Q4 2018 Shareholder Letter March 7, 2019 investor.eventbrite.com Singapore American School Singapore

Business Highlights: 2018 at a Glance 3.9M events 795,000 creators 265M tickets issued 100% retention rate Up 28.9% YoY Up 13.1% YoY Up 33.0% YoY on gross ticket fees Up from 97% in 2017 (1) Fourth Quarter Business Highlights • In the fourth quarter of 2018, Eventbrite showed another quarter of strong net revenue and paid ticket growth: »» Net revenue grew 21.1% year-over-year to $75.9 million. »» Paid tickets grew 17.6% year-over-year to 26.7 million. • International product capabilities improved, and as a result, paid Featured on our cover is the Singapore tickets grew by 33.0% internationally compared to the fourth American School which is focused on engaging students through quarter of 2017. exploration, risk-taking, innovation, creativity and excellence. They have four theatre spaces where they host • Eventbrite continues to ramp native checkout, allowing creators both free and paid events throughout the year. Since joining Eventbrite in to enable transactions directly on their website, which is 2017, they have processed more than currently used by 8,200 creators for 18,700 events. 6,000 tickets. “Since moving to Eventbrite, we • Progress was made on the migration of Ticketfly and we have sold out nearly every show in anticipate concluding this migration and sunsetting the advance.” platform in the second half of 2019. - Corey Gillam, Schoolwide Theater Coordinator (Singapore) (1) To obtain our retention rate, we determine (i) the gross ticket fees generated by all creators in the year prior to the year of measurement (Prior Year Gross Ticket Fees) and (ii) the gross ticket fees those same creators generated in the year of measurement (Measurement Year Gross Ticket Fees). We calculate our retention rate for a measurement year by dividing the Measurement Year Gross Ticket Fees by the Prior Year Gross Ticket Fees. Fees associated with the sale of tickets on our platform are gross ticket fees, which are the total fees Eventbrite Q4 2018 Shareholder Letter Page 2

To Eventbrite Shareholders: Fourth Quarter 2018 Eventbrite’s fourth quarter showcased our ability to deliver sustainable growth while driving operating leverage. Net revenue grew 21.1% on a year-over-year basis, or $13.2 million, to $75.9 million in the fourth quarter, due in large part to a 17.6% increase in paid tickets to 26.7 million. At the same time, our operating loss was $9.3 million in the fourth quarter, a $5.3 million year-over-year improvement. This led to Adjusted EBITDA of $7.3 million in the fourth quarter, a $7.8 million improvement over the same period Heineken Nederland B.V. produces De Vrienden van Amstel LIVE, one of (2) the prior year .This increase highlights our ability to scale our the largest reserved seating music business without a significant cost increase, with an incremental festivals in the Netherlands. Since joining the Eventbrite platform in Adjusted EBITDA margin of 59.1% in the quarter. 2017, they have sold nearly 350,000 tickets. Our 2018 performance sets the stage for strong momentum in "Through solutions like 2019. We are focused on three key priorities to drive financial [Eventbrite’s] integrated checkout, we can strengthen our brand, results: transactional volume, product innovation and platform while simplifying the purchase experience." extension. Success in these areas will enable us to better serve creators and consumers around the world and ultimately grow - Yvonne de Liefde, Head of revenue. Our self-service and platform-driven approach to ticketing Sponsorships (Netherlands) will enable us to continue to make significant investments in product innovation while generating both sustainable growth and operating leverage. (2) Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Adjusted EBITDA, including the limitations of such measure, and see the end of this letter for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. Eventbrite Q4 2018 Shareholder Letter Page 3

Driving Transaction Volume by Expanding Our Global Footprint During our first decade, we grew our platform to enable events in more than 170 countries. We continue to see an opportunity to broaden and deepen our substantial global footprint by enhancing our product. Our ability to do this stems from our modular and extensible platform that we tailor to be market-specific. In 2018, international net revenue reached 27.4% of our overall net revenue, a testament to our ability to scale our business worldwide. Garzón Productions produces and organizes concert events throughout Because people from all over the world sign up to use our platform, Argentina. Through the adoption of Eventbrite’s Organizer App, coupled we have robust data to inform our decisions about where to deploy with Mercado Pago, they have been product resources to enhance creator and consumer experiences. able to provide a better check-in experience for attendees and sell This approach allows us to solve critical issues for creators in different more tickets. markets. “Eventbrite’s change to Mercado Pago allows us... to have more We launched the following efforts to enhance international growth in options for ticket sales, in which the user can choose alternatives for 2019 and beyond: local, national or international use.” - Hernán Garzón, Owner (Argentina) • We added a new payment provider, Mercado Pago, to deliver an improved payment experience for consumers and creators in Latin America as well as support new payment methods that are widely used in a variety of local markets. For example, Mercado Pago will allow us to better support installment payments, which are popular in Brazil and Argentina. • We launched enhanced functionality in two fast-growing markets: Mexico and Singapore. In each location, we deployed our proprietary Eventbrite Payment Processing (EPP) capabilities in local currency, along with numerous features to enhance the creator and consumer experience. Eventbrite Q4 2018 Shareholder Letter Page 4

Advancing Product Innovation with a Platform Approach We built the Eventbrite platform to be modular and extensible. Our platform APIs, design system and modular components are the building blocks that our internal teams and external developer partners use to build great solutions. As a result of this structure, platform components can be reimagined to build additional creator tools, thereby having a future value that is larger than their original use case. The Golden Gate Restaurant Association’s mission is to celebrate In our last letter, we highlighted our native distribution capability, and empower the restaurant community through advocacy, which allows consumers to purchase tickets through distribution education, marketing, events and partners without ever leaving the partner’s site. Using the same native training. Eventbrite helps power one of their annual flagship events, Eat Drink distribution technology, we built native checkout to allow consumers SF, where native checkout technology embedded on their official website to purchase tickets without leaving the creator’s site, creating a processed 43% of tickets in 2018. seamless experience without redirects or vouchers that need to "Leveraging [Eventbrite’s] native be redeemed elsewhere. This allows creators to take advantage checkout technology through of Eventbrite’s powerful ticketing platform while maintaining their our own website, as well as [their native distribution experience on] branded presence. Although the product has only been in use for a Facebook, has been hugely helpful little more than a year, it is currently being used by 8,200 creators for ... We rely on Eventbrite's great customer service, robust tutorials 18,700 events. and a clear understanding of what event organizers (and event goers) need to create a smooth purchase process." - Yuliya Patsay, Director of Marketing (San Francisco, CA) Eventbrite Q4 2018 Shareholder Letter Page 5

