Exhibit 99.2

| Supplemental Financial Information |

| Second Quarter 2014 |

| Table of Contents | PRIMERICA, INC.

Financial Supplement |

| | Page |

| Preface, definition of Non-GAAP financial measures | 3 |

| | |

| Condensed balance sheets and reconciliation of balance sheet non-GAAP to GAAP financial measures | 4 |

| | |

| Financial results and other statistical data | 5 |

| | |

| Statements of income | 6 |

| | |

| Reconciliation of statement of income non-GAAP to GAAP financial measures | 7 |

| | |

| Segment operating results | 8 |

| Term Life Insurance segment - financial results, key statistics, and financial analysis | 9-12 |

| Investment and Savings Products segment - financial results, key statistics, and financial analysis | 13 |

| | |

| Investment portfolio | 14-16 |

| | |

| Five-year historical key statistics | 17 |

This document may contain forward-looking statements and information. Additional information and factors that could cause actual results to differ materially from any forward-looking statements or information in this document is available in our Form 10-K for the year ended December 31, 2013.

| Table of Contents | PRIMERICA, INC.

Financial Supplement |

SECOND QUARTER 2014

This document is a financial supplement to our second quarter 2014 earnings release. It is designed to enable comprehensive analysis of our ongoing business using the same core metrics that our management utilizes in assessing our business and making strategic and operational decisions. Throughout this document we provide financial information that is derived from our U.S. GAAP financial statements and adjusted for three different purposes, as follows:

| · | Operating adjustments exclude the expense associated with equity awards granted in connection with our initial public offering (“IPO”), the impact of realized investment gains and losses, and the impact of certain charges related to claims made by certain Florida Retirement System (FRS) plan participants as described in our Form 8-K dated January 16, 2014 and subsequent filings. |

| · | Adjusted when used in describing stockholders’ equity refers to the removal of the impact of net unrealized gains and losses on invested assets. |

| · | Citi reinsurance transaction adjustments relate to transactions in the first quarter of 2010, where we reinsured between 80% and 90% of our business that was in-force at year-end 2009 to various affiliates of Citigroup Inc. (“Citi”) that were executed concurrent with our IPO. |

Management utilizes certain non-GAAP financial measures in managing the business and believes they present relevant and meaningful analytical metrics for evaluating the ongoing business. Reconciliations of non-GAAP to GAAP financial measures are included in this financial supplement.

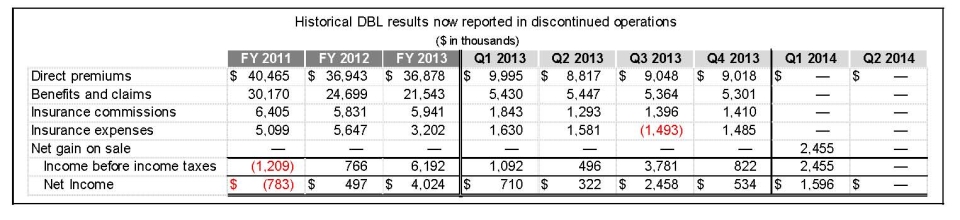

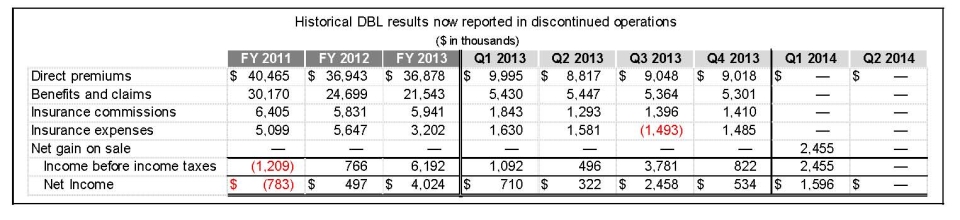

Discontinued Operations

In January 2014, National Benefit Life Insurance Company, our New York insurance company, sold the assets and liabilities of its short-term statutory disability benefit insurance business ("DBL") to AmTrust North America, Inc., which assumed all liabilities for DBL insurance. The results of operations for DBL were previously reported in our Corporate and Other Distributed Products segment. As a result, beginning in the first quarter of 2014, the historical results of DBL have been eliminated from our Corporate and Other Distributed Products segment and are now reported in discontinued operations in Primerica’s consolidated statements of income for all periods presented.

Certain items throughout this supplement may not add due to rounding and as such, may not agree to other public reporting of the respective item. Certain items throughout this supplement are noted as ‘na’ to indicate not applicable. Certain variances are noted as ‘nm’ to indicate not meaningful. Certain reclassifications have been made to prior-period amounts to conform to current-period reporting classifications. These reclassifications had no impact on net income or total stockholders’ equity.

Condensed Balance Sheets and Reconciliation of Balance Sheet Non-GAAP to GAAP Financial Measures | PRIMERICA, INC.

Financial Supplement |

| (Dollars in thousands) | | Dec 31, 2012 | | | Mar 31, 2013 | | | Jun 30, 2013 | | | Sep 30, 2013 | | | Dec 31, 2013 | | | Mar 31, 2014 | | | Jun 30, 2014 | |

| Condensed Balance Sheets | | | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | | | |

| Investments and cash | | $ | 2,068,752 | | | $ | 2,115,144 | | | $ | 1,876,077 | | | $ | 1,909,560 | | | $ | 1,984,592 | | | $ | 2,014,610 | | | $ | 2,042,834 | |

| Due from reinsurers | | | 4,005,194 | | | | 4,005,539 | | | | 3,993,258 | | | | 4,033,138 | | | | 4,055,054 | | | | 4,074,527 | | | | 4,077,734 | |

| Deferred policy acquisition costs | | | 1,066,422 | | | | 1,098,124 | | | | 1,133,542 | | | | 1,179,143 | | | | 1,208,466 | | | | 1,242,983 | | | | 1,293,974 | |

| Other assets | | | 579,393 | | | | 599,840 | | | | 566,809 | | | | 564,953 | | | | 578,009 | | | | 597,265 | | | | 597,348 | |

| Separate account assets | | | 2,618,115 | | | | 2,614,669 | | | | 2,435,740 | | | | 2,512,886 | | | | 2,503,829 | | | | 2,458,739 | | | | 2,581,659 | |

| Total assets | | $ | 10,337,877 | | | $ | 10,433,316 | | | $ | 10,005,426 | | | $ | 10,199,680 | | | $ | 10,329,950 | | | $ | 10,388,124 | | | $ | 10,593,549 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Future policy benefits | | $ | 4,850,488 | | | $ | 4,898,538 | | | $ | 4,943,743 | | | $ | 5,022,048 | | | $ | 5,063,103 | | | $ | 5,103,278 | | | $ | 5,180,013 | |

| Other policy liabilities | | | 606,310 | | | | 614,892 | | | | 584,587 | | | | 587,646 | | | | 593,083 | | | | 585,216 | | | | 576,737 | |

| Income taxes | | | 114,611 | | | | 122,925 | | | | 89,713 | | | | 101,708 | | | | 105,885 | | | | 127,906 | | | | 137,797 | |

| Other liabilities | | | 358,577 | | | | 366,670 | | | | 344,649 | | | | 329,567 | | | | 377,690 | | | | 375,864 | | | | 346,536 | |

| Notes payable | | | 374,433 | | | | 374,445 | | | | 374,457 | | | | 374,469 | | | | 374,481 | | | | 374,494 | | | | 374,506 | |

| Payable under securities lending | | | 139,927 | | | | 133,325 | | | | 86,272 | | | | 75,852 | | | | 89,852 | | | | 109,094 | | | | 93,569 | |

| Separate account liabilities | | | 2,618,115 | | | | 2,614,669 | | | | 2,435,740 | | | | 2,512,886 | | | | 2,503,829 | | | | 2,458,739 | | | | 2,581,659 | |

| Total liabilities | | | 9,062,461 | | | | 9,125,463 | | | | 8,859,162 | | | | 9,004,174 | | | | 9,107,923 | | | | 9,134,591 | | | | 9,290,818 | |

| Stockholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common stock ($0.01 par value) (1) | | | 564 | | | | 567 | | | | 545 | | | | 547 | | | | 548 | | | | 546 | | | | 542 | |

| Paid-in capital | | | 602,269 | | | | 609,100 | | | | 456,050 | | | | 464,784 | | | | 472,632 | | | | 462,837 | | | | 447,949 | |

| Retained earnings | | | 503,173 | | | | 535,609 | | | | 572,714 | | | | 609,778 | | | | 640,840 | | | | 679,183 | | | | 721,788 | |

| Treasury stock | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Accumulated other comprehensive income (loss), net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net unrealized investment gains (losses) not other-than-temporarily impaired | | | 114,958 | | | | 112,263 | | | | 74,845 | | | | 72,773 | | | | 67,378 | | | | 78,911 | | | | 92,049 | |

| Net unrealized investment losses other-than-temporarily impaired | | | (1,035 | ) | | | (1,045 | ) | | | (1,047 | ) | | | (1,047 | ) | | | (1,346 | ) | | | (1,346 | ) | | | (1,346 | ) |

| Cumulative translation adjustment | | | 55,488 | | | | 51,358 | | | | 43,158 | | | | 48,672 | | | | 41,975 | | | | 33,404 | | | | 41,749 | |

| Total stockholders’ equity | | | 1,275,416 | | | | 1,307,853 | | | | 1,146,265 | | | | 1,195,505 | | | | 1,222,027 | | | | 1,253,532 | | | | 1,302,731 | |

| Total liabilities and stockholders' equity | | $ | 10,337,877 | | | $ | 10,433,316 | | | $ | 10,005,426 | | | $ | 10,199,680 | | | $ | 10,329,950 | | | $ | 10,388,124 | | | $ | 10,593,549 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted Stockholders' Equity to Total Stockholders' Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted stockholders' equity | | $ | 1,161,494 | | | $ | 1,196,634 | | | $ | 1,072,467 | | | $ | 1,123,780 | | | $ | 1,155,996 | | | $ | 1,175,968 | | | $ | 1,212,028 | |

| Reconciling items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net unrealized investment gains (losses) not other-than-temporarily impaired | | | 114,958 | | | | 112,263 | | | | 74,845 | | | | 72,773 | | | | 67,378 | | | | 78,911 | | | | 92,049 | |

| Net unrealized investment losses other-than-temporarily impaired | | | (1,035 | ) | | | (1,045 | ) | | | (1,047 | ) | | | (1,047 | ) | | | (1,346 | ) | | | (1,346 | ) | | | (1,346 | ) |

| Total reconciling items | | | 113,923 | | | | 111,219 | | | | 73,797 | | | | 71,726 | | | | 66,032 | | | | 77,564 | | | | 90,703 | |

| Total stockholders’ equity | | $ | 1,275,416 | | | $ | 1,307,853 | | | $ | 1,146,265 | | | $ | 1,195,505 | | | $ | 1,222,027 | | | $ | 1,253,532 | | | $ | 1,302,731 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Stockholders' Equity Rollforward | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | $ | 1,218,939 | | | $ | 1,161,494 | | | $ | 1,196,634 | | | $ | 1,072,467 | | | $ | 1,123,780 | | | $ | 1,155,996 | | | $ | 1,175,968 | |

| Net Income | | | 40,270 | | | | 38,845 | | | | 43,490 | | | | 43,190 | | | | 37,201 | | | | 45,080 | | | | 49,271 | |

