1 Q1 2015 Investor Presentation

2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contain words such as “anticipate,” “believe,” “can,” “would,” “should,” “could,” “may,” “predict,” “seek,” “potential,” “will,” “estimate,” “target,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “intend” or similar expressions that relate to the Company’s strategy, plans or intentions. Forward-looking statements involve certain important risks, uncertainties and other factors, any of which could cause actual results to differ materially from those in such statements. Such factors include, without limitation, the “Risk Factors” referenced in our most recent Form 10-K filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, and the following additional factors: ability to execute our business strategy; business and economic conditions; economic, market, operational, liquidity, credit and interest rate risks associated with the Company’s business; effects of any changes in trade, monetary and fiscal policies and laws; changes imposed by regulatory agencies to increase capital standards; effects of inflation, as well as, interest rate, securities market and monetary supply fluctuations; changes in consumer spending, borrowings and savings habits; the Company’s ability to identify potential candidates for, consummate, integrate and realize operating efficiencies from, acquisitions; the Company's ability to successfully convert core operating systems, at the estimated cost, without significant business interruption and to realize the anticipated benefits; the Company’s ability to achieve organic loan and deposit growth and the composition of such growth; changes in sources and uses of funds; increased competition in the financial services industry; the effect of changes in accounting policies and practices; the share price of the Company’s stock; the Company's ability to realize deferred tax assets or the need for a valuation allowance; continued consolidation in the financial services industry; ability to maintain or increase market share and control expenses; costs and effects of changes in laws and regulations and of other legal and regulatory developments; technological changes; the timely development and acceptance of new products and services; the Company’s continued ability to attract and maintain qualified personnel; ability to implement and/or improve operational management and other internal risk controls and processes and its reporting system and procedures; regulatory limitations on dividends from the Company’s bank subsidiary; changes in estimates of future loan reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; widespread natural and other disasters, dislocations, political instability, acts of war or terrorist activities, cyberattacks or international hostilities; impact of reputational risk; and success at managing the risks involved in the foregoing items. The Company can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this presentation, and the Company does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Further Information This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in our Form 10-K and quarterly reports. Non-GAAP Measures We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. Please see the Appendix to this presentation and our Form 10-K and quarterly reports for a further description of our use of non-GAAP financial measures and a reconciliation of the differences from the most directly comparable GAAP financial measures.

3 Company Overview

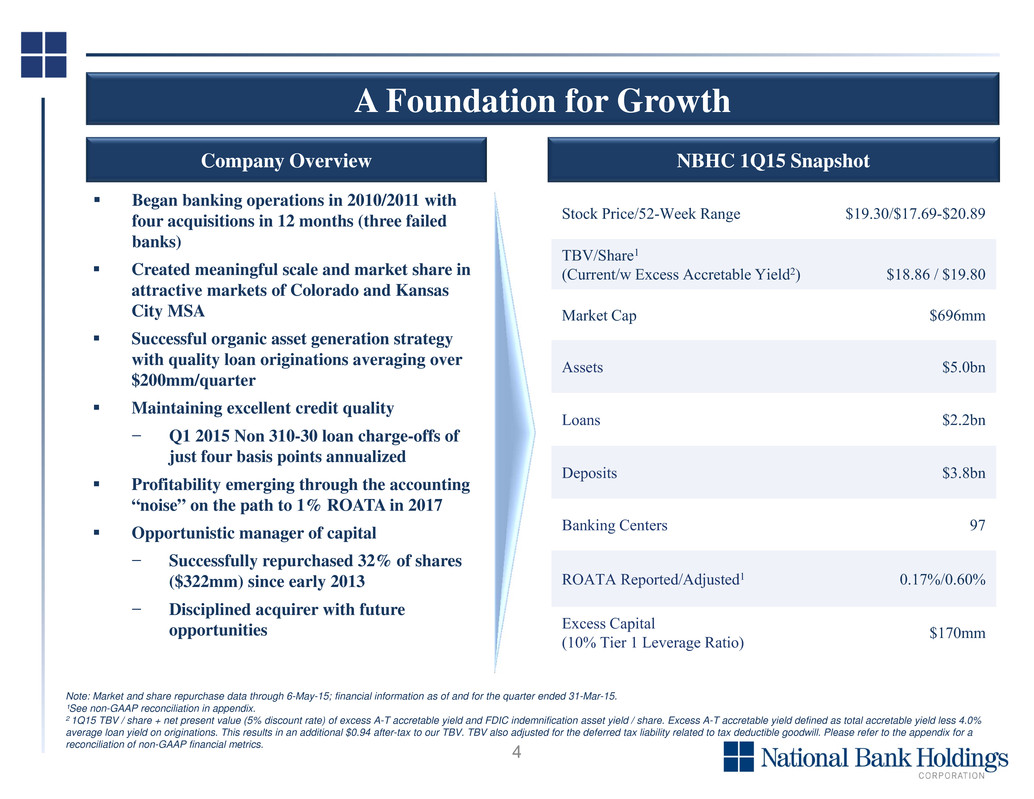

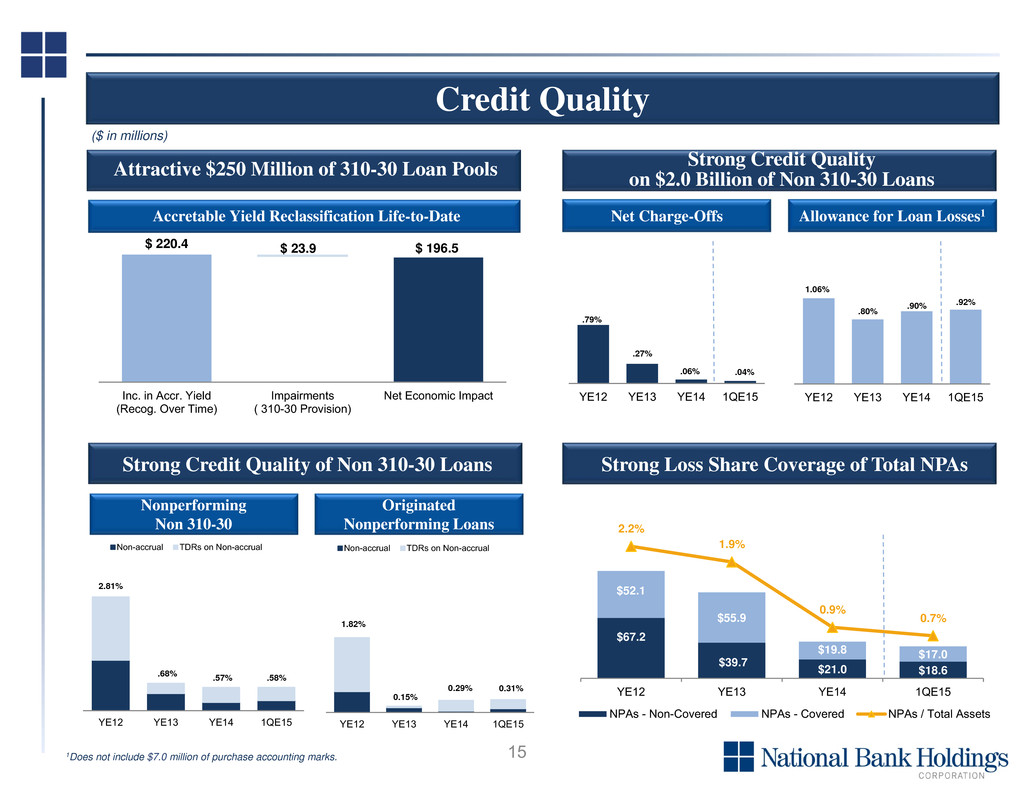

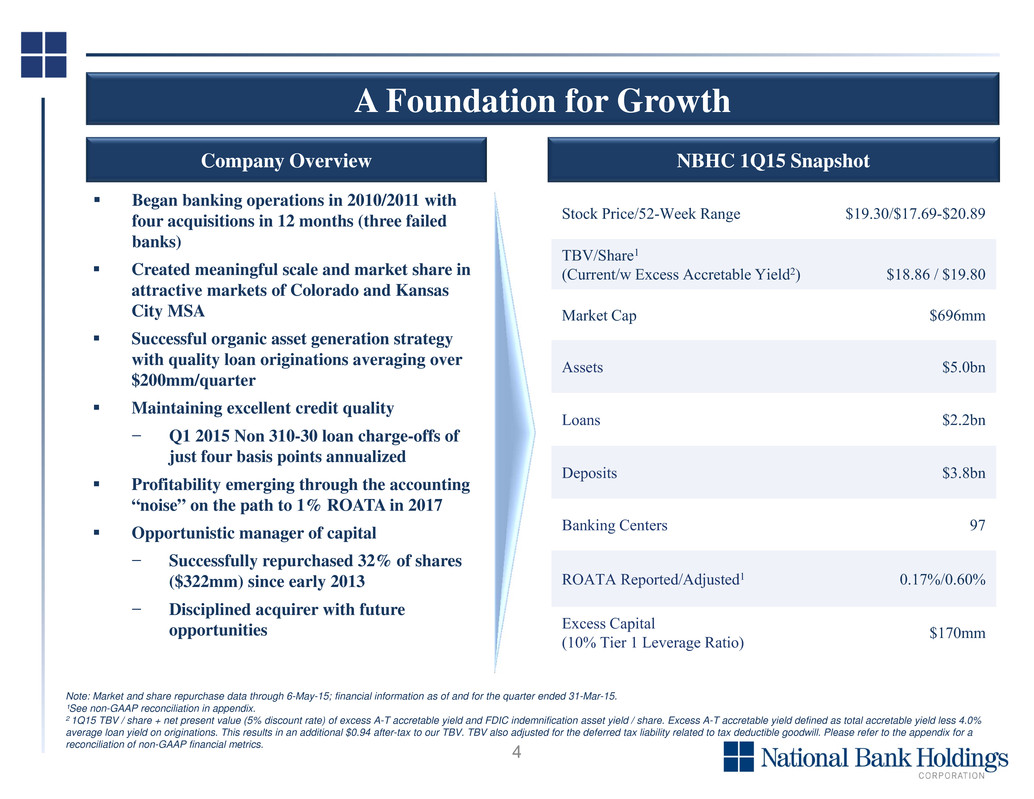

4 Began banking operations in 2010/2011 with four acquisitions in 12 months (three failed banks) Created meaningful scale and market share in attractive markets of Colorado and Kansas City MSA Successful organic asset generation strategy with quality loan originations averaging over $200mm/quarter Maintaining excellent credit quality ̶ Q1 2015 Non 310-30 loan charge-offs of just four basis points annualized Profitability emerging through the accounting “noise” on the path to 1% ROATA in 2017 Opportunistic manager of capital ̶ Successfully repurchased 32% of shares ($322mm) since early 2013 ̶ Disciplined acquirer with future opportunities Stock Price/52-Week Range $19.30/$17.69-$20.89 TBV/Share1 (Current/w Excess Accretable Yield2) $18.86 / $19.80 Market Cap $696mm Assets $5.0bn Loans $2.2bn Deposits $3.8bn Banking Centers 97 ROATA Reported/Adjusted1 0.17%/0.60% Excess Capital (10% Tier 1 Leverage Ratio) $170mm NBHC 1Q15 Snapshot Note: Market and share repurchase data through 6-May-15; financial information as of and for the quarter ended 31-Mar-15. ¹See non-GAAP reconciliation in appendix. 2 1Q15 TBV / share + net present value (5% discount rate) of excess A-T accretable yield and FDIC indemnification asset yield / share. Excess A-T accretable yield defined as total accretable yield less 4.0% average loan yield on originations. This results in an additional $0.94 after-tax to our TBV. TBV also adjusted for the deferred tax liability related to tax deductible goodwill. Please refer to the appendix for a reconciliation of non-GAAP financial metrics. Company Overview A Foundation for Growth

