- CVE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cenovus Energy (CVE) 6-KCenovus reports solid 2017 results

Filed: 15 Feb 18, 12:00am

Exhibit 99.1

Cenovus reports solid 2017 results

Company remains focused on deleveraging and reducing costs

Calgary, Alberta (February 15, 2018)– Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered strong cash from operating activities and adjusted funds flow in 2017. Through its continued focus on capital discipline and reliable operational performance, the company generated almost $1.3 billion in free funds flow last year. Cenovus also completed the divestitures of its legacy conventional oil and natural gas assets within its expected timeframe. Divestiture proceeds and cash on hand were used to repay and retire the company’s bridge credit facility prior toyear-end.

Key 2017 highlights

| ● | Increased free funds flow by 216% compared with 2016 |

| ● | Increased cash from operating activities and adjusted funds flow by 255% and 105%, respectively, compared with 2016 |

| ● | Recorded net earnings of $3.4 billion versus a net loss of $545 million in 2016 |

| ● | Repaid and retired the company’s $3.6 billion bridge credit facility |

| ● | Doubled proved bitumen reserves to approximately 4.8 billion barrels |

| ● | Reduced general and administrative (G&A) costs by 44% per barrel of oil equivalent (BOE) and oil sands operating costs by 6% per barrel from 2016 |

2017 production & financial summary

| ||||||||||||

(for the period ended December 31)

|

2017 Q4

|

2016 Q4

| % change | 2017 Full year

| 2016

Full year | % change | ||||||

Financial1 ($ millions, except per share amounts)

| ||||||||||||

Cash from operating activities

| 900 | 164 | 449 | 3,059 | 861 | 255 | ||||||

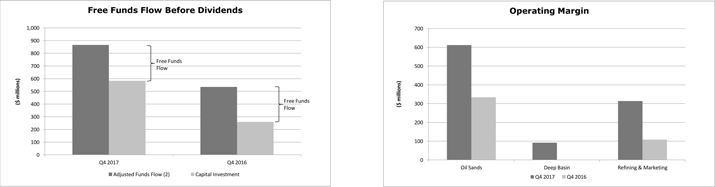

Adjusted funds flow2 | 866 | 535 | 62 | 2,914 | 1,423 | 105 | ||||||

Per share diluted

| 0.70 | 0.64 | 2.64 | 1.71 | ||||||||

Free funds flow2

| 283 | 276 | 3 | 1,253 | 397 | 216 | ||||||

Operating earnings2 | -514 | 321 | 126 | -377 | ||||||||

Per share diluted

| -0.42 | 0.39 | 0.11 | -0.45 | ||||||||

Net earnings3 | 620 | 91 | 581 | 3,366 | -545 | |||||||

Per share diluted

| 0.50 | 0.11 | 3.05 | -0.65 | ||||||||

Capital investment

| 583 | 259 | 125 | 1,661 | 1,026 | 62 | ||||||

Production (before royalties)

| ||||||||||||

Oil sands (bbls/d)

| 361,363 | 164,396 | 120 | 292,479 | 149,693 | 95 | ||||||

Deep Basin liquids4 (bbls/d)

| 33,147 | n/a | 20,850 | n/a | ||||||||

Conventional liquids4,5 (bbls/d)

| 27,647 | 55,155 | -50 | 47,375 | 56,165 | -16 | ||||||

Total oil and liquids(bbls/d)

| 422,157 | 219,551 | 92 | 360,704 | 205,858 | 75 | ||||||

Deep Basin natural gas (MMcf/d)

| 509 | n/a | 316 | n/a | ||||||||

Conventional natural gas5 (MMcf/d)

| 286 | 379 | -25 | 343 | 394 | -13 | ||||||

Total natural gas (MMcf/d)

| 795 | 379 | 110 | 659 | 394 | 67 | ||||||

Total production (BOE/d)

| 554,606 | 282,718 | 96 | 470,490 | 271,525 | 73 | ||||||

| 1 | Financial information includes results from discontinued operations. |

| 2 | Adjusted funds flow, free funds flow and operating earnings/loss arenon-GAAP measures. See Advisory. |

| 3 | For a description of items included in net earnings, see page 3 of this news release. |

| 4 | Includes oil and natural gas liquids (NGLs). |

| 5 | All conventional assets other than Athabasca natural gas were sold as of January 5, 2018 and are presented as discontinued operations. |

| Page 1 Q4 2017 | |

2017 Overview

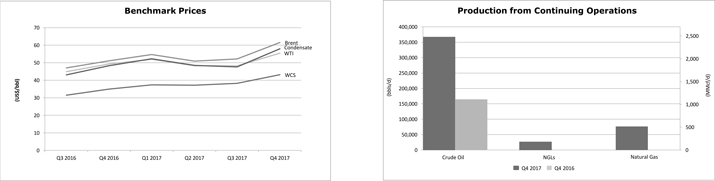

In 2017, cash from operating activities and adjusted funds flow increased by 255% and 105%, respectively, while free funds flow and production were 216% and 73% higher compared with the previous year. The company benefited from higher average full-year benchmark commodity prices and stronger refining operating margin. Production increased last year largely due to Cenovus’s May 2017 acquisition of the remaining 50% working interest in the company’sbest-in-class oil sands projects in northern Alberta, and assets in the Deep Basin in Alberta and British Columbia.

Deleveraging and cost reduction

Paying down debt and reducing costs remain priorities for Cenovus, and the company made significant progress on both in 2017. As part of its strategy to refocus its portfolio and deleverage its balance sheet, Cenovus successfully completed the sale of its four legacy conventional oil and natural gas assets for combined gross cash proceeds of $3.7 billion. The company used the net proceeds from the three asset sales that closed in 2017, plus cash on hand, to repay and retire its $3.6 billion bridge facility prior to the end of the year. The Suffield asset sale, which was announced in the fourth quarter of 2017, closed on January 5, 2018 for gross cash proceeds of $512 million. At the end of 2017, Cenovus’s net debt was $8.9 billion, or 2.8 times adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) on a trailing12-month basis. Between the end of the second quarter and the end of 2017, the company reduced net debt by approximately $4 billion, or 31%, largely through asset sales and free funds flow generation. Cenovus continues to target a long-term net debt to adjusted EBITDA ratio of less than two times.

In 2017, Cenovus had oil sands sustaining capital costs of $6.34 per barrel (bbl), down 12% from $7.24/bbl the previous year. In 2018, the company expects to further reduce itsper-barrel oil sands sustaining capital costs by 13%. Oil sands operating costs were $8.40/bbl in 2017, 6% lower than the previous year, and are expected to decline by another 6% per barrel in 2018.

Cenovus is also on track to meet its accelerated goal of achieving at least $1 billion in cumulative capital, operating and G&A cost reductions over two years versus an earlier targeted timeline of three years. This includes the company’s previously-announced plan to further reduce its workforce by approximately 15% this year, which was largely completed in January and February. In 2017, G&A costs per BOE decreased 44% to $1.83 from $3.29 the previous year, primarily as a result of increased production related to the acquisition. G&A costs per BOE were also reduced due to lower long-term employee incentive costs related to a decline in Cenovus’s share price, lowernon-cash charges related to the company’s excess office space compared with 2016 and lower information technology costs.

“I’m extremely pleased with the progress we’ve made to date in strengthening our balance sheet and lowering our cost structure,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “In the short to medium term, we’ll remain focused on driving additional efficiencies across our business while further reducing debt. This will give us greater flexibility to balance returning cash to shareholders with making disciplined investments in projects that have the potential for high-return growth.”

| Page 2 Q4 2017 | |

Financial performance

In 2017, Cenovus increased cash from operating activities to $3.1 billion from $861 million the previous year and adjusted funds flow to $2.9 billion from $1.4 billion in 2016. Free funds flow rose to nearly $1.3 billion from $397 million in 2016. The company benefited from higher average benchmark crude oil prices, including Western Canadian Select (WCS) which increased 32% compared with 2016. In 2017, the average differential between WCS and West Texas Intermediate (WTI) narrowed from the previous year but widened significantly towards the end of last year and into 2018. Cenovus is actively mitigating wider differentials through its downstream integration, pipeline commitments to the U.S. Gulf Coast and Canadian West Coast, rail optionality including the company’s Bruderheimcrude-by-rail terminal, as well as through financial contracts. Cenovus’s refining and marketing segment benefited from higher average market crack spreads and rising commodity prices. Refining and marketing operating margin rose 73% to $598 million in 2017 from the previous year.

Cenovus recorded full-year operating earnings of $126 million compared with an operating loss of $377 million in 2016. Operating earnings includednon-cash items such as $2 billion in depreciation, depletion and amortization (DD&A) expense, and $890 million in exploration expense related primarily to Cenovus’s emerging oil sands assets in the Greater Borealis region of northern Alberta. Net earnings of $3.4 billion in 2017 included abefore-tax revaluation gain of $2.6 billion related to the deemed disposition of Cenovus’spre-existing 50% ownership interest in the Foster Creek and Christina Lake oil sands partnership, abefore-tax gain on discontinuance of $1.3 billion related to asset sales, unrealized foreign exchange gains of $651 million and unrealized risk management losses of $729 million.

