G al ve st on H is to ric al Fo un da tio n Shareholder Letter Q4 2024 Feb 27, 2025

. Paid Tickets Net Revenue Gross Ticket Sales Net Revenue Per Ticket (1) Includes reduction in force adjustments totaling ($0.1) million in the fourth quarter. (2) Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Adjusted EBITDA, including the limitations of non-GAAP measures, and see the end of this letter for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. Quarterly Highlights Net revenue of $76.5 million was at the high end of the outlook range for the fourth quarter. Consumer reach exceeded 87 million average monthly active users, with paid ticket volume at 21.6 million in the fourth quarter. Paid Creators Net Loss (1) Paid Buyers Adjusted EBITDA(1)(2) (9%) Y/Y (9%) Y/Y 166.4K $8.4M 10.4M $6.5M Q4 2024 Q4 2023 $88M $76M (13%) Y/Y Q4 2024 Q4 2023 $872M $794M (9%) Y/Y Q4 2024 Q4 2023 24M 22M (10%) Y/Y Q4 2024 Q4 2023 $3.64 $3.53 (3%) Y/Y Creator acquisition, in the fourth quarter, continued to improve following the reintroduction of the free tier in September. Page 2Eventbrite Q4 2024 Shareholder Letter

Dear Eventbrite Shareholder, In 2024, we reinforced our position as a go-to marketplace for live experiences, powering over 4.7 million events around the world and facilitating 270 million free and paid tickets. Even as we worked diligently to stabilize our business and drive our return to growth, we continued to make significant strides in transforming Eventbrite into a thriving marketplace. To empower creators with greater control over their events that span multiple time slots, we rolled out a timed entry feature in October, which has been adopted by thousands of creators and has been well received. We enhanced Eventbrite Ads, which grew 83% in 2024, with smarter targeting to improve conversion rates. We introduced Instant Payouts to put capital into the hands of our creators more quickly and expanded our 24/7 live customer support. We also enhanced creator reporting, offering faster, more scalable, and clearer insights into sales performance and marketing effectiveness. For consumers, we made event discovery more personalized and engaging, leveraging machine learning recommendations and a strategic partnership with TikTok to surface more relevant events. We believe these advances, along with our focus on expanding strategic inventory and enhancing the user experience, led to a 10% lift year-over-year in discovery-driven ticket sales in the fourth quarter. While we achieved important progress toward our strategic objectives, 2024 was not without challenges. Among our most critical initiatives for the year was resolving the disruption caused by the introduction of a fee for event organizers in addition to our ticketing fee. As the unintended friction became clear, we course-corrected, simplifying our pricing structure by eliminating per-event organizer fees and reinstating our free tier in September. Galveston Historical Foundation Galveston Historical Foundation Galveston Historical Foundation (GHF) has been bringing Galveston’s rich history to life for over 150 years — and they’ve turned to Eventbrite to help make it happen. In the past year alone, they’ve hosted over 4,000 events, sold 25,000 paid tickets, and generated $70,000 in GTF. From holiday celebrations and live music to historical tours and nature experiences, GHF is one of the largest historic nonprofits in the United States. Whether it’s stepping inside a historic home, setting sail on a restored vessel, or enjoying live music in a one-of-a-kind setting, GHF continues to make history exciting and accessible. With such a diverse lineup, GHF needed a reliable platform to manage ticketing, promotion, and attendee engagement. Eventbrite’s easy-to-use tools have helped them seamlessly organize and market their events, allowing them to reach a broad audience and sell more tickets. With Eventbrite handling the logistics, they can focus on what they do best — bringing locals and visitors together to experience Galveston’s past in unforgettable ways. Page 3Eventbrite Q4 2024 Shareholder Letter

Since taking these steps, ticketing trends have improved steadily. We previously noted that in October, year-to-year comparisons in creator acquisition, new creator event volume, and ticket transactions from new creators improved across both free and paid events. That improvement continued through November and December. Fourth quarter total ticketing volume returned to growth, increasing 2% from the prior year. Free ticket volume grew 8% year to year in Q4, representing a 25 percentage-point improvement from the 17% year-over-year decline reported in Q3. The year-to- year comparisons in paid tickets, paid transacting creators, and paid events on the platform all improved from Q3 to Q4. With a more engaged creator base, a stabilizing ticketing business, and continued strong growth in ads monetization, we believe that we are back on the path to creating long-term value. COLORS Worldwide A journalist-turned-event producer, Jabari Johnson threw his first R&B ONLY show at a Los Angeles bar in 2014, bringing fans of the genre together for a celebration soundtracked by classic and contemporary tunes selected by talented DJs. Johnson founded COLORS Worldwide as an “experience company,” bringing R&B ONLY to venues across North America as well as the UK — the event is currently in the midst of a 10- year anniversary tour, traveling to more than 40 cities. COLORS Worldwide joined Eventbrite in 2016, going from hosting hundreds of attendees at its events to venues that hold thousands. Many of these attendees are the Social Scouts that Eventbrite caters to, contributing to 52% of lifetime ticket sales driven by the platform. This is even more evident over the past 12 months, with Eventbrite driving sales of 26k tickets to COLORS Worldwide events, generating $157k GTF. “What’s next for us is expansion — bigger, better, louder,” Johnson says about the future of COLORS Worldwide, teasing international events and video content that builds on the R&B ONLY brand. COLORS is also preparing to explore genres beyond R&B, launching a new event called Y’ALL COUNTRY that’s set to tour North America in 2025. Delivering Improving Results Our decisive actions on pricing and packaging enabled us to achieve our outlook for the fourth quarter. We delivered net revenue of $76.5 million, at the upper end of our outlook range. We reported a net loss of $8.4 million and Adjusted EBITDA of $6.5 million, which enabled us to exceed our 10% full-year Adjusted EBITDA margin outlook. Momentum has continued to build since the start of 2025. In January, year-over-year trends in paid tickets, paid transacting creators, and paid events each showed sequential improvement. Excluding February 2024’s additional leap year day, we are on pace for a fifth consecutive month of sequential improvement in year-over-year paid ticket volume. Our work for the year ahead builds on this momentum by enhancing discovery and expanding creator tools to deepen our marketplace advantage. "A "returning creator" refers to a creator who has previously used Eventbrite to host events and has come back to use the platform again. " Q3 2024 Ticket YoY Trends (8%) Free Paid Q4 2024 Total 8% (17%) 8% (16%) (14%) (10%) 2% Page 4Eventbrite Q4 2024 Shareholder Letter

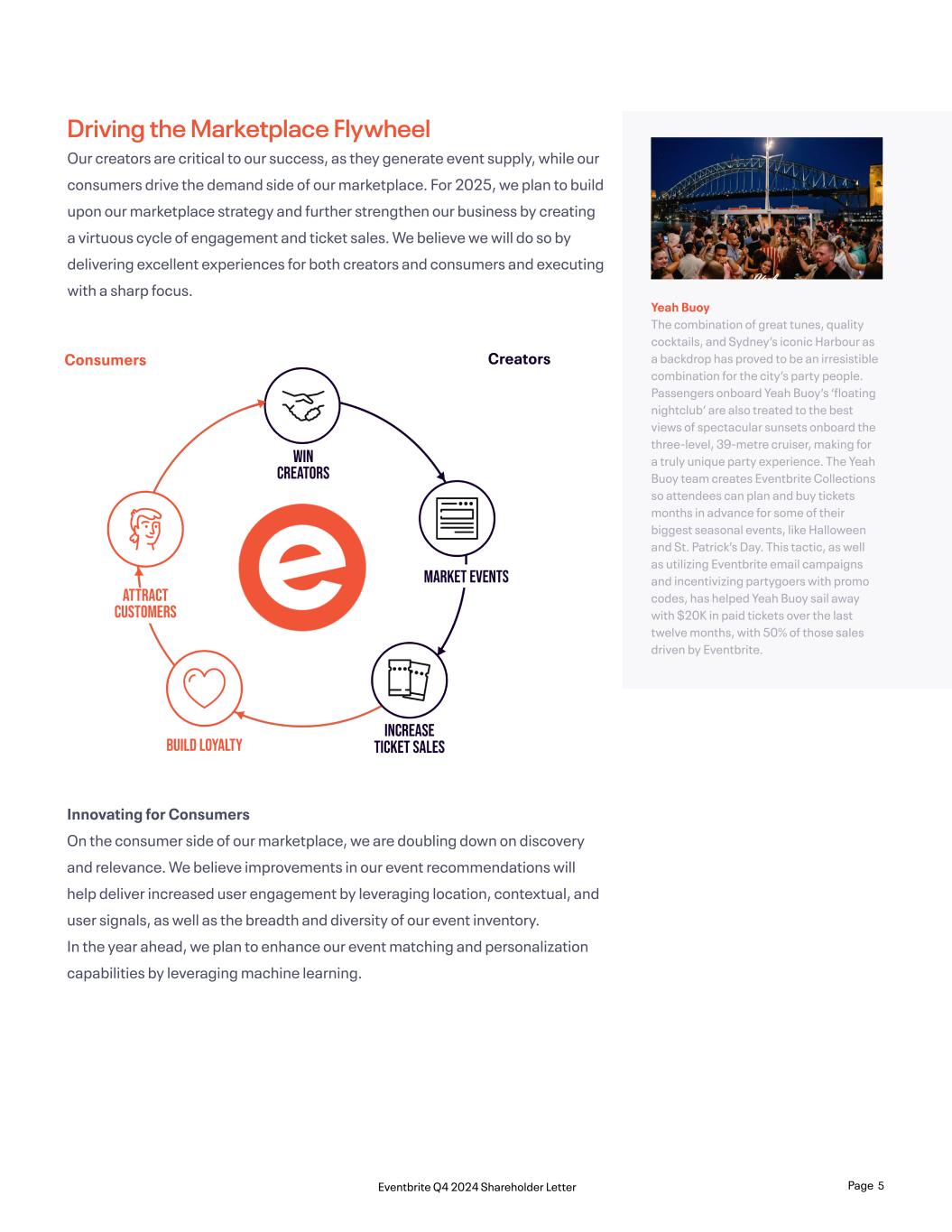

Yeah Buoy The combination of great tunes, quality cocktails, and Sydney’s iconic Harbour as a backdrop has proved to be an irresistible combination for the city’s party people. Passengers onboard Yeah Buoy’s ‘floating nightclub’ are also treated to the best views of spectacular sunsets onboard the three-level, 39-metre cruiser, making for a truly unique party experience. The Yeah Buoy team creates Eventbrite Collections so attendees can plan and buy tickets months in advance for some of their biggest seasonal events, like Halloween and St. Patrick’s Day. This tactic, as well as utilizing Eventbrite email campaigns and incentivizing partygoers with promo codes, has helped Yeah Buoy sail away with $20K in paid tickets over the last twelve months, with 50% of those sales driven by Eventbrite. Driving the Marketplace Flywheel Our creators are critical to our success, as they generate event supply, while our consumers drive the demand side of our marketplace. For 2025, we plan to build upon our marketplace strategy and further strengthen our business by creating a virtuous cycle of engagement and ticket sales. We believe we will do so by delivering excellent experiences for both creators and consumers and executing with a sharp focus. Consumers Creators Innovating for Consumers On the consumer side of our marketplace, we are doubling down on discovery and relevance. We believe improvements in our event recommendations will help deliver increased user engagement by leveraging location, contextual, and user signals, as well as the breadth and diversity of our event inventory. In the year ahead, we plan to enhance our event matching and personalization capabilities by leveraging machine learning. Page 5Eventbrite Q4 2024 Shareholder Letter