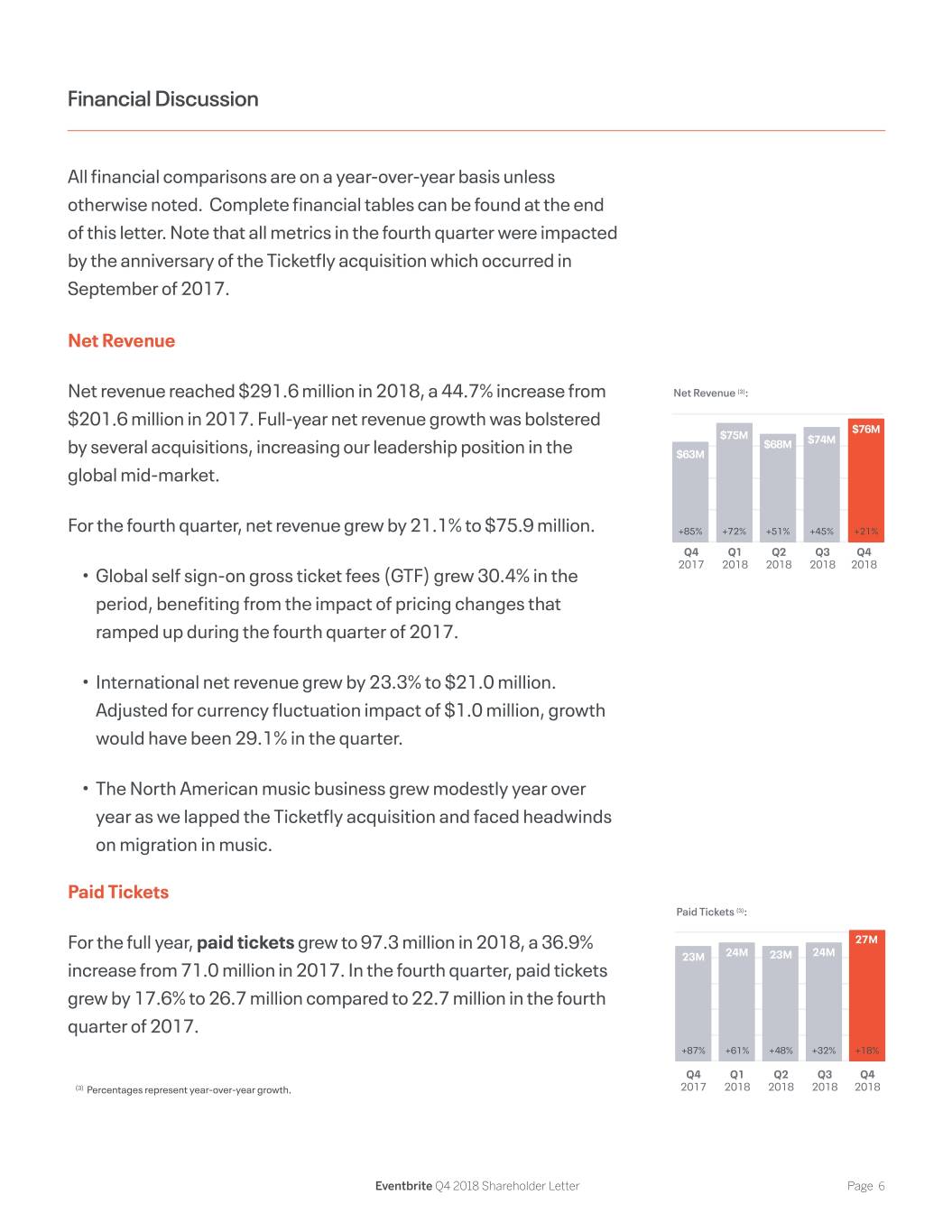

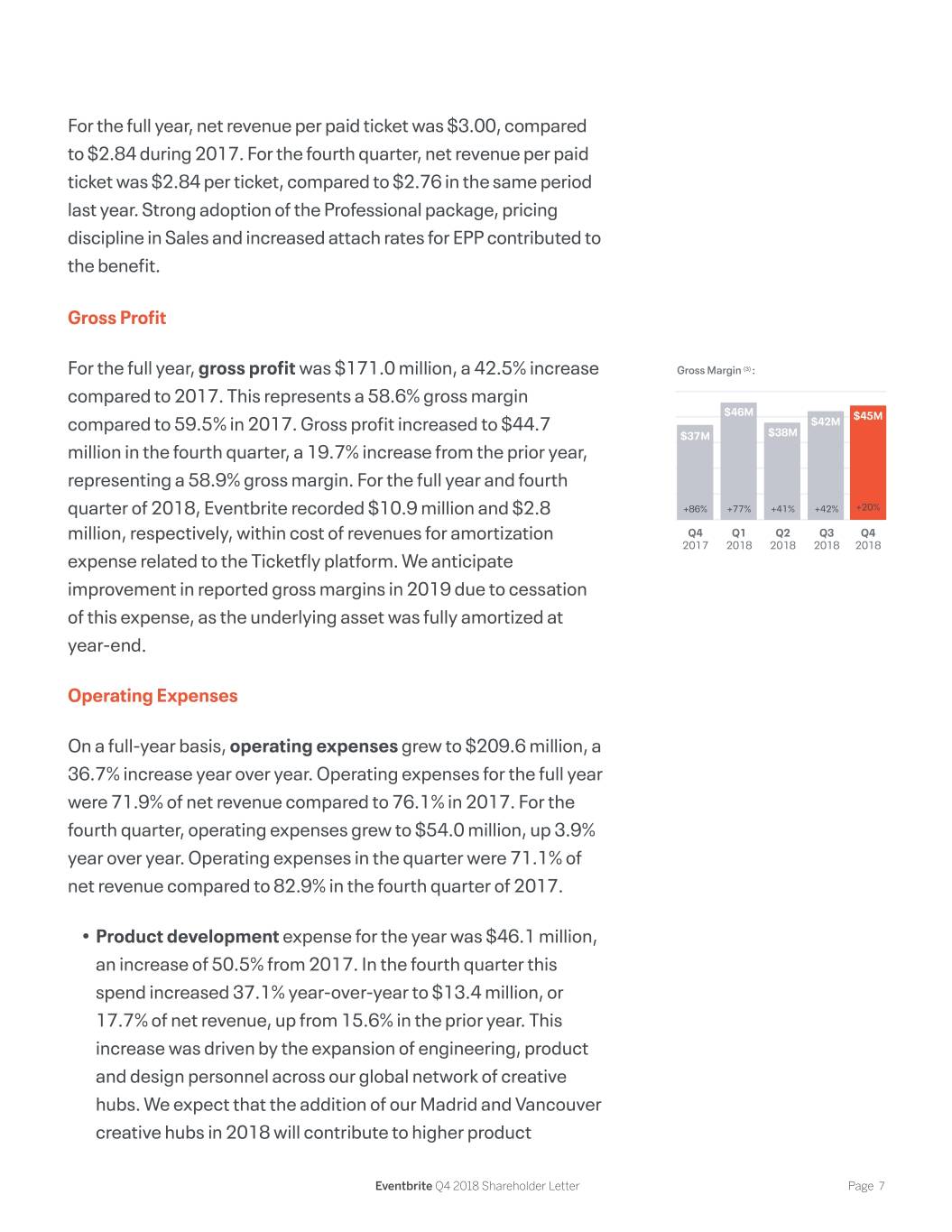

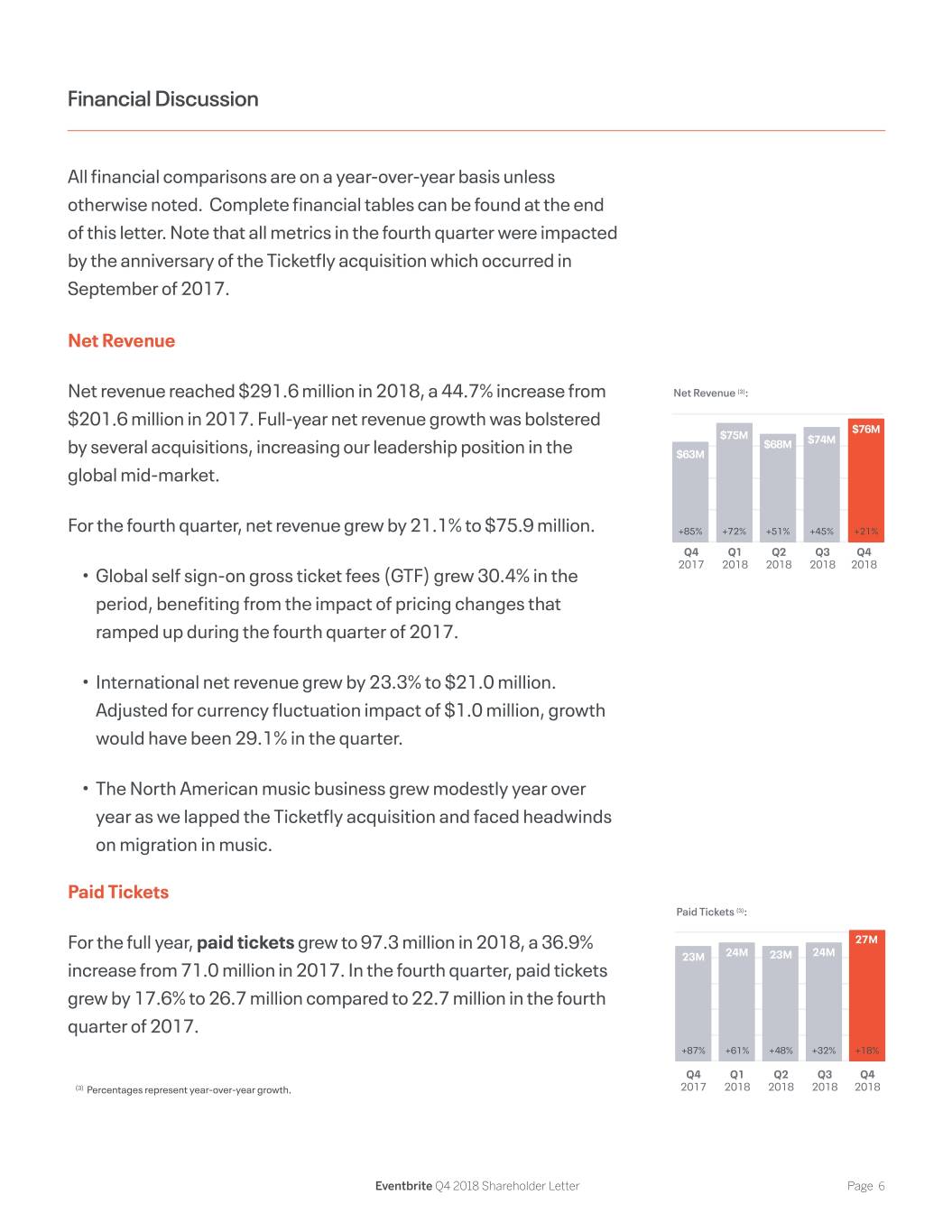

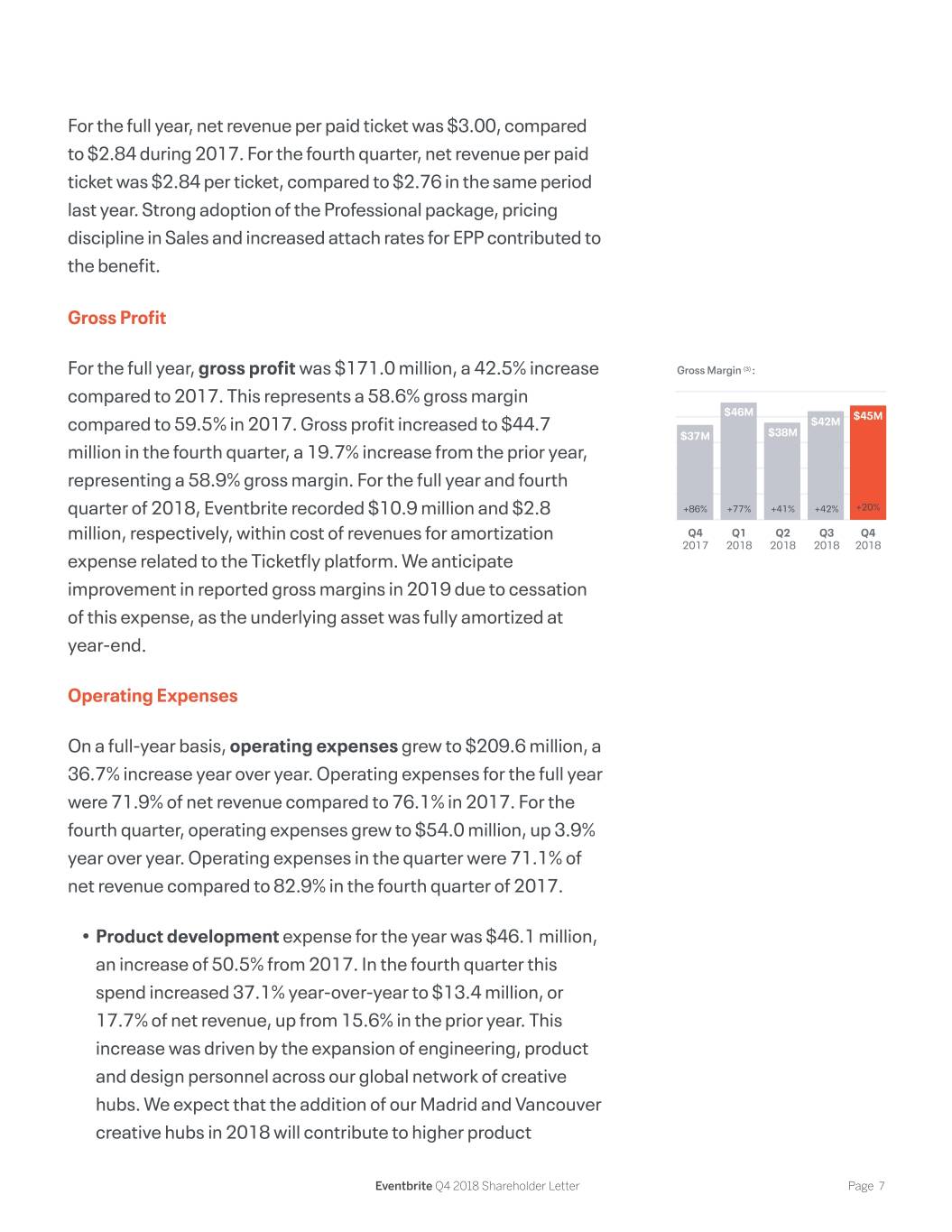

Financial Discussion All financial comparisons are on a year-over-year basis unless otherwise noted. Complete financial tables can be found at the end of this letter. Note that all metrics in the fourth quarter were impacted by the anniversary of the Ticketfly acquisition which occurred in September of 2017. Net Revenue Net revenue reached $291.6 million in 2018, a 44.7% increase from Net Revenue (3): $201.6 million in 2017. Full-year net revenue growth was bolstered $76M $75M $68M $74M by several acquisitions, increasing our leadership position in the $63M global mid-market. For the fourth quarter, net revenue grew by 21.1% to $75.9 million. +85% +72% +51% +45% +21% Q4 Q1 Q2 Q3 Q4 2017 2018 2018 2018 2018 • Global self sign-on gross ticket fees (GTF) grew 30.4% in the period, benefiting from the impact of pricing changes that ramped up during the fourth quarter of 2017. • International net revenue grew by 23.3% to $21.0 million. Adjusted for currency fluctuation impact of $1.0 million, growth would have been 29.1% in the quarter. • The North American music business grew modestly year over year as we lapped the Ticketfly acquisition and faced headwinds on migration in music. Paid Tickets Paid Tickets (3): For the full year, paid tickets grew to 97.3 million in 2018, a 36.9% 27M 23M 24M 23M 24M increase from 71.0 million in 2017. In the fourth quarter, paid tickets grew by 17.6% to 26.7 million compared to 22.7 million in the fourth quarter of 2017. +87% +61% +48% +32% +18% Q4 Q1 Q2 Q3 Q4 (3) Percentages represent year-over-year growth. 2017 2018 2018 2018 2018 Eventbrite Q4 2018 Shareholder Letter Page 6