Reserves

Cenovus’s proved and probable reserves are evaluated each year by independent qualified reserves evaluators (IQREs).

At the end of 2017, Cenovus had total proved reserves of approximately 5.2 billion BOE, an increase of 96% compared with 2016, largely due to the acquisition. Proved bitumen reserves increased 103% to approximately 4.8 billion barrels. Total proved plus probable reserves increased 88% to approximately 7.1 billion BOE. Based on the evaluation of Cenovus’s bitumen reserves by IQREs, estimated future capital costs to develop the company’s remaining proved undeveloped bitumen reserves declined to approximately $7.00/bbl in 2017 compared with approximately $8.00/bbl the previous year.

More details about Cenovus’s reserves are available under Financial Information in the Advisory, the company’s Annual Information Form (AIF) and Annual Report on Form40-F for the year ended December 31, 2017, which are available on SEDAR atsedar.com, EDGAR atsec.gov and Cenovus’s website atcenovus.com.

Hedging

To support the company’s financial resilience as it continued to deleverage its balance sheet in 2017, Cenovus hedged a greater percentage of 2018 forecast liquids production than it typically does, establishing a floor on crude oil prices. Approximately 80% of the company’s forecast oil production is hedged for the first half of the year. Approximately 37% of forecast oil production is hedged for the second half of 2018. There were no natural gas hedges in place as of December 31, 2017. As of the end of 2017, no hedge positions were in place for 2019.

| Page 3 Q4 2017 | |

Operating highlights

Cenovus had another strong operating year in 2017, with improvements in capital efficiencies, execution, operating costs, reliability of production delivery and facility uptime.

Oil sands

Combined production at Cenovus’s Christina Lake and Foster Creek oil sands operations was 292,479 net barrels per day (bbls/d) in 2017, 95% higher than the previous year. The increase was mainly due to the company’s May 17, 2017 acquisition, which resulted in full ownership of the Foster Creek and Christina Lake assets, as well as incremental volumes from Foster Creek phase G and Christina Lake phase F, both of which began producing in the second half of 2016. Fourth-quarter oil sands production was 361,363 bbls/d, an increase of 120% from the same period in 2016. Sales volumes for the quarter were approximately 7% lower than production due to unplanned third-party pipeline bottlenecks late in the quarter. At Foster Creek, the steam to oil ratio (SOR), the amount of steam needed to produce one barrel of oil, was 2.5 in 2017, compared with 2.7 in 2016. At Christina Lake, the SOR was 1.8 in 2017, down from 1.9 a year earlier.

Construction at the Christina Lake phase G expansion resumed in the first quarter of 2017, with activity increasing through the end of the year and into 2018. Cenovus expects the expansion will havego-forward capital costs, from the time the project was restarted last year through to completion, of between $13,000 and $14,000 per flowing barrel, well below the company’s original estimate. Phase G has approved capacity of 50,000 bbls/d and is anticipated to begin production in the second half of 2019.

Deep Basin

Production between May 17, 2017 and the end of the year averaged 117,138 BOE/d, with average operating costs of $8.56/BOE. In December, production averaged 120,243 BOE/d. Cenovus continues to take a disciplined approach to development in the Deep Basin. The company drilled 24 net horizontal wells and participated in drilling fournon-operated net horizontal wells targeting liquids-rich natural gas in 2017. Twenty net wells were completed and 14 net wells started production. To date, Cenovus has achieved very strong drilling efficiencies with its Deep Basin program, and initial well results have met or exceeded the company’s expectations. As previously announced, Cenovus plans to drill 15 net wells in the Deep Basin in 2018.

Downstream

In 2017, Cenovus’s refining assets continued to deliver strong and reliable operating performance. The company achieved refining and marketing operating margin of $598 million compared with $346 million a year earlier. The increase was largely the result of higher average market crack spreads and stronger margins on the sale of secondary products such asnatural-gas liquids. The increase was partially offset by narrower heavy crude oil differentials and the strengthening of the Canadian dollar relative to the U.S. dollar in 2017 compared with 2016.

Cenovus’s refining operating margin is calculated on afirst-in,first-out (FIFO) inventory accounting basis. Using thelast-in,first-out (LIFO) accounting method employed by most U.S. refiners, operating margin from refining and marketing would have been $93 million lower in 2017. In 2016, operating margin would have been $108 million lower on a LIFO reporting basis.

| Page 4 Q4 2017 | |

Dividend

For the first quarter of 2018, the Board of Directors has declared a dividend of $0.05 per share, payable on March 29, 2018 to common shareholders of record as of March 15, 2018. Based on the February 14, 2018 closing share price on the Toronto Stock Exchange of $9.88, this represents an annualized yield of about 2%. Declaration of dividends is at the sole discretion of the Board and will continue to be evaluated on a quarterly basis.

Year-end disclosure documents

Today, Cenovus Energy Inc. is filing its audited Consolidated Financial Statements for the year ended December 31, 2017 as well as related Management’s Discussion and Analysis (MD&A) with Canadian securities regulatory authorities. Cenovus is also filing today its AIF for the year ended December 31, 2017, which includes disclosure relating to reserves data and other oil and gas information, and its Annual Report on Form40-F for the year ended December 31, 2017 with the U.S. Securities and Exchange Commission. Copies of these documents will be available today on SEDAR atsedar.com, EDGAR atsec.gov (for the Form40-F), and the company’s website atcenovus.com under Investors. They can also be requested by email at investor.relations@cenovus.com.

Conference Call Today 9 a.m. Mountain Time (11 a.m. Eastern Time) Cenovus will host a conference call today, February 15, 2018, starting at 9 a.m. MT (11 a.m. ET). To participate, please dial888-231-8191 (toll-free in North America) or647-427-7450 approximately 10 minutes prior to the conference call. A live audio webcast of the conference call will also be available viacenovus.com. The webcast will be archived for approximately 90 days.

|

ADVISORY

Basis of Presentation– Cenovus reports financial results in Canadian dollars and presents production volumes on a net to Cenovus before royalties basis, unless otherwise stated. Cenovus prepares its financial statements in accordance with International Financial Reporting Standards (IFRS).

Barrels of Oil Equivalent – Natural gas volumes have been converted to barrels of oil equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A conversion ratio of one bbl to six Mcf is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil compared with natural gas is significantly different from the energy equivalency conversion ratio of 6:1, utilizing a conversion on a 6:1 basis is not an accurate reflection of value.

Oil and Gas Information– Estimates of reserves referenced in this release were prepared effective December 31, 2017 by independent qualified reserves evaluators, based on the Canadian Oil and Gas Evaluation Handbook and in compliance with the requirements ofNational Instrument51-101 Standards of Disclosure for Oil and Gas Activities. Estimates are presented using an average of the January 1, 2018 price forecasts from three IQREs. For additional information about our reserves and other oil and gas information, see “Reserves

| Page 5 Q4 2017 | |

Data and Other Oil and Gas Information” in Cenovus’s Annual Information Form (AIF) and Annual Report for Form40-F for the year ended December 31, 2017 (available on SEDAR atsedar.com, on EDGAR atsec.gov and Cenovus’s website atcenovus.com).

Non-GAAP Measures and Additional Subtotal

This news release contains references to adjusted funds flow, free funds flow, operating earnings/loss, net debt, and net debt to adjusted EBITDA, which arenon-GAAP measures, and operating margin, which is an additional subtotal found in Note 1 of Cenovus’s Consolidated Financial Statements for the year ended December 31, 2017. These measures do not have a standardized meaning as prescribed by IFRS. Readers should not consider these measures in isolation or as a substitute for analysis of the company’s results as reported under IFRS. These measures are defined differently by different companies and therefore are not comparable to similar measures presented by other issuers. For definitions, as well as reconciliations to GAAP measures, and more information on these and othernon-GAAP measures and additional subtotals, refer to“Non-GAAP Measures and Additional Subtotals” and the Advisory section of Cenovus’s Management’s Discussion & Analysis (MD&A) for the year ended December 31, 2017 (available on SEDAR atsedar.com, on EDGAR atsec.gov and Cenovus’s website atcenovus.com).

Forward-looking Information

This news release contains certain forward-looking statements and forward-looking information (collectively referred to as “forward-looking information”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995, about Cenovus’s current expectations, estimates and projections about the future, based on certain assumptions made in light of Cenovus’s experience and perception of historical trends. Although Cenovus believes that the expectations represented by such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Forward-looking information in this document is identified by words such as “anticipate”, “expect”, “estimate”, “on track”, “goal”, “mitigating”, “capacity”, “plan”, “forecast”, “future”, “target”, “position”, “project”, “will”, “focus”, “potential”, “strategy”, “forward” or similar expressions and includes suggestions of future outcomes, including statements about: the company’s targeted net debt to adjusted EBITDA ratio; the company’s expectations with respect to further cost reductions, including expected reduction inper-barrel oil sands sustaining capital costs by 13% in 2018; that the company is on track to meet its goal of achieving at least $1 billion in cumulative capital, operating and G&A cost reductions over two years; expected workforce reductions; Cenovus’s focus in the short to medium term on driving additional efficiencies across its business while further reducing debt, and anticipated outcome of greater flexibility to balance returning cash to shareholders with making disciplined investments in projects that have the potential for high-return growth; anticipated mitigating effect of the company’s downstream integration, pipeline commitments, rail optionality and financial contracts on wider differentials; all statements and information related to “reserves”; estimated future capital costs to develop the company’s remaining proved undeveloped bitumen reserves; expected impacts of Cenovus’s hedging program; Cenovus’s hedge position as a percentage of its forecast production; expectedgo-forward capital costs for the Christina Lake expansion phase G and expectation that production from phase G will begin in the second half of 2019; and Cenovus’s drilling plans in the Deep Basin in 2018. Readers are cautioned not to place undue reliance on

| Page 6 Q4 2017 | |

forward-looking information as actual results may differ materially from those expressed or implied.

