Exhibit 99.1

Cenovus has strong third-quarter operational performance

Oil sands production increases; operating costs decline

Calgary, Alberta (October 27, 2016)– Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) continues to deliver safe and reliable operating performance. In 2016, the company has achieved consistent quarter-over-quarter increases in its oil sands production and steadily reduced total per-barrel oil operating costs. Compared with the same period in 2015, third-quarter oil sands volumes grew 5%, while total oil operating costs declined 14% per barrel (bbl).

“We continue to deliver on our commitments, including significantly lowering our costs, bringing on new oil sands production capacity and maintaining one of the best balance sheets in the business,” said Brian Ferguson, Cenovus President & Chief Executive Officer. “While I’m encouraged by the recent increase in oil prices, we remain firmly committed to pursuing additional cost reductions to position us to add shareholder value regardless of the commodity price environment.”

Key developments

| ● | | Achieved first oil at Foster Creek phase G, began start-up of Christina Lake phase F and completed the Wood River Refinery debottlenecking project |

| ● | | Reached oil sands production of almost 74,000 barrels per day (bbls/d) net at Foster Creek, 3% higher than in the third quarter of 2015 |

| ● | | Increased production at Christina Lake to almost 80,000 bbls/d net, 6% higher than in the third quarter of 2015 |

| ● | | Decreased total per-barrel oil operating costs by 14%, including a 9% reduction in oil sands per-barrel operating costs, compared with the third quarter of 2015 |

| ● | | Achieved target of reducing capital, operating and general and administrative (G&A) costs by $500 million for the year compared with original 2016 budget |

| ● | | Exited the quarter with nearly $8 billion in liquidity, including $4 billion in unused credit facilities and almost $3.9 billion in cash, with net debt to capitalization of 17% |

| | | | | | | | | | |

| | | Production & financial summary |

| | | (For the period ended September 30)

Production (before royalties) | | | | 2016 Q3 | | 2015 Q3 | | % change |

| | Oil sands (bbls/d) | | | | 153,591 | | 146,743 | | 5 |

| | Conventional oil1 (bbls/d) | | | | 54,481 | | 63,679 | | -14 |

| | Total oil(bbls/d) | | | | 208,072 | | 210,422 | | -1 |

| | Natural gas (MMcf/d) | | | | 392 | | 430 | | -9 |

| | Financial ($ millions, except per share amounts) | | | | |

| | Cash flow2 | | | | 422 | | 444 | | -5 |

| | Per share diluted | | | | 0.51 | | 0.53 | | |

| | Operating earnings/loss2 | | | | -236 | | -28 | | |

| | Per share diluted | | | | -0.28 | | -0.03 | | |

| | Net earnings/loss3 | | | | -251 | | 1,801 | | |

| | Per share diluted | | | | -0.30 | | 2.16 | | |

| | Capital investment | | | | 208 | | 400 | | -48 |

1Includes natural gas liquids (NGLs).

2Cash flow and operating earnings/loss are non-GAAP measures as defined in the Advisory.

3Net earnings in the third quarter of 2015 included a $1.9 billion after-tax gain related to an asset divestiture.

Overview

Cenovus remains focused on delivering safe and reliable operating performance. In the third quarter of 2016, the company achieved a 14% decrease in total per-barrel oil operating costs as well as a 5% increase in production at its oil sands business compared with the same quarter of 2015. While benchmark crude oil prices and Cenovus’s netbacks have somewhat recovered from the multi-year lows seen in the first quarter of 2016, Cenovus intends to remain disciplined in its approach to capital spending and will look for further opportunities to reduce its cost structures and provide growth.

Oil production

In 2016, Foster Creek has achieved steady production increases with oil sands volumes growing 21% from the first quarter through the third quarter. Production in the third quarter averaged approximately 74,000 bbls/d net, 3% higher than in the same period of 2015. The year-over-year increase was primarily due to incremental volumes from the start-up of processing facilities for the phase G expansion as well as additional sustaining wells being brought online. Phase G, which adds 30,000 bbls/d gross in incremental production capacity, is expected to continue ramping up over an 18-month period. Foster Creek remains on track to meet its full-year production guidance.

Christina Lake production has also increased consistently in 2016, growing 4% from the first quarter through the third quarter. Volumes averaged approximately 80,000 bbls/d net in the third quarter, a 6% increase from the same period in 2015. The increase was largely due to additional wells being brought online and the strong performance of Christina Lake’s facilities, which operated near design capacity through the third quarter. Commissioning and start-up of the phase F expansion continues, with first oil anticipated in November, followed by an expected ramp-up period of about 12 months. With the progression of phase F, Cenovus is on track to add 50,000 bbls/d gross in incremental production capacity at Christina Lake. As part of the expansion, the company continues to commission its new 100 megawatt Christina Lake cogeneration plant, which is anticipated to be online shortly.

“By continuing to invest in our top-tier oil sands assets during an extremely challenging period for our industry, we are now on track to increase combined oil sands production capacity to 390,000 barrels per day gross,” said Ferguson.

Cenovus is spending a small amount of capital to complete detailed engineering on the Christina Lake phase G expansion and has rebid work on the project. The company expects to provide more information about future oil sands investment at the time of its 2017 budget announcement in December.

Cost reductions

During the third quarter, Cenovus achieved its 2016 target of reducing planned capital, operating and G&A spending by $500 million this year compared with its original 2016 budget. The company continues to pursue additional cost reductions across its business to help position it to be competitive with oil producers across North America.

| | |

Cenovus Energy Inc. Third Quarter 2016 Report | | Page 2 News Release |

“With the significant improvements we’ve made in our cost structures, we forecast that we can cover all of our operating and capital costs as well as our dividend with a West Texas Intermediate price in the US$45 to $50 range,” said Ferguson. “As prices move beyond that range, we expect to generate free cash flow, giving us more capacity to further invest in growth.”

In 2016, Cenovus has achieved a steady reduction in its total per-barrel oil operating costs. Non-fuel oil operating costs averaged $8.02/bbl in the third quarter compared with $9.46/bbl in the first quarter of the year. Compared with the same period in 2015, third-quarter oil operating costs declined 14%, including a 9% reduction in oil sands operating costs. Oil sands non-fuel operating costs were $6.37/bbl in the third quarter compared with $6.99/bbl in the same period a year ago. Year to date in 2016, Cenovus’s non-fuel oil sands operating costs are almost 30% lower per barrel than they were for the full-year 2014.

Financial performance

Crude oil sales prices and volumes remained relatively consistent in the third quarter of 2016 compared with the same period a year earlier. Third-quarter operating cash flow declined to $487 million, down 19% year over year, primarily due to smaller realized hedging gains at Cenovus’s oil and natural gas production assets compared with the same quarter in 2015. The company had realized hedging gains, excluding refining and marketing, of $42 million in the third quarter of 2016 compared with gains of $206 million a year earlier. The decline was partially offset by higher operating cash flow from refining and marketing as well as lower crude oil operating and transportation and blending expenses.

The company’s refineries had strong operating performance in the third quarter. Operating cash flow from refining and marketing was $68 million compared with $30 million in the same period of 2015. The increase was primarily due to wider heavy and medium oil price differentials, which contributed to a feedstock cost advantage, higher crude utilization rates and a decline in operating expenses compared with 2015. This was partially offset by lower average market crack spreads compared with the year-earlier period. The successful completion of the Wood River debottlenecking project has increased available heavy oil processing capability by 18,000 bbls/d gross.

Cenovus had a net loss of $251 million in the third quarter of 2016. This compares with net earnings of $1.8 billion in the same period of 2015 when the company recorded an after-tax gain of approximately $1.9 billion from the sale of its royalty interest and mineral fee title lands business. Cenovus’s third quarter 2016 results were negatively impacted by asset impairments of $292 million primarily due to the decline in long-term forward heavy oil and natural gas prices. This includes a $210 million impairment associated with the company’s northern Alberta conventional assets and a $65 million impairment related to its Suffield conventional oil and natural gas assets in southern Alberta.

Cenovus ended the third quarter of 2016 with cash and cash equivalents of approximately $3.9 billion. Including $4 billion in undrawn capacity under its committed credit facility, the company has nearly $8 billion in liquidity available, with no debt maturing until the fourth quarter of 2019. At the end of the third quarter, the company’s net debt to capitalization was 17% compared with 13% a year earlier. Cenovus’s net debt to adjusted earnings before

| | |

Cenovus Energy Inc. Third Quarter 2016 Report | | Page 3 News Release |

interest, taxes, depreciation and amortization (EBITDA) was 2.0 times on a trailing 12-month basis, compared with 0.8 times at the end of the third quarter of 2015.

Cenovus has an active hedging program to support financial resilience and stabilize cash flow. As of October 25, 2016, the company has hedges in place on approximately 64,000 bbls/d for 2017. About 37% of these barrels are hedged using costless collars, which set an average minimum price of US$44.78/bbl and average maximum price of US$56.24/bbl that the company will receive for its hedged oil. This limits downside risk on the hedged barrels while giving the company some ability to benefit in a rising price environment. Cenovus will continue to evaluate additional hedging opportunities.

Guidance update and outlook

Cenovus has updated its 2016 guidance to reflect actual results for the first nine months of the year and the company’s estimates for the full year. The revised guidance is available atcenovus.com under “Investors.” Cenovus will provide details of its plans for the coming year on December 8 when it releases its 2017 budget.