| Shareholder dividends | | | (5,321 | ) | | | (6,409 | ) | | | (6,385 | ) | | | (6,126 | ) | | | (6,138 | ) | | | (6,738 | ) | | | (6,666 | ) |

| Retirement of shares and warrants | | | (98,208 | ) | | | (3,077 | ) | | | (166,395 | ) | | | — | | | | — | | | | (19,187 | ) | | | (21,972 | ) |

| Net foreign currency translation adjustment | | | (2,746 | ) | | | (4,130 | ) | | | (8,200 | ) | | | 5,514 | | | | (6,697 | ) | | | (8,571 | ) | | | 8,346 | |

| Other, net | | | 8,559 | | | | 9,911 | | | | 13,323 | | | | 8,736 | | | | 7,850 | | | | 9,389 | | | | 7,081 | |

| Balance, end of period | | $ | 1,161,494 | | | $ | 1,196,634 | | | $ | 1,072,467 | | | $ | 1,123,780 | | | $ | 1,155,996 | | | $ | 1,175,968 | | | $ | 1,212,028 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deferred Policy Acquisition Costs Rollforward | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | $ | 1,036,020 | | | $ | 1,066,422 | | | $ | 1,098,124 | | | $ | 1,133,542 | | | $ | 1,179,143 | | | $ | 1,208,466 | | | $ | 1,242,983 | |

| General expenses deferred | | | 6,869 | | | | 6,631 | | | | 8,669 | | | | 7,399 | | | | 7,396 | | | | 7,273 | | | | 8,136 | |

| Commission costs deferred | | | 60,349 | | | | 60,048 | | | | 63,835 | | | | 65,535 | | | | 63,828 | | | | 69,559 | | | | 68,674 | |

| Amortization of deferred policy acquisition costs | | | (34,628 | ) | | | (31,252 | ) | | | (30,111 | ) | | | (32,192 | ) | | | (35,627 | ) | | | (35,193 | ) | | | (32,696 | ) |

| Foreign currency impact and other, net | | | (2,187 | ) | | | (3,726 | ) | | | (6,974 | ) | | | 4,860 | | | | (6,274 | ) | | | (7,122 | ) | | | 6,877 | |

| Balance, end of period | | $ | 1,066,422 | | | $ | 1,098,124 | | | $ | 1,133,542 | | | $ | 1,179,143 | | | $ | 1,208,466 | | | $ | 1,242,983 | | | $ | 1,293,974 | |

| (1) | Outstanding common shares exclude restricted stock units. |

Financial Results and Other Statistical Data | PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | YOY YTD | |

| (Dollars in thousands, except per-share data) | Q1 2013 | | | Q2 2013 | | | Q3 2013 | | | Q4 2013 | | | Q1 2014 | | | Q2 2014 | | | Change | | % Change | | | | YTD 2013 | | YTD 2014 | | | $ Change | | Change | |

| Earnings per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic earnings per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted-average common shares and fully vested equity awards | | | 56,598,327 | | | | 56,510,785 | | | | 54,957,274 | | | | 55,080,615 | | | | 55,224,404 | | | | 54,926,561 | | | | (1,584,224 | ) | -2.8 | % | | | | 56,553,204 | | | 55,074,660 | | | | (1,478,544 | ) | -2.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 38,845 | | | $ | 43,490 | | | $ | 43,190 | | | $ | 37,201 | | | $ | 45,080 | | | $ | 49,271 | | | $ | 5,781 | | 13.3 | % | | | $ | 82,335 | | $ | 94,352 | | | $ | 12,017 | | 14.6 | % |

| Less income attributable to unvested participating securities | | | (1,017 | ) | | | (553 | ) | | | (556 | ) | | | (482 | ) | | | (576 | ) | | | (542 | ) | | | 10 | | 1.9 | % | | | | (1,602 | ) | | (1,122 | ) | | | 480 | | 30.0 | % |

| Net income used in computing basic EPS | | $ | 37,828 | | | $ | 42,938 | | | $ | 42,633 | | | $ | 36,718 | | | $ | 44,504 | | | $ | 48,729 | | | $ | 5,792 | | 13.5 | % | | | $ | 80,733 | | $ | 93,229 | | | $ | 12,497 | | 15.5 | % |

| Basic earnings per share | | $ | 0.67 | | | $ | 0.76 | | | $ | 0.78 | | | $ | 0.67 | | | $ | 0.81 | | | $ | 0.89 | | | $ | 0.13 | | 16.8 | % | | | $ | 1.43 | | $ | 1.69 | | | $ | 0.27 | | 18.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income | | $ | 38,602 | | | $ | 41,165 | | | $ | 40,996 | | | $ | 46,234 | | | $ | 43,314 | | | $ | 48,731 | | | $ | 7,566 | | 18.4 | % | | | $ | 79,767 | | $ | 92,044 | | | $ | 12,277 | | 15.4 | % |

| Less operating income attributable to unvested participating securities | | | (1,011 | ) | | | (523 | ) | | | (528 | ) | | | (600 | ) | | | (554 | ) | | | (536 | ) | | | (13 | ) | -2.6 | % | | | | (1,552 | ) | | (1,095 | ) | | | 457 | | 29.5 | % |

| Net operating income used in computing basic operating EPS | | $ | 37,591 | | | $ | 40,642 | | | $ | 40,468 | | | $ | 45,634 | | | $ | 42,760 | | | $ | 48,194 | | | $ | 7,552 | | 18.6 | % | | | $ | 78,215 | | $ | 90,950 | | | $ | 12,735 | | 16.3 | % |

| Basic operating income per share | | $ | 0.66 | | | $ | 0.72 | | | $ | 0.74 | | | $ | 0.83 | | | $ | 0.77 | | | $ | 0.88 | | | $ | 0.16 | | 22.0 | % | | | $ | 1.38 | | $ | 1.65 | | | $ | 0.27 | | 19.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted-average common shares and fully vested equity awards | | | 56,598,327 | | | | 56,510,785 | | | | 54,957,274 | | | | 55,080,615 | | | | 55,224,404 | | | | 54,926,561 | | | | (1,584,224 | ) | -2.8 | % | | | | 56,553,204 | | | 55,074,660 | | | | (1,478,544 | ) | -2.6 | % |

| Dilutive impact of warrants and options | | | 1,809,066 | | | | 1,338,164 | | | | 1,187 | | | | 15,012 | | | | 21,997 | | | | 23,046 | | | | (1,315,118 | ) | -98.3 | % | | | | 1,573,615 | | | 22,522 | | | | (1,551,093 | ) | -98.6 | % |

| Shares used to calculate diluted EPS | | | 58,407,393 | | | | 57,848,949 | | | | 54,958,461 | | | | 55,095,627 | | | | 55,246,401 | | | | 54,949,607 | | | | (2,899,342 | ) | -5.0 | % | | | | 58,126,819 | | | 55,097,182 | | | | (3,029,637 | ) | -5.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 38,845 | | | $ | 43,490 | | | $ | 43,190 | | | $ | 37,201 | | | $ | 45,080 | | | $ | 49,271 | | | $ | 5,781 | | 13.3 | % | | | $ | 82,335 | | $ | 94,352 | | | $ | 12,017 | | 14.6 | % |

| Less income attributable to unvested participating securities | | | (991 | ) | | | (542 | ) | | | (556 | ) | | | (482 | ) | | | (576 | ) | | | (542 | ) | | | (0 | ) | -0.1 | % | | | | (1,566 | ) | | (1,122 | ) | | | 444 | | 28.4 | % |

| Net income used in computing diluted EPS | | $ | 37,854 | | | $ | 42,948 | | | $ | 42,633 | | | $ | 36,718 | | | $ | 44,504 | | | $ | 48,729 | | | $ | 5,781 | | 13.5 | % | | | $ | 80,769 | | $ | 93,230 | | | $ | 12,461 | | 15.4 | % |

| Diluted earnings per share | | $ | 0.65 | | | $ | 0.74 | | | $ | 0.78 | | | $ | 0.67 | | | $ | 0.81 | | | $ | 0.89 | | | $ | 0.14 | | 19.4 | % | | | $ | 1.39 | | $ | 1.69 | | | $ | 0.30 | | 21.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income | | $ | 38,602 | | | $ | 41,165 | | | $ | 40,996 | | | $ | 46,234 | | | $ | 43,314 | | | $ | 48,731 | | | $ | 7,566 | | 18.4 | % | | | $ | 79,767 | | $ | 92,044 | | | $ | 12,277 | | 15.4 | % |

| Less operating income attributable to unvested participating securities | | | (985 | ) | | | (513 | ) | | | (528 | ) | | | (600 | ) | | | (554 | ) | | | (536 | ) | | | (23 | ) | -4.6 | % | | | | (1,517 | ) | | (1,094 | ) | | | 423 | | 27.9 | % |

| Net operating income used in computing diluted operating EPS | | $ | 37,617 | | | $ | 40,652 | | | $ | 40,468 | | | $ | 45,635 | | | $ | 42,760 | | | $ | 48,194 | | | $ | 7,542 | | 18.6 | % | | | $ | 78,250 | | $ | 90,950 | | | $ | 12,700 | | 16.2 | % |

| Diluted operating income per share | | $ | 0.64 | | | $ | 0.70 | | | $ | 0.74 | | | $ | 0.83 | | | $ | 0.77 | | | $ | 0.88 | | | $ | 0.17 | | 24.8 | % | | | $ | 1.35 | | $ | 1.65 | | | $ | 0.30 | | 22.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | | YOY YTD | |

| | | Q1 2013 | | | Q2 2013 | | | Q3 2013 | | | Q4 2013 | | | | Q1 2014 | | | Q2 2014 | | | | Change | | | % Change | | | | YTD 2013 | | | YTD 2014 | | | $ Change | | % Change | |

| Annualized Return on Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average stockholders' equity | | $ | 1,291,635 | | | $ | 1,227,059 | | | $ | 1,170,885 | | | $ | 1,208,766 | | | | $ | 1,237,780 | | | $ | 1,278,132 | | | | $ | 51,073 | | | 4.2 | % | | | $ | 1,259,347 | | | $ | 1,257,956 | | | $ | (1,391 | ) | -0.1 | % |

| Average adjusted stockholders' equity | | $ | 1,179,064 | | | $ | 1,134,551 | | | $ | 1,098,123 | | | $ | 1,139,888 | | | | $ | 1,165,982 | | | $ | 1,193,998 | | | | $ | 59,448 | | | 5.2 | % | | | $ | 1,156,807 | | | $ | 1,179,990 | | | $ | 23,183 | | 2.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income return on stockholders' equity | | | 12.0 | % | | | 14.2 | % | | | 14.8 | % | | | 12.3 | % | | | | 14.6 | % | | | 15.4 | % | | | | 1.2 | % | | nm | | | | | 13.1 | % | | | 15.0 | % | | | 1.9 | % | nm | |

