UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

Form 10-K

_________________________ | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 001-34603

_________________________

Terreno Realty Corporation

(Exact Name of Registrant as Specified in Its Charter)

_________________________ | | | | | | | | | | | |

| Maryland | | 27-1262675 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | |

10500 NE 8th Street, Suite 1910 Bellevue, WA | | 98004 |

|

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (415) 655-4580

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | TRNO | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price, as reported by the New York Stock Exchange, at which the common equity was last sold, as of June 28, 2024, the last business day of the Registrant’s most recently completed second fiscal quarter: $5,612,026,380. (For this computation, the Registrant has excluded the market value of all shares of its common stock reported as beneficially owned by executive officers and directors of the Registrant. Such exclusion shall not be deemed to constitute and admission that any such person is an affiliate of the Registrant).

The registrant had 99,777,658 shares of its common stock, $0.01 par value per share, outstanding as of February 3, 2025.

Documents Incorporated by Reference

Part III of this Annual Report on Form 10-K incorporates by reference portions of Terreno Realty Corporation’s Proxy Statement for its 2025 Annual Meeting of Stockholders, which the registrant anticipates will be filed with the Securities and Exchange Commission no later than 120 days after the end of its 2024 fiscal year pursuant to Regulation 14A.

Terreno Realty Corporation

Annual Report on Form 10-K

for the Year Ended December 31, 2024

Table of Contents

| | | | | | | | |

| Part I: | |

| | |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 1C | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| |

| Part II: | |

| | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| |

| Part III: | |

| | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| |

| Part IV: | |

| | |

| Item 15 | | |

| | |

| Item 16 | | |

| | |

| | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We caution investors that forward-looking statements are based on management’s beliefs and on assumptions made by, and information currently available to, management. When used, the words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “project”, “result”, “should”, “will”, “seek”, “target”, “see”, “likely”, “position”, “opportunity”, “outlook”, “potential”, “future” and similar expressions which do not relate solely to historical matters are intended to identify forward-looking statements. These statements are subject to risks, uncertainties, and assumptions and are not guarantees of future performance, which may be affected by known and unknown risks, trends, uncertainties, and factors, that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, or projected. We expressly disclaim any responsibility to update our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance, or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

•the factors included in this Annual Report on Form 10-K, including those set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”;

•our ability to identify and acquire industrial properties on terms favorable to us;

•general volatility of the capital markets and the market price of our common stock;

•adverse economic or real estate conditions or developments in the industrial real estate sector and/or in the markets in which we own properties;

•our dependence on key personnel and our reliance on third-party property managers;

•our inability to comply with the laws, rules and regulations applicable to companies, and in particular, public companies;

•our ability to manage our growth effectively;

•tenant bankruptcies and defaults on, or non-renewal of, leases by tenants;

•decreased rental rates or increased vacancy rates;

•elevated interest rates and operating costs;

•declining real estate valuations and impairment charges;

•our expected leverage, our failure to obtain necessary outside financing, and existing and future debt service obligations;

•our ability to make distributions to our stockholders;

•our failure to successfully hedge against interest rate increases;

•our failure to successfully operate acquired properties;

•risks relating to our real estate development, redevelopment, renovation and expansion strategies and activities (including elevated inflation, supply chain disruptions and construction delays);

•the impact of any future pandemic, epidemic or outbreak of any highly infectious disease on the U.S., regional and global economies and on our business, financial condition and results of operations and that of our tenants;

•risks associated with security breaches through cyber attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology networks and related systems;

•our failure to qualify or maintain our status as a real estate investment trust (“REIT”), and possible adverse changes to tax laws;

•uninsured or underinsured losses and costs relating to our properties or that otherwise result from future litigation;

•environmental uncertainties and risks related to natural disasters;

•financial market fluctuations; and

•changes in real estate and zoning laws and increases in real property tax rates.

PART I

Item 1. Business.

Overview

Terreno Realty Corporation (“Terreno”, and together with its subsidiaries, “we”, “us”, “our”, “our Company” or “the Company”) acquires, owns and operates industrial real estate in six major coastal U.S. markets: New York City/Northern New Jersey, Los Angeles, Miami, San Francisco Bay Area, Seattle, and Washington, D.C. We invest in several types of industrial real estate, including warehouse/distribution (approximately 79.7% of our total annualized base rent as of December 31, 2024), flex (including light industrial and research and development, or R&D) (approximately 3.4%), transshipment (approximately 6.0%) and improved land (approximately 10.9%). We target functional properties in infill locations that may be shared by multiple tenants and that cater to customer demand within the various submarkets in which we operate. Infill locations are geographic locations surrounded by high concentrations of already developed land and existing buildings. As of December 31, 2024, we owned a total of 299 buildings (including one building held for sale) aggregating approximately 19.3 million square feet, 47 improved land parcels consisting of approximately 150.6 acres, six properties under development or redevelopment and approximately 22.4 acres of land entitled for future development. As of December 31, 2024, the buildings and improved land parcels were approximately 97.4% and 95.1% leased, respectively, to 670 customers, the largest of which accounted for approximately 5.5% of our total annualized base rent.

We are an internally managed Maryland corporation and elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code, commencing with our taxable year ended December 31, 2010.

Our Investment Strategy

We acquire, own and operate industrial real estate in six major coastal U.S. markets: New York City/Northern New Jersey, Los Angeles, Miami, San Francisco Bay Area, Seattle, and Washington, D.C.

As described in more detail below, we invest in several types of industrial real estate, including warehouse/distribution, flex (including light industrial and R&D), transshipment and improved land. We target functional properties in infill locations that may be shared by multiple tenants and that cater to customer demand within the various submarkets in which we operate.

Industrial Facility General Characteristics

Warehouse / distribution (approximately 79.7% of our total annualized base rent as of December 31, 2024)

•Single and multiple tenant facilities that typically serve tenants greater than 10,000 square feet of space

•Generally less than 20% office space

•Typical clear height from 18 feet to 36 feet

•May include production/manufacturing areas

•Interior access via dock-high and/or grade-level doors

•Truck court for large and small truck distribution options, possibly including staging for a high volume of truck activity and/or trailer storage

Flex (including light industrial and R&D, approximately 3.4% of our total annualized base rent as of

December 31, 2024)

•Single and multiple tenant facilities that typically serve tenants less than 10,000 square feet of space

•Facilities generally accommodate both office and warehouse/manufacturing activities

•Typically has a larger amount of office space and shallower bay depths than warehouse/distribution facilities

•Parking consistent with increased office use

•Interior access via grade-level and/or dock-high doors

•Staging for moderate truck activity

•May include a showroom, service center, or assembly/light manufacturing component

•Enhanced landscaping

Transshipment (approximately 6.0% of our total annualized base rent as of December 31, 2024)

