UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to§240.14a-12 |

|

| UNILIFE CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| þ | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | | | |

| | (3) | | Filing Party: |

| | |

| | | | |

| | (4) | | Date Filed: |

| | |

| | | | |

October 2, 2015

Dear Unilife Stockholder:

You are cordially invited to attend this year’s annual meeting of stockholders to be held on Monday, November 16, 2015, at 4:00 P.M., U.S. Eastern Time (8:00 A.M. Australian Eastern Time on Tuesday, November 17, 2015), at the Rittenhouse Hotel, 210 W. Rittenhouse Square, Philadelphia, Pennsylvania 19103. The meeting will be broadcast via the Investor Relations section of our websitewww.unilife.com as a “live” listen only webcast.

All stockholders and holders of CHESS Depositary Interests, or CDIs, are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, we urge you to submit your proxy card or CDI voting instruction form as soon as possible so that your shares (or shares underlying your CDIs) can be voted at the meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on the proxy card or CDI voting instruction form.

We are furnishing our proxy materials over the Internet. Therefore, you will not receive paper copies of our proxy materials. We will instead send you a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides instructions on how you may obtain paper copies of the proxy materials if you so choose.

Whether or not you plan to attend the meeting, your vote is very important and we encourage you to vote promptly. As a Delaware corporation and under our bylaws, a minimum of one-third of our outstanding shares of common stock (including shares underlying our outstanding CDIs) must be present in person or represented by proxy at the meeting in order for the meeting to be considered valid. You may vote your shares (or direct CHESS Depositary Nominees Pty Ltd, to vote if you hold your shares in the form of CDIs) online or by mailing a completed proxy card or CDI voting instruction form if you elect to receive the proxy materials by mail. Instructions regarding each method of voting are provided on the proxy card and the CDI voting instruction form. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

We look forward to seeing you at the meeting.

Sincerely yours,

Alan D. Shortall

Chairman of the Board

and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 16, 2015 AT4:00 P.M.

(U.S. EASTERN TIME)

TO THE STOCKHOLDERS OF UNILIFE CORPORATION:

Notice is hereby given that the annual meeting of stockholders of Unilife Corporation, a Delaware corporation, will be held on Monday, November 16, 2015, at 4:00 P.M., U.S. Eastern Time, (8:00 A.M. Australian Eastern Time on Tuesday, November 17, 2015), at the Rittenhouse Hotel, 210 W. Rittenhouse Square, Philadelphia, Pennsylvania 19103, for the following purposes:

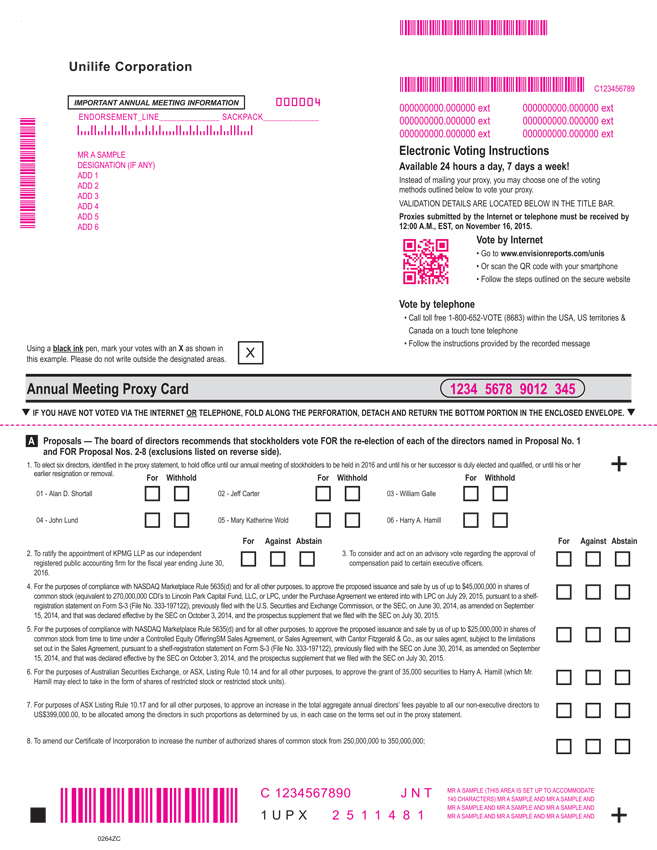

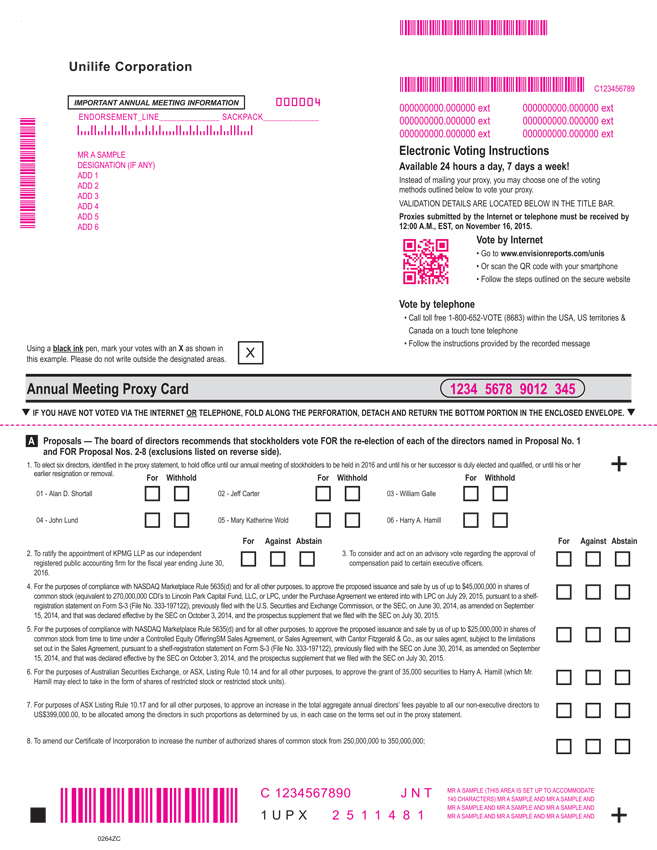

1. To elect six directors, identified in the accompanying proxy statement, to hold office until our annual meeting of stockholders to be held in 2016 and until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal, or Proposal No. 1;

2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2016, or Proposal No. 2;

3. To consider and act on an advisory vote regarding the approval of compensation paid to certain executive officers, or Proposal No. 3;

4. For the purposes of compliance with NASDAQ Marketplace Rule 5635(d) and for all other purposes, to approve the proposed issuance and sale by us of up to $45,000,000 in shares of common stock (equivalent to 270,000,000 CDI’s to Lincoln Park Capital Fund, LLC, or LPC, under the Purchase Agreement we entered into with LPC on July 29, 2015, pursuant to a shelf-registration statement on Form S-3 (File No. 333-197122), previously filed with the U.S. Securities and Exchange Commission, or the SEC, on June 30, 2014, as amended on September 15, 2014, and that was declared effective by the SEC on October 3, 2014, and the accompanying prospectus supplement that we filed with the SEC on July 30, 2015, or Proposal No. 4;

5. For the purposes of compliance with NASDAQ Marketplace Rule 5635(d) and for all other purposes, to approve the proposed issuance and sale by us of up to $25,000,000 in shares of common stock from time to time under a Controlled Equity OfferingSM Sales Agreement, or Sales Agreement, with Cantor Fitzgerald & Co., as our sales agent, subject to the limitations set out in the Sales Agreement, pursuant to a shelf-registration statement on Form S-3 (File No. 333-197122), previously filed with the SEC on June 30, 2014, as amended on September 15, 2014, and that was declared effective by the SEC on October 3, 2014, and the accompanying prospectus supplement that we filed with the SEC on July 30, 2015, or Proposal No. 5;