Third quarter details

Oil sands

Foster Creek

| | ● | | Production averaged 73,798 bbls/d net in the third quarter of 2016, a 3% increase from the same period of 2015. |

| | ● | | Operating costs declined 15% to $9.63/bbl in the quarter. Non-fuel operating costs were $7.19/bbl, a 17% decrease from a year earlier. |

| | ● | | The steam to oil ratio (SOR), the amount of steam needed to produce one barrel of oil, was 2.6 for the third quarter compared with 2.4 in the same period of 2015. |

Christina Lake

| | ● | | Production averaged 79,793 bbls/d net in the third quarter of 2016, a 6% increase from the same period a year earlier. |

| | ● | | Operating costs were $7.72/bbl in the quarter, a slight decline from a year earlier. Non-fuel operating costs were $5.58/bbl, comparable to the same period in 2015. |

| | ● | | The SOR was 1.9 during the third quarter compared with 1.7 a year earlier. |

Conventional oil

| | ● | | Total conventional oil production decreased 14% to 54,481 bbls/d in the third quarter of 2016 compared with the same quarter a year ago, primarily due to natural reservoir declines and the 2015 sale of Cenovus’s royalty interest and mineral fee title lands business. The divested assets contributed an average of 1,250 bbls/d of production in the third quarter of 2015. |

| | ● | | Operating costs were $12.89/bbl in the quarter, 17% lower than in the third quarter of 2015, primarily due to lower workforce, chemical, electricity and repairs and maintenance costs. |

| | |

Cenovus Energy Inc. Third Quarter 2016 Report | | Page 4 News Release |

Natural gas

| | ● | | Natural gas production averaged 392 million cubic feet per day (MMcf/d) in the third quarter of 2016, down 9% from the same period a year earlier, primarily due to expected natural declines and the company’s 2015 sale of its royalty interest and mineral fee title lands business. |

| | ● | | Operating costs fell 9% to $1.05 per thousand cubic feet (Mcf) in the quarter compared with the same period a year earlier. |

Downstream

| | ● | | Cenovus’s Wood River Refinery in Illinois and Borger Refinery in Texas, which are jointly owned with the operator, Phillips 66, continued to deliver strong operating performance in the third quarter of 2016, including: |

| | |

| o | | processing a combined average of 463,000 bbls/d gross of oil (101% utilization) compared with 394,000 bbls/d gross in the same period in 2015 (86% utilization) |

| o | | producing a combined average of 494,000 bbls/d gross of refined products compared with 414,000 bbls/d gross a year earlier. |

| | ● | | Cenovus had refining and marketing operating cash flow of $68 million in the quarter compared with $30 million in the third quarter of 2015. The company’s refining operating cash flow is calculated on a first-in, first-out (FIFO) inventory accounting basis. Using the last-in, first-out (LIFO) accounting method employed by most U.S. refiners, Cenovus’s operating cash flow from refining and marketing would have been $37 million higher in the third quarter of 2016. In the third quarter of 2015, operating cash flow would have been $130 million higher on a LIFO reporting basis. |

Financial

Corporate and financial information

| | ● | | Operating cash flow was $487 million in the third quarter, down 19% from the same period a year earlier, largely due to gains of $41 million from the company’s realized hedges compared with gains of $220 million the same period in 2015. |

| | ● | | Cash flow declined 5% in the third quarter to $422 million compared with the same period in 2015. This was due to lower operating cash flow, partially offset by a current income tax recovery compared with an expense in the same period a year earlier. |

| | ● | | After investing approximately $208 million during the third quarter, Cenovus had free cash flow of $214 million compared with free cash flow of $44 million in the same period a year earlier. |

| | ● | | Cenovus had a third-quarter operating loss of $236 million compared with an operating loss of $28 million in the same quarter of 2015. The 2016 third-quarter loss was largely the result of asset impairments of $292 million caused by a decline in long-term forward heavy oil and natural gas prices. |

| | ● | | Net loss was $251 million in the third quarter. This compares with net earnings of $1.8 billion in the same period of 2015 when the company recorded an after-tax gain of approximately $1.9 billion from the sale of its royalty interest and mineral fee title lands business. In the third quarter of 2016, Cenovus had unrealized risk management losses of $7 million compared with unrealized gains of $127 million a |

| | |

Cenovus Energy Inc. Third Quarter 2016 Report | | Page 5 News Release |

| | year earlier and a $111 million deferred income tax recovery in the third quarter of 2016 compared with a $228 million recovery a year earlier. The declines were partially offset by non-operating unrealized foreign exchange losses of $52 million compared with losses of $437 million in the same period a year earlier. |

| | ● | | G&A expenses were $71 million in the quarter, 9% lower than in the same period of 2015. The decrease was primarily due to lower workforce expenses as well as reduced information technology costs. |

| | ● | | The Board of Directors has declared a fourth-quarter dividend of $0.05 per share, payable on December 30, 2016 to common shareholders of record as of December 15, 2016. Based on the October 26, 2016 closing share price on the Toronto Stock Exchange of $20.16, this represents an annualized yield of about 1%. Declaration of dividends is at the sole discretion of the Board and will continue to be evaluated on a quarterly basis. |

Other developments

| | ● | | In the third quarter, Cenovus was included in the Dow Jones Sustainability North America Index for the seventh consecutive year. Cenovus is one of only three Canadian oil and gas producers to make the index this year. Areas where the company scored well include corporate governance, stakeholder engagement, social and environmental reporting, biodiversity, climate strategy, and risk and crisis management. |

| | |

Cenovus Energy Inc. Third Quarter 2016 Report | | Page 6 News Release |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) for Cenovus Energy Inc. (“we”, “our”, “us”, “its”, “Cenovus”, or the “Company”) dated October 26, 2016, should be read in conjunction with our September 30, 2016 unaudited interim Consolidated Financial Statements and accompanying notes (“interim Consolidated Financial Statements”), the December 31, 2015 audited Consolidated Financial Statements and accompanying notes (“Consolidated Financial Statements”) and the December 31, 2015 MD&A (“annual MD&A”). All of the information and statements contained in this MD&A are made as of October 26, 2016, unless otherwise indicated. This MD&A provides an update to our annual MD&A and contains forward-looking information about our current expectations, estimates, projections and assumptions. See the Advisory for information on the risk factors that could cause actual results to differ materially and the assumptions underlying our forward-looking information. Cenovus Management prepared the MD&A. The interim MD&As are approved by the Audit Committee of the Cenovus Board of Directors (the “Board”) and the annual MD&A is reviewed by the Audit Committee and recommended for its approval by the Board. Additional information about Cenovus, including our quarterly and annual reports, the Annual Information Form (“AIF”) and Form 40-F, is available on SEDAR at sedar.com, EDGAR at sec.gov and on our website at cenovus.com. Information on or connected to our website, even if referred to in this MD&A, does not constitute part of this MD&A.

Basis of Presentation

This MD&A and the interim Consolidated Financial Statements and comparative information have been prepared in Canadian dollars, except where another currency has been indicated, and in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) as issued by the International Accounting Standards Board (“IASB”). Production volumes are presented on a before royalties basis.

Non-GAAP Measures

Certain financial measures in this document do not have a standardized meaning as prescribed by IFRS, such as Operating Cash Flow, Cash Flow, Operating Earnings, Free Cash Flow, Debt, Net Debt, Capitalization and Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) and therefore are considered non-GAAP measures. These measures may not be comparable to similar measures presented by other issuers. These measures have been described and presented in order to provide shareholders and potential investors with additional measures for analyzing our ability to generate funds to finance our operations and information regarding our liquidity. This additional information should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The definition and reconciliation of each non-GAAP measure is presented in the Financial Results or Liquidity and Capital Resources sections of this MD&A.

OVERVIEW OF CENOVUS

We are a Canadian integrated oil company headquartered in Calgary, Alberta, with shares listed on the Toronto and New York stock exchanges. On September 30, 2016, we had a market capitalization of approximately $16 billion. We are in the business of developing, producing and marketing crude oil, natural gas liquids (“NGLs”) and natural gas in Canada with marketing activities and refining operations in the United States (“U.S.”). Our average crude oil and NGLs (collectively, “crude oil”) production for the nine months ended September 30, 2016 was approximately 201,300 barrels per day and our average natural gas production was 399 MMcf per day. Our refineries processed an average of 452,000 gross barrels per day of crude oil feedstock into an average of 479,000 gross barrels per day of refined products.

Our Operations

Oil Sands

Our operations include the following steam-assisted gravity drainage (“SAGD”) oil sands projects in northern Alberta:

| | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2016 | |

| | | Ownership Interest | | | | | Net Production Volumes | | | | | Gross Production Volumes | |

| | | (percent) | | | | | (bbls/d) | | | | | (bbls/d) | |

| | | | | |

Existing Projects | | | | | | | | | | | | | | | | |

Foster Creek | | | 50 | | | | | | 66,435 | | | | | | 132,870 | |

Christina Lake | | | 50 | | | | | | 78,321 | | | | | | 156,642 | |

Narrows Lake | | | 50 | | | | | | - | | | | | | - | |

Emerging Projects | | | | | | | | | | | | | | | | |

Telephone Lake | | | 100 | | | | | | - | | | | | | - | |

Grand Rapids | | | 100 | | | | | | - | | | | | | - | |

Foster Creek, Christina Lake and Narrows Lake are operated by Cenovus and jointly owned with ConocoPhillips, an unrelated U.S. public company. Foster Creek and Christina Lake are producing and Narrows Lake is in the initial stages of development. These projects are located in the Athabasca region of northeastern Alberta. Two of our 100 percent-owned emerging projects are Telephone Lake and Grand Rapids, located within the Borealis and Greater Pelican Lake regions of northeastern Alberta, respectively.

| | | | | | | | | | |

| | | Nine Months Ended September 30, 2016 | |

| ($ millions) | | Crude Oil | | | | | Natural Gas | |

| | | |

Operating Cash Flow | | | 542 | | | | | | 4 | |

Capital Investment | | | 472 | | | | | | 4 | |

Operating Cash Flow Net of Related Capital Investment | | | 70 | | | | | | - | |

| | |

| Cenovus Energy Inc. | | Page 7 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Conventional

Crude oil production from our Conventional business segment continues to generate dependable near-term cash flow. This production provides diversification to our revenue stream and enables further development of our oil sands assets. Our natural gas production acts as an economic hedge for the natural gas required as a fuel source at both our oil sands and refining operations and provides cash flow to help fund our growth opportunities.

| | | | | | | | | | |

| | | Nine Months Ended September 30, 2016 | |

| ($ millions) | | Crude Oil (1) | | | | | Natural Gas | |

| | | |

Operating Cash Flow | | | 302 | | | | | | 87 | |

Capital Investment | | | 108 | | | | | | 6 | |

Operating Cash Flow Net of Related Capital Investment | | | 194 | | | | | | 81 | |

We have established crude oil and natural gas producing assets, including heavy oil assets at Pelican Lake, a carbon dioxide (“CO2”) enhanced oil recovery project in Weyburn, Saskatchewan and emerging tight oil assets in Alberta.