•Includes truck terminals and other transshipment facilities, which serve both single and multiple tenants

•Typically has a high number of dock-high doors, shallow bay depth and lower clear height

•Staging for a high volume of truck activity and trailer storage

Improved land (approximately 10.9% of our total annualized base rent as of December 31, 2024)

•Used for industrial outdoor storage, including truck, trailer and car parking

•May be redeveloped in the future

We selected our target markets by drawing upon the experience of our executive management investing and operating in over 50 global industrial markets located in North America, Europe and Asia, the fundamentals of supply and demand, and in anticipation of trends in logistics patterns resulting from population changes, regulatory, geopolitical and physical constraints, changes in technology, e-commerce, the economic and environmental benefits of reducing vehicle miles traveled and other factors. We believe that our target markets have attractive long-term investment attributes. We target assets with characteristics that include, but are not limited to, the following:

•Located in high population coastal markets;

•Close proximity to transportation infrastructure (such as sea ports, airports, highways and railways);

•Situated in supply-constrained submarkets with barriers to new industrial development, as a result of physical and/or regulatory constraints;

•Functional and flexible layout that can be modified to accommodate single and multiple tenants;

•Acquisition price at a discount to the replacement cost of the property;

•Potential for enhanced return through re-tenanting or operational or physical improvements; and

•Opportunity for higher and better use of the property over time.

In general, we prefer to utilize local third-party property managers for day-to-day property management. We believe outsourcing property management is cost effective, provides us with operational flexibility and is a source of acquisition opportunities. We have directly managed certain of our properties in the past and may do so in the future if we determine such direct property management is in our best interest.

We have no current intention to acquire undeveloped or unimproved industrial land or to pursue greenfield ground-up development. Nevertheless, we pursue development, redevelopment, renovation and expansion opportunities of properties that we own, acquire properties and improved land parcels with the intent to redevelop in the near-term, and acquire adjacent land to expand our existing facilities.

We expect that we will continue to acquire the significant majority of our investments as equity interests in individual properties or portfolios of properties. We may acquire industrial properties through the acquisition of other corporations or entities that own industrial real estate. We will opportunistically make investments in debt secured by industrial real estate that would otherwise meet our investment criteria with the intention of ultimately acquiring the underlying real estate. We currently do not intend to target specific percentages of holdings of particular types of industrial properties. This expectation is based upon prevailing market conditions and may change over time in response to different prevailing market conditions.

The properties we acquire may be stabilized (fully leased) or unstabilized (have near term lease expirations or be partially or fully vacant). Since inception in 2010, we have stabilized 128 properties.

We sell properties from time to time when we believe the prospective total return from a property is particularly low relative to its market value or the market value of the property is significantly greater than its estimated replacement cost. Capital from such sales is reinvested into properties that are expected to provide better prospective returns or returned to shareholders. We have disposed of 37 properties since inception in 2010 for an aggregate sales price of approximately $727.6 million and a total gain of approximately $332.3 million.

Competitive Strengths

We believe we distinguish ourselves from our competitors through the following competitive advantages:

•Focused Investment Strategy. We invest exclusively in six major coastal U.S. markets and focus on infill locations. We selected our six target markets based upon the experience of our executive management investing and operating in over 50 global industrial markets located in North America, Europe and Asia, the fundamentals of supply and demand, and in anticipation of trends in logistics patterns resulting from population changes, regulatory, geopolitical and

physical constraints, changes in technology, e-commerce, the economic and environmental benefits of reducing vehicle miles traveled and other factors. We have no current intention to acquire undeveloped or unimproved land or pursue greenfield ground-up development, but we pursue development, redevelopment, renovation and expansion activities.

