | | | | | | | | | | |

Dan Hollenbach Chief Financial Officer and Secretary | | 2015 | | $76,729 | | $17,500 | | | $— | | $119,921 | | $— | | $— | | $19,863 | (8) | | $234,013 |

| | 2014 | | $— | | $— | | | $— | | $— | | $— | | $— | | $— | | | $— |

| |

| (*) | The amounts reflects the dollar amounts recognized for financial statement reporting purposes in accordance with FASB ASC Topic 718. The assumptions used in the calculation of these amounts are included in Note 13 Share-based Compensation to the audited consolidated financial statements included in the Form 10-K. |

| |

| (1) | Mr. Baker also serves on our board of directors, but does not receive additional compensation to do so. |

| |

| (2) | Includes $178,750 of 2015 bonus was earned in 2015 and $100,000 discretionary bonus paid in 2015. |

| |

| (3) | Includes $11,750 representing matching 401(k) contributions made by us and $7,983 in medical benefits. |

| |

| (4) | 2014 bonus was earned in 2014 and paid in 2015. |

| |

| (5) | Includes $11,750 representing matching 401(k) contributions made by us and $9,175 in medical benefits. |

| |

| (6) | Includes $5,525 representing matching 401(k) contributions made by us, $11,062 in medical benefits, and $40,519 in relation to his amended separation agreement effective August 24, 2015. |

| |

| (7) | Includes $20,099 in medical benefits and $35 of other perquisites. |

| |

| (8) | Includes $19,825 in taxable moving expenses and $38 of other perquisites. |

Agreements with Executive Officers

President and Chief Executive Officer

On February 1, 2016, we executed an employment agreement effective December 28, 2015 with L. Allen Baker, Jr., pursuant to which Mr. Baker serves as our President and Chief Executive Officer. The contract is effective through December 31, 2018 and automatically renews for successive one-year periods until terminated in accordance with its terms. We refer to each of these one-year periods as employment periods. Mr. Baker’s annual compensation is evaluated annually, but may not be less than $375,000 per year. Mr. Baker received an annual base salary of $325,000 for the fiscal year-ended December 27, 2015.

Mr. Baker is eligible to receive an annual cash bonus based on our adjusted EBITDA (as defined in the employment agreement). At the beginning of each calendar year, our board of directors approves an operating adjsuted EBITDA budget. If we achieve:

| |

| • | at least 85% of the approved adjusted EBITDA budget for the fiscal year, then Mr. Baker receives a cash bonus in an amount equal to 10% his annual base salary for the applicable employment period in which the calendar year ends (or such greater amount as decided by our board of directors); |

BG STAFFING – 2016 Proxy Statement – 17

| |

| • | at least 95% of the approved adjusted EBITDA budget for the fiscal year, then Mr. Baker receives a cash bonus in an amount equal to 25% of his annual base salary for the applicable employment period in which the calendar year ends (or such other greater amount as decided by our board of directors); |

| |

| • | at least 100% of the approved adjusted EBITDA budget for the fiscal year, then Mr. Baker receives a cash bonus in an amount equal to 40% of his annual base salary for the applicable employment period in which the calendar year ends (or such other greater amount as decided by our board of directors ); and |

| |

| • | at least 110% of the approved adjusted EBITDA budget for the fiscal year, then Mr. Baker receives a cash bonus in an amount equal to 55% of his annual base salary for the applicable employment period in which the calendar year ends (or such other greater amount as decided by our board of directors). |

In the event that Mr. Baker’s employment is terminated by us without cause or by Mr. Baker for good reason, Mr. Baker will receive as severance installments equal to twelve months of base salary plus COBRA premiums for 18 months. In the event that Mr. Baker’s employment is terminated without cause or for good reason within one year of a change in control (as defined in the employment agreement), Mr. Baker will receive as severance installments his base salary plus COBRA premiums for Mr. Baker and his dependents for 18 months. Mr. Baker will also generally be entitled to receive any bonus payable but unpaid, payment for unused vacation days, and unpaid reimbursements. The severance is contingent upon Mr. Baker’s execution of a separation agreement including a general release. In the event that Mr. Baker’s employment is terminated by us for cause, or by Mr. Baker other than for good reason, we will pay to Mr. Baker any monthly salary, bonus payable but unpaid, unused vacation, and expense reimbursements, earned or due to Mr. Baker but unpaid.

