UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14A-12 |

RetailMeNot, Inc.

|

| (Name of Registrant as Specified in its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5. | | Total Fee Paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | | | |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3. | | Filing Party: |

| | | | |

| | 4. | | Date Filed: |

| | | | |

March 16, 2016

Dear Stockholder:

You are cordially invited to attend this year’s annual meeting of stockholders of RetailMeNot, Inc. onApril 28, 2016, at 8:30 a.m. Central Time. The meeting will be held at the offices of DLA Piper LLP (US) at 401 Congress Avenue, Austin, Texas 78701 in Suite 2500.

We are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials primarily over the Internet. On March 16, 2016, we mailed to our stockholders (other than those who previously requested electronic or paper delivery) a Notice Regarding the Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including our Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 2015 (the “Annual Report”) over the Internet. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how you can receive a paper copy of the proxy materials by mail. If you receive your annual meeting materials by mail, the Notice of Annual Meeting of Stockholders, Proxy Statement, Annual Report and proxy card will be enclosed. If you receive your proxy materials via e-mail, the e-mail will contain voting instructions and links to the Annual Report and Proxy Statement on the Internet, both of which are available at www.proxyvote.com.

The matters to be acted upon are described in the Notice of Annual Meeting of Stockholders and Proxy Statement. Following the formal business of the meeting, we will be available to report on our operations and respond to questions from stockholders.

Whether or not you plan to attend the meeting, your vote is very important and we encourage you to vote promptly. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. If you attend the meeting you will have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares.

We look forward to seeing you at the annual meeting.

Sincerely yours,

Jonathan B. Kaplan

General Counsel and Corporate Secretary

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 28, 2016

The 2016 annual meeting of stockholders of RetailMeNot, Inc., a Delaware corporation, will be held onApril 28, 2016, at 8:30 a.m., Central Time, at the offices of DLA Piper LLP (US), located at 401 Congress Avenue, Austin, Texas 78701 in Suite 2500, for the following purposes:

1. To elect three Class III directors to hold office for three-year terms and until their respective successors are elected and qualified.

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

3. To vote on a non-binding basis to approve the compensation of our named executive officers.

4. To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Our board of directors recommends a vote FOR the election of all nominees for the board of directors and FOR Proposals 2 and 3. Stockholders of record at the close of business on February 29, 2016 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 301 Congress Avenue, Suite 700, Austin, Texas 78701.

By order of the board of directors,

Jonathan B. Kaplan

General Counsel and Corporate Secretary

March 16, 2016

IMPORTANT: Please vote your shares via telephone or the Internet, as described in the accompanying materials, to assure that your shares are represented at the meeting, or, if you received a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 28, 2016:Our Proxy Statement is enclosed. Financial and other information concerning RetailMeNot, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2015. A complete set of proxy materials relating to our annual meeting, consisting of the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report, is available on the Internet and may be viewed at www.proxyvote.com.

Attending the Meeting

The meeting will be held at the offices of DLA Piper LLP (US) located at 401 Congress Avenue, Austin, Texas 78701 in Suite 2500 (25th Floor).

| | • | | Doors open at 8:00 a.m. Central Time. |

| | • | | Meeting starts at 8:30 a.m. Central Time. |

| | • | | Proof of RetailMeNot, Inc. stock ownership and photo identification is required to attend the annual meeting. |

| | • | | The use of cameras or other audio or video recording devices is not allowed. |

Questions

| | |

For Questions Regarding: | | Contact: |

| |

Annual meeting | | RetailMeNot, Inc. Investor Relations IR@rmn.com |

| |

Stock ownership for registered holders | | Toll Free Phone Number: (866) 321-8022 Direct Phone Number: (720) 378-5956 Email: shareholder@broadridge.com |

| |

Stock ownership for beneficial holders | | Please contact your broker, bank or other nominee |

| |

Voting for registered holders | | RetailMeNot, Inc. Investor Relations IR@rmn.com |

| |

Voting for beneficial holders | | Please contact your broker, bank or other nominee |

RetailMeNot, Inc.

Table of Contents

RETAILMENOT, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 28, 2016

The board of directors of RetailMeNot, Inc. is soliciting your proxy for the 2016 Annual Meeting of Stockholders to be held on April 28, 2016, or any adjournment or postponement thereof, at 401 Congress Avenue, Austin, Texas 78701 in Suite 2500, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and related materials are first being made available to stockholders on or about March 16, 2016. References in this Proxy Statement to the “Company,” “we,” “our,” “us” and “RetailMeNot” are to RetailMeNot, Inc. and its consolidated subsidiaries, and references to the “annual meeting” are to the 2016 Annual Meeting of Stockholders. When we refer to the Company’s fiscal year, we mean the annual period ending on December 31, 2015. This Proxy Statement covers our 2015 fiscal year, which was from January 1, 2015 through December 31, 2015 (“fiscal 2015”). Certain information contained in this Proxy Statement is incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) on February 19, 2016.

SOLICITATION AND VOTING

Record Date

Only stockholders of record at the close of business on February 29, 2016 will be entitled to notice of and to vote at the meeting and any adjournment thereof. As of this record date there were 48,692,553 shares of Series 1 common stock and no shares of Series 2 common stock outstanding and entitled to vote.

Internet Availability of Annual Meeting Materials

We are pleased to take advantage of the rules adopted by the SEC, allowing companies to furnish proxy materials over the Internet to their stockholders rather than mailing paper copies of those materials to each stockholder. On March 16, 2016, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials (the “Notice”) directing stockholders to a website where they can access our Proxy Statement for the annual meeting and our Annual Report to Stockholders for the fiscal year ended December 31, 2015 and view instructions on how to vote via the Internet or by phone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

Quorum

A majority of the shares of common stock issued and outstanding as of the record date must be represented at the meeting, either in person or by proxy, to constitute a quorum for the transaction of business at the meeting. Your shares will be counted towards the quorum if you submit a valid proxy (or one is submitted on your behalf by your broker or bank) or if you vote in person at the meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for purposes of determining the presence of a quorum.

Vote Required to Adopt Proposals; Impact of Advisory Votes

Each share of our Series 1 common stock outstanding on the record date is entitled to one vote on each of the three director nominees. For the election of directors, the three director nominees who receive the highest number of “For” votes will be elected as Class III directors. You may vote “For” or “Withhold” with respect to each director nominee. Votes that are withheld will be excluded entirely from the vote with respect to the

1

nominee from which they are withheld and will have the same effect as an abstention. With respect to Proposal No. 2 regarding ratification of our independent auditors, approval of the proposal requires the affirmative vote of a majority of the shares present and entitled to vote. Approval of Proposal No. 3, the advisory vote to approve executive compensation, requires the affirmative vote of a majority of the shares present and entitled to vote. Proposal No. 3 is advisory and therefore will not be binding on our board of directors. Our board of directors will, however, consider the outcome of this vote when determining issues with respect to executive compensation in the future.