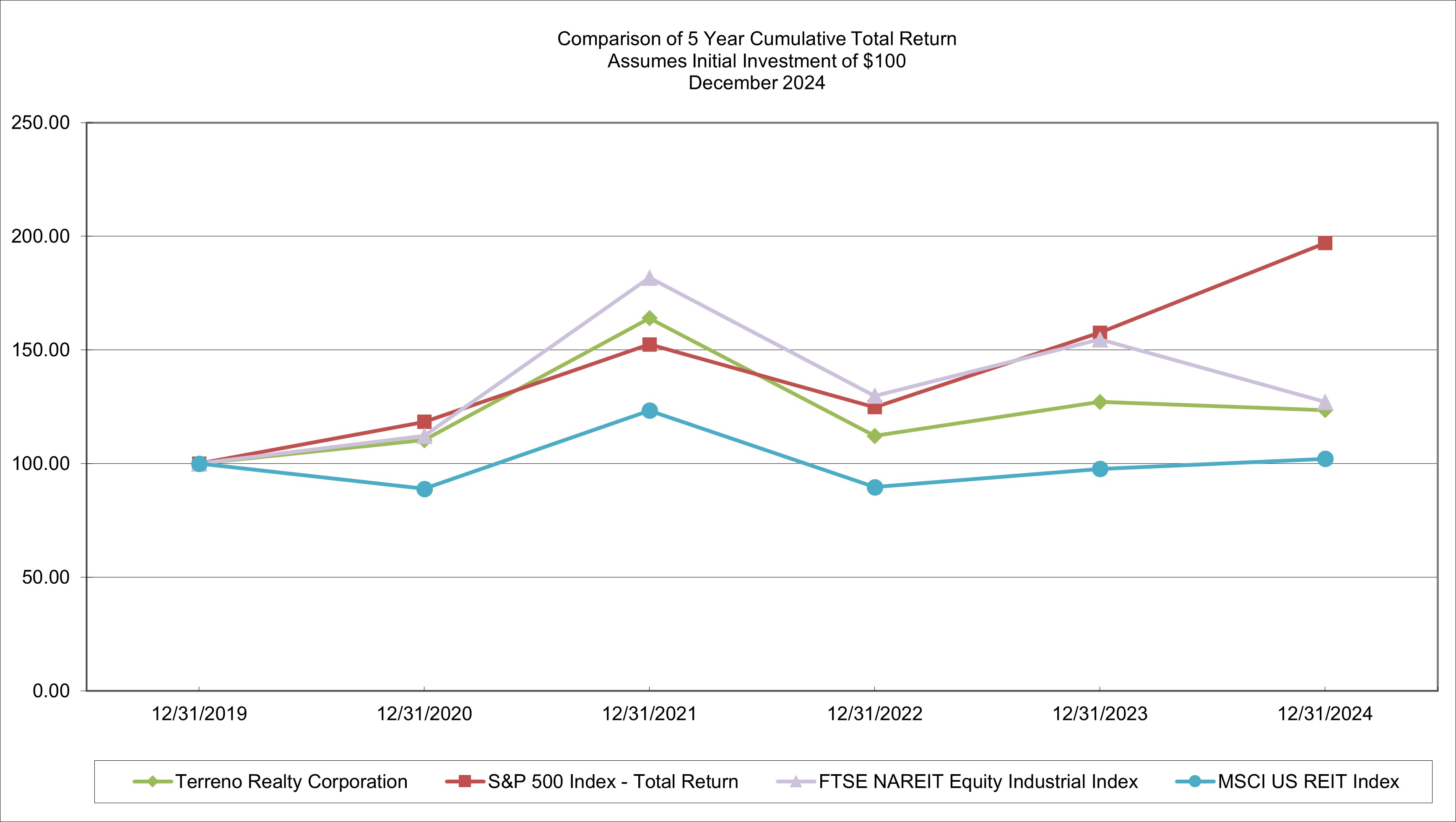

•Highly Aligned Compensation Structure. We believe that executive compensation should be closely aligned with long-term stockholder value creation. As a result, the long-term performance-based equity incentive compensation of our executive officers is based exclusively on our total shareholder return exceeding the total shareholder return of the MSCI U.S. REIT Index (RMS) or the FTSE National Association of Real Estate Investment Trusts (“Nareit”) Equity Industrial Index.

•Commitment to Strong Corporate Governance. We are committed to strong corporate governance, as demonstrated by the following:

–all members of our board of directors serve annual terms;

–we have adopted a majority voting standard in non-contested director elections;

–we have opted out of three Maryland anti-takeover provisions and, in the future, we cannot opt back in to these provisions without stockholder approval;

–we designed our ownership limits solely to protect our status as a REIT and not for the purpose of serving as an anti-takeover device; and

–we have no stockholder rights plan. In the future, we will not adopt a stockholder rights plan unless our stockholders approve in advance the adoption of such a plan or, if adopted by our board of directors, we will submit the stockholder rights plan to our stockholders for a ratification vote within 12 months of adoption or the plan will terminate.

Our Financing Strategy

The primary objective of our financing strategy is to maintain financial flexibility with a conservative capital structure using retained cash flows, proceeds from dispositions of properties, long-term debt and the issuance of common and perpetual preferred stock to finance our growth. Over the long term, we intend to:

•limit the sum of the outstanding principal amount of our consolidated indebtedness and the liquidation preference of any outstanding perpetual preferred stock to less than 35% of our total enterprise value;

•maintain a fixed charge coverage ratio in excess of 2.0x;

•maintain a net debt-to-adjusted EBITDA ratio below 5.0x;

•limit the principal amount of our outstanding floating rate debt to less than 20% of our total consolidated indebtedness; and

•have staggered debt maturities that are aligned to our expected average lease term (5-7 years), positioning us to re-price parts of our capital structure as our rental rates change with market conditions.

We intend to preserve a flexible capital structure with a long-term goal to maintain our investment grade rating and be in a position to issue additional unsecured debt and perpetual preferred stock. Fitch Ratings assigned us an issuer rating of BBB+ with a stable outlook. A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. There can be no assurance that we will be able to maintain our current credit rating. Our credit rating can affect the amount and type of capital we can access, as well as the terms of any financings we may obtain. In the event our current credit rating is downgraded, it may become difficult or expensive to obtain additional financing or refinance existing obligations and commitments. We intend to primarily utilize senior unsecured notes, term loans, credit facilities, dispositions of properties, and proceeds from the issuance of common stock and perpetual preferred stock. We may also assume debt in connection with property acquisitions which may have a higher loan-to-value ratio.

Our Corporate Structure

We are a Maryland corporation formed on November 6, 2009 and have been publicly held and subject to U.S. Securities and Exchange Commission (“SEC”) reporting obligations since 2010. We are not structured as an Umbrella Partnership Real Estate Investment Trust, or UPREIT, although we could put in place a similar structure to facilitate an acquisition if needed. We currently own our properties indirectly through subsidiaries, including through taxable REIT subsidiaries and subsidiaries that intend to qualify as REITs for U.S. federal income tax purposes.

Our Tax Status

We elected to be taxed as a REIT under Sections 856 through 860 of the Code commencing with our taxable year ended December 31, 2010. We believe that our organization and method of operation has enabled and will continue to enable us to meet the requirements for qualification and taxation as a REIT for U.S. federal income tax purposes. To maintain REIT status we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our net taxable income to our stockholders, excluding net capital gains. As a REIT, we generally will not be subject to U.S. federal income tax on REIT taxable income we currently distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to U.S. federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some U.S. federal, state and local taxes on our income or property and the income of our taxable REIT subsidiaries will be subject to taxation at regular corporate rates.

Competition

We believe the current market for industrial real estate acquisitions to be highly competitive. We compete for real property investments with pension funds and their advisors, bank and insurance company investment accounts, other public and private real estate investment companies, including other REITs, real estate limited partnerships, owner-users, individuals and other entities engaged in real estate investment activities, some of which have greater financial resources than we do. We believe the leasing of real estate to be competitive. We experience competition for customers from owners and managers of competing properties. As a result, we may have to provide free rental periods, incur charges for tenant improvements or offer other inducements, all of which may have an adverse impact on our results of operations.

Governmental Regulations

Compliance with various governmental regulations has an impact on our business, including our capital expenditures, earnings and competitive position, which can be material. We incur costs to monitor and take actions to comply with governmental regulations that are applicable to our business, which include, among others, federal securities laws and regulations, applicable stock exchange requirements, REIT and other tax laws and regulations, environmental and health and safety laws and regulations, local zoning, usage and other regulations relating to real property and the Americans with Disabilities Act of 1990.

In addition to the discussion below, see “Item 1A. Risk Factors” for a discussion of material risks to us, including, to the extent material, to our competitive position, relating to governmental regulations, and see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” together with our audited consolidated financial statements and the related notes thereto for a discussion of material information relevant to an assessment of our financial condition and results of operations, including, to the extent material, the effects that compliance with governmental regulations may have upon our capital expenditures and earnings.

Environmental Matters

The industrial properties that we own and will acquire are subject to various federal, state and local environmental laws. Under these laws, courts and government agencies have the authority to require us, as owner of a contaminated property, to clean up the property, even if we did not know of or were not responsible for the contamination. These laws also apply to persons who owned a property at the time it became contaminated, and therefore it is possible we could incur these costs even after we sell some of our properties. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow using the property as collateral or to sell the property. Under applicable environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, such as a landfill or an incinerator, pay for the clean up of that facility if it becomes contaminated and threatens human health or the environment.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos at one of our properties may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. An example would be laws that require a business using chemicals to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for any of the costs discussed above. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our stockholders. We generally obtain “Phase I environmental site assessments”, or ESAs, on each property prior

to acquiring it. However, these ESAs may not reveal all environmental costs that might have a material adverse effect on our business, assets, results of operations or liquidity and may not identify all potential environmental liabilities.