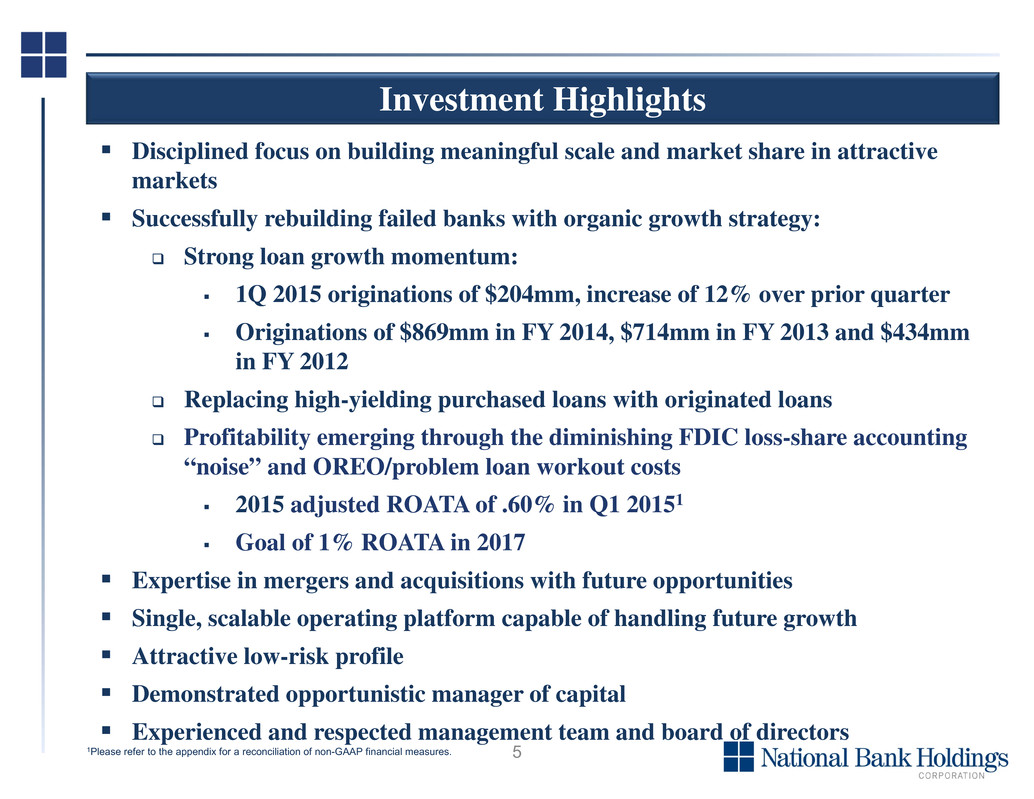

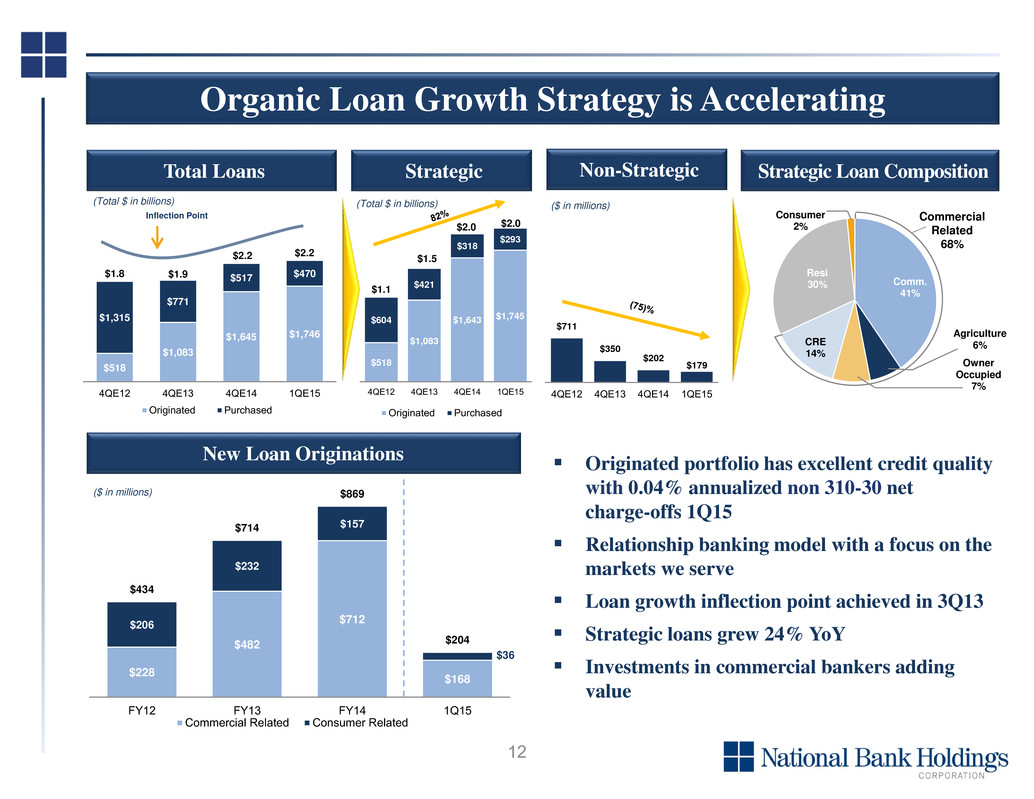

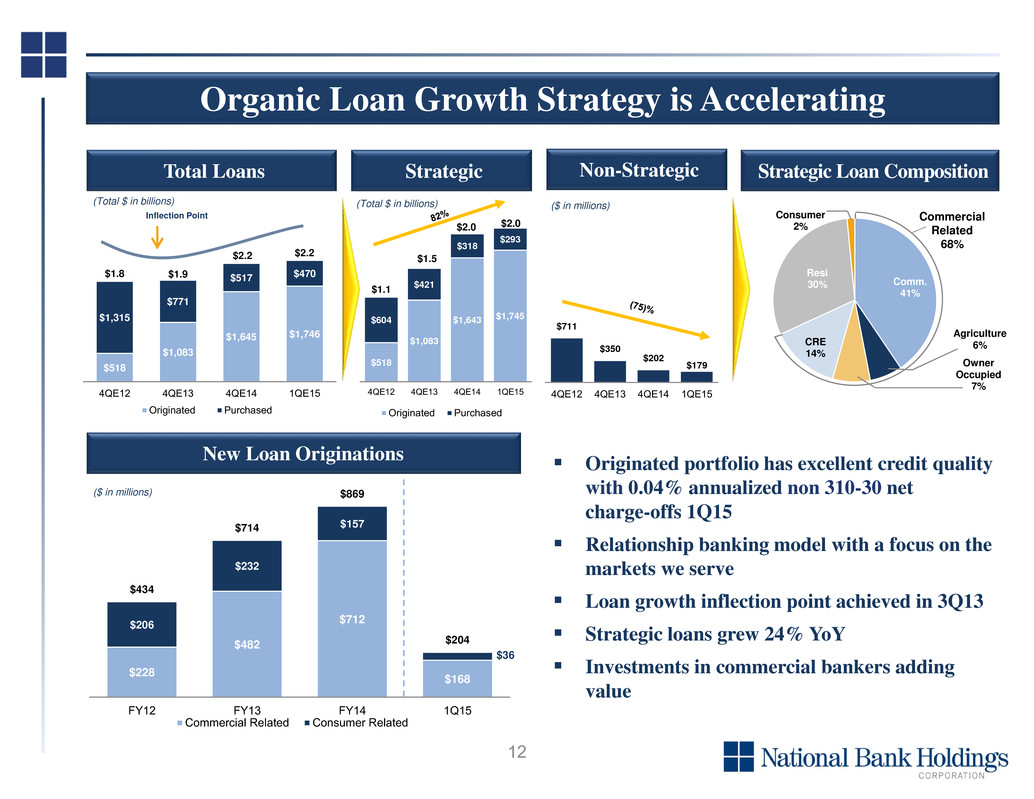

5 Investment Highlights Disciplined focus on building meaningful scale and market share in attractive markets Successfully rebuilding failed banks with organic growth strategy: Strong loan growth momentum: 1Q 2015 originations of $204mm, increase of 12% over prior quarter Originations of $869mm in FY 2014, $714mm in FY 2013 and $434mm in FY 2012 Replacing high-yielding purchased loans with originated loans Profitability emerging through the diminishing FDIC loss-share accounting “noise” and OREO/problem loan workout costs 2015 adjusted ROATA of .60% in Q1 20151 Goal of 1% ROATA in 2017 Expertise in mergers and acquisitions with future opportunities Single, scalable operating platform capable of handling future growth Attractive low-risk profile Demonstrated opportunistic manager of capital Experienced and respected management team and board of directors 1Please refer to the appendix for a reconciliation of non-GAAP financial measures.

6

7 Executive Team Tim Laney Chairman, President & Chief Executive Officer Brian Lilly Richard Newfield Chief Financial Officer Chief Risk Officer Zsolt Bessko Tom Metzger Chief Administrative Officer Chief of Enterprise Technology & Integration & General Counsel Market President, Bank Midwest & Hillcrest Bank Banking EVP, Consumer Central Division EVP, Consumer Western Division EVP, Specialty Banking Commerce Bancshares Bank of America Colorado Business Bank EVP, Commercial Central Division EVP, Commercial Western Division Managing Director, Capital Finance UMB Bank Bank of Choice Colorado Business Bank Director of Consumer Lending Director of Commercial Credit Management Director of Special Assets Bank Midwest Bank of America Hillcrest Bank Manager, Strategic Accounts Manager, Treasury Management Manager, Energy Banking First National Bank of Omaha Bank Midwest Bank of the West Risk Chief Compliance Officer Chief Credit Officer Director of Enterprise Risk & Credit Admin FDIC Bank of America Hillcrest Bank BSA Officer Director of Loan Operations Director of Internal Audit Jefferson Wells/Western Alliance First National Bank of Kansas M&I Bank Director of Security Enterprise Risk Manager Information Security Officer Federal Bureau of Investigation JP Morgan Chase Deloitte & Touche LLP Administration/Finance/Operations Treasurer Director of Enterprise Technology Director of Marketing M&I Bank Commerce Bancshares Bank of America Chief Accounting Officer Director of Project Management Office Director of Corporate Development & Deloitte Hillcrest Bank Strategy Director of Management Reporting & Analysis Director of Human Resources Goldman Sachs Jeppeson Sanderson, a Boeing Company JE Dunn Construction NBHC LEADERSHIP

8 Organic Growth Acquisition Growth Client-Centered, Relationship-Driven Enhanced Product Offerings Attractive Markets Disciplined Acquisitions Scalable Operating Platform & Efficiencies Leading Regional Bank Holding Company Our Objectives Opportunistic Capital Management

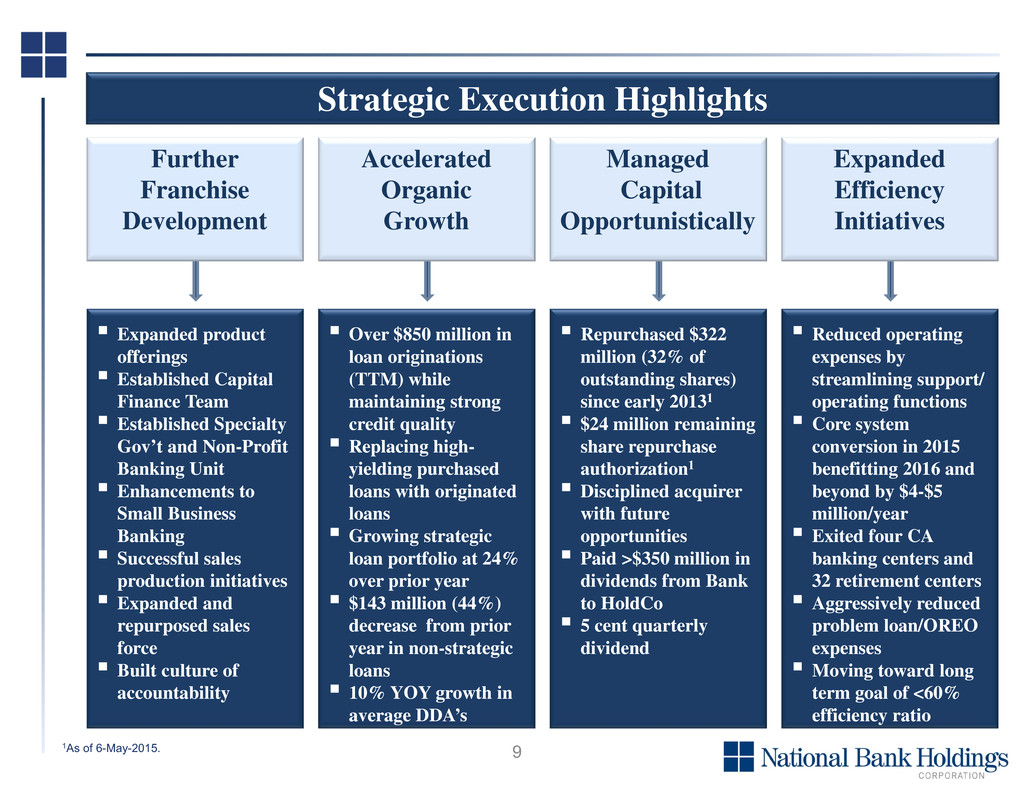

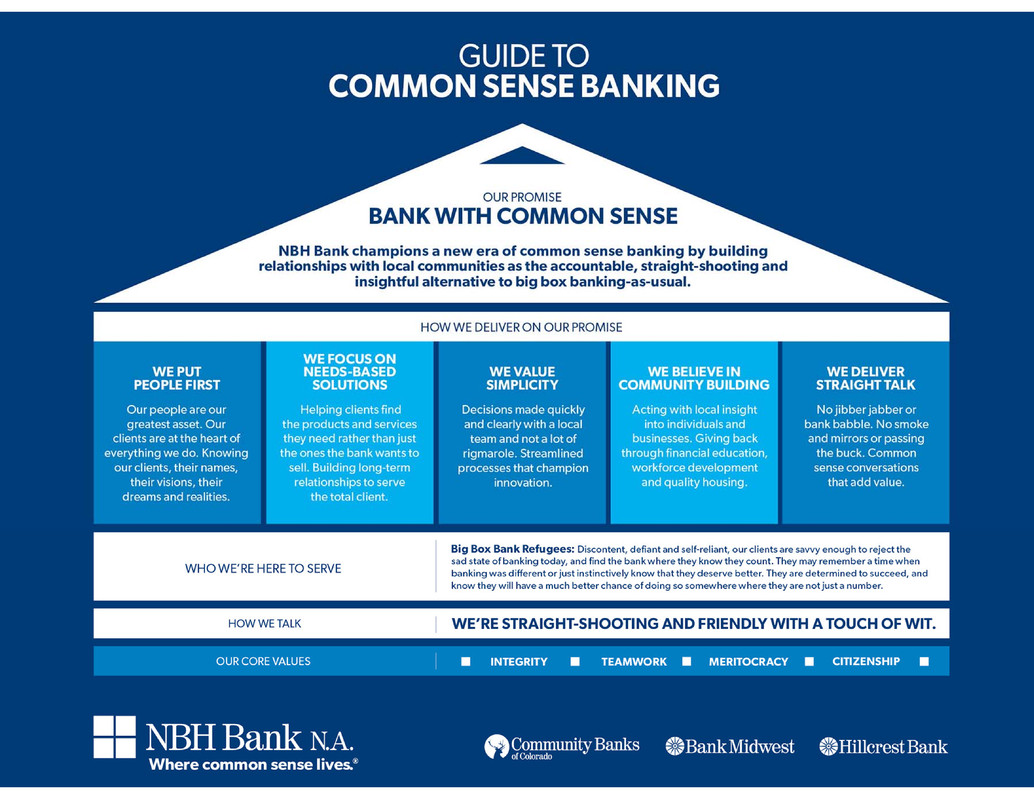

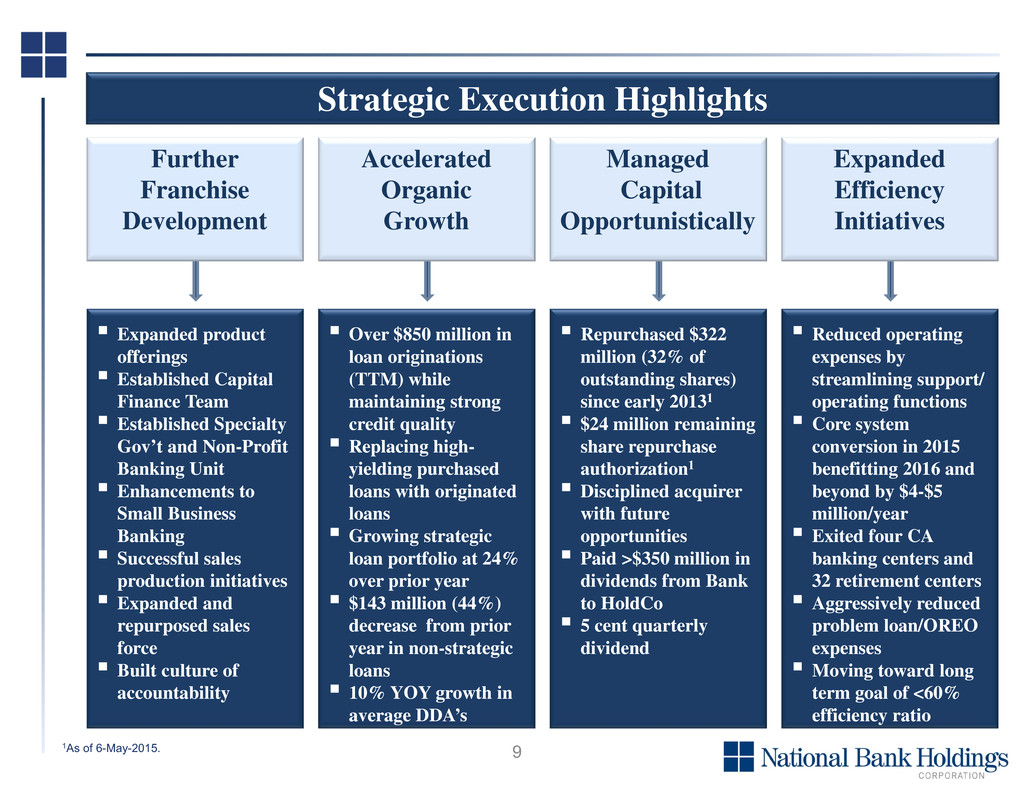

9 Strategic Execution Highlights Expanded Efficiency Initiatives Managed Capital Opportunistically Further Franchise Development Expanded product offerings Established Capital Finance Team Established Specialty Gov’t and Non-Profit Banking Unit Enhancements to Small Business Banking Successful sales production initiatives Expanded and repurposed sales force Built culture of accountability Repurchased $322 million (32% of outstanding shares) since early 20131 $24 million remaining share repurchase authorization1 Disciplined acquirer with future opportunities Paid >$350 million in dividends from Bank to HoldCo 5 cent quarterly dividend Reduced operating expenses by streamlining support/ operating functions Core system conversion in 2015 benefitting 2016 and beyond by $4-$5 million/year Exited four CA banking centers and 32 retirement centers Aggressively reduced problem loan/OREO expenses Moving toward long term goal of <60% efficiency ratio Accelerated Organic Growth Over $850 million in loan originations (TTM) while maintaining strong credit quality Replacing high- yielding purchased loans with originated loans Growing strategic loan portfolio at 24% over prior year $143 million (44%) decrease from prior year in non-strategic loans 10% YOY growth in average DDA’s 1As of 6-May-2015.

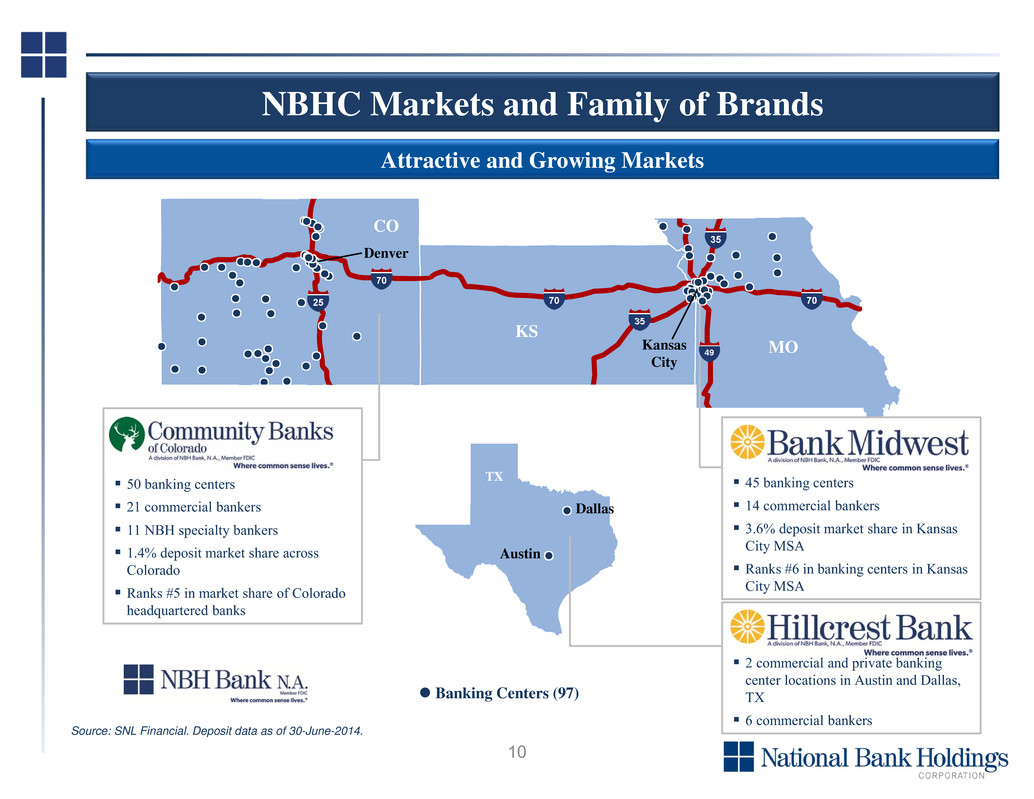

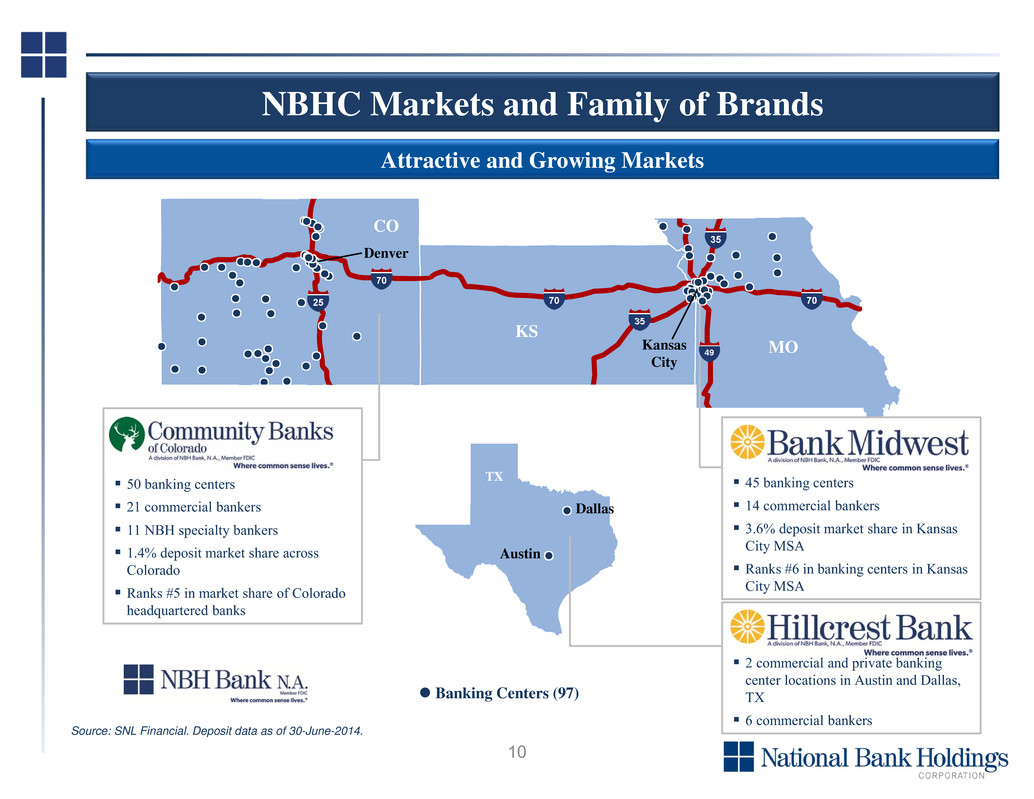

10 NBHC Markets and Family of Brands Banking Centers (97) 50 banking centers 21 commercial bankers 11 NBH specialty bankers 1.4% deposit market share across Colorado Ranks #5 in market share of Colorado headquartered banks 45 banking centers 14 commercial bankers 3.6% deposit market share in Kansas City MSA Ranks #6 in banking centers in Kansas City MSA 2 commercial and private banking center locations in Austin and Dallas, TX 6 commercial bankers CO TX Source: SNL Financial. Deposit data as of 30-June-2014. Attractive and Growing Markets Dallas Austin MO Denver Kansas City CO KS 49