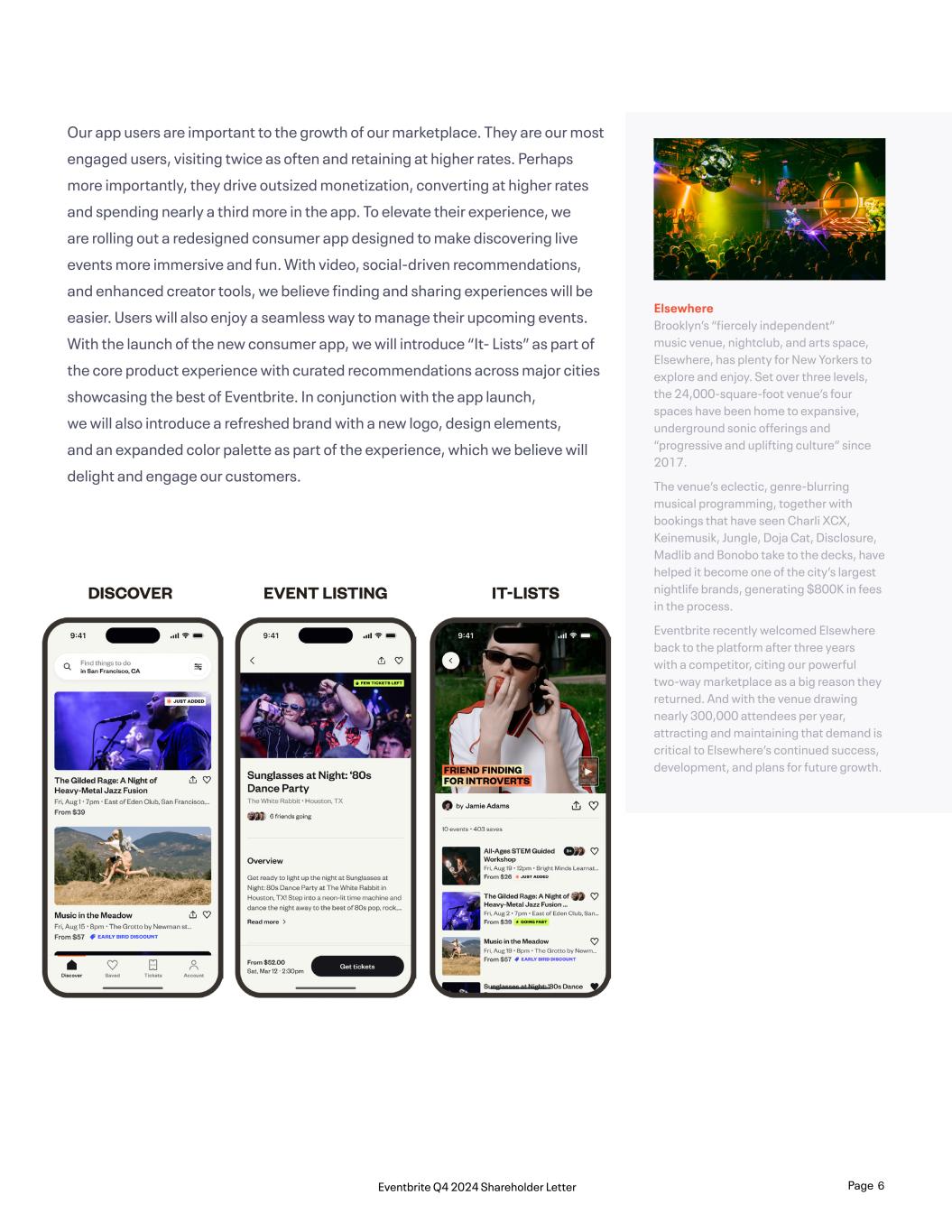

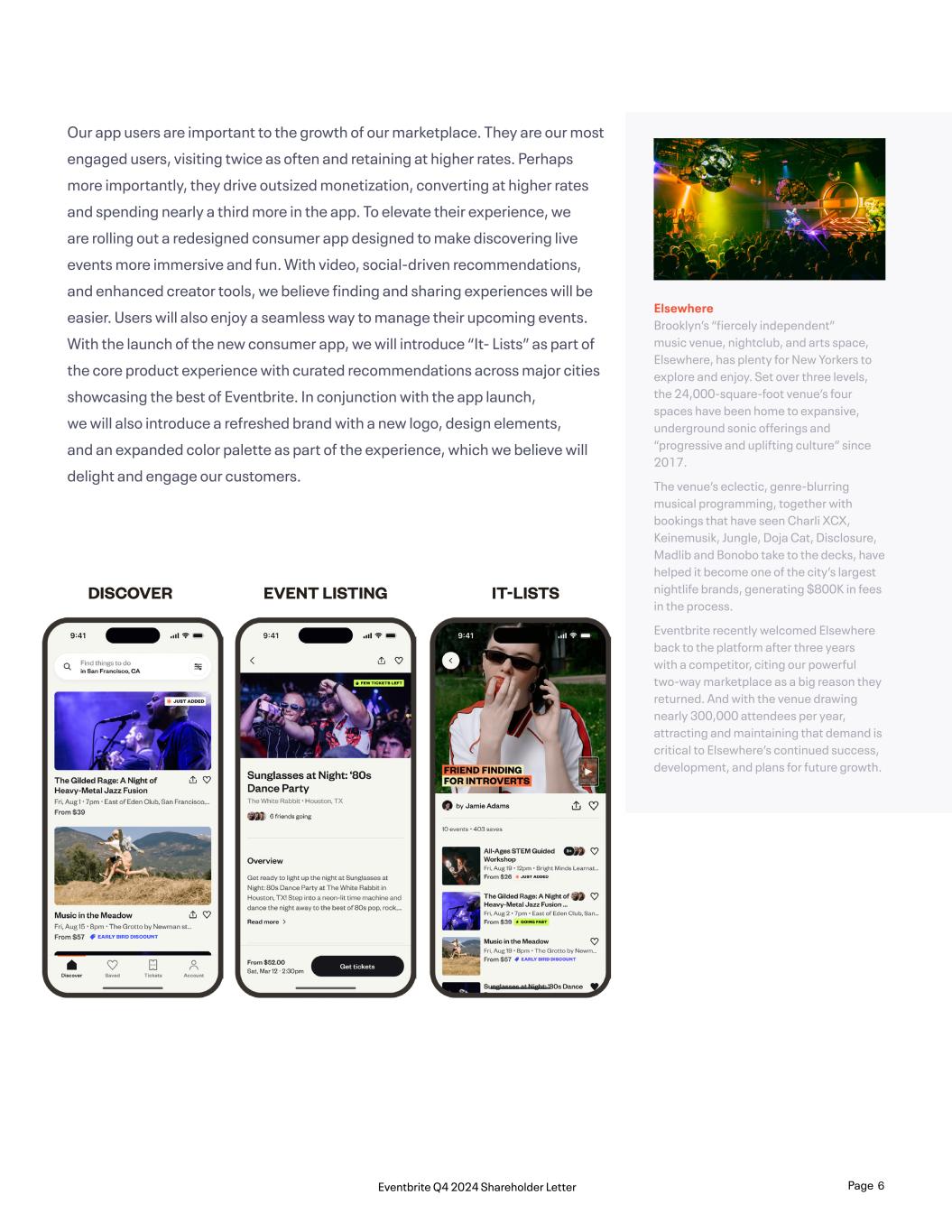

Elsewhere Brooklyn’s “fiercely independent” music venue, nightclub, and arts space, Elsewhere, has plenty for New Yorkers to explore and enjoy. Set over three levels, the 24,000-square-foot venue’s four spaces have been home to expansive, underground sonic offerings and “progressive and uplifting culture” since 2017. The venue’s eclectic, genre-blurring musical programming, together with bookings that have seen Charli XCX, Keinemusik, Jungle, Doja Cat, Disclosure, Madlib and Bonobo take to the decks, have helped it become one of the city’s largest nightlife brands, generating $800K in fees in the process. Eventbrite recently welcomed Elsewhere back to the platform after three years with a competitor, citing our powerful two-way marketplace as a big reason they returned. And with the venue drawing nearly 300,000 attendees per year, attracting and maintaining that demand is critical to Elsewhere’s continued success, development, and plans for future growth. Our app users are important to the growth of our marketplace. They are our most engaged users, visiting twice as often and retaining at higher rates. Perhaps more importantly, they drive outsized monetization, converting at higher rates and spending nearly a third more in the app. To elevate their experience, we are rolling out a redesigned consumer app designed to make discovering live events more immersive and fun. With video, social-driven recommendations, and enhanced creator tools, we believe finding and sharing experiences will be easier. Users will also enjoy a seamless way to manage their upcoming events. With the launch of the new consumer app, we will introduce “It- Lists” as part of the core product experience with curated recommendations across major cities showcasing the best of Eventbrite. In conjunction with the app launch, we will also introduce a refreshed brand with a new logo, design elements, and an expanded color palette as part of the experience, which we believe will delight and engage our customers. DISCOVER EVENT LISTING IT-LISTS Page 6Eventbrite Q4 2024 Shareholder Letter

