UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2011.

Commission File Number 333-170434

Sumitomo Mitsui Trust Holdings, Inc.

(Translation of registrant’s name into English)

9-2, Marunouchi, 1-chome

Chiyoda-ku, Tokyo 100-6611

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F: x Form 40-F: ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No ¨

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

This report on Form 6-K contains the following:

Formation of a Strategic Partnership with and Acquisition of an Interest in NewSmith LLP

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | Sumitomo Mitsui Trust Holdings, Inc. |

| | | |

| Date: December 14, 2011 | | | | By: | | /s/ Tadashi Nishimura |

| | | | Name: | | Tadashi Nishimura |

| | | | Title: | | Executive Officer |

To whom it may concern

December 14, 2011

Sumitomo Mitsui Trust Holdings, Inc.

(Securities Code: 8309 TSE, OSE, NSE)

The Sumitomo Trust and Banking Co., Ltd.

Formation of a Strategic Partnership with and Acquisition of an Interest in NewSmith LLP

Sumitomo Mitsui Trust Holdings, Inc. (President: Kazuo Tanabe; hereinafter “SMTH”) announces that The Sumitomo Trust and Banking Co., Ltd. (Chairman of the Board and President: Hitoshi Tsunekage; hereinafter “STB”), a subsidiary of SMTH, has entered into certain agreements with, amongst others, partners of NewSmith Capital Partners LLP (Founding Partners: Michael Marks, Paul Roy, Stephen Zimmerman, Ron Carlson; hereinafter “NSCP”), to acquire an interest in certain business operations of NSCP, a London based investment manager, subject to regulatory approvals and permits (the “Transaction”).

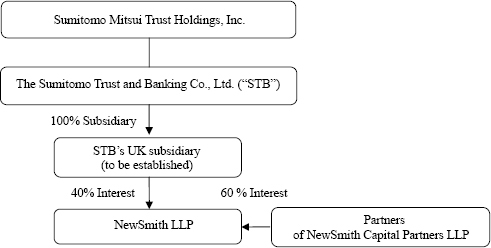

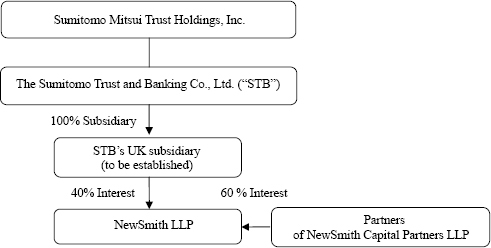

Pursuant to a reorganization of NSCP’s business, partners of NSCP will form a new limited liability partnership, NewSmith LLP (hereinafter “NSP”) to acquire and carry on certain investment management business operations of NSCP. STB, through a wholly owned UK subsidiary, will acquire a 40% interest in NSP by making an initial investment of 35 million pounds sterling (corresponding to approx. 4.2 billion yen). (Please refer to “2) Scheme Structure” below)

1) The purpose of STB’s investment:

In expanding its global asset management business, STB’s strategy is to broaden its client base and to enhance its profitability in Europe. STB aims to strengthen its asset management business platform and fulfill its strategy by way of strategic alliances with or acquisitions of interests in boutique investment managers with strong products. NSP clearly meets this strategic objective.

NSP is an investment manager with AUM of 2.1 billion pounds sterling (corresponding to approx. 260.0 billion yen) and has a business that: 1) offers UK, European, Global, and Japanese equity products with an excellent reputation; 2) maintains strong relationships with institutional clients such as UK pension funds and foundations.

STB’s acquisition of an interest in NSP will be mutually beneficial to both parties. In particular, STB adds a solid foundation to its global asset management business and the Transaction offers NSP the opportunity to strengthen its financial stability and expand its client base in areas outside Europe, in particular Japan.

1

2) Scheme Structure:

3) NewSmith LLP:

| | |

| Name | | NewSmith LLP |

| Location of Headquarters | | London, UK |

| Founding Partners | | Michael Marks, Paul Roy, Stephen Zimmerman, Ron Carlson |

| Main Business | | Investment Management |

| Number of Employees | | 55 |

| AUM | | 2.1 billion pounds sterling (as of end of December, 2010) (approx. 260.0 billion yen, 1 pounds sterling=120yen) |

(For reference) Certain Details of NewSmith Capital Partners LLP

NewSmith Capital Partners LLP was established in 2003 and is headquartered in London, UK. The company offers UK, European and Global equity products to institutional clients such as UK pension funds and foundations. In Japan, it created a representative office in 2006, and later acquired authorization as an investment manager to offer Japanese equity hedge fund products to Japanese pension funds and financial institutions.

For further information, please contact:

IR Office, Sumitomo Mitsui Trust Holdings, Inc.

Telephone: +81-3-3286-8354

Facsimile: +81-3-3286-4654

2

Cautionary Statement Regarding Forward-Looking Statements

This material contains forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995) regarding our intent, belief or current expectations in respect to our future financial conditions, operating results and overall management. These forward-looking statements may be identified by words such as “believes”, “expects”, “anticipates”, “projects”, “intends”, “should”, “seeks”, “estimates”, “future”, or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Such forward-looking statements are not guarantees of future performance and actual results may differ, owing to risks and uncertainties, including without limitation: (1) potential difficulties in integrating the management and business operations of our subsidiaries; (2) our ability to successfully execute our group business strategies; and (3) unanticipated events that result in an increase in our credit costs and a deterioration in the quality of our group companies’ loan portfolios. Given such risks and uncertainties, you should not place undue reliance on forward-looking statements, which speak only as of the release date of this material. We undertake no obligation to update or revise any forward-looking statements. In addition to this material, please refer to our most recently disclosed documents, such as our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, or press releases we have issued, for a more detailed description of matters that may affect our financial condition and operating results.