| Net income return on adjusted stockholders' equity | | | 13.2 | % | | | 15.3 | % | | | 15.7 | % | | | 13.1 | % | | | | 15.5 | % | | | 16.5 | % | | | | 1.2 | % | | nm | | | | | 14.2 | % | | | 16.0 | % | | | 1.8 | % | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income return on adjusted stockholders' equity | | | 13.1 | % | | | 14.5 | % | | | 14.9 | % | | | 16.2 | % | | | | 14.9 | % | | | 16.3 | % | | | | 1.8 | % | | nm | | | | | 13.8 | % | | | 15.6 | % | | | 1.8 | % | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Structure | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt-to-capital (1) | | | 22.3 | % | | | 24.6 | % | | | 23.9 | % | | | 23.5 | % | | | | 23.0 | % | | | 22.3 | % | | | | -2.3 | % | | nm | | | | | 24.6 | % | | | 22.3 | % | | | -2.3 | % | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and invested assets to stockholders' equity | | | 1.6 | x | | | 1.6 | x | | | 1.6 | x | | | 1.6 | x | | | | 1.6 | x | | | 1.6 | x | | | | (0.1x | ) | | nm | | | | | 1.6 | x | | | 1.6 | x | | | (0.1x | ) | nm | |

| Cash and invested assets to adjusted stockholders' equity | | | 1.8 | x | | | 1.7 | x | | | 1.7 | x | | | 1.7 | x | | | | 1.7 | x | | | 1.7 | x | | | | (0.1x | ) | | nm | | | | | 1.7 | x | | | 1.7 | x | | | (0.1x | ) | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Share count, end of period (2) | | | 56,682,195 | | | | 54,503,822 | | | | 54,686,613 | | | | 54,833,510 | | | | | 54,569,108 | | | | 54,193,684 | | | | | (310,138 | ) | | -0.6 | % | | | | 54,503,822 | | | | 54,193,684 | | | | (310,138 | ) | -0.6 | % |

| Adjusted stockholders' equity per share | | $ | 21.11 | | | $ | 19.68 | | | $ | 20.55 | | | $ | 21.08 | | | | $ | 21.55 | | | $ | 22.36 | | | | $ | 2.69 | | | 13.7 | % | | | $ | 19.68 | | | $ | 22.36 | | | $ | 2.69 | | 13.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Strength Ratings - Primerica Life Insurance Co | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Moody's | | | A2 | | | | A2 | | | | A2 | | | | A2 | | | | | A2 | | | | A3 | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| S&P | | AA- | | | AA- | | | AA- | | | AA- | | | | AA- | | | AA- | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| A.M. Best | | | A+ | | | | A+ | | | | A+ | | | | A+ | | | | | A+ | | | | A+ | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Holding Company Senior Debt Ratings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Moody's | | Baa2 | | | Baa2 | | | Baa2 | | | Baa2 | | | | Baa2 | | | Baa3 | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| S&P | | | A- | | | | A- | | | | A- | | | | A- | | | | | A- | | | | A- | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| A.M. Best | | | a- | | | | a- | | | | a- | | | | a- | | | | | a- | | | | a- | | | | nm | | | nm | | | | nm | | | nm | | | nm | | nm | |

| (1) | Capital in the debt-to-capital ratio includes stockholders' equity and the note payable. |

| (2) | Share count reflects outstanding common shares, including restricted shares, but excludes restricted stock units (RSUs). |

| PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | YOY YTD | |

| (Dollars in thousands) | | Q1 2013 | | Q2 2013 | | Q3 2013 | | Q4 2013 | | | Q1 2014 | | Q2 2014 | | | $ Change | | % Change | | | | YTD 2013 | | YTD 2014 | | | $ Change | | % Change | |

| Statement of Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premiums | | $ | 560,904 | | $ | 568,391 | | $ | 567,047 | | $ | 568,848 | | | $ | 568,205 | | $ | 576,740 | | | $ | 8,349 | | 1.5 | % | | | $ | 1,129,295 | | $ | 1,144,945 | | | $ | 15,650 | | 1.4 | % |

| Ceded premiums | | | (410,604 | ) | | (417,450 | ) | | (407,489 | ) | | (408,615 | ) | | | (402,715 | ) | | (410,546 | ) | | | 6,904 | | 1.7 | % | | | | (828,054 | ) | | (813,261 | ) | | | 14,793 | | 1.8 | % |

| Net premiums | | | 150,300 | | | 150,941 | | | 159,558 | | | 160,233 | | | | 165,490 | | | 166,194 | | | | 15,253 | | 10.1 | % | | | | 301,241 | | | 331,684 | | | | 30,443 | | 10.1 | % |

| Net investment income | | | 23,216 | | | 21,027 | | | 22,103 | | | 22,407 | | | | 21,599 | | | 21,681 | | | | 654 | | 3.1 | % | | | | 44,243 | | | 43,280 | | | | (963 | ) | -2.2 | % |

| Commissions and fees: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales-based (1) | | | 49,718 | | | 52,164 | | | 51,991 | | | 54,447 | | | | 57,963 | | | 60,311 | | | | 8,148 | | 15.6 | % | | | | 101,881 | | | 118,274 | | | | 16,393 | | 16.1 | % |

Asset-based (2) | | | 47,428 | | | 49,436 | | | 50,981 | | | 53,432 | | | | 53,749 | | | 56,058 | | | | 6,621 | | 13.4 | % | | | | 96,864 | | | 109,806 | | | | 12,942 | | 13.4 | % |

Account-based (3) | | | 9,453 | | | 9,588 | | | 9,811 | | | 10,010 | | | | 9,720 | | | 9,957 | | | | 369 | | 3.8 | % | | | | 19,042 | | | 19,678 | | | | 636 | | 3.3 | % |

| Other commissions and fees | | | 5,674 | | | 5,994 | | | 5,658 | | | 6,019 | | | | 5,499 | | | 5,713 | | | | (281 | ) | -4.7 | % | | | | 11,668 | | | 11,212 | | | | (455 | ) | -3.9 | % |

| Realized investment (losses) gains | | | 2,286 | | | 3,468 | | | (407 | ) | | 899 | | | | 263 | | | 831 | | | | (2,636 | ) | -76.0 | % | | | | 5,754 | | | 1,094 | | | | (4,660 | ) | -81.0 | % |

| Other, net | | | 10,376 | | | 10,872 | | | 10,714 | | | 10,776 | | | | 10,045 | | | 10,384 | | | | (488 | ) | -4.5 | % | | | | 21,247 | | | 20,429 | | | | (818 | ) | -3.9 | % |

| Total revenues | | | 298,450 | | | 303,490 | | | 310,408 | | | 318,222 | | | | 324,328 | | | 331,130 | | | | 27,640 | | 9.1 | % | | | | 601,940 | | | 655,458 | | | | 53,517 | | 8.9 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 68,816 | | | 64,322 | | | 76,548 | | | 70,246 | | | | 75,191 | | | 72,412 | | | | 8,090 | | 12.6 | % | | | | 133,138 | | | 147,604 | | | | 14,466 | | 10.9 | % |

| Amortization of DAC | | | 31,252 | | | 30,111 | | | 32,192 | | | 35,627 | | | | 35,193 | | | 32,696 | | | | 2,585 | | 8.6 | % | | | | 61,364 | | | 67,890 | | | | 6,526 | | 10.6 | % |

| Insurance commissions | | | 4,223 | | | 4,131 | | | 3,933 | | | 4,242 | | | | 4,083 | | | 3,881 | | | | (251 | ) | -6.1 | % | | | | 8,354 | | | 7,964 | | | | (391 | ) | -4.7 | % |

| Insurance expenses | | | 25,512 | | | 26,513 | | | 26,576 | | | 26,854 | | | | 28,502 | | | 28,192 | | | | 1,679 | | 6.3 | % | | | | 52,026 | | | 56,694 | | | | 4,668 | | 9.0 | % |

| Sales commissions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sales-based (1) | | | 35,403 | | | 36,730 | | | 36,296 | | | 38,222 | | | | 41,594 | | | 42,729 | | | | 5,999 | | 16.3 | % | | | | 72,134 | | | 84,323 | | | | 12,189 | | 16.9 | % |

Asset-based (2) | | | 16,637 | | | 17,778 | | | 18,775 | | | 19,956 | | | | 20,695 | | | 21,831 | | | | 4,053 | | 22.8 | % | | | | 34,415 | | | 42,526 | | | | 8,111 | | 23.6 | % |

| Other sales commissions | | | 3,007 | | | 3,129 | | | 3,316 | | | 2,986 | | | | 2,833 | | | 2,803 | | | | (327 | ) | -10.4 | % | | | | 6,137 | | | 5,636 | | | | (501 | ) | -8.2 | % |

| Interest expense | | | 8,795 | | | 8,792 | | | 8,726 | | | 8,704 | | | | 8,606 | | | 8,552 | | | | (240 | ) | -2.7 | % | | | | 17,588 | | | 17,159 | | | | (429 | ) | -2.4 | % |

| Other operating expenses | | | 45,664 | | | 45,031 | | | 41,273 | | | 55,241 | | | | 40,798 | | | 42,292 | | | | (2,739 | ) | -6.1 | % | | | | 90,694 | | | 83,090 | | | | (7,604 | ) | -8.4 | % |

| Total benefits and expenses | | | 239,310 | | | 236,539 | | | 247,636 | | | 262,078 | | | | 257,495 | | | 255,390 | | | | 18,850 | | 8.0 | % | | | | 475,850 | | | 512,885 | | | | 37,035 | | 7.8 | % |

| Income from continued operations before income taxes | | | 59,140 | | | 66,950 | | | 62,772 | | | 56,143 | | | | 66,832 | | | 75,740 | | | | 8,790 | | 13.1 | % | | | | 126,090 | | | 142,573 | | | | 16,482 | | 13.1 | % |

| Income taxes | | | 21,005 | | | 23,783 | | | 22,041 | | | 19,477 | | | | 23,347 | | | 26,469 | | | | 2,686 | | 11.3 | % | | | | 44,787 | | | 49,816 | | | | 5,029 | | 11.2 | % |

| Net income from continued operations | | | 38,135 | | | 43,168 | | | 40,732 | | | 36,666 | | | | 43,485 | | | 49,271 | | | | 6,103 | | 14.1 | % | | | | 81,303 | | | 92,756 | | | | 11,453 | | 14.1 | % |

| Net income from discontinued operations net tax | | | 710 | | | 322 | | | 2,458 | | | 534 | | | �� | 1,596 | | | — | | | | (322 | ) | -100.0 | % | | | | 1,032 | | | 1,596 | | | | 563 | | 54.6 | % |

| Net income | | $ | 38,845 | | $ | 43,490 | | $ | 43,190 | | $ | 37,201 | | | $ | 45,080 | | $ | 49,271 | | | $ | 5,781 | | 13.3 | % | | | $ | 82,335 | | $ | 94,352 | | | $ | 12,017 | | 14.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from Continued Operations Before Income Taxes by Segment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term Life | | $ | 45,125 | | $ | 51,898 | | $ | 50,136 | | $ | 50,042 | | | $ | 47,204 | | $ | 55,070 | | | $ | 3,172 | | 6.1 | % | | | $ | 97,023 | | $ | 102,274 | | | $ | 5,251 | | 5.4 | % |

| Investment & Savings Products | | | 26,353 | | | 27,488 | | | 31,498 | | | 19,810 | | | | 34,028 | | | 36,048 | | | | 8,560 | | 31.1 | % | | | | 53,841 | | | 70,075 | | | | 16,234 | | 30.2 | % |

| Corporate & Other Distributed Products | | | (12,338 | ) | | (12,435 | ) | | (18,862 | ) | | (13,709 | ) | | | (14,399 | ) | | (15,377 | ) | | | (2,941 | ) | -23.7 | % | | | | (24,773 | ) | | (29,776 | ) | | | (5,003 | ) | -20.2 | % |

| Income from continued operations before income taxes | | $ | 59,140 | | $ | 66,950 | | $ | 62,772 | | $ | 56,143 | | | $ | 66,832 | | $ | 75,740 | | | $ | 8,790 | | 13.1 | % | | | $ | 126,090 | | $ | 142,573 | | | $ | 16,482 | | 13.1 | % |

| (1) | Sales-based - revenues or commission expenses relating to the sales of mutual funds and variable annuities |

| (2) | Asset-based - revenues or commission expenses relating to the value of assets in client accounts for which we earn ongoing service, distribution, and other fees |

| (3) | Account-based - revenues relating to the fee generating client accounts we administer |