Developing forward-looking information involves reliance on a number of assumptions and consideration of certain risks and uncertainties, some of which are specific to Cenovus and others that apply to the industry generally. Material factors or assumptions on which the forward-looking information in this news release is based include: forecast oil and natural gas, natural gas liquids, condensate and refined products prices and other assumptions and sensitivities inherent in Cenovus’s 2018 guidance, available atcenovus.com; projected capital investment levels, the flexibility of Cenovus’s capital spending plans and the associated sources of funding; accuracy of reserves estimates; future use and development of technology; ability to obtain necessary regulatory and partner approvals; successful and timely implementation of capital projects or stages thereof; ability to generate sufficient cash flow to meet current and future obligations; estimated abandonment and reclamation costs, including associated levies and regulations applicable thereto; Cenovus’s ability to access sufficient capital to pursue its development plans; sustainability of achieved cost reductions, achievement of further cost reductions and sustainability thereof; and other risks and uncertainties described from time to time in the filings we make with securities regulatory authorities. 2018 Guidance (as updated December 13, 2017) assumes: Brent prices of US$55.00/bbl, WTI prices of US$52.00/bbl; WCS of US$37.00/bbl; NYMEX natural gas prices of US$3.00/MMBtu; AECO natural gas prices of $2.20/GJ; Chicago3-2-1 crack spread of US$15.00/bbl; and an exchange rate of $0.78 US$/C$.

Readers are cautioned that the foregoing lists are not exhaustive and are made as at the date hereof. Events or circumstances could cause Cenovus’s actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information. Additional information about the material risk factors that could cause Cenovus’s actual results to differ materially from those expressed or implied by its forward-looking statements is contained under “Risk Management and Risk Factors” in Cenovus’s MD&A for the year ended December 31, 2017 (available on SEDAR atsedar.com, on EDGAR atsec.gov and Cenovus’s website atcenovus.com).

Cenovus Energy Inc.

Cenovus Energy Inc. is a Canadian integrated oil company. It is committed to applying fresh, progressive thinking to safely and responsibly unlock energy resources the world needs. Operations include oil sands projects in northern Alberta, which use specialized methods to drill and pump the oil to the surface, and established natural gas and oil production in Alberta and British Columbia. The company also has 50% ownership in two U.S. refineries. Cenovus shares trade under the symbol CVE, and are listed on the Toronto and New York stock exchanges. For more information, visitcenovus.com.

Find Cenovus onFacebook,Twitter,LinkedIn,YouTube andInstagram.

| Page 7 Q4 2017 | |

CENOVUS CONTACTS:

Investor Relations Kam Sandhar Senior Vice-President, Strategy & Corporate Development 403-766-5883

Steven Murray Manager, Investor Relations 403-766-3382 | Media Sonja Franklin Senior Media Advisor 403-766-7264

Media Relations general line 403-766-7751 |

| Page 8 Q4 2017 | |

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS)

(unaudited)

For the periods ended December 31,

($ millions, except per share amounts)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||

| Notes | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

| (Restated) (1) | (Restated) (1) | |||||||||||||||||||||

Revenues | 1 | |||||||||||||||||||||

Gross Sales | 5,212 | 3,326 | 17,314 | 11,015 | ||||||||||||||||||

Less: Royalties | 133 | 2 | 271 | 9 | ||||||||||||||||||

| 5,079 | 3,324 | 17,043 | 11,006 | |||||||||||||||||||

Expenses | 1 | |||||||||||||||||||||

Purchased Product | 2,052 | 2,075 | 8,033 | 6,978 | ||||||||||||||||||

Transportation and Blending | 1,214 | 491 | 3,748 | 1,715 | ||||||||||||||||||

Operating | 557 | 326 | 1,949 | 1,239 | ||||||||||||||||||

Production and Mineral Taxes | 1 | - | 1 | - | ||||||||||||||||||

(Gain) Loss on Risk Management | 23 | 887 | 103 | 896 | 401 | |||||||||||||||||

Depreciation, Depletion and Amortization | 13 | 618 | 239 | 1,838 | 931 | |||||||||||||||||

Exploration Expense | 12 | 887 | - | 888 | 2 | |||||||||||||||||

General and Administrative | 91 | 101 | 308 | 326 | ||||||||||||||||||

Finance Costs | 5 | 187 | 98 | 645 | 390 | |||||||||||||||||

Interest Income | (3) | (7) | (62) | (52) | ||||||||||||||||||

Foreign Exchange (Gain) Loss, Net | 6 | 24 | 140 | (812) | (198) | |||||||||||||||||

Revaluation (Gain) | 4 | - | - | (2,555) | - | |||||||||||||||||

Transaction Costs | 4 | - | - | 56 | - | |||||||||||||||||

Re-measurement of Contingent Payment | 4,15 | (29) | - | (138) | - | |||||||||||||||||

Research Costs | 21 | 6 | 36 | 36 | ||||||||||||||||||

(Gain) Loss on Divestiture of Assets | 1 | - | 1 | 6 | ||||||||||||||||||

Other (Income) Loss, Net | 7 | (1) | 27 | (5) | 34 | |||||||||||||||||

Earnings (Loss) From Continuing Operations Before Income Tax | (1,428) | (275) | 2,216 | (802) | ||||||||||||||||||

Income Tax Expense (Recovery) | 10 | (652) | (66) | (52) | (343) | |||||||||||||||||

Net Earnings (Loss) From Continuing Operations | (776) | (209) | 2,268 | (459) | ||||||||||||||||||

Net Earnings (Loss) From Discontinued Operations | 9 | 1,396 | 300 | 1,098 | (86) | |||||||||||||||||

Net Earnings (Loss) | 620 | 91 | 3,366 | (545) | ||||||||||||||||||

Basic and Diluted Earnings (Loss) Per Share($) | 11 | |||||||||||||||||||||

Continuing Operations | (0.63) | (0.25) | 2.06 | (0.55) | ||||||||||||||||||

Discontinued Operations | 1.13 | 0.36 | 0.99 | (0.10) | ||||||||||||||||||

Net Earnings (Loss) Per Share | 0.50 | 0.11 | 3.05 | (0.65) | ||||||||||||||||||

| (1) | The comparative periods have been restated to reflect discontinued operations as discussed in Notes 1 and 9. |

See accompanying Notes to Consolidated Financial Statements (unaudited).

| Cenovus Energy Inc. | 3 | For the period ended December 31, 2017 |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (unaudited)

For the periods ended December 31,

($ millions)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||

| Notes | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||

Net Earnings (Loss) | 620 | 91 | 3,366 | (545 | ) | |||||||||||||||||||||||||

Other Comprehensive Income (Loss), Net of Tax | 20 | |||||||||||||||||||||||||||||

Items That Will Not be Reclassified to Profit or Loss: | ||||||||||||||||||||||||||||||

Actuarial Gain (Loss) Relating to Pension and Other Post-Retirement Benefits | 8 | 6 | 9 | (3 | ) | |||||||||||||||||||||||||

Items That May be Reclassified to Profit or Loss: | ||||||||||||||||||||||||||||||

Available for Sale Financial Assets – Change in Fair Value | - | - | (1 | ) | (2 | ) | ||||||||||||||||||||||||

Available for Sale Financial Assets – Reclassified to Profit or Loss | - | - | - | 1 | ||||||||||||||||||||||||||

Foreign Currency Translation Adjustment | 15 | 99 | (275 | ) | (106 | ) | ||||||||||||||||||||||||

Total Other Comprehensive Income (Loss), Net of Tax | 23 | 105 | (267 | ) | (110 | ) | ||||||||||||||||||||||||

Comprehensive Income (Loss) | 643 | 196 | 3,099 | (655 | ) | |||||||||||||||||||||||||

See accompanying Notes to Consolidated Financial Statements (unaudited).

| Cenovus Energy Inc. | 4 | For the period ended December 31, 2017 |

CONSOLIDATED BALANCE SHEETS (unaudited)