Refining and Marketing

Our operations include two refineries located in Illinois and Texas that are jointly owned with and operated by Phillips 66, an unrelated U.S. public company. The gross crude oil capacity at the Wood River and Borger refineries is approximately 314,000 barrels per day and 146,000 barrels per day, respectively. Our refining operations allow us to capture the value from crude oil production through to refined products, such as diesel, gasoline and jet fuel, to partially mitigate volatility associated with regional North American light/heavy crude oil price differential fluctuations. This segment also includes our crude-by-rail terminal operations, located in Bruderheim, Alberta, and the marketing of third-party purchases and sales of product undertaken to provide operational flexibility for transportation commitments, product quality, delivery points and customer diversification.

| | | | |

| ($ millions) | | Nine Months Ended

September 30, 2016 | |

Operating Cash Flow | | | 238 | |

Capital Investment | | | 156 | |

Operating Cash Flow Net of Related Capital Investment | | | 82 | |

QUARTERLY HIGHLIGHTS

Crude oil prices remained relatively flat in the third quarter compared with the second quarter of 2016 with the West Texas Intermediate (“WTI”) benchmark price averaging US$44.94 per barrel. Our average crude oil sales price was $34.64 per barrel in the quarter, a slight increase from $33.87 per barrel in the second quarter and more than double first quarter prices.

Our crude oil netback, before realized risk management activities, was $17.17 per barrel, a 12 percent increase from the third quarter of 2015. Year to date, our netback was $10.32 per barrel, which remains significantly lower than in 2015. We continue to focus on maintaining our financial resilience and safe and reliable operations. Our ongoing efforts to reduce costs have helped our balance sheet remain strong, with approximately $3.9 billion of cash on hand at September 30, 2016.

In the third quarter, we:

| ● | | Decreased our total crude oil operating costs by 14 percent or $1.54 per barrel, compared with 2015; |

| ● | | Achieved Cash Flow of $422 million, a decrease of five percent from the third quarter of 2015 primarily due to lower realized gains on risk management activities; |

| ● | | Incurred Operating Losses of $236 million or $9.28 per BOE sold compared with Operating Losses of $28 million or $1.08 per BOE sold in the third quarter of 2015; |

| ● | | Added incremental crude oil production volumes from Foster Creek phase G and began steam generation at Christina Lake phase F. These phases, which include cogeneration at Christina Lake phase F, are expected to add 80,000 gross barrels per day of production capacity; |

| ● | | Increased crude utilization as a result of strong performance at both refineries. In addition, the debottlenecking project at Wood River was successfully completed and is expected to increase our heavy crude oil processing capability by 18,000 gross barrels per day; and |

| ● | | Recorded asset impairments of $292 million due to a decline in long-term forward commodity prices. |

| | |

| Cenovus Energy Inc. | | Page 8 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

OPERATING RESULTS

Total crude oil production decreased slightly in the three and nine months ended September 30, 2016, as higher production from our Oil Sands segment was offset by lower production from our Conventional properties.

Crude Oil Production Volumes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | | | Nine Months Ended September 30, | |

| (barrels per day) | | 2016 | | | | | Percent Change | | | | | | 2015 | | | | | 2016 | | | | | | Percent Change | | | | | | 2015 | |

| | | | | | | | | | | |

Oil Sands | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foster Creek | | | 73,798 | | | | | | 3% | | | | | | | | 71,414 | | | | | | 66,435 | | | | | | | | 1% | | | | | | | | 65,906 | |

Christina Lake | | | 79,793 | | | | | | 6% | | | | | | | | 75,329 | | | | | | 78,321 | | | | | | | | 5% | | | | | | | | 74,720 | |

| | | 153,591 | | | | | | 5% | | | | | | | | 146,743 | | | | | | 144,756 | | | | | | | | 3% | | | | | | | | 140,626 | |

| | | | | | | | | | | |

Conventional | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Heavy Oil | | | 28,096 | | | | | | (17)% | | | | | | | | 33,997 | | | | | | 29,276 | | | | | | | | (18)% | | | | | | | | 35,739 | |

Light and Medium Oil | | | 25,311 | | | | | | (11)% | | | | | | | | 28,491 | | | | | | 26,200 | | | | | | | | (18)% | | | | | | | | 31,787 | |

NGLs(1) | | | 1,074 | | | | | | (10)% | | | | | | | | 1,191 | | | | | | 1,027 | | | | | | | | (20)% | | | | | | | | 1,286 | |

| | | 54,481 | | | | | | (14)% | | | | | | | | 63,679 | | | | | | 56,503 | | | | | | | | (18)% | | | | | | | | 68,812 | |

Total Crude Oil Production | | | 208,072 | | | | | | (1)% | | | | | | | | 210,422 | | | | | | 201,259 | | | | | | | | (4)% | | | | | | | | 209,438 | |

| (1) | NGLs include condensate volumes. |

In the third quarter and on a year-to-date basis, production rose at Foster Creek primarily due to incremental production volumes from the phase G facility and additional wells being brought online. Ramp-up of phase G is on track and is expected to take 18 months. In the nine months ended September 30, 2015, production was decreased by approximately 3,500 barrels per day due to a nearby forest fire which resulted in the temporary shutdown of operations in the second quarter.

Production from Christina Lake increased in the three and nine months ended September 30, 2016 due to additional wells being brought online, incremental production from the optimization project completed in 2015 and reliable performance of our facilities.

Our Conventional crude oil production decreased in the third quarter and on a year-to-date basis due to expected natural declines and the sale of our royalty interest and mineral fee title lands business in July 2015. Divested assets contributed an average of 1,250 barrels per day and 3,415 barrels per day, respectively, in the three and nine months ended September 30, 2015.

Natural Gas Production Volumes

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended September 30, | |

| (MMcf per day) | | 2016 | | | | | 2015 | | | | | 2016 | | | | | 2015 | |

| | | | | | | |

Conventional | | | 374 | | | | | | 411 | | | | | | 382 | | | | | | 427 | |

Oil Sands | | | 18 | | | | | | 19 | | | | | | 17 | | | | | | 20 | |

| | | 392 | | | | | | 430 | | | | | | 399 | | | | | | 447 | |

In the third quarter and on a year-to-date basis, our natural gas production decreased nine percent and 11 percent, respectively. Production was lower primarily due to expected natural declines and the sale of our royalty interest and mineral fee title lands business in 2015.

Operating Netbacks

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | Crude Oil(1) | | Natural Gas | | Crude Oil(1) | | Natural Gas | |

| | | ($/bbl) | | | | | ($/Mcf) | | | | | ($/bbl) | | | | | ($/Mcf) | |

| | | 2016 | | | 2015 | | | | | 2016 | | | 2015 | | | | | 2016 | | | 2015 | | | | | 2016 | | | 2015 | |

| | | | | | | | | | | |

Price(2) | | | 34.64 | | | | 34.03 | | | | | | 2.49 | | | | 3.00 | | | | | | 28.25 | | | | 37.90 | | | | | | 2.11 | | | | 2.96 | |

Royalties | | | 1.84 | | | | 1.60 | | | | | | 0.10 | | | | 0.11 | | | | | | 1.57 | | | | 1.85 | | | | | | 0.08 | | | | 0.06 | |

Transportation and Blending(2) | | | 5.71 | | | | 5.61 | | | | | | 0.10 | | | | 0.10 | | | | | | 6.02 | | | | 5.39 | | | | | | 0.11 | | | | 0.11 | |

Operating Expenses(3) | | | 9.74 | | | | 11.28 | | | | | | 1.05 | | | | 1.16 | | | | | | 10.19 | | | | 12.15 | | | | | | 1.11 | | | | 1.19 | |

Production and Mineral Taxes | | | 0.18 | | | | 0.23 | | | | | | 0.01 | | | | 0.01 | | | | | | 0.15 | | | | 0.25 | | | | | | - | | | | 0.01 | |

Netback Excluding Realized Risk Management | | | 17.17 | | | | 15.31 | | | | | | 1.23 | | | | 1.62 | | | | | | 10.32 | | | | 18.26 | | | | | | 0.81 | | | | 1.59 | |

Realized Risk Management Gain (Loss) | | | 2.14 | | | | 10.07 | | | | | | - | | | | 0.37 | | | | | | 4.06 | | | | 6.25 | | | | | | - | | | | 0.35 | |

Netback Including Realized Risk Management | | | 19.31 | | | | 25.38 | | | | | | 1.23 | | | | 1.99 | | | | | | 14.38 | | | | 24.51 | | | | | | 0.81 | | | | 1.94 | |

| (2) | The crude oil price and transportation and blending costs exclude the cost of purchased condensate which is blended with the heavy oil. On aper-barrel of unblended crude oil basis, the cost of condensate was $18.46 per barrel for the third quarter (2015 – $19.18 per barrel) and $19.40 per barrel for the nine months ended September 30, 2016 (2015 – $21.32 per barrel). |

| (3) | Employee long-term incentive costs in prior periods were reclassified from operating expenses to general and administrative costs to conform to the presentation adopted for the year ended December 31, 2015. |

| | |

| Cenovus Energy Inc. | | Page 9 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Our average crude oil netback, excluding realized risk management gains and losses, increased 12 percent in the three months ended September 30, 2016 compared with 2015. The increase was primarily due to lower operating expenses and higher average sales prices, partially offset by higher royalties. Royalties increased primarily due to additional royalty burdens resulting from the sale of our royalty interest and mineral fee title lands business in 2015. Our average sales price increased primarily due to the decline in the cost of condensate used for blending in the third quarter of 2016 compared with 2015. As the cost of condensate decreases relative to the price of blended crude oil, our bitumen and heavy oil sales price increases. Refer to the Reportable Segments section for more details.