Reconciliation of Statement of Income Non-GAAP to GAAP Financial Measures | PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | | YOY YTD | |

| (Dollars in thousands) | | Q1 2013 | | Q2 2013 | | Q3 2013 | | Q4 2013 | | | Q1 2014 | | Q2 2014 | | | $ Change | | % Change | | | | YTD 2013 | | | YTD 2014 | | | $ Change | | | % Change | |

| Reconciliation from Term Life Adjusted Direct Premiums to Term Life Direct Premiums | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term Life adjusted direct premiums | | $ | 193,409 | | $ | 201,422 | | $ | 205,503 | | $ | 210,572 | | | $ | 214,780 | | $ | 223,706 | | | $ | 22,284 | | | 11.1 | % | | | $ | 394,831 | | | $ | 438,486 | | | $ | 43,655 | | | 11.1 | % |

| Premiums ceded to Citi | | | 358,625 | | | 357,613 | | | 351,983 | | | 350,077 | | | | 344,883 | | | 344,143 | | | | (13,471 | ) | | -3.8 | % | | | | 716,238 | | | | 689,026 | | | | (27,212 | ) | | -3.8 | % |

| Term Life direct premiums | | $ | 552,034 | | $ | 559,035 | | $ | 557,486 | | $ | 560,649 | | | $ | 559,663 | | $ | 567,849 | | | $ | 8,814 | | | 1.6 | % | | | | 1,111,069 | | | | 1,127,512 | | | $ | 16,443 | | | 1.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation from Term Life Other Ceded Premiums to Term Life Ceded Premiums | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term Life other ceded premiums | | $ | (49,229 | ) | $ | (56,608 | ) | $ | (52,476 | ) | $ | (55,430 | ) | | $ | (55,450 | ) | $ | (63,424 | ) | | $ | (6,815 | ) | | -12.0 | % | | | $ | (105,837 | ) | | $ | (118,874 | ) | | $ | (13,036 | ) | | -12.3 | % |

| Premiums ceded to Citi | | | (358,625 | ) | | (357,613 | ) | | (351,983 | ) | | (350,077 | ) | | | (344,883 | ) | | (344,143 | ) | | | 13,471 | | | 3.8 | % | | | | (716,238 | ) | | | (689,026 | ) | | | 27,212 | | | 3.8 | % |

| Term Life ceded premiums | | $ | (407,854 | ) | $ | (414,222 | ) | $ | (404,459 | ) | $ | (405,506 | ) | | $ | (400,334 | ) | $ | (407,566 | ) | | $ | 6,655 | | | 1.6 | % | | | $ | (822,076 | ) | | $ | (807,900 | ) | | $ | 14,176 | | | 1.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation from Operating Revenues to Total Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenues | | $ | 296,164 | | $ | 300,022 | | $ | 310,815 | | $ | 317,323 | | | $ | 324,065 | | $ | 330,299 | | | $ | 30,276 | | | 10.1 | % | | | $ | 596,186 | | | $ | 654,363 | | | $ | 58,177 | | | 9.8 | % |

| Realized investment gains/(losses) | | | 2,286 | | | 3,468 | | | (407 | ) | | 899 | | | | 263 | | | 831 | | | nm | | nm | | | | | 5,754 | | | | 1,094 | | | nm | | | nm | |

| Total revenues | | $ | 298,450 | | $ | 303,490 | | $ | 310,408 | | $ | 318,222 | | | $ | 324,328 | | $ | 331,130 | | | $ | 27,640 | | | 9.1 | % | | | $ | 601,940 | | | $ | 655,458 | | | $ | 53,517 | | | 8.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation from Operating Income Before Income Taxes to Income from Continued Operations Before Income Taxes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income before income taxes | | $ | 59,864 | | $ | 63,844 | | $ | 63,179 | | $ | 70,795 | | | $ | 66,569 | | $ | 74,909 | | | $ | 11,065 | | | 17.3 | % | | | $ | 123,708 | | | $ | 141,478 | | | $ | 17,770 | | | 14.4 | % |

| Operating income before income taxes reconciling items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Realized investment gains/(losses) | | | 2,286 | | | 3,468 | | | (407 | ) | | 899 | | | | 263 | | | 831 | | | nm | | nm | | | | | 5,754 | | | | 1,094 | | | nm | | | nm | |

| FRS legal settlements | | | — | | | (188 | ) | | — | | | (15,551 | ) | | | — | | | — | | | nm | | nm | | | | | (188 | ) | | | — | | | nm | | | nm | |

| IPO equity award grants | | | (3,010 | ) | | (174 | ) | | — | | | — | | | | — | | | — | | | nm | | nm | | | | | (3,184 | ) | | | — | | | nm | | | nm | |

| Total operating income before income taxes reconciling items | | | (724 | ) | | 3,106 | | | (407 | ) | | (14,652 | ) | | | 263 | | | 831 | | | nm | | nm | | | | | 2,382 | | | | 1,094 | | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from continued operations before income taxes | | $ | 59,140 | | $ | 66,950 | | $ | 62,772 | | $ | 56,143 | | | $ | 66,832 | | $ | 75,740 | | | $ | 8,790 | | | 13.1 | % | | | $ | 126,090 | | | $ | 142,573 | | | $ | 16,482 | | | 13.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation from Net Operating Income to Net Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income | | $ | 38,602 | | $ | 41,165 | | $ | 40,996 | | $ | 46,234 | | | $ | 43,314 | | $ | 48,731 | | | $ | 7,566 | | | 18.4 | % | | | $ | 79,767 | | | $ | 92,044 | | | $ | 12,277 | | | 15.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income reconciling items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating income before income taxes reconciling items | | | (724 | ) | | 3,106 | | | (407 | ) | | (14,652 | ) | | | 263 | | | 831 | | | nm | | nm | | | | | 2,382 | | | | 1,094 | | | nm | | | nm | |

| Tax impact of operating income reconciling items at effective tax rate | | | 257 | | | (1,103 | ) | | 143 | | | 5,084 | | | | (92 | ) | | (291 | ) | | nm | | nm | | | | | (846 | ) | | | (382 | ) | | nm | | | nm | |

| Total net operating income reconciling items | | | (467 | ) | | 2,003 | | | (264 | ) | | (9,568 | ) | | | 171 | | | 541 | | | nm | | nm | | | | | 1,536 | | | | 712 | | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income from continued operations | | $ | 38,135 | | $ | 43,168 | | $ | 40,732 | | $ | 36,666 | | | $ | 43,485 | | $ | 49,271 | | | $ | 6,103 | | | 14.1 | % | | | $ | 81,303 | | | $ | 92,756 | | | $ | 11,453 | | | 14.1 | % |

| Net income from discontinued operations net tax | | | 710 | | | 322 | | | 2,458 | | | 534 | | | | 1,596 | | | — | | | nm | | nm | | | | | 1,032 | | | | 1,596 | | | nm | | | nm | |

| Net income | | $ | 38,845 | | $ | 43,490 | | $ | 43,190 | | $ | 37,201 | | | $ | 45,080 | | $ | 49,271 | | | $ | 5,781 | | | 13.3 | % | | | $ | 82,335 | | | $ | 94,352 | | | $ | 12,017 | | | 14.6 | % |

Segment Operating Results | PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | | YOY YTD | |

| (Dollars in thousands) | | | Q1 2013 | | | | Q2 2013 | | | | Q3 2013 | | | | Q4 2013 | | | | Q1 2014 | | | | Q2 2014 | | | $ Change | | | % Change | | | | YTD 2013 | | | YTD 2014 | | | $ Change | | | % Change | |

| Term Life Insurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premiums | | $ | 552,034 | | | $ | 559,035 | | | $ | 557,486 | | | $ | 560,649 | | | $ | 559,663 | | | $ | 567,849 | | | $ | 8,814 | | | | 1.6 | % | | | $ | 1,111,069 | | | $ | 1,127,512 | | | $ | 16,443 | | | | 1.5 | % |

| Ceded premiums | | | (407,854 | ) | | | (414,222 | ) | | | (404,459 | ) | | | (405,506 | ) | | | (400,334 | ) | | | (407,566 | ) | | | 6,655 | | | | 1.6 | % | | | | (822,076 | ) | | | (807,900 | ) | | | 14,176 | | | | 1.7 | % |

| Net premiums | | | 144,180 | | | | 144,813 | | | | 153,027 | | | | 155,142 | | | | 159,330 | | | | 160,282 | | | | 15,469 | | | | 10.7 | % | | | | 288,993 | | | | 319,612 | | | | 30,619 | | | | 10.6 | % |

| Allocated net investment income | | | 16,670 | | | | 16,935 | | | | 17,385 | | | | 17,807 | | | | 16,713 | | | | 16,839 | | | | (96 | ) | | | -0.6 | % | | | | 33,604 | | | | 33,552 | | | | (52 | ) | | | -0.2 | % |

| Other, net | | | 6,984 | | | | 7,435 | | | | 7,399 | | | | 7,199 | | | | 6,937 | | | | 7,244 | | | | (191 | ) | | | -2.6 | % | | | | 14,419 | | | | 14,182 | | | | (237 | ) | | | -1.6 | % |

| Operating revenues | | | 167,833 | | | | 169,183 | | | | 177,811 | | | | 180,147 | | | | 182,980 | | | | 184,366 | | | | 15,183 | | | | 9.0 | % | | | | 337,016 | | | | 367,346 | | | | 30,329 | | | | 9.0 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 65,547 | | | | 61,689 | | | | 67,788 | | | | 67,334 | | | | 71,263 | | | | 68,287 | | | | 6,599 | | | | 10.7 | % | | | | 127,235 | | | | 139,551 | | | | 12,315 | | | | 9.7 | % |

| Amortization of DAC | | | 27,865 | | | | 25,777 | | | | 29,679 | | | | 32,570 | | | | 32,721 | | | | 29,778 | | | | 4,001 | | | | 15.5 | % | | | | 53,642 | | | | 62,499 | | | | 8,858 | | | | 16.5 | % |

| Insurance commissions | | | 1,199 | | | | 1,062 | | | | 901 | | | | 1,437 | | | | 1,315 | | | | 929 | | | | (133 | ) | | | -12.5 | % | | | | 2,261 | | | | 2,244 | | | | (17 | ) | | | -0.8 | % |

| Insurance expenses | | | 23,846 | | | | 24,508 | | | | 25,125 | | | | 24,603 | | | | 26,413 | | | | 26,293 | | | | 1,785 | | | | 7.3 | % | | | | 48,353 | | | | 52,706 | | | | 4,353 | | | | 9.0 | % |