We and Mr. Baker have also entered into a confidentiality, non-solicitation, non-interference and non-competition agreement. Pursuant to the agreement, Mr. Baker generally agrees not to disclose our confidential information (as defined in the agreement) and, for a period of 18 months following his termination, not to solicit our customers, interfere with our customer and supplier relationships, or solicit our employees. Mr. Baker also agrees not to compete with us for a period of 12 months or for the period during which he is entitled to severance payments (if longer).

Mr. Baker was granted stock options in 2014 and 2015 as further described under “Outstanding Equity Awards” below.

Chief Financial Officer

On October 27, 2015, we executed an employment agreement effective August 24, 2015 with Dan Hollenbach pursuant to which Mr. Hollenbach serves as our Chief Financial Officer and Secretary. The contract is effective through August 23, 2016 and automatically renews for successive one-year periods until terminated in accordance with its terms. We refer to each of these one-year periods as employment periods. Mr. Hollenbach's annual compensation is evaluated annually, but may not be less than $210,000 per year. Mr. Hollenbach received an annual base salary of $210,000 pro rated for the fiscal year-ended December 27, 2015.

Mr. Hollenbach is eligible to receive an annual cash bonus based on achieving certain fiscal year objectives as determined by us and Mr. Hollenbach is in our employment on the date such bonus amount is paid. For purposes of the 2015 fiscal year only, Mr Hollenbach was eligible to receive a discretionary bonus in the gross lump sum amount $17,500. Mr. Hollenbach shall be reimbursed for moving and relocation costs and temporary living expenses not to exceed $33,000.

In the event that Mr. Hollenbach’s employment is terminated by us without cause or by Mr. Hollenbach for good reason, Mr. Hollenbach will receive as severance installments equal to six months of base salary. In the event that Mr. Hollenbach’s employment is terminated without cause or for good reason within one year of a change in control, Mr. Hollenbach will receive as severance installments his base salary plus COBRA premiums for Mr. Hollebach and his dependents for 12 months. Mr. Hollenbach will also generally be entitled to receive any bonus payable but unpaid, payment for unused vacation days, and unpaid reimbursements. The severance is contingent upon Mr. Hollenbach’s execution of a separation agreement including a general release. In the event that Mr. Hollenbach’s employment is terminated by us for cause, or by Mr. Hollenbach other than for good reason, we will pay to Mr. Hollenbach any monthly salary, bonus payable but unpaid, unused vacation, and expense reimbursements, earned or due to Mr. Hollenbach but unpaid.

We and Mr. Hollenbach have also entered into a confidentiality, non-solicitation, non-interference and non-competition agreement. Pursuant to the agreement, Mr. Hollenbach generally agrees not to disclose our confidential information (as defined in the agreement)

BG STAFFING – 2016 Proxy Statement – 18

and, for a preiod of 18 months following his termination, not to solicit our customers, interfere with our customer and supplier relationships, or solicit our employees. Mr. Hollenbach also agrees not to compete with us for a period of 12 months after termination.

Mr. Hollenbach was granted stock options as further described under “Outstanding Equity Awards” below.

Michael A. Rutledge resigned as CFO and Secretary in August of 2015. Mr. Rutledge further agreed not to disclose our confidential information (as defined in the agreement) and, for a period of one year following his termination, not to compete with us, solicit our customers, employees or vendors, or interfere with our employee, contractor, customer or supplier relationships.

Outstanding Equity Awards

The following table presents outstanding equity awards as of December 27, 2015. No unvested stock awards were outstanding as of December 27, 2015.

|

| | | | | | | | | | | |

Name (*) | Option Awards |

| Grant date | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Equity incentive plan awards: Number of securities underlying unexercised unearned options (#) | Option exercise price ($) | Option expiration date |

| (a) | | (b) | (c) | (d) | (e) | (f) |

| | | | | | | | |

| L. Allen Baker, Jr. | 06/09/2015 | 6,000 | 24,000 |

| (1) | — |

| $ | 11.00 |

| 06/09/2025 |

| | 02/06/2014 | 170,271 | — |

| (2) | — |

| $ | 6.25 |

| 02/06/2024 |

| | 02/06/2014 | 17,402 | — |

| (2) | — |

| $ | 12.50 |

| 02/06/2024 |

| | 02/06/2014 | 28,000 | 42,000 |

| (3) | — |

| $ | 6.25 |

| 02/06/2024 |

| | 02/06/2014 | 32,000 | 48,000 |

| (4) | — |

| $ | 6.25 |

| 02/06/2024 |

| | | | | | | | |

| Dan Hollenbach | 10/27/2015 | 13,000 | 52,000 |

| (5) | — |

| $ | 11.07 |

| 10/27/2025 |

| |

| (*) | Michael A. Rutledge held no options at December 27, 2015. |

| |

| (1) | Nonqualified stock options vested one-fifth on June 9, 2015 and the remainder of the options vest in four equal annual increments beginning on June 9, 2016. |

| |

| (2) | Nonqualified stock options vested in full on the date of grant |

| |

| (3) | Nonqualified stock options vested one-fifth on February 6, 2014 and the remainder of the options vest in four equal annual increments beginning on February 6, 2015. |

| |

| (4) | Incentive stock options vested one-fifth on February 6, 2014 and the remainder of the options vest in four equal annual increments beginning on February 6, 2015. |

| |

| (5) | Incentive stock options vested one-fifth on October 27, 2015 and the remainder of the options vest in four equal annual increments beginning on October 27, 2016. |

Each option is subject to the condition that the optionee will have remained employed by the Company, or any one or more of its subsidiaries, through such vesting dates, and each option is further subject to the terms and conditions set forth in the 2013 Plan and in the applicable Stock Option Agreement.

Vesting Equity Awards

No stock awards were granted to our named executive officers during 2015.

Michael A. Rutledge

Micheal A. Rutledge acquired 20,000 shares our common stock upon the exercise of incentive stock options in a cash exercise, each option with a $6.25 exercise price per share. The value realized on exercise $103,000, which represents the difference between the fair value per share and the exercise price per share, multiplied by the number of shares exercised.

BG STAFFING – 2016 Proxy Statement – 19

2013 Long-Term Incentive Plan

Our Board adopted our 2013 Plan effective December 20, 2013, and was approved by our shareholders on February 6, 2014. Our 2013 Plan provides for the grant of incentive stock options, within the meaning of Section 422 of the Internal Revenue Code, to our employees and any subsidiary corporations’ employees, and for the grant of nonstatutory stock options, restricted stock, RSUs, stock appreciation rights, performance units and performance shares to our employees, directors and consultants and our parent and subsidiary corporations’ employees and consultants.

A total of 900,000 shares of our common stock were originally reserved for issuance pursuant to our 2013 Plan.

Plan Administration. Our Compensation Committee administers our 2013 Plan. In the case of awards intended to qualify as ‘‘performance-based compensation’’ within the meaning of Section 162(m), the committee consists of two or more ‘‘outside directors’’ within the meaning of Section 162(m). Subject to the provisions of our 2013 Plan, the administrator has the power to administer our 2013 Plan, including but not limited to, the power to interpret the terms of our 2013 Plan and awards granted under it, to create, amend and revoke rules relating to our 2013 Plan, and to determine the terms of the awards, including the exercise price, the number of shares subject to each such award, the exercisability of the awards, and the form of consideration, if any, payable upon exercise. The administrator also has the authority to amend existing awards to reduce or increase their exercise prices, to allow participants the opportunity to transfer outstanding awards to a financial institution or other person or entity selected by the administrator and to institute an exchange program by which outstanding awards may be surrendered in exchange for awards of the same type that may have a higher or lower exercise price or different terms, awards of a different type and/or cash.

Stock Options. Stock options may be granted under our 2013 Plan. The exercise price of options granted under our 2013 Plan must at least be equal to the fair market value of our common stock on the date of grant. The term of an incentive stock option may not exceed ten years, except that with respect to any participant who owns more than 10% of the voting power of all classes of our outstanding stock, the term must not exceed five years and the exercise price must equal at least 110% of the fair market value on the grant date. For nonstatutory stock options the exercise price must equal at least 100% of the fair market value. The administrator will determine the methods of payment of the exercise price of an option, which may include cash, shares or other property acceptable to the administrator, as well as other types of consideration permitted by applicable law. After the termination of service of an employee, director or consultant, he or she may exercise his or her option for the period of time stated in his or her option agreement. Generally, if termination is due to death or disability, the option will remain exercisable for 12 months. In all other cases, the option generally will remain exercisable for three months following the termination of service. An option may not be exercised later than the expiration of its term. However, if the exercise of an option is prevented by applicable law the exercise period may be extended under certain circumstances. Subject to the provisions of our 2013 Plan, the administrator determines the other terms of options.

Stock Appreciation Rights. Stock appreciation rights may be granted under our 2013 Plan. Stock appreciation rights allow the recipient to receive the appreciation in the fair market value of our common stock between the exercise date and the date of grant. Stock appreciation rights may not have a term exceeding ten years. After the termination of service of an employee, director or consultant, he or she may exercise his or her stock appreciation right for the period of time stated in his or her stock appreciation rights agreement. However, in no event may a stock appreciation right be exercised later than the expiration of its term. Subject to the provisions of our 2013 Plan, the administrator determines the other terms of stock appreciation rights, including when such rights become exercisable and whether to pay any increased appreciation in cash or with shares of our common stock, or a combination thereof, except that the per share exercise price for the shares to be issued pursuant to the exercise of a stock appreciation right will be no less than 100% of the fair market value per share on the date of grant.

Restricted Stock. Restricted stock may be granted under our 2013 Plan. Restricted stock awards are grants of shares of our common stock that vest in accordance with terms and conditions established by the administrator. The administrator will determine the number of shares of restricted stock granted to any employee, director or consultant and, subject to the provisions of our 2013 Plan, will determine the terms and conditions of such awards. The administrator may impose whatever conditions to vesting it determines to be appropriate (for example, the administrator may set restrictions based on the achievement of specific performance goals or continued service to us); provided, however, that the administrator, in its sole discretion, may accelerate the time at which any restrictions will lapse or be removed. Recipients of restricted stock awards generally will have voting and dividend rights with respect to such shares upon grant without regard to vesting, unless the administrator provides otherwise. Shares of restricted stock that do not vest are subject to our right of repurchase or forfeiture.

BG STAFFING – 2016 Proxy Statement – 20

RSUs. RSUs may be granted under our 2013 Plan. RSUs are bookkeeping entries representing an amount equal to the fair market value of one share of our common stock. Subject to the provisions of our 2013 Plan, the administrator determines the terms and conditions of RSUs, including the vesting criteria (which may include accomplishing specified performance criteria or continued service to us) and the form and timing of payment. Notwithstanding the foregoing, the administrator, in its sole discretion, may accelerate the time at which any restrictions will lapse or be removed.

Performance Units and Performance Shares. Performance units and performance shares may be granted under our 2013 Plan. Performance units and performance shares are awards that will result in a payment to a participant only if performance goals established by the administrator are achieved or the awards otherwise vest. The administrator will establish organizational or individual performance goals or other vesting criteria in its discretion, which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants. After the grant of a performance unit or performance share, the administrator, in its sole discretion, may reduce or waive any performance criteria or other vesting provisions for such performance units or performance shares. Performance units shall have an initial dollar value established by the administrator on or prior to the grant date. Performance shares shall have an initial value equal to the fair market value of our common stock on the grant date. The administrator, in its sole discretion, may pay earned performance units or performance shares in the form of cash, in shares or in some combination thereof.

Outside Directors. Our 2013 Plan provides that all outside directors will be eligible to receive all types of awards (except for incentive stock options) under our 2013 Plan.

Non-Transferability of Awards. Unless the administrator provides otherwise, our 2013 Plan generally does not allow for the transfer of awards and only the recipient of an award may exercise an award during his or her lifetime.

Certain Adjustments. In the event of certain changes in our capitalization, to prevent diminution or enlargement of the benefits or potential benefits available under our 2013 Plan, the administrator will adjust the number and class of shares that may be delivered under our 2013 Plan and/or the number, class and price of shares covered by each outstanding award, and the numerical share limits set forth in our 2013 Plan. In the event of our proposed liquidation or dissolution, the administrator will notify participants as soon as practicable and all awards will terminate immediately prior to the consummation of such proposed transaction.

Merger or Change in Control. Our 2013 Plan provides that in the event of a merger or change in control, as defined under our 2013 Plan, each outstanding award will be treated as our board of directors determines.

Amendment; Termination. The administrator will have the authority to amend, suspend or terminate our 2013 Plan provided such action does not impair the existing rights of any participant. Our 2013 Plan automatically will terminate in 2023, unless we terminate it sooner.

BG STAFFING – 2016 Proxy Statement – 21

RELATED PERSON TRANSACTIONS

Policy on Review and Approval of Transactions with Related Persons

Our Board is currently primarily responsible for developing and implementing processes and controls to obtain information from our directors, executive officers and significant stockholders regarding related-person transactions and then determining, based on the facts and circumstances, whether we or a related person has a direct or indirect material interest in these transactions. Our Audit Committee is responsible for the review, approval and ratification of “related-person transactions” between us and any related person. Under SEC rules, a related person is a director, executive officer, nominee for director or beneficial holder of more than of 5% of any class of our voting securities or an immediate family member of any of the foregoing. In the course of its review and approval or ratification of a related-person transaction, the Audit Committee will consider:

| |

| • | the nature of the related person’s interest in the transaction; |

| |

| • | the material terms of the transaction, including the amount involved and type of transaction; |

| |

| • | the importance of the transaction to the related person and to the Company; |

| |

| • | whether the transaction would impair the judgment of a director or executive officer to act in our best interest and the best interest of our stockholders; and |

| |

| • | any other matters the Audit Committee deems appropriate. |

Any member of the Audit Committee who is a related person with respect to a transaction under review will not be able to participate in the deliberations or vote on the approval or ratification of the transaction. However, such a director may be counted in determining the presence of a quorum at a meeting of the committee that considers the transaction.

In June 2016, we sold an aggregate of 1,191,246 shares of our common stock in a registered underwritten public offering at a price to the public of $14.00 per share. Roth Capital Partners, LLC and Taglich Brothers, Inc. served as book-running managers for the offering, and underwriting discounts and commissions paid by us to Taglich Brothers, Inc. were approximately $625,000. We also issued to Taglich Brothers, Inc. a warrant to purchase 16,125 shares of our common stock at an exercise price of $16.80 per share. The warrants are exercisable in whole or in part at any time commencing on the one-year anniversary of the closing of the offering and expire on the fifth-year anniversary of the closing of the offering. The underwriters in the offering were also reimbursed for out-of-pocket expenses of $120,000 in the aggregate. Michael N. Taglich is a significant stockholder of the Company and is co-founder and a principal and the president and chairman of Taglich Brothers, and Robert F. Taglich, also a significant stockholder of the Company, is co-founder and a principal and a managing director of Taglich Brothers, Inc.

2015 Registered Offering

On May 6, 2015, the Company issued and sold 636,500 shares of common stock, $0.01 par value per share, to various investors in a registered offering for an aggregate purchase price of $7,001,500 in cash. The purchase price was $11.00 per share, which constituted approximately 9.6% of the total of issued and outstanding shares of common stock immediately before the initial execution of the Securities Purchase Agreement. In connection with the closing, we paid Taglich Brothers, Inc., as placement agent, commissions of approximately $420,090.

BG STAFFING – 2016 Proxy Statement – 22

2014 Private Placement

In December 2014, we sold an aggregate of 963,750 shares of our common stock to various accredited investors in a private placement at a price of $9.75 per share. In connection with the private placement, we paid Taglich Brothers, Inc., as placement agent, commissions of approximately $751,725. We also issued to designees of Taglich Brothers warrants to purchase 96,375 shares of our common stock. The warrants are exercisable at any time commencing on the sixth month anniversary of the issuance date in whole or in part, at an initial exercise price per share of $9.75, and may be exercised in a cashless exercise. The exercise price and number of shares of common stock issuable under the warrants are subject to adjustments for stock dividends, splits, combinations and similar events. The warrants expire on the fifth anniversary of the date of issuance. The holders of the warrants are also entitled to certain registration rights.

BG STAFFING – 2016 Proxy Statement – 23

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based on a review of reports filed by our directors, executive officers, and beneficial owners of more than 10% of our shares of common stock pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, and other information available to us, we believe that all such ownership reports required to be filed by those reporting persons during and with respect to the 2015 fiscal year were timely made.

BG STAFFING – 2016 Proxy Statement – 24

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of June 15, 2016 by:

| |

| • | each person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

| |

| • | each of our named executive officers and directors; and |

| |

| • | all our executive officers and directors as a group. |

Each stockholder’s percentage ownership is based on 8,590,008 shares of common stock outstanding as of June 15, 2016.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Except as otherwise indicated, each person or entity named in the table has sole voting and investment power with respect to all shares of our capital shown as beneficially owned, subject to applicable community property laws.

The number and percentage of shares beneficially owned by a person includes shares that may be acquired by such person within 60 days of June 15, 2016 through the exercise of vested options or warrants, while these shares are not counted as outstanding for computing the percentage ownership of any other person.

Except as otherwise set forth below, the address of the persons below is c/o BG Staffing, Inc., 5850 Granite Parkway Drive, Suite 730, Plano, Texas 75024.

|

| | | | | | |

| Name of Beneficial Owner | | Shares of

Common

Beneficially

Stock Owned | | Percent of

Common Stock

Beneficially

Owned |

| | | | | | |

| Dan Hollenbach | | 13,000 | (1) | | * |

|

| L. Allen Baker, Jr. | | 472,192 | (2) | | 5.3 | % |

| Douglas E. Hailey | | 110,394 | (3) | | 1.3 | % |

| Richard L. Baum, Jr. | | 83,471 | (4) | | 1.0 | % |

| C. David Allen, Jr. | | 7,125 | (5) | | * |

|

| Paul A. Seid | | 77,022 | (6) | | * |

|

| All executive officers and directors as a group (6 total) | | 763,204 | | | 8.5 | % |

| Michael A. Rutledge | | 20,050 | | | * |

|

Michael N. Taglich (9) | | 621,534 | (7) | | 7.2 | % |

Robert F. Taglich (9) | | 474,867 | (8) | | 5.5 | % |

|

| |

| * | Less than 1%. |

| (1) | Includes 13,000 shares of common stock issuable upon exercise of stock options. |

| (2) | Includes 289,673 shares of common stock issuable upon exercise of stock options and 182,519 shares of common stock held by a trust. |

| (3) | Includes 18,623 shares of common stock issuable upon exercise of stock options. |

| (4) | Includes 7,125 shares of common stock issuable upon exercise of stock options, 65,111 shares of common stock held by a private investment company controlled by Mr. Baum, and 5,388 shares of common stock held by a family trust.

|

BG STAFFING – 2016 Proxy Statement – 25

|

| |

| (5) | Includes 7,125 shares of common stock issuable upon exercise of stock options. |

| (6) | Includes 7,125 shares of common stock issuable upon exercise of stock options. |

| (7) | Includes 41,870 shares of common stock held by a private investment company controlled by Mr. Taglich, 10,000 shares of common stock held by a partnership 50% controlled by Mr. Taglich, 63,433 shares of common stock registered in the name of an individual third party but over which Mr. Taglich has voting and investment control, 34,777 shares of common stock issuable upon exercise of warrants to purchase shares of common stock, and 12,204 shares of common stock held by Mr. Taglich as custodian for third parties. |

| (8) | Includes 220 shares of common stock registered in the name of an individual third party but over which Mr. Taglich has voting and investment control, 10,000 shares of common stock held by a partnership 50% controlled by Mr. Taglich, 31,257 shares of common stock issuable upon exercise of warrants to purchase shares of common stock, and 4,950 shares of common stock held by Mr. Taglich as custodian for third parties. |

| (9) | The address of Michael N. Taglich and Robert F. Taglich is c/o Taglich Brothers, Inc., 790 New York Avenue, Suite 209, Huntington, New York 11743. |

BG STAFFING – 2016 Proxy Statement – 26

SUBMISSION OF STOCKHOLDER PROPOSALS