In general, we utilize local third-party property managers for day-to-day property management and will rely on these third parties to operate our industrial properties in compliance with applicable federal, state and local environmental laws in their daily operation of the respective properties and to promptly notify us of any environmental contaminations or similar issues. As a result, we may become subject to material environmental liabilities of which we are unaware. We can make no assurances that (i) future laws or regulations will not impose material environmental liabilities on us, or (ii) the environmental condition of our industrial properties will not be affected by the condition of the properties in the vicinity of our industrial properties (such as the presence of leaking underground storage tanks) or by third parties unrelated to us. We were not aware of any significant or material exposures as of December 31, 2024 or 2023.

General Uninsured Losses

We carry property and rental loss, liability and terrorism insurance. We believe that the policy terms, conditions, limits and deductibles are adequate and appropriate under the circumstances, given the relative risk of loss, the cost of such coverage and current industry practice. In addition, our properties are located, or may in the future be located, in areas that are subject to earthquake, flood and fire activity. As a result, we have obtained, as applicable, limited earthquake, flood and fire insurance on those properties. There are, however, certain types of extraordinary losses, such as those due to acts of war that may be either uninsurable or not economically insurable. Although we have obtained coverage for certain acts of terrorism, with policy specifications and insured limits that we believe are commercially reasonable, there can be no assurance that we will be able to collect under such policies. Should an uninsured loss occur, we could lose our investment in, and anticipated profits and cash flows from, a property. We were not aware of any significant or material exposures as of December 31, 2024 or 2023.

Employees and Human Capital

As of February 4, 2025, we had 49 employees. None of our employees is a member of any union or is subject to a collective bargaining agreement.

We recognize that our success is linked to the talent and expertise of our people. We invest in our employees and are committed to growing individual skills and leadership qualities across our business. Our human capital objectives include, as applicable, identifying, recruiting, retaining, developing, incenting and integrating our existing and prospective employees. We also emphasize external community engagement by encouraging volunteer work, providing paid time off to participate in charitable activities and matching a portion of employee donations to qualifying nonprofit organizations.

As an equal opportunity employer, we reward our employees based on merit and their contributions. Since 2019, we have continued to increase our board diversity in terms of gender, underrepresented communities and work experience. We have designed an executive compensation program intended to (i) align the interests of our executives and stockholders, (ii) motivate our executives to manage our business to meet our near, medium and long-term objectives, (iii) assist in attracting and retaining talented and well-qualified executives, (iv) be competitive with other industrial REITs and (v) encourage and provide the opportunity for our executives to obtain meaningful ownership levels of our stock.

The health and safety of our employees, third-party property managers, tenants and communities where our properties are located are of primary concern. Our employees are encouraged to make healthy lifestyle decisions that can ultimately benefit the company by reducing insurance claims and boosting productivity. We also provide our employees with highly competitive health and wellness benefits, including medical, dental, vision, life and short-term disability insurance, and also offer a wellness reimbursement program, a program to pay commuting and office parking costs with pre-tax income and a competitive vacation policy, including paid holidays and personal time off.

Available Information

We maintain an internet website at the following address: http://terreno.com. The information on our website is neither part of nor incorporated by reference in this Annual Report on Form 10-K. We make available, free of charge, on or through our website certain reports and amendments to those reports that we file with or furnish to the SEC in accordance with the Exchange Act. These include our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and exhibits and amendments to these reports, and Section 16 filings. We make this information available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC. You may also obtain our reports by accessing the EDGAR database at the SEC’s website at http://www.sec.gov.

Item 1A. Risk Factors.

Set forth below are the risks that we believe are material to our investors and they should be carefully considered. If any of the following risks occur, our business, financial condition, results of operations and cash flows, our ability to satisfy our debt service obligations and our ability to pay distributions on, and the per share trading price of, our common stock could be adversely affected. These risks are not all of the risks we face and other factors not presently known to us or that we currently believe are immaterial may also affect our business if they occur. Investors should refer to the explanation of the qualifications and limitations on forward-looking statements beginning on page 2 and should also refer to our quarterly reports on Form 10-Q and current reports on Form 8-K for any material updates to these risk factors.

Risks Related to Our Business and Our Properties

Our long-term growth will depend, in part, upon future acquisitions of properties, and we may acquire properties that pose integration and other risks that could harm our business.

We intend to continue to acquire industrial properties in our six target markets. The acquisition of properties entails various risks, including the risks that our investments may not perform as well as we had expected, that we may be unable to quickly and efficiently integrate our new acquisitions into our existing operations and that our cost estimates for bringing an acquired property up to market standards may prove inaccurate. We may also own or acquire properties that are subject to contingent or pre-existing undisclosed liabilities including, but not limited to, liabilities for adverse environmental conditions, accrued but unpaid liabilities incurred in the ordinary course of business or tax liabilities. We may have no recourse, or only limited recourse, with respect to such unknown liabilities or may be unable to secure insurance coverage on the property in a sufficient amount to cover the liability, or at all. As a result, if a liability were asserted against us based upon ownership of any of these entities or properties, we might have to pay substantial sums to settle it, which could adversely affect our cash flows. There is no assurance we would successfully overcome these risks or any other problems encountered with these acquisitions.

In addition, we cannot assure you of the availability of investment opportunities in our targeted markets at attractive pricing levels, or at all. As a result of competition in our targeted markets, we may be unable to acquire properties as we desire or the purchase price may be significantly elevated. In the event that such opportunities are not available in our targeted markets as we expect, our ability to execute our business plan and realize our projections for growth may be materially adversely affected.

The availability and timing of cash distributions is uncertain and is limited by the requirements of Maryland law.

We have made regular quarterly cash distributions (which we also refer to as dividends) to our stockholders, and we intend to continue to pay regular quarterly cash distributions. Our corporate strategy is to fund the payment of quarterly distributions entirely from distributable cash flows. However, our board of directors has the sole discretion to determine the timing, form and amount of any cash distributions and may fund our quarterly distributions from a combination of available cash flows, net of recurring capital expenditures and/or proceeds from borrowings and property dispositions or may retain any portion of our distributable cash flows for working capital. We cannot assure our stockholders that sufficient funds will be available to pay distributions or that the level of any distributions we do make will increase or even be maintained over time, any of which could materially and adversely affect the market price of our shares of common stock.

Our ability to pay distributions on our stock is also limited by applicable Maryland law, under which we generally may not make a distribution on our stock if, after giving effect to the distribution, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of our total liabilities plus, unless the terms of such class or series provide otherwise, the amount that would be needed to satisfy the preferential rights upon dissolution of the holders of shares of any class or series of preferred stock then outstanding, if any, with preferences senior to those of our outstanding stock.

Our investments are concentrated in the industrial real estate sector, and our business would be adversely affected by an economic downturn in that sector.

