Investor Presentation March 31, 2020 Simone Lagomarsino President & Chief Executive Officer Laura Tarantino Executive Vice President & Chief Financial Officer

Forward‐Looking Statement This communication contains a number of forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward‐looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. All statements contained in this communication that are not clearly historical in nature are forward‐looking, and the words such as "anticipate," "believe," “continue,” "could," "estimate," "expect," “impact,” "intend," "seek," "may," "outlook," "plan," "potential," "predict," "project," "should," "will," "would" and similar terms and phrases are generally intended to identify forward‐looking statements. These forward‐looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward‐ looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward‐looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward‐looking statements. The COVID‐19 pandemic is adversely affecting us, our customers, counterparties, employees, and third‐party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity, and prospects is uncertain. Continued deterioration in general business and economic conditions, including further increases in unemployment rates, or turbulence in domestic or global financial markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, lead to a tightening of credit, and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID‐19, could affect us in substantial and unpredictable ways. Other factors include, without limitation, the “Risk Factors” referenced in our Annual Report on Form 10‐K for the year ended December 31, 2019 and other reports we file with the Securities and Exchange Commission (“SEC”). The risks and uncertainties listed from time to time in our reports and documents filed with the SEC include the following factors: challenges and uncertainties regarding the COVID‐19 pandemic, business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; the occurrence of significant natural or man‐made disasters, including fires, earthquakes, and terrorist acts; public health crisis and pandemics, including the COVID‐19 pandemic, and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; our management of risks inherent in our real estate loan portfolio, and the risk of a prolonged downturn in the real estate market; our ability to achieve organic loan and deposit growth and the composition ofsuchgrowth;thefiscal position of the U.S federal government and the soundness of other financial institutions; changes in consumer spending and savings habits; technological and social media changes; the laws and regulations applicable to our business; increased competition in the financial services industry; changes in the level of our nonperforming assets and charge‐offs; uncertainty regarding the future of LIBOR; our involvement from time to time in legal proceedings and examination and remedial actions by regulators; the composition of our management team and our ability to attract and retain key personnel; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems; and potential exposure to fraud, negligence, computer theft and cyber‐crime. Luther Burbank Corporation ("LBC", the "Company", "we", "us", or "our") can give no assurance that any goal or expectation set forth in forward‐looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. These forward‐looking statements are made as of the date of this communication, and the Company does not intend, and assumes no obligation, to update any forward‐looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by law. 2

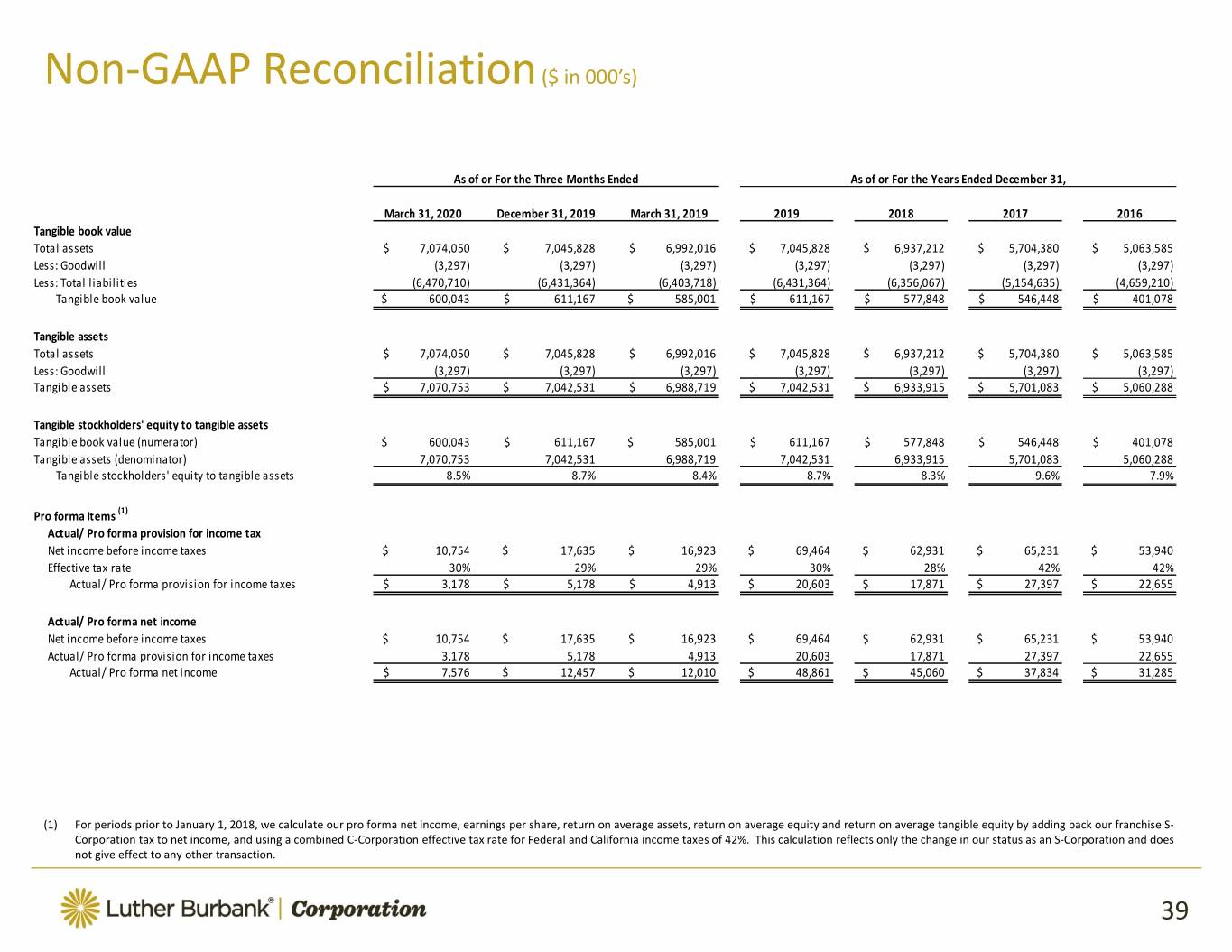

Use of Non‐GAAP Financial Measures This investor presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore, are considered non‐GAAP financial measures. The Company’s management uses these non‐GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations. Management believes that these non‐GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant changes in the current period. The Company’s management also believes that investors find these non‐GAAP financial measures useful as they assist investors in understanding our underlying operating performance and the analysis of ongoing operating trends. However, the non‐GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate the non‐GAAP financial measures discussed herein may differ from thatofothercompanies reporting measures with similar names. You should understand how such other banking organizations calculate their similar financial measures or with names similar to the non‐ GAAP financial measures we have discussed herein when comparing such non‐GAAP financial measures. Below is a listing of the non‐GAAP financial measures used in this investor presentation. • Pro forma items include provision for income taxes, net income, return on average assets, return on average equity and earnings per share. Prior to January 1, 2018, these pro forma amounts are calculated by adding back our franchise S‐Corporation tax to net income, and using a combined C‐Corporation effective tax rate for Federal and California income taxes of 42.0%. This calculation reflects only the changes in our status as a S‐Corporation and does not give effect to any other transaction. • Efficiency ratio is defined as noninterest expenses divided by operating revenue, which is equal to net interest income plus noninterest income. • Tangible book value and tangible stockholders’ equity to tangible assets are non‐GAAP measures that exclude the impact of goodwill and are used by the Company’s management to evaluate capital adequacy. Because intangible assets such as goodwill vary extensively from company to company, we believe that the presentation of these non‐GAAP financial measures allows investors to more easily compare the Company’s capital position to other companies. A reconciliation to these non‐GAAP financial measures to the most directly comparable GAAP measures are provided in the appendix to this investor presentation. 3

LBC Responding to COVID‐19 Our Depositors Our Borrowers Our Employees Our Communities • Branch offices remain open • Increased staffing dedicated • Remote work capabilities • Increased contributions • Ability to transact business to handling borrower and flexible working hours to to nonprofit programs via mobile, online or by inquiries maintain our productivity that provide access to telephone • Modifications with no and efficiency while food and shelter for • Increased ATM withdrawal payments for 6 months for minimizing COVID‐19 those most in need limits and no ATM fees; SFR first‐time home buyer exposure risk • Sponsored nearly $1.5 waivers of certain early borrowers • Reduced branch hours from million in Federal Home withdrawal penalties and • Modifications with no 10 a.m. to 3 p.m. to limit Loan Bank Affordable overdraft fees payments for 3 to 6 months public exposure Housing Program (“FHLB • Customer mailings and for portfolio Single Family • Special wellness payment for AHP”) grant applications website postings: LBC Residential (“SFR”) and eligible branch employees to partners providing contact information; how to Commercial Real Estate • Implemented federal, state, affordable housing and transact business; greater (“CRE”) borrowers and local guidance on primary health and awareness around scams • Accepting applications and protective measures, dental care and cybercriminals; and links continuing to originate new including social distancing • Donated N95 masks to to the CDC/WHO real estate loans with protocols and providing local hospital tightened credit disinfectants/hand sanitizer underwriting guidelines • Frequent communication about access to employee benefits 4

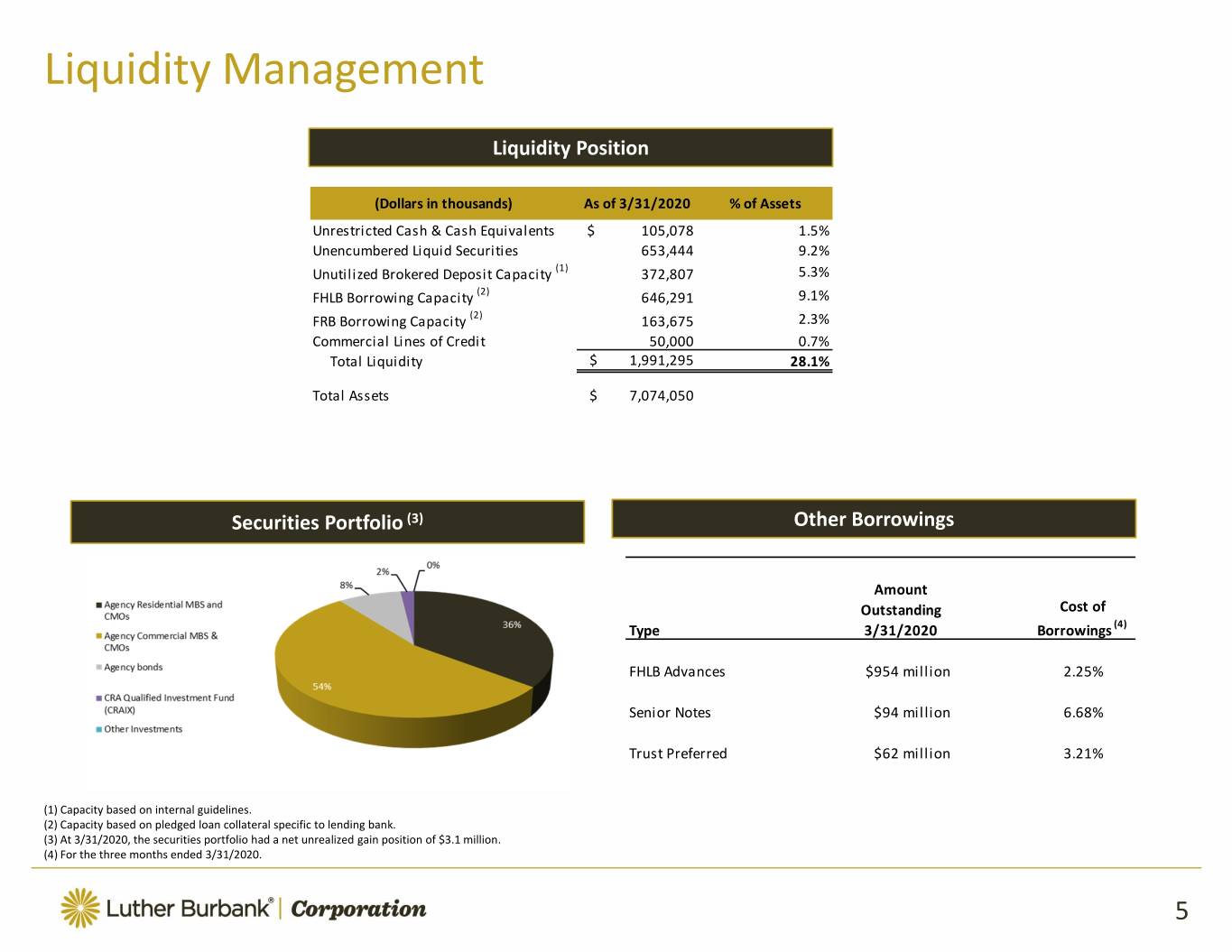

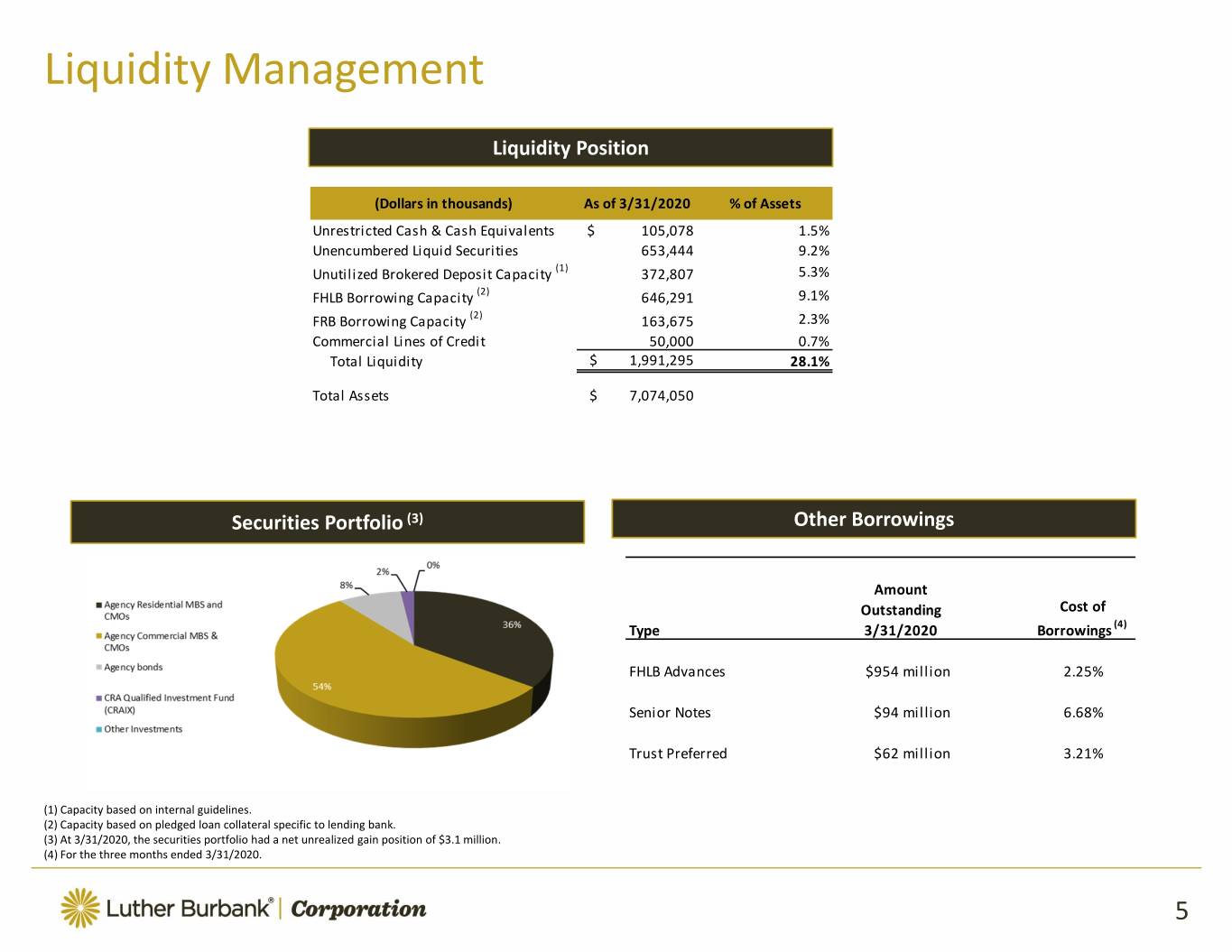

Liquidity Management Liquidity Position (Dollars in thousands) As of 3/31/2020 % of Assets Unrestricted Cash & Cash Equivalents $ 105,078 1.5% Unencumbered Liquid Securities 653,444 9.2% Unutilized Brokered Deposit Capacity (1) 372,807 5.3% FHLB Borrowing Capacity (2) 646,291 9.1% FRB Borrowing Capacity (2) 163,675 2.3% Commercial Lines of Credit 50,000 0.7% Total Liquidity $ 1,991,295 28.1% Total Assets $ 7,074,050 Securities Portfolio (3) Other Borrowings Amount Outstanding Cost of Type 3/31/2020 Borrowings (4) FHLB Advances $954 million 2.25% Senior Notes $94 million 6.68% Trust Preferred $62 million 3.21% (1) Capacity based on internal guidelines. (2) Capacity based on pledged loan collateral specific to lending bank. (3) At 3/31/2020, the securities portfolio had a net unrealized gain position of $3.1 million. (4) For the three months ended 3/31/2020. 5

Limited Exposure to Nonresidential CRE 3/31/2020 Loan Portfolio Composition Weighted % of Tot a l ($ in 000's) Count Balance Avg. LTV (1) Loans Multifamily Real Estate 2,525 $ 4,058,869 56.6% 65.3% Single Family Real Estate 2,114 1,930,831 64.7% 31.1% Commercial Real Estate Type: Strip Retail 23 49,205 51.4% 0.8% Mid Rise Office 7 39,303 65.1% 0.6% Low Rise Office 14 25,448 55.2% 0.4% Medical Office 8 20,822 63.1% 0.3% Shopping Center 5 14,635 53.7% 0.2% Multi-Tenant Industrial 8 12,917 49.4% 0.2% Anchored Retail 3 12,477 53.9% 0.2% Mixed Use > 50% Commercial 10 9,611 49.2% 0.2% Unanchored Retail 6 7,603 44.9% 0.1% Shadow Retail 3 4,980 58.4% 0.1% Warehouse 4 3,110 41.4% 0.1% Flex Industrial 2 2,531 65.1% 0.0% Restaurant 2 1,550 34.4% 0.0% Single-Tenant Industrial 2 1,372 50.5% 0.0% Other 1 93 17.7% 0.0% Commer cial Re al Es t at e 98 205,657 55.6% 3.2% Construction & Land Development 14 22,857 53.0% 0.4% No n - mo r t g a g e Lo a n s 1 100 NA 0.0% (1) Construction and land developmTotalent LTV is calculated based on an “as completed” property value. 4,752 $ 6,218,314 59.1% 100.0% Other Loan Notes: • At March 31, 2020, the Bank had three secured lines of credit with a total commitment of $4.6 million. There are no unsecured lines of credit in the portfolio. • LBC does not intend to participate in the Paycheck Protection Program given the small amount of business clients in our customer base. 6

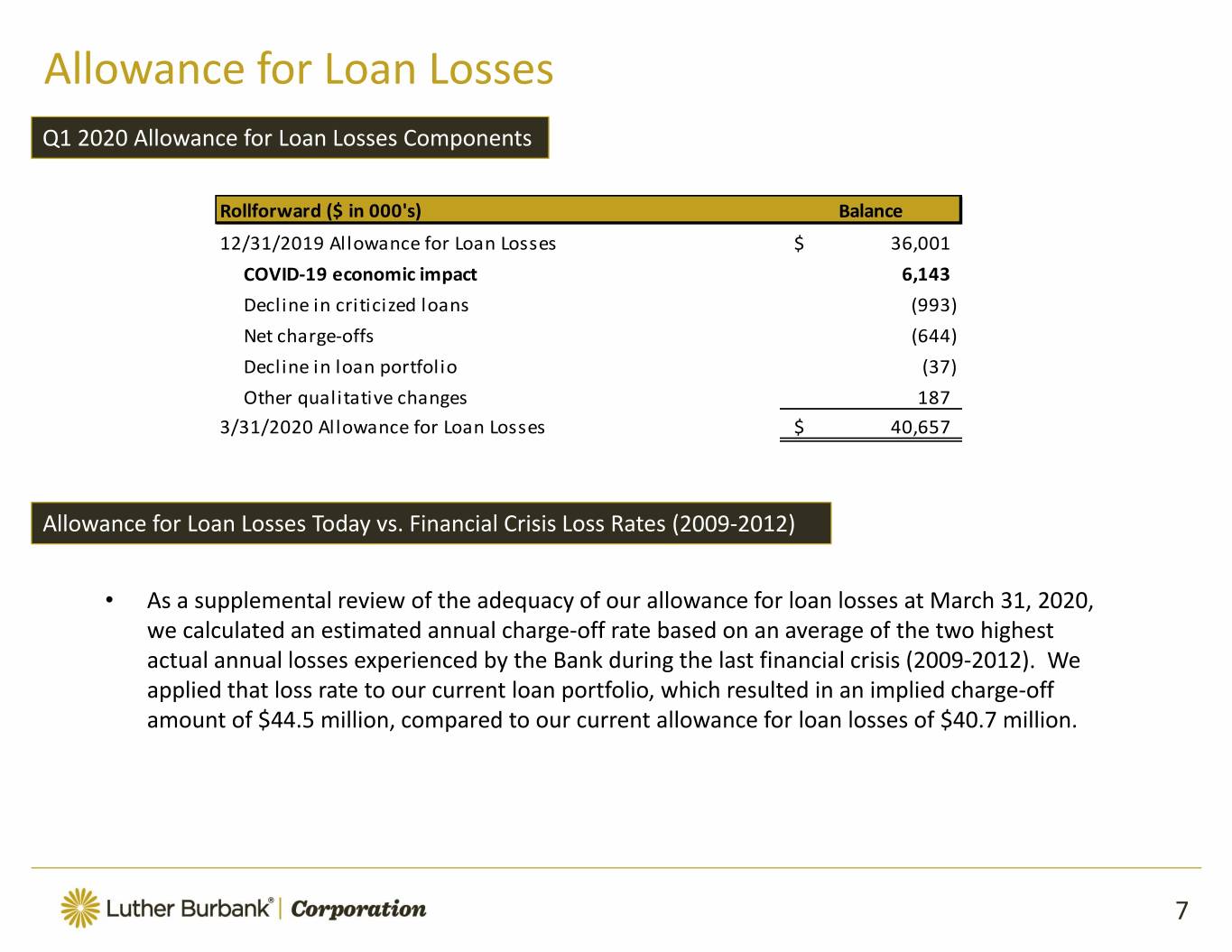

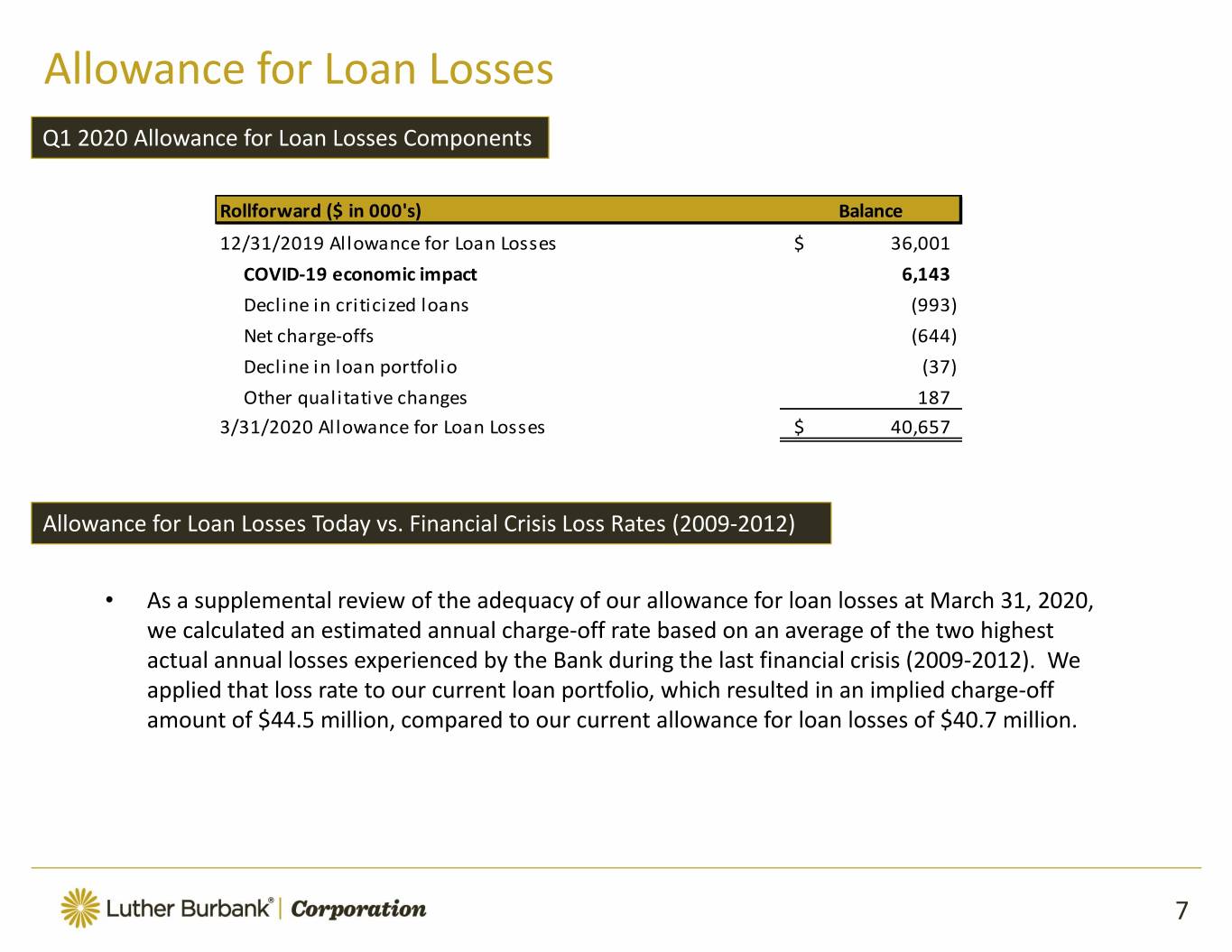

Allowance for Loan Losses Q1 2020 Allowance for Loan Losses Components Rollforward ($ in 000's) Balance 12/31/2019 Allowance for Loan Losses$ 36,001 COVID‐19 economic impact 6,143 Decline in criticized loans (993) Net charge‐offs (644) Decline in loan portfolio (37) Other qualitative changes 187 3/31/2020 Allowance for Loan Losses$ 40,657 Allowance for Loan Losses Today vs. Financial Crisis Loss Rates (2009‐2012) • As a supplemental review of the adequacy of our allowance for loan losses at March 31, 2020, we calculated an estimated annual charge‐off rate based on an average of the two highest actual annual losses experienced by the Bank during the last financial crisis (2009‐2012). We applied that loss rate to our current loan portfolio, which resulted in an implied charge‐off amount of $44.5 million, compared to our current allowance for loan losses of $40.7 million. 7