As at December 31,

($ millions)

| Notes | 2017 | 2016 | ||||||||||||

Assets | ||||||||||||||

Current Assets | ||||||||||||||

Cash and Cash Equivalents | 610 | 3,720 | ||||||||||||

Accounts Receivable and Accrued Revenues | 1,830 | 1,838 | ||||||||||||

Income Tax Receivable | 68 | 6 | ||||||||||||

Inventories | 1,389 | 1,237 | ||||||||||||

Risk Management | 23,24 | 63 | 21 | |||||||||||

Assets Held for Sale | 9 | 1,048 | - | |||||||||||

Total Current Assets | 5,008 | 6,822 | ||||||||||||

Exploration and Evaluation Assets | 1,12 | 3,673 | 1,585 | |||||||||||

Property, Plant and Equipment, Net | 1,13 | 29,596 | 16,426 | |||||||||||

Income Tax Receivable | 311 | 124 | ||||||||||||

Risk Management | 23,24 | 2 | 3 | |||||||||||

Other Assets | 71 | 56 | ||||||||||||

Goodwill | 14 | 2,272 | 242 | |||||||||||

Total Assets | 40,933 | 25,258 | ||||||||||||

Liabilities and Shareholders’ Equity | ||||||||||||||

Current Liabilities | ||||||||||||||

Accounts Payable and Accrued Liabilities | 2,635 | 2,266 | ||||||||||||

Contingent Payment | 15 | 38 | - | |||||||||||

Income Tax Payable | 129 | 112 | ||||||||||||

Risk Management | 23,24 | 1,031 | 293 | |||||||||||

Liabilities Related to Assets Held for Sale | 9 | 603 | - | |||||||||||

Total Current Liabilities | 4,436 | 2,671 | ||||||||||||

Long-Term Debt | 16 | 9,513 | 6,332 | |||||||||||

Contingent Payment | 15 | 168 | - | |||||||||||

Risk Management | 23,24 | 20 | 22 | |||||||||||

Decommissioning Liabilities | 17 | 1,029 | 1,847 | |||||||||||

Other Liabilities | 18 | 173 | 211 | |||||||||||

Deferred Income Taxes | 5,613 | 2,585 | ||||||||||||

Total Liabilities | 20,952 | 13,668 | ||||||||||||

Shareholders’ Equity | 19,981 | 11,590 | ||||||||||||

Total Liabilities and Shareholders’ Equity | 40,933 | 25,258 | ||||||||||||

See accompanying Notes to Consolidated Financial Statements (unaudited).

| Cenovus Energy Inc. | 5 | For the period ended December 31, 2017 |

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(unaudited)

($ millions)

Share Capital | Paid in Surplus | Retained Earnings | AOCI (1) | Total | ||||||||||||||||||||||||

| (Note 19 | ) | (Note 20 | ) | |||||||||||||||||||||||||

As at December 31, 2015 | 5,534 | 4,330 | 1,507 | 1,020 | 12,391 | |||||||||||||||||||||||

Net Earnings (Loss) | - | - | (545 | ) | - | (545 | ) | |||||||||||||||||||||

Other Comprehensive Income (Loss) | - | - | - | (110 | ) | (110 | ) | |||||||||||||||||||||

Total Comprehensive Income (Loss) | - | - | (545 | ) | (110 | ) | (655 | ) | ||||||||||||||||||||

Stock-Based Compensation Expense | - | 20 | - | - | 20 | |||||||||||||||||||||||

Dividends on Common Shares | - | - | (166 | ) | - | (166 | ) | |||||||||||||||||||||

As at December 31, 2016 | 5,534 | 4,350 | 796 | 910 | 11,590 | |||||||||||||||||||||||

Net Earnings (Loss) | - | - | 3,366 | - | 3,366 | |||||||||||||||||||||||

Other Comprehensive Income (Loss) | - | - | - | (267 | ) | (267 | ) | |||||||||||||||||||||

Total Comprehensive Income (Loss) | - | - | 3,366 | (267 | ) | 3,099 | ||||||||||||||||||||||

Common Shares Issued | 5,506 | - | - | - | 5,506 | |||||||||||||||||||||||

Stock-Based Compensation Expense | - | 11 | - | - | 11 | |||||||||||||||||||||||

Dividends on Common Shares | - | - | (225 | ) | - | (225 | ) | |||||||||||||||||||||

As at December 31, 2017 | 11,040 | 4,361 | 3,937 | 643 | 19,981 | |||||||||||||||||||||||

| (1) | Accumulated Other Comprehensive Income (Loss). |

See accompanying Notes to Consolidated Financial Statements (unaudited).

| Cenovus Energy Inc. | 6 | For the period ended December 31, 2017 |

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

For the periods ended December 31,

($ millions)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||

| Notes | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||

Operating Activities | ||||||||||||||||||||||||||

Net Earnings (Loss) | 620 | 91 | 3,366 | (545 | ) | |||||||||||||||||||||

Depreciation, Depletion and Amortization | 13 | 620 | (71 | ) | 2,030 | 1,498 | ||||||||||||||||||||

Exploration Expense | 12 | 887 | - | 890 | 2 | |||||||||||||||||||||

Deferred Income Taxes | 10 | (153 | ) | 144 | 583 | (209 | ) | |||||||||||||||||||

Unrealized (Gain) Loss on Risk Management | 23 | 654 | 114 | 729 | 554 | |||||||||||||||||||||

Unrealized Foreign Exchange (Gain) Loss | 6 | 51 | 152 | (857 | ) | (189 | ) | |||||||||||||||||||

Revaluation (Gain) | 4 | - | - | (2,555 | ) | - | ||||||||||||||||||||

Re-measurement of Contingent Payment | 15 | (29 | ) | - | (138 | ) | - | |||||||||||||||||||

(Gain) Loss on Discontinuance | 9 | (1,888 | ) | - | (1,285 | ) | - | |||||||||||||||||||

(Gain) Loss on Divestiture of Assets | 1 | - | 1 | 6 | ||||||||||||||||||||||

Unwinding of Discount on Decommissioning Liabilities | 17 | 60 | 33 | 128 | 130 | |||||||||||||||||||||

Onerous Contract Provisions, Net of Cash Paid | (1 | ) | 27 | (8 | ) | 53 | ||||||||||||||||||||

Other Asset Impairments | 7 | - | 23 | - | 30 | |||||||||||||||||||||

Other | 44 | 22 | 30 | 93 | ||||||||||||||||||||||

Net Change in Other Assets and Liabilities | (32 | ) | (32 | ) | (107 | ) | (91 | ) | ||||||||||||||||||

Net Change inNon-Cash Working Capital | 66 | (339 | ) | 252 | (471 | ) | ||||||||||||||||||||

Cash From Operating Activities | 900 | 164 | 3,059 | 861 | ||||||||||||||||||||||

Investing Activities | ||||||||||||||||||||||||||

Acquisition, Net of Cash Acquired | 4 | (3 | ) | - | (14,565 | ) | - | |||||||||||||||||||

Capital Expenditures – Exploration and Evaluation Assets | 12 | (19 | ) | (11 | ) | (147 | ) | (67 | ) | |||||||||||||||||

Capital Expenditures – Property, Plant and Equipment | 13 | (568 | ) | (248 | ) | (1,523 | ) | (967 | ) | |||||||||||||||||

Proceeds From Divestiture of Assets | 2,271 | - | 3,210 | 8 | ||||||||||||||||||||||

Net Change in Investments and Other | - | (1 | ) | - | (1 | ) | ||||||||||||||||||||

Net Change inNon-Cash Working Capital | 106 | 16 | 159 | (52 | ) | |||||||||||||||||||||

Cash From (Used in) Investing Activities | 1,787 | (244 | ) | (12,866 | ) | (1,079 | ) | |||||||||||||||||||

Net Cash Provided (Used) Before Financing Activities | 2,687 | (80 | ) | (9,807 | ) | (218 | ) | |||||||||||||||||||

Financing Activities | 25 | |||||||||||||||||||||||||

Issuance of Long-Term Debt | 16 | - | - | 3,842 | - | |||||||||||||||||||||

Net Issuance (Repayment) of Revolving Long-Term Debt | 16 | (1 | ) | - | 32 | - | ||||||||||||||||||||

Net Issuance of Debt Under Asset Sale Bridge Facility | 16 | - | - | 3,569 | - | |||||||||||||||||||||

Repayment of Debt Under Asset Sale Bridge Facility | 16 | (2,650 | ) | - | (3,600 | ) | - | |||||||||||||||||||

Common Shares Issued, Net of Issuance Costs | 19 | - | - | 2,899 | - | |||||||||||||||||||||

Dividends Paid on Common Shares | 11 | (61 | ) | (42 | ) | (225 | ) | (166 | ) | |||||||||||||||||

Other | - | (1 | ) | (2 | ) | (2 | ) | |||||||||||||||||||

Cash From (Used in) Financing Activities | (2,712 | ) | (43 | ) | 6,515 | (168 | ) | |||||||||||||||||||

Foreign Exchange Gain (Loss) on Cash and Cash Equivalents Held in Foreign Currency | 3 | (7 | ) | 182 | 1 | |||||||||||||||||||||

Increase (Decrease) in Cash and Cash Equivalents | (22 | ) | (130 | ) | (3,110 | ) | (385 | ) | ||||||||||||||||||

Cash and Cash Equivalents, Beginning of Period | 632 | 3,850 | 3,720 | 4,105 | ||||||||||||||||||||||

Cash and Cash Equivalents, End of Period | 610 | 3,720 | 610 | 3,720 | ||||||||||||||||||||||

See accompanying Notes to Consolidated Financial Statements (unaudited).

| Cenovus Energy Inc. | 7 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

1. DESCRIPTION OF BUSINESS AND SEGMENTED DISCLOSURES

Cenovus Energy Inc. and its subsidiaries, (together “Cenovus” or the “Company”) are in the business of developing, producing and marketing crude oil, natural gas liquids (“NGLs”) and natural gas in Canada with marketing activities and refining operations in the United States (“U.S.”).

