UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 001-34564

CHINA NUOKANG BIO-PHARMACEUTICAL INC.

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name Into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

No. 18-1 East Nanping Road

Hunnan National New & High-tech Development Zone

Shenyang, Liaoning Province

People’s Republic of China 110171

(Address of Principal Executive Offices)

Tianruo Pu, Chief Financial Officer

No. 18-1 East Nanping Road

Hunnan National New & High-tech Development Zone

Shenyang, Liaoning Province

People’s Republic of China 110171

Tel: +86-024-2469-6033

Fax: +86-024-2469-6133

E-mail: info@lnnk.net

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| American Depositary Shares, each representing eight ordinary shares, par value $0.0005 per share | | The NASDAQ Stock Market LLC (The NASDAQ Global Market) |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

158,420,142 ordinary shares, par value $0.0005 per share, as of December 31, 2009.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x | | | | |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP x International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ Other ¨

* If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

TABLE OF CONTENTS

2

INTRODUCTION

Unless the context otherwise requires, in this annual report on Form 20-F:

| | • | | “we,” “us,” “our company,” and “our” refer to China Nuokang Bio-Pharmaceutical Inc., its predecessor entities, subsidiaries and consolidated entities; |

| | • | | “China” or “PRC” refers to the People’s Republic of China, excluding Taiwan, Hong Kong and Macau; |

| | • | | “ADSs” refers to American Depositary Shares, each representing eight of our ordinary shares; |

| | • | | “Renminbi” or “RMB” refers to the legal currency of China; and |

| | • | | “$” or “U.S. dollars” refers to the legal currency of the United States. |

Names of certain companies provided in this annual report are translated or transliterated from their original Chinese legal names.

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2007, 2008 and 2009.

We and certain selling shareholders of our company completed the initial public offering of 5,000,000 ADSs on December 15, 2009. On December 9, 2009, we listed our ADSs on the NASDAQ Global Market under the symbol “NKBP.”

3

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

The words “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” and other similar expressions may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements about:

| | • | | competition from other domestic and foreign pharmaceutical companies; |

| | • | | our ability to enhance existing products and develop, obtain government approvals for, and market future generations of our existing products and other new products; |

| | • | | the expected market growth for pharmaceutical products in China; |

| | • | | market acceptance of our products; |

| | • | | our expectations regarding hospital or patient demand for our products; |

| | • | | our ability to expand our production, sales and distribution network and other aspects of our operations; |

| | • | | our ability to diversify our product range; |

| | • | | our ability to effectively protect our intellectual property; |

| | • | | our ability to identify and acquire new medical technologies, pharmaceutical products and product candidates; |

| | • | | changes in the healthcare industry in China, including changes in the healthcare policies and regulations of the PRC government and changes in the healthcare insurance sector in the PRC; |

| | • | | fluctuations in general economic and business conditions in China; and |

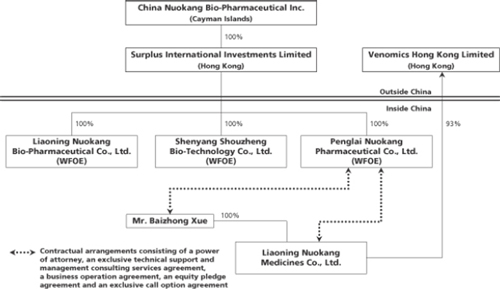

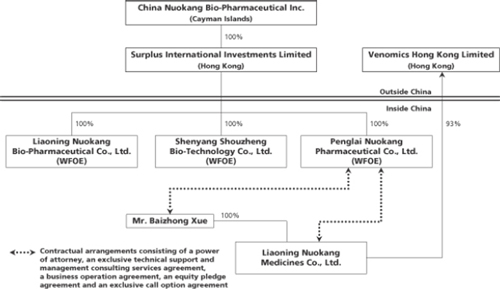

| | • | | our ability to control Liaoning Nuokang Medicines Co., Ltd., or Nuokang Distribution, our variable interest entity, through contractual arrangements. |

You should thoroughly read this annual report and the documents that we refer to with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements. We would like to caution you not to place undue reliance on forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3.D. Key Information — Risk Factors” of this annual report. Those risks are not exhaustive. We operate in an emerging and evolving environment. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, and we cannot assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to materially differ from results contained in any forward-looking statement.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required under applicable law.

4

PART I

| Item 1. | IDENTITYOF DIRECTORS, SENIOR MANAGEMENTAND ADVISERS |

Not Applicable.

| Item 2. | OFFER STATISTICSAND EXPECTED TIMETABLE |

Not Applicable.

A. Selected Financial Data

We have derived our consolidated statement of income data for the years ended December 31, 2007, 2008 and 2009 and our consolidated balance sheet data as of December 31, 2008 and 2009 from our audited consolidated financial statements included in this annual report. Our selected consolidated statement of income data for the year ended December 31, 2005 and 2006 and our consolidated balance sheet data as of December 31, 2005, 2006 and 2007 have been derived from our audited consolidated financial statements not included in this annual report. Our historical operating results presented below are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2010 or any other future fiscal period. Our financial statements have been prepared in accordance with the accounting principles generally accepted in the United States, or U.S. GAAP. You should read the selected consolidated financial data set forth below in conjunction with “Item 5. Operating and Financial Review and Prospects – A. Operating Results” and with our consolidated financial statements and related notes included in this annual report.

| | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | RMB | | | $ | |

| | | (in thousands, except share and per share data and percentages) | |

Consolidated Statement of Income Data: | | | | | | | | | | | | | | | | | | |

Net revenue | | 129,422 | | | 121,661 | | | 147,875 | | | 225,399 | | | 282,911 | | | 41,447 | |

Cost of revenue | | (52,826 | ) | | (44,083 | ) | | (34,745 | ) | | (30,963 | ) | | (35,625 | ) | | (5,219 | ) |

| | | | | | | | | | | | | | | | | | |

Gross profit | | 76,596 | | | 77,578 | | | 113,130 | | | 194,436 | | | 247,286 | | | 36,228 | |

Operating expenses: | | | | | | | | | | | | | | | | | | |

Research and development costs | | (6,422 | ) | | (6,054 | ) | | (7,995 | ) | | (5,585 | ) | | (8,297 | ) | | (1,216 | ) |

Sales, marketing and distribution expenses | | (22,427 | ) | | (23,173 | ) | | (52,443 | ) | | (92,404 | ) | | (110,513 | ) | | (16,190 | ) |

General and administrative expenses | | (17,275 | ) | | (14,809 | ) | | (16,796 | ) | | (31,884 | ) | | (47,582 | ) | | (6,971 | ) |

| | | | | | | | | | | | | | | | | | |

Total operating expenses | | (46,124 | ) | | (44,036 | ) | | (77,234 | ) | | (129,873 | ) | | (166,392 | ) | | (24,377 | ) |

| | | | | | | | | | | | | | | | | | |

Operating profit | | 30,472 | | | 33,542 | | | 35,896 | | | 64,563 | | | 80,894 | | | 11,851 | |