COVID‐19 Hardship Applications As of April 30, 2020 Total Completed Applications Received % of Loan Monthly # of Portfolio Cashflow ($ in 000's) Loans Current Balance Segment Impact Multifamily residential 61 $ 88,527 2.2% $ 445 Single family residential 90 111,920 5.9% 517 Commercial real estate 14 51,167 24.4% 274 Construction and land loans 1 1,142 5.4% 147 Total (1) 166 $ 252,756 4.1% $ 1,383 Approved for Payment Deferral % of Loan Monthly # of Portfolio Cashflow ($ in 000's) Loans Current Balance Segment Impact Multifamily residential 11 $ 12,280 0.3% $ 61 Single family residential 49 57,718 3.0% 259 Commercial real estate 3 13,559 6.5% 73 Construction and land loans 1 1,142 5.4% 147 Total 64 $ 84,699 1.4% $ 540 (1) Included in the total completed applications table above are 13 loans totaling $11.2 million, where an application was received and the deferral request was denied given a lack of current hardship. Not included in the tables above are 232 incomplete applications received related to loans totaling $332.1 million and 17 withdrawn applications totaling $18.2 million. 8

Capital Management Tier 1 Leverage Ratio Common Equity Tier 1 Risk‐Based Ratio $379mm, or $317mm, or 135%, above 113%, above regulatory regulatory minimum minimum Tier 1 Risk‐Based Capital Ratio Total Risk‐Based Capital Ratio $318mm, or $280mm, or 93%, above 67%, above regulatory regulatory minimum minimum • After returning excess capital to shareholders over the past few years, our capital ratios continue to be well above regulatory minimums. • Common shares outstanding at March 31, 2020 were reduced by 1.7 million shares, or 3%, compared to December 31, 2019. • Returned $19.7 million to shareholders during Q1 2020 • Net share repurchases of $16.5 million • Quarterly common stock dividend of $0.0575 per share, or $3.2 million 9

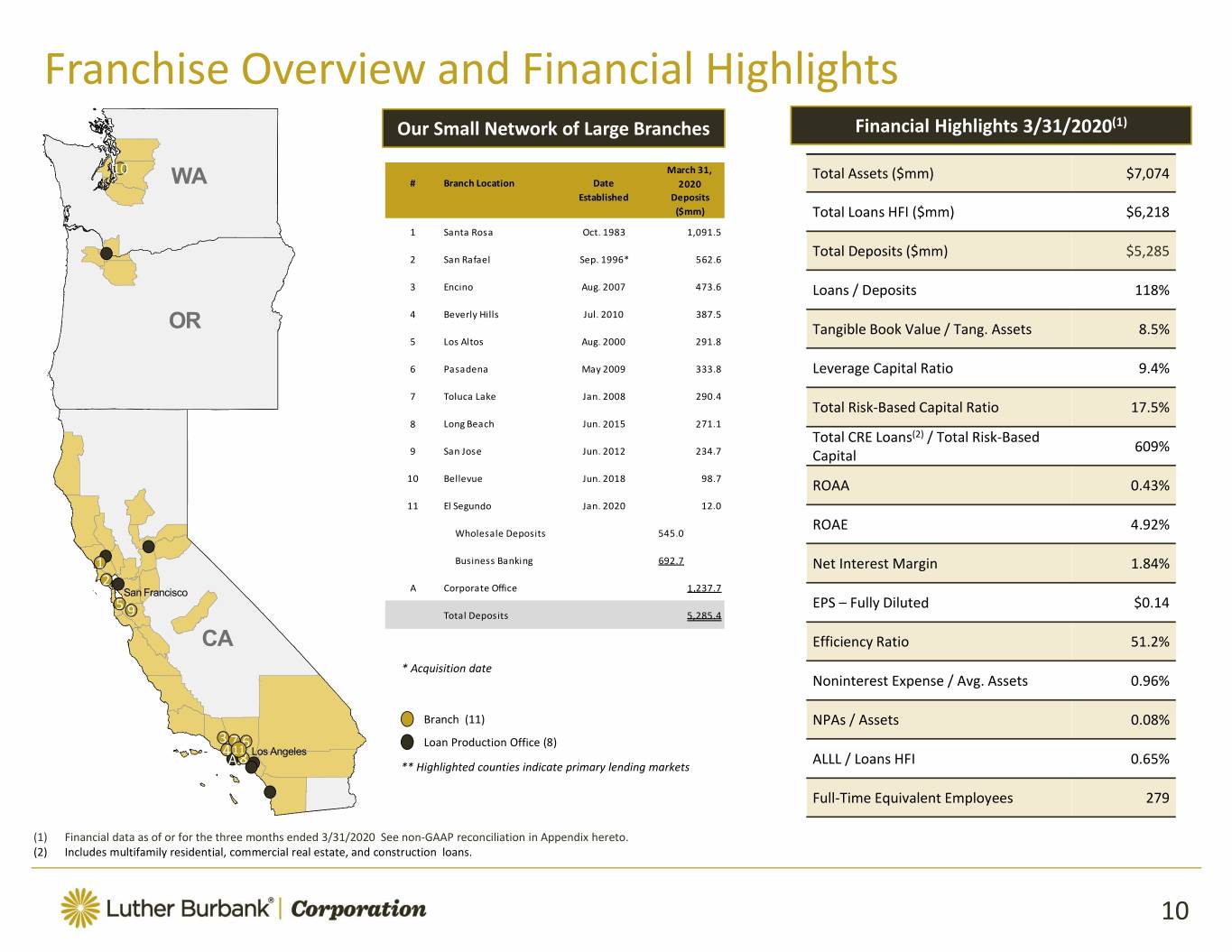

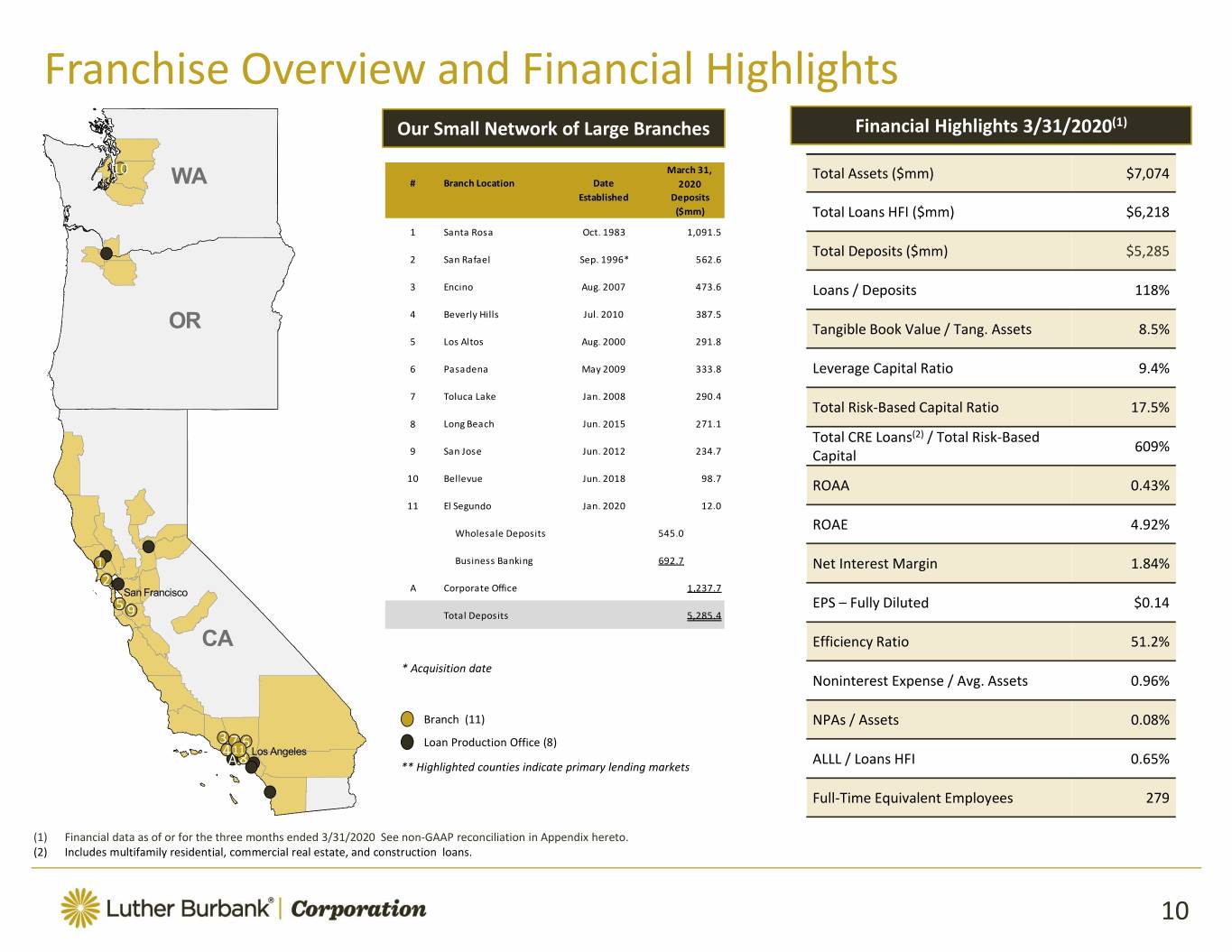

Franchise Overview and Financial Highlights Our Small Network of Large Branches Financial Highlights 3/31/2020(1) 10 March 31, Total Assets ($mm) $7,074 WA # Branch Location Date 2020 Established Deposits ($mm) Total Loans HFI ($mm) $6,218 1 Santa Rosa Oct. 1983 1,091.5 Total Deposits ($mm) $5,285 2 San Rafael Sep. 1996* 562.6 3 Encino Aug. 2007 473.6 Loans / Deposits 118% 4 Beverly Hills Jul. 2010 387.5 OR Tangible Book Value / Tang. Assets 8.5% 5 Los Altos Aug. 2000 291.8 6 Pasadena May 2009 333.8 Leverage Capital Ratio 9.4% 7Toluca Lake Jan. 2008 290.4 Total Risk‐Based Capital Ratio 17.5% 8 Long Beach Jun. 2015 271.1 Total CRE Loans(2) / Total Risk‐Based 609% 9 San Jose Jun. 2012 234.7 Capital 10 Bellevue Jun. 2018 98.7 ROAA 0.43% 11 El Segundo Jan. 2020 12.0 ROAE 4.92% Wholesale Deposits 545.0 11 Business Banking 692.7 Net Interest Margin 1.84% 22 San Francisco A Corporate Office 1,237.7 55 9 EPS – Fully Diluted $0.14 9 Total Deposits 5,285.4 CA Efficiency Ratio 51.2% * Acquisition date Noninterest Expense / Avg. Assets 0.96% Branch (11) NPAs / Assets 0.08% 33 6 77 6 Loan Production Office (8) 4411 Los Angeles 8 ALLL / Loans HFI 0.65% A ** Highlighted counties indicate primary lending markets Full‐Time Equivalent Employees 279 (1) Financial data as of or for the three months ended 3/31/2020 See non‐GAAP reconciliation in Appendix hereto. (2) Includes multifamily residential, commercial real estate, and construction loans. 10

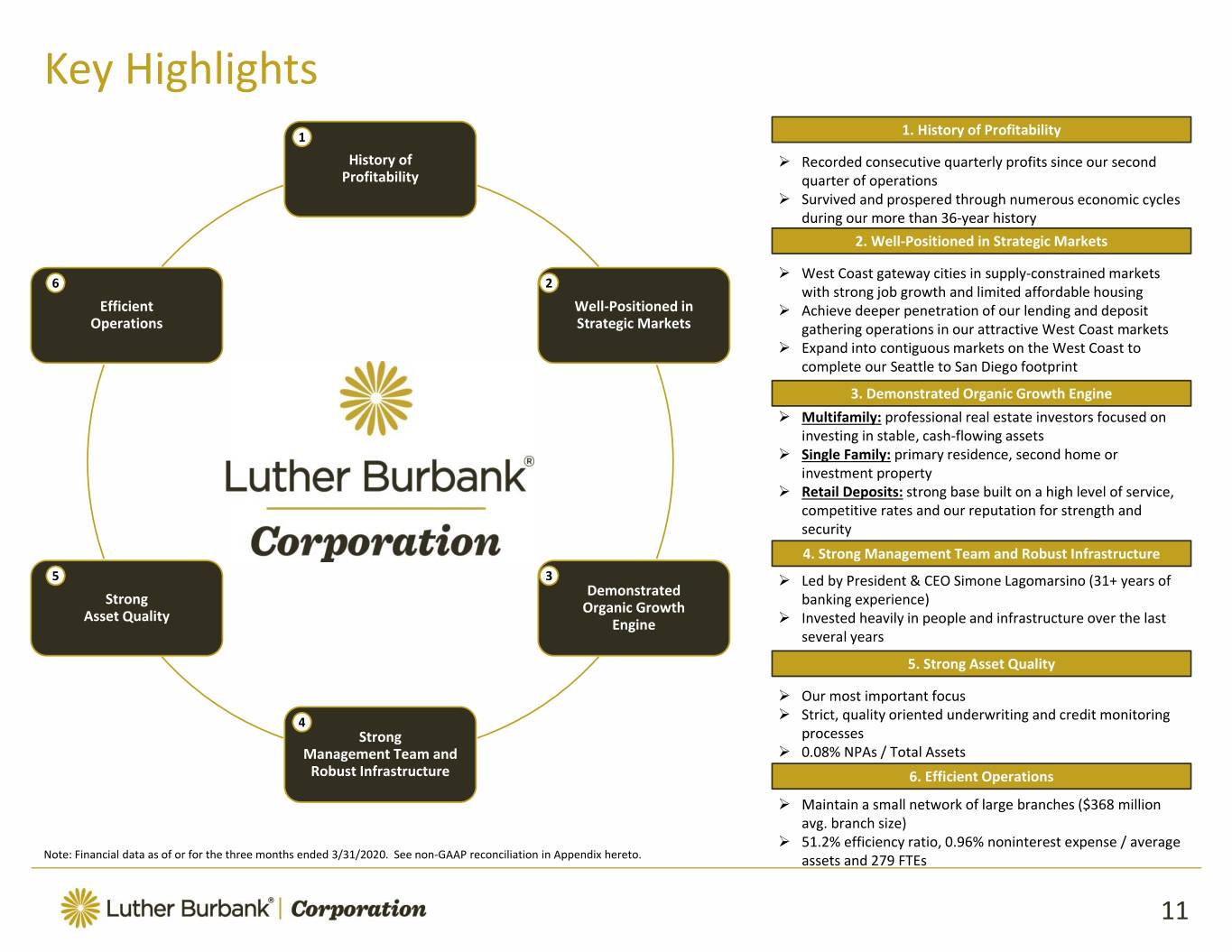

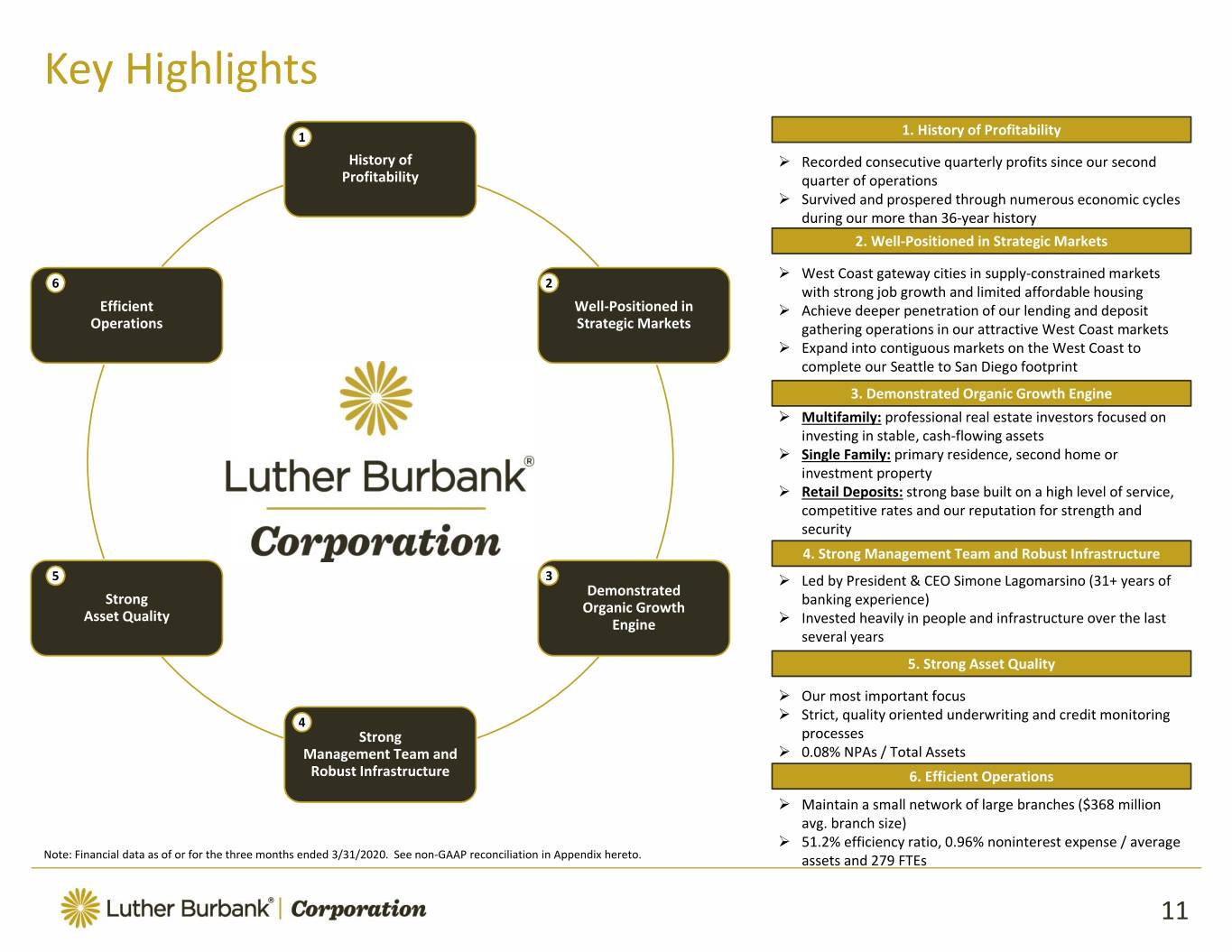

Key Highlights 1 1. History of Profitability History of Recorded consecutive quarterly profits since our second Profitability quarter of operations Survived and prospered through numerous economic cycles during our more than 36‐year history 2. Well‐Positioned in Strategic Markets West Coast gateway cities in supply‐constrained markets 6 2 with strong job growth and limited affordable housing Efficient Well‐Positioned in Achieve deeper penetration of our lending and deposit Operations Strategic Markets gathering operations in our attractive West Coast markets Expand into contiguous markets on the West Coast to complete our Seattle to San Diego footprint 3. Demonstrated Organic Growth Engine Multifamily: professional real estate investors focused on investing in stable, cash‐flowing assets Single Family: primary residence, second home or investment property Retail Deposits: strong base built on a high level of service, competitive rates and our reputation for strength and security 4. Strong Management Team and Robust Infrastructure 5 3 Led by President & CEO Simone Lagomarsino (31+ years of Demonstrated Strong banking experience) Organic Growth Asset Quality Engine Invested heavily in people and infrastructure over the last several years 5. Strong Asset Quality Our most important focus 4 Strict, quality oriented underwriting and credit monitoring Strong processes Management Team and 0.08% NPAs / Total Assets Robust Infrastructure 6. Efficient Operations Maintain a small network of large branches ($368 million avg. branch size) 51.2% efficiency ratio, 0.96% noninterest expense / average Note: Financial data as of or for the three months ended 3/31/2020. See non‐GAAP reconciliation in Appendix hereto. assets and 279 FTEs 11

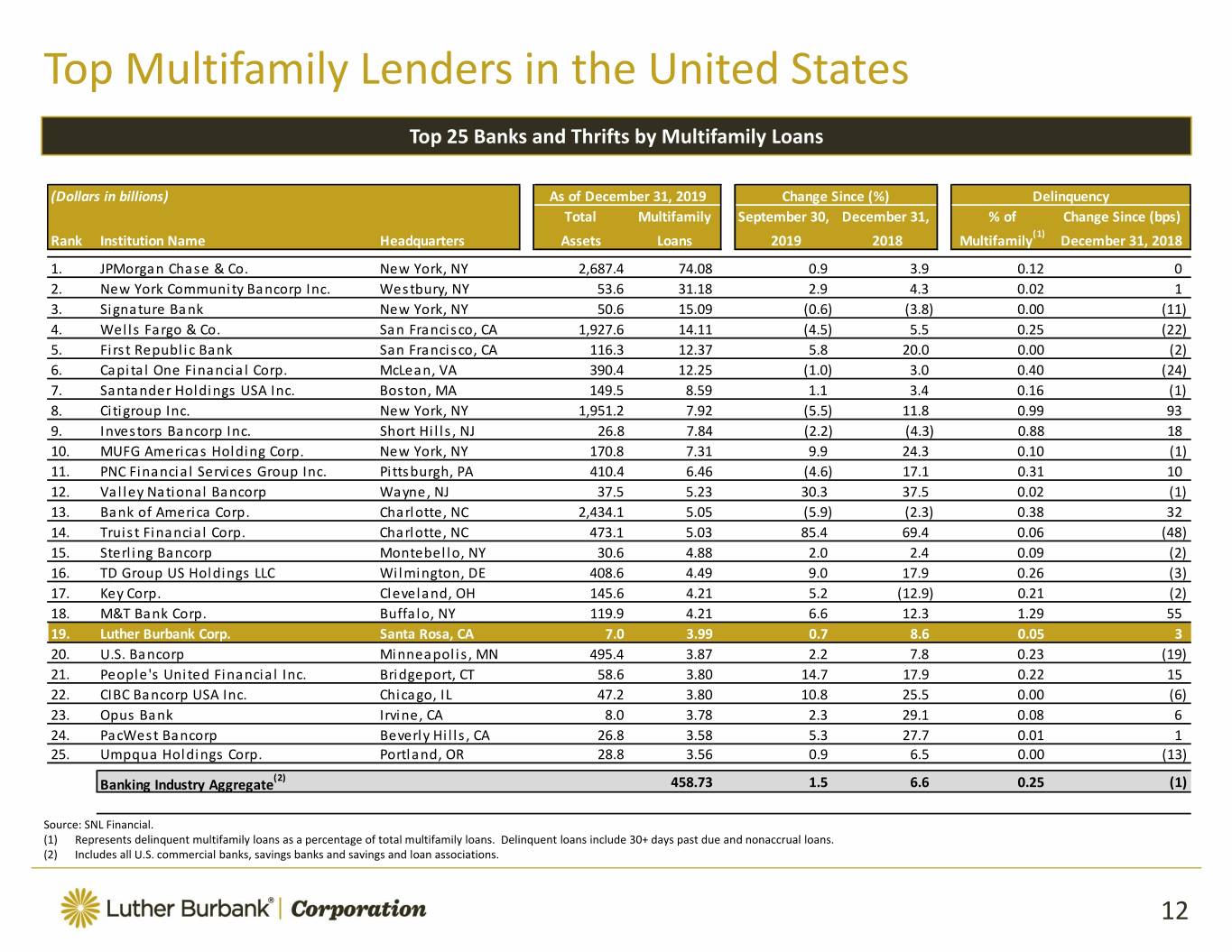

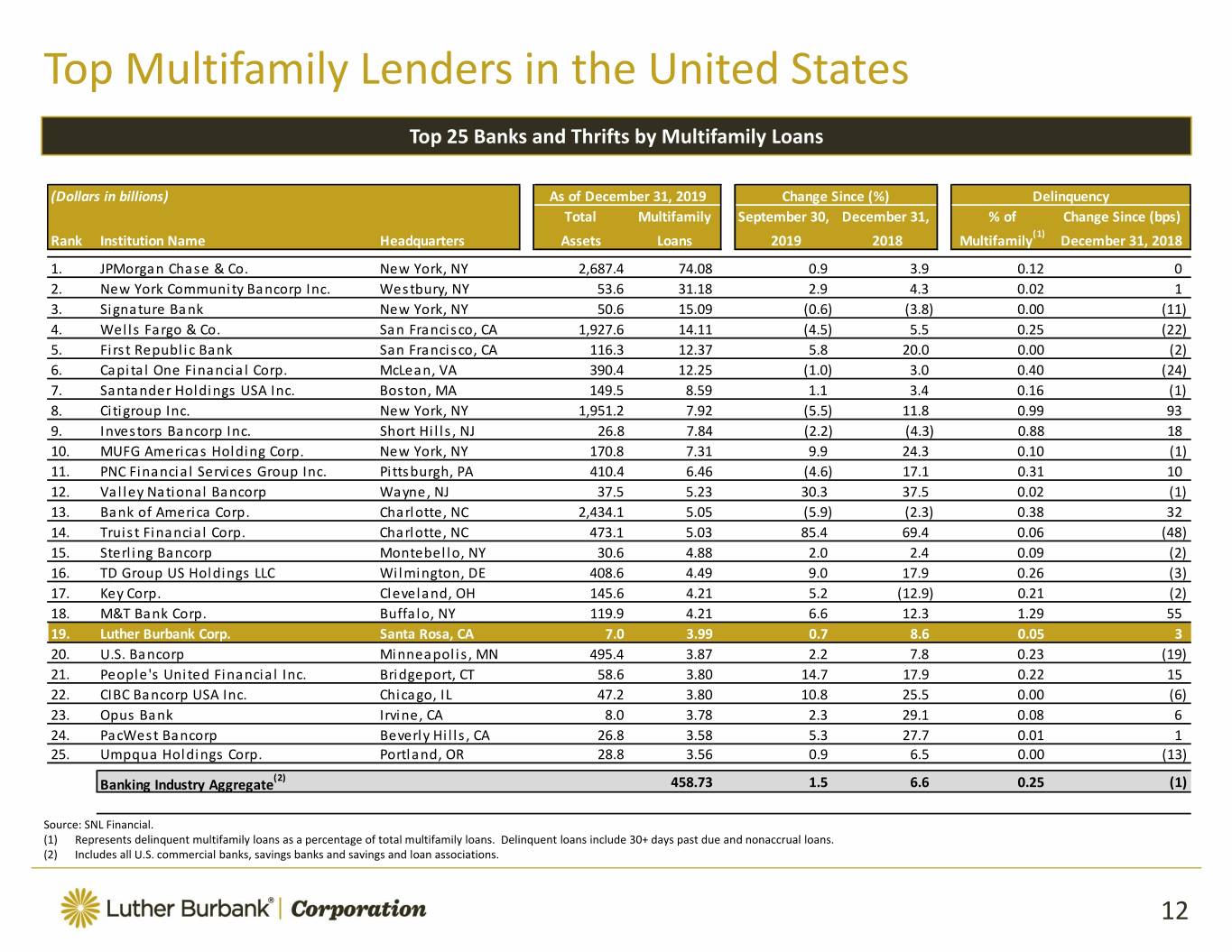

Top Multifamily Lenders in the United States Top 25 Banks and Thrifts by Multifamily Loans (Dollars in billions) As of December 31, 2019 Change Since (%) Delinquency Total Multifamily September 30, December 31, % of Change Since (bps) Rank Institution Name Headquarters Assets Loans 2019 2018 Multifamily(1) December 31, 2018 1. JPMorgan Chase & Co. New York, NY 2,687.4 74.08 0.9 3.9 0.12 0 2. New York Community Bancorp Inc. Westbury, NY 53.6 31.18 2.9 4.3 0.02 1 3. Signature Bank New York, NY 50.6 15.09 (0.6) (3.8) 0.00 (11) 4. Wells Fargo & Co. San Francisco, CA 1,927.6 14.11 (4.5) 5.5 0.25 (22) 5. First Republic Bank San Francisco, CA 116.3 12.37 5.8 20.0 0.00 (2) 6. Capital One Financial Corp. McLean, VA 390.4 12.25 (1.0) 3.0 0.40 (24) 7. Santander Holdings USA Inc. Boston, MA 149.5 8.59 1.1 3.4 0.16 (1) 8. Citigroup Inc. New York, NY 1,951.2 7.92 (5.5) 11.8 0.99 93 9. Investors Bancorp Inc. Short Hills, NJ 26.8 7.84 (2.2) (4.3) 0.88 18 10. MUFG Americas Holding Corp. New York, NY 170.8 7.31 9.9 24.3 0.10 (1) 11. PNC Financial Services Group Inc. Pittsburgh, PA 410.4 6.46 (4.6) 17.1 0.31 10 12. Valley National Bancorp Wayne, NJ 37.5 5.23 30.3 37.5 0.02 (1) 13. Bank of America Corp. Charlotte, NC 2,434.1 5.05 (5.9) (2.3) 0.38 32 14. Truist Financial Corp. Charlotte, NC 473.1 5.03 85.4 69.4 0.06 (48) 15. Sterling Bancorp Montebello, NY 30.6 4.88 2.0 2.4 0.09 (2) 16. TD Group US Holdings LLC Wilmington, DE 408.6 4.49 9.0 17.9 0.26 (3) 17. Key Corp. Cleveland, OH 145.6 4.21 5.2 (12.9) 0.21 (2) 18. M&T Bank Corp. Buffalo, NY 119.9 4.21 6.6 12.3 1.29 55 19. Luther Burbank Corp. Santa Rosa, CA 7.0 3.99 0.7 8.6 0.05 3 20. U.S. Bancorp Minneapolis, MN 495.4 3.87 2.2 7.8 0.23 (19) 21. People's United Financial Inc. Bridgeport, CT 58.6 3.80 14.7 17.90.2215 22. CIBC Bancorp USA Inc. Chicago, IL 47.2 3.80 10.8 25.5 0.00 (6) 23. Opus Bank Irvine, CA 8.0 3.78 2.3 29.1 0.08 6 24. PacWest Bancorp Beverly Hills, CA 26.8 3.58 5.3 27.7 0.01 1 25. Umpqua Holdings Corp. Portland, OR 28.8 3.56 0.9 6.5 0.00 (13) Banking Industry Aggregate(2) 458.73 1.5 6.6 0.25 (1) Source: SNL Financial. (1) Represents delinquent multifamily loans as a percentage of total multifamily loans. Delinquent loans include 30+ days past due and nonaccrual loans. (2) Includes all U.S. commercial banks, savings banks and savings and loan associations. 12