11 Key Statistics by MSA Source: FHFA, SNL Financial, U.S. Census, U.S. Bureau of Economic Analysis. Note: “Front Range” statistics include populated weighted values for Denver, Boulder, Colorado Springs, Fort Collins, and Greeley MSAs. Deposit data as of 30-Jun-14. Front Range unemployment based on a weighted average unemployment and 2015 population for each MSA. ¹ HHI projections based on current dollar values (inflation adjusted). 2 FHFA home price index based on quarterly all-transaction data as of 31-December-14. 3 Based on U.S. Top 20 MSAs (determined by population). Our Markets are Attractive Equal or Better Than U.S. Average U.S. 2015 Population (mm) 319.5 2.8 4.4 2.1 Population CAGR (‘15-’20E) 0.7 % 1.4 % 1.4 % 0.6 % 2014 Median Household Income $53.7K $64.4K $63.3K $56.8K Household Income Growth (‘15-’20E) ¹ 6.7 % 7.2 % 7.5 % 4.9 % # of Businesses (000s) - 114.9 182.7 76.0 Unemployment Rate (Feb-15) 5.5 % 4.5 % 4.6 % 5.9 % 2013 Real GDP per Capita $52.1K $61.6K $57.6K $53.7K Real GDP Growth (’08-’13) 5.2 % 9.7 % 9.8 % 4.2 % Home Price Index 5yr ∆ ² 6.1 % 24.7 % 22.1 % 1.4 % Building Permit 5yr CAGR (’09-’14) 12.2 % 31.0 % 31.6 % 19.1 % Branch Penetration (per 100k people) 29.6 24.5 25.4 34.3 Top 3 Combined Deposit Market Share 52% ³ 55% 54% 40% Denver, CO Front Range Kansas City, MO B a n k s D e m o g r a p h i c s E c o n o m i c s

12 $518 $1,083 $1,643 $1,745 $604 $421 $318 $293 $1.1 $1.5 $2.0 $2.0 4QE12 4QE13 4QE14 1QE15 Originated Purchased $518 $1,083 $1,645 $1,746 $1,315 $771 $517 $470 $1.8 $1.9 $2.2 $2.2 4QE12 4QE13 4QE14 1QE15 Originated Purchased Comm. 41% Agriculture 6% Owner Occupied 7% CRE 14% Resi 30% Consumer 2% Originated portfolio has excellent credit quality with 0.04% annualized non 310-30 net charge-offs 1Q15 Relationship banking model with a focus on the markets we serve Loan growth inflection point achieved in 3Q13 Strategic loans grew 24% YoY Investments in commercial bankers adding value Strategic Loan CompositionTotal Loans ($ in millions) New Loan Originations Organic Loan Growth Strategy is Accelerating Strategic Non-Strategic Commercial Related 68% Inflection Point $228 $482 $712 $168 $206 $232 $157 $36 $434 $714 $869 $204 FY12 FY13 FY14 1Q15 Commercial Related Consumer Related ($ in millions) (Total $ in billions)(Total $ in billions) $711 $350 $202 $179 4QE12 4QE13 4QE14 1QE15

13 7% 6% 6% 5% 4% 3% 3% 2% 3% 1%1% 11%4% 2%<1% 5% 6% 26% 2% 2% Loans Credit Quality ($2.2 Billion Outstanding) Portfolio Characteristics 1Includes owner-occupied CRE. Consumer, 30.2% Non Owner- Occupied CRE, 17.6% Commercial & Industrial1, 52.2% 1Q15 annualized non 310-30 net charge offs of 4 bps FY 2014 non 310-30 net charge-offs of 6 bps Commercial loans originated 1Q15: Average funding of $1.2 million Average commitment, including unused, of $1.5 million Residential loans originated 1Q15: Average FICO of 765 Average LTV of 64% Average funding per loan of $129k Top 25 originated relationships: Average funded balance of $14.6 million Average commitment of $19.3 million Energy loans were 7% of total loans, 3% of earning assets 7% 6% 6% 5% 4% 3% 3% 3% 2% 2% 1% 114 4% 2% >1% 0% 6% 26% 1 (3.1% is Non-strategic)

14 $150 Million Energy Portfolio Energy Portfolio Profile 6.8% of loans, 3.3% of earning assets Granular - $6.8mm avg. balance per relationship Strong credit quality at 3/31/2015 Prolonged/further pricing pressure could increase stress on energy clients; however, client capital and liquidity, as well as loan structures, protect against credit loss Energy Production, 44% Energy Services, 25% Energy Midstream, 31% Prudent Energy Banking Approach Disciplined energy lending Clients selected based on strong balance sheets, low leverage and management quality All clients have been recently reviewed and we maintain monthly monitoring for clients in this sector Experienced energy banking team Specialized and experienced bankers Specialized and experienced underwriters In-house petroleum geologist Energy Production – Loans to companies engaged in exploration and production Clients governed by borrowing base against proved reserves Clients are hedged into 2015 and 2016 Average utilization of 58% against lines Most recent price deck has downside set at $37 for oil and $2.00 for natural gas Energy Services – Companies that provide products and services to oil/gas companies Asset-based lending structures Secured by accounts receivable, inventory and equipment Energy Midstream – Loans to companies that engage in consolidation, storage and transportation of oil and gas Well capitalized, low leverage Take or pay contracts, sustainable cash flows Secured by plant and equipment

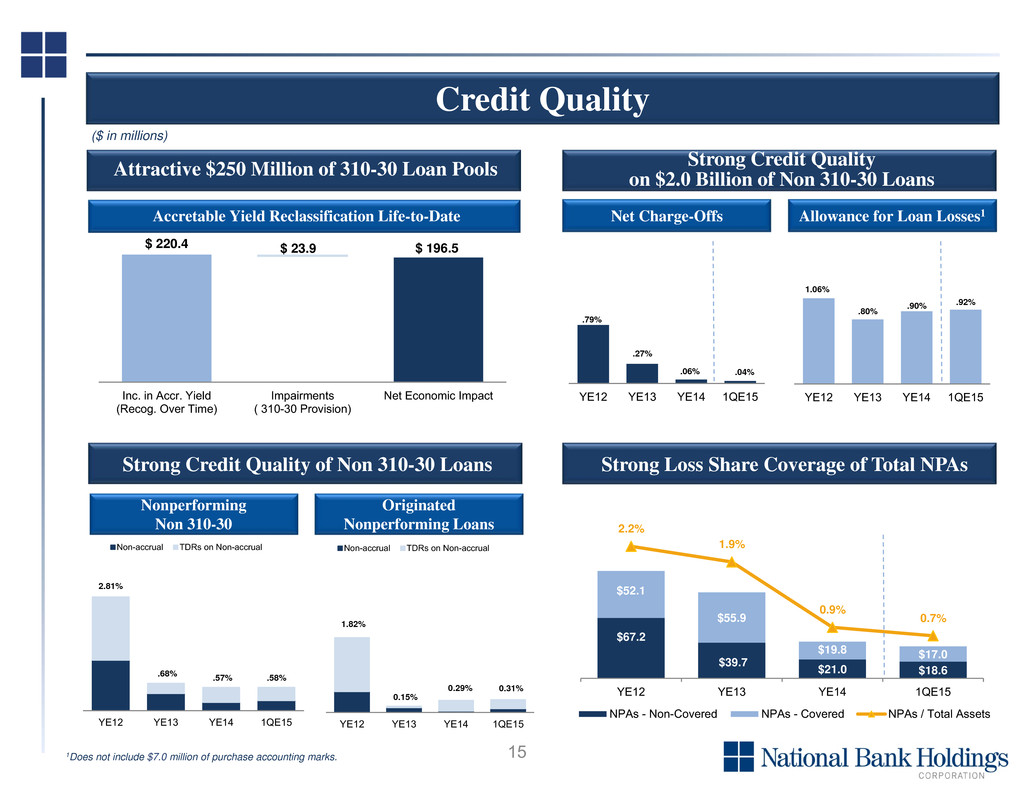

15 $ 220.4 $ 23.9 $ 196.5 Inc. in Accr. Yield (Recog. Over Time) Impairments ( 310-30 Provision) Net Economic Impact Attractive $250 Million of 310-30 Loan Pools Strong Credit Quality of Non 310-30 Loans Strong Loss Share Coverage of Total NPAs Credit Quality ($ in millions) Net Charge-Offs Allowance for Loan Losses1 Nonperforming Non 310-30 Originated Nonperforming Loans 1Does not include $7.0 million of purchase accounting marks. Strong Credit Quality on $2.0 Billion of Non 310-30 Loans Accretable Yield Reclassification Life-to-Date .79% .27% .06% .04% YE12 YE13 YE14 1QE15 1.06% .80% .90% .92% YE12 YE13 YE14 1QE15 $67.2 $39.7 $21.0 $18.6 $52.1 $55.9 $19.8 $17.0 2.2% 1.9% 0.9% 0.7% YE12 YE13 YE14 1QE15 NPAs - Non-Covered NPAs - Covered NPAs / Total Assets 2.81% .68% .57% .58% YE12 YE13 YE14 1QE15 Non-accrual TDRs on Non-accrual 1.82% 0.15% 0.29% 0.31% YE12 YE13 YE14 1QE15 Non-accrual TDRs on Non-accrual

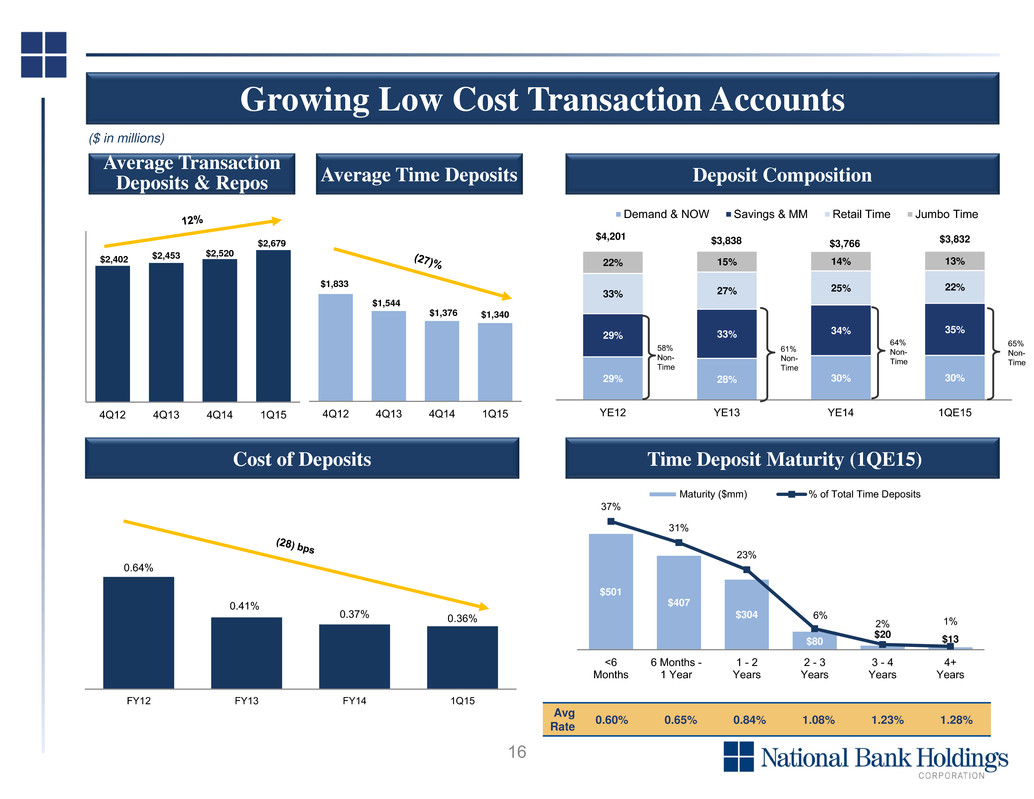

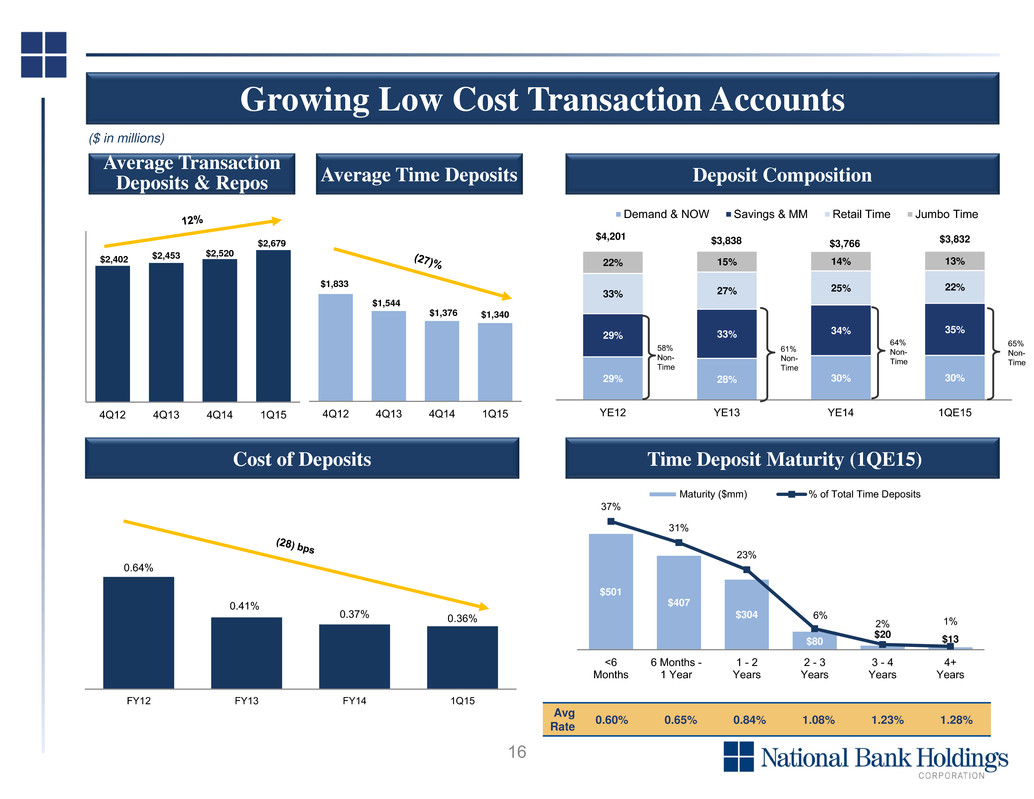

16 0.64% 0.41% 0.37% 0.36% FY12 FY13 FY14 1Q15 Deposit Composition Cost of Deposits Time Deposit Maturity (1QE15) ($ in millions) Average Transaction Deposits & Repos Average Time Deposits Avg Rate 0.60% 0.65% 0.84% 1.08% 1.23% 1.28% Growing Low Cost Transaction Accounts $2,402 $2,453 $2,520 $2,679 4Q12 4Q13 4Q14 1Q15 $1,833 $1,544 $1,376 $1,340 4Q12 4Q13 4Q14 1Q15 29% 28% 30% 30% 29% 33% 34% 35% 33% 27% 25% 22% 22% 15% 14% 13% $4,201 $3,838 $3,766 $3,832 YE12 YE13 YE14 1QE15 Demand & NOW Savings & MM Retail Time Jumbo Time 64% Non- Time 58% Non- Time 61% Non- Time 65% Non- Time $501 $407 $304 $80 $20 $13 37% 31% 23% 6% 2% 1% <6 Months 6 Months - 1 Year 1 - 2 Years 2 - 3 Years 3 - 4 Years 4+ Years Maturity ($mm) % of Total Time Deposits