Interest income | | 44 | | | 47 | | | 196 | | | 1,259 | | | 1,372 | | | 201 | |

Interest expense | | (1,248 | ) | | (1,672 | ) | | (5,190 | ) | | (1,309 | ) | | (3,327 | ) | | (487 | ) |

Other (expenses) income, net | | (346 | ) | | (344 | ) | | 2,191 | | | 6,353 | | | 3,014 | | | 441 | |

| | | | | | | | | | | | | | | | | | |

Income before income tax expense and non-controlling interest | | 28,922 | | | 31,573 | | | 33,093 | | | 70,866 | | | 81,953 | | | 12,006 | |

5

| | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | RMB | | | RMB | | | RMB | | | RMB | | | RMB | | | $ | |

| | | (in thousands, except share and per share data and percentages) | |

Income tax (expense) benefit | | (7,042 | ) | | (6,181 | ) | | 2,102 | | | (7,246 | ) | | (16,858 | ) | | (2,470 | ) |

Non-controlling interest | | (3,359 | ) | | 912 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

Net income | | 18,521 | | | 26,304 | | | 35,195 | | | 63,620 | | | 65,095 | | | 9,536 | |

Accretion of Series A convertible redeemable preference shares | | — | | | — | | | (30,156 | ) | | (13,403 | ) | | (13,886 | ) | | (2,034 | ) |

Allocation to Series A convertible redeemable preference shares for participating rights to dividends | | — | | | — | | | (326 | ) | | (9,458 | ) | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

Net income attributed to ordinary shares | | 18,521 | | | 26,304 | | | 4,713 | | | 40,759 | | | 51,209 | | | 7,502 | |

| | | | | | | | | | | | | | | | | | |

Net income per share | | | | | | | | | | | | | | | | | | |

Basic | | 0.19 | | | 0.26 | | | 0.05 | | | 0.43 | | | 0.52 | | | 0.08 | |

Diluted | | 0.19 | | | 0.26 | | | 0.05 | | | 0.43 | | | 0.51 | | | 0.08 | |

Shares used in net income per share computation | | | | | | | | | | | | | | | | | | |

Basic | | 100,000,000 | | | 100,000,000 | | | 99,850,334 | | | 95,447,648 | | | 98,885,045 | | | 98,885,045 | |

Diluted | | 100,000,000 | | | 100,000,000 | | | 99,850,334 | | | 95,460,841 | | | 99,725,253 | | | 99,725,253 | |

Pro forma net income per share (unaudited) | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | 0.28 | | | 0.52 | | | | | | | |

Diluted | | | | | | | | 0.28 | | | 0.52 | | | | | | | |

Shares used in pro forma net income per share computation (unaudited) | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | 125,646,996 | | | 121,244,310 | | | | | | | |

Diluted | | | | | | | | 125,646,996 | | | 121,257,503 | | | | | | | |

6

| | | | | | | | | | | | |

| | | As of December 31, |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| | | RMB | | RMB | | RMB | | RMB | | RMB | | $ |

| | | (in thousands) |

Consolidated Balance Sheet Data: | | | | | | | | | | | | |

Cash and cash equivalents | | 18,197 | | 2,395 | | 112,589 | | 81,837 | | 351,258 | | 51,460 |

Restricted cash | | — | | 2,400 | | — | | 20,000 | | 34,200 | | 5,010 |

Accounts receivable | | 12,482 | | 14,569 | | 30,417 | | 71,312 | | 103,719 | | 15,195 |

Inventories | | 26,212 | | 21,585 | | 7,034 | | 10,610 | | 14,765 | | 2,163 |

Property, plant and equipment | | 27,294 | | 53,614 | | 119,029 | | 149,679 | | 163,915 | | 24,014 |

Total assets | | 112,783 | | 152,704 | | 320,724 | | 405,031 | | 781,454 | | 114,484 |

Short-term bank loans | | 30,580 | | 18,380 | | 50,380 | | 72,430 | | 125,618 | | 18,403 |

Total current liabilities | | 77,378 | | 78,210 | | 95,293 | | 119,760 | | 167,246 | | 24,502 |

Total shareholders’ equity | | 28,483 | | 53,872 | | 77,157 | | 127,721 | | 580,384 | | 85,027 |

Total liabilities and shareholders’ equity | | 112,783 | | 152,704 | | 320,724 | | 405,031 | | 781,454 | | 114,484 |

Exchange Rate Information

Our business is primarily conducted in China and all of our revenues are denominated in RMB. This annual report contains translations of RMB amounts into U.S. dollars at specific rates solely for the convenience of the readers. Unless otherwise noted, all translations from RMB to U.S. dollars in this annual report were made at a rate of RMB6.8259 to US$1.00, the noon buying rate in effect as of December 31, 2009 in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade. On May 28, 2010, the noon buying rate was RMB6.8305 to US$1.00.

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our future periodic reports or any other information to be provided to you. The source of these rates is the Federal Reserve Bank of New York.

7

| | | | | | | | |

| | | Noon Buying Rate

(RMB per US$1.00) |

Period | | Period

End | | Average(1) | | Low | | High |

2005 | | 8.0702 | | 8.1826 | | 8.2765 | | 8.0702 |

2006 | | 7.8041 | | 7.9579 | | 8.0702 | | 7.8041 |

2007 | | 7.2946 | | 7.5806 | | 7.8127 | | 7.2946 |

2008 | | 6.8225 | | 6.9193 | | 7.2946 | | 6.7800 |

2009 | | 6.8259 | | 6.8295 | | 6.8470 | | 6.8176 |

November | | 6.8265 | | 6.8271 | | 6.8300 | | 6.8255 |

December | | 6.8259 | | 6.8275 | | 6.8299 | | 6.8244 |

2010 | | | | | | | | |

January | | 6.8268 | | 6.8269 | | 6.8295 | | 6.8258 |

February | | 6.8258 | | 6.8285 | | 6.8330 | | 6.8258 |

March | | 6.8258 | | 6.8262 | | 6.8270 | | 6.8254 |

April | | 6.8247 | | 6.8256 | | 6.8275 | | 6.8229 |

May (through May 28, 2010) | | 6.8305 | | 6.8275 | | 6.8310 | | 6.8245 |

| (1) | Annual averages are calculated using the average of month-end rates of the relevant year. Monthly averages are calculated using the average of the daily rates during the relevant period. |

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

Risks Related to Our Business

We are dependent and expect to continue to be dependent on the revenue contribution from our flagship product, Baquting. A reduction in Baquting sales would cause our revenues to decline and materially harm our business.