6. For the purposes of Australian Securities Exchange, or ASX, Listing Rule 10.14 and for all other purposes, to approve the grant of 35,000 securities to Harry A. Hamill (which Mr. Hamill may elect to take in the form of shares of restricted stock or restricted stock units), or Proposal No. 6;

7. For purposes of ASX Listing Rule 10.17 and for all other purposes, to approve an increase in the total aggregate annual directors’ fees payable to all our non-executive directors to US$399,000.00, to be allocated among the directors in such proportions as determined by us, in each case on the terms set out in the accompanying proxy statement, or Proposal No. 7;

8. To amend our Certificate of Incorporation to increase the number of authorized shares of common stock from 250,000,000 to 350,000,000, or Proposal No. 8; and

9. To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Our board of directors recommends that stockholders vote FOR the re-election of each of the directors named in Proposal No. 1 and FOR Proposal Nos. 2-8, excluding Alan Shortall (with respect to Proposal No. 3 only), who abstains from making a recommendation with respect to the proposal due to his personal interest in that proposal and excluding Harry A. Hamill (with respect to Proposal No. 6 only), who abstains from making a recommendation with respect to that proposal due to his personal interest in that proposal and excluding our non-employee directors (with respect to Proposal No. 7 only), who abstain from making a recommendation with respect to that proposal due to their personal interest in that proposal.

Stockholders of record as of the close of business on September 30, 2015 (U.S. Eastern Time), the record date for the meeting, are entitled to receive notice of, and to vote at, the meeting and any adjournment or postponement of the meeting. Record holders of CDIs as of the close of business on the record date are entitled to receive notice of and to attend the meeting or any adjournment or postponement of the meeting and, in order to vote, may instruct our CDI Depositary, CHESS Depositary Nominees Pty Ltd, or CDN, to vote the shares underlying their CDIs by either following the instructions on the enclosed CDI voting instruction form or by voting online atwww.investorvote.com.au. Doing so permits each CDI holder to instruct CDN to vote on behalf of the CDI holder at the meeting in accordance with instructions received via the CDI voting instruction form or online.

The proxy statement that accompanies and forms part of this notice of meeting provides information in relation to each of the matters to be considered. This notice of meeting and the proxy statement should be read in their entirety. If stockholders are in doubt as to how they should vote, they should seek advice from their legal counsel, accountant or other professional adviser prior to voting.

By Order of the Board of Directors,

John C. Ryan

Senior Vice President, General Counsel

and Secretary

October 2, 2015

IMPORTANT: To assure that your shares are represented at the meeting, please vote (or, for CDI holders, direct CDN to vote) your shares via the Internet or by marking, signing, dating and returning the enclosed proxy card or CDI voting instruction form to the address specified, or, for the holders of our common stock only, via telephone. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI voting instruction form or voting online atwww.investorvote.com.au and may not vote in person.

TABLE OF CONTENTS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD AT 4:00 P.M. U.S. EASTERN TIME ON MONDAY, NOVEMBER 16, 2015 (8:00 A.M. Australian Eastern Time on Tuesday, November 17, 2015): A complete set of proxy materials relating to our meeting is available on the Internet. These materials, consisting of the Notice of Meeting, proxy statement, proxy card, CDI voting instruction form and Annual Report on Form 10-K for the fiscal year ended June 30, 2015, may be viewed and printed atwww.envisionreports.com/unis. If you are a CDI holder, you may also view and print these materials online atwww.investorvote.com.au.

UNILIFE CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 16, 2015 AT 4:00 P.M.

(U.S. EASTERN TIME)

The accompanying proxy is solicited by the board of directors of Unilife Corporation, a Delaware corporation (“we,” “us,” “our,” “Unilife” or the “Company”), for use at our annual meeting of stockholders to be held at 4:00 P.M. U.S. Eastern Time on Monday, November 16, 2015 (8:00 A.M. Australian Eastern Time on Tuesday, November 17, 2015), or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Meeting of Stockholders.

A Notice of Internet Availability of Proxy Materials is being mailed to our stockholders on or about October 7, 2015.

INTERNET AVAILABILITY OF PROXY MATERIALS

A complete set of proxy materials relating to the meeting is available on the Internet. These materials, consisting of the Notice of Meeting, proxy statement, proxy card, CDI voting instruction form and Annual Report on Form 10-K for the fiscal year ended June 30, 2015 may be viewed and printed atwww.envisionreports.com/unis. If you are a CDI holder, you may also view and print these materials online atwww.investorvote.com.au.

SOLICITATION AND VOTING

Voting Rights and Procedures

Only those stockholders or CDI holders of record as of the close of business on September 30, 2015 (U.S. Eastern Time), the record date, will be entitled to vote at the meeting and any adjournment or postponement thereof. Those persons holding CDIs are entitled to receive notice of and attend the meeting and may instruct CDN to vote at the meeting by following the instructions on the CDI voting instruction form or by voting online atwww.investorvote.com.au.

As of the record date, we had 139,110,228 shares of common stock outstanding (equivalent to 834,661,368 CDIs assuming all shares of common stock were converted into CDIs on the record date), all of which are entitled to vote with respect to all matters to be acted upon at the meeting, except to the extent of the voting exclusions for Proposal Nos. 3, 4, 5, 6 and 7 described below. Each stockholder as of the close of business on the record date is entitled to one vote for each share of common stock held by such stockholder. Each CDI holder as of the close of business on the record date is entitled to direct CDN to vote one share for every six CDIs held by such holder. One-third of the outstanding shares of our common stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” (shares held by a broker or nominee that does not have discretionary voting authority and has not received instructions as to how to vote on a particular proposal) will each be counted as present and entitled to vote for the purposes of determining whether a quorum is present.

The following describes how you may vote on each proposal and the votes required for approval of each proposal:

Proposal No. 1 — Our six director nominees will be elected by a plurality of votes cast at the meeting, which means that the director nominees receiving the highest number of ‘FOR’ votes will be elected. You may vote for each director nominee or withhold your vote from one or more of the nominees. Withholding a vote as to any director nominee is the equivalent of abstaining. In an uncontested election such as this, abstentions and broker non-votes have no effect, because approval by a specific percentage of the shares present or outstanding is not required.

1

Proposal Nos. 2 through 8 — The affirmative vote of the holders of a majority in voting power of the shares of common stock present in person or represented by proxy at the meeting and entitled to vote on the matter must be obtained in order to approve each of these proposals. You may vote for or against the proposal or you may abstain from voting. Abstentions will not be counted as affirmative votes and will have the same effect as AGAINST votes, and broker non-votes will not be counted as entitled to vote and will have no effect on the outcome of such proposals.

Solicitation of Proxies

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. If you choose to vote over the Internet, you are responsible for Internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. In addition to soliciting stockholders through our employees, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to solicit the beneficial owners and will reimburse them for their reasonable expenses in so doing.

Voting Instructions

All shares of our common stock represented by a properly executed proxy received before the time indicated on the proxy will, unless the proxy is revoked, be voted in accordance with the instructions indicated on the proxy. If no instructions are indicated on the proxy, the shares will be voted as the proxy holder nominated on the proxy card determines, or, if no person is nominated, the shares will be voted “FOR” each proposal. The persons named as proxies will vote on any other matters properly presented at the meeting in accordance with their best judgment. A stockholder giving a proxy has the power to revoke his or her proxy at any time before it is exercised by delivering to the Corporate Secretary of Unilife Corporation at our principal executive office, located at 250 Cross Farm Lane, York, Pennsylvania 17406, a written notice revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person. Attendance at the meeting will not, in and of itself, constitute revocation of a proxy.