| Interest expense | | | 4,252 | | | | 4,250 | | | | 4,183 | | | | 4,161 | | | | 4,063 | | | | 4,009 | | | | (241 | ) | | | -5.7 | % | | | | 8,502 | | | | 8,072 | | | | (430 | ) | | | -5.1 | % |

| Operating benefits and expenses | | | 122,708 | | | | 117,285 | | | | 127,676 | | | | 130,105 | | | | 135,776 | | | | 129,296 | | | | 12,011 | | | | 10.2 | % | | | | 239,993 | | | | 265,072 | | | | 25,079 | | | | 10.4 | % |

| Operating income before income taxes | | $ | 45,125 | | | $ | 51,898 | | | $ | 50,136 | | | $ | 50,042 | | | $ | 47,204 | | | $ | 55,070 | | | $ | 3,172 | | | | 6.1 | % | | | $ | 97,023 | | | $ | 102,274 | | | $ | 5,251 | | | | 5.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment & Savings Products | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commissions and fees: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales-based | | $ | 49,718 | | | $ | 52,164 | | | $ | 51,991 | | | $ | 54,447 | | | $ | 57,963 | | | $ | 60,311 | | | $ | 8,148 | | | | 15.6 | % | | | $ | 101,881 | | | $ | 118,274 | | | $ | 16,393 | | | | 16.1 | % |

| Asset-based | | | 47,428 | | | | 49,436 | | | | 50,981 | | | | 53,432 | | | | 53,749 | | | | 56,058 | | | | 6,621 | | | | 13.4 | % | | | | 96,864 | | | | 109,806 | | | | 12,942 | | | | 13.4 | % |

| Account-based | | | 9,453 | | | | 9,588 | | | | 9,811 | | | | 10,010 | | | | 9,720 | | | | 9,957 | | | | 369 | | | | 3.8 | % | | | | 19,042 | | | | 19,678 | | | | 636 | | | | 3.3 | % |

| Other, net | | | 2,122 | | | | 2,173 | | | | 1,941 | | | | 2,444 | | | | 1,839 | | | | 1,821 | | | | (352 | ) | | | -16.2 | % | | | | 4,295 | | | | 3,660 | | | | (635 | ) | | | -14.8 | % |

| Operating revenues | | | 108,721 | | | | 113,361 | | | | 114,723 | | | | 120,333 | | | | 123,270 | | | | 128,148 | | | | 14,787 | | | | 13.0 | % | | | | 222,082 | | | | 251,418 | | | | 29,336 | | | | 13.2 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of DAC | | | 2,892 | | | | 3,876 | | | | 2,542 | | | | 1,885 | | | | 2,335 | | | | 2,172 | | | | (1,704 | ) | | | -44.0 | % | | | | 6,768 | | | | 4,507 | | | | (2,261 | ) | | | -33.4 | % |

| Insurance commissions | | | 2,274 | | | | 2,331 | | | | 2,249 | | | | 2,193 | | | | 2,086 | | | | 2,237 | | | | (93 | ) | | | -4.0 | % | | | | 4,605 | | | | 4,324 | | | | (281 | ) | | | -6.1 | % |

| Sales commissions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | #DIV/0! | |

| Sales-based | | | 35,403 | | | | 36,730 | | | | 36,296 | | | | 38,222 | | | | 41,594 | | | | 42,729 | | | | 5,999 | | | | 16.3 | % | | | | 72,134 | | | | 84,323 | | | | 12,189 | | | | 16.9 | % |

| Asset-based | | | 16,637 | | | | 17,778 | | | | 18,775 | | | | 19,956 | | | | 20,695 | | | | 21,831 | | | | 4,053 | | | | 22.8 | % | | | | 34,415 | | | | 42,526 | | | | 8,111 | | | | 23.6 | % |

| Other operating expenses | | | 25,162 | | | | 24,971 | | | | 23,362 | | | | 22,716 | | | | 22,532 | | | | 23,131 | | | | (1,840 | ) | | | -7.4 | % | | | | 50,133 | | | | 45,663 | | | | (4,470 | ) | | | -8.9 | % |

| Operating benefits and expenses | | | 82,368 | | | | 85,686 | | | | 83,224 | | | | 84,972 | | | | 89,243 | | | | 92,100 | | | | 6,414 | | | | 7.5 | % | | | | 168,054 | | | | 181,343 | | | | 13,289 | | | | 7.9 | % |

| Operating income before income taxes | | $ | 26,353 | | | $ | 27,675 | | | $ | 31,498 | | | $ | 35,361 | | | $ | 34,028 | | | $ | 36,048 | | | $ | 8,372 | | | | 30.3 | % | | | $ | 54,028 | | | $ | 70,075 | | | $ | 16,047 | | | | 29.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate & Other Distributed Products | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premiums | | $ | 8,870 | | | $ | 9,356 | | | $ | 9,561 | | | $ | 8,200 | | | $ | 8,542 | | | $ | 8,892 | | | $ | (464 | ) | | | -5.0 | % | | | $ | 18,226 | | | $ | 17,434 | | | $ | (793 | ) | | | -4.3 | % |

| Ceded premiums | | | (2,750 | ) | | | (3,229 | ) | | | (3,030 | ) | | | (3,109 | ) | | | (2,381 | ) | | | (2,980 | ) | | | 249 | | | | 7.7 | % | | | | (5,978 | ) | | | (5,362 | ) | | | 617 | | | | 10.3 | % |

| Net premiums | | | 6,120 | | | | 6,127 | | | | 6,531 | | | | 5,091 | | | | 6,160 | | | | 5,912 | | | | (216 | ) | | | -3.5 | % | | | | 12,248 | | | | 12,072 | | | | (176 | ) | | | -1.4 | % |

| Allocated net investment income | | | 6,546 | | | | 4,092 | | | | 4,718 | | | | 4,600 | | | | 4,885 | | | | 4,842 | | | | 750 | | | | 18.3 | % | | | | 10,638 | | | | 9,728 | | | | (911 | ) | | | -8.6 | % |

| Commissions and fees: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans | | | 293 | | | | 406 | | | | 264 | | | | 256 | | | | 200 | | | | 101 | | | | (305 | ) | | | -75.1 | % | | | | 699 | | | | 300 | | | | (398 | ) | | | -57.0 | % |

| DebtWatchers | | | 491 | | | | 462 | | | | 482 | | | | 411 | | | | 385 | | | | 360 | | | | (102 | ) | | | -22.2 | % | | | | 953 | | | | 745 | | | | (208 | ) | | nm | |

| Prepaid Legal Services | | | 2,254 | | | | 2,255 | | | | 2,396 | | | | 2,415 | | | | 2,339 | | | | 2,285 | | | | 30 | | | | 1.3 | % | | | | 4,509 | | | | 4,624 | | | | 115 | | | | 2.5 | % |

| Auto and Homeowners Insurance | | | 1,685 | | | | 1,890 | | | | 1,470 | | | | 1,982 | | | | 1,719 | | | | 1,998 | | | | 107 | | | | 5.7 | % | | | | 3,575 | | | | 3,717 | | | | 141 | | | | 3.9 | % |

| Long-Term Care Insurance | | | 627 | | | | 664 | | | | 704 | | | | 565 | | | | 521 | | | | 570 | | | | (94 | ) | | | -14.1 | % | | | | 1,291 | | | | 1,091 | | | | (200 | ) | | | -15.5 | % |

| Other sales commissions | | | 323 | | | | 316 | | | | 342 | | | | 389 | | | | 337 | | | | 399 | | | | 82 | | | | 26.0 | % | | | | 640 | | | | 736 | | | | 96 | | | | 15.0 | % |

| Other, net | | | 1,270 | | | | 1,264 | | | | 1,374 | | | | 1,133 | | | | 1,269 | | | | 1,318 | | | | 54 | | | | 4.3 | % | | | | 2,533 | | | | 2,587 | | | | 54 | | | | 2.1 | % |

| Operating revenues | | | 19,610 | | | | 17,478 | | | | 18,281 | | | | 16,843 | | | | 17,814 | | | | 17,785 | | | | 307 | | | | 1.8 | % | | | | 37,087 | | | | 35,599 | | | | (1,488 | ) | | | -4.0 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 3,269 | | | | 2,634 | | | | 8,760 | | | | 2,912 | | | | 3,928 | | | | 4,125 | | | | 1,491 | | | | 56.6 | % | | | | 5,903 | | | | 8,053 | | | | 2,150 | | | | 36.4 | % |

| Amortization of DAC | | | 496 | | | | 459 | | | | (29 | ) | | | 1,171 | | | | 137 | | | | 747 | | | | 288 | | | | 62.8 | % | | | | 955 | | | | 883 | | | | (71 | ) | | | -7.5 | % |

| Insurance commissions | | | 750 | | | | 738 | | | | 783 | | | | 612 | | | | 681 | | | | 715 | | | | (24 | ) | | | -3.2 | % | | | | 1,488 | | | | 1,396 | | | | (93 | ) | | | -6.2 | % |

| Insurance expenses | | | 1,667 | | | | 2,006 | | | | 1,451 | | | | 2,252 | | | | 2,088 | | | | 1,900 | | | | (106 | ) | | | -5.3 | % | | | | 3,673 | | | | 3,988 | | | | 315 | | | | 8.6 | % |

| Sales commissions | | | 3,007 | | | | 3,129 | | | | 3,316 | | | | 2,986 | | | | 2,833 | | | | 2,803 | | | | (327 | ) | | | -10.4 | % | | | | 6,137 | | | | 5,636 | | | | (501 | ) | | | -8.2 | % |

| Interest expense | | | 4,543 | | | | 4,543 | | | | 4,543 | | | | 4,543 | | | | 4,543 | | | | 4,543 | | | | 1 | | | nm | | | | | 9,086 | | | | 9,087 | | | | 1 | | | nm | |

| Other operating expenses | | | 17,492 | | | | 19,698 | | | | 17,911 | | | | 16,975 | | | | 18,266 | | | | 19,161 | | | | (537 | ) | | | -2.7 | % | | | | 37,190 | | | | 37,427 | | | | 238 | | | | 0.6 | % |

| Operating benefits and expenses | | | 31,224 | | | | 33,207 | | | | 36,736 | | | | 31,451 | | | | 32,477 | | | | 33,993 | | | | 786 | | | | 2.4 | % | | | | 64,430 | | | | 66,470 | | | | 2,039 | | | | 3.2 | % |

| Operating income before income taxes | | $ | (11,614 | ) | | $ | (15,729 | ) | | $ | (18,455 | ) | | $ | (14,608 | ) | | $ | (14,662 | ) | | $ | (16,208 | ) | | $ | (479 | ) | | | -3.0 | % | | | $ | (27,343 | ) | | $ | (30,871 | ) | | $ | (3,527 | ) | | | -12.9 | % |

Term Life Insurance - New Term / Legacy Format of Financial Results | PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | YOY YTD | |

| (Dollars in thousands) | | | Q1 2013 | | | | Q2 2013 | | | | Q3 2013 | | | | Q4 2013 | | | | Q1 2014 | | | | Q2 2014 | | | $ Change | | % Change | | | | YTD 2013 | | YTD 2014 | | | $ Change | | % Change | |