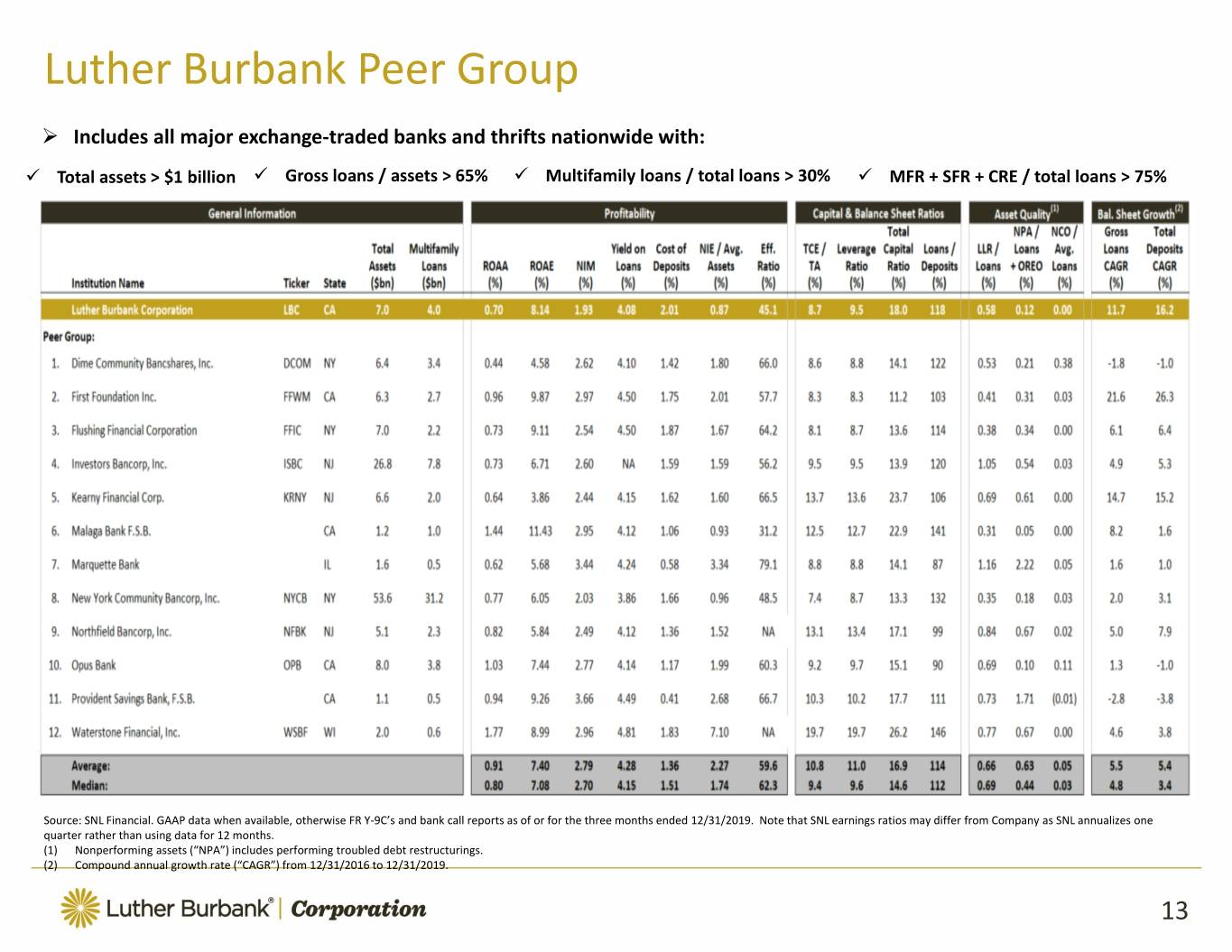

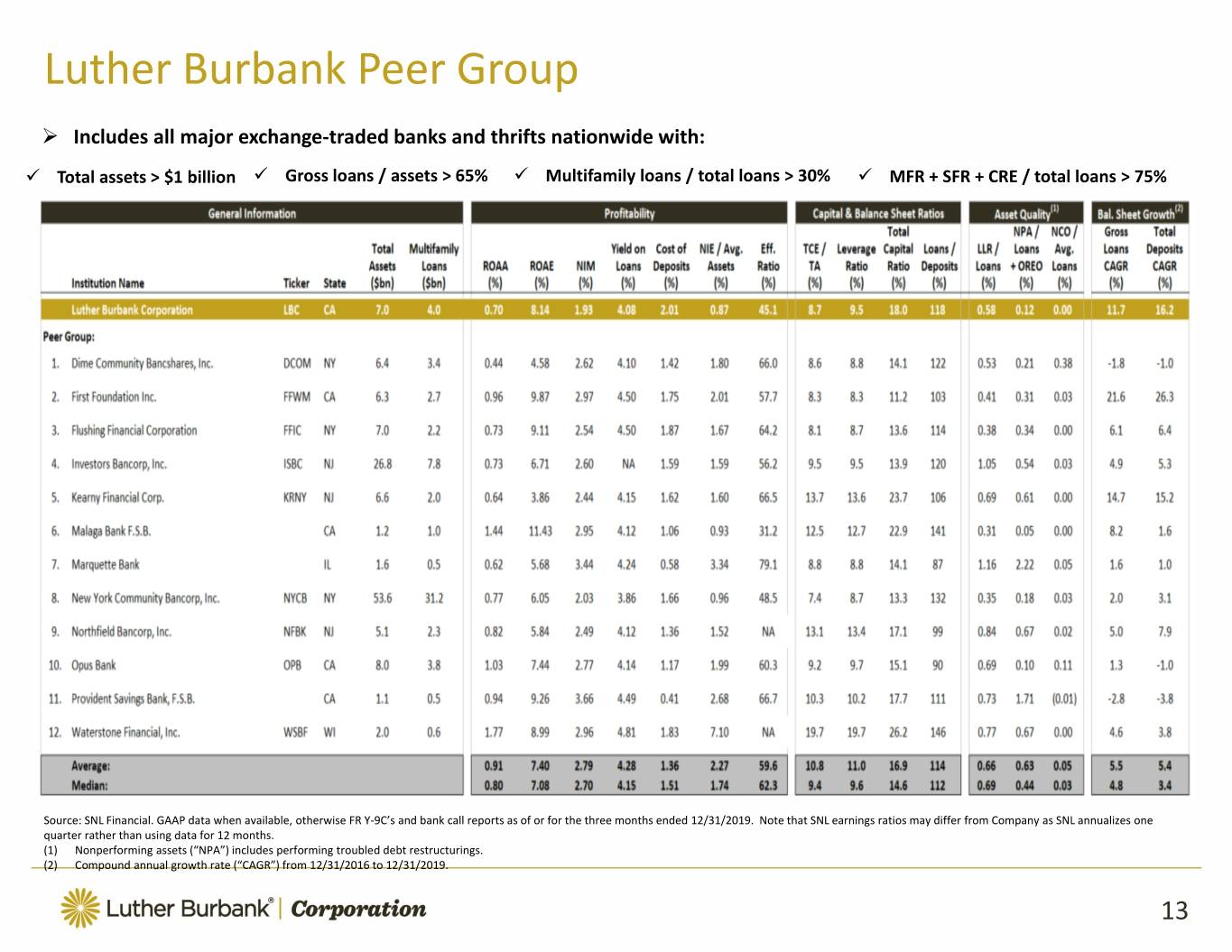

Luther Burbank Peer Group Includes all major exchange‐traded banks and thrifts nationwide with: Total assets > $1 billion Gross loans / assets > 65% Multifamily loans / total loans > 30% MFR + SFR + CRE / total loans > 75% Source: SNL Financial. GAAP data when available, otherwise FR Y‐9C’s and bank call reports as of or for the three months ended 12/31/2019. Note that SNL earnings ratios may differ from Company as SNL annualizes one quarter rather than using data for 12 months. (1) Nonperforming assets (“NPA”) includes performing troubled debt restructurings. (2) Compound annual growth rate (“CAGR”) from 12/31/2016 to 12/31/2019. 13

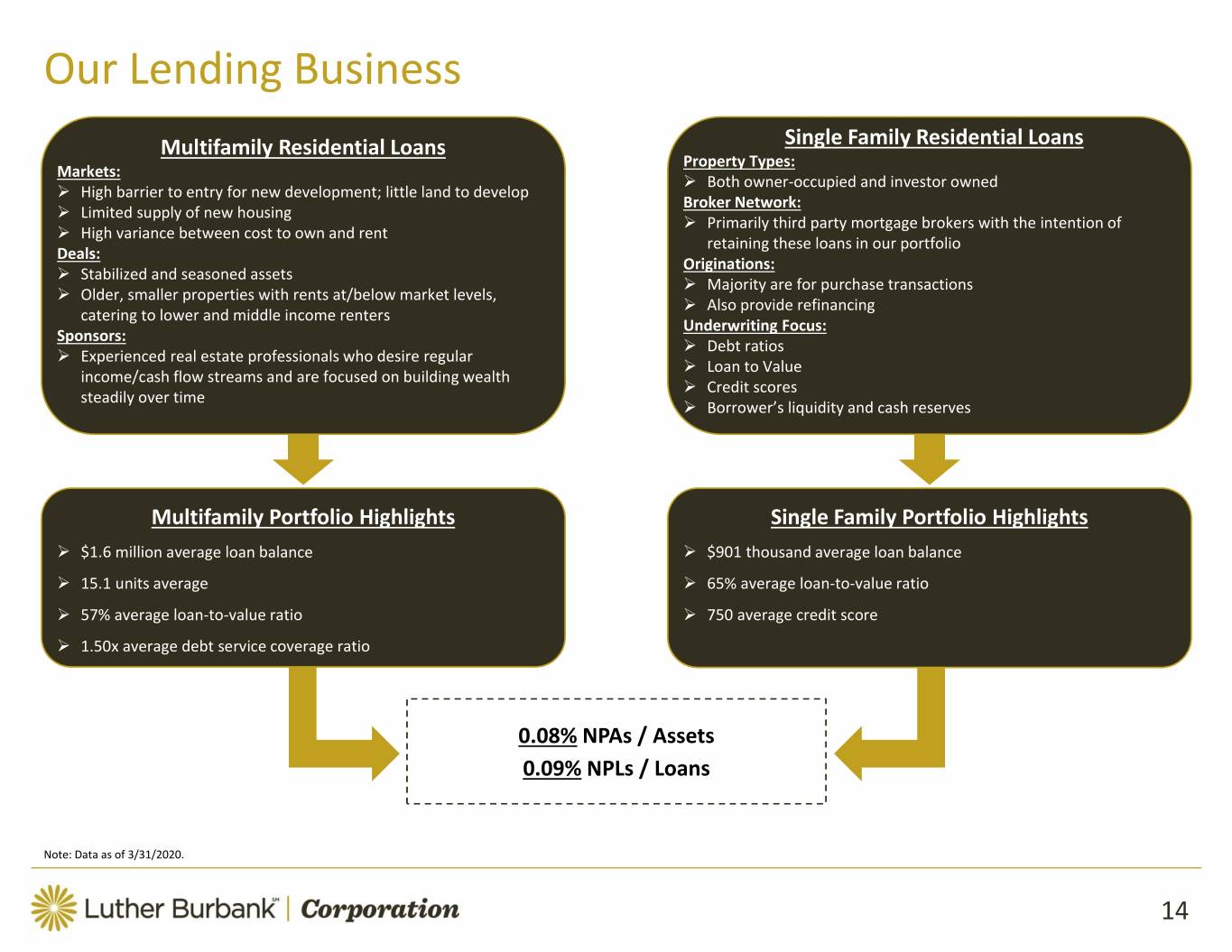

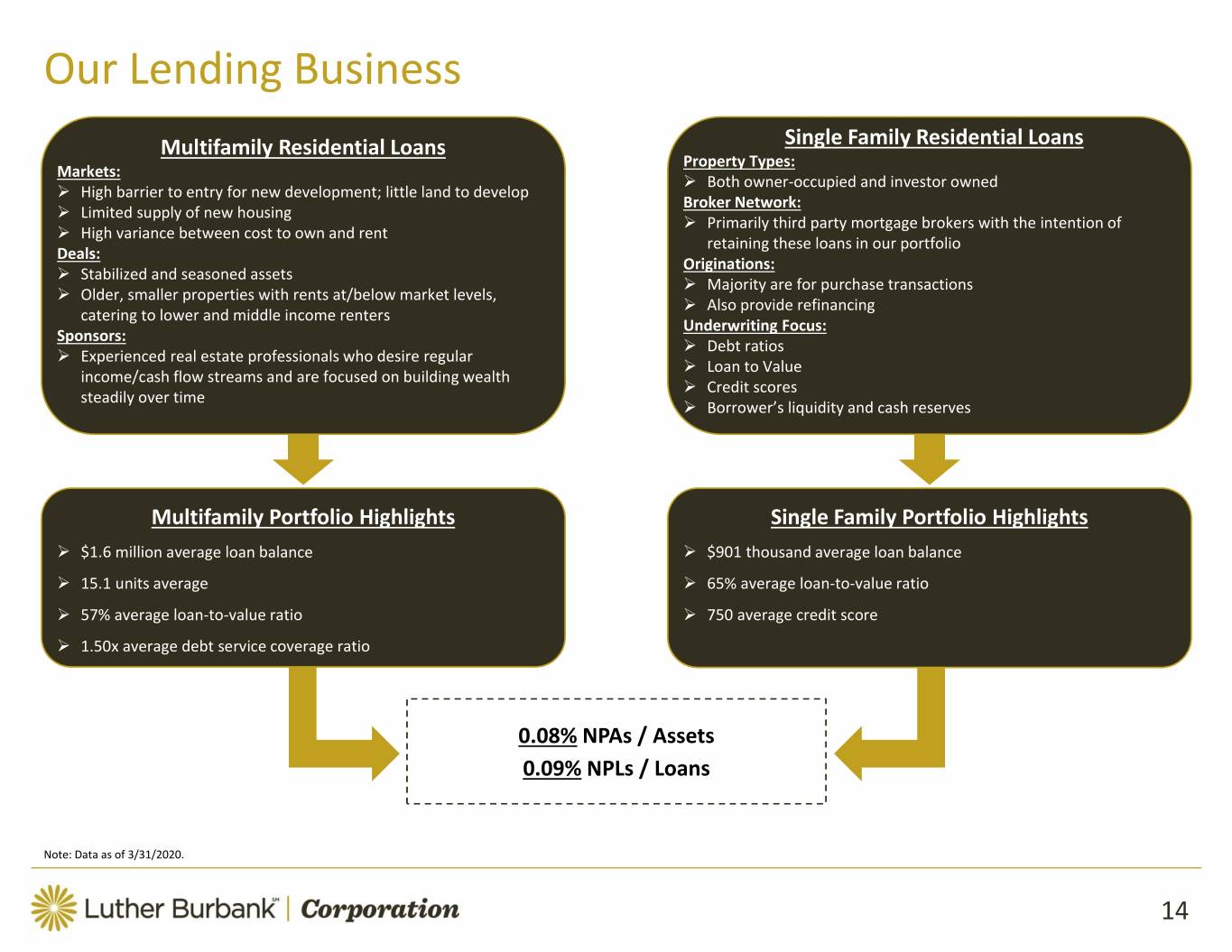

Our Lending Business Multifamily Residential Loans Single Family Residential Loans Property Types: Markets: Both owner‐occupied and investor owned High barrier to entry for new development; little land to develop Broker Network: Limited supply of new housing Primarily third party mortgage brokers with the intention of High variance between cost to own and rent retaining these loans in our portfolio Deals: Originations: Stabilized and seasoned assets Majority are for purchase transactions Older, smaller properties with rents at/below market levels, Also provide refinancing catering to lower and middle income renters Underwriting Focus: Sponsors: Debt ratios Experienced real estate professionals who desire regular Loan to Value income/cash flow streams and are focused on building wealth Credit scores steadily over time Borrower’s liquidity and cash reserves Multifamily Portfolio Highlights Single Family Portfolio Highlights $1.6 million average loan balance $901 thousand average loan balance 15.1 units average 65% average loan‐to‐value ratio 57% average loan‐to‐value ratio 750 average credit score 1.50x average debt service coverage ratio 0.08% NPAs / Assets 0.09% NPLs / Loans Note: Data as of 3/31/2020. 14

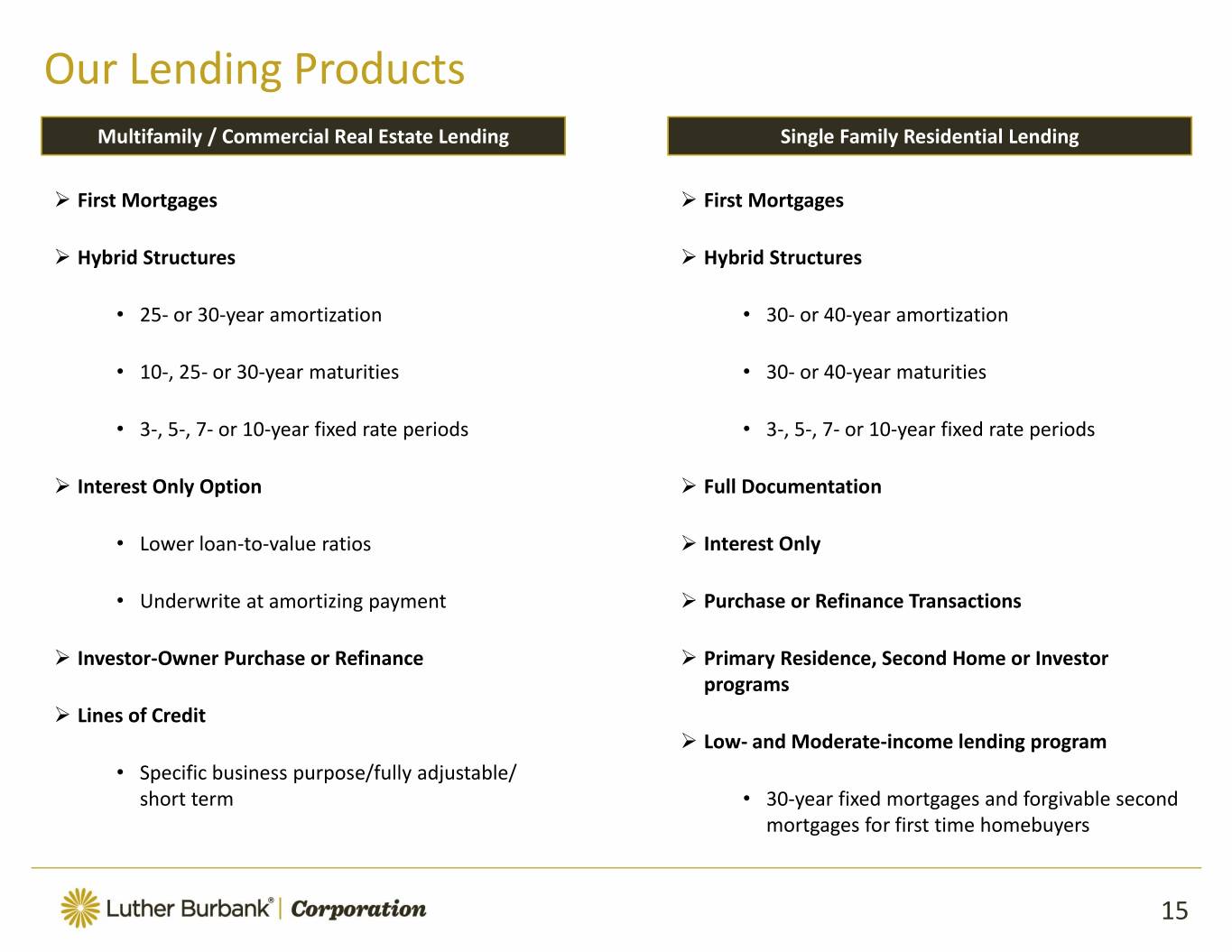

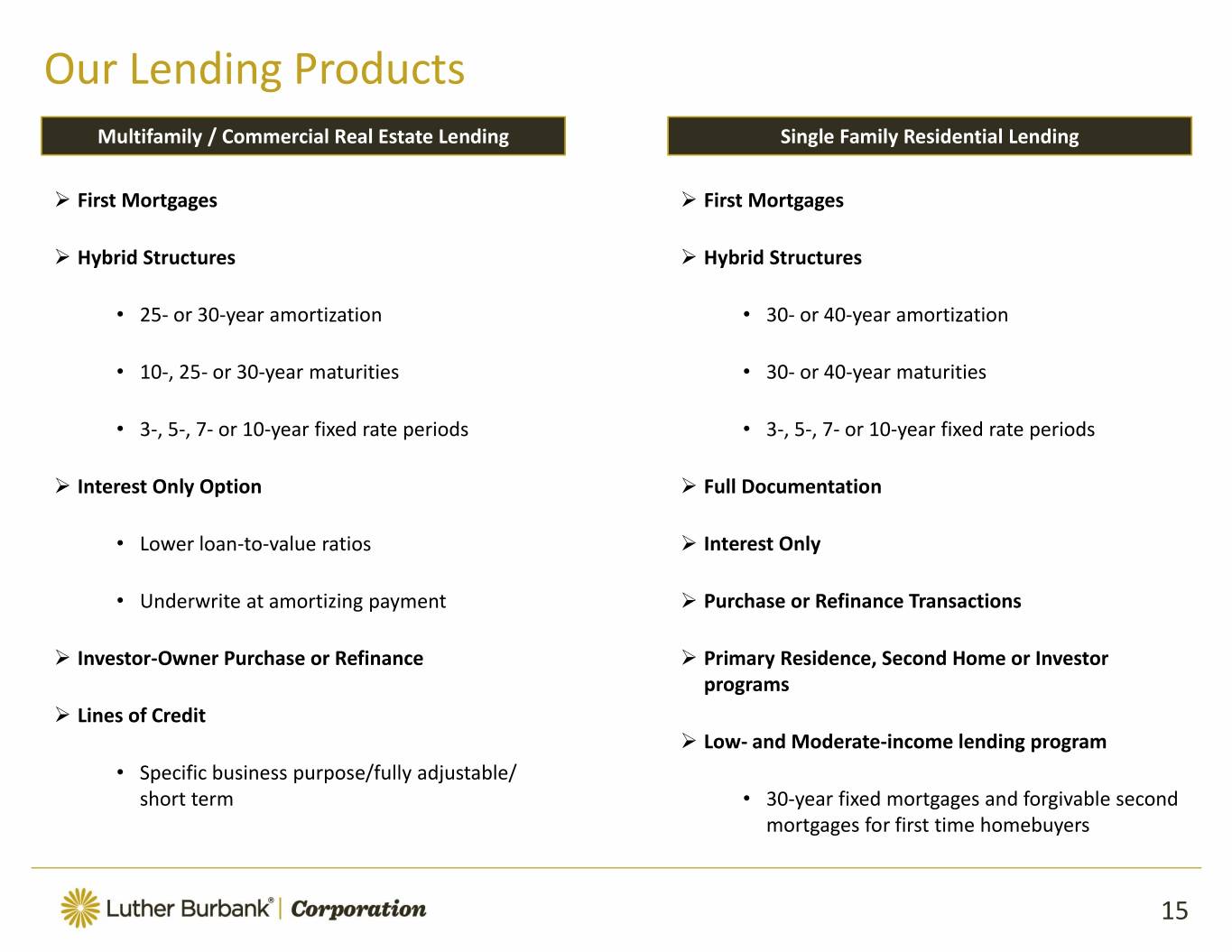

Our Lending Products Multifamily / Commercial Real Estate Lending Single Family Residential Lending First Mortgages First Mortgages Hybrid Structures Hybrid Structures • 25‐ or 30‐year amortization • 30‐ or 40‐year amortization • 10‐, 25‐ or 30‐year maturities • 30‐ or 40‐year maturities • 3‐, 5‐, 7‐ or 10‐year fixed rate periods • 3‐, 5‐, 7‐ or 10‐year fixed rate periods Interest Only Option Full Documentation • Lower loan‐to‐value ratios Interest Only • Underwrite at amortizing payment Purchase or Refinance Transactions Investor‐Owner Purchase or Refinance Primary Residence, Second Home or Investor programs Lines of Credit Low‐ and Moderate‐income lending program • Specific business purpose/fully adjustable/ short term • 30‐year fixed mortgages and forgivable second mortgages for first time homebuyers 15