Shares held directly in your name as the stockholder of record may be voted in person at the meeting. If you choose to vote in person, please bring proof of identification. Even if you plan to attend the meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend. Shares held in street name through a brokerage account or by a bank or other nominee may be voted in person by you if you obtain a valid proxy from the record holder giving you the right to vote the shares. CDI holders may attend the meeting, but cannot vote in person at the meeting.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may vote without attending the meeting. Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted as follows:

| | • | | If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet or telephone by following the instructions provided on the proxy card or you can vote by proxy by mail pursuant to instructions provided on the proxy card. |

| | • | | If your shares are held in a stock brokerage account or by a bank or other nominee, you have the right to direct your broker or other nominee on how to vote the shares in your account. If you hold shares beneficially in street name, you may vote by proxy over the Internet or telephone by following the instructions provided on the proxy card or you may vote by mail by following the voting instruction card provided to you by your broker, bank, trustee or nominee. |

Under Delaware law, votes cast by Internet have the same effect as votes cast by submitting a written proxy card.

2

Special Instructions for CDI Holders

Specific instructions to be followed by any CDI holder interested in directing CDN to vote the shares underlying their CDIs are set forth on the CDI voting instruction form. The Internet voting procedures for CDI holders are designed to authenticate the CDI holder’s identity and to allow the CDI holder to direct CDN to vote his or her shares and confirm that his or her voting instructions have been properly recorded.

CDI holders may direct CDN to vote their underlying shares at the meeting by following the instructions in the CDI voting instruction form and voting online atwww.investorvote.com.au or by returning the CDI voting instruction form to Computershare, the agent we designated for the collection and processing of voting instructions from our CDI holders, no later than 4:00 A.M. on November 11, 2015 U.S. Eastern Time (8:00 P.M. on November 11, 2015 Australian Eastern Time) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions. If you direct CDN to vote by completing the CDI voting instruction form, you may revoke those directions by delivering to Computershare, no later than 4:00 A.M. on November 11, 2015 U.S. Eastern Time (8:00 P.M. on November 11, 2015 Australian Eastern Time), a written notice of revocation bearing a later date than the CDI voting instruction form previously sent.

CDI holders may attend the meeting, but cannot vote in person at the meeting unless they are appointed as proxy by CDN.

3

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

The terms of office of each of our current directors will expire at the meeting. Our board has determined to nominate for election each of our current directors until our next annual meeting of stockholders to be held in 2016 and until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal. Directors are elected by a plurality (i.e., nominees with the highest number of votes for their election will be elected as directors) of votes present or represented by proxy and entitled to vote at the meeting. Shares represented by validly executed proxies will be voted, if authority to do so is not withheld, for the election of each of the nominees. If any of the nominees is unexpectedly unavailable for election, these shares will be voted for the election of a substitute nominee proposed by our nominating and corporate governance committee or our board may determine to reduce the size of our board. Each person nominated for election has agreed to serve if elected.

Our bylaws provide for the re-election of directors to occur by plurality of votes. Under this mechanism, stockholders are effectively not provided with an option to vote ‘against’ a proposed resolution to re-elect a director. Stockholders who withhold their vote or vote against a director being re-elected will not be counted as votes cast and will have no effect on the re-election of directors.

Set forth below is biographical information for the nominees as well as the key attributes, experience and skills that our board believes such nominee brings to our board. Please note that the tenure of the nominees on the Unilife board described below includes service on the board of Unilife Medical Solutions Limited, or UMSL, our Australian predecessor.

Alan D. Shortall (age 62). Mr. Shortall has served as chief executive officer since September 2002 and as chairman of our board since November 2013. Mr. Shortall founded Unilife Medical Solutions Limited in 2001 and listed UMSL on the Australian Stock Exchange in November 2002. In 2008, he led the redomiciliation from Australia to the U.S., and completed a listing of Unilife on the NASDAQ Global Exchange. In 2013, Mr. Shortall was appointed by the board of directors to also serve as chairman of Unilife. In 2008, the trade magazine Medical Device and Diagnostic Industry named him as one of 100 Notable People in the medical device industry. In 2013, he was appointed to the Advisory Board of Drug Development and Delivery magazine. In 2015, Mr. Shortall was named the Ernst and Young, or EY, Entrepreneur of the Year 2015 in Greater Philadelphia for Manufacturing and Transport. As a result, Mr. Shortall is now eligible for the EY Entrepreneur of the Year Overall National Award within the same category in November 2015, as well as the World Entrepreneur of the Year Award in 2016. Prior to founding Unilife, Mr. Shortall enjoyed a successful career as an entrepreneur managing businesses across a range of markets, including retail, consumer goods, IT, insurance and banking. Our board believes that Mr. Shortall’s strategic vision and intimate understanding of our innovative injectable drug delivery systems, as well as his substantial marketing and commercial experience make him well-suited to serve as a director.

Mary Katherine Wold (age 62). Ms. Wold has served as our director since May 2010 and as vice chair and lead independent director since August 2015. Since 2011, Ms. Wold has served as chief executive officer of the Church Pension Fund, which oversees defined benefit and defined contribution pension plans for clergy and lay employees of the Episcopal Church. Prior to her position at the Church Pension Fund, Ms. Wold served as senior vice president of finance from 2007 to 2009, senior vice president of tax and treasury from 2005 to 2007 and vice president of tax from 2002 to 2005, of Wyeth, a NYSE-listed pharmaceutical company, which was acquired by Pfizer in October 2009. Prior thereto, Ms. Wold spent 17 years with the international law firm of Shearman & Sterling based in New York, specializing in international tax planning for multinational corporations and in the tax aspects of mergers and acquisitions, capital markets and private equity transactions. Ms. Wold received her law degree from the University of Michigan and her Bachelor of Arts degree from Hamline University. Our board believes that Ms. Wold’s knowledge in financial, tax, and treasury matters along with her broad experience in global operations at one of the world’s largest pharmaceutical companies make her well-suited to serve as a director.

John Lund (age 49). Mr. Lund has served as our director since November 2009. Since February 2012, Mr. Lund has served as chief financial officer of Reliant Rehabilitation, a private equity backed company, which is a leading provider of long-term care rehabilitation services with over 4,500 U.S. based employees. Mr. Lund

4

has also served as a partner of Upstart CFO, LLC, a financial consulting company providing chief financial officer advisory services since December 2010. Mr. Lund was vice president of finance and controller of E-rewards, Inc., an internet market research company from February 2009 to March 2011. Prior to that, Mr. Lund held chief financial officer and controller positions for various public and private companies, and was a manager at KPMG LLP, or KPMG. Mr. Lund, a certified public accountant, graduated from University of North Texas and received his Master of Business Administration from the Kellogg School of Management of Northwestern University. Mr. Lund received theCertificate of Director Educationfrom the National Association of Corporate Directors, or NACD, and completed various corporate governance courses at Harvard Business School. Mr. Lund is actively involved in the NACD, Financial Executive Institute, American Institute of Certified Public Accountants and the Texas Society of Certified Public Accountants. Our board believes that Mr. Lund’s expertise in finance and accounting and his experience with corporate transactions and publicly listed companies make him well-suited to serve as a director.

