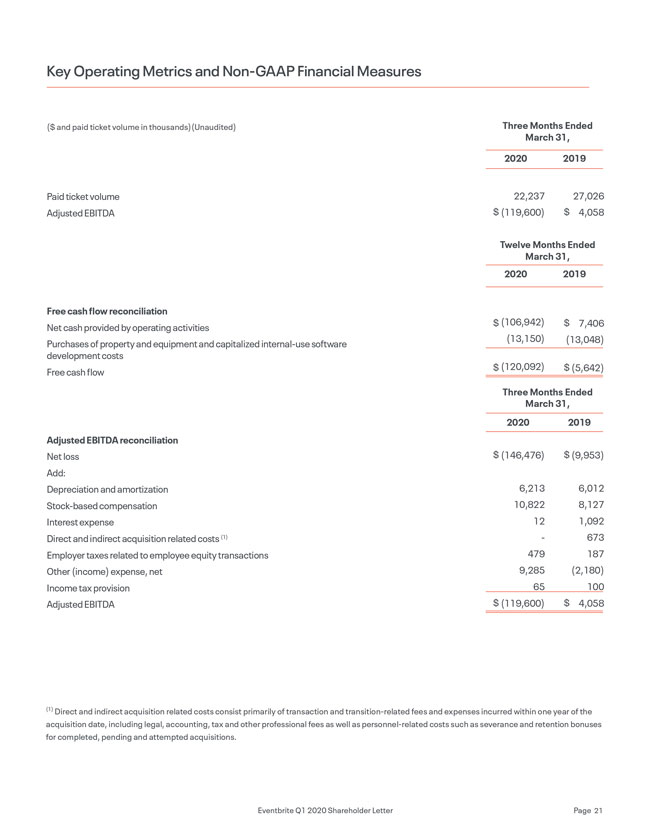

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the impacts of theCOVID-19 global health pandemic, including its impact on the Company, its operations, or its future financial or operational results; the impact of the Companyre-centering its business around a self-service model; the Company’s expectations regarding restructuring charges with respect to the workforce reduction implemented in response to theCOVID-19 global health pandemic; the Company’s expectations regarding the timing of recovery of paid ticket volumes; growth strategies in the Company’s businesses and products; the Company’s expectations regarding the development of its platform and products; the Company’s expectations regarding scale, profitability, market trends, and the demand for or benefits from its products, product features, and services in the U.S. and in international markets; and statements regarding the expectations of our resource reallocation. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied, and reported results should not be considered as an indication of future performance. The forward-looking statements contained in this letter are also subject to additional risks, uncertainties and factors, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on10-K for the year ended December 31, 2019. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time, including the Company’s Quarterly Report on Form10-Q for the quarter ended March 31, 2020. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. AboutNon-GAAP Financial Measures We believe that the use of Adjusted EBITDA and free cash flow is helpful to our investors as they are metrics used by management in assessing the health of our business and our operating performance. These measures, which we refer to as ournon-GAAP financial measures, are not prepared in accordance with GAAP and have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate nonGAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Adjusted EBITDA Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We calculate Adjusted EBITDA as net income (loss) adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, direct and indirect acquisition-related costs, employer taxes related to employee transactions and other income (expense), net which consisted of interest income and foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization arenon-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this letter. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual ornon-recurring items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. Free Cash Flow Free cash flow is a key performance measure that our management uses to assess our overall performance. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions and strengthening our financial position. We calculate free cash flow as cash flow from operating activities less purchases of property and equipment and capitalizedinternal-use software development costs, over a trailing twelve-month period. Since quarters are not uniform in terms of cash usage, we believe a trailing twelve-month view provides the best understanding of the underlying trends of our business. Although we believe free cash flow provides another important lens into the business, free cash flow is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. Free cash flow has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as cash provided by operating activities. Some of the limitations of free cash flow include that it may not properly reflect capital commitments to creators that need to be paid in the future or future contractual commitments that have not been realized in the current period. Eventbrite Q1 2020 Shareholder Letter Page 16