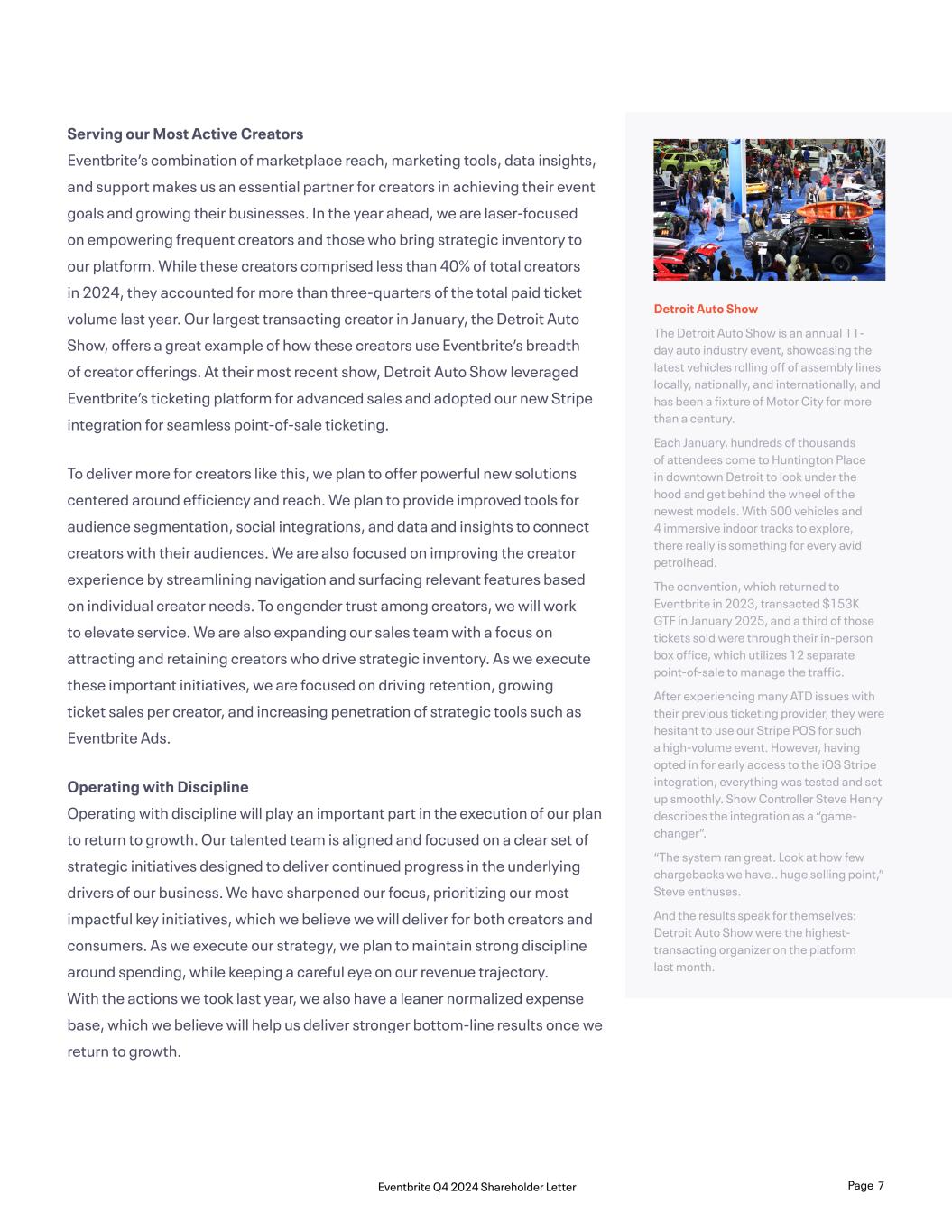

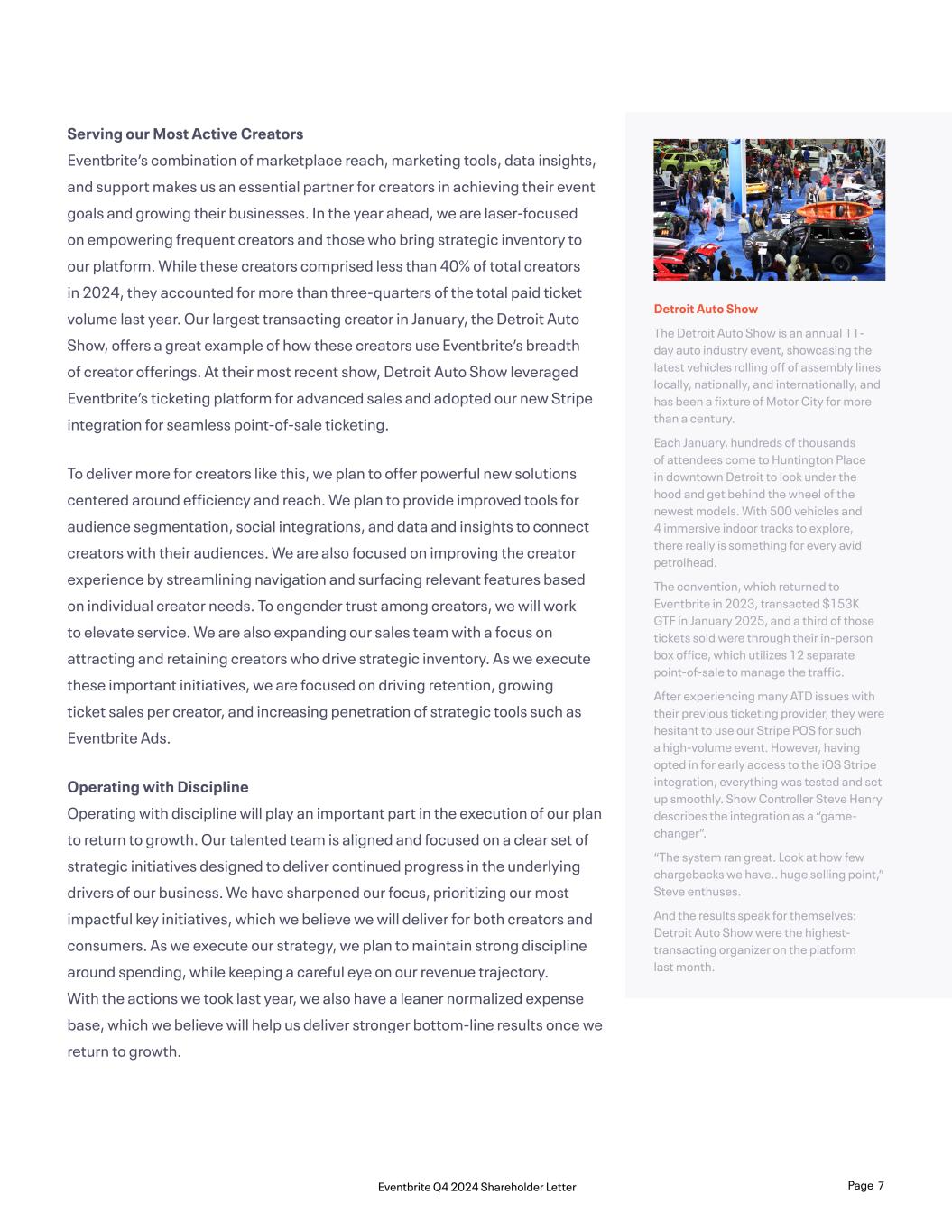

Serving our Most Active Creators Eventbrite’s combination of marketplace reach, marketing tools, data insights, and support makes us an essential partner for creators in achieving their event goals and growing their businesses. In the year ahead, we are laser-focused on empowering frequent creators and those who bring strategic inventory to our platform. While these creators comprised less than 40% of total creators in 2024, they accounted for more than three-quarters of the total paid ticket volume last year. Our largest transacting creator in January, the Detroit Auto Show, offers a great example of how these creators use Eventbrite’s breadth of creator offerings. At their most recent show, Detroit Auto Show leveraged Eventbrite’s ticketing platform for advanced sales and adopted our new Stripe integration for seamless point-of-sale ticketing. To deliver more for creators like this, we plan to offer powerful new solutions centered around efficiency and reach. We plan to provide improved tools for audience segmentation, social integrations, and data and insights to connect creators with their audiences. We are also focused on improving the creator experience by streamlining navigation and surfacing relevant features based on individual creator needs. To engender trust among creators, we will work to elevate service. We are also expanding our sales team with a focus on attracting and retaining creators who drive strategic inventory. As we execute these important initiatives, we are focused on driving retention, growing ticket sales per creator, and increasing penetration of strategic tools such as Eventbrite Ads. Operating with Discipline Operating with discipline will play an important part in the execution of our plan to return to growth. Our talented team is aligned and focused on a clear set of strategic initiatives designed to deliver continued progress in the underlying drivers of our business. We have sharpened our focus, prioritizing our most impactful key initiatives, which we believe we will deliver for both creators and consumers. As we execute our strategy, we plan to maintain strong discipline around spending, while keeping a careful eye on our revenue trajectory. With the actions we took last year, we also have a leaner normalized expense base, which we believe will help us deliver stronger bottom-line results once we return to growth. Detroit Auto Show The Detroit Auto Show is an annual 11- day auto industry event, showcasing the latest vehicles rolling off of assembly lines locally, nationally, and internationally, and has been a fixture of Motor City for more than a century. Each January, hundreds of thousands of attendees come to Huntington Place in downtown Detroit to look under the hood and get behind the wheel of the newest models. With 500 vehicles and 4 immersive indoor tracks to explore, there really is something for every avid petrolhead. The convention, which returned to Eventbrite in 2023, transacted $153K GTF in January 2025, and a third of those tickets sold were through their in-person box office, which utilizes 12 separate point-of-sale to manage the traffic. After experiencing many ATD issues with their previous ticketing provider, they were hesitant to use our Stripe POS for such a high-volume event. However, having opted in for early access to the iOS Stripe integration, everything was tested and set up smoothly. Show Controller Steve Henry describes the integration as a “game- changer”. “The system ran great. Look at how few chargebacks we have.. huge selling point,” Steve enthuses. And the results speak for themselves: Detroit Auto Show were the highest- transacting organizer on the platform last month. Page 7Eventbrite Q4 2024 Shareholder Letter

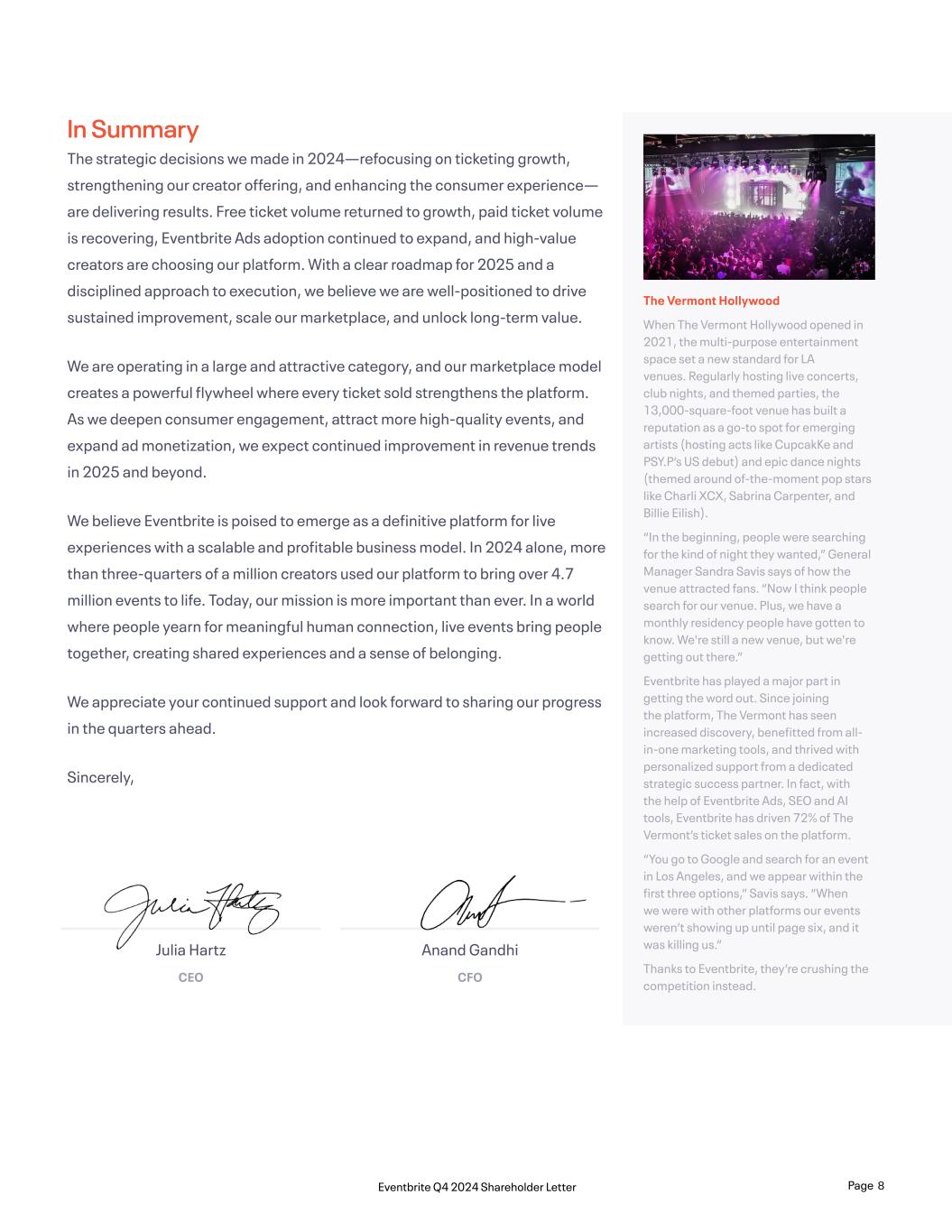

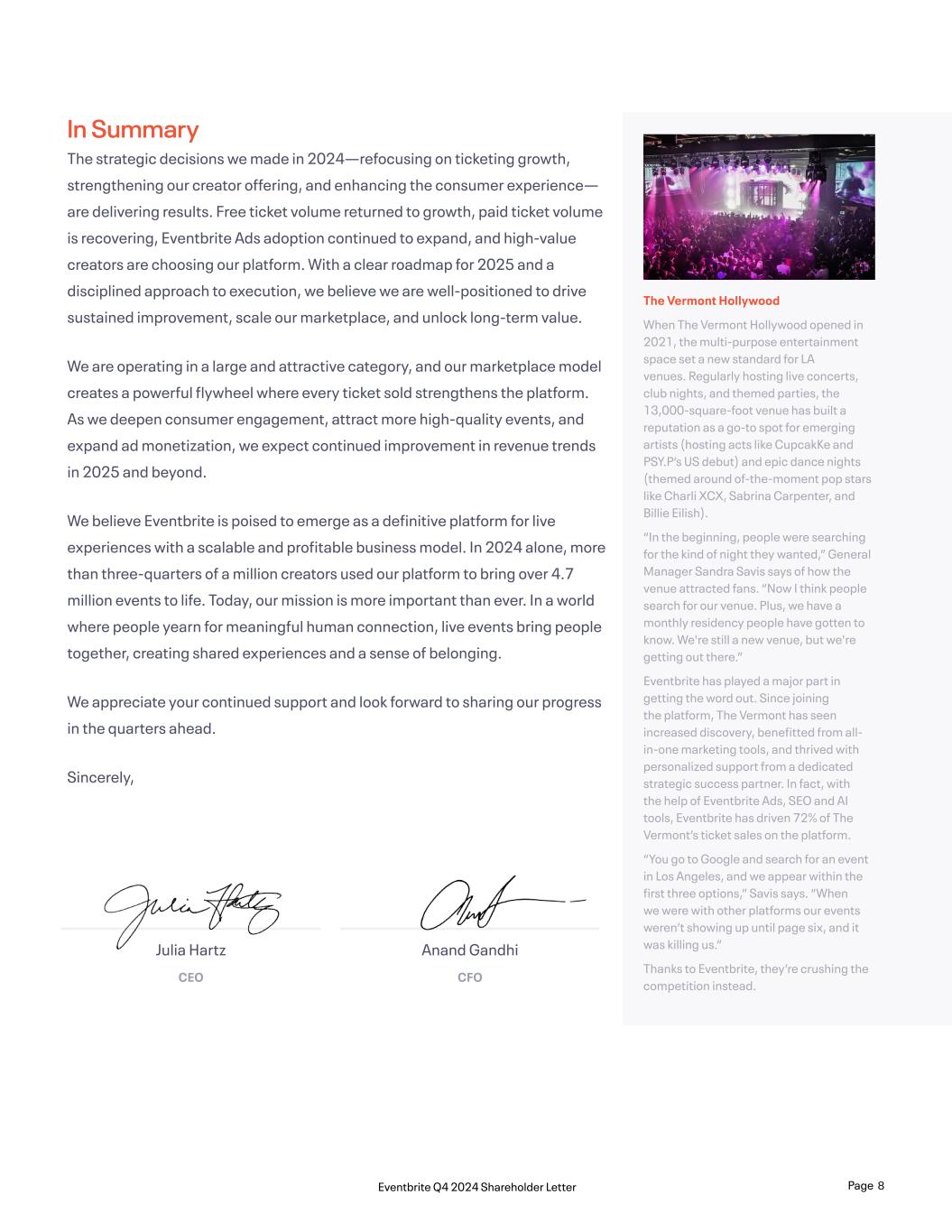

In Summary The strategic decisions we made in 2024—refocusing on ticketing growth, strengthening our creator offering, and enhancing the consumer experience— are delivering results. Free ticket volume returned to growth, paid ticket volume is recovering, Eventbrite Ads adoption continued to expand, and high-value creators are choosing our platform. With a clear roadmap for 2025 and a disciplined approach to execution, we believe we are well-positioned to drive sustained improvement, scale our marketplace, and unlock long-term value. We are operating in a large and attractive category, and our marketplace model creates a powerful flywheel where every ticket sold strengthens the platform. As we deepen consumer engagement, attract more high-quality events, and expand ad monetization, we expect continued improvement in revenue trends in 2025 and beyond. We believe Eventbrite is poised to emerge as a definitive platform for live experiences with a scalable and profitable business model. In 2024 alone, more than three-quarters of a million creators used our platform to bring over 4.7 million events to life. Today, our mission is more important than ever. In a world where people yearn for meaningful human connection, live events bring people together, creating shared experiences and a sense of belonging. We appreciate your continued support and look forward to sharing our progress in the quarters ahead. Sincerely, Julia Hartz CEO The Vermont Hollywood When The Vermont Hollywood opened in 2021, the multi-purpose entertainment space set a new standard for LA venues. Regularly hosting live concerts, club nights, and themed parties, the 13,000-square-foot venue has built a reputation as a go-to spot for emerging artists (hosting acts like CupcakKe and PSY.P’s US debut) and epic dance nights (themed around of-the-moment pop stars like Charli XCX, Sabrina Carpenter, and Billie Eilish). “In the beginning, people were searching for the kind of night they wanted,” General Manager Sandra Savis says of how the venue attracted fans. “Now I think people search for our venue. Plus, we have a monthly residency people have gotten to know. We're still a new venue, but we're getting out there.” Eventbrite has played a major part in getting the word out. Since joining the platform, The Vermont has seen increased discovery, benefitted from all- in-one marketing tools, and thrived with personalized support from a dedicated strategic success partner. In fact, with the help of Eventbrite Ads, SEO and AI tools, Eventbrite has driven 72% of The Vermont’s ticket sales on the platform. “You go to Google and search for an event in Los Angeles, and we appear within the first three options,” Savis says. “When we were with other platforms our events weren’t showing up until page six, and it was killing us.” Thanks to Eventbrite, they’re crushing the competition instead. Anand Gandhi CFO Page 8Eventbrite Q4 2024 Shareholder Letter