William Galle (age 76). Mr. Galle has served as our director since June 2008. Since 2009, Mr. Galle has been affiliated as an investment banker with Bradley Woods, a 40 year-old New York City-based independent research and investment banking firm specializing in federal regulatory and legislative developments impacting substantial investor portfolios. Since 1993, Mr. Galle has been president of Diversified Portfolio Strategies LLC in Washington D.C., which provides alternative investment advisory services for institutions and substantial investors. Prior to his time at Diversified Portfolio Strategies LLC, Mr. Galle was vice president of pension services at Smith Barney, Harris Upham and director of corporate services at NASDAQ in Washington, D.C. Mr. Galle is a graduate of Columbia University, Rutgers University, and the New York Institute of Finance. Mr. Galle completed the National Association of Directors Governance Fellowship program designed to enhance corporate directors’ leadership and is currently a NACD Fellow. Our board believes that Mr. Galle’s investment advisory experience makes him well-suited to serve as a director.

Jeff Carter (age 57). Mr. Carter has served as our director since April 2006. From March 2007 to July 2010, Mr. Carter served as company secretary for UMSL. From February 2005 until January 2009, Mr. Carter served as chief financial officer of UMSL. Mr. Carter was a chief financial officer of various publicly listed healthcare companies prior to joining UMSL in February 2005. Prior to entering the healthcare industry, Mr. Carter held senior management positions with Coca Cola Amatil, Santos Ltd., Canadian Imperial Bank of Commerce and Touche Ross (now known as Deloitte Touche Tohmsatsu Limited). Mr. Carter has in excess of 30 years of experience in professional accounting, investment banking, corporate finance and commercial/strategic planning roles. Mr. Carter is a chartered accountant and holds a master’s degree in applied finance from Macquarie University. Our board believes that Mr. Carter’s experience in financial and management roles, with a strong background in the healthcare industry, make him well-suited to serve as a director.

Harry A. Hamill (age 61). Mr. Hamill has served as our director since August 2015. Mr. Hamill has served as an advisor in the life sciences industry since 2010. From 2008 to 2010, Mr. Hamill served as vice president and deputy controller of Wyeth (formerly known as American Home Products Corporation), and held other senior positions at Wyeth from 1992 to 2008, including leading global mergers and acquisitions, vice-president finance for Wyeth’s global manufacturing and distribution operations, and chief financial officer of a global animal health business unit. Wyeth was acquired by Pfizer in October 2009. Prior to his career at Wyeth, Mr. Hamill was a partner with Parente Randolph Orlando Carey and Associates, a regional U.S. accounting firm. Prior to that, Mr. Hamill was a senior audit manager with Arthur Andersen LLP in New York. He is a certified public accountant and a graduate of Bernard M. Baruch College, City University of New York. Our board believes that Mr. Hamill’s experience in finance and accounting and as an executive at a large, global pharmaceutical company with responsibility for, among other things, strategic transactions, financial controls, reporting and planning, and risk management, make him well-suited to serve as a director.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE.

5

INFORMATION ON OUR BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business is managed under the direction and oversight of our board. We keep board members informed of our business through discussions with management, materials we provide to them, visits to our offices, and their participation in board and board committee meetings. We believe open, effective, and accountable corporate governance practices are key to our relationship with our stockholders. Our board has adopted corporate governance guidelines, or our board charter, that, along with the charters of our board committees and our code of business conduct and ethics, provide the framework for our governance. A complete copy of our corporate governance guidelines, the charters of our board committees, and our code of ethics may be found on the investor relations section of our website atwww.unilife.com under the heading of “Governance”. Information contained on, or accessed through, our website is not part of this proxy statement. Our board regularly reviews corporate governance developments and modifies these policies as warranted. Any changes in these governance documents will be reflected on the same location of our website.

Director Independence

Our board has determined that each of Mary Katherine Wold, John Lund, William Galle and Harry A. Hamill are “independent” within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, NASDAQ listing standards and the Australian Securities Exchange, or ASX, Corporate Governance Council Corporate Governance Principles and Recommendations.

Board Leadership Structure

Our board has determined that in order to provide flexibility and to best serve the needs of the Company, our board should have the ability to either elect a chairman of the board who also serves as the chief executive officer or to vest those offices with two different people. The needs of the Company and the individuals available to serve in these roles may dictate different outcomes at different times, and the board believes that retaining flexibility in these decisions will enable the board to take advantage of the best skill sets available at the time to further the interests of the Company and its stockholders.

Alan D. Shortall currently serves as chairman of our board and chief executive officer. Mary Katherine Wold serves as our lead independent director on our board and exercises that role as vice chair of the board. We believe this leadership structure is presently the most appropriate structure for us.

Board’s Role in Risk Oversight

Our board is ultimately responsible for ensuring that appropriate risk management policies and procedures are in place to protect our assets and business. Our board requires senior management to ensure that an approach to managing risk is implemented as part of our day to day operations and to design internal control systems with a view to identifying and managing material risks. The committees of our board are responsible for evaluating the risks related to their respective responsibilities and overseeing the management of such risks. Our board periodically reviews the material risks faced by us, our risk management processes and systems and the adequacy of our policies and procedures designed to respond to and mitigate these risks.

Meetings and Committees of the Board

Directors are expected to attend meetings of our board and any board committees on which they serve. Our board has four standing committees to facilitate and assist our board in the execution of its responsibilities: the audit committee, the compensation committee, the nominating and corporate governance committee, and the strategic partnerships committee.

6

During the fiscal year ended June 30, 2015, our board held six meetings and the audit, compensation, nominating and corporate governance, and strategic partnerships committees held four, five, two and four meetings, respectively. Each director attended 75% or more of the aggregate of all meetings of our board and board committees on which such director served at the time of such meetings.

In accordance with our corporate governance guidelines, we make every effort to schedule our meeting of stockholders at a time and date to maximize attendance by directors taking into account the directors’ schedules. Under our corporate governance guidelines, all directors should make every effort to attend our annual meeting of stockholders absent an unavoidable and irreconcilable conflict. In November 2014, the meeting was held in New York City and all of the directors then in office attended the meeting in person, except for Jeff Carter, who attended by telephone from Australia.

Audit Committee

The primary purpose of the audit committee is to oversee our accounting and financial reporting processes and the audits of our financial statements. The committee also reviews the qualifications, independence and performance, and approves the terms of engagement of our independent auditors, and reviews and approves any related party transactions. The audit committee is governed by a written charter approved by our board, a copy of which is available from the investor relations section of our website atwww.unilife.com under the heading of “Governance.”

The audit committee currently consists of John Lund (Chair), Mary Katherine Wold, and Harry A. Hamill. Our board has determined that Mr. Lund qualifies as an “audit committee financial expert” as defined under SEC rules.

Compensation Committee

The primary purpose of the compensation committee is to supervise and review our affairs as they relate to the compensation and benefits of our named executive officers. In carrying out these responsibilities, the compensation committee reviews all components of executive compensation for consistency with our compensation philosophy and with the interests of our stockholders. The compensation committee is governed by a written charter approved by our board, a copy of which is available from the investor relations section of our website atwww.unilife.com under the heading of “Governance.”

Our compensation committee’s responsibilities include the following:

| | • | | develop and implement an executive compensation policy to support overall business strategies and objectives, attract and retain key executives, link compensation with business objectives and company performance, and provide competitive compensation; |

| | • | | approve compensation for the chief executive officer, including relevant performance goals and objectives, review and approve compensation for other named executive officers, and oversee their evaluations; |

| | • | | make recommendations to our board with respect to the adoption of stock-based compensation plans and incentive compensation plans; |

| | • | | review the outside directors’ compensation program for competitiveness and plan design, and recommend changes to our board, as appropriate; and |

| | • | | oversee general compensation plans and initiatives. |

The compensation committee currently consists of John Lund (Chair), William Galle, and Harry A. Hamill. The compensation committee performs its role with the assistance of an independent compensation consultant, Radford.