We are largely dependent on sales of our hemocoagulase product, which we market under the name of Baquting. We launched Baquting in November 2001. In 2007, 2008 and 2009, we sold 6.3 million, 9.7 million and 13.1 million units of Baquting, respectively. Revenues from Baquting sales accounted for 91.5%, 90.1% and 93.5% of our total revenues in 2007, 2008 and 2009, respectively. We plan to dedicate additional resources toward maintaining and expanding Baquting’s market share, such as for improved quality control, production technology and formulation and dosage upgrades and modifications. Sales of Baquting will continue to comprise a substantial portion of our revenues in the future.

Any reduction in revenues from Baquting will have a direct negative impact on our business, financial condition and results of operations. Baquting sales could be adversely affected by a variety of factors, including:

| | • | | new product introductions to the market; |

8

| | • | | government-imposed pricing constraints; |

| | • | | problems with raw material supplies; |

| | • | | disruptions in manufacturing or distribution; |

| | • | | newly discovered safety issues arising from misuse of or adverse reactions from our products; and |

| | • | | intellectual property issues. |

Because of our relative lack of product diversification, an investment in our company may entail more risk than investments in companies that offer a wider variety of products or services. Despite our efforts, we may be unable to develop or acquire new products that would enable us to diversify our business and reduce our dependence on Baquting.

The commercial success of our products depends upon the degree of their market acceptance by the medical community. If our products do not attain market acceptance by the medical community, our operations and profitability would be adversely affected.

The commercial success of our products depends upon the degree of market acceptance they receive from the medical community, particularly physicians and hospital administrators. Physicians may not prescribe or recommend our products to patients and hospital procurement departments may not purchase our products if physicians or hospital pharmacists do not find our products attractive. The acceptance and use of our products by the medical community depend upon a number of factors, including:

| | • | | perceptions of physicians, patients and other members of the medical community regarding the safety and effectiveness of our products; |

| | • | | the prevalence and severity of any side effects; |

| | • | | the efficacy, pharmacological benefit and potential advantages of our products relative to competing products and products under development; |

| | • | | the relative convenience and ease of administration of our products; |

| | • | | effectiveness of our and our distributors’ education, marketing and distribution efforts; |

| | • | | publicity concerning our products or competing products; and |

| | • | | the price for our products and competing products. |

In addition, the continued success of Baquting depends in part upon perceptions of blood transfusion risk and blood supply quality in China. If our products fail to gain market acceptance by the medical community, or if our currently marketed products cannot maintain market acceptance, our results of operations and profitability would be adversely affected.

9

We may not be able to obtain manufacturing or marketing approvals for our products, including Aiduo, Aiwen and Kaitong, or pass on-site inspections of our production facilities. Failure to obtain approvals for our products or pass on-site inspections of our production facilities could materially harm our operations and business prospects.

All medicines must be approved by the PRC State Food and Drug Administration, or the SFDA, before they can be manufactured, marketed or sold in the PRC. The SFDA requires a pharmaceutical manufacturer to successfully complete clinical trials of a new medicine and demonstrate its manufacturing capability before granting manufacturing approval for the new medicine. Clinical trials are expensive and their results are uncertain. In addition, the SFDA and other regulatory authorities may apply new standards for safety, manufacturing, labeling, marketing and distribution of future products. Complying with these standards may be time-consuming and expensive. Furthermore, our future products may not be efficacious or may have undesirable or unintended side effects, toxicities or other characteristics that may preclude us from obtaining approval or may prevent or limit their commercial use. As a result, we may not be able to obtain SFDA or other governmental approvals for our future products on a timely basis or at all.

In particular, Jilin Yuhua Pharmaceutical Co., Ltd., or Jilin Yuhua, our manufacturer and distributor for Kaitong, requires a permit for its production facility to produce Kaitong. In March 2010, Jilin Yuhua received a request from the SFDA for supplementary chemical manufacturing control data on Kaitong and was informed that SFDA review of Kaitong will take longer than initially anticipated due to additional review time of this supplemental data. If the production permit for Kaitong is delayed or not granted at all, Jilin Yuhua will be unable to commence its production and we will be unable to launch Kaitong in the market. In addition, we submitted our bioequivalence clinical trial data for dipyridamole aspirin sustained release capsules to the SFDA in December 2007, and we received an SFDA request in June 2009 for supplementary research data. We are in process of compiling this data and expect to receive SFDA approval for this product in 2010. However, we or Jilin Yuhua may not be able to obtain approvals for these products on a timely basis, or at all. Even if we or Jilin Yuhua do obtain these approvals, such approvals may be modified or revoked or subject to limitations on the indicated uses for which we may market the product, which may limit the size of its market. We will not be able to manufacture and market our new products or at all if we do not obtain require governmental approvals.

Furthermore, even after we obtain such approvals, we may not be able to pass the on-site inspections of our facilities required prior to the launch of our products. For example, in 2004, we entered into agreements for the acquisition of Aiduo and Aiwen from Shenyang Guangda Pharmaceutical Co., Ltd., or Shenyang Guangda, and Shenyang Wanjia Biotechnology Research Institute, or Shenyang Wanjia. We require approval from the SFDA for the transfer of the production permit for Aiduo and Aiwen from Shenyang Guangda to us and Good Manufacturing Practice, or GMP, certification for our Shenyang facility in order to complete the acquisition of Aiduo and Aiwen from Shenyang Guangda and to commence production of these products at our production facility. If we fail to pass the on-site inspection in connection with our production permit application, we will not be able to obtain the production permit and commence production. If we fail to pass the on-site inspection in connection with GMP certification, we will not be able to obtain a GMP certificate, which is required for pharmaceutical production and sale. GMP certificates are subject to review and renewal every five years. See “Item 4. Information on the Company – B. Business Overview — Certificates and Permit” for a description of our current licenses and permits. Failure to obtain or renew approvals for our existing or future products or pass on-site inspections of our facilities could materially harm our business and operations.

10

Selling prices of our products may decline over time. Our success depends on our ability to successfully develop and commercialize biopharmaceutical products. Our product development efforts may not result in commercially viable products.

As is typical in the Chinese pharmaceutical industry, the average selling prices of biopharmaceutical products may decline significantly over the life of the product. These declines principally result from increased competition and price controls. Historically, the average selling prices of our products have not declined significantly. However, there may be a material decline of selling prices in the future. We have sought to mitigate downward pricing pressure by introducing new products or enhanced versions of existing products with higher margins. We must therefore constantly identify product candidates that can be developed into cost-effective therapeutic products. We have devoted substantial resources to our research and development efforts; however, successful product development in our industry is highly uncertain, and relatively few research and development projects produce commercially viable products. If we cannot offset declines in revenues from and margins of our existing products with new products, our overall results of operations will suffer.