Effect of Abstentions and Broker Non-Votes

Shares not present at the meeting and shares voted “Withhold” will have no effect on the election of directors. For the other proposals, abstentions will have the same effect as negative votes. If your shares are held in an account at a bank or brokerage firm, that bank or brokerage firm may vote your shares on Proposal No. 2 regarding ratification of our independent auditors, but will not be permitted to vote your shares of common stock with respect to Proposal Nos. 1 or 3 unless you provide instructions as to how your shares should be voted. If an executed proxy card is returned by a bank or broker holding shares which indicates that the bank or broker has not received voting instructions and does not have discretionary authority to vote on the proposals, the shares will not be considered to have been voted in favor of the proposals. Your bank or broker will vote your shares of common stock on Proposal Nos. 1 and 3 only if you provide instructions on how to vote by following the instructions they provide to you. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Voting Instructions

If you complete and submit your proxy card or voting instructions, the persons named as proxies will follow your voting instructions. If no choice is indicated on the proxy card, the shares will be voted as the board recommends on each proposal. Many banks and brokerage firms have a process for their beneficial owners to provide instructions via telephone or the Internet. The voting form that you receive from your bank or broker will contain instructions for voting.

Depending on how you hold your shares, you may vote in one of the following ways:

Stockholders of Record:You may vote by proxy, over the Internet or by telephone. Please follow the instructions provided in the Notice, or, if you requested printed copies of the proxy materials, on the proxy card you received, then sign and return it in the prepaid envelope. You may also vote in person at the annual meeting.

Beneficial Stockholders:Your bank, broker or other holder of record will provide you with a voting instruction card for you to use to instruct them on how to vote your shares. Check the instructions provided by your bank, broker or other holder of record to see which options are available to you. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid legal proxy from your bank, broker or other agent.

Votes submitted by telephone or via the Internet must be received by 11:59 p.m. Eastern Time on April 27, 2016. Submitting your proxy by telephone or via the Internet will not affect your right to vote in person should you decide to attend the annual meeting in-person.

If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the polls close by returning a later-dated proxy card, by voting again by Internet or telephone as more fully detailed in your Notice or proxy card or by delivering written instructions to the Corporate Secretary before the annual meeting. Attendance at the annual meeting will not in and of itself cause your previously voted proxy to be revoked unless you specifically so request or vote again at the annual meeting. If your shares are held in an

2

account at a bank, brokerage firm or other agent, you may change your vote by submitting new voting instructions to your bank, brokerage firm or other agent, or, if you have obtained a legal proxy from your bank, brokerage firm or other agent giving you the right to vote your shares, by attending the annual meeting and voting in person.

Solicitation of Proxies

We will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable, out-of-pocket costs for forwarding proxy and solicitation material to the beneficial owners of common stock. We may use the services of our officers, directors and employees to solicit proxies, personally, by telephone or by email, without additional compensation. Additionally, we have retained D. F. King & Co. to solicit proxies for a fee of $12,500 plus reimbursement of reasonable out-of-pocket fees and expenses.

Voting Results

We will announce preliminary voting results at the annual meeting. We will report final results in aForm 8-K report filed with the SEC.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified board of directors consisting of three Class I directors, three Class II directors and three Class III directors. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting date.

The term of the Class III directors, G. Cotter Cunningham, Gokul Rajaram and Greg J. Santora, will expire on the date of the upcoming annual meeting. Accordingly, three persons are to be elected to serve as Class III directors of the board of directors at the meeting. The board’s nominees for election by the stockholders to those three positions are the three current Class III members of the board of directors, G. Cotter Cunningham, Gokul Rajaram and Greg J. Santora. If elected, each nominee will serve as a director until our annual meeting of stockholders in 2019 and until their respective successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason (although we know of no reason to anticipate that this will occur), or if a vacancy occurs before the election, the proxies may be voted for such substitute nominees as we may designate. The proxies cannot vote for more than three persons.

The three nominees for Class III director receiving the highest number of votes of shares of outstanding common stock will be elected as Class III directors.

We believe that each of our directors has demonstrated business acumen, ethical integrity and an ability to exercise sound judgment as well as a commitment of service to us and our board of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF G. COTTER CUNNINGHAM, GOKUL RAJARAM AND GREG J. SANTORA AS CLASS III DIRECTORS.

The names of our directors who will continue in office until the 2017 and 2018 annual meetings of stockholders, including the nominees for Class III directors to be elected at this meeting, and certain information about them as of February 29, 2016 is set forth below. Also set forth below are the specific experience, qualifications, attributes or skills that led our nominating and corporate governance committee to conclude that each person should serve as a director.

| | | | | | | | | | |

| Name | | Principal Occupation | | Age | | | Director

Since | |

|

| Class I Directors Whose Terms Expire at the 2017 Annual Meeting of Stockholders: | |

C. Thomas Ball | | Private Investor; Former General Partner of Austin Ventures | | | 49 | | | | 2007 | |

| | | |

Jeffrey M. Crowe | | Managing Partner of Norwest Venture Partners | | | 59 | | | | 2010 | |

| | | |

Eric A. Korman | | Chief Executive Officer of Phlur, Inc.; Former President, Ralph Lauren Digital & E-Commerce | | | 45 | | | | 2014 | |

|

| Class II Directors Whose Terms Expire at the 2018 Annual Meeting of Stockholders: | |

Jules A. Maltz | | General Partner of Institutional Venture Partners | | | 36 | | | | 2011 | |

| | | |

Brian Sharples | | President, HomeAway, Expedia, Inc. | | | 55 | | | | 2011 | |

| | | |

Tamar Yehoshua | | Vice President of Product Management, Google, Inc. | | | 51 | | | | 2015 | |

|

| Class III Directors Nominated for Election at the 2016 Annual Meeting of Stockholders: | |

G. Cotter Cunningham | | President and Chief Executive Officer of RetailMeNot, Inc. | | | 53 | | | | 2007 | |

| | | |

Gokul Rajaram | | Product Engineering Lead at Square, Inc. | | | 41 | | | | 2013 | |

| | | |

Greg J. Santora | | Independent Management Consultant | | | 64 | | | | 2013 | |

4

Class I Directors

C. Thomas Ball has been a member of our board of directors since September 2007. Mr. Ball is a private investor and entrepreneur. From April 2005 through June 2015, Mr. Ball was with Austin Ventures, where he started as a Venture Partner and finished as a General Partner. From November 2001 to December 2004, Mr. Ball was Chief Executive Officer and co-founder of Openfield Technologies, a provider of e-commerce and business management software and technology solutions. Mr. Ball was also a founder of eCoupons.com, where he served as Chief Executive Officer from January 1999 through December 2000. Mr. Ball has served on a number of private company boards, including Social Gaming Network, Adometry and Boundless Network, and also served on the board of Convio (CNVO) from December 2006 through February 2011. Mr. Ball holds an M.B.A. from the Stanford Graduate School of Business and a B.S. in finance from the University of Florida. We have determined that Mr. Ball’s experience in the digital offers industry as founder of eCoupons.com, as well as his experience in both managing and evaluating companies as an officer, board member and investor makes him a valuable member of our board of directors, our compensation committee and our nominating and corporate governance committee.