New Term Life Insurance Operating Income Before Income Taxes (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premiums | | $ | 106,077 | | | $ | 114,407 | | | $ | 119,852 | | | $ | 125,394 | | | $ | 130,855 | | | $ | 139,973 | | | $ | 25,566 | | 22.3 | % | | | $ | 220,484 | | $ | 270,828 | | | $ | 50,343 | | 22.8 | % |

| Ceded premiums | | | (18,577 | ) | | | (20,927 | ) | | | (18,937 | ) | | | (19,934 | ) | | | (23,400 | ) | | | (25,838 | ) | | | (4,911 | ) | -23.5 | % | | | | (39,504 | ) | | (49,238 | ) | | | (9,734 | ) | -24.6 | % |

| Net premiums | | | 87,501 | | | | 93,479 | | | | 100,915 | | | | 105,460 | | | | 107,455 | | | | 114,135 | | | | 20,655 | | 22.1 | % | | | | 180,980 | | | 221,589 | | | | 40,609 | | 22.4 | % |

| Allocated net investment income | | | 3,513 | | | | 3,941 | | | | 4,438 | | | | 5,055 | | | | 5,182 | | | | 5,734 | | | | 1,793 | | 45.5 | % | | | | 7,454 | | | 10,916 | | | | 3,462 | | 46.4 | % |

| Other, net | | | 6,957 | | | | 7,366 | | | | 7,304 | | | | 7,128 | | | | 6,924 | | | | 7,314 | | | | (52 | ) | -0.7 | % | | | | 14,322 | | | 14,238 | | | | (85 | ) | -0.6 | % |

| Operating revenues | | | 97,971 | | | | 104,786 | | | | 112,657 | | | | 117,643 | | | | 119,561 | | | | 127,182 | | | | 22,397 | | 21.4 | % | | | | 202,756 | | | 246,743 | | | | 43,986 | | 21.7 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 32,124 | | | | 33,764 | | | | 39,105 | | | | 40,357 | | | | 40,597 | | | | 40,773 | | | | 7,009 | | 20.8 | % | | | | 65,888 | | | 81,370 | | | | 15,481 | | 23.5 | % |

| Amortization of DAC | | | 17,759 | | | | 17,091 | | | | 20,417 | | | | 23,817 | | | | 23,470 | | | | 21,267 | | | | 4,176 | | 24.4 | % | | | | 34,850 | | | 44,736 | | | | 9,886 | | 28.4 | % |

| Insurance commissions | | | 829 | | | | 659 | | | | 493 | | | | 585 | | | | 911 | | | | 534 | | | | (124 | ) | -18.9 | % | | | | 1,487 | | | 1,446 | | | | (42 | ) | -2.8 | % |

| Insurance expenses | | | 31,613 | | | | 32,550 | | | | 33,040 | | | | 33,567 | | | | 34,961 | | | | 34,935 | | | | 2,385 | | 7.3 | % | | | | 64,163 | | | 69,896 | | | | 5,733 | | 8.9 | % |

| Interest expense | | | 361 | | | | 403 | | | | 422 | | | | 464 | | | | 483 | | | | 511 | | | | 108 | | 26.9 | % | | | | 763 | | | 994 | | | | 231 | | 30.2 | % |

| Operating benefits and expenses | | | 82,686 | | | | 84,466 | | | | 93,477 | | | | 98,789 | | | | 100,422 | | | | 98,020 | | | | 13,554 | | 16.0 | % | | | | 167,152 | | | 198,442 | | | | 31,290 | | 18.7 | % |

| Operating income before income taxes | | $ | 15,284 | | | $ | 20,320 | | | $ | 19,180 | | | $ | 18,854 | | | $ | 19,138 | | | $ | 29,163 | | | $ | 8,843 | | 43.5 | % | | | $ | 35,604 | | $ | 48,301 | | | $ | 12,697 | | 35.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Term Life Insurance - Financial Analysis (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premium | | $ | 106,077 | | | $ | 114,407 | | | $ | 119,852 | | | $ | 125,394 | | | $ | 130,855 | | | $ | 139,973 | | | | 25,566 | | 22.3 | % | | | | 220,484 | | | 270,828 | | | | 50,343 | | 22.8 | % |

| | | | | | | | | | | | | | | | | | | | | �� | | | | | | | | | | | | | | | | | | | | | | | | |

| New term life operating income before income taxes | | $ | 15,284 | | | $ | 20,320 | | | $ | 19,180 | | | $ | 18,854 | | | $ | 19,138 | | | $ | 29,163 | | | | 8,843 | | 43.5 | % | | | | 35,604 | | | 48,301 | | | | 12,697 | | 35.7 | % |

| % of direct premium | | | 14.4 | % | | | 17.8 | % | | | 16.0 | % | | | 15.0 | % | | | 14.6 | % | | | 20.8 | % | | nm | | nm | | | | | 16.1 | % | | 17.8 | % | | nm | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Benefits & expenses, net (2) | | $ | 69,289 | | | $ | 72,441 | | | $ | 78,952 | | | $ | 84,692 | | | $ | 88,378 | | | $ | 88,412 | | | | 15,971 | | 22.0 | % | | | | 141,730 | | | 176,790 | | | | 35,060 | | 24.7 | % |

| % of direct premium | | | 65.3 | % | | | 63.3 | % | | | 65.9 | % | | | 67.5 | % | | | 67.5 | % | | | 63.2 | % | | nm | | nm | | | | | 64.3 | % | | 65.3 | % | | nm | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance expenses, net (3) | | $ | 24,656 | | | $ | 25,184 | | | $ | 25,736 | | | $ | 26,439 | | | $ | 28,038 | | | $ | 27,621 | | | | 2,436 | | 9.7 | % | | | | 49,841 | | | 55,658 | | | | 5,818 | | 11.7 | % |

| % of direct premium | | | 23.2 | % | | | 22.0 | % | | | 21.5 | % | | | 21.1 | % | | | 21.4 | % | | | 19.7 | % | | nm | | nm | | | | | 22.6 | % | | 20.6 | % | | nm | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Legacy Term Life Insurance Operating Income Before Income Taxes (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premiums | | $ | 445,957 | | | $ | 444,628 | | | $ | 437,634 | | | $ | 435,255 | | | $ | 428,809 | | | $ | 427,876 | | | $ | (16,752 | ) | -3.8 | % | | | $ | 890,585 | | $ | 856,684 | | | $ | (33,901 | ) | -3.8 | % |

| Ceded premiums | | | (389,277 | ) | | | (393,294 | ) | | | (385,522 | ) | | | (385,572 | ) | | | (376,934 | ) | | | (381,728 | ) | | | 11,566 | | 2.9 | % | | | | (782,572 | ) | | (758,662 | ) | | | 23,910 | | 3.1 | % |

| Net premiums | | | 56,679 | | | | 51,334 | | | | 52,112 | | | | 49,682 | | | | 51,875 | | | | 46,148 | | | | (5,186 | ) | -10.1 | % | | | | 108,013 | | | 98,023 | | | | (9,991 | ) | -9.2 | % |

| Allocated net investment income | | | 13,156 | | | | 12,994 | | | | 12,947 | | | | 12,752 | | | | 11,531 | | | | 11,105 | | | | (1,889 | ) | -14.5 | % | | | | 26,150 | | | 22,636 | | | | (3,514 | ) | -13.4 | % |

| Other, net | | | 27 | | | | 70 | | | | 96 | | | | 70 | | | | 14 | | | | (69 | ) | | | (139 | ) | nm | | | | | 96 | | | (56 | ) | | | (152 | ) | nm | |

| Operating revenues | | | 69,863 | | | | 64,397 | | | | 65,155 | | | | 62,504 | | | | 63,420 | | | | 57,183 | | | | (7,214 | ) | -11.2 | % | | | | 134,260 | | | 120,603 | | | | (13,657 | ) | -10.2 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 33,422 | | | | 27,925 | | | | 28,683 | | | | 26,977 | | | | 30,666 | | | | 27,514 | | | | (410 | ) | -1.5 | % | | | | 61,347 | | | 58,181 | | | | (3,166 | ) | -5.2 | % |

| Amortization of DAC | | | 10,105 | | | | 8,686 | | | | 9,262 | | | | 8,753 | | | | 9,252 | | | | 8,511 | | | | (175 | ) | -2.0 | % | | | | 18,791 | | | 17,763 | | | | (1,028 | ) | -5.5 | % |

| Insurance commissions | | | 371 | | | | 404 | | | | 408 | | | | 852 | | | | 404 | | | | 395 | | | | (9 | ) | -2.2 | % | | | | 774 | | | 799 | | | | 25 | | 3.2 | % |

| Insurance expenses | | | 9,128 | | | | 8,598 | | | | 8,490 | | | | 7,203 | | | | 7,664 | | | | 7,384 | | | | (1,214 | ) | -14.1 | % | | | | 17,726 | | | 15,047 | | | | (2,678 | ) | -15.1 | % |

| Insurance expense allowance | | | (16,896 | ) | | | (16,640 | ) | | | (16,405 | ) | | | (16,168 | ) | | | (16,212 | ) | | | (16,025 | ) | | | 615 | | 3.7 | % | | | | (33,536 | ) | | (32,237 | ) | | | 1,298 | | 3.9 | % |

| Interest expense | | | 3,892 | | | | 3,847 | | | | 3,761 | | | | 3,698 | | | | 3,580 | | | | 3,498 | | | | (349 | ) | -9.1 | % | | | | 7,739 | | | 7,077 | | | | (661 | ) | -8.5 | % |

| Operating benefits and expenses | | | 40,022 | | | | 32,819 | | | | 34,199 | | | | 31,316 | | | | 35,354 | | | | 31,276 | | | | (1,543 | ) | -4.7 | % | | | | 72,841 | | | 66,630 | | | | (6,211 | ) | -8.5 | % |

| Operating income before income taxes | | $ | 29,841 | | | $ | 31,578 | | | $ | 30,956 | | | $ | 31,188 | | | $ | 28,066 | | | $ | 25,907 | | | $ | (5,671 | ) | -18.0 | % | | | $ | 61,419 | | $ | 53,973 | | | $ | (7,446 | ) | -12.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Legacy Term Life Insurance - Financial Analysis (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct premium | | $ | 445,957 | | | $ | 444,628 | | | $ | 437,634 | | | $ | 435,255 | | | $ | 428,809 | | | $ | 427,876 | | | | (16,752 | ) | -3.8 | % | | | | 890,585 | | | 856,684 | | | | (33,901 | ) | -3.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Legacy term life operating income before income taxes | | $ | 29,841 | | | $ | 31,578 | | | $ | 30,956 | | | $ | 31,188 | | | $ | 28,066 | | | $ | 25,907 | | | | (5,671 | ) | -18.0 | % | | | | 61,419 | | | 53,973 | | | | (7,446 | ) | -12.1 | % |

| % of direct premium | | | 6.7 | % | | | 7.1 | % | | | 7.1 | % | | | 7.2 | % | | | 6.5 | % | | | 6.1 | % | | nm | | nm | | | | | 6.9 | % | | 6.3 | % | | nm | | nm | |

| (1) | Represents results associated with business not subject to the 2010 Citi reinsurance transactions. |

| (2) | Benefits & expenses, net - includes total benefits & claims, ceded premiums, insurance commissions, and amortization of deferred policy acquisition costs |

| (3) | Insurance expenses, net - insurance expenses, net of other net revenues |

| (4) | Represents results associated with business subject to the 2010 Citi reinsurance transactions. |

Term Life Insurance - Key Statistics | PRIMERICA, INC.