Our products face substantial competition. Our competitors may discover, develop, acquire or commercialize products earlier or more successfully than we do.

We operate in a highly competitive environment and our products compete with other products or treatments. Baquting competes with existing hemocoagulase products and potential new drug candidates. In China, our major competitors in the hemocoagulase market include Aohong Pharma’s Bangting, Solco Basel’s Reptilase and Lee’s Pharm’s Sulejuan, which in 2009 held approximately 28%, 23% and 12% market share, by volume, respectively. Our products may compete against products with lower prices, superior performance, greater ease of administration or other advantages compared to our products. We do not have patents of any commercial significance for many of our products and product candidates to protect these products and product candidates from direct competition. Our inability to compete effectively could reduce sales or margins, which could materially and adversely affect our results of operations.

Certain of our competitors market products or are actively engaged in research and development in areas where we have products or where we are developing product candidates or new indications, or usage purposes, for existing products. Our products compete with new drugs in development, drugs that may be approved for the same indications as our products and drugs approved for other indications that are used off-label. Additionally, an increasing number of foreign pharmaceutical companies have introduced their pharmaceutical products into the Chinese market. If less expensive alternatives to our products are dispensed or prescribed to patients, our sales may be adversely impacted.

Large Chinese state-owned and privately owned pharmaceutical companies and foreign-invested or foreign pharmaceutical companies may have greater clinical, research, regulatory, manufacturing, marketing, financial and human resources than we do. In addition, certain of our competitors may have technical or competitive advantages over us with respect to the development of technologies and processes. These resources may make it difficult for us to compete with them to successfully discover, develop and market new products and for our current products to compete with new products or indications that these competitors may bring to market. Our competitors in the pharmaceutical industry may also consolidate and acquire market share.

11

Furthermore, in order to gain market share in China, competitors may significantly increase their advertising expenditures and promotional activities or engage in irrational or predatory pricing behavior. In addition, our competitors may engage in inappropriate competitive practices or illegal acts, such as bribery. Third parties may actively engage in activities designed to undermine our brand name and product quality or to influence customer confidence in our products. Increased competition may result in price reductions, reduced margins and loss of market share, any of which could materially adversely affect our profit margins. We may not be able to compete effectively against current and future competitors, which may harm our business and operations.

Our business depends on our well-known brands such as Nuokang and Baquting, and if we are not able to maintain and enhance our brand recognition to maintain our competitive advantage, our reputation, business and operating results may be harmed.

We believe that market awareness of our Nuokang and Baquting brands has contributed significantly to our success, and that maintaining and enhancing these brands is critical to maintaining our competitive advantage. We may not be successful in promoting our brands. If we are unable to enhance our brand recognition and increase awareness of our products, or if we incur excessive expenses to maintain our brand awareness, our business and results of operations may be materially and adversely affected. Furthermore, our sales and results of operations could be adversely affected if our brands or reputation are impaired by actions taken by our distributors, competitors, third-party marketing firms or relevant regulatory authorities.

Pricing of our principal products is subject to government approval. Changes in government control on prices of our products may limit our profitability or cause us to stop manufacturing certain products.

The prices of pharmaceutical products listed in the PRC national medical insurance catalog and certain other medicines are subject to the regulation of the PRC National Development and Reform Commission, or NDRC, and relevant authorized provincial or local price control authorities, in the form of fixed prices or price ceilings. From time to time, the NDRC publishes a list of medicines subject to price controls. Our principal product, Baquting, and the product candidate under our exclusive distributorship, Kaitong, are subject to price ceilings set by the NDRC. The limitation on our ability to raise the wholesale prices of our products may prevent us from absorbing or offsetting any increase in the costs of producing our products, which would lower our margins. Additionally, we are required to file the prices of Aiduo, Aiwen and our other products with provincial price control authorities. In aggregate, seven out of 14 of our products, sales of which accounted for 97.6%, 94.2% and 96.5% of our total sales in 2007, 2008 and 2009, respectively, are subject to price controls imposed by the NDRC and provincial price control authorities. Furthermore, the prices of our products may be adjusted downward by the relevant governmental authorities in the future. In May 2007, the NDRC lowered the price ceilings of 260 medicines in China in response to a rapid increase in the medicine prices, resulting in an average reduction of 19% in retail prices of medicines affected. As a result, the maximum retail price at which hemocoagulase products such as Baquting may be sold to patients was reduced from RMB56.7 per unit to RMB51.6 per unit in May 2007. If we are required to lower wholesale prices of our principal products in the future as a result of any government-mandated reduction in the price ceilings, our future results of operation and profitability would be adversely affected. In addition, in order to access certain local or provincial-level markets, we are required to enter into competitive bidding processes with a pre-defined price range for Baquting, Aiduo, Aiwen and our other products every one or two years. The competitive bidding effectively sets price ceilings for our products, thereby limiting our profitability. We may stop manufacturing of certain products of its price range designated by the local or provincial government falls below production costs.

12

Reimbursement may not be available for our products, which could diminish our sales or affect our ability to sell our products profitably.

Market acceptance and sales of our products depend to a large extent on the reimbursement policies of the PRC government. The PRC Ministry of Labor and Social Security or provincial or local labor and social security authorities, together with other government authorities, review the inclusion or removal of drugs from the national medical insurance catalog or provincial or local medical insurance catalogs for the National Medical Insurance Program every two years, and the tier under which a drug will be classified, both of which affect the amounts reimbursable to program participants for their purchases of those medicines. These determinations are made based on a number of factors, including price and efficacy of the drug. Depending on the tier under which a drug is classified in the provincial medicine catalog, a National Medical Insurance Program participant residing in that province can be reimbursed for the full cost of Tier 1 medicine and for 80% to 90% of the cost of Tier 2 medicine. Our principal product, Baquting, and the product candidate under our exclusive distributorship, Kaitong, are currently included in the national medical insurance catalog as Tier 2 medicines. Aiduo and Aiwen are Tier 2 medicines in the Zhejiang, Hubei, Gansu, Hunan and Ningxia provincial medical insurance catalogs and the Changchun municipal medicine catalog. If our products are removed from medical insurance catalogs by relevant government authorities, sales of these products and our revenues in turn may be materially adversely affected. Furthermore, if our new products are not included in national, provincial or local medical insurance catalogs, sales of these products may be materially adversely affected.

The growth and success of our business depends on our ability to successfully market our principal products to hospitals and their selection in tender processes used by hospitals for medicine purchases.