Jeffrey M. Crowehas been a member of our board of directors since November 2010. Mr. Crowe was CEO-in-residence with Norwest Venture Partners from January 2002 to December 2003, joined the firm as a Venture Partner in January 2004, became a General Partner in January 2005 and became Managing Partner of the firm in January 2013. He focuses on investments in the software, Internet and consumer arenas. Mr. Crowe currently serves on the boards of Badgeville, deCarta, Owler, Lending Club (LC), Madison Reed, Glint (formerly Aware AI), Extole, HoneyBook, Turn, and Pencil and Pixel. He previously served on the boards of AdChina, Admeld, deCarta, Jigsaw, Nano-Tex, The Echo Nest, TrueX Media and Tuvox. From December 1999 to April 2001, Mr. Crowe served as President, Chief Operating Officer and Director of DoveBid, a privately held business auction firm. From May 1990 to November 1999, Mr. Crowe served as Chief Executive Officer of Edify Corporation (EDFY), a publicly traded enterprise software company. Mr. Crowe holds an M.B.A. from the Stanford Graduate School of Business and a B.A. in history from Dartmouth College. We have determined that the breadth and depth of Mr. Crowe’s operational background and experience as an investor, director and officer in a number of technology companies make him an effective member of our board of directors and our audit committee.

Eric A. Korman has been a member of our board of directors since September 2014. Mr. Korman is the founder and Chief Executive Officer of Phlur, Inc., an early-stage, vertically integrated retailer which he founded in May 2015. Mr. Korman was previously the President, Digital & Global e-Commerce at Ralph Lauren from October 2011 to February 2014. Prior to this role, Mr. Korman was Senior Vice President, Strategy & Development at Ralph Lauren from November 2010 to January 2012. Before joining Ralph Lauren, Mr. Korman was President of Ticketmaster Entertainment from October 2008 to January 2010 and served as its Executive Vice President from May 2006 to October 2008 after its spin-off from IAC. Prior to that, Mr. Korman held a variety of senior positions at IAC from September 2001 to May 2006, serving as Senior Vice President, Mergers & Acquisitions from February 2005 to May 2006. Mr. Korman has served on the boards of directors of Points International (TSX: PTS), The Active Network (ACTV), BET Digital and OpenTable (OPEN). Mr. Korman holds an M.B.A from the J.L. Kellogg Graduate School of Management and a B.A., cum laude, in economics and political science from Emory University. We have determined that Mr. Korman’s extensive experience in senior management positions of various commerce and retail companies makes him a valuable member of our board of directors and our nominating and corporate governance committee.

Class II Directors

Jules A. Maltz has served as a member of our board of directors since October 2011. Mr. Maltz is General Partner at Institutional Venture Partners, which he joined in August 2008, and focuses on investments in rapidly growing Internet and software companies. In addition to his service on our board of directors, Mr. Maltz serves on the board of directors of Yext, Oportun, NerdWallet, Indiegogo and TuneIn and previously served on the

5

board of directors of Buddy Media and H5. He is actively involved in a number of other portfolio companies of Institutional Venture Partners. Mr. Maltz received an M.B.A. from Stanford University and a B.A. in economics from Yale University. We have determined that Mr. Maltz’s knowledge and experience with growth-stage Internet and software companies, as well as his financial expertise, makes him an integral member of our board of directors, our audit committee and our nominating and corporate governance committee.

Brian Sharples has served as a member of our board of directors since July 2011. Mr. Sharples is one of the co-founders of HomeAway and served as its President, Chief Executive Officer and board member since its inception in April 2004 until its sale to Expedia, Inc. (EXPE) in December 2015; he continues to serve as President, HomeAway for Expedia. Prior to co-founding HomeAway, Mr. Sharples was an angel investor from 2001 until 2004 and also served as Chief Executive Officer of Elysium Partners from 2002 until 2003. Mr. Sharples served as President and Chief Executive Officer of IntelliQuest Information Group, a supplier of marketing data and research to Fortune 500 technology companies, from 1996 to 2001, as President from 1991 to 1996, and as Senior Vice President from 1989 to 1991. Prior to IntelliQuest, Mr. Sharples was Chief Executive Officer of Practical Productions, an event-based automotive distribution business, from 1988 to 1989 and a consultant with Bain & Co. from 1986 to 1988. Mr. Sharples served on the board of directors of Kayak Software (KYAK), an online travel resource aggregator, until November 2012. He received an M.B.A. from the Stanford Graduate School of Business and a B.S. in math and economics from Colby College. We have determined that Mr. Sharples’s current and previous tenures in executive positions at various public and private technology companies and his experience with online aggregation service companies allow him to bring valuable insight to our board of directors and our compensation committee.

Tamar Yehoshua has served as a member of our board of directors since December 2015. Ms. Yehoshua is a vice president of product management in the Search team at Google, Inc. Prior to joining Google in 2010, Tamar served as vice president for advertising technology at A9, an Amazon company, from 2005-2010, and director of engineering from 2004-2005. She previously served in senior engineering leadership roles at Reasoning, Inc. from 2002-2004, and Noosh, Inc. from 1999-2002. Tamar holds a Bachelor of Arts degree in Mathematics from the University of Pennsylvania and a Master’s degree in Computer Science from The Hebrew University of Jerusalem.

Class III Directors

G. Cotter Cunninghamis our Founder, President, Chief Executive Officer and Chairman of the Board, and has overseen our growth from inception. Previously, Mr. Cunningham served in various positions with Bankrate (RATE) from April 2000 through April 2007, most recently as Chief Operating Officer. He also previously served as CEO-in-Residence at Austin Ventures, Vice President and General Manager of VML, Vice President of Block Financial Corporation and Assistant Vice President of H&R Block. He holds an M.B.A. from Vanderbilt University and a B.B.A. in economics from the University of Memphis. Mr. Cunningham’s perspective as our Founder and Chief Executive Officer makes him a critical member of our board of directors.

Gokul Rajaram has served as a member of our board of directors since October 2013. Mr. Rajaram is the Product Engineering Lead at Square, the commerce company based in San Francisco, California. Before joining Square in July 2013, Mr. Rajaram was Product Director, Ads at Facebook (FB) from September 2010 to June 2013. Mr. Rajaram was Co-Founder and Chief Executive Officer of Chai Labs, a semantic technology startup, from December 2007 until its acquisition by Facebook in September 2010. Prior to Chai Labs, Mr. Rajaram served as Product Management Director for Google AdSense (GOOG) from January 2003 to November 2007. Mr. Rajaram holds an M.B.A. from the Massachusetts Institute of Technology Sloan School of Management, a M.S. in computer science from the University of Texas and a B. Tech in computer science from the Indian Institute of Technology Kanpur. We have determined that Mr. Rajaram’s knowledge and experience with product development and innovation at Internet and technology companies makes him a valuable member of our board of directors and our compensation committee.

6

Greg J. Santora has served as a member of our board of directors since May 2013. Mr. Santora has worked as an independent management consultant since September 2005. Prior to that, he served as Chief Financial Officer of Shopping.com, a provider of Internet-based comparison shopping resources, from December 2003 through September 2005. From January 1997 through December 2002, he served as Chief Financial Officer of Intuit. Mr. Santora currently serves on the board of directors of Align Technology (ALGN) and MarkLogic Corporation. He previously served on the board of directors of Taleo Corporation (TLEO) and Digital Insight Corporation (DGIN). He holds an M.B.A. from San Jose State University and a B.A. in accounting from the University of Illinois. We have determined that Mr. Santora’s experience as a financial leader, his financial reporting and audit expertise and his current service on public and private company boards allows him to bring valuable insight to our board of directors and our audit committee.