Cenovus is incorporated under the Canada Business Corporations Act and its shares are listed on the Toronto (“TSX”) and New York (“NYSE”) stock exchanges. The executive and registered office is located at 2600, 500 Centre Street S.E., Calgary, Alberta, Canada, T2G 1A6. Information on the Company’s basis of preparation for these interim Consolidated Financial Statements is found in Note 2.

On May 17, 2017, Cenovus acquired from ConocoPhillips Company and certain of its subsidiaries (collectively, “ConocoPhillips”) a 50 percent interest in FCCL Partnership (“FCCL”) and the majority of ConocoPhillips’ western Canadian conventional crude oil and natural gas assets (the “Deep Basin Assets”). This acquisition (the “Acquisition”) increased Cenovus’s interest in FCCL to 100 percent and expanded Cenovus’s operating areas to include more than three million net acres of land, exploration and production assets and related infrastructure and agreements in Alberta and British Columbia. The Acquisition had an effective date of January 1, 2017 (see Note 4).

Management has determined the operating segments based on information regularly reviewed for the purposes of decision making, allocating resources and assessing operational performance by Cenovus’s chief operating decision makers. The Company evaluates the financial performance of its operating segments primarily based on operating margin. The Company’s reportable segments are:

| ● | Oil Sands, which includes the development and production of bitumen and natural gas in northeast Alberta. Cenovus’s bitumen assets include Foster Creek, Christina Lake and Narrows Lake as well as other projects in the early stages of development. The Company’s interest in certain of its operated oil sands properties, notably Foster Creek, Christina Lake and Narrows Lake, increased from 50 percent to 100 percent on May 17, 2017. |

| ● | Deep Basin, which includes approximately three million net acres of land primarily in the Elmworth-Wapiti, Kaybob-Edson, and Clearwater operating areas, rich in natural gas and NGLs. The assets reside in Alberta and British Columbia and include interests in numerous natural gas processing facilities. The Deep Basin Assets were acquired on May 17, 2017. |

| ● | Refining and Marketing, which is responsible for transporting, selling and refining crude oil into petroleum and chemical products. Cenovus jointly owns two refineries in the U.S. with the operator Phillips 66, an unrelated U.S. public company. In addition, Cenovus owns and operates acrude-by-rail terminal in Alberta. This segment coordinates Cenovus’s marketing and transportation initiatives to optimize product mix, delivery points, transportation commitments and customer diversification. The marketing of crude oil and natural gas sourced from Canada, including physical product sales that settle in the U.S., is considered to be undertaken by a Canadian business. U.S. sourced crude oil and natural gas purchases and sales are attributed to the U.S. |

| ● | Corporate and Eliminations, which primarily includes unrealized gains and losses recorded on derivative financial instruments, gains and losses on divestiture of assets, as well as other Cenovus-wide costs for general and administrative, financing activities and research costs. As financial instruments are settled, the realized gains and losses are recorded in the reportable segment to which the derivative instrument relates. Eliminations relate to sales and operating revenues, and purchased product between segments, recorded at transfer prices based on current market prices, and to unrealized intersegment profits in inventory. The Corporate and Eliminations segment is attributed to Canada, with the exception of unrealized risk management gains and losses, which have been attributed to the country in which the transacting entity resides. |

In 2017, Cenovus disposed of the majority of the crude oil and natural gas assets in the Company’s Conventional segment. As such, the results of operations have been classified as a discontinued operation (see Note 9). This segment included the production of conventional crude oil, NGLs and natural gas in Alberta and Saskatchewan, including the heavy oil assets at Pelican Lake, the CO2 enhanced oil recovery project at Weyburn and emerging tight oil opportunities. As at December 31, 2017, all Conventional assets were sold, except for the Company’s Suffield operations. The sale of the Suffield assets closed on January 5, 2018.

| Cenovus Energy Inc. | 8 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

The following tabular financial information presents the segmented information first by segment, then by product and geographic location.

A) Results of Operations — Segment and Operational Information

| Oil Sands | Deep Basin | Refining and Marketing | ||||||||||||||||||||||||||||||||

| For the three months ended December 31, | 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||

Revenues | ||||||||||||||||||||||||||||||||||

Gross Sales | 2,424 | 957 | 231 | - | 2,690 | 2,477 | ||||||||||||||||||||||||||||

Less: Royalties | 113 | 2 | 20 | - | - | - | ||||||||||||||||||||||||||||

| 2,311 | 955 | 211 | - | 2,690 | 2,477 | |||||||||||||||||||||||||||||

Expenses | ||||||||||||||||||||||||||||||||||

Purchased Product | - | - | - | - | 2,181 | 2,181 | ||||||||||||||||||||||||||||

Transportation and Blending | 1,193 | 493 | 24 | - | - | - | ||||||||||||||||||||||||||||

Operating | 271 | 142 | 94 | - | 193 | 185 | ||||||||||||||||||||||||||||

Production and Mineral Taxes | - | - | 1 | - | - | - | ||||||||||||||||||||||||||||

(Gain) Loss on Risk Management | 235 | (14 | ) | - | - | 2 | 3 | |||||||||||||||||||||||||||

Operating Margin | 612 | 334 | 92 | - | 314 | 108 | ||||||||||||||||||||||||||||

Depreciation, Depletion and Amortization | 383 | 170 | 167 | - | 53 | 54 | ||||||||||||||||||||||||||||

Exploration Expense | 887 | - | - | - | - | - | ||||||||||||||||||||||||||||

Segment Income (Loss) | (658 | ) | 164 | (75 | ) | - | 261 | 54 | ||||||||||||||||||||||||||

| Corporate and Eliminations | Consolidated | |||||||||||||||||||||||||||||||||

| For the three months ended December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||||

Revenues | ||||||||||||||||||||||||||||||||||

Gross Sales | (133 | ) | (108 | ) | 5,212 | 3,326 | ||||||||||||||||||||||||||||

Less: Royalties | - | - | 133 | 2 | ||||||||||||||||||||||||||||||

|

(133 |

) | (108 | ) | 5,079 | 3,324 | ||||||||||||||||||||||||||||

Expenses | ||||||||||||||||||||||||||||||||||

Purchased Product | (129 | ) | (106 | ) | 2,052 | 2,075 | ||||||||||||||||||||||||||||

Transportation and Blending | (3 | ) | (2 | ) | 1,214 | 491 | ||||||||||||||||||||||||||||

Operating | (1 | ) | (1 | ) | 557 | 326 | ||||||||||||||||||||||||||||

Production and Mineral Taxes | - | - | 1 | - | ||||||||||||||||||||||||||||||

(Gain) Loss on Risk Management | 650 | 114 | 887 | 103 | ||||||||||||||||||||||||||||||

Depreciation, Depletion and Amortization | 15 | 15 | 618 | 239 | ||||||||||||||||||||||||||||||

Exploration Expense | - | - | 887 | - | ||||||||||||||||||||||||||||||

Segment Income (Loss) | (665 | ) | (128 | ) | (1,137 | ) | 90 | |||||||||||||||||||||||||||

General and Administrative | 91 | 101 | 91 | 101 | ||||||||||||||||||||||||||||||

Finance Costs | 187 | 98 | 187 | 98 | ||||||||||||||||||||||||||||||

Interest Income | (3 | ) | (7 | ) | (3 | ) | (7 | ) | ||||||||||||||||||||||||||

Foreign Exchange (Gain) Loss, Net | 24 | 140 | 24 | 140 | ||||||||||||||||||||||||||||||

Revaluation (Gain) | - | - | - | - | ||||||||||||||||||||||||||||||

Transaction Costs | - | - | - | - | ||||||||||||||||||||||||||||||

Re-measurement of Contingent Payment | (29 | ) | - | (29 | ) | - | ||||||||||||||||||||||||||||

Research Costs | 21 | 6 | 21 | 6 | ||||||||||||||||||||||||||||||

(Gain) Loss on Divestiture of Assets | 1 | - | 1 | - | ||||||||||||||||||||||||||||||

Other (Income) Loss, Net | (1 | ) | 27 | (1 | ) | 27 | ||||||||||||||||||||||||||||

|

291 |

| 365 | 291 | 365 | |||||||||||||||||||||||||||||

Earnings (Loss) From Continuing Operations Before Income Tax |

|

(1,428 |

) | (275 | ) | |||||||||||||||||||||||||||||

Income Tax Expense (Recovery) | (652 | ) | (66 | ) | ||||||||||||||||||||||||||||||

Net Earnings (Loss) From Continuing Operations |

|

(776 |

) | (209 | ) | |||||||||||||||||||||||||||||

| Cenovus Energy Inc. | 9 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

| Oil Sands | Deep Basin | Refining and Marketing | ||||||||||||||||||||||||||||||||

| For the twelve months ended December 31, | 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||