On a year-to-date basis, our average crude oil netback, excluding realized risk management gains and losses, declined 43 percent compared with 2015. The decline was primarily due to lower average sales prices and lower royalties, partially offset by a decline in operating expenses. The decrease in price is consistent with the decline in benchmark prices and a widening of the WTI-Western Canadian Select (“WCS”) differential, partially offset by the weakening of the Canadian dollar relative to the U.S. dollar, a decline in the cost of condensate used in blending and increased sales into the U.S. market, which generally secures a higher sales price. Our year-to-date netbacks were strongly impacted by crude oil sales prices in the first quarter which were approximately 50 percent lower than our crude oil sales prices in the second and third quarters.

In the third quarter, the value of the Canadian dollar relative to the U.S. dollar was consistent with the value in 2015. The weakening of the Canadian dollar relative to the U.S. dollar on a year-to-date basis, compared with 2015, had a positive impact on our crude oil price of approximately $1.32 per barrel.

In 2016, our average natural gas netback, excluding realized risk management gains and losses, decreased primarily due to lower sales prices, consistent with the decline in the AECO benchmark price.

Refining

In the third quarter, crude utilization increased due to consistent performance at both the Wood River and Borger refineries. In September, there was unplanned maintenance at the Borger refinery. As a result, a portion of the maintenance originally scheduled for October was started in the third quarter. In the third quarter of 2015, crude utilization was reduced by unplanned process unit outages at the Borger refinery for most of July and the start of a planned turnaround at the Wood River refinery.

On a year-to-date basis, crude utilization increased. Strong performance at both refineries was slightly offset by planned and unplanned maintenance at both refineries in the first quarter of 2016 and unplanned maintenance at the Borger refinery in September. In 2015, we experienced unplanned outages at the Borger refinery and planned turnarounds at both refineries.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2016 | | | | | Percent Change | | | | | 2015 | | | | | 2016 | | | | | Percent Change | | | | | 2015 | |

| | | | | | | | | | | |

Crude Oil Runs(1)(Mbbls/d) | | | 463 | | | | | | 18% | | | | | | 394 | | | | | | 452 | | | | | | 7% | | | | | | 424 | |

Heavy Crude Oil(1) | | | 241 | | | | | | 30% | | | | | | 186 | | | | | | 237 | | | | | | 17% | | | | | | 202 | |

Refined Product(1)(Mbbls/d) | | | 494 | | | | | | 19% | | | | | | 414 | | | | | | 479 | | | | | | 7% | | | | | | 448 | |

Crude Utilization(1)(percent) | | | 101 | | | | | | 15% | | | | | | 86 | | | | | | 98 | | | | | | 6% | | | | | | 92 | |

| (1) | Represents 100 percent of the Wood River and Borger refinery operations. |

Further information on the changes in our production volumes, items included in our operating netbacks and refining results can be found in the Reportable Segments section of this MD&A. Further information on our risk management activities can be found in the Risk Management section of this MD&A and in the notes to the Consolidated Financial Statements.

COMMODITY PRICES UNDERLYING OUR FINANCIAL RESULTS

Key performance drivers for our financial results include commodity prices, price differentials, refining crack spreads as well as the U.S./Canadian dollar exchange rate.

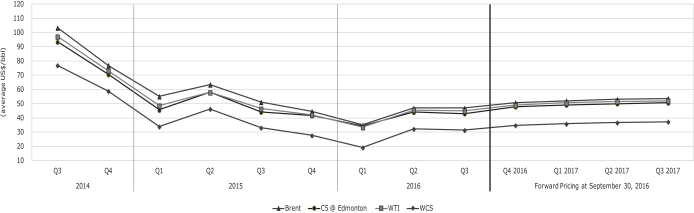

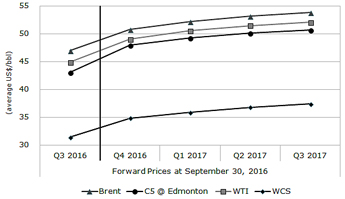

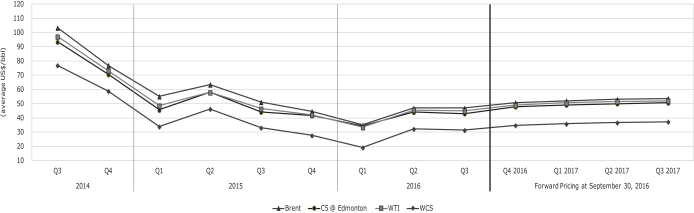

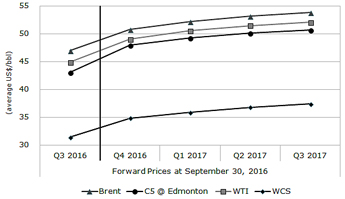

Crude Oil Benchmarks

Average crude oil benchmark prices in the third quarter were relatively consistent with the second quarter of 2016 and six percent lower than in the third quarter of 2015. Crude oil prices continued to be volatile, driven by stronger production from Saudi Arabia and Iran in combination with higher seasonal demand and lower gasoline prices for consumers. Additional volatility was introduced in late September when the Organization of Petroleum Exporting Countries (“OPEC”) announced a plan to limit its crude oil production.

| | |

| Cenovus Energy Inc. | | Page 10 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

WTI is an important benchmark for Canadian crude oil since it reflects inland North American crude oil prices and its Canadian dollar equivalent is the basis for determining royalties for a number of our crude oil properties. The average Brent-WTI differential narrowed in the third quarter of 2016 and on a year-to-date basis compared with 2015 as a result of lifting the U.S. export ban and a decrease in U.S. domestic light oil supply. The Brent-WTI differential continues to be primarily driven by transportation costs.

WCS is blended heavy oil which consists of both conventional heavy oil and unconventional diluted bitumen. Despite the decline in WTI, the average WTI-WCS differential was wider in the third quarter of 2016 and on a year-to-date basis compared with 2015. The differential widened as additional U.S. imports of medium crude competed for refining capacity and heavy oil prices were pressured by an oversupply of heavy oil products, such as fuel oil and bunker fuel.

Blending condensate with bitumen and heavy oil enables our production to be transported through pipelines. Our blending ratios range from approximately 10 percent to 33 percent. The WCS-Condensate differential is an important benchmark as a narrower differential generally results in an increase in the recovery of condensate costs when selling a barrel of blended crude oil. Since the supply of condensate in Alberta does not meet demand, Edmonton condensate prices may be driven by U.S. Gulf Coast condensate prices plus the cost attributed to transporting the condensate to Edmonton.

Average condensate prices were stronger relative to WTI in the third quarter of 2016 and on a year-to-date basis as declining U.S. light oil production reduced condensate supply from the U.S. Gulf Coast while higher heavy oil production in Alberta increased demand.

Selected Benchmark Prices and Exchange Rates(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, | | | | | | | | | | | | | | |

| | | 2016 | | | | | Percent Change | | | 2015 | | | | | Q3 2016 | | | Q2 2016 | | | | | Q3

2015 | |

| | | | | | | | | |

Crude Oil Prices(US$/bbl) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brent | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average | | | 43.01 | | | | | | (24)% | | | | 56.61 | | | | | | 46.98 | | | | 46.97 | | | | | | 51.17 | |

End of Period | | | 49.06 | | | | | | 1% | | | | 48.37 | | | | | | 49.06 | | | | 49.68 | | | | | | 48.37 | |

WTI | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average | | | 41.33 | | | | | | (19)% | | | | 51.00 | | | | | | 44.94 | | | | 45.59 | | | | | | 46.43 | |

End of Period | | | 48.24 | | | | | | 7% | | | | 45.09 | | | | | | 48.24 | | | | 48.33 | | | | | | 45.09 | |

Average Differential Brent-WTI | | | 1.68 | | | | | | (70)% | | | | 5.61 | | | | | | 2.04 | | | | 1.38 | | | | | | 4.74 | |

WCS(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average | | | 27.65 | | | | | | (27)% | | | | 37.80 | | | | | | 31.44 | | | | 32.29 | | | | | | 33.16 | |

End of Period | | | 34.97 | | | | | | 11% | | | | 31.62 | | | | | | 34.97 | | | | 35.79 | | | | | | 31.62 | |

Average Differential WTI-WCS | | | 13.68 | | | | | | 4% | | | | 13.20 | | | | | | 13.50 | | | | 13.30 | | | | | | 13.27 | |

Condensate (C5 @ Edmonton)(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average | | | 40.51 | | | | | | (18)% | | | | 49.25 | | | | | | 43.07 | | | | 44.07 | | | | | | 44.21 | |

Average Differential WTI-Condensate (Premium)/Discount | | | 0.82 | | | | | | (53)% | | | | 1.75 | | | | | | 1.87 | | | | 1.52 | | | | | | 2.22 | |

Average Differential WCS-Condensate (Premium)/Discount | | | (12.86) | | | | | | 12% | | | | (11.45) | | | | | | (11.63) | | | | (11.78) | | | | | | (11.05) | |

Average Refined Product Prices(US$/bbl) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chicago Regular Unleaded Gasoline (“RUL”) | | | 55.17 | | | | | | (23)% | | | | 71.82 | | | | | | 59.27 | | | | 64.25 | | | | | | 73.05 | |

Chicago Ultra-low Sulphur Diesel (“ULSD”) | | | 54.60 | | | | | | (23)% | | | | 71.09 | | | | | | 59.86 | | | | 59.40 | | | | | | 67.02 | |

Refining Margin: Average 3-2-1 Crack Spreads(US$/bbl) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chicago | | | 13.77 | | | | | | (33)% | | | | 20.66 | | | | | | 14.58 | | | | 17.15 | | | | | | 24.67 | |

Group 3 | | | 12.71 | | | | | | (35)% | | | | 19.61 | | | | | | 14.56 | | | | 13.03 | | | | | | 22.03 | |

Average Natural Gas Prices | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AECO(C$/Mcf) | | | 1.85 | | | | | | (34)% | | | | 2.81 | | | | | | 2.20 | | | | 1.25 | | | | | | 2.80 | |

NYMEX(US$/Mcf) | | | 2.29 | | | | | | (18)% | | | | 2.80 | | | | | | 2.81 | | | | 1.95 | | | | | | 2.77 | |

Basis Differential NYMEX-AECO(US$/Mcf) | | | 0.89 | | | | | | 59% | | | | 0.56 | | | | | | 1.13 | | | | 0.99 | | | | | | 0.61 | |