7

CORPORATE GOVERNANCE

Director Independence

In February 2016, the board of directors determined that, other than Mr. Cunningham, each of the current members of the board is an “independent director” for purposes of the Nasdaq Listing Rules andRule 10A-3(b)(1) under the Exchange Act as the term relates to membership on the board of directors.

The definition of independence under the Nasdaq Listing Rules includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director, nor any of his or her family members, has engaged in various types of business dealings with us. In addition, as further required by the Nasdaq Listing Rules, our board has made a subjective determination as to each independent director that no material relationships exist that, in the opinion of our board, would interfere with his exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board reviewed and discussed information provided by the directors in questionnaires with questions tailored to the Nasdaq Listing Rules with regard to each director’s business and personal activities as they may relate to us and our management.

Board of Directors Leadership Structure

The board of directors has adopted Corporate Governance Guidelines to promote the functioning of the board and its committees. These guidelines address board composition, board functions and responsibilities, qualifications, leadership structure, committees and meetings.

Our Corporate Governance Guidelines do not contain a policy mandating the separation of the offices of the Chairman of the Board and the Chief Executive Officer, or CEO, and the board is given the flexibility to select its Chairman and our CEO in the manner that it believes is in the best interests of our stockholders. Accordingly, the Chairman and the CEO may be filled by one individual or two. The board has not separated the positions of Chairman of the Board and CEO and both positions are held by Mr. Cunningham. The board believes that this structure has historically served the company well and continues to do so, by creating a critical link between management and the board of directors, enabling the board to perform its oversight function with the benefits of management’s perspectives on the business, facilitating communication between the board and our senior management and providing the board with direct oversight of our business and affairs.

The board does not believe that mandating a particular structure that requires an independent lead director be designated is necessary to achieve effective oversight of management or to protect stockholder interests. Other than Mr. Cunningham, all members of our board of directors are independent under the Nasdaq Listing Rules, and each of the board’s audit committee, compensation committee and nominating and corporate governance committee are comprised solely of independent directors. Additionally, each committee is chaired by a different director, thus promoting diverse perspectives and styles in critical areas of corporate governance. Based on the board and committee structures currently in place our nominating and corporate governance committee believes that each independent director plays a critical role in oversight, leadership and governance and that designating a lead independent director would not create additional benefits at this time.

Risk Management

Our risk management function is overseen by our board of directors. Through our internal risk management committee, management reports and company policies, such as our Corporate Governance Guidelines, our Code of Business Conduct and Ethics and our audit committee’s and compensation committee’s review of financial, executive compensation and other risks, we keep our board of directors apprised of material risks and provide our directors access to all information necessary for them to understand and evaluate how these risks interrelate, how they affect us and how our management addresses those risks. Mr. Cunningham, as our CEO, works with our

8

independent directors and with management when material risks are identified by the board of directors or management to address such risk. If the identified risk poses an actual or potential conflict with management, our independent directors would conduct an assessment by themselves.

Executive Sessions

Independent directors meet in executive session at certain of the board of directors’ meetings. The board’s policy is to hold executive sessions without the presence of management, including the CEO, who is the only non-independent director.

Meetings of the Board of Directors and Committees

The board of directors held four meetings during the fiscal year ended December 31, 2015. The board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. During the last fiscal year, each of our directors attended at least 75% of the total number of meetings of the board and all of the committees of the board on which such director served during that period.

The following table sets forth the standing committees of the board of directors and the members of each committee as of the date that this Proxy Statement was first made available to our stockholders:

| | | | | | |

Name of Director | | Audit | | Compensation | | Nominating and Corporate

Governance |

C. Thomas Ball | | | | Chair | | X |

Jeffrey M. Crowe | | X | | | | |

Eric Korman | | | | | | X |

Jules A. Maltz | | X | | | | Chair |

Gokul Rajaram | | | | X | | |

Greg J. Santora | | Chair | | | | |

Brian Sharples | | | | X | | |

Mr. Cunningham and Ms. Yehoshua do not serve on any committees, and, consequently are not included in the table above.

Audit Committee

The members of the audit committee are Messrs. Crowe, Maltz and Santora. Mr. Santora serves as the chair of the audit committee. In February 2016, our board of directors determined that each of Messrs. Crowe, Maltz and Santora was independent for purposes of the Nasdaq Listing Rules and SEC rules and regulations as they apply to audit committee members. Our board of directors has determined that each of Messrs. Crowe, Maltz and Santora meet the requirements for financial literacy and sophistication, and that Mr. Santora qualifies as an “audit committee financial expert,” under the applicable requirements of the Nasdaq Listing Rules and SEC rules and regulations. The composition of our audit committee complies with all applicable requirements in the Nasdaq Listing Rules and SEC rules and regulations and all of our audit committee members are independent directors.

The functions of the audit committee include:

| | • | | appointing, compensating, retaining and overseeing our independent registered public accounting firm; |

| | • | | approving the terms of the audit and pre-approving the engagement of our independent registered public accounting firm to perform permissible non-audit services; |

| | • | | reviewing, with our independent auditors, all critical accounting policies and procedures; |

| | • | | reviewing with management the adequacy and effectiveness of our internal control structure and procedures for financial reports; |

9

| | • | | ensure the rotation of the lead audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law and to consider whether to rotate the audit firm itself; |

| | • | | reviewing and discussing with management and our independent auditor our annual audited financial statements and any certification, report, opinion or review rendered by the independent auditor; |

| | • | | reviewing and investigating conduct alleged to be in violation of our Code of Business Conduct and Ethics; |

| | • | | reviewing and approving any related party transactions; |

| | • | | preparing the audit committee report required in our annual proxy statement; and |

| | • | | reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

The audit committee held four meetings during fiscal 2015. Additional information regarding the audit committee is set forth in the Report of the Audit Committee immediately following Proposal No. 2.

Compensation Committee

The members of the compensation committee are Messrs. Ball, Rajaram and Sharples, each of whom is a non-employee member of our board of directors. Mr. Ball serves as the chairperson of the compensation committee. In February 2016, our board of directors determined that each member of the compensation committee is independent for purposes of the Nasdaq Listing Rules, is a non-employee director, as defined by Rule 16b-3 promulgated under the Exchange Act, and is an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code.

The functions of the compensation committee include:

| | • | | reviewing and approving corporate goals and objectives relevant to the compensation of our CEO and our other executive officers; |

| | • | | reviewing and approving the following for our CEO and our other executive officers: salaries, bonuses, incentive compensation, equity awards, benefits and perquisites; |

| | • | | recommending the establishment and terms of our incentive compensation plans and equity compensation plans, and administering such plans; |

| | • | | recommending compensation programs for the non-employee members of our board of directors; |

| | • | | preparing disclosures regarding executive compensation and any related reports required by Nasdaq Listing Rules and SEC rules and regulations; |

| | • | | reviewing grants of equity awards made by the management equity award committee to employees and other eligible individuals pursuant to the authority delegated to it by the compensation committee; |

| | • | | making and approving grants of options and other equity awards to all executive officers, directors and other individuals whose equity awards are not made by the management equity award committee; and |

| | • | | reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

The compensation committee and our board of directors believe that attracting, retaining and motivating our employees, and particularly the company’s senior management team and key operating personnel, are essential to RetailMeNot’s performance and enhancing stockholder value. The compensation committee will continue to administer and develop our compensation programs in a manner designed to achieve these objectives.