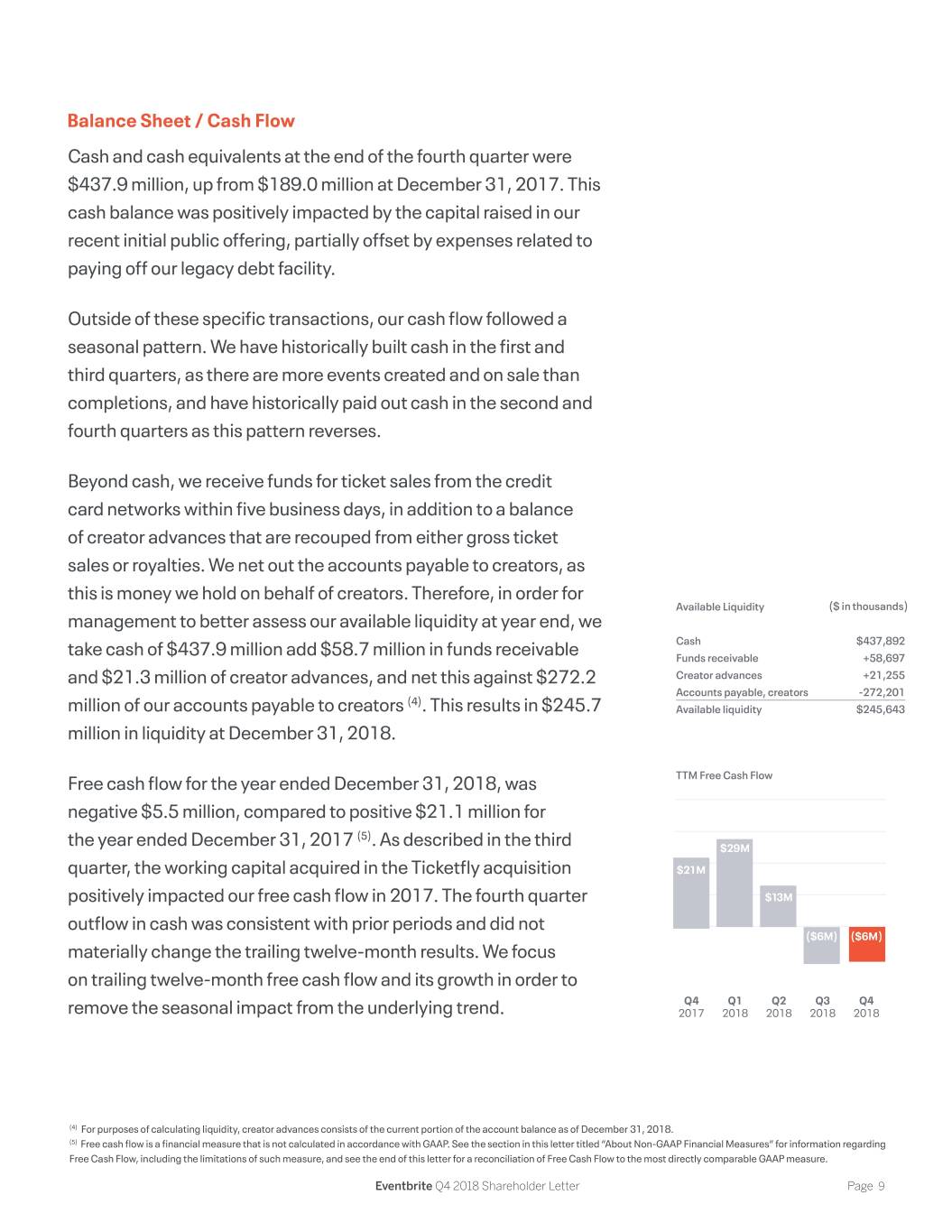

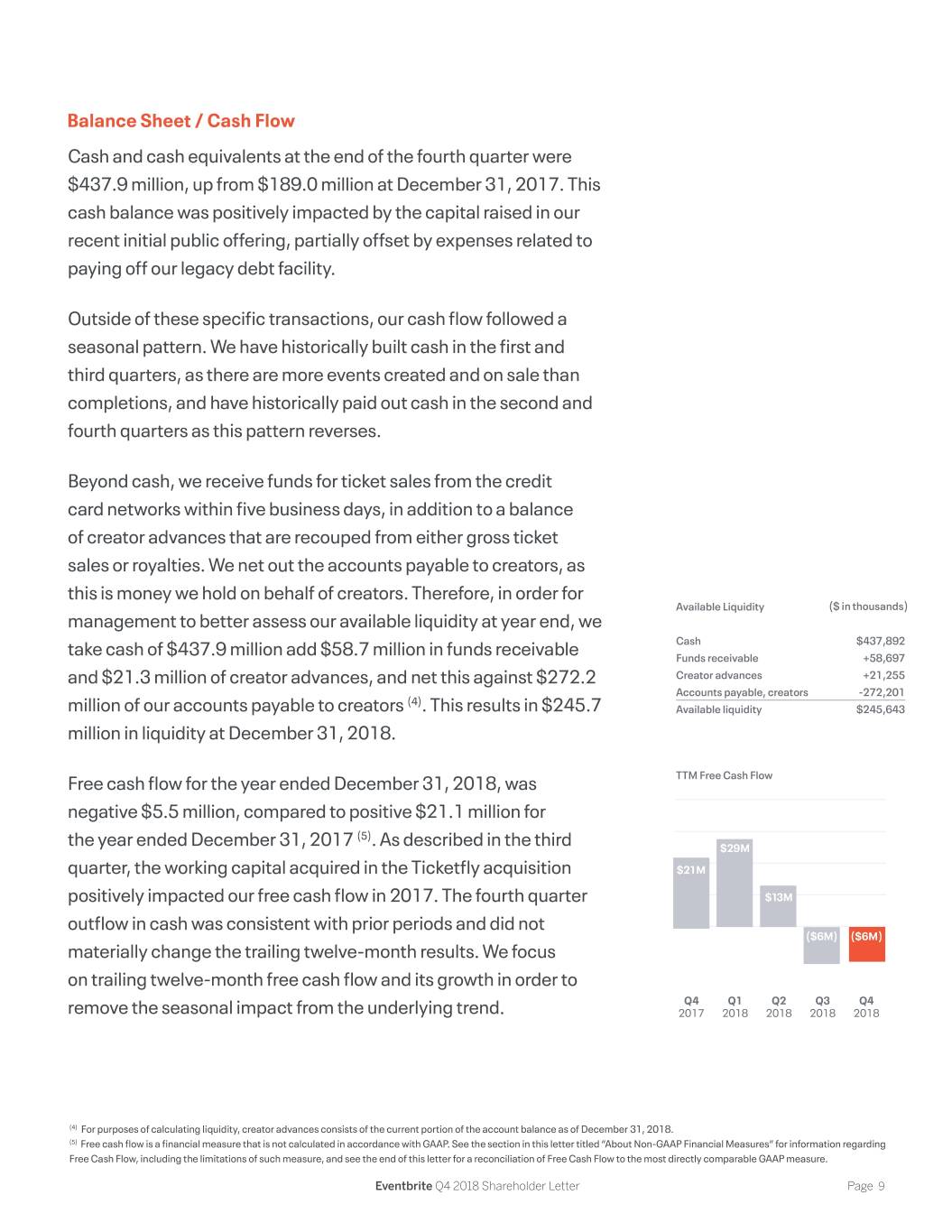

For the full year, net revenue per paid ticket was $3.00, compared to $2.84 during 2017. For the fourth quarter, net revenue per paid ticket was $2.84 per ticket, compared to $2.76 in the same period last year. Strong adoption of the Professional package, pricing discipline in Sales and increased attach rates for EPP contributed to the benefit. Gross Profit For the full year, gross profit was $171.0 million, a 42.5% increase Gross Margin (3) : compared to 2017. This represents a 58.6% gross margin $46M $45M compared to 59.5% in 2017. Gross profit increased to $44.7 $42M $37M $38M million in the fourth quarter, a 19.7% increase from the prior year, representing a 58.9% gross margin. For the full year and fourth quarter of 2018, Eventbrite recorded $10.9 million and $2.8 +86% +77% +41% +42% +20% million, respectively, within cost of revenues for amortization Q4 Q1 Q2 Q3 Q4 2017 2018 2018 2018 2018 expense related to the Ticketfly platform. We anticipate improvement in reported gross margins in 2019 due to cessation of this expense, as the underlying asset was fully amortized at year-end. Operating Expenses On a full-year basis, operating expenses grew to $209.6 million, a 36.7% increase year over year. Operating expenses for the full year were 71.9% of net revenue compared to 76.1% in 2017. For the fourth quarter, operating expenses grew to $54.0 million, up 3.9% year over year. Operating expenses in the quarter were 71.1% of net revenue compared to 82.9% in the fourth quarter of 2017. • Product development expense for the year was $46.1 million, an increase of 50.5% from 2017. In the fourth quarter this spend increased 37.1% year-over-year to $13.4 million, or 17.7% of net revenue, up from 15.6% in the prior year. This increase was driven by the expansion of engineering, product and design personnel across our global network of creative hubs. We expect that the addition of our Madrid and Vancouver creative hubs in 2018 will contribute to higher product Eventbrite Q4 2018 Shareholder Letter Page 7

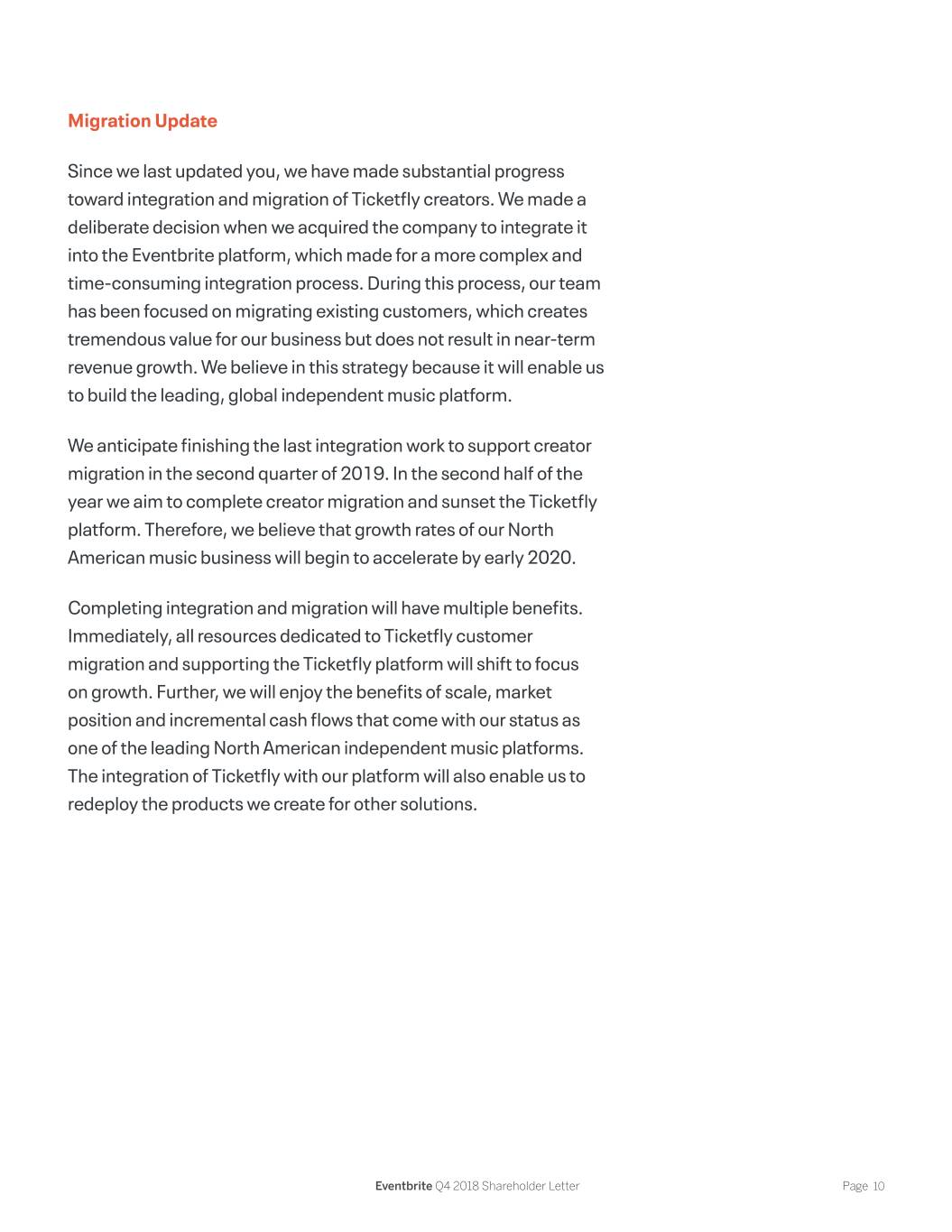

development expenses in future periods. • Sales, marketing and support spend for the full year was $69.8 million, an increase of 26.5% compared to 2017. In the fourth quarter, this expense declined 5.2% year-over-year to $16.7 million, or 22.0% of net revenue, down from 28.1% the prior year. We have seen leverage in our global demand generation and marketing infrastructure. We will continue to invest to grow through self sign-on and sales globally. • General and administrative expenses for the full year were $93.8 million, an increase of 38.8% from 2017. For the fourth quarter expenses decreased by 2.7% year-over-year to $23.9 million, or 31.4% of net revenue, down from 39.1% the prior year. Adjusted EBITDA Adjusted EBITDA was $28.8 million in 2018, up from $4.2 million Adjusted EBITDA: in 2017. The combination of organic and acquired growth led to an $11M Adjusted EBITDA increase of $24.6 million year-over-year against a $9M $7M net revenue increase of $90.0 million over the same period, a 27.3% incremental Adjusted EBITDA margin. Our Adjusted EBITDA was $7.3 million in the fourth quarter, up from negative $0.5 million in the fourth $1M ($1M) quarter of 2017. Q4 Q1 Q2 Q3 Q4 2017 2018 2018 2018 2018 As disclosed in our third-quarter shareholder letter, these results were positively impacted by insurance recoveries related to the Ticketfly data security incident. We recognized an additional $3.1 million in insurance proceeds in the fourth quarter. While we expect continued insurance recoveries in 2019, with $6.6 million of recoveries recorded to date, we believe we have received the majority of the anticipated benefit and expect the absolute level to taper off. Eventbrite Q4 2018 Shareholder Letter Page 8