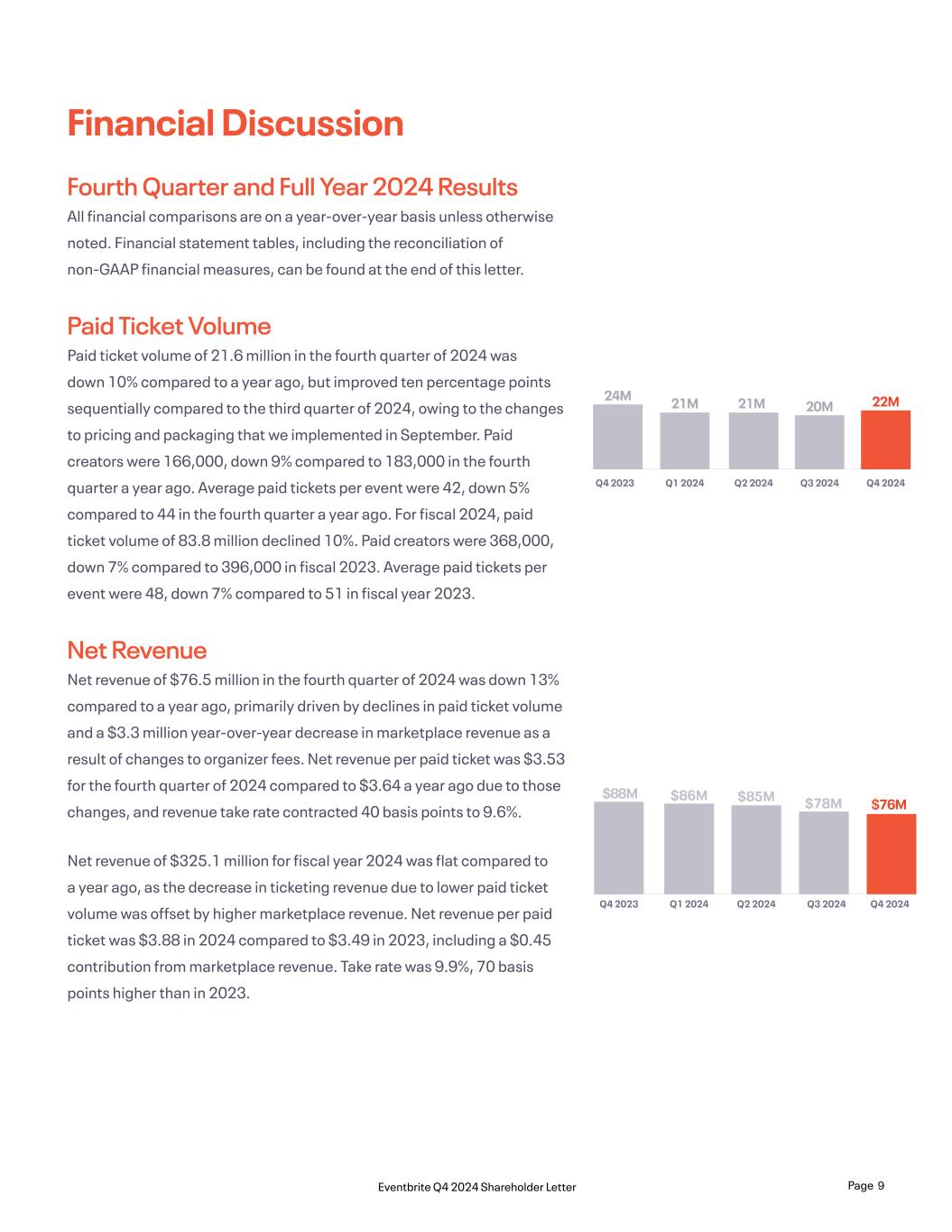

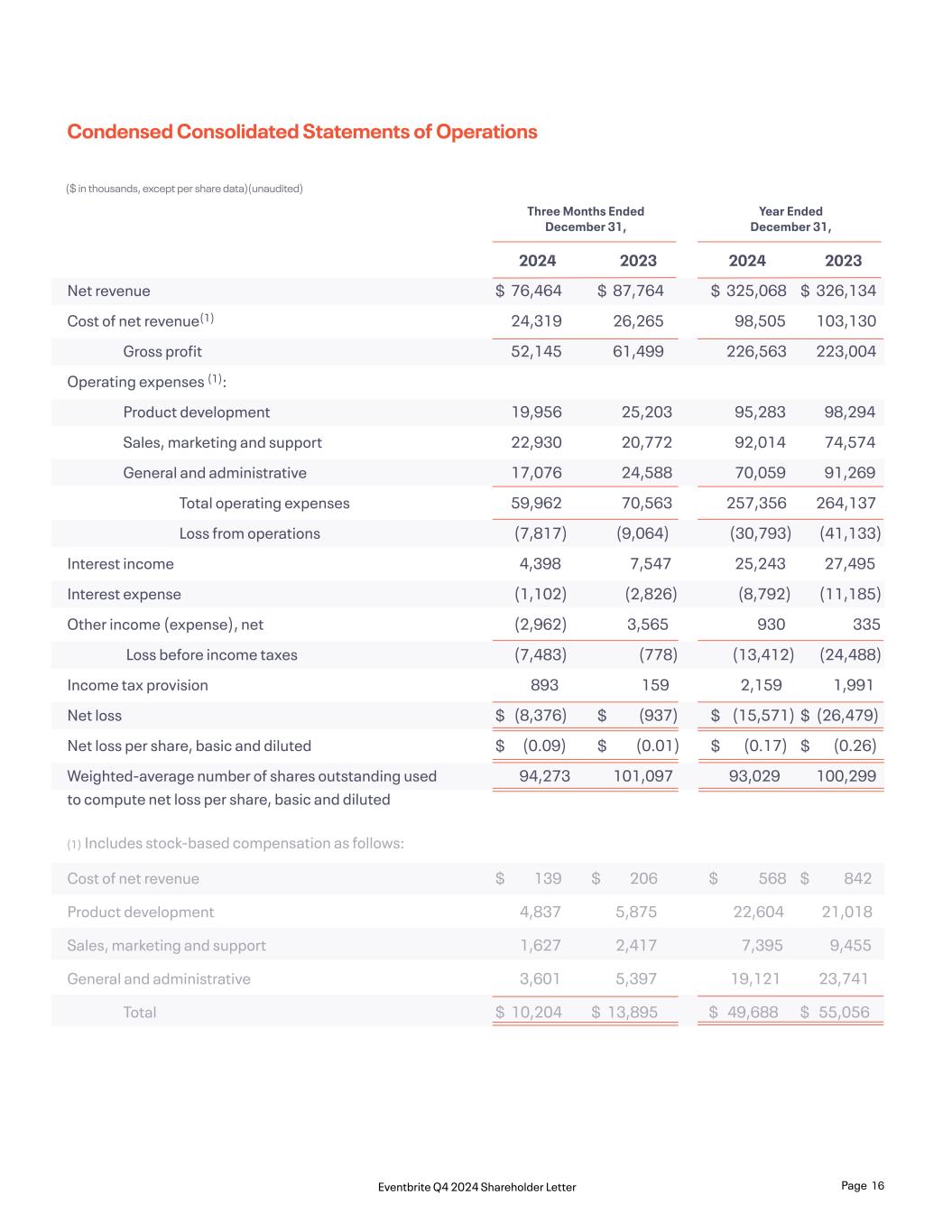

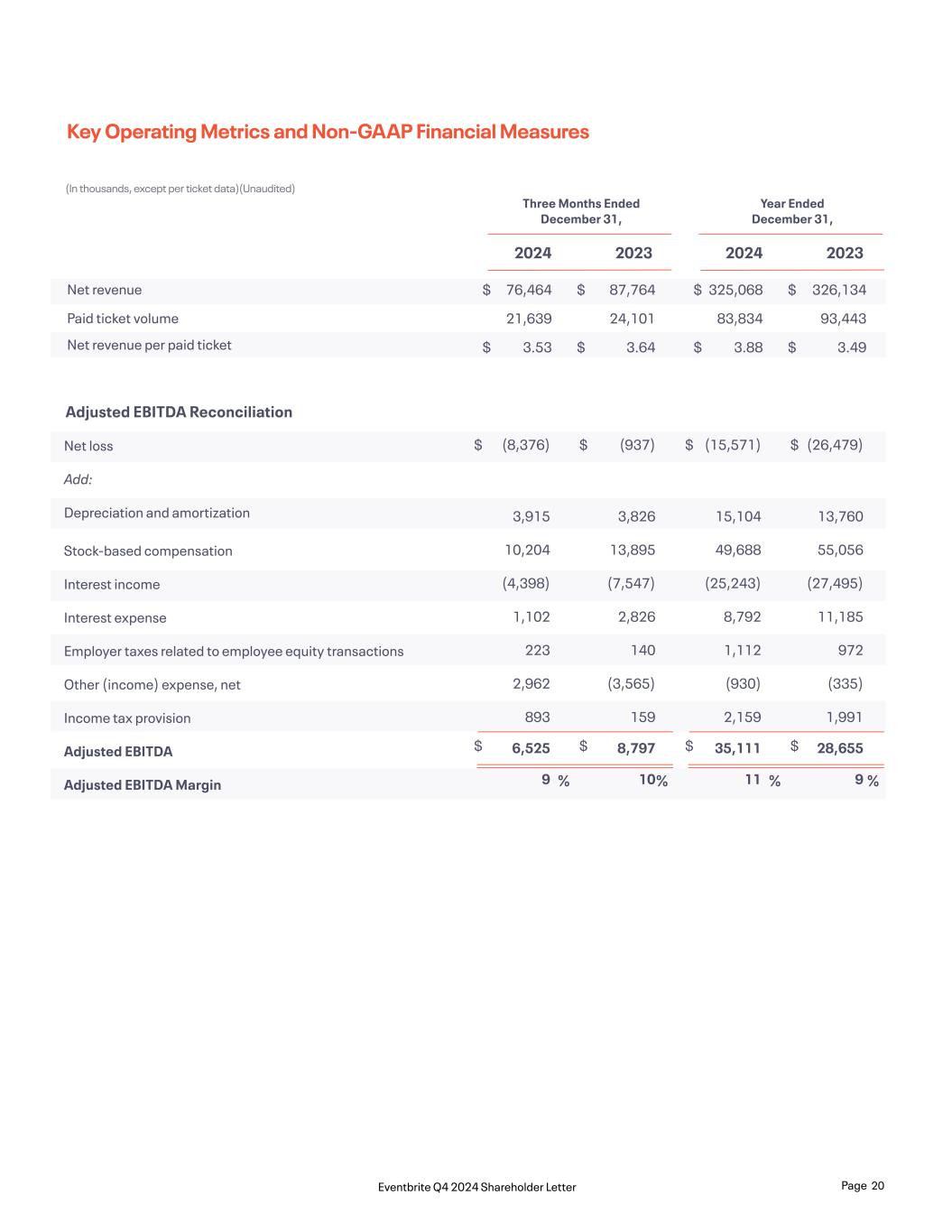

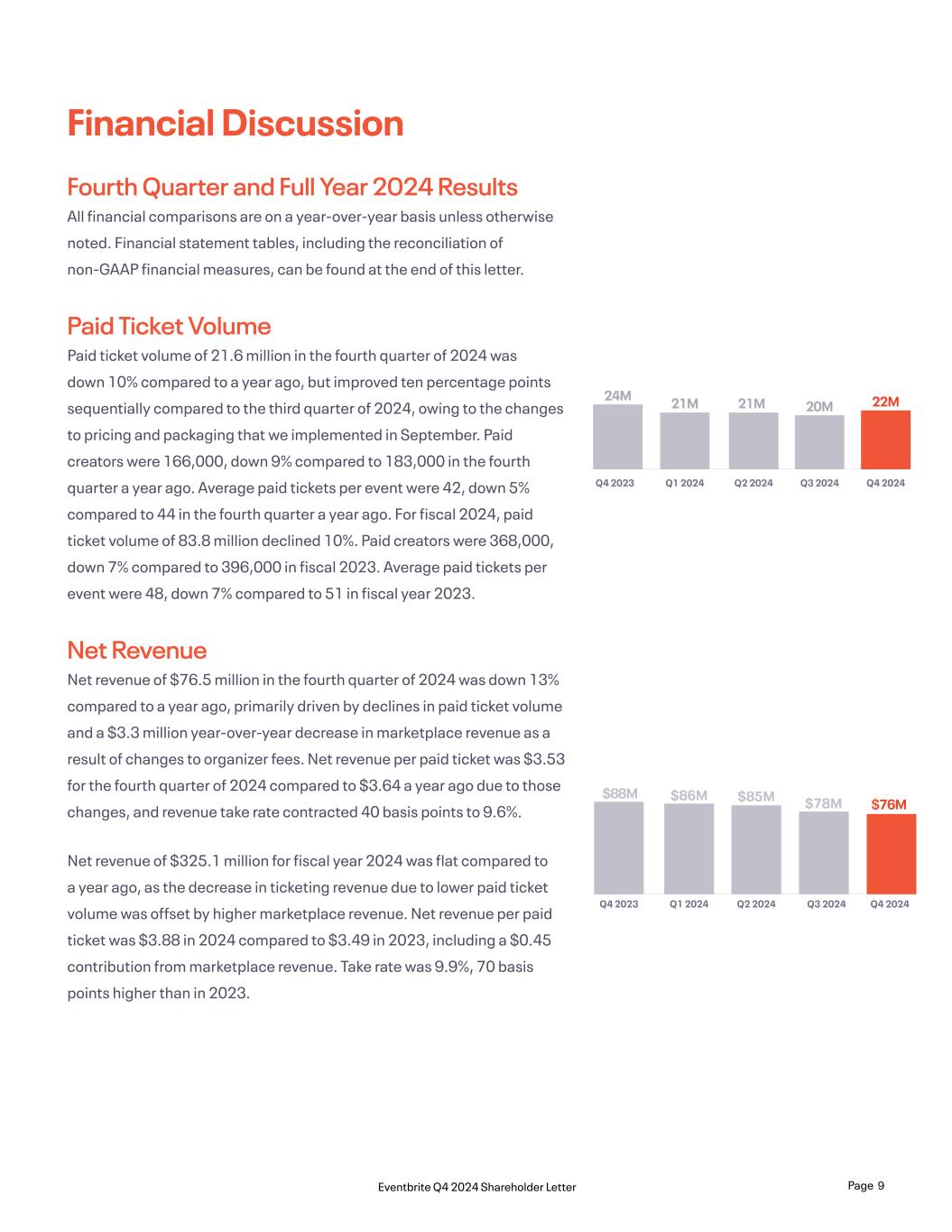

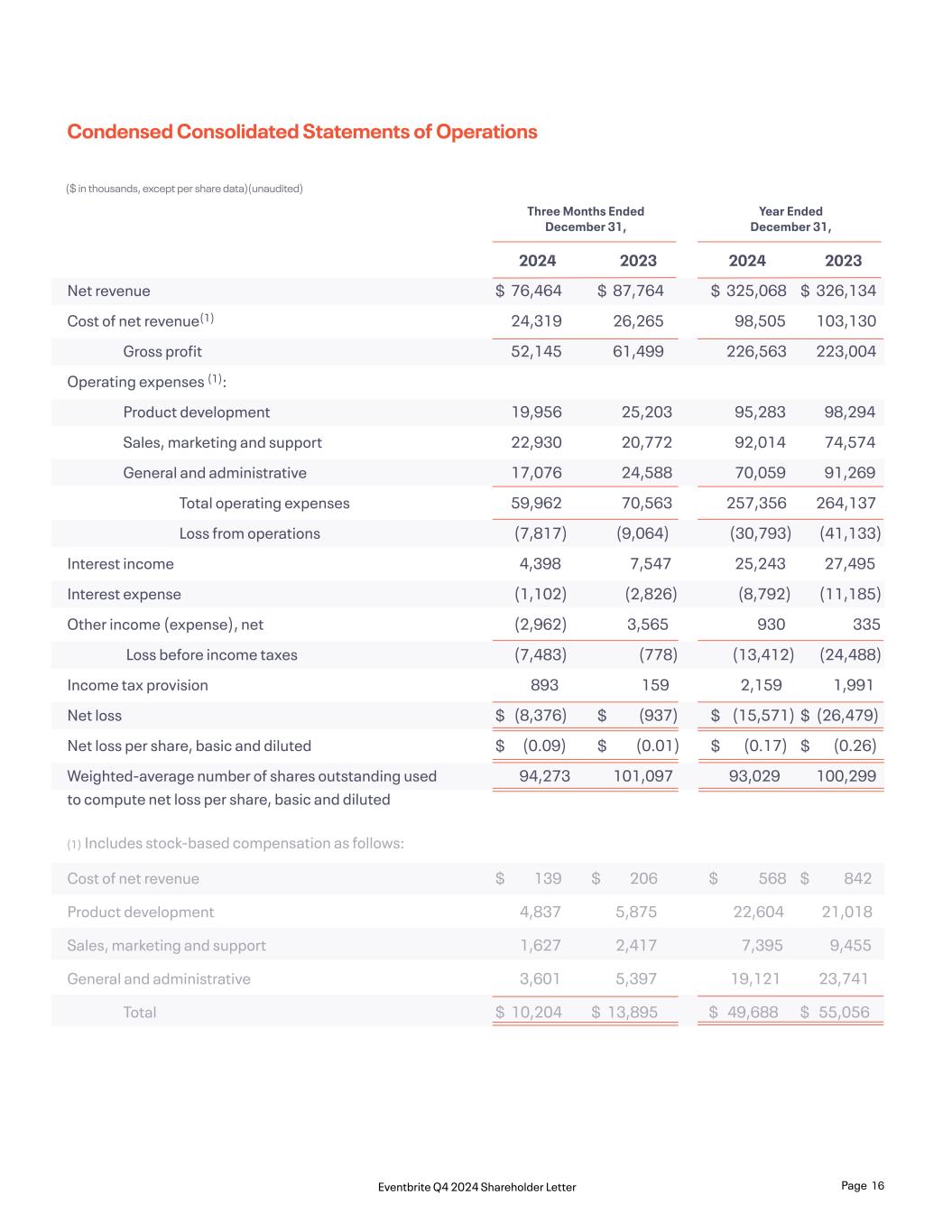

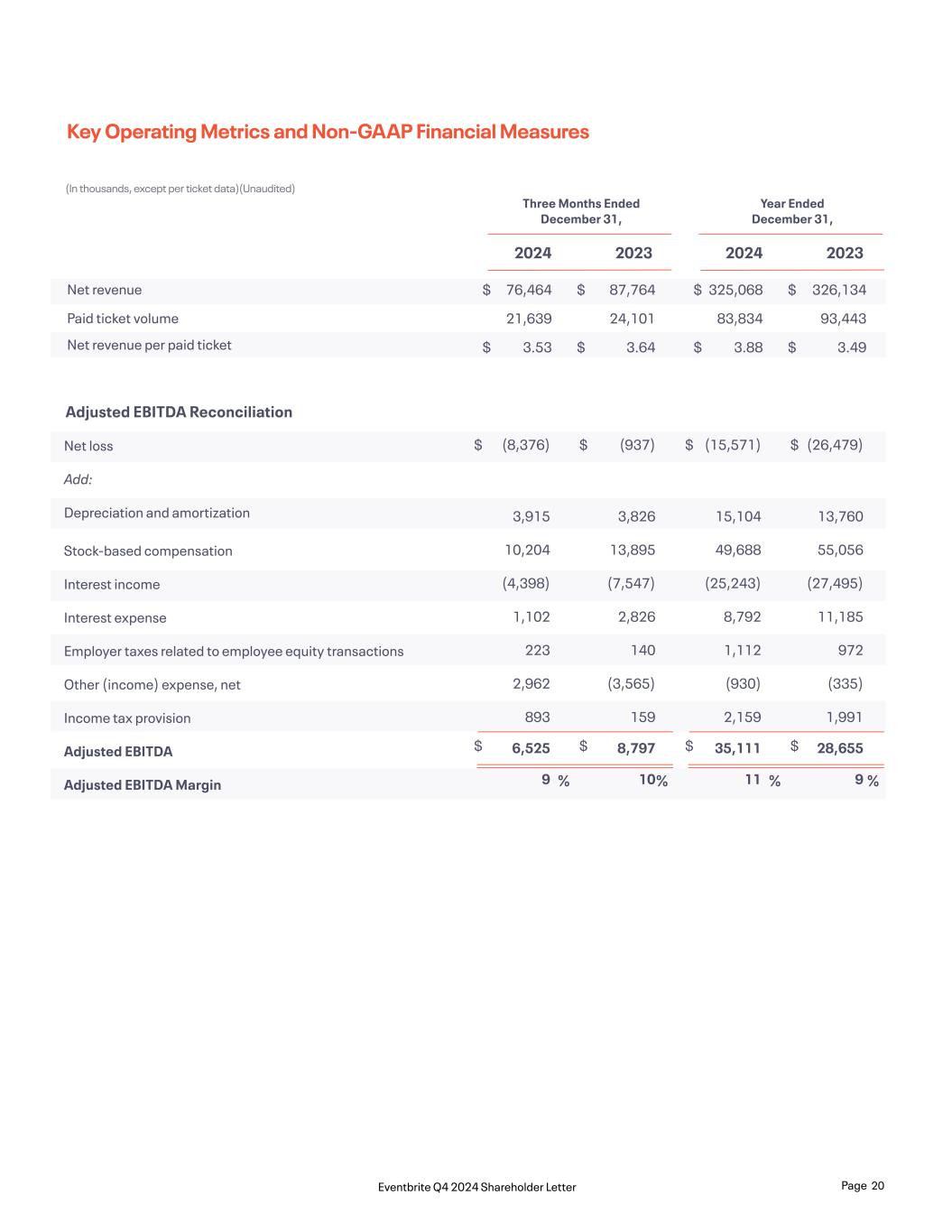

Q3 2024Q2 2024Q1 2024Q4 2023 24M 21M 21M 20M Q4 2024 22M Financial Discussion Fourth Quarter and Full Year 2024 Results All financial comparisons are on a year-over-year basis unless otherwise noted. Financial statement tables, including the reconciliation of non-GAAP financial measures, can be found at the end of this letter. Paid Ticket Volume Paid ticket volume of 21.6 million in the fourth quarter of 2024 was down 10% compared to a year ago, but improved ten percentage points sequentially compared to the third quarter of 2024, owing to the changes to pricing and packaging that we implemented in September. Paid creators were 166,000, down 9% compared to 183,000 in the fourth quarter a year ago. Average paid tickets per event were 42, down 5% compared to 44 in the fourth quarter a year ago. For fiscal 2024, paid ticket volume of 83.8 million declined 10%. Paid creators were 368,000, down 7% compared to 396,000 in fiscal 2023. Average paid tickets per event were 48, down 7% compared to 51 in fiscal year 2023. Net Revenue Net revenue of $76.5 million in the fourth quarter of 2024 was down 13% compared to a year ago, primarily driven by declines in paid ticket volume and a $3.3 million year-over-year decrease in marketplace revenue as a result of changes to organizer fees. Net revenue per paid ticket was $3.53 for the fourth quarter of 2024 compared to $3.64 a year ago due to those changes, and revenue take rate contracted 40 basis points to 9.6%. Net revenue of $325.1 million for fiscal year 2024 was flat compared to a year ago, as the decrease in ticketing revenue due to lower paid ticket volume was offset by higher marketplace revenue. Net revenue per paid ticket was $3.88 in 2024 compared to $3.49 in 2023, including a $0.45 contribution from marketplace revenue. Take rate was 9.9%, 70 basis points higher than in 2023. Q3 2024 Q4 2024Q2 2024Q1 2024Q4 2023 $88M $86M $85M $78M $76M Page 9Eventbrite Q4 2024 Shareholder Letter