10

The compensation committee reviews and determines executive officer compensation. Our CEO makes recommendations to the compensation committee regarding base salary increases, bonuses, incentive compensation, equity awards, benefits and perquisites for each executive officer other than himself. These recommendations are based upon objective criteria, including market data for our peer group, competitive positioning, our financial performance, accomplishment of strategic objectives, retention and individual performance. The compensation committee reviews and evaluates submitted proposals, discusses them with our CEO, and uses these recommendations as one factor in determining compensation levels for our executive officers. The compensation committee is ultimately responsible for establishing executive compensation levels, including for the CEO.

In January 2012, the compensation committee selected Compensia, Inc. (“Compensia”) to provide compensation consulting support. Compensia has provided market information on compensation trends and practices and compensation analysis based on competitive data drawn from a peer group of companies. Compensia is also available to perform special projects at the compensation committee’s request. Compensia provides analyses that inform the compensation committee’s decisions, but does not decide or approve any compensation actions. As needed, the compensation committee also consults with Compensia on program design matters. The engagement of any compensation consultant rests exclusively with the compensation committee, which has sole authority to retain and terminate any compensation consultant or other advisor that it uses.

In October 2015, the compensation committee assessed the independence of Compensia and concluded that no conflicts of interest exist that would prevent Compensia from providing independent and objective advice to the compensation committee. In making this determination, our compensation committee reviewed and discussed information provided by Compensia in a questionnaire that included questions tailored to the Nasdaq Listing Rules with regards to Compensia’s independence and provision of services.

The compensation committee held four meetings during fiscal 2015.

Nominating and Corporate Governance Committee

The members of the nominating and corporate governance committee are Messrs. Ball, Korman and Maltz. Mr. Maltz serves as the chairperson of the nominating and corporate governance committee. In February 2016, our board of directors determined that each member of the nominating and corporate governance committee is independent for purposes of the Nasdaq Listing Rules and under applicable SEC rules and regulations.

The functions of the nominating and corporate governance committee include:

| | • | | assisting our board of directors in identifying qualified director nominees and recommending nominees for each annual meeting of stockholders; |

| | • | | developing, recommending and reviewing our Corporate Governance Guidelines and our Code of Business Conduct and Ethics; |

| | • | | assisting the board in its evaluation of the performance of our board of directors and each committee thereof; |

| | • | | recommending corporate governance principles; and |

| | • | | reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

The nominating and corporate governance committee held four meetings during fiscal 2015.

Director Nominations

Our nominating and corporate governance committee is responsible for, among other things, assisting our board of directors in identifying qualified director nominees and recommending nominees for election at each

11

annual meeting of stockholders. The nominating and corporate governance committee’s goal is to assemble a board that brings to our company a diversity of experience in areas that are relevant to our business and that complies with the Nasdaq Listing Rules and applicable SEC rules and regulations. While we do not have a formal diversity policy for board membership, the nominating and corporate governance committee generally considers the diversity of nominees in terms of knowledge, experience, background, skills, expertise and demographic factors. When considering nominees for election as directors, the nominating and corporate governance committee reviews the needs of the board for various skills, background, experience and expected contributions and the qualification standards established from time to time by the nominating and corporate governance committee. The nominating and corporate governance committee believes that directors must also have an inquisitive and objective outlook and mature judgment. Director candidates must have sufficient time available in the judgment of the nominating and corporate governance committee to perform all board and committee responsibilities. Members of the board of directors are expected to rigorously prepare for, attend and participate in all meetings of the board and applicable committee meetings.

Other than the foregoing and the applicable rules regarding director qualification, there are no stated minimum criteria for director nominees. Under the Nasdaq Listing Rules, at least a majority of the members of the board must meet the definition of “independence” and at least one director must be a “financial expert” under the Exchange Act and the Nasdaq Listing Rules and applicable SEC rules and regulations. The nominating and corporate governance committee also believes it appropriate for our CEO to participate as a member of the board of directors.

The nominating and corporate governance committee will evaluate annually the current members of the board whose terms are expiring and who are willing to continue in service against the criteria set forth above in determining whether to recommend these directors for election. The nominating and corporate governance committee will assess regularly the optimum size of the board and its committees and the needs of the board for various skills, background and business experience in determining if the board requires additional candidates for nomination.

Candidates for director nomination come to our attention from time to time through incumbent directors, management, stockholders or third parties. These candidates may be considered at meetings of the nominating and corporate governance committee at any point during the year. Such candidates are to be evaluated against the criteria set forth above. If the nominating and corporate governance committee believes at any time that it is desirable that the board consider additional candidates for nomination, the committee may poll directors and management for suggestions or conduct research to identify possible candidates and may engage, if the nominating and corporate governance committee believes it is appropriate, a third party search firm to assist in identifying qualified candidates. For example, Ms. Yehoshua was first identified as a potential director candidate by a third party search firm and then recommended to the board by our nominating and corporate governance committee to fill the remaining vacancy on the board in 2015.

Our bylaws permit stockholders to nominate directors for consideration at an annual meeting. The nominating and corporate governance committee will consider director candidates validly recommended by stockholders. For more information regarding the requirements for stockholders to validly submit a nomination for director, see “Stockholder Proposals or Nominations to Be Presented at Next Annual Meeting” elsewhere in this Proxy Statement.

Compensation of Directors

In March 2013, we implemented a director compensation plan, pursuant to which certain of our non-employee directors are eligible to receive equity awards and cash retainers as compensation for service on our board of directors and its committees. Under our director compensation plan, our non-employee directors are

12

entitled to receive a $30,000 annual retainer fee. The details of fiscal 2015 cash compensation for service by non-employee directors on committees of our board of directors is set forth in the table below.

| | | | | | | | |

Committee | | Chairperson Fee ($) | | | Member Fee ($) | |

Audit Committee | | | 20,000 | | | | 10,000 | |

Compensation Committee | | | 10,000 | | | | 5,000 | |

Nominating and Corporate Governance Committee | | | 7,500 | | | | 3,500 | |

Non-employee directors generally receive an initial (i) option award to purchase that number of shares of our Series 1 common stock equal to $150,000 divided by the then current Black-Scholes-Merton value of our Series 1 common stock and (ii) restricted stock unit (“RSU”) award to be settled for that number of shares of our Series 1 common stock equal to $150,000 divided by the then current share price of our Series 1 common stock. These awards vest on the earlier of (a) the first anniversary of the date of grant and (b) the day prior to the annual meeting of stockholder at which such director’s term expires, provided that the director continues to serve through such vesting date.