Foreign Exchange Rates(US$ per C$1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average | | | 0.757 | | | | | | (5)% | | | | 0.794 | | | | | | 0.766 | | | | 0.776 | | | | | | 0.764 | |

| (1) | These benchmark prices do not reflect our sales prices. For our average sales prices and realized risk management results, refer to the operating netbacks table in the Operating Results section of this MD&A. |

| (2) | The average Canadian dollar WCS benchmark price for the third quarter of 2016 was $41.04 per barrel (2015 – $43.40 per barrel) and for the nine months ended September 30, 2016 was $36.53 per barrel (2015 – $47.61 per barrel). |

| (3) | The average Canadian dollar condensate benchmark price for the third quarter of 2016 was $56.23 per barrel (2015 – $57.87 per barrel) and for the nine months ended September 30, 2016 was $53.51 per barrel (2015 – $62.03 per barrel). |

| | |

| Cenovus Energy Inc. | | Page 11 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Crude Oil Benchmarks

Crude Oil Benchmarks

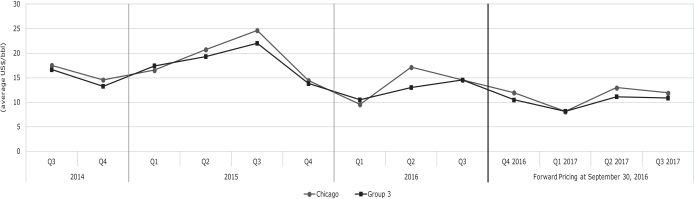

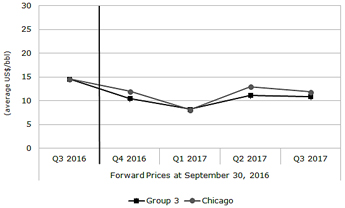

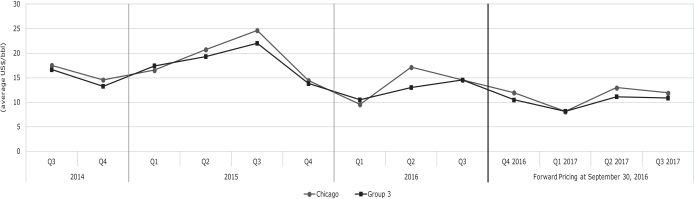

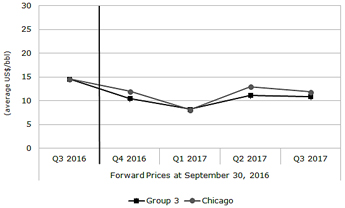

Refining Benchmarks

The Chicago Regular Unleaded Gasoline (“RUL”) and Chicago Ultra-low Sulphur Diesel (“ULSD”) benchmark prices are representative of inland refined product prices and are used to derive the Chicago 3-2-1 crack spread. The3-2-1 crack spread is an indicator of the refining margin generated by converting three barrels of crude oil into two barrels of regular unleaded gasoline and one barrel of ultra-low sulphur diesel using current month WTI-based crude oil feedstock prices and valued on a last in, first out accounting basis.

Average Chicago and Group 3 crack spreads decreased in the three and nine months ended September 30, 2016 compared with 2015 due to higher global refined product inventory and strengthening of the WTI benchmark price compared with Brent, as evidenced by narrowing of the Brent-WTI differential.

Our realized crack spreads are affected by many other factors such as the variety of feedstock crude oil, refinery configuration and product output, the time lag between the purchase and delivery of crude oil feedstock, and the cost of feedstock, which is valued on a first in, first out (“FIFO”) accounting basis.

Refining 3-2-1 Crack Spread Benchmarks

Natural Gas Benchmarks

Average natural gas prices decreased in the third quarter of 2016 and on a year-to-date basis compared with 2015 primarily due to high inventory levels in North America given a warmer than normal 2015/2016 winter and the resiliency of North American supply.

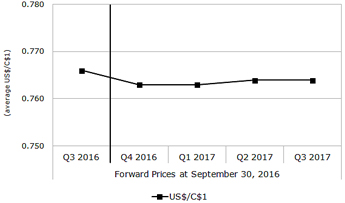

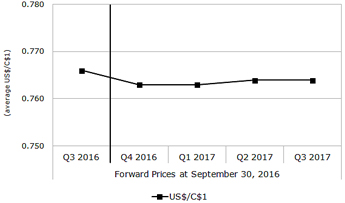

Foreign Exchange Benchmarks

Revenues are subject to foreign exchange exposure as the sales prices of our crude oil, natural gas and refined products are determined by reference to U.S. benchmark prices. A decrease in the value of the Canadian dollar compared with the U.S. dollar has a positive impact on our reported results. Likewise, as the Canadian dollar strengthens, our reported results are lower. In addition to our revenues being denominated in U.S. dollars, we chose to borrow U.S. dollar long-term debt. In periods of a weakening Canadian dollar, our U.S. dollar debt gives rise to unrealized foreign exchange losses when translated to Canadian dollars.

In the third quarter, compared with 2015, the Canadian dollar relative to the U.S. dollar was largely unchanged. On a year-to-date basis, the Canadian dollar weakened relative to the U.S. dollar due to lower commodity prices and the expectation of higher U.S. interest rates. The weakening of the Canadian dollar for the nine months ended September 30, 2016 compared with 2015, had a positive impact of approximately $397 million on our revenues. As at September 30, 2016, the Canadian dollar was stronger relative to the U.S. dollar on December 31, 2015, which resulted in $343 million of unrealized foreign exchange gains on the translation of our U.S. dollar debt for the nine months ended September 30, 2016.

| | |

| Cenovus Energy Inc. | | Page 12 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

FINANCIAL RESULTS

Selected Consolidated Financial Results

While crude oil prices in the third quarter improved from the first half of 2016, they were lower than in 2015 and had a significant impact on our year-to-date financial results. The following key performance measures are discussed in more detail within this MD&A.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months

Ended

September 30, | | | 2016 | | | 2015 | | | 2014 | |

| ($ millions, except per share amounts) | | 2016 | | 2015 | | | Q3 | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | |

| | | | | | | | | | | |

Revenues | | 8,492 | | | 10,140 | | | 3,240 | | | 3,007 | | | | 2,245 | | | | 2,924 | | | | 3,273 | | | | 3,726 | | | | 3,141 | | | | 4,238 | | | | 4,970 | |

Operating Cash Flow(1) (2) | | 1,172 | | | 2,082 | | | 487 | | | 541 | | | | 144 | | | | 357 | | | | 602 | | | | 932 | | | | 548 | | | | 537 | | | | 1,156 | |

Cash Flow(1) | | 888 | | | 1,416 | | | 422 | | | 440 | | | | 26 | | | | 275 | | | | 444 | | | | 477 | | | | 495 | | | | 401 | | | | 985 | |

Operating Earnings (Loss)(1) | | (698) | | | 35 | | | (236) | | | (39) | | | | (423) | | | | (438) | | | | (28) | | | | 151 | | | | (88) | | | | (590) | | | | 372 | |

Per Share – Diluted | | (0.84) | | | 0.04 | | | (0.28) | | | (0.05) | | | | (0.51) | | | | (0.53) | | | | (0.03) | | | | 0.18 | | | | (0.11) | | | | (0.78) | | | | 0.49 | |

Net Earnings (Loss) | | (636) | | | 1,259 | | | (251) | | | (267) | | | | (118) | | | | (641) | | | | 1,801 | | | | 126 | | | | (668) | | | | (472) | | | | 354 | |

Per Share – Basic and Diluted | | (0.76) | | | 1.55 | | | (0.30) | | | (0.32) | | | | (0.14) | | | | (0.77) | | | | 2.16 | | | | 0.15 | | | | (0.86) | | | | (0.62) | | | | 0.47 | |

Capital Investment(3) | | 767 | | | 1,286 | | | 208 | | | 236 | | | | 323 | | | | 428 | | | | 400 | | | | 357 | | | | 529 | | | | 786 | | | | 750 | |

Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Dividends | | 124 | | | 396 | | | 41 | | | 42 | | | | 41 | | | | 132 | | | | 133 | | | | 125 | | | | 138 | | | | 201 | | | | 201 | |

In Shares from Treasury | | - | | | 182 | | | - | | | - | | | | - | | | | - | | | | - | | | | 98 | | | | 84 | | | | - | | | | - | |

Per Share | | 0.15 | | | 0.6924 | | | 0.05 | | | 0.05 | | | | 0.05 | | | | 0.16 | | | | 0.16 | | | | 0.2662 | | | | 0.2662 | | | | 0.2662 | | | | 0.2662 | |

| (1) | Non-GAAP measure defined in this MD&A. |

| (2) | Employee long-term incentive costs in prior periods were reclassified from operating expenses to general and administrative costs to conform to the presentation adopted for the year ended December 31, 2015. |

| (3) | Includes expenditures on Property, Plant and Equipment (“PP&E”) and Exploration and Evaluation (“E&E”) assets. |

Revenues

| | | | | | | | | | | | |

| | | Three Months | | | | | | Nine Months | |

| ($ millions) | | Ended | | | | | | Ended | |

| | | |

Revenues for the Periods Ended September 30, 2015 | | | 3,273 | | | | | | | | 10,140 | |

Increase (Decrease) due to: | | | | | | | | | | | | |

Oil Sands | | | 40 | | | | | | | | (388) | |

Conventional | | | (73) | | | | | | | | (462) | |

Refining and Marketing | | | 3 | | | | | | | | (813) | |

Corporate and Eliminations | | | (3) | | | | | | | | 15 | |

Revenues for the Periods Ended September 30, 2016 | | | 3,240 | | | | | | | | 8,492 | |

Combined Oil Sands and Conventional revenues declined three percent in the third quarter, compared with 2015, primarily due to lower natural gas sales prices and volumes, partially offset by an increase in crude oil sales prices. On a year-to-date basis, combined Oil Sands and Conventional revenues decreased 23 percent primarily due to lower crude oil and natural gas sales prices and a decline in sales volumes, partially offset by the weakening of the Canadian dollar relative to the U.S. dollar. The sale of our royalty interest and mineral fee title lands business in 2015 also reduced revenues.

