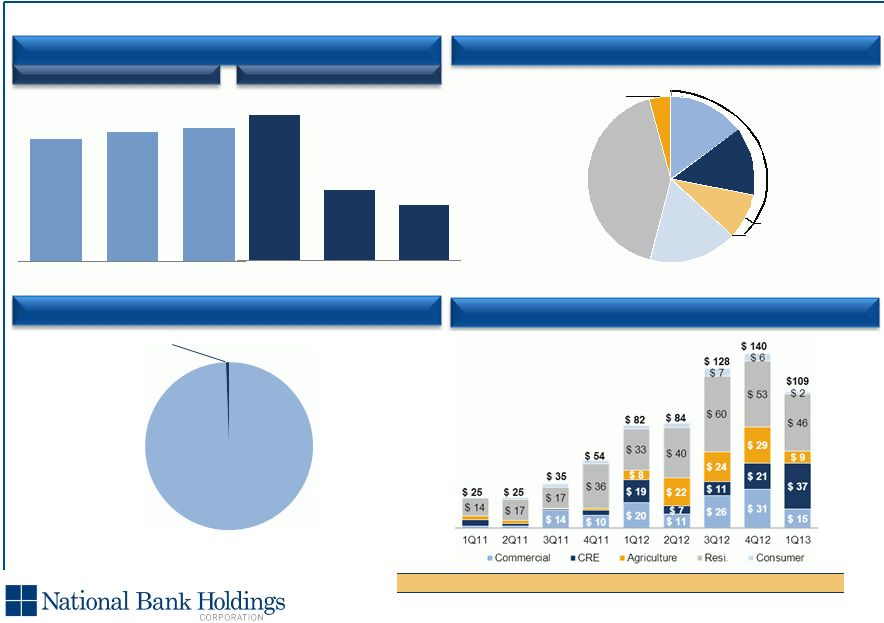

First Quarter Earnings Summary 7 Reported 1Q13 net income of $2.1 million or $0.04 per share. Grew the strategic loan portfolio by 11.4% annualized and successfully exited $98.7 million of non- strategic loan portfolio. Grew average transaction account deposit balances 4.8% annualized, driving a 3 basis point improvement in total cost of deposits. Added $14.9 million to accretable yield for the acquired loans accounted for under ASC 310-30, while only taking $0.3 million in impairments, netting to a $14.6 million economic improvement in the quarter and $83.6 million on a life-to-date basis. Credit quality continued to improve, with non-performing loans improving to 2.08% from 2.23%. Net charge-offs on non-310-30 loans were 0.44% annualized. Net interest margin of 3.88% during the first quarter, driven by attractive yields on loans accounted for under ASC 310-30 loan pools and lower cost of deposits. Expenses before problem loan/OREO workout expenses were flat for the third consecutive quarter, adjusting for the third quarter IPO expenses. The problem loan/OREO workout expenses totaled $7.1 million, decreasing $2.9 million from the prior quarter. Tangible book value per share of $19.13 before consideration of the excess accretable yield value of $0.52 per share. Approximately $400 million in excess strategic capital (above 10% Tier 1 Leverage), which positions us for future growth opportunities. |