Our future growth and success significantly depend on our ability to successfully market Baquting, Aiduo and Aiwen to hospitals as prescription medicines. In 2007, 2008 and 2009, substantially all of the end-customers of Baquting, Aiduo and Aiwen were hospitals. Hospitals may make bulk purchases of a medicine included in the national and provincial medicine catalogs only if that medicine is selected under a government-administered tender process. Every one or two years, bidding is organized on a provincial or municipal basis. A medicine manufacturer is invited to participate in the tender based on the level of interest that hospitals have in purchasing the medicine. A hospital’s interest in a medicine is evidenced by:

| | • | | the inclusion of the medicine on the hospital’s formulary, which lists medicines its physicians may prescribe; and |

| | • | | the willingness of physicians at this hospital to prescribe this medicine to their patients. |

13

We believe that effective marketing efforts are critical to maintaining hospital interest in Baquting, Aiduo and Aiwen. If our marketing efforts are ineffective, hospital administrators may not want to include Baquting, Aiduo and Aiwen in their formularies and physicians may not be interested in prescribing Baquting, Aiduo or Aiwen to their patients, which decreases our chances of being invited to and succeeding at tenders. As a result, we may find it difficult to maintain the existing level of sales of our products, and our revenues and profitability may decline.

Rapid changes in the pharmaceutical industry may render our products obsolete.

The pharmaceutical industry is characterized by rapid changes in technology, constant enhancement of industrial know-how and frequent emergence of new products. Future technological improvements and continual product developments in the pharmaceutical market may render our existing products obsolete or affect our viability and competitiveness. Therefore, our future success will largely depend on our ability to:

| | • | | improve our existing products; |

| | • | | diversify our product portfolio; and |

| | • | | develop new and competitively priced products which meet the requirements of the constantly changing market. |

If we fail to respond to this environment by improving our existing products or developing new products in a timely fashion, or if our new or improved products do not achieve adequate market acceptance, our business and profitability may be materially and adversely affected.

The recent global economic and financial market crisis has had and could continue to have a material adverse effect on our business, financial condition, results of operations and cash flow.

The recent global economic and financial market crisis has caused, among other things, a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, lower consumer and business spending, and lower consumer net worth, in the United States and other parts of the world. This global economic and financial market crisis may impair our ability to raise funds through capital market transactions or enter into other financial arrangements if and when additional funds become necessary for our operations. The recent economic and financial market crisis has caused, among other things, lower customer spending across China. People may have diminished financial resources to purchase even critical medical care, which could lead to reduced demand for our products and reduced gross margins. In addition, some of our distributors and their customers, primarily hospitals and other healthcare institutions, have been adversely affected by the recent economic crisis, resulting in delays in payment to us or defaults of payments by our distributor customers. Our accounts receivable net of allowance for doubtful accounts increased from RMB71.3 million as of December 31, 2008 to RMB103.7 million ($15.2 million) as of December 31, 2009 and our receivable turnover days increased from 89 days in the year ended December 31, 2008 to 112 days in the year ended December 31, 2009. Our accounts receivable may also continue to increase in the near future. Therefore, the global economic and financial market crisis has had and could continue to have a material adverse effect on our business, financial condition, results of operations and cash flow. In addition, the timing and nature of any recovery in the economic and financial markets remains uncertain, and there can be no assurance that market conditions will improve in the near future or that our results will not continue to be materially and adversely affected.

14

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We commenced operations in 1997 and have gradually built up our research, development, manufacturing, sales and marketing capabilities. We have a limited operating history under our current business model upon which you can evaluate the viability and sustainability of our business. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by other China-based early stage pharmaceutical companies. If we are unsuccessful in addressing any of these risks and uncertainties, our business, financial condition, results of operations and future growth would be adversely affected.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for, and made disclosures in this annual report regarding, timing of the accomplishment of objectives material to our success, such as the commencement and completion of pre-clinical tests, clinical trials, anticipated regulatory submission and approval dates and timing of product launches. As a public U.S.-listed company, we anticipate that we will make additional announcements in our public reports and in press releases regarding these events. The actual timing of these events can vary dramatically due to factors beyond our control, such as delays or failures in our pre-clinical tests or clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize our products. There can be no assurance that our pre-clinical tests or clinical trials will be completed as planned or at all, that we will make regulatory submissions or receive regulatory approvals as planned or that we will be able to adhere to our current schedule for the launch of any of our products. If we fail to achieve one or more of these milestones as planned, the price of our shares could decline.

New product development in the pharmaceutical industry is time-consuming and costly and has a low rate of successful commercialization.

Our success will depend in part on our ability to enhance our existing products and to develop new products. The development process for pharmaceutical products is complex and uncertain, as well as time-consuming and costly. Relatively few research and development programs produce a commercial product. A product candidate that appears promising in the early phases of development may fail to reach the market for a number of reasons, such as:

| | • | | the failure to demonstrate safety and efficacy in preclinical and clinical trials; |

| | • | | the failure to obtain approvals for intended use from relevant regulatory bodies, such as the SFDA; |

| | • | | our inability to manufacture and commercialize sufficient quantities of the product economically; and |

15

| | • | | proprietary rights, such as patent rights, held by others to our product candidates and their refusal to sell or license such rights to us on reasonable terms, or at all. |

In addition, product development requires the accurate assessment of market trends. We cannot assure you that:

| | • | | our new product research and development efforts will be successfully and timely completed; |

| | • | | our clinical trials on humans for our product candidate will be successful; |

| | • | | SFDA or other regulatory bodies will grant necessary regulatory clearances or approvals on a timely basis, or at all; or |

| | • | | any product we develop will be commercialized or achieve market acceptance. |

Delays in any part of the development process or our inability to obtain regulatory approval of our products could adversely affect our operating results by restricting or delaying our introduction of new products. Even if we successfully commercialize new products, these products may address markets that are currently being served by our mature products and may result in a reduction in the sales volume of our mature product or vice versa. Failure to develop, obtain necessary regulatory clearances or approvals for or successfully commercialize or market potential new products or technologies could have a material adverse effect on our financial condition and results of operations.

We will not be able to commercialize our product candidates if our preclinical studies do not produce successful results or our clinical trials do not demonstrate safety and efficacy in humans.

Before obtaining regulatory approvals for the manufacturing and sale of our product candidates, we must conduct, at our own expense, extensive preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of our product candidates. Preclinical and clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and interim results of a clinical trial do not necessarily predict final results. A failure of one or more of our clinical trials can occur at any stage of testing. We may experience numerous unforeseen events during, or as a result of, preclinical testing and the clinical trial process that could delay or prevent our ability to receive regulatory approval or commercialize our product candidates, including the following:

| | • | | our preclinical tests or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical testing or clinical trials, or we may abandon projects that appear promising; |

| | • | | we might have to suspend or terminate our clinical trials if the participating patients are being exposed to unacceptable health risks; |

| | • | | regulators may require that we hold, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or safety concerns; |

16

| | • | | the time or cost of our clinical trials may be greater than we currently anticipate; |

| | • | | any regulatory approval we ultimately obtain may be limited or subject to restrictions or post-approval commitments that render the product not commercially viable; and |

| | • | | our product candidates may produce undesirable side effects or may have other unexpected characteristics. |

If we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete our clinical trials or other testing or if the results of these trials or tests are not positive or are only modestly positive, we may:

| | • | | be delayed in obtaining approval for our product candidates; |

| | • | | not be able to obtain approval; or |

| | • | | obtain approval for indications that are not as broad as intended. |

Our product development costs will also increase if we experience delays in testing or approvals. We do not know whether planned clinical trials will begin as planned, will need to be restructured or will be completed on schedule, if at all. Significant clinical trial delays also could allow our competitors to bring products to market before we do and impair our ability to commercialize our products or product candidates.