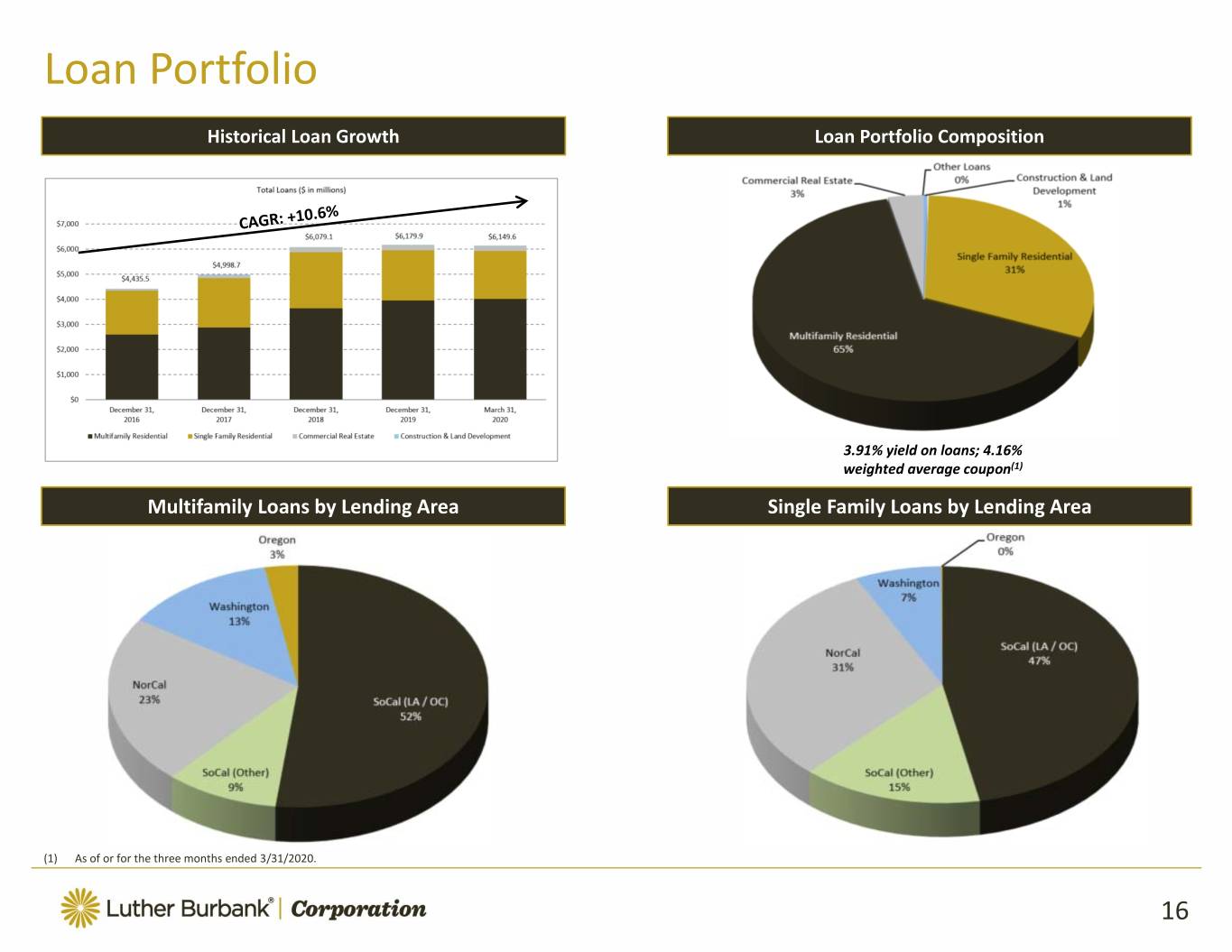

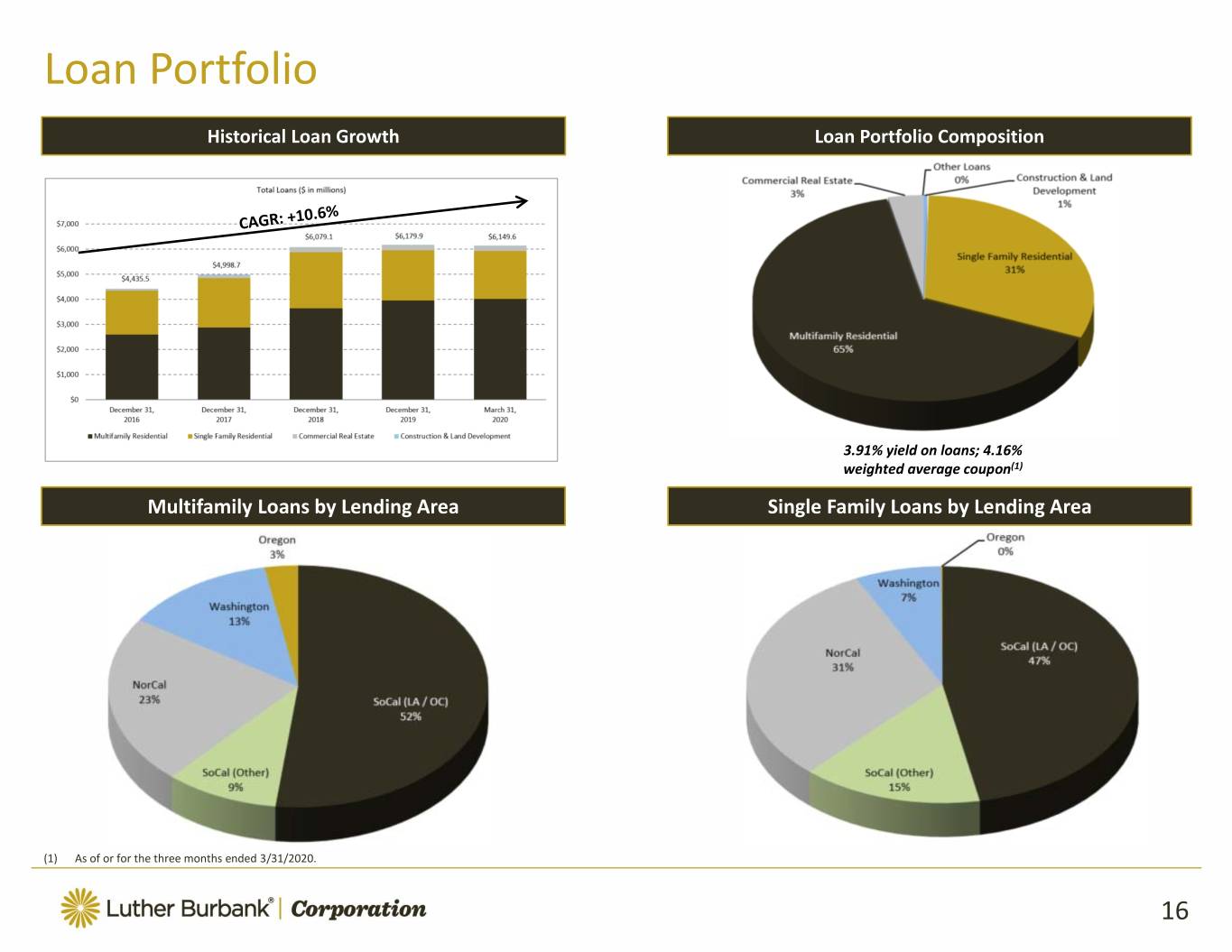

Loan Portfolio Historical Loan Growth Loan Portfolio Composition 3.91% yield on loans; 4.16% weighted average coupon(1) Multifamily Loans by Lending Area Single Family Loans by Lending Area (1) As of or for the three months ended 3/31/2020. 16

Asset Quality Nonperforming Assets(1) / Total Assets Culture Approach Results Risk management is a core competency of Continuous evaluation of risk and return 3/31/2020 NPAs / Total Assets of 0.08%; our business NPLs / Total Loans of 0.09% Strict separation between business Extensive expertise among our lending development and credit decisions NPAs and loans 90+ days past due to total and credit administration staff and assets have been at low levels since 2016 Vigilant response to adverse economic executive officers conditions and specific problem credits Only one foreclosure in the past five years Credit decisions are made efficiently and Strict, quality oriented underwriting and consistent with our underwriting credit monitoring processes standards (1) Excludes performing troubled debt restructurings. 17

Loan Origination Volume and Rates $1,564.1 Q4 4.15% Q3 4.26% Q2 4.44% Q1 Q1 4.62% 3.98% Pipeline: • Total loan pipeline at March 31, 2020 is $526.4 million ($271.7 million CRE at 3.815% WAC, $239.9 million SFR at 3.701% WAC & $14.8 million Construction at 5.335% WAC). A portion of our pipeline will ultimately fallout/not fund and loans without rate locks are subject to ongoing rate increases/decreases. • Q2 2019 originations include a $10.1 million CRE loan purchase. • Q1 2020 originations include a $20.4 million CRE loan purchase. 18

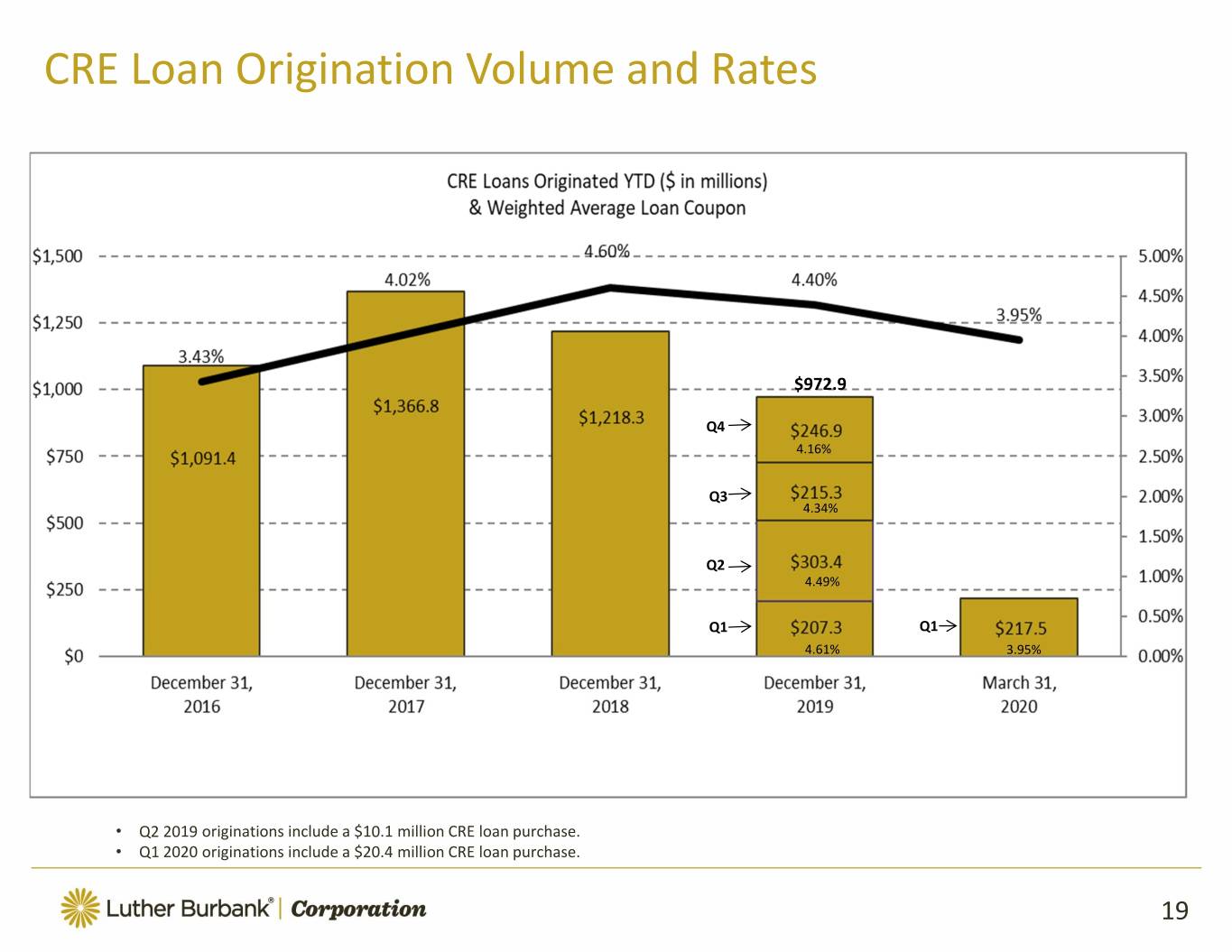

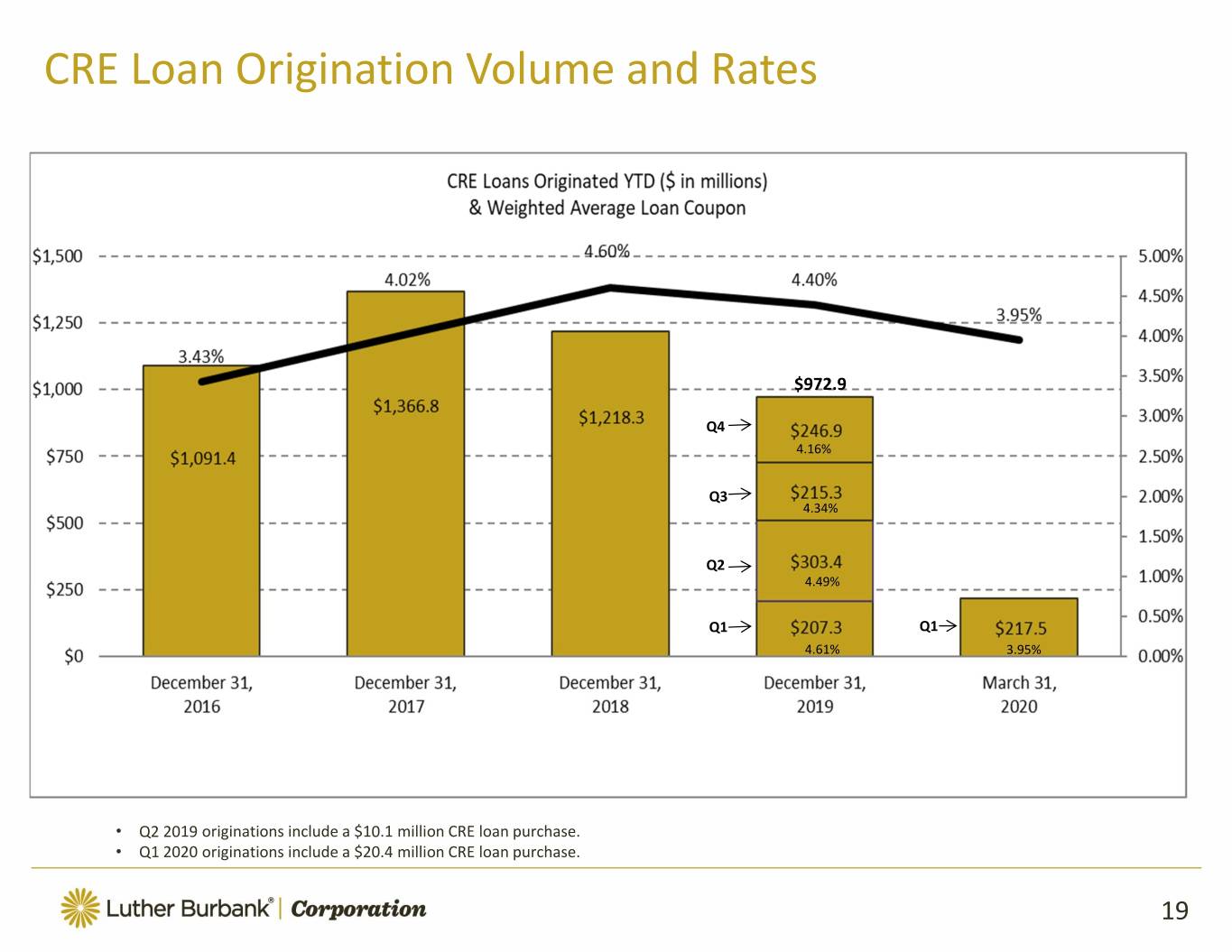

CRE Loan Origination Volume and Rates $972.9 Q4 4.16% Q3 4.34% Q2 4.49% Q1 Q1 4.61% 3.95% • Q2 2019 originations include a $10.1 million CRE loan purchase. • Q1 2020 originations include a $20.4 million CRE loan purchase. 19

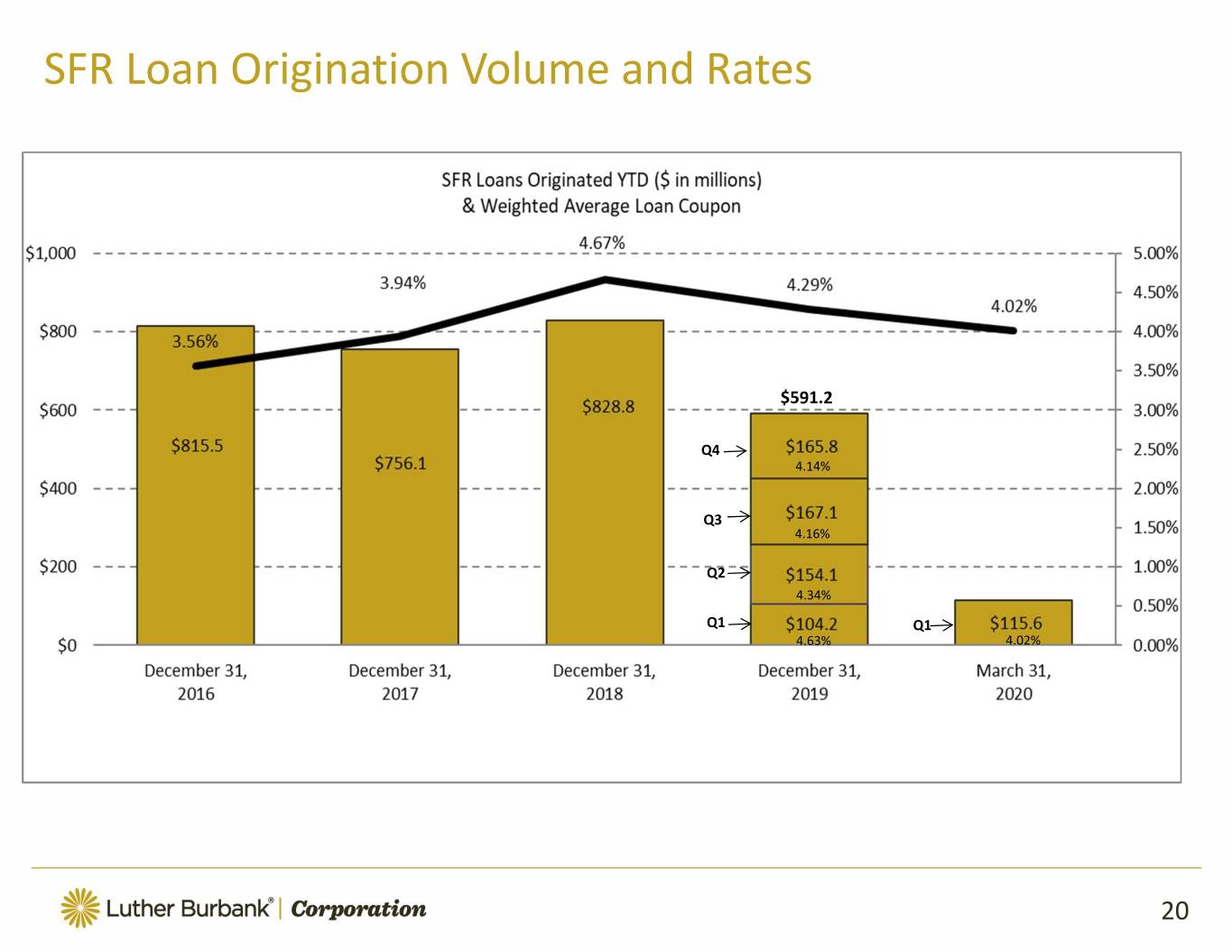

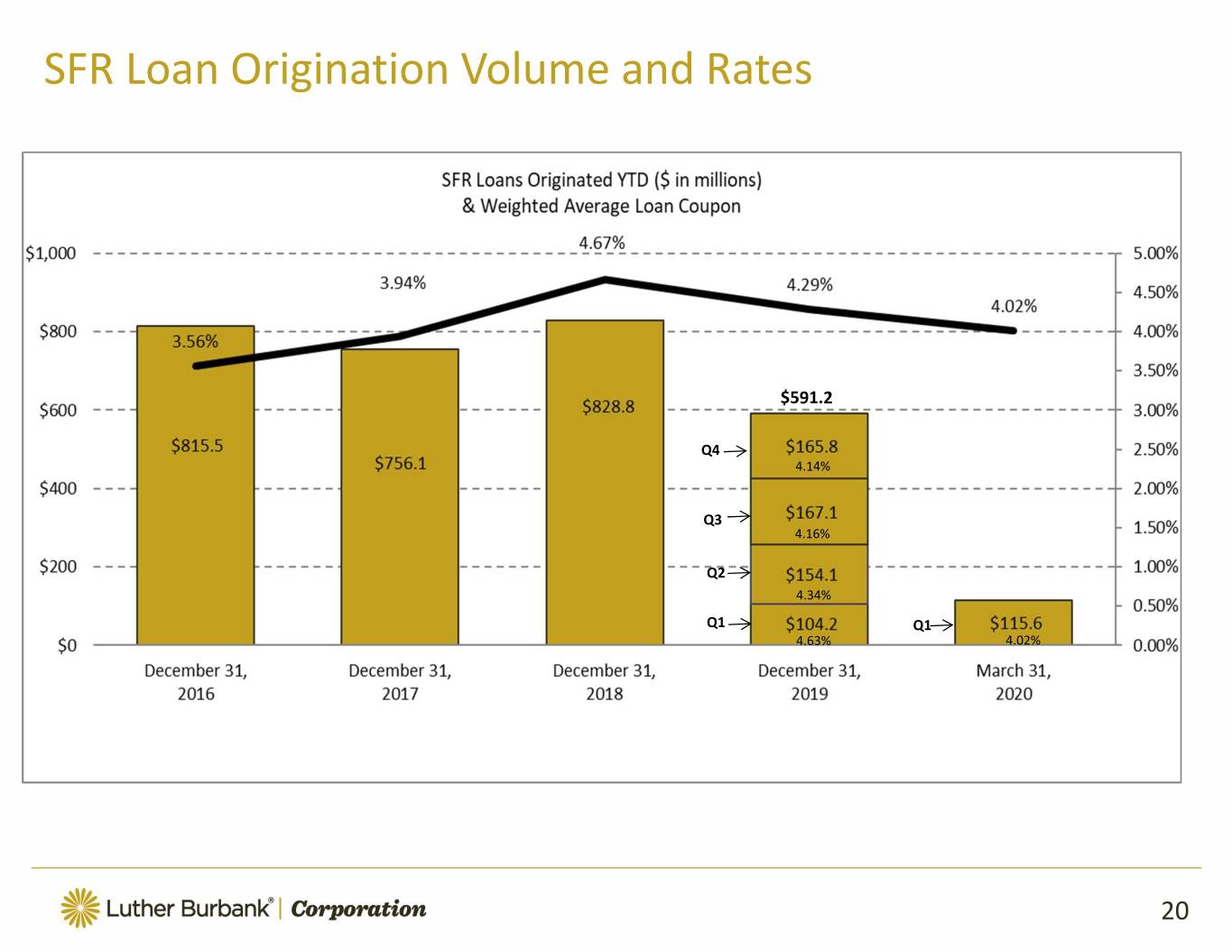

SFR Loan Origination Volume and Rates 5.15% $591.2 Q4 4.14% Q3 4.16% Q2 4.34% Q1 Q1 4.63% 4.02% 20

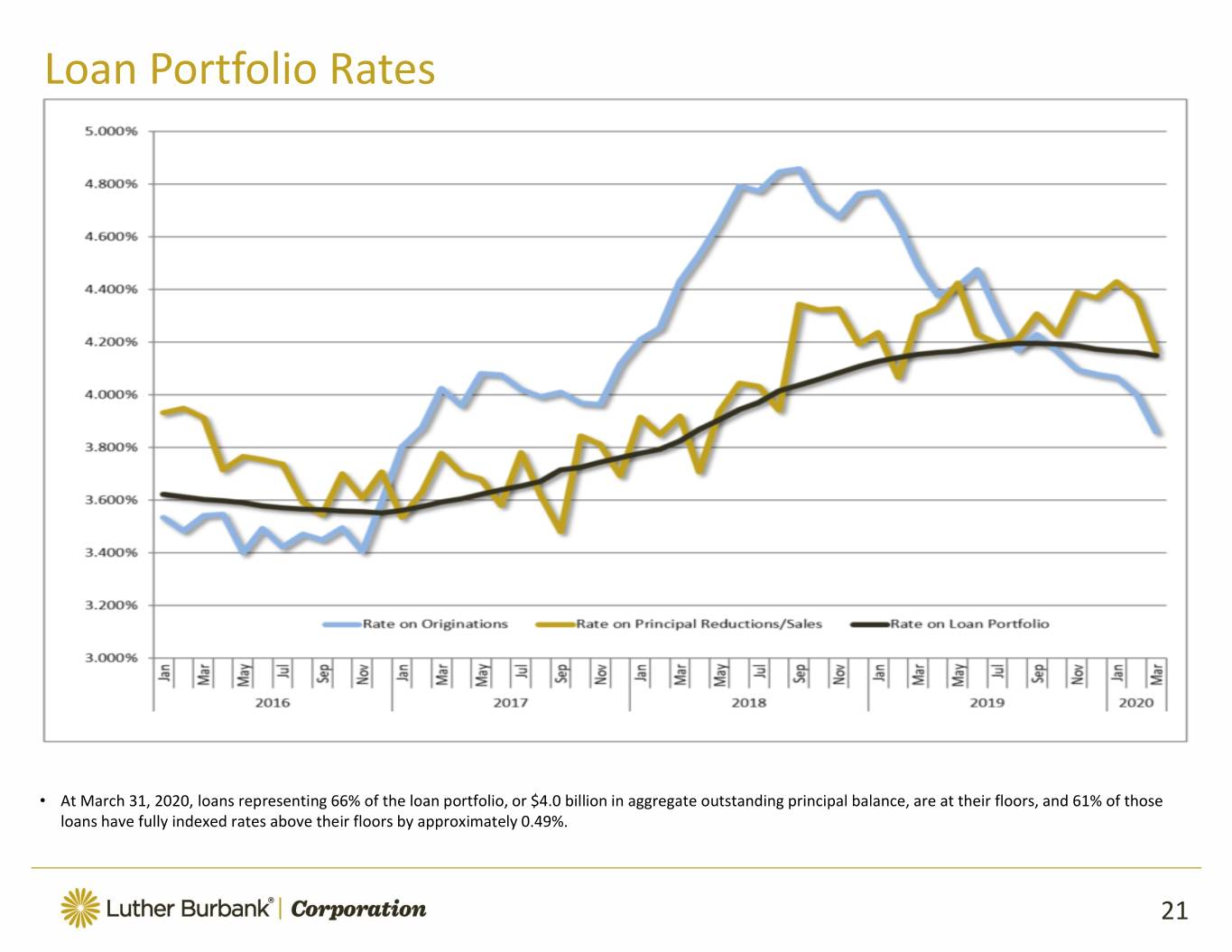

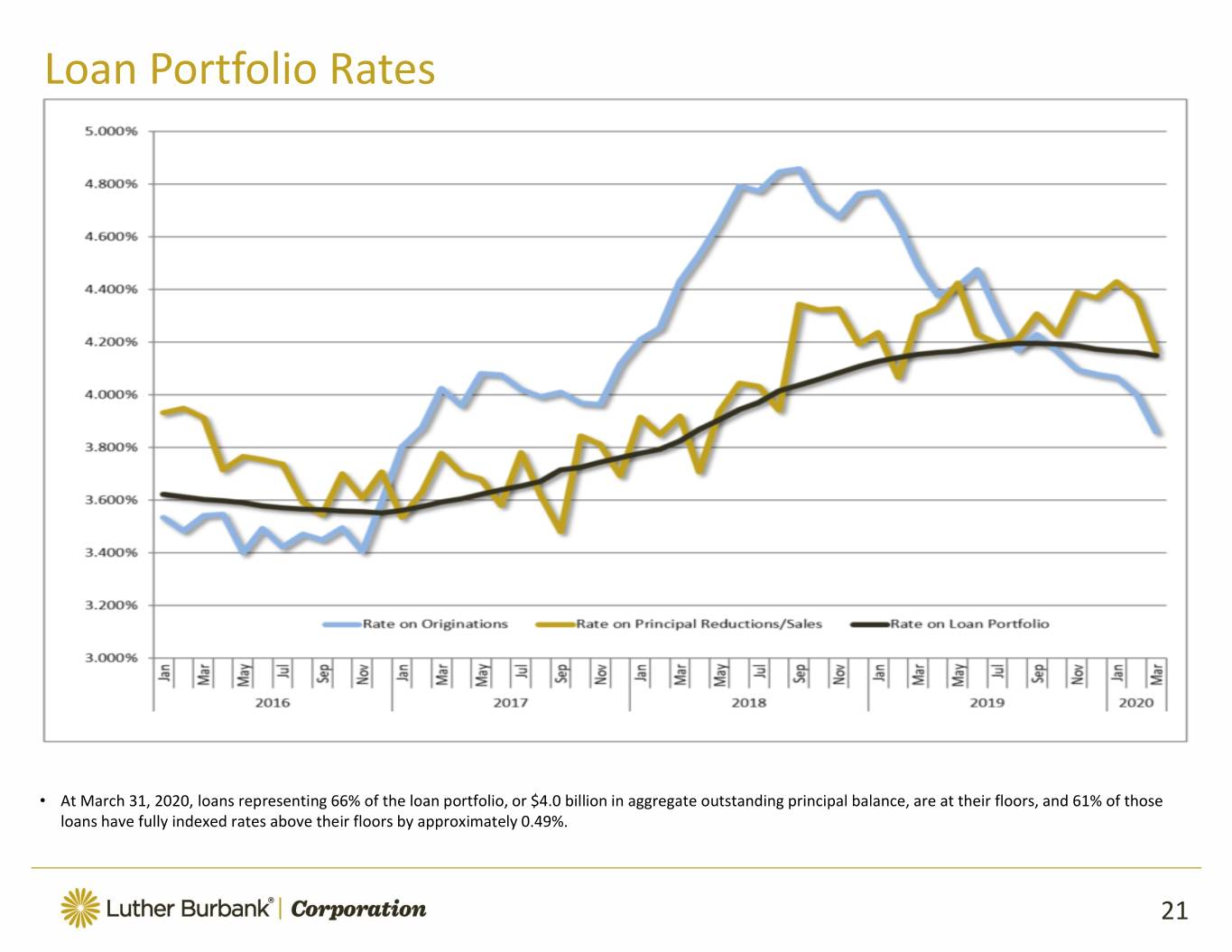

Loan Portfolio Rates • At March 31, 2020, loans representing 66% of the loan portfolio, or $4.0 billion in aggregate outstanding principal balance, are at their floors, and 61% of those loans have fully indexed rates above their floors by approximately 0.49%. 21