7

The compensation committee, in consultation with the chief executive officer, evaluates the performance of our other executive officers and sets their compensation packages. The compensation committee evaluates and sets the compensation of the chief executive officer without the consultation of the chief executive officer or any other executive officer.

The compensation committee may, to the extent permitted by applicable laws, regulations and NASDAQ requirements, form and delegate any of its responsibilities to a subcommittee consisting of one or more members of the compensation committee. To the extent permitted by law and stock exchange rules, the compensation committee may also delegate to one or more persons (who may or may not be directors) its authority to grant options or other stock-based awards to persons other than executive officers.

Strategic Partnerships Committee

The primary purpose of the strategic partnerships committee is to provide support to our senior management in establishing and maintaining strategic partnership relationships between us, pharmaceutical companies, potential customers and other third parties that the committee considers can be of strategic importance in our growth. To that end, the strategic partnerships committee will review and evaluate strategic partnership status, strategies and opportunities with our senior management, assist our senior management in developing strategic partnerships and relationships and, from time to time, initiate proposals and make recommendations on strategic partnerships. The strategic partnerships committee is governed by a written charter approved by our board, a copy of which is available from the investor relations section of our website atwww.unilife.com under the heading of “Governance.”

The strategic partnerships committee consists of Mary Katherine Wold (Chair), Alan Shortall, William Galle, John Lund, and Harry A. Hamill.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee oversees our director nomination and corporate governance matters. The nominating and corporate governance committee is governed by a written charter approved by our board, a copy of which is available from the investor relations section of our website atwww.unilife.com under the heading of “Governance.”

The nominating and corporate governance committee’s primary responsibilities are to:

| | • | | identify individuals qualified to become board members; |

| | • | | select, or recommend to our board, director nominees for each election of directors; |

| | • | | develop and recommend to our board criteria for selecting qualified director candidates; |

| | • | | consider committee member qualifications, appointment and removal; |

| | • | | recommend corporate governance principles, codes of ethics and compliance mechanisms applicable to us; and |

| | • | | provide oversight in the evaluation of our board and each committee. |

The nominating and corporate governance committee currently consists of William Galle (Chair), John Lund and Mary Katherine Wold.

Nominations Process and Director Qualifications

In evaluating candidates for directors proposed by directors, stockholders and/or management, the nominating and corporate governance committee or our board, as the case may be, considers the following factors, among others:

| | • | | the committee’s views of the current needs of our board for certain skills, experience or other characteristics; |

| | • | | the candidate’s background, skills, and experience; |

8

| | • | | other characteristics and expected contributions of the candidate; and |

| | • | | the qualification standards established from time to time by the nominating and corporate governance committee. |

The nominating and corporate governance committee considers the appropriate skills and characteristics required of board members in the context of the current makeup of our board. In accordance with our corporate governance guidelines, this assessment includes issues of diversity, age, skills such as understanding of manufacturing, technology, finance and marketing, and international background, all in the context of an assessment of the perceived needs of our board at that point in time. Pursuant to our corporate governance guidelines, directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of stockholders. They must also have an inquisitive and objective perspective and mature judgment.

In identifying director nominees, the nominating and corporate governance committee or our board, as the case may be, first evaluates the current members of our board willing to continue in service. Current members of our board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our board with that of obtaining a new perspective. If any member of our board does not wish to continue in service or if the nominating and corporate governance committee or our board decides not to re-nominate a member for re-election, the nominating and corporate governance committee or the board identifies the desired skills and experience of a new nominee in light of the criteria above. Other than the foregoing, there are no specific, minimum qualifications that the nominating and corporate governance committee believes that a committee-recommended nominee to our board must possess, although the nominating and corporate governance committee may also consider such other factors as it may deem are in the best interests of us and our stockholders. If the nominating and corporate governance committee believes, at any time, that our board requires additional candidates for nomination, the committee may engage, as appropriate, a third party search firm to assist in identifying qualified candidates. The nominating and corporate governance committee also considers suggestions of nominees from our stockholders. Persons suggested by stockholders to be nominees are evaluated based on the same criteria and using the same process described above for other potential nominees. Stockholders may recommend individuals for consideration by following the procedures set forth in our bylaws.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee has ever been an executive officer or employee of us or any of our subsidiaries, or has any relationship with us or our executives, other than their directorship and equity interests in us as disclosed in the section entitled “Security Ownership of Certain Beneficial Owners and Management.” During fiscal 2015, none of our executive officers served on the compensation committee or board of any other entity that had any executive officer who also served on our board.

Code of Business Conduct and Ethics

Our board recently adopted a new business conduct policy to replace our prior code of business conduct and ethics. The new policy is intended to be more readable and more in line with our needs as a company at this time. Our business conduct policy meets the definition of “code of ethics” under the SEC rules. The policy applies to all of our employees and directors. A copy of the business conduct policy is available from the investor relations section of our website atwww.unilife.com under the heading of “Governance.” We intend to disclose any amendment to, or waiver from, a provision of the policy that applies to any of our principal executive, financial or accounting officers in the investor relations section of our website.

9

Communications with Directors

Stockholders may communicate with our directors by transmitting correspondence by mail, facsimile or email, addressed as follows:

Chairman of the Board

or Board of Directors

or [individual director]

c/o John C. Ryan

250 Cross Farm Lane

York, Pennsylvania 17406 USA

Fax: + 717 384-3402

Email Address: john.ryan@unilife.com

All incoming communications are screened by our corporate secretary and transmitted to the intended recipient absent safety or security issues.

10

DIRECTOR COMPENSATION

The following table provides information regarding the total compensation that we paid or awarded to our non-executive directors during the fiscal year ended June 30, 2015. Directors who are also employees do not receive compensation for their services as directors. Mr. Bosnjak, who is included in the tables below, retired from our board in August 2015 for health reasons after ably serving on our board since 2003, including as chairman between 2006 and 2013.

| | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid

in Cash | | | Stock

Awards | | | Nonqualified

Deferred

Compensation

Earnings | | | Total | |

| | | ($) | | | ($)(1)(2) | | | ($)(3) | | | ($) | |

Slavko James Joseph Bosnjak | | | 119,800 | (4) | | | 99,050 | | | | 11,381 | | | | 230,231 | |

William Galle | | | 64,500 | | | | 99,050 | | | | — | | | | 163,550 | |

Jeff Carter | | | 66,260 | (5) | | | 99,050 | | | | 6,295 | | | | 171,605 | |

John Lund | | | 84,504 | | | | 99,050 | | | | — | | | | 183,554 | |

Mary Katherine Wold | | | 70,500 | | | | 99,050 | | | | — | | | | 169,550 | |

| (1) | The amount referenced is the grant date fair value of stock awards determined in accordance with ASC Topic 718. See Note 4 to our consolidated financial statements included in our Annual Report onForm 10-K for the fiscal year ended June 30, 2015. |

| (2) | The aggregate number of outstanding stock awards issued to each director during fiscal 2015 was 35,000 shares. |

| (3) | Represents statutory contributions of 9.5% of fees to a superannuation fund (i.e., pension) for Australian directors only. |

| (4) | Amount includes US$3,800 in fees earned in fiscal 2014 and paid in fiscal 2015 after reconciling for exchange rate impact. Mr. Bosnjak’s fees represent A$145,139 paid in Australian dollars. Amounts were converted using the average exchange rate during the applicable period. |

| (5) | Amount includes US$6,260 in fees earned in fiscal 2014 and paid in fiscal 2015 after reconciling for exchange rate impact. Mr. Carter’s fees represent A$81,325 paid in Australian dollars. Amounts were converted using the average exchange rate during the applicable period. This amount represents fees earned solely for serving as a director. |

Compensation Program for Non-Employee Directors

We provide our non-employee directors a mix of cash and equity compensation as part of our annual director compensation program. We believe this mix of pay not only provides an ability to attract and retain highly-qualified and diverse individuals to serve on our board but also aligns their interests with the interests of our stockholders. Because our CDIs are listed on the ASX, any long-term equity incentive awards to our directors must be approved by our stockholders in order to comply with ASX Listing Rules.