If we are unable to protect our products through intellectual property rights, our competitors may compete directly against us.

Our success depends, in part, on our ability to protect our products from competition by establishing, maintaining and enforcing intellectual property rights. We seek to protect the products and technology that we consider important to our business by filing PRC and international patent applications, relying on trade secrets or pharmaceutical regulatory protection or employing a combination of these methods. We have patents and patent applications relating to Baquting upgrades, adenosine for myocardial protection, Kaitong,Agkistrodon acutus hemocoagulase and lanthanum polystyrene. For more details, see “Item 4. Information on the Company – B. Business Overview —Intellectual Property.” However, the filing of a patent application does not mean that we will be issued a patent, or that any patent eventually issued will be as broad as requested in the patent application or sufficient to protect our technology. There are a number of factors that could cause our patents, if granted, to become invalid or unenforceable or that could cause our patent applications to not be granted, including known or unknown prior art, deficiencies in the patent application or the lack of originality of the technology. In addition, the PRC adopts the first-to-file system under which whoever first files a patent application will be awarded the patent. By contrast, U.S. patent law endorses the first-to-invent system under which whoever makes the first actual discovery will be awarded the patent. Under the first-to-file system, a third party may be granted a patent relating to a technology which we invented. For more details on the process for applying for and obtaining intellectual property protection in the PRC, see “Item 4. Information on the Company – B. Business Overview —Regulations—Regulation of patent and trademark protection.” Furthermore, the terms of our patents are limited. The patents we hold and patents to be issued from our currently pending patent applications have a twenty-year protection period starting from the date of application.

17

We may become involved in patent litigation against third parties to enforce our patent rights, to invalidate patents held by such third parties, or to defend against such claims. The cost to us of any patent litigation or similar proceeding could be substantial, and it may consume significant management time. We do not maintain insurance to cover intellectual property infringement.

Intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries, because, among other reasons, of the lack of procedural rules for discovery and evidence, low damage awards and lack of judicial independence. Implementation and enforcement of PRC intellectual property laws have historically been deficient and ineffective and may be hampered by corruption and local protectionism. Policing unauthorized use of proprietary technology is difficult and expensive, and we may need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of our proprietary rights or those of others. The experience and capabilities of PRC courts in handling intellectual property litigation varies, and outcomes are unpredictable. Further, such litigation may require a significant expenditure of cash and may divert management’s attention, which could harm our business, financial condition and results of operations. An adverse determination in any such litigation could materially impair our intellectual property rights and may harm our business, prospects and reputation.

If our products infringe the intellectual property rights of third parties, we may incur substantial liabilities, and we may be unable to sell these products.

Our commercial success depends significantly on our ability to operate without infringing the patents and other proprietary rights of third parties. Under the PRC Patent Law, patent applications are maintained in confidence until their publication 18 months from the filing date. The publication of discoveries in the scientific or patent literature frequently occurs substantially later than the date on which the underlying discoveries were made and patent applications are filed. Even after reasonable investigation, we may not know with certainty whether any third party may have filed a patent application without our knowledge while we are still developing or producing that product. While the success of pending patent applications and applicability of any of them to our programs are uncertain, if asserted against us, we could incur substantial costs and we may have to:

| | • | | obtain licenses, which may not be available on commercially reasonable terms, if at all; |

| | • | | redesign our products or processes to avoid infringement; and |

| | • | | stop producing our products using the patents held by others, which could cause us to lose the use of one or more of our products. |

We are currently in the process of disputing an objection raised by a third party during the publication period of the registration of our “Shunxin” trademark. On May 5, 2010, we received a letter from the PRC Trademark Office indicating that there was insufficient evidence supporting Beijing Shunxin’s claims and that if Beijing Shunxun does not request a second review of its objection, we will receive registration for our “Shunxin” trademark. To date, we have not received any other claims of infringement by any third parties. If a third party claims that we infringe its proprietary rights, any of the following may occur:

| | • | | we may have to defend litigation or administrative proceedings that may be costly whether we win or lose, and which could result in a substantial diversion of management resources; |

18

| | • | | we may become liable for substantial damages for past infringement if a court decides that our technology infringes a third party’s intellectual property rights; |

| | • | | a court may prohibit us from producing and selling our product without a license from the holder of the intellectual property rights, which may not be available on commercially acceptable terms, if at all; and |

| | • | | we may have to reformulate our product so that it does not infringe the intellectual property rights of others, which may not be possible or could be very expensive and time consuming. |

Any costs incurred in connection with such events or the inability to sell our products may have a material adverse effect on our business and results of operations.

We rely on confidentiality agreements that could be breached and may be difficult to enforce, which could have a material adverse effect on our business and competitive position.

Our policy is to enter agreements relating to the non-disclosure of confidential information with third parties, including our contractors, consultants, advisors and research collaborators, as well as agreements that purport to require the disclosure and assignment to us of the rights to the ideas, developments, discoveries and inventions of our employees and consultants while we employ them. However, these agreements can be difficult and costly to enforce. Moreover, to the extent that our contractors, consultants, advisors and research collaborators apply or independently develop intellectual property in connection with any of our projects, disputes may arise as to the proprietary rights to this type of information. If a dispute arises, a court may determine that the right belongs to a third party, and enforcement of our rights can be costly and unpredictable. In addition, we rely on trade secrets and proprietary know-how that we will seek to protect in part by confidentiality agreements with our employees, contractors, consultants, advisors or others. Despite the protective measures we employ, we still face the risk that:

| | • | | These agreements may be breached; |

| | • | | These agreements may not provide adequate remedies for the applicable type of breach; or |

| | • | | our trade secrets or proprietary know-how will otherwise become known. |

Any breach of our confidentiality agreements or our failure to effectively enforce such agreements would have a material adverse effect on our business and competitive position.

19

We source our primary raw material, Bothrops atrox venom, from a single third-party supplier and any supply failure could adversely affect our ability to manufacture our products.