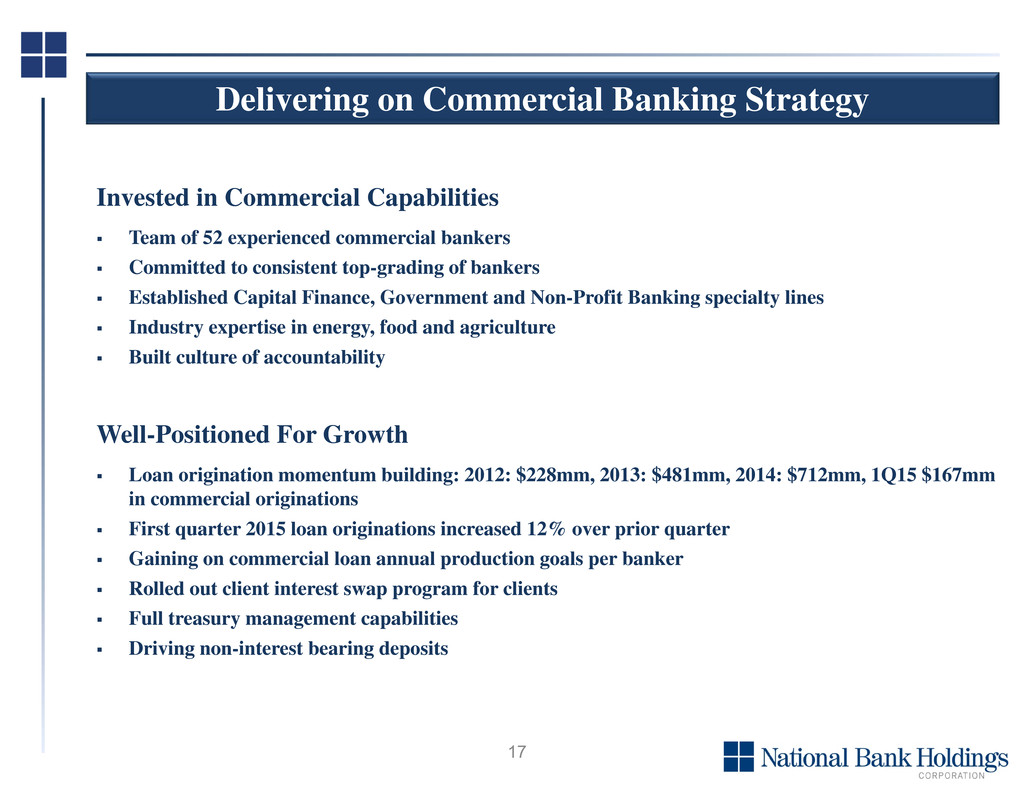

17 Delivering on Commercial Banking Strategy Invested in Commercial Capabilities Team of 52 experienced commercial bankers Committed to consistent top-grading of bankers Established Capital Finance, Government and Non-Profit Banking specialty lines Industry expertise in energy, food and agriculture Built culture of accountability Well-Positioned For Growth Loan origination momentum building: 2012: $228mm, 2013: $481mm, 2014: $712mm, 1Q15 $167mm in commercial originations First quarter 2015 loan originations increased 12% over prior quarter Gaining on commercial loan annual production goals per banker Rolled out client interest swap program for clients Full treasury management capabilities Driving non-interest bearing deposits

18 Delivering on Consumer & Small Business Banking Strategy Optimized Banking Center Distribution Exited California and retirement center locations Rolled out teller staffing efficiency model Consolidated management responsibilities Built culture of accountability Well Positioned For Growth Launched consumer and small business relationship product suites Emphasis on growing small business deposits and loans Focus on increasing transaction accounts and client share of wallet Emphasis on residential mortgages (1st, 2nd and home equity loans/lines) Gaining on consumer loan production goals per banking center Continue to invest in client facing talent

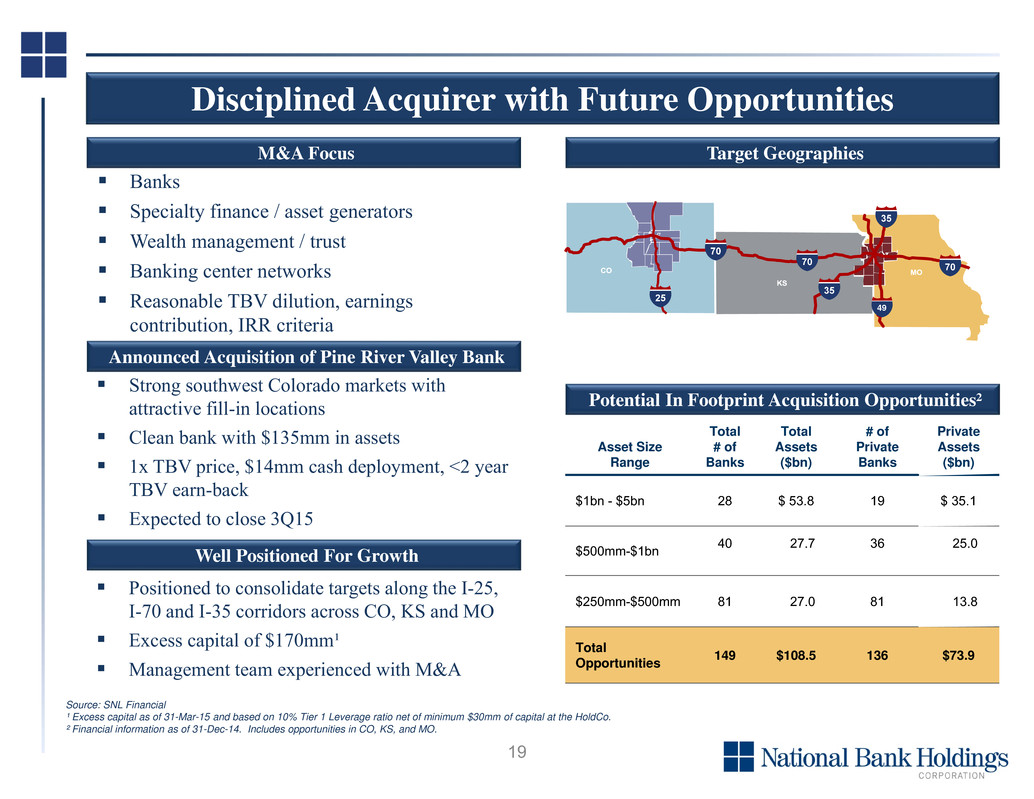

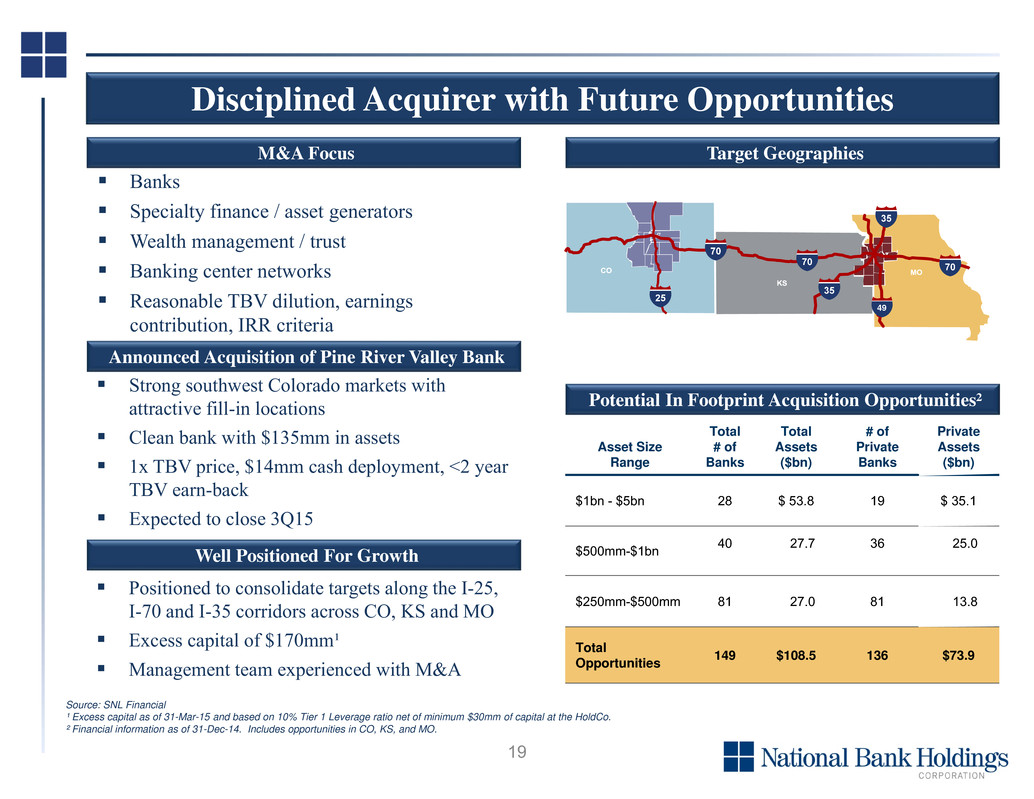

19 Disciplined Acquirer with Future Opportunities M&A Focus Target Geographies Positioned to consolidate targets along the I-25, I-70 and I-35 corridors across CO, KS and MO Excess capital of $170mm¹ Management team experienced with M&A Announced Acquisition of Pine River Valley Bank Potential In Footprint Acquisition Opportunities² Asset Size Range Total # of Banks Total Assets ($bn) # of Private Banks Private Assets ($bn) $1bn - $5bn 28 $ 53.8 19 $ 35.1 $500mm-$1bn 40 27.7 36 25.0 $250mm-$500mm 81 27.0 81 13.8 Total Opportunities 149 $108.5 136 $73.9 Source: SNL Financial ¹ Excess capital as of 31-Mar-15 and based on 10% Tier 1 Leverage ratio net of minimum $30mm of capital at the HoldCo. ² Financial information as of 31-Dec-14. Includes opportunities in CO, KS, and MO. Banks Specialty finance / asset generators Wealth management / trust Banking center networks Reasonable TBV dilution, earnings contribution, IRR criteria Well Positioned For Growth Strong southwest Colorado markets with attractive fill-in locations Clean bank with $135mm in assets 1x TBV price, $14mm cash deployment, <2 year TBV earn-back Expected to close 3Q15 49

20 Financial Overview

21 Grew the strategic loan portfolio by $77.1 million, or 15.9% annualized, driven by $203.7 million in originations. Credit quality remained strong, as annualized net charge-offs in the non 310-30 portfolio were only 0.04% of average non 310-30 loans. Successfully exited $23.2 million, or 46.7% annualized, of the remaining non-strategic loan portfolio. Added a net $10.0 million to accretable yield for the acquired loans accounted for under ASC 310-30. Average total deposits and client repurchase agreements grew $123.1 million, while higher-cost average time deposits declined $35.9 million. Net interest income totaled $39.5 million, a $3.1 million decrease from the prior quarter. The quarterly decrease was primarily driven by the $1.7 million in accelerated loan accretion recognized during the prior quarter, lower balances of high-yielding purchased loans and two fewer days in the quarter. FDIC loss-share related non-interest income totaled a negative $8.5 million, including $7.7 million of non-cash amortization of the FDIC indemnification asset. Operating expenses decreased $1.4 million, or 15.2% annualized, from the prior quarter, while lower OREO gains drove a $3.6 million increase in total non-interest expense. Repurchased 2.1 million shares during the first quarter, or 5.4% of outstanding shares. Since early 2013, 15.6 million shares have been repurchased, or 29.8% of then outstanding shares, at a weighted average price of $19.48. At March 31, 2015, tangible common book value per share was $18.86 before consideration of the excess accretable yield value of $0.94 per share. Note: Please refer to the appendix for a reconciliation of non-GAAP financial metrics. First Quarter 2015 Results Summary

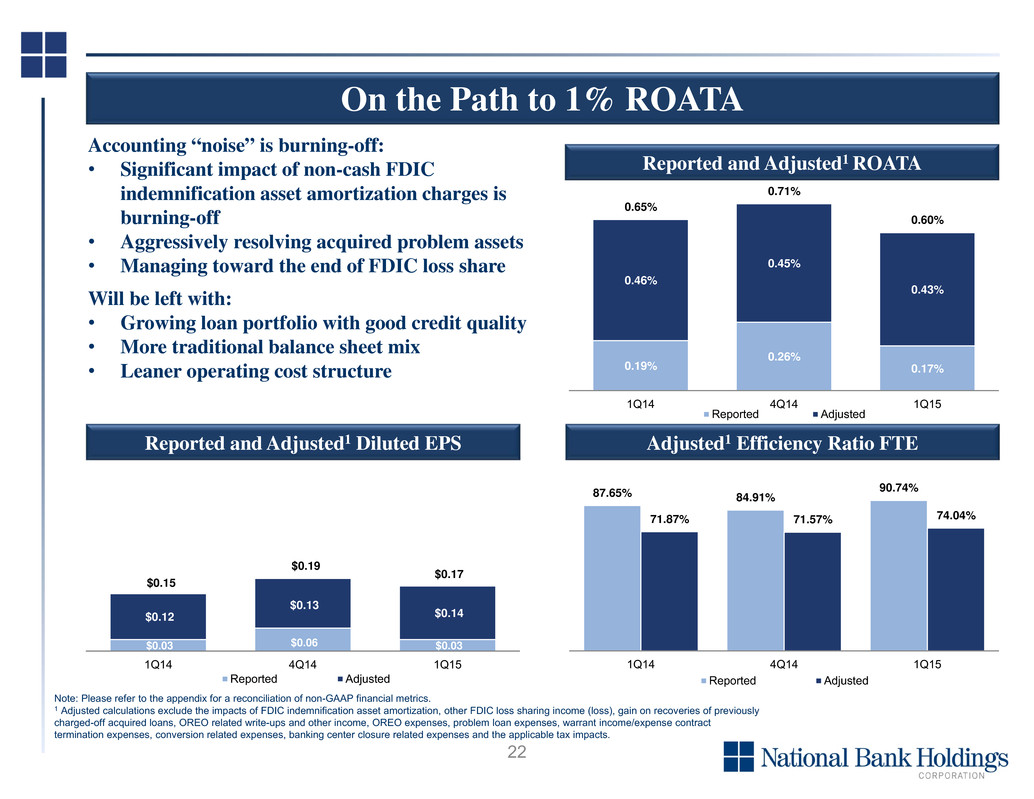

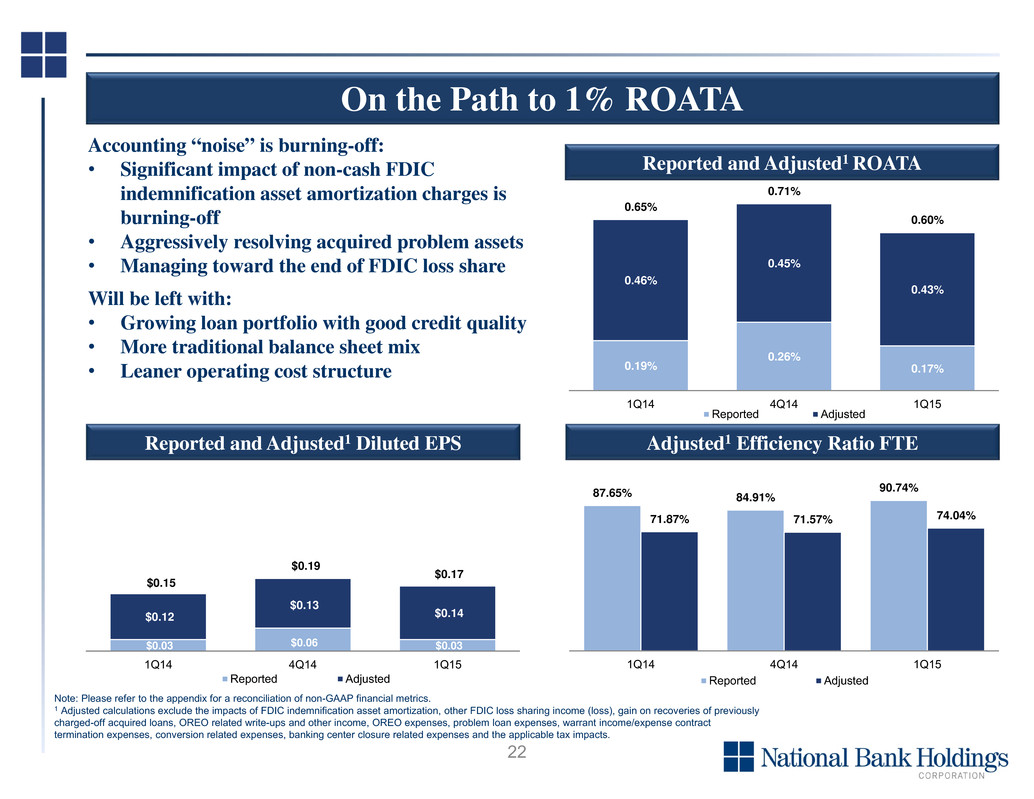

22 0.19% 0.26% 0.17% 0.46% 0.45% 0.43% 0.65% 0.71% 0.60% 1Q14 4Q14 1Q15 Reported Adjusted On the Path to 1% ROATA Reported and Adjusted1 ROATA $0.03 $0.06 $0.03 $0.12 $0.13 $0.14 $0.15 $0.19 $0.17 1Q14 4Q14 1Q15 Reported Adjusted Reported and Adjusted1 Diluted EPS Accounting “noise” is burning-off: • Significant impact of non-cash FDIC indemnification asset amortization charges is burning-off • Aggressively resolving acquired problem assets • Managing toward the end of FDIC loss share Will be left with: • Growing loan portfolio with good credit quality • More traditional balance sheet mix • Leaner operating cost structure Adjusted1 Efficiency Ratio FTE 87.65% 84.91% 90.74% 71.87% 71.57% 74.04% 1Q14 4Q14 1Q15 Reported Adjusted Note: Please refer to the appendix for a reconciliation of non-GAAP financial metrics. 1 Adjusted calculations exclude the impacts of FDIC indemnification asset amortization, other FDIC loss sharing income (loss), gain on recoveries of previously charged-off acquired loans, OREO related write-ups and other income, OREO expenses, problem loan expenses, warrant income/expense contract termination expenses, conversion related expenses, banking center closure related expenses and the applicable tax impacts.