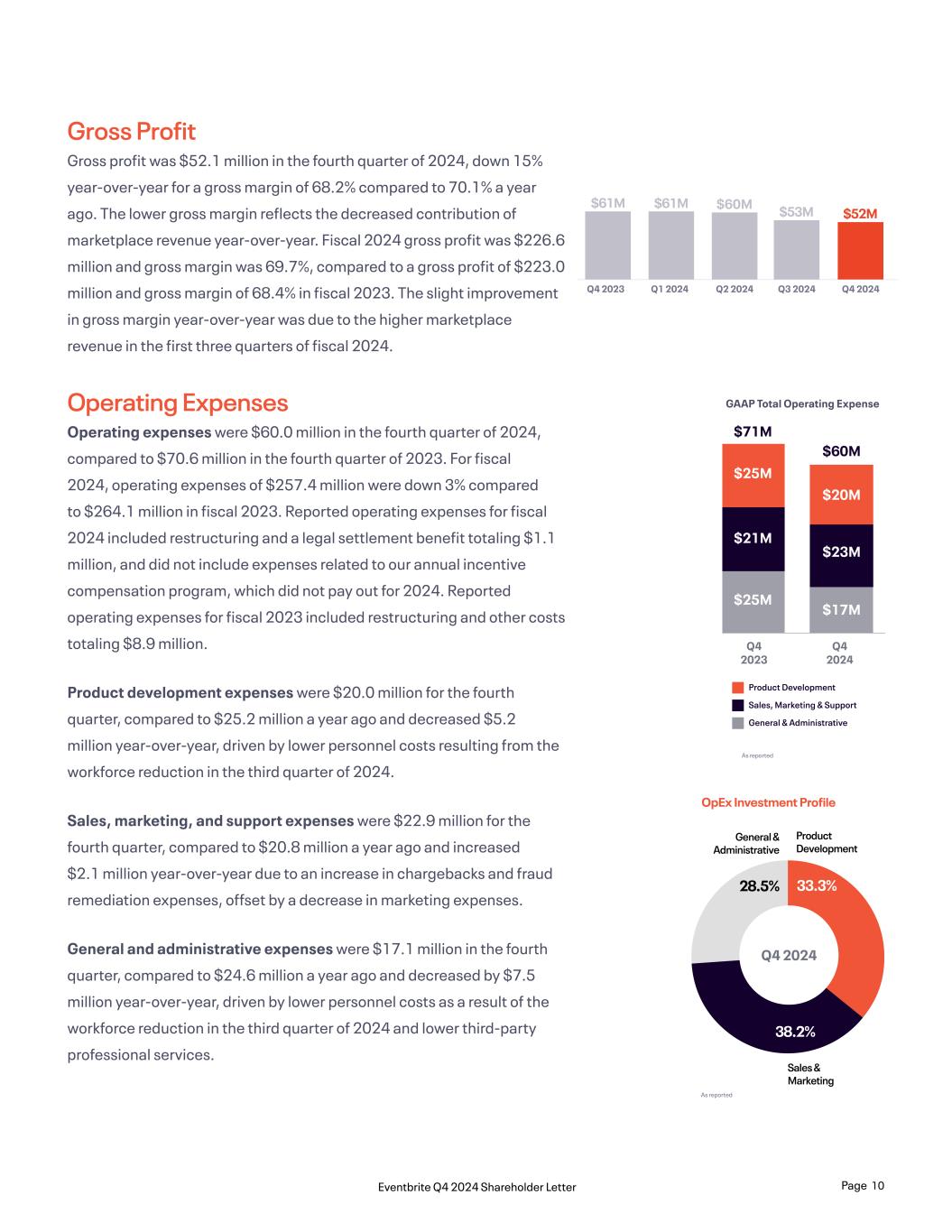

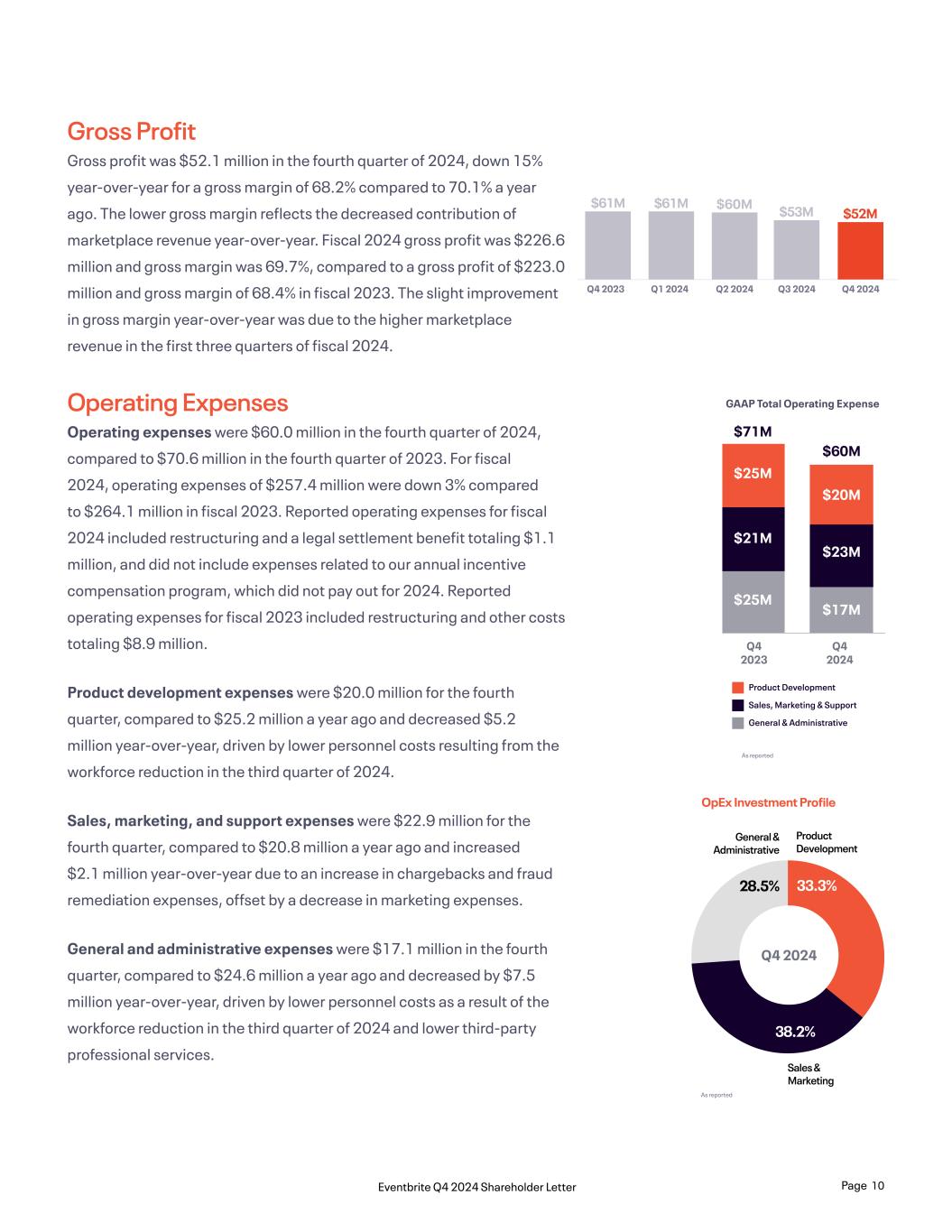

Q3 2024Q2 2024Q1 2024Q4 2023 $61M $61M $60M $53M Q4 2024 $52M Product Development Sales, Marketing & Support General & Administrative Q4 2023 Q4 2024 $25M $21M $25M $71M $23M $20M $60M $17M As reported GAAP Total Operating Expense OpEx Investment Profile Q4 2024 28.5% General & Administrative 33.3% 38.2% Product Development Sales & Marketing As reported Gross Profit Gross profit was $52.1 million in the fourth quarter of 2024, down 15% year-over-year for a gross margin of 68.2% compared to 70.1% a year ago. The lower gross margin reflects the decreased contribution of marketplace revenue year-over-year. Fiscal 2024 gross profit was $226.6 million and gross margin was 69.7%, compared to a gross profit of $223.0 million and gross margin of 68.4% in fiscal 2023. The slight improvement in gross margin year-over-year was due to the higher marketplace revenue in the first three quarters of fiscal 2024. Operating Expenses Operating expenses were $60.0 million in the fourth quarter of 2024, compared to $70.6 million in the fourth quarter of 2023. For fiscal 2024, operating expenses of $257.4 million were down 3% compared to $264.1 million in fiscal 2023. Reported operating expenses for fiscal 2024 included restructuring and a legal settlement benefit totaling $1.1 million, and did not include expenses related to our annual incentive compensation program, which did not pay out for 2024. Reported operating expenses for fiscal 2023 included restructuring and other costs totaling $8.9 million. Product development expenses were $20.0 million for the fourth quarter, compared to $25.2 million a year ago and decreased $5.2 million year-over-year, driven by lower personnel costs resulting from the workforce reduction in the third quarter of 2024. Sales, marketing, and support expenses were $22.9 million for the fourth quarter, compared to $20.8 million a year ago and increased $2.1 million year-over-year due to an increase in chargebacks and fraud remediation expenses, offset by a decrease in marketing expenses. General and administrative expenses were $17.1 million in the fourth quarter, compared to $24.6 million a year ago and decreased by $7.5 million year-over-year, driven by lower personnel costs as a result of the workforce reduction in the third quarter of 2024 and lower third-party professional services. Page 10Eventbrite Q4 2024 Shareholder Letter

As reported $1M ($1M) Q3 2024 Q4 2024Q2 2024Q1 2024Q4 2023 ($4M) ($4M) ($8M) $5M $13M $10M $9M Q3 2024 $7M Q4 2024Q2 2024Q1 2024Q4 2023 Net Loss Net loss was $8.4 million for the fourth quarter of 2024, compared with a net loss of $0.9 million in the same period in 2023. Net loss for fiscal 2024 was $15.6 million, which included a net benefit of $2.4 million from a legal settlement partially offset by workforce reduction and other costs. Net loss for fiscal 2023 was $26.5 million which included $10.1 million of restructuring and other costs. Adjusted EBITDA Adjusted EBITDA in the fourth quarter of 2024 was $6.5 million compared to $8.8 million in the prior year. Reported Adjusted EBITDA for fiscal 2024 was $35.1 million, which included a net impact of $1.2 million in workforce reduction costs partially offset by a legal settlement benefit. Reported Adjusted EBITDA of $28.7 million for fiscal 2023 included restructuring and other costs totaling $10.1 million. Balance Sheet and Cash Flow Cash, cash equivalents, and restricted cash totaled $464.5 million as of December 31, 2024, down from $531.0 million as of September 30, 2024. To evaluate Eventbrite’s liquidity, the company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, restricted cash, and cash and cash equivalents and then reduces the balance by creator payables. On that basis, the company’s available liquidity as of December 31, 2024 was $230.3 million compared to $236.9 million as of September 30, 2024, reflecting 3 million shares repurchased or $10.4 million of our stock during the fourth quarter. Total current and long-term debt as of December 31, 2024 was $240.7 million compared to $240.4 million as of September 30, 2024. Available Liquidity in Q4 2024 Cash and cash equivalents Restricted Cash Funds receivable Short term investments Creator advances, net Accounts payable, creators Available liquidity Recorded Amount ($M) 48.0 $416.5 37.6 25.0 3.4 (300.2) $230.3 Page 11Eventbrite Q4 2024 Shareholder Letter

*We have not provided an outlook for GAAP net income (loss) or GAAP net income (loss) margin or reconciliations of expected Adjusted EBITDA to GAAP net income (loss) or expected Adjusted EBITDA margin to GAAP net income (loss) margin, because GAAP net income (loss) and GAAP net income (loss) margin on a forward-looking basis are not available without unreasonable efforts due to the potential variability and complexity of the items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin, such as share-based compensation expense, foreign exchange rate gains and losses, and other non-recurring expenses. Business Outlook Based on current information, we anticipate net revenue for the first quarter of 2025 will be within the range of $71 to $74 million with an Adjusted EBITDA margin percentage in the mid-single digits, excluding non-routine items. Full year 2025 will be a year of transition as we lap the impacts of organizer fees. Going forward, Ticketing and Ads will essentially comprise Eventbrite’s revenue. We expect a continued recovery in ticketing trends, with paid ticket volume returning to growth in the second half of the year. Also, we anticipate Eventbrite Ads to continue to deliver growth throughout the year. We expect the elimination of organizer fees to result in an approximately $20 million revenue headwind compared to 2024. As a result of the continued recovery in ticketing revenue and the elimination of organizer fees, we expect full year net revenue will be within a range of $295 to $310 million. We expect an Adjusted EBITDA margin percentage in the mid-single digits for the year, excluding non-routine items, with the decline in year-over-year margin primarily driven by the loss of high margin organizer fee revenue. Page 12Eventbrite Q4 2024 Shareholder Letter

About Eventbrite Eventbrite is a global events marketplace that serves event creators and event-goers in nearly 180 countries. Since its inception, Eventbrite has been at the center of the experience economy, transforming the way people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz, and Renaud Visage, with a vision to build a self-service platform that empowers anyone to host and discover live experiences. In 2024, Eventbrite distributed 270 million tickets to over 4.7 million events across a global community of 89 million monthly average users, helping people find new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer, with special designations that include a coveted spot on Fast Company’s prestigious “The World’s 50 Most Innovative Companies” and “Brands That Matter” lists, the Great Place to Work® Award in the U.S., and Inc.'s “Best-Led Companies” honor. Learn more at www.eventbrite.com. Page 13Eventbrite Q4 2024 Shareholder Letter

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s business model and investments to support growth, including the Company’s marketplace strategy and impact on results; the Company’s expectations regarding the development of its marketplace, app and products; the Company’s long-term growth strategy, growth areas, pursuit of profitability, cash flows, operating expenses, and investment initiatives and focus areas; the Company’s expectations with respect to its operating model, financial results and trends; and the Company’s expectations described under “Business Outlook” above. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied. All forward-looking statements are based on information and estimates available to the Company at the time of this letter, and are not guarantees of future performance, and reported results should not be considered as an indication of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. Disclaimer Regarding Ticketing and Creator Metrics This letter includes certain measures related to our ticketing business, such as free and paid tickets, paid creators, paid buyers, monthly active users (MAUs), and Eventbrite Ads. We believe that the use of these metrics is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. These metrics are based on what we believe to be reasonable estimates for the applicable period of measurement. There are inherent challenges in measuring these metrics, and we regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. You should not consider these metrics in isolation or as substitutes for analysis of our results of operations as reported under GAAP. About Non-GAAP Financial Measures We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin and Available Liquidity is helpful to our investors in understanding and evaluating our results of operations and useful measures for period-to-period comparisons of our business performance as they are metrics used by management in assessing the health of our business and our operating performance, making operating decisions, and performing strategic planning and annual budgeting. These measures are not prepared in accordance with GAAP and have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Some amounts in this shareholder letter may not sum due to rounding. Adjusted EBITDA We calculate Adjusted EBITDA as net loss adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, interest income, employer taxes related to employee transactions, other (income) expense net, which consists of foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net loss or any other measure of financial performance calculated and presented in accordance with GAAP. Page 14Eventbrite Q4 2024 Shareholder Letter

Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this release. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-routine items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. Adjusted EBITDA Margin Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net revenue. Because of the limitations described above, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net loss, net loss margin and our other GAAP results. Available Liquidity To evaluate Eventbrite’s liquidity, the Company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, restricted cash, and cash and cash equivalents, and then reduces the balance by creator payables. See page 11 for the reconciliation table. Page 15Eventbrite Q4 2024 Shareholder Letter

Net revenue Cost of net revenue(1) Gross profit Operating expenses (1): Product development Sales, marketing and support General and administrative Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Income tax provision Net loss Net loss per share, basic and diluted Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted 76,464 24,319 52,145 19,956 22,930 17,076 59,962 (7,817) 4,398 (1,102) (2,962) (7,483) 893 (8,376) (0.09) 94,273 87,764 26,265 61,499 25,203 20,772 24,588 70,563 (9,064) 7,547 (2,826) 3,565 (778) 159 (937) (0.01) 101,097 325,068 98,505 226,563 95,283 92,014 70,059 257,356 (30,793) 25,243 (8,792) 930 (13,412) 2,159 (15,571) (0.17) 93,029 326,134 103,130 223,004 98,294 74,574 91,269 264,137 (41,133) 27,495 (11,185) 335 (24,488) 1,991 (26,479) (0.26) 100,299 Cost of net revenue Product development Sales, marketing and support General and administrative Total 139 4,837 1,627 3,601 10,204 568 22,604 7,395 19,121 49,688 206 5,875 2,417 5,397 13,895 842 21,018 9,455 23,741 55,056 Condensed Consolidated Statements of Operations ($ in thousands, except per share data)(unaudited) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Year Ended December 31, Three Months Ended December 31, 20242024 20232023 (1) Includes stock-based compensation as follows: Page 16Eventbrite Q4 2024 Shareholder Letter