Financial Supplement |

| | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | YOY YTD | |

| (Dollars in thousands, except as noted) | | | Q1 2013 | | | Q2 2013 | | | Q3 2013 | | | Q4 2013 | | | | Q1 2014 | | | Q2 2014 | | | $ Change | | % Change | | | | YTD 2013 | | YTD 2014 | | | $ Change | | % Change | |

| Key Statistics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Life-insurance licensed sales force, beginning of period | | | 92,373 | | | 90,917 | | | 92,227 | | | 94,529 | | | | 95,566 | | | 95,382 | | | | 4,465 | | | 4.9 | % | | | | 92,373 | | | 95,566 | | | | 3,193 | | 3.5 | % |

| New life-licensed representatives | | | 7,165 | | | 8,875 | | | 9,630 | | | 8,485 | | | | 7,447 | | | 9,082 | | | | 207 | | | 2.3 | % | | | | 16,040 | | | 16,529 | | | | 489 | | 3.0 | % |

| Non-renewal and terminated representatives | | | (8,621 | ) | | (7,565 | ) | | (7,328 | ) | | (7,448 | ) | | | (7,631 | ) | | (7,868 | ) | | | (303 | ) | | -4.0 | % | | | | (16,186 | ) | | (15,499 | ) | | | 687 | | 4.2 | % |

| Life-insurance licensed sales force, end of period | | | 90,917 | | | 92,227 | | | 94,529 | | | 95,566 | | | | 95,382 | | | 96,596 | | | | 4,369 | | | 4.7 | % | | | | 92,227 | | | 96,596 | | | | 4,369 | | 4.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Estimated annualized issued term life premium ($mills) (1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Premium from new policies | | $ | 40.2 | | $ | 45.9 | | $ | 43.9 | | $ | 43.5 | | | $ | 40.1 | | $ | 48.0 | | | $ | 2.1 | | | 4.6 | % | | | $ | 86.1 | | $ | 88.1 | | | $ | 2.0 | | 2.3 | % |

| Additions and increases in premium | | | 11.4 | | | 12.3 | | | 12.3 | | | 12.5 | | | | 12.4 | | | 13.0 | | | | 0.7 | | | 5.7 | % | | | | 23.7 | | | 25.4 | | | | 1.7 | | 7.1 | % |

| Total estimated annualized issued term life premium | | $ | 51.6 | | $ | 58.2 | | $ | 56.2 | | $ | 56.0 | | | $ | 52.5 | | $ | 61.1 | | | $ | 2.8 | | | 4.9 | % | | | $ | 109.8 | | $ | 113.5 | | | $ | 3.7 | | 3.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issued term life policies | | | 50,356 | | | 57,622 | | | 53,997 | | | 52,642 | | | | 49,320 | | | 59,569 | | | | 1,947 | | | 3.4 | % | | | | 107,978 | | | 108,889 | | | | 911 | | 0.8 | % |

Estimated average annualized issued term life premium per policy (1)(2) | | $ | 799 | | $ | 797 | | $ | 813 | | $ | 826 | | | $ | 813 | | $ | 806 | | | $ | 10 | | | 1.2 | % | | | $ | 798 | | $ | 809 | | | $ | 12 | | 1.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term life face amount in-force, beginning of period ($mills) | | $ | 670,412 | | $ | 670,414 | | $ | 674,355 | | $ | 676,360 | | | $ | 674,868 | | $ | 673,078 | | | $ | 2,663 | | | 0.4 | % | | | $ | 670,412 | | $ | 674,868 | | | $ | 4,456 | | 0.7 | % |

| Issued term life face amount (3) | | | 15,709 | | | 17,798 | | | 17,056 | | | 17,219 | | | | 15,748 | | | 18,494 | | | | 695 | | | 3.9 | % | | | | 33,508 | | | 34,241 | | | | 734 | | 2.2 | % |

| Terminated term life face amount | | | (14,917 | ) | | (13,139 | ) | | (14,346 | ) | | (15,329 | ) | | | (14,160 | ) | | (12,759 | ) | | | 380 | | | 2.9 | % | | | | (28,056 | ) | | (26,919 | ) | | | 1,137 | | 4.1 | % |

| Foreign currency impact, net | | | (790 | ) | | (719 | ) | | (704 | ) | | (3,383 | ) | | | (3,378 | ) | | 3,166 | | | | 3,885 | | nm | | | | | (1,509 | ) | | (212 | ) | | | 1,297 | | nm | |

| Term life face amount in-force, end of period | | $ | 670,414 | | $ | 674,355 | | $ | 676,360 | | $ | 674,868 | | | $ | 673,078 | | $ | 681,978 | | | $ | 7,623 | | | 1.1 | % | | | $ | 674,355 | | $ | 681,978 | | | $ | 7,623 | | 1.1 | % |

| (1) | Estimated annualized issued term life premium - estimated as average premium per $1,000 of face amounts issued on new policies and additions (before free look returns) multiplied by actual face amount issued on new policies, rider additions and face amount increases. |

| (2) | In whole dollars |

| (3) | Issued term life face amount - includes face amount on issued term life policies, additional riders added to existing policies, and face increases under increasing benefit riders |

Term Life Insurance - Financial Results and Analysis | PRIMERICA, INC.

Financial Supplement |

| (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | YOY Q2 | | | | | | | | | | YOY YTD | |

| Term Life Insurance Operating Income Before Income Taxes | | | Q1 2013 | | | | Q2 2013 | | | | Q3 2013 | | | | Q4 2013 | | | | Q1 2014 | | | | Q2 2014 | | | $ Change | | | % Change | | | | YTD 2013 | | | YTD 2014 | | | $ Change | | | % Change | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct Premiums | | $ | 552,034 | | | $ | 559,035 | | | $ | 557,486 | | | $ | 560,649 | | | $ | 559,663 | | | $ | 567,849 | | | | 8,814 | | | | 1.6 | % | | | $ | 1,111,069 | | | $ | 1,127,512 | | | $ | 16,443 | | | | 1.5 | % |

Premiums ceded to Citi (1) | | | (358,625 | ) | | | (357,613 | ) | | | (351,983 | ) | | | (350,077 | ) | | | (344,883 | ) | | | (344,143 | ) | | | 13,471 | | | | 3.8 | % | | | | (716,238 | ) | | | (689,026 | ) | | | 27,212 | | | | 3.8 | % |

Adjusted direct premiums (2) | | | 193,409 | | | | 201,422 | | | | 205,503 | | | | 210,572 | | | | 214,780 | | | | 223,706 | | | | 22,284 | | | | 11.1 | % | | | | 394,831 | | | | 438,486 | | | | 43,655 | | | | 11.1 | % |

Other ceded premiums (3) | | | (49,229 | ) | | | (56,608 | ) | | | (52,476 | ) | | | (55,430 | ) | | | (55,450 | ) | | | (63,424 | ) | | | (6,815 | ) | | | -12.0 | % | | | | (105,837 | ) | | | (118,874 | ) | | | (13,036 | ) | | | -12.3 | % |

| Net premiums | | | 144,180 | | | | 144,813 | | | | 153,027 | | | | 155,142 | | | | 159,330 | | | | 160,282 | | | | 15,469 | | | | 10.7 | % | | | | 288,993 | | | | 319,612 | | | | 30,619 | | | | 10.6 | % |

| Allocated net investment income | | | 16,670 | | | | 16,935 | | | | 17,385 | | | | 17,807 | | | | 16,713 | | | | 16,839 | | | | (96 | ) | | | -0.6 | % | | | | 33,604 | | | | 33,552 | | | | (52 | ) | | | -0.2 | % |

| Other, net | | | 6,984 | | | | 7,435 | | | | 7,399 | | | | 7,199 | | | | 6,937 | | | | 7,244 | | | | (191 | ) | | | -2.6 | % | | | | 14,419 | | | | 14,182 | | | | (237 | ) | | | -1.6 | % |

| Operating revenues | | | 167,833 | | | | 169,183 | | | | 177,811 | | | | 180,147 | | | | 182,980 | | | | 184,366 | | | | 15,183 | | | | 9.0 | % | | | | 337,016 | | | | 367,346 | | | | 30,329 | | | | 9.0 | % |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 65,547 | | | | 61,689 | | | | 67,788 | | | | 67,334 | | | | 71,263 | | | | 68,287 | | | | 6,599 | | | | 10.7 | % | | | | 127,235 | | | | 139,551 | | | | 12,315 | | | | 9.7 | % |

| Amortization of DAC | | | 27,865 | | | | 25,777 | | | | 29,679 | | | | 32,570 | | | | 32,721 | | | | 29,778 | | | | 4,001 | | | | 15.5 | % | | | | 53,642 | | | | 62,499 | | | | 8,858 | | | | 16.5 | % |

| Insurance commissions | | | 1,199 | | | | 1,062 | | | | 901 | | | | 1,437 | | | | 1,315 | | | | 929 | | | | (133 | ) | | | -12.5 | % | | | | 2,261 | | | | 2,244 | | | | (17 | ) | | | -0.8 | % |

| Insurance expenses | | | 23,846 | | | | 24,508 | | | | 25,125 | | | | 24,603 | | | | 26,413 | | | | 26,293 | | | | 1,785 | | | | 7.3 | % | | | | 48,353 | | | | 52,706 | | | | 4,353 | | | | 9.0 | % |

| Interest expense | | | 4,252 | | | | 4,250 | | | | 4,183 | | | | 4,161 | | | | 4,063 | | | | 4,009 | | | | (241 | ) | | | -5.7 | % | | | | 8,502 | | | | 8,072 | | | | (430 | ) | | | -5.1 | % |

| Operating benefits and expenses | | | 122,708 | | | | 117,285 | | | | 127,676 | | | | 130,105 | | | | 135,776 | | | | 129,296 | | | | 12,011 | | | | 10.2 | % | | | | 239,993 | | | | 265,072 | | | | 25,079 | | | | 10.4 | % |

| Operating income before income taxes | | $ | 45,125 | | | $ | 51,898 | | | $ | 50,136 | | | $ | 50,042 | | | $ | 47,204 | | | $ | 55,070 | | | $ | 3,172 | | | | 6.1 | % | | | $ | 97,023 | | | $ | 102,274 | | | $ | 5,251 | | | | 5.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Term Life Insurance - Financial Analysis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Primary direct premiums (4) | | $ | 106,077 | | | $ | 114,407 | | | $ | 119,852 | | | $ | 125,394 | | | $ | 130,855 | | | $ | 139,973 | | | $ | 25,566 | | | | 22.3 | % | | | $ | 220,484 | | | $ | 270,828 | | | $ | 50,343 | | | | 22.8 | % |