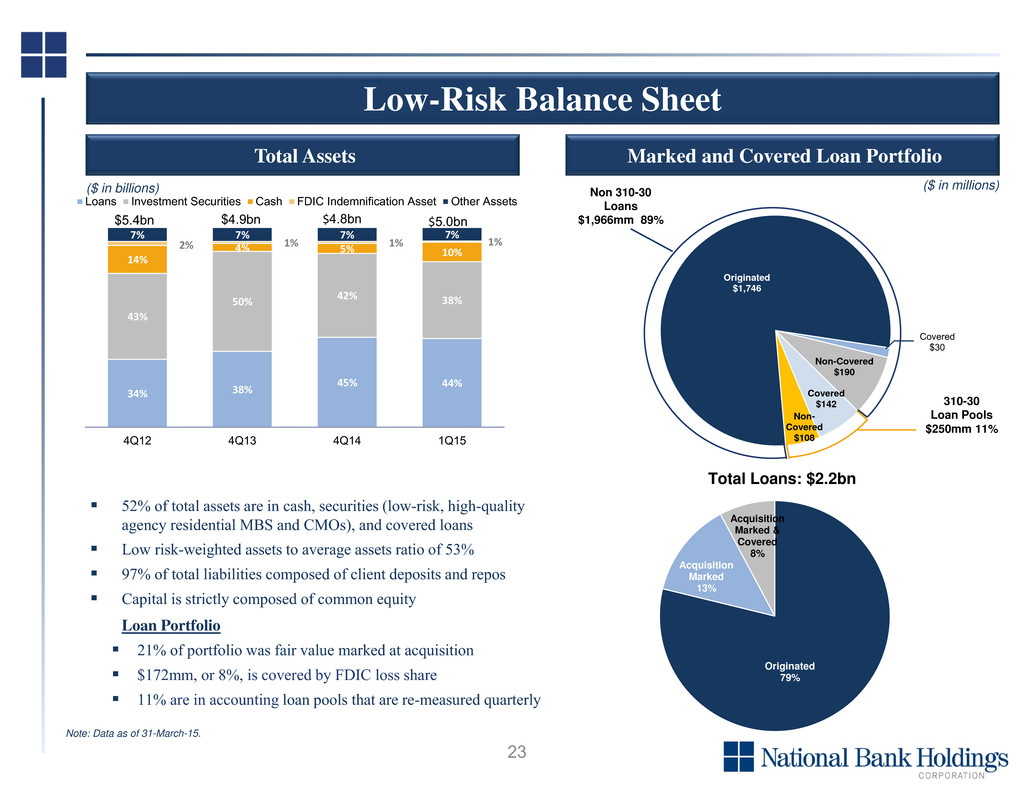

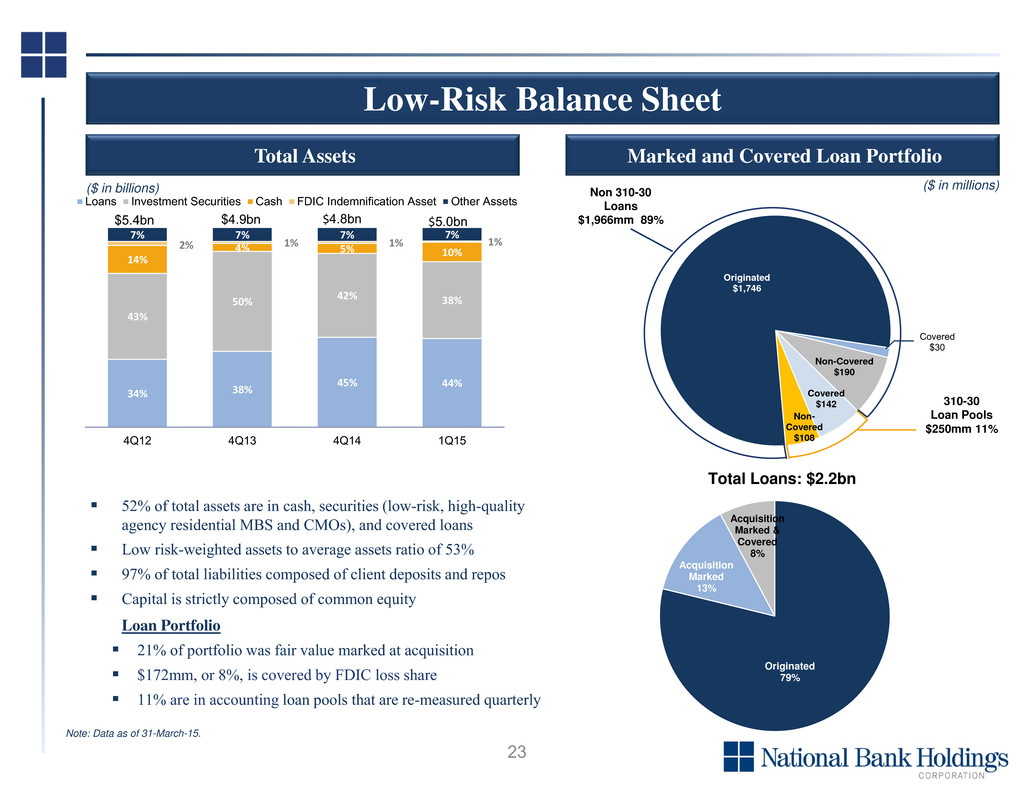

23 Originated $1,746 Covered $30 Non-Covered $190 Covered $142 Non- Covered $108 Originated 79% Acquisition Marked 13% Acquisition Marked & Covered 8% 34% 38% 45% 44% 43% 50% 42% 38% 14% 4% 5% 10%2% 1% 1% 1%7% 7% 7% 7% 4Q12 4Q13 4Q14 1Q15 Loans Investment Securities Cash FDIC Indemnification Asset Other Assets ($ in billions) $4.8bn$4.9bn$5.4bn $5.0bn Non 310-30 Loans $1,966mm 89% 310-30 Loan Pools $250mm 11% Total Assets Marked and Covered Loan Portfolio Low-Risk Balance Sheet 52% of total assets are in cash, securities (low-risk, high-quality agency residential MBS and CMOs), and covered loans Low risk-weighted assets to average assets ratio of 53% 97% of total liabilities composed of client deposits and repos Capital is strictly composed of common equity Loan Portfolio 21% of portfolio was fair value marked at acquisition $172mm, or 8%, is covered by FDIC loss share 11% are in accounting loan pools that are re-measured quarterly Note: Data as of 31-March-15. Total Loans: $2.2bn ($ in millions)

24 $48 $45 $17 $10 $39 $20 $22 $18 $87 $64 $39 $28 YE12 YE13 YE14 1QE15 Projected Improved Client Cash Flows Projected FDIC Loss-Share Billings Covered Assets Covered Assets Strong Covered Asset Performance FDIC Loss-Share Related ($ in millions) Quarterly valuations continue to show cash flow improvements in covered assets Most covered loans accounted for under ASC 310-30; yielding 19.05% in 1Q15 FDIC loss-sharing expires in 4Q15 and 4Q16 $608 $309 $194 $172 $46 $39 $18 $16 $654 $348 $212 $188 YE12 YE13 YE14 1QE15 Loans OREO FDIC Indemnification Asset $19.0 $27.7 $7.7 $18.0 $28.0 $(2.8) $8.9 $0.8 $5.0 $5.0 $16.2 $36.6 $8.5 $23.0 $33.0 2013 2014 1Q15 Other FDIC Loss-Share Related Expense/(Income) Indemnification Asset Amortization 1 FY 2015 Guidance 1 Other FDIC Loss-Share Related Income includes loss share income/(expense), clawback accretion, and sharing of OREO gains/losses.

25 21% 6% 72% 1% Mortgage Backed Securities - Fixed Rate Mortgage Backed Securities - ARMs Collateralized Mortgage Obligations - Fixed Rate Collateralized Mortgage Obligations - Floating Rate 31-Dec-13 31-Dec14 31-Mar 15 Book Value Available-for-Sale $ 1,816 $ 1,484 $1,407 Held-to-Maturity 622 516 490 "Locked-in" Gains (HTM) 20 15 14 Total Book Value $ 2,458 $ 2,015 $1,911 Available-for-Sale Unrealized Gains / (Losses) (31) (5) 6 Held-to-Maturity Unrealized Gains / (Losses) 4 4 7 Fair Market Value of Portfolio $ 2,422 $ 2, 014 $1,924 Portfolio Yield (Spot) 2.21 % 2.13% 2.13% Portfolio Duration 3.6 3.2 3.1 Weighted-Average Life 3.9 3.4 3.3 Investments by Asset Class1 (1Q15) Portfolio Summary1 ($ in millions) ¹ Excludes $32mm, $27mm and $27mm of FHLB / FRB stock as of 31-Dec-13, 31-Dec-14, and 31-Mar-15 respectively. ² AAA rated by Moody’s, AAA by Fitch, and AA+ by S&P. 100% of portfolio AAA rated or U.S. agency backed2 Stable duration of 3.1 years OCI fluctuations minimized by 26% of portfolio in Held-To-Maturity As of March 31, 2015 AOCI was $12.1 million gain, net of tax Conservative Investment Portfolio

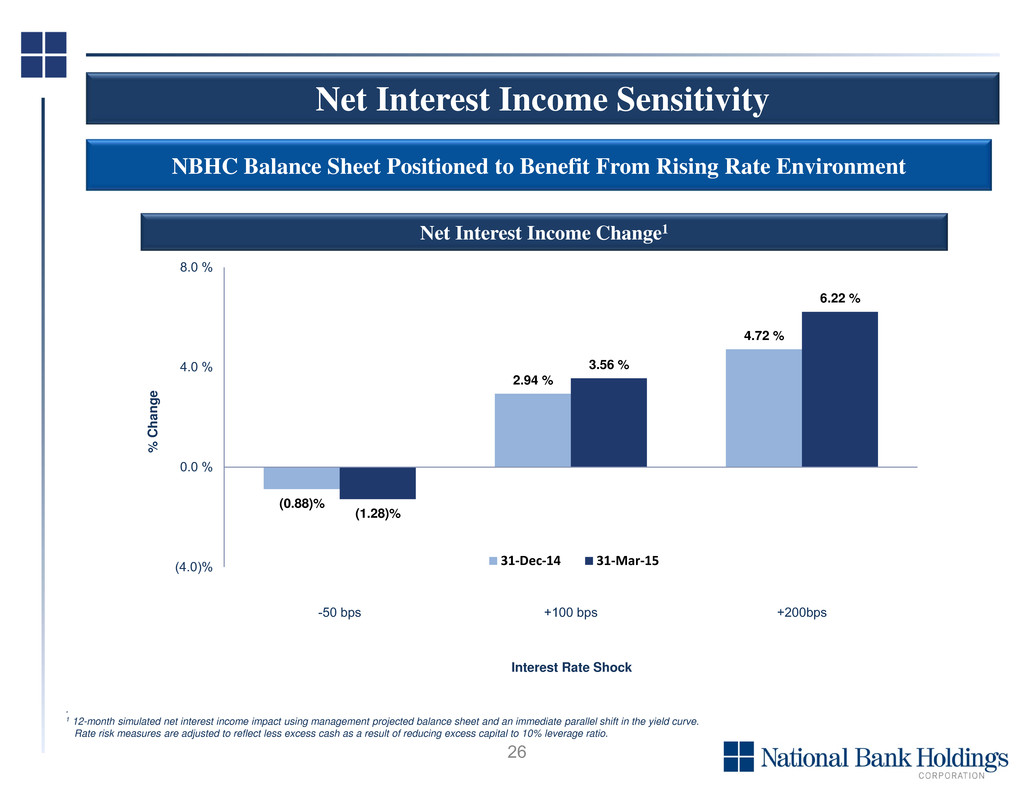

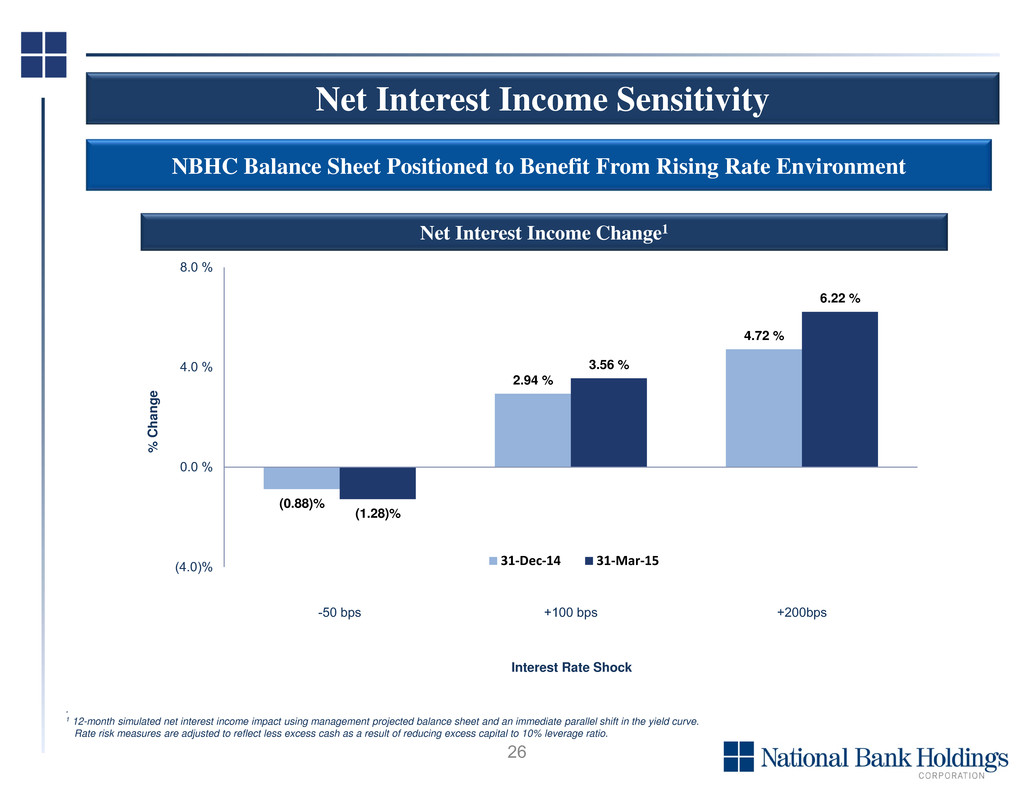

26 . 1 12-month simulated net interest income impact using management projected balance sheet and an immediate parallel shift in the yield curve. Rate risk measures are adjusted to reflect less excess cash as a result of reducing excess capital to 10% leverage ratio. NBHC Balance Sheet Positioned to Benefit From Rising Rate Environment Net Interest Income Change1 (0.88)% 2.94 % 4.72 % (1.28)% 3.56 % 6.22 % (4.0)% 0.0 % 4.0 % 8.0 % -50 bps +100 bps +200bps % C h a n g e Interest Rate Shock 31-Dec-14 31-Mar-15 Net Interest Income Sensitivity

27 3.98% 3.81% 3.85% 3.59% FY12 FY13 FY14 1Q15 $204.3 $179.0 $170.2 $39.5 FY12 FY13 FY14 1Q15 $ 37.4 $ 20.2 $(1.7) $(0.5) $31.2 $30.2 $30.4 $7.4 13.3 % 14.4 % 15.1 % 15.9 % FY12 FY13 FY14 1Q15 Non-interest income Adjusted NII Adj. Fee Income Ratio Net Interest Margin1 Note: Please refer to the appendix for a reconciliation of non-GAAP financial metrics. ¹ Presented on a fully taxable equivalent basis using the statutory rate of 35% beginning in 2014. The tax equivalent adjustments included for FY14 and 1Q15 were $930 and $395 thousand, respectively. 2Adjusted non-interest income excludes gain on sale of securities, FDIC indemnification asset amortization, FDIC loss sharing income (expense), gain on previously charged-off acquired loans and OREO related write-ups and other income. Strong Yields on Loan Portfolio Reported and Adjusted Non-Interest Income2 ($ in millions) Net Interest Income Replacing High-Yielding Purchased Loans with Originations P&L Metrics 9.49% 12.35% 16.82% 19.05% 7.15% 5.50% 4.41% 4.16% FY12 FY13 FY14 1Q15 310-30 Loans Non 310-30 Loans 1