In addition, in subsequent years, on the date of the annual meeting of stockholders, non-employee directors receive an annual (i) option award to purchase that number of shares of our Series 1 common stock equal to $60,000 divided by the then current Black-Scholes-Merton value of our Series 1 common stock and (ii) award of RSUs to be settled for that number of shares of our Series 1 common stock equal to $60,000 divided by the then current share price of our Series 1 common stock. These awards vest on the earlier of (i) the first anniversary of the grant and (ii) the date of the annual meeting of stockholders in the year following the year of the grant, provided that the director continues to serve through such vesting date.

2015 Director Compensation

The following table sets forth information concerning the compensation earned during the fiscal 2015. Members of our board of directors who are affiliated with venture capital firms that invested in shares of our preferred stock prior to our initial public offering do not currently receive compensation for service on our board of directors. Our CEO did not receive additional compensation for his service as a director and, consequently, is not included in the table. The compensation received by our CEO as an employee is presented in the Summary Compensation Table:

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash ($) | | | Stock

Awards ($)(1) | | | Option Awards

($)(1) | | | Total ($) | |

C. Thomas Ball | | | 16,313 | (2) | | | 60,001 | (3) | | | 60,499 | (4) | | | 136,813 | |

Jeffrey M. Crowe | | | — | | | | — | | | | — | | | | — | |

Eric A. Korman | | | 32,333 | (5) | | | 59,992 | (6) | | | 60,269 | (7) | | | 152,594 | |

Jules A. Maltz | | | — | | | | — | | | | — | | | | — | |

Gokul Rajaram | | | 35,000 | (8) | | | 59,992 | (6) | | | 60,269 | (7) | | | 155,261 | |

Greg A. Santora | | | 50,000 | (9) | | | 59,992 | (6) | | | 60,269 | (7) | | | 170,261 | |

Brian Sharples | | | 35,000 | (10) | | | 59,992 | (6) | | | 60,269 | (7) | | | 155,261 | |

Tamar Yehoshua | | | 2,055 | (11) | | | 150,002 | (12) | | | 150,710 | (13) | | | 302,767 | |

| (1) | Amounts represent the aggregate grant date fair value of stock options and RSUs granted during the year computed in accordance with ASC Topic 718. Assumptions used in calculating the grant date fair value of the options and RSUs reported in this column are set forth in Note 8 “Stockholders’ Equity and Stock-Based Compensation” of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015. Note that the amounts reported in this column reflect the accounting cost for these stock options and RSUs, and do not correspond to the actual economic value that our non-employee directors may receive from the options and RSUs. |

13

| (2) | Amount consists of pro-rated portions of the $30,000 annual retainer fee for service on the board of directors, $10,000 fee as chairman of the compensation committee and $3,500 fee as a member of the nominating and corporate governance committee for the portion of 2015 when Mr. Ball was no longer affiliated with a venture capital firm that invested in shares of our preferred stock prior to our initial public offering. |

| (3) | Represents the grant on October 30, 2015 of 6,826 RSUs. All of such RSUs vest on the earlier of (i) the first anniversary of the date of grant and (ii) the day prior to the date of the annual shareholder meeting in the year following the year of grant and were outstanding as of December 31, 2015. |

| (4) | Represents the grant on October 30, 2015 of an option to purchase 15,030 shares of Series 1 common stock at an exercise price of $8.79 per share. All of such options vest on the earlier of (i) the first anniversary of the date of grant and (ii) the day prior to the date of the annual shareholder meeting in the year following the year of grant and were outstanding as of December 31, 2015. |

| (5) | Amount consists of $30,000 annual retainer fee for service on the board of directors and the pro-rated portion of the $3,500 fee for service as a member of the nominating and corporate governance committee for the portion of 2015 when Mr. Korman served on the committee. |

| (6) | Represents the grant on April 30, 2015 of 3,264 RSUs. All of such RSUs vest on the earlier of (i) the first anniversary of the date of grant and (ii) the day prior to the date of the annual shareholder meeting in the year following the date of grant and were outstanding as of December 31, 2015. |

| (7) | Represents the grant on April 30, 2015 of an option to purchase 7,129 shares of Series 1 common stock at an exercise price of $18.38 per share. All of such options vest on the earlier of (i) the first anniversary of the date of grant and (ii) the day prior to the date of the annual shareholder meeting in the year following the date of grant and were outstanding as of December 31, 2015. |

| (8) | Amount consists of $30,000 annual retainer fee for service on the board of directors and $5,000 fee for service as a member of our compensation committee. |

| (9) | Amount consists of $30,000 annual retainer fee for service on the board of directors and $20,000 fee for service as the chairperson of our audit committee. |

| (10) | Amount consists of $30,000 annual retainer fee for service on the board of directors and $5,000 fee for service as a member of our compensation committee. |

| (11) | Amount consists of the pro-rated portion of the $30,000 annual retainer fee for the portion of 2015 when Ms. Yehoshua served on the board of directors. |

| (12) | Represents a grant on December 15, 2015 of 14,764 RSUs in connection with Ms. Yehoshua joining our board of directors. All of such RSUs vest on the one year anniversary of the date of grant and were outstanding as of December 31, 2015. |

| (13) | Represents the grant on December 15, 2015 of an option to purchase 32,280 shares of Series 1 common stock at an exercise price of $10.16 per share in connection with Ms. Yehoshua joining our board of directors. All of such options vest on the one year anniversary of the date of grant and were outstanding as of December 31, 2015. |

14

Communications with Directors

Stockholders and other interested parties may communicate with the board of directors by mail or e-mail addressed as follows:

Board of Directors of RetailMeNot, Inc.

c/o Corporate Secretary

301 Congress Avenue, Suite 700

Austin, Texas 78701

E-mail address: corporatesecretary@rmn.com

All directors have access to this correspondence. In accordance with instructions from the board, the Corporate Secretary logs and reviews all correspondence and transmits such communications to the full board or individual directors, as appropriate. Certain communications, such as business solicitations, job inquiries, junk mail, patently offensive material or communications that present security concerns may not be transmitted, as determined by the Corporate Secretary.

Director Attendance at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by members of our board of directors taking into account the directors’ schedules. All directors are encouraged to attend our annual meeting of stockholders.

Committee Charters and Other Corporate Governance Materials

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors. The Code of Business Conduct and Ethics is available on the investor relations portion of our website athttp://investor.retailmenot.com. A printed copy of the code may also be obtained by any stockholder free of charge upon request to the Corporate Secretary, RetailMeNot, Inc., 301 Congress Avenue, Suite 700, Austin, Texas 78701. Any substantive amendment to or waiver of any provision of the Code of Business Conduct and Ethics may be made only by the board of directors, and will be disclosed on our website as well as via any other means then required by Nasdaq Listing Rules or applicable law.

Our board of directors has also adopted a written charter for each of the audit committee, the compensation committee and the nominating and corporate governance committee. Each charter is available on the investor relations portion of our website athttp://investor.retailmenot.com.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines that address the composition of the board, criteria for board membership and other board governance matters. The Corporate Governance Guidelines are available on the investor relations portion of our website athttp://investor.retailmenot.com. A printed copy may also be obtained by any stockholder free of charge upon request to the Corporate Secretary, RetailMeNot, Inc., 301 Congress Avenue, Suite 700, Austin, Texas 78701.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee are or have been an officer or employee of RetailMeNot. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or our compensation committee.