Revenues from our Refining and Marketing segment in the third quarter of 2016 remained relatively flat as lower refined product pricing, consistent with lower Chicago RUL and Chicago ULSD benchmark prices, was offset by higher refined product output. On a year-to-date basis, refining revenues declined 12 percent due to lower refined product pricing, partially offset by higher refined product output and the weakening of the Canadian dollar relative to the U.S. dollar. Revenues fromthird-party sales undertaken by the marketing group increased from 2015 due to higher purchased crude oil and natural gas volumes, partially offset by lower natural gas sales prices. Crude oil sales prices increased in the third quarter compared with 2015 and declined on a year-to-date basis.

Corporate and Eliminations revenues relate to sales and operating revenues between segments and are recorded at transfer prices based on current market prices.

Further information regarding our revenues can be found in the Reportable Segments section of this MD&A.

Operating Cash Flow

Operating Cash Flow is a non-GAAP measure used to provide a consistent measure of the cash generating performance of our assets for comparability of our underlying financial performance between periods. Operating Cash Flow is defined as revenues less purchased product, transportation and blending, operating expenses and production and mineral taxes plus realized gains less realized losses on risk management activities. Items within the Corporate and Eliminations segment are excluded from the calculation of Operating Cash Flow.

| | |

| Cenovus Energy Inc. | | Page 13 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | | | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | | 2015 | | | | | | 2016 | | | | | | 2015 | |

| | | | | | | |

Revenues | | | 3,329 | | | | | | | | 3,359 | | | | | | | | 8,737 | | | | | | | | 10,400 | |

(Add) Deduct: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchased Product | | | 2,004 | | | | | | | | 2,012 | | | | | | | | 5,144 | | | | | | | | 5,826 | |

Transportation and Blending | | | 473 | | | | | | | | 483 | | | | | | | | 1,364 | | | | | | | | 1,509 | |

Operating Expenses(1) | | | 402 | | | | | | | | 477 | | | | | | | | 1,247 | | | | | | | | 1,384 | |

Production and Mineral Taxes | | | 4 | | | | | | | | 5 | | | | | | | | 9 | | | | | | | | 16 | |

Realized (Gain) Loss on Risk Management | | | (41) | | | | | | | | (220) | | | | | | | | (199) | | | | | | | | (417) | |

Operating Cash Flow | | | 487 | | | | | | | | 602 | | | | | | | | 1,172 | | | | | | | | 2,082 | |

| (1) | Employee long-term incentive costs in prior periods were reclassified from operating expenses to general and administrative costs to conform to the presentation adopted for the year ended December 31, 2015. |

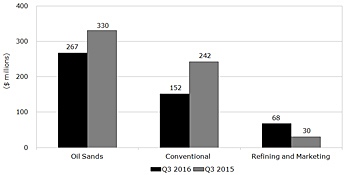

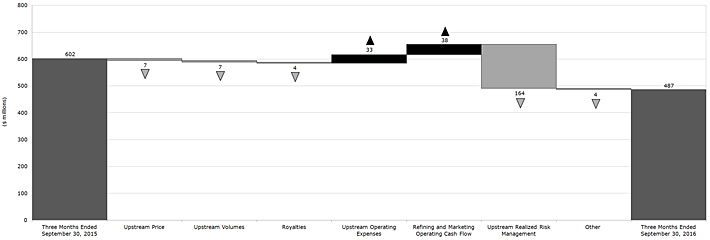

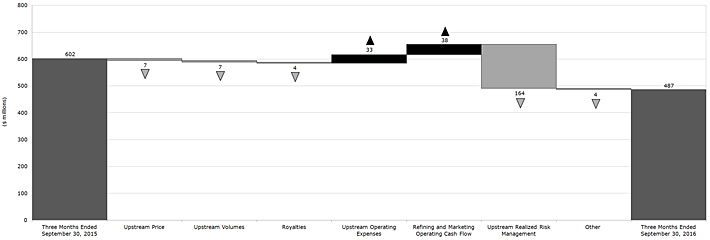

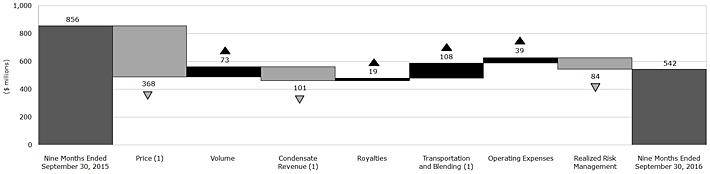

Three Months Ended September 30, 2016 Compared With September 30, 2015

| | |

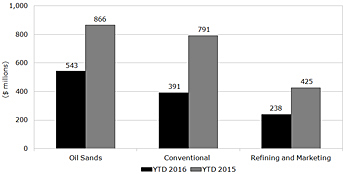

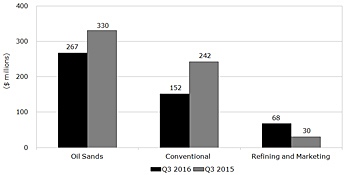

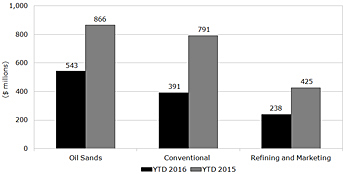

| Operating Cash Flow by Segment | | Upstream Operating Cash Flow by Product |

| |  |

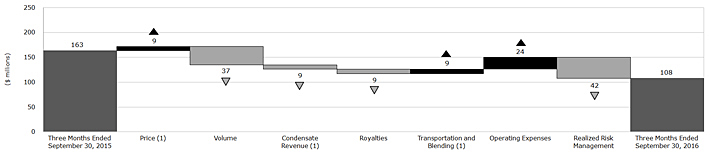

Crude oil prices and sales volumes remained relatively consistent in the third quarter of 2016 compared with 2015. Operating Cash Flow declined 19 percent in 2016 primarily due to upstream realized risk management gains of $42 million compared with gains of $206 million in 2015.

The decline in Operating Cash Flow was partially offset by:

| ● | | Higher Operating Cash Flow from Refining and Marketing as a result of widening heavy and medium crude oil differentials, increased utilization rates, and lower operating expenses, partially offset by lower average market crack spreads; |

| ● | | A $26 million decrease in crude oil operating expenses primarily due to lower repairs and maintenance, workforce, chemicals and electricity costs; and |

| ● | | An $11 million decrease in crude oil transportation and blending costs primarily due to lower condensate prices, partially offset by an increase in condensate volumes and transportation costs. |

Operating Cash Flow Variance

| | |

| Cenovus Energy Inc. | | Page 14 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

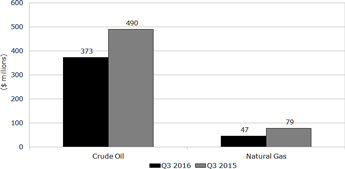

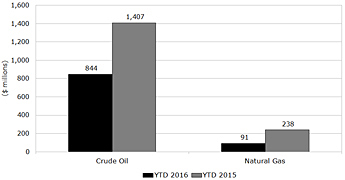

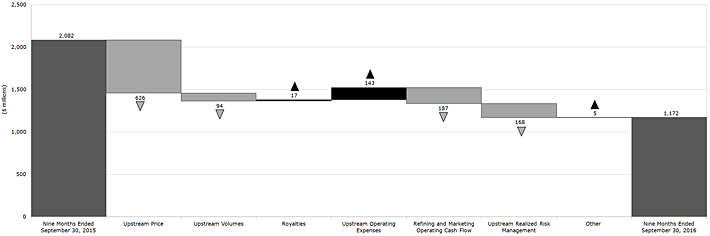

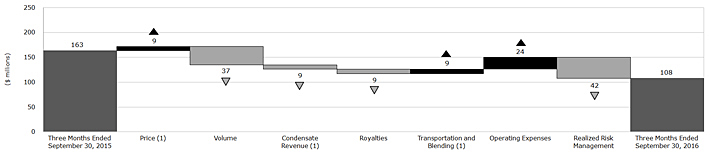

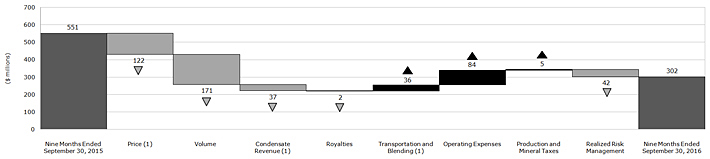

Nine Months Ended September 30, 2016 Compared With September 30, 2015

| | |

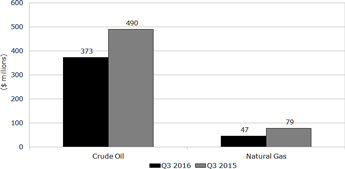

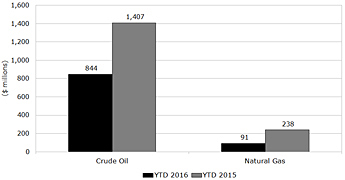

| Operating Cash Flow by Segment | | Upstream Operating Cash Flow by Product |

| |  |

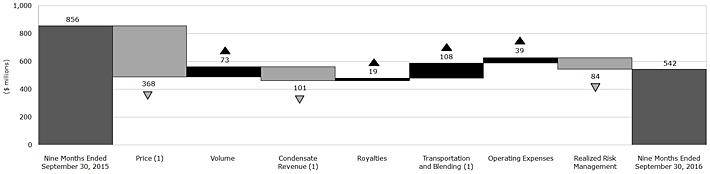

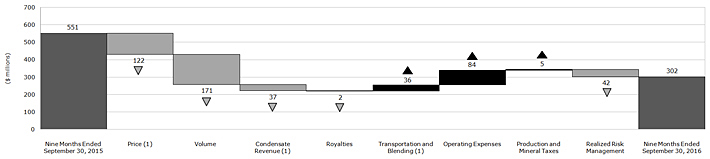

Operating Cash Flow declined 44 percent in the nine months ended September 30, 2016 compared with 2015 primarily due to:

| ● | | A 25 percent decrease in our average crude oil sales price and a 29 percent reduction in our average natural gas sales price. The steep declines in crude oil prices during the first quarter of 2016 significantly impacted our year-to-date average prices; |

| ● | | Lower Operating Cash Flow from Refining and Marketing as a result of a decrease in average market crack spreads, partially offset by widening heavy and medium crude oil differentials, increased utilization rates, weakening of the Canadian dollar relative to the U.S. dollar, and improved margins on the sale of secondary products; |

| ● | | Realized risk management gains of $222 million, excluding Refining and Marketing, compared with gains of $390 million in 2015; and |

| ● | | A three percent decrease in our crude oil sales volumes and an 11 percent decline in our natural gas sales volumes. |

These declines to Operating Cash Flow were partially offset by:

| ● | | A $144 million decrease in crude oil transportation and blending costs primarily due to lower condensate prices, partially offset by an increase in condensate volumes and higher transportation costs; |

| ● | | A $123 million decrease in crude oil operating expenses primarily due to workforce reductions, decreased repairs and maintenance, chemicals, fuel, and workover activities; and |

| ● | | A decline in royalties primarily due to reduced crude oil sales prices. |

Operating Cash Flow Variance

Additional details explaining the changes in Operating Cash Flow can be found in the Reportable Segments section of this MD&A.