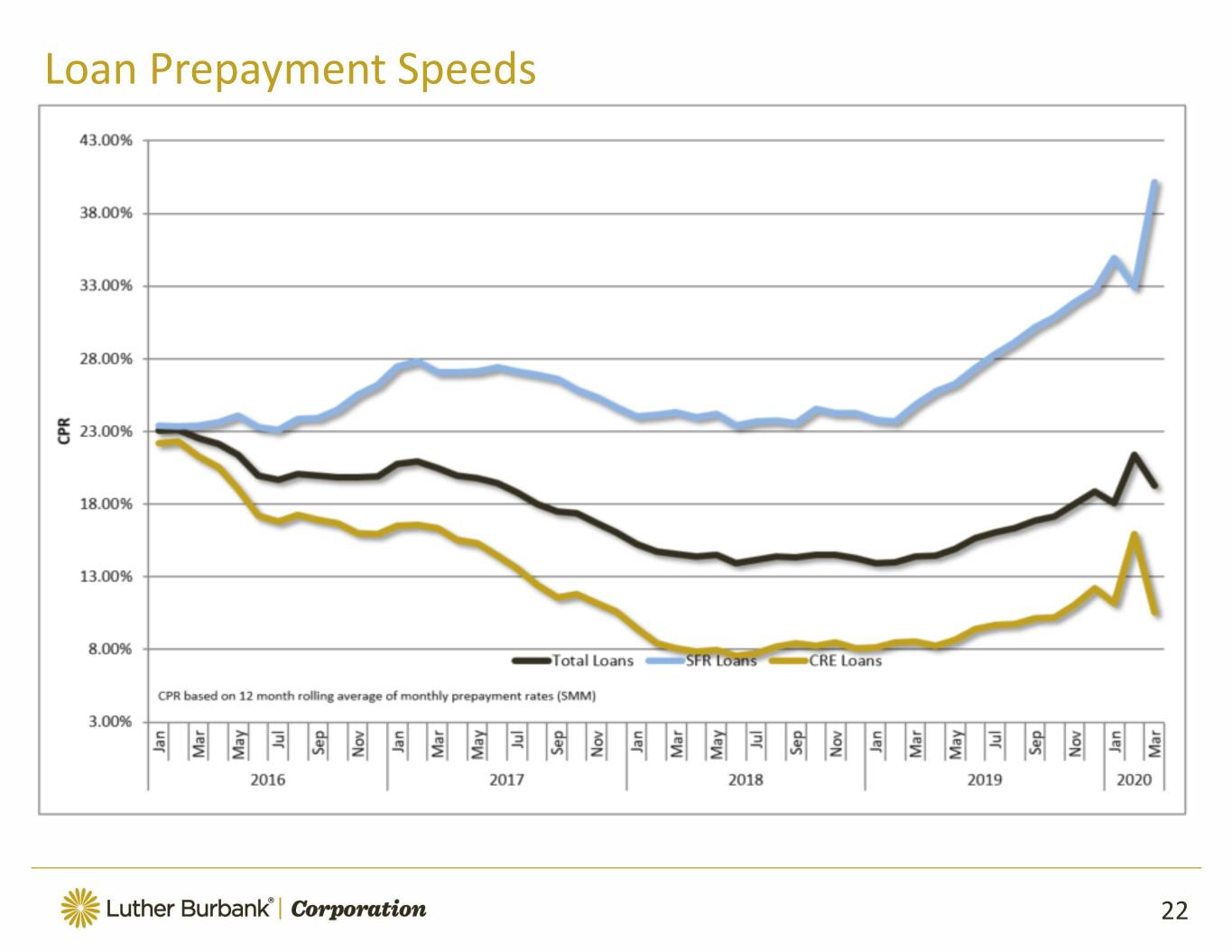

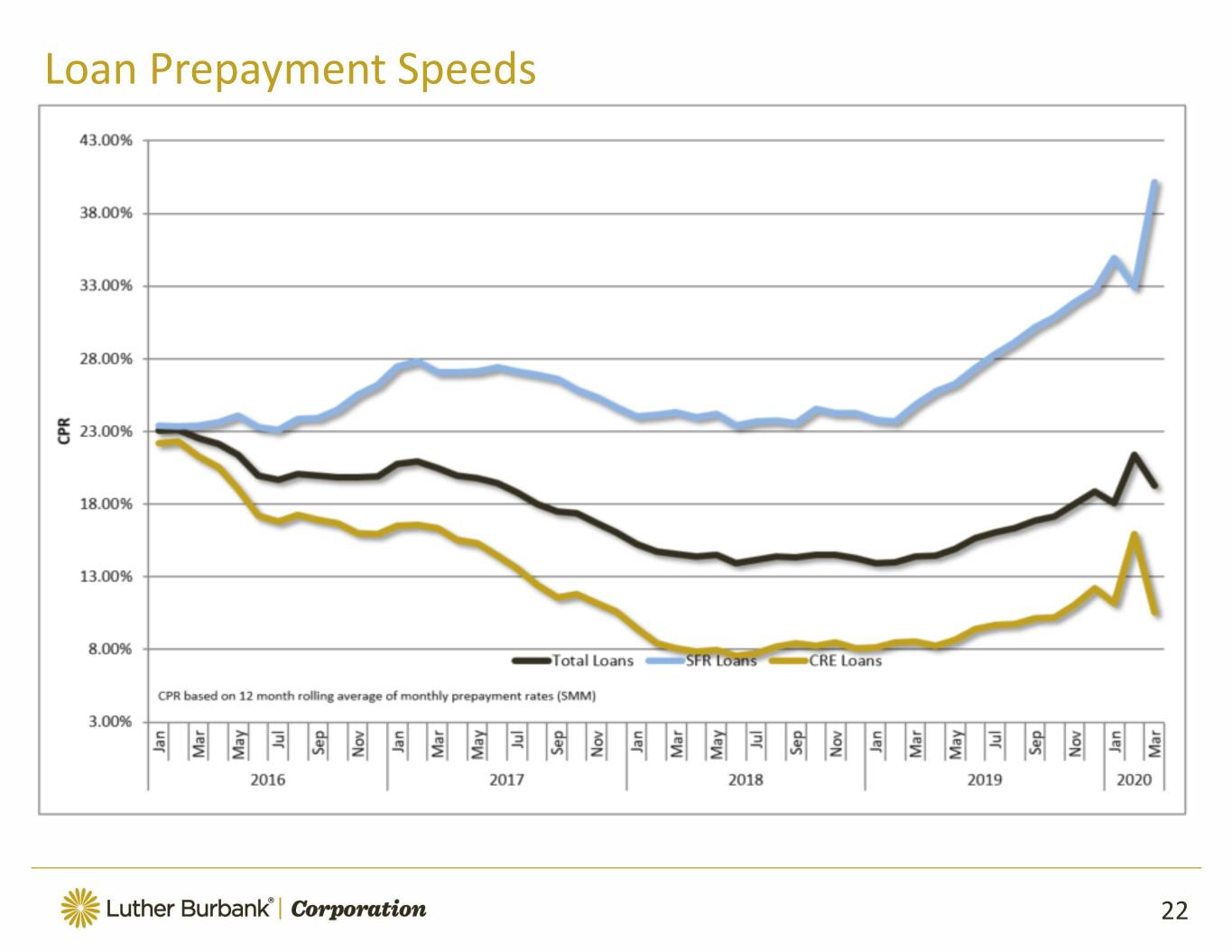

Loan Prepayment Speeds 22

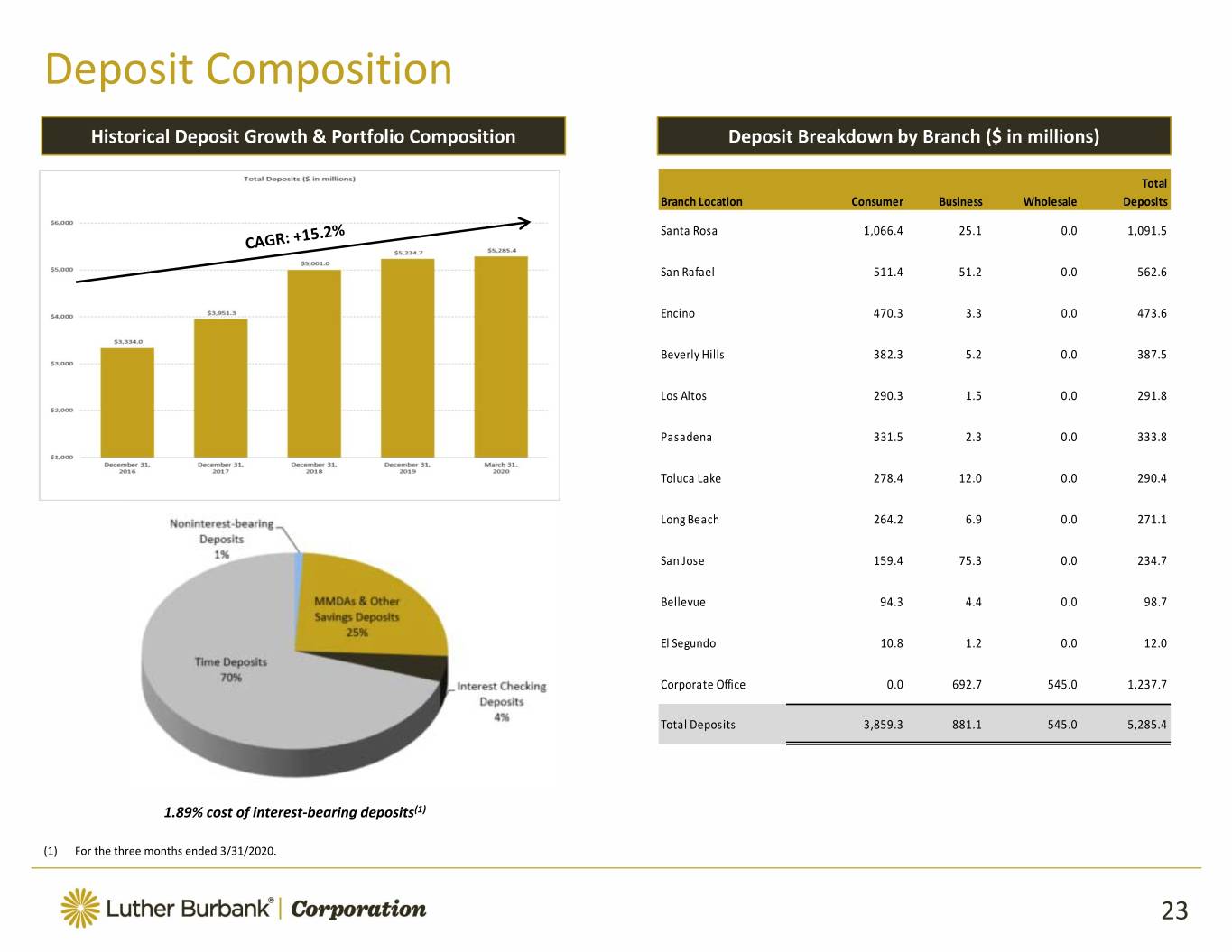

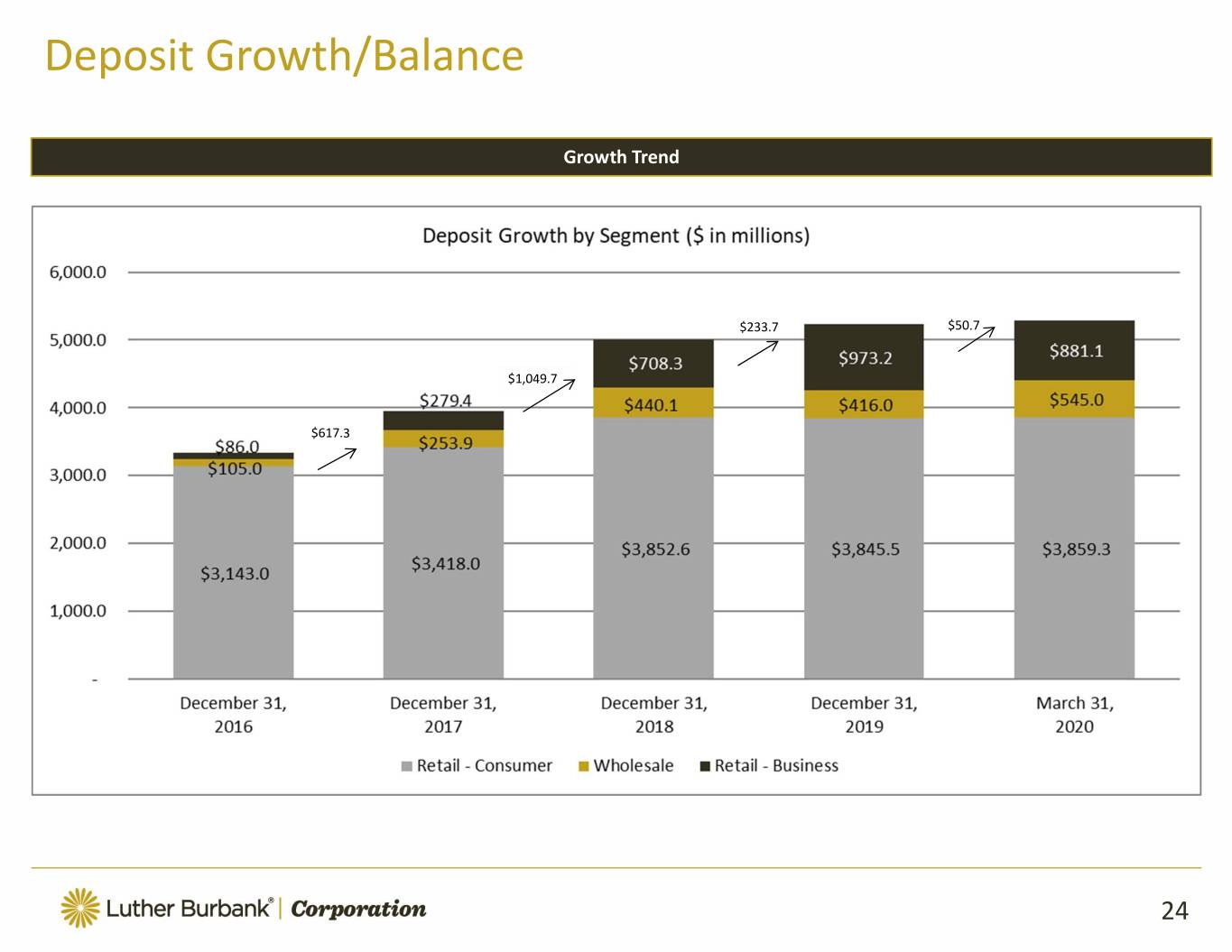

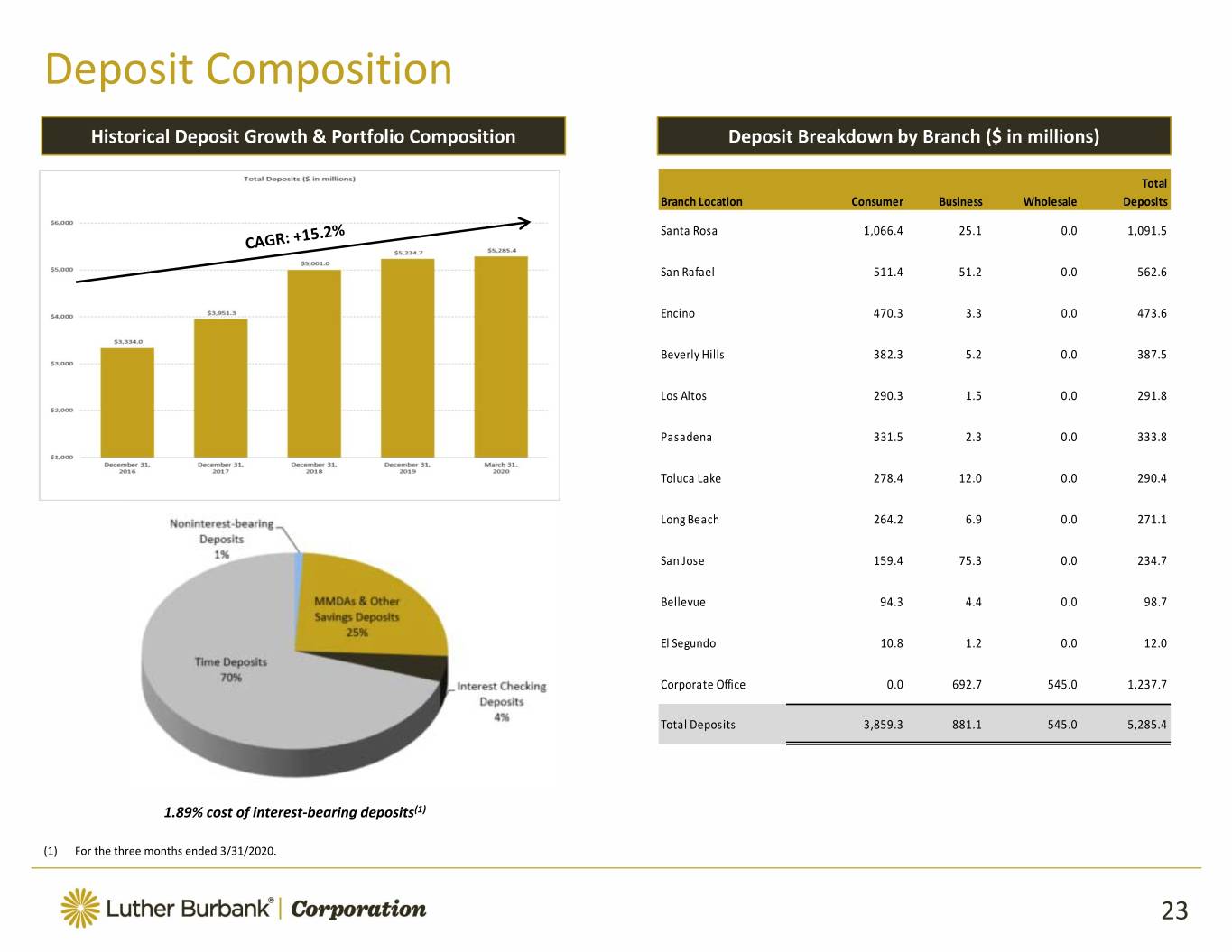

Deposit Composition Historical Deposit Growth & Portfolio Composition Deposit Breakdown by Branch ($ in millions) Total Branch Location Consumer Business Wholesale Deposits Santa Rosa 1,066.4 25.1 0.0 1,091.5 San Rafael 511.4 51.2 0.0 562.6 Encino 470.3 3.3 0.0 473.6 Beverly Hills 382.3 5.2 0.0 387.5 Los Altos 290.3 1.5 0.0 291.8 Pasadena 331.5 2.3 0.0 333.8 Toluca Lake 278.4 12.0 0.0 290.4 Long Beach 264.2 6.9 0.0 271.1 San Jose 159.4 75.3 0.0 234.7 Bellevue 94.3 4.4 0.0 98.7 El Segundo 10.8 1.2 0.0 12.0 Corporate Office 0.0 692.7 545.0 1,237.7 Total Deposits 3,859.3 881.1 545.0 5,285.4 1.89% cost of interest‐bearing deposits(1) (1) For the three months ended 3/31/2020. 23

