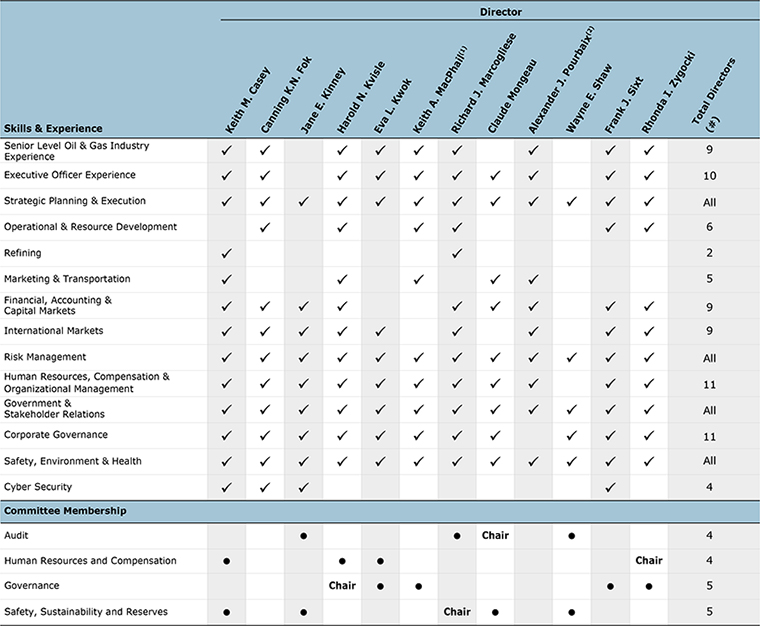

Audit Committee members are not permitted to simultaneously serve on the audit committee of more than two other public companies, unless the Board first determines that such simultaneous service will not impair the ability of the relevant members to effectively serve on our Audit Committee, and required public disclosure is made.

Audit Quality The Audit Committee oversees and monitors the qualifications, independence and performance of our external auditor. In 2019, the Audit Committee conducted a comprehensive review of Cenovus’s external auditor, PricewaterhouseCoopers LLP, to ensure audit quality as required by the Audit Committee’s Mandate. The comprehensive review was prepared in accordance with guidance published by Chartered Professional Accountants Canada, the Institute of Corporate Directors and the Canadian Public Accountability Board. The review covered the period from January 1, 2015 to December 31, 2019 and focused on the following key factors affecting audit quality:

| • | | independence, objectivity and professional skepticism of the external auditor; |

| • | | quality of the external auditor’s engagement team; and |

| • | | quality of the communications and interactions between the Audit Committee and the external auditor. |

The comprehensive review was completed and reported on in early 2020 and the Audit Committee determined it was satisfied with the audit quality provided by PricewaterhouseCoopers LLP.

In 2019, the Audit Committee oversaw the external audit partner rotation process. Effective upon the release of the consolidated financial statements of Cenovus for the year ended December 31, 2019 and the auditor’s report thereon, the audit partner responsible for Cenovus’s audit retired and the new designated audit partner with significant industry experience, was designated. In accordance with applicable requirements, the audit partner is rotated at least every five years.

In late 2020, in preparation for the completion of the Husky transaction, the Audit Committee oversaw a request for proposal process to determine our external auditor on a go-forward basis, and conducted a detailed assessment of each of Cenovus’s and Husky’s external auditor. Based on the results of this process, following the completion of the 2020 audit, the Audit Committee and the Board recommended that PricewaterhouseCoopers LLP continue as the Corporation’s independent auditors. In addition to the comprehensive review that is completed every five years, Management conducts a review and reports to the Audit Committee annually.

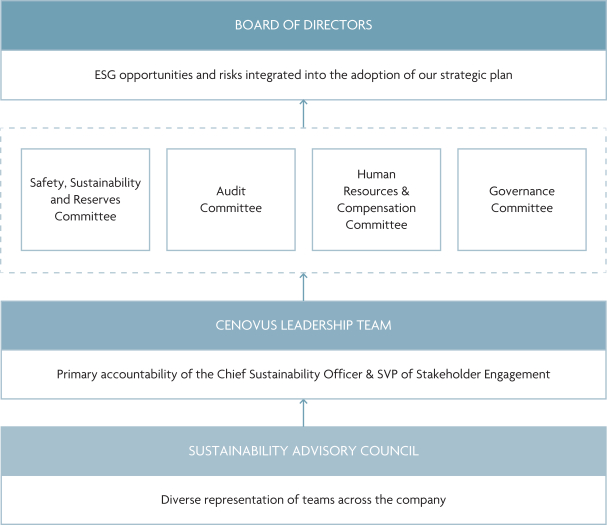

Risk Oversight The Audit Committee oversees and reports to the Board about risks related to: the design and operating effectiveness of the Corporation’s market risk management control framework and the processes to manage such risks; non-compliance with regulations and policies relating to matters within the committee’s mandate; all financial filings and public documents, including Cenovus’s and any subsidiary with public securities’ annual audited financial statements and related documents, all unaudited financial statements and related documents, and other filings and public documents as to financial information; the evaluation, appointment, compensation, retention and work of the external auditors; and, together with management, the appointment, compensation, replacement, reassignment, or dismissal of the head of internal audit. The Audit Committee also oversees risks relating to the receipt, retention and treatment of complaints received by Cenovus regarding accounting, internal accounting controls, or auditing matters; significant financial risks or exposures, including those related to ESG matters, such as climate change; and such principal or emerging risks that have been assigned to the Audit Committee, from time to time, by the Board, as recommended by the Governance Committee.

For further information about our Audit Committee and our Audit Committee Mandate, please see the Audit Committee section of our Annual Information Form for the year ended December 31, 2021, filed on SEDAR at sedar.com and available on our website at cenovus.com.

The Audit Committee Mandate is available on our website at cenovus.com.

Governance Committee

The Governance Committee assists the Board in carrying out its responsibilities with respect to corporate governance, including issues or principles related to risk governance, strategic market risk management, Board composition and nomination issues, director compensation and minimum shareholding guidelines for directors, by reviewing such issues and making recommendations to the Board as appropriate.

Members Harold N. Kvisle (Chair), Eva L. Kwok, Keith A. MacPhail, Frank J. Sixt and Rhonda I. Zygocki. The Governance Committee is comprised exclusively of independent directors.

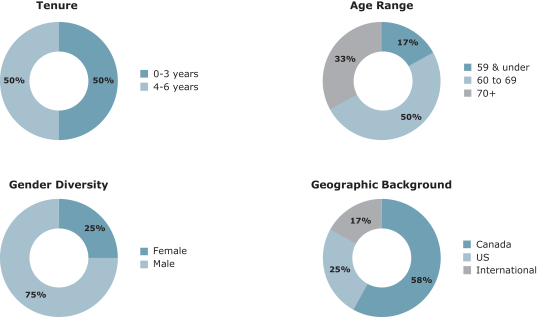

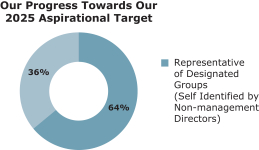

Succession Planning The Governance Committee’s primary duties and responsibilities are succession planning for the Board as a whole, including assessing the effectiveness of achieving the Board diversity objectives, the

| | | | |

| Cenovus Energy Inc. | | B-16 | | 2022 Management Information Circular |