Our compensation committee reviews our director compensation program periodically to determine whether the program remains appropriate and competitive, and recommends any changes to our full board for consideration and approval. In 2013, the compensation committee conducted a non-employee director compensation review in consultation with Radford, its independent compensation consultant. As part of our compensation committee’s 2013 review of the non-employee director compensation, the compensation committee and Radford considered our non-employee director compensation program in comparison to those of the members of our peer group and decided to make certain revisions to our program. Radford’s analysis showed that our director compensation, both on a per director basis and in aggregate for the entire board, was below market competitive practices. In addition, Radford’s analysis indicated that the market is increasingly phasing out meeting fees in favor of flat retainers that better reflect the “on-call” nature of service on the board and its

11

committees. As part of the process, the compensation committee and Radford also took into consideration extraordinary factors specific to us, including the additional work and meetings required by our dual-listing on the NASDAQ and ASX, and the small size of our board as compared to other companies in our peer group, which requires our directors to serve on more committees than their counterparts in our peer group. After reviewing Radford’s findings and recommendations, our board approved the compensation program described below, comprising the replacement of meeting fees with larger retainers and an increase to the annual equity grant.

Cash Compensation

In December 2013, in connection with our non-employee director compensation review, our compensation committee recommended and our board approved, changing the structure of non-employee director cash compensation from a hybrid of an annual retainer and meeting fees, to flat annual retainers for (i) serving as a member of our board, and (ii) for chairing and serving on committees of our board. This change to a retainer-based compensation model resulted in a reduction of the annual aggregate cash compensation for our directors from approximately $410,000 to approximately $389,500. Such change is consistent with a majority of the companies in our peer group, reflecting the trend in public companies, which takes into account the “on-call” relationship between management and our board.

Annual retainer fees are paid in monthly payments at the beginning of each month.

Below is the current fee structure for the independent members of our board:

| | | | |

Board: | | | | |

Annual retainer per director | | $ | 35,000 | |

Lead Director and Vice Chairman of the board fee (in addition to retainer) | | | 45,000 | |

Audit Committee: | | | | |

Annual retainer for chairperson | | | 25,000 | |

Annual retainer for other members | | | 10,000 | |

Compensation Committee: | | | | |

Annual retainer for chairperson | | | 20,000 | |

Annual retainer for other members | | | 9,000 | |

Nominating and Corporate Governance Committee: | | | | |

Annual retainer for chairperson | | | 11,000 | |

Annual retainer for other members | | | 6,000 | |

Strategic Partnerships Committee: | | | | |

Annual retainer for chairperson | | | 19,500 | |

Annual retainer for other members | | | 9,500 | |

Because he is not an independent director, Mr. Carter is not a member of any board committees. However, Mr. Carter does attend certain committee meetings at the request of the committee members, provides our board with additional accounting and financial expertise, and advises our board on ASX listing rules and Australian Securities and Investment Commission requirements. As such, our board has decided to pay Mr. Carter an additional annual retainer amount of $25,000 to compensate him accordingly for his service as a director. Mr. Shortall does not receive fees for his service as a director.

Our compensation committee engaged Radford again in June 2015 to refresh the analysis of our peer group and evaluate non-employee director compensation as compared to our peers. Radford reported that our use of flat annual retainers remains consistent with the majority of our peer group as 76% of our peer group follows this approach. In addition, our mix of cash (54%) and equity (46%) is aligned with governance best practice of a roughly even split between cash and equity. Radford also reported that although our average non-employee director cash compensation approximates the market 75th percentile, our aggregate annual equity compensation is

12

positioned below the market 25th percentile and our aggregate total director compensation approximates the market 25th percentile. Our compensation committee is comfortable with higher cash than equity compensation for our directors, given the volatility of our stock price and the desire to retain and engage our directors. Radford did not recommend changes to our director compensation and our committee is not proposing changes to our director compensation for fiscal 2016 other than the modest increase discussed under “Proposal No. 7.” The new peer group recommended by Radford is included below in the section titled “Compensation Discussion and Analysis – Setting Executive Compensation/Role of Consultants” and we will use that updated 2015 peer group to benchmark both director and executive compensation going forward:

Expense Reimbursement

We reimburse all directors for their expenses in connection with their activities as members of our board.

Equity Compensation

As part of the non-employee director compensation review conducted by the compensation committee in 2013, our board in September 2013 approved an annual equity grant of 35,000 shares of restricted stock or restricted stock units for our non-executive directors in each of fiscal 2014, 2015 and 2016, which was approved by the stockholders in November 2013 as required under the ASX Listing Rules. The restricted stock and restricted stock units vest on the date of the next annual meeting to occur immediately following the date of issuance, subject to the non-employee director still being a director of the Company on the applicable vesting date. If a non-employee director resigns from our board or is removed from our board prior to the applicable vesting date, any unvested restricted stock or restricted stock units will expire. Mr. Bosnjak will not receive a grant of unvested restricted stock or restricted stock units in fiscal 2016, as he resigned from our board in August 2015, prior to the date of our 2015 annual meeting. If a non-employee director dies or becomes permanently disabled prior to the vesting date, all granted but unvested restricted stock or restricted stock units will vest immediately. All issued and unvested restricted stock or restricted stock units will vest immediately prior to a change in control transaction. All stockholder-approved stock-based awards that have not been issued will be issued and vested immediately prior to a change in control.

As part of Radford’s 2015 report on our non-employee director compensation, Radford advised that our non-employee director equity compensation is below the market 25th percentile. If stockholder approval is obtained for Proposal No. 6, Mr. Hamill will receive the same equity grant in fiscal 2016 as our other directors and on the same terms.

Stock Ownership and Retention Guidelines for Non-Executive Directors

Stock Ownership Guideline

Under the stock ownership and retention guidelines for non-executive directors that was adopted in September 2013, each non-executive director is strongly encouraged to acquire and hold shares of our common stock having an aggregate value equal to five times a director’s annual cash compensation, which further aligns our board members with stockholders as well as governance best practices. All of the non-executive directors have met the increased stock ownership guideline, with the exception of Mr. Hamill who has been newly added to our board and has been made aware of this governance best practice. For purposes of this stock ownership guideline, directly and indirectly owned shares, unvested shares of restricted stock, and vested and unvested stock units are counted as shares owned, but unexercised stock options are not. Directors are expected, to the extent possible based on the then current price of our common stock, to achieve their ownership goal within three years after our board’s initial adoption of this stock ownership guideline or the director’s appointment to our board, whichever is later. Although this guideline does not constitute a mandatory time-based holding period, in order achieve this stock ownership standard at a share price of $1.34 per share, which was the closing price of our shares of common stock on September 4, 2015, a non-employee director would have to hold his or her shares

13

for longer than seven years from adoption or appointment, assuming an annual equity grant of 35,000 shares of common stock per year. As such, this guideline promotes director stock ownership in a manner which is even more protective of shareholders than what is typically considered governance best practice.

This stock ownership guideline applies to the minimum number of shares that have an aggregate fair market value equal to the director’s ownership goal on the date that his or her ownership interest first meets the applicable ownership goal. Upon meeting the ownership goal, that number of shares becomes fixed and ownership of that number of shares must be maintained until the end of the director’s service on our board. A director’s ownership goal will not change as a result of changes in his or her annual cash compensation or fluctuations in the price of our common stock.