We source our primary raw material,Bothrops atrox venom, for the production of Baquting, from Centro De Extracão De Toxinas Animais, an unaffiliated third-party supplier in Brazil. Export ofBothrops atrox venom is subject to the laws and administrative rules and regulations related to export-control in Brazil and its import to China is also required to comply with laws, regulations and restrictions imposed by the relevant national and local authorities in China. We must receive governmental approval from PRC authorities for each shipment ofBothrops atrox venom. We may not be able to obtain such approval in time to meet our production requirements or at all. The Brazilian government may impose more stringent control over exports, and the PRC government may impose stricter restrictions on imports, which, in either case, may impair our ability to import, or prevent us from importing,Bothrops atrox venom from Brazil to China.

If there is any supply interruption for an indeterminate period of time, we may not be able to identify and obtain alternative supplies that comply with our quality standards in a timely manner. Any supply disruption could adversely affect our ability to satisfy demand for our products, and materially and adversely affect our product sales and operating results.

The manufacture of our products is an exacting and complex process, and if we or our contract manufacturers encounter problems in manufacturing our products, our business and results of operations would be materially and adversely affected.

The SFDA and foreign regulators require manufacturers to register manufacturing facilities. The SFDA and foreign regulators also inspect these facilities to confirm compliance with GMP or similar requirements that the SFDA or foreign regulators establish. We or our contract manufacturers may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or contract manufacturers may not be able to maintain compliance with the SFDA’s GMP requirements, or those of foreign regulators, necessary to continue manufacturing our drug candidates. A new inspection rule for GMP certification recently became effective on January 1, 2008 that implemented more stringent GMP standards. Any failure to comply with GMP requirements or other SFDA or foreign regulatory requirements could adversely affect our ability to manufacture, market and sell our products.

We rely on a limited number of distributors for sales of our products.

We rely on a limited number of distributors for most of our net revenue. Our top five distributors in the aggregate accounted for 37.2%, 33.4% and 42.1% of our net revenue in 2007, 2008 and 2009, respectively. We expect that a relatively small number of our distributors will continue to account for a major portion of our net revenue in the near future. Our dependence on a few distributors could expose us to the risk of substantial losses if a single large distributor stops purchasing our products, purchases fewer of our products or goes out of business and we cannot find substitute distributors on equivalent terms. If any of our significant distributors reduces the quantity of the products they purchase from us or stops purchasing from us, our net revenue would be materially and adversely affected.

We do not have long-term distribution agreements with our distributors, and we compete for desired distributors with other pharmaceutical manufacturers. Consequently, maintaining relationships with existing distributors and replacing distributors may be difficult and time consuming. Any disruption of our distribution network, including failure to renew existing distribution agreements with desired distributors, could negatively affect our ability to effectively sell our products and materially and adversely affect our business, financial condition and results of operations.

20

We enter into distribution agreements with our distributors which generally provide distribution rights for our products in a designated geographic area for a period of one year. We generally have one to three distributors in each provincial-level region. If any distributor sells our products outside its designated geographic area, harmful competition among our distributors could result, which may adversely impact our product sales activities and operating results.

If we are unable to attract, train, retain and motivate our direct sales force and third-party marketing agents, sales of our products may be materially and adversely affected.

We rely on our direct sales force and third-party marketing agents, who are dispersed across China, to market our products to hospitals and other healthcare institutions. We believe that Baquting’s current leading position in the market was the result, to a significant extent, of the dedication, efforts and performance of our direct sales force and third-party marketing agents. We believe that our future success will continue to depend on these same factors. There are only limited numbers of competent and qualified marketing agents in the Chinese pharmaceutical industry. We do not provide compensation to, or contract directly with, our marketing agents. Our marketing agents are instead compensated for their marketing and promotional activities by distributors. We therefore are unable to directly incentivize the marketing agents for their abilities. Our competitors may provide commissions or other economic incentives to third-party marketing agents significantly above the market standard, which may cause such agents to cease marketing our products. If we are unable to attract, train, retain and motivate our direct sales force and marketing agents, sales of our products may be materially and adversely affected.

Anti-corruption measures taken by the government to correct corruptive practices in the pharmaceutical industry could adversely affect our sales and reputation.

The government has recently taken anti-corruption measures to correct corrupt practices. In the pharmaceutical industry, such practices include, among others, acceptance of kickbacks, bribery or other illegal gains or benefits by the hospitals and medical practitioners from pharmaceutical distributors in connection with the prescription of a certain drug. Substantially all of our sales are made to hospitals through third-party distributors. We have no control over our third-party marketing agents and distributors, who may engage in corrupt practices to promote our products. While we maintain strict anti-corruption policies applicable to our internal sales force and third-party marketing agents and distributors, these policies may not be completely effective. If our sales staff or any of our third-party marketing agents and distributors engage in such practices and the government takes enforcement action, our products may be seized and our own practices, and involvement in the distributors’ practices may be investigated. If this occurs, our sales and reputation may be materially and adversely affected.

In addition, government-sponsored anti-corruption campaigns from time to time could have an adverse effect on our efforts to reach new hospital customers. Our sales representatives primarily rely on hospital visits to better educate physicians on our products and promote our brand awareness. Recently, there have been occasions on which our sales representatives were denied access to hospitals in order to avoid the perception of corruption. If this attitude becomes widespread among our potential customers, our ability to promote our products will be adversely affected.

21

If we are unable to successfully manage our growth, there could be a material adverse impact on our business, results of operations and financial condition.

We have grown rapidly and expect to continue to grow. We expect to hire more employees, particularly in the areas of research and development, regulatory affairs and sales and marketing, and enhance our facilities and corporate infrastructure, further increasing the size of our organization and related expenses. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. Because of our limited resources, we may not be able to effectively manage the expansion of our operations or recruit and train additional qualified personnel. The expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability on the part of our management to manage growth could delay the execution of our business plans or disrupt our operations. If we are unable to manage our growth effectively, we may be unable to use our resources in an efficient manner, which may negatively impact our business, results of operations and financial condition.

We depend upon key employees and consultants in a competitive market for skilled personnel. If we are unable to attract and retain key personnel, it could adversely affect our ability to develop and market our products.

We are highly dependent upon the principal members of our management team, especially our chairman and chief executive officer, Mr. Baizhong Xue. We have employment agreements, non-compete agreements and confidentiality agreements with these key employees. Although these agreements provide for severance payments that are contingent upon the applicable employee’s refraining from competition with us, the applicable provisions can be difficult and costly to monitor and enforce. The loss of any of these persons’ services would adversely affect our ability to develop and market our products.

We also depend in part on the continued services of our key scientific personnel and our ability to identify, hire and retain additional personnel, including marketing and sales staff. We face intense competition for qualified personnel, and the existence of non-competition agreements between prospective employees and their former employers may prevent us from hiring those individuals or subject us to suit from their former employers. While we attempt to provide competitive compensation packages to attract and retain key personnel, many of our competitors are likely to have greater resources and more experience than we have, making it difficult for us to compete successfully for key personnel.