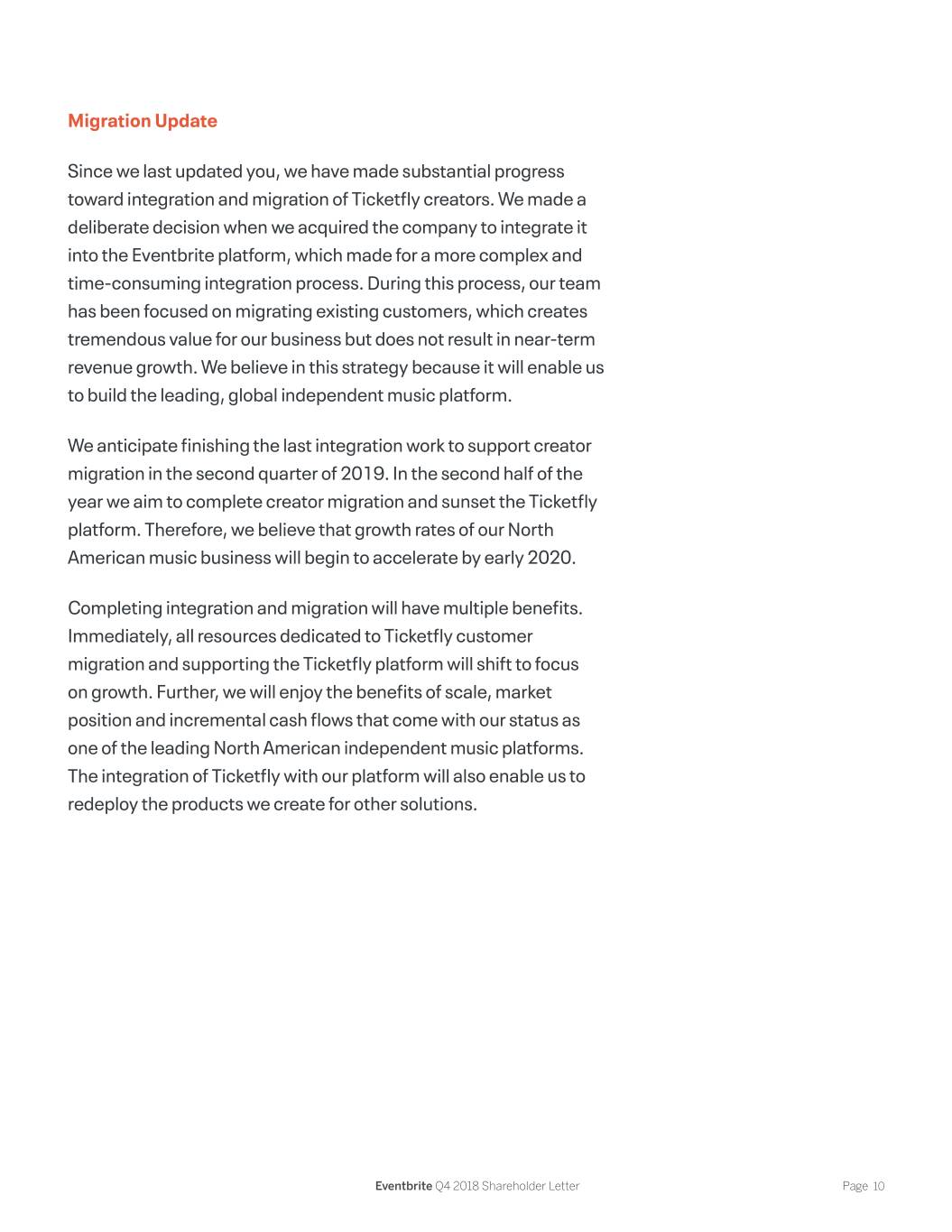

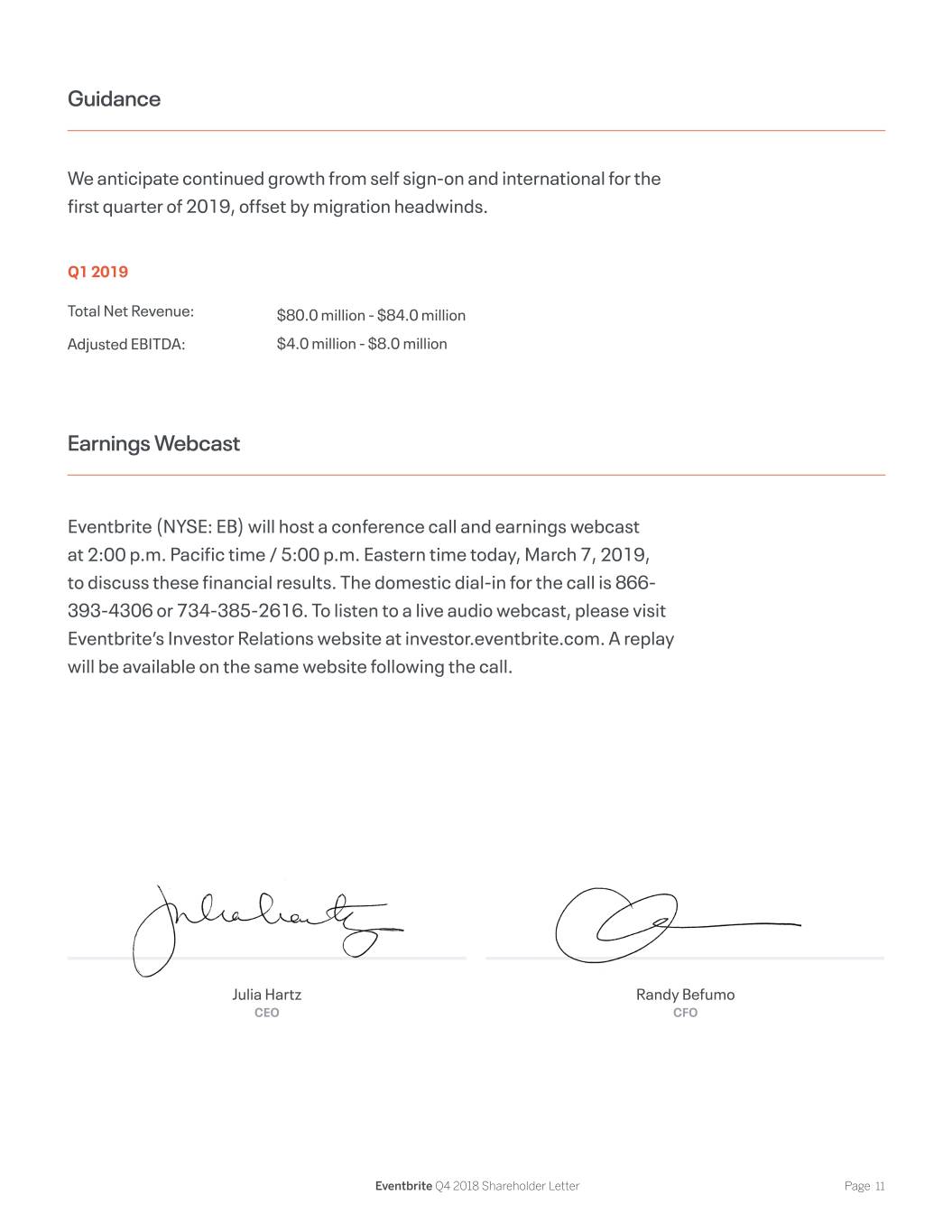

Balance Sheet / Cash Flow Cash and cash equivalents at the end of the fourth quarter were $437.9 million, up from $189.0 million at December 31, 2017. This cash balance was positively impacted by the capital raised in our recent initial public offering, partially offset by expenses related to paying off our legacy debt facility. Outside of these specific transactions, our cash flow followed a seasonal pattern. We have historically built cash in the first and third quarters, as there are more events created and on sale than completions, and have historically paid out cash in the second and fourth quarters as this pattern reverses. Beyond cash, we receive funds for ticket sales from the credit card networks within five business days, in addition to a balance of creator advances that are recouped from either gross ticket sales or royalties. We net out the accounts payable to creators, as this is money we hold on behalf of creators. Therefore, in order for Available Liquidity ($ in thousands) management to better assess our available liquidity at year end, we Cash $437,892 take cash of $437.9 million add $58.7 million in funds receivable Funds receivable +58,697 and $21.3 million of creator advances, and net this against $272.2 Creator advances +21,255 Accounts payable, creators -272,201 (4) million of our accounts payable to creators . This results in $245.7 Available liquidity $245,643 million in liquidity at December 31, 2018. Free cash flow for the year ended December 31, 2018, was TTM Free Cash Flow negative $5.5 million, compared to positive $21.1 million for (5) the year ended December 31, 2017 . As described in the third $29M quarter, the working capital acquired in the Ticketfly acquisition $21M positively impacted our free cash flow in 2017. The fourth quarter $13M outflow in cash was consistent with prior periods and did not ($6M) ($6M) materially change the trailing twelve-month results. We focus on trailing twelve-month free cash flow and its growth in order to Q4 Q1 Q2 Q3 Q4 remove the seasonal impact from the underlying trend. 2017 2018 2018 2018 2018 (4) For purposes of calculating liquidity, creator advances consists of the current portion of the account balance as of December 31, 2018. (5) Free cash flow is a financial measure that is not calculated in accordance with GAAP. See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Free Cash Flow, including the limitations of such measure, and see the end of this letter for a reconciliation of Free Cash Flow to the most directly comparable GAAP measure. Eventbrite Q4 2018 Shareholder Letter Page 9

Migration Update Since we last updated you, we have made substantial progress toward integration and migration of Ticketfly creators. We made a deliberate decision when we acquired the company to integrate it into the Eventbrite platform, which made for a more complex and time-consuming integration process. During this process, our team has been focused on migrating existing customers, which creates tremendous value for our business but does not result in near-term revenue growth. We believe in this strategy because it will enable us to build the leading, global independent music platform. We anticipate finishing the last integration work to support creator migration in the second quarter of 2019. In the second half of the year we aim to complete creator migration and sunset the Ticketfly platform. Therefore, we believe that growth rates of our North American music business will begin to accelerate by early 2020. Completing integration and migration will have multiple benefits. Immediately, all resources dedicated to Ticketfly customer migration and supporting the Ticketfly platform will shift to focus on growth. Further, we will enjoy the benefits of scale, market position and incremental cash flows that come with our status as one of the leading North American independent music platforms. The integration of Ticketfly with our platform will also enable us to redeploy the products we create for other solutions. Eventbrite Q4 2018 Shareholder Letter Page 10

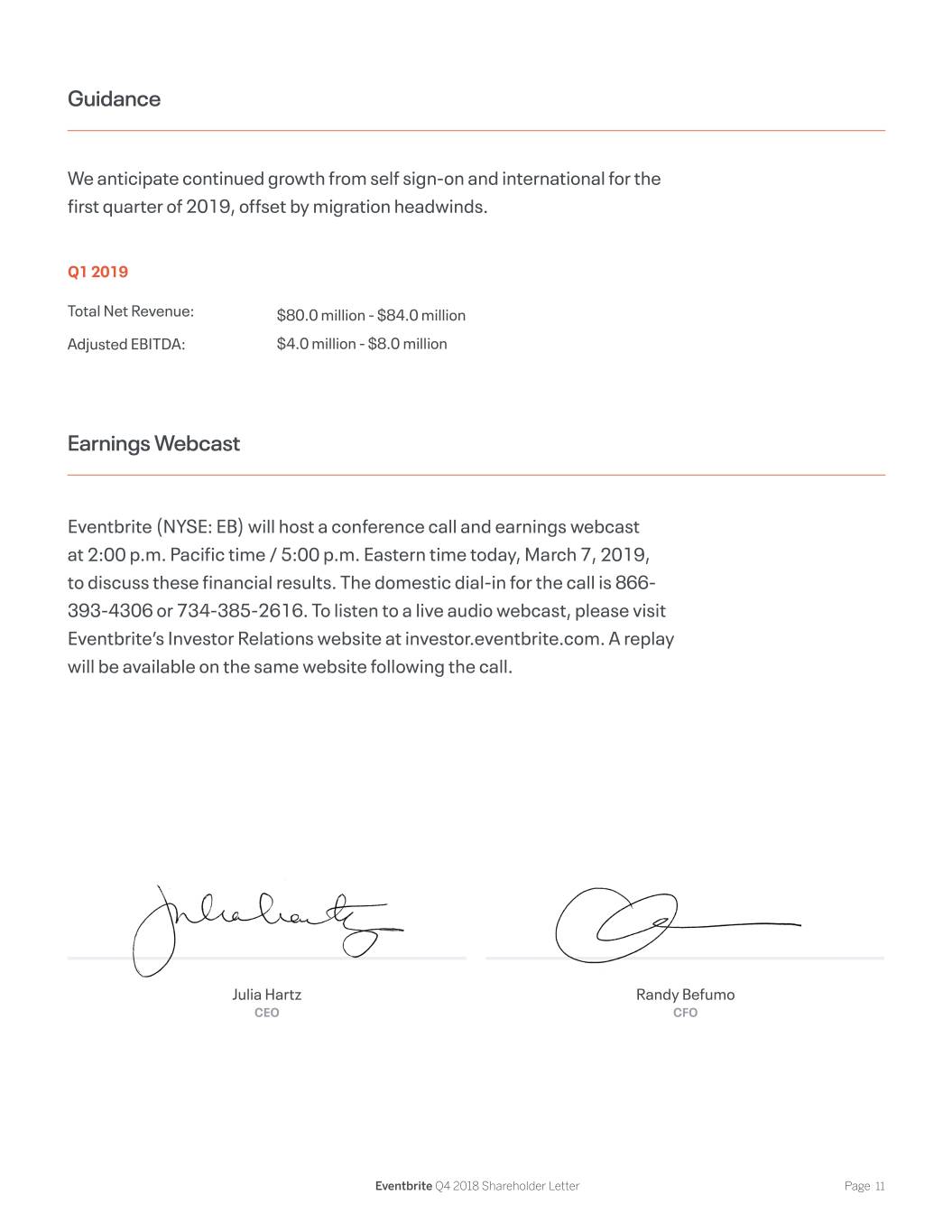

Guidance We anticipate continued growth from self sign-on and international for the first quarter of 2019, offset by migration headwinds. Q1 2019 Total Net Revenue: $80.0 million - $84.0 million Adjusted EBITDA: $4.0 million - $8.0 million Earnings Webcast Eventbrite (NYSE: EB) will host a conference call and earnings webcast at 2:00 p.m. Pacific time / 5:00 p.m. Eastern time today, March 7, 2019, to discuss these financial results. The domestic dial-in for the call is 866- 393-4306 or 734-385-2616. To listen to a live audio webcast, please visit Eventbrite’s Investor Relations website at investor.eventbrite.com. A replay will be available on the same website following the call. Julia Hartz Randy Befumo CEO CFO Eventbrite Q4 2018 Shareholder Letter Page 11