Our investments in real estate assets are concentrated in the industrial real estate sector. This concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities included a more significant portion of other sectors of the real estate industry.

Any future pandemic, epidemic or outbreak of any highly infectious disease could have an adverse effect on our business, financial condition, results of operations and cash flows and the business, financial condition, results of operations and cash flows of our tenants.

The extent to which any future pandemic, epidemic or outbreak of any highly infectious disease, impacts our operations will depend on future developments, which are highly uncertain and cannot be predicted accurately, including the scope, severity and duration of such pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Any future pandemic, epidemic or outbreak of any highly infectious disease may materially and adversely affect our businesses, financial condition, results of operations and cash flows and may also have the effect of heightening many of the risks described below and within this “Risk Factors” section, including:

•the complete or partial closure of, or other operational restrictions or other issues at, one or more of our properties resulting from government or tenant action could have a material adverse impact on our operations and those of our tenants and third-party property managers;

•reduced economic activity impacting the businesses, financial condition and liquidity of our tenants could cause one or more of our tenants, including certain significant tenants, or one or more of our third-party managers, to be unable to meet their rent payment or other obligations to us in full, or at all, to otherwise seek modifications of such obligations, including rent payment deferrals, or to file for bankruptcy protection;

•our inability to renew leases, lease vacant space, including vacant space from tenant defaults, or re-lease space as leases expire on favorable terms, or at all, which could result in lower rental revenues or cause interruptions or delays in the receipt, or non-receipt, of rental payments;

•severe disruption and instability in the U.S. and global financial markets or deteriorations in credit and financing conditions could make it difficult for us to access debt and equity capital on attractive terms, or at all, and impact our ability to fund business activities and repay debt on a timely basis; and

•disruptions in the supply of materials or products or the inability of contractors to perform on a timely basis, or at all, including as a result of restrictions on construction activity, could cause delays in completing ongoing or future construction or re-development projects.

Events or occurrences that affect areas in which our properties are located may materially adversely impact our financial results.

In addition to general regional, national and international economic conditions that may materially adversely affect our business and financial results, our operating performance may be materially adversely impacted by adverse economic conditions in the specific markets in which we operate and particularly in the markets in which we have significant concentrations of properties. For example, as of December 31, 2024, approximately 19.9% of our rentable square feet and approximately 41.4% of our improved land parcels were located in New York City/Northern New Jersey, representing a combined percentage of approximately 27.9% of our total annualized base rent. See “Item 2 - Properties” in this Annual Report on Form 10-K for additional information regarding our ownership of properties in our markets. Any downturn in the economy in the real estate market or any of the markets in which we own properties and any failure to accurately predict the timing of any economic improvement in these markets could cause our operations and our revenue and cash available for distribution to our stockholders to be materially adversely affected.

We may be unable to renew leases, lease vacant space, including vacant space resulting from tenant defaults, or re-lease space as leases expire.

We cannot assure you that leases at our properties will be renewed or that such properties will be re-leased at net effective rental rates equal to or above the then current average net effective rental rates, or at all. In addition, we may be required to grant concessions or fund improvements. If the rental rates for our properties decrease, our tenants do not renew their leases or we do not re-lease a significant portion of our available space, including vacant space resulting from tenant defaults, and space for which leases are scheduled to expire, our financial condition, results of operations, cash flows, cash available for distribution to stockholders, per share trading price of our common stock and our ability to satisfy our debt service obligations could be materially adversely affected. In addition, if we are unable to renew leases or re-lease a property, the resale value of that property could be diminished because the market value of a particular property will depend in part upon the value of the leases of such property.

We may be required to fund future tenant improvements, and we may not have funding for those improvements.

When a tenant at one of our properties does not renew its lease or otherwise vacates its space in one of our buildings in the future, it is likely that, in order to attract one or more new tenants, we will be required to expend funds to construct new tenant improvements in the vacated space. We may also be required to fund tenant improvements to retain tenants. Although we intend to manage our cash position or financing availability to pay for any improvements required for re-leasing, we cannot assure our stockholders that we will have adequate sources of funding available to us for such purposes in the future.

We face potential adverse effects from the bankruptcies or insolvencies of tenants or from tenant defaults generally.

We are dependent on tenants for our revenues, including certain significant tenants and single tenants that occupy entire properties. As a result, the bankruptcy or insolvency of our tenants, or tenant defaults generally, may adversely affect the income produced by our properties. In the event of a tenant default, we may experience delays in enforcing our rights as landlord and may incur substantial costs, including litigation and related expenses, in protecting our investment and re-leasing our property.

Our tenants, particularly those that are highly leveraged, could file for bankruptcy protection or become insolvent in the future. Under bankruptcy law, a tenant cannot be evicted solely because of its bankruptcy but the bankrupt tenant may be authorized to reject and terminate its lease with us. In such case, our claim against the bankrupt tenant for unpaid and future rent would be subject to a statutory cap that might be substantially less than the remaining rent actually owed under the lease, and, even so, our claim for unpaid rent would likely not be paid in full. This shortfall could force us to find an alternative source of revenues to pay any mortgage loan or operating expenses on the property, adversely affect our cash flows and results of operations and could cause us to reduce the amount of distributions to stockholders.

Declining real estate valuations and impairment charges could adversely affect our earnings and financial condition.

We review the carrying value of our properties when circumstances, such as adverse market conditions, indicate potential impairment may exist. We base our review on an estimate of the future cash flows (excluding interest charges) expected to result from the real estate investment’s use and eventual disposition. We consider factors such as future operating income, trends and prospects, as well as the effects of leasing demand, competition and other factors. If our evaluation indicates that we may be unable to recover the carrying value of a real estate investment, an impairment loss will be recorded to the extent that the carrying value exceeds the estimated fair value of the property. These losses would have a direct impact on our net income because recording an impairment loss results in an immediate negative adjustment to net income. The evaluation of anticipated cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results in future periods. A worsening real estate market may cause us to reevaluate the assumptions used in our impairment analysis. Impairment charges could adversely affect our financial condition, results of operations, cash available for distribution, including cash available for us to pay distributions to our stockholders and per share trading price of our common stock.

We utilize local third-party managers for day-to-day property management for substantially all of our properties.

In general, we prefer to utilize local third-party managers for day-to-day property management, although we may directly manage other properties in the future. To the extent we utilize third-party managers, our cash flows from our industrial properties may be adversely affected if our managers fail to provide quality services. In addition, our managers or their affiliates may manage, and in some cases may own, invest in or provide credit support or operating guarantees to industrial properties that compete with our industrial properties, which may result in conflicts of interest and decisions regarding the operation of our industrial properties that are not in our best interests.

Our development, redevelopment, renovation or expansion strategies may not be successful.