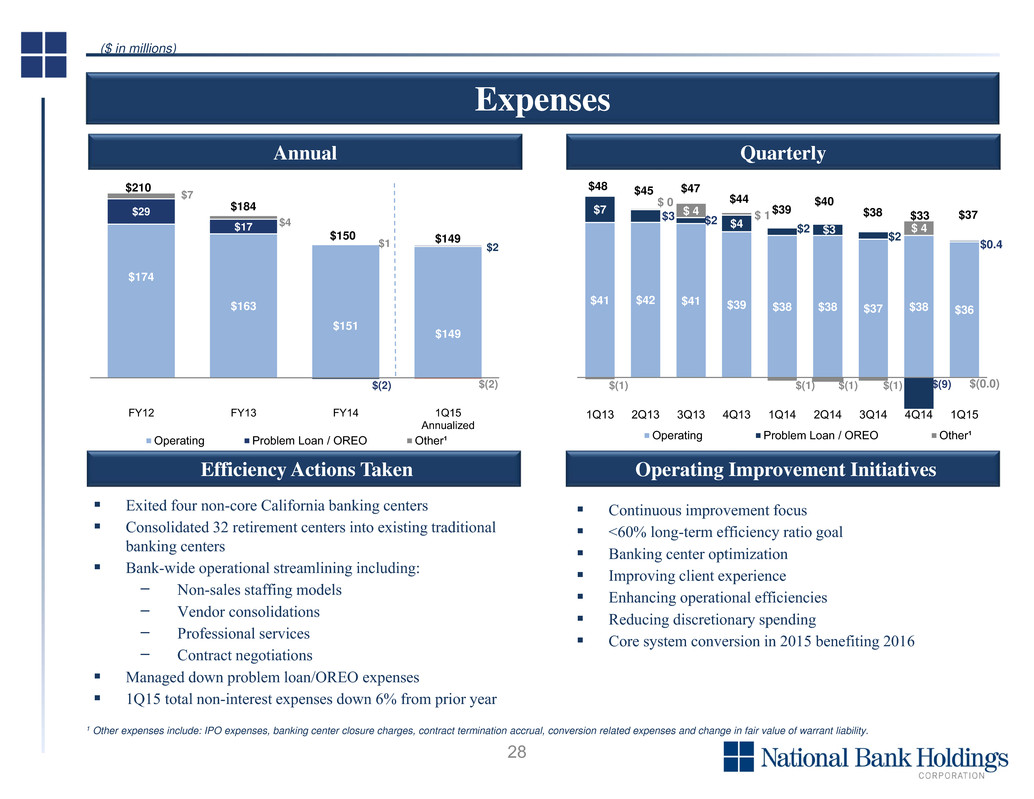

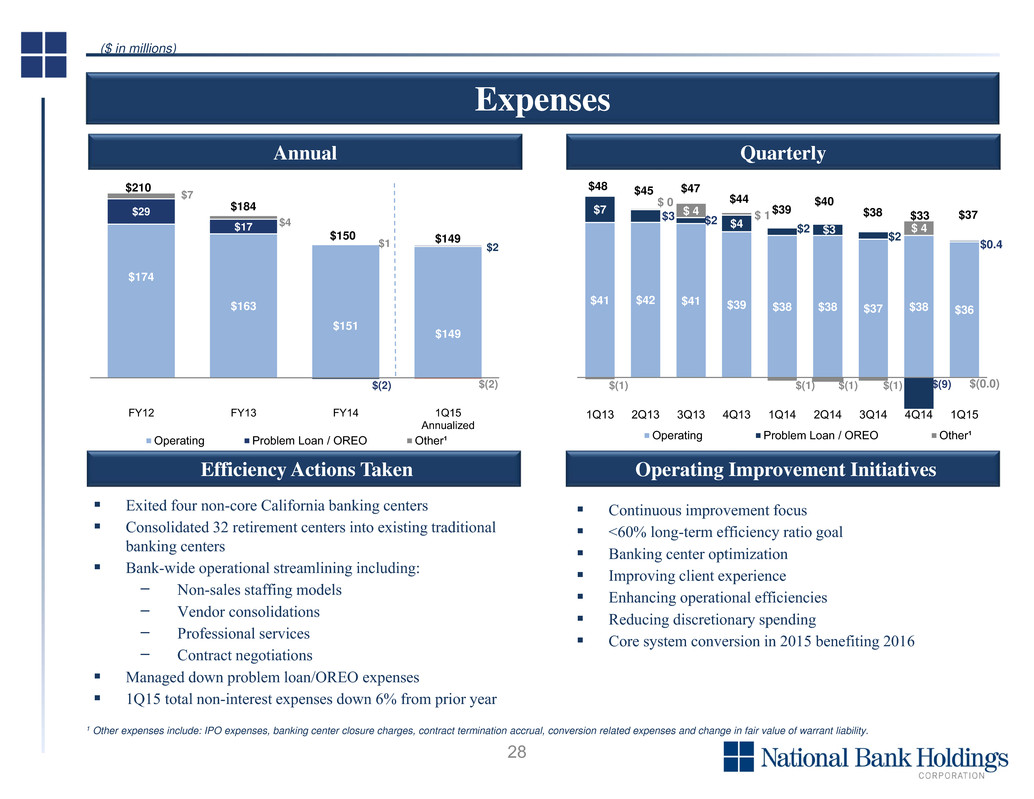

28 $41 $42 $41 $39 $38 $38 $37 $38 $36 $7 $3 $2 $4 $2 $3 $2 $(9) $0.4 $(1) $ 0 $ 4 $ 1 $(1) $(1) $(1) $ 4 $(0.0) $48 $45 $47 $44 $39 $40 $38 $33 $37 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Operating Problem Loan / OREO Other¹ $174 $163 $151 $149 $29 $17 $(2) $2 $7 $4 $1 $(2) $210 $184 $150 $149 FY12 FY13 FY14 1Q15 Annualized Operating Problem Loan / OREO Other¹ Expenses Exited four non-core California banking centers Consolidated 32 retirement centers into existing traditional banking centers Bank-wide operational streamlining including: ̶ Non-sales staffing models ̶ Vendor consolidations ̶ Professional services ̶ Contract negotiations Managed down problem loan/OREO expenses 1Q15 total non-interest expenses down 6% from prior year Efficiency Actions Taken Operating Improvement Initiatives Continuous improvement focus <60% long-term efficiency ratio goal Banking center optimization Improving client experience Enhancing operational efficiencies Reducing discretionary spending Core system conversion in 2015 benefiting 2016 1 Other expenses include: IPO expenses, banking center closure charges, contract termination accrual, conversion related expenses and change in fair value of warrant liability. ($ in millions) Annual Quarterly

29 Looking Ahead

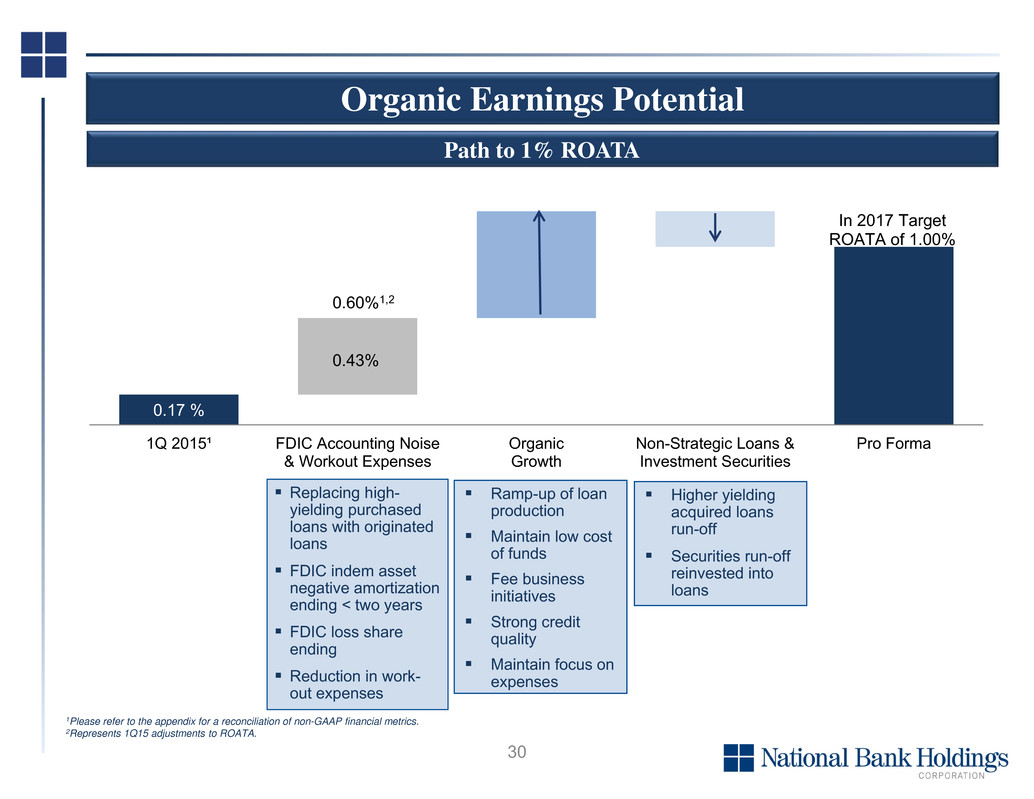

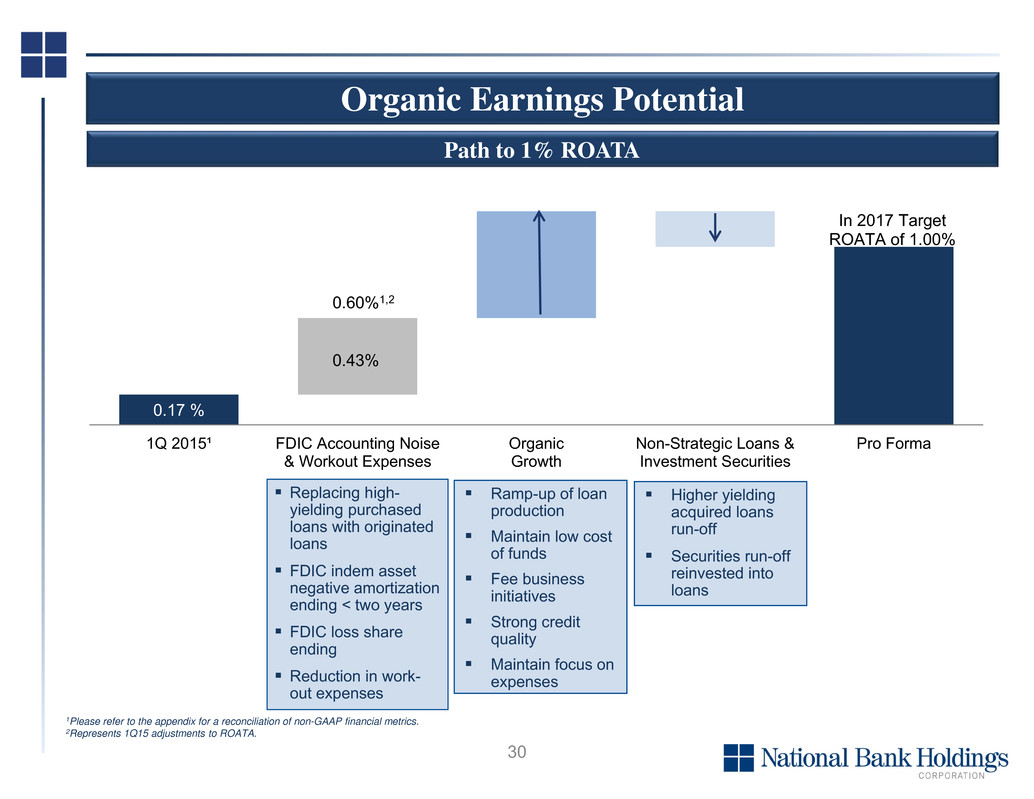

30 Path to 1% ROATA 1Please refer to the appendix for a reconciliation of non-GAAP financial metrics. 2Represents 1Q15 adjustments to ROATA. Replacing high- yielding purchased loans with originated loans FDIC indem asset negative amortization ending < two years FDIC loss share ending Reduction in work- out expenses Ramp-up of loan production Maintain low cost of funds Fee business initiatives Strong credit quality Maintain focus on expenses Higher yielding acquired loans run-off Securities run-off reinvested into loans Organic Earnings Potential 0.17 % In 2017 Target ROATA of 1.00% 1Q 2015¹ FDIC Accounting Noise & Workout Expenses Organic Growth Non-Strategic Loans & Investment Securities Pro Forma 0.60%1,2 0.43%

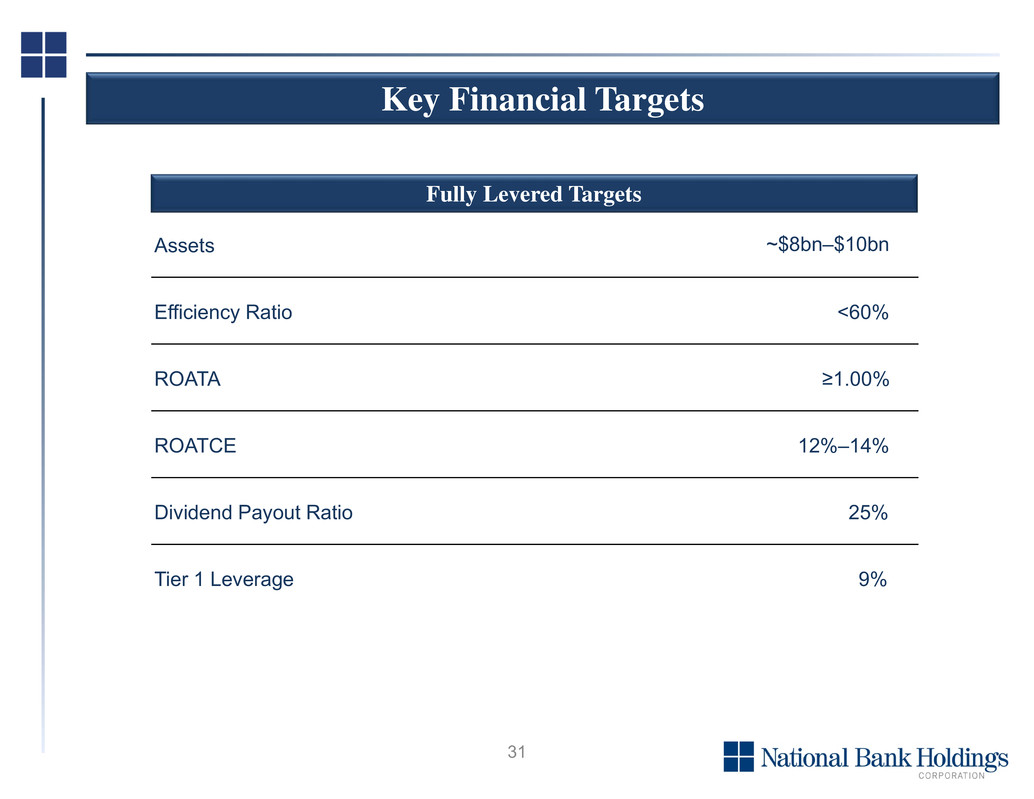

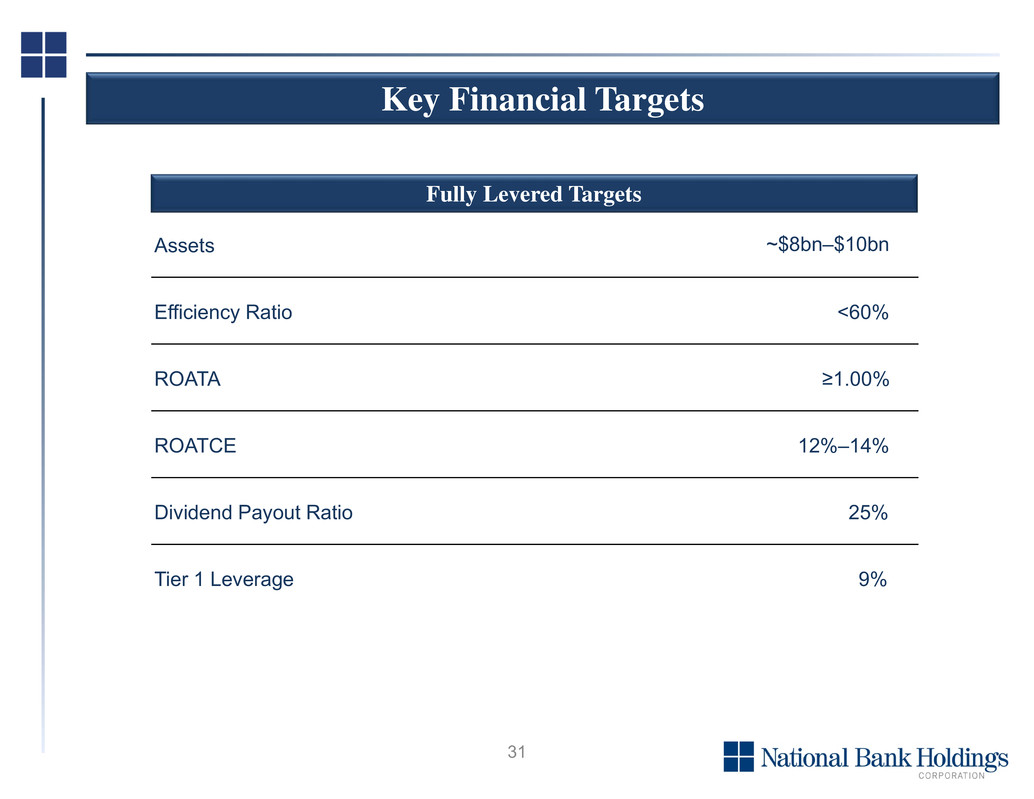

31 Fully Levered Targets Assets ~$8bn–$10bn Efficiency Ratio <60% ROATA ≥1.00% ROATCE 12%–14% Dividend Payout Ratio 25% Tier 1 Leverage 9% Key Financial Targets

32 Investment Highlights Disciplined focus on building meaningful scale and market share in attractive markets Successfully rebuilding failed banks with organic growth strategy: Strong loan growth momentum: 1Q 2015 originations of $204mm, increase of 12% over prior quarter Originations of $869mm in FY 2014, $714mm in FY 2013 and $434mm in FY 2012 Replacing high-yielding purchased loans with originated loans Profitability emerging through the diminishing FDIC loss-share accounting “noise” and OREO/problem loan workout costs 2015 adjusted ROATA of .60% in Q1 20151 Goal of 1% ROATA in 2017 Expertise in mergers and acquisitions with future opportunities Single, scalable operating platform capable of handling future growth Attractive low-risk profile Demonstrated opportunistic manager of capital Experienced and respected management team and board of directors 1Please refer to the appendix for a reconciliation of non-GAAP financial measures.