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s expected financial results for future periods; future growth and growth strategies in the Company’s businesses and products; the expected impact of the Company’s recent acquisitions; expectations regarding the Company’s ability to migrate customers from acquired platforms; the Company’s expectations regarding scale, profitability, market trends, and the demand for or benefits from its products, product features, and services in the U.S. and in international markets; expectations regarding the amortization of the Ticketfly platform; and statements related to business strategy, plans, and objectives for future operations. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied, and reported results should not be considered as an indication of future performance. The forward-looking statements contained in this letter are also subject to additional risks, uncertainties and factors, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Quarterly Report on 10-Q for the quarter ended September 30, 2018. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. About Non-GAAP Financial Measures We believe that the use of Adjusted EBITDA and free cash flow is helpful to our investors as they are metrics used by management in assessing the health of our business and our operating performance. These measures, which we refer to as our non-GAAP financial measures, are not prepared in accordance with GAAP and have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations as reported under GAAP. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Adjusted EBITDA Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We calculate Adjusted EBITDA as net loss attributable to common stockholders adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, the change in fair value of redeemable convertible preferred stock warrant liability, gains on extinguishment of promissory note, direct and indirect acquisition-related costs, income tax provision (benefit) and other income (expense), which consisted of interest income and foreign exchange rate gains and losses. Adjusted EBITDA should not be considered as an alternative to net loss or any other measure of financial performance calculated and presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. Our Adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate Adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. In evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this letter. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. Free Cash Flow Free cash flow is a key performance measure that our management uses to assess our overall performance. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investing in our business, making strategic acquisitions and strengthening our financial position. We calculate free cash flow as net cash flow from operating activities less purchases of property and equipment and capitalized internal-use software development costs, over a trailing twelve-month period. Since quarters are not uniform in terms of cash usage, we believe a trailing twelve-month view provides the best understanding of the underlying trends of the business. Although we believe free cash flow provides another important lens into the business, free cash flow is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. Free cash flow has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as cash provided by operating activities. Some of the limitations of free cash flow is that it may not properly reflect capital commitments to creators that need to be paid in the future or future contractual commitments that have not been realized in the current period. Our free cash flow may not be comparable to similarly titled measures of other companies because they may not calculate free cash flow in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. Eventbrite Q4 2018 Shareholder Letter Page 12

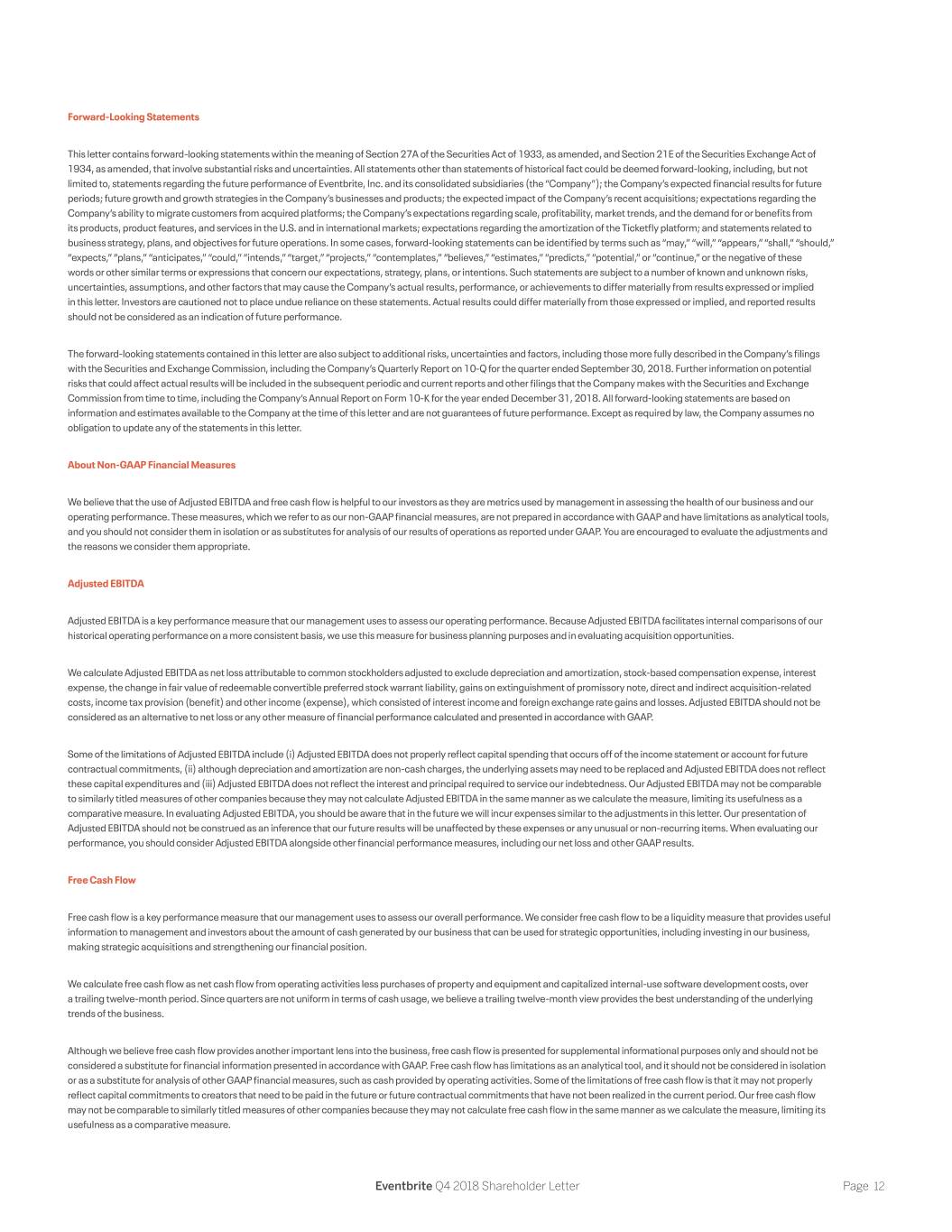

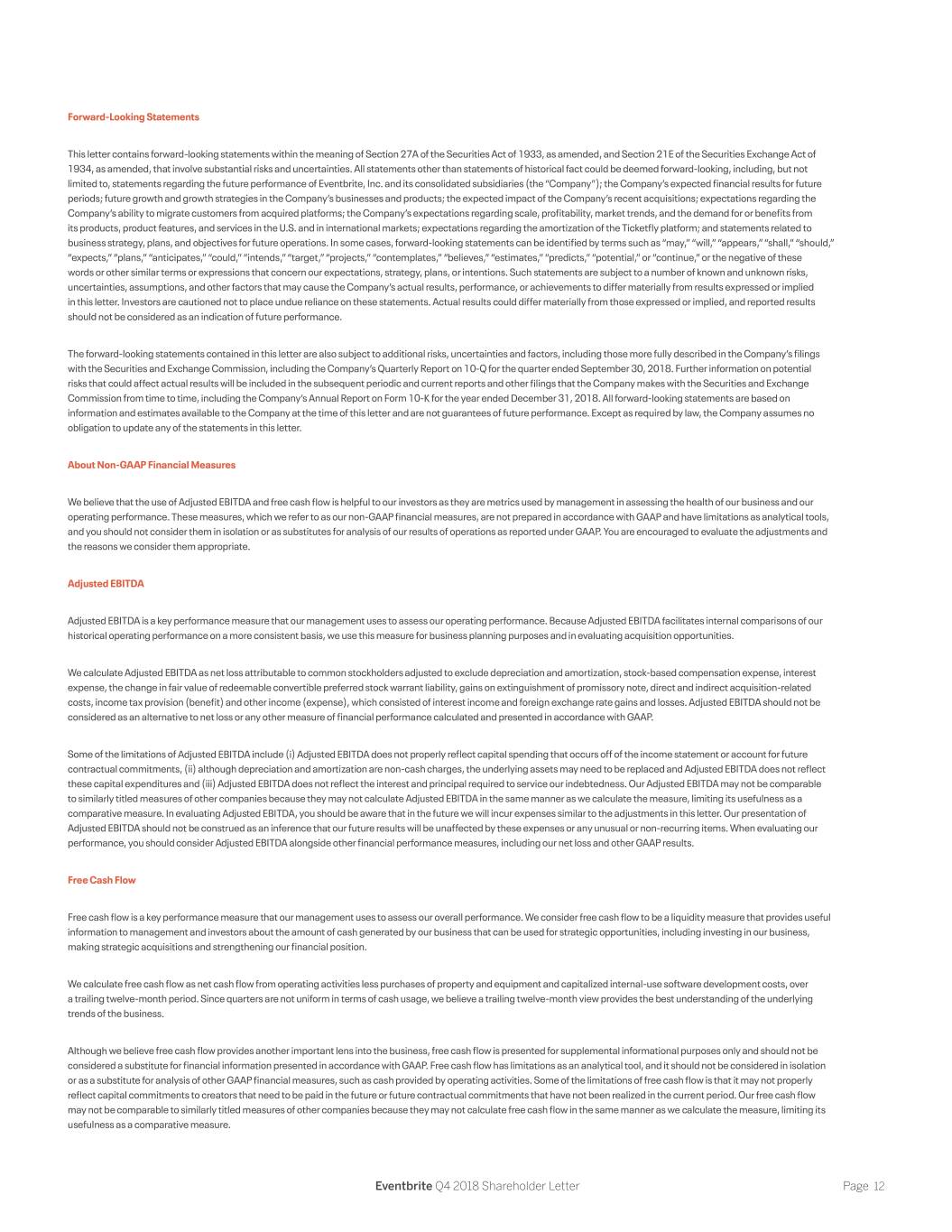

Supplemental Information Consolidated Statements of Operations $ in thousands, except per share data THREE MONTHS ENDED DECEMBER 31, YEAR ENDED DECEMBER 31, 2018 2017 2018 2017 (Unaudited) Net revenue $ 75,915 $ 62,695 $ 291,611 $ 201,597 Cost of net revenue(1) 31,229 25,372 120,653 81,667 Gross profit 44,686 37,323 170,958 119,930 Gross margin 58.9% 59.5% 58.6% 59.5% Operating expenses(1): Product development 13,400 9,776 46,071 30,608 Sales, marketing and support 16,729 17,648 69,780 55,170 General and administrative 23,867 24,534 93,782 67,559 Total operating expenses 53,996 51,958 209,633 153,337 Loss from operations (9,310) (14,635) (38,675) (33,407) Interest expense (1,896) (2,830) (11,295) (6,462) Change in fair value of redeemable convertible preferred stock warrant liability - (796) (9,591) (2,200) Loss on debt extinguishment - - (178) - Other income (expense), net (1,309) (1) (3,189) 3,509 Loss before provision for (benefit from) income taxes (12,515) (18,262) (62,928) (38,560) Income tax provision (benefit) 467 82 1,150 (13) Net loss $ (12,982) $ (18,344) $ (64,078) $ (38,547) Net loss per share, basic and diluted $ (0.17) $ (0.89) $ (1.71) $ (1.98) Weighted-average shares outstanding used to compute net loss per share, basic and diluted 78,242 20,540 37,540 19,500 (1) Amounts include stock-based compensation as follows: Cost of net revenue $ 151 $ 100 $ 429 $ 200 Product development 1,968 1,113 5,813 2,411 Sales, marketing and support 841 1,184 3,570 2,364 General and administrative 4,114 2,754 20,419 5,883 Eventbrite Q4 2018 Shareholder Letter Page 13