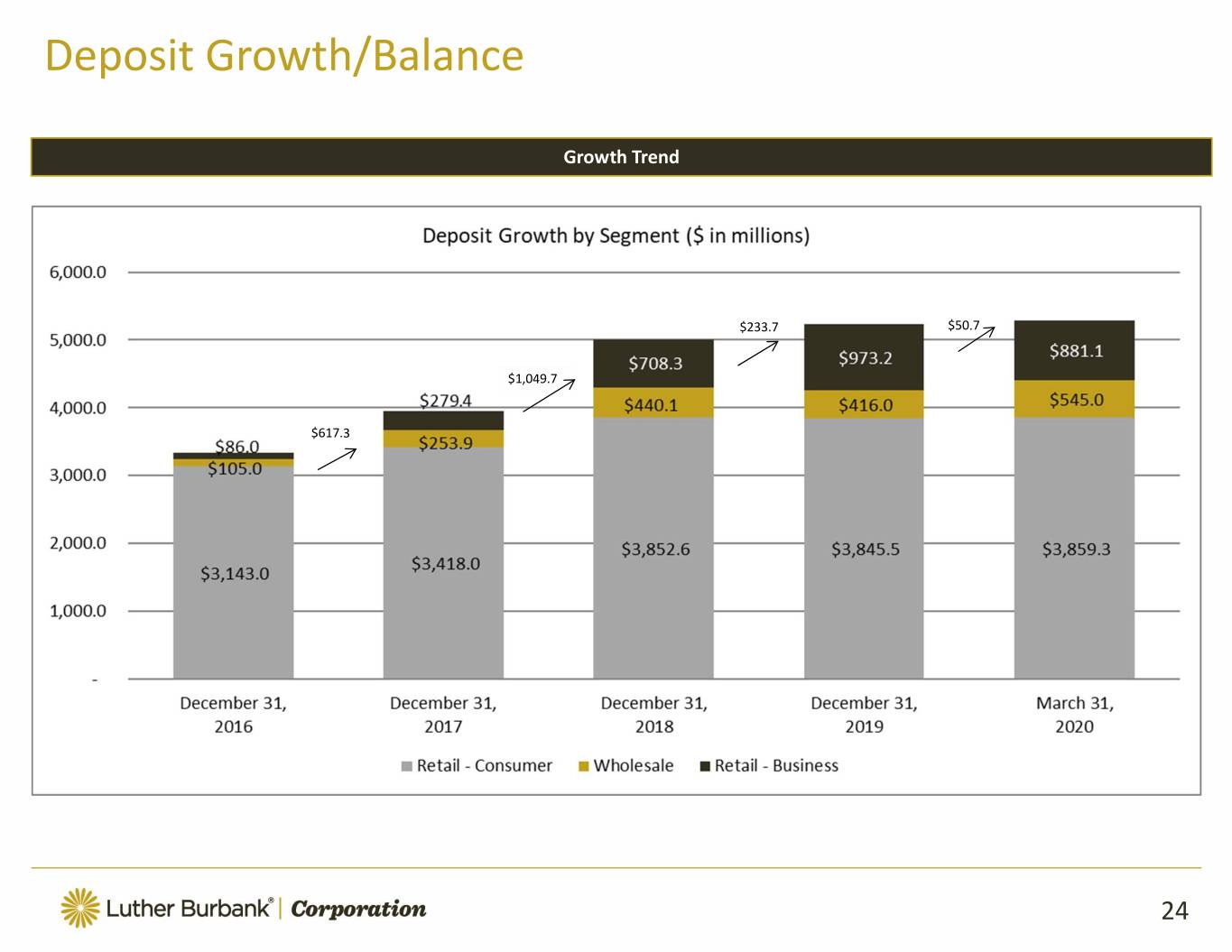

Deposit Growth/Balance Growth Trend $233.7 $50.7 $1,049.7 $617.3 24

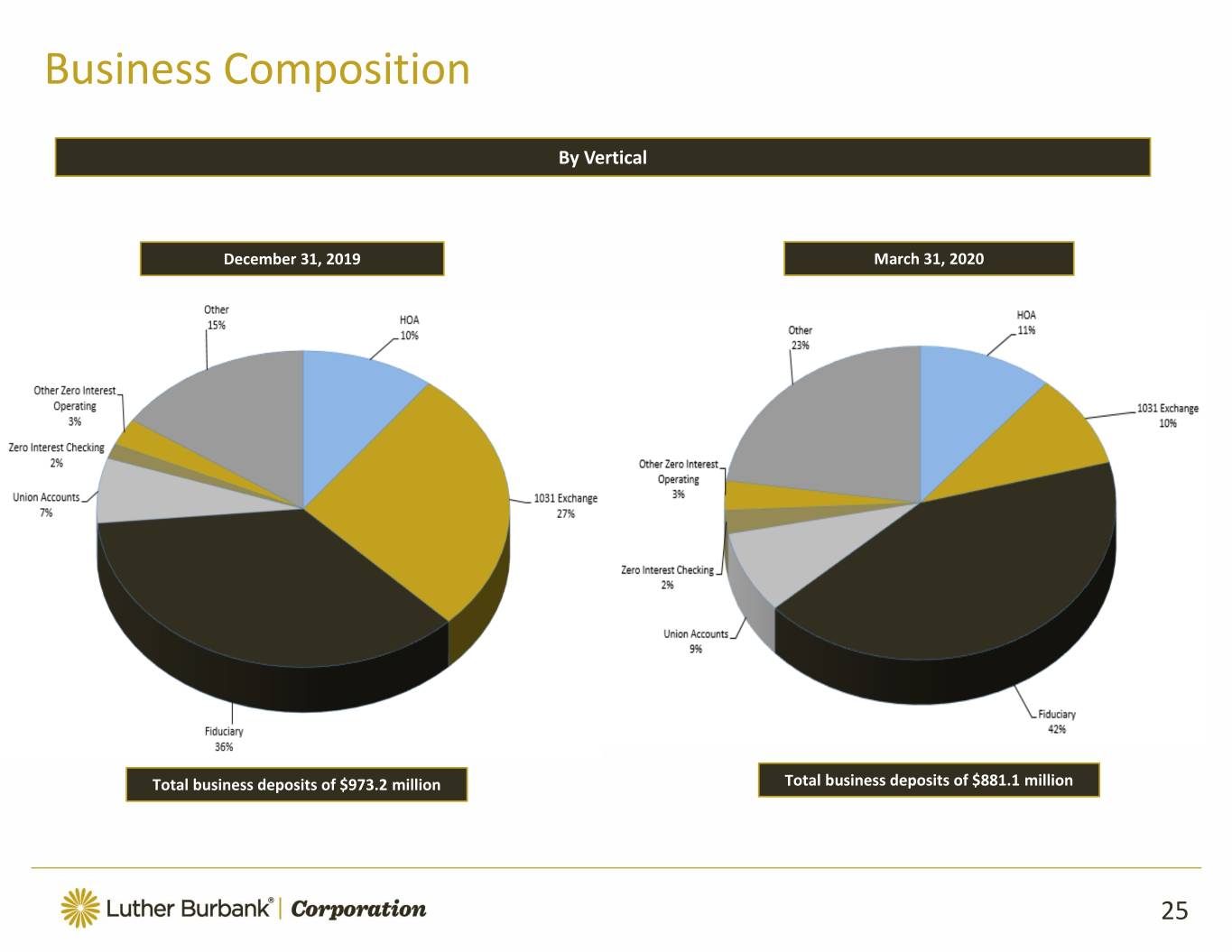

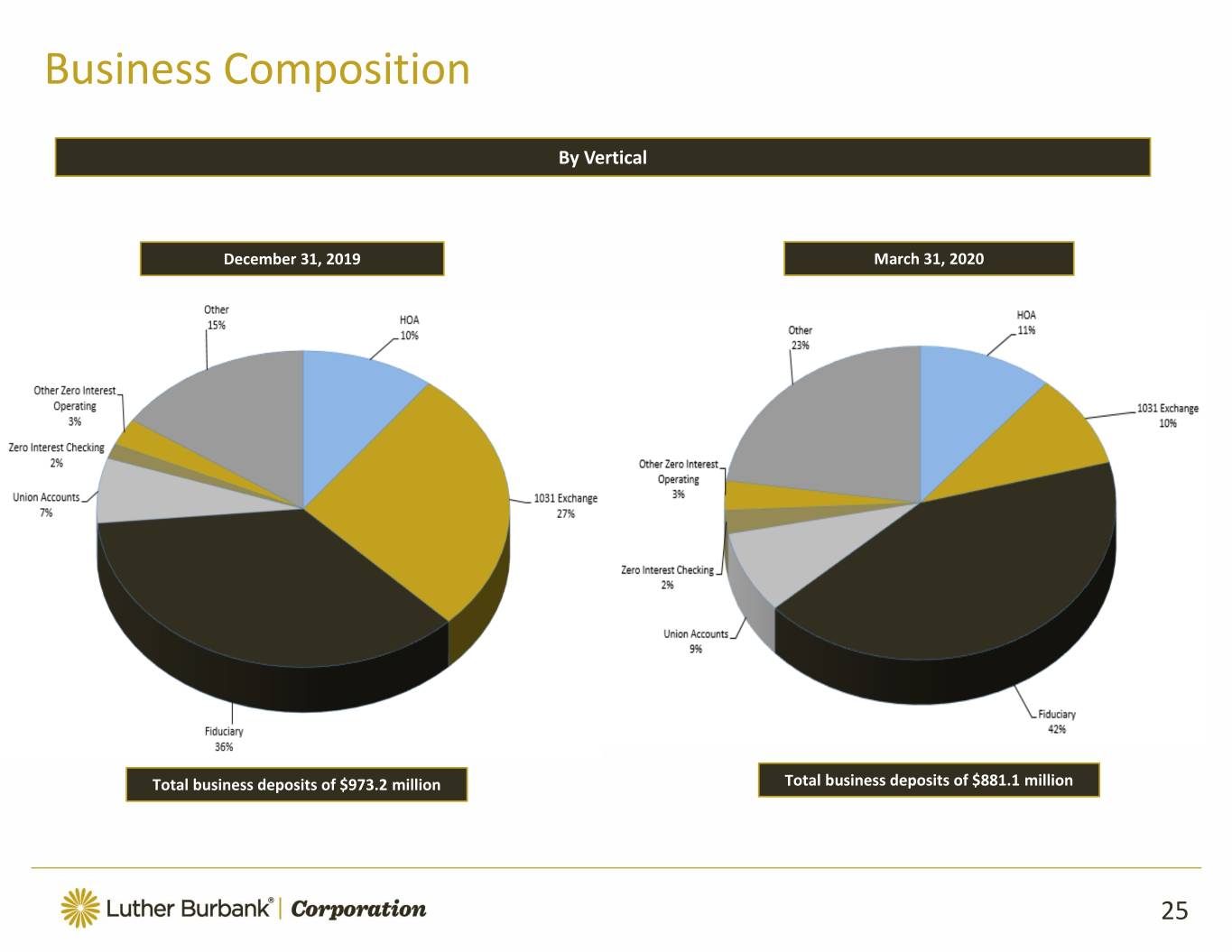

Business Composition By Vertical December 31, 2019 March 31, 2020 1.572% 1.572% 1.082% 0.830% 1.220% Total business deposits of $973.2 million Total business deposits of $881.1 million 25

Efficient Operations Result in Consistent Profitability Return on Average Assets(1) Return on Average Equity(1) Efficiency Ratio Noninterest Expense to Average Assets (1) For periods prior to 2018, net income adjusted for C‐Corp status assumes 42% tax rate. See non‐GAAP reconciliation in Appendix hereto. 26

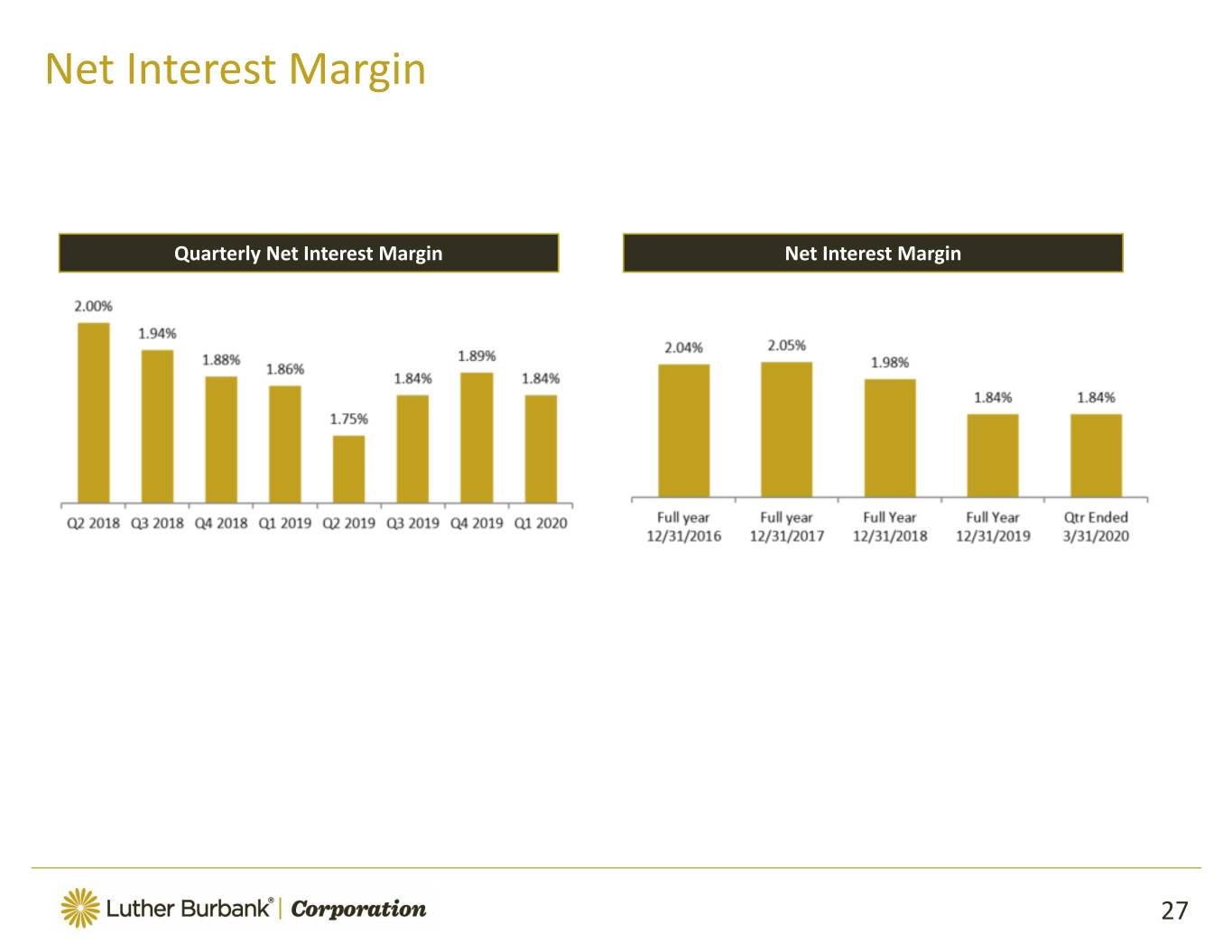

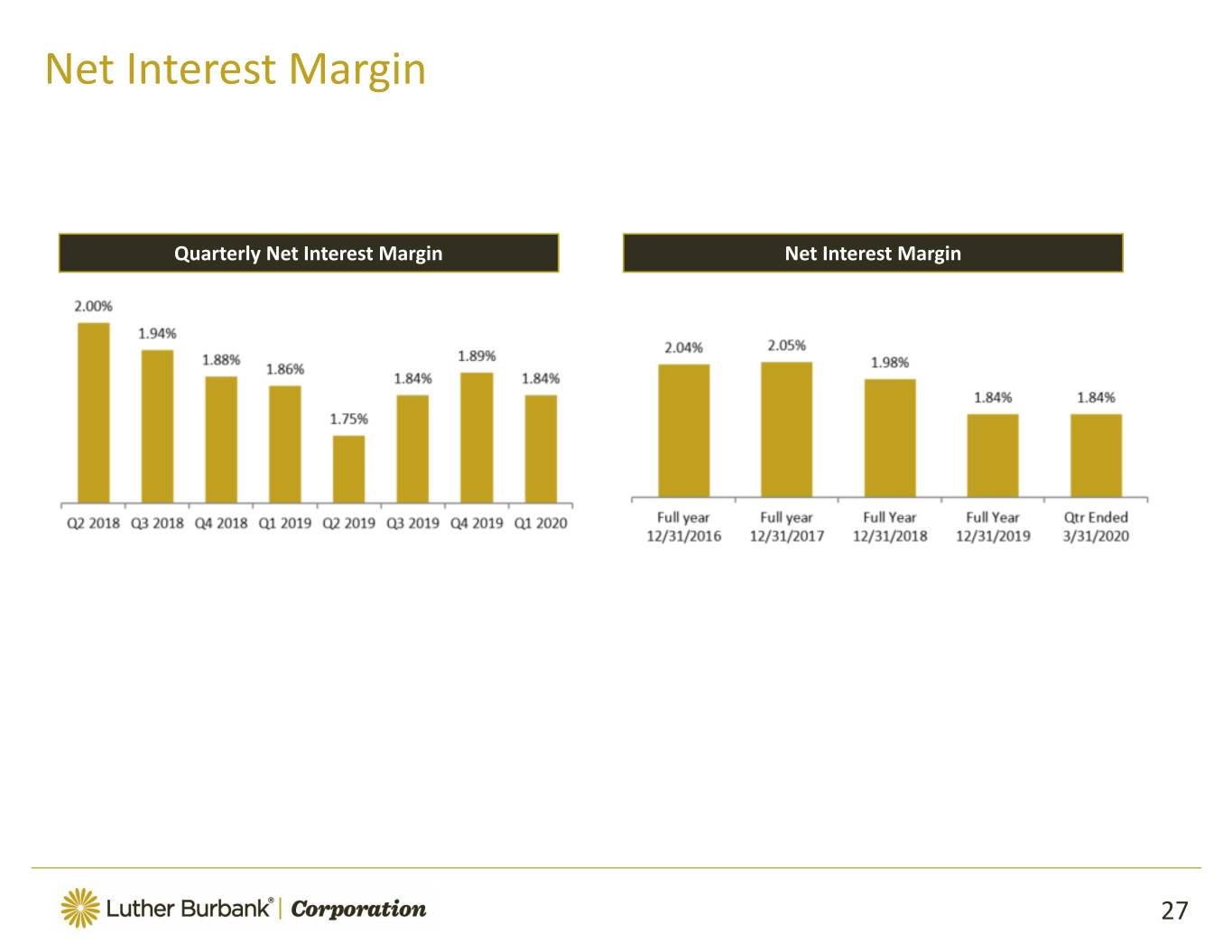

Net Interest Margin Quarterly Net Interest Margin Net Interest Margin 27

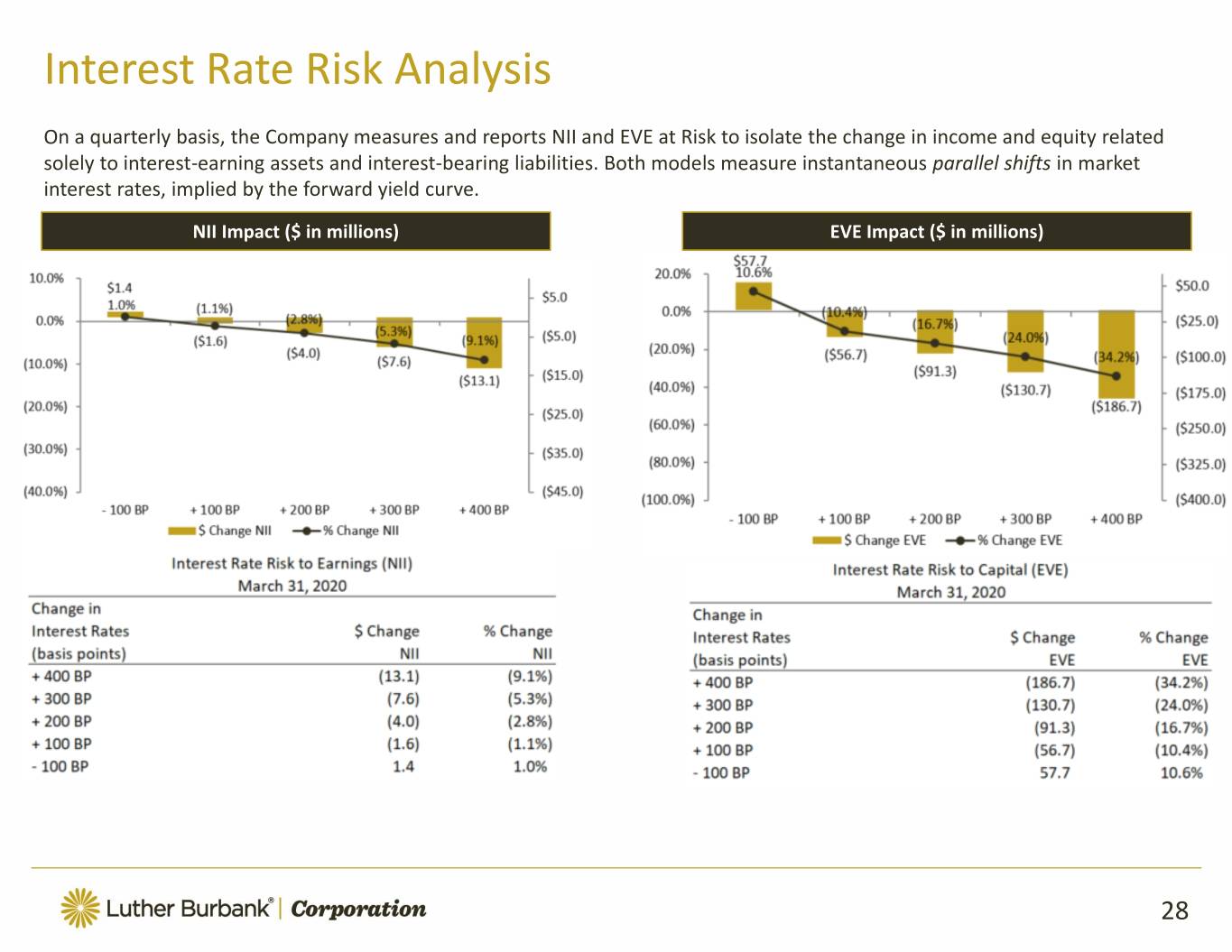

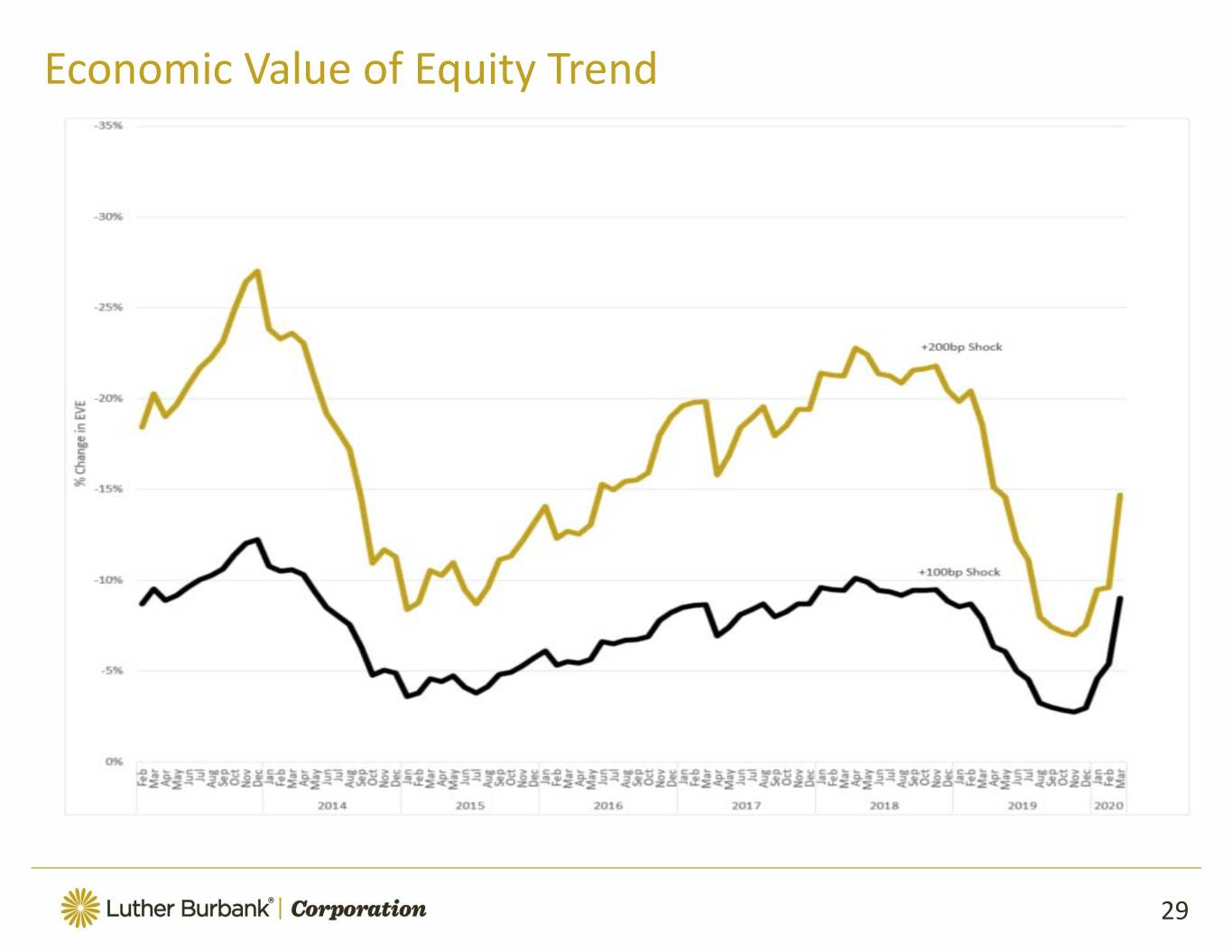

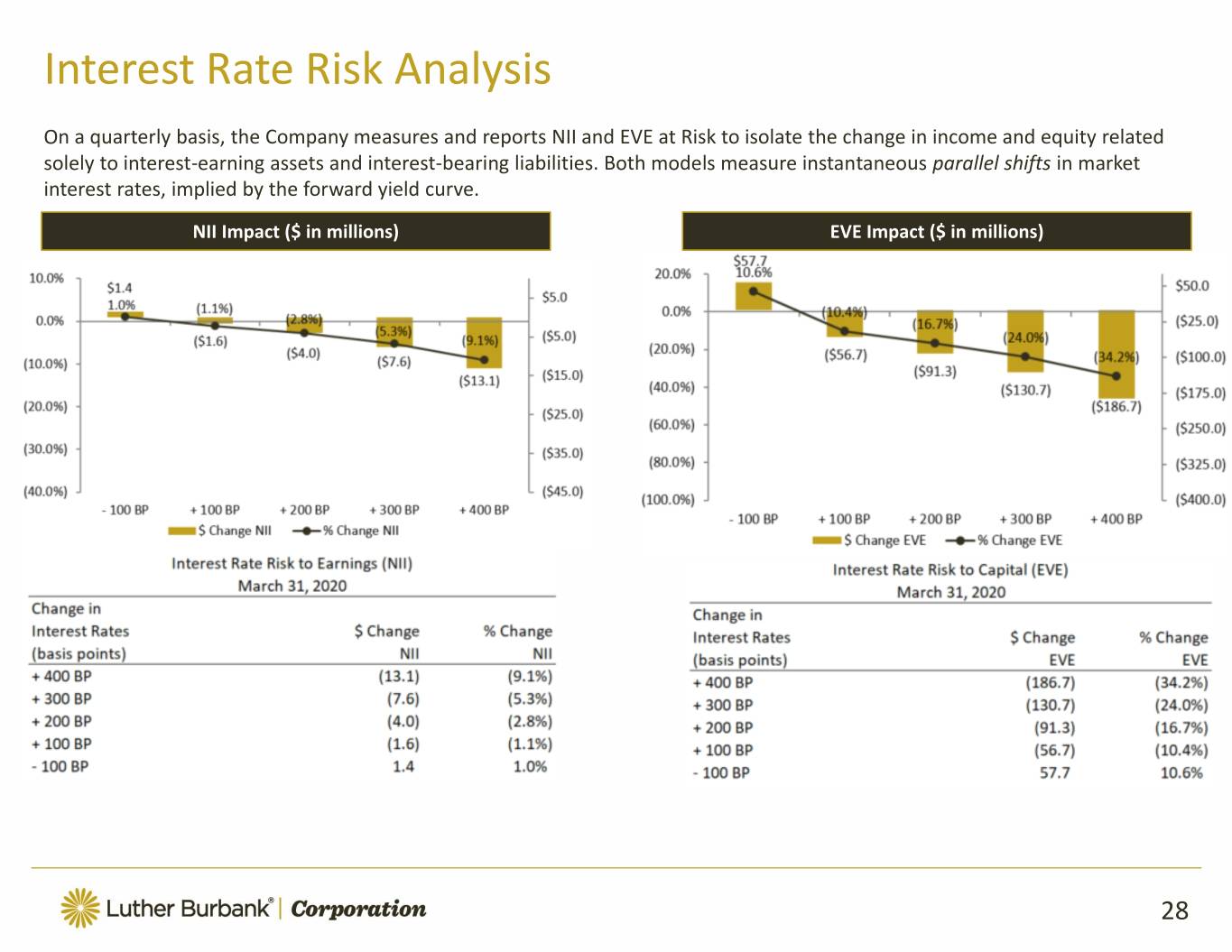

Interest Rate Risk Analysis On a quarterly basis, the Company measures and reports NII and EVE at Risk to isolate the change in income and equity related solely to interest‐earning assets and interest‐bearing liabilities. Both models measure instantaneous parallel shifts in market interest rates, implied by the forward yield curve. NII Impact ($ in millions) EVE Impact ($ in millions) 28