We may pursue development or redevelopment opportunities or construct expansions or improvements of industrial properties that we own. These activities are subject to risks, including, but not limited to, the risks that: we will expend money and time on projects that do not perform as expected; the actual construction or operating costs, including labor and material costs, will be higher than originally estimated; we may experience delays in obtaining construction materials; we may fail to obtain, or experience delays in obtaining, any necessary permits and authorizations; permits and authorizations may be subject to stringent conditions that could impede or delay our progress; we are unable to complete construction on the timeframe we expect, or at all; occupancy and rental rates may not meet expectations; and we may be unable to obtain financing on favorable terms, or at all, for such projects.

We may not acquire the industrial properties that we have entered into agreements or non-binding letters of intent to acquire.

We have entered, and may in the future enter, into agreements and non-binding letters of intent with third-party sellers to acquire properties as more fully described under the heading “Material Cash Commitments” in this Annual Report on Form 10-K. There is no assurance that we will acquire the properties under contract and non-binding letters of intent because the proposed acquisitions are subject to the completion of satisfactory due diligence and various closing conditions, and in the case of properties under non-binding letters of intent, our entry into purchase and sale agreements with respect to the properties. There is no assurance that such proposed acquisitions, if completed, will be completed on the timeframe or terms we expect. If we do not complete the acquisition of the properties under contract or non-binding letters of intent, we will have incurred expenses without our stockholders realizing any benefit from the acquisition of such properties.

We depend on key personnel.

Our success depends to a significant degree upon the contributions of our senior management team whose continued service is not guaranteed. The loss of services from our senior management team or our inability to find suitable replacements could adversely impact our financial condition and cash flows. Further, such a loss could be negatively perceived in the capital markets, which may also adversely impact our financial condition and cash flows.

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (“IT”) networks and related systems.

Our IT networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations and, in some cases, may be critical to the operations of certain of our tenants. We face risks associated with security breaches, whether through cyber-attacks or intrusions, malware, computer viruses, attachments to e-mails, people with access or who gain access to our systems and other significant disruptions of our IT networks and related systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased, which, in turn, may lead to increased costs to protect our network and systems. Additionally, third-party security events at our vendors or other service providers could impact our data and operations via unauthorized access to, or loss or other compromise of information or disruption of services. Although we make efforts to maintain the security and integrity of our IT networks and related systems, and we have implemented various measures to manage the risk of a security breach or disruption, including but not limited to password protection, ongoing training modules throughout the year, frequent backups and a redundant data system, there can be no assurance that our security efforts and measures will be effective or that attempted security breaches or disruptions would not be successful or damaging. A security breach or other significant disruption involving our IT networks and related systems could significantly disrupt the proper functioning of our networks and systems and, as a result, disrupt our operations, which could have a material adverse effect on our cash flow, financial condition and results of operations.

We may from time to time be subject to litigation that may negatively impact our cash flow, financial condition, results of operations and market price of our common stock.

We may from time to time be a defendant in lawsuits and regulatory proceedings relating to our business. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such litigation or proceedings. An unfavorable outcome could negatively impact our cash flow, financial condition, results of operations and trading price of our common stock.

Risks Related to Financing and Capital

If we cannot obtain additional financing, our growth will be limited.

If adverse conditions in the credit markets, in particular with respect to real estate, materially deteriorate, our business could be materially and adversely affected. Our long-term ability to grow through investments in industrial properties, including our ability to realize our projections for growth, will be limited if we cannot obtain additional financing on favorable terms, or at all. In the future, we will rely on equity and debt financing, including issuances of common and perpetual preferred stock, borrowings under our revolving credit facility, term loans, issuances of unsecured debt securities and debt secured by individual properties or pools of properties, and recycling of capital to finance our acquisition, development, redevelopment, renovation and expansion activities and for working capital. If we are unable to obtain equity or debt financing from these or other sources, or to refinance existing indebtedness upon maturity, our financial condition and results of operations would likely be adversely affected. Any additional debt we incur will increase our leverage and likelihood of default. Market conditions may make it

difficult to obtain additional financing, and we cannot assure you that we will be able to obtain additional debt or equity financing or that we will be able to obtain it on favorable terms.

In addition, to qualify as a REIT, we are required to distribute at least 90% of our taxable income (determined before the deduction for dividends paid and excluding any net capital gains) each year to our stockholders, and we generally expect to make distributions in excess of such amount. As a result, our ability to retain earnings to fund acquisitions, development, redevelopment, renovation and expansion, if any, or other capital expenditures will be limited.

Debt service obligations could adversely affect our overall operating results, may require us to sell industrial properties and could adversely affect our ability to make distributions to our stockholders and the market price of our shares of common stock.

Our business strategy contemplates the use of both non-recourse secured debt and unsecured debt to finance long-term growth. As of December 31, 2024, we had total debt, net of deferred financing costs and unamortized fair value adjustment, of approximately $823.4 million, which consisted of revolving credit facility borrowings, term loan borrowings, senior unsecured note borrowings and a mortgage loan payable. While over the long term we intend to limit the sum of the outstanding principal amount of our consolidated indebtedness and the liquidation preference of any outstanding shares of preferred stock to less than 35% of our total enterprise value, our governing documents contain no limitations on the amount of debt that we may incur, and our board of directors may change our financing policy at any time without stockholder approval. We also intend to maintain a fixed charge coverage ratio in excess of 2.0x and a net debt-to-adjusted EBITDA ratio below 5.0x and limit the principal amount of our outstanding floating rate debt to less than 20% of our total consolidated indebtedness but our board of directors may modify or eliminate these limitations at any time without the approval of our stockholders. As a result, we may be able to incur substantial additional debt, including secured debt, in the future. Our existing debt, and the incurrence of additional debt, could subject us to many risks, including the risks that:

•our cash flows from operations will be insufficient to make required payments of principal and interest;

•our debt may increase our vulnerability to adverse economic and industry conditions;

•we may be required to dedicate a substantial portion of our cash flows from operations to payments on our debt, thereby reducing cash available for distribution to our stockholders, funds available for operations and capital expenditures, future business opportunities or other purposes;

•the terms of any refinancing may not be as favorable as the terms of the debt being refinanced; and

•the use of leverage could adversely affect our ability to make distributions to our stockholders and the market price of our shares of common stock.