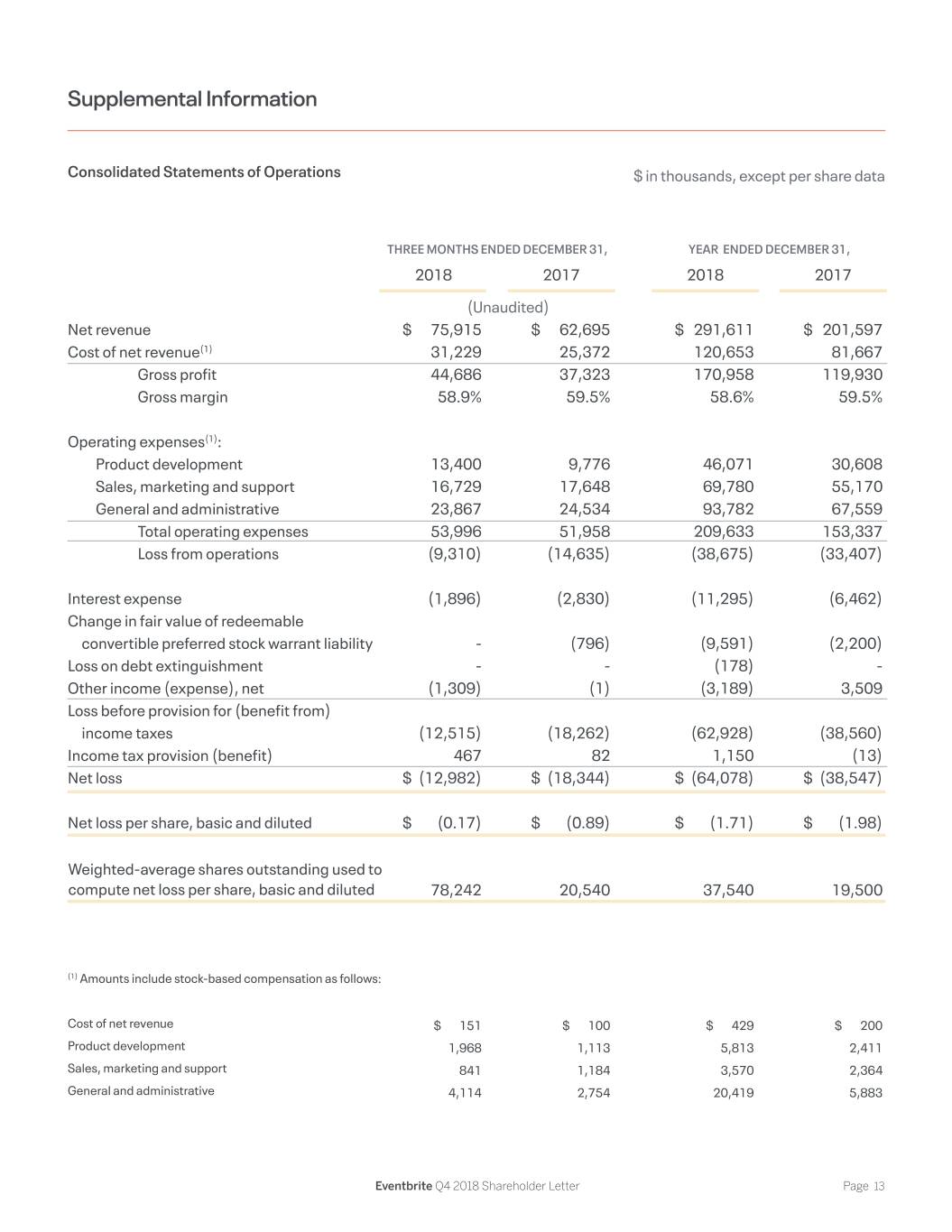

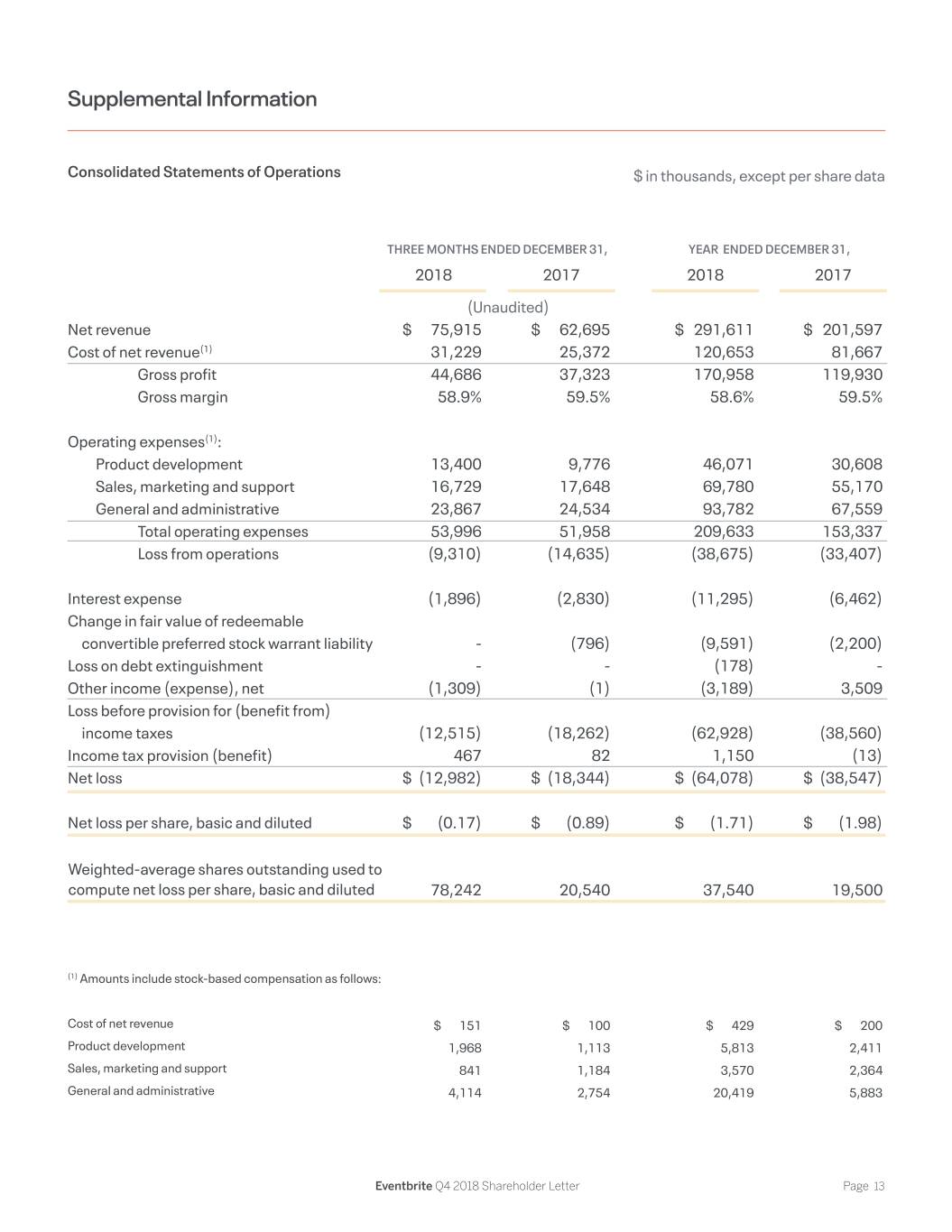

Consolidated Balance Sheets $ in thousands DECEMBER 31, DECEMBER 31, 2018 2017 Assets Current assets Cash $ 437,892 $ 188,986 Funds receivable 58,697 51,639 Accounts receivable, net 4,069 2,885 Creator signing fees, net 7,324 4,235 Creator advances, net 21,255 17,641 Prepaid expenses and other current assets 16,467 10,662 Total current assets 545,704 276,048 Property, plant and equipment, net 44,219 42,492 Goodwill 170, 560 158,766 Acquired intangible assets, net 59,973 79,541 Restricted cash 1,508 3,235 Creator signing fees, noncurrent 9,681 6,186 Creator advances, noncurrent 1,887 2,435 Other assets, noncurrent 3,352 2,134 Total assets $ 836,884 $ 570,837 Liabilities & Stockholders' Equity Current liabilities Accounts payable, creators $ 272,201 $ 228,007 Accounts payable, trade 1,028 1,481 Accrued compensation and benefits 5,586 3,535 Accrued taxes 8,028 2,615 Current portion of term loans 5,635 - Other accrued liabilities 15,726 10,544 Total current liabilities 308,204 246,182 Build-to-suit lease financing obligation 28,510 29,494 Accrued taxes, noncurrent 15,691 30,047 Redeemable convertible preferred stock warrant liability - 7,271 Promissory note - 51,082 Term loans 67,087 26,669 Other liabilities 2,170 1,888 Total liabilities 421,662 392,633 Stockholders' equity Redeemable convertible preferred stock - 334,018 Common stock - - Treasury stock, at cost (488) (488) Additional paid-in capital 718,405 83,291 Accumulated deficit (302,695) (238,617) Total stockholders' equity 415,222 155,814 Total liabilities & stockholders' equity $ 836,884 $ 570,837 Eventbrite Q4 2018 Shareholder Letter Page 14