Legacy direct premiums (5) | | | 445,957 | | | | 444,628 | | | | 437,634 | | | | 435,255 | | | | 428,809 | | | | 427,876 | | | | (16,752 | ) | | | -3.8 | % | | | | 890,585 | | | | 856,684 | | | | (33,901 | ) | | | -3.8 | % |

| Total direct premiums | | $ | 552,034 | | | $ | 559,035 | | | $ | 557,486 | | | $ | 560,649 | | | $ | 559,663 | | | $ | 567,849 | | | $ | 8,814 | | | | 1.6 | % | | | $ | 1,111,069 | | | $ | 1,127,512 | | | $ | 16,443 | | | | 1.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Premiums ceded to Citi | | $ | 358,625 | | | $ | 357,613 | | | $ | 351,983 | | | $ | 350,077 | | | $ | 344,883 | | | $ | 344,143 | | | | (13,471 | ) | | | -3.8 | % | | | $ | 716,238 | | | $ | 689,026 | | | $ | (27,212 | ) | | | -3.8 | % |

| % of Legacy direct premiums | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | nm | | | nm | | | | | 80.4 | % | | | 80.4 | % | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Benefits and claims, net (6) | | $ | 114,776 | | | $ | 118,297 | | | $ | 120,263 | | | $ | 122,764 | | | $ | 126,713 | | | $ | 131,711 | | | | 13,414 | | | | 11.3 | % | | | $ | 233,073 | | | $ | 258,424 | | | $ | 25,352 | | | | 10.9 | % |

| % of adjusted direct premiums | | | 59.3 | % | | | 58.7 | % | | | 58.5 | % | | | 58.3 | % | | | 59.0 | % | | | 58.9 | % | | nm | | | nm | | | | | 59.0 | % | | | 58.9 | % | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DAC amortization & insurance commissions | | $ | 29,064 | | | $ | 26,839 | | | $ | 30,580 | | | $ | 34,007 | | | $ | 34,037 | | | $ | 30,707 | | | | 3,868 | | | | 14.4 | % | | | $ | 55,903 | | | $ | 64,744 | | | $ | 8,841 | | | | 15.8 | % |

| % of adjusted direct premiums | | | 15.0 | % | | | 13.3 | % | | | 14.9 | % | | | 16.1 | % | | | 15.8 | % | | | 13.7 | % | | nm | | | nm | | | | | 14.2 | % | | | 14.8 | % | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance expenses, net (7) | | $ | 16,862 | | | $ | 17,072 | | | $ | 17,726 | | | $ | 17,404 | | | $ | 19,476 | | | $ | 19,048 | | | | 1,976 | | | | 11.6 | % | | | $ | 33,934 | | | $ | 38,524 | | | $ | 4,590 | | | | 13.5 | % |

| % of adjusted direct premiums | | | 8.7 | % | | | 8.5 | % | | | 8.6 | % | | | 8.3 | % | | | 9.1 | % | | | 8.5 | % | | nm | | | nm | | | | | 8.6 | % | | | 8.8 | % | | nm | | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total term life operating income before income taxes | | $ | 45,125 | | | $ | 51,898 | | | $ | 50,136 | | | $ | 50,042 | | | $ | 47,204 | | | $ | 55,070 | | | | 3,172 | | | | 6.1 | % | | | $ | 97,023 | | | $ | 102,274 | | | $ | 5,251 | | | | 5.4 | % |

| % of adjusted direct premiums | | | 23.3 | % | | | 25.8 | % | | | 24.4 | % | | | 23.8 | % | | | 22.0 | % | | | 24.6 | % | | nm | | | nm | | | | | 24.6 | % | | | 23.3 | % | | nm | | | nm | |

| (1) | Premiums ceded to Citi - premiums ceded to Citi under the Citi reinsurance transactions excluding any reimbursements from Citi on previously existing reinsurance agreements |

| (2) | Adjusted direct premiums - direct premiums net of premiums ceded to Citi |

| (3) | Other ceded premiums - premiums ceded to non-Citi reinsurers net of any applicable reimbursements from Citi |

| (4) | Primary direct premiums - direct premiums not subject to the 2010 Citi reinsurance transactions |

| (5) | Legacy direct premiums - direct premiums subject to the 2010 Citi reinsurance transactions |

| (6) | Benefits and claims, net - benefits & claims net of other ceded premiums which are largely YRT |

| (7) | Insurance expenses, net - insurance expenses net of other net revenues |

Term Life Insurance - Historical Financial Results and Analysis | PRIMERICA, INC.

Financial Supplement |

| (Dollars in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term Life Insurance Operating Income Before Income Taxes | | FY 2011 | | | FY 2012 | | | FY 2013 | | | | Q1 2011 | | | | Q2 2011 | | | | Q3 2011 | | | | Q4 2011 | | | | Q1 2012 | | | | Q2 2012 | | | | Q3 2012 | | | | Q4 2012 | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct Premiums | | $ | 2,149,594 | | | $ | 2,193,280 | | | $ | 2,229,204 | | | $ | 532,167 | | | $ | 540,283 | | | $ | 539,693 | | | $ | 537,450 | | | $ | 542,157 | | | $ | 550,329 | | | $ | 549,069 | | | $ | 551,725 | |

Premiums ceded to Citi (1) | | | (1,536,631 | ) | | | (1,473,314 | ) | | | (1,418,299 | ) | | | (390,441 | ) | | | (389,078 | ) | | | (382,104 | ) | | | (375,008 | ) | | | (372,420 | ) | | | (371,184 | ) | | | (365,906 | ) | | | (363,804 | ) |

Adjusted direct premiums (2) | | | 612,963 | | | | 719,966 | | | | 810,905 | | | | 141,726 | | | | 151,205 | | | | 157,589 | | | | 162,443 | | | | 169,737 | | | | 179,145 | | | | 183,163 | | | | 187,921 | |

Other ceded premiums (3) | | | (161,051 | ) | | | (176,308 | ) | | | (213,743 | ) | | | (36,940 | ) | | | (42,812 | ) | | | (39,829 | ) | | | (41,469 | ) | | | (42,139 | ) | | | (40,854 | ) | | | (45,334 | ) | | | (47,981 | ) |

| Net premiums | | | 451,912 | | | | 543,658 | | | | 597,162 | | | | 104,786 | | | | 108,393 | | | | 117,760 | | | | 120,973 | | | | 127,598 | | | | 138,292 | | | | 137,829 | | | | 139,939 | |

| Allocated net investment income | | | 60,668 | | | | 66,119 | | | | 68,796 | | | | 15,286 | | | | 15,018 | | | | 15,215 | | | | 15,148 | | | | 15,630 | | | | 16,112 | | | | 17,411 | | | | 16,967 | |

| Other, net | | | 31,666 | | | | 30,357 | | | | 29,017 | | | | 7,653 | | | | 7,580 | | | | 8,289 | | | | 8,144 | | | | 7,547 | | | | 7,753 | | | | 7,788 | | | | 7,268 | |

| Operating revenues | | | 544,246 | | | | 640,134 | | | | 694,975 | | | | 127,725 | | | | 130,991 | | | | 141,264 | | | | 144,266 | | | | 150,775 | | | | 162,157 | | | | 163,028 | | | | 164,174 | |

| Benefits and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Benefits and claims | | | 197,159 | | | | 239,346 | | | | 262,357 | | | | 47,351 | | | | 43,921 | | | | 52,067 | | | | 53,820 | | | | 57,509 | | | | 59,984 | | | | 60,733 | | | | 61,120 | |

| Amortization of DAC | | | 89,474 | | | | 104,272 | | | | 115,891 | | | | 20,127 | | | | 19,894 | | | | 22,289 | | | | 27,163 | | | | 23,933 | | | | 22,547 | | | | 27,645 | | | | 30,147 | |

| Insurance commissions | | | 19,396 | | | | 9,599 | | | | 4,599 | | | | 4,063 | | | | 5,320 | | | | 5,633 | | | | 4,380 | | | | 3,577 | | | | 2,314 | | | | 2,168 | | | | 1,539 | |

| Insurance expenses | | | 75,048 | | | | 85,156 | | | | 98,081 | | | | 12,833 | | | | 23,607 | | | | 19,186 | | | | 19,421 | | | | 19,717 | | | | 21,782 | | | | 20,532 | | | | 23,125 | |

| Interest expense | | | 11,468 | | | | 15,835 | | | | 16,846 | | | | 2,872 | | | | 2,873 | | | | 2,875 | | | | 2,848 | | | | 2,785 | | | | 4,380 | | | | 4,357 | | | | 4,313 | |

| Operating benefits and expenses | | | 392,545 | | | | 454,208 | | | | 497,774 | | | | 87,246 | | | | 95,615 | | | | 102,050 | | | | 107,633 | | | | 107,521 | | | | 111,008 | | | | 115,435 | | | | 120,244 | |

| Operating income before income taxes | | $ | 151,701 | | | $ | 185,926 | | | $ | 197,201 | | | $ | 40,479 | | | $ | 35,376 | | | $ | 39,214 | | | $ | 36,633 | | | $ | 43,254 | | | $ | 51,148 | | | $ | 47,593 | | | $ | 43,931 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Term Life Insurance - Financial Analysis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Primary direct premiums (4) | | $ | 239,247 | | | $ | 361,596 | | | $ | 465,730 | | | $ | 46,771 | | | $ | 56,581 | | | $ | 64,655 | | | $ | 71,240 | | | $ | 79,146 | | | $ | 88,860 | | | $ | 94,133 | | | $ | 99,458 | |

Legacy direct premiums (5) | | | 1,910,347 | | | | 1,831,684 | | | | 1,763,473 | | | | 485,396 | | | | 483,702 | | | | 475,038 | | | | 466,211 | | | | 463,011 | | | | 461,470 | | | | 454,936 | | | | 452,267 | |

| Total direct premiums | | $ | 2,149,594 | | | $ | 2,193,280 | | | $ | 2,229,204 | | | $ | 532,167 | | | $ | 540,283 | | | $ | 539,693 | | | $ | 537,450 | | | $ | 542,157 | | | $ | 550,329 | | | $ | 549,069 | | | $ | 551,725 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Premiums ceded to Citi | | $ | 1,536,631 | | | $ | 1,473,314 | | | $ | 1,418,299 | | | $ | 390,441 | | | $ | 389,078 | | | $ | 382,104 | | | $ | 375,008 | | | $ | 372,420 | | | $ | 371,184 | | | $ | 365,906 | | | $ | 363,804 | |

| % of Legacy direct premiums | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % | | | 80.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Benefits and claims, net (6) | | $ | 358,210 | | | $ | 415,654 | | | $ | 476,100 | | | $ | 84,291 | | | $ | 86,733 | | | $ | 91,897 | | | $ | 95,290 | | | $ | 99,648 | | | $ | 100,838 | | | $ | 106,067 | | | $ | 109,101 | |

| % of adjusted direct premiums | | | 58.4 | % | | | 57.7 | % | | | 58.7 | % | | | 59.5 | % | | | 57.4 | % | | | 58.3 | % | | | 58.7 | % | | | 58.7 | % | | | 56.3 | % | | | 57.9 | % | | | 58.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DAC amortization & insurance commissions | | $ | 108,870 | | | $ | 113,871 | | | $ | 120,490 | | | $ | 24,191 | | | $ | 25,214 | | | $ | 27,922 | | | $ | 31,543 | | | $ | 27,510 | | | $ | 24,861 | | | $ | 29,813 | | | $ | 31,686 | |

| % of adjusted direct premiums | | | 17.8 | % | | | 15.8 | % | | | 14.9 | % | | | 17.1 | % | | | 16.7 | % | | | 17.7 | % | | | 19.4 | % | | | 16.2 | % | | | 13.9 | % | | | 16.3 | % | | | 16.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance expenses, net (7) | | $ | 43,381 | | | $ | 54,798 | | | $ | 69,064 | | | $ | 5,180 | | | $ | 16,027 | | | $ | 10,897 | | | $ | 11,277 | | | $ | 12,169 | | | $ | 14,029 | | | $ | 12,743 | | | $ | 15,857 | |