Certain of our debt, such as our term loans, senior unsecured notes and mortgage loan, require that the principal be repaid at the maturity of the loan in a “balloon payment.” As of December 31, 2024, the financing arrangements of our outstanding indebtedness could require us to make lump-sum or “balloon” payments of approximately $829.9 million at maturity dates that range from 2026 to 2031. If we do not have sufficient funds to repay existing or future debt at maturity, including debt under our credit facility, term loans and senior unsecured notes, it may be necessary to refinance the debt through additional debt or raise additional funds through equity financings. If the credit environment is constrained at the time of any refinancing, we could have a very difficult time refinancing debt on acceptable terms, or at all. For example, if prevailing interest rates or other factors result in higher interest rates on refinancings, the increase in interest expense would adversely affect our cash flows, and, consequently, cash available for distribution to our stockholders. If we are unable to refinance our debt on acceptable terms, we may be forced to choose from a number of unfavorable options, including agreeing to otherwise unfavorable financing terms on new debt or disposing of one or more of our industrial properties on disadvantageous terms, potentially resulting in losses. We may also place mortgages on our properties that we own to secure a revolving credit facility or other debt. To the extent we cannot meet any future debt service obligations, we will risk losing some or all of our industrial properties that may be pledged to secure our obligations to foreclosure.

Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions and policies of various governmental and regulatory agencies. Higher interest rates could increase debt service requirements on any floating rate debt that we incur, which could reduce the amounts available for distribution to our stockholders, as well as reduce funds available for our operations, future business opportunities, or other purposes. In addition, an increase in interest rates could decrease the amount third parties are willing to pay for our assets, thereby limiting our ability to implement our business strategy, recycle capital and/or change our portfolio promptly in response to changes in economic or other conditions.

The agreements relating to our existing debt contain, and we expect that agreements relating to our future indebtedness will contain, covenants that could limit our operations and our ability to make distributions to our stockholders.

We have a credit facility, which consists of a $100.0 million term loan that matures in January 2027, a $100.0 million term loan that matures in January 2028 and a revolving credit facility with $600.0 million in borrowing capacity that matures in January 2029. As of December 31, 2024, the revolving credit facility had an outstanding balance of approximately $82.0 million. We also have $475.0 million of senior unsecured notes outstanding as well as an outstanding mortgage loan with a total contractual principal amount of approximately $72.9 million. We have agreed to guarantee the obligations of the borrower (a wholly-owned subsidiary) under our revolving credit facility, our term loans and our senior unsecured notes. Our revolving credit facility, our term loans and our senior unsecured notes contain, and we expect that our agreements for future indebtedness will contain, financial and operating covenants, such as fixed charge coverage and debt ratios and other limitations that will limit or restrict our ability to make distributions or other payments to our stockholders and may restrict our investment activities. For example, our credit facility restricts distributions if we are in default. These covenants may limit our operating and financial flexibility and our ability to respond to changes in our business or competitive activities in the future and may also restrict our ability to engage in transactions that we believe would otherwise be in the best interests of our stockholders or obtain necessary funds.

Failure to meet our financial covenants could result from, among other things, changes in our results of operations, the incurrence of additional debt or changes in general economic conditions. If we violate covenants or if there is an event of default under our credit facility, our term loans, our senior unsecured notes, or in our future agreements, we could be required to repay all or a portion of our indebtedness before maturity and might be unable to arrange financing for such repayment on attractive terms, if at all. In addition, the note purchase agreements with respect to our existing senior unsecured notes contain, and any unsecured debt agreements we enter into in the future may contain, specific cross-default provisions with respect to specified other indebtedness, giving the unsecured lenders the right to declare a default if we are in default under other loans in some circumstances. Defaults under our debt agreements could materially and adversely affect our cash flows, financial condition and results of operations.

We may acquire outstanding debt or provide a loan, in each case secured by an industrial property, which will expose us to risks.

We may acquire outstanding debt secured by an industrial property from lenders and investors or provide a loan secured by industrial property if we believe we can acquire ownership of the underlying property through foreclosure, deed-in-lieu of foreclosure or other means. If we acquire such debt or provide such a loan, borrowers may seek to assert various defenses to our foreclosure or other actions, and we may not be successful in acquiring the underlying property on a timely basis, or at all, in which event we could incur significant costs and experience significant delays in acquiring such properties, all of which could adversely affect our financial performance and reduce our expected returns from such investments. In addition, we may not earn a current return on such investments particularly if the loan that we acquire or provide is in, or goes into, default.

If we provide debtor-in-possession financing or provide a loan, a default by the borrower could adversely affect our cash flows.

We may on a limited basis provide debtor-in-possession financing to a property owner that has filed for bankruptcy or make a loan secured by real estate that we might otherwise purchase directly. We expect that any such loans would be secured by one or more properties that we intend to acquire and that we would have the option to acquire such property in lieu of the repayment of such loan. Any default by the borrower under any such loan could negatively impact our cash flows and our ability to make cash distributions to our stockholders and result in litigation and related expenses. Although we would expect to acquire the secured property upon a borrower’s default, there is no assurance that we will successfully foreclose on a property, and any such foreclosure could result in significant expenses.

Adverse changes in our credit rating could negatively affect our financing activity.

Fitch Ratings assigned us an issuer rating of BBB+ with a stable outlook. A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. Our credit rating can affect the amount of capital we can access, as well as the terms and pricing of any debt we may incur. There can be no assurance that we will be able to maintain our current credit rating, and in the event our credit rating is downgraded, we would likely incur higher borrowing costs and may encounter difficulty in obtaining additional financing. Also, a downgrade in our credit rating may trigger additional payments or other negative consequences under our existing and future credit facilities and debt instruments. For example, if our credit rating is downgraded to below investment grade levels, we may not be able to obtain or maintain extensions on certain of our existing debt. Adverse changes in our credit rating could negatively impact our refinancing activities, our ability to manage our debt maturities, our future growth, our financial condition, the market price of our stock and our acquisition activities.

Failure to hedge effectively against interest rate changes may adversely affect results of operations.

We may seek to manage our exposure to interest rate volatility by using interest rate hedging arrangements, such as cap contracts and swap agreements. We do not currently have any hedging arrangements in place but have previously used interest rate caps to hedge the variable cash flows associated with our term loans. Any future hedging arrangements we enter into may not be effective in reducing our exposure to interest rate changes and a court could rule that such arrangements are not legally enforceable. Hedging may reduce overall returns on our investments and the failure to hedge effectively against interest rate changes may materially adversely affect our results of operations.

Our existing stockholders may experience dilution if we issue additional common stock.

Sales of substantial amounts of shares of our common stock in the public market, including the issuance of our common stock in connection with property, portfolio or business acquisitions, the issuance and vesting of any restricted stock granted to employees under our 2019 Equity Incentive Plan and the issuance of our common stock upon the vesting of awards under our Amended and Restated Long-Term Incentive Plan, may be dilutive to existing stockholders and could have an adverse effect on the market price of our common stock.

We may issue preferred stock or debt securities and may also incur other future indebtedness which would rank senior to our common stock upon liquidation and may adversely affect the market price of our common stock.