Revenues | ||||||||||||||||||||||||||||||||||

Gross Sales | 7,362 | 2,929 | 555 | - | 9,852 | 8,439 | ||||||||||||||||||||||||||||

Less: Royalties | 230 | 9 | 41 | - | - | - | ||||||||||||||||||||||||||||

|

7,132 |

| 2,920 | 514 | - | 9,852 | 8,439 | |||||||||||||||||||||||||||

Expenses | ||||||||||||||||||||||||||||||||||

Purchased Product | - | - | - | - | 8,476 | 7,325 | ||||||||||||||||||||||||||||

Transportation and Blending | 3,704 | 1,721 | 56 | - | - | - | ||||||||||||||||||||||||||||

Operating | 934 | 501 | 250 | - | 772 | 742 | ||||||||||||||||||||||||||||

Production and Mineral Taxes | - | - | 1 | - | - | - | ||||||||||||||||||||||||||||

(Gain) Loss on Risk Management | 307 | (179) | - | - | 6 | 26 | ||||||||||||||||||||||||||||

Operating Margin |

|

2,187 |

| 877 | 207 | - | 598 | 346 | ||||||||||||||||||||||||||

Depreciation, Depletion and Amortization | 1,230 | 655 | 331 | - | 215 | 211 | ||||||||||||||||||||||||||||

Exploration Expense | 888 | 2 | - | - | - | - | ||||||||||||||||||||||||||||

Segment Income (Loss) | 69 | 220 | (124 | ) | - | 383 | 135 | |||||||||||||||||||||||||||

| Corporate and Eliminations | Consolidated | |||||||||||||||||||||||||||||||||

| For the twelve months ended December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||||

Revenues | ||||||||||||||||||||||||||||||||||

Gross Sales | (455 | ) | (353 | ) | 17,314 | 11,015 | ||||||||||||||||||||||||||||

Less: Royalties | - | - | 271 | 9 | ||||||||||||||||||||||||||||||

|

(455 |

) | (353 | ) | 17,043 | 11,006 | ||||||||||||||||||||||||||||

Expenses | ||||||||||||||||||||||||||||||||||

Purchased Product | (443 | ) | (347 | ) | 8,033 | 6,978 | ||||||||||||||||||||||||||||

Transportation and Blending | (12 | ) | (6 | ) | 3,748 | 1,715 | ||||||||||||||||||||||||||||

Operating | (7 | ) | (4 | ) | 1,949 | 1,239 | ||||||||||||||||||||||||||||

Production and Mineral Taxes | - | - | 1 | - | ||||||||||||||||||||||||||||||

(Gain) Loss on Risk Management | 583 | 554 | 896 | 401 | ||||||||||||||||||||||||||||||

Depreciation, Depletion and Amortization | 62 | 65 | 1,838 | 931 | ||||||||||||||||||||||||||||||

Exploration Expense | - | - | 888 | 2 | ||||||||||||||||||||||||||||||

Segment Income (Loss) |

|

(638 |

) | (615 | ) | (310 | ) | (260 | ) | |||||||||||||||||||||||||

General and Administrative | 308 | 326 | 308 | 326 | ||||||||||||||||||||||||||||||

Finance Costs | 645 | 390 | 645 | 390 | ||||||||||||||||||||||||||||||

Interest Income | (62 | ) | (52 | ) | (62 | ) | (52 | ) | ||||||||||||||||||||||||||

Foreign Exchange (Gain) Loss, Net | (812 | ) | (198 | ) | (812 | ) | (198 | ) | ||||||||||||||||||||||||||

Revaluation (Gain) | (2,555 | ) | - | (2,555 | ) | - | ||||||||||||||||||||||||||||

Transaction Costs | 56 | - | 56 | - | ||||||||||||||||||||||||||||||

Re-measurement of Contingent Payment | (138 | ) | - | (138 | ) | - | ||||||||||||||||||||||||||||

Research Costs | 36 | 36 | 36 | 36 | ||||||||||||||||||||||||||||||

(Gain) Loss on Divestiture of Assets | 1 | 6 | 1 | 6 | ||||||||||||||||||||||||||||||

Other (Income) Loss, Net | (5 | ) | 34 | (5 | ) | 34 | ||||||||||||||||||||||||||||

|

(2,526 |

) | 542 | (2,526 | ) | 542 | ||||||||||||||||||||||||||||

Earnings (Loss) From Continuing Operations Before Income Tax | 2,216 | (802 | ) | |||||||||||||||||||||||||||||||

Income Tax Expense (Recovery) | (52 | ) | (343 | ) | ||||||||||||||||||||||||||||||

Net Earnings (Loss) From Continuing Operations | 2,268 | (459 | ) | |||||||||||||||||||||||||||||||

| Cenovus Energy Inc. | 10 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

B) Revenues by Product

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||

| For the periods ended December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

Upstream | ||||||||||||||||||||||

Crude Oil | 2,339 | 949 | 7,184 | 2,902 | ||||||||||||||||||

Natural Gas(1) | 84 | 5 | 235 | 16 | ||||||||||||||||||

NGLs | 84 | - | 184 | - | ||||||||||||||||||

Other | 15 | 1 | 43 | 2 | ||||||||||||||||||

Refining and Marketing | 2,690 | 2,477 | 9,852 | 8,439 | ||||||||||||||||||

Corporate and Eliminations | (133 | ) | (108 | ) | (455 | ) | (353 | ) | ||||||||||||||

Revenues From Continuing Operations | 5,079 | 3,324 | 17,043 | 11,006 | ||||||||||||||||||

(1) In the three and twelve months ending December 31, 2017, approximately 11 percent and 14 percent, respectively, of the natural gas produced by Cenovus’s Deep Basin Assets was sold to ConocoPhillips resulting in gross sales of $10 million and $32 million, respectively. |

| |||||||||||||||||||||

| C) Geographical Information | ||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||

For the periods ended December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

Canada | 2,970 | 1,648 | 9,723 | 4,978 | ||||||||||||||||||

United States | 2,109 | 1,676 | 7,320 | 6,028 | ||||||||||||||||||

Revenues From Continuing Operations | 5,079 | 3,324 | 17,043 | 11,006 | ||||||||||||||||||

| Non-Current Assets (1) | ||||||||||||||||||||||

| As at December 31, | 2017 | 2016 | ||||||||||||||||||||

Canada(2) | 31,756 | 14,130 | ||||||||||||||||||||

United States | 3,856 | 4,179 | ||||||||||||||||||||

Consolidated | 35,612 | 18,309 | ||||||||||||||||||||

(1) Includes exploration and evaluation (“E&E”) assets, property, plant and equipment (“PP&E”), goodwill and other assets. |

| |||||||||||||||||||||

(2) Certain crude oil and natural gas properties of the Conventional and Deep Basin segments, which reside in Canada, have been reclassified as held for sale in 2017 in current assets. 2016 includes $3.1 billion related to the Conventional segment. |

| |||||||||||||||||||||

| D) Exploration and Evaluation Assets, Property, Plant and Equipment, Goodwill and Total Assets | ||||||||||||||||||||||

| E&E | PP&E | |||||||||||||||||||||

| As at December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

Oil Sands | 617 | 1,564 | 22,320 | 8,798 | ||||||||||||||||||

Deep Basin | 3,056 | - | 3,019 | - | ||||||||||||||||||

Conventional | - | 21 | - | 3,080 | ||||||||||||||||||

Refining and Marketing | - | - | 3,967 | 4,273 | ||||||||||||||||||

Corporate and Eliminations | - | - | 290 | 275 | ||||||||||||||||||

Consolidated | 3,673 | 1,585 | 29,596 | 16,426 | ||||||||||||||||||

| Goodwill | Total Assets | |||||||||||||||||||||

| As at December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||

Oil Sands | 2,272 | 242 | 26,799 | 11,112 | ||||||||||||||||||

Deep Basin | - | - | 6,694 | - | ||||||||||||||||||

Conventional | - | - | 644 | 3,196 | ||||||||||||||||||

Refining and Marketing | - | - | 5,432 | 6,613 | ||||||||||||||||||

Corporate and Eliminations | - | - | 1,364 | 4,337 | ||||||||||||||||||

Consolidated | 2,272 | 242 | 40,933 | 25,258 | ||||||||||||||||||

| Cenovus Energy Inc. | 11 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

E) Capital Expenditures(1)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||

| For the periods ended December 31, | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||

Capital | ||||||||||||||||||||||||

Oil Sands | 313 | 128 | 973 | 604 | ||||||||||||||||||||

Deep Basin | 148 | - | 225 | - | ||||||||||||||||||||

Conventional | 26 | 57 | 206 | 171 | ||||||||||||||||||||

Refining and Marketing | 56 | 65 | 180 | 220 | ||||||||||||||||||||

Corporate | 40 | 9 | 77 | 31 | ||||||||||||||||||||

Capital Investment | 583 | 259 | 1,661 | 1,026 | ||||||||||||||||||||

Acquisition Capital | ||||||||||||||||||||||||

Oil Sands(2) | 7 | - | 11,614 | 11 | ||||||||||||||||||||

Deep Basin | 80 | - | 6,774 | - | ||||||||||||||||||||

Total Capital Expenditures | 670 | 259 | 20,049 | 1,037 | ||||||||||||||||||||

| (1) | Includes expenditures on PP&E, E&E assets and assets held for sale. |

| (2) | In connection with the Acquisition discussed in Note 4, Cenovus was deemed to have disposed of itspre-existing interest in FCCL andre-acquired it at fair value as required by International Financial Reporting Standard 3, “Business Combinations” (“IFRS 3”), which is not reflected in the table above. The carrying value of thepre-existing interest was $9,081 million and the estimated fair value was $11,605 million as at May 17, 2017. |

2. BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE

In these interim Consolidated Financial Statements, unless otherwise indicated, all dollars are expressed in Canadian dollars. All references to C$ or $ are to Canadian dollars and references to US$ are to U.S. dollars.