33 Appendix

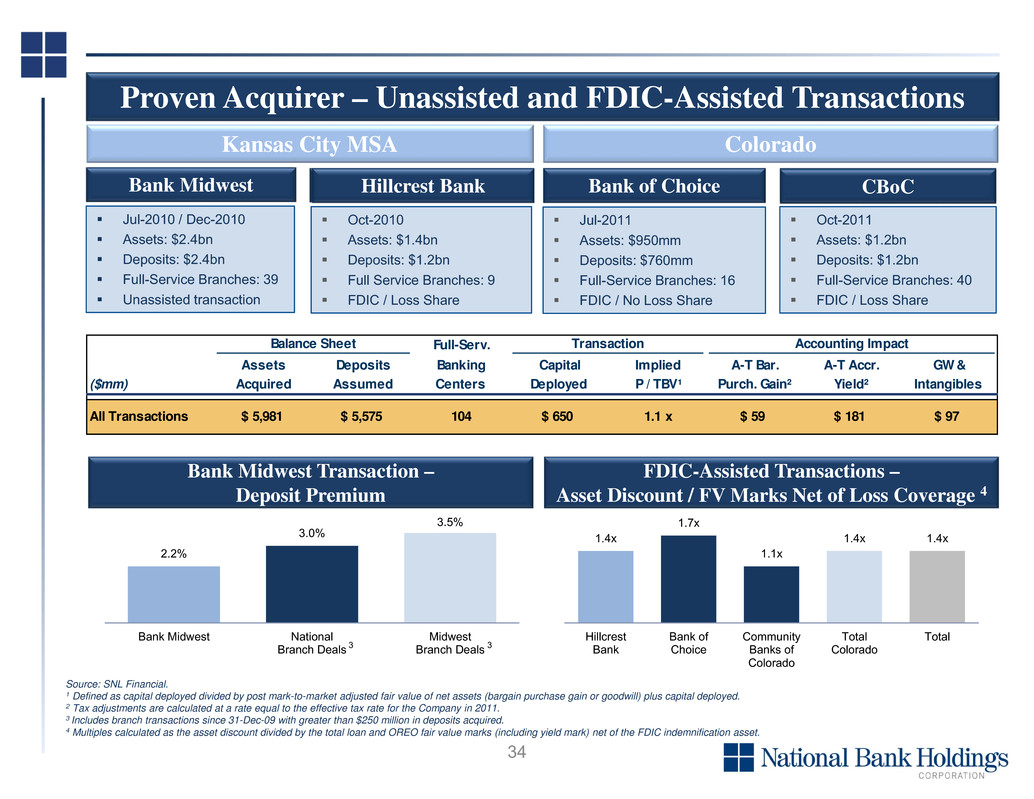

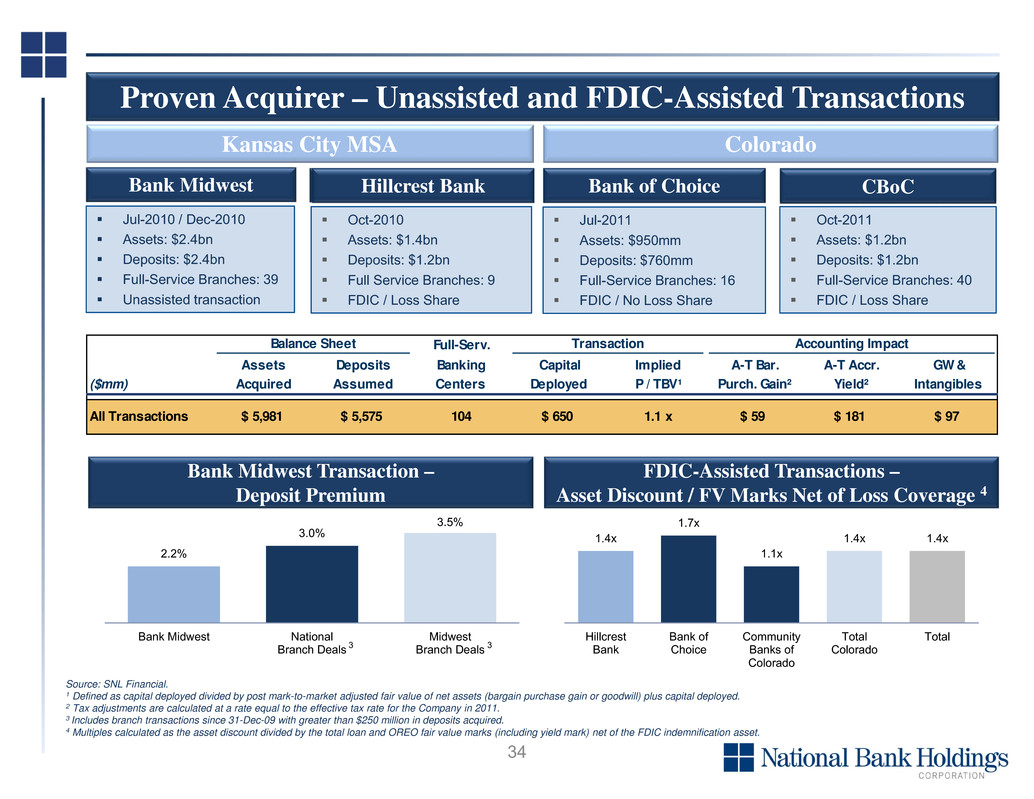

34 2.2% 3.0% 3.5% Bank Midwest National Branch Deals Midwest Branch Deals Bank Midwest Hillcrest Bank Bank of Choice CBoC Source: SNL Financial. 1 Defined as capital deployed divided by post mark-to-market adjusted fair value of net assets (bargain purchase gain or goodwill) plus capital deployed. 2 Tax adjustments are calculated at a rate equal to the effective tax rate for the Company in 2011. 3 Includes branch transactions since 31-Dec-09 with greater than $250 million in deposits acquired. 4 Multiples calculated as the asset discount divided by the total loan and OREO fair value marks (including yield mark) net of the FDIC indemnification asset. Kansas City MSA Colorado Jul-2011 Assets: $950mm Deposits: $760mm Full-Service Branches: 16 FDIC / No Loss Share Bank Midwest Transaction – Deposit Premium FDIC-Assisted Transactions – Asset Discount / FV Marks Net of Loss Coverage 4 Jul-2010 / Dec-2010 Assets: $2.4bn Deposits: $2.4bn Full-Service Branches: 39 Unassisted transaction Oct-2010 Assets: $1.4bn Deposits: $1.2bn Full Service Branches: 9 FDIC / Loss Share Oct-2011 Assets: $1.2bn Deposits: $1.2bn Full-Service Branches: 40 FDIC / Loss Share Balance Sheet Full-Serv. Transaction Accounting Impact Assets Deposits Banking Capital Implied A-T Bar. A-T Accr. GW & ($mm) Acquired Assumed Centers Deployed P / TBV¹ Purch. Gain² Yield² Intangibles All Transactions $ 5,981 $ 5,575 104 $ 650 1.1 x $ 59 $ 181 $ 97 Proven Acquirer – Unassisted and FDIC-Assisted Transactions 3 3 1.4x 1.7x 1.1x 1.4x 1.4x Hillcrest Bank Bank of Choice Community Banks of Colorado Total Colorado Total

35 Head of Business Services at Regions Financial, where he also led the transformation of wholesale lines of business Senior management roles in small business, commercial banking, private banking, corporate marketing and change management, and Management Operating Committee member at Bank of America; also served as President, Bank of America, Florida Tim Laney Chairman, President & Chief Executive Officer (32 years in banking) Head of Business Services Credit at Regions Financial Senior roles in risk management, credit, commercial banking, global bank debt and corporate marketing at Bank of America Richard Newfield Chief Risk Management Officer (29 years in banking) Vice Chairman and Chief Operating Officer at F.N.B. Corporation Corporate strategic planning, line-of-business and geographic Chief Financial Officer roles at PNC Brian Lilly Chief Financial Officer (34 years in banking) NBHC Management Team Partner with law firm Stinson Leonard Street LLP Executive Vice President, General Counsel and Secretary at Guaranty Bancorp Zsolt Bessko Chief Administrative Officer & General Counsel (18 years in legal and banking) Bank president and chief risk officer and group EVP of Citizens Financial Group Executive roles at US Bank, Firstar Bank and Mercantile Bank Tom Metzger Chief of Enterprise Technology & Integration & President, Bank Midwest & Hillcrest Bank (41 years in banking)

36 Title Past ExperienceName Tim Laney Chairman, President and CEO Senior EVP and Head of Business Services of Regions Financial EVP and Management Operating Committee at Bank of America Ralph Clermont Lead Director / Chairman of the Audit and Risk Committee Managing Partner of the St. Louis office of KPMG LLP Frank Cahouet Director Chairman, President and Chief Executive Officer of Mellon Financial President and Chief Operating Officer of Fannie Mae Robert Dean Director / Chairman of the Nominating and Governance Committee Senior Managing Director at Ernst & Young Corporate Finance LLC Co-Chair of Gibson, Dunn & Crutcher LLP’s banking practice Fred Joseph Director Banking and Securities Commissioner for the state of Colorado President of the North American Securities Administrators Association Micho Spring Director Chair of Global Corporate Practice of Weber Shandwick CEO of Boston Communications Company Burney Warren Director / Chairman of the Compensation Committee EVP and Director of Mergers and Acquisitions of BB&T President and Chief Executive Officer of First Federal Savings Bank Accomplished Board of Directors

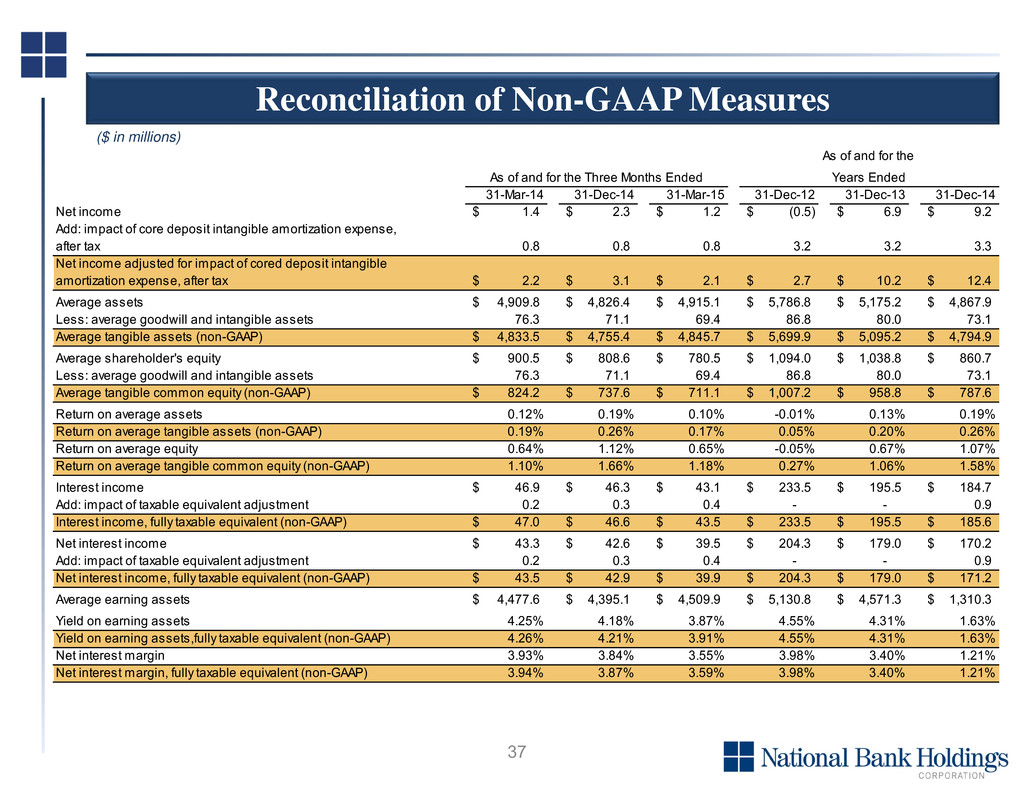

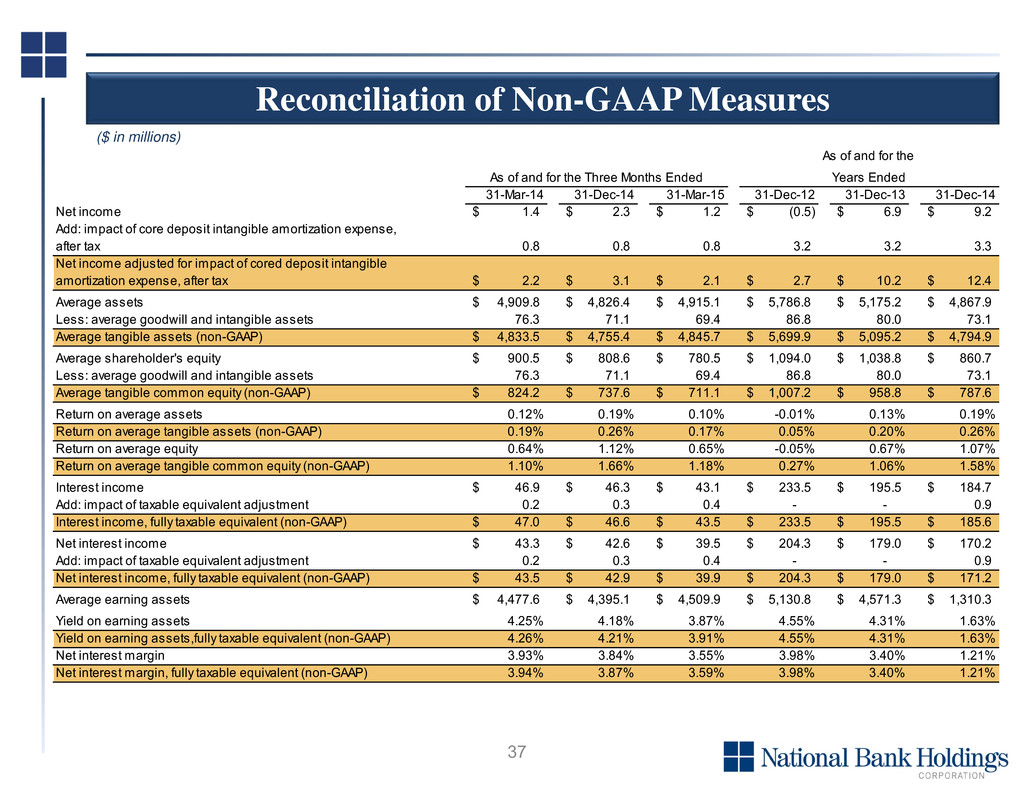

37 ($ in millions) Reconciliation of Non-GAAP Measures 31-Mar-14 31-Dec-14 31-Mar-15 31-Dec-12 31-Dec-13 31-Dec-14 Net income 1.4$ 2.3$ 1.2$ (0.5)$ 6.9$ 9.2$ Add: impact of core deposit intangible amortization expense, after tax 0.8 0.8 0.8 3.2 3.2 3.3 Net income adjusted for impact of cored deposit intangible amortization expense, after tax 2.2$ 3.1$ 2.1$ 2.7$ 10.2$ 12.4$ Average assets 4,909.8$ 4,826.4$ 4,915.1$ 5,786.8$ 5,175.2$ 4,867.9$ Less: average goodwill and intangible assets 76.3 71.1 69.4 86.8 80.0 73.1 Average tangible assets (non-GAAP) 4,833.5$ 4,755.4$ 4,845.7$ 5,699.9$ 5,095.2$ 4,794.9$ Average shareholder's equity 900.5$ 808.6$ 780.5$ 1,094.0$ 1,038.8$ 860.7$ Less: average goodwill and intangible assets 76.3 71.1 69.4 86.8 80.0 73.1 Average tangible common equity (non-GAAP) 824.2$ 737.6$ 711.1$ 1,007.2$ 958.8$ 787.6$ Return on average assets 0.12% 0.19% 0.10% -0.01% 0.13% 0.19% Return on average tangible assets (non-GAAP) 0.19% 0.26% 0.17% 0.05% 0.20% 0.26% Return on average equity 0.64% 1.12% 0.65% -0.05% 0.67% 1.07% Return on average tangible common equity (non-GAAP) 1.10% 1.66% 1.18% 0.27% 1.06% 1.58% Interest income 46.9$ 46.3$ 43.1$ 233.5$ 195.5$ 184.7$ Add: impact of taxable equivalent adjustment 0.2 0.3 0.4 - - 0.9 Interest income, fully taxable equivalent (non-GAAP) 47.0$ 46.6$ 43.5$ 233.5$ 195.5$ 185.6$ Net interest income 43.3$ 42.6$ 39.5$ 204.3$ 179.0$ 170.2$ Add: impact of taxable equivalent adjustment 0.2 0.3 0.4 - - 0.9 Net interest income, fully taxable equivalent (non-GAAP) 43.5$ 42.9$ 39.9$ 204.3$ 179.0$ 171.2$ Average earning assets 4,477.6$ 4,395.1$ 4,509.9$ 5,130.8$ 4,571.3$ 1,310.3$ Yield on earning assets 4.25% 4.18% 3.87% 4.55% 4.31% 1.63% Yield on earning assets,fully taxable equivalent (non-GAAP) 4.26% 4.21% 3.91% 4.55% 4.31% 1.63% Net interest margin 3.93% 3.84% 3.55% 3.98% 3.40% 1.21% Net interest margin, fully taxable equivalent (non-GAAP) 3.94% 3.87% 3.59% 3.98% 3.40% 1.21% As of and for the Years EndedAs of and for the Three Months Ended