Holders of our common stock are not entitled to preemptive rights or other protections against dilution. Upon liquidation, holders of our debt securities and any shares of preferred stock, and lenders with respect to other borrowings, including our existing credit facility and mortgage loans payable, will receive distributions of our available assets prior to the holders of our common stock. In addition, future offerings of debt securities or the incurrence of additional indebtedness may reduce the market price of our common stock. Shares of our preferred stock, if issued in the future, could have a preference on liquidating distributions and a preference on dividend payments that could limit our ability to pay a dividend or make another distribution to the holders of our common stock and, as a result, may reduce the market price of our common stock.

Volatility in the capital and credit markets could materially and adversely impact us.

The capital and credit markets have experienced, and may continue to experience, extreme volatility and disruption from time to time, which may make it more difficult for us to raise equity capital, hinder our ability to borrow money, obtain new debt financing or refinance our maturing debt on favorable terms, or at all. Market turmoil and tightening of credit, which have occurred in the past, can also lead to an increased lack of consumer confidence and widespread reduction of business activity generally, which also could materially and adversely impact us, including our ability to acquire and dispose of assets on favorable terms or at all. Volatility in capital and credit markets may also have a material adverse effect on the market price of our common stock.

Risks Related to the Real Estate Industry

Investments in real estate properties are subject to risks that could adversely affect our business.

Investments in real estate properties are subject to varying degrees of risk and our performance and value are subject to general economic conditions and risks associated with our properties. While we seek to minimize these risks through geographic diversification of our portfolio, market research and our asset management capabilities, these risks cannot be eliminated. Factors that may affect real estate values and cash flows include:

•downturns in national, regional and local economic conditions (particularly increases in unemployment);

•the attractiveness of our properties to potential tenants and competition from other industrial properties;

•changes in supply of, or demand for, similar or competing properties in an area;

•bankruptcies, financial difficulties or lease defaults by the tenants of our properties;

•adverse capital and credit market conditions, which may restrict our operating activities;

•changes in interest rates, availability and terms of debt financing, including periods of high or rising interest rates;

•changes in operating costs and expenses and our ability to control rents, including periods of high and persistent inflation;

•changes in, or increased costs of compliance with, governmental rules, regulations and fiscal policies, including changes in tax, tariff, real estate, environmental and zoning laws, and our potential liability thereunder;

•increasing costs of maintaining, insuring, renovating and making improvements to our properties;

•unanticipated changes in costs associated with known adverse environmental conditions or retained liabilities for such conditions;

•tenant turnover;

•re-leasing that may require concessions or reduced rental rates under the new leases due to reduced demand;

•our ability to renovate and reposition our properties due to changes in the business and logistical needs of our tenants;

•technological changes, such as reconfiguration of supply chains, autonomous vehicles, robotics, 3D printing or other technologies;

•disruptions in the global supply chain caused by political, regulatory or other factors, including terrorism and domestic terrorist attacks;

•disruptions to political, governmental or regulatory systems, including shutdowns of the government and its agencies; and

•the effects of deflation, including credit market dislocation, weakened consumer demand and a decline in general price levels.

In addition, throughout 2023 and 2024, we observed economic and geopolitical uncertainty in the United States and abroad. If such uncertainty continues or is heightened, it could lead to sustained periods of economic slowdown or recession, continued inflation and higher interest rates or declining demand for real estate, and the occurrence of such events or public perception that any of these events may occur, would result in a general decrease in rents or an increased occurrence of defaults under existing leases, which would materially adversely affect our financial condition and results of operations. Future terrorist attacks or wars may also result in declining economic activity, which could reduce the demand for, and the value of, our properties and adversely impact our tenants, including their ability to meet obligations under their leases. For these and other reasons, we cannot assure our stockholders that we will be profitable or that we will realize growth in the value of our properties.

Actions by our competitors may decrease or prevent increases in the occupancy and rental rates of our properties.

We compete with other developers, owners and operators of real estate, some of which own properties similar to our properties in the same markets in which the properties we own are located. If our competitors offer space at rental rates below current market rates or below the rental rates we will charge the tenants of our properties, we may lose existing or potential tenants, and we may be pressured to reduce our rental rates or offer tenant concessions or favorable lease terms in order to retain tenants when such tenants’ leases expire or attract new tenants. As a result of these actions by our competitors, our financial condition, cash flows, cash available for distribution, trading price of our common stock and ability to satisfy our debt service obligations could be materially adversely affected.

Real estate investments are not as liquid as other types of assets, which may reduce economic returns to investors.

Real estate investments are not as liquid as other types of investments and significant expenditures associated with real estate investments, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investments. In addition, we intend to comply with the safe harbor rules relating to the number of properties that can be disposed of in a year, the tax bases and the costs of improvements made to these properties, and meet other tests which enable a REIT to avoid punitive taxation on the sale of assets. Thus, our ability at any time to sell assets may be restricted. This lack of liquidity may limit our ability to vary our portfolio promptly in response to changes in economic, financial, investment or other conditions and, as a result, could adversely affect our financial condition, results of operations, cash flows and our ability to pay distributions on, and the market price of, our common stock.

Uninsured or underinsured losses relating to real property may adversely affect our returns.

We will attempt to ensure that all of our properties are adequately insured to cover casualty losses. We carry property and rental loss, liability and terrorism insurance resulting from certain perils such as fire, windstorm, flood, earthquake and terrorism; commercial general liability insurance; and environmental insurance, as appropriate where each of our properties are located. However, there are certain losses, including losses from floods, hurricanes, fires, earthquakes and other natural disasters, acts of war, acts of terrorism or riots, that are not generally insured against or that are not generally fully insured against because it is not deemed economically feasible or prudent to do so. In addition, changes in the cost or availability of insurance could expose us to uninsured casualty losses. Under those circumstances, the insurance proceeds we receive might be inadequate to restore our economic position on the damaged or destroyed property and we may not have access to an alternative source of funding to repair or reconstruct the damaged property. In the event that any of our properties incurs a casualty loss that is not fully covered by insurance, the value of our assets will be reduced by the amount of any such uninsured loss, and we

could experience a significant loss of capital invested and potential revenues in these properties and could potentially remain obligated under any recourse debt associated with the property. Inflation, changes in building codes and ordinances, environmental considerations and other factors might also keep us from using insurance proceeds to replace or renovate a property after it has been damaged or destroyed. Any such losses could adversely affect our financial condition, results of operations, cash flows and ability to pay distributions on, and the market price of, our common stock.

We own properties in Los Angeles, the San Francisco Bay Area and Seattle, which are located in areas that are known to be subject to earthquake activity. Although we carry replacement-cost earthquake insurance on all of our properties located in areas historically subject to seismic activity, subject to coverage limitations and deductibles that we believe are commercially reasonable, we may not be able to obtain coverage to cover all losses with respect to such properties on economically favorable terms, which could expose us to uninsured casualty losses. We intend to evaluate our earthquake insurance coverage annually in light of current industry practice.

Environmentally hazardous conditions may adversely affect our operating results.