Cash Flow

Cash Flow is a non-GAAP measure commonly used in the oil and gas industry to assist in measuring a company’s ability to finance its capital programs and meet its financial obligations. Cash Flow is defined as cash from operating activities excluding net change in other assets and liabilities and net change in non-cash working capital.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | 2015 | | | | | 2016 | | | | | 2015 | |

| | | | | | | |

Cash From Operating Activities | | | 310 | | | | | | 542 | | | | | | 697 | | | | | | 1,152 | |

(Add) Deduct: | | | | | | | | | | | | | | | | | | | | | | |

Net Change in Other Assets and Liabilities | | | (13) | | | | | | (13) | | | | | | (59) | | | | | | (81) | |

Net Change in Non-Cash Working Capital | | | (99) | | | | | | 111 | | | | | | (132) | | | | | | (183) | |

Cash Flow | | | 422 | | | | | | 444 | | | | | | 888 | | | | | | 1,416 | |

| | |

| Cenovus Energy Inc. | | Page 15 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

In the three and nine months ended September 30, 2016, Cash Flow decreased primarily due to lower Operating Cash Flow, as discussed above, partially offset by a current income tax recovery compared with an expense in 2015.

Operating Earnings (Loss)

Operating Earnings (Loss) is a non-GAAP measure used to provide a consistent measure of the comparability of our underlying financial performance between periods by removing non-operating items. Operating Earnings (Loss) is defined as Earnings (Loss) Before Income Tax excluding gain (loss) on discontinuance, gain on bargain purchase, unrealized risk management gains (losses) on derivative instruments, unrealized foreign exchange gains (losses) on translation of U.S. dollar denominated notes issued from Canada, foreign exchange gains (losses) on settlement of intercompany transactions, gains (losses) on divestiture of assets, less income taxes on Operating Earnings (Loss) before tax, excluding the effect of changes in statutory income tax rates and the recognition of an increase in U.S. tax basis.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | 2015 | | | | | 2016 | | | | | 2015 | |

| | | | | | | |

Earnings (Loss), Before Income Tax | | | (406) | | | | | | 2,020 | | | | | | (1,089) | | | | | | 1,419 | |

Add (Deduct): | | | | | | | | | | | | | | | | | | | | | | |

Unrealized Risk Management (Gain) Loss(1) | | | 7 | | | | | | (127) | | | | | | 440 | | | | | | 169 | |

Non-operating Unrealized Foreign Exchange (Gain) Loss(2) | | | 52 | | | | | | 437 | | | | | | (343) | | | | | | 852 | |

(Gain) Loss on Divestiture of Assets | | | 5 | | | | | | (2,379) | | | | | | 6 | | | | | | (2,395) | |

Operating Earnings (Loss), Before Income Tax | | | (342) | | | | | | (49) | | | | | | (986) | | | | | | 45 | |

Income Tax Expense (Recovery) | | | (106) | | | | | | (21) | | | | | | (288) | | | | | | 10 | |

Operating Earnings (Loss) | | | (236) | | | | | | (28) | | | | | | (698) | | | | | | 35 | |

| (1) | Includes the reversal of unrealized (gains) losses recorded in prior periods. |

| (2) | Includes unrealized foreign exchange (gains) losses on translation of U.S. dollar denominated notes issued from Canada and foreign exchange (gains) losses on settlement of intercompany transactions. |

Operating Earnings declined in the three and nine months ended September 30, 2016 compared with 2015 primarily due to lower Cash Flow, as discussed above, higher depreciation, depletion and amortization (“DD&A”) from asset impairments, and a $31 million non-cash expense on a year-to-date basis ($nil recorded in the third quarter) for office space in excess of Cenovus’s current and near-term requirements, partially offset by the change in income taxes. We recorded impairment losses of $292 million and $467 million in the three and nine months ended September 30, 2016, respectively, due to a decline in long-term forward heavy crude oil and natural gas prices. Refer to the Reportable Segments section for more details.

Net Earnings

| | | | | | | | | | |

| ($ millions) | | Three Months

Ended | | | | | Nine Months

Ended | |

| | | |

Net Earnings (Loss) for the Periods Ended September 30, 2015 | | | 1,801 | | | | | | 1,259 | |

Increase (Decrease) due to: | | | | | | | | | | |

Operating Cash Flow(1) (2) | | | (115) | | | | | | (910) | |

Corporate and Eliminations: | | | | | | | | | | |

Unrealized Risk Management Gain (Loss) | | | (134) | | | | | | (271) | |

Unrealized Foreign Exchange Gain (Loss) | | | 407 | | | | | | 1,219 | |

Gain (Loss) on Divestiture of Assets | | | (2,384) | | | | | | (2,401) | |

Expenses(2) (3) | | | (13) | | | | | | (50) | |

Depreciation, Depletion and Amortization | | | (186) | | | | | | (114) | |

Exploration Expense | | | (1) | | | | | | 19 | |

Income Tax Recovery | | | 374 | | | | | | 613 | |

Net Earnings (Loss) for the Periods Ended September 30, 2016 | | | (251) | | | | | | (636) | |

| (1) | Non-GAAP measure defined in this MD&A. |

| (2) | Employee long-term incentive costs in prior periods were reclassified from operating expenses to general and administrative costs to conform to the presentation adopted for the year ended December 31, 2015. |

| (3) | Includes general and administrative, finance costs, interest income, realized foreign exchange (gains) losses, research costs, other (income) loss, net and Corporate and Eliminations revenues, purchased product, transportation and blending, and operating expenses. |

Net Earnings for the three and nine months ended September 30, 2016 decreased primarily due to an after-tax gain in 2015 of approximately $1.9 billion from the divestiture of our royalty interest and mineral fee title lands business. In addition, the decrease was due to:

| ● | | A decline in Operating Earnings, as discussed above; |

| ● | | Unrealized risk management losses of $7 million in the quarter and $440 million on a year-to-date basis (2015 – gains of $127 million and losses of $169 million, respectively); and |

| ● | | A deferred income tax recovery of $111 million in the quarter and $353 million on a year-to-date basis (2015 – $228 million and $516 million, respectively). |

The declines were partially offset bynon-operating unrealized foreign exchange losses of $52 million in the quarter and gains of $343 million on a year-to-date basis (2015 – losses of $437 million and $852 million, respectively).

| | |

| Cenovus Energy Inc. | | Page 16 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Net Capital Investment

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | 2015 | | | | | 2016 | | | | | 2015 | |

| | | | | | | |

Oil Sands | | | 110 | | | | | | 272 | | | | | | 476 | | | | | | 946 | |

Conventional | | | 41 | | | | | | 55 | | | | | | 114 | | | | | | 157 | |

Refining and Marketing | | | 51 | | | | | | 67 | | | | | | 156 | | | | | | 159 | |

Corporate and Eliminations | | | 6 | | | | | | 6 | | | | | | 21 | | | | | | 24 | |

Capital Investment | | | 208 | | | | | | 400 | | | | | | 767 | | | | | | 1,286 | |

Acquisitions | | | - | | | | | | 84 | | | | | | 11 | | | | | | 84 | |

Divestitures | | | (8) | | | | | | (3,329) | | | | | | (8) | | | | | | (3,345) | |

Net Capital Investment (1) | | | 200 | | | | | | (2,845) | | | | | | 770 | | | | | | (1,975) | |

| (1) | Includes expenditures on PP&E and E&E. |

Capital investment in the three and nine months ended September 30, 2016 declined 48 percent and 40 percent, respectively, compared with 2015, as we reduced our spending in light of the low commodity price environment. Divestitures in the third quarter of 2016 related to non-core conventional crude oil and natural gas properties.

Oil Sands capital investment focused primarily on sustaining capital related to existing production, as well as work to complete Foster Creek phase G and Christina Lake phase F. Conventional capital investment focused on stratigraphic test well drilling for tight oil, maintenance capital and spending for our CO2 enhanced oil recovery project at Weyburn.

Capital investment in the Refining and Marketing segment focused on completion of the debottlenecking project at Wood River, in addition to capital maintenance, projects to improve our refinery reliability and safety, and environmental initiatives.

Further information regarding our capital investment can be found in the Reportable Segments section of this MD&A.