15

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected Ernst & Young LLP (“Ernst & Young”) to serve as our independent registered public accounting firm to audit the consolidated financial statements of RetailMeNot, Inc. for the fiscal year ending December 31, 2015. Ernst & Young has served as our auditor since 2010. A representative of Ernst & Young is expected to be present at the annual meeting to be available to respond to appropriate questions.

Fees Billed by Ernst & Young

The following table sets forth the aggregate fees billed by Ernst & Young for the fiscal years ended December 31, 2015 and 2014:

| | | | | | | | |

| | | Fiscal

2015 | | | Fiscal

2014 | |

Audit fees(1) | | $ | 1,094,400 | | | $ | 871,000 | |

Audit-related fees(2) | | $ | — | | | $ | — | |

Tax fees(3) | | $ | 46,600 | | | $ | 130,000 | |

All other fees(4) | | $ | — | | | $ | — | |

Total | | $ | 1,141,100 | | | $ | 1,001,000 | |

| | | | | | | | |

| (1) | Audit fees consist of fees billed for professional services rendered in connection with the audit of our consolidated annual financial statements, review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by the independent auditor in connection with statutory and regulatory filings or engagements, consultations concerning financial reporting in connection with acquisitions and issuances of auditor consents and comfort letters in connection with SEC registration statements and related SEC registered securities offerings. |

| (2) | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit fees.” |

| (3) | Tax fees consist of fees billed for professional services rendered for tax compliance, tax advice and tax planning (domestic and international). These services include assistance regarding federal, state and international tax compliance, acquisitions and international tax planning. |

| (4) | All other fees consist of fees for products and services other than the services reported above. |

Policy on Audit Committee Pre-approval of Audit and Non-audit Services Performed by Independent Registered Public Accounting Firm

The audit committee has determined that all services performed by Ernst & Young are compatible with maintaining the independence of Ernst & Young. The audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Unless the specific service has been pre-approved with respect to that year, the audit committee must approve the permitted service before the independent registered public accounting firm is engaged to perform it. The independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval process.

16

Vote Required and Board of Directors Recommendation

The affirmative vote of a majority of the votes cast on the proposal at the annual meeting is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum and will have the same effect as voting against the proposal. Your bank or broker will have discretion to vote any uninstructed shares on this proposal. If the stockholders do not approve the ratification of Ernst & Young as our independent registered public accounting firm, the audit committee will reconsider its selection.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016. PROXIES WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE IN THEIR PROXIES.

17

REPORT OF THE AUDIT COMMITTEE

The audit committee currently consists of three directors, Messrs. Crowe, Santora and Maltz. Each of Messrs. Crowe, Santora and Maltz is, in the judgment of the board of directors, an independent director. The audit committee acts pursuant to a written charter that has been adopted by the board of directors. A copy of the charter is available on the investor relations portion of RetailMeNot’s website athttp://investor.retailmenot.com.

The audit committee oversees RetailMeNot’s financial reporting process on behalf of the board of directors. The audit committee is responsible for retaining RetailMeNot’s independent registered public accounting firm, evaluating its independence, qualifications and performance, and approving in advance the engagement of the independent registered public accounting firm for all audit and non-audit services. The audit committee’s specific responsibilities are set forth in its charter. The audit committee reviews its charter at least annually.

Management has the primary responsibility for the financial statements and the financial reporting process, including internal control systems, and procedures designed to insure compliance with applicable laws and regulations. RetailMeNot’s independent registered public accounting firm, Ernst & Young, is responsible for expressing an opinion as to the conformity of our audited financial statements with generally accepted accounting principles.

The audit committee has reviewed and discussed with management the company’s audited financial statements. The audit committee has discussed with the independent registered public accounting firm the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (“PCAOB”). In addition, the audit committee has met with the independent registered public accounting firm, with and without management present, to discuss the overall scope of the independent registered public accounting firm’s audit, the results of its examinations, its evaluations of the company’s internal controls and the overall quality of RetailMeNot’s financial reporting.

The audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the audit committee concerning independence and has discussed with the independent registered public accounting firm its independence.

Based on the review and discussions referred to above, the audit committee recommended to RetailMeNot’s board of directors that the company’s audited financial statements be included in RetailMeNot’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

AUDIT COMMITTEE

Greg J. Santora, Chair

Jeffrey M. Crowe

Jules A. Maltz

The foregoing Report of the Audit Committee shall not be deemed to be incorporated by reference into any filing of RetailMeNot under the Securities Act of 1933 or the Exchange Act, except to the extent that RetailMeNot specifically incorporates such information by reference in such filing and shall not otherwise be deemed “filed” under either the Securities Act or the Exchange Act or considered to be “soliciting material.”

18

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of March 16, 2016.

| | | | | | |

Name | | Age | | | Position |

G. Cotter Cunningham | | | 53 | | | Chief Executive Officer, President and Chairman of the Board |

J. Scott Di Valerio | | | 53 | | | Chief Financial Officer |

Louis J. Agnese, III | | | 37 | | | Senior Vice President, Administration |

Kelli A. Beougher | | | 46 | | | Chief Operating Officer |

Paul M. Rogers | | | 47 | | | Chief Technology Officer |

Michael Magaro | | | 43 | | | Senior Vice President, Corporate Development and Investor Relations |

Jonathan B. Kaplan | | | 42 | | | General Counsel and Secretary |

G. Cotter Cunningham’s biography can be found on page 6 of this Proxy Statement with the biographies of the other members of the board of directors. Biographies for our other executive officers, including our other named executive offers, are below.

J. Scott Di Valerio has served as our Chief Financial Officer since December 2015. Mr. Di Valerio has more than 30 years of management, operations, and financial experience. He most recently served as chief executive officer at Outerwall, Inc. Mr. Di Valerio joined Outerwall in 2010 and served as the company’s chief financial officer until he was appointed chief executive officer in late 2013. In addition to his leadership of Outerwall’s financial organization, strategy, and operatings roles, Mr. Di Valerio also led the company’s corporate information technology and supply chain functions. Prior to Outerwall, Mr. Di Valerio served as president of the Americas for the Lenovo Group Limited. He also held senior positions at Microsoft Corporation, as corporate vice president of Microsoft’s OEM division from and as corporate vice president of finance and administration and chief accounting officer. Previously Mr. Di Valerio served in management positions at The Walt Disney Company and Mindwave Software Inc., and as a partner at PricewaterhouseCoopers. Mr. Di Valerio has a B.B.A. in accounting from the University of San Diego.

Louis J. Agnese, III has served as our Senior Vice President, Administration since December 2015. Mr. Agnese joined the company as General Counsel and Corporate Secretary in 2011 and was appointed interim Chief Financial Officer in December 2014. Prior to RetailMeNot, Mr. Agnese was an attorney with DLA Piper LLP and Akin Gump Strauss Hauer & Feld, representing numerous companies in capital markets transactions, public company compliance obligations and a wide range of private and public mergers and acquisitions. Mr. Agnese holds a J.D. from the University of Texas and a B.B.A. in international business with a minor in Japanese from the University of the Incarnate Word.