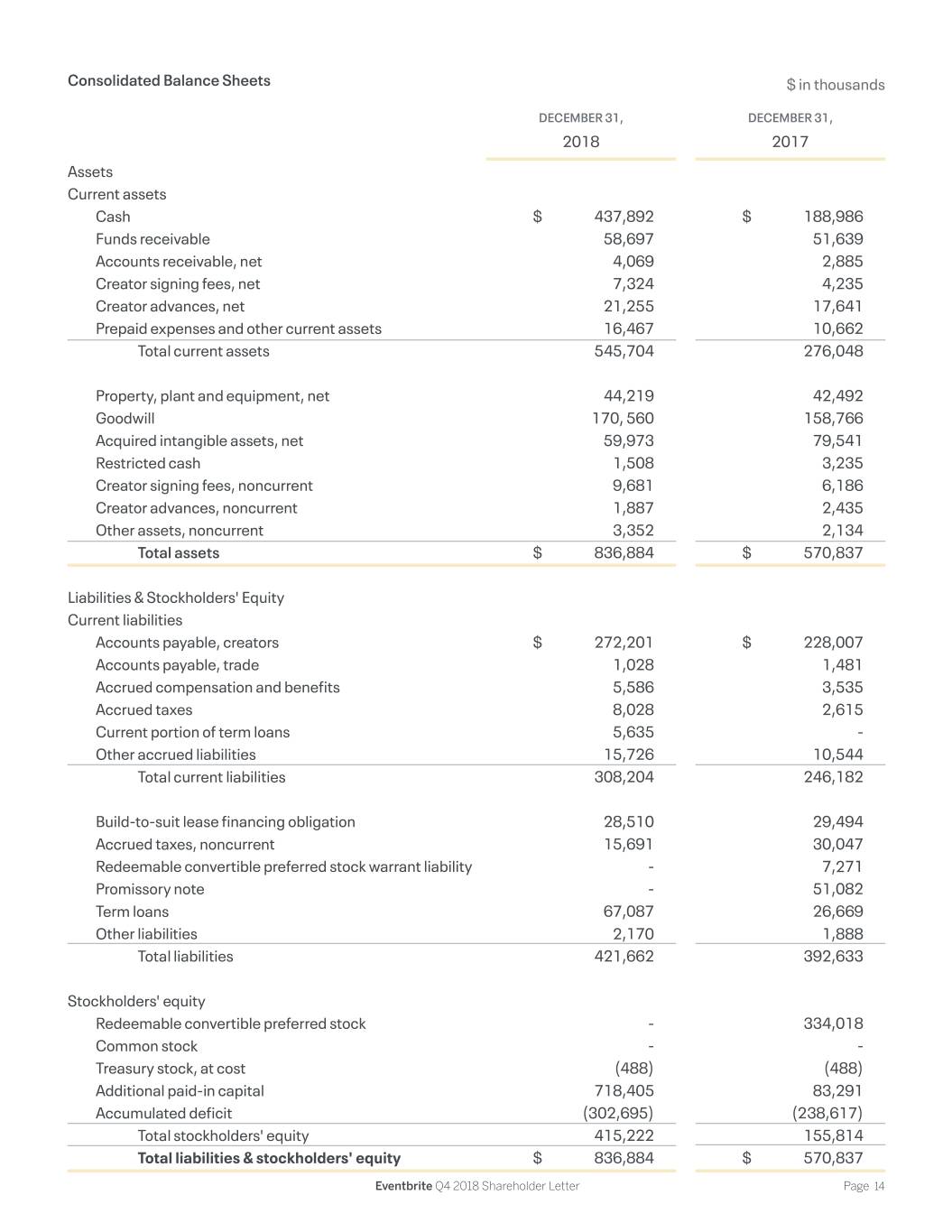

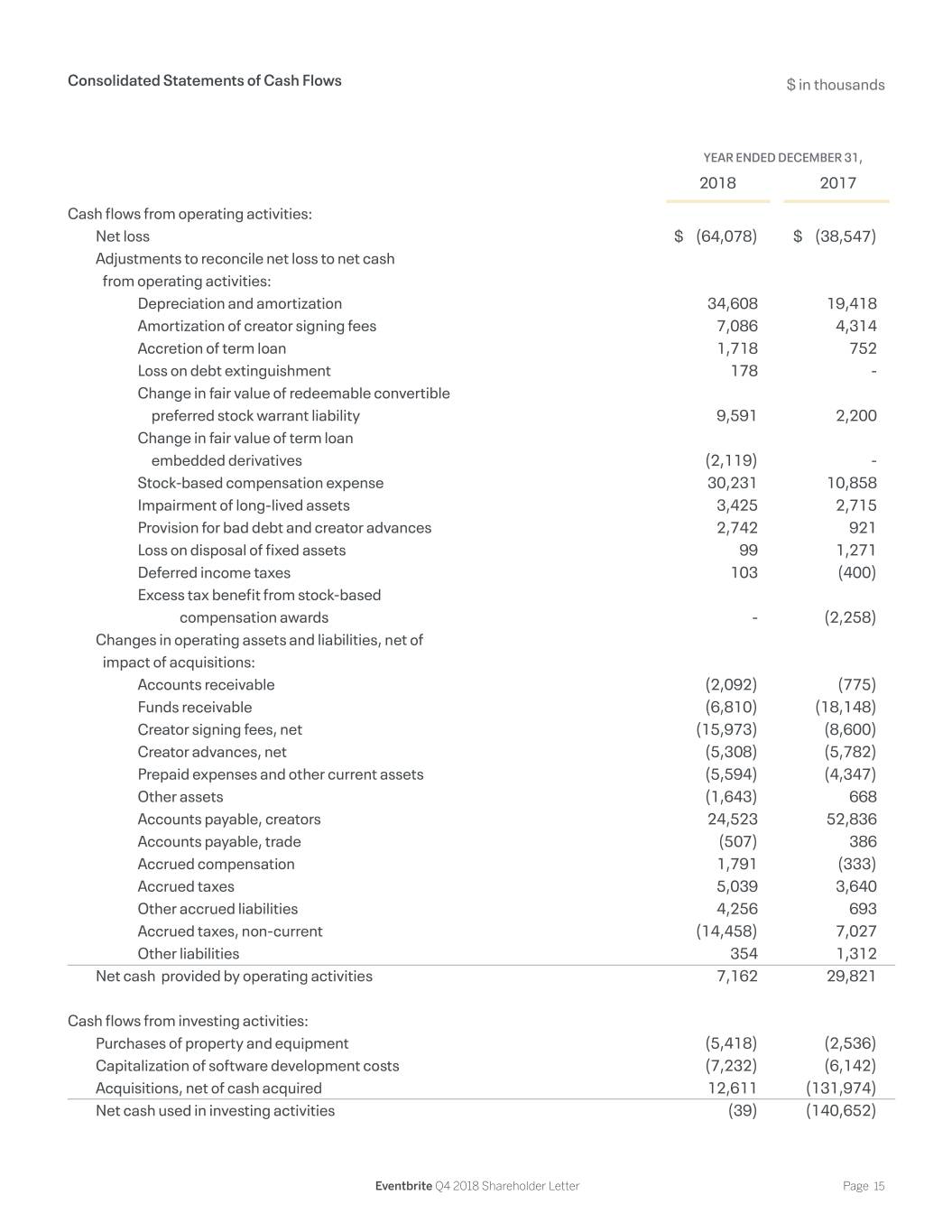

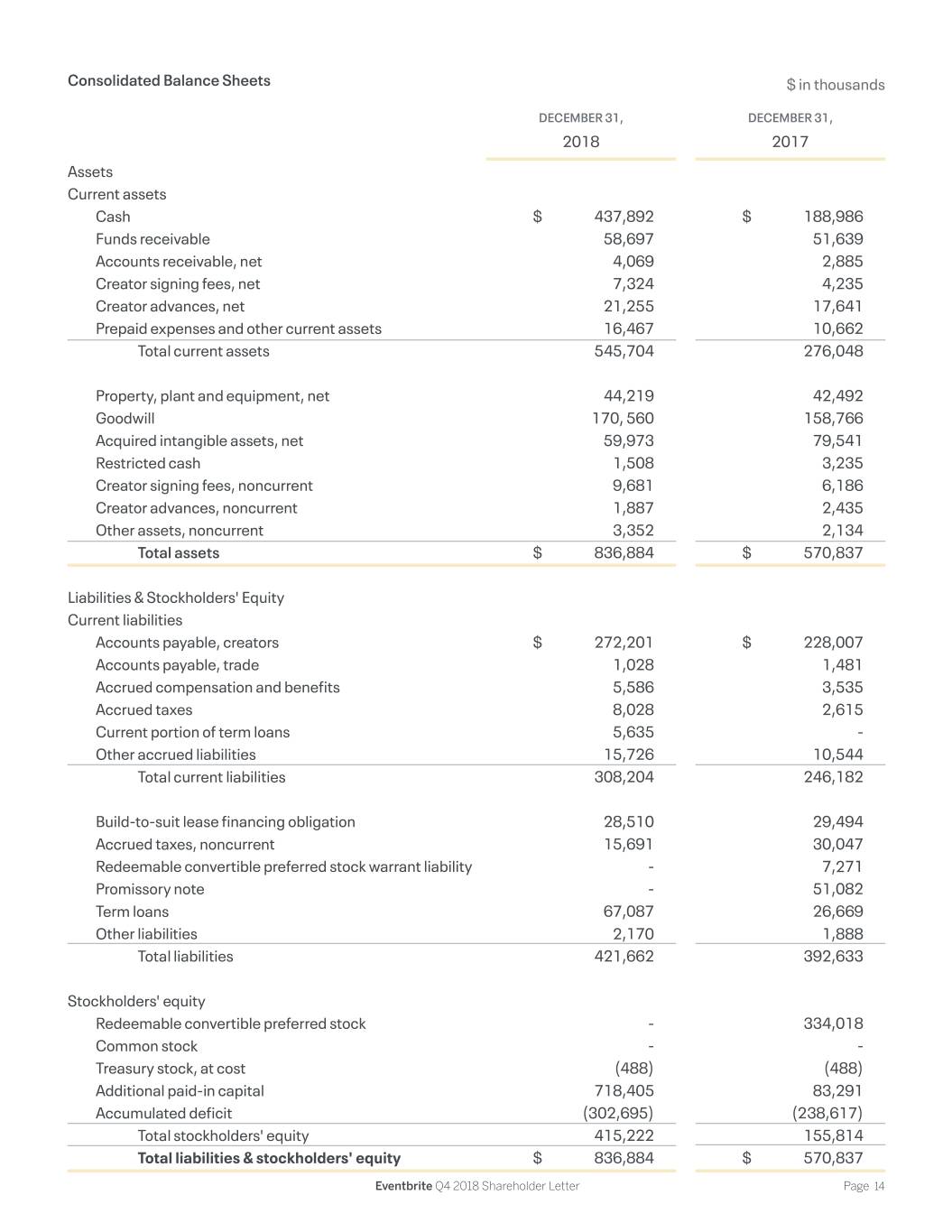

Consolidated Statements of Cash Flows $ in thousands YEAR ENDED DECEMBER 31, 2018 2017 Cash flows from operating activities: Net loss $ (64,078) $ (38,547) Adjustments to reconcile net loss to net cash from operating activities: Depreciation and amortization 34,608 19,418 Amortization of creator signing fees 7,086 4,314 Accretion of term loan 1,718 752 Loss on debt extinguishment 178 - Change in fair value of redeemable convertible preferred stock warrant liability 9,591 2,200 Change in fair value of term loan embedded derivatives (2,119) - Stock-based compensation expense 30,231 10,858 Impairment of long-lived assets 3,425 2,715 Provision for bad debt and creator advances 2,742 921 Loss on disposal of fixed assets 99 1,271 Deferred income taxes 103 (400) Excess tax benefit from stock-based compensation awards - (2,258) Changes in operating assets and liabilities, net of impact of acquisitions: Accounts receivable (2,092) (775) Funds receivable (6,810) (18,148) Creator signing fees, net (15,973) (8,600) Creator advances, net (5,308) (5,782) Prepaid expenses and other current assets (5,594) (4,347) Other assets (1,643) 668 Accounts payable, creators 24,523 52,836 Accounts payable, trade (507) 386 Accrued compensation 1,791 (333) Accrued taxes 5,039 3,640 Other accrued liabilities 4,256 693 Accrued taxes, non-current (14,458) 7,027 Other liabilities 354 1,312 Net cash provided by operating activities 7,162 29,821 Cash flows from investing activities: Purchases of property and equipment (5,418) (2,536) Capitalization of software development costs (7,232) (6,142) Acquisitions, net of cash acquired 12,611 (131,974) Net cash used in investing activities (39) (140,652) Eventbrite Q4 2018 Shareholder Letter Page 15