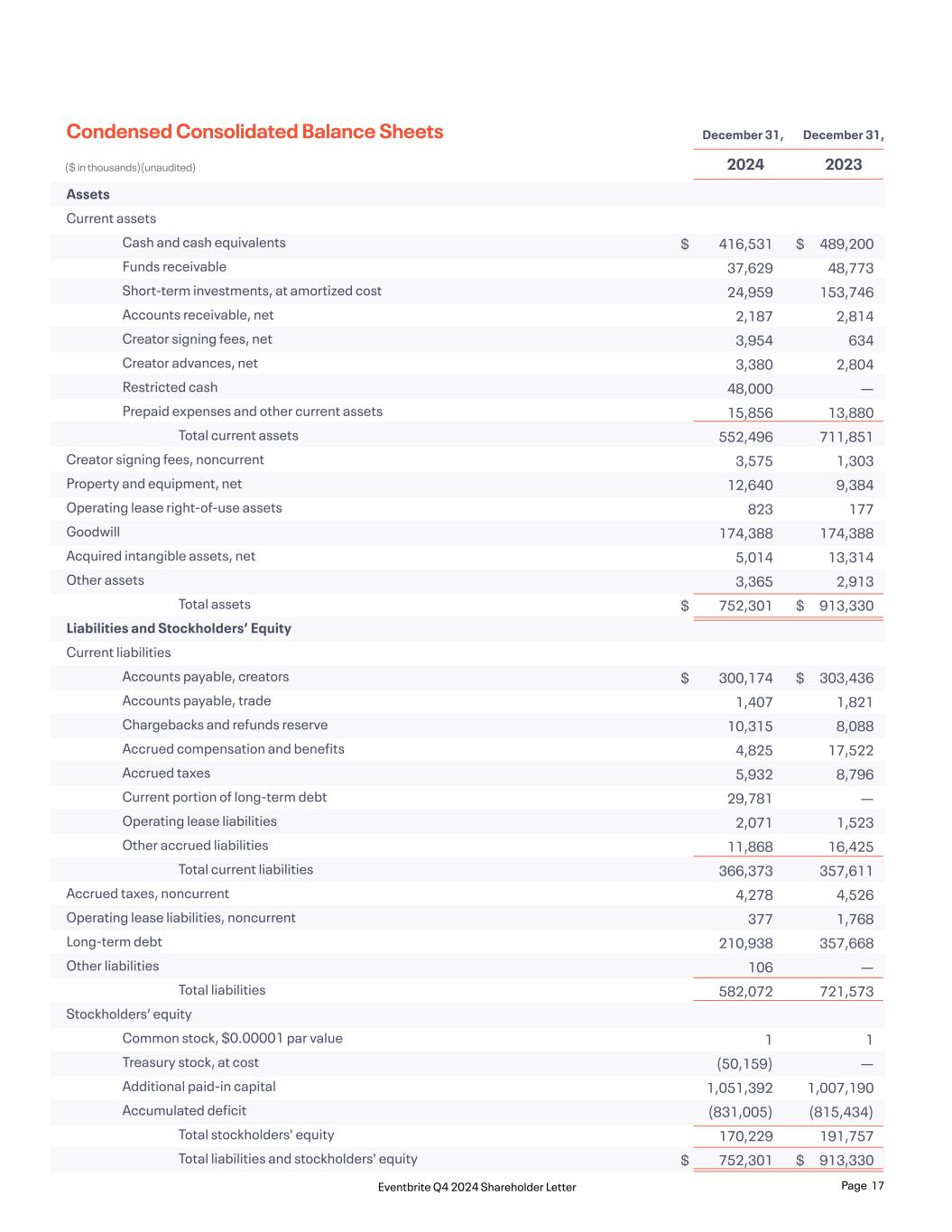

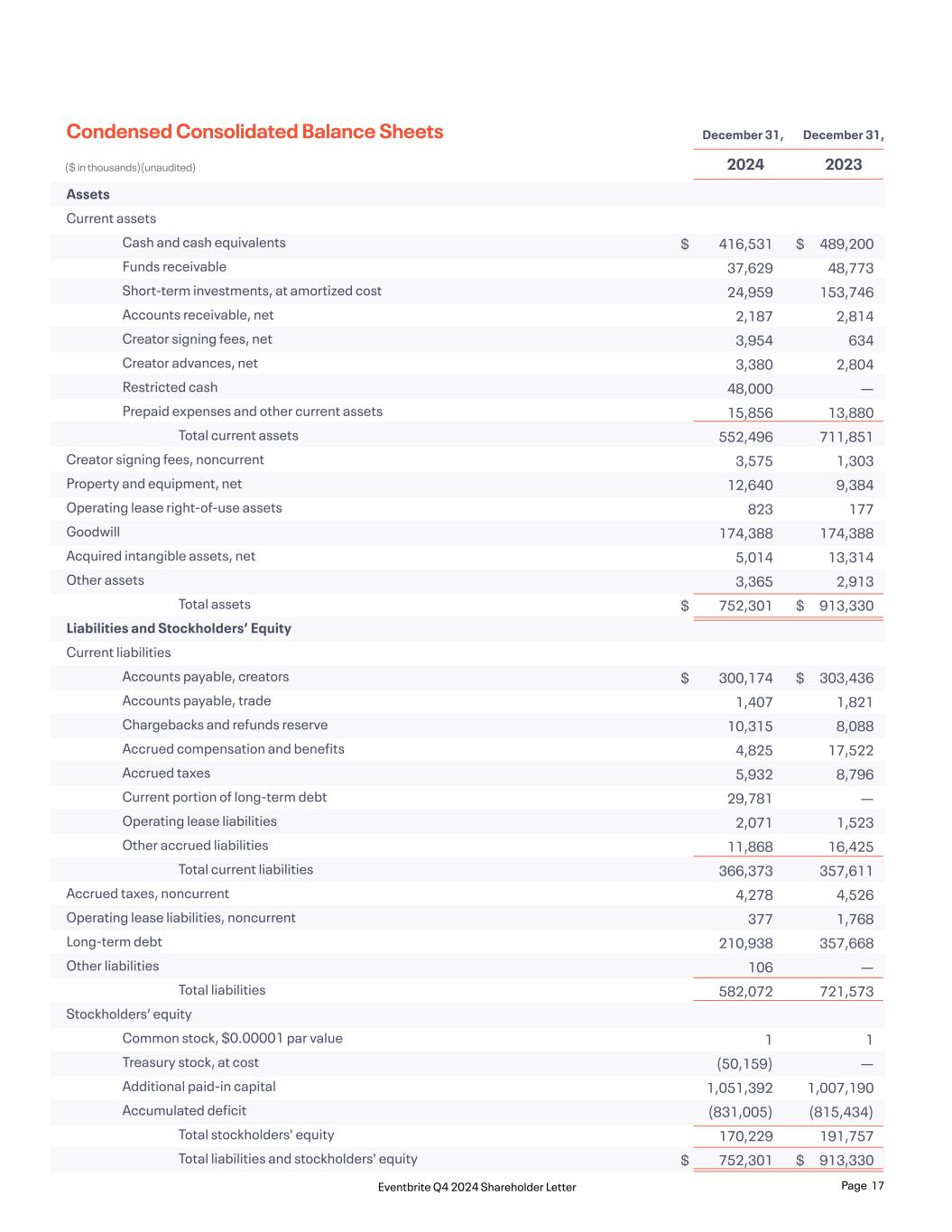

Assets Current assets Cash and cash equivalents Funds receivable Short-term investments, at amortized cost Accounts receivable, net Creator signing fees, net Creator advances, net Restricted cash Prepaid expenses and other current assets Total current assets Creator signing fees, noncurrent Property and equipment, net Operating lease right-of-use assets Goodwill Acquired intangible assets, net Other assets Total assets Liabilities and Stockholders’ Equity Current liabilities Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Current portion of long-term debt Operating lease liabilities Other accrued liabilities Total current liabilities Accrued taxes, noncurrent Operating lease liabilities, noncurrent Long-term debt Other liabilities Total liabilities Stockholders’ equity Common stock, $0.00001 par value Treasury stock, at cost Additional paid-in capital Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 416,531 37,629 24,959 2,187 3,954 3,380 48,000 15,856 552,496 3,575 12,640 823 174,388 5,014 3,365 752,301 300,174 1,407 10,315 4,825 5,932 29,781 2,071 11,868 366,373 4,278 377 210,938 106 582,072 1 (50,159) 1,051,392 (831,005) 170,229 752,301 $ $ $ $ $ $ $ $ 489,200 48,773 153,746 2,814 634 2,804 — 13,880 711,851 1,303 9,384 177 174,388 13,314 2,913 913,330 303,436 1,821 8,088 17,522 8,796 — 1,523 16,425 357,611 4,526 1,768 357,668 — 721,573 1 — 1,007,190 (815,434) 191,757 913,330 Condensed Consolidated Balance Sheets ($ in thousands)(unaudited) December 31, December 31, 2024 2023 Page 17Eventbrite Q4 2024 Shareholder Letter