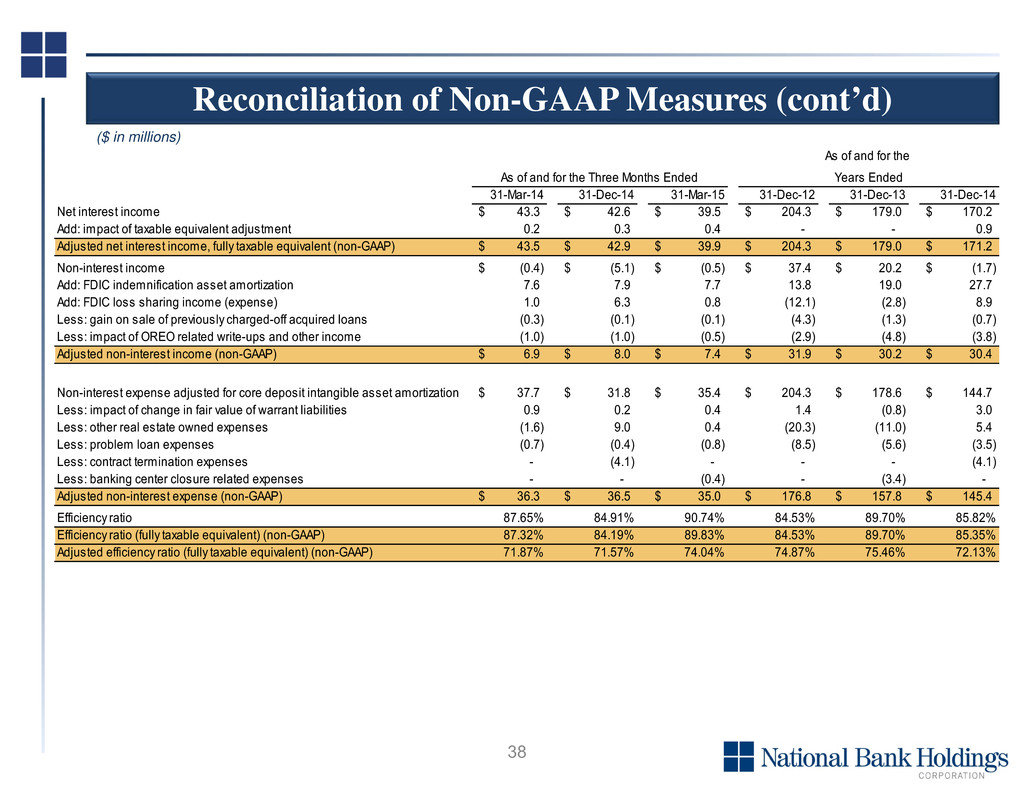

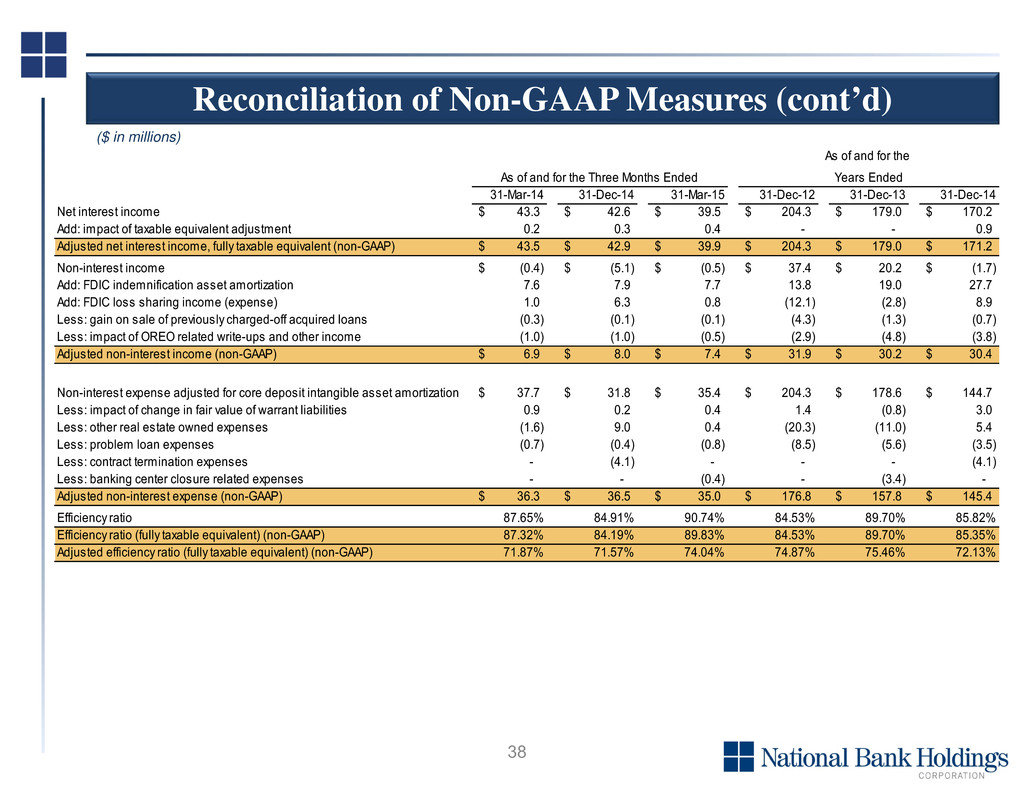

38 ($ in millions) Reconciliation of Non-GAAP Measures (cont’d) 31-Mar-14 31-Dec-14 31-Mar-15 31-Dec-12 31-Dec-13 31-Dec-14 Net interest income 43.3$ 42.6$ 39.5$ 204.3$ 179.0$ 170.2$ Add: impact of taxable equivalent adjustment 0.2 0.3 0.4 - - 0.9 Adjusted net interest income, fully taxable equivalent (non-GAAP) 43.5$ 42.9$ 39.9$ 204.3$ 179.0$ 171.2$ Non-interest income (0.4)$ (5.1)$ (0.5)$ 37.4$ 20.2$ (1.7)$ Add: FDIC indemnification asset amortization 7.6 7.9 7.7 13.8 19.0 27.7 Add: FDIC loss sharing income (expense) 1.0 6.3 0.8 (12.1) (2.8) 8.9 Less: gain on sale of previously charged-off acquired loans (0.3) (0.1) (0.1) (4.3) (1.3) (0.7) Less: impact of OREO related write-ups and other income (1.0) (1.0) (0.5) (2.9) (4.8) (3.8) Adjusted non-interest income (non-GAAP) 6.9$ 8.0$ 7.4$ 31.9$ 30.2$ 30.4$ Non-interest expense adjusted for core deposit intangible asset amortization 37.7$ 31.8$ 35.4$ 204.3$ 178.6$ 144.7$ Less: impact of change in fair value of warrant liabilities 0.9 0.2 0.4 1.4 (0.8) 3.0 Less: other real estate owned expenses (1.6) 9.0 0.4 (20.3) (11.0) 5.4 Less: problem loan expenses (0.7) (0.4) (0.8) (8.5) (5.6) (3.5) Less: contract termination expenses - (4.1) - - - (4.1) Less: banking center closure related expenses - - (0.4) - (3.4) - Adjusted non-interest expense (non-GAAP) 36.3$ 36.5$ 35.0$ 176.8$ 157.8$ 145.4$ Efficiency ratio 87.65% 84.91% 90.74% 84.53% 89.70% 85.82% Efficiency ratio (fully taxable equivalent) (non-GAAP) 87.32% 84.19% 89.83% 84.53% 89.70% 85.35% Adjusted efficiency ratio (fully taxable equivalent) (non-GAAP) 71.87% 71.57% 74.04% 74.87% 75.46% 72.13% As of and for the Years EndedAs of and for the Three Months Ended

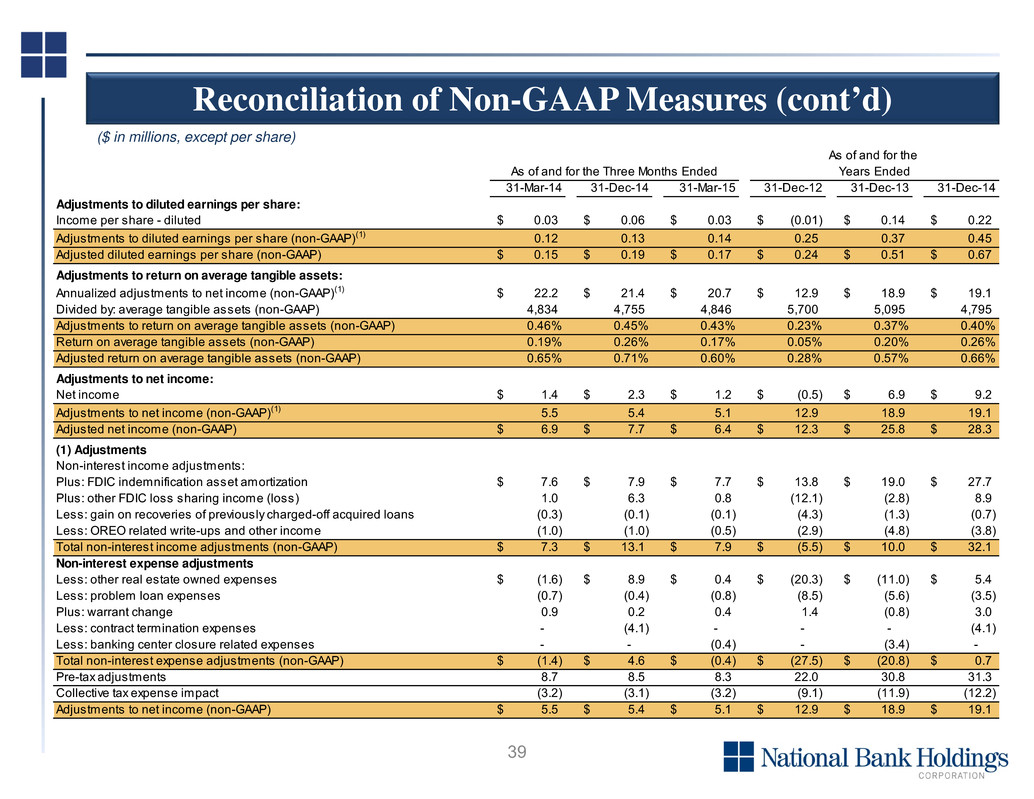

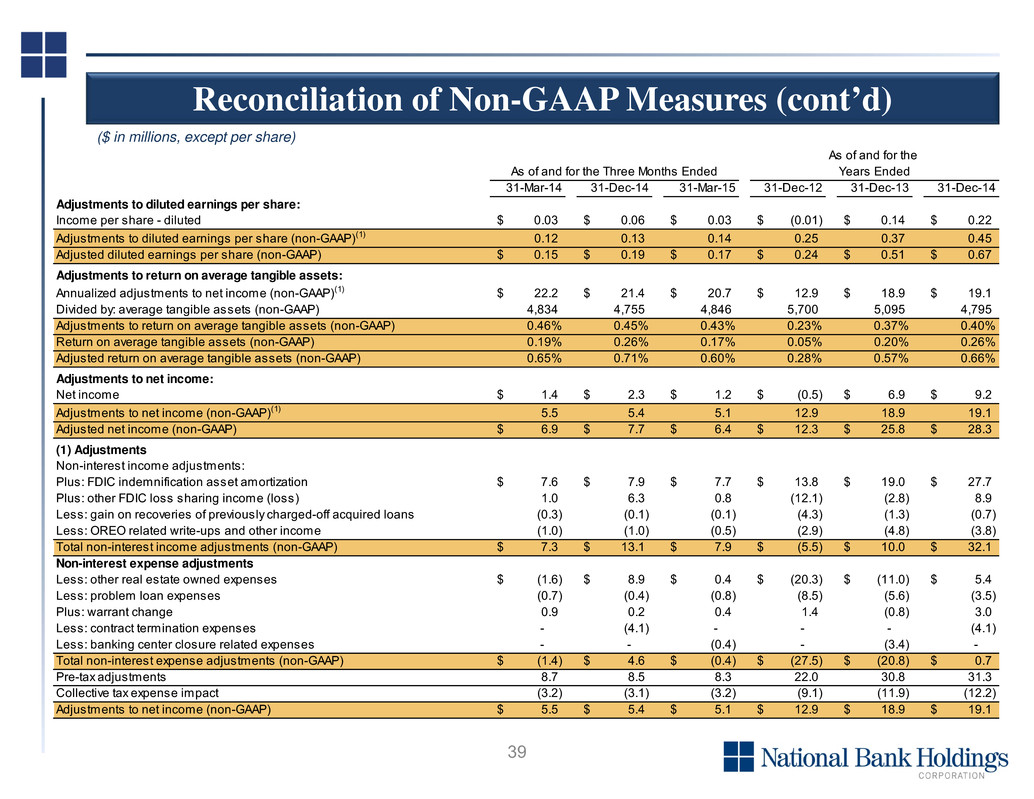

39 ($ in millions, except per share) Reconciliation of Non-GAAP Measures (cont’d) 31-Mar-14 31-Dec-14 31-Mar-15 31-Dec-12 31-Dec-13 31-Dec-14 Adjustments to diluted earnings per share: Income per share - diluted 0.03$ 0.06$ 0.03$ (0.01)$ 0.14$ 0.22$ Adjustments to diluted earnings per share (non-GAAP)(1) 0.12 0.13 0.14 0.25 0.37 0.45 Adjusted diluted earnings per share (non-GAAP) 0.15$ 0.19$ 0.17$ 0.24$ 0.51$ 0.67$ Adjustments to return on average tangible assets: Annualized adjustments to net income (non-GAAP)(1) 22.2$ 21.4$ 20.7$ 12.9$ 18.9$ 19.1$ Divided by: average tangible assets (non-GAAP) 4,834 4,755 4,846 5,700 5,095 4,795 Adjustments to return on average tangible assets (non-GAAP) 0.46% 0.45% 0.43% 0.23% 0.37% 0.40% Return on average tangible assets (non-GAAP) 0.19% 0.26% 0.17% 0.05% 0.20% 0.26% Adjusted return on average tangible assets (non-GAAP) 0.65% 0.71% 0.60% 0.28% 0.57% 0.66% Adjustments to net income: Net income 1.4$ 2.3$ 1.2$ (0.5)$ 6.9$ 9.2$ Adjustments to net income (non-GAAP)(1) 5.5 5.4 5.1 12.9 18.9 19.1 Adjusted net income (non-GAAP) 6.9$ 7.7$ 6.4$ 12.3$ 25.8$ 28.3$ (1) Adjustments Non-interest income adjustments: Plus: FDIC indemnification asset amortization 7.6$ 7.9$ 7.7$ 13.8$ 19.0$ 27.7$ Plus: other FDIC loss sharing income (loss) 1.0 6.3 0.8 (12.1) (2.8) 8.9 Less: gain on recoveries of previously charged-off acquired loans (0.3) (0.1) (0.1) (4.3) (1.3) (0.7) Less: OREO related write-ups and other income (1.0) (1.0) (0.5) (2.9) (4.8) (3.8) Total non-interest income adjustments (non-GAAP) 7.3$ 13.1$ 7.9$ (5.5)$ 10.0$ 32.1$ Non-interest expense adjustments Less: other real estate owned expenses (1.6)$ 8.9$ 0.4$ (20.3)$ (11.0)$ 5.4$ Less: problem loan expenses (0.7) (0.4) (0.8) (8.5) (5.6) (3.5) Plus: warrant change 0.9 0.2 0.4 1.4 (0.8) 3.0 Less: contract termination expenses - (4.1) - - - (4.1) Less: banking center closure related expenses - - (0.4) - (3.4) - Total non-interest expense adjustments (non-GAAP) (1.4)$ 4.6$ (0.4)$ (27.5)$ (20.8)$ 0.7$ Pre-tax adjustments 8.7 8.5 8.3 22.0 30.8 31.3 Collective tax expense impact (3.2) (3.1) (3.2) (9.1) (11.9) (12.2) Adjustments to net income (non-GAAP) 5.5$ 5.4$ 5.1$ 12.9$ 18.9$ 19.1$ As of and for the Years EndedAs of and for the Three Months Ended