These interim Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) applicable to the preparation of interim financial statements, including International Accounting Standard 34, “Interim Financial Reporting” (“IAS 34”).

Certain information provided for the prior year has been reclassified to conform to the presentation adopted for the period ended December 31, 2017.

These interim Consolidated Financial Statements were approved by the Audit Committee effective February 14, 2018.

3. SIGNIFICANT ACCOUNTING POLICIES

A) Accounting Policies

Certain information and disclosures normally included in the notes to the annual Consolidated Financial Statements have been condensed or have been disclosed on an annual basis only. Accordingly, these interim Consolidated Financial Statements should be read in conjunction with the annual Consolidated Financial Statements for the year ended December 31, 2016, which have been prepared in accordance with IFRS as issued by the IASB. These interim Consolidated Financial Statements have been prepared following the same accounting policies and methods of computation as the annual Consolidated Financial Statements for the year ended December 31, 2016, except for income taxes. Clarification on the Company’s business combinations and goodwill accounting policy has been added below.

Income Taxes

Income taxes on earnings or loss in interim periods are accrued using the income tax rate that would be applicable to the expected total annual earnings or loss.

Business Combinations and Goodwill

Business combinations are accounted for using the acquisition method of accounting in which the identifiable assets acquired, liabilities assumed andnon-controlling interest, if any, are recognized and measured at their fair value at the date of acquisition. Any excess of the purchase price plus anynon-controlling interest over the fair value of the net assets acquired is recognized as goodwill. Any deficiency of the purchase price over the fair value of the net assets acquired is credited to net earnings.

At acquisition, goodwill is allocated to each of the cash-generating units (“CGUs”) to which it relates. Subsequent measurement of goodwill is at cost less any accumulated impairment losses.

| Cenovus Energy Inc. | 12 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

Contingent consideration transferred in a business combination is measured at fair value on the date of acquisition and classified as a financial liability or equity. Contingent consideration classified as a liability isre-measured at fair value at each reporting date, with changes in fair value recognized in net earnings. Payments are classified as cash used in investing activities until the cumulative payments exceed the acquisition date fair value of the liability. Cumulative payments in excess of the acquisition date fair value are classified as cash used in operating activities. Contingent consideration classified as equity are notre-measured and settlements are accounted for within equity.

When a business combination is achieved in stages, the Companyre-measures itspre-existing interest at the acquisition date fair value and recognizes the resulting gain or loss, if any, in net earnings.

B) Recent Accounting Pronouncements

New Accounting Standards and Interpretations not yet Adopted

A number of new accounting standards, amendments to accounting standards and interpretations are effective for annual periods beginning on or after January 1, 2018 and have not been applied in preparing the Consolidated Financial Statements for the year ended December 31, 2017. The standards applicable to Cenovus are as follows and will be adopted on their respective effective dates:

Financial Instruments

On July 24, 2014, the IASB issued the final version of IFRS 9, “Financial Instruments” (“IFRS 9”) to replace IAS 39, “Financial Instruments: Recognition and Measurement” (“IAS 39”).

IFRS 9 introduces a single approach to determine whether a financial asset is measured at amortized cost or fair value and replaces the multiple rules in IAS 39. The approach is based on how an entity manages its financial instruments in the context of its business model and the contractual cash flow characteristics of the financial assets. The IAS 39 measurement categories for financial assets will be replaced by fair value through profit or loss, fair value through other comprehensive income (“FVOCI”) and amortized cost. The standard eliminates the existing IAS 39 categories of held to maturity, loans and receivables and available for sale. Based on Management’s assessment, the change in categories will not have a material impact on the Consolidated Financial Statements. As at December 31, 2017, the Company has private equity investments classified as available for sale with a fair value of $37 million. Under IFRS 9, the Company has elected to measure these investments as FVOCI. As such, all fair value gains or losses will be recorded in other comprehensive income (“OCI”), impairments will not be recognized in net earnings and fair value gains or losses will not be recycled to net earnings on disposition.

IFRS 9 retains most of the IAS 39 requirements for financial liabilities. However, where the fair value option is applied to financial liabilities, the change in fair value resulting from an entity’s own credit risk is recorded in OCI rather than net earnings, unless this creates an accounting mismatch. Cenovus currently does not designate any financial liabilities as fair value through profit or loss; therefore, there will be no impact on the accounting for financial liabilities.

A new expected credit loss model for calculating impairment on financial assets replaces the incurred loss impairment model used in IAS 39. The new model will result in more timely recognition of expected credit losses. Management does not expect a material change to its impairment provision as at January 1, 2018.

In addition, IFRS 9 includes a simplified hedge accounting model, aligning hedge accounting more closely with risk management. Cenovus does not currently apply hedge accounting.

IFRS 9 must be adopted for years beginning on or after January 1, 2018. The Company will apply the new standard retrospectively and elect to use the practical expedients permitted under the standard. Comparative periods will not be restated.

Revenue Recognition

On May 28, 2014, the IASB issued IFRS 15, “Revenue From Contracts With Customers” (“IFRS 15”) replacing IAS 11, “Construction Contracts”, IAS 18, “Revenue” and several revenue-related interpretations. IFRS 15 establishes a single revenue recognition framework that applies to contracts with customers. The standard requires an entity to recognize revenue to reflect the transfer of goods and services for the amount it expects to receive, when control is transferred to the purchaser. Disclosure requirements have also been expanded.

Management has assessed the impact of applying the new standard on the Consolidated Financial Statements and has not identified any material differences from its current revenue recognition practice.

The adoption of IFRS 15 is mandatory for years beginning on or after January 1, 2018. The standard may be applied either retrospectively or using a modified retrospective approach. Cenovus intends to adopt the standard using the modified retrospective approach recognizing the cumulative impact of adoption in retained earnings as of January 1, 2018. Comparative periods will not be restated. The Company will apply IFRS 15 using the practical expedient in paragraph C5(a) of IFRS 15, under which the Company will not restate contracts that are completed contracts as at the date of adoption.

| Cenovus Energy Inc. | 13 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

Leases

On January 13, 2016, the IASB issued IFRS 16, “Leases” (“IFRS 16”), which requires entities to recognize lease assets and lease obligations on the balance sheet. For lessees, IFRS 16 removes the classification of leases as either operating leases or finance leases, effectively treating all leases as finance leases. Certain short-term leases (less than 12 months) and leases oflow-value assets are exempt from the requirements, and may continue to be treated as operating leases.

Lessors will continue with a dual lease classification model. Classification will determine how and when a lessor will recognize lease revenue, and what assets would be recorded.

IFRS 16 is effective for years beginning on or after January 1, 2019, with early adoption permitted if IFRS 15 has been adopted. The standard may be applied retrospectively or using a modified retrospective approach. The modified retrospective approach does not require restatement of prior period financial information as it recognizes the cumulative effect of applying the standard to prior periods as an adjustment to opening retained earnings. It is anticipated that the adoption of IFRS 16 will have a material impact on the Company’s Consolidated Balance Sheets due to material operating lease commitments. Cenovus will adopt IFRS 16 effective January 1, 2019. The Company intends to adopt the standard using the retrospective with cumulative effect approach and apply several of the practical expedients available.

Uncertain Tax Positions

In June 2017, the IASB issued International Financial Reporting Interpretation Committee 23,“Uncertainty Over Income Tax Treatments” (“IFRIC 23”). The interpretation provides clarity on how to account for a tax position when there is uncertainty over income tax treatments. In determining the likely resolution of the uncertain tax positions, a position may be considered separately or as a group. In addition, an assessment is required to determine the probability that the tax authority will accept the tax position taken in income tax filings. If the uncertain income tax treatment is unlikely to be accepted, the accounting tax position must reflect an appropriate level of uncertainty. An uncertain tax position may be reassessed if new information changes the original assessment. IFRIC 23 is effective for annual periods beginning on or after January 1, 2019 using either a modified or full retrospective approach. IFRIC 23 is not expected to have a significant impact on the Consolidated Financial Statements.

C) Key Sources of Estimation Uncertainty

Critical accounting estimates are those estimates that require Management to make particularly subjective or complex judgments about matters that are inherently uncertain. Estimates and underlying assumptions are reviewed on an ongoing basis and any revisions to accounting estimates are recorded in the period in which the estimates are revised. Further to those areas discussed in the annual Consolidated Financial Statements for the year ended December 31, 2016, the estimation of fair values of the assets acquired and liabilities assumed in a business combination, including contingent payment and goodwill, is a key area involving significant estimates or judgments.