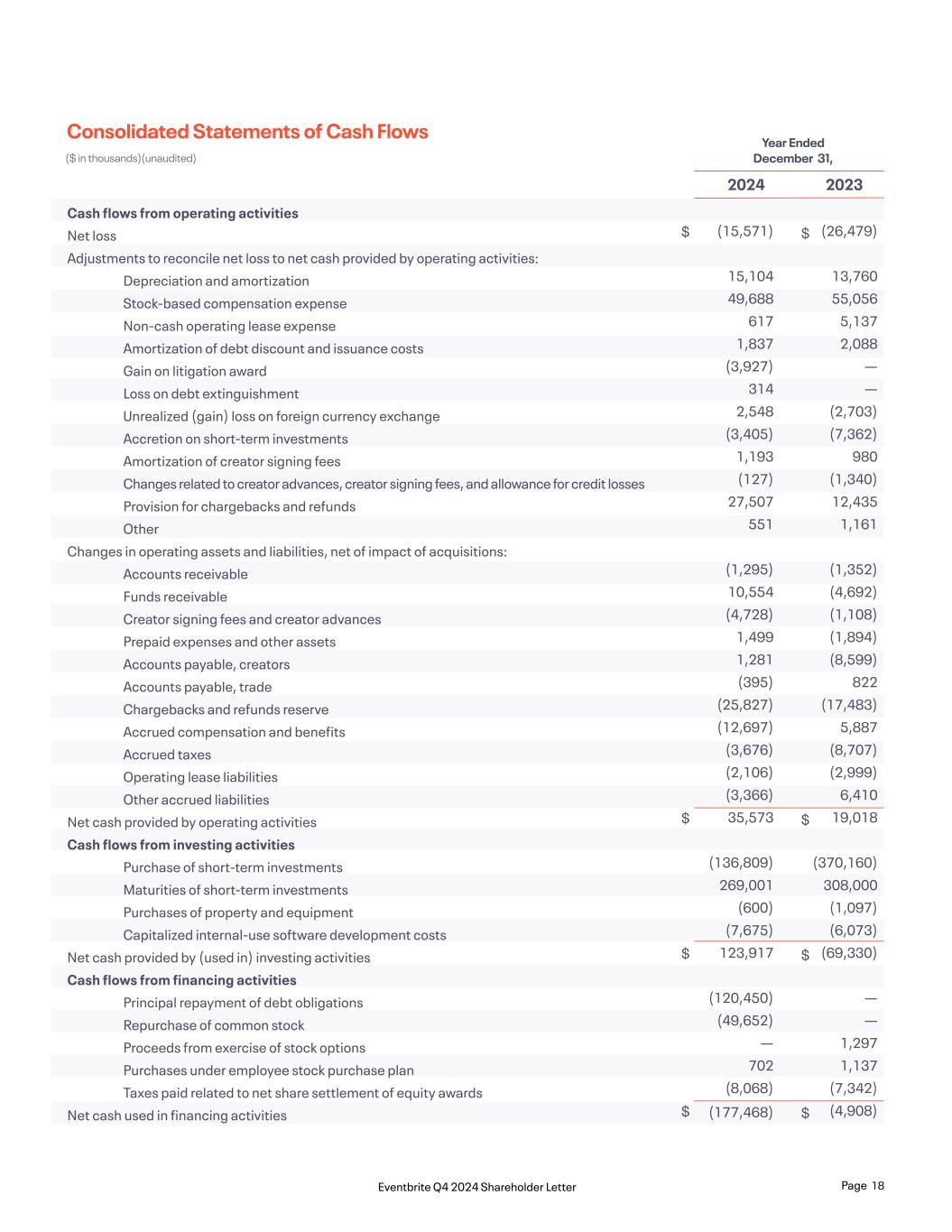

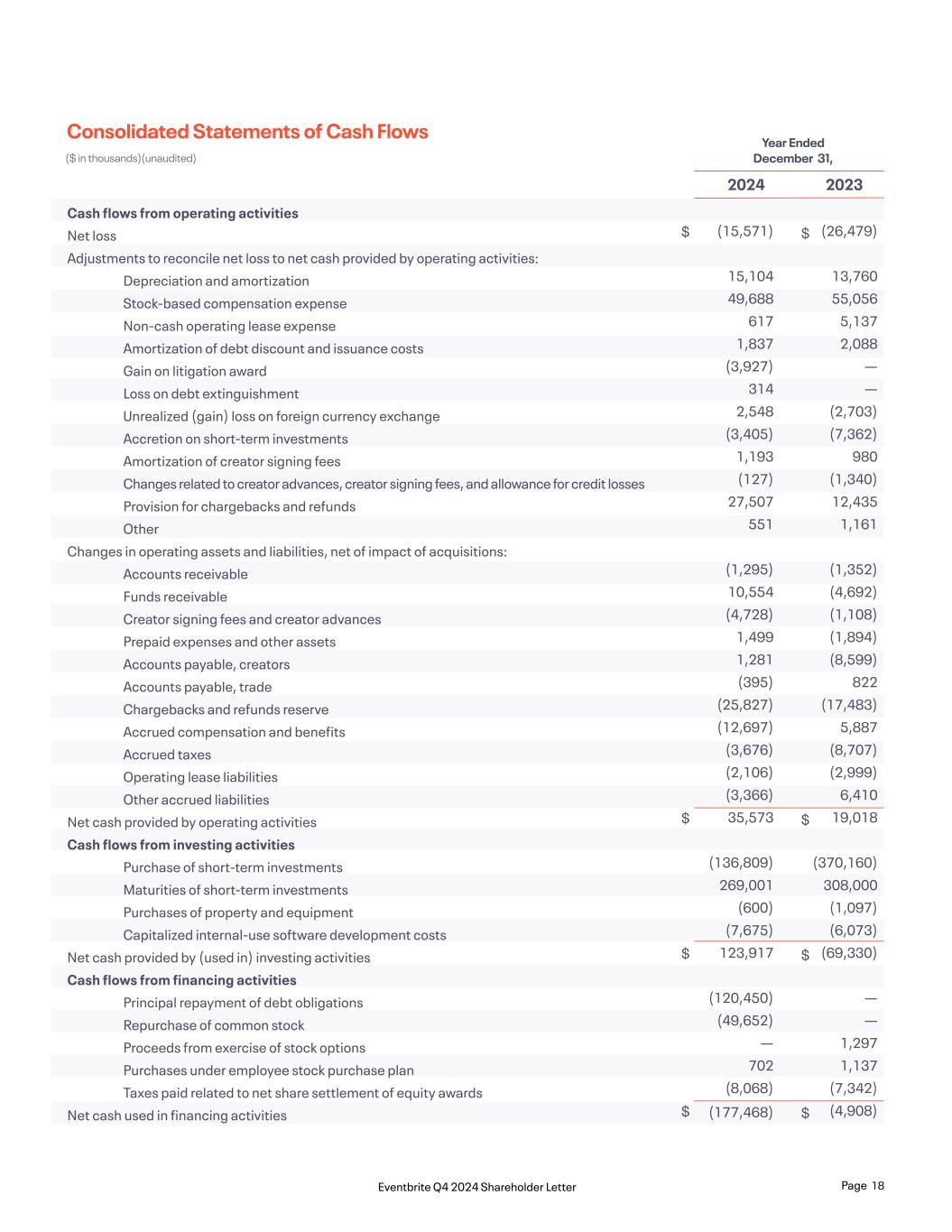

Cash flows from operating activities Net loss Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Non-cash operating lease expense Amortization of debt discount and issuance costs Gain on litigation award Loss on debt extinguishment Unrealized (gain) loss on foreign currency exchange Accretion on short-term investments Amortization of creator signing fees Changes related to creator advances, creator signing fees, and allowance for credit losses Provision for chargebacks and refunds Other Changes in operating assets and liabilities, net of impact of acquisitions: Accounts receivable Funds receivable Creator signing fees and creator advances Prepaid expenses and other assets Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Net cash provided by operating activities Cash flows from investing activities Purchase of short-term investments Maturities of short-term investments Purchases of property and equipment Capitalized internal-use software development costs Net cash provided by (used in) investing activities Cash flows from financing activities Principal repayment of debt obligations Repurchase of common stock Proceeds from exercise of stock options Purchases under employee stock purchase plan Taxes paid related to net share settlement of equity awards Net cash used in financing activities (15,571) 15,104 49,688 617 1,837 (3,927) 314 2,548 (3,405) 1,193 (127) 27,507 551 (1,295) 10,554 (4,728) 1,499 1,281 (395) (25,827) (12,697) (3,676) (2,106) (3,366) 35,573 (136,809) 269,001 (600) (7,675) 123,917 (120,450) (49,652) — 702 (8,068) (177,468) (26,479) 13,760 55,056 5,137 2,088 — — (2,703) (7,362) 980 (1,340) 12,435 1,161 (1,352) (4,692) (1,108) (1,894) (8,599) 822 (17,483) 5,887 (8,707) (2,999) 6,410 19,018 (370,160) 308,000 (1,097) (6,073) (69,330) — — 1,297 1,137 (7,342) (4,908) $ $ $ $ $ $ $ $ Consolidated Statements of Cash Flows ($ in thousands)(unaudited) Year Ended December 31, 2024 2023 Page 18Eventbrite Q4 2024 Shareholder Letter

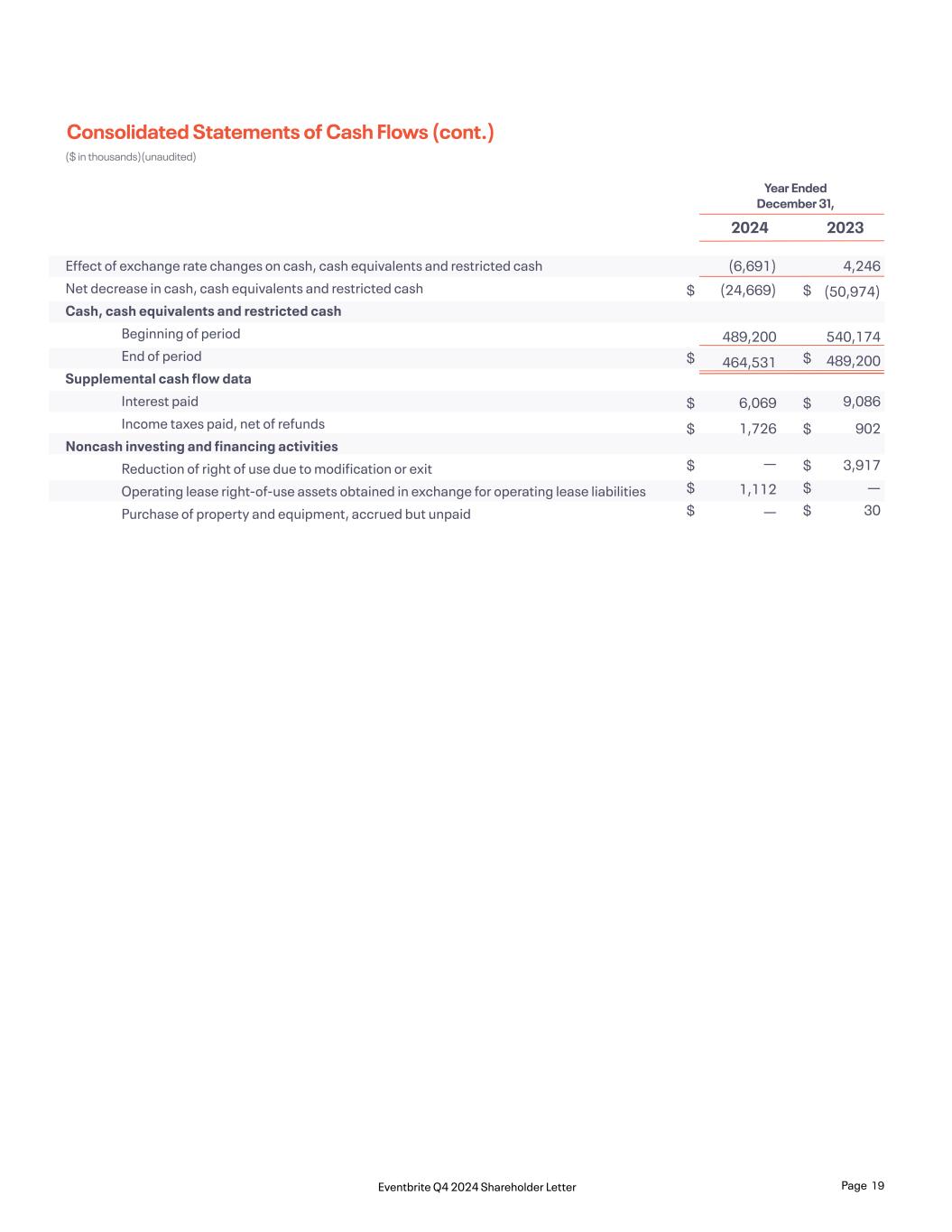

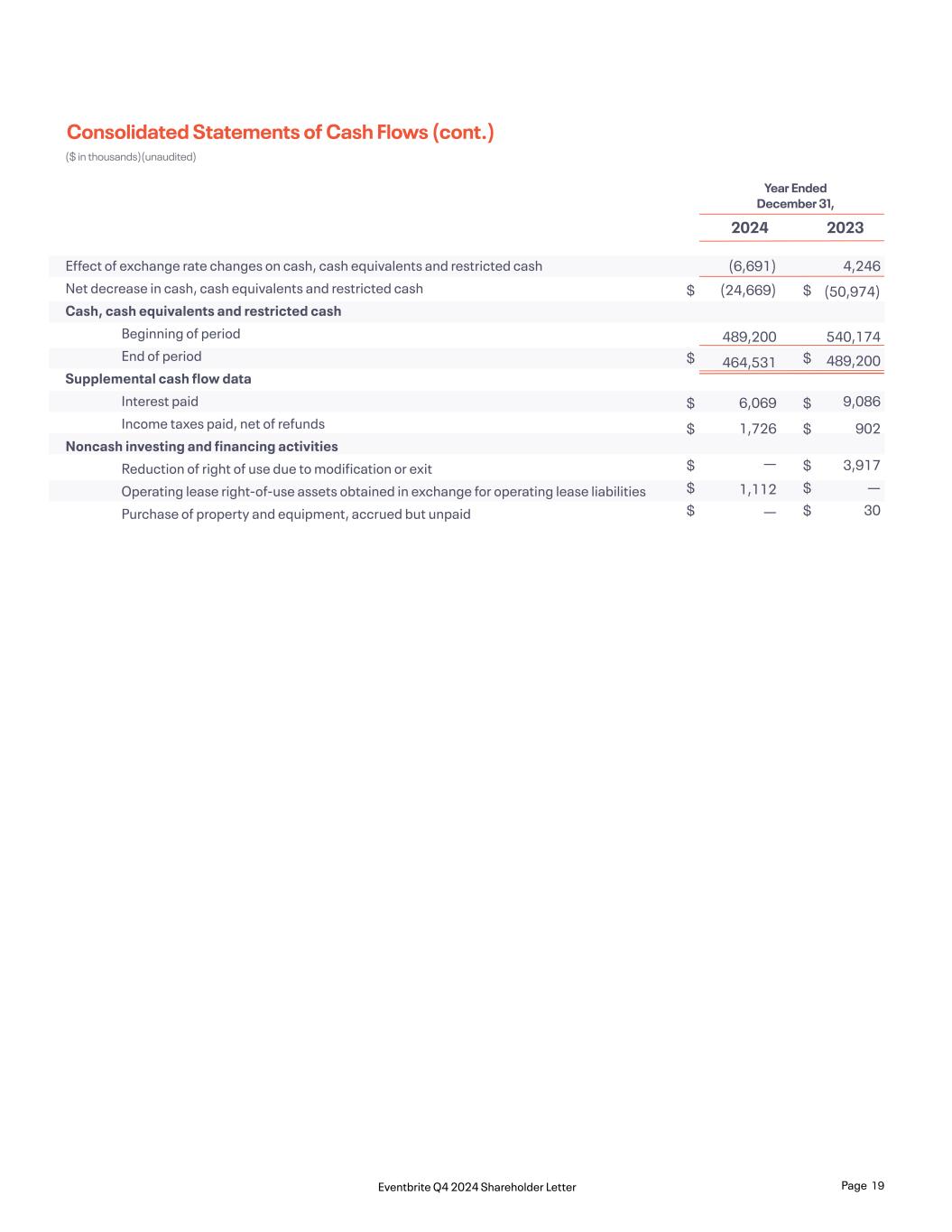

Effect of exchange rate changes on cash, cash equivalents and restricted cash Net decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash Beginning of period End of period Supplemental cash flow data Interest paid Income taxes paid, net of refunds Noncash investing and financing activities Reduction of right of use due to modification or exit Operating lease right-of-use assets obtained in exchange for operating lease liabilities Purchase of property and equipment, accrued but unpaid (6,691) (24,669) 489,200 464,531 6,069 1,726 — 1,112 — 4,246 (50,974) 540,174 489,200 9,086 902 3,917 — 30 Consolidated Statements of Cash Flows (cont.) ($ in thousands)(unaudited) Year Ended December 31, 2024 2023 $ $ $ $ $ $ $ $ $ $ $ $ $ $ Page 19Eventbrite Q4 2024 Shareholder Letter

Net revenue Paid ticket volume Net revenue per paid ticket Net loss Add: Depreciation and amortization Stock-based compensation Interest income Interest expense Employer taxes related to employee equity transactions Other (income) expense, net Income tax provision Adjusted EBITDA Adjusted EBITDA Margin (15,571) 15,104 49,688 (25,243) 8,792 1,112 (930) 2,159 35,111 11 (26,479) 13,760 55,056 (27,495) 11,185 972 (335) 1,991 28,655 9 (8,376) 3,915 10,204 (4,398) 1,102 223 2,962 893 6,525 9 (937) 3,826 13,895 (7,547) 2,826 140 (3,565) 159 8,797 10 $ $ $ $ $ $ $ $ Key Operating Metrics and Non-GAAP Financial Measures (In thousands, except per ticket data)(Unaudited) 325,068 83,834 3.88 76,464 21,639 3.53 326,134 93,443 3.49 87,764 24,101 3.64 $ $ $ $ $ $ $ $ Year Ended December 31, Three Months Ended December 31, 20242024 20232023 Adjusted EBITDA Reconciliation %% %% Page 20Eventbrite Q4 2024 Shareholder Letter