To facilitate achievement of the ownership goal, until the ownership goal is achieved the director is expected to retain all of the “net gain shares” resulting from the exercise of stock options, the grant of vested shares, or the vesting of restricted stock or stock units granted under our equity incentive plans. “Net gain shares” means the net number of shares remaining after reduction by the number of shares of common stock that the director would need to sell to cover the exercise price and taxes owed with respect to the grant, exercise or vesting event (assuming, for this purpose, a flat 40 percent tax rate and sale of shares at the closing price on the date of the taxable event).

Stock Retention Guideline

To further align the interests of the non-executive directors with those of our stockholders, in addition to satisfying the ownership goal described above, a further retention requirement applies to shares acquired from us by each non-executive director. Sixty percent of all net gain shares that are issued to the director after his or her achievement of the ownership goal, which net gain shares result from the exercise of stock options, the grant of vested shares, the vesting of restricted stock or the settlement of stock units granted under our equity incentive plans, and are not otherwise subject to the ownership goal are expected to be held until the end of the director’s service on our board. This retention guideline applies to net gain shares that arise in connection with stock options, restricted stock awards and stock units outstanding as of the date the guideline is adopted by our board and stock-based awards granted after that date. Slightly different stock retention requirements apply to incentives granted to Australian non-executive directors.

Waiver and Modification of Guidelines

These stock ownership and retention guidelines may be waived at the discretion of a majority of the members of the compensation committee in the event compliance would place severe hardship on a director or prevent a director from complying with a court order, such as in the case of divorce settlement; provided, however, that a member of the compensation committee may not cast a vote on his or her own waiver request. It is expected that these instances of waiver requests will be rare.

Our board may, upon recommendation of the compensation committee, amend or modify these stock ownership and retention guidelines at any time, in whole or in part.

14

PROPOSAL NO. 2 — RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee is directly responsible for the appointment, retention, compensation and oversight of the work of our independent registered public accounting firm. In making its determination regarding whether to appoint or retain a particular independent registered public accounting firm, the audit committee takes into account the views of management.

The audit committee has appointed KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2016. KPMG has acted in such capacity since its appointment in March 2010. The audit committee has considered whether KPMG’s provision of services other than audit services is compatible with maintaining independence as our independent registered public accounting firm and determined that such services are compatible.

Although ratification by stockholders is not a prerequisite to the ability of the audit committee to select KPMG as our independent registered public accounting firm, we believe such ratification to be desirable. Accordingly, stockholders are being requested to ratify, confirm and approve the selection of KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2016. If the stockholders do not ratify the selection of KPMG, the selection of the independent registered public accounting firm will be reconsidered by the audit committee; however, the audit committee may select KPMG notwithstanding the failure of the stockholders to ratify its selection. If the appointment of KPMG is ratified, the audit committee will continue to conduct an ongoing review of KPMG’s scope of engagement, pricing and work quality, among other factors, and will retain the right to replace KPMG at any time.

Representatives of KPMG are expected to be present at the annual meeting, with the opportunity to make a statement if the representatives desire to do so. It is also expected that they will be available to respond to appropriate questions.

Fees Paid

The following table sets forth the fees for services provided by KPMG during the years ended June 30, 2015 and 2014.

| | | | | | | | |

| | | 2015 | | | 2014 | |

Audit Fees(1) | | $ | 587,000 | | | $ | 553,250 | |

Audit-Related Fees(2) | | | 234,000 | | | | 30,000 | |

Tax Fees(3) | | | 28,879 | | | | 25,000 | |

All Other Fees | | | — | | | | — | |

| | | | | | | | |

Total Fees | | $ | 849,879 | | | $ | 608,250 | |

| | | | | | | | |

| (1) | Audit fees include amounts for professional services in connection with the integrated audit of our consolidated financial statements and the review of our consolidated financial statements included in our Quarterly Reports on Form 10-Q. |

| (2) | Audit-related fees include amounts for professional services in connection with the review of our SEC registration statements. |

| (3) | Tax fees include amounts paid for professional services in connection with tax compliance, tax advice and tax planning. |

15

Audit Committee’s Pre-Approval Policy

It is the audit committee’s policy to approve in advance the engagement of the independent registered public accounting firm for all audit services and non-audit services. The audit committee may delegate authority to pre-approve audit or non-audit services to one or more of its members. Any pre-approval authorized by a member of the audit committee to whom authority has been delegated must specify clearly in writing the services and fees approved by such member. Any member to whom such authority is delegated shall report any pre-approval decisions made under such delegated authority to the audit committee at its next scheduled meeting. All of the 2014 and 2015 fees paid to the independent registered public accounting firm described above were pre-approved by the audit committee in accordance with the pre-approval policy.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL NO. 2.

16

REPORT OF THE AUDIT COMMITTEE

The audit committee of our board is composed of John Lund (Chairman), Mary Katherine Wold and Harry A. Hamill. The audit committee members are not professional accountants or auditors (although Messrs. Lund and Hamill are certified public accountants, they currently do not work as accountants or auditors). Management has the primary responsibility for preparing the financial statements and designing and assessing the effectiveness of internal control over financial reporting. Management is responsible for maintaining appropriate accounting and financial reporting principles and policies and the internal controls and procedures that provide for compliance with accounting standards and applicable laws and regulations. In this context, the audit committee has reviewed and discussed with management the audited financial statements included in our Annual Report on Form 10-K for the year ended June 30, 2015 filed with the SEC.

The audit committee also has discussed with KPMG the matters required to be discussed by the applicable standards of the Public Company Accounting Oversight Board, or the PCAOB.

The audit committee has received the written disclosures and the letters from KPMG required by applicable requirements of the PCAOB regarding KPMG’s communications with the audit committee concerning independence and has discussed with KPMG their independence.

Based on the audit committee’s review and discussions with management and KPMG, the audit committee recommended that our board include the audited consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 filed with the SEC.

THE AUDIT COMMITTEE

John Lund (Chairman)

Mary Katherine Wold

Harry A. Hamill

17

EXECUTIVE OFFICERS

The following are biographical summaries of our executive officers and their ages, except for Mr. Shortall, whose biography is included under the heading “Proposal No. 1 — Election of Directors”:

Ramin Mojdeh (54).Dr. Mojdeh has served as President and Chief Operating Officer since November 2013 and previously served as Executive Vice President and Chief Operating Officer commencing in February 2011. Dr. Mojdeh served as Vice President and General Manager of Becton Dickinson, or BD, Pharmaceutical Systems, North America, between 2008 and 2010 and Worldwide Vice President of Research and Development, BD Medical, from 2002 to 2008. He was also a board member of BD Ventures Inc., the venture capital arm of BD, and he served as Chairman of BD’s Advanced Drug Delivery Council. Prior to his work with BD, Dr. Mojdeh was Business Director, Invasive Cardiology at GE Healthcare in 2002, and spent ten years with Guidant Corporation, where he held several management positions. Dr. Mojdeh received his Ph.D. in Computer Science from the University of Minnesota and his MBA from Kellogg Graduate School of Management, Northwestern University.

David Hastings (54). Mr. Hastings, CPA, has served as Senior Vice President and Chief Financial Officer since February 2015. Prior to joining Unilife, Mr. Hastings served as Executive Vice President and Chief Financial Officer of Incyte Corporation, a pharmaceutical company, from 2003 through 2014. From February 2000 to September 2003, Mr. Hastings served as Vice President, Chief Financial Officer, and Treasurer of ArQule, Inc., or ArQule. Prior to his employment with ArQule, Mr. Hastings was Vice President and Corporate Controller at Genzyme, Inc., or Genzyme, where he was responsible for the management of the finance department. Prior to his employment with Genzyme, Mr. Hastings was the Director of Finance at Sepracor, Inc. (now known as Sunovion Pharmaceuticals, Inc.), or Sepracor, a pharmaceutical company, where he was primarily responsible for Sepracor’s internal and external reporting. Mr. Hastings is a certified public accountant and received his B.A. in Economics at the University of Vermont.