4. ACQUISITION

FCCL and Deep Basin Acquisition

A) Summary of the Acquisition

On May 17, 2017, Cenovus acquired ConocoPhillips’ 50 percent interest in FCCL and the majority of ConocoPhillips’ Deep Basin Assets in Alberta and British Columbia (the “Acquisition”). The Acquisition provides Cenovus with control over the Company’s oil sands operations, doubles the Company’s oil sands production, and almost doubles the Company’s proved bitumen reserves. The Deep Basin Assets provide a second core operating area with more than three million net acres of land, exploration and production assets, and related infrastructure in Alberta and British Columbia.

The Acquisition has been accounted for using the acquisition method pursuant to IFRS 3. Under the acquisition method, assets and liabilities are recorded at their fair values on the date of acquisition and the total consideration is allocated to the tangible and intangible assets acquired and liabilities assumed. The excess of consideration given over the fair value of the net assets acquired has been recorded as goodwill.

B) Identifiable Assets Acquired and Liabilities Assumed

The final purchase price allocation is based on Management’s best estimate of fair value and has been retrospectively adjusted to reflect new information obtained between May 17, 2017 and December 31, 2017 about conditions that existed at the acquisition date. As a result of these adjustments, the final purchase price allocation includes an increase of $912 million to PP&E, $56 million to inventory and $16 million to accounts receivable and accrued revenues, as well as an $822 million decrease to E&E assets. Goodwill from the Acquisition was reduced to $2,030 million and the revaluation gain increased to $2,555 million. These adjustments also resulted in a $9 million increase to the deferred income tax liability. Depreciation, depletion and amortization (“DD&A”), operating

| Cenovus Energy Inc. | 14 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

expenses and deferred income tax expense of prior quarters have been restated to reflect the impact of these measurement period adjustments.

The following table summarizes the recognized amounts of assets acquired and liabilities assumed at the date of the Acquisition.

| Notes | ||||||||||

100 Percent of the Identifiable Assets Acquired and Liabilities Assumed for FCCL | ||||||||||

Cash | 880 | |||||||||

Accounts Receivable and Accrued Revenues | 964 | |||||||||

Inventories | 345 | |||||||||

E&E Assets | 12 | 491 | ||||||||

PP&E | 13 | 22,717 | ||||||||

Other Assets | 27 | |||||||||

Accounts Payable and Accrued Liabilities | (445 | ) | ||||||||

Decommissioning Liabilities | 17 | (277 | ) | |||||||

Other Liabilities | (8 | ) | ||||||||

Deferred Income Taxes | (2,506 | ) | ||||||||

|

22,188 |

| ||||||||

Recognized Amounts of Identifiable Assets Acquired and Liabilities Assumed for Deep Basin | ||||||||||

Accounts Receivable and Accrued Revenues | 16 | |||||||||

Inventories | 14 | |||||||||

E&E Assets | 12 | 3,117 | ||||||||

PP&E | 13 | 3,600 | ||||||||

Accounts Payable and Accrued Liabilities | (6 | ) | ||||||||

Decommissioning Liabilities | 17 | (667 | ) | |||||||

|

6,074 |

| ||||||||

Total Identifiable Net Assets | 28,262 | |||||||||

The fair value of acquired accounts receivables and accrued revenues was $980 million. As at December 31, 2017, $964 million has been received and the remainder is expected to be collected.

C) Total Consideration

Total consideration for the Acquisition consisted of US$10.6 billion in cash and 208 million Cenovus common shares plus closing adjustments. At the same time, Cenovus agreed to make certain quarterly contingent payments to ConocoPhillips during the five years subsequent to May 17, 2017 if crude oil prices exceed a specific threshold. The following table summarizes the fair value of the consideration:

Common Shares | 2,579 | |||

Cash | 15,005 | |||

| 17,584 | ||||

Estimated Contingent Payment (Note 15) | 361 | |||

Total Consideration |

|

17,945 |

|

At the date of closing, the Company issued 208 million common shares to ConocoPhillips that were accounted for at $12.40 per share, the estimated fair value for accounting purposes.

Consideration paid in cash was US$10.6 billion, before closing adjustments, and was financed through a bought-deal common share offering (see Note 19) and an offering in the United States for senior unsecured notes (see Note 16). In addition, Cenovus borrowed $3.6 billion under a committed asset sale bridge credit facility (see Note 16). The remainder of the cash purchase price was funded with cash on hand and a draw on Cenovus’s existing committed credit facility.

The estimated contingent payment related to oil sands production reflects that Cenovus agreed to make quarterly payments to ConocoPhillips during the five years subsequent to the closing date for quarters in which the average Western Canadian Select (“WCS”) crude oil price exceeds $52.00 per barrel during the quarter. The quarterly payment will be $6 million for each dollar that the WCS price exceeds $52.00 per barrel. There are no maximum payment terms.

The calculation of any contingent payment includes an adjustment mechanism related to certain significant production outages at Foster Creek and Christina Lake, which may reduce the amount of a contingent payment. The terms of the contingent payment agreement allow Cenovus to retain 80 percent to 85 percent of the WCS prices above $52.00 per barrel, based on gross production capacity at Foster Creek and Christina Lake at the time

| Cenovus Energy Inc. | 15 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

of the Acquisition. As production capacity increases with future expansions, the percentage of upside available to Cenovus will increase further.

The contingent payment is accounted for as a financial option. The fair value of $361 million on May 17, 2017 was estimated by calculating the present value of the future expected cash flows using an option pricing model, which assumes the probability distribution for WCS is based on the volatility of West Texas Intermediate (“WTI”) options, volatility ofCanadian-U.S. foreign exchange rate options and WCS futures pricing, and discounted at a credit-adjusted risk-free rate of 2.9 percent. The contingent payment will bere-measured at fair value at each reporting date with changes in fair value recognized in net earnings (see Note 15).

D) Goodwill

Goodwill arising from the Acquisition has been recognized as follows:

| Notes | ||||||||||||

Total Purchase Consideration | 4C | 17,945 | ||||||||||

Fair Value ofPre-Existing 50 Percent Ownership Interest in FCCL | 12,347 | |||||||||||

Fair Value of Identifiable Net Assets | 4B | (28,262) | ||||||||||

Goodwill | 2,030 | |||||||||||

Fair Value ofPre-Existing 50 Percent Ownership Interest in FCCL

Prior to the Acquisition, Cenovus’s 50 percent interest in FCCL was jointly controlled with ConocoPhillips and met the definition of a joint operation under IFRS 11,“Joint Arrangements” and as such Cenovus recognized its share of the assets, liabilities, revenues and expenses in its consolidated results. Subsequent to the Acquisition, Cenovus controls FCCL, as defined under IFRS 10,“Consolidated Financial Statements”and, accordingly, FCCL has been consolidated from the date of acquisition. As required by IFRS 3, when an acquirer achieves control in stages, the previously held interest isre-measured to fair value at the acquisition date with any gain or loss recognized in net earnings. The acquisition-date fair value of the previously held interest was $12.3 billion and has been included in the measurement of the total consideration transferred. The carrying value of the FCCL assets was $9.7 billion. As a result, Cenovus recognized anon-cash revaluation gain of $2.6 billion ($1.9 billion,after-tax) on there-measurement to fair value of its existing interest in FCCL.

Goodwill was recorded in connection with deferred tax liabilities arising from the difference between the purchase price allocated to the FCCL assets and liabilities based on fair value and the tax basis of these assets and liabilities. In addition, the consideration paid for FCCL included a control premium, which resulted in a higher value compared to the fair value of the net assets acquired.

E) Acquisition-Related Costs

The Company incurred $56 million of Acquisition-related costs, excluding common share and debt issuance costs. These costs have been included in transaction costs in the Consolidated Statements of Earnings.

Debt issuance costs related to the Acquisition financing were $72 million. These costs are netted against the carrying amount of the debt and amortized using the effective interest method.

F) Transitional Services

Under the purchase and sales agreement, Cenovus and ConocoPhillips agreed to certain transitional services where ConocoPhillips provided certainday-to-day services required by Cenovus for a period of approximately nine months. These transactions were in the normal course of operations and have been measured at the exchange amounts.

Costs related to the transitional services of approximately $40 million were recorded in general and administrative expenses.

G) Revenue and Profit Contribution

The acquired business contributed revenues of $3.3 billion and net earnings of $172 million for the period from May 17, 2017 to December 31, 2017.

| Cenovus Energy Inc. | 16 | For the period ended December 31, 2017 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

All amounts in $ millions, unless otherwise indicated

For the period ended December 31, 2017

If the closing of the Acquisition had occurred on January 1, 2017, Cenovus’s consolidated pro forma revenue and net earnings for the twelve months ended December 31, 2017 would have been $19.0 billion and $3.5 billion, respectively. These amounts have been calculated using results from the acquired business and adjusting them for:

| ● | Differences in accounting policies; |

| ● | Additional finance costs that would have been incurred if the amounts drawn on the Company’s committed asset sale bridge credit facility and the senior unsecured notes issued to fund the Acquisition had occurred on January 1, 2017; |