Capital Investment Decisions

Our disciplined approach to capital allocation includes prioritizing our uses of cash flow in the following manner:

| ● | | First, to capital for our existing business operations; |

| ● | | Second, to paying a dividend as part of providing strong total shareholder return; and |

| ● | | Third, for growth or discretionary capital. |

Our approach to capital allocation includes evaluating all opportunities using specific rigorous criteria within the context of achieving our objectives of maintaining a prudent and flexible capital structure and strong balance sheet metrics, which position us to be financially resilient in times of lower cash flow. In addition, we continue to evaluate other corporate and financial opportunities, including generating cash from our existing portfolio. Refer to the Liquidity and Capital Resources section of this MD&A for further information.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | | | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | 2015 | | | | | | 2016 | | | | | | 2015 | |

| | | | | | | |

Cash Flow (1) | | | 422 | | | | | | 444 | | | | | | | | 888 | | | | | | | | 1,416 | |

Capital Investment (Sustaining and Growth) | | | 208 | | | | | | 400 | | | | | | | | 767 | | | | | | | | 1,286 | |

Free Cash Flow(2) | | | 214 | | | | | | 44 | | | | | | | | 121 | | | | | | | | 130 | |

Cash Dividends | | | 41 | | | | | | 133 | | | | | | | | 124 | | | | | | | | 396 | |

| | | 173 | | | | | | (89) | | | | | | | | (3) | | | | | | | | (266) | |

| (1) | Non-GAAP measure defined in this MD&A. |

| (2) | Free Cash Flow is a non-GAAP measure defined as Cash Flow less capital investment. |

We expect our capital investment for 2016 to be funded from internally generated cash flow and our cash balance on hand.

| | |

| Cenovus Energy Inc. | | Page 17 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

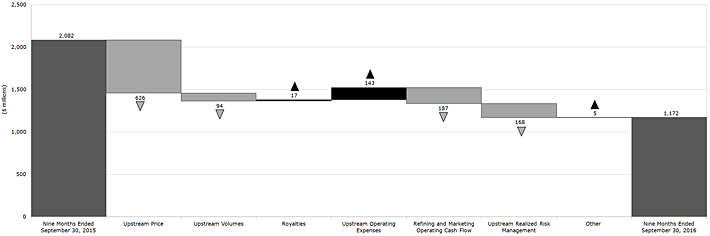

REPORTABLE SEGMENTS

| | |

Our reportable segments are as follows: Oil Sands,which includes the development and production of bitumen and natural gas in northeast Alberta. Cenovus’s bitumen assets include Foster Creek, Christina Lake and Narrows Lake as well as projects in the early stages of development, such as Grand Rapids and Telephone Lake. Certain of Cenovus’s operated oil sands properties, notably Foster Creek, Christina Lake and Narrows Lake, are jointly owned with ConocoPhillips, an unrelated U.S. public company. Conventional,which includes the development and production of conventional crude oil, NGLs and natural gas in Alberta and Saskatchewan, including the heavy oil assets at Pelican Lake, the carbon dioxide enhanced oil recovery project at Weyburn and emerging tight oil opportunities. Refining and Marketing,which is responsible for transporting, selling and refining crude oil into petroleum and chemical products. Cenovus jointly owns two refineries in the U.S. with the operator Phillips 66, an unrelated U.S. public company. In addition, Cenovus owns and operates a crude-by-rail terminal in Alberta. This segment coordinates Cenovus’s marketing and transportation initiatives to optimize product mix, delivery points, transportation commitments and customer diversification. | |  |

Corporate and Eliminations,which primarily includes unrealized gains and losses recorded on derivative financial instruments, gains and losses on divestiture of assets, as well as other Cenovus-wide costs for general and administrative, financing activities and research costs. As financial instruments are settled, the realized gains and losses are recorded in the operating segment to which the derivative instrument relates. Eliminations relate to sales and operating revenues, and purchased product between segments, recorded at transfer prices based on current market prices, and to unrealized intersegment profits in inventory.

Revenues by Reportable Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| ($ millions) | | 2016 | | | | | | 2015 | | | | | 2016 | | | | | | 2015 | |

| | | | | | | |

Oil Sands | | | 789 | | | | | | | | 749 | | | | | | 1,965 | | | | | | | | 2,353 | |

Conventional | | | 295 | | | | | | | | 368 | | | | | | 810 | | | | | | | | 1,272 | |

Refining and Marketing | | | 2,245 | | | | | | | | 2,242 | | | | | | 5,962 | | | | | | | | 6,775 | |

Corporate and Eliminations | | | (89) | | | | | | | | (86) | | | | | | (245) | | | | | | | | (260) | |

| | | 3,240 | | | | | | | | 3,273 | | | | | | 8,492 | | | | | | | | 10,140 | |

OIL SANDS

In northeastern Alberta, we are a 50 percent partner in the Foster Creek, Christina Lake and Narrows Lake oil sands projects. We have several emerging projects, including our100 percent-owned projects at Telephone Lake and Grand Rapids. The Oil Sands segment also includes the Athabasca natural gas property, from which a portion of the natural gas production is used as fuel at the adjacent Foster Creek operations.

Significant developments in our Oil Sands segment in the third quarter of 2016 compared with 2015 includes:

| ● | | Decreasing our crude oil operating costs by $2 million or $0.81 per barrel to $8.65 per barrel; |

| ● | | Crude oil netbacks, excluding realized risk management activities, of $15.96 per barrel (2015 – $13.65 per barrel); |

| ● | | Generating Operating Cash Flow net of capital investment of $157 million, an increase of $99 million; |

| ● | | Adding incremental crude oil production volumes at Foster Creek phase G, our twelfth oil sands expansion phase, which is expected to ramp-up over the next 18 months; and |

| ● | | Began steam generation at Christina Lake phase F. |

| | |

| Cenovus Energy Inc. | | Page 18 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Oil Sands – Crude Oil

Three Months Ended September 30, 2016 Compared With September 30, 2015

Financial Results

| | | | | | | | | | | | |

| | | Three Months Ended

September 30, | |

| ($ millions) | | 2016 | | | | | | 2015 | |

| | | |

Gross Sales | | | 788 | | | | | | | | 749 | |

Less: Royalties | | | 4 | | | | | | | | 7 | |

Revenues | | | 784 | | | | | | | | 742 | |

Expenses | | | | | | | | | | | | |

Transportation and Blending | | | 429 | | | | | | | | 431 | |

Operating(1) | | | 125 | | | | | | | | 127 | |

(Gain) Loss on Risk Management | | | (35) | | | | | | | | (143) | |

Operating Cash Flow | | | 265 | | | | | | | | 327 | |

Capital Investment | | | 107 | | | | | | | | 272 | |

Operating Cash Flow Net of Related Capital Investment | | | 158 | | | | | | | | 55 | |

| (1) | Employee long-term incentive costs in prior periods were reclassified from operating expenses to general and administrative costs to conform to the presentation adopted for the year ended December 31, 2015. |

When capital investment exceeds Operating Cash Flow from Oil Sands, it is funded through Operating Cash Flow generated by our Conventional segment as well as our cash balance on hand.

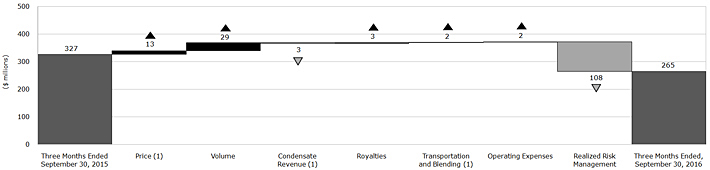

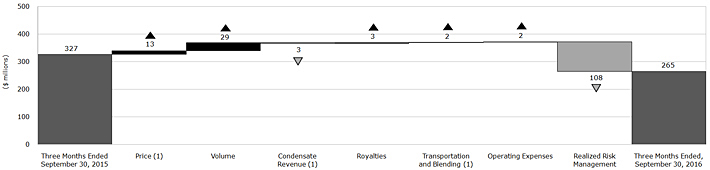

Operating Cash Flow Variance

Operating Cash Flow declined 19 percent in the third quarter of 2016 compared with 2015 primarily due to lower realized risk management gains, partially offset by higher crude oil prices and sales volumes.

| (1) | Revenues include the value of condensate sold as heavy oil blend. Condensate costs are recorded in transportation and blending expense. The crude oil price excludes the impact of condensate purchases. |

Revenues

Pricing

In the third quarter, our average crude oil sales price was $31.30 per barrel, a three percent increase from 2015. The increase in our crude oil price was due to the decline in the cost of condensate used for blending, the narrowing of the WCS-Christina Dilbit Blend (“CDB”) differential, and higher sales into the U.S. market, which generally secures a higher sales price, partially offset by a decrease in the WCS benchmark price.

Our bitumen sales price is influenced by the cost of condensate used in blending. Our blending ratios range from approximately 25 percent to 33 percent. As the cost of condensate decreases relative to the price of blended crude oil, our bitumen sales price increases. Due to high demand for condensate at Edmonton, we also purchase condensate from U.S. markets. As such, our cost of condensate is generally higher than the Edmonton benchmark price due to transportation between market hubs and to field locations. In addition, up to three months may elapse from when we purchase condensate to when we blend it with our production. In a rising price environment, we will see some benefit in our bitumen sales price as we are using condensate purchased at a lower price earlier in the year.

The WCS-CDB differential narrowed to a discount of US$2.05 per barrel (2015 – US$3.00 per barrel). In the third quarter, 88 percent of our Christina Lake production was sold as CDB (2015 – 84 percent), with the remainder sold into the WCS stream. Christina Lake production, whether sold as CDB or blended with WCS and subject to a quality equalization charge, is priced at a discount to WCS.

| | |

| Cenovus Energy Inc. | | Page 19 |

| Third Quarter 2016 Report | | Management’s Discussion and Analysis |

Production Volumes

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | |

| (barrels per day) | | 2016 | | | | | Percent Change | | | | | | 2015 | |

| | | | | |

Foster Creek | | | 73,798 | | | | | | 3% | | | | | | | | 71,414 | |

Christina Lake | | | 79,793 | | | | | | 6% | | | | | | | | 75,329 | |

| | | 153,591 | | | | | | 5% | | | | | | | | 146,743 | |

Production at Foster Creek for the third quarter was higher than 2015 primarily due to incremental production volumes from the phase G oil processing facility and additional wells being brought online. Ramp-up of phase G is on track and expected to take 18 months. In 2015, Foster Creek experienced strong initial production after operations were temporarily shut down in the second quarter due to a nearby forest fire.

Production from Christina Lake increased compared with the third quarter of 2015 due to additional wells being brought online, incremental production from the optimization project completed in 2015, and consistent performance of our facilities.

Condensate

The bitumen currently produced by Cenovus must be blended with condensate to reduce its thickness in order to transport it to market. Revenues represent the total value of blended crude oil sold and include the value of condensate. Consistent with the widening of the WCS-Condensate differential during the third quarter, the proportion of the cost of condensate recovered decreased.

Royalties