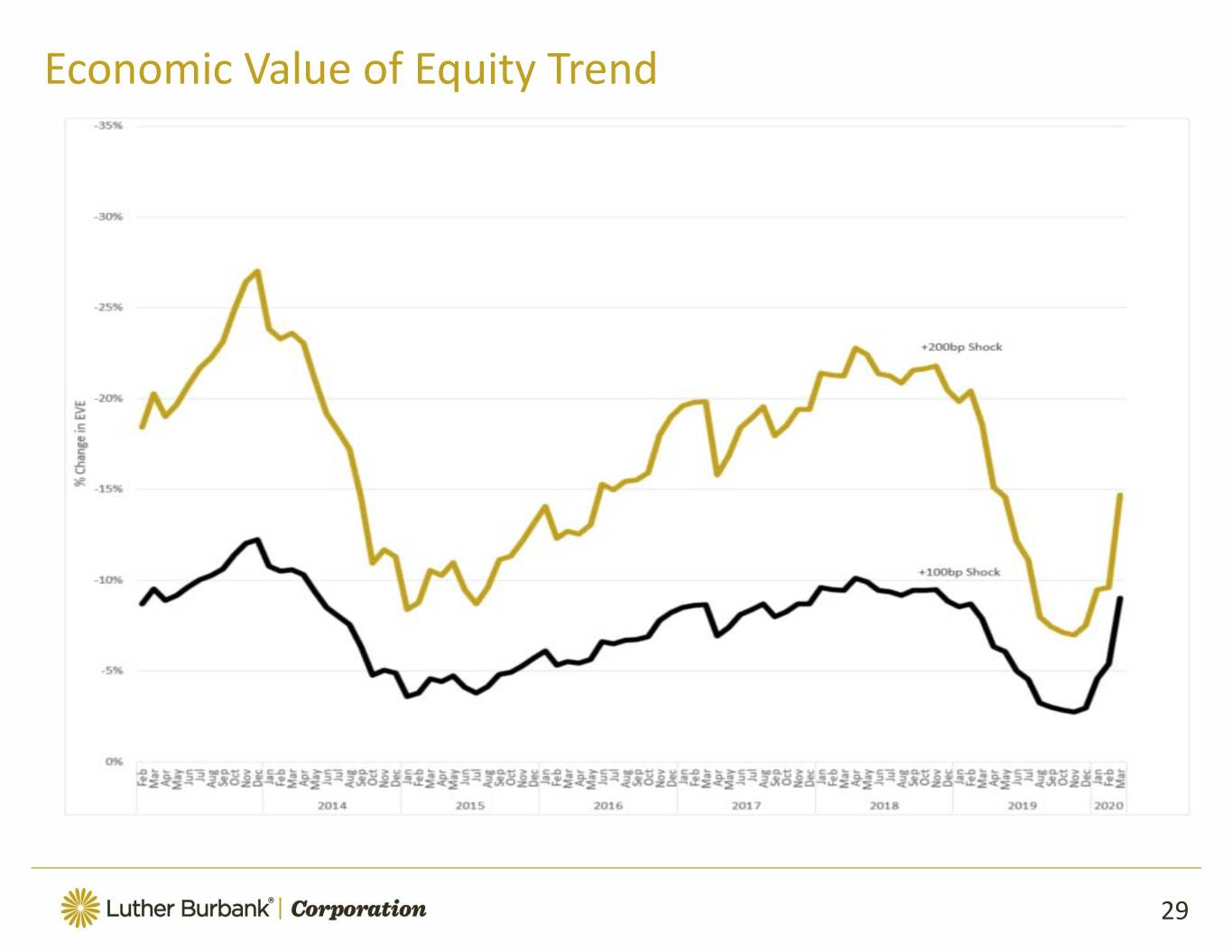

Economic Value of Equity Trend 29

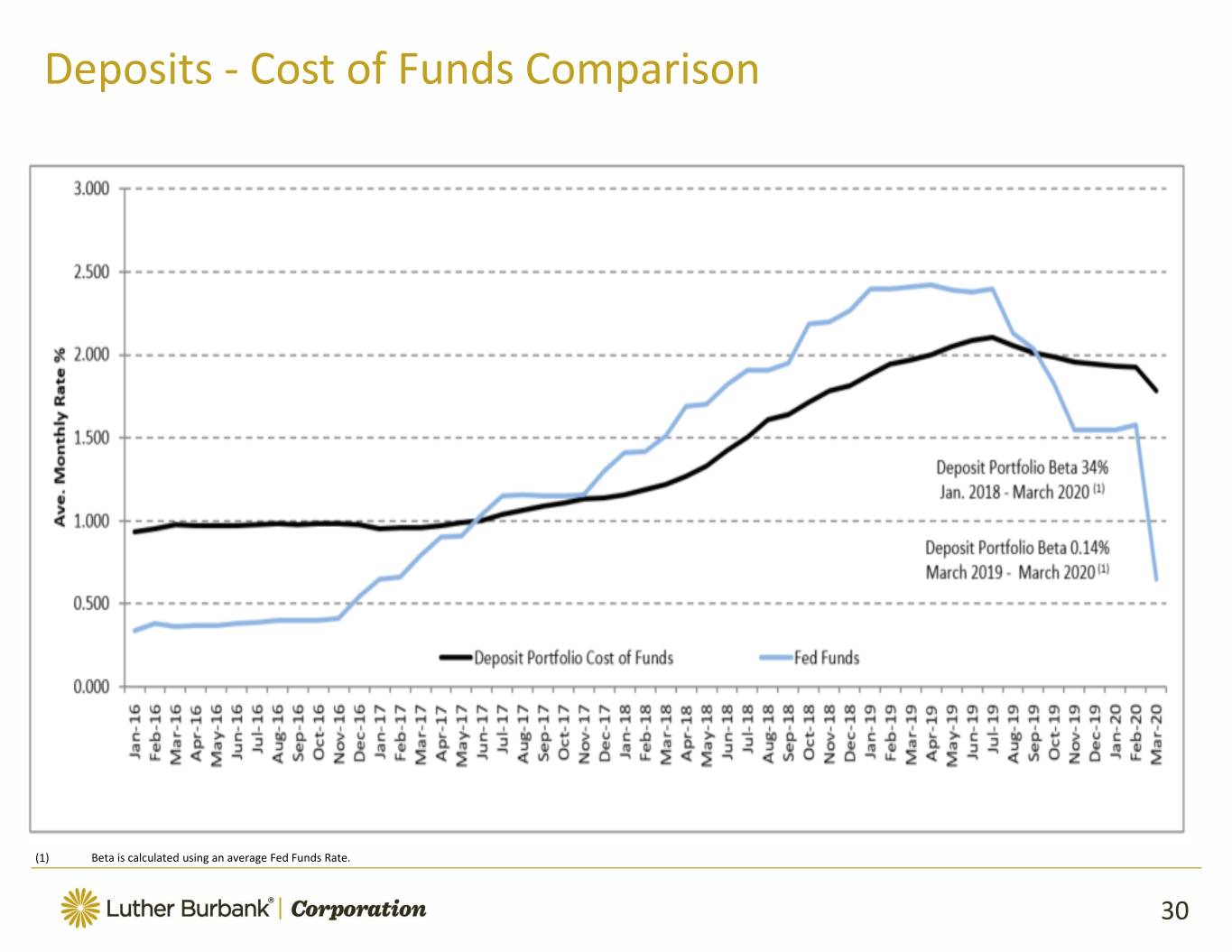

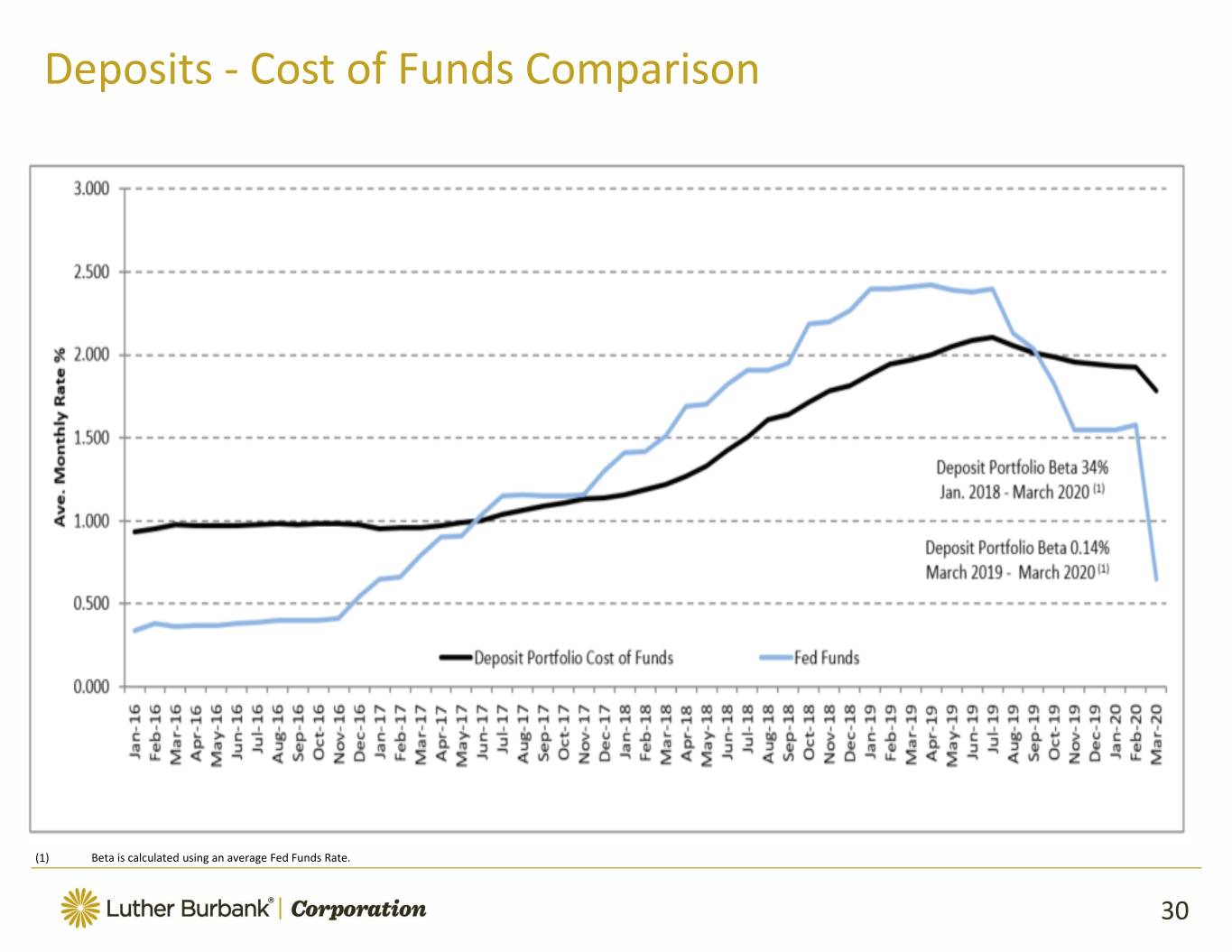

Deposits ‐ Cost of Funds Comparison (1) Beta is calculated using an average Fed Funds Rate. 30

Executive Management Simone Lagomarsino. Ms. Lagomarsino, serves as President and Chief Executive Officer (“CEO”) of the Company and the Bank. Ms. Lagomarsino has served on our Board of Directors since November 30, 2018. Prior to joining the Company, Ms. Lagomarsino was President and CEO of the Western Bankers Association anda director of Pacific Premier Bancorp. (NASDAQ: PPBI). From 2011 to 2016, she served as CEO of Heritage Oaks Bank, and President and CEO and a director of Heritage Oaks Bancorp. Ms. Lagomarsino also previously held executive positions with Hawthorne Financial Corporation, Ventura County National Bank, and Kinecta Federal Credit Union. In addition to her role at the Company, Ms. Lagomarsino serves on the board of directors of the Federal Home Loan Bank of San Francisco and Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE: HASI). We believe Ms. Lagomarsino's extensive experience in leadership roles in numerous financial institutions, including public companies, gives her valuable insight and enables her to make significant contributions as a member of our Board. Laura Tarantino. Ms. Tarantino serves as Chief Financial Officer of the Company and Bank, a position she has held since 2006. In this role, she oversees all aspects of financial reporting including strategic planning, asset/liability management, taxation and regulatory filings. She also serves on the Company's Executive Committee. Ms. Tarantino has over 26 years of experience with the Bank, having joined as Controller in 1992. She previously served as Audit Manager for KPMG LLP, San Francisco, specializing in the financial services industry. In addition to her role at the Company, Ms. Tarantino has served as an audit committee member for the Santa Rosa Council on Aging since 2012. Ms. Tarantino is a CPA (inactive) and holds a B.S. in Business Administration ‐ Finance & Accounting with summa cum laude honors from San Francisco State University. John A. Cardamone. Mr. Cardamone joined the Bank as Chief Credit Officer in 2014. He oversees the Bank's credit administration, appraisal and special assets activities and serves on the Executive Committee. Prior to joining the Bank, Mr. Cardamone served as a Senior Vice President & Divisional Credit Manager ‐ Commercial Real Estate at Bank of the West from 2008 until 2014, Chief Credit Officer at GreenPoint Mortgage, Senior Vice President ‐ Global Risk Management at GE Capital's Mortgage Insurance Unit and Managing Director and Chief Credit Officer at the Federal Home Loan Bank of San Francisco. Mr. Cardamone holds an M.B.A. in Finance from the Wharton School at the University of Pennsylvania, an M.B.A. in Management from St. Mary's College and a B.B.A. in Business Statistics from Temple University. 31

Executive Management ‐ Continued Tammy Mahoney. Ms. Mahoney joined the Company in 2016 and serves as the Chief Risk Officer. In her role, Ms. Mahoney oversees the Company's compliance, internal audit and risk management functions; she is also a member of its Executive Committee. Prior to joining the Bank, Ms. Mahoney served as Senior Vice President of Enterprise Risk and Compliance at Opus Bank from 2011 through 2015; as Director, Risk Advisory Services at KPMG LLP from 1995 to 2004; and as Associate National Bank Examiner with the Office of the Comptroller of the Currency. A Certified Enterprise Risk Professional, Certified Regulatory Compliance Manager and Certified Internal Auditor, Ms. Mahoney holds a B.S. in Business Administration ‐ Finance from San Diego State University. Liana Prieto. Ms. Prieto serves as General Counsel and Corporate Secretary of the Company and Bank. In this role she is responsible for leading a team of legal, human resources, Bank Secrecy Act, fair and responsible banking and third party risk management professionals. She is also a member of the Company's Executive Committee. Prior to joining the Bank in 2014, Ms. Prieto served as Associate and then Counsel at Buckley LLP from 2009 to 2014, and as a trial attorney in the Enforcement & Compliance Division of the Office of the Comptroller of the Currency. In addition to her role at the Company, Ms. Prieto has served in leadership and advisory roles on the Banking Law Committee of the American Bar Association's Business Law Section and the American Association of Bank Directors. She also serves on the Board of Directors of Long Beach Local, a non‐profit that supports sustainable urban agriculture. Ms. Prieto holds a J.D. from Fordham University School of Law and a B.A. from Georgetown University. Brian Skelton. Mr. Skelton serves the Company as Chief Banking Officer. In this role he is responsible for expanding Luther Burbank’s deposit offerings and creating greater access to its products and services, including consumer deposit generation across traditional branch and online banking platforms, as well as business banking activities; he is also a member of the Company's Executive Committee. Prior to joining in 2019, Mr. Skelton served as Senior Vice President, Regional Sales Manager at Farmers and Merchants Bank of Long Beach from 2014 to 2019; previous to that as Senior Vice President, Region Manager at Union Bank of California from 2006‐2014. His background also includes positions as Vice President, Branch Manager at City National Bank; Vice President, Branch Manager at Union Bank; Customer Service and Sales Manager at Pacific Mercantile Bank; Account Executive at US Capital Funding; and Loan Specialist at Bank of America. In addition to his role at Luther Burbank, Mr. Skelton sits on the Executive Advisory Board of Mihaylo College of Business and Economics at California State University, Fullerton and is an active advocate for the American Heart Association of Orange County as well as Junior Achievement Orange County. Mr. Skelton holds a Masters in Banking from Pacific Coast Banking School and a B.A. in Education from California State University, Fullerton. 32

Board of Directors Victor S. Trione. Mr. Trione, serves as Chair of the Board of Directors of the Company and the Bank, a position he has held since founding the Bank in 1983. In addition to serving as our Chair, Mr. Trione is President of Vimark, Inc., a real estate development and vineyard management company, and co‐proprietor of Trione Winery. Mr. Trione also serves in the following roles: Director and Chair of the Executive Committee of Empire College; Advisory Board member of the Stanford Institute for Economic Policy Research; Board of Overseers of Stanford University's Hoover Institution; and, trustee of the U.S. Navy Memorial Foundation. As one of our founders, Mr. Trione brings continuity and deep historic knowledge of the Company to the Board, which enables him to make significant contributionsasa member of our Board. John C. Erickson. Mr. Erickson, serves on the Audit and Risk Committee and on the Compensation Committee. Mr. Erickson has served on our Board of Directors since 2017. Mr. Erickson has more than 35 years of financial services experience, including over 30 years at Union Bank N.A. He served in many executiveroles across that institution, culminating in two vice chairman positions (Chief Risk Officer and Chief Corporate Banking Officer) between 2007 and 2014.AsChief Corporate Banking Officer, he oversaw commercial banking, real estate, global treasury management, wealth management and global capital markets.Hewasa director of Zions Bancorporation (NASDAQ: ZION) from 2014 to 2016, and chair of that board's Risk Committee, as well as a member of the Audit Committee.Healso served as President, Consumer Banking and President, California, for CIT Group, Inc. (NYSE: CIT) in 2016. He joined the board of directors of Bank of Hawaii Corporation (NYSE: BOH) in January 2019, and serves as a member of its Audit and Risk Committee and Nominating and Governance Committee. Mr. Erickson qualifies as an "audit committee financial expert" as defined in SEC rules. We believe Mr. Erickson's extensive knowledge of banking and his service on public company boards give him valuable insight and enable him to make significant contributions as a member of our Board. Jack Krouskup. Mr. Krouskup, serves as Chair of the Audit and Risk Committee and also servesontheGovernanceandNominatingCommittee.Mr.Krouskuphas served on our Board of Directors since 2012. He is a certified public accountant (inactive) with more than 35 years of experience serving customers in avarietyof industries. At Deloitte, he served as partner‐in‐charge of the company's Northern California Financial Services practice and also served on Deloitte's Financial Services Advisory Committee. Mr. Krouskup has years of boardroom experience representing Deloitte with numerous global and highly complex organizations. Consequently, he has an extensive corporate governance background and deep familiarity with board and audit committee best practices. Mr. Krouskup retired from Deloitte in 2011. He currently serves on the board of directors of Verity Health System and on the Board of Trustees of the University of California, Santa Barbara, Alumni Association. Mr. Krouskup qualifies as an "audit committee financial expert" as defined in SEC rules. We believe Mr. Krouskup's significant experience as an auditor and certified public accountant give him valuable insight and enable him to make significant contributions as a member of our Board. 33

Board of Directors ‐ Continued Anita Gentle Newcomb. Mrs. Newcomb, serves on the Audit and Risk Committee. Ms. Newcomb has served on our Board of Directors since 2014. Her experience spans over three decades in the financial services industry as a commercial banker, investment banker, and strategic consultant. She has advised numerous banks and financial services companies on a wide range of corporate development initiatives, from strategic planning, consumer and business banking strategy, and corporate governance best practices, to mutual conversions and valuing and structuring acquisitions. Most recently, Ms. Newcomb was president of A.G. Newcomb & Co., a financial services consultancy, she founded and managed from 1999 to 2019. She also served on the board of the Federal Reserve Bank of Richmond‐ Baltimore Branch from 2010 through 2015. She is also a certified public accountant (inactive). Ms. Newcomb qualifies as an "audit committee financial expert" as defined in SEC rules. We believe Ms. Newcomb's extensive knowledge of banking, as well as her expertise in strategic planning for community and regional banks, give her valuable insight and enable her to make significant contributions as a member of our Board. Bradley M. Shuster. Mr. Shuster, serves as Chair of the Compensation Committee and also serves on the Governance and Nominating Committee. Mr. Shuster has served on our Board of Directors since 1999. Mr. Shuster has served as Executive Chairman and Chairman of the Board of NMI Holdings, Inc. (NASDAQ: NMIH)since January 2019. Mr. Shuster founded National MI and served as Chairman and Chief Executive Officer of the company from 2012 to 2018. Prior to founding National MI, he was a senior executive of The PMI Group, Inc. (NYSE: PMI), where he served as Chief Executive Officer of PMI Capital Corporation. Before joining PMI in 1995, Mr. Shuster was a partner at Deloitte, where he served as partner‐in‐charge of Deloitte's Northern California Insurance and Mortgage Banking practices. Mr. Shuster has received both CPA and CFA certifications. He is a member of the board of directors of McGrath Rentcorp (NASDAQ: MGRC), and serves as a member of its Audit and Governance Committees. We believe Mr. Shuster's experience leading a public company, as well as his service on public company boards and his tenure on our Board, give him valuable insight and enable him to make significant contributions as a member of our Board. Thomas C. Wajnert. Mr. Wajnert, serves as our Lead Independent Director, Chair of the Governance and Nominating Committee, and a member of the Compensation Committee. Mr. Wajnert has served on our Board of Directors since 2013. He launched his career in 1968 with US Leasing, a NYSE‐listed company. For over 40 years, Mr. Wajnert has navigated the changing currents of the equipment leasing industry and built an impressive list of accomplishments, including serving as Chief Executive Officer and Chair of AT&T Capital Corporation, an international, full‐service equipment leasing and commercial finance company, from 1984 to 1996. Mr. Wajnert also has extensive public company board experience at Reynolds American as Chair, and at Solera, UDR, Inc., NYFIX, and JLG Industries as a director. Mr. Wajnert also serves on the board of International Finance Group, one of the largest privately owned P&C insurance companies in the U.S.,andformany years served as a Trustee of Wharton's Center for Financial Institutions. We believe Mr. Wajnert's substantial experience in leadership of public companies, both as an executive and a director, give him valuable insight and enable him to make significant contributions as a member of our Board. 34

Appendix

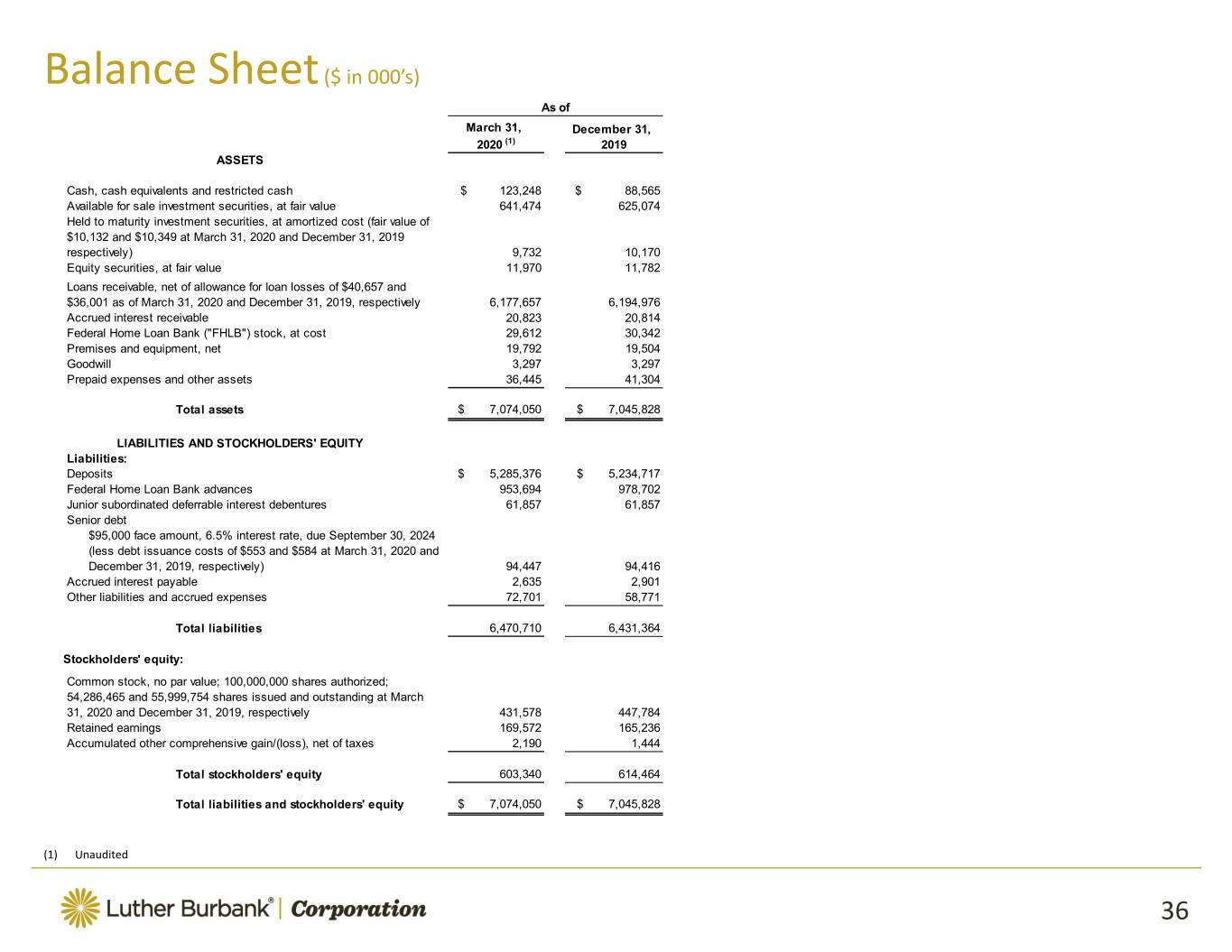

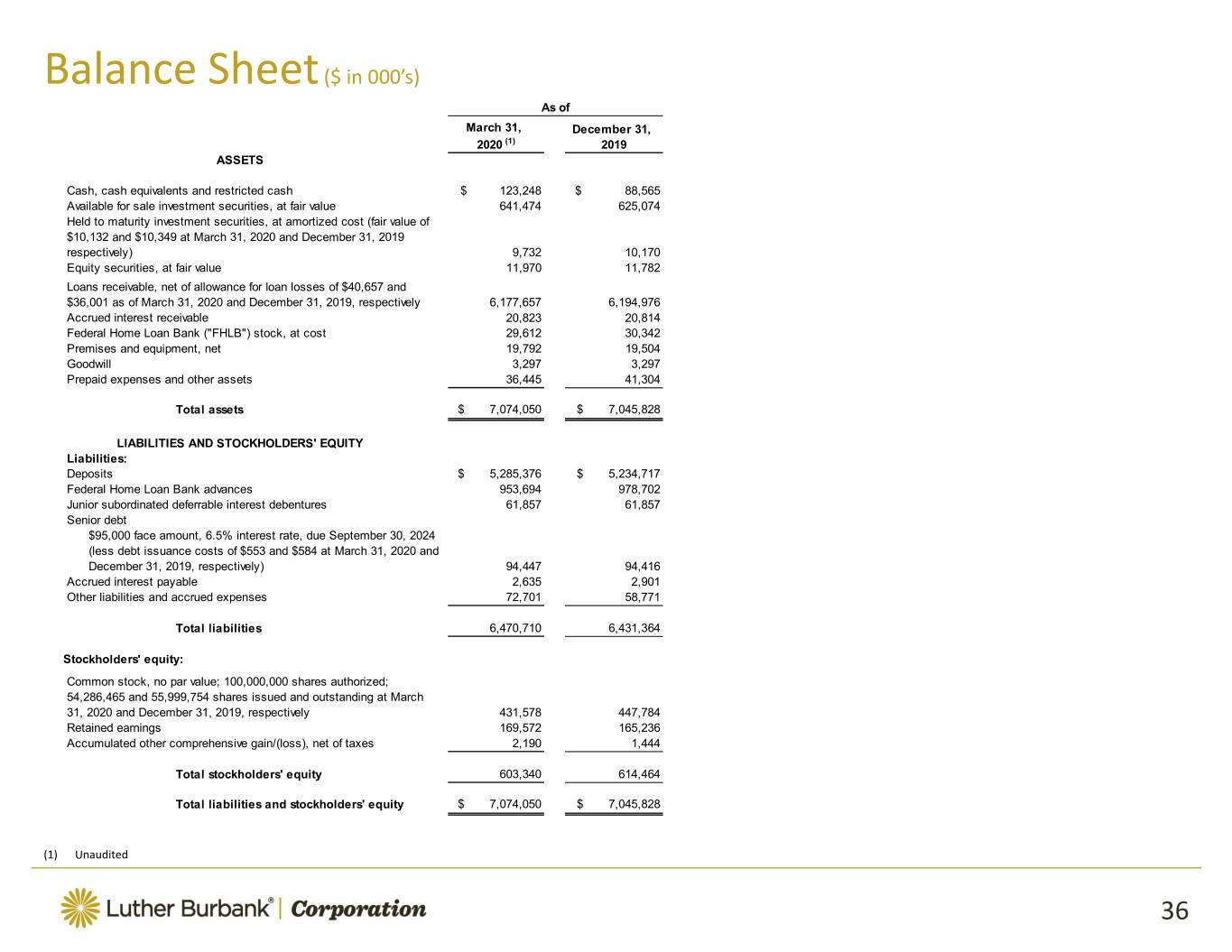

Balance Sheet ($ in 000’s) As of March 31, December 31, 2020 (1) 2019 ASSETS Cash, cash equivalents and restricted cash $ 123,248 $ 88,565 Available for sale investment securities, at fair value 641,474 625,074 Held to maturity investment securities, at amortized cost (fair value of $10,132 and $10,349 at March 31, 2020 and December 31, 2019 respectively) 9,732 10,170 Equity securities, at fair value 11,970 11,782 Loans receivable, net of allowance for loan losses of $40,657 and $36,001 as of March 31, 2020 and December 31, 2019, respectively 6,177,657 6,194,976 Accrued interest receivable 20,823 20,814 Federal Home Loan Bank ("FHLB") stock, at cost 29,612 30,342 Premises and equipment, net 19,792 19,504 Goodwill 3,297 3,297 Prepaid expenses and other assets 36,445 41,304 Total assets $ 7,074,050 $ 7,045,828 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Deposits $ 5,285,376 $ 5,234,717 Federal Home Loan Bank advances 953,694 978,702 Junior subordinated deferrable interest debentures 61,857 61,857 Senior debt $95,000 face amount, 6.5% interest rate, due September 30, 2024 (less debt issuance costs of $553 and $584 at March 31, 2020 and December 31, 2019, respectively) 94,447 94,416 Accrued interest payable 2,635 2,901 Other liabilities and accrued expenses 72,701 58,771 Total liabilities 6,470,710 6,431,364 Stockholders' equity: Common stock, no par value; 100,000,000 shares authorized; 54,286,465 and 55,999,754 shares issued and outstanding at March 31, 2020 and December 31, 2019, respectively 431,578 447,784 Retained earnings 169,572 165,236 Accumulated other comprehensive gain/(loss), net of taxes 2,190 1,444 Total stockholders' equity 603,340 614,464 Total liabilities and stockholders' equity $ 7,074,050 $ 7,045,828 (1) Unaudited 36