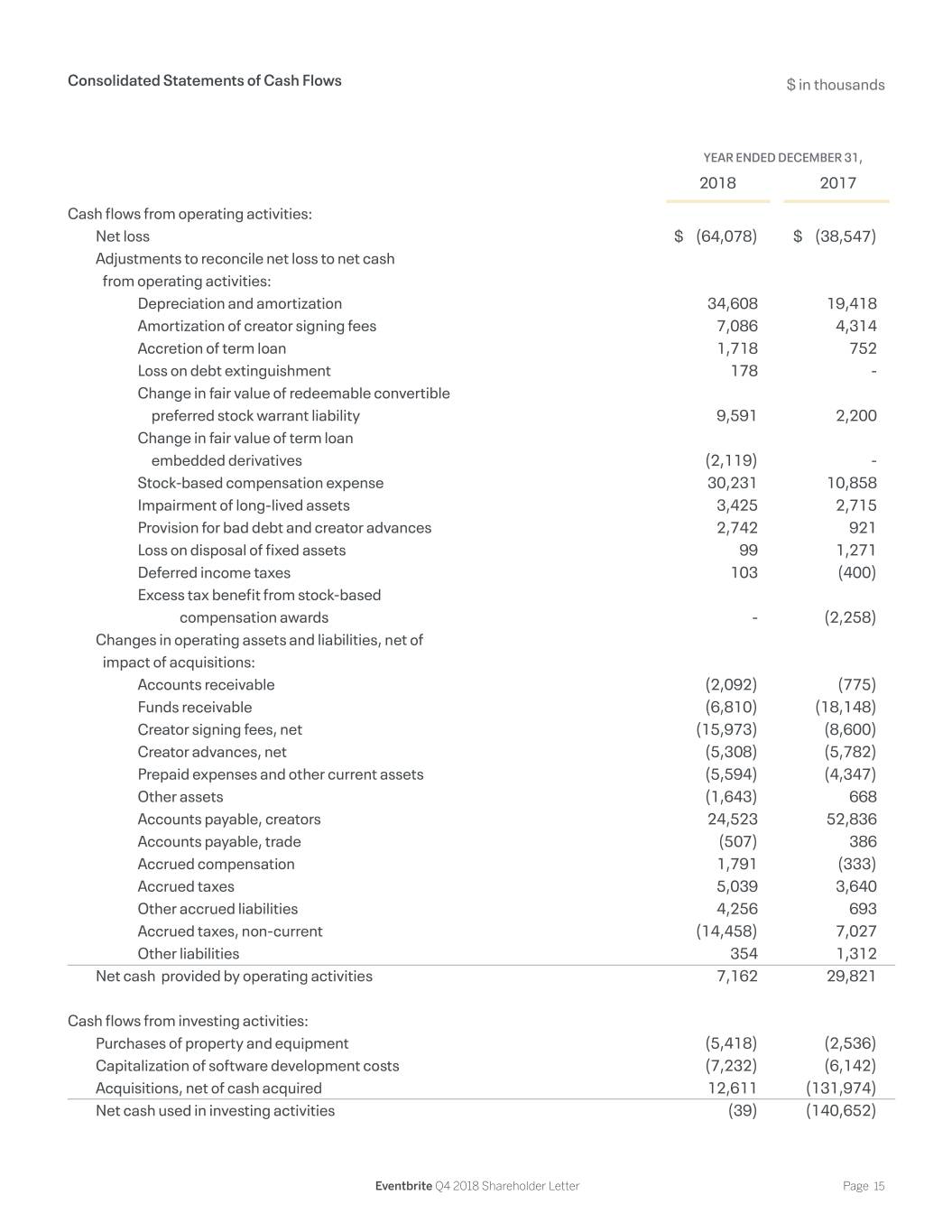

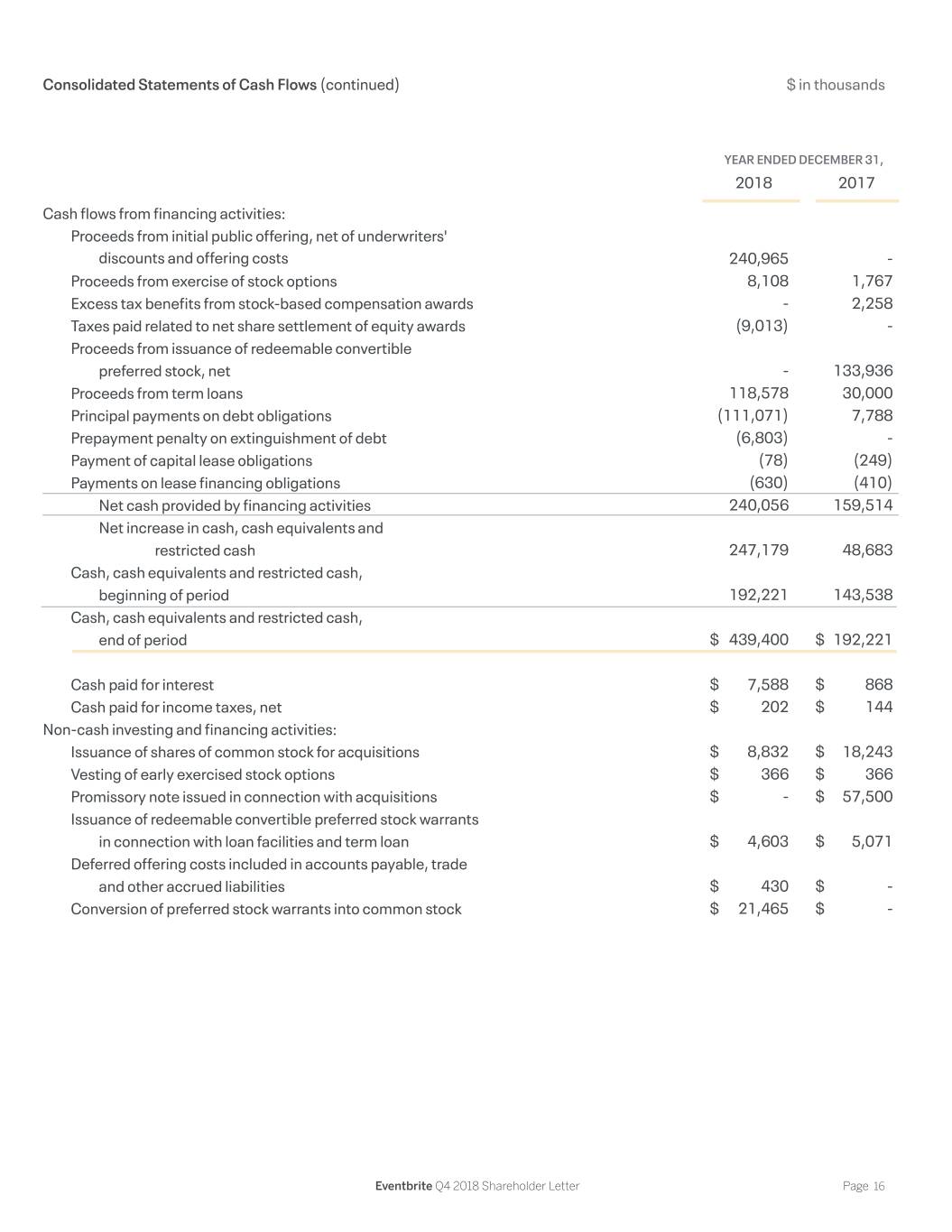

Consolidated Statements of Cash Flows (continued) $ in thousands YEAR ENDED DECEMBER 31, 2018 2017 Cash flows from financing activities: Proceeds from initial public offering, net of underwriters' discounts and offering costs 240,965 - Proceeds from exercise of stock options 8,108 1,767 Excess tax benefits from stock-based compensation awards - 2,258 Taxes paid related to net share settlement of equity awards (9,013) - Proceeds from issuance of redeemable convertible preferred stock, net - 133,936 Proceeds from term loans 118,578 30,000 Principal payments on debt obligations (111,071) 7,788 Prepayment penalty on extinguishment of debt (6,803) - Payment of capital lease obligations (78) (249) Payments on lease financing obligations (630) (410) Net cash provided by financing activities 240,056 159,514 Net increase in cash, cash equivalents and restricted cash 247,179 48,683 Cash, cash equivalents and restricted cash, beginning of period 192,221 143,538 Cash, cash equivalents and restricted cash, end of period $ 439,400 $ 192,221 Cash paid for interest $ 7,588 $ 868 Cash paid for income taxes, net $ 202 $ 144 Non-cash investing and financing activities: Issuance of shares of common stock for acquisitions $ 8,832 $ 18,243 Vesting of early exercised stock options $ 366 $ 366 Promissory note issued in connection with acquisitions $ - $ 57,500 Issuance of redeemable convertible preferred stock warrants in connection with loan facilities and term loan $ 4,603 $ 5,071 Deferred offering costs included in accounts payable, trade and other accrued liabilities $ 430 $ - Conversion of preferred stock warrants into common stock $ 21,465 $ - Eventbrite Q4 2018 Shareholder Letter Page 16

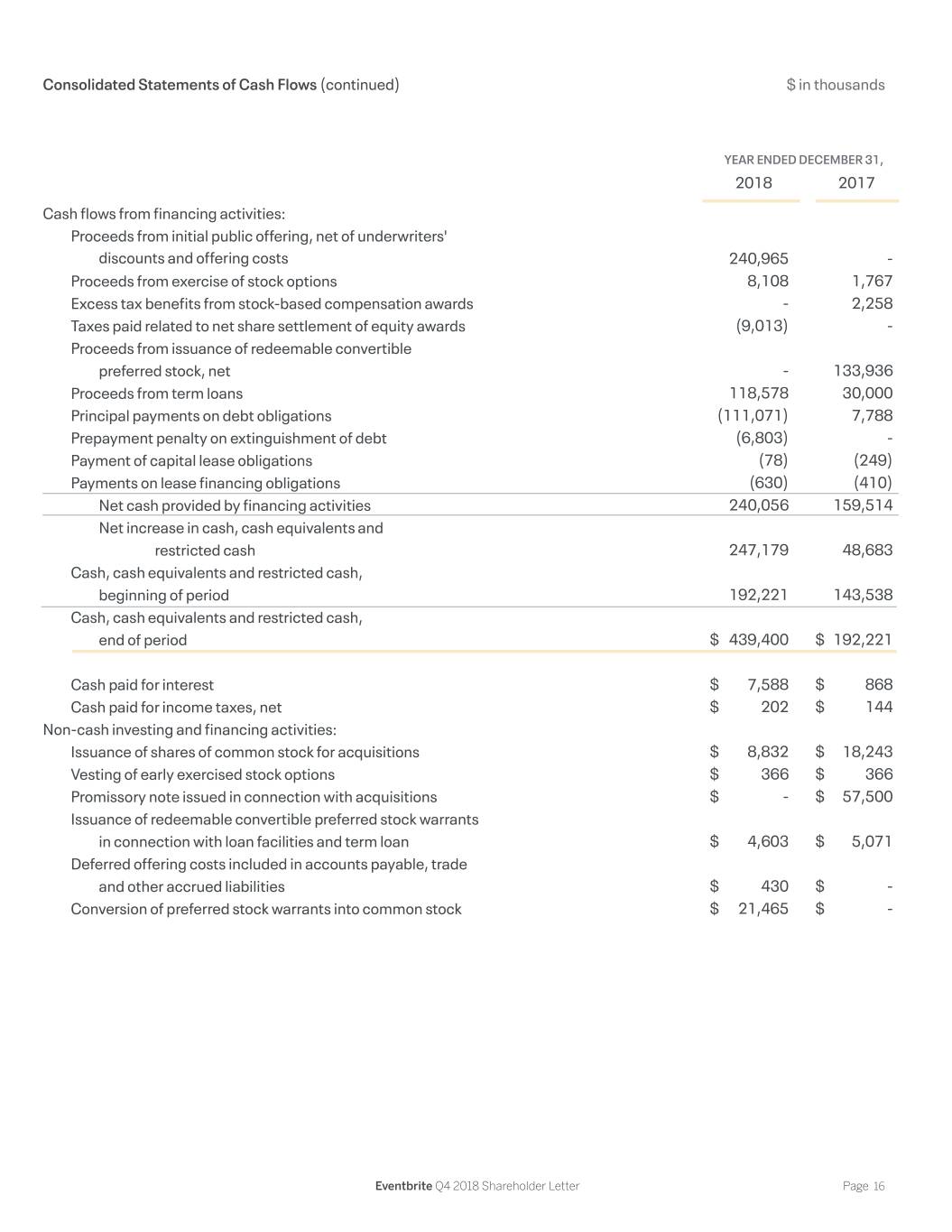

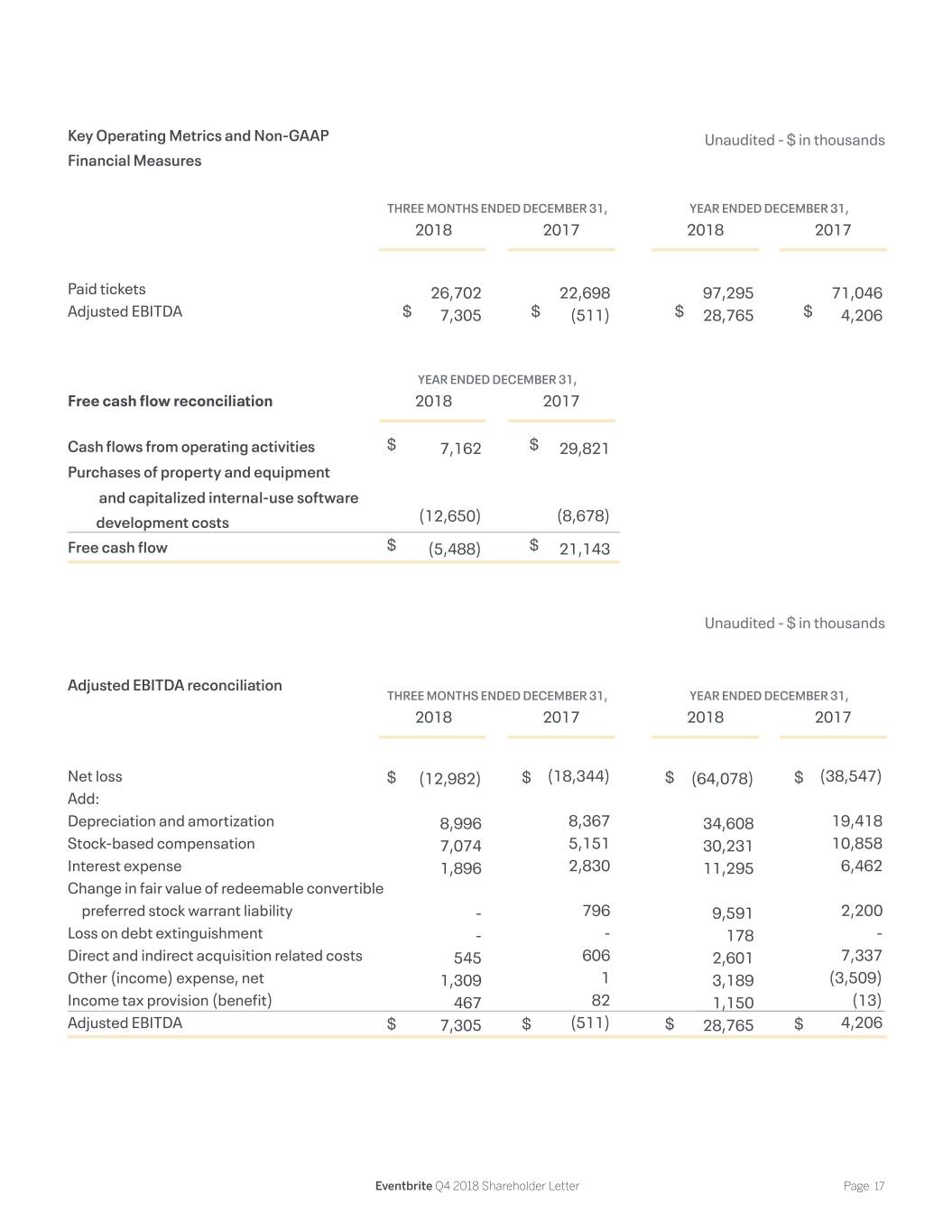

Key Operating Metrics and Non-GAAP Unaudited - $ in thousands Financial Measures THREE MONTHS ENDED DECEMBER 31, YEAR ENDED DECEMBER 31, 2018 2017 2018 2017 Paid tickets 26,702 22,698 97,295 71,046 Adjusted EBITDA $ 7,305 $ (511) $ 28,765 $ 4,206 YEAR ENDED DECEMBER 31, Free cash flow reconciliation 2018 2017 Cash flows from operating activities $ 7,162 $ 29,821 Purchases of property and equipment and capitalized internal-use software development costs (12,650) (8,678) Free cash flow $ (5,488) $ 21,143 Unaudited - $ in thousands Adjusted EBITDA reconciliation THREE MONTHS ENDED DECEMBER 31, YEAR ENDED DECEMBER 31, 2018 2017 2018 2017 Net loss $ (12,982) $ (18,344) $ (64,078) $ (38,547) Add: Depreciation and amortization 8,996 8,367 34,608 19,418 Stock-based compensation 7,074 5,151 30,231 10,858 Interest expense 1,896 2,830 11,295 6,462 Change in fair value of redeemable convertible preferred stock warrant liability - 796 9,591 2,200 Loss on debt extinguishment - - 178 - Direct and indirect acquisition related costs 545 606 2,601 7,337 Other (income) expense, net 1,309 1 3,189 (3,509) Income tax provision (benefit) 467 82 1,150 (13) Adjusted EBITDA $ 7,305 $ (511) $ 28,765 $ 4,206 Eventbrite Q4 2018 Shareholder Letter Page 17