John C. Ryan (45).Mr. Ryan has served as Senior Vice President, General Counsel and Secretary since May 2014. Mr. Ryan served as a Partner at Duane Morris LLP, from 2013 to 2014. From 2012 to 2013, Mr. Ryan served as Senior Vice President and Deputy General Counsel of Aramark Corporation, and from 2005 to 2012, Mr. Ryan served as Senior Vice President and Associate General Counsel of Aramark Corporation. From 1999 to 2005, Mr. Ryan served first as an Associate and later as a Partner at Duane Morris LLP. From 1995 to 1999, Mr. Ryan served as an Assistant District Attorney at the New York County District Attorney’s Office. Mr. Ryan received a J.D. from Northwestern University School of Law and a B.A. from New York University. Mr. Ryan is a member in good standing of the bars of Pennsylvania and New York.

Dennis P. Pyers (54). Mr. Pyers, CPA, has served as our Senior Vice President, Controller, Treasurer and Chief Accounting Officer since February 2015. From March 2014 to February 2015, he served as Vice President, Controller & Interim Chief Financial Officer and, from 2010 to 2014, he served as our Chief Accounting Officer, Vice President and Controller. Prior to that, from May 2009 to June 2010, Mr. Pyers served as an independent consultant, including as a consultant to us from May 2010 to June 2010. Before joining us, Mr. Pyers spent over twenty-five years with KPMG LLP, including serving as a partner from 2002 to 2009, providing a broad range of financial reporting, auditing, accounting and business advice to clients in the industrial markets and consumer products industries. He is a certified public accountant licensed in Pennsylvania, Maryland and New Jersey. He obtained his Bachelors of Science in Accounting from the Pennsylvania State University.

Mark V. Iampietro (62).Mr. Iampietro has served as Vice President, Corporate Quality & Regulatory Affairs and Chief Compliance Officer since June 2014 and previously served as Vice President of Corporate Quality and Regulatory Affairs since October 2008. Mr. Iampietro came to Unilife from Spherics Inc., a Boston-based pharmaceutical manufacturer, where he managed all phases of quality, regulatory, and clinical programsfrom 2002 to 2008. Prior to that, Mr. Iampietro held senior quality and regulatory positions at Cynosure, Inc.,

18

from 1998 to 2002, MedChem Products, a division of C.R. Bard, Inc., from 1994 to 1998, Summit Technology Inc., from 1990 to 1994, and Tambrands Inc. (now known as Procter & Gamble), from 1985 to 1990. He previously served as a visiting scientist at Brown University, is a senior member of The American Society for Quality, or ASQ, and holds ASQ certifications as both a quality and reliability engineer. He received a Bachelor of Science degree in life sciences with a minor in engineering from Worcester Polytechnic Institute.

19

EXECUTIVE COMPENSATION

RISK MANAGEMENT AND INCENTIVE COMPENSATION

Our compensation committee has reviewed our compensation systems and has determined that it is not reasonably likely that our compensation plans would have a material adverse effect on us for the following reasons:

| | • | | Any operational performance objectives of our annual cash incentive and stock-based grant programs are objectives that are reviewed and approved by our compensation committee and board, are focused on business activity that advances our stockholders’ interests and are designed to reward bonus-eligible employees for committing to and delivering goals that are aligned with our strategic plan. |

| | • | | Our annual cash incentive program is designed to reward performance. |

| | • | | The performance goals are reviewed by senior management, the compensation committee and our board to ensure that they are focused on business activity that advances our stockholders’ interests and do not encourage excessive or potentially damaging risk-taking. |

| | • | | The amount of annual cash incentive compensation is not set at such an aggressive level that it would induce bonus-eligible employees to take inappropriate risks that could threaten our financial and operating stability. |

| | • | | Our annual cash incentive compensation program does not contain highly leveraged payout curves or uncapped payouts. |

| | • | | Our adoption of new compensation related policies such as the stock ownership guidelines for executive officers and the claw-back policy (both as further described below) causes executive officers to focus on our long-term success in a manner similar to our stockholders. |

| | • | | The compensation of our chief executive officer and chief operating officer is heavily weighted towards long-term equity incentives rather than cash compensation, to ensure alignment with our stockholders. |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis describes our compensation philosophy and practices for those individuals who were our most highly compensated executives based on their fiscal 2015 compensation. We refer to these individuals as “named executive officers.” Our fiscal year begins on July 1st and ends on June 30th of each year. Thus, all references to “fiscal 2015” mean the period that spans July 1, 2014 to June 30, 2015.

Our named executive officers are:

| | • | | Alan D. Shortall, who is our chairman and chief executive officer; |

| | • | | Ramin Mojdeh, Ph.D., who is our president and chief operating officer; |

| | • | | David Hastings, who became our senior vice president and chief financial officer in February 2015; |

| | • | | John C. Ryan, who became our senior vice president, general counsel and secretary in May 2014; |

| | • | | Dennis P. Pyers, who was our interim chief financial officer from the start of fiscal 2015 until he transitioned to the positions of senior vice president, controller, treasurer and chief accounting officer in February 2015; and |

| | • | | Mark V. Iampietro, who is our vice president, corporate quality and regulatory affairs and chief compliance officer. |

20

Executive Summary

Fiscal 2015 was our fifth full year as a public company in the United States. We set a number of important goals for our company for fiscal 2015, including the following:

| | • | | Entering into long-term development, licensing and supply agreements with pharmaceutical and biotechnology companies for our innovative injectable drug delivery systems; |

| | • | | Producing and customizing products to meet customer needs; |

| | • | | Commencing sales shipments to customers; |

| | • | | Expanding our organizational capability; |

| | • | | Strengthening our financial position; and |

| | • | | Further developing our technical staff resources. |

By the end of fiscal 2015, we achieved many of these goals and made significant progress building our business. Our major achievements for fiscal 2015 include the following:

| | • | | We signed multiple long-term commercial supply agreements with pharmaceutical companies; |

| | • | | We commenced initial sales of our products to customers; |

| | • | | We made significant investments in manufacturing capacity, R&D, and facilities, and we expanded our production capacity and the scale-up capability of our product portfolio through our relationship with a leading end-to-end supply chain solutions company; |

| | • | | We continued to enhance our operational focus, spurred further product development and the creation of additional intellectual property and improved production efficiencies; |

| | • | | We have built a strong team of technical talent and continued to develop and diversify our innovative portfolio of advanced drug delivery systems, which is customizable for our pharmaceutical customers. During fiscal year 2015, we received 45 new patents and by the end of fiscal year 2015, we had approximately 180 issued patents in aggregate relating to our product platforms across more than 24 worldwide jurisdictions; and |

| | • | | We delivered on customer commitments. |

When designing the annual and long-term compensation program for our named executive officers, our compensation committee balanced the creation of appropriate incentives for the achievement of our strategic goals with the desire to retain our key executives while being mindful of our cash resources. We believe that our compensation program for our named executive officers was instrumental in helping us achieve our objectives for fiscal 2015. Material actions taken by the committee during fiscal 2015 and thereafter include the following:

| | • | | Approval of extensions to the Employment Agreements of Mr. Shortall and Dr. Mojdeh to December 31, 2019. |

| | • | | Approval of Employment Agreements for Messrs. Ryan, Iampietro, Hastings and Pyers. |