Kelli A. Beougher has served with us since December 2009, and was promoted to Chief Operating Officer in May 2012. Prior to joining us, Ms. Beougher served in various positions at Rakuten LinkShare from December 2001 to May 2009, most recently as Senior Vice President of Services. Before that time, she served in various capacities at GE Capital. Ms. Beougher holds a B.B.A. in marketing from the University of Texas.

Paul M. Rogers has served as our Chief Technology Officer since June 2011. Previously, he worked as Engineering Director with Google (GOOG) from February 2008 to May 2011. Prior to that time, he led the engineering team at Bazaarvoice (BV). He also held multiple development and technical management roles at Trilogy Software. Mr. Rogers holds a B.A. in psychology and managerial studies from Rice University.

Michael Magaro has served as our Senior Vice President of Corporate Development and Investor Relations since June 1, 2015. Mr. Magaro previously served as our Vice President, Investor Relations since May 2013 and as Vice President of Investor Relations, Strategic Operations and Corporate Development at ServiceSource from

19

August 2012 to May 2013. Prior to that, he served as Vice President of Investor Relations and Taleo and FormFactor from July 2010 to June 2012 and January 2008 to September 2010, respectively. He also served as Vice President of Corporate Development and Investor Relations at TIBCO Software from September 2005 to January 2008 and as its Vice President of Investor Relations from December 2000 to September 2005. Mr. Magaro holds a B.S. in finance from San Diego State University.

Jonathan B. Kaplan has served as our General Counsel and Secretary since August 2015. He previously served as our interim General Counsel beginning in December 2014 and as our Assistant General Counsel, Corporate from March 2014 until November 2014, after having joined RetailMeNot in January 2014 to work on various matters prior to his appointment. Prior to that, Mr. Kaplan worked as a corporate attorney at DLA Piper LLP from June 2011 through November 2013. He served as Chief Operating Officer of ROI Pop, Inc., a digital marketing agency from September 2010 to April 2011. Mr. Kaplan worked as a corporate attorney at Vinson & Elkins LLP from November 2008 through August 2010 and at Latham & Watkins LLP from September 2006 to October 2008. Mr. Kaplan holds a J.D. from the University of California, Davis School of Law (Order of the Coif) and a B.A., with honors, in religious studies from the University of California, Santa Barbara.

20

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the compensation program for our Principal Executive Officer, the two individuals who served as our Principal Financial Officer, and the next three most highly-compensated executive officers of the Company during 2015 (the “Named Executive Officers”). During 2015, these individuals were:

| | • | | G. Cotter Cunningham, our President and Chief Executive Officer (our “CEO”); |

| | • | | J. Scott Valerio, our Chief Financial Officer; |

| | • | | Louis J. Agnese, III, our Senior Vice President, Administration and, during a portion of 2015, our Interim Chief Financial Officer; |

| | • | | Kelli A. Beougher, our Chief Operating Officer; |

| | • | | Paul M. Rogers, our Chief Technology Officer; and |

| | • | | Michael Magaro, our Senior Vice President, Corporate Development and Investor Relations. |

Senior Management Changes in 2015

Effective June 1, 2015, Mr. Magaro, our Vice President, Investor Relations, was appointed our Senior Vice President, Corporate Development and Investor Relations.

Effective December 29, 2015, Mr. Di Valerio was appointed as our Chief Financial Officer, replacing Mr. Agnese who had been serving as our interim Chief Financial Officer. At that time, Mr. Agnese was appointed our Senior Vice President, Administration.

This Compensation Discussion and Analysis describes the material elements of our executive compensation program during 2015. It also provides an overview of our executive compensation philosophy and objectives. Finally, it analyzes how and why the Compensation Committee of our Board of Directors (the “Compensation Committee”) arrived at the specific compensation decisions for our executive officers, including the Named Executive Officers, for 2015, including the key factors that the Compensation Committee considered in determining their compensation.

This Compensation Discussion and Analysis contains forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. The actual compensation programs that we adopt in the future may differ materially from currently planned programs as summarized in this discussion.

Executive Summary

2015 Business Highlights

We operate a leading digital savings destination connecting consumers with retailers, restaurants and brands, both online and in-store. In 2015, our marketplace featured more than 800,000 digital offers each month. In addition to RetailMeNot.com, our international brand portfolio includes VoucherCodes.co.uk in the U.K., Poulpeo.com and Ma-Reduc.com in France, Actiepagina.nl in the Netherlands, RetailMeNot.de in Germany, RetailMeNot.it in Italy, RetailMeNot.es in Spain and RetailMeNot.ca in Canada.

21

2015 was a challenging year for our business, largely attributable to (i) consumers’ continuing shift to mobile devices, which monetize at a comparably lower rate to traffic to our desktop websites and (ii) deceleration in online traffic on our desktop and mobile websites. Despite these challenges, we had strong growth in both in-store and advertising net revenues. Our key financial results were as follows:

| | • | | Net revenues were $249.1 million, representing a decrease of 6% from $264.7 million in 2014; |

| | • | | Desktop online transaction net revenues were $173.9 million, representing a decrease of 21% from $220.5 million in 2014; |

| | • | | Mobile online transaction net revenues were $24.4 million, representing an increase of 56% from $14.7 million in 2014; |

| | • | | In-store and advertising net revenues were $50.8 million, representing an increase of 70.3% from $29.4 million in 2014; |

| | • | | Net income was $11.8 million, representing a decrease of 56.3% from $27.0 million in 2014; |

| | • | | Non-GAAP net income was $41.2 million, representing a decrease of 27.6% from $56.9 million in 2014; |

| | • | | Adjusted EBITDA was $71.9 million, down 23.4% from 2014 and representing 29.8% of net revenues; |

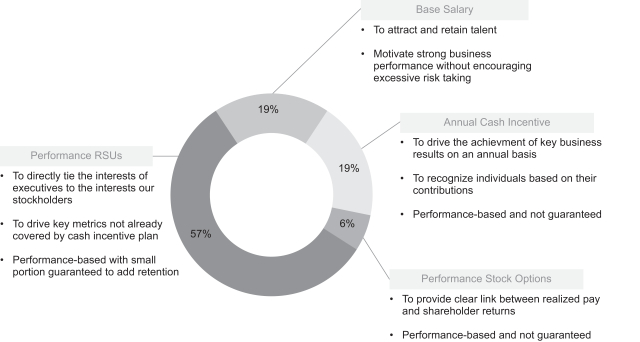

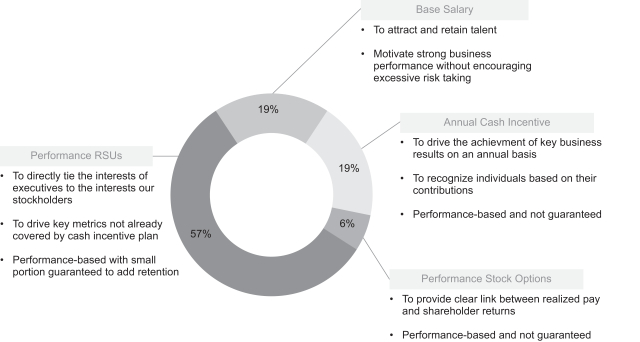

| | • | | Total visits grew 3% from 2014 to 718.4 million; and |