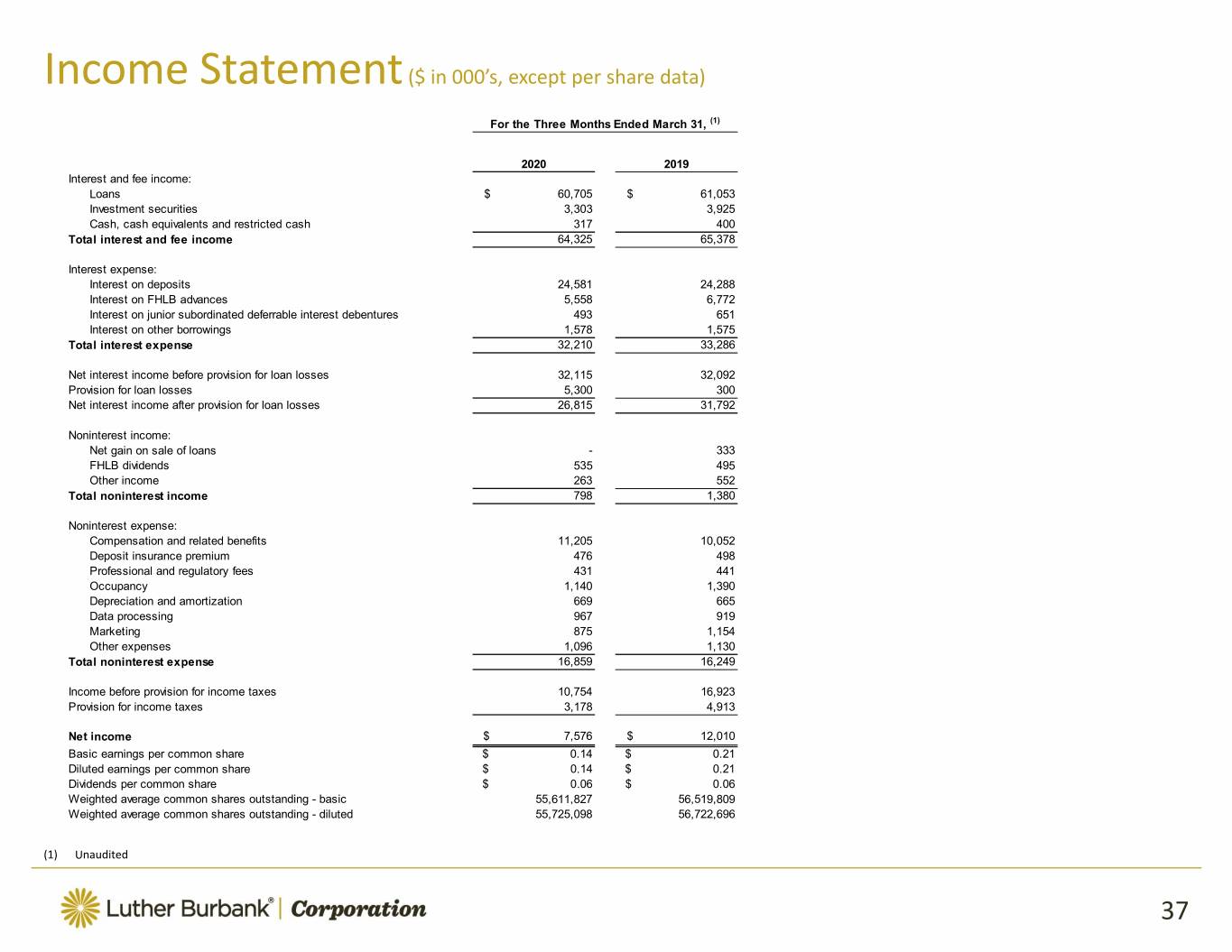

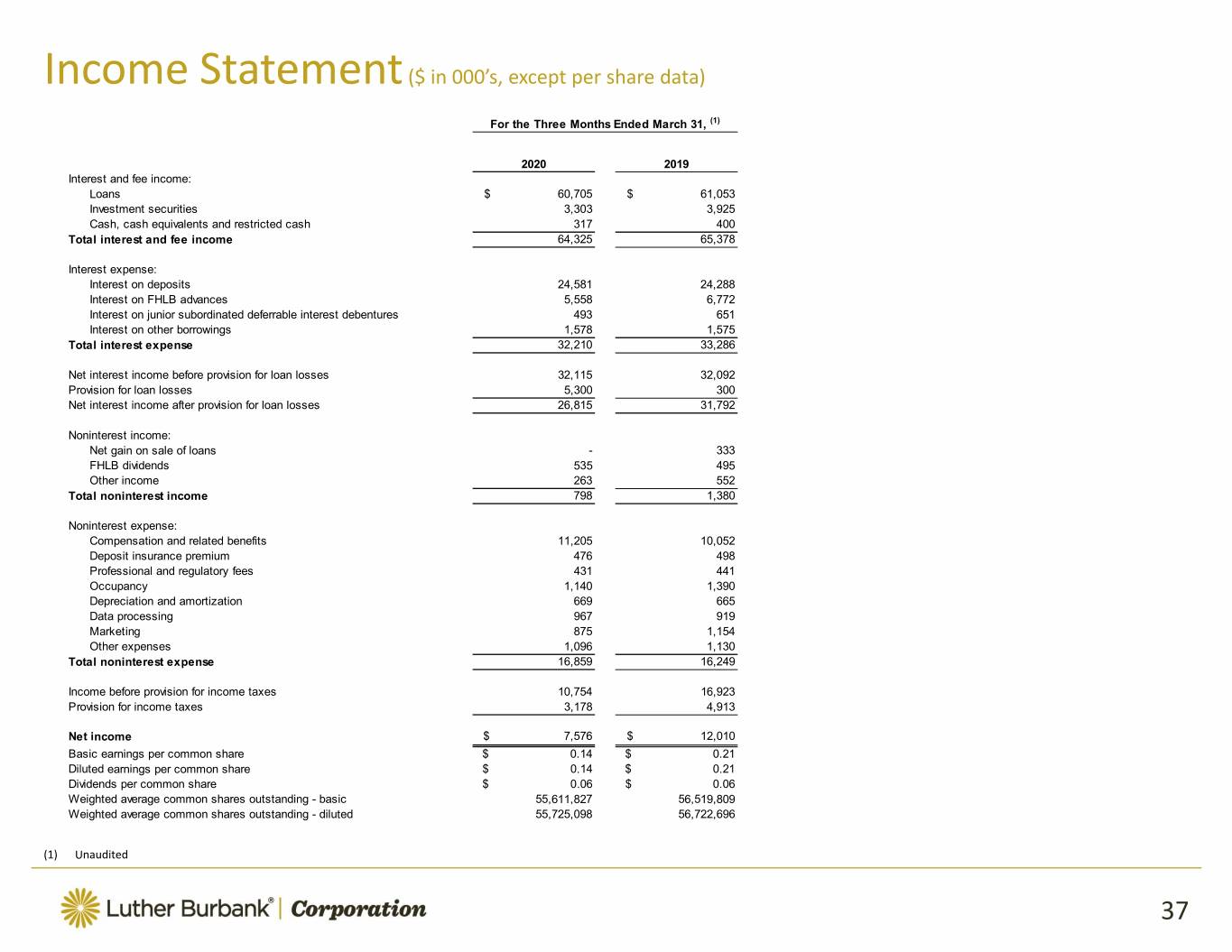

Income Statement ($ in 000’s, except per share data) For the Three Months Ended March 31, (1) 2020 2019 Interest and fee income: Loans $ 60,705 $ 61,053 Investment securities 3,303 3,925 Cash, cash equivalents and restricted cash 317 400 Total interest and fee income 64,325 65,378 Interest expense: Interest on deposits 24,581 24,288 Interest on FHLB advances 5,558 6,772 Interest on junior subordinated deferrable interest debentures 493 651 Interest on other borrowings 1,578 1,575 Total interest expense 32,210 33,286 Net interest income before provision for loan losses 32,115 32,092 Provision for loan losses 5,300 300 Net interest income after provision for loan losses 26,815 31,792 Noninterest income: Net gain on sale of loans - 333 FHLB dividends 535 495 Other income 263 552 Total noninterest income 798 1,380 Noninterest expense: Compensation and related benefits 11,205 10,052 Deposit insurance premium 476 498 Professional and regulatory fees 431 441 Occupancy 1,140 1,390 Depreciation and amortization 669 665 Data processing 967 919 Marketing 875 1,154 Other expenses 1,096 1,130 Total noninterest expense 16,859 16,249 Income before provision for income taxes 10,754 16,923 Provision for income taxes 3,178 4,913 Net income $ 7,576 $ 12,010 Basic earnings per common share $ 0.14 $ 0.21 Diluted earnings per common share $ 0.14 $ 0.21 Dividends per common share $ 0.06 $ 0.06 Weighted average common shares outstanding - basic 55,611,827 56,519,809 Weighted average common shares outstanding - diluted 55,725,098 56,722,696 (1) Unaudited 37

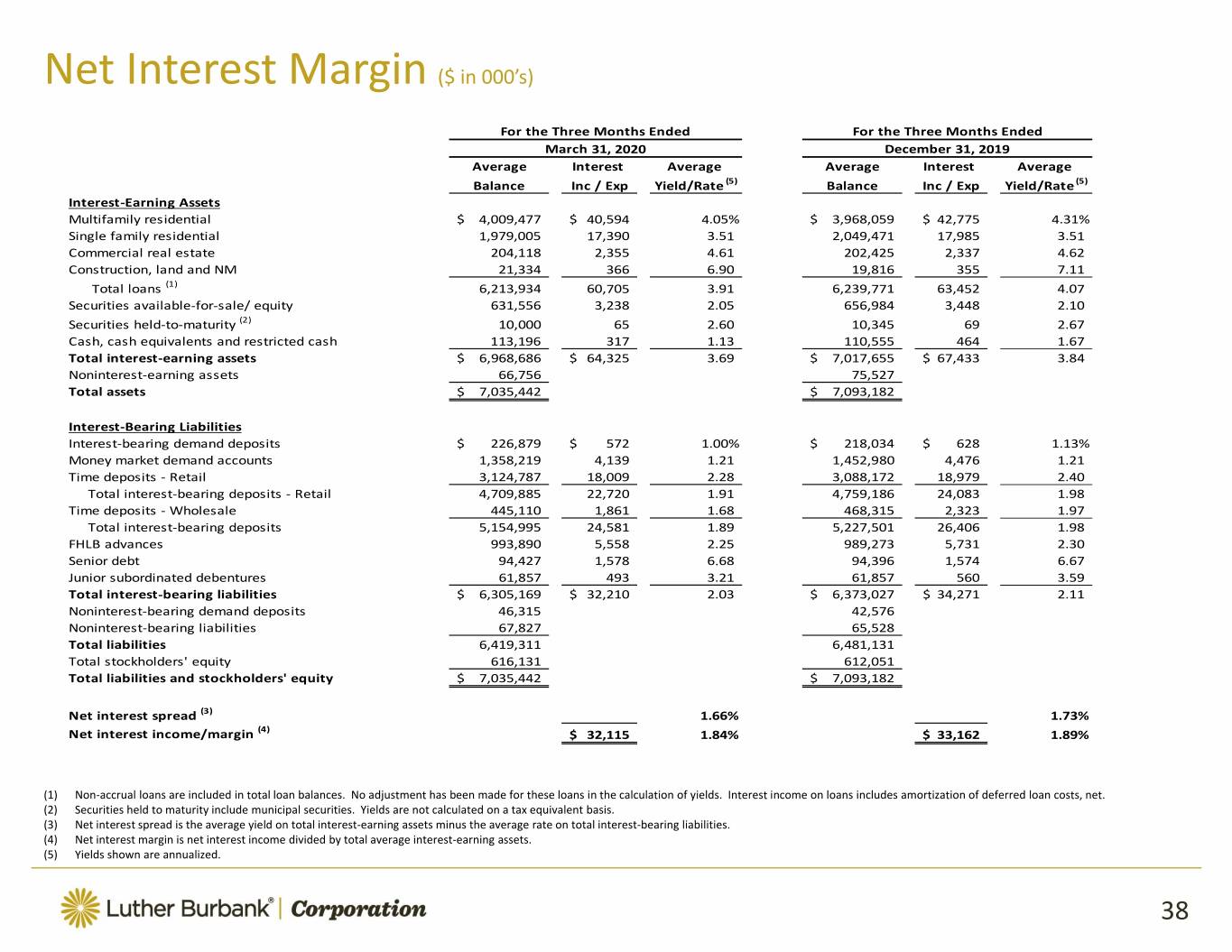

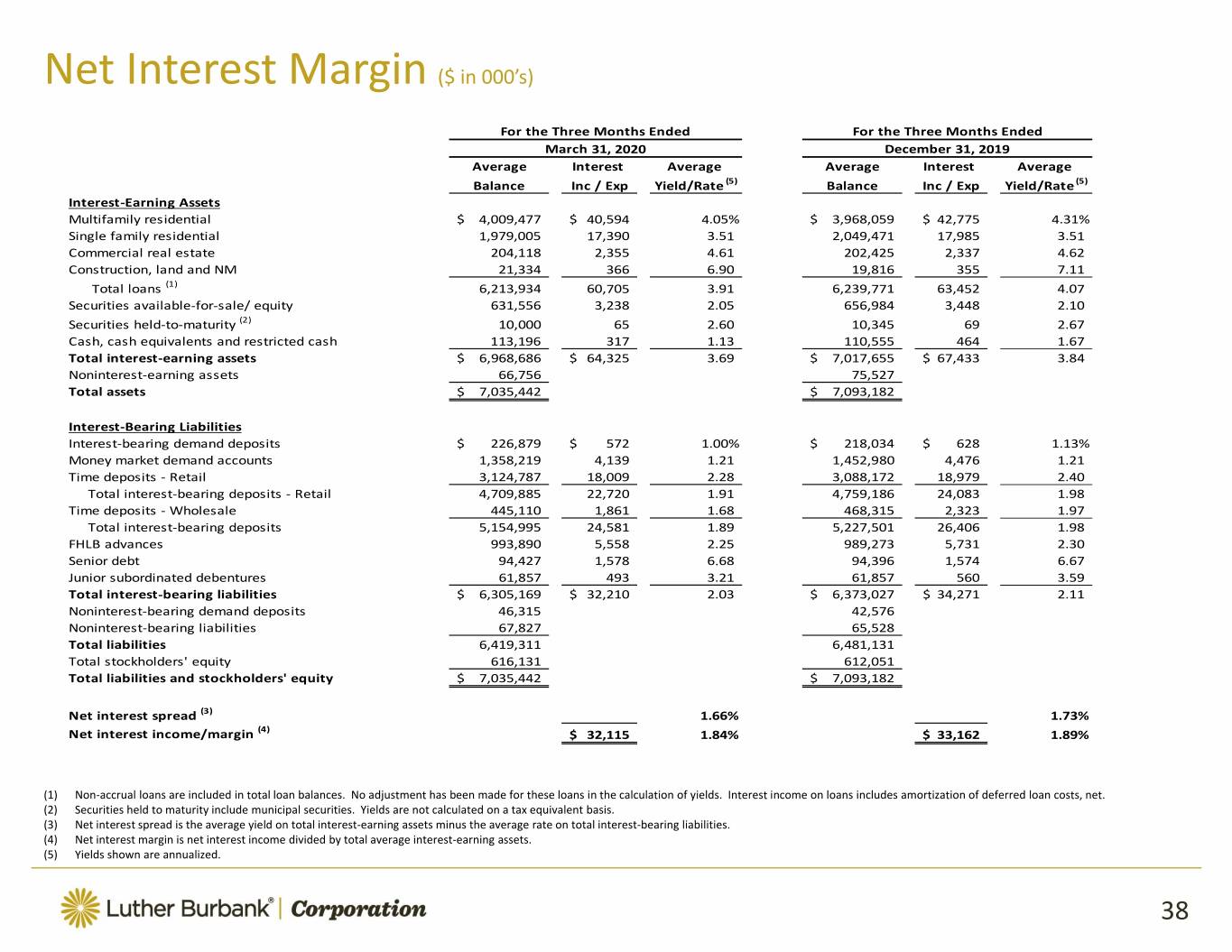

For the Three Months Ended For the Three Months Ended March 31, 2020 December 31, 2019 Net Interest Margin ($ in 000’s) Average Interest Average Average Interest Average (5) (5) Balance Inc / Exp Yield/Rate Balance Inc / Exp Yield/Rate Interest‐Earning Assets Multifamily residential$ 4,009,477 $ 40,594 4.05%$ 3,968,059 $ 42,775 4.31% Single family residential 1,979,005 17,390 3.51 2,049,471 17,985 3.51 Commercial real estate 204,118 2,355 4.61 202,425 2,337 4.62 Construction, land and NM 21,334 366 6.90 19,816 355 7.11 (1) 6,213,934 60,705 3.91 6,239,771 63,452 4.07 Total loans Securities available‐for‐sale/ equity 631,556 3,238 2.05 656,984 3,448 2.10 (2) Securities held‐to‐maturity 10,000 65 2.60 10,345 69 2.67 Cash, cash equivalents and restricted cash 113,196 317 1.13 110,555 464 1.67 Total interest‐earning assets $ 6,968,686 $ 64,325 3.69 $ 7,017,655 $ 67,433 3.84 Noninterest‐earning assets 66,756 75,527 Total assets $ 7,035,442 $ 7,093,182 Interest‐bearing demand depositsInterest‐Bearing Liabilities $ 226,879 $ 572 1.00%$ 218,034 $ 628 1.13% Money market demand accounts 1,358,219 4,139 1.21 1,452,980 4,476 1.21 Time deposits ‐ Retail 3,124,787 18,009 2.28 3,088,172 18,979 2.40 Total interest‐bearing deposits ‐ Retail 4,709,885 22,720 1.91 4,759,186 24,083 1.98 Time deposits ‐ Wholesale 445,110 1,861 1.68 468,315 2,323 1.97 Total interest‐bearing deposits 5,154,995 24,581 1.89 5,227,501 26,406 1.98 FHLB advances 993,890 5,558 2.25 989,273 5,731 2.30 Senior debt 94,427 1,578 6.68 94,396 1,574 6.67 Junior subordinated debentures 61,857 493 3.21 61,857 560 3.59 Total interest‐bearing liabilities $ 6,305,169 $ 32,210 2.03 $ 6,373,027 $ 34,271 2.11 Noninterest‐bearing demand deposits 46,315 42,576 Noninterest‐bearing liabilities 67,827 65,528 Total liabilities 6,419,311 6,481,131 Total stockholders' equity(3) 616,131 1.66% 612,051 1.73% Total liabilities and stockholders' equity(4) $ 7,035,442 $ 7,093,182 Net interest income/margin $ 32,115 1.84%$ 33,162 1.89% Net interest spread (1) Non‐accrual loans are included in total loan balances. No adjustment has been made for these loans in the calculation of yields. Interest income on loans includes amortization of deferred loan costs, net. (2) Securities held to maturity include municipal securities. Yields are not calculated on a tax equivalent basis. (3) Net interest spread is the average yield on total interest‐earning assets minus the average rate on total interest‐bearing liabilities. (4) Net interest margin is net interest income divided by total average interest‐earning assets. (5) Yields shown are annualized. 38

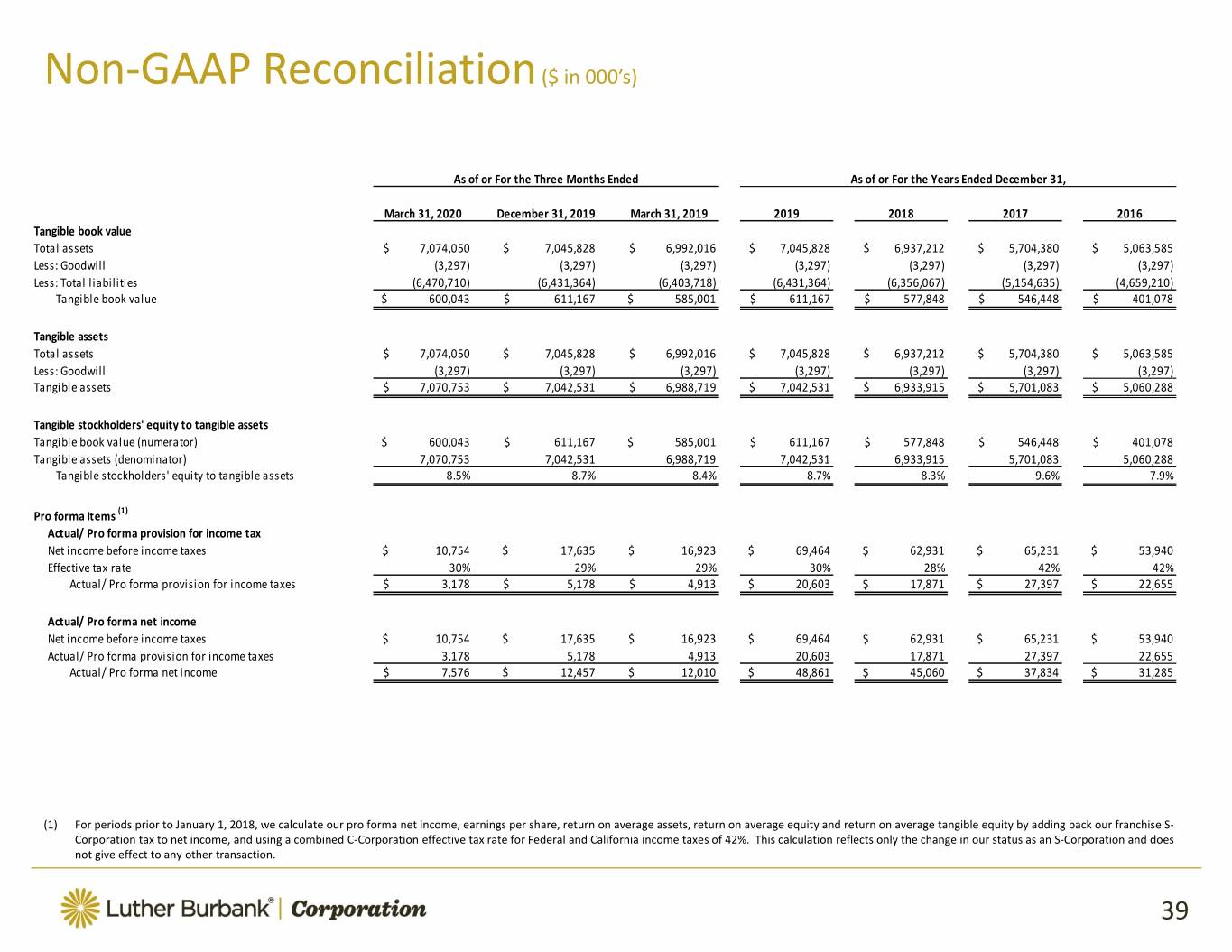

Non‐GAAP Reconciliation ($ in 000’s) March 31, 2020As of or For the Three Months Ended December 31, 2019 March 31, 2019 2019 As of or For the Years Ended 2018 2017 December 31, 2016 Tangible book value Total assets $ 7,074,050 $ 7,045,828 $ 6,992,016 $ 7,045,828 $ 6,937,212 $ 5,704,380 $ 5,063,585 Less: Goodwill (3,297) (3,297) (3,297) (3,297) (3,297) (3,297) (3,297) Less: Total liabilities (6,470,710) (6,431,364) (6,403,718) (6,431,364) (6,356,067) (5,154,635) (4,659,210) Tangible book value $ 600,043 $ 611,167 $ 585,001 $ 611,167 $ 577,848 $ 546,448 $ 401,078 Tangible assets Total assets $ 7,074,050 $ 7,045,828 $ 6,992,016 $ 7,045,828 $ 6,937,212 $ 5,704,380 $ 5,063,585 Less: Goodwill (3,297) (3,297) (3,297) (3,297) (3,297) (3,297) (3,297) Tangible assets $ 7,070,753 $ 7,042,531 $ 6,988,719 $ 7,042,531 $ 6,933,915 $ 5,701,083 $ 5,060,288 Tangible stockholders' equity to tangible assets Tangible book value (numerator) $ 600,043 $ 611,167 $ 585,001 $ 611,167 $ 577,848 $ 546,448 $ 401,078 Tangible assets (denominator) 7,070,753 7,042,531 6,988,719 7,042,531 6,933,915 5,701,083 5,060,288 Tangible stockholders' equity to tangible assets 8.5% 8.7% 8.4% 8.7%8.3%9.6%7.9% Pro forma Items (1) Actual/ Pro forma provision for income tax Net income before income taxes $ 10,754 $ 17,635 $ 16,923 $ 69,464 $ 62,931 $ 65,231 $ 53,940 Effective tax rate 30% 29% 29% 30% 28% 42% 42% Actual/ Pro forma provision for income taxes $ 3,178 $ 5,178 $ 4,913 $ 20,603 $ 17,871 $ 27,397 $ 22,655 Actual/ Pro forma net income Net income before income taxes $ 10,754 $ 17,635 $ 16,923 $ 69,464 $ 62,931 $ 65,231 $ 53,940 Actual/ Pro forma provision for income taxes 3,178 5,178 4,913 20,603 17,871 27,397 22,655 Actual/ Pro forma net income $ 7,576 $ 12,457 $ 12,010 $ 48,861 $ 45,060 $ 37,834 $ 31,285 (1) For periods prior to January 1, 2018, we calculate our pro forma net income, earnings per share, return on average assets, return on average equity and return on average tangible equity by adding back our franchise S‐ Corporation tax to net income, and using a combined C‐Corporation effective tax rate for Federal and California income taxes of 42%. This calculation reflects only the change in our status as an S‐Corporation and does not give effect to any other transaction. 39

Non‐GAAP Reconciliation ($ in 000’s, except per share data) As of or For the Three Months Ended As of or For the Years Ended December 31, March 31, 2020 December 31, 2019 March 31, 2019 2019 2018 2017 2016 Pro forma Items Continued (1) Actual/ Pro forma ratios and per share data Actual/ Pro forma net income (numerator) $ 7,576 $ 12,457 $ 12,010 $ 48,861 $ 45,060 $ 37,834 $ 31,285 Average assets (denominator) 7,035,442 7,093,182 6,967,947 7,066,547 6,405,931 5,485,832 4,676,676 Actual/ Pro forma return on average assets 0.43% 0.70% 0.69% 0.69% 0.70% 0.69% 0.67% Average stockholders' equity (denominator) $ 616,131 $ 612,051 $ 586,824 $ 599,574 $ 566,275 $ 425,698 $ 390,318 Actual/ Pro forma return on average stockholders' equity 4.92% 8.14% 8.19% 8.15% 7.96% 8.89% 8.02% Weighted average shares outstanding ‐ diluted (denominator) 55,725,098 56,937,952 56,722,696 56,219,892 56,825,402 42,957,936 42,000,000 Actual/ Pro forma earnings per share—diluted $ 0.14 $ 0.22 $ 0.21 $ 0.87 $ 0.79 $ 0.88 $ 0.74 Efficiency ratio Noninterest expense (numerator) $ 16,859 $ 15,341 $ 16,249 $ 62,386 $ 62,687 $ 56,544 $ 61,242 Net interest income $ 32,115 $ 33,162 $ 32,092 $ 128,407 $ 125,087 $ 110,895 $ 94,594 Noninterest income 798 814 1,380 4,675 4,131 7,508 7,885 Operating revenue (denominator) $ 32,913 $ 33,976 $ 33,472 $ 133,082 $ 129,218 $ 118,403 $ 102,479 Efficiency ratio 51.2% 45.2% 48.5% 46.9% 48.5% 47.8% 59.8% (1) For periods prior to January 1, 2018, we calculate our pro forma net income, earnings per share, return on average assets, return on average equity and return on average tangible equity by adding back our franchise S‐ Corporation tax to net income, and using a combined C‐Corporation effective tax rate for Federal and California income taxes of 42%. This calculation reflects only the change in our status as an S‐Corporation and does not give effect to any other transaction. 40