Certain of our employees and consultants were previously employed at other biotechnology or pharmaceutical companies, including our competitors or potential competitors, or at universities or other research institutions. Although no claims against us are currently pending, we may be subject to claims that these employees or consultants have, inadvertently or otherwise, used or disclosed trade secrets or other proprietary information of their former employers. Litigation may be necessary to defend against these claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to our management. If we fail in defending such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights or personnel.

22

Our collaborations with outside scientists and consultants may be subject to restriction and change.

We work with chemists, biologists and other scientists at academic and other institutions, and consultants who assist us in our research, development, regulatory and commercial efforts. These scientists and consultants have provided, and we expect that they will continue to provide, valuable advice on our programs. These scientists and consultants are not our employees, may have other commitments that would limit their future availability to us and typically will not enter into non-compete agreements with us. If a conflict of interest arises between their work for us and their work for another entity, we may lose their services. In addition, we will be unable to prevent them from establishing competing businesses or developing competing products. For example, if a key scientist acting as a principal investigator in any of our clinical trials identifies a potential product or compound that is more scientifically interesting to his or her professional interests, his or her availability to remain involved in such clinical trials could be restricted or eliminated.

If we acquire companies, products or technologies, we may face integration risks and costs associated with those acquisitions that could negatively impact our business, results from operations and financial condition.

If we are presented with appropriate opportunities, we may acquire or make investments in complementary companies, products or technologies. For example, we entered into a joint venture with QRxPharma Limited, an Australian company, to develop and commercialize two bleeding control products based on technologies developed by QRxPharma and the University of Queensland. We invested $5.0 million in the joint venture for it to fund the clinical trials for the product candidates, regardless of whether we are able to obtain regulatory approvals for their production or successfully commercialize them. We may not realize the anticipated benefit of any acquisition or investment. If we acquire companies or technologies, we will face risks, uncertainties and disruptions associated with the integration process, including difficulties in the integration of the operations of an acquired company, integration of acquired technology with our products, diversion of our management’s attention from other business concerns, the potential loss of key employees or customers of the acquired business, the potential involvement into any litigation related to the acquired company, and impairment charges if future acquisitions are not as successful as we originally anticipate. In addition, our operating results may suffer because of acquisition-related costs or amortization expenses or charges relating to acquired intangible assets. Any failure to successfully integrate other companies, products or technologies that we may acquire may have a material adverse effect on our business and results of operations. Furthermore, we may have to incur debt or issue equity securities to pay for any additional future acquisitions or investments, the issuance of which could be dilutive to our existing shareholders.

The pharmaceutical industry in China is highly regulated, and future government regulation may place additional burdens on our business.

The pharmaceutical industry in China is subject to extensive government regulation and supervision. The regulatory framework addresses all aspects of operating in the pharmaceutical industry, including approval, production, distribution, licensing and certification requirements and procedures, periodic renewal and reassessment processes, registration of new drugs and environmental protection. Violation of applicable laws and regulations may materially adversely affect our business. In order to manufacture pharmaceutical products in China, we are required to obtain a pharmaceutical manufacturing permit and GMP certificate for each production line from the relevant food and drug administrative authority. We are required to obtain the drug registration certificate, which includes a drug approval number, from the SFDA for each drug manufactured by us. In addition, in order to distribute any drug in China, we must obtain a pharmaceutical distribution permit and good supply practice, or GSP, certificate from the SFDA. We are required to renew the pharmaceutical manufacturing permits, the pharmaceutical distribution permits, drug registration certificates, GMP certificates and GSP certificates every five years. If we are unable to obtain or renew such permits or any other permits or licenses required for our operation, we will not be able to engage in the manufacture and distribution of our products and our business may be adversely affected.

23

The regulatory framework regarding the pharmaceutical industry in China is subject to change and amendment from time to time. Any such change or amendment may have an adverse effect on our business. Changes to the regulatory framework could materially and adversely impact our business, financial condition and results of operations. The PRC government has released a number of announcements since April 2009 that collectively outlined a comprehensive plan to reform the healthcare system in China within the next few years, with an overall objective to expand the basic medical insurance coverage and improve the quality and reliability of healthcare services. The details of the reform have yet to be announced and the specific regulatory changes under the reform still remain uncertain. The implementing measures to be issued may not be sufficiently effective to achieve the stated goals, and as a result, we may not be able to benefit from such reform to the level we expect, if at all. Moreover, the reform could give rise to regulatory developments, such as tighter control over product pricing or more burdensome administrative procedures, which may have an adverse effect on our business and prospects.

For further information regarding government regulation in China, see “Item 4. Information on the Company – B. Business Overview —Regulations.”

The pharmaceutical industry is extremely competitive and China’s entry to the WTO may intensify this competition in China.

Our business is subject to competition from other pharmaceutical manufacturers. Local and overseas pharmaceutical manufacturers engaged in the manufacture and sale of similar products to ours in China may have more capital resources, superior research and development capabilities and more experience in manufacturing and marketing their products. China joined the WTO in December 2001. Following its entry, China lowered tariffs on certain imported pharmaceutical products as part of its obligation under the WTO framework. The reduction or removal of tariffs on imported pharmaceutical products made such products more competitive with domestic pharmaceutical products. In addition, an increasing number of foreign-invested pharmaceutical manufacturers may establish operations to engage in the manufacture or distribution of pharmaceutical products in China, which would increase the number of suppliers of pharmaceutical products in the market and intensify the competition with domestic manufacturers. If the domestic pharmaceutical manufacturers are unable to distinguish their products from imported products or products produced domestically by foreign-invested pharmaceutical manufacturers, they may lose market share to imported products or products produced domestically by foreign-invested pharmaceutical manufacturers which may be of higher quality and are sold at competitive prices. Furthermore, due to the lack of capital for the research and development of new medicines, most of the domestic pharmaceuticals are imitations of foreign products. Following China’s entry to the WTO, many more companies in Europe and the U.S. have applied for patents in the PRC, thereby increasing the likelihood of litigation for Chinese domestic pharmaceutical companies whose products may be covered by PRC patents owned by foreign companies.

24

Adverse publicity associated with our company or our products or similar products manufactured by our competitors could have a material adverse effect on our results of operations.

There have been recent incidents reported in the Chinese media of a significant number of patients experiencing severe adverse health consequences following their use of biopharmaceutical products manufactured by certain biopharmaceutical companies in China. A number of patients have become ill and a number of fatalities have been reported. For example, several deaths were caused by human immunoglobulin manufactured and sold by Jiangxi Boya Biopharmaceutical Co., Ltd., a PRC biopharmaceutical product manufacturer, in May 2008. We are highly dependent upon market perceptions of the safety and quality of our products. Concerns over the safety of biopharmaceutical products manufactured in China could have an adverse effect on the